Form 8-K FEDEX CORP For: Jun 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

Commission File Number

| |

| |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) | |

| |

| |

| (Address of principal executive offices) |

(ZIP Code) |

Registrant’s telephone number, including area code:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| |

|

| ||

| |

|

| ||

| |

|

| ||

| |

|

| ||

| |

|

| ||

| |

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2. FINANCIAL INFORMATION.

| Item 2.06. | Material Impairments. |

On June 15, 2020, the management of FedEx Corporation (“FedEx” or the “Company”) concluded that a noncash charge of approximately $348 million for impairment of the value of goodwill would need to be recorded in the fourth quarter ended May 31, 2020, related to reduction in the value of the goodwill recorded as a result of the February 2004 acquisition of Kinko’s, Inc. (now known as FedEx Office and Print Services, Inc. (“FedEx Office”)). The conclusion was made in connection with FedEx’s impairment testing of goodwill and other intangible assets conducted in the fourth quarter in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 350, “Intangibles—Goodwill and Other” and in connection with the preparation of the financial statements to be included in FedEx’s annual report on Form 10-K for the fiscal year ended May 31, 2020.

The goodwill impairment charge was recognized based on declining print revenue and temporary store closures at FedEx Office during the fourth quarter of fiscal 2020 resulting from the COVID-19 pandemic. The COVID-19 pandemic is expected to continue to negatively impact FedEx Office’s near-term operating performance. The goodwill impairment charge of $348 million represents all of the remaining goodwill attributed to the FedEx Office reporting unit.

Total asset impairment charges for the fourth quarter ended May 31, 2020 are expected to be approximately $370 million. This includes the goodwill impairment charge discussed above, impairment charges related to reduction of the value of the goodwill recorded as a result of the January 2015 acquisition of GENCO Distribution System, Inc. (now known as FedEx Supply Chain Distribution System, Inc. (“FedEx Supply Chain”)), and other asset impairment charges at FedEx Supply Chain and FedEx Logistics, Inc.

All of these charges are noncash, and FedEx does not expect to be required to make any current or future cash expenditures as a result of these impairments.

SECTION 5. CORPORATE GOVERNANCE AND MANAGEMENT.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

FY21 Annual Incentive Compensation Plan for Executive Officers

Given the current economic and business uncertainty resulting from the COVID-19 pandemic, there will not be an annual incentive compensation plan for executive officers for fiscal 2021.

FY21 Equity Awards to Executive Officers

The Compensation Committee of the Company’s Board of Directors (the “Committee”) generally grants stock options and restricted stock to executive officers on an annual basis. For fiscal 2021, in addition to the annual grants, the Committee approved a one-time, special restricted stock grant to each of the Company’s executive officers, other than the Chairman and Chief Executive Officer, that approximates 50% of such executive officer’s annual restricted stock grant. The restricted stock will vest ratably over four years beginning on June 15, 2021, in accordance with the terms of the Company’s 2019 Omnibus Stock Incentive Plan (“2019 Stock Plan”). Consistent with prior practice and as disclosed in the Company’s proxy statement for its 2019 annual meeting of stockholders, the Company will also pay the taxes resulting from the restricted stock awards on behalf of each recipient.

In addition, the Committee approved a one-time, special stock option grant for each of the Chairman and Chief Executive Officer and the President and Chief Operating Officer. The stock options have an exercise price of $130.96 and will vest ratably over four years beginning on June 15, 2021, in accordance with the terms of the 2019 Stock Plan.

FY21-FY23 Long-Term Incentive Plan

On June 15, 2020, the Company’s Board of Directors (the “Board”), upon the recommendation of the Committee, approved the long-term incentive (“LTI”) plan for fiscal 2021 through fiscal 2023 (the “FY21-FY23 LTI Plan”), which provides a long-term cash payment opportunity to members of management, including the Company’s executive officers, based upon achievement of plan objectives for financial performance. The FY21-FY23 LTI Plan includes two financial performance metrics: (1) aggregate earnings per share (“EPS”) goals for the three-fiscal-year period, weighted at 75% of the total payout opportunity; and (2) total capital expenditures as a percentage of total revenue over the three-fiscal-year period (“CapEx/Revenue”), weighted at 25% of the total payout opportunity.

EPS has historically been the sole metric for the Company’s LTI plans. The Committee and Board determined that EPS was still an appropriate financial metric for the FY21-FY23 LTI Plan given that growth in the Company’s EPS strongly correlates to long-term stock price appreciation. The EPS performance goals under the FY21-FY23 LTI Plan are consistent with the EPS goals in current LTI plans: there will be no payout under the EPS component of the plan unless the three-year average annual EPS growth rate is at least 5%; a target payout if the three-year average annual EPS growth rate is 12.5%; an above-target payout if the growth rate is above 12.5%, up to a maximum amount (equal to 150% of the target payout) if the growth rate is 15% or higher; and a below-target payout if the growth rate is below 12.5%, down to a threshold amount (equal to 25% of the target payout) if the growth rate is 5%.

The baseline EPS for purposes of the FY21-FY23 LTI Plan will be final fiscal 2020 EPS, adjusted to exclude (i) the effect of the mark-to-market retirement plan accounting adjustment (“MTM Adjustment”) for fiscal 2020 and (ii) fiscal 2020 TNT Express integration expenses (including any restructuring charges at TNT Express). For purposes of determining payouts under the FY21-FY23 LTI Plan, EPS for fiscal years 2021, 2022, and 2023 will exclude the annual MTM Adjustment for such year.

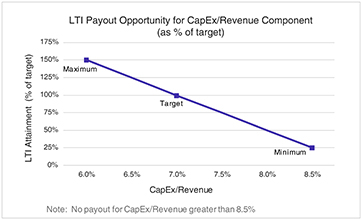

The second metric, CapEx/Revenue, was chosen to incent management to further optimize capital deployment and efficiency over the three-fiscal-year period. For the CapEx/Revenue component of the FY21-FY23 LTI Plan, there will be no payout unless CapEx/Revenue is at or below 8.5%; a target payout if CapEx/Revenue is at 7%; an above-target payout if CapEx/Revenue is below 7.0%, up to a maximum payout (equal to 150% of the target payout) if CapEx/Revenue is at or below 6.0%; and a below-target payout if CapEx/Revenue is above 7.0%, down to a threshold amount (equal to 25% of the target payout) if CapEx/Revenue is at 8.5%. The following chart illustrates the relationship between CapEx/Revenue and payout opportunities for the CapEx/Revenue component:

Forward-Looking Statements

Certain statements in this report are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations, cash flows, plans, objectives, future performance and business. Forward-looking statements include those preceded by, followed by or that include the words “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,” “plans,” “estimates,” “targets,” “projects,” “intends” or similar expressions. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical experience or from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, the factors that can be found in FedEx’s and its subsidiaries’ press releases and FedEx’s filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made. FedEx does not undertake or assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FedEx Corporation | ||||||

| Date: June 19, 2020 |

By: |

/s/ John L. Merino | ||||

| John L. Merino | ||||||

| Corporate Vice President and | ||||||

| Principal Accounting Officer | ||||||