Form 8-K VIASAT INC For: May 26

Exhibit 99.1

Viasat Releases Fourth Quarter and Fiscal Year 2020 Financial Results

CARLSBAD, Calif., May 26, 2020 — Viasat Inc. (NASDAQ: VSAT), a global communications company, today announced its fourth quarter and fiscal year 2020 financial results. Starting with this earnings period, Viasat is introducing a new format for its quarterly communications, in which the complete financial results are included in a letter to shareholders posted to the investor relations section of its website.

As previously announced, the Company will host a conference call and webcast today at 2:00 p.m. Pacific / 5:00 p.m. Eastern Time. To participate on the live conference call, please dial: (877) 640-9809 in the U.S. or (914) 495-8528 internationally, and reference the conference ID 5272964. The live webcast will be available on Viasat’s investor relations website at: investors.viasat.com.

A replay of the conference call will be available from 8:00 p.m. Eastern Time on Tuesday, May 26, until 11:59 p.m. Eastern Time on Wednesday, May 27. To access the replay, please dial: (855) 859-2056 in the U.S. and (404) 537-3406 internationally, and enter the conference ID 5272964. The webcast will be archived and available on the Viasat investor relations website for approximately one month immediately following the conference call.

About Viasat

Viasat is a global communications company that believes everyone and everything in the world can be connected. For more than 30 years, Viasat has helped shape how consumers, businesses, governments and militaries around the world communicate. Today, the Company is developing the ultimate global communications network to power high-quality, secure, affordable, fast connections to impact people’s lives anywhere they are—on the ground, in the air or at sea. To learn more about Viasat, visit: viasat.com, go to Viasat’s Corporate Blog, or follow the Company on social media at: Facebook, Instagram, LinkedIn, Twitter or YouTube.

Copyright © 2020 Viasat, Inc. All rights reserved. Viasat, the Viasat logo and the Viasat signal are registered trademarks of Viasat, Inc. All other product or company names mentioned are used for identification purposes only and may be trademarks of their respective owners.

Viasat, Inc. Contacts

Chris Phillips, Corporate Communications & Public Relations, +1 760-476-2322, [email protected]

June Harrison, Investor Relations, +1 760-476-2633, [email protected]

# # #

Exhibit 99.2

Q4 FY20 Shareholders Letter

Fellow Shareholders, We hope everyone reading this letter today is healthy and staying safe. Today we are introducing a new format for our quarterly communications. This letter is designed to provide a simplified discussion of our performance, strategic progress and future growth plans. We will continue to host a conference call, providing more time for questions and interactive discussion. We hope you find this approach more useful, and we welcome your feedback. Viasat’s fourth quarter fiscal year 2020 (Q4 FY2020) capped a successful year despite the onset of the COVID-19 pandemic. We had a strong fourth quarter that allowed us to achieve corporate records for annual revenue and other important financial metrics. We were also recognized as a Fortune 1000 company for the first time. Of course, in the latter weeks of our fiscal fourth quarter we began to feel the impact of the pandemic like everyone else. As a result, in this letter we will spend a little less time on the way things were in Q4 FY2020 – and focus more on the way things are today, and what we are likely to encounter in the months ahead. It is our view that we can emerge even stronger when the crisis has passed. Viasat has been built with a strategy of using vertical integration to deliver a diverse portfolio of products and services across an integrated set of horizontal markets. We sell to government and commercial customers both in the U.S. and internationally. Having a good business mix has protected us in past crises and is a significant source of strength today. As we have worked through this difficult last few months, we are fortunate that only one of our end markets – Commercial In-Flight Connectivity (IFC) – has been highly impacted by the pandemic. Other businesses are either not materially affected, or are experiencing greater immediate demand and/or increased new opportunity flow. We believe our strategy remains a powerful competitive advantage, with substantial entry barriers to competitors. We are determined to extend our market leading positions, and sustain our growth trajectory, with the launch of the ViaSat-3 series of global broadband satellites. Sadly, the downturn in commercial air travel meant we needed to reduce costs to preserve the ViaSat-3 schedule with a prudent capital structure. But, we took action promptly and our team is energized about our future. In the pages ahead we’ll provide more detail on FY2020 results and insight on our view of FY2021 and beyond. One thing the COVID-19 crisis has affirmed is the demand for trusted broadband connectivity – for home, work, education, health, entertainment, communication, information and security. We’re proud to be a leader in delivering that to the most challenging places on earth. FORTUNE 1000 Shareholder Letter | Q4 and Fiscal Year 2020 1

Q4 and FY2020 Financial Results Viasat posted record revenue, a significantly lower net loss, and record Adjusted EBITDA in FY2020 – demonstrating the fundamental strength of our vertically-integrated business model across commercial broadband services and secure government networking markets. During FY2020 we focused on execution to realize the value of prior year investments, and on keeping pace with our current investments in the ViaSat-3 constellation. Virtually all of our core businesses sustained through the COVID-19 crisis – except our near-term IFC business, which currently comprises less than 10% of our annual revenues. Fiscal Year 2020 Highlights › Awards, revenue and earnings performance were ahead of › Satellite Services earned record FY2020 revenue, as fixed our expectations, resulting in a sharp improvement in our consumer broadband service average revenue per user net loss for the year and record Adjusted EBITDA (ARPU) in the U.S. increased again with migration toward higher ARPU, higher value plans › Overall Q4 Adjusted EBITDA margins as a % of revenue expanded nearly 90 basis points compared to last year. › We ended FY2020 with 1,390 aircraft in service in our Without the transient and IFC impacts of COVID-19, margins commercial IFC business, with our widebody fleet expanding would have expanded nearly 400 basis points to include 787s for American Airlines and Aeromexico › Some Government Systems shipments were delayed out › In Commercial Networks we saw a positive book-to-bill of Q4 FY2020 due to shelter-in-place process delays with ratio in Q4 and FY2020 supported by strong demand for some U.S. Department of Defense (DoD) customers. FY2020 complex full motion antenna systems still set revenue and Adjusted EBITDA records, with strong orders and Indefinite-Delivery / Indefinite-Quantity (IDIQ) ordering agreements FISCAL YEAR AWARDS FISCAL YEAR REVENUE FISCAL YEAR ADJ. EBITDA $ in billions $ in billions $ in millions $2.4 $2.3 $2.3 $458 $1.5 $1.7 $1.7 $2.1 $331 $341 $339 $1.6 $235 $1.6 $1.4 FY16 FY17 FY18 FY19 FY20 FY16 FY17 FY18 FY19 FY20 FY16 FY17 FY18 FY19 FY20 QUARTERLY AWARDS QUARTERLY REVENUE QUARTERLY ADJ. EBITDA $ in millions $ in millions $ in millions $612 $577 $557 $588 $592 $552 $122 $120 $108 Q4 Q3 Q4 Q4 Q3 Q4 Q4 Q3 Q4 FY19 FY20 FY20 FY19 FY20 FY20 FY19 FY20 FY20 Shareholder Letter | Q4 and Fiscal Year 2020 2

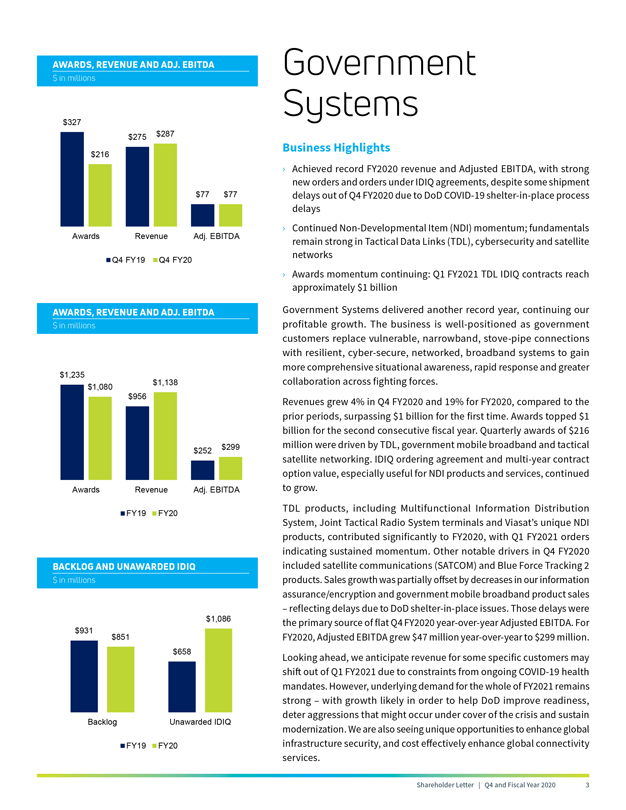

AWARDS, REVENUE AND ADJ. EBITDA $ in millions $327 $275 $287 $216 $77 $77 Awards Revenue Adj. EBITDA Q4 FY19 Q4 FY20 AWARDS, REVENUE AND ADJ. EBITDA $ in millions $1,235 $1,138 $1,080 $956 $252 $299 Awards Revenue Adj. EBITDA FY19 FY20 BACKLOG AND UNAWARDED IDIQ $ in millions $1,086 $931 $851 $658 Backlog Unawarded IDIQ FY19 FY20 Government Systems Business Highlights › Achieved record FY2020 revenue and Adjusted EBITDA, with strong new orders and orders under IDIQ agreements, despite some shipment delays out of Q4 FY2020 due to DoD COVID-19 shelter-in-place process delays › Continued Non-Developmental Item (NDI) momentum; fundamentals remain strong in Tactical Data Links (TDL), cybersecurity and satellite networks › Awards momentum continuing: Q1 FY2021 TDL IDIQ contracts reach approximately $1 billion Government Systems delivered another record year, continuing our profitable growth. The business is well-positioned as government customers replace vulnerable, narrowband, stove-pipe connections with resilient, cyber-secure, networked, broadband systems to gain more comprehensive situational awareness, rapid response and greater collaboration across fighting forces. Revenues grew 4% in Q4 FY2020 and 19% for FY2020, compared to the prior periods, surpassing $1 billion for the first time. Awards topped $1 billion for the second consecutive fiscal year. Quarterly awards of $216 million were driven by TDL, government mobile broadband and tactical satellite networking. IDIQ ordering agreement and multi-year contract option value, especially useful for NDI products and services, continued to grow. TDL products, including Multifunctional Information Distribution System, Joint Tactical Radio System terminals and Viasat’s unique NDI products, contributed significantly to FY2020, with Q1 FY2021 orders indicating sustained momentum. Other notable drivers in Q4 FY2020 included satellite communications (SATCOM) and Blue Force Tracking 2 products. Sales growth was partially offset by decreases in our information assurance/encryption and government mobile broadband product sales – reflecting delays due to DoD shelter-in-place issues. Those delays were the primary source of flat Q4 FY2020 year-over-year Adjusted EBITDA. For FY2020, Adjusted EBITDA grew $47 million year-over-year to $299 million. Looking ahead, we anticipate revenue for some specific customers may shift out of Q1 FY2021 due to constraints from ongoing COVID-19 health mandates. However, underlying demand for the whole of FY2021 remains strong – with growth likely in order to help DoD improve readiness, deter aggressions that might occur under cover of the crisis and sustain modernization. We are also seeing unique opportunities to enhance global infrastructure security, and cost effectively enhance global connectivity services. Shareholder Letter | Q4 and Fiscal Year 2020 3

AWARDS, REVENUE AND ADJ. EBITDA $ in millions $211 $212 $190 $190 $65 $70 Awards Revenue Adj. EBITDA Q4 FY19 Q4 FY20 AWARDS, REVENUE AND ADJ. EBITDA $ in millions $827 $827 $693 $684 $283 $196 Awards Revenue Adj. EBITDA FY19 FY20 ARPU ($) $81.99 $84.26 $86.94 $89.71 $93.06 Fixed Subscribers (End of Period) 586K 587K 587K 586K 590K Aircraft in Service (End of Period) 1,312 1,335 1,353 1,379 1,390 Q4 FY19 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 Satellite Services Business Highlights › Significant increase in fixed broadband demand resulted in existing subscribers shifting to higher value plans and overall growth in the subscriber base, largely due to the COVID-19 shelter-in-place orders › Continued growth in consumer ARPU as we balance capacity constraints with demand for bandwidth › IFC impacted by reduced air travel, but competitively well-positioned long-term Satellite Services achieved nine straight quarters of revenue growth, up 12% in Q4 FY2020 year-over-year. Adjusted EBITDA grew 8% year-over-year from a diversified service portfolio. FY2020 revenue and Adjusted EBITDA grew 21% and 44%, respectively, illustrating our focus on operating efficiency. Record revenue reflected benefits of our premium fixed broadband service strategy and sustained ARPU growth. Our higher speed and bandwidth-rich broadband plans helped us earn a U.S. News & World Report Top 10 ranking for U.S. ISPs – out of 30 candidates. COVID-19 shelter-in-place orders surfaced incremental demand, and we added 4,000 net new subscribers in Q4 FY2020 where capacity allowed. Geographic demand distribution further emphasizes the importance of having a flexible satellite architecture. Our year-end fixed broadband subscribers in the U.S. totaled 590,000, excluding ~2,000 under the FCC’s “Keep Americans Connected” pledge. Additionally in FY2020 we helped bring fixed satellite internet to over 11,000 sites in Brazil, which included 9,000 schools and 2.4 million students, through the Governo Eletrônico —Serviço de Atendimento ao Cidadão (GESAC) initiative. Turning to in-flight services, we saw continued growth, with Q4 2020 revenue up 13% year-over-year, even with the impact of the COVID-19 pandemic late in the quarter. We ended the year with 1,390 commercial aircraft in service. In the near-term, we are seeing fewer planes in service and a decrease in passenger load, which has yielded reduced IFC-based revenues as we enter into FY2021. We have taken cost reduction actions to compensate for a significant portion, though not all, of the expected earnings impact. Despite near-term pressures we are in a very strong relative position to increase market share post-crisis given multiple competitive advantages and the stability of our diverse, vertically-integrated business model. Shareholder Letter | Q4 and Fiscal Year 2020 4

AWARDS, REVENUE AND ADJ. EBITDA $ in millions $125 $96 $92 $93 ($27) Awards Revenue Adj. ($34) EBITDA Q4 FY19 Q4 FY20 AWARDS, REVENUE AND ADJ. EBITDA $ in millions $441 $420 $428 $345 ($109) ($125) Awards Revenue Adj. EBITDA FY19 FY20 Commercial Networks Q4 FY2020 revenues were flat year-over-year as growth in antenna systems was offset by last year’s accelerated IFC terminal deliveries for American Airlines. Q4 FY2020 Adjusted EBITDA loss improved by 21% year-over-year and 12% sequentially, benefiting from higher antenna systems revenue and improved commercial air margins. We continue to invest in R&D to support high priority long-term strategic growth opportunities, such as Ku-/Ka-band hybrid capabilities and system-level components planned for use in our next-gen consumer and mobile terminals. ViaSat-3 Development Highlights › Continued progress towards payload delivery, supporting project schedule › Ongoing hardware build, assembly and testing at Tempe, AZ facility (pictured) › Took mitigating actions to preserve supply chain continuity During FY2020, and to date in FY2021, we’ve made substantial progress on our ViaSat-3 constellation. The ViaSat-3 (Americas) and ViaSat-3 (Europe, Middle East, Africa) satellites achieved important payload and ground network assembly, test and integration milestones, while ViaSat-3 (Asia Pacific) successfully completed Preliminary Design Review. To date, we’ve mitigated multiple challenges posed by the COVID-19 crisis by working with subcontractors to implement safe working conditions and processes for production activities. While we continue to target mid-2021 for the launch of our first ViaSat-3 class satellite, the current COVID-19 health-related disruptions pose greater risk to both the payload completion schedule and the final spacecraft assembly, integration and test schedule. Shareholder Letter | Q4 and Fiscal Year 2020 5

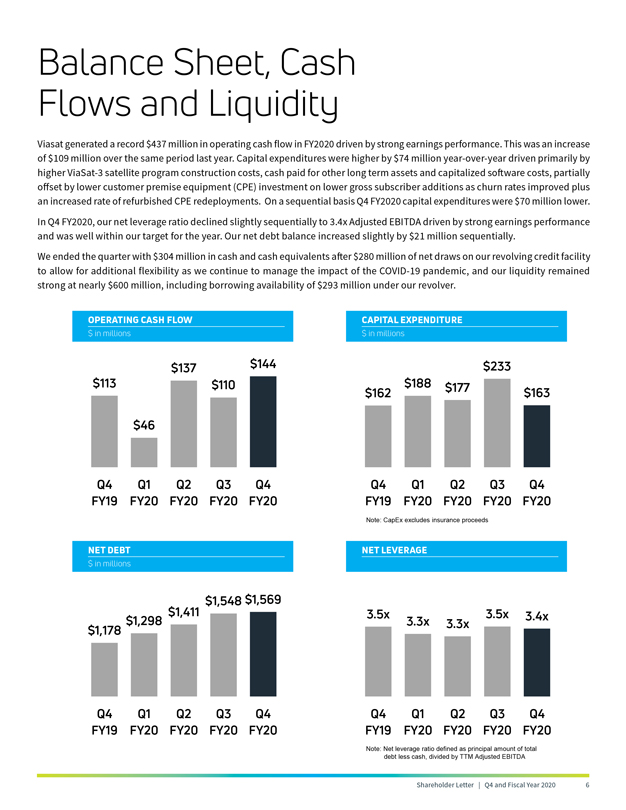

Balance Sheet, Cash Flows and Liquidity Viasat generated a record $437 million in operating cash flow in FY2020 driven by strong earnings performance. This was an increase of $109 million over the same period last year. Capital expenditures were higher by $74 million year-over-year driven primarily by higher ViaSat-3 satellite program construction costs, cash paid for other long term assets and capitalized software costs, partially offset by lower customer premise equipment (CPE) investment on lower gross subscriber additions as churn rates improved plus an increased rate of refurbished CPE redeployments. On a sequential basis Q4 FY2020 capital expenditures were $70 million lower. In Q4 FY2020, our net leverage ratio declined slightly sequentially to 3.4x Adjusted EBITDA driven by strong earnings performance and was well within our target for the year. Our net debt balance increased slightly by $21 million sequentially. We ended the quarter with $304 million in cash and cash equivalents after $280 million of net draws on our revolving credit facility to allow for additional flexibility as we continue to manage the impact of the COVID-19 pandemic, and our liquidity remained strong at nearly $600 million, including borrowing availability of $293 million under our revolver. OPERATING CASH FLOW CAPITAL EXPENDITURE $ in millions$ in millions $137$144$233 $113$110$162$188$177$163 $46 Q4Q1Q2Q3Q4Q4Q1Q2Q3Q4 FY19FY20FY20FY20FY20FY19FY20FY20FY20FY20 Note: CapEx excludes insurance proceeds NET DEBTNET LEVERAGE $ in millions $1,548 $1,569 $1,4113.5x3.5x3.4x $1,178 $1,2983.3x3.3x Q4Q1Q2Q3Q4Q4Q1Q2Q3Q4 FY19FY20FY20FY20FY20FY19FY20FY20FY20FY20 Note: Net leverage ratio defined as principal amount of total debt less cash, divided by TTM Adjusted EBITDA Shareholder Letter| Q4 and Fiscal Year 20206

Current Business Environment We continue to see increased demand for fixed broadband and anticipate further growth in net subscribers during Q1 FY2021, subject to geographic distribution of demand relative to capacity. It is clear there are significant growth opportunities for U.S. satellite broadband as school-from-home, work-from-home, video communications and over-the-top (OTT) video stress less capable terrestrial networks in challenging locations. We believe this affirms our focus on delivering valuable bandwidth services by maximizing space systems useful bandwidth to high demand geographic markets per unit of capital invested. Satellite TV net subscriber losses (somewhat driven by the absence of live sports), and rapid growth in OTT, reinforce the value of high bandwidth data plans to our customers. We believe high-speed, high-bandwidth data plans supporting more video should allow us to serve a larger portion of the consumer residential market, which is important for services growth aligned with our ViaSat-3 constellation. IFC is expected to remain significantly impacted until air travel recovers. Our FY2020 year-over-year IFC revenue growth benefited from terminal deliveries. FY2020 IFC service revenues were increasing and continued growth was expected to contribute to FY2021. We are working closely with our airline customers to manage the downturn while engaging in multiple growth opportunities. Several metrics, such as the Transportation Security Administration (TSA) daily traveler measurements below, indicate April 2020 likely was a floor for passenger traffic. We had been gaining market share steadily in North America, and our interactions with airlines suggest good opportunities to sustain, or improve, market share gains globally post crisis. Government Systems has seen delays in revenues for specific government customers adjusting to work-from-home restrictions. While these administrative delays inhibited Q4 FY2020 growth and are anticipated to continue into early FY2021, the net effect is expected to delay, versus decrease, those revenues. Core product and service demand remains strong, and we see several opportunities for significant new government initiatives. The diversity, and vertical integration, of our business is a distinctive strength. It provides maneuvering room during times of uncertainty. Still, we have taken key steps to manage our cost structure and prioritize investments while keeping strategic opportunities and long-term growth in sight. North American Narrow-Body TSA Daily Market Share1 Passenger Volumes Sep-19 29% 45% 17% 9% Sep-18 21% 52% 17% 10% Sep-17 16% 55% 19% 9% Sep-16 10% 58% 22% 10% 1-Mar 16-Mar 31-Mar 15-Apr 30-Apr 15-May 2020 2019 0% 20% 40% 60% 80% 100% (1) Viasat’s estimate of market size and market share using data from FlightGlobal Fleet Analyzer database, publicly filed documents, earnings call transcripts, press releases, industry announcements and Viasat management estimates. Shareholder Letter | Q4 and Fiscal Year 2020 7

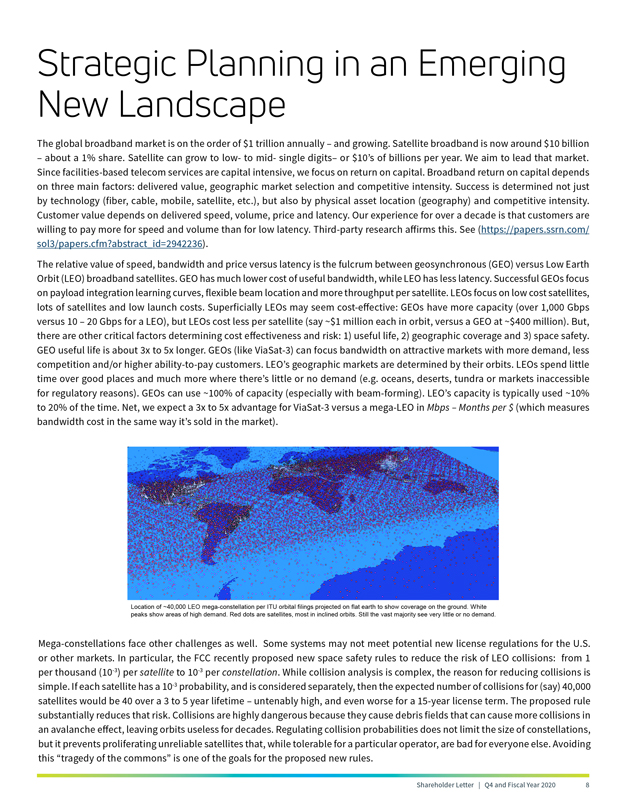

Strategic Planning in an Emerging New Landscape The global broadband market is on the order of $1 trillion annually – and growing. Satellite broadband is now around $10 billion – about a 1% share. Satellite can grow to low- to mid- single digits– or $10’s of billions per year. We aim to lead that market. Since facilities-based telecom services are capital intensive, we focus on return on capital. Broadband return on capital depends on three main factors: delivered value, geographic market selection and competitive intensity. Success is determined not just by technology (fiber, cable, mobile, satellite, etc.), but also by physical asset location (geography) and competitive intensity. Customer value depends on delivered speed, volume, price and latency. Our experience for over a decade is that customers are willing to pay more for speed and volume than for low latency. Third-party research affirms this. See (https://papers.ssrn.com/ sol3/papers.cfm?abstract_id=2942236). The relative value of speed, bandwidth and price versus latency is the fulcrum between geosynchronous (GEO) versus Low Earth Orbit (LEO) broadband satellites. GEO has much lower cost of useful bandwidth, while LEO has less latency. Successful GEOs focus on payload integration learning curves, flexible beam location and more throughput per satellite. LEOs focus on low cost satellites, lots of satellites and low launch costs. Superficially LEOs may seem cost-effective: GEOs have more capacity (over 1,000 Gbps versus 10 – 20 Gbps for a LEO), but LEOs cost less per satellite (say ~$1 million each in orbit, versus a GEO at ~$400 million). But, there are other critical factors determining cost effectiveness and risk: 1) useful life, 2) geographic coverage and 3) space safety. GEO useful life is about 3x to 5x longer. GEOs (like ViaSat-3) can focus bandwidth on attractive markets with more demand, less competition and/or higher ability-to-pay customers. LEO’s geographic markets are determined by their orbits. LEOs spend little time over good places and much more where there’s little or no demand (e.g. oceans, deserts, tundra or markets inaccessible for regulatory reasons). GEOs can use ~100% of capacity (especially with beam-forming). LEO’s capacity is typically used ~10% to 20% of the time. Net, we expect a 3x to 5x advantage for ViaSat-3 versus a mega-LEO in Mbps – Months per $ (which measures bandwidth cost in the same way it’s sold in the market). Location of ~40,000 LEO mega-constellation per ITU orbital filings projected on flat earth to show coverage on the ground. White peaks show areas of high demand. Red dots are satellites, most in inclined orbits. Still the vast majority see very little or no demand.Mega-constellations face other challenges as well. Some systems may not meet potential new license regulations for the U.S. or other markets. In particular, the FCC recently proposed new space safety rules to reduce the risk of LEO collisions: from 1 per thousand (10-3) per satellite to 10-3 per constellation. While collision analysis is complex, the reason for reducing collisions is simple. If each satellite has a 10-3 probability, and is considered separately, then the expected number of collisions for (say) 40,000 satellites would be 40 over a 3 to 5 year lifetime – untenably high, and even worse for a 15-year license term. The proposed rule substantially reduces that risk. Collisions are highly dangerous because they cause debris fields that can cause more collisions in an avalanche effect, leaving orbits useless for decades. Regulating collision probabilities does not limit the size of constellations, but it prevents proliferating unreliable satellites that, while tolerable for a particular operator, are bad for everyone else. Avoiding this “tragedy of the commons” is one of the goals for the proposed new rules. Shareholder Letter | Q4 and Fiscal Year 2020 8

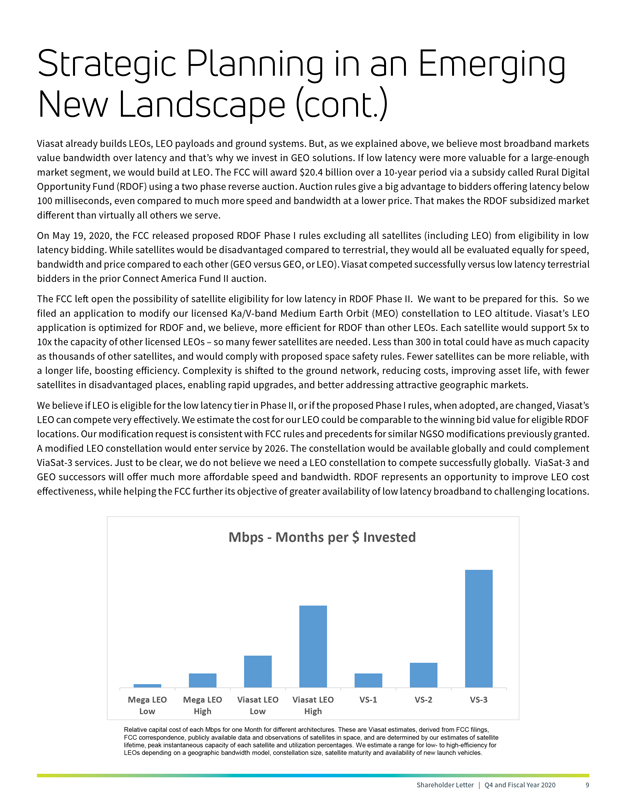

Strategic Planning in an Emerging New Landscape (cont.) Viasat already builds LEOs, LEO payloads and ground systems. But, as we explained above, we believe most broadband markets value bandwidth over latency and that’s why we invest in GEO solutions. If low latency were more valuable for a large-enough market segment, we would build at LEO. The FCC will award $20.4 billion over a 10-year period via a subsidy called Rural Digital Opportunity Fund (RDOF) using a two phase reverse auction. Auction rules give a big advantage to bidders offering latency below 100 milliseconds, even compared to much more speed and bandwidth at a lower price. That makes the RDOF subsidized market different than virtually all others we serve. On May 19, 2020, the FCC released proposed RDOF Phase I rules excluding all satellites (including LEO) from eligibility in low latency bidding. While satellites would be disadvantaged compared to terrestrial, they would all be evaluated equally for speed, bandwidth and price compared to each other (GEO versus GEO, or LEO). Viasat competed successfully versus low latency terrestrial bidders in the prior Connect America Fund II auction. The FCC left open the possibility of satellite eligibility for low latency in RDOF Phase II. We want to be prepared for this. So we filed an application to modify our licensed Ka/V-band Medium Earth Orbit (MEO) constellation to LEO altitude. Viasat’s LEO application is optimized for RDOF and, we believe, more efficient for RDOF than other LEOs. Each satellite would support 5x to 10x the capacity of other licensed LEOs – so many fewer satellites are needed. Less than 300 in total could have as much capacity as thousands of other satellites, and would comply with proposed space safety rules. Fewer satellites can be more reliable, with a longer life, boosting efficiency. Complexity is shifted to the ground network, reducing costs, improving asset life, with fewer satellites in disadvantaged places, enabling rapid upgrades, and better addressing attractive geographic markets. We believe if LEO is eligible for the low latency tier in Phase II, or if the proposed Phase I rules, when adopted, are changed, Viasat’s LEO can compete very effectively. We estimate the cost for our LEO could be comparable to the winning bid value for eligible RDOF locations. Our modification request is consistent with FCC rules and precedents for similar NGSO modifications previously granted. A modified LEO constellation would enter service by 2026. The constellation would be available globally and could complement ViaSat-3 services. Just to be clear, we do not believe we need a LEO constellation to compete successfully globally. ViaSat-3 and GEO successors will offer much more affordable speed and bandwidth. RDOF represents an opportunity to improve LEO cost effectiveness, while helping the FCC further its objective of greater availability of low latency broadband to challenging locations. Mbps—Months per $ Invested Mega LEO Mega LEO Viasat LEO Viasat LEO VS-1 VS-2 VS-3 Low High Low High Relative capital cost of each Mbps for one Month for different architectures. These are Viasat estimates, derived from FCC filings, FCC correspondence, publicly available data and observations of satellites in space, and are determined by our estimates of satellite lifetime, peak instantaneous capacity of each satellite and utilization percentages. We estimate a range for low- to high-efficiency for LEOs depending on a geographic bandwidth model, constellation size, satellite maturity and availability of new launch vehicles. Shareholder Letter | Q4 and Fiscal Year 2020 9

FY2021 Priorities and Outlook › We remain focused on the ViaSat-3 (Americas) satellite first flight, as well as advancing progress on the ViaSat-3 global constellation as a whole › We believe the value of our diverse, resilient business portfolio will be reinforced in FY2021, with anticipated strength in residential and government sales; however, we expect continued IFC weakness resulting from the COVID-19 crisis will likely inhibit revenue growth in FY2021 › We expect our broadband portfolio to remain attractive post crisis – and anticipate increasing demand for our broadband services, globally › We continue to see attractive domestic and global IFC opportunities, and will remain in active pursuit of critical airline wins › Cost reduction actions already taken in FY2020 should offset much, but not all, of margin impacts of anticipated IFC revenue weakness; current plans support Adjusted EBITDA growth for FY2021 › We are vigilant to new risks, and will maintain financial prudence in both ongoing expenses and capital investments as necessary › Our liquidity is expected to be solid, but moderating Adjusted EBITDA growth will likely result in net leverage near the higher end of our target range › We see multiple potential strategic growth opportunities and intend to preserve maneuvering room for economically-attractive ones, which includes evaluating success-based investments aligned with attractive global expansion This is a time of major landscape shifts in satellite and broadband connectivity. We’re seeing financial pressures on both traditional GEO operators and non-GEO orbit ventures, and we believe we’re in a position of competitive advantage across commercial and government markets. Our team has weathered previous downturns. We can survive, thrive and seize opportunities to accelerate growth as events permit. On behalf of everyone on the Viasat team, I want to thank our shareholders, customers, partners and employees for their continued support, and we look forward to keeping you posted on our progress. Sicerly Future 1000 Mark Dangberk Shareholder Letter | Q4 and Fiscal Year 2020 10

Forward Looking Statements This presentation contains forward-looking statements that are subject to the safe harbors created under the Securities Act of 1933 and the Securities Exchange Act of 1934. Forward-looking statements include, among others, statements that refer to the impact of the novel coronavirus (COVID-19) pandemic on our business and expectations of demand, market share and strategic opportunities post-crisis; projections of earnings, revenue, costs, Adjusted EBITDA, liquidity, net leverage ratio or other financial items; resilience of our business portfolio in FY2021 and future years; anticipated growth, opportunities and trends in our business or key markets; future economic conditions and performance; the development, customer acceptance and anticipated performance of technologies, products or services; satellite construction and launch activities, including progress and timing of construction and launch of our ViaSat-3 satellites; the performance and anticipated benefits of our ViaSat-3 class satellites; the expected completion, capacity, service, coverage, service speeds and other features of our satellites, and the timing, cost, economics and other benefits associated therewith; potential RDOF and LEO satellite opportunities; anticipated subscriber growth; plans, objectives and strategies for future operations; domestic and global IFC opportunities and future airline wins; and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. Factors that could cause actual results to differ materially and adversely include: our ability to realize the anticipated benefits of the ViaSat-2 and ViaSat-3 class satellites and any future satellite we may construct or acquire; unexpected expenses related to our satellite projects; our ability to successfully implement our business plan for our broadband services on our anticipated timeline or at all; risks associated with the construction, launch and operation of satellites, including the effect of any anomaly, operational failure or degradation in satellite performance; the impact of the COVID-19 pandemic on our business, suppliers, consumers, customers, and employees or the overall economy; our ability to realize the anticipated benefits of our acquisitions or strategic partnering arrangements; our ability to successfully develop, introduce and sell new technologies, products and services; audits by the U.S. government; changes in the global business environment and economic conditions; delays in approving U.S. government budgets and cuts in government defense expenditures; our reliance on U.S. government contracts, and on a small number of contracts which account for a significant percentage of our revenues; reduced demand for products and services as a result of continued constraints on capital spending by customers; changes in relationships with, or the financial condition of, key customers or suppliers; our reliance on a limited number of third parties to manufacture and supply our products; increased competition; introduction of new technologies and other factors affecting the communications and defense industries generally; the effect of adverse regulatory changes (including changes affecting spectrum availability or permitted uses) on our ability to sell or deploy our products and services; changes in the way others use spectrum; our inability to access additional spectrum, use spectrum for additional purposes, and/or operate satellites at additional orbital locations; competing uses of the same spectrum or orbital locations that we utilize or seek to utilize; the effect of recent changes to U.S. tax laws; our level of indebtedness and ability to comply with applicable debt covenants; our involvement in litigation, including intellectual property claims and litigation to protect our proprietary technology; and our dependence on a limited number of key employees. In addition, please refer to the risk factors contained in our SEC filings available at www.sec.gov, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements for any reason. Use of Non-GAAP Financial Information To supplement Viasat’s consolidated financial statements presented in accordance with generally accepted accounting principles (GAAP), Viasat uses non-GAAP net income (loss) attributable to Viasat Inc. and Adjusted EBITDA, measures Viasat believes are appropriate to enhance an overall understanding of Viasat’s past financial performance and prospects for the future. We believe the non-GAAP results provide useful information to both management and investors by excluding specific expenses that we believe are not indicative of our core operating results. In addition, since we have historically reported non-GAAP results to the investment community, we believe the inclusion of non-GAAP numbers provides consistency in our financial reporting and facilitates comparisons to the Company’s historical operating results. Further, these non-GAAP results are among the primary indicators that management uses as a basis for evaluating the operating performance of our segments, allocating resources to such segments, planning and forecasting in future periods. The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP. A reconciliation of specific adjustments to GAAP results is provided in the tables below. Copyright © 2020 Viasat, Inc. All rights reserved. Viasat, the Viasat logo and the Viasat signal are registered trademarks of Viasat, Inc. All other product or company names mentioned are used for identification purposes only and may be trademarks of their respective owners. Shareholder Letter | Q4 and Fiscal Year 2020 11

Viasat Fourth Quarter and Fiscal Year 2020 Results

| Financial Results |

||||||||||||

| (In millions, except per share data) | Q4 FY20 | Q4 FY19 | Year-Over- Year Change |

FY20 | FY19 | Year-Over- Year Change | ||||||

|

Revenues |

$591.7 | $557.2 | 6% | $2,309.2 | $2,068.3 | 12% | ||||||

|

Net income (loss)1 |

$1.6 | $2.5 | (37)% | ($0.2) | ($67.6) | (100)% | ||||||

|

Non-GAAP net income1 |

$20.0 | $20.4 | (2)% | $72.0 | $0.9 | 8038% | ||||||

|

Adjusted EBITDA |

$120.3 | $108.3 | 11% | $457.6 | $339.4 | 35% | ||||||

|

Diluted per share net income (loss)1 |

$0.03 | $0.04 | (25)% | ($0.00) | ($1.13) | (100)% | ||||||

|

Non-GAAP diluted per share net income1,2 |

$0.32 | $0.33 | (3)% | $1.14 | $0.01 | 11300% | ||||||

|

Fully diluted weighted average shares2 |

63.1 | 61.4 | 3% | 61.6 | 59.9 | 5% | ||||||

|

New contract awards3 |

$551.6 | $612.3 | (10)% | $2,327.1 | $2,369.2 | (2)% | ||||||

|

Sales backlog4 |

$1,870.7 | $1,866.3 | 0% | $1,870.7 | $1,866.3 | 0% | ||||||

| Segment Results |

||||||||||||

| (In millions) | Q4 FY20 | Q4 FY19 | Year-Over- Year Change |

FY20 | FY19 |

Year-Over- Year Change | ||||||

|

Satellite Services |

||||||||||||

|

New contract awards3 |

$211.4 | $189.6 | 11% | $826.7 | $693.2 | 19% | ||||||

|

Revenues |

$212.4 | $190.0 | 12% | $826.6 | $684.2 | 21% | ||||||

|

Operating profit (loss)5 |

$0.4 | $0.7 | (44)% | $7.0 | ($64.3) | * | ||||||

|

Adjusted EBITDA |

$70.1 | $65.2 | 8% | $283.0 | $196.1 | 44% | ||||||

|

Commercial Networks |

||||||||||||

|

New contract awards |

$124.6 | $95.8 | 30% | $419.9 | $440.5 | (5)% | ||||||

|

Revenues |

$92.8 | $91.8 | 1% | $344.6 | $428.4 | (20)% | ||||||

|

Operating loss5 |

($43.3) | ($49.2) | (12)% | ($186.9) | ($166.6) | 12% | ||||||

|

Adjusted EBITDA |

($26.9) | ($34.3) | (21)% | ($124.5) | ($108.6) | 15% | ||||||

|

Government Systems |

||||||||||||

|

New contract awards |

$215.6 | $326.9 | (34)% | $1,080.5 | $1,235.5 | (13)% | ||||||

|

Revenues |

$286.6 | $275.3 | 4% | $1,138.1 | $955.6 | 19% | ||||||

|

Operating profit5 |

$58.7 | $60.2 | (3)% | $225.9 | $180.0 | 26% | ||||||

|

Adjusted EBITDA |

$77.1 | $77.3 | 0% | $299.0 | $252.0 | 19% | ||||||

| 1 | Attributable to Viasat, Inc. common stockholders. |

| 2 | As the fiscal years ended March 31, 2020 and 2019 financial information resulted in a net loss, the weighted average number of shares used to calculate basic and diluted net loss per share is the same, as diluted shares would be anti-dilutive. However, as the non-GAAP financial information for the fiscal year ended March 31, 2020 resulted in non-GAAP net income, 63.0 million diluted weighted average number of shares were used instead to calculate non-GAAP diluted net income per share. |

| 3 | Awards exclude future revenue under recurring consumer commitment arrangements. |

| 4 | Amounts include certain backlog adjustments due to contract changes and amendments. Our backlog includes contracts with subscribers for fixed broadband services in our satellite services segment. Backlog does not include anticipated purchase orders and requests for the installation of in-flight connectivity systems or future recurring in-flight internet service revenues under our commercial in-flight internet agreements in our Commercial Networks and Satellite Services segments, respectively. |

| 5 | Before corporate and amortization of acquired intangible assets. |

| * | Percentage not meaningful. |

Shareholder Letter | Q4 and Fiscal Year 2020 12

Viasat Fourth Quarter and Fiscal Year 2020 Results (cont.)

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share data)

| Three months ended | Twelve months ended | |||||||||||||||

| March 31, 2020 | March 31, 2019 | March 31, 2020 | March 31, 2019 | |||||||||||||

| Revenues: | ||||||||||||||||

| Product revenues | $ | 299,006 | $ | 292,262 | $ | 1,172,541 | $ | 1,092,691 | ||||||||

| Service revenues | 292,715 | 264,959 | 1,136,697 | 975,567 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues | 591,721 | 557,221 | 2,309,238 | 2,068,258 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of product revenues | 211,644 | 218,104 | 845,757 | 834,472 | ||||||||||||

| Cost of service revenues | 199,255 | 179,901 | 763,930 | 703,249 | ||||||||||||

| Selling, general and administrative | 134,557 | 118,130 | 523,085 | 458,458 | ||||||||||||

| Independent research and development | 30,482 | 29,383 | 130,434 | 123,044 | ||||||||||||

| Amortization of acquired intangible assets | 1,691 | 2,280 | 7,611 | 9,655 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations | 14,092 | 9,423 | 38,421 | (60,620) | ||||||||||||

| Interest expense, net | (8,520) | (9,663) | (36,993) | (49,861) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes | 5,572 | (240) | 1,428 | (110,481) | ||||||||||||

| (Provision for) benefit from income taxes | (816) | 5,335 | 7,915 | 41,014 | ||||||||||||

| Equity in income of unconsolidated affiliate, net | 142 | 268 | 4,470 | 2,998 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) | 4,898 | 5,363 | 13,813 | (66,469) | ||||||||||||

| Less: net income attributable to noncontrolling interests, net of tax |

3,312 | 2,848 | 14,025 | 1,154 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to Viasat Inc. | $ | 1,586 | $ | 2,515 | $ | (212) | $ | (67,623) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted net income (loss) per share attributable to Viasat Inc. common stockholders |

$ | 0.03 | $ | 0.04 | $ | (0.00) | $ | (1.13) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted common equivalent shares (2) | 63,090 | 61,356 | 61,632 | 59,942 | ||||||||||||

| AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO VIASAT INC. |

|

|||||||||||||||

| ON A GAAP BASIS AND NON-GAAP BASIS IS AS FOLLOWS: |

|

|||||||||||||||

| (In thousands, except per share data) | Three months ended | Twelve months ended | ||||||||||||||

| March 31, 2020 | March 31, 2019 | March 31, 2020 | March 31, 2019 | |||||||||||||

| GAAP net income (loss) attributable to Viasat Inc. | $ | 1,586 | $ | 2,515 | $ | (212) | $ | (67,623) | ||||||||

| Amortization of acquired intangible assets | 1,691 | 2,280 | 7,611 | 9,655 | ||||||||||||

| Stock-based compensation expense | 22,317 | 20,941 | 86,553 | 79,599 | ||||||||||||

| Income tax effect (1) | (5,610) | (5,353) | (21,930) | (20,746) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP net income attributable to Viasat Inc. | $ | 19,984 | $ | 20,383 | $ | 72,022 | $ | 885 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP diluted net income per share attributable to Viasat Inc. common stockholders |

$ | 0.32 | $ | 0.33 | $ | 1.14 | $ | 0.01 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted common equivalent shares (2) | 63,090 | 61,356 | 63,021 | 59,942 | ||||||||||||

| (1) | The income tax effect is calculated using the tax rate applicable for the non-GAAP adjustments. |

| (2) | As the fiscal years ended March 31, 2020 and 2019 financial information resulted in a net loss, the weighted average number of shares used to calculate basic and diluted net loss per share is the same, as diluted shares would be anti-dilutive. However, as the non-GAAP financial information for the fiscal year ended March 31, 2020 resulted in non-GAAP net income, diluted weighted average number of shares were used instead to calculate non-GAAP diluted net income per share. |

AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO VIASAT INC.

AND ADJUSTED EBITDA IS AS FOLLOWS:

| (In thousands) | Three months ended | Twelve months ended | ||||||||||||||

| March 31, 2020 | March 31, 2019 | March 31, 2020 | March 31, 2019 | |||||||||||||

| GAAP net income (loss) attributable to Viasat Inc. | $ | 1,586 | $ | 2,515 | $ | (212) | $ | (67,623) | ||||||||

| Provision for (benefit from) income taxes | 816 | (5,335) | (7,915) | (41,014) | ||||||||||||

| Interest expense, net | 8,520 | 9,663 | 36,993 | 49,861 | ||||||||||||

| Depreciation and amortization | 87,069 | 80,508 | 342,178 | 318,613 | ||||||||||||

| Stock-based compensation expense | 22,317 | 20,941 | 86,553 | 79,599 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA | $ | 120,308 | $ | 108,292 | $ | 457,597 | $ | 339,436 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Shareholder Letter | Q4 and Fiscal Year 2020 13

Viasat Fourth Quarter and Fiscal Year 2020 Results (cont.)

AN ITEMIZED RECONCILIATION BETWEEN NET INCOME (LOSS) ATTRIBUTABLE TO VIASAT INC.

AND ADJUSTED EBITDA IS AS FOLLOWS:

| (In thousands) | Three months ended | Twelve months ended | ||||||||||||||

| December 31, 2019 | March 31, 2018 | March 31, 2017 | March 31, 2016 | |||||||||||||

| GAAP net income (loss) attributable to Viasat Inc. | $ | 6,476 | $ | (67,305) | $ | 23,767 | $ | 21,741 | ||||||||

| (Benefit from) provision for income taxes | (3,911) | (35,217) | 3,617 | (4,173) | ||||||||||||

| Interest expense, net | 9,097 | 3,066 | 11,075 | 23,522 | ||||||||||||

| Depreciation and amortization | 88,759 | 255,652 | 245,922 | 242,076 | ||||||||||||

| Stock-based compensation expense | 21,908 | 68,545 | 55,775 | 47,510 | ||||||||||||

| Loss on extinguishment of debt | - | 10,217 | - | - | ||||||||||||

| Acquisition related expenses | - | - | 615 | - | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA | $ | 122,329 | $ | 234,958 | $ | 340,771 | $ | 330,676 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

AN ITEMIZED RECONCILIATION BETWEEN SEGMENT OPERATING PROFIT (LOSS) BEFORE

CORPORATE AND AMORTIZATION OF ACQUIRED INTANGIBLE ASSETS AND ADJUSTED EBITDA IS AS FOLLOWS:

(In thousands)

| Three months ended March 31, 2020 | Three months ended March 31, 2019 | |||||||||||||||||||||||||||||||

| Satellite Services |

Commercial Networks |

Government Systems |

Total | Satellite Services |

Commercial Networks |

Government Systems |

Total | |||||||||||||||||||||||||

| Segment operating profit (loss) before corporate and amortization of acquired intangible assets |

$ | 367 | $ | (43,318) | $ | 58,734 | $ | 15,783 | $ | 650 | $ | (49,189) | $ | 60,242 | $ | 11,703 | ||||||||||||||||

| Depreciation (3) | 54,915 | 6,419 | 10,449 | 71,783 | 50,439 | 6,140 | 10,148 | 66,727 | ||||||||||||||||||||||||

| Stock-based compensation expense | 6,737 | 8,013 | 7,567 | 22,317 | 6,460 | 7,071 | 7,410 | 20,941 | ||||||||||||||||||||||||

| Other amortization | 7,984 | 1,977 | 3,634 | 13,595 | 7,429 | 1,720 | 2,352 | 11,501 | ||||||||||||||||||||||||

| Equity in income of unconsolidated affiliate, net | 142 | - | - | 142 | 268 | - | - | 268 | ||||||||||||||||||||||||

| Noncontrolling interests | - | - | (3,312) | (3,312) | - | - | (2,848) | (2,848) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Adjusted EBITDA | $ | 70,145 | $ | (26,909) | $ | 77,072 | $ | 120,308 | $ | 65,246 | $ | (34,258) | $ | 77,304 | $ | 108,292 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Twelve months ended March 31, 2020 | Twelve months ended March 31, 2019 | |||||||||||||||||||||||||||||||

| Satellite Services |

Commercial Networks |

Government Systems |

Total | Satellite Services |

Commercial Networks |

Government Systems |

Total | |||||||||||||||||||||||||

| Segment operating profit (loss) before corporate and amortization of acquired intangible assets | $ | 7,015 | $ | (186,877) | $ | 225,894 | $ | 46,032 | $ | (64,321) | $ | (166,613) | $ | 179,969 | $ | (50,965) | ||||||||||||||||

| Depreciation (3) | 213,616 | 24,489 | 41,628 | 279,733 | 202,332 | 22,798 | 37,159 | 262,289 | ||||||||||||||||||||||||

| Stock-based compensation expense | 26,260 | 30,309 | 29,984 | 86,553 | 23,736 | 27,777 | 28,086 | 79,599 | ||||||||||||||||||||||||

| Other amortization | 31,675 | 7,618 | 15,541 | 54,834 | 29,037 | 7,436 | 10,196 | 46,669 | ||||||||||||||||||||||||

| Equity in income of unconsolidated affiliate, net | 4,470 | - | - | 4,470 | 2,998 | - | - | 2,998 | ||||||||||||||||||||||||

| Noncontrolling interests | - | - | (14,025) | (14,025) | 2,269 | - | (3,423) | (1,154) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Adjusted EBITDA | $ | 283,036 | $ | (124,461) | $ | 299,022 | $ | 457,597 | $ | 196,051 | $ | (108,602) | $ | 251,987 | $ | 339,436 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (3) | Depreciation expenses not specifically recorded in a particular segment have been allocated based on other indirect allocable costs, which management believes is a reasonable method. |

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

| As of | As of | As of | As of | |||||||||||||||

| Assets | March 31, 2020 | March 31, 2019 | Liabilities and Equity | March 1, 2020 | March 31, 2019 | |||||||||||||

| Current assets: | Current liabilities: | |||||||||||||||||

| Cash and cash equivalents | $ | 304,309 | $ | 261,701 | Accounts payable | $ | 183,601 | $ | 157,275 | |||||||||

| Accounts receivable, net | 330,698 | 300,307 | Accrued and other liabilities (4) | 391,190 | 308,268 | |||||||||||||

| Inventories | 294,416 | 234,518 | Current portion of long-term debt | 29,788 | 19,937 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| Prepaid expenses and other current assets |

116,281 | 90,646 | Total current liabilities | 604,579 | 485,480 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| Total current assets | 1,045,704 | 887,172 | ||||||||||||||||

| Senior notes | 1,285,497 | 1,282,898 | ||||||||||||||||

| Other long-term debt | 536,166 | 110,005 | ||||||||||||||||

| Non-current operating lease liabilities (4) |

286,550 | - | ||||||||||||||||

| Property, equipment and satellites, net | 2,586,735 | 2,125,290 | Other liabilities | 120,934 | 120,826 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| Operating lease right-of-use assets (4) | 308,441 | - | Total liabilities | 2,833,726 | 1,999,209 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| Other acquired intangible assets, net | 14,439 | 22,301 | Total Viasat Inc. stockholders’ equity |

2,027,787 | 1,907,748 | |||||||||||||

| Goodwill | 121,197 | 121,719 | Noncontrolling interest in subsidiary |

22,355 | 8,330 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| Other assets | 807,352 | 758,805 | Total equity | 2,050,142 | 1,916,078 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets | $ | 4,883,868 | $ | 3,915,287 | Total liabilities and equity | $ | 4,883,868 | $ | 3,915,287 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

(4) The balances as of March 31, 2020 reflect the Company’s adoption of Accounting Standards Update 2016-02, Leases, commonly referred to as ASC 842.

Shareholder Letter | Q4 and Fiscal Year 2020 14