Form 6-K RIO TINTO LTD For: Apr 30 Filed by: RIO TINTO PLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Month of April 2020

| Commission file number: 001-10533 | Commission file number: 001-34121 | ||||

| Rio Tinto plc | Rio Tinto Limited | ||||

| ABN 96 004 458 404 | |||||

| (Translation of registrant’s name into English) | (Translation of registrant’s name into English) | ||||

| 6 St. James’s Square | Level 7, 360 Collins Street | ||||

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia | ||||

| (Address of principal executive offices) | (Address of principal executive offices) | ||||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If "Yes" is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82- ________

EXHIBIT 99

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorised.

| Rio Tinto plc | Rio Tinto Limited | ||||||||||

| (Registrant) | (Registrant) | ||||||||||

| By | /s/ Steve Allen | By | /s/ Steve Allen | ||||||||

| Name | Steve Allen | Name | Steve Allen | ||||||||

| Title | Company Secretary | Title | Joint Company Secretary | ||||||||

| Date | 1 May 2020 | Date | 1 May 2020 | ||||||||

Exhibit 99.1

Notice to ASX/LSE

Total voting rights and issued capital

1 April 2020

In accordance with the Financial Conduct Authority’s (FCA) Disclosure Guidance and Transparency Rule 5.6.1R, Rio Tinto plc notifies the market that as of 31 March 2020:

1.Rio Tinto plc’s issued share capital comprised 1,255,726,174 Ordinary shares of 10p each, each with one vote.

2.9,046,354 Ordinary shares of 10p each are held in treasury. These shares are not taken into consideration in relation to the payment of dividends and voting at shareholder meetings.

Accordingly the total number of voting rights in Rio Tinto plc is 1,246,679,820. This figure may be used by shareholders (and others with notification obligations) as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, Rio Tinto plc under the FCA’s Disclosure Guidance and Transparency Rules.

Note:

As at the date of this announcement:

(a)Rio Tinto plc has also issued one Special Voting Share of 10p and one DLC Dividend Share of 10p in connection with its dual listed companies (‘DLC’) merger with Rio Tinto Limited which was designed to place the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both companies;

(b)the Special Voting Share facilitates joint voting by shareholders of Rio Tinto plc and Rio Tinto Limited on joint electorate resolutions; and

(c)there are 371,216,214 publicly held Rio Tinto Limited shares in issue which do not form part of the share capital of Rio Tinto plc.

LEI: 213800YOEO5OQ72G2R82

Classification: 2.5 Total number of voting rights and capital disclosed under article 15 of the Transparency Directive

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Steve Allen Group Company Secretary | |||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2058 Registered in England No. 719885 | |||||

Exhibit 99.2

Media release

8 April 2020

Rio Tinto discloses details of the $7.6 billion taxes paid in 2019

Rio Tinto paid $7.6 billion in taxes and royalties globally in 2019, including $4.8 billion of corporate tax, as detailed in its latest Taxes paid report, published today.

The majority of its taxes were paid in Australia ($6.2 billion), home to the largest part of Rio Tinto’s business. The company also made significant payments in Chile ($311 million), Mongolia ($305 million), Canada ($291million), United States ($178 million), the United Kingdom ($117 million) and South Africa ($80 million).

The report also outlines the $45.1 billion direct economic contribution Rio Tinto made in 2019 to the countries and communities where it operates, taking the company’s direct economic contribution since 2015 to $210 billion.

Rio Tinto chief financial officer Jakob Stausholm said “Our business, including the taxes and royalties we pay, play a critical role in the overall economic health and development of the regions where we operate.

“The funds we provide to governments and communities support the basic infrastructure of society – bridges and roads, schools and hospitals – as well as other local development priorities, like job creation and skills training. Being transparent about where these payments go helps our stakeholders better understand how these funds may be used.”

A decade ago Rio Tinto became the first company in the resources industry to voluntarily disclose its payments to governments in detail, and has continued to report on taxes and royalties paid, and economic contribution, in increasing detail ever since. Over that period, Rio Tinto has paid over $70 billion in taxes and royalties to governments around the world, including $52 billion paid in Australia.

This year, consistent with Rio Tinto’s commitment to building on transparency about its economic contribution, the company has for the first time released comprehensive financial and tax related disclosures for each country in which it operates. The company’s 2018 Country by Country report can be found on our website.

Rio Tinto is a founding member of the Extractive Industries Transparency Initiative and a signatory to the B Team Tax Principles, a not-for-profit initiative formed by a group of cross-sector, cross-regional companies to help define what leadership in responsible tax looks like.

Contacts

media.enquiries@riotinto.com

riotinto.com

Follow @RioTinto on Twitter

Media Relations, United Kingdom Illtud Harri M +44 7920 503 600 David Outhwaite T +44 20 7781 1623 M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 | Media Relations, Australia Jonathan Rose T +61 3 9283 3088 M +61 447 028 913 Matt Chambers T +61 3 9283 3087 M +61 433 525 739 Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412 | ||||

Investor Relations, United Kingdom Menno Sanderse T: +44 20 7781 1517 M: +44 7825 195 178 David Ovington T +44 20 7781 2051 M +44 7920 010 978 | Investor Relations, Australia Natalie Worley T +61 3 9283 3063 M +61 409 210 462 Amar Jambaa T +61 3 9283 3627 M +61 4 7286 5948 | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

LEGAL INFORMATION © 2020 Rio Tinto. This email is for internal use only and contains information that is strictly confidential and proprietary to the Rio Tinto Group. The contents of this email are intended only for use within the Rio Tinto Group and any unauthorised access, use, copying or distribution by or to persons outside the Rio Tinto Group is strictly prohibited.

Exhibit 99.3

Notice to ASX/LSE

Notice of dividend currency exchange rates – 2019 final dividend

8 April 2020

On 26 February 2020, Rio Tinto announced a final dividend of 231.00 US cents per share for the full year ending 31 December 2019, with Rio Tinto Limited shareholders to be paid 349.74 Australian cents per ordinary share and Rio Tinto plc shareholders to be paid 177.47 pence per ordinary share.

American Depositary Receipt (ADR) holders receive dividends in US dollars as announced on 26 February 2020.

The currency exchange rates which apply for Rio Tinto Limited shareholders who elect to receive the final dividend in pounds sterling and Rio Tinto plc shareholders who elect to receive the final dividend in Australian dollars are the currency exchange rates applicable on 7 April 2020, being five business days prior to the dividend payment date.

This announcement confirms the currency exchange rates applicable for the 2019 final dividend for shareholders who have made a currency election:

Declared 2019 final dividend | Exchange rate | Dividend per share following currency election | ||||||

| 349.74 Australian cents | 0.50212 | 175.61 British pence | ||||||

| 177.47 British pence | 1.99155 | 353.44 Australian cents | ||||||

The final dividend will be paid to shareholders of Rio Tinto Limited and Rio Tinto plc and to ADR holders on 16 April 2020.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to be disclosed under the laws of a Member State

Page 1 of 2

Contacts

media.enquiries@riotinto.com

riotinto.com

Follow @RioTinto on Twitter

Media Relations, United Kingdom Illtud Harri M +44 7920 503 600 David Outhwaite T +44 20 7781 1623 M +44 7787 597 493 Media Relations, Americas Matthew Klar T +1 514 608 4429 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 | Media Relations, Australia Jonathan Rose T +61 3 9283 3088 M +61 447 028 913 Matt Chambers T +61 3 9283 3087 M +61 433 525 739 Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412 | ||||

Investor Relations, United Kingdom Menno Sanderse T: +44 20 7781 1517 M: +44 7825 195 178 David Ovington T +44 20 7781 2051 M +44 7920 010 978 | Investor Relations, Australia Natalie Worley T +61 3 9283 3063 M +61 409 210 462 Amar Jambaa T +61 3 9283 3627 M +61 472 865 948 | ||||

Group Company Secretary Steve Allen Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Joint Company Secretary Tim Paine Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Page 2 of 2

Exhibit 99.4 Notice to ASX/LSE Climate and water seminar 20 April 2020 Attached is a presentation for the Climate and water seminar hosted by Rio Tinto’s Chief Executive, J-S Jacques, and including presentations from: • Jakob Stausholm, Chief Financial Officer; • Peter Toth, Head of Corporate Development; • Theresia Ott, Chief Advisor Environment; and • Nigel Steward, Head of Group Technical - Processing. The presentation slides are also available on our website (see link below), together with the pre-recorded audio presentation: https://www.riotinto.com/invest/presentations/2020/climate-water-seminar-2020. Page 1 of 2

Contacts [email protected] riotinto.com Follow @RioTinto on Twitter Media Relations, United Kingdom Media Relations, Australia Illtud Harri Jonathan Rose M +44 7920 503 600 T +61 3 9283 3088 M +61 447 028 913 David Outhwaite T +44 20 7781 1623 Matt Chambers M +44 7787 597 493 T +61 3 9283 3087 M +61 433 525 739 Media Relations, Americas Matthew Klar Jesse Riseborough T +1 514 608 4429 T +61 8 6211 6013 M +61 436 653 412 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 Investor Relations, United Kingdom Investor Relations, Australia Menno Sanderse Natalie Worley T: +44 20 7781 1517 T +61 3 9283 3063 M: +44 7825 195 178 M +61 409 210 462 David Ovington Amar Jambaa T +44 20 7781 2051 T +61 3 9283 3627 M +44 7920 010 978 M +61 472 865 948 Group Company Secretary Joint Company Secretary Steve Allen Tim Paine Rio Tinto plc Rio Tinto Limited 6 St James’s Square Level 7, 360 Collins Street London SW1Y 4AD Melbourne 3000 United Kingdom Australia T +44 20 7781 2000 T +61 3 9283 3333 Registered in England Registered in Australia No. 719885 ABN 96 004 458 404 This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary. Page 2 of 2

Our approach to climate and water 21 April 2020

Cautionary and supporting statements This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (“Rio Tinto”). By accessing / attending this presentation you acknowledge that you have read and understood the following statement. Forward-looking statements Disclaimer This document, including but not limited to all forward looking figures, contains certain forward-looking Neither this presentation, nor the question and answer session, nor any part thereof, may be recorded, statements with respect to the financial condition, results of operations and business of the Rio Tinto transcribed, distributed, published or reproduced in any form, except as permitted by Rio Tinto. By Group. These statements are forward-looking statements within the meaning of Section 27A of the US accessing/attending this presentation, you agree with the foregoing and, upon request, you will Securities Act of 1933, and Section 21E of the US Securities Exchange Act of 1934. The words promptly return any records or transcripts at the presentation without retaining any copies. “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, This presentation contains a number of non-IFRS financial measures. Rio Tinto management considers “target”, “set to” or similar expressions, commonly identify such forward-looking statements. these to be key financial performance indicators of the business and they are defined and/or reconciled Examples of forward-looking statements include those regarding estimated ore reserves, anticipated in Rio Tinto’s annual results press release and/or Annual report. production or construction dates, costs, outputs and productive lives of assets or similar factors. Reference to consensus figures are not based on Rio Tinto’s own opinions, estimates or forecasts and Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other are compiled and published without comment from, or endorsement or verification by, Rio Tinto. The factors set forth in this presentation. consensus figures do not necessarily reflect guidance provided from time to time by Rio Tinto where For example, future ore reserves will be based in part on market prices that may vary significantly from given in relation to equivalent metrics, which to the extent available can be found on the Rio Tinto current levels. These may materially affect the timing and feasibility of particular developments. Other website. factors include the ability to produce and transport products profitably, demand for our products, By referencing consensus figures, Rio Tinto does not imply that it endorses, confirms or expresses a changes to the assumptions regarding the recoverable value of our tangible and intangible assets, the view on the consensus figures. The consensus figures are provided for informational purposes only and effect of foreign currency exchange rates on market prices and operating costs, and activities by are not intended to, nor do they, constitute investment advice or any solicitation to buy, hold or sell governmental authorities, such as changes in taxation or regulation, and political uncertainty. securities or other financial instruments. No warranty or representation, either express or implied, is In light of these risks, uncertainties and assumptions, actual results could be materially different from made by Rio Tinto or its affiliates, or their respective directors, officers and employees, in relation to the projected future results expressed or implied by these forward-looking statements which speak only as accuracy, completeness or achievability of the consensus figures and, to the fullest extent permitted by to the date of this presentation. Except as required by applicable regulations or by law, the Rio Tinto law, no responsibility or liability is accepted by any of those persons in respect of those matters. Rio Group does not undertake any obligation to publicly update or revise any forward-looking statements, Tinto assumes no obligation to update, revise or supplement the consensus figures to reflect whether as a result of new information or future events. The Group cannot guarantee that its forward- circumstances existing after the date hereof. looking statements will not differ materially from actual results. In this presentation all figures are US dollars unless stated otherwise. 2 ©2020, Rio Tinto, All Rights Reserved

Our strategic approach J-S Jacques Chief Executive

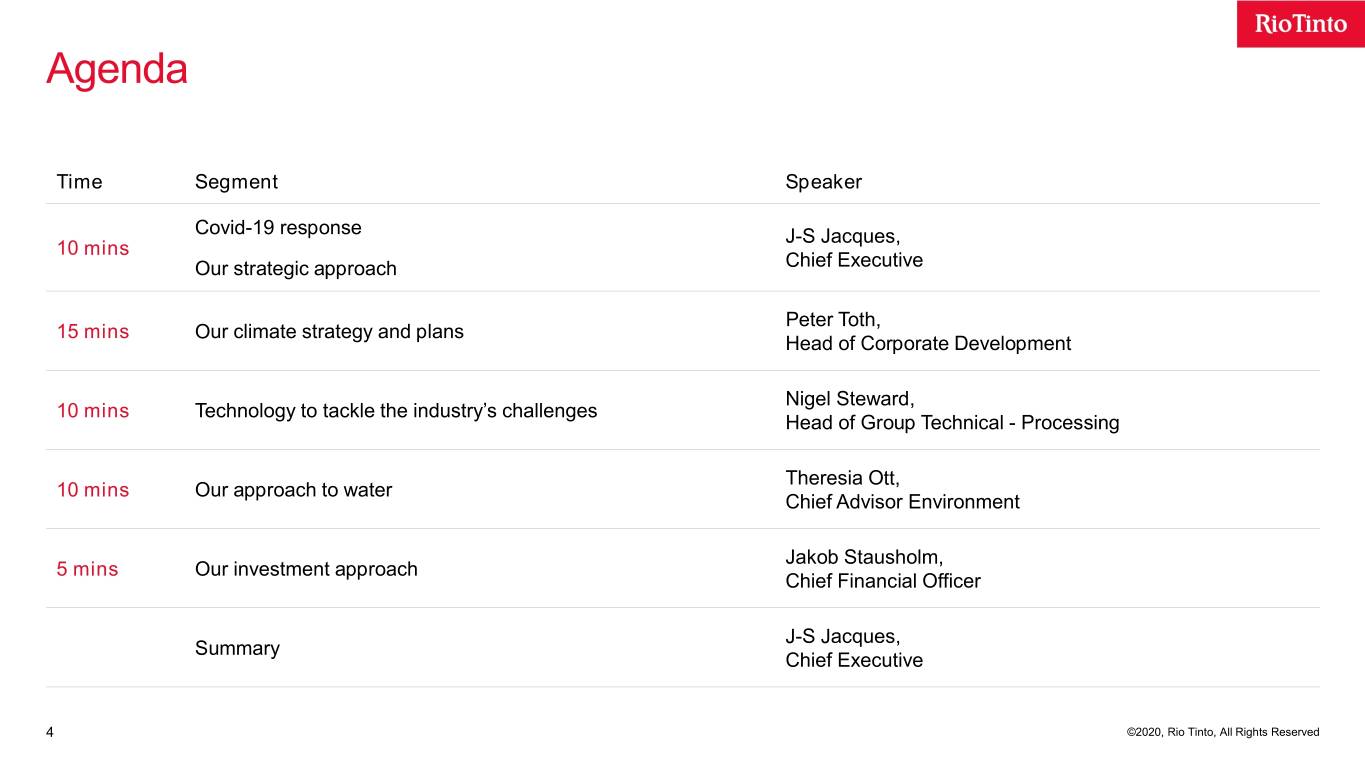

Agenda Time Segment Speaker Covid-19 response J-S Jacques, 10 mins Our strategic approach Chief Executive Peter Toth, 15 mins Our climate strategy and plans Head of Corporate Development Nigel Steward, 10 mins Technology to tackle the industry’s challenges Head of Group Technical - Processing Theresia Ott, 10 mins Our approach to water Chief Advisor Environment Jakob Stausholm, 5 mins Our investment approach Chief Financial Officer J-S Jacques, Summary Chief Executive 4 ©2020, Rio Tinto, All Rights Reserved

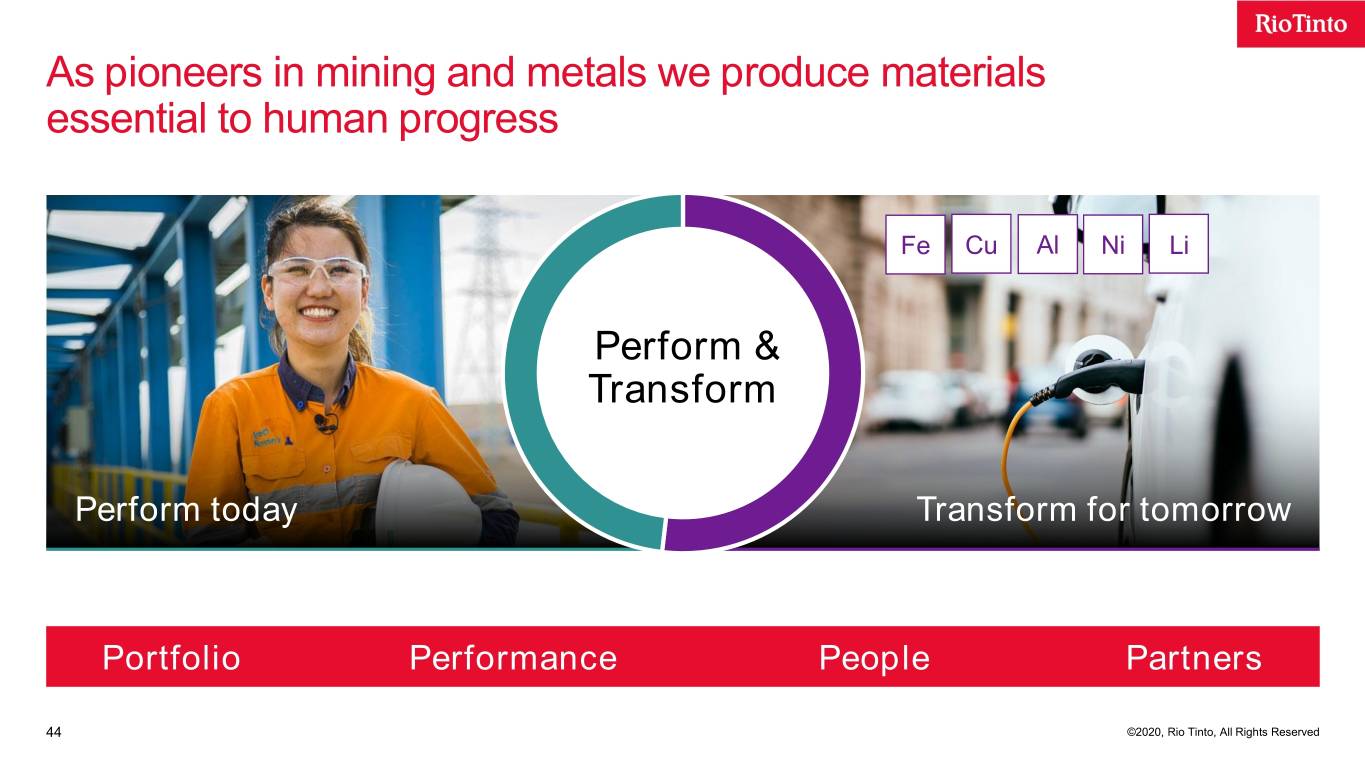

As pioneers in mining and metals we produce materials essential to human progress Fe Cu Al Ni Li Perform & Transform Perform today Transform for tomorrow Portfolio Performance People Partners 5 ©2020, Rio Tinto, All Rights Reserved

Navigating the impact of Covid-19 Our priorities are clear, we continue to: 1. Keep our employees and communities healthy and safe 2. Serve our customers and protect our assets 3. Keep the company and balance sheet strong 4. Maintain strong partnerships – with governments, customers, suppliers and shareholders 5. Continue to be a resilient organisation 6 ©2020, Rio Tinto, All Rights Reserved

Pressures are growing in a ‘New Era’ of complexity Framed by three interconnected global forces Geopolitics Technology Geopolitics Society Technology – Political, economic – Strong domestic, – Fast-paced and technological regional technology fragmentation and global development, – Changing nature collaboration dispersion and of US-China – Coordinated execution Society relationship carbon policies – Low-cost low- – Lack of global – Rapidly rising carbon solutions and regional and converging – >2OC coordination carbon prices – >3OC – <2OC 7 ©2020, Rio Tinto, All Rights Reserved

Our assets mirror global demand themes Transition to the Urbanisation Electrification low-carbon economy Iron Ore Copper Aluminium Minerals & Exploration World leader Well-timed World leader Ventures World leading growth Products for the future We do not mine coal 43% EBITDA margin Our assets are at bottom or extract oil and gas 18% ROCE in the last 4 years of carbon intensity curves 8 ©2020, Rio Tinto, All Rights Reserved

We need an honest debate amongst stakeholders Consumers Climate Shareholders change & partnership Business Government 9 ©2020, Rio Tinto, All Rights Reserved

An integrated approach to sustainability Running a safe, responsible Collaborating to enable Pioneering materials and profitable business long-term economic benefits for human progress Health, safety & wellbeing Communities Climate change People Social & economic development Materials of the future Human rights Taxes paid Partnerships Environment Closure Tailings Ethics & integrity 10 ©2020, Rio Tinto, All Rights Reserved

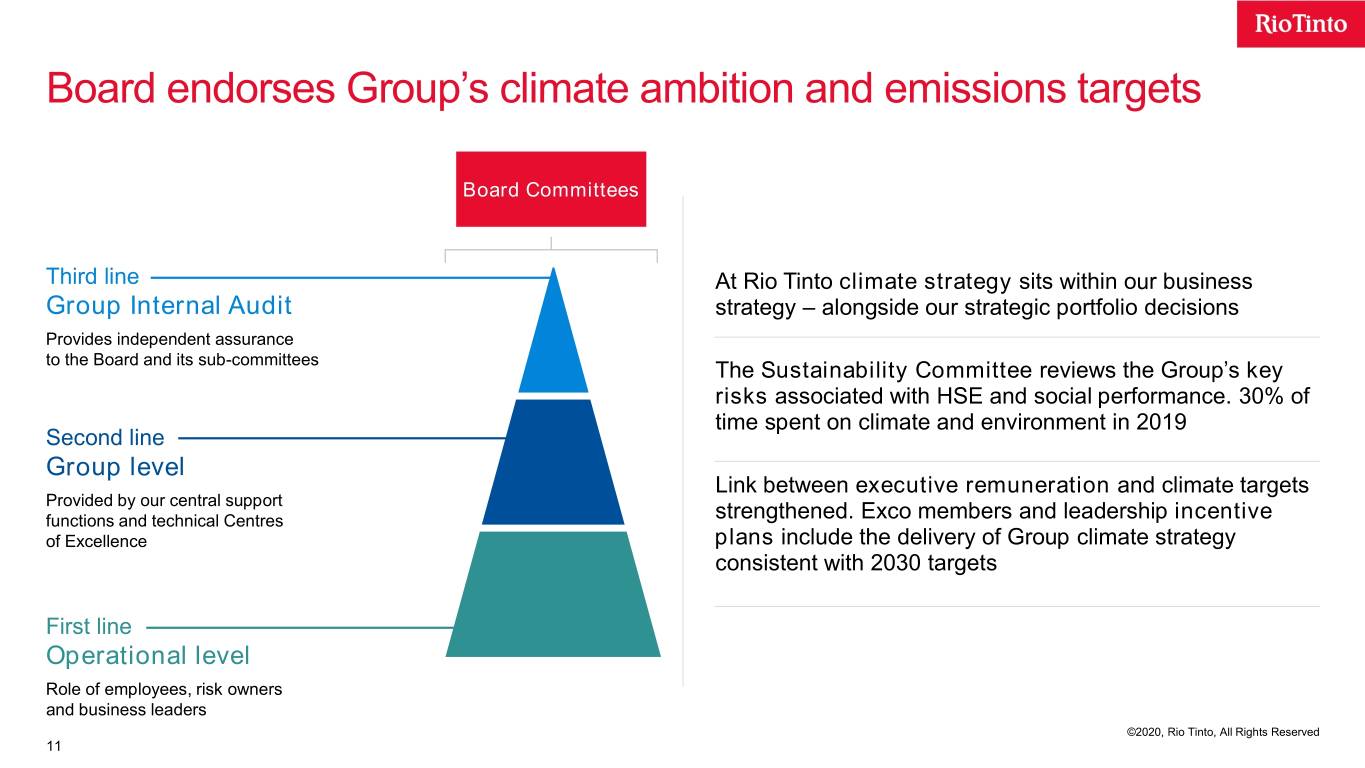

Board endorses Group’s climate ambition and emissions targets Board Committees Third line At Rio Tinto climate strategy sits within our business Group Internal Audit strategy – alongside our strategic portfolio decisions Provides independent assurance to the Board and its sub-committees The Sustainability Committee reviews the Group’s key risks associated with HSE and social performance. 30% of time spent on climate and environment in 2019 Second line Group level Link between executive remuneration and climate targets Provided by our central support functions and technical Centres strengthened. Exco members and leadership incentive of Excellence plans include the delivery of Group climate strategy consistent with 2030 targets First line Operational level Role of employees, risk owners and business leaders ©2020, Rio Tinto, All Rights Reserved 11

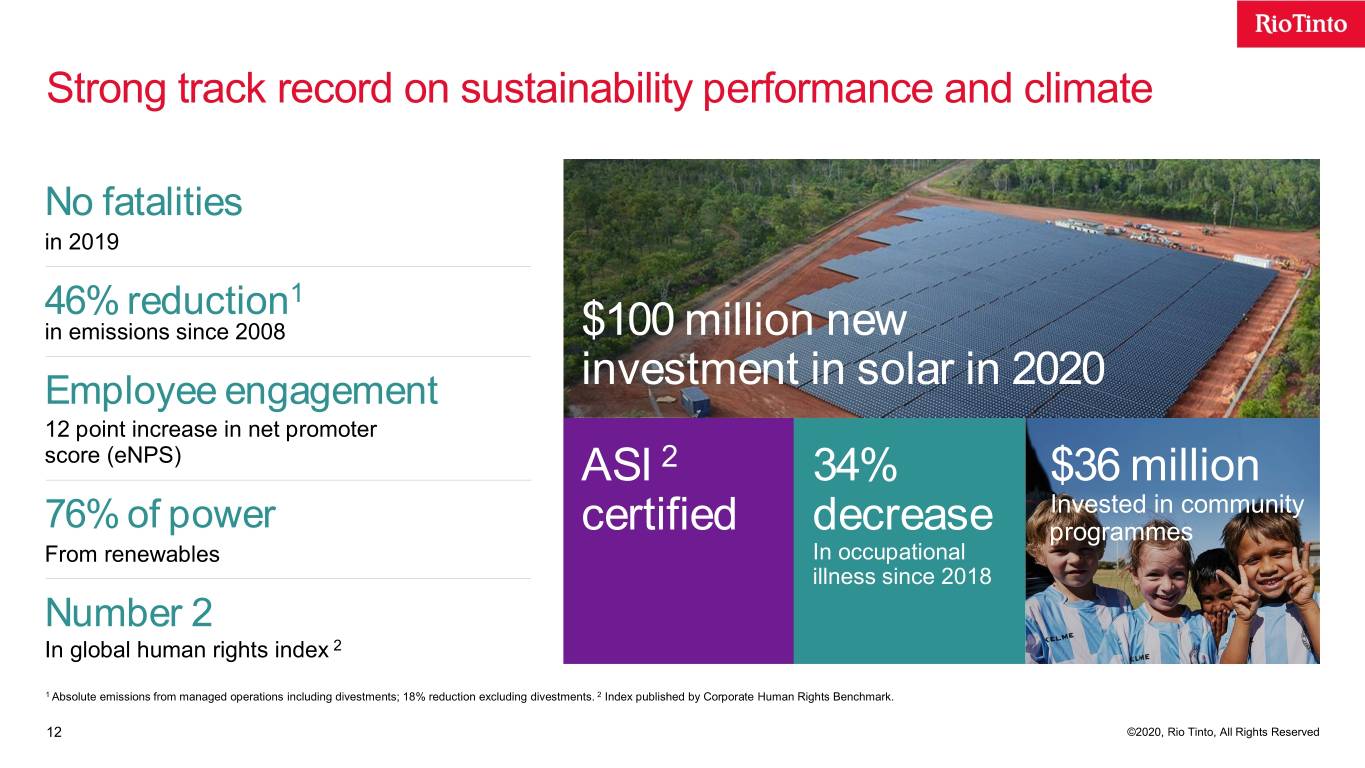

Strong track record on sustainability performance and climate No fatalities in 2019 46% reduction1 in emissions since 2008 $100 million new Employee engagement investment in solar in 2020 12 point increase in net promoter score (eNPS) ASI 2 34% $36 million Invested in community 76% of power certified decrease programmes From renewables In occupational illness since 2018 Number 2 In global human rights index 2 1 Absolute emissions from managed operations including divestments; 18% reduction excluding divestments. 2 Index published by Corporate Human Rights Benchmark. 12 ©2020, Rio Tinto, All Rights Reserved

Our climate strategy and plans Peter Toth Head of Corporate Development

Our climate change strategy is in four areas Producing materials essential 1 for low-carbon future Reducing the carbon 2 footprint of our operations Partnering to reduce the carbon 3 footprint across our value chain Enhancing our resilience 4 to physical climate risk 14 ©2020, Rio Tinto, All Rights Reserved

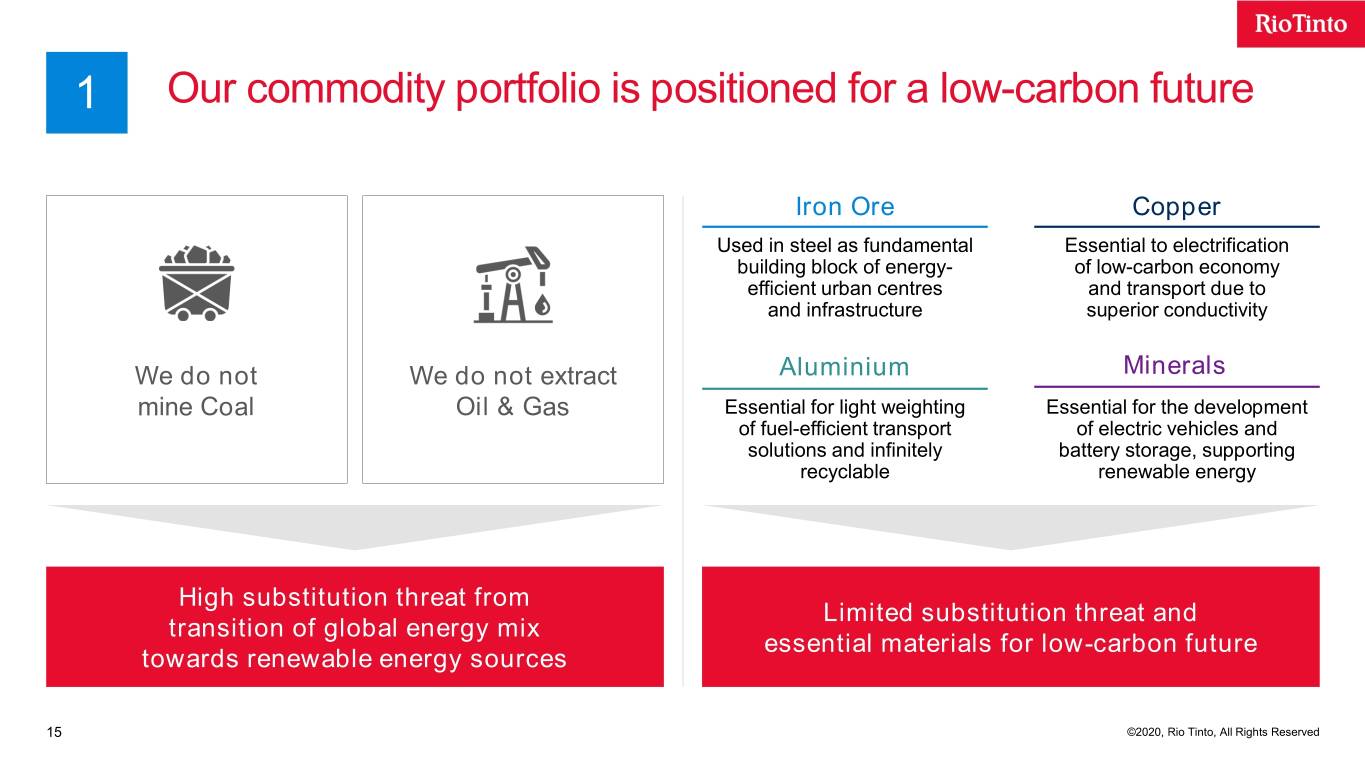

1 Our commodity portfolio is positioned for a low-carbon future Iron Ore Copper Used in steel as fundamental Essential to electrification building block of energy- of low-carbon economy efficient urban centres and transport due to and infrastructure superior conductivity We do not We do not extract Aluminium Minerals mine Coal Oil & Gas Essential for light weighting Essential for the development of fuel-efficient transport of electric vehicles and solutions and infinitely battery storage, supporting recyclable renewable energy High substitution threat from Limited substitution threat and transition of global energy mix essential materials for low-carbon future towards renewable energy sources 15 ©2020, Rio Tinto, All Rights Reserved

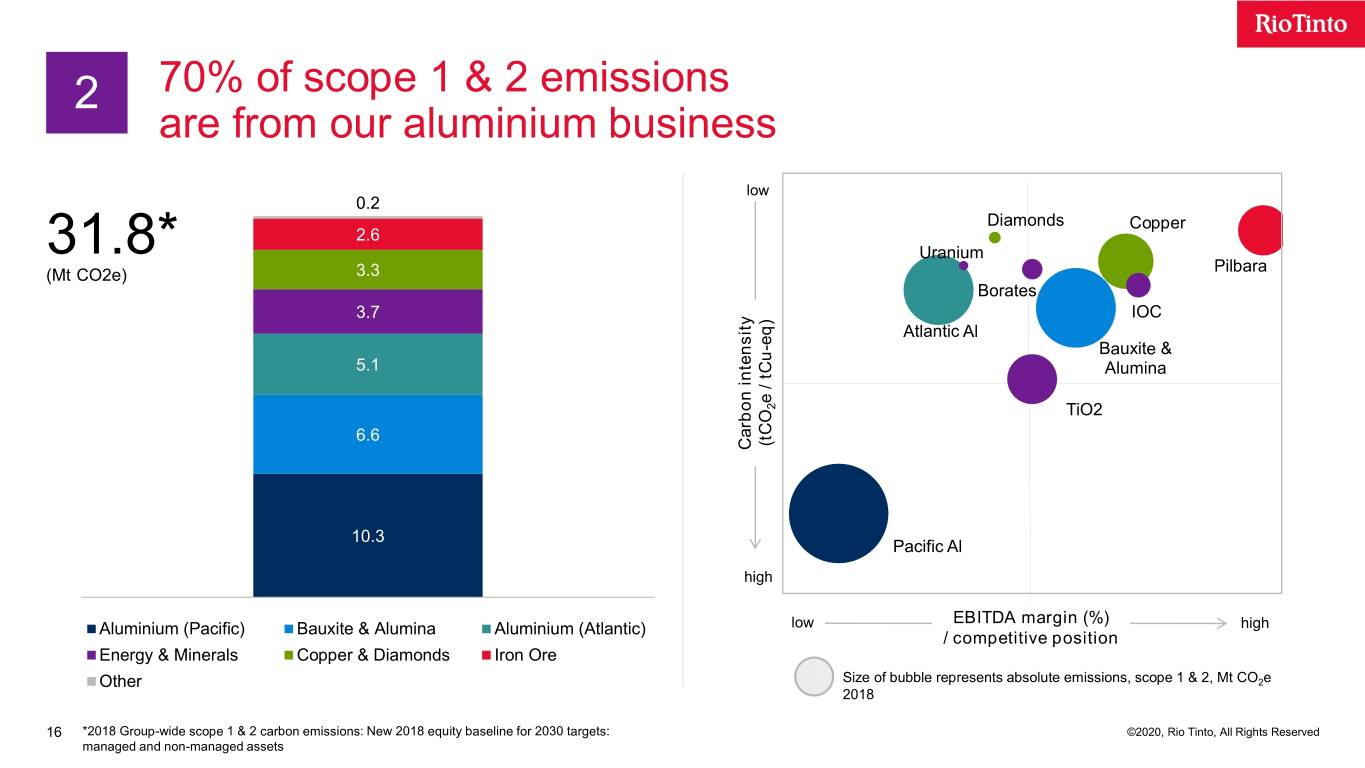

2 70% of scope 1 & 2 emissions are from our aluminium business low 0.2 Diamonds Copper 2.6 31.8* Uranium Pilbara (Mt CO2e) 3.3 Borates 3.7 IOC ) Atlantic Al eq - Bauxite & 5.1 Alumina tCu e/ 2 TiO2 6.6 tCO ( Carbon intensity intensity Carbon 10.3 Pacific Al high EBITDA margin (%) Aluminium (Pacific) Bauxite & Alumina Aluminium (Atlantic) low high / competitive position Energy & Minerals Copper & Diamonds Iron Ore Other Size of bubble represents absolute emissions, scope 1 & 2, Mt CO2e 2018 16 *2018 Group-wide scope 1 & 2 carbon emissions: New 2018 equity baseline for 2030 targets: ©2020, Rio Tinto, All Rights Reserved managed and non-managed assets

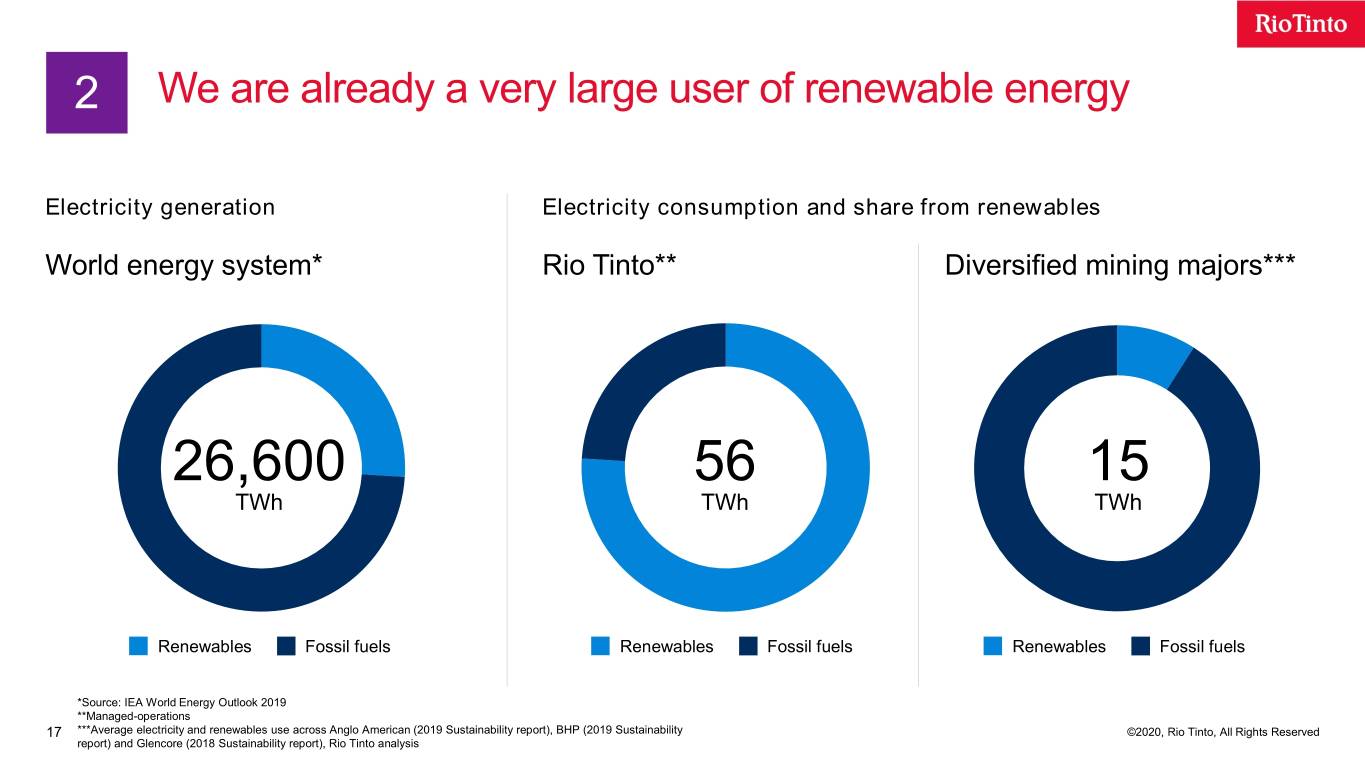

2 We are already a very large user of renewable energy Electricity generation Electricity consumption and share from renewables World energy system* Rio Tinto** Diversified mining majors*** 26,600 56 15 TWh TWh TWh Renewables Fossil fuels Renewables Fossil fuels Renewables Fossil fuels *Source: IEA World Energy Outlook 2019 **Managed-operations 17 ***Average electricity and renewables use across Anglo American (2019 Sustainability report), BHP (2019 Sustainability ©2020, Rio Tinto, All Rights Reserved report) and Glencore (2018 Sustainability report), Rio Tinto analysis

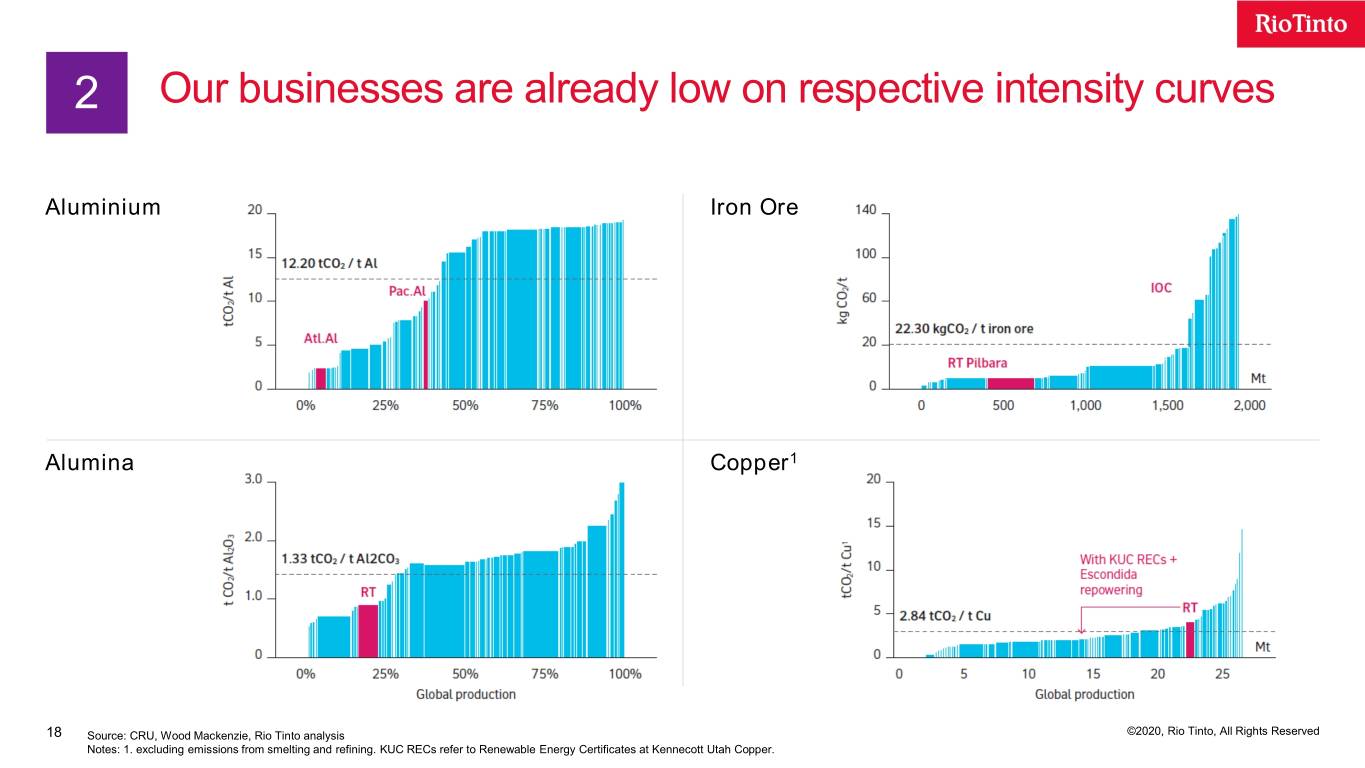

2 Our businesses are already low on respective intensity curves Aluminium Iron Ore Alumina Copper1 18 Source: CRU, Wood Mackenzie, Rio Tinto analysis ©2020, Rio Tinto, All Rights Reserved Notes: 1. excluding emissions from smelting and refining. KUC RECs refer to Renewable Energy Certificates at Kennecott Utah Copper.

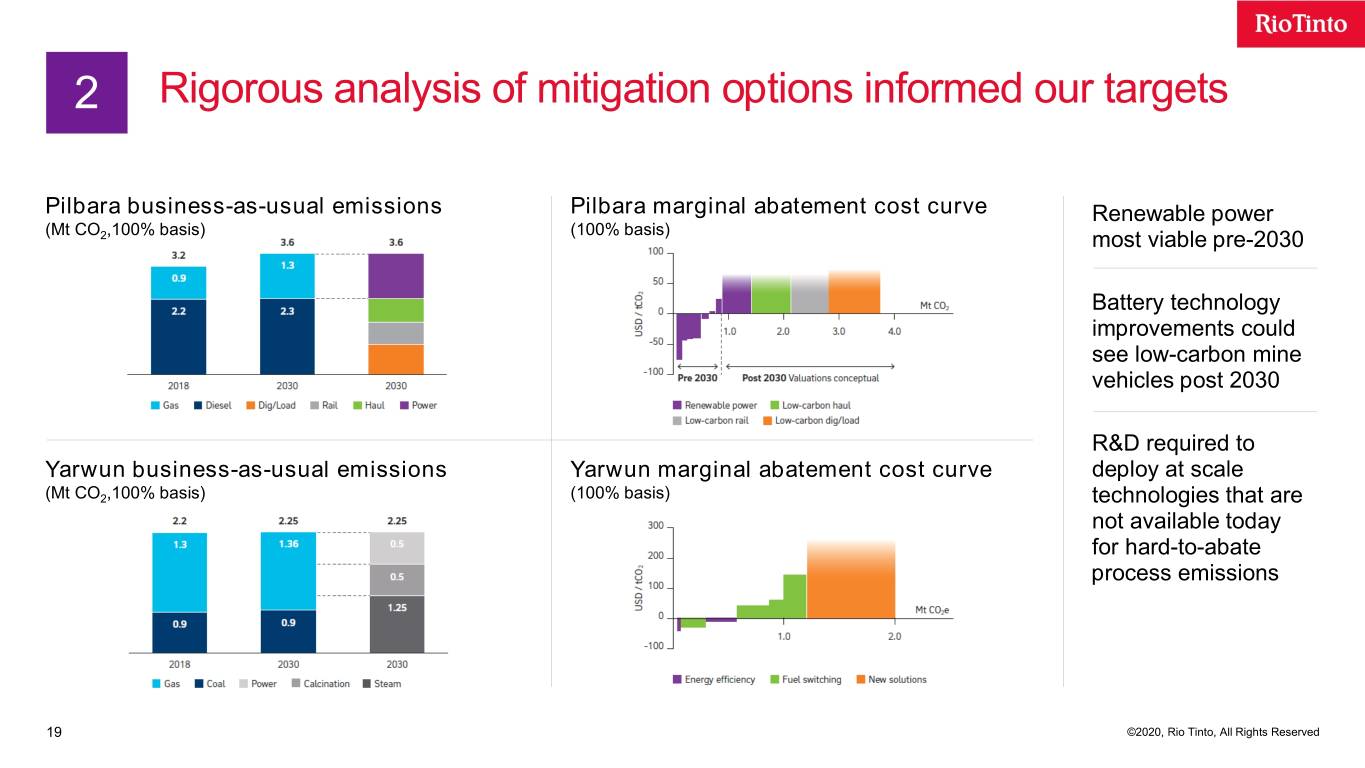

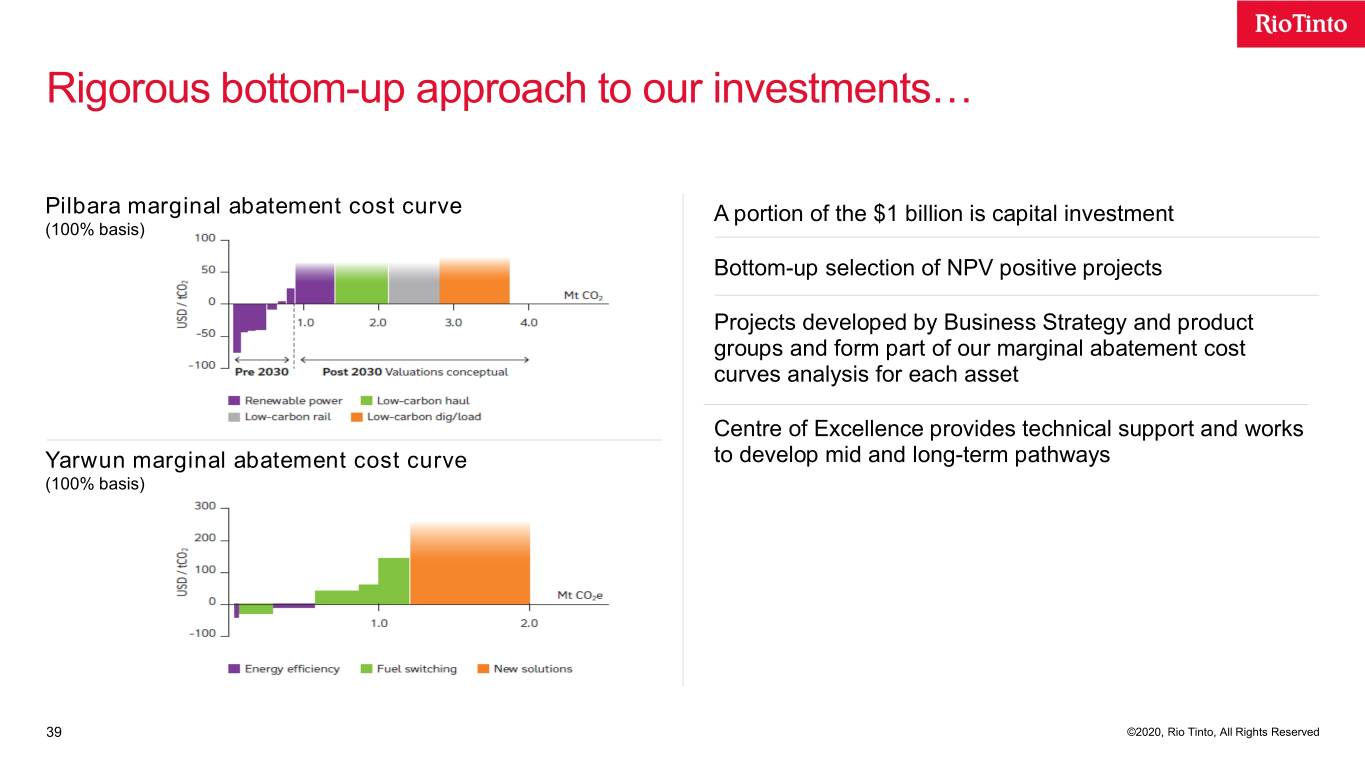

2 Rigorous analysis of mitigation options informed our targets Pilbara business-as-usual emissions Pilbara marginal abatement cost curve Renewable power (Mt CO ,100% basis) (100% basis) 2 most viable pre-2030 Battery technology improvements could see low-carbon mine vehicles post 2030 R&D required to Yarwun business-as-usual emissions Yarwun marginal abatement cost curve deploy at scale (Mt CO2,100% basis) (100% basis) technologies that are not available today for hard-to-abate process emissions 19 ©2020, Rio Tinto, All Rights Reserved

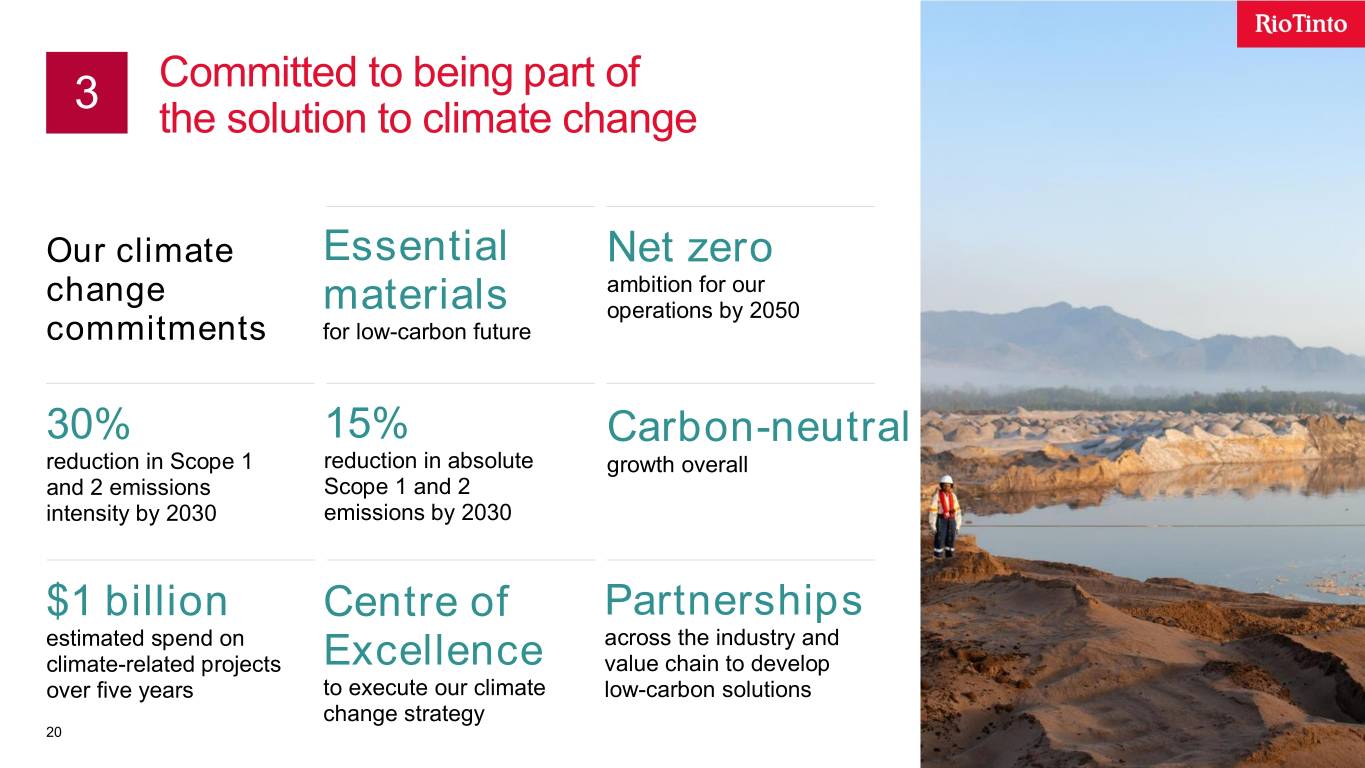

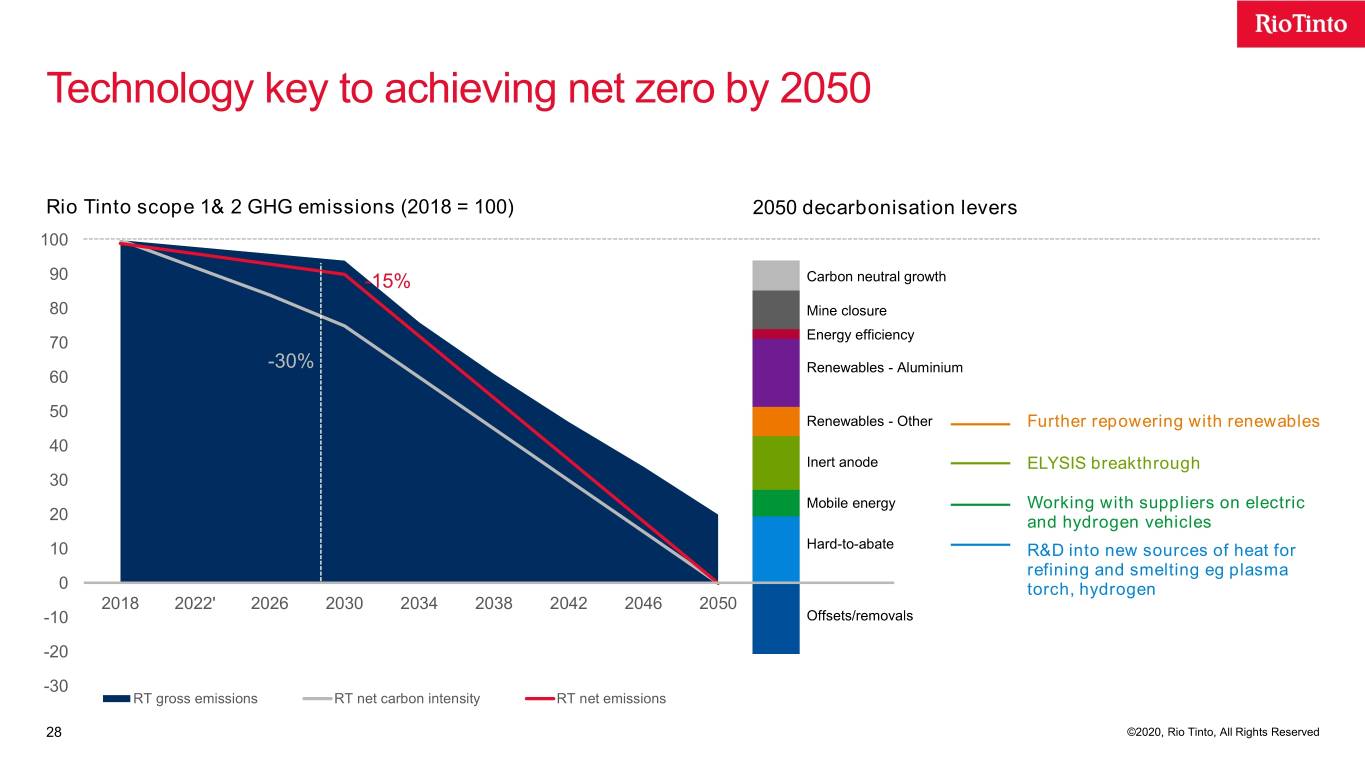

3 Committed to being part of the solution to climate change Our climate Essential Net zero change ambition for our materials operations by 2050 commitments for low-carbon future 30% 15% Carbon-neutral reduction in Scope 1 reduction in absolute growth overall and 2 emissions Scope 1 and 2 intensity by 2030 emissions by 2030 $1 billion Centre of Partnerships estimated spend on across the industry and climate-related projects Excellence value chain to develop over five years to execute our climate low-carbon solutions change strategy 20 ©2020, Rio Tinto, All Rights Reserved

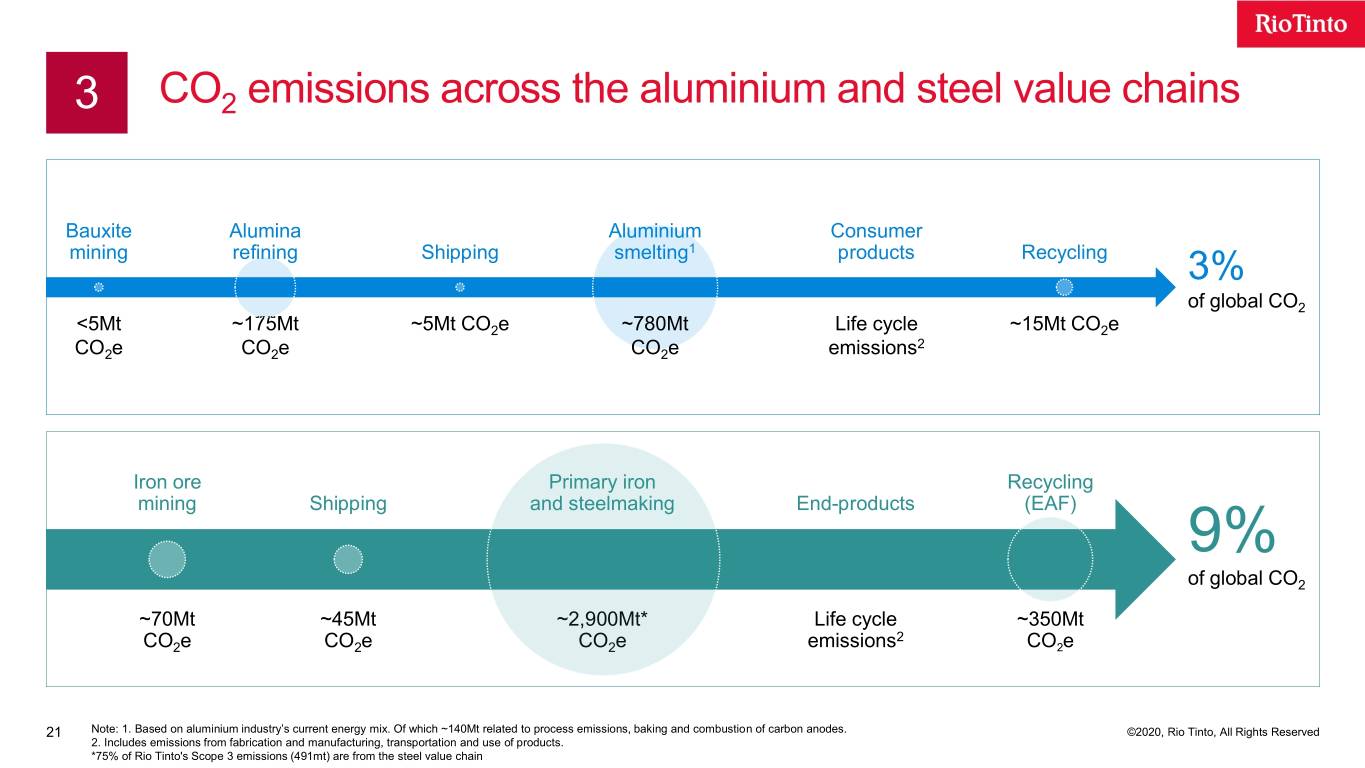

3 CO2 emissions across the aluminium and steel value chains Bauxite Alumina Aluminium Consumer mining refining Shipping smelting1 products Recycling 3% of global CO2 <5Mt ~175Mt ~5Mt CO2e ~780Mt Life cycle ~15Mt CO2e 2 CO2e CO2e CO2e emissions Iron ore Primary iron Recycling mining Shipping and steelmaking End-products (EAF) 9% of global CO2 ~70Mt ~45Mt ~2,900Mt* Life cycle ~350Mt 2 CO2e CO2e CO2e emissions CO2e 21 Note: 1. Based on aluminium industry’s current energy mix. Of which ~140Mt related to process emissions, baking and combustion of carbon anodes. ©2020, Rio Tinto, All Rights Reserved 2. Includes emissions from fabrication and manufacturing, transportation and use of products. *75% of Rio Tinto's Scope 3 emissions (491mt) are from the steel value chain

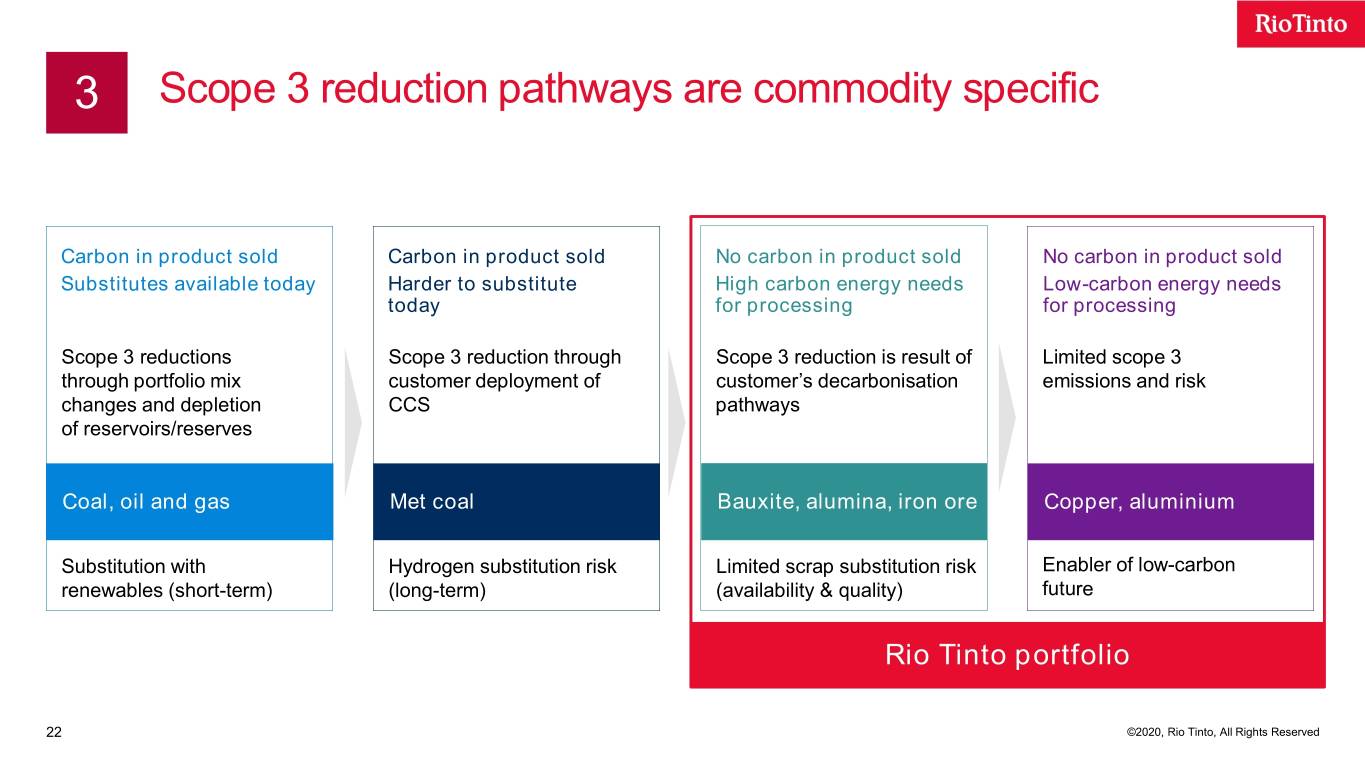

3 Scope 3 reduction pathways are commodity specific Carbon in product sold Carbon in product sold No carbon in product sold No carbon in product sold Substitutes available today Harder to substitute High carbon energy needs Low-carbon energy needs today for processing for processing Scope 3 reductions Scope 3 reduction through Scope 3 reduction is result of Limited scope 3 through portfolio mix customer deployment of customer’s decarbonisation emissions and risk changes and depletion CCS pathways of reservoirs/reserves Coal, oil and gas Met coal Bauxite, alumina, iron ore Copper, aluminium Substitution with Hydrogen substitution risk Limited scrap substitution risk Enabler of low-carbon renewables (short-term) (long-term) (availability & quality) future Rio Tinto portfolio 22 ©2020, Rio Tinto, All Rights Reserved

3 Our partnership with Baowu / Tsinghua University 2020 work programme 1 Carbon inventory and reporting Steel value chain carbon model Expand Tsinghua University carbon modelling with industry insights 2 Carbon reduction and R&D Optimise ore consumption R&D programmes on ore characteristics and blends to reduce carbon emissions from steelmaking Long-term pathway to low-carbon steel Using the resources of the RT-TU joint research centre to explore long-term commercial pathways to low-carbon steel 3 Cooperation on advocacy 2020 partnership forum Bringing together our climate leaders to focus on decarbonisation over the full value chain 23 ©2020, Rio Tinto, All Rights Reserved

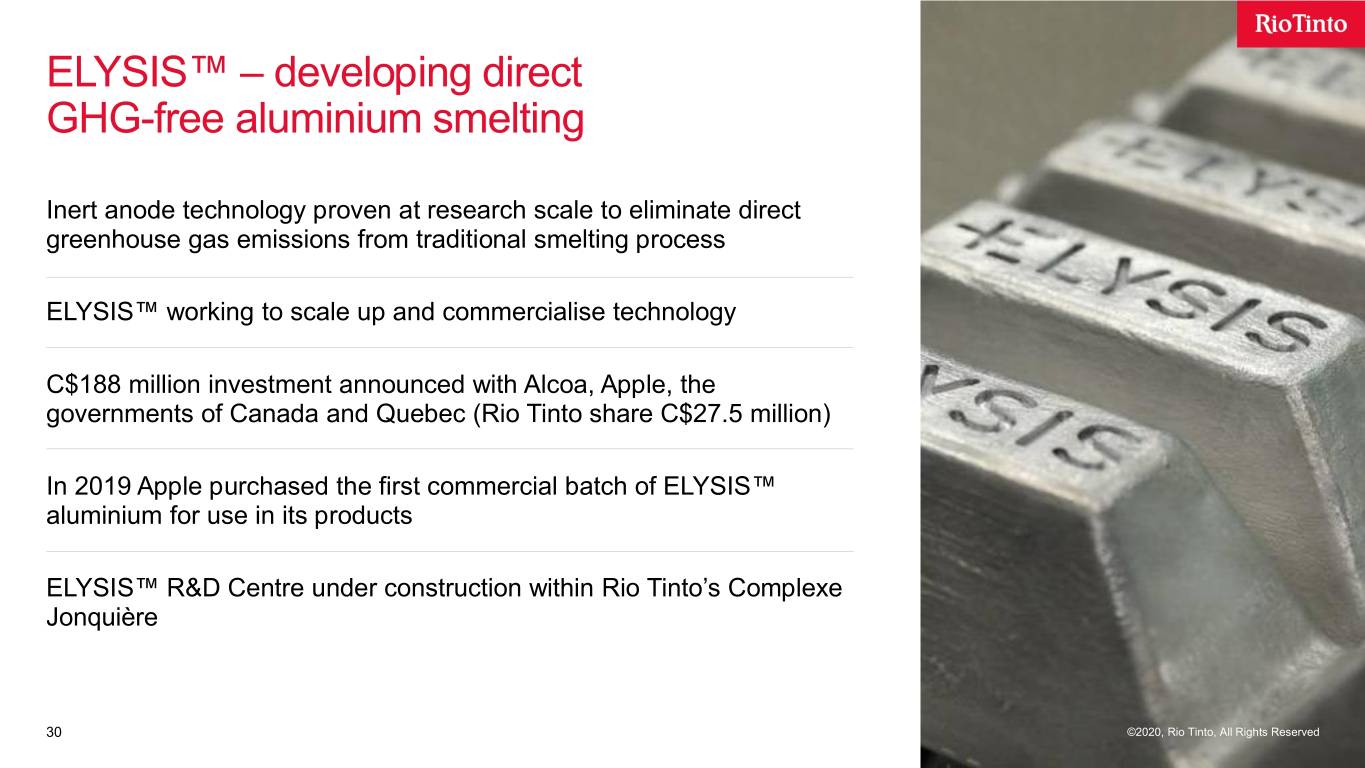

3 The world’s first carbon-free aluminium smelting process In 2018, in partnership with Alcoa In Canada alone, the use of and with support from Apple and ELYSIS™ technology has the the governments of Canada and potential to reduce GHG Quebec, we announced ELYSIS™ emissions by 7 million tonnes – the world’s first carbon-free equivalent to taking 1.8 million aluminium smelting process cars off the road 24 ©2020, Rio Tinto, All Rights Reserved

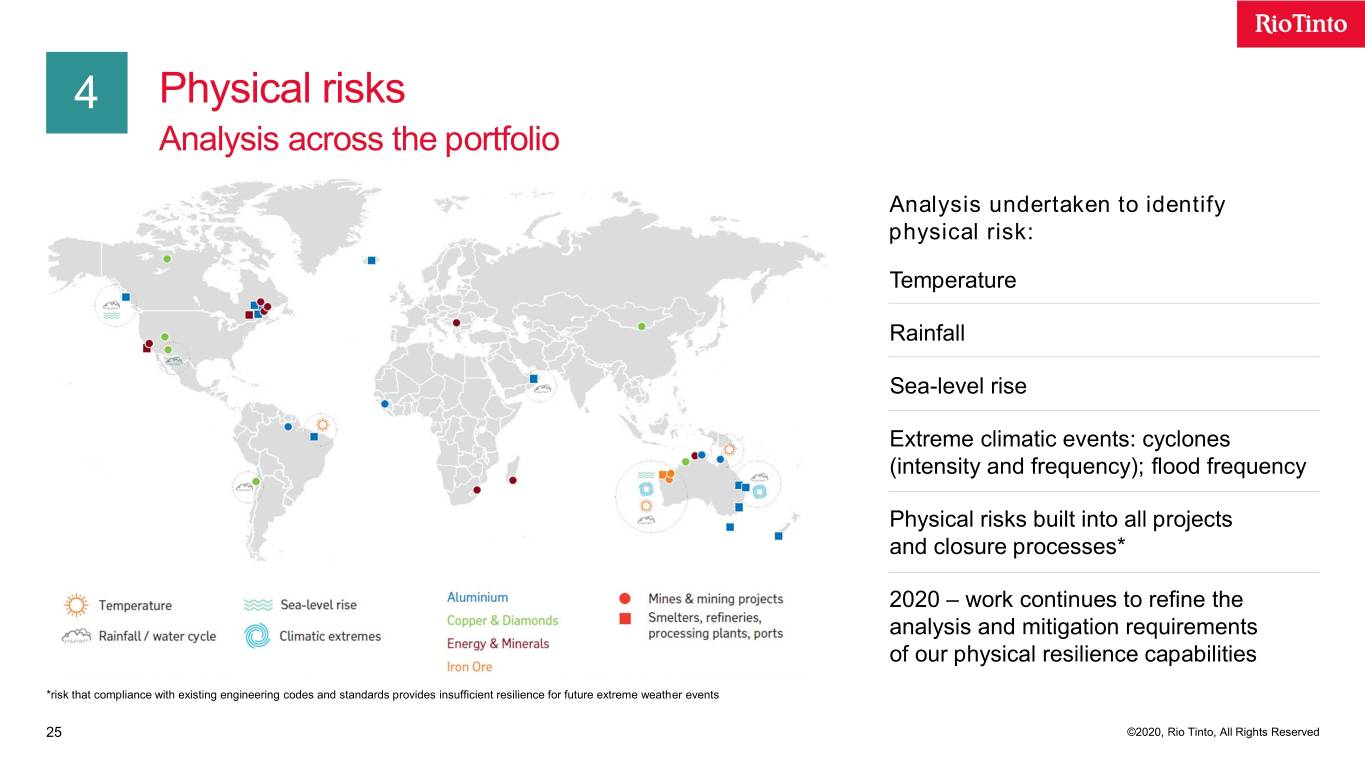

4 Physical risks Analysis across the portfolio Analysis undertaken to identify physical risk: Temperature Rainfall Sea-level rise Extreme climatic events: cyclones (intensity and frequency); flood frequency Physical risks built into all projects and closure processes* 2020 – work continues to refine the analysis and mitigation requirements of our physical resilience capabilities *risk that compliance with existing engineering codes and standards provides insufficient resilience for future extreme weather events 25 ©2020, Rio Tinto, All Rights Reserved

Technology to tackle the industry’s challenges Nigel Steward Head of Group Technical - Processing

New Energy and Climate Change Centre of Excellence key enabler of successful execution of our climate change strategy Accountable for GHG emissions & own energy and climate change projects Product Groups GHG emissions monitoring & Technical experts reporting Co-ordinate across group Energy & HSE Relationships with partners Climate CoE Energy productivity projects Identify value-accretive Climate change strategy, Corporate repowering options targets & portfolio implications Strategy Develop technology roadmap Group post 2030 Economics Technical Climate scenarios CoEs Development of new abatement & carbon prices technologies and options Projects and Studies Designing and building our future low-emission operations 27 ©2020, Rio Tinto, All Rights Reserved

Technology key to achieving net zero by 2050 Rio Tinto scope 1& 2 GHG emissions (2018 = 100) 2050 decarbonisation levers 100 90 -15% Carbon neutral growth 80 Mine closure 70 Energy efficiency -30% Renewables - Aluminium 60 50 Renewables - Other Further repowering with renewables 40 Inert anode ELYSIS breakthrough 30 Mobile energy Working with suppliers on electric 20 and hydrogen vehicles 10 Hard-to-abate R&D into new sources of heat for refining and smelting eg plasma 0 torch, hydrogen 2018 2022' 2026 2030 2034 2038 2042 2046 2050 -10 Offsets/removals -20 -30 RT gross emissions RT net carbon intensity RT net emissions 28 ©2020, Rio Tinto, All Rights Reserved

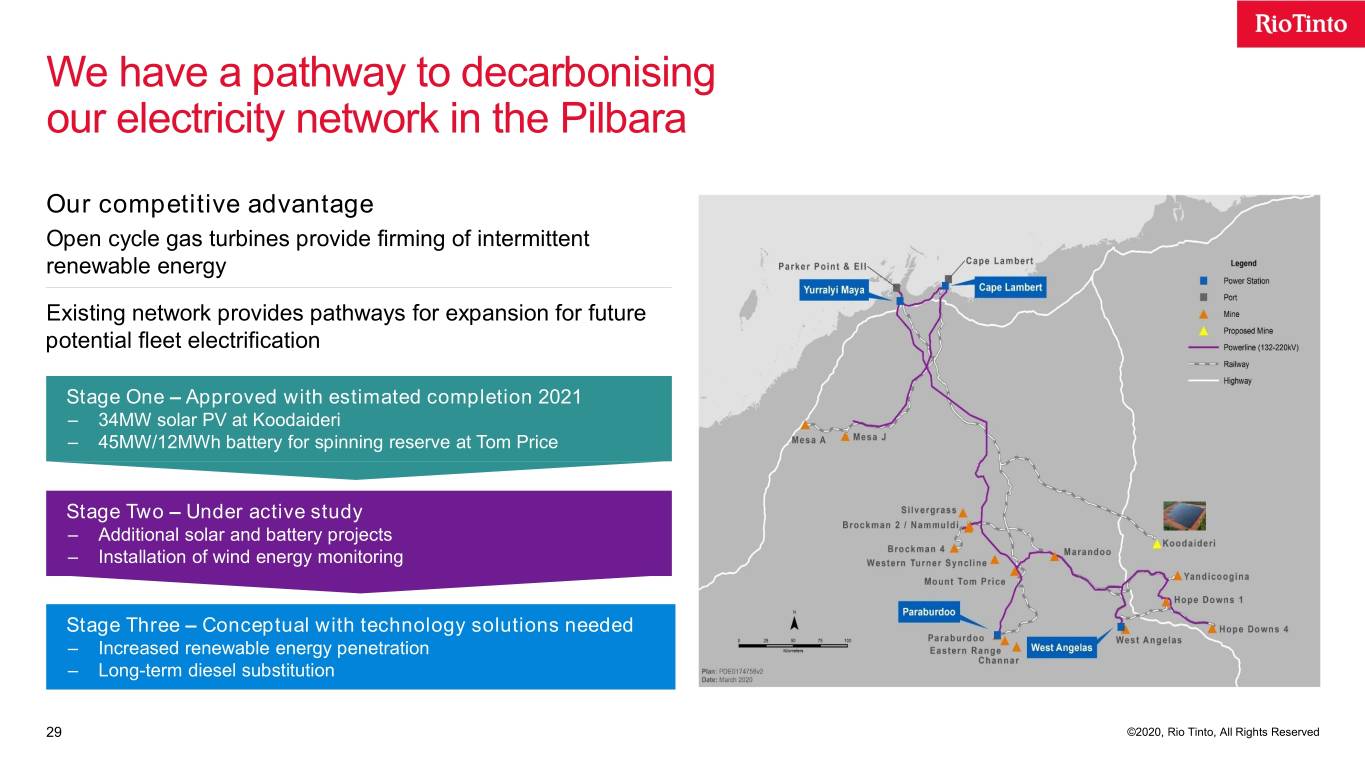

We have a pathway to decarbonising our electricity network in the Pilbara Our competitive advantage Open cycle gas turbines provide firming of intermittent renewable energy Existing network provides pathways for expansion for future potential fleet electrification Stage One – Approved with estimated completion 2021 – 34MW solar PV at Koodaideri – 45MW/12MWh battery for spinning reserve at Tom Price Stage Two – Under active study – Additional solar and battery projects – Installation of wind energy monitoring Stage Three – Conceptual with technology solutions needed – Increased renewable energy penetration – Long-term diesel substitution 29 ©2020, Rio Tinto, All Rights Reserved

ELYSIS™ – developing direct GHG-free aluminium smelting Inert anode technology proven at research scale to eliminate direct greenhouse gas emissions from traditional smelting process ELYSIS™ working to scale up and commercialise technology C$188 million investment announced with Alcoa, Apple, the governments of Canada and Quebec (Rio Tinto share C$27.5 million) In 2019 Apple purchased the first commercial batch of ELYSIS™ aluminium for use in its products ELYSIS™ R&D Centre under construction within Rio Tinto’s Complexe Jonquière 30 ©2020, Rio Tinto, All Rights Reserved

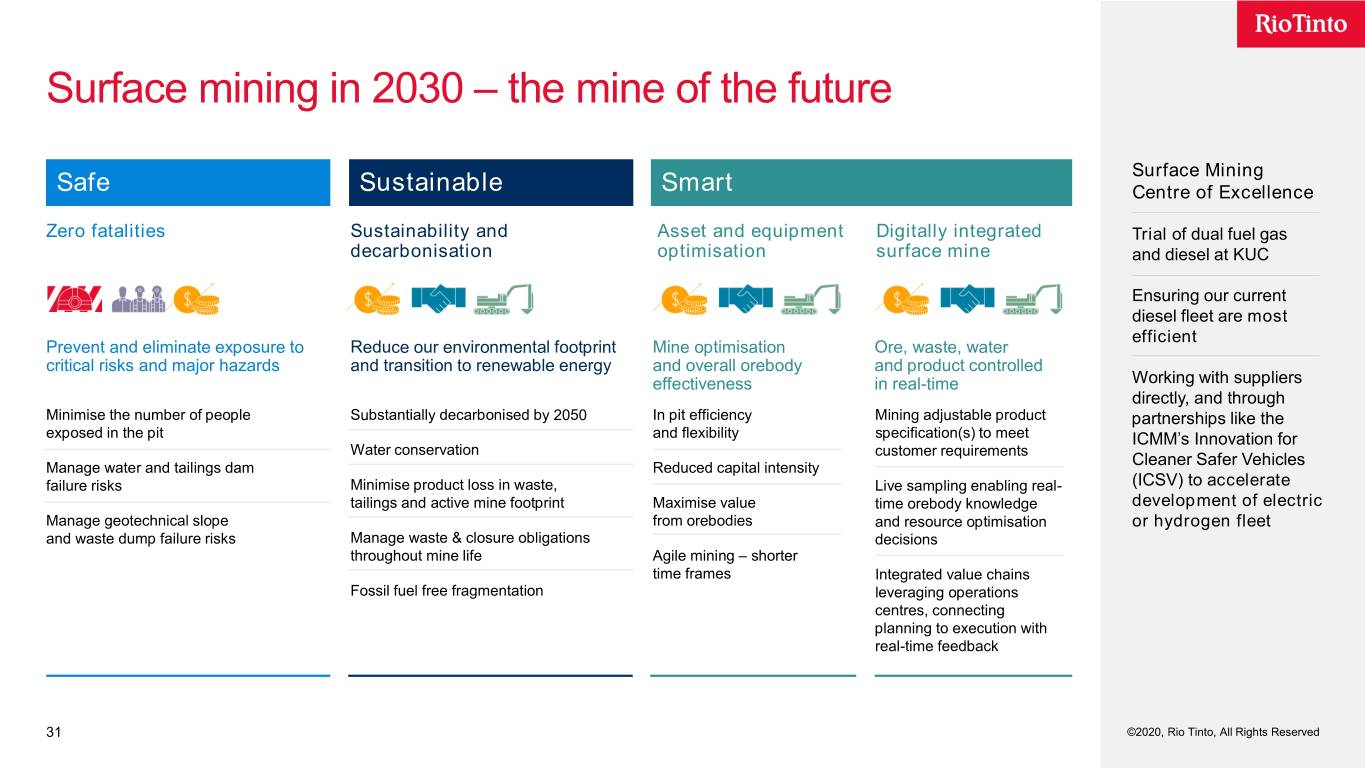

Surface mining in 2030 – the mine of the future Surface Mining Safe Sustainable Smart Centre of Excellence Zero fatalities Sustainability and Asset and equipment Digitally integrated Trial of dual fuel gas decarbonisation optimisation surface mine and diesel at KUC Ensuring our current diesel fleet are most efficient Prevent and eliminate exposure to Reduce our environmental footprint Mine optimisation Ore, waste, water critical risks and major hazards and transition to renewable energy and overall orebody and product controlled effectiveness in real-time Working with suppliers directly, and through Minimise the number of people Substantially decarbonised by 2050 In pit efficiency Mining adjustable product partnerships like the exposed in the pit and flexibility specification(s) to meet ICMM’s Innovation for Water conservation customer requirements Manage water and tailings dam Reduced capital intensity Cleaner Safer Vehicles failure risks Minimise product loss in waste, Live sampling enabling real- (ICSV) to accelerate tailings and active mine footprint Maximise value time orebody knowledge development of electric Manage geotechnical slope from orebodies and resource optimisation or hydrogen fleet and waste dump failure risks Manage waste & closure obligations decisions throughout mine life Agile mining – shorter time frames Integrated value chains Fossil fuel free fragmentation leveraging operations centres, connecting planning to execution with real-time feedback 31 ©2020, Rio Tinto, All Rights Reserved

Our approach to water Theresia Ott Chief Advisor Environment

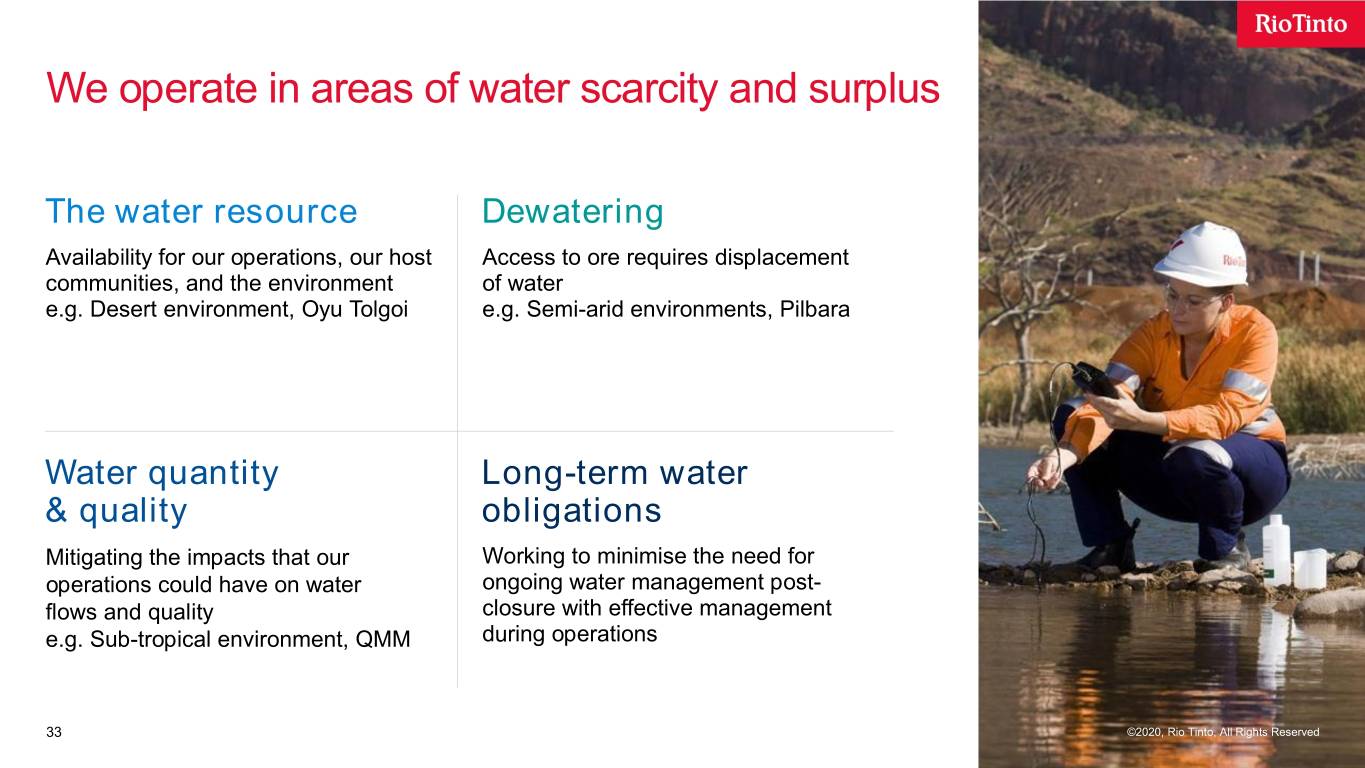

We operate in areas of water scarcity and surplus The water resource Dewatering Availability for our operations, our host Access to ore requires displacement communities, and the environment of water e.g. Desert environment, Oyu Tolgoi e.g. Semi-arid environments, Pilbara Water quantity Long-term water & quality obligations Mitigating the impacts that our Working to minimise the need for operations could have on water ongoing water management post- flows and quality closure with effective management e.g. Sub-tropical environment, QMM during operations 33 ©2020, Rio Tinto, All Rights Reserved

Our water targets – focusing our efforts Our group target Our site-based targets By 2023, we will disclose for all managed operations: Pilbara Iron Ore Energy Kennecott 1 Permitted surface water allocation volumes managed Resources Copper aquifer of Australia import reinjection inventory reduction reduction 2 Annual allocation usage Estimated catchment runoff from average Oyu Queensland Alumina QIT Madagascar 3 annual rainfalls Tolgoi (QAL) Minerals water joint venture integrated site intensity performance water management improvement 34 ©2020, Rio Tinto, All Rights Reserved

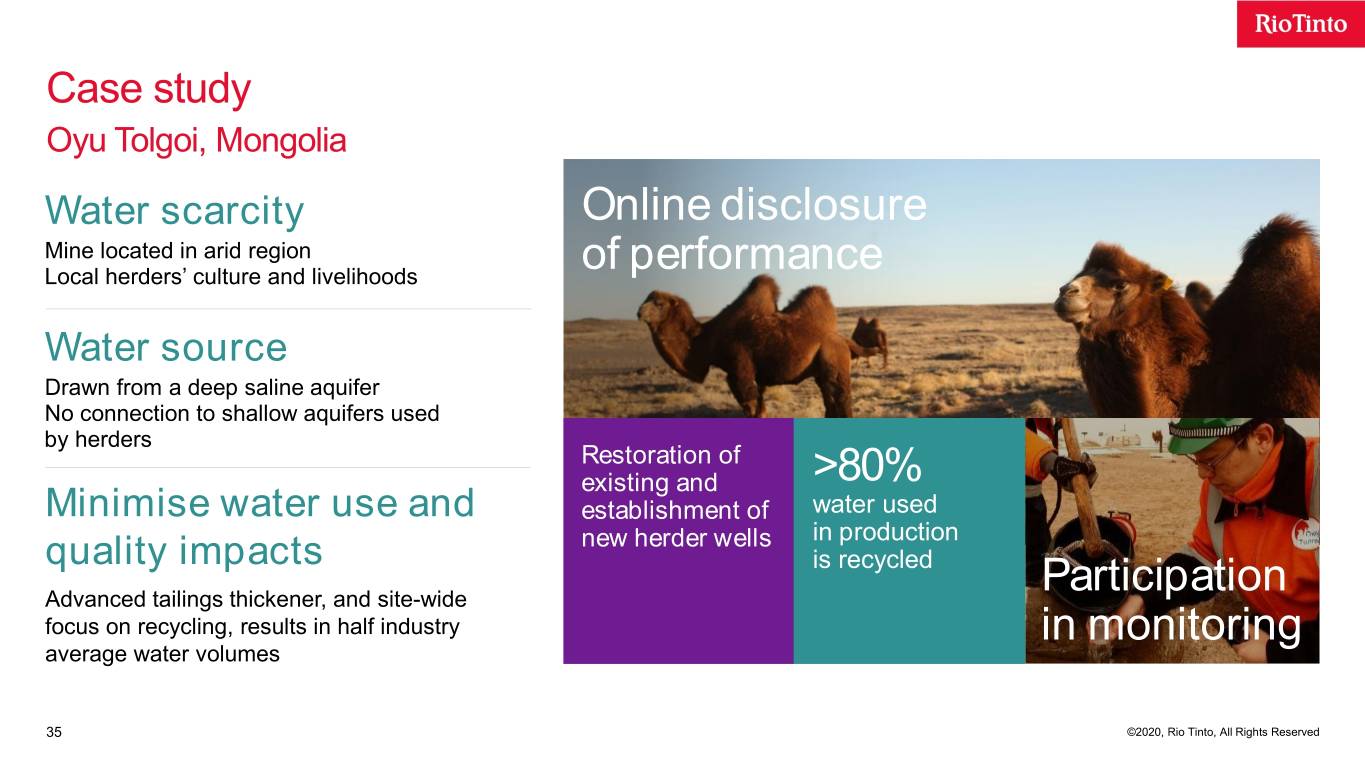

Case study Oyu Tolgoi, Mongolia Water scarcity Online disclosure Mine located in arid region Local herders’ culture and livelihoods of performance Water source Drawn from a deep saline aquifer No connection to shallow aquifers used by herders Restoration of existing and >80% Minimise water use and establishment of water used quality impacts new herder wells in production is recycled Participation Advanced tailings thickener, and site-wide focus on recycling, results in half industry in monitoring average water volumes 35 ©2020, Rio Tinto, All Rights Reserved

Case study Pilbara iron ore Groundwater impacts Mining below water table presents potential Orebody impact to Pilbara groundwater levels access Managed aquifer recharge requires Is the method under study for mitigation dewatering of impacts Reinstatement Consideration Understanding geology of groundwater of ecosystem Field testing provides the hydrogeological levels post impacts information to critically assess the viability mining is a focus of this method Studies proposed for a number of Pilbara Looking forward operational sites Studies will inform the programme going forward 36 ©2020, Rio Tinto, All Rights Reserved

Our investment approach Jakob Stausholm Chief Financial Officer

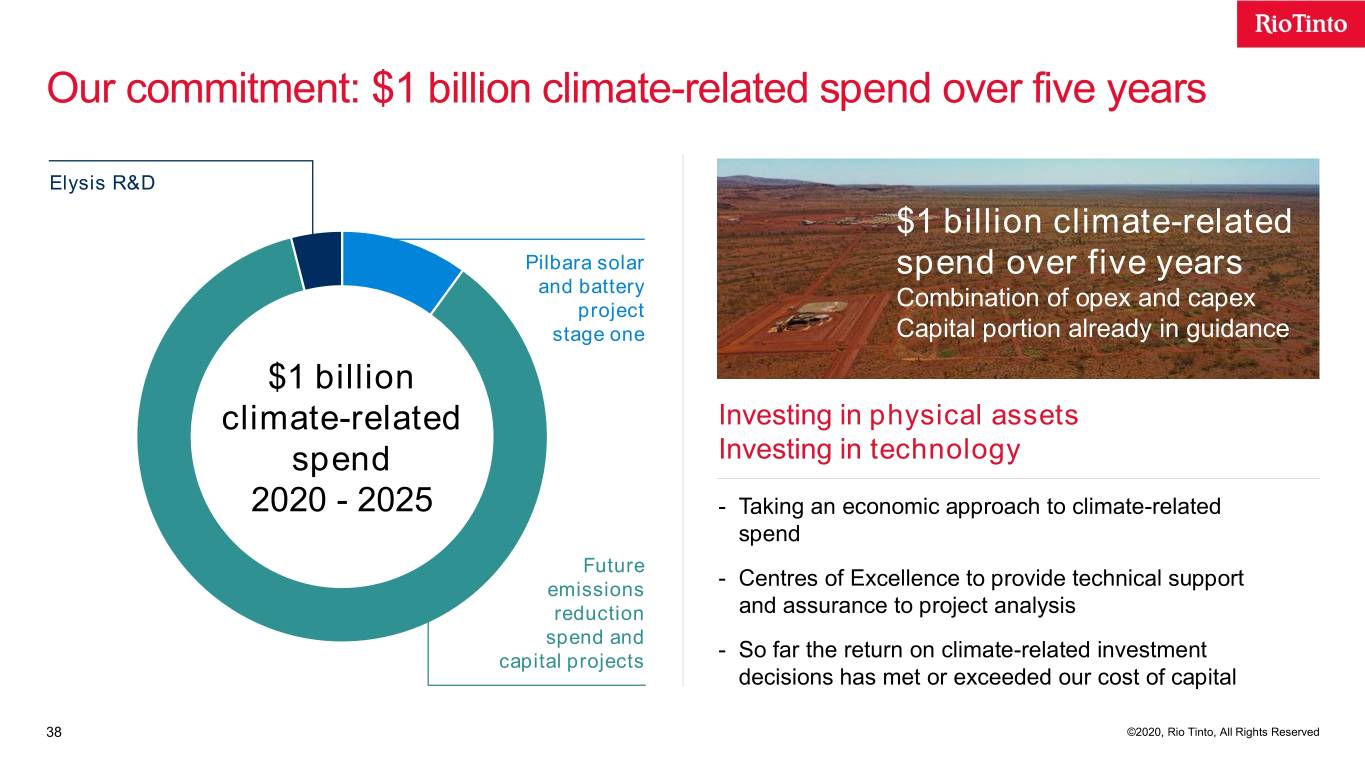

Our commitment: $1 billion climate-related spend over five years Elysis R&D $1 billion climate-related Pilbara solar spend over five years and battery project Combination of opex and capex stage one Capital portion already in guidance $1 billion climate-related Investing in physical assets spend Investing in technology 2020 - 2025 - Taking an economic approach to climate-related spend Future emissions - Centres of Excellence to provide technical support reduction and assurance to project analysis spend and capital projects - So far the return on climate-related investment decisions has met or exceeded our cost of capital 38 ©2020, Rio Tinto, All Rights Reserved

Rigorous bottom-up approach to our investments… Pilbara marginal abatement cost curve A portion of the $1 billion is capital investment (100% basis) Bottom-up selection of NPV positive projects Projects developed by Business Strategy and product groups and form part of our marginal abatement cost curves analysis for each asset Centre of Excellence provides technical support and works Yarwun marginal abatement cost curve to develop mid and long-term pathways (100% basis) 39 ©2020, Rio Tinto, All Rights Reserved

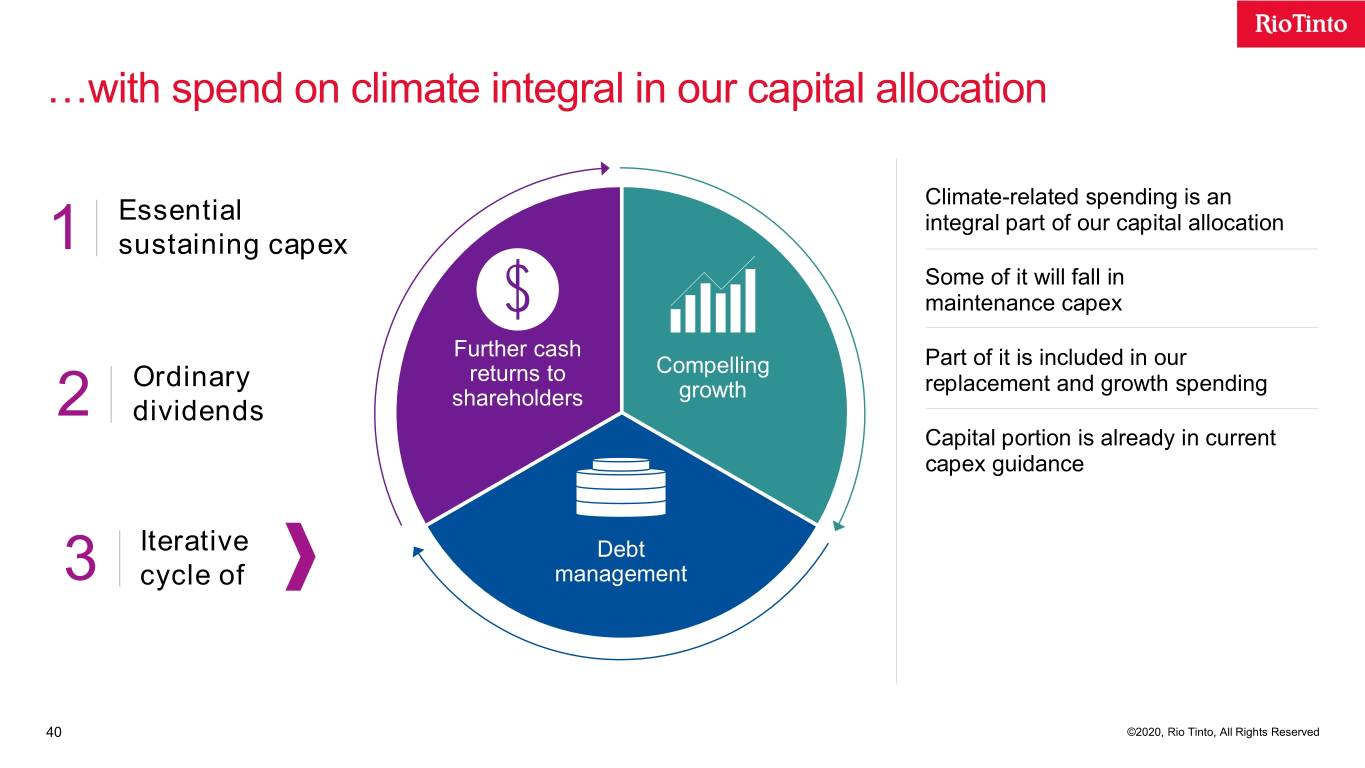

…with spend on climate integral in our capital allocation Climate-related spending is an Essential integral part of our capital allocation 1 sustaining capex Some of it will fall in maintenance capex Further cash Part of it is included in our returns to Compelling Ordinary growth replacement and growth spending 2 dividends shareholders Capital portion is already in current capex guidance Iterative Debt 3 cycle of management 40 ©2020, Rio Tinto, All Rights Reserved

Sustainability supports our resilience and our competitiveness Our Assets Our Approach Our Performance in 2019 Long life Sustainability (ESG) $10.4 billion earnings1 Competitive Operational Excellence $17.2 billion supplier payments Expandable + Value over volume = $5.5 billion invested in capital projects Sustainable Capital discipline $7.6 billion of taxes paid Strong balance sheet Counter-cyclical $11.9 billion dividends and share buy-backs2 Unique strength and resilience 1 underlying earnings. 2 Cash returns (dividends and share buy-backs) are stated on a cash flow basis. 41 ©2020, Rio Tinto, All Rights Reserved

Summary J-S Jacques Chief Executive

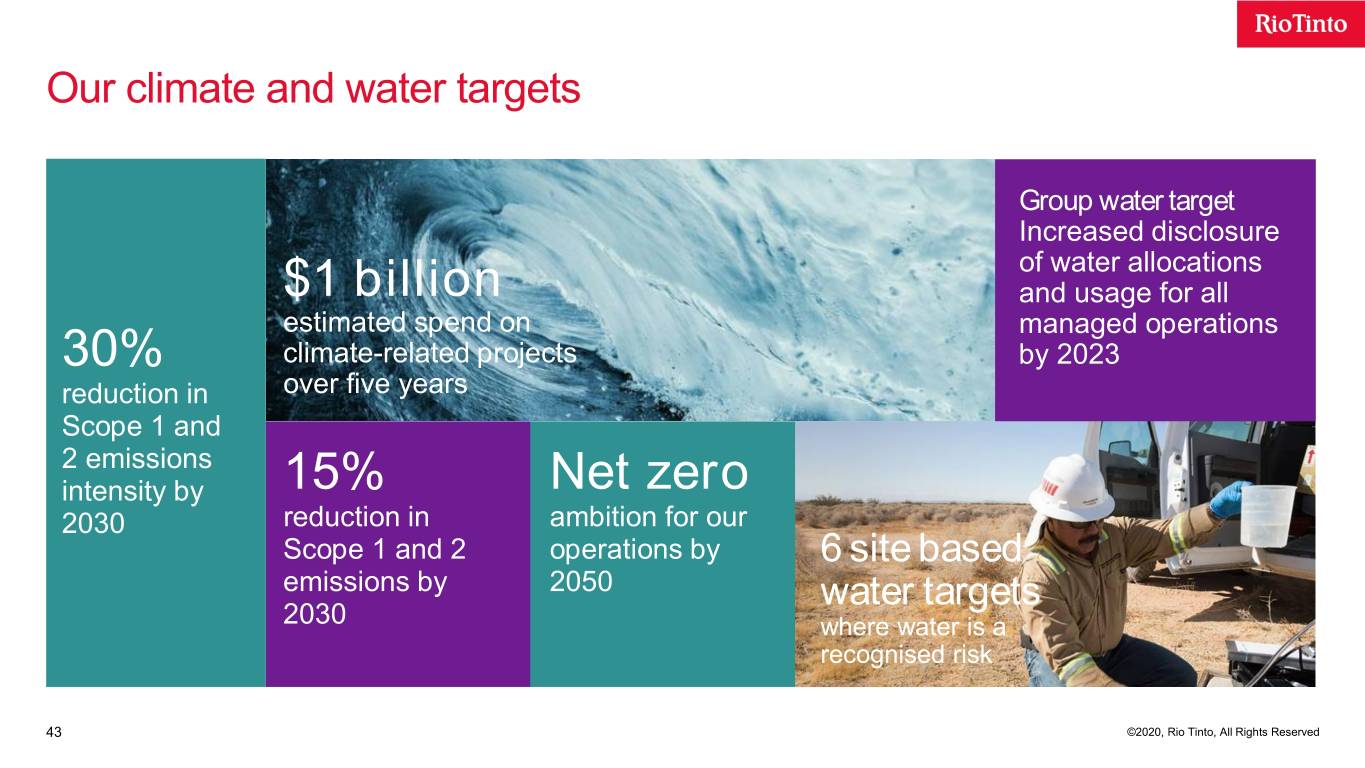

Our climate and water targets Group water target Increased disclosure of water allocations $1 billion and usage for all estimated spend on managed operations 30% climate-related projects by 2023 reduction in over five years Scope 1 and 2 emissions intensity by 15% Net zero 2030 reduction in ambition for our Scope 1 and 2 operations by 6 site based emissions by 2050 water targets 2030 where water is a recognised risk 43 ©2020, Rio Tinto, All Rights Reserved

As pioneers in mining and metals we produce materials essential to human progress Fe Cu Al Ni Li Perform & Transform Perform today Transform for tomorrow Portfolio Performance People Partners 44 ©2020, Rio Tinto, All Rights Reserved

Exhibit 99.5

Notice to ASX/LSE

Shareholdings of directors and persons discharging managerial responsibility (PDMR)

21 April 2020

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each, Rio Tinto plc ADRs or Rio Tinto Limited ordinary shares (‘shares’). Shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares or ADRs free of charge (‘matching shares’ and ‘matching ADRs’), conditional upon satisfying the terms of myShare.

The following PDMRs acquired Rio Tinto shares or ADRs under myShare and were allocated the same number of matching share awards or matching ADR awards as follows:

| Security | Name of PDMR | Number of shares or ADRs | Matching shares or matching ADRs | Price per share or ADR | Date of transaction | ||||||||||||

| Rio Tinto plc shares | Baatar, Bold | 9.6301 | 9.6301 | 38.9404 GBP | 17/04/2020 | ||||||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 19.0252 | 19.0252 | 38.9404 GBP | 17/04/2020 | ||||||||||||

| Rio Tinto plc shares | Soirat, Arnaud | 9.6301 | 9.6301 | 38.9404 GBP | 17/04/2020 | ||||||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 9.6301 | 9.6301 | 38.9404 GBP | 17/04/2020 | ||||||||||||

UK Share Plan (UKSP)

The UKSP is an HMRC approved Share Incentive Plan under which qualifying UK employees are able to purchase, on a quarterly basis, Rio Tinto plc shares. Rio Tinto plc shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares free of charge (UKSP matching shares). Qualifying UK employees are also awarded Free Shares once a year.

The following PDMRs purchased Rio Tinto plc shares under the UKSP and were allocated the same number of matching shares as follows:

| Security | Name of PDMR | Number of Shares Acquired | Matching shares | Price per Share GBP | Date of transaction | ||||||||||||

| Rio Tinto plc shares | Baatar, Bold | 9 | 9 | 38.9404 GBP | 17/04/2020 | ||||||||||||

| Rio Tinto plc shares | Soirat, Arnaud | 9 | 9 | 38.9404 GBP | 17/04/2020 | ||||||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 9 | 9 | 38.9404 GBP | 17/04/2020 | ||||||||||||

CA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2058 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

Exhibit 99.6

Notice to ASX/LSE

Block Listing Six Monthly Return

23 April 2020

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Share Savings Plan | ||||

| Period of return: | 22 October 2019 to 22 April 2020 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 730,181 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 0 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 730,181 | ||||

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Share Option Plan | ||||

| Period of return: | 22 October 2019 to 22 April 2020 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 946,979 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 0 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 946,979 | ||||

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Performance Share Plan | ||||

| Period of return: | 22 October 2019 to 22 April 2020 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 358,183 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 0 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 0 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 358,183 | ||||

| Name of applicant: | Rio Tinto plc | ||||

| Name of scheme: | Rio Tinto plc Global Employee Share Plan | ||||

| Period of return: | 22 October 2019 to 22 April 2020 | ||||

| Balance of unallotted securities under scheme(s) from previous return: | 27,305 | ||||

Plus: The amount by which the block scheme(s) has been increased since the date of the last return (if any increase has been applied for): | 45,000 | ||||

Less: Number of securities issued/allotted under scheme(s) during period: | 20,687 | ||||

| Equals: Balance under scheme(s) not yet issued/allotted at end of period: | 51,618 | ||||

| Name of contact: | Steve Allen | ||||

| Telephone number of contact: | 0207 781 2000 | ||||

This announcement has been authorised for release to the market by Rio Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Additional regulated information required to be disclosed under the laws of a Member State.

Exhibit 99.7

Notice to ASX/LSE

Shareholdings of directors and persons discharging managerial responsibility (PDMR)

23 April 2020

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each, Rio Tinto plc ADRs or Rio Tinto Limited ordinary shares (‘shares’). Shares are purchased out of monthly deductions from salary and participants are allocated an equivalent number of shares or ADRs free of charge (‘matching shares’ and ‘matching ADRs’), conditional upon satisfying the terms of myShare. The matching shares or matching ADRs are subject to a three year holding period, and vest after this period.

Upon vesting, on 18 April 2020, the following PDMR received matching shares or matching ADRs under myShare, of which sufficient were sold on 21 April 2020 to pay applicable withholding tax and other deductions.

| Security | Name of PDMR | No: of Matching Shares Granted | No: of Shares Vested* | No: of Shares Sold | Price per Share Sold | No: of Shares Retained | ||||||||||||||

| Rio Tinto plc shares | Baatar, Bold | 16.4310 | 20.7464 | 8.7137 | 36.887292 GBP | 12.0327 | ||||||||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 25.4454 | 32.1293 | 15.3542 | 36.887292 GBP | 16.7751 | ||||||||||||||

Rio Tinto plc shares | Jacques, Jean-Sébastien | 12.3232 | 15.5596 | 6.5352 | 36.887292 GBP | 9.0244 | ||||||||||||||

| Rio Tinto Limited shares | Trott, Simon | 24.0330 | 28.8418 | N/A | N/A | 28.8418 | ||||||||||||||

*The number of shares vested includes additional shares calculated to reflect dividends declared during the vesting period on the original shares granted, in accordance with the plan rules.

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

Page 2 of 2

Exhibit 99.8

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR)

Dividend Reinvestment

23 April 2020

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

Vested Share Account (VSA)

Rio Tinto plc ordinary shares of 10p each and Rio Tinto Limited ordinary shares (‘Shares’) held in a VSA are subject to dividend reinvestment whereby cash dividends are used to buy Shares in the market.

On 21 April 2020 the following PDMRs acquired shares in Rio Tinto plc by way of reinvestment of dividends received on shares held in a VSA.

| Security | Name of PDMR | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Baatar, Bold | 462.96931 | 36.9866 | ||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 2,618.15579 | 36.9866 | ||||||||

| Rio Tinto plc shares | Soirat, Arnaud | 99.73641 | 36.9866 | ||||||||

On 22 April 2020 the following PDMRs acquired shares in Rio Tinto Limited by way of reinvestment of dividends received on shares held in a VSA.

| Security | Name of PDMR | Number of Shares Acquired | Price per Share AUD | ||||||||

| Rio Tinto Limited shares | Salisbury, Christopher | 369.05819 | 91.7600 | ||||||||

| Rio Tinto Limited shares | Soirat, Arnaud | 1,234.2088 | 91.7600 | ||||||||

| Rio Tinto Limited shares | Trott, Simon | 290.0803 | 91.7600 | ||||||||

UK Share Plan (UKSP)

The UKSP is an HMRC approved Share Incentive Plan under which qualifying UK employees are able to purchase, on a quarterly basis, Rio Tinto plc shares. Rio Tinto plc shares are purchased out of monthly deductions from salary, and participants are allocated an equivalent number of shares free of charge (UKSP matching shares). Qualifying UK employees are also awarded Free Shares once a year.

Rio Tinto plc shares held in the UKSP are subject to dividend reinvestment whereby cash dividends are used to buy Rio Tinto plc shares in the market.

Page 1 of 3

On 21 April 2020 the following PDMRs acquired shares in Rio Tinto plc by way of reinvestment of dividends received on shares held in a UKSP.

| Security | Name of PDMR | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Baatar, Bold | 11 | 36.9866 | ||||||||

| Rio Tinto plc shares | Jacques, Jean-Sébastien | 102 | 36.9866 | ||||||||

| Rio Tinto plc shares | Soirat, Arnaud | 14 | 36.9866 | ||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 4 | 36.9866 | ||||||||

Global Employee Share Plan (myShare)

Under myShare employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each, Rio Tinto plc ADRs or Rio Tinto Limited ordinary shares (‘Shares’). Shares are purchased out of monthly deductions from salary and participants are allocated an equivalent number of shares or ADRs free of charge (‘matching shares’ and ‘matching ADRs’), conditional upon satisfying the terms of myShare. The matching shares or matching ADRs are subject to a three year holding period, and vest after this period.

Rio Tinto Shares held in myShare are subject to dividend reinvestment whereby cash dividends are used to buy Shares in the market under the terms of myShare.

On 21 April 2020 the following PDMRs acquired Rio Tinto plc shares by way of reinvestment of dividends received on shares held in myShare.

| Security | Name of PDMR | Number of Shares Acquired | Price per Share GBP | ||||||||

| Rio Tinto plc shares | Baatar, Bold | 18.717 | 36.9866 | ||||||||

| Rio Tinto plc shares | Barrios, Alfredo | 36.8273 | 36.9866 | ||||||||

| Rio Tinto plc shares | Jacques, Jean-Sébastien | 28.2686 | 36.9866 | ||||||||

| Rio Tinto plc shares | Stausholm, Jakob | 1.2207 | 36.9866 | ||||||||

| Rio Tinto plc shares | Trott, Simon | 8.1437 | 36.9866 | ||||||||

On 22 April 2020 the following PDMRs acquired Rio Tinto Limited shares by way of reinvestment of dividends received on shares held in myShare.

| Security | Name of PDMR | Number of Shares Acquired | Price per Share AUD | ||||||||

| Rio Tinto Limited shares | Trott, Simon | 43.6515 | 91.7600 | ||||||||

Page 2 of 3

FCA notifications in accordance with the EU Market Abuse Regulation have been issued to the London Stock Exchange contemporaneously with this release.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary.

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

Page 3 of 3

Exhibit 99.9 Notice to ASX This appendix is not available as an online form Please fill in and submit as a PDF announcement +Rule 3.10.3A, 3.10.3B, 3.10.3C Appendix 3G Notification of issue, conversion or payment up of equity +securities Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. If you are an entity incorporated outside Australia and you are issuing a new class of +securities other than CDIs, you will need to obtain and provide an International Securities Identification Number (ISIN) for that class. Further information on the requirement for the notification of an ISIN is available from the Create Online Forms page. ASX is unable to create the new ISIN for non-Australian issuers. *Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity. Part 1 – Entity and announcement details Question Question Answer no 1.1 *Name of entity Rio Tinto Limited We (the entity here named) give notice of the issue, conversion or payment up of the following unquoted +securities. 1.2 *Registration type and number 96 004 458 404 Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). 1.3 *ASX issuer code RIO 1.4 *This announcement is ☒ A new announcement Tick whichever is applicable. ☐ An update/amendment to a previous announcement ☐ A cancellation of a previous announcement 1.5 *Date of this announcement 24 April 2020 + See chapter 19 for defined terms 31 January 2020 Page 1

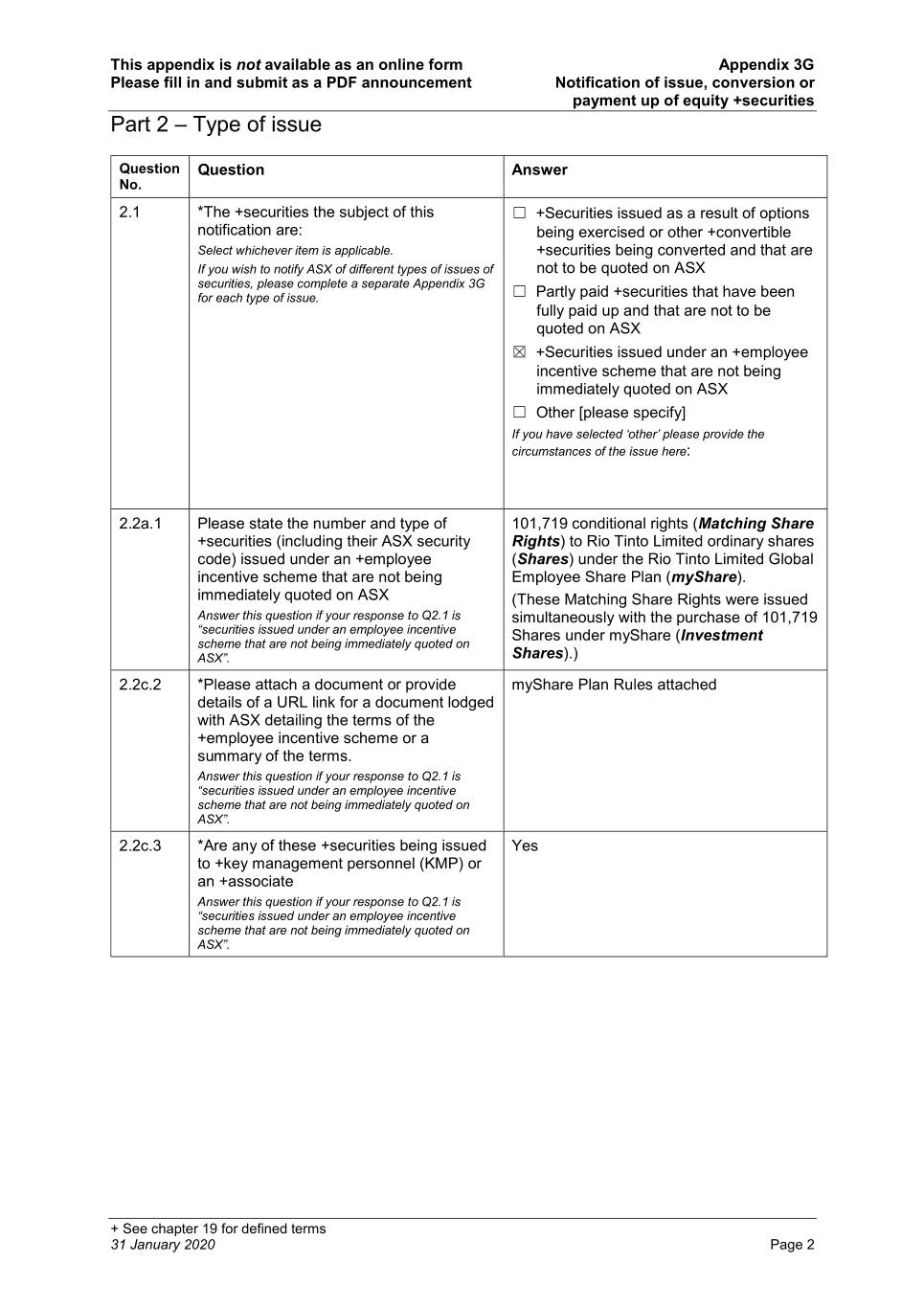

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 2 – Type of issue Question Question Answer No. 2.1 *The +securities the subject of this ☐ +Securities issued as a result of options notification are: being exercised or other +convertible Select whichever item is applicable. +securities being converted and that are If you wish to notify ASX of different types of issues of not to be quoted on ASX securities, please complete a separate Appendix 3G ☐ for each type of issue. Partly paid +securities that have been fully paid up and that are not to be quoted on ASX ☒ +Securities issued under an +employee incentive scheme that are not being immediately quoted on ASX ☐ Other [please specify] If you have selected ‘other’ please provide the circumstances of the issue here: 2.2a.1 Please state the number and type of 101,719 conditional rights (Matching Share +securities (including their ASX security Rights) to Rio Tinto Limited ordinary shares code) issued under an +employee (Shares) under the Rio Tinto Limited Global incentive scheme that are not being Employee Share Plan (myShare). immediately quoted on ASX (These Matching Share Rights were issued Answer this question if your response to Q2.1 is simultaneously with the purchase of 101,719 “securities issued under an employee incentive Shares under myShare ( scheme that are not being immediately quoted on Investment ASX”. Shares).) 2.2c.2 *Please attach a document or provide myShare Plan Rules attached details of a URL link for a document lodged with ASX detailing the terms of the +employee incentive scheme or a summary of the terms. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 2.2c.3 *Are any of these +securities being issued Yes to +key management personnel (KMP) or an +associate Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. + See chapter 19 for defined terms 31 January 2020 Page 2

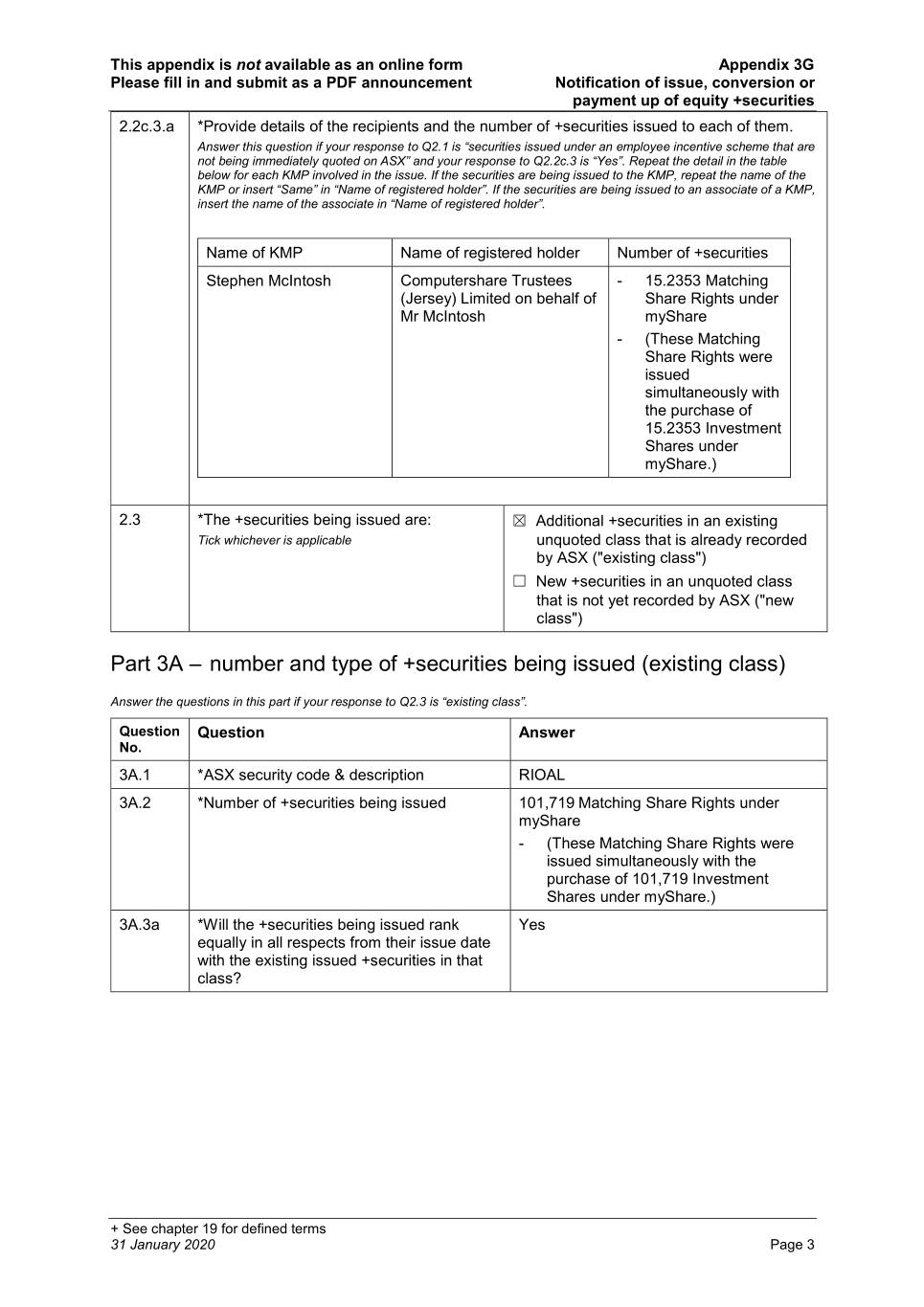

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities 2.2c.3.a *Provide details of the recipients and the number of +securities issued to each of them. Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX” and your response to Q2.2c.3 is “Yes”. Repeat the detail in the table below for each KMP involved in the issue. If the securities are being issued to the KMP, repeat the name of the KMP or insert “Same” in “Name of registered holder”. If the securities are being issued to an associate of a KMP, insert the name of the associate in “Name of registered holder”. Name of KMP Name of registered holder Number of +securities Stephen McIntosh Computershare Trustees - 15.2353 Matching (Jersey) Limited on behalf of Share Rights under Mr McIntosh myShare - (These Matching Share Rights were issued simultaneously with the purchase of 15.2353 Investment Shares under myShare.) 2.3 *The +securities being issued are: ☒ Additional +securities in an existing Tick whichever is applicable unquoted class that is already recorded by ASX ("existing class") ☐ New +securities in an unquoted class that is not yet recorded by ASX ("new class") Part 3A – number and type of +securities being issued (existing class) Answer the questions in this part if your response to Q2.3 is “existing class”. Question Question Answer No. 3A.1 *ASX security code & description RIOAL 3A.2 *Number of +securities being issued 101,719 Matching Share Rights under myShare - (These Matching Share Rights were issued simultaneously with the purchase of 101,719 Investment Shares under myShare.) 3A.3a *Will the +securities being issued rank Yes equally in all respects from their issue date with the existing issued +securities in that class? + See chapter 19 for defined terms 31 January 2020 Page 3

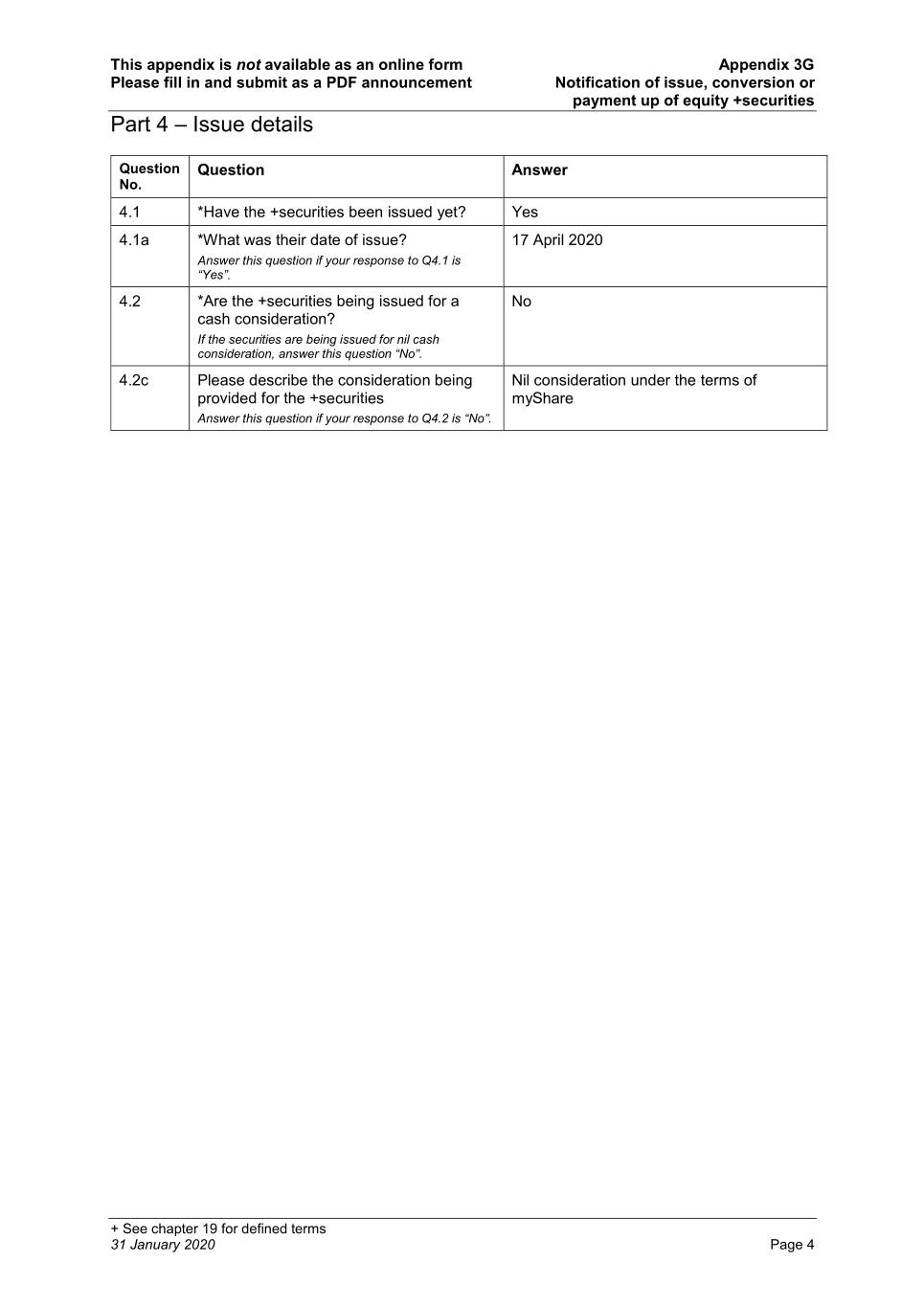

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 4 – Issue details Question Question Answer No. 4.1 *Have the +securities been issued yet? Yes 4.1a *What was their date of issue? 17 April 2020 Answer this question if your response to Q4.1 is “Yes”. 4.2 *Are the +securities being issued for a No cash consideration? If the securities are being issued for nil cash consideration, answer this question “No”. 4.2c Please describe the consideration being Nil consideration under the terms of provided for the +securities myShare Answer this question if your response to Q4.2 is “No”. + See chapter 19 for defined terms 31 January 2020 Page 4

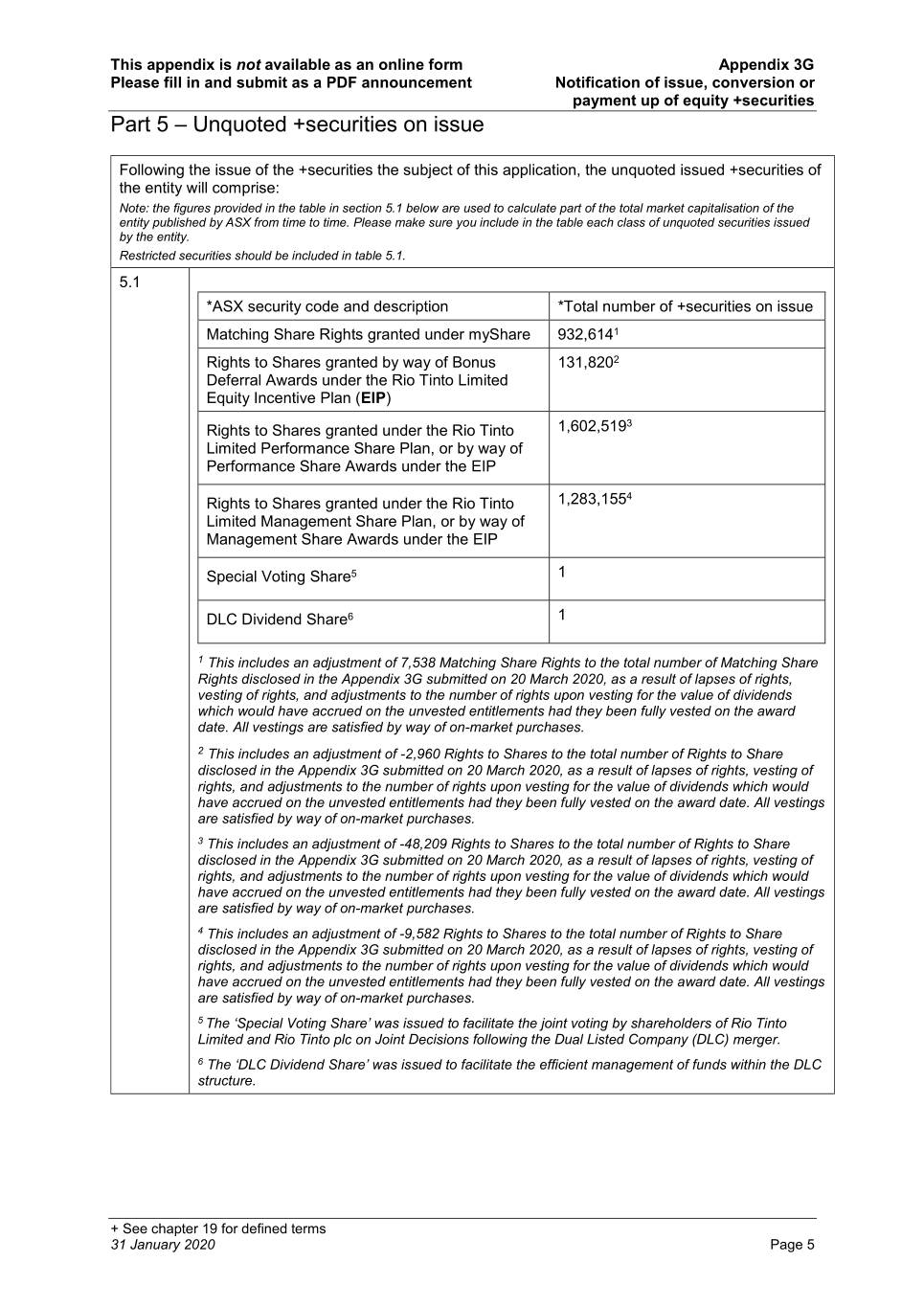

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 5 – Unquoted +securities on issue Following the issue of the +securities the subject of this application, the unquoted issued +securities of the entity will comprise: Note: the figures provided in the table in section 5.1 below are used to calculate part of the total market capitalisation of the entity published by ASX from time to time. Please make sure you include in the table each class of unquoted securities issued by the entity. Restricted securities should be included in table 5.1. 5.1 *ASX security code and description *Total number of +securities on issue Matching Share Rights granted under myShare 932,6141 Rights to Shares granted by way of Bonus 131,8202 Deferral Awards under the Rio Tinto Limited Equity Incentive Plan (EIP) 3 Rights to Shares granted under the Rio Tinto 1,602,519 Limited Performance Share Plan, or by way of Performance Share Awards under the EIP 4 Rights to Shares granted under the Rio Tinto 1,283,155 Limited Management Share Plan, or by way of Management Share Awards under the EIP Special Voting Share5 1 DLC Dividend Share6 1 1 This includes an adjustment of 7,538 Matching Share Rights to the total number of Matching Share Rights disclosed in the Appendix 3G submitted on 20 March 2020, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 2 This includes an adjustment of -2,960 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 20 March 2020, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 3 This includes an adjustment of -48,209 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 20 March 2020, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 4 This includes an adjustment of -9,582 Rights to Shares to the total number of Rights to Share disclosed in the Appendix 3G submitted on 20 March 2020, as a result of lapses of rights, vesting of rights, and adjustments to the number of rights upon vesting for the value of dividends which would have accrued on the unvested entitlements had they been fully vested on the award date. All vestings are satisfied by way of on-market purchases. 5 The ‘Special Voting Share’ was issued to facilitate the joint voting by shareholders of Rio Tinto Limited and Rio Tinto plc on Joint Decisions following the Dual Listed Company (DLC) merger. 6 The ‘DLC Dividend Share’ was issued to facilitate the efficient management of funds within the DLC structure. + See chapter 19 for defined terms 31 January 2020 Page 5

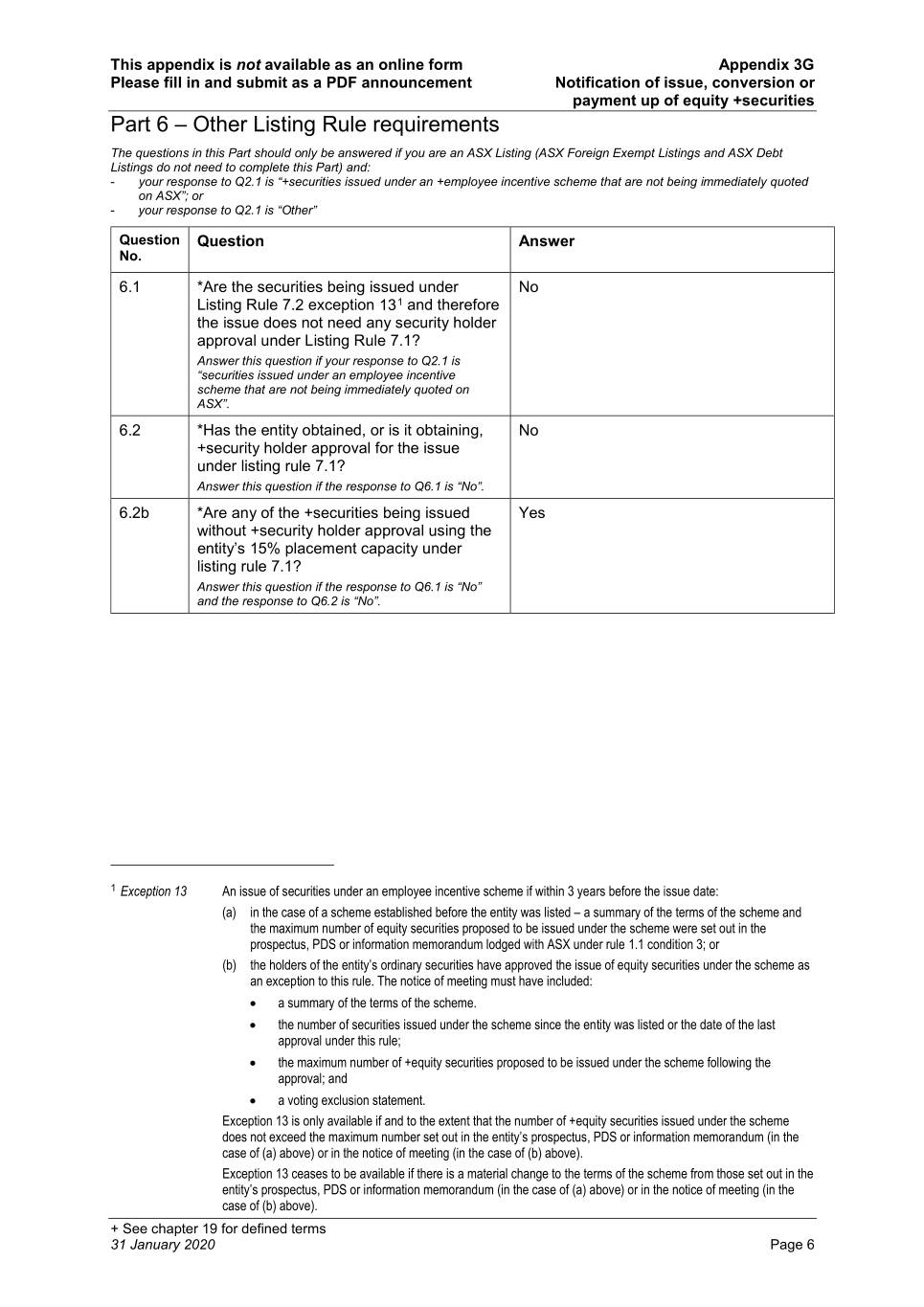

This appendix is not available as an online form Appendix 3G Please fill in and submit as a PDF announcement Notification of issue, conversion or payment up of equity +securities Part 6 – Other Listing Rule requirements The questions in this Part should only be answered if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not need to complete this Part) and: - your response to Q2.1 is “+securities issued under an +employee incentive scheme that are not being immediately quoted on ASX”; or - your response to Q2.1 is “Other” Question Question Answer No. 6.1 *Are the securities being issued under No Listing Rule 7.2 exception 131 and therefore the issue does not need any security holder approval under Listing Rule 7.1? Answer this question if your response to Q2.1 is “securities issued under an employee incentive scheme that are not being immediately quoted on ASX”. 6.2 *Has the entity obtained, or is it obtaining, No +security holder approval for the issue under listing rule 7.1? Answer this question if the response to Q6.1 is “No”. 6.2b *Are any of the +securities being issued Yes without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q6.1 is “No” and the response to Q6.2 is “No”. 1 Exception 13 An issue of securities under an employee incentive scheme if within 3 years before the issue date: (a) in the case of a scheme established before the entity was listed – a summary of the terms of the scheme and the maximum number of equity securities proposed to be issued under the scheme were set out in the prospectus, PDS or information memorandum lodged with ASX under rule 1.1 condition 3; or (b) the holders of the entity’s ordinary securities have approved the issue of equity securities under the scheme as an exception to this rule. The notice of meeting must have included: • a summary of the terms of the scheme. • the number of securities issued under the scheme since the entity was listed or the date of the last approval under this rule; • the maximum number of +equity securities proposed to be issued under the scheme following the approval; and • a voting exclusion statement. Exception 13 is only available if and to the extent that the number of +equity securities issued under the scheme does not exceed the maximum number set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above). Exception 13 ceases to be available if there is a material change to the terms of the scheme from those set out in the entity’s prospectus, PDS or information memorandum (in the case of (a) above) or in the notice of meeting (in the case of (b) above). + See chapter 19 for defined terms 31 January 2020 Page 6

Exhibit 99.10 Notice to ASX Rio Tinto Limited annual general meeting – revised arrangements 28 April 2020 THIS ANNOUNCEMENT IS IMPORTANT AND REQUIRES SHAREHOLDERS’ IMMEDIATE ATTENTION • Attendance in person at annual general meeting is no longer possible • Shareholders will be able to participate in the meeting either online or by telephone On 10 March 2020, Rio Tinto Limited issued notice of its annual general meeting to be held in Brisbane at 9:30am Australian Eastern Standard Time (AEST) on Thursday, 7 May 2020. On 25 March 2020, Rio Tinto Limited issued an addendum to the notice of meeting explaining that we were continuing to closely monitoring the impact of the COVID-19 virus in Australia and how this may affect the arrangements for the meeting. Attending the meeting in person no longer possible The Australian Government has announced a number of measures to reduce spread of COVID-19, including requiring people to stay at home, except in very limited circumstances, and imposing restrictions on public gatherings. As a result, a number of changes are being made to the previously announced arrangements for the 2020 Rio Tinto Limited annual general meeting. The 2020 Annual General Meeting for Rio Tinto Limited will be held as a virtual meeting only. There will not be a physical meeting that shareholders can attend in person. Revised arrangements The time of the meeting has been changed. The meeting will commence at 4.00pm AEST on 7 May 2020. This decision was made to provide shareholders in as many different time zones as possible the best opportunity to participate in the meeting. Shareholders will be able to participate in the meeting and ask questions, either online or by telephone. Shareholders will also be able to vote online during the meeting. Details of how to participate in the meeting either online or by telephone is set out on our website at https://www.riotinto.com/invest/shareholder-information/annual-general-meetings. As a result of the change to the commencement time of the meeting, shareholders now have until 4.00pm AEST on Tuesday 5 May 2020 to lodge their proxy forms. Further information on how to submit the proxy forms is set out on page 5 of the 2020 Notice of annual general meeting dated 10 March 2020. Page 1 of 2

Contacts [email protected] riotinto.com Follow @RioTinto on Twitter Media Relations, United Kingdom Media Relations, Australia Illtud Harri Jonathan Rose M +44 7920 503 600 T +61 3 9283 3088 M +61 447 028 913 David Outhwaite T +44 20 7781 1623 Matt Chambers M +44 7787 597 493 T +61 3 9283 3087 M +61 433 525 739 Media Relations, Americas Matthew Klar Jesse Riseborough T +1 514 608 4429 T +61 8 6211 6013 M +61 436 653 412 Media Relations, Asia Grant Donald T +65 6679 9290 M +65 9722 6028 Investor Relations, United Kingdom Investor Relations, Australia Menno Sanderse Natalie Worley T: +44 20 7781 1517 T +61 3 9283 3063 M: +44 7825 195 178 M +61 409 210 462 David Ovington Amar Jambaa T +44 20 7781 2051 T +61 3 9283 3627 M +44 7920 010 978 M +61 472 865 948 Group Company Secretary Joint Company Secretary Steve Allen Tim Paine Rio Tinto plc Rio Tinto Limited 6 St James’s Square Level 7, 360 Collins Street London SW1Y 4AD Melbourne 3000 United Kingdom Australia T +44 20 7781 2000 T +61 3 9283 3333 Registered in England Registered in Australia No. 719885 ABN 96 004 458 404 This announcement is authorised for release to the market by Rio Tinto’s Group Company Secretary. Page 2 of 2

Exhibit 99.11

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR)

28 April 2020

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR and both ASX and the London Stock Exchange (LSE) of material dealings by PDMR in Rio Tinto Limited securities.

On 23 April 2020, the following PDMR sold shares as follows:

| Security | Name of PDMR | Number of shares sold | Price per share AUD$ | ||||||||

Rio Tinto Limited shares | Simon Trott | 2,400 | 86.086113 | ||||||||

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

This announcement is authorised for release to the market by Rio Tinto's Group Company Secretary.

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James's Square London SW1Y 4AD United Kingdom T +44 20 7781 2058 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||

Exhibit 99.12

Notice to ASX/LSE

Shareholdings of persons discharging managerial responsibility (PDMR)

30 April 2020

As part of its dual listed company structure, Rio Tinto notifies dealings in Rio Tinto plc and Rio Tinto Limited securities by PDMRs to both the Australian Securities Exchange (ASX) and the London Stock Exchange (LSE).

UK Share Plan (UKSP)

The UK Share Plan is an HMRC approved Share Incentive Plan under which qualifying UK employees are able to purchase, on a quarterly basis, Rio Tinto plc ordinary shares of 10p each (‘shares’). Shares are purchased out of monthly deductions from salary and participants are allocated an equivalent number of shares free of charge (‘matching shares’). Qualifying UK employees are also awarded Free shares once a year.

The following PDMRs were awarded Free shares on 30 April 2020:

| Security | Name of PDMR / KMP | Number of shares awarded | Price per share GBP | ||||||||

| Rio Tinto plc | Baatar, Bold | 91 | 39.43 | ||||||||

| Rio Tinto plc | Jacques, Jean-Sébastien | 91 | 39.43 | ||||||||

| Rio Tinto plc | Soirat, Arnaud | 91 | 39.43 | ||||||||

| Rio Tinto plc | Stausholm, Jakob | 91 | 39.43 | ||||||||

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1. Information disclosed under article 19 of the Market Abuse Regulation.

This announcement is authorised for release to the market by Rio Tinto's Group Company Secretary

Steve Allen Group Company Secretary | Tim Paine Joint Company Secretary | ||||

Rio Tinto plc 6 St James’s Square London SW1Y 4AD T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 7, 360 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 | ||||