Form 8-K Tesla, Inc. For: Apr 29

Q1 2020 Update Exhibit 99.1

Highlights 03 Financial Summary04 Operational Summary06 Vehicle Capacity 07 Core Technology08 Other Highlights09 Outlook10 Photos & Charts11 Financial Statements19 Additional Information24

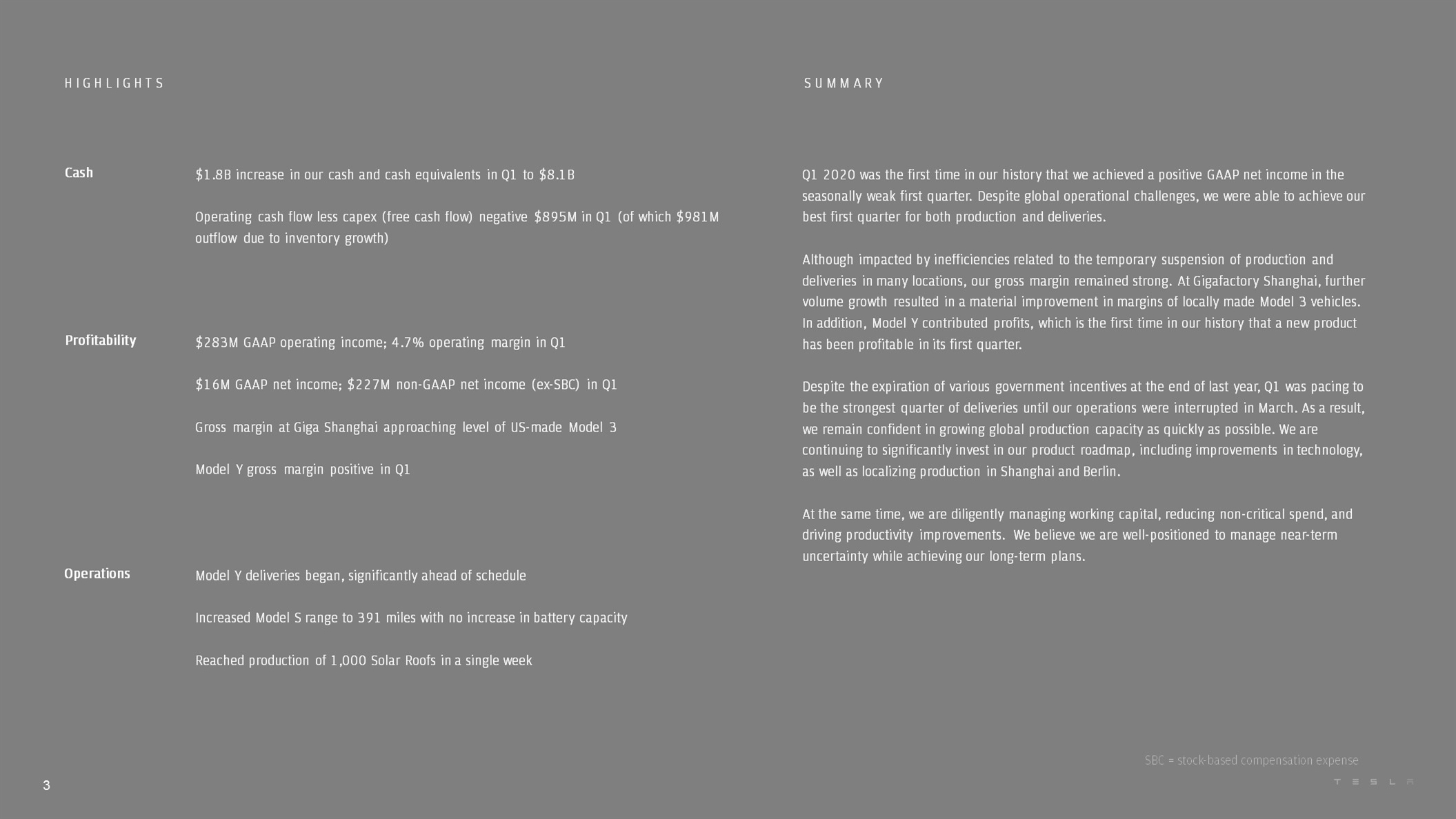

Q1 2020 was the first time in our history that we achieved a positive GAAP net income in the seasonally weak first quarter. Despite global operational challenges, we were able to achieve our best first quarter for both production and deliveries. Although impacted by inefficiencies related to the temporary suspension of production and deliveries in many locations, our gross margin remained strong. At Gigafactory Shanghai, further volume growth resulted in a material improvement in margins of locally made Model 3 vehicles. In addition, Model Y contributed profits, which is the first time in our history that a new product has been profitable in its first quarter. Despite the expiration of various government incentives at the end of last year, Q1 was pacing to be the strongest quarter of deliveries until our operations were interrupted in March. As a result, we remain confident in growing global production capacity as quickly as possible. We are continuing to significantly invest in our product roadmap, including improvements in technology, as well as localizing production in Shanghai and Berlin. At the same time, we are diligently managing working capital, reducing non-critical spend, and driving productivity improvements. We believe we are well-positioned to manage near-term uncertainty while achieving our long-term plans. $1.8B increase in our cash and cash equivalents in Q1 to $8.1B Operating cash flow less capex (free cash flow) negative $895M in Q1 (of which $981M outflow due to inventory growth) Cash Model Y deliveries began, significantly ahead of schedule Increased Model S range to 391 miles with no increase in battery capacity Reached production of 1,000 Solar Roofs in a single week Profitability $283M GAAP operating income; 4.7% operating margin in Q1 $16M GAAP net income; $227M non-GAAP net income (ex-SBC) in Q1 Gross margin at Giga Shanghai approaching level of US-made Model 3 Model Y gross margin positive in Q1 Operations S U M M A R Y H I G H L I G H T S 3 SBC = stock-based compensation expense

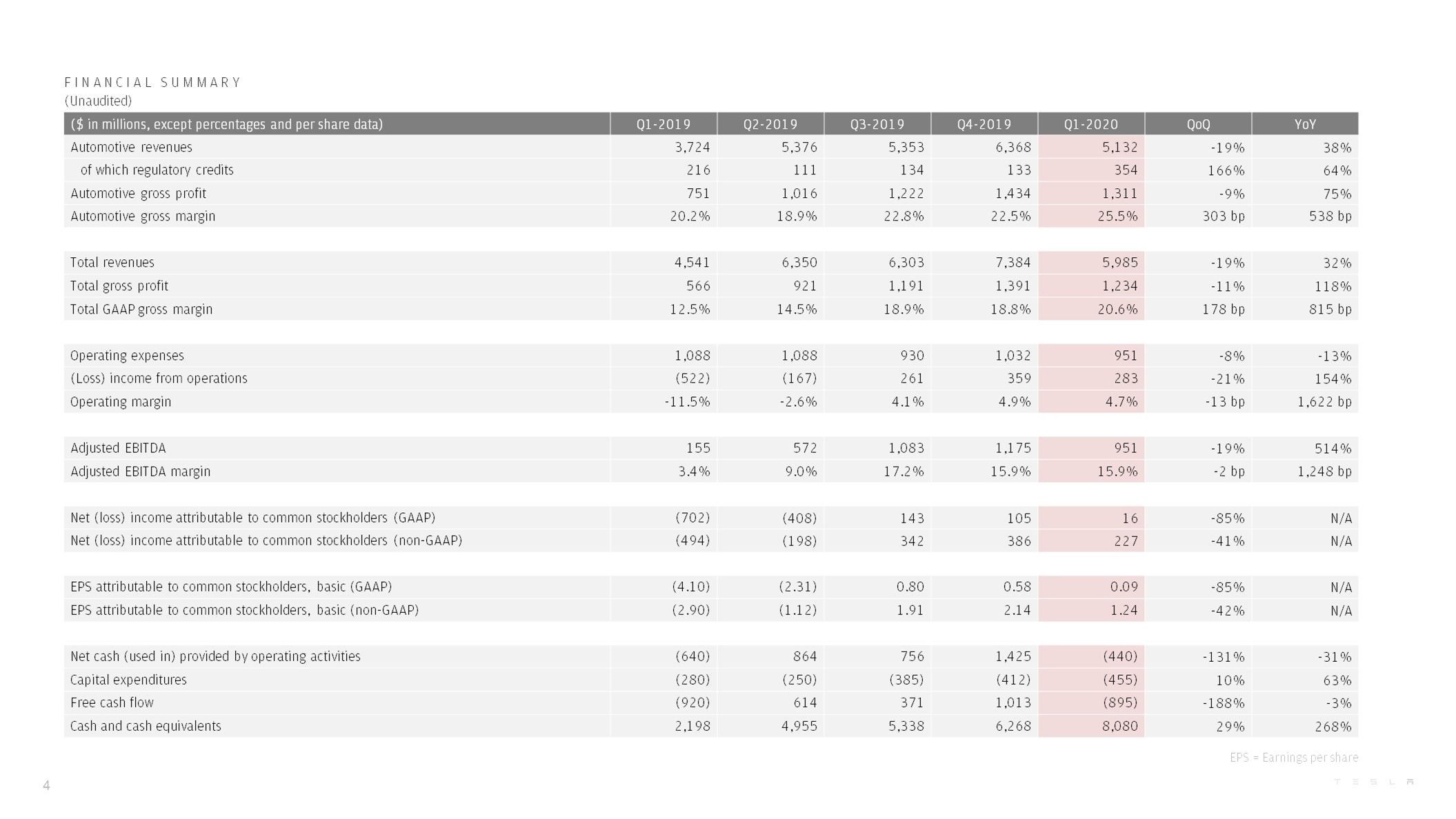

F I N A N C I A L S U M M A R Y (Unaudited) 4 ($ in millions, except percentages and per share data) Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 QoQ YoY Automotive revenues 3,724 5,376 5,353 6,368 5,132 -19% 38% of which regulatory credits 216 111 134 133 354 166% 64% Automotive gross profit 751 1,016 1,222 1,434 1,311 -9% 75% Automotive gross margin 20.2% 18.9% 22.8% 22.5% 25.5% 303 bp 538 bp Total revenues 4,541 6,350 6,303 7,384 5,985 -19% 32% Total gross profit 566 921 1,191 1,391 1,234 -11% 118% Total GAAP gross margin 12.5% 14.5% 18.9% 18.8% 20.6% 178 bp 815 bp Operating expenses 1,088 1,088 930 1,032 951 -8% -13% (Loss) income from operations (522) (167) 261 359 283 -21% 154% Operating margin -11.5% -2.6% 4.1% 4.9% 4.7% -13 bp 1,622 bp Adjusted EBITDA 155 572 1,083 1,175 951 -19% 514% Adjusted EBITDA margin 3.4% 9.0% 17.2% 15.9% 15.9% -2 bp 1,248 bp Net (loss) income attributable to common stockholders (GAAP) (702) (408) 143 105 16 -85% N/A Net (loss) income attributable to common stockholders (non-GAAP) (494) (198) 342 386 227 -41% N/A EPS attributable to common stockholders, basic (GAAP) (4.10) (2.31) 0.80 0.58 0.09 -85% N/A EPS attributable to common stockholders, basic (non-GAAP) (2.90) (1.12) 1.91 2.14 1.24 -42% N/A Net cash (used in) provided by operating activities (640) 864 756 1,425 (440) -131% -31% Capital expenditures (280) (250) (385) (412) (455) 10% 63% Free cash flow (920) 614 371 1,013 (895) -188% -3% Cash and cash equivalents 2,198 4,955 5,338 6,268 8,080 29% 268% EPS = Earnings per share

F I N A N C I A L S U M M A R Y Revenue Profitability Cash In Q1, we reached our highest ever revenue for a seasonally slower first quarter as our total revenue grew 32% YoY. Sequentially, our revenue was mainly impacted by lower deliveries, driven primarily by limitations on our ability to deliver vehicles towards the end of the quarter. As expected, our average selling price (ASP) declined further as our mix continues to shift from Model S and Model X to the more affordable Model 3 and Model Y. Our automotive gross margin of 25.5% as well as total gross margin of 20.6% both reached their highest levels in 18 months. Sequentially, GAAP gross margin was impacted by improved profitability of Gigafactory Shanghai, higher regulatory credit revenue, lower delivery volume, Model Y and Solar Roof ramp cost and lower volumes of solar and storage. Quarter-end cash and cash equivalents increased by $1.8B QoQ to $8.1B, driven mainly by our recent $2.3B capital raise and offset by negative quarterly free cash flow of $895M. Sequential inventory growth impacted our operating cash flow negatively by $981M, which was primarily attributed to the interruption of our operations at the end of the quarter. Capital expenditures increased sequentially mainly due to investments in Model Y preparations in Fremont and Gigafactory Shanghai. 5

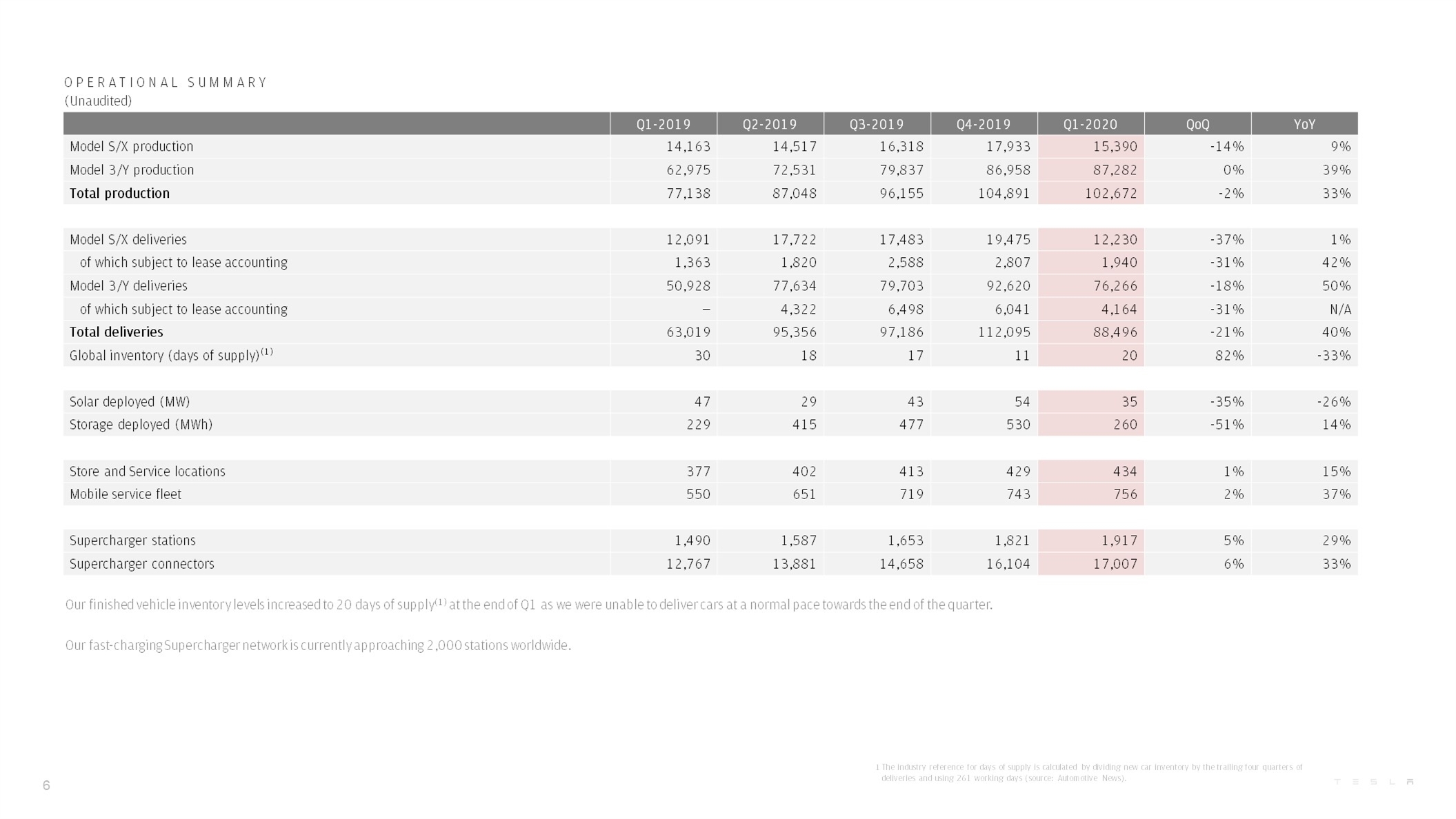

Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 QoQ YoY Model S/X production 14,163 14,517 16,318 17,933 15,390 -14% 9% Model 3/Y production 62,975 72,531 79,837 86,958 87,282 0% 39% Total production 77,138 87,048 96,155 104,891 102,672 -2% 33% Model S/X deliveries 12,091 17,722 17,483 19,475 12,230 -37% 1% of which subject to lease accounting 1,363 1,820 2,588 2,807 1,940 -31% 42% Model 3/Y deliveries 50,928 77,634 79,703 92,620 76,266 -18% 50% of which subject to lease accounting — 4,322 6,498 6,041 4,164 -31% N/A Total deliveries 63,019 95,356 97,186 112,095 88,496 -21% 40% Global inventory (days of supply)(1) 30 18 17 11 20 82% -33% Solar deployed (MW) 47 29 43 54 35 -35% -26% Storage deployed (MWh) 229 415 477 530 260 -51% 14% Store and Service locations 377 402 413 429 434 1% 15% Mobile service fleet 550 651 719 743 756 2% 37% Supercharger stations 1,490 1,587 1,653 1,821 1,917 5% 29% Supercharger connectors 12,767 13,881 14,658 16,104 17,007 6% 33% Our finished vehicle inventory levels increased to 20 days of supply(1) at the end of Q1 as we were unable to deliver cars at a normal pace towards the end of the quarter. Our fast-charging Supercharger network is currently approaching 2,000 stations worldwide. 1 The industry reference for days of supply is calculated by dividing new car inventory by the trailing four quarters of deliveries and using 261 working days (source: Automotive News). 6 O P E R A T I O N A L S U M M A R Y (Unaudited)

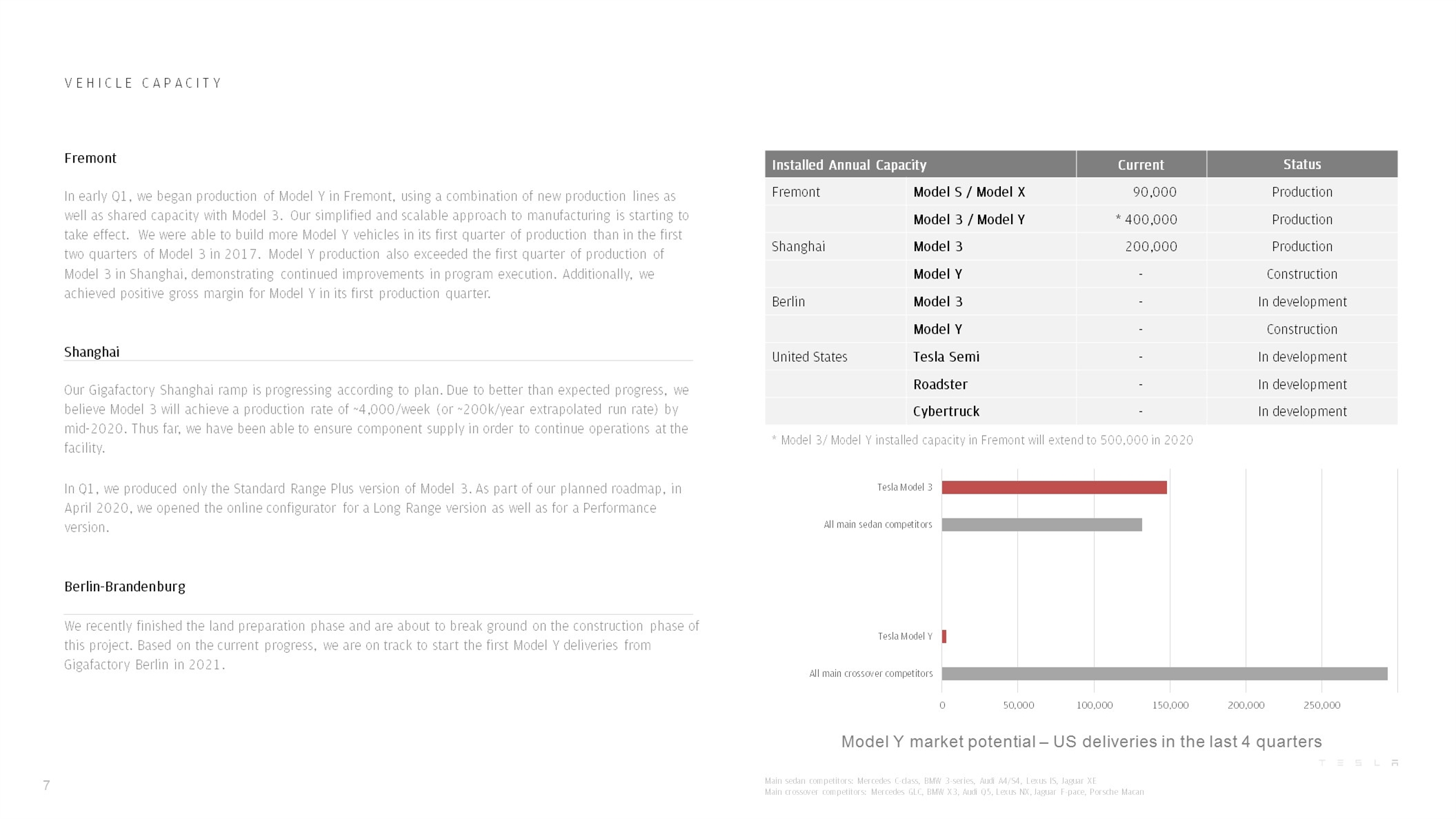

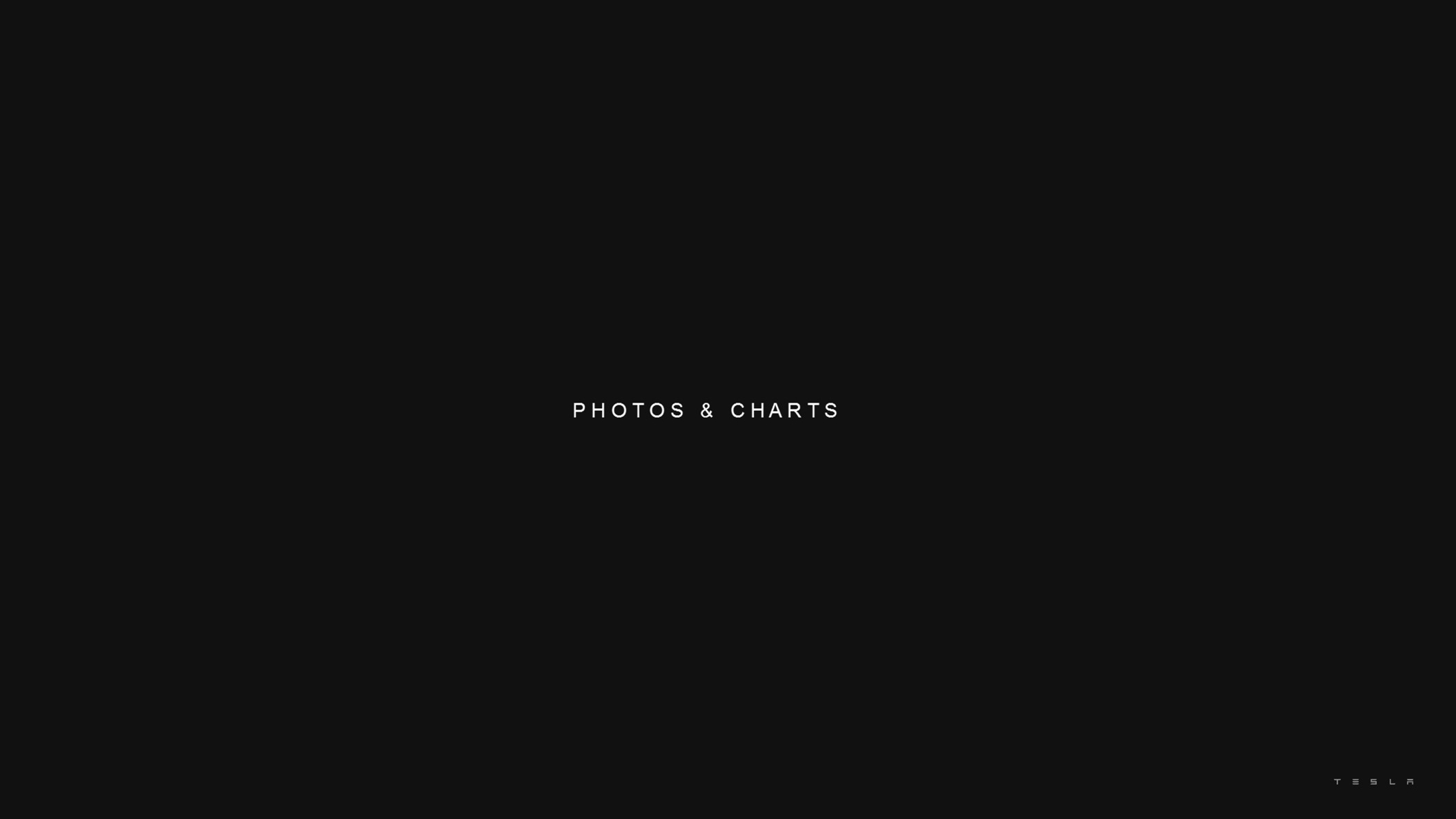

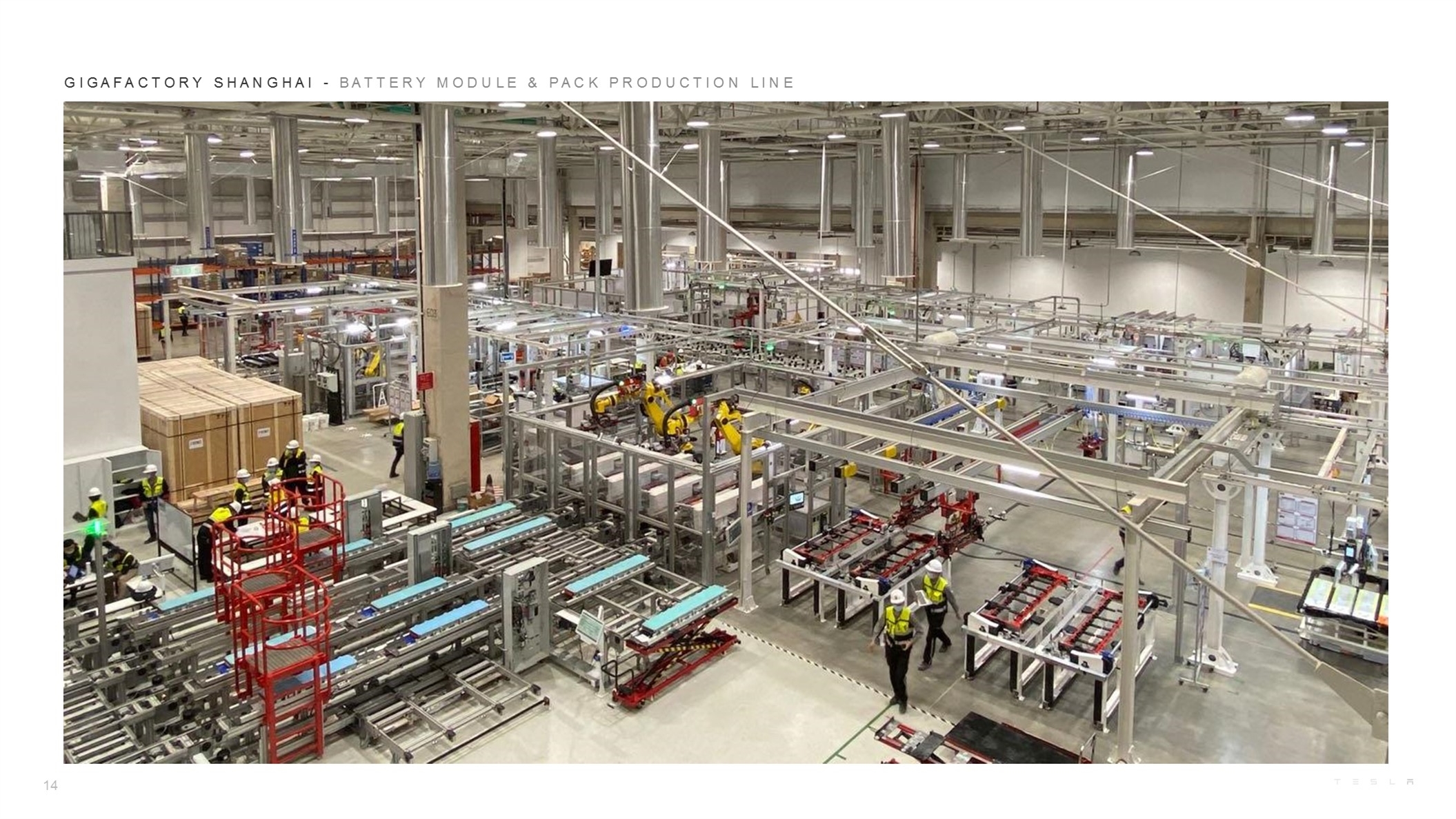

Model Y market potential – US deliveries in the last 4 quarters V E H I C L E C A P A C I T Y Fremont In early Q1, we began production of Model Y in Fremont, using a combination of new production lines as well as shared capacity with Model 3. Our simplified and scalable approach to manufacturing is starting to take effect. We were able to build more Model Y vehicles in its first quarter of production than in the first two quarters of Model 3 in 2017. Model Y production also exceeded the first quarter of production of Model 3 in Shanghai, demonstrating continued improvements in program execution. Additionally, we achieved positive gross margin for Model Y in its first production quarter. Shanghai Our Gigafactory Shanghai ramp is progressing according to plan. Due to better than expected progress, we believe Model 3 will achieve a production rate of ~4,000/week (or ~200k/year extrapolated run rate) by mid-2020. Thus far, we have been able to ensure component supply in order to continue operations at the facility. In Q1, we produced only the Standard Range Plus version of Model 3. As part of our planned roadmap, in April 2020, we opened the online configurator for a Long Range version as well as for a Performance version. Berlin-Brandenburg We recently finished the land preparation phase and are about to break ground on the construction phase of this project. Based on the current progress, we are on track to start the first Model Y deliveries from Gigafactory Berlin in 2021. Installed Annual Capacity Current Status Fremont Model S / Model X 90,000 Production Model 3 / Model Y * 400,000 Production Shanghai Model 3 200,000 Production Model Y - Construction Berlin Model 3 - In development Model Y - Construction United States Tesla Semi - In development Roadster - In development Cybertruck - In development * Model 3/ Model Y installed capacity in Fremont will extend to 500,000 in 2020 7 Main sedan competitors: Mercedes C-class, BMW 3-series, Audi A4/S4, Lexus IS, Jaguar XE Main crossover competitors: Mercedes GLC, BMW X3, Audi Q5, Lexus NX, Jaguar F-pace, Porsche Macan

C O R E T E C H N O L O G Y Autopilot & Full Self Driving (FSD) We enabled stop sign and traffic light recognition and braking for our Early Access Program users at the end of Q1 and to the wider public in April 2020. As we have done with previous releases of major new features, drivers will be required to confirm their attention in order to continue. Once enough real-world data is collected, the system will become more capable and our vehicles will continue driving through intersections without a confirmation. Vehicle Software Among many other security and functionality improvements, we launched "DashCam Viewer”. Many customers have been requesting the possibility to view footage recorded by Autopilot cameras directly on the car screen. With the latest software update, our users can now view their Sentry Mode videos from all four angles (front, back, left & right cameras). That way, Tesla owners know right away if the Sentry Mode recording requires further attention. Battery & Powertrain The maximum range of both Model S and Model X has been extended further, even without increasing the size of the battery pack. Customers consider long range as one of the most important factors when switching from a combustion engine vehicle to an EV, and our lead has continued to increase, with 391 miles for Model S and 351 miles for Model X. We recently introduced the new heat pump system, including the octovalve for Model Y, which allowed us to reach similar EPA range to Model 3 while being ~10% heavier. Traffic light recognition and braking 8 EPA range – extending the range gap 97 mile gap 132 mile gap

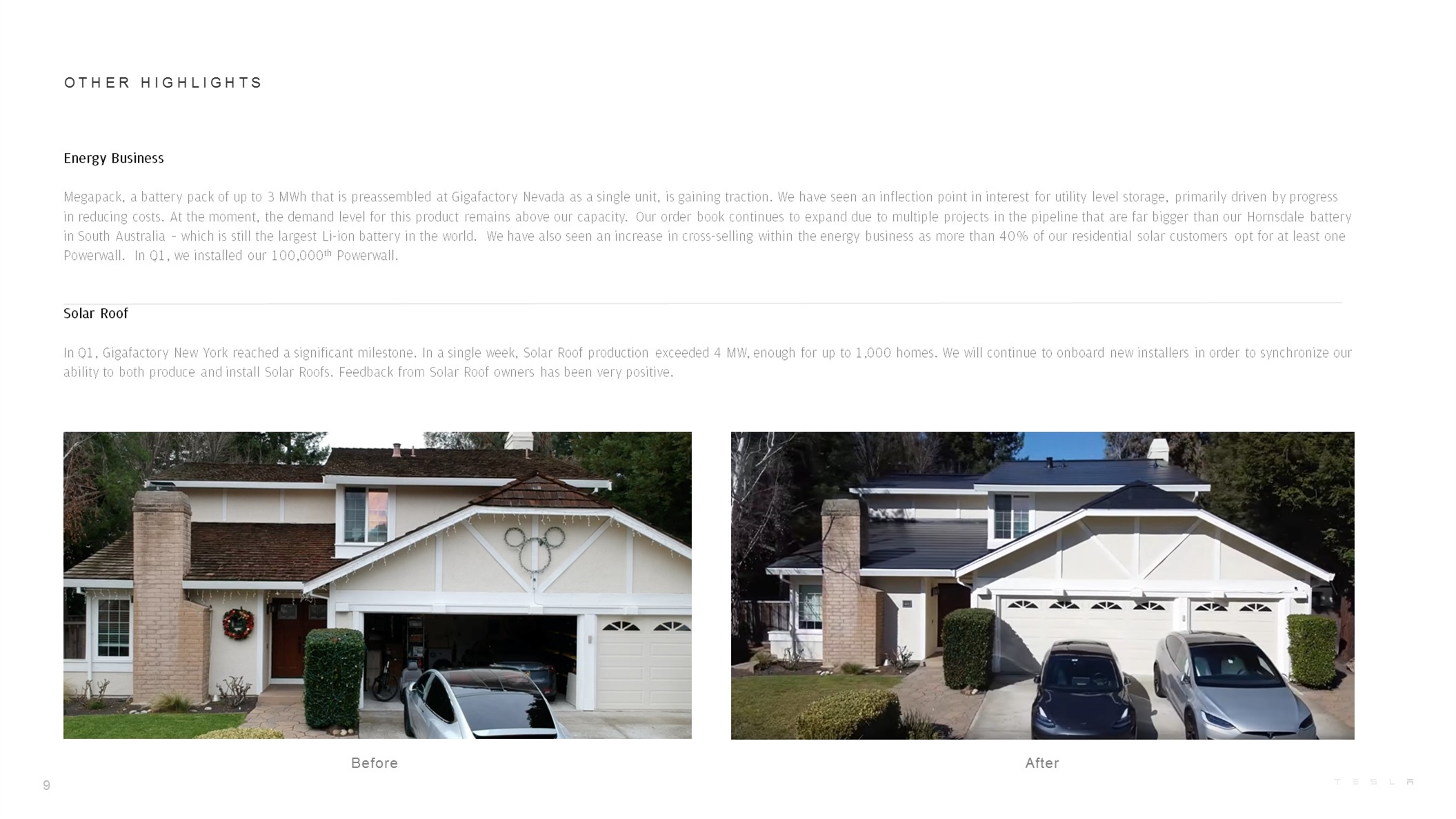

O T H E R H I G H L I G H T S Energy Business Megapack, a battery pack of up to 3 MWh that is preassembled at Gigafactory Nevada as a single unit, is gaining traction. We have seen an inflection point in interest for utility level storage, primarily driven by progress in reducing costs. At the moment, the demand level for this product remains above our capacity. Our order book continues to expand due to multiple projects in the pipeline that are far bigger than our Hornsdale battery in South Australia – which is still the largest Li-ion battery in the world. We have also seen an increase in cross-selling within the energy business as more than 40% of our residential solar customers opt for at least one Powerwall. In Q1, we installed our 100,000th Powerwall. Solar Roof In Q1, Gigafactory New York reached a significant milestone. In a single week, Solar Roof production exceeded 4 MW, enough for up to 1,000 homes. We will continue to onboard new installers in order to synchronize our ability to both produce and install Solar Roofs. Feedback from Solar Roof owners has been very positive. Before 9 After

O U T L O O K Introduction Volume Cash Flow Profit Product It is difficult to predict how quickly vehicle manufacturing and its global supply chain will return to prior levels. Due to the wide range of potential outcomes, near-term guidance of net income and free cash flow would likely be inaccurate. We will again revisit our 2020 guidance in our Q2 update. We have the capacity installed to exceed 500,000 vehicle deliveries this year, despite announced production interruptions. For our US factories, it remains uncertain how quickly we and our suppliers will be able to ramp production after resuming operations. We are coordinating closely with each supplier and associated government. While near-term cash flow guidance is currently on hold, we are continuing to significantly invest in our product roadmap and long-term capacity expansion plans as we have sufficient liquidity. Model Y production lines in Shanghai and Berlin remain our most important near-term projects. While near-term profit guidance is currently on hold, we believe we will achieve industry leading operating margins and profitability with capacity expansion and localization plans underway. We expect that production of both Model Y in Fremont and Model 3 in Shanghai will continue to ramp gradually through Q2. We are continuing to build capacity for Model Y at Gigafactory Berlin and Gigafactory Shanghai and remain on track to start deliveries from both locations in 2021. Lastly, we are shifting our first Tesla Semi deliveries to 2021. 10

P H O T O S & C H A R T S

G I G A F A C T O R Y S H A N G H A I - F U T U R E M O D E L Y F A C T O R Y 12

13 G I G A F A C T O R Y S H A N G H A I - B A T T E R Y M O D U L E & P A C K F A C T O R Y

14 G I G A F A C T O R Y S H A N G H A I - B A T T E R Y M O D U L E & P A C K P R O D U C T I O N L I N E

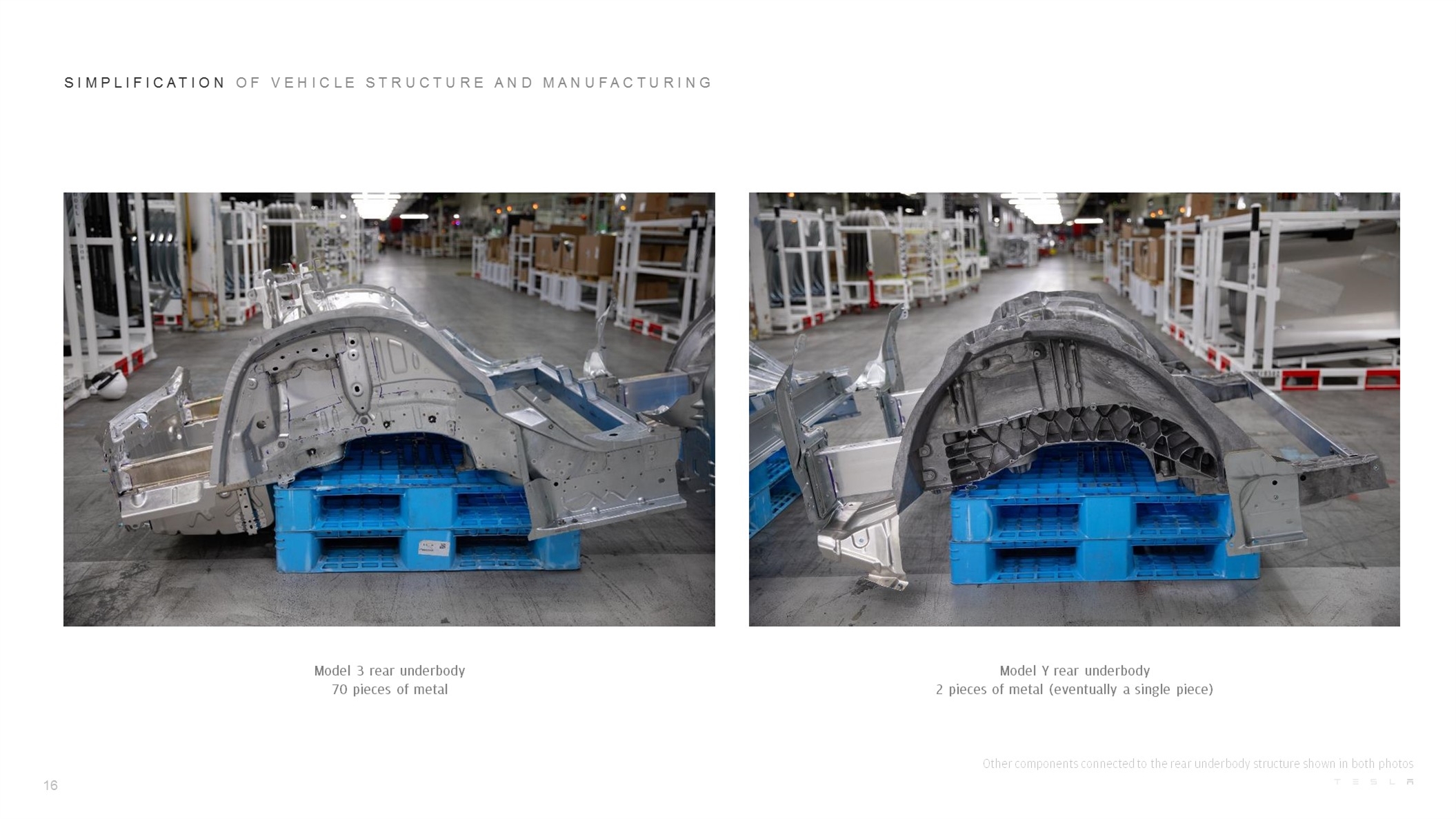

S I M P L I F I C A T I O N O F V E H I C L E S T R U C T U R E A N D M A N U F A C T U R I N G 15 Model 3 rear underbody 70 pieces of metal Model Y rear underbody 2 pieces of metal (eventually a single piece)

Model 3 rear underbody 70 pieces of metal Model Y rear underbody 2 pieces of metal (eventually a single piece) S I M P L I F I C A T I O N O F V E H I C L E S T R U C T U R E A N D M A N U F A C T U R I N G 16 Other components connected to the rear underbody structure shown in both photos

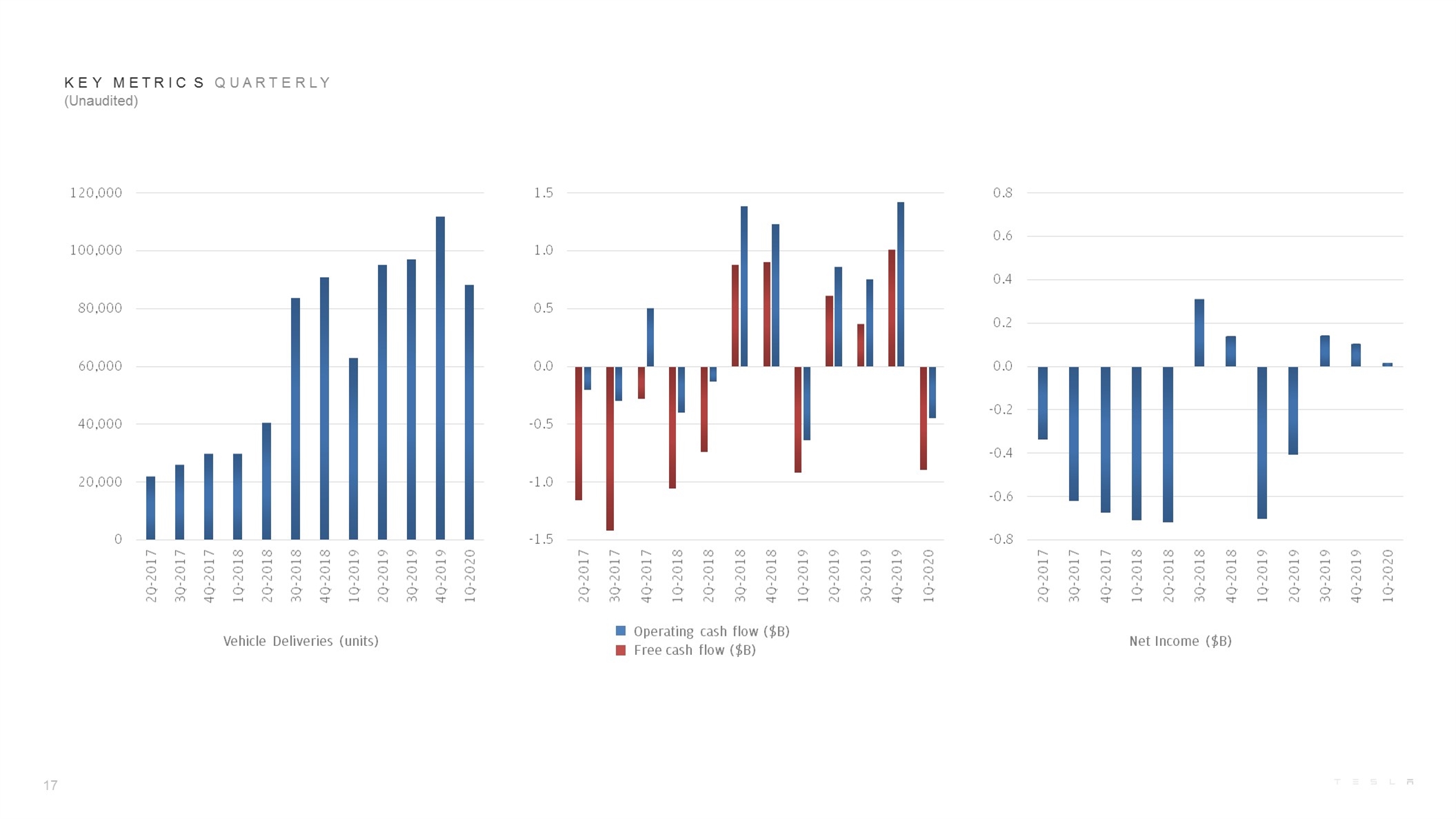

Vehicle Deliveries (units) Net Income ($B) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) 17 Operating cash flow ($B) Free cash flow ($B)

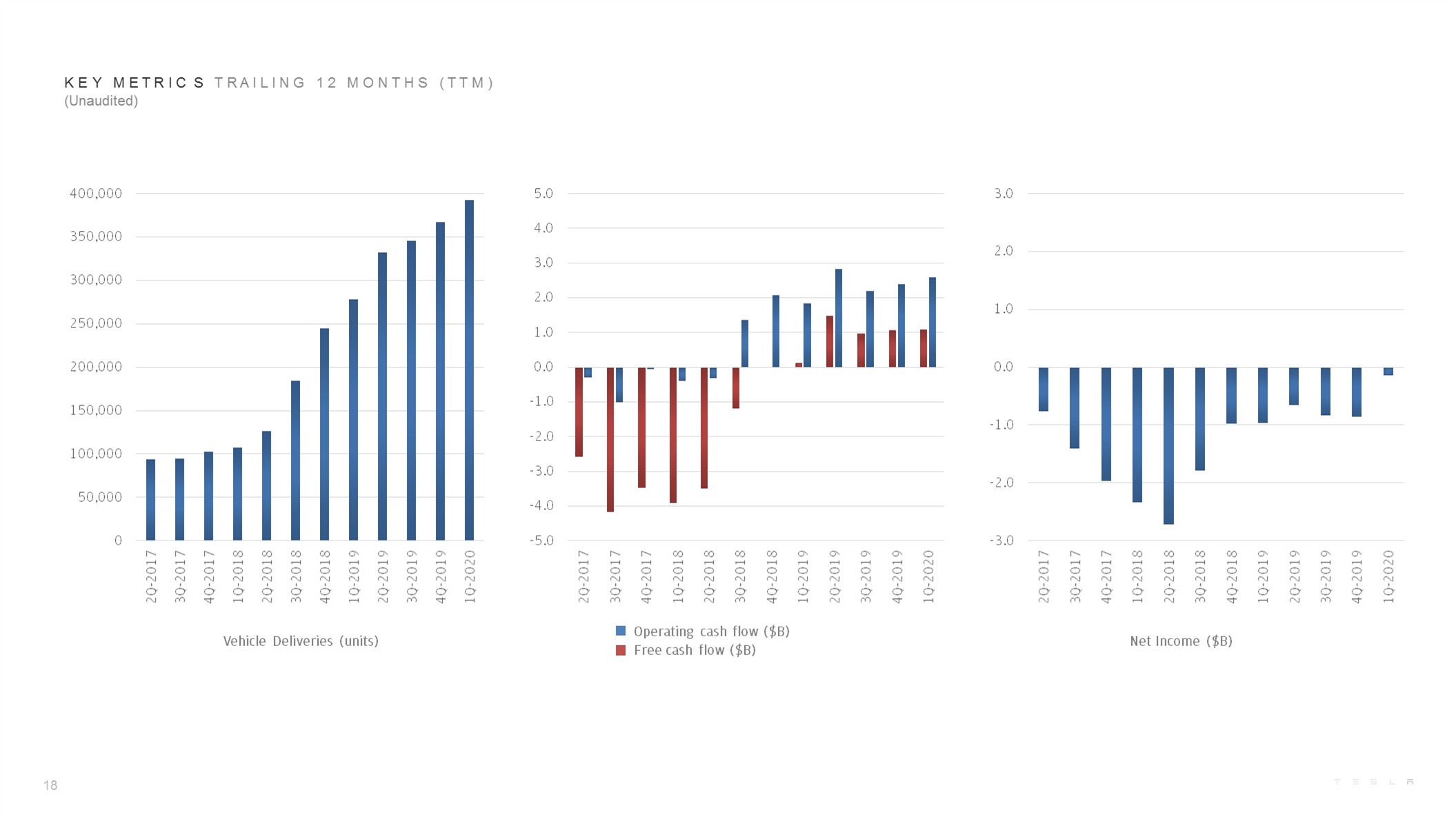

K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Vehicle Deliveries (units) Operating cash flow ($B) Free cash flow ($B) Net Income ($B) 18

F I N A N C I A L S T A T E M E N T S

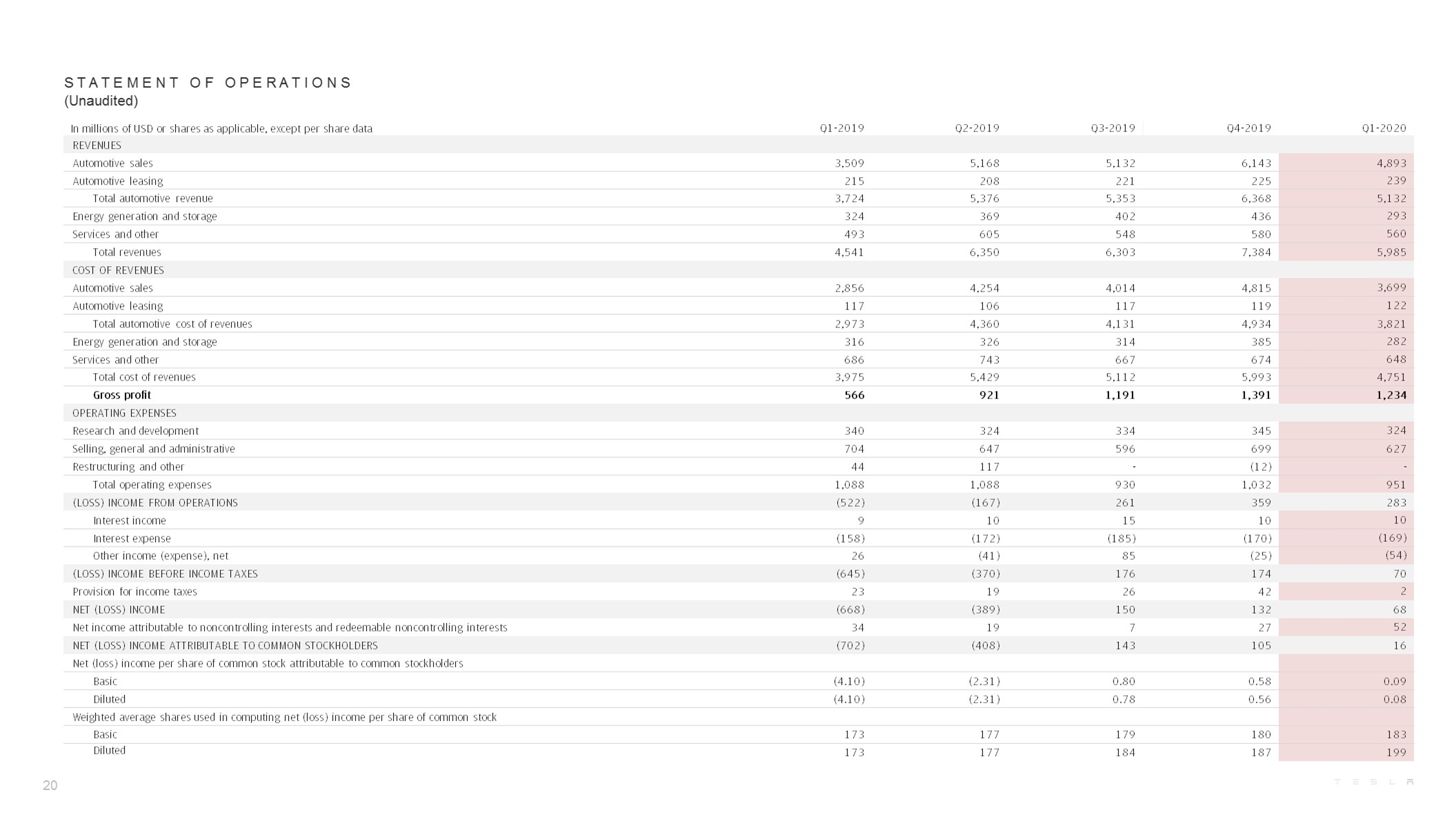

In millions of USD or shares as applicable, except per share data Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 REVENUES Automotive sales 3,509 5,168 5,132 6,143 4,893 Automotive leasing 215 208 221 225 239 Total automotive revenue 3,724 5,376 5,353 6,368 5,132 Energy generation and storage 324 369 402 436 293 Services and other 493 605 548 580 560 Total revenues 4,541 6,350 6,303 7,384 5,985 COST OF REVENUES Automotive sales 2,856 4,254 4,014 4,815 3,699 Automotive leasing 117 106 117 119 122 Total automotive cost of revenues 2,973 4,360 4,131 4,934 3,821 Energy generation and storage 316 326 314 385 282 Services and other 686 743 667 674 648 Total cost of revenues 3,975 5,429 5,112 5,993 4,751 Gross profit 566 921 1,191 1,391 1,234 OPERATING EXPENSES Research and development 340 324 334 345 324 Selling, general and administrative 704 647 596 699 627 Restructuring and other 44 117 - (12) - Total operating expenses 1,088 1,088 930 1,032 951 (LOSS) INCOME FROM OPERATIONS (522) (167) 261 359 283 Interest income 9 10 15 10 10 Interest expense (158) (172) (185) (170) (169) Other income (expense), net 26 (41) 85 (25) (54) (LOSS) INCOME BEFORE INCOME TAXES (645) (370) 176 174 70 Provision for income taxes 23 19 26 42 2 NET (LOSS) INCOME (668) (389) 150 132 68 Net income attributable to noncontrolling interests and redeemable noncontrolling interests 34 19 7 27 52 NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS (702) (408) 143 105 16 Net (loss) income per share of common stock attributable to common stockholders Basic (4.10) (2.31) 0.80 0.58 0.09 Diluted (4.10) (2.31) 0.78 0.56 0.08 Weighted average shares used in computing net (loss) income per share of common stock Basic 173 177 179 180 183 Diluted 173 177 184 187 199 S T A T E M E N T O F O P E R A T I O N S (Unaudited) 20

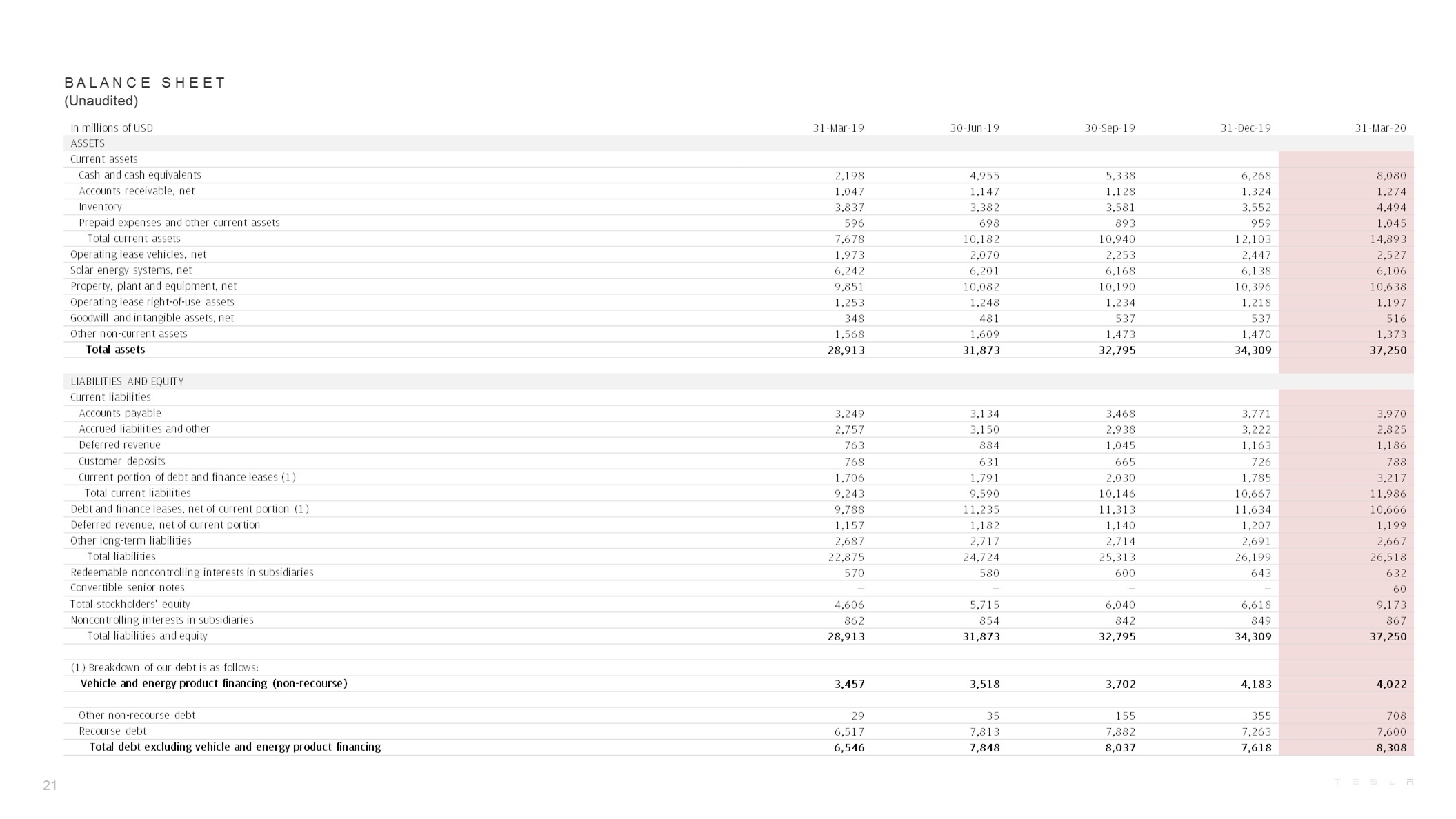

B A L A N C E S H E E T (Unaudited) In millions of USD 31-Mar-19 30-Jun-19 30-Sep-19 31-Dec-19 31-Mar-20 ASSETS Current assets Cash and cash equivalents 2,198 4,955 5,338 6,268 8,080 Accounts receivable, net 1,047 1,147 1,128 1,324 1,274 Inventory 3,837 3,382 3,581 3,552 4,494 Prepaid expenses and other current assets 596 698 893 959 1,045 Total current assets 7,678 10,182 10,940 12,103 14,893 Operating lease vehicles, net 1,973 2,070 2,253 2,447 2,527 Solar energy systems, net 6,242 6,201 6,168 6,138 6,106 Property, plant and equipment, net 9,851 10,082 10,190 10,396 10,638 Operating lease right-of-use assets 1,253 1,248 1,234 1,218 1,197 Goodwill and intangible assets, net 348 481 537 537 516 Other non-current assets 1,568 1,609 1,473 1,470 1,373 Total assets 28,913 31,873 32,795 34,309 37,250 LIABILITIES AND EQUITY Current liabilities Accounts payable 3,249 3,134 3,468 3,771 3,970 Accrued liabilities and other 2,757 3,150 2,938 3,222 2,825 Deferred revenue 763 884 1,045 1,163 1,186 Customer deposits 768 631 665 726 788 Current portion of debt and finance leases (1) 1,706 1,791 2,030 1,785 3,217 Total current liabilities 9,243 9,590 10,146 10,667 11,986 Debt and finance leases, net of current portion (1) 9,788 11,235 11,313 11,634 10,666 Deferred revenue, net of current portion 1,157 1,182 1,140 1,207 1,199 Other long-term liabilities 2,687 2,717 2,714 2,691 2,667 Total liabilities 22,875 24,724 25,313 26,199 26,518 Redeemable noncontrolling interests in subsidiaries 570 580 600 643 632 Convertible senior notes — — — — 60 Total stockholders' equity 4,606 5,715 6,040 6,618 9,173 Noncontrolling interests in subsidiaries 862 854 842 849 867 Total liabilities and equity 28,913 31,873 32,795 34,309 37,250 (1) Breakdown of our debt is as follows: Vehicle and energy product financing (non-recourse) 3,457 3,518 3,702 4,183 4,022 Other non-recourse debt 29 35 155 355 708 Recourse debt 6,517 7,813 7,882 7,263 7,600 Total debt excluding vehicle and energy product financing 6,546 7,848 8,037 7,618 8,308 21

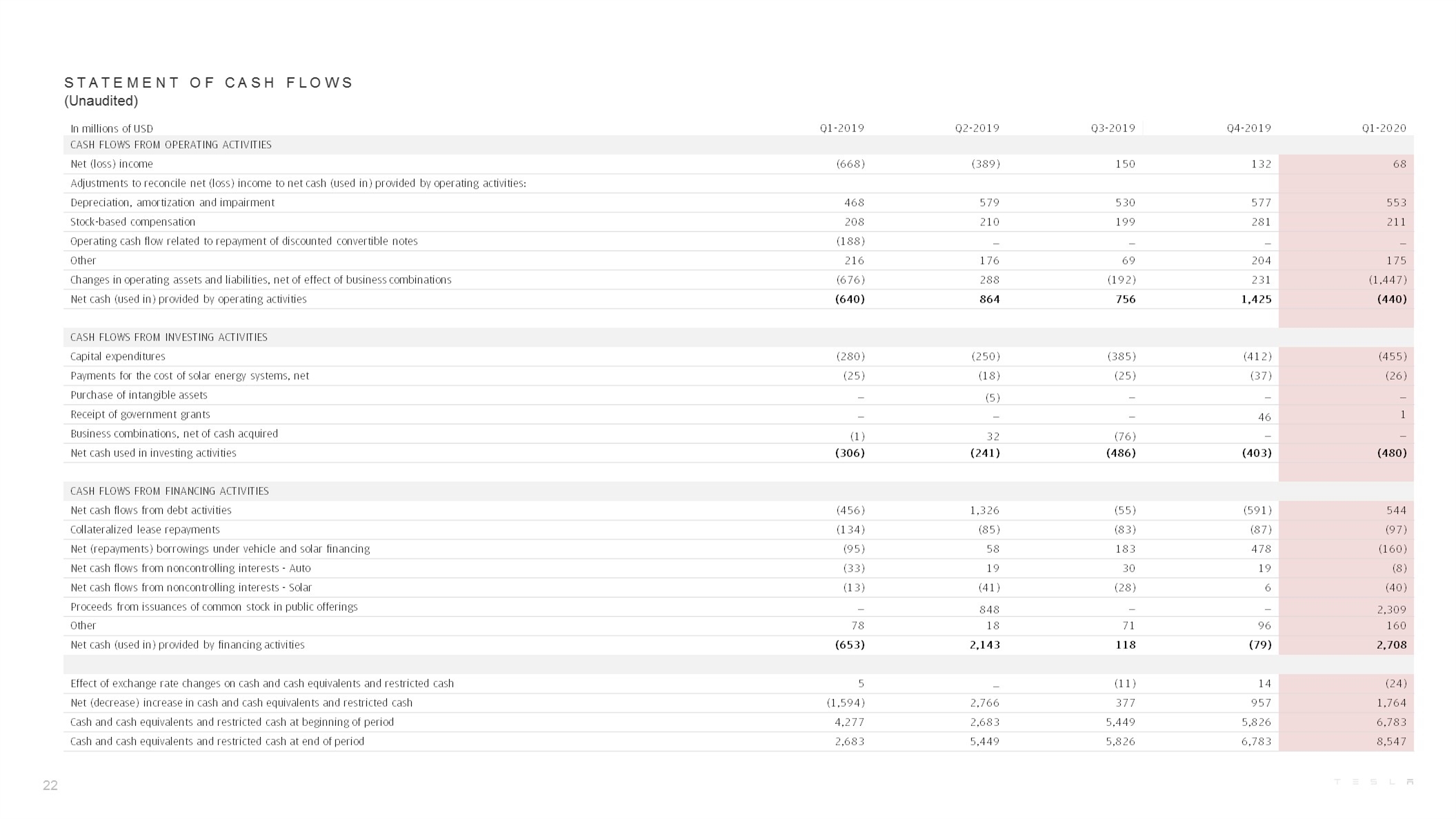

In millions of USD Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 CASH FLOWS FROM OPERATING ACTIVITIES Net (loss) income (668) (389) 150 132 68 Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: Depreciation, amortization and impairment 468 579 530 577 553 Stock-based compensation 208 210 199 281 211 Operating cash flow related to repayment of discounted convertible notes (188) — — — — Other 216 176 69 204 175 Changes in operating assets and liabilities, net of effect of business combinations (676) 288 (192) 231 (1,447) Net cash (used in) provided by operating activities (640) 864 756 1,425 (440) CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (280) (250) (385) (412) (455) Payments for the cost of solar energy systems, net (25) (18) (25) (37) (26) Purchase of intangible assets — (5) — — — Receipt of government grants — — — 46 1 Business combinations, net of cash acquired (1) 32 (76) — — Net cash used in investing activities (306) (241) (486) (403) (480) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from debt activities (456) 1,326 (55) (591) 544 Collateralized lease repayments (134) (85) (83) (87) (97) Net (repayments) borrowings under vehicle and solar financing (95) 58 183 478 (160) Net cash flows from noncontrolling interests - Auto (33) 19 30 19 (8) Net cash flows from noncontrolling interests - Solar (13) (41) (28) 6 (40) Proceeds from issuances of common stock in public offerings — 848 — — 2,309 Other 78 18 71 96 160 Net cash (used in) provided by financing activities (653) 2,143 118 (79) 2,708 Effect of exchange rate changes on cash and cash equivalents and restricted cash 5 — (11) 14 (24) Net (decrease) increase in cash and cash equivalents and restricted cash (1,594) 2,766 377 957 1,764 Cash and cash equivalents and restricted cash at beginning of period 4,277 2,683 5,449 5,826 6,783 Cash and cash equivalents and restricted cash at end of period 2,683 5,449 5,826 6,783 8,547 S T A T E M E N T O F C A S H F L O W S (Unaudited) 22

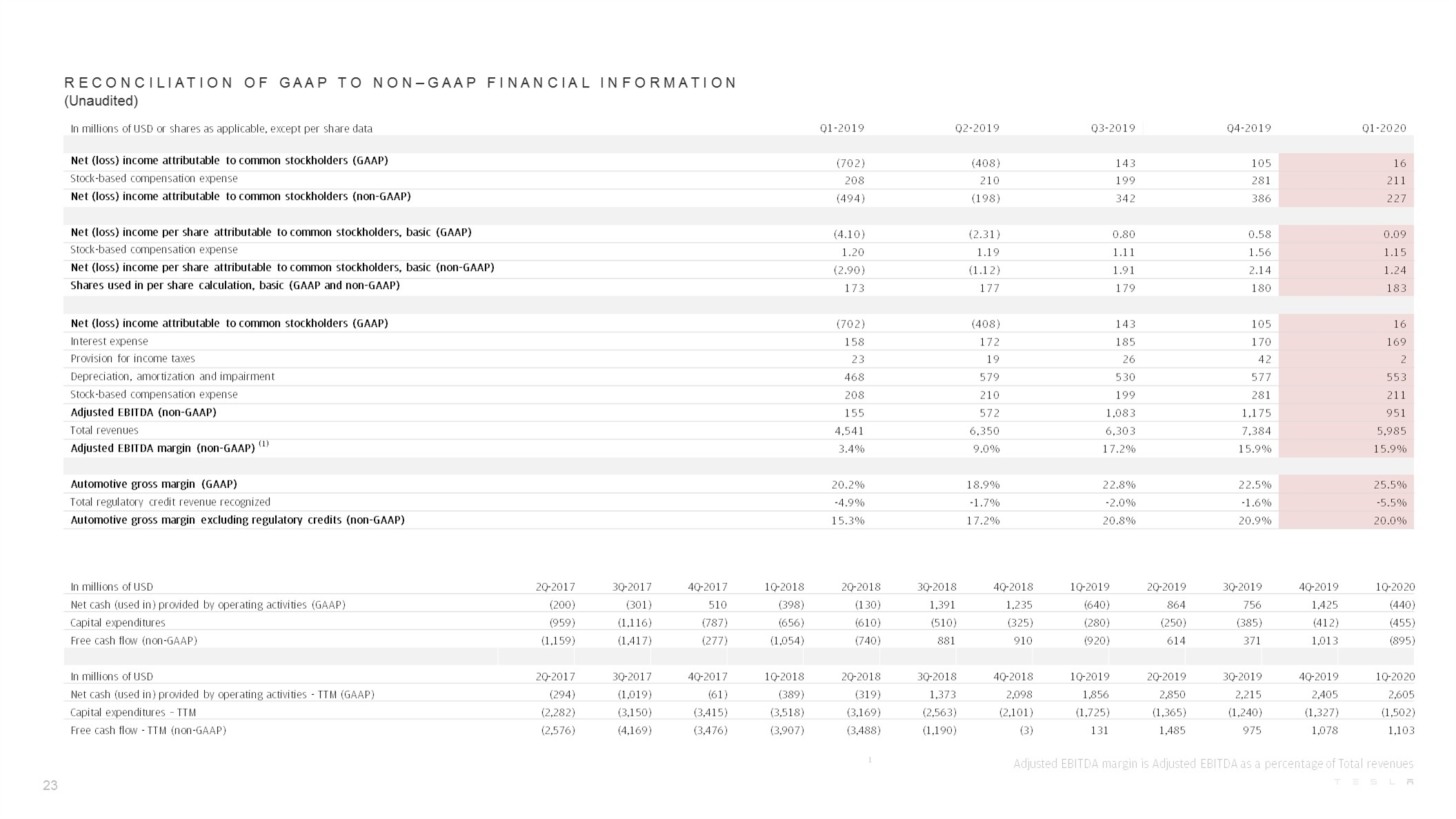

In millions of USD or shares as applicable, except per share data Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 Net (loss) income attributable to common stockholders (GAAP) (702) (408) 143 105 16 Stock-based compensation expense 208 210 199 281 211 Net (loss) income attributable to common stockholders (non-GAAP) (494) (198) 342 386 227 Net (loss) income per share attributable to common stockholders, basic (GAAP) (4.10) (2.31) 0.80 0.58 0.09 Stock-based compensation expense 1.20 1.19 1.11 1.56 1.15 Net (loss) income per share attributable to common stockholders, basic (non-GAAP) (2.90) (1.12) 1.91 2.14 1.24 Shares used in per share calculation, basic (GAAP and non-GAAP) 173 177 179 180 183 Net (loss) income attributable to common stockholders (GAAP) (702) (408) 143 105 16 Interest expense 158 172 185 170 169 Provision for income taxes 23 19 26 42 2 Depreciation, amortization and impairment 468 579 530 577 553 Stock-based compensation expense 208 210 199 281 211 Adjusted EBITDA (non-GAAP) 155 572 1,083 1,175 951 Total revenues 4,541 6,350 6,303 7,384 5,985 Adjusted EBITDA margin (non-GAAP) (1) 3.4% 9.0% 17.2% 15.9% 15.9% Automotive gross margin (GAAP) 20.2% 18.9% 22.8% 22.5% 25.5% Total regulatory credit revenue recognized -4.9% -1.7% -2.0% -1.6% -5.5% Automotive gross margin excluding regulatory credits (non-GAAP) 15.3% 17.2% 20.8% 20.9% 20.0% R e c o n c I l I a t I o n o f G A A P t o N o n – G A A P F I n a n c I a l I n f o r m a t I o n (Unaudited) Adjusted EBITDA margin is Adjusted EBITDA as a percentage of Total revenues 1 23 In millions of USD 2Q-2017 3Q-2017 4Q-2017 1Q-2018 2Q-2018 3Q-2018 4Q-2018 1Q-2019 2Q-2019 3Q-2019 4Q-2019 1Q-2020 Net cash (used in) provided by operating activities (GAAP) (200) (301) 510 (398) (130) 1,391 1,235 (640) 864 756 1,425 (440) Capital expenditures (959) (1,116) (787) (656) (610) (510) (325) (280) (250) (385) (412) (455) Free cash flow (non-GAAP) (1,159) (1,417) (277) (1,054) (740) 881 910 (920) 614 371 1,013 (895) In millions of USD 2Q-2017 3Q-2017 4Q-2017 1Q-2018 2Q-2018 3Q-2018 4Q-2018 1Q-2019 2Q-2019 3Q-2019 4Q-2019 1Q-2020 Net cash (used in) provided by operating activities - TTM (GAAP) (294) (1,019) (61) (389) (319) 1,373 2,098 1,856 2,850 2,215 2,405 2,605 Capital expenditures – TTM (2,282) (3,150) (3,415) (3,518) (3,169) (2,563) (2,101) (1,725) (1,365) (1,240) (1,327) (1,502) Free cash flow - TTM (non-GAAP) (2,576) (4,169) (3,476) (3,907) (3,488) (1,190) (3) 131 1,485 975 1,078 1,103

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its first quarter 2020 financial results conference call beginning at 3:30 p.m. PT on April 29, 2020 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units installed and equipment sales; we report installations at time of commissioning for storage projects or inspection for solar projects, and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii) interest expense, (iii) provision for income taxes, (iv) depreciation, amortization and impairment and (v) stock-based compensation, which is the same measurement for this term pursuant to the performance-based stock option award granted to our CEO in 2018. "Free cash flow" is operating cash flow less capital expenditures. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. non-GAAP automotive gross margin, non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a basic per share basis, Adjusted EBITDA, Adjusted EBITDA margin, and free cash flow. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations because it allows investors greater transparency to the information used by Tesla management in its financial and operational decision-making so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla management uses to run the business as well as allows investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the development, production capacity and rates, volumes, demand, deliveries, deployment, features and/or timing of existing and future Tesla products and technologies such as Model 3, Model Y, Tesla Semi, Autopilot and Full Self Driving, and our energy products such as Megapack, statements regarding cash flow, gross margin, spending, capital expenditure and profitability targets; statements regarding productivity improvements and cost reductions; statements regarding construction, expansion and/or ramp at the Tesla Factory, Gigafactory Shanghai and Gigafactory Berlin; and statements regarding our ability to manage near-term uncertainties, are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in the manufacture, production, delivery and/or completion of our vehicles and energy products and product features, including Model 3, Model Y and our autonomous driving features; our ability to grow our production, sales, delivery and servicing capabilities, and manage future growth effectively, especially internationally; consumers’ willingness to adopt electric vehicles generally and our ability to design and grow simultaneous and separate market acceptance of and demand for our vehicles; the ability of suppliers to meet quality and part delivery expectations at increasing volumes, especially with respect to our high-volume models; our ability to sustain and further grow our ramp of battery cell, energy product and product component production at Gigafactory Nevada; our ability to ramp Gigafactory Shanghai in accordance with our plans; any failures by Tesla products to perform as expected or if product recalls occur; our ability to continue to reduce or control manufacturing and other costs; competition in the automotive and energy product markets generally and the alternative fuel vehicle market and the premium vehicle markets in particular; our ability to execute on our evolving strategy for product sales, service, charging and other customer infrastructure; the unavailability, reduction or elimination of government and economic incentives for electric vehicles and energy products; potential difficulties in performing and realizing potential benefits under definitive agreements for our existing and future manufacturing facilities; our ability to attract and retain key employees and qualified personnel; our ability to maintain the security of our information and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on February 13, 2020. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. 24