Form N-CSR Stone Harbor Emerging For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22473

Stone Harbor Emerging Markets Income Fund

(Exact name of registrant as specified in charter)

31 West 52nd Street, 16th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Adam J. Shapiro, Esq.

c/o Stone Harbor Investment Partners LP

31 West 52nd Street, 16th Floor

New York, NY 10019

(Name and address of agent for service)

With copies To:

Michael G. Doherty, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: (303) 623-2577

Date of fiscal year end: November 30

Date of reporting period: November 30, 2019

Item 1. Report to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.shiplpcef.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.shiplpcef.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-866-390-3910 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Distribution

Policy

November 30, 2019

Stone Harbor Emerging Markets Income Fund (the “Fund”), acting pursuant to a U.S. Securities and Exchange Commission exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, effective February 2020 the Fund will distribute $0.17 per share on a monthly basis.

The fixed amount distributed per share is subject to change at the discretion of the Fund’s Board. Under the Plan, the Fund will typically distribute most or all of its available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). The Fund may also distribute long term capital gains and short term capital gains and return capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code. In addition, the Fund currently distributes more than its net income and net realized capital gains, and therefore, a portion of the distribution is a return of capital. A return of capital may occur, for example, when some or all of the money that a shareholder invested in the Fund is paid back to that shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income’. When distributions exceed total return performance, the difference will reduce the Fund’s net asset value per share. The amounts and sources of distributions reported to shareholders during the fiscal year are only estimates and are not provided for tax or financial reporting purposes. The actual amounts and sources of the amounts for tax or financial reporting purposes will depend upon the Fund’s investment experience during the year and are subject to change.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Fund’s Plan without prior notice if it deems such action to be in the best interest of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, investments in foreign securities, foreign currency fluctuations and changes in the Code. Please refer to the Fund’s prospectus for a more complete description of its risks.

Table of Contents

| Shareholder Letter | 2 |

| Summary of Portfolio Holdings | 5 |

| Growth of $10,000 Investment | 6 |

| Report of Independent Registered Public Accounting Firm | 7 |

| Statement of Investments | 8 |

| Statement of Assets & Liabilities | 16 |

| Statement of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Statement of Cash Flows | 19 |

| Financial Highlights | 20 |

| Notes to Financial Statements | 21 |

| Summary of Dividend Reinvestment Plan | 32 |

| Additional Information | 33 |

| Trustees & Officers | 35 |

| Benchmark Descriptions | 38 |

| Stone Harbor Emerging Markets Income Fund | Shareholder Letter |

November 30, 2019 (Unaudited)

Dear Investor,

The Stone Harbor Emerging Markets Income Fund (“EDF” or “Fund”) seeks to maximize total return, which consists of income on its investments and capital appreciation. The Fund invests in fixed income securities and related instruments that are economically tied to emerging markets (“EM”) countries, including sovereign external debt, local currency debt (non-U.S. dollar), and corporate debt from issuers domiciled in emerging markets.

Despite defaults, drought, oil price shocks and geopolitical tensions, including war, EM external sovereign debt (as represented by the JPMorgan EMBI Global Diversified Index) has delivered negative returns in only five years since 1991. By and large, EM countries have lowered debt levels and improved their fiscal positions, particularly when compared to developed countries. In addition, as gross domestic product (“GDP”) growth slows across the globe, EM countries as a whole continue to expand at a faster rate, on average, than the developed world. And yet, despite better fundamentals in most cases, EM debt offers higher yields than advanced economy debt.

We continue to believe that these factors support our investment thesis: EM bonds and currencies provide attractive returns for patient total return investors. While our investment thesis is straightforward, navigating the current macroeconomic and geopolitical environment is anything but easy. We monitor external risks while also assessing the credit quality of each of the countries and companies in which we invest. Doing so requires frequent travel, continuous and disciplined evaluation of the fundamentals, and a consistent framework for analyzing potential macroeconomic scenarios.

Over the past 12-month period, central banks successfully intervened to stabilize potentially deteriorating conditions across markets. In particular, perceived dovish comments by the Federal Reserve (“Fed”) spurred a rally in bond and stock markets in January 2019. In July, the Fed delivered the first of three rate cuts, which brought the Fed Funds target rate down to 1.75% by the third rate cut in October. This change in policy direction, coupled with indications of strength in select areas of the economy — namely, the housing sector and the labor market — helped to partially offset the negative impact from ongoing weakness, particularly in the manufacturing sector.

The Fed’s rate reductions, which were characterized as mid-cycle adjustments to protect against downside risk, dovetailed with further accommodation in Europe, China and elsewhere. In Europe, ongoing concerns about negative effects of the trade war dragged down the European manufacturing sector. The weakness in manufacturing, coupled with subdued Eurozone core inflation at just over 1% versus the European Central Bank’s (“ECB”) target of just under 2%, led the ECB to provide further support with a package that included lower policy rates, more quantitative easing (“QE”), tiering of reserves and a renewal of the targeted longer-term refinancing operations (“TLTROs”). In China, economic data were mixed, though easing measures from earlier in 2019 appeared to have helped support the economy. On the trade front, the sharp decline in exports to the U.S. was offset by increasing Chinese exports to other countries. Likewise, the global slowdown in manufacturing weighed on emerging markets, as did idiosyncratic risks stemming from political uncertainties in select countries. Nonetheless, the trend of easing monetary policy in developing countries continued throughout the reporting period. By the end of November, signs of some reconciliation between China and the U.S. began to take shape, along with suggestion of stabilization and even improvement in PMI readings.

We believe that having the latitude to adjust risk levels in the portfolio based on our fundamental economic and credit views, and according to our assessment of the macroeconomic environment, is a key advantage in managing the Fund. Our investment process focuses on allocating to three distinct sectors of EM debt — hard currency sovereign debt, local currency sovereign debt, and corporate debt — each of which tend to behave differently in various macroeconomic environments.

In addition, we can vary the amount of leverage used by the Fund, depending on our confidence in our return expectations. In general, we employ leverage to seek higher returns. However, when uncertainty rises, and with it greater perceived risks, we can also reduce leverage in order to decrease the Fund’s exposure to EM risk.

Performance Review

The total return on net asset value (NAV) and market price of EDF for the 12 months ended November 30, 2019 (net of expenses) was 4.45%(1) and 29.86%(2), respectively. For the same period, the Fund had an average premium to its NAV of 31.61%. Market tracking indices for the three sectors of EM debt(3) — hard currency sovereign debt, local currency sovereign debt, and corporate debt — delivered total returns of 14.29%, 10.39% and 12.80%, respectively, during the reporting period.

The largest driver of returns for the period was falling interest rates across both developed and emerging markets. The Fed’s loose monetary policy further pushed down global interest rates and supported growth in the U.S. for the period. On the other hand, trade uncertainty between the U.S. and China remained a headwind for markets, though there appeared to be some de-escalation of tensions between the two countries later in the reporting period.

| 2 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Shareholder Letter |

November 30, 2019 (Unaudited)

Overall, the Fund’s local currency exposure contributed significantly to total returns during the period, led by contributions from Russia, Mexico and Egypt. In Russia, bonds rallied due to conservative interest rate policies that supported the ruble, the country’s strong balance sheet and strengthening oil prices. In Mexico, local bond markets benefitted from preliminary approval of a trade agreement between the United States, Canada and Mexico and falling yields on U.S. Treasury securities, as well as an apparent shift to pragmatism by Mexican President Andrés Manuel López Obrador. In Egypt, returns were driven by a strengthening of the Egyptian pound, which rallied during the period. Egypt has performed well under a program administered by the International Monetary Fund (“IMF”) and its ratio of long-term debt to GDP has fallen, leading to lower local rates.

The Fund’s exposure to Argentina detracted most from total returns during the period. In our view, political events drove down the price of Argentine debt. Argentina’s presidential election season began with a primary in August 2019, with the incumbent Mauricio Macri facing opposition leader Alberto Fernández in what was expected to be a tight race. Following Fernández’s unexpectedly resounding defeat of Macri in the primary, Argentine equity and bond markets fell sharply in value. In October 2019, Fernández was elected president in the general election, cementing the shift in leadership in Argentina and initiating a departure from Macri’s economic policies. Despite the volatility in Argentine bond markets, we believe that Fernández is eager to resolve the debt issue quickly. In addition, Fernández appears to have shown willingness to engage with the IMF and to set responsible fiscal targets. As a result, we believe bond recovery values will be substantially higher even in the event of a broader restructuring. The Fund continues to hold Argentine bonds. The Fund’s exposure to Brazil, Turkey and Uruguay also detracted from performance during the period, though to a lesser extent than the negative contribution from Argentina.

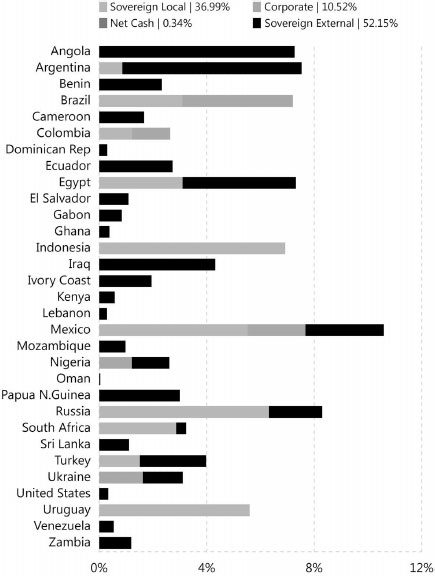

Asset allocation is an important decision in the management of the Fund. The Fund’s allocation to hard currency sovereign debt ranged between 48.8% and 57.6% during the reporting period, with an allocation of 52.2% as of November 30, 2019. The Fund’s allocation to local currency sovereign debt ranged between 31.0% and 40.3%, with an allocation of 37.0% as of November 30, 2019. The Fund’s allocation to corporate debt ranged between 6.2% and 12.3%, with an allocation of 10.5% as of November 30, 2019.

Throughout the reporting period, leverage consisted primarily of short-term reverse repurchase agreements through which the Fund borrowed funds by selling securities under the obligation to repurchase them at a later date at a fixed price. The implied borrowing costs of the repurchase agreements averaged approximately 2.67% per annum for the 12 months ended November 30, 2019. The level of gross leverage reached a maximum of 33.3% of managed assets on December 6, 2018 and a minimum of 0% on March 18, 2019. By the end of the reporting period, leverage was 5.78%.

Net leverage (gross leverage less cash held) remained lower than gross leverage throughout the period. The Fund’s management team varied borrowing levels to reflect the team’s outlook on EM risk, increasing borrowings when it felt opportunities had improved and reducing borrowings when, in the team’s judgment, macroeconomic risks had risen.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk, foreign exchange risk and efficiently gain certain investment exposure. These derivative positions may increase or decrease the Fund’s exposure to these risks. At the end of the reporting period the Fund had net exposure to derivatives of approximately ($109) thousand. Over the course of the reporting period derivative positions generated net realized loss of approximately $1.2 million and $2.4 million in unrealized depreciation for a net decrease in operations of approximately $3.6 million.

Market Review and Outlook

In our base case scenario, we believe that the U.S. GDP growth rate will be approximately 1.75% in 2020. In our view, U.S./China trade tensions will continue but are likely to de-escalate. In terms of monetary policy, we believe the Fed is finished cutting interest rates for now, though we think the Fed will act decisively if the unemployment rate rises meaningfully. In Europe, we do not foresee additional easing by the ECB, though we believe that the effects of the ECB’s looser monetary policy implemented in 2019 will help growth in 2020. Growth in Japan will likely remain sluggish due to the effects of the increased value-added tax, though we believe the Japanese economy will recover somewhat in 2020.

Looking ahead, we believe that protectionist policies will remain central to macroeconomic conditions in the months ahead and will be watching for further developments between the U.S. and China. We are also closely following upcoming political events in developed markets that carry broad implications. At the time of writing, these events included uncertainty surrounding the implementation of Brexit; the risk of an early election in Germany, where the coalition looks at risk; and the Presidential election in the U.S., where the outcome remains difficult to gauge at this juncture.

In this environment, we continue to believe that many EM country growth rates will outperform developed country growth in the next 12 to 18 months. Slow growth across most of the developed world and abnormally low interest rates in select countries continue to underscore the higher yields and stronger fundamentals available in EM, in our view. In addition to solid fundamentals, we believe that EM debt assets continue to offer attractive valuations.

| Annual Report | November 30, 2019 | 3 |

| Stone Harbor Emerging Markets Income Fund | Shareholder Letter |

November 30, 2019 (Unaudited)

Despite these headwinds from advanced economies, our positive views on EM fundamentals remain intact. We continue to believe that many EM country growth rates will outperform developed country growth in the next 12 to 18 months. In addition to solid fundamentals, EM debt assets continue to offer attractive valuations, in our opinion.

In the past, we have detailed some of the key risks to our constructive outlook for EM debt. Today, those risks come from both developed and EM countries. The uncertainties surrounding ongoing trade wars and the potential for policy mistakes by developed market central banks are potential risks for EM debt investors. We anticipate that protectionist trade policies will continue to be a reality for the medium term. Geopolitical strife in the Middle East and ongoing domestic political tensions in a range of developing countries — including Chile, Ecuador and Lebanon, among others — also may increase volatility as well as opportunity in emerging markets. In assessing all these factors, our base case return scenarios for EM debt over the coming year remain positive. Our view derives from a disciplined investment process in which we review the ability and willingness of borrowers to repay their debts. We also assess whether current prices of EM bonds, currencies and local interest rates reflect adequate compensation for the risks the Fund is incurring. Based on this analysis, we continue to believe that EM debt will generate among the highest returns in the fixed income markets.

Other general risks of the Fund relate to our use of leverage and also to the longer-term prospects for a global recession, in the event that proactive monetary policies fail to offset weaker growth. Stone Harbor Investment Partners LP attempts to mitigate the risk of loss of principal due to the possibility of weaker growth, depreciating currencies and widening of bond credit spreads and yields through our investment process that determines sector and country allocations, as well as security selection. We also seek to reduce interest rate sensitivity during periods of rising interest rates. Notwithstanding these efforts, rising interest rates or wider credit spreads could increase the Fund’s cost of leverage and could also decrease the value of its portfolio securities, adversely affecting Fund performance.

We continue to believe that investing in EDF may offer an attractive means of capitalizing on further improvements in credit quality in EM. We thank you for your confidence in our ability to invest in these volatile markets and look forward to reporting on EDF in six months.

Sincerely,

Peter

J. Wilby, CFA

President

| (1) | Total return assumes the reinvestment of all distributions at NAV |

| (2) | Total return assumes the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvest Plan |

| (3) | JPMorgan EMBI Global Diversified Index, JPMorgan GBI-EM Global Diversified Index, and JPMorgan CEMBI Broad Diversified Index |

| 4 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Summary of Portfolio Holdings |

November 30, 2019 (Unaudited)

| Fund Details | |

| Market Price | $13.18 |

| Net Asset Value (NAV) | $8.91 |

| Premium/(Discount) | 47.92% |

| Current Distribution Rate(1) | 16.39% |

| Net Assets (in millions) | $146 |

| Country Allocation | |

| (as a% of Total Net Assets)(3) | |

| Country Breakdown | % |

| Mexico | 11.07% |

| Russia | 8.73% |

| Egypt | 7.61% |

| Argentina | 7.59% |

| Brazil | 7.47% |

| Angola | 7.46% |

| Indonesia | 7.33% |

| Uruguay | 5.75% |

| Iraq | 4.53% |

| Turkey | 3.98% |

| South Africa | 3.37% |

| Ukraine | 3.25% |

| Papua New Guinea | 3.16% |

| Nigeria | 2.75% |

| Colombia | 2.75% |

| Benin | 2.39% |

| Ivory Coast | 2.03% |

| Cameroon | 1.77% |

| Ecuador | 1.43% |

| Zambia | 1.25% |

| Sri Lanka | 1.17% |

| El Salvador | 1.12% |

| Mozambique | 1.02% |

| Gabon | 0.87% |

| Kenya | 0.61% |

| Venezuela | 0.57% |

| Ghana | 0.40% |

| Dominican Republic | 0.31% |

| Lebanon | 0.31% |

| Hong Kong | 0.04% |

| Oman | 0.04% |

| Short Term Investments | 1.87% |

| Other Liabilities in Excess of Assets | -4.00% |

| Total Net Assets | 100.00% |

Security Type Allocation(2)

Sector Allocation(2) |

Regional Breakdown(2) |

Sovereign Local Currency Breakdown(2) |

|||||

| Sovereign Local | 36.99% | Latin America | 38.24% | Brazilian Real | 3.09% | ||

| Sovereign External | 52.15% | Africa | 30.36% | Argentine Peso | 0.86% | ||

| Corporate | 10.52% | Europe | 15.39% | Colombian Peso | 1.22% | ||

| Net Cash | 0.34% | Asia | 11.03% | Egyptian Pound | 3.10% | ||

| Middle East | 4.64% | Indonesian Rupiah | 6.92% | ||||

| Net Cash | 0.34% | Mexican Peso | 5.52% | ||||

| Russian Ruble | 6.31% | ||||||

| Turkish New Lira | 1.51% | ||||||

| South African Rand | 2.86% | ||||||

| Uruguayan Peso | 5.60% | ||||||

| Total | 36.99% |

| (1) | Current Distribution Rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and return of capital in order to maintain a level distribution. |

| (2) | Based on managed assets and investment manager’s sector classifications including derivative exposure. For purposes of this example, managed assets include total net assets plus any borrowings attributed to the use of reverse repurchase agreements and the notional values of credit default swaps as described on pages 14 and 15. |

| (3) | Country refers to country of primary risk exposure, as determined by Stone Harbor. In certain instances, a security’s country of incorporation may be different from its country of risk. |

| Annual Report | November 30, 2019 | 5 |

| Stone Harbor Emerging Markets Income Fund | Growth of $10,000 Investment |

November 30, 2019 (Unaudited)

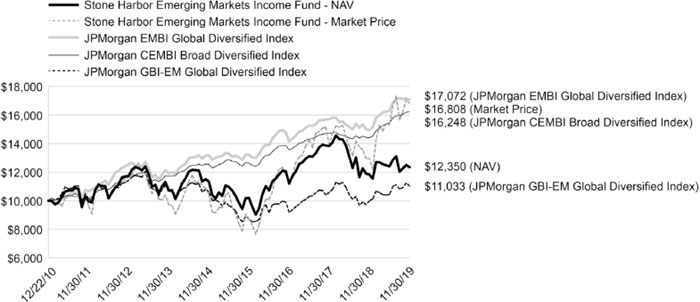

Comparison of Change in Value of $10,000 Investment in Stone Harbor Emerging Markets Income Fund and the JPMorgan Emerging Markets Bond Indices: JPMorgan EMBI Global Diversified Index, JPMorgan CEMBI Broad Diversified Index, and JPMorgan GBI-EM Global Diversified Index (Please refer to the Benchmark Descriptions section for detailed benchmark descriptions).

Total Returns as of November 30, 2019 (Inception Date December 22, 2010)

| Average Annual Return | ||||

| One Year | Three Year | Five Year | Since Inception | |

| Stone Harbor Emerging Markets Income Fund – NAV | 4.45% | 3.29% | 1.74% | 2.39% |

| Stone Harbor Emerging Markets Income Fund – Market Price | 29.86% | 14.49% | 10.02% | 5.98% |

| JPMorgan CEMBI Broad Diversified Index | 12.80% | 6.22% | 5.31% | 5.58% |

| JPMorgan EMBI Global Diversified Index | 14.29% | 6.45% | 5.32% | 6.17% |

| JPMorgan GBI-EM Global Diversified Index | 10.39% | 6.25% | 0.71% | 1.11% |

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance shown. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all income dividends, capital gain and return of capital distributions, if any, have been reinvested and includes all fee waivers and expense reimbursements. Total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or broker commissions or sales charges in connection with the purchase or sale of Fund shares. Investment return and principal value will vary, and shares, when sold, may be worth more or less than their original cost. Total returns for a period of less than one year are not annualized. Index returns do not include the effects of sales charges, management fees and fund expenses or transaction costs. It is not possible to invest directly in an index.

Performance at market price will differ from its results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in Fund dividends.

An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a onetime public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

| 6 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Report of Independent Registered Public Accounting Firm |

To the shareholders and the Board of Trustees of Stone Harbor Emerging Markets Income Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Stone Harbor Emerging Markets Income Fund (the “Fund”), including the statement of investments, as of November 30, 2019, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of November 30, 2019, and the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of November 30, 2019, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Denver, Colorado

January 27, 2020

We have served as the auditor of one or more Stone Harbor Investment Partners investment companies since 2008.

| Annual Report | November 30, 2019 | 7 |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| SOVEREIGN DEBT OBLIGATIONS - 80.24% | ||||||||||||||||

| Angola - 7.46% | ||||||||||||||||

| Republic of Angola: | ||||||||||||||||

| USD | 6M US L + 7.50 | % | 07/01/23 | 8,207,692 | $ | 8,874,567 | (1) | |||||||||

| USD | 6M US L + 4.50 | % | 12/07/23 | 1,557,000 | 1,560,893 | (1) | ||||||||||

| USD | 8.25 | % | 05/09/28 | 454,000 | 464,924 | (2)(3) | ||||||||||

| 10,900,384 | ||||||||||||||||

| Argentina - 7.59% | ||||||||||||||||

| Argent Letras Del Tesoro | ARS | 0.00 | % | 02/26/20 | 140,805,000 | 1,344,665 | (4) | |||||||||

| Provincia Del Chaco | USD | 9.38 | % | 08/18/24 | 1,107,000 | 459,405 | (2) | |||||||||

| Republic of Argentina: | ||||||||||||||||

| USD | 6.88 | % | 04/22/21 | 1,414,000 | 641,382 | |||||||||||

| EUR | 3.38 | % | 01/15/23 | 832,000 | 347,341 | |||||||||||

| EUR | 7.82 | % | 12/31/33 | 15,413,738 | 8,086,575 | |||||||||||

| EUR | 3.38 | % | 12/31/38 | 509,052 | 216,776 | (5) | ||||||||||

| 11,096,144 | ||||||||||||||||

| Benin - 2.39% | ||||||||||||||||

| Republic of Benin | EUR | 5.75 | % | 03/26/26 | 3,053,000 | 3,498,331 | (6) | |||||||||

| Brazil - 3.17% | ||||||||||||||||

| Nota Do Tesouro Nacional: | ||||||||||||||||

| BRL | 10.00 | % | 01/01/21 | 10,160,000 | 2,529,938 | |||||||||||

| BRL | 10.00 | % | 01/01/27 | 4,210,000 | 1,165,783 | |||||||||||

| BRL | 10.00 | % | 01/01/29 | 3,340,000 | 943,817 | |||||||||||

| 4,639,538 | ||||||||||||||||

| Cameroon - 1.77% | ||||||||||||||||

| Republic of Cameroon | USD | 9.50 | % | 11/19/25 | 2,359,000 | 2,588,634 | (6) | |||||||||

| Colombia - 0.71% | ||||||||||||||||

| Titulos De Tesoreria | COP | 6.00 | % | 04/28/28 | 3,730,000,000 | 1,043,770 | ||||||||||

| Dominican Republic - 0.31% | ||||||||||||||||

| Dominican Republic | USD | 6.88 | % | 01/29/26 | 400,000 | 453,375 | (2)(3) | |||||||||

| Ecuador - 1.04% | ||||||||||||||||

| Republic of Ecuador: | ||||||||||||||||

| USD | 7.88 | % | 03/27/25 | 548,000 | 435,147 | (2) | ||||||||||

| USD | 7.88 | % | 03/27/25 | 580,000 | 460,556 | (6) | ||||||||||

| USD | 9.63 | % | 06/02/27 | 552,000 | 455,400 | (6) | ||||||||||

| USD | 9.50 | % | 03/27/30 | 200,000 | 165,500 | (6) | ||||||||||

| 1,516,603 | ||||||||||||||||

| Egypt - 7.61% | ||||||||||||||||

| Egypt Government Bond | EGP | 15.60 | % | 08/06/26 | 34,650,000 | 2,307,837 | ||||||||||

| Egypt Treasury Bill | EGP | 0.00 | % | 03/10/20 | 40,700,000 | 2,428,114 | (4) | |||||||||

See Notes to Financial Statements.

| 8 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| Egypt (continued) | ||||||||||||||||

| Republic of Egypt: | ||||||||||||||||

| EUR | 5.63 | % | 04/16/30 | 1,249,000 | $ | 1,381,517 | (6) | |||||||||

| EUR | 6.38 | % | 04/11/31 | 3,031,000 | 3,488,776 | (6) | ||||||||||

| USD | 8.50 | % | 01/31/47 | 325,000 | 345,312 | (6) | ||||||||||

| USD | 8.50 | % | 01/31/47 | 395,000 | 419,688 | (2) | ||||||||||

| USD | 8.15 | % | 11/20/59 | 731,000 | 749,275 | (3)(6) | ||||||||||

| 11,120,519 | ||||||||||||||||

| El Salvador - 1.12% | ||||||||||||||||

| Republic of El Salvador | USD | 7.65 | % | 06/15/35 | 1,513,000 | 1,643,260 | (2)(3) | |||||||||

| Gabon - 0.87% | ||||||||||||||||

| Republic of Gabon | USD | 6.95 | % | 06/16/25 | 1,248,000 | 1,267,500 | (3)(6) | |||||||||

| Ghana - 0.40% | ||||||||||||||||

| Republic of Ghana: | ||||||||||||||||

| USD | 8.13 | % | 01/18/26 | 424,000 | 448,446 | (6) | ||||||||||

| USD | 8.63 | % | 06/16/49 | 8,000 | 7,748 | (6) | ||||||||||

| USD | 8.95 | % | 03/26/51 | 128,000 | 125,960 | (6) | ||||||||||

| 582,154 | ||||||||||||||||

| Indonesia - 7.33% | ||||||||||||||||

| Republic of Indonesia: | ||||||||||||||||

| IDR | 8.25 | % | 05/15/36 | 107,190,000,000 | 8,017,402 | |||||||||||

| IDR | 7.50 | % | 05/15/38 | 38,650,000,000 | 2,705,911 | |||||||||||

| 10,723,313 | ||||||||||||||||

| Ivory Coast - 2.03% | ||||||||||||||||

| Ivory Coast Government: | ||||||||||||||||

| EUR | 5.88 | % | 10/17/31 | 1,503,000 | 1,674,627 | (6) | ||||||||||

| USD | 6.13 | % | 06/15/33 | 602,000 | 591,089 | (2) | ||||||||||

| USD | 6.13 | % | 06/15/33 | 712,000 | 699,095 | (6) | ||||||||||

| 2,964,811 | ||||||||||||||||

| Kenya - 0.61% | ||||||||||||||||

| Republic of Kenya | USD | 8.00 | % | 05/22/32 | 844,000 | 893,453 | (3)(6) | |||||||||

| Lebanon - 0.31% | ||||||||||||||||

| Lebanese Republic: | ||||||||||||||||

| USD | 6.40 | % | 05/26/23 | 691,000 | 319,695 | |||||||||||

| USD | 6.85 | % | 05/25/29 | 275,000 | 125,813 | |||||||||||

| 445,508 | ||||||||||||||||

| Mexico - 4.39% | ||||||||||||||||

| Mexican Bonos: | ||||||||||||||||

| MXN | 5.75 | % | 03/05/26 | 38,940,000 | 1,867,046 | |||||||||||

| MXN | 7.50 | % | 06/03/27 | 86,890,000 | 4,558,007 | |||||||||||

| 6,425,053 | ||||||||||||||||

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 9 |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| Mozambique - 1.02% | ||||||||||||||||

| Republic of Mozambique | USD | 5.00 | % | 09/15/31 | 1,634,000 | $ | 1,495,110 | (6) | ||||||||

| Nigeria - 1.48% | ||||||||||||||||

| Republic of Nigeria | USD | 7.63 | % | 11/28/47 | 2,293,000 | 2,169,393 | (2) | |||||||||

| Oman - 0.04% | ||||||||||||||||

| Oman Government | USD | 5.63 | % | 01/17/28 | 54,000 | 54,270 | (6) | |||||||||

| Papua New Guinea - 3.16% | ||||||||||||||||

| Papua New Guinea Government: | ||||||||||||||||

| USD | 8.38 | % | 10/04/28 | 2,330,000 | 2,479,630 | (3)(6) | ||||||||||

| USD | 8.38 | % | 10/04/28 | 2,004,000 | 2,132,694 | (2)(3) | ||||||||||

| 4,612,324 | ||||||||||||||||

| Russia - 8.73% | ||||||||||||||||

| Russian Federation: | ||||||||||||||||

| RUB | 8.50 | % | 09/17/31 | 532,559,000 | 9,697,820 | |||||||||||

| USD | 5.10 | % | 03/28/35 | 2,600,000 | 3,069,300 | (2) | ||||||||||

| 12,767,120 | ||||||||||||||||

| South Africa - 3.37% | ||||||||||||||||

| Republic of South Africa: | ||||||||||||||||

| ZAR | 8.75 | % | 02/28/48 | 73,500,000 | 4,334,052 | |||||||||||

| USD | 5.75 | % | 09/30/49 | 614,000 | 587,791 | |||||||||||

| 4,921,843 | ||||||||||||||||

| Sri Lanka - 1.17% | ||||||||||||||||

| Republic of Sri Lanka | USD | 5.75 | % | 04/18/23 | 1,750,000 | 1,711,994 | (3)(6) | |||||||||

| Turkey - 3.98% | ||||||||||||||||

| International Finance Corp. | TRY | 20.00 | % | 01/22/20 | 11,450,000 | 2,009,129 | ||||||||||

| Republic of Turkey: | ||||||||||||||||

| USD | 5.75 | % | 03/22/24 | 450,000 | 457,875 | |||||||||||

| USD | 6.00 | % | 03/25/27 | 758,000 | 755,631 | |||||||||||

| USD | 5.75 | % | 05/11/47 | 3,035,000 | 2,604,884 | |||||||||||

| 5,827,519 | ||||||||||||||||

| Ukraine - 0.99% | ||||||||||||||||

| Ukraine Government | USD | 7.75 | % | 09/01/26 | 225,000 | 238,050 | (2) | |||||||||

| Ukreximbank Via Biz Finance PLC | USD | 9.75 | % | 01/22/25 | 1,150,000 | 1,213,250 | (2) | |||||||||

| 1,451,300 | ||||||||||||||||

| Uruguay - 5.75% | ||||||||||||||||

| Republic of Uruguay | UYU | 4.38 | % | 12/15/28 | 61,000,000 | 3,180,512 | ||||||||||

See Notes to Financial Statements.

| 10 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| Uruguay (continued) | ||||||||||||||||

| Uruguay Notas del Teso | UYU | 13.90 | % | 07/29/20 | 192,000,000 | $ | 5,220,797 | |||||||||

| 8,401,309 | ||||||||||||||||

| Venezuela - 0.19% | ||||||||||||||||

| Republic of Venezuela | USD | 9.00 | % | 05/07/23 | 2,250,000 | 281,250 | (7) | |||||||||

| Zambia - 1.25% | ||||||||||||||||

| Republic of Zambia: | ||||||||||||||||

| USD | 5.38 | % | 09/20/22 | 425,000 | 270,605 | (6) | ||||||||||

| USD | 5.38 | % | 09/20/22 | 1,457,000 | 927,699 | (2) | ||||||||||

| USD | 8.50 | % | 04/14/24 | 966,000 | 628,957 | (6) | ||||||||||

| 1,827,261 | ||||||||||||||||

| TOTAL SOVEREIGN DEBT OBLIGATIONS | 117,323,043 | |||||||||||||||

| (Cost $121,112,718) | ||||||||||||||||

| CORPORATE BONDS - 17.32% | ||||||||||||||||

| Brazil - 4.30% | ||||||||||||||||

| Banco do Brasil SA | USD | 9.00 | % | Perpetual | 1,150,000 | 1,310,102 | (1)(6)(8) | |||||||||

| Gol Finance SA | USD | 7.00 | % | 01/31/25 | 2,344,000 | 2,359,749 | (6) | |||||||||

| JSL Europe SA | USD | 7.75 | % | 07/26/24 | 750,000 | 806,062 | (6) | |||||||||

| MV24 Capital BV | USD | 6.75 | % | 06/01/34 | 1,750,000 | 1,809,762 | (6) | |||||||||

| 6,285,675 | ||||||||||||||||

| Colombia - 2.04% | ||||||||||||||||

| AI Candelaria Spain SLU | USD | 7.50 | % | 12/15/28 | 1,250,000 | 1,372,194 | (6) | |||||||||

| Empresas Publicas de Medellin ESP | COP | 7.63 | % | 09/10/24 | 2,700,000,000 | 808,668 | (2) | |||||||||

| Gran Tierra Energy, Inc. | USD | 7.75 | % | 05/23/27 | 883,000 | 795,804 | (6) | |||||||||

| 2,976,666 | ||||||||||||||||

| Ecuador - 0.39% | ||||||||||||||||

| Petroamazonas EP | USD | 4.63 | % | 02/16/20 | 584,500 | 573,950 | (6) | |||||||||

| Indonesia - 0.00%(9) | ||||||||||||||||

| PT Bakrie & Brothers TBK | IDR | 0.00 | % | 12/22/22 | 27,175,847,000 | 198 | (4)(10) | |||||||||

| Mexico - 6.68% | ||||||||||||||||

| Banco Mercantil del Norte SA/Grand Cayman: | ||||||||||||||||

| USD | 6.75 | % | Perpetual | 1,010,000 | 1,041,878 | (1)(6)(8) | ||||||||||

| USD | 7.50 | % | Perpetual | 673,000 | 711,698 | (1)(6)(8) | ||||||||||

| Petroleos Mexicanos: | ||||||||||||||||

| MXN | 7.65 | % | 11/24/21 | 19,300,000 | 959,183 | (2) | ||||||||||

| MXN | 7.47 | % | 11/12/26 | 23,050,000 | 1,021,079 | |||||||||||

| USD | 5.35 | % | 02/12/28 | 1,502,000 | 1,458,442 | |||||||||||

| USD | 6.50 | % | 01/23/29 | 443,000 | 456,467 | |||||||||||

| USD | 6.84 | % | 01/23/30 | 892,000 | 937,492 | (6) | ||||||||||

| USD | 7.69 | % | 01/23/50 | 1,507,000 | 1,619,272 | (6) | ||||||||||

| Sixsigma Networks Mexico SA de CV | USD | 7.50 | % | 05/02/25 | 1,541,000 | 1,553,039 | (6) | |||||||||

| 9,758,550 | ||||||||||||||||

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 11 |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| Nigeria - 1.27% | ||||||||||||||||

| IHS Netherlands Holdco BV | USD | 8.00 | % | 09/18/27 | 1,745,000 | $ | 1,858,425 | (6) | ||||||||

| Ukraine - 2.26% | ||||||||||||||||

| Metinvest BV: | ||||||||||||||||

| USD | 7.75 | % | 04/23/23 | 593,000 | 615,386 | (6) | ||||||||||

| USD | 7.75 | % | 10/17/29 | 1,895,000 | 1,871,312 | (6) | ||||||||||

| NAK Naftogaz Ukraine via Kondor Finance PLC | USD | 7.63 | % | 11/08/26 | 829,000 | 820,254 | (6) | |||||||||

| 3,306,952 | ||||||||||||||||

| Venezuela - 0.38% | ||||||||||||||||

| Petroleos de Venezuela SA: | ||||||||||||||||

| USD | 6.00 | % | 11/15/26 | 2,550,000 | 210,375 | (2)(7) | ||||||||||

| USD | 9.75 | % | 05/17/35 | 4,200,000 | 346,500 | (2)(7) | ||||||||||

| 556,875 | ||||||||||||||||

| TOTAL CORPORATE BONDS | 25,317,291 | |||||||||||||||

| (Cost $25,898,107) | ||||||||||||||||

| CREDIT LINKED NOTES - 4.53% | ||||||||||||||||

| Iraq - 4.53% | ||||||||||||||||

| Republic of Iraq (Counterparty: Bank of America - Merrill Lynch): | ||||||||||||||||

| JPY | 2.89 | % | 01/01/28 | 837,643,291 | 6,283,473 | (1)(10) | ||||||||||

| JPY | 0.00 | % | 01/01/28 | 46,326,878 | 346,668 | (4)(10) | ||||||||||

| 6,630,141 | ||||||||||||||||

| TOTAL CREDIT LINKED NOTES | 6,630,141 | |||||||||||||||

| (Cost $8,552,496) | ||||||||||||||||

| Contracts | Currency | Exercise Price | Expiration Date | Notional Amount | Value (Expressed in USD) | |||||||||||||||

| PURCHASED OPTIONS - 0.04% | ||||||||||||||||||||

| Foreign Currency Call Option - 0.04% | ||||||||||||||||||||

| Hong Kong Dollar (Goldman Sachs) | 3,559,357 | USD | 7.86 | 9/1/2020 | 3,559,357 | 15,555 | ||||||||||||||

| Hong Kong Dollar (Goldman Sachs) | 8,542,456 | USD | 7.86 | 9/1/2020 | 8,542,456 | 38,091 | ||||||||||||||

| TOTAL PURCHASED OPTIONS | 53,646 | |||||||||||||||||||

| (Cost $117,104) | ||||||||||||||||||||

See Notes to Financial Statements.

| 12 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

| Currency | Rate | Maturity Date | Principal Amount/Shares* | Value (Expressed in USD) | ||||||||||||

| SHORT TERM INVESTMENTS - 1.87% | ||||||||||||||||

| Money Market Fund - 1.87% | ||||||||||||||||

| State Street Institutional Liquid Reserves Fund - Institutional Class (7-Day Yield) | USD | 1.76 | % | N/A | 2,739,137 | $ | 2,739,411 | |||||||||

| TOTAL SHORT TERM INVESTMENTS | 2,739,411 | |||||||||||||||

| (Cost $2,739,461) | ||||||||||||||||

| Total Investments - 104.00% | 152,063,532 | |||||||||||||||

| (Cost $158,419,886) | ||||||||||||||||

| Liabilities in Excess of Other Assets - (4.00)% | (5,850,327 | ) | ||||||||||||||

| Net Assets - 100.00% | $ | 146,213,205 | ||||||||||||||

| * | The principal amount/shares of each security is stated in the currency in which the security is denominated. |

Currency Abbreviations:

| ARS | - | Argentine Peso |

| BRL | - | Brazilian Real |

| COP | - | Colombian Peso |

| EGP | - | Egyptian Pound |

| EUR | - | Euro Currency |

| IDR | - | Indonesian Rupiah |

| JPY | - | Japanese Yen |

| MXN | - | Mexican Peso |

| RUB | - | Russian Ruble |

| TRY | - | New Turkish Lira |

| USD | - | United States Dollar |

| UYU | - | Uruguayan Peso |

| ZAR | - | South African Rand |

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 13 |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Libor Rates:

6M US L - 6 Month LIBOR as of November 30, 2019 was 1.90%

| (1) | Floating or variable rate security. The reference rate is described above. The rate in effect as of November 30, 2019 is based on the reference rate plus the displayed spread as of the security's last reset date. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| (2) | Securities were originally issued pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of November 30, 2019, the aggregate fair value of those securities was $16,542,000, which represents approximately 11.31% of net assets. |

| (3) | On November 30, 2019, securities valued at $10,967,239 were pledged as collateral for reverse repurchase agreements. |

| (4) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

| (5) | Step bond. Coupon changes periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect as of November 30, 2019. |

| (6) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. Total fair value of Rule 144A securities amounts to $44,947,075, which represents approximately 30.74% of net assets as of November 30, 2019. |

| (7) | Security is in default and therefore is non-income producing. |

| (8) | Security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (9) | Amount represents less than 0.005% of net assets. |

| (10) | The level 3 assets were valued using significant unobservable inputs as a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

OUTSTANDING FORWARD FOREIGN CURRENCY CONTRACTS

| Counterparty | Settlement Date | Fund Receiving | U.S. $ Value at November 30, 2019 | Fund Delivering | U.S. $ Value at November 30, 2019 | Unrealized Appreciation/ (Depreciation) | ||||||||||||||

| Goldman Sachs & Co. | 01/24/20 | USD | 3,120,082 | MXN | 3,094,598 | 25,484 | ||||||||||||||

| J.P. Morgan Chase & Co. | 01/03/20 | BRL | 5,205,533 | USD | 5,177,367 | 28,166 | ||||||||||||||

| J.P. Morgan Chase & Co. | 01/24/20 | USD | 6,972,087 | JPY | 6,845,294 | 126,793 | ||||||||||||||

| $ | 180,443 | |||||||||||||||||||

| Goldman Sachs & Co. | 12/20/19 | COP | 768,591 | USD | 777,877 | (9,286 | ) | |||||||||||||

| J.P. Morgan Chase & Co. | 12/03/19 | BRL | 5,214,115 | USD | 5,528,633 | (314,518 | ) | |||||||||||||

| J.P. Morgan Chase & Co. | 12/03/19 | USD | 5,185,577 | BRL | 5,214,115 | (28,538 | ) | |||||||||||||

| $ | (352,342 | ) | ||||||||||||||||||

REVERSE REPURCHASE AGREEMENTS

| Counterparty | Interest Rate | Acquisition Date | Maturity Date | Amount | |||||||

| Credit Suisse First Boston | 2.100% | 10/31/2019 | 11/01/2020 | $ | 3,304,999 | ||||||

| Credit Suisse First Boston | 2.100% | 11/05/2019 | 11/06/2020 | 1,374,388 | |||||||

| Credit Suisse First Boston | 2.100% | 11/19/2019 | 11/20/2020 | 2,028,258 | |||||||

| Credit Suisse First Boston | 2.000% | 11/20/2019 | 11/21/2020 | 592,266 | |||||||

| Credit Suisse First Boston | 2.100% | 11/21/2019 | 11/22/2020 | 1,306,808 | |||||||

| Credit Suisse First Boston | 2.000% | 11/25/2019 | 11/26/2020 | 368,800 | |||||||

| $ | 8,975,519 | ||||||||||

All agreements can be terminated by either party on demand at value plus accrued interest.

See Notes to Financial Statements.

| 14 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Investments |

November 30, 2019

CREDIT DEFAULT SWAP CONTRACTS ON SOVEREIGN DEBT OBLIGATIONS ISSUE - SELL PROTECTION (OVER THE COUNTER)(1)

Reference Obligations | Counterparty | Fixed Deal Receive Rate | Currency | Maturity Date | Implied Credit Spread at November 30, 2019(2) | Notional Amount**(3) | Value | Upfront Premiums Received/(Paid) | Unrealized Appreciation | ||||||||||||||||||

| Republic of Ecuador CDS SR 1Y(4) | Credit Suisse | 5.000% | USD | 12/20/2019 | 15.185% | 2,100,000 | $ | (12,368 | ) | $ | 39,456 | $ | 27,088 | ||||||||||||||

| $ | (12,368 | ) | $ | 39,456 | $ | 27,088 | |||||||||||||||||||||

Credit default swaps pay quarterly.

| ** | The notional amount of each security is stated in the currency in which the security is denominated. |

| (1) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (2) | Implied credit spreads, represented in absolute terms, are utilized in determining the market value of credit default swap agreements on sovereign issues of an emerging country as of period end, and serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

| (3) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| (4) | Based on Republic of Ecuador Sovereign Debt Obligation, USD denominated 7.88% fixed coupon, 01/23/2028 maturity. |

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 15 |

| Stone Harbor Emerging Markets Income Fund | Statement of Assets & Liabilities |

November 30, 2019

| ASSETS: | ||||

| Investments, at value(1) | $ | 152,063,532 | ||

| Cash | 381,357 | |||

| Foreign currency, at value (Cost $650) | 571 | |||

| Unrealized appreciation on credit default swap contracts | 27,088 | |||

| Unrealized appreciation on forward foreign currency contracts | 180,443 | |||

| Receivable for investments sold | 114,798 | |||

| Receivable on credit default swap contracts | 21,160 | |||

| Interest receivable | 3,687,482 | |||

| Prepaid and other assets | 2,196 | |||

| Total Assets | 156,478,627 | |||

| LIABILITIES: | ||||

| Payable for reverse repurchase agreements | 8,975,519 | |||

| Interest payable on reverse repurchase agreements | 10,207 | |||

| Swap premium received | 39,456 | |||

| Payable for investments purchased | 526,600 | |||

| Unrealized depreciation on forward foreign currency contracts | 352,342 | |||

| Payable to adviser | 127,915 | |||

| Payable to administrator | 49,770 | |||

| Other payables | 183,613 | |||

| Total Liabilities | 10,265,422 | |||

| Net Assets | $ | 146,213,205 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid-in capital | $ | 254,722,133 | ||

| Total distributable earnings | (108,508,928 | ) | ||

| Net Assets | $ | 146,213,205 | ||

| PRICING OF SHARES: | ||||

| Net Assets | $ | 146,213,205 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, par value of $0.001 per share authorized) | 16,402,095 | |||

| Net assets value, offering and redemption price per share | $ | 8.91 | ||

| (1) Cost of Investments | $ | 158,419,886 | ||

See Notes to Financial Statements.

| 16 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Operations |

For the Year Ended November 30, 2019

| INVESTMENT INCOME: | ||||

| Interest (net of foreign withholding tax of $121,301) | $ | 17,716,717 | ||

| Total Investment Income | 17,716,717 | |||

| EXPENSES: | ||||

| Investment advisory fees | 1,836,489 | |||

| Interest on reverse repurchase agreements | 613,619 | |||

| Administration fees | 286,477 | |||

| Custodian fees | 49,117 | |||

| Professional fees | 181,139 | |||

| Printing fees | 108,594 | |||

| Trustee fees | 29,324 | |||

| Transfer agent fees | 20,411 | |||

| Insurance fees | 6,452 | |||

| Other | 78,024 | |||

| Total Expenses | 3,209,646 | |||

| Net Investment Income | 14,507,071 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||

| Net realized gain/(loss) on: | ||||

| Investments | (18,842,591 | ) | ||

| Credit default swap contracts | 191,178 | |||

| Interest rate swap contracts | (978,082 | ) | ||

| Forward foreign currency contracts | (413,140 | ) | ||

| Foreign currency transactions | (550,515 | ) | ||

| Net realized loss | (20,593,150 | ) | ||

| Net change in unrealized appreciation/(depreciation) on: | ||||

| Investments | 15,950,576 | |||

| Credit default swap contracts | (2,660 | ) | ||

| Interest rate swap contracts | (2,127,878 | ) | ||

| Forward foreign currency contracts | (236,894 | ) | ||

| Translation of assets and liabilities denominated in foreign currencies | (50,246 | ) | ||

| Net change in unrealized appreciation | 13,532,898 | |||

| Net Realized and Unrealized Loss on Investments | (7,060,252 | ) | ||

| Net Increase in Net Assets Resulting from Operations | $ | 7,446,819 | ||

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 17 |

| Stone Harbor Emerging Markets Income Fund | Statements of Changes in Net Assets |

For the Year Ended November 30, 2019 | For the Year Ended November 30, 2018 | |||||||

| OPERATIONS: | ||||||||

| Net investment income | $ | 14,507,071 | $ | 18,173,072 | ||||

| Net realized loss | (20,593,150 | ) | (24,851,663 | ) | ||||

| Net change in unrealized appreciation/(depreciation) | 13,532,898 | (24,537,613 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 7,446,819 | (31,216,204 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | (12,330,480 | ) | (6,798,725 | ) | ||||

| From tax return of capital | (22,810,192 | ) | (27,881,362 | ) | ||||

| Net decrease in net assets from distributions to shareholders | (35,140,672 | ) | (34,680,087 | ) | ||||

| Value of common shares issued to stockholders from reinvestment of dividends | 2,914,559 | 2,608,149 | ||||||

| Net increase in net assets from capital share transactions | 2,914,559 | 2,608,149 | ||||||

| Net Decrease in Net Assets | (24,779,294 | ) | (63,288,142 | ) | ||||

| NET ASSETS: | ||||||||

| Beginning of year | 170,992,499 | 234,280,641 | ||||||

| End of year | $ | 146,213,205 | $ | 170,992,499 | ||||

| OTHER INFORMATION: | ||||||||

| Share Transactions: | ||||||||

| Beginning shares | 16,168,916 | 15,973,492 | ||||||

| Shares issued as reinvestment of dividends | 233,179 | 195,424 | ||||||

| Shares outstanding - end of year | 16,402,095 | 16,168,916 | ||||||

See Notes to Financial Statements.

| 18 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Statement of Cash Flows |

For the Year Ended November 30, 2019

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||

| Net increase in net assets from operations | $ | 7,446,819 | ||

| Purchase of investment securities | (177,283,009 | ) | ||

| Proceeds from disposition of investment securities | 262,240,277 | |||

| Net sales of short-term investment securities | 10,573,755 | |||

| Net amortization of discounts, accretion of premiums and inflation income | (3,390,835 | ) | ||

| Net realized (gain)/loss on: | ||||

| Investments | 18,842,591 | |||

| Net change in unrealized (appreciation)/depreciation on: | ||||

| Investments | (15,950,576 | ) | ||

| Credit default swap contracts | 2,660 | |||

| Forward foreign currency contracts | 236,894 | |||

| Decrease in interest receivable | 1,976,868 | |||

| Increase in receivable on credit default swap contracts | (160 | ) | ||

| Increase in prepaid and other assets | (22 | ) | ||

| Decrease in payable due to brokers for forward foreign currency contracts | (20,000 | ) | ||

| Decrease in variation margin payable on interest rate swap contracts | (109,791 | ) | ||

| Decrease in payable to adviser | (85,137 | ) | ||

| Increase in payable to administrator | 13,608 | |||

| Increase in other payables | 38,045 | |||

| Decrease in interest payable on reverse repurchase agreements | (446,763 | ) | ||

| Net cash provided by operating activities | 104,085,224 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||

| Cash receipts from reverse repurchase agreements | 277,820,892 | |||

| Cash payments for reverse repurchase agreements | (353,532,357 | ) | ||

| Cash distributions paid | (32,226,113 | ) | ||

| Cash payments for borrowings from bank overdraft | (1,586,293 | ) | ||

| Net cash used in financing activities | (109,523,871 | ) | ||

| Net decrease in restricted cash and unrestricted cash | (5,438,647 | ) | ||

| Restricted and unrestricted cash, beginning balance | 5,820,575 | |||

| Restricted and unrestricted cash, ending balance | $ | 381,928 | ||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||

| Cash paid during the period for interest expense on reverse repurchase agreements: | $ | 1,060,382 | ||

| Non-cash financing activities not included herein consist of reinvestment of dividends and distributions of: | $ | 2,914,559 | ||

| RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE BEGINNING OF PERIOD TO THE STATEMENT OF ASSETS AND LIABILITIES | ||||

| Deposits with broker | ||||

| Interest rate swap contracts | 1,943,575 | |||

| Reverse repurchase agreements | 3,877,000 | |||

| RECONCILIATION OF RESTRICTED AND UNRESTRICTED CASH AT THE END OF PERIOD TO THE STATEMENT OF ASSETS AND LIABILITIES | ||||

| Cash | 381,357 | |||

| Foreign currency | 571 | |||

See Notes to Financial Statements.

| Annual Report | November 30, 2019 | 19 |

| Stone Harbor Emerging Markets Income Fund | Financial Highlights |

For a share outstanding throughout the periods presented.

For the Year Ended November 30, 2019 | For the Year Ended November 30, 2018 | For the Year Ended November 30, 2017 | For the Year Ended November 30, 2016 | For the Year Ended November 30, 2015 | ||||||||||||

| Net asset value - beginning of period | $ | 10.58 | $ | 14.67 | $ | 13.76 | $ | 14.55 | $ | 18.56 | ||||||

| Income/(loss) from investment operations: | ||||||||||||||||

| Net investment income(1) | 0.89 | 1.13 | 1.40 | 1.42 | 2.24 | |||||||||||

| Net realized and unrealized gain/(loss) on investments | (0.40 | ) | (3.06 | ) | 1.67 | (0.05 | ) | (4.09 | ) | |||||||

| Total income/(loss) from investment operations | 0.49 | (1.93 | ) | 3.07 | 1.37 | (1.85 | ) | |||||||||

| Less distributions to shareholders: | ||||||||||||||||

| From net investment income | (0.76 | ) | (0.42 | ) | (1.08 | ) | (0.35 | ) | (0.33 | ) | ||||||

| From tax return of capital | (1.40 | ) | (1.74 | ) | (1.08 | ) | (1.81 | ) | (1.83 | ) | ||||||

| Total distributions | (2.16 | ) | (2.16 | ) | (2.16 | ) | (2.16 | ) | (2.16 | ) | ||||||

| Net Increase/(Decrease) in Net Asset Value | (1.67 | ) | (4.09 | ) | 0.91 | (0.79 | ) | (4.01 | ) | |||||||

| Net asset value - end of period | $ | 8.91 | $ | 10.58 | $ | 14.67 | $ | 13.76 | $ | 14.55 | ||||||

| Market price - end of period | $ | 13.18 | $ | 12.05 | $ | 15.19 | $ | 14.09 | $ | 12.86 | ||||||

| Total Return - Net Asset Value - DRP(2) | (0.01 | %) | (15.35 | %) | 22.74 | % | 10.87 | % | (9.27 | %) | ||||||

| Total Return - Net Asset Value - NAV(3) | 4.45 | % | (14.51 | %) | 23.43 | % | 10.20 | % | (10.24 | %) | ||||||

| Total Return - Market Price(2) | 29.86 | % | (6.89 | %) | 24.11 | % | 28.45 | % | (16.38 | %) | ||||||

| Ratios/Supplemental Data: | ||||||||||||||||

| Net assets, end of period (in millions) | $ | 146 | $ | 171 | $ | 234 | $ | 218 | $ | 230 | ||||||

| Ratio of expenses to average net assets | 1.97 | %(4) | 2.96 | %(4) | 2.59 | %(4) | 2.18 | %(4) | 2.13 | %(4) | ||||||

| Ratio of net investment income to average net assets | 8.88 | % | 8.76 | % | 9.47 | % | 10.03 | % | 14.08 | % | ||||||

| Ratio of expenses to average managed assets(5) | 1.75 | %(4) | 2.09 | %(4) | 1.85 | %(4) | 1.62 | %(4) | 1.46 | %(4) | ||||||

| Portfolio turnover rate | 107 | % | 130 | % | 107 | % | 105 | % | 89 | % | ||||||

| Borrowings at End of Period | ||||||||||||||||

| Aggregate Amount Outstanding (in millions) | $ | 9 | $ | 85 | $ | 65 | $ | 101 | $ | 90 | ||||||

| Asset Coverage | $ | 17 | $ | 3 | $ | 5 | $ | 3 | $ | 4 | ||||||

| (1) | Calculated using average shares throughout the period. |

| (2) | Total investment return is calculated assuming a purchase of one common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan ("DRP"). Total investment returns do not reflect brokerage commissions, if any. |

| (3) | Total return is calculated assuming a purchase of one common share at the beginning of the period and a sale on the last day of the period reported at net asset value (“NAV”) per share. Dividends and distributions are assumed to be reinvested at NAV. Total return does not reflect brokerage commissions. |

| (4) | For the years ended 2019, 2018, 2017, 2016, and 2015, includes borrowing costs of 0.38%, 1.08%, 0.74%, 0.41% and 0.30% to average net assets and 0.34%, 0.76%, 0.53%, 0.30% and 0.21% to average managed assets, respectively. |

| (5) | Average managed assets represent average net assets applicable to common shares plus average amount of borrowings during the period. |

See Notes to Financial Statements.

| 20 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Notes to Financial Statements |

November 30, 2019

1. ORGANIZATION

The Fund is a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is organized as a Massachusetts business trust pursuant to an Agreement and Declaration of Trust governed by the laws of The Commonwealth of Massachusetts (the “Declaration of Trust”). The Fund’s inception date is December 22, 2010. Prior to that, the Fund had no operations other than matters relating to its organization and the sale and issuance of 4,188 shares of beneficial interest (“Common Shares”) in the Fund to the Stone Harbor Investment Partners LP (the “Adviser” or “Stone Harbor”) at a price of $23.88 per share. The Fund’s common shares are listed on the New York Stock Exchange (the “Exchange”) and trade under the ticker symbol “EDF”.

The Fund’s investment objective is to maximize total return, which consists of income on its investments and capital appreciation. The Fund will normally invest at least 80% of its net assets (plus any borrowings made for investment purposes) in emerging markets securities. Emerging markets securities include fixed income securities and other instruments (including derivatives) that are economically tied to emerging market countries, which are denominated in the predominant currency of the local market of an emerging market country or whose performance is linked to those countries’ markets, currencies, economies or ability to repay loans. A security or instrument is economically tied to an emerging market country if it is principally traded on the country’s securities markets or if the issuer is organized or principally operates in the country, derives a majority of its income from its operations within the country or has a majority of its assets within the country.

The Fund is classified as “non-diversified” under the 1940 Act. As a result, it can invest a greater portion of its assets in obligations of a single issuer than a “diversified” fund. The Fund may therefore be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence.

2. SIGNIFICANT ACCOUNTING POLICIES AND RISK DISCLOSURES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is considered an investment company for financial reporting purposes under generally accepted accounting principles in the United States of America (“GAAP”). The policies are in conformity with GAAP. The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Investment Valuation: Sovereign debt obligations, corporate bonds, and convertible corporate bonds, are generally valued at the mean between the closing bid and asked prices provided by an independent pricing service. The pricing service generally uses market models that consider trade data, yields, spreads, quotations from dealers and active market makers, credit worthiness, market information on comparable securities, and other relevant security specific information. Bank Loans are primarily valued by a loan pricing provider using a composite loan price at the mean of the bid and ask prices from one or more brokers of dealers. Credit Linked securities are generally valued using quotations from the broker through which the Fund executed the transaction. The broker’s quotation considers cash flows, default and recovery rates, and other security specific information. Equity securities for which market quotations are available are generally valued at the last sale price or official closing price on the primary market or exchange on which they trade. If, on a given day, a closing price is not available on the exchange, the equity security is valued at the mean between the closing bid and ask prices, as such prices are provided by a pricing service. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter (“OTC”) market and are valued at the mean between the bid and asked prices as of the close of business of that market. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board. Short term obligations with maturities of 60 days or less are valued at amortized cost, which approximates market value. Exchange Traded Funds (“ETFs”) are valued at the close price on the exchange it is listed. Money market mutual funds are valued at their net asset value. OTC traded derivatives (primarily swaps and foreign currency options) are generally priced by an independent pricing service. OTC traded credit default swaps are valued by the independent pricing source using a mid price that is calculated based on data an independent pricing source receives from dealers. OTC traded foreign currency options are valued by an independent pricing source using mid foreign exchange rates against USD for all currencies at 4:00 p.m. EST. Derivatives which are cleared by an exchange are priced by using the last price on such exchange. Foreign currency positions including forward currency contracts are priced at the mean between the closing bid and asked prices at 4:00 p.m. Eastern time.

A three-tier hierarchy has been established to measure fair value based on the extent of use of “observable inputs” as compared to “unobservable inputs” for disclosure purposes and requires additional disclosures about these valuations measurements. Inputs refer broadly to the assumptions that market participants would use in pricing a security. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the security developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the security developed based on the best information available in the circumstances.

| Annual Report | November 30, 2019 | 21 |

| Stone Harbor Emerging Markets Income Fund | Notes to Financial Statements |

November 30, 2019

The three-tier hierarchy is summarized as follows:

| Level 1 | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| Level 2 | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available. |

The following is a summary of the Fund’s investment and financial instruments based on the three-tier hierarchy as of November 30, 2019:

| Investments in Securities at Value* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Sovereign Debt Obligations | $ | – | $ | 117,323,043 | $ | – | $ | 117,323,043 | ||||||||

| Corporate Bonds | ||||||||||||||||

| Indonesia | – | – | 198 | 198 | ||||||||||||

| Other | – | 25,317,093 | – | 25,317,093 | ||||||||||||

| Credit Linked Notes | – | – | 6,630,141 | 6,630,141 | ||||||||||||

| Purchased Options | – | 53,646 | – | 53,646 | ||||||||||||

| Short Term Investments | 2,739,411 | – | – | 2,739,411 | ||||||||||||

| Total | $ | 2,739,411 | $ | 142,693,782 | $ | 6,630,339 | $ | 152,063,532 | ||||||||

| Other Financial Instruments** | ||||||||||||||||

| Assets | ||||||||||||||||

| Forward Foreign Currency Contracts | $ | – | $ | 180,443 | $ | – | $ | 180,443 | ||||||||

| Credit Default Swap Contracts | – | 27,088 | – | 27,088 | ||||||||||||

| Liabilities | ||||||||||||||||

| Forward Foreign Currency Contracts | – | (352,342 | ) | – | (352,342 | ) | ||||||||||

| Total | $ | – | $ | (144,811 | ) | $ | – | $ | (144,811 | ) |

| * | For detailed country descriptions, see accompanying Statement of Investments. |

| ** | Other financial instruments are derivative instruments reflected in the Statement of Investments. The derivatives shown in this table are reported at their unrealized appreciation/(depreciation) at measurement date, which represents the change in the contract's value from trade date. For liabilities arising from reverse repurchase agreements, the carrying amount approximates fair value due to the relatively short-term maturity of these financial instruments. |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| Asset Type | Balance November 30, 2018 | Accrued Discount/ Premium | Realized Gain/(Loss) | Change

in Unrealized Appreciation/ Depreciation | Purchases | Sales Proceeds | Balance November 30, 2019 | Net change in November 30, 2019 | ||||||||||||||||||||||||

| Corporate Bonds | $ | 195 | $ | – | $ | – | $ | 3 | $ | – | $ | – | $ | 198 | $ | 3 | ||||||||||||||||

| Credit Linked Notes | 6,010,257 | 130,422 | (42,910 | ) | 1,086,304 | 360,081 | (914,013 | ) | 6,630,141 | 1,086,304 | ||||||||||||||||||||||

| $ | 6,010,452 | $ | 130,422 | $ | (42,910 | ) | $ | 1,086,307 | $ | 360,081 | $ | (914,013 | ) | $ | 6,630,339 | $ | 1,086,307 | |||||||||||||||

All level 3 investments have values determined utilizing third-party pricing information without adjustment.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| 22 | www.shiplpcef.com |

| Stone Harbor Emerging Markets Income Fund | Notes to Financial Statements |

November 30, 2019

In the event a Board approved independent pricing service is unable to provide an evaluated price for a security or the Adviser believes the price provided is not reliable, the Adviser may seek to find an alternative independent source, such as a broker/dealer to provide a price quote, or use evaluated pricing models similar to the techniques and models used by the independent pricing service. These fair value measurement techniques may utilize unobservable inputs (Level 3).

On at least a quarterly basis, the Adviser presents the factors considered in determining the fair value measurements and presents that information to the Board which meets at least quarterly.

Security Transactions and Investment Income: Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practical after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. If applicable, any foreign capital gains taxes are accrued, net of unrealized gains, and are payable upon the sale of such investments. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Prevailing foreign exchange rates may generally be obtained at the close of the NYSE (normally 4:00 p.m. Eastern time).

The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.