Form DEFA14A Delphi Technologies PLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material under §240.14a-12 | |

DELPHI TECHNOLOGIES PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of Delphi Technologies PLC (“Delphi” or the “Company”) by BorgWarner Inc., a Delaware corporation (“Buyer”), pursuant to the terms of a Transaction Agreement, dated January 28, 2020, by and between the Company and Buyer:

| ● | Company Staff Presentation, presented on January 29, 2020. |

Delphi Technologies and BorgWarner: Stronger Together All Staff Briefing 29 January 2020

No Offer or Solicitation. This communication is being made in respect of the proposed acquisition (the “proposed transaction”) of Delphi Technologies PLC (“Delphi Technologies”) by BorgWarner Inc. (“BorgWarner”). This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In particular, this communication is not an offer of securities for sale into the United States. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued in the proposed transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the Securities Act. In connection with the proposed transaction, Delphi Technologies will file certain proxy materials, which shall constitute the scheme document and the proxy statement relating to the proposed transaction (the “proxy statement”). The proxy statement will contain the full terms and conditions of the proposed transaction, including details with respect to the Delphi Technologies shareholder vote in respect of the proposed transaction. Any decision in respect of, or other response to, the proposed transaction should be made only on the basis of the information contained in the proxy statement. Participants in the Solicitation. Delphi Technologies, BorgWarner and certain of their respective directors, executive officers and employees may be deemed “participants” in the solicitation of proxies from Delphi Technologies shareholders in respect of the proposed transaction. Information regarding the foregoing persons, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and any other relevant documents to be filed with the Securities and Exchange Commission (the “SEC”). You can find information about Delphi Technologies’ directors and executive officers in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018, its definitive proxy statement filed with the SEC on Schedule 14A on March 15, 2019, and certain of Delphi Technologies’ Current Reports on Form 8-K filed with the SEC on January 7, 2019 and July 30, 2019. You can find information about BorgWarner’s directors and executive officers in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and its definitive proxy statement filed with the SEC on Schedule 14A on March 15, 2019. Additional Information and Where to Find It. This communication may be deemed solicitation material in respect of the proposed transaction. In connection with the proposed transaction, Delphi Technologies will file with the SEC and furnish to Delphi Technologies’ shareholders a proxy statement and other relevant documents. This communication does not constitute a solicitation of any vote or approval. Before making any voting decision, Delphi Technologies’ shareholders are urged to read the proxy statement and any other relevant documents filed or to be filed with the SEC in connection with the proposed transaction or incorporated by reference in the proxy statement (if any) carefully and in their entirety when they become available because they will contain important information about the proposed transaction and the parties to the proposed transaction. Investors will be able to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, the proxy statement and Delphi Technologies’ and BorgWarner’s respective annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, are available free of charge through Delphi Technologies’ and BorgWarner’s websites at www.delphi.com and www.borgwarner.com, respectively, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Forward-Looking Statements. This communication may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act that reflect, when made, Delphi Technologies’ current views with respect to future events, including the proposed transaction, and financial performance or that are based on its management’s current outlook, expectations, estimates and projections, including with respect to the combined group following the proposed transaction, if completed. Such forward-looking statements are subject to many risks, uncertainties and factors relating to Delphi Technologies’ or BorgWarner’s respective operations and business environment, which may cause actual results to be materially different from those indicated in the forward-looking statements. All statements that address future operating, financial or business performance or Delphi Technologies’ strategies or expectations are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “could,” “designed,” “effect,” “evaluates,” “forecasts,” “goal,” “guidance,” “initiative,” “intends,” “pursue,” “seek,” “target,” “when,” “will,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “outlook” or “continue,” the negatives thereof and other comparable terminology. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the possibility that the proposed transaction will not be pursued; failure to obtain necessary regulatory approvals or required financing or to satisfy any of the other conditions to the proposed transaction; adverse effects on the market price of Delphi Technologies’ ordinary shares or BorgWarner’s shares of common stock and on Delphi Technologies’ or BorgWarner’s operating results because of a failure to complete the proposed transaction; failure to realize the expected benefits of the proposed transaction; failure to promptly and effectively integrate Delphi Technologies’ businesses; negative effects relating to the announcement of the proposed transaction or any further announcements relating to the proposed transaction or the consummation of the proposed transaction on the market price of Delphi Technologies’ ordinary shares or BorgWarner’s shares of common stock; significant transaction costs and/or unknown or inestimable liabilities; potential litigation associated with the proposed transaction; general economic and business conditions that affect the combined group following the consummation of the proposed transaction; changes in global, political, economic, business, competitive, market and regulatory forces; changes in tax laws, regulations, rates and policies; future business acquisitions or disposals; competitive developments; and the timing and occurrence (or non-occurrence) of other events or circumstances that may be beyond Delphi Technologies’ control. For additional information about these and other factors, see the information under the caption “Risk Factors” in Delphi Technologies’ most recent Annual Report on Form 10-K filed with the SEC and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” filed on February 21, 2019, and the information under the caption “Risk Factors” in BorgWarner’s most recent Annual Report on Form 10-K filed with the SEC and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on February 19, 2019. Delphi Technologies’ forward-looking statements speak only as of the date of this communication or as of the date they are made. Delphi Technologies disclaims any intent or obligation to update or revise any “forward looking statement” made in this communication to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as may be required by law. All subsequent written and oral forward-looking statements attributable to Delphi Technologies or its directors, executive officers or any person acting on behalf of any of them are expressly qualified in their entirety by this paragraph. General. The release, publication or distribution of this communication in or into certain jurisdictions may be restricted by the laws of those jurisdictions. Accordingly, copies of this communication and all other documents relating to the proposed transaction are not being, and must not be, released, published, mailed or otherwise forwarded, distributed or sent in, into or from any such jurisdictions. Persons receiving such documents (including, without limitation, nominees, trustees and custodians) should observe these restrictions. Failure to do so may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law, the companies involved in the proposed transaction disclaim any responsibility or liability for the violations of any such restrictions by any person. Any response in relation to the proposed transaction should be made only on the basis of the information contained in the proxy statement and other relevant documents. Delphi Technologies shareholders are advised to read carefully the formal documentation in relation to the proposed transaction once the proxy statement and other relevant documents have been dispatched. Legal Disclaimers INTERNAL USE ONLY

Background: BorgWarner Two complementary businesses Vision and values Summary 1 2 3 4 Delphi Technologies and BorgWarner: Stronger Together Agenda Next steps 5 INTERNAL USE ONLY

Compelling transaction for Delphi Technologies’ stakeholders Combination of market leaders creates exciting opportunities for Delphi Technologies’ employees Common values and cultures based on respect, integrity, excellence, responsibility and teamwork Delphi Technologies’ shareholders receive ability to benefit from future upside and enhanced prospects of the combined company Combination allows Delphi Technologies to become part of a pioneering propulsion technologies company with enhanced scale and unique capabilities Provides greater flexibility to execute existing restructuring plan, with opportunity to accelerate profitable growth INTERNAL USE ONLY

BorgWarner at a glance, side by side with Delphi Technologies INTERNAL USE ONLY

BorgWarner corporate video INTERNAL USE ONLY https://www.borgwarner.com/company

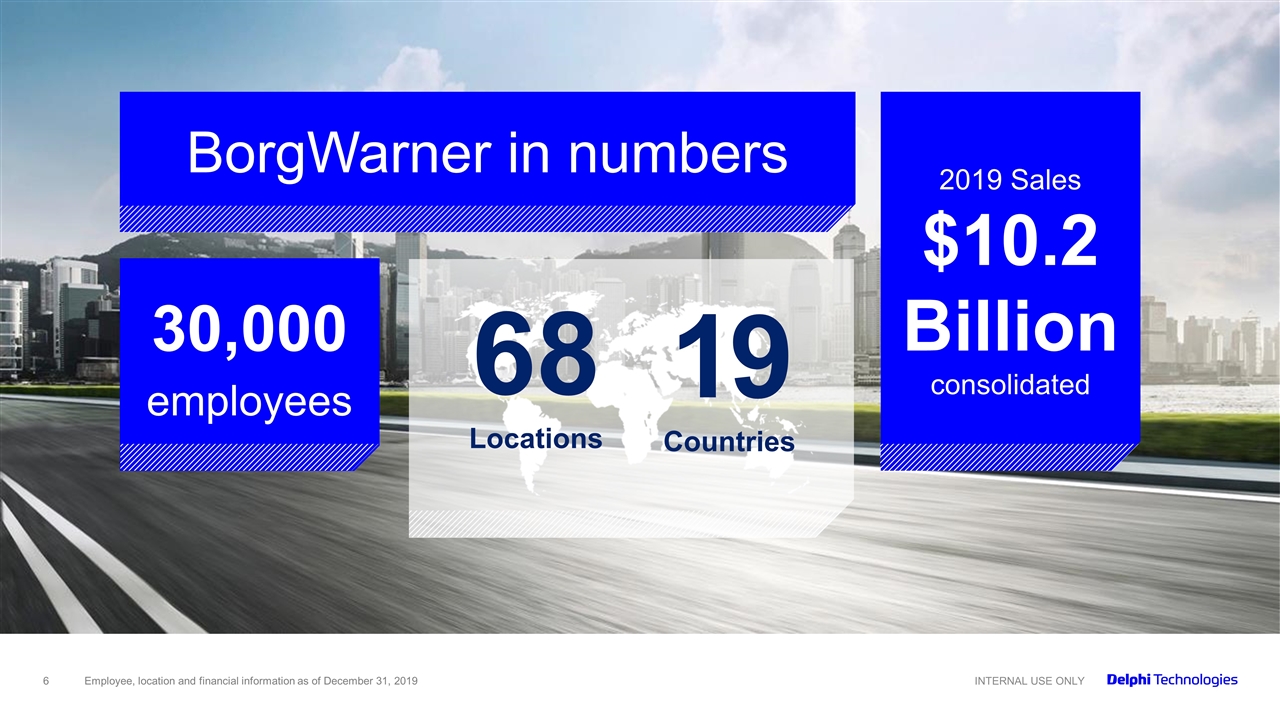

BorgWarner in numbers 30,000 employees 68 Locations 19 Countries 2019 Sales $10.2 Billion consolidated Employee, location and financial information as of December 31, 2019 INTERNAL USE ONLY

Strategic Global Operations Location information as of December 31, 2019 24 locations in the Americas 20 locations in Europe 24 locations in Asia BorgWarner partners with customers around the world to bring the right technology to market at the right value. INTERNAL USE ONLY

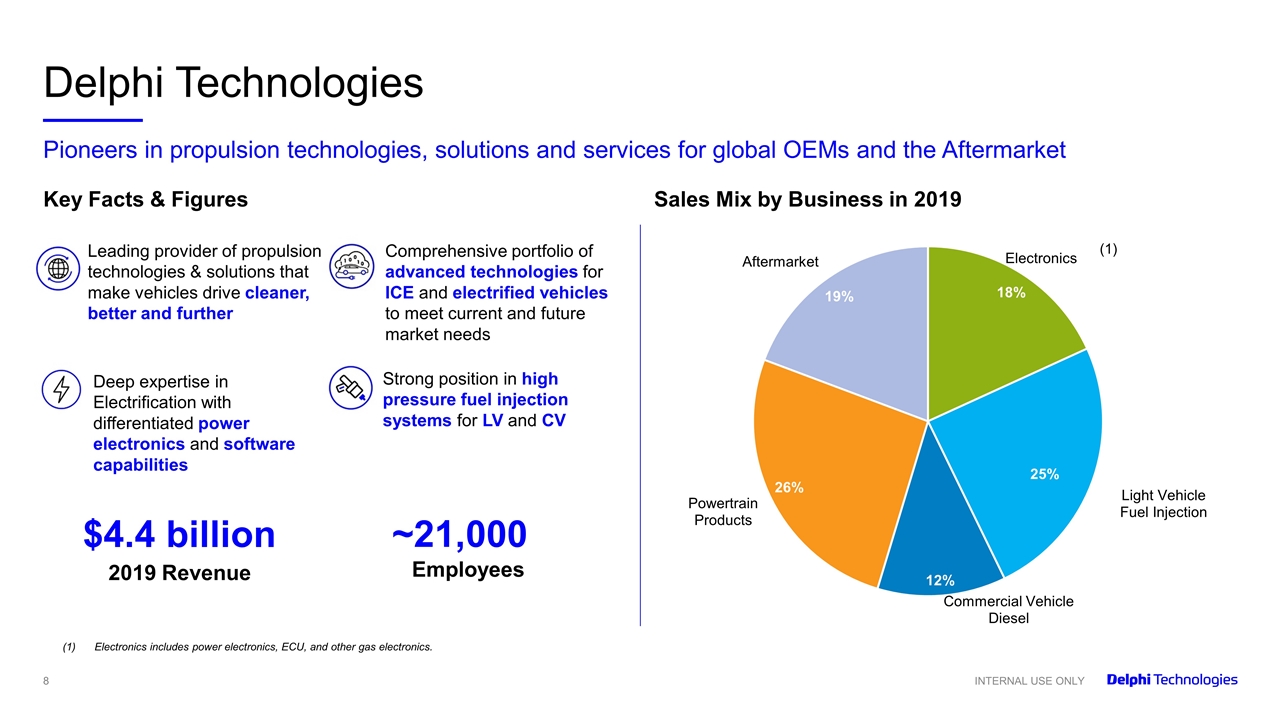

Pioneers in propulsion technologies, solutions and services for global OEMs and the Aftermarket Delphi Technologies $4.4 billion Key Facts & Figures Sales Mix by Business in 2019 Leading provider of propulsion technologies & solutions that make vehicles drive cleaner, better and further Comprehensive portfolio of advanced technologies for ICE and electrified vehicles to meet current and future market needs 2019 Revenue Deep expertise in Electrification with differentiated power electronics and software capabilities Strong position in high pressure fuel injection systems for LV and CV ~21,000 Employees Electronics includes power electronics, ECU, and other gas electronics. (1) INTERNAL USE ONLY

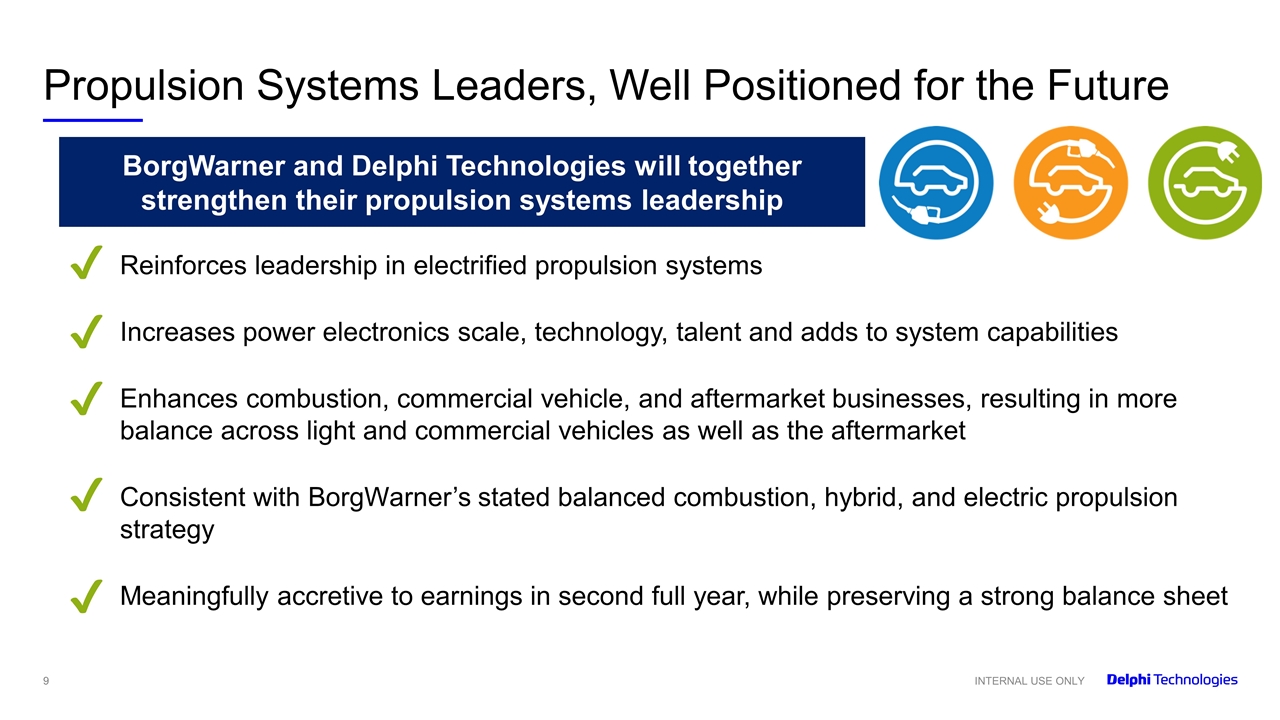

Timing Considerations Propulsion Systems Leaders, Well Positioned for the Future Reinforces leadership in electrified propulsion systems Increases power electronics scale, technology, talent and adds to system capabilities Enhances combustion, commercial vehicle, and aftermarket businesses, resulting in more balance across light and commercial vehicles as well as the aftermarket Consistent with BorgWarner’s stated balanced combustion, hybrid, and electric propulsion strategy Meaningfully accretive to earnings in second full year, while preserving a strong balance sheet BorgWarner and Delphi Technologies will together strengthen their propulsion systems leadership ✔ ✔ ✔ ✔ ✔ INTERNAL USE ONLY

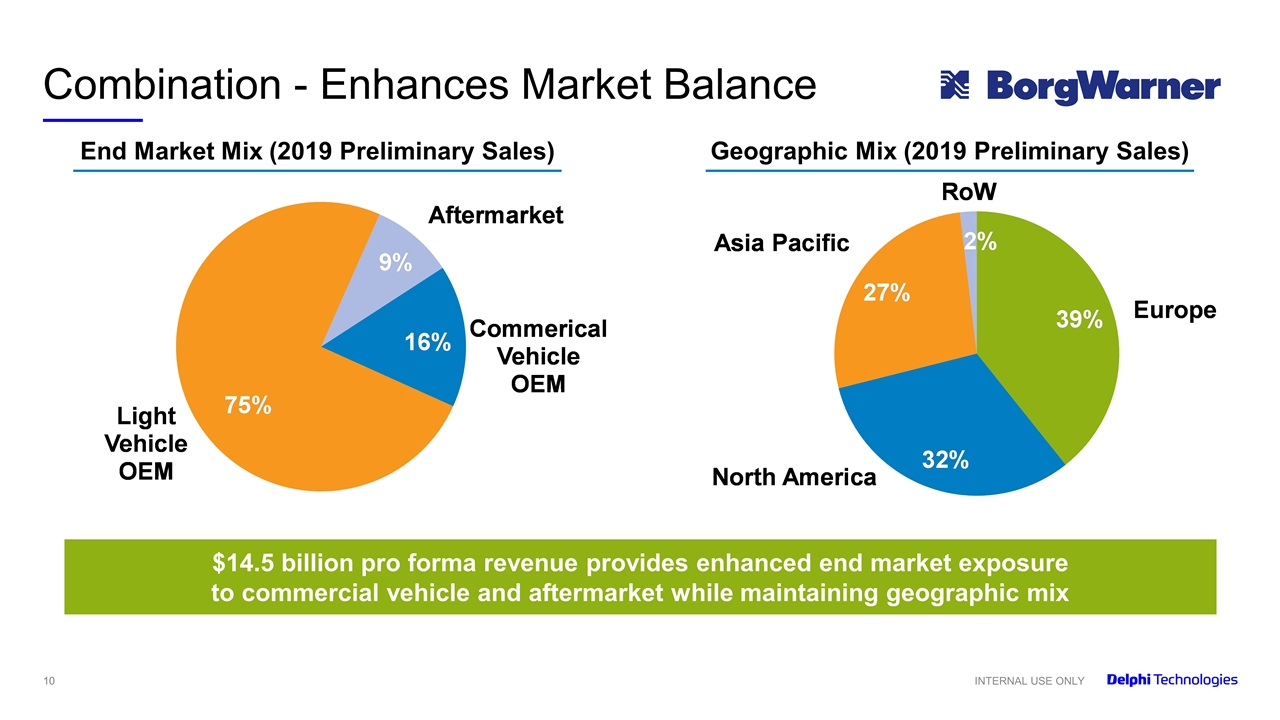

Timing Considerations Combination - Enhances Market Balance End Market Mix (2019 Preliminary Sales) Geographic Mix (2019 Preliminary Sales) $14.5 billion pro forma revenue provides enhanced end market exposure to commercial vehicle and aftermarket while maintaining geographic mix INTERNAL USE ONLY

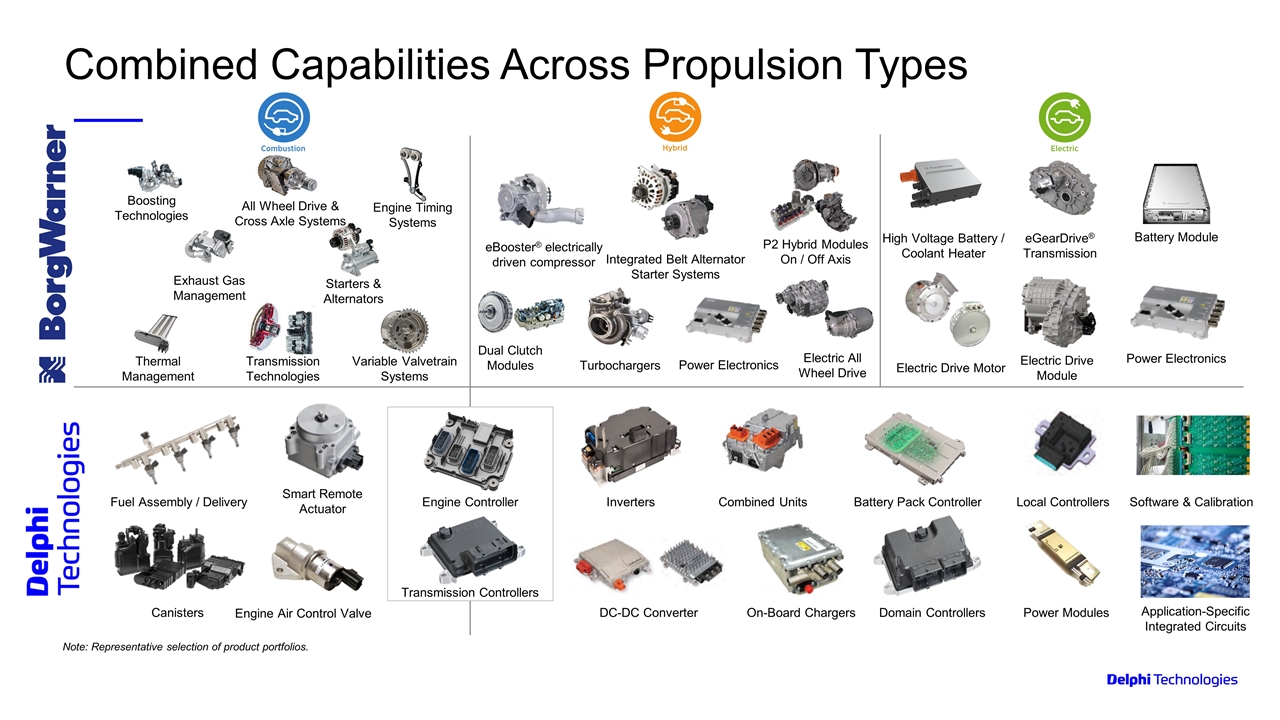

Timing Considerations Combined Capabilities Across Propulsion Types Application-Specific Integrated Circuits Canisters Smart Remote Actuator Inverters Combined Units DC-DC Converter On-Board Chargers Domain Controllers Local Controllers Software & Calibration eBooster® electrically driven compressor Integrated Belt Alternator Starter Systems Power Electronics P2 Hybrid Modules On / Off Axis Electric All Wheel Drive Turbochargers Dual Clutch Modules eGearDrive® Transmission Electric Drive Motor Power Electronics Electric Drive Module Fuel Assembly / Delivery High Voltage Battery / Coolant Heater Battery Module All Wheel Drive & Cross Axle Systems Boosting Technologies Engine Timing Systems Exhaust Gas Management Starters & Alternators Thermal Management Transmission Technologies Variable Valvetrain Systems Note: Representative selection of product portfolios. Engine Controller Engine Air Control Valve Transmission Controllers Battery Pack Controller Power Modules

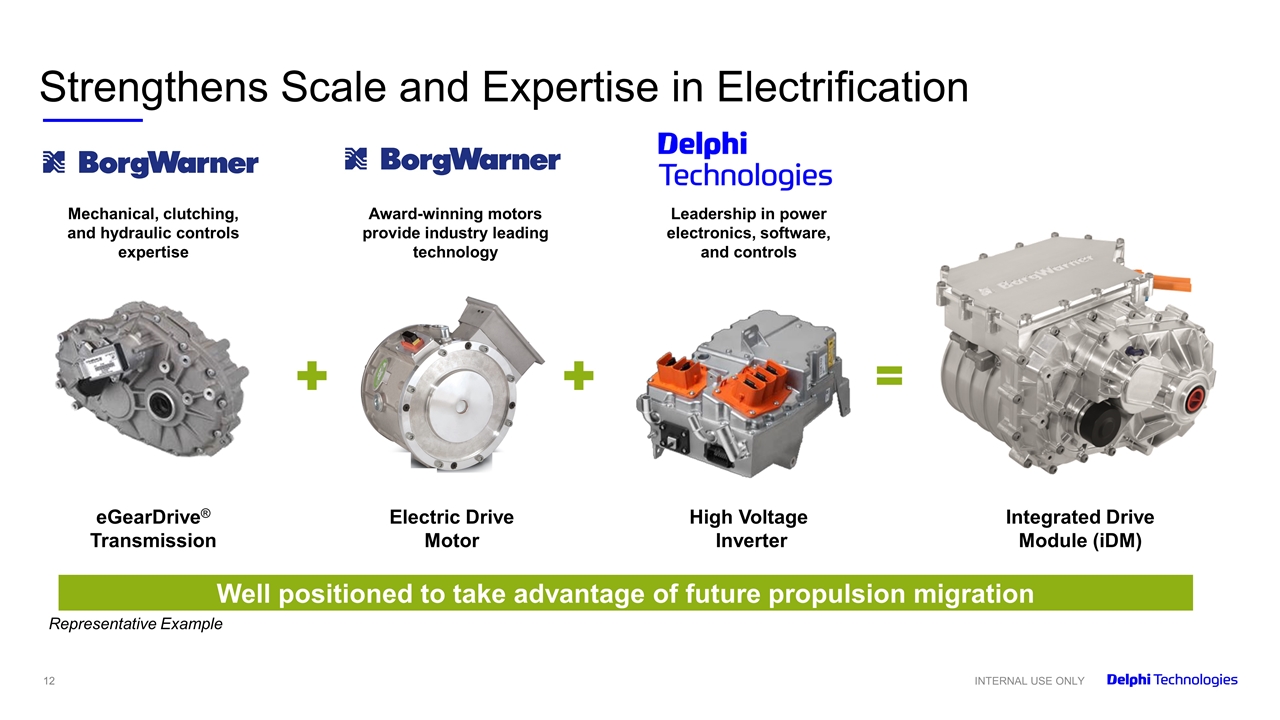

Mechanical, clutching, and hydraulic controls expertise Award-winning motors provide industry leading technology Strengthens Scale and Expertise in Electrification Integrated Drive Module (iDM) Electric Drive Motor eGearDrive® Transmission High Voltage Inverter Representative Example Well positioned to take advantage of future propulsion migration Leadership in power electronics, software, and controls INTERNAL USE ONLY

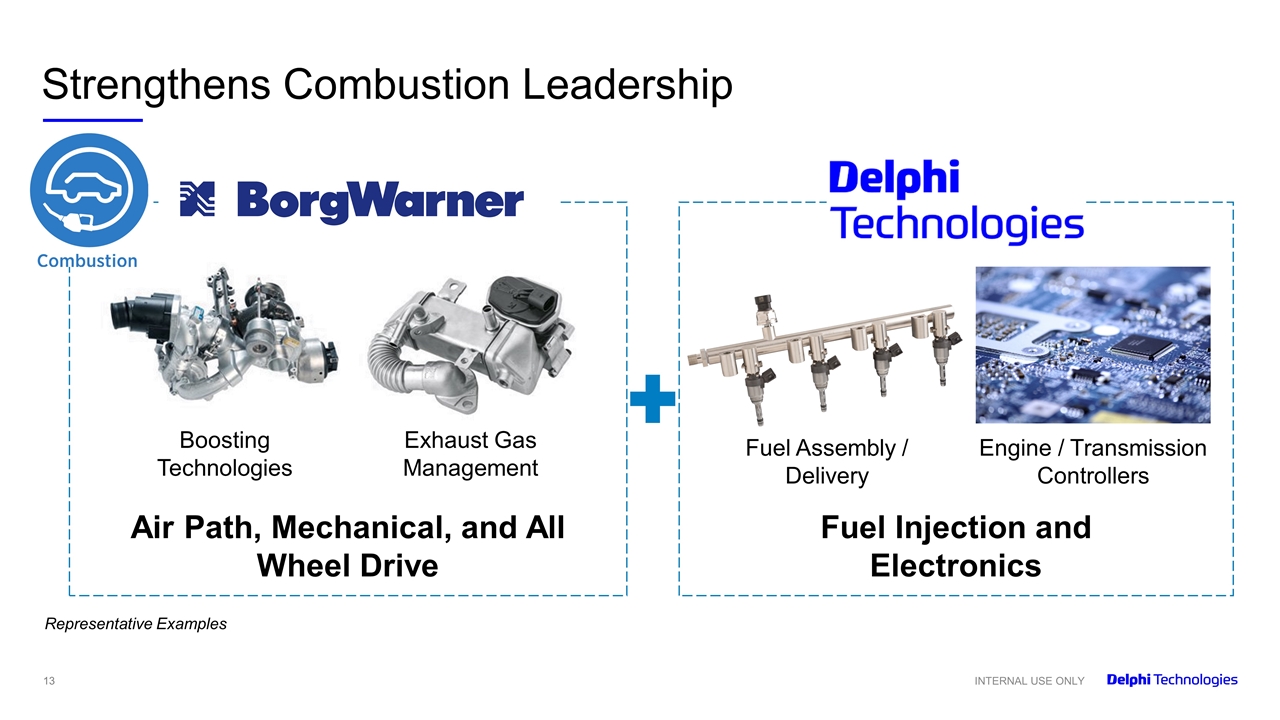

so so Strengthens Combustion Leadership Fuel Assembly / Delivery Boosting Technologies Exhaust Gas Management Engine / Transmission Controllers Air Path, Mechanical, and All Wheel Drive Fuel Injection and Electronics Representative Examples INTERNAL USE ONLY

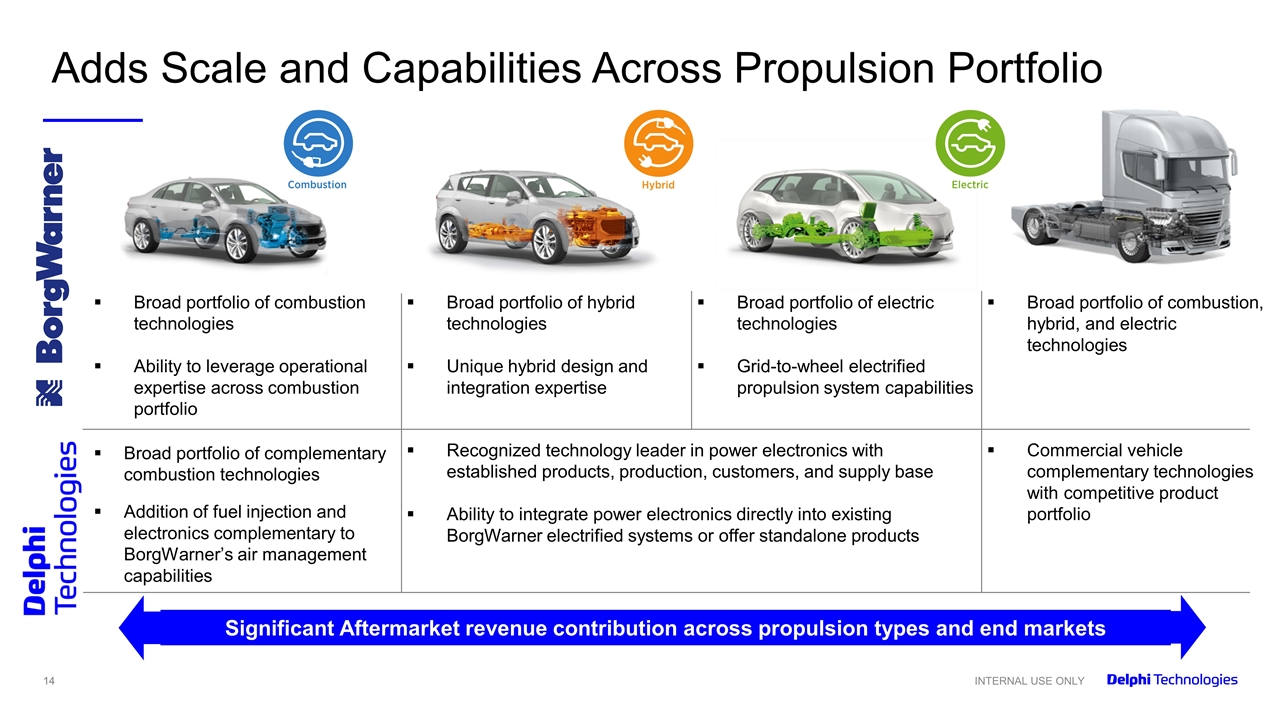

Timing Considerations Adds Scale and Capabilities Across Propulsion Portfolio Broad portfolio of combustion technologies Ability to leverage operational expertise across combustion portfolio Broad portfolio of hybrid technologies Unique hybrid design and integration expertise Broad portfolio of electric technologies Grid-to-wheel electrified propulsion system capabilities Broad portfolio of complementary combustion technologies Addition of fuel injection and electronics complementary to BorgWarner’s air management capabilities Recognized technology leader in power electronics with established products, production, customers, and supply base Ability to integrate power electronics directly into existing BorgWarner electrified systems or offer standalone products Broad portfolio of combustion, hybrid, and electric technologies Commercial vehicle complementary technologies with competitive product portfolio INTERNAL USE ONLY Significant Aftermarket revenue contribution across propulsion types and end markets

Market reaction INTERNAL USE ONLY

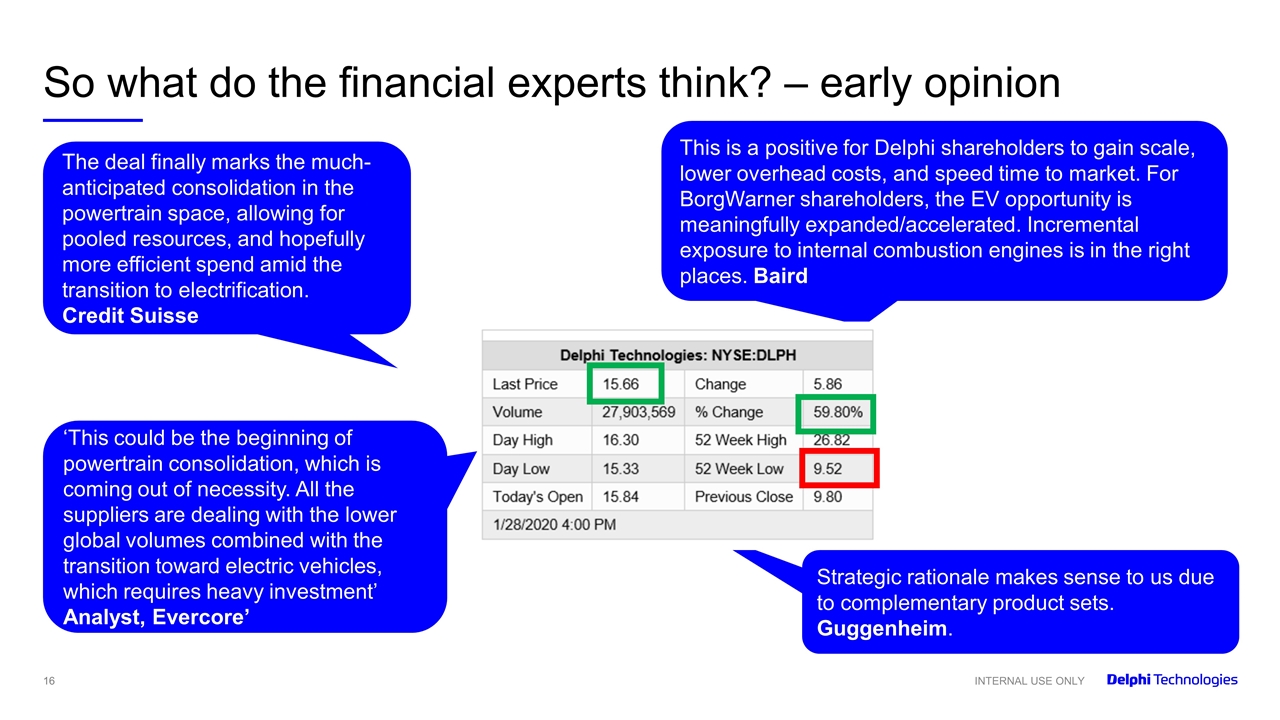

So what do the financial experts think? – early opinion INTERNAL USE ONLY ‘This could be the beginning of powertrain consolidation, which is coming out of necessity. All the suppliers are dealing with the lower global volumes combined with the transition toward electric vehicles, which requires heavy investment’ Analyst, Evercore’ The deal finally marks the much-anticipated consolidation in the powertrain space, allowing for pooled resources, and hopefully more efficient spend amid the transition to electrification. Credit Suisse Strategic rationale makes sense to us due to complementary product sets. Guggenheim. This is a positive for Delphi shareholders to gain scale, lower overhead costs, and speed time to market. For BorgWarner shareholders, the EV opportunity is meaningfully expanded/accelerated. Incremental exposure to internal combustion engines is in the right places. Baird

Shared vision and values INTERNAL USE ONLY

OUR VISION OUR MISSION A clean, energy-efficient world Propulsion System Leader for Combustion, Hybrid and Electric Vehicles

INTERNAL USE ONLY Our vision To be the pioneers in propulsion technologies, solutions and services. Our mission To make vehicles drive cleaner, better and further while being the partner of choice for all stakeholders. Our values

OUR BELIEFS Respect for Each Other Power of Collaboration Passion for Excellence Personal Integrity Responsibility to Our Communities

What happens next? INTERNAL USE ONLY

The transaction is expected to close in the second half of 2020: Subject to approval by Delphi Technologies shareholders Various closing conditions and regulatory approvals ELT members and site managers will hold Skype briefings and town halls Look out for details and contact your manager or ELT member if you do not receive an invitation. In the meantime it’s business as usual, please stay focused on your role and deliver on our operational and financial commitments. Achieve 2020 budget Execute new program and product launches – on time and on budget Project Pioneer Win new profitable business We must deliver on our commitments to create the strongest business we can for all stakeholders. What happens next? INTERNAL USE ONLY

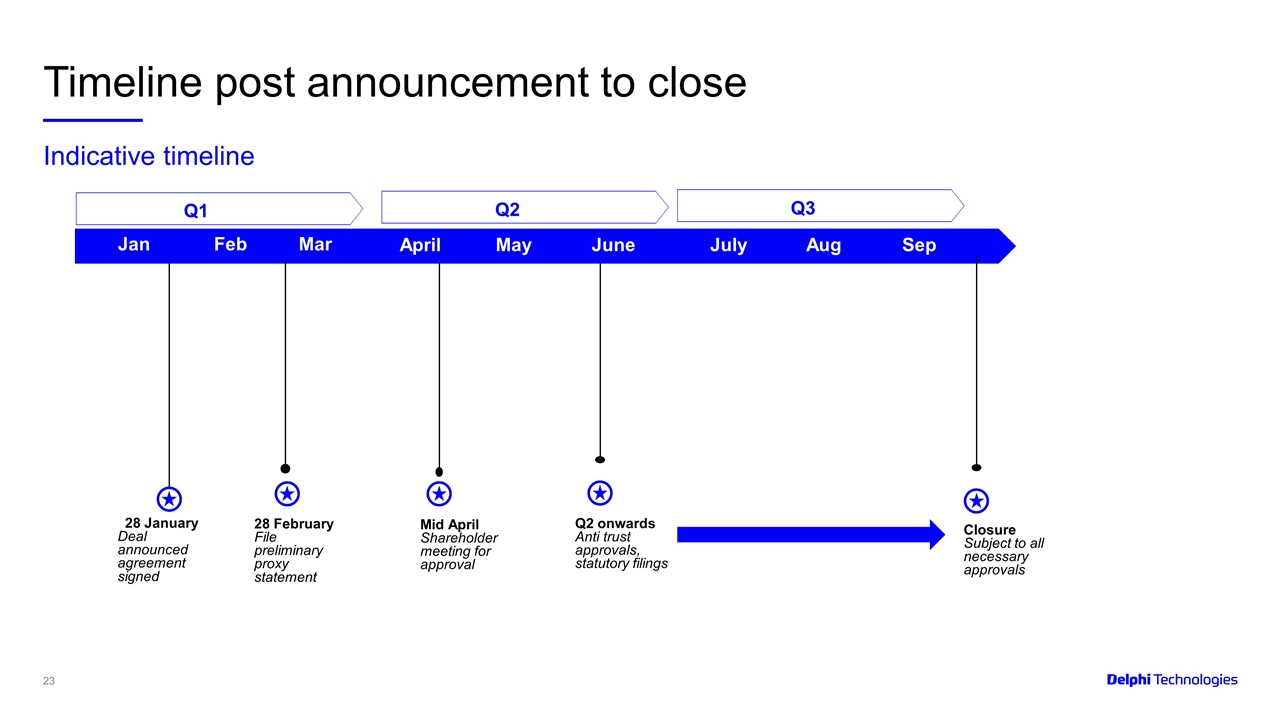

Timeline post announcement to close Indicative timeline Q1 JanFeb Mar April May June Q2 28 January Deal announced agreement signed Mid April Shareholder meeting for approval 28 February File preliminary proxy statement Q2 onwards Anti trust approvals, statutory filings Q3 July Aug Sep Closure Subject to all necessary approvals

There will be a lot of questions – we will cover some now, and others as we go Questions can also be submitted via the Stronger Together SharePoint site and updates will be posted regularly What happens next? INTERNAL USE ONLY Click here for a link to the Sharepoint page

Questions? INTERNAL USE ONLY

INTERNAL USE ONLY Thank you