Form DEFA14A LAM RESEARCH CORP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

LAM RESEARCH CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

Lam Research Corporation 4650 Cushing Parkway Fremont, CA 94538-6470 U.S.A. Main: 1-510-572-0200 www.lamresearch.com

October 16, 2019 |

| Re: | Lam Research Corporation 2019 Annual Meeting of Stockholders |

Supplemental Information Regarding Proposal #2 – Advisory Vote to Approve Our Named

Executive Officer Compensation, or “Say on Pay”

Dear Fellow Stockholder,

At Lam Research Corporation’s 2019 Annual Meeting of Stockholders, you will once again be asked to cast an advisory vote to approve our named executive officer compensation, or “Say on Pay”. Our Board of Directors has recommended that you cast your vote in favor of this proposal.

As you may know, Glass Lewis has recommended that you vote in favor of all of our proposals for the 2019 Annual Meeting, included our Say on Pay proposal. However, Institutional Shareholder Services, or ISS, has recommended that stockholders vote against this proposal. ISS supported our Say on Pay proposals in all prior years. This year, ISS has expressed concerns regarding our annual incentive program. The design of this program has remained unchanged, and has garnered greater than 90% support through our Say on Pay votes, over each of the last five years. ISS also voiced concerns regarding one-time retention awards that we granted to our Chief Executive Officer (CEO) and Chief Financial Officer (CFO) in connection with the Company’s leadership transition that occurred at the end of 2018, a critical time for our Company. We are disappointed in ISS’s recommendation, and would like to provide you with our views regarding ISS’s concerns, to help inform your decision regarding our Say on Pay proposal.

Our executive compensation program is designed to pay for performance, and we believe it is in the best interests of our stockholders. We strongly encourage you to vote FOR all of the proposals included in our proxy statement, including the Say on Pay proposal.

Our Approach to Executive Compensation

As described in our proxy statement for the Annual Meeting, our objectives for our executive compensation program are to motivate:

| • | performance that creates long-term stockholder value; |

| • | outstanding performance at the corporate, organization, and individual levels; and |

| • | retention of a long-term, high-quality management team. |

| Lam Research Corp. | Page 1 of 6 | |

Our program design uses a mix of annual and long-term components, and a mix of cash and equity components. Our executive compensation program includes base salary, an annual incentive program, a long-term incentive program, promotion, retention and/or new hire awards when appropriate, as well as stock ownership guidelines and a clawback policy.

Because ISS has focused on specific aspects of our executive compensation program in reaching their decision to recommend against our Say on Pay proposal, we will address each of their concerns in turn below.

ISS Concern:

ISS expressed a concern that our Annual Incentive Program permits a significant degree of discretion, as half of the payout in 2018 was based on Individual Performance Factors, with limited disclosure regarding the targets and accomplishments considered in determining payouts. According to ISS, shareholders generally prefer short-term pay programs that more closely align payouts with corporate or financial goals. Further, ISS expressed concern that the financial target used for our Annual Incentive Program (that is, the Corporate Performance Factor) in calendar year 2018 was set below our actual performance in calendar year 2017, and this portion of the Annual Incentive Program award was earned above target.

Response:

Our Annual Incentive Program (AIP) has been in effect in its current design for more than five years. ISS has recommended a vote in favor of our Say on Pay proposal during that period, and the proposal has received favorable shareholder votes ranging from 91% to 98% over that time period.

The AIP is designed to provide annual, performance-based compensation that:

| • | is based on the achievement of pre-set annual financial, strategic, and operational objectives aligned with outstanding performance; and |

| • | will allow us to attract and retain top talent, while maintaining cost-effectiveness to the Company. |

AIP payouts to our named executive officers (NEOs) are based on two equally-weighted performance factors:

| • | a Corporate Performance Factor, which is based on a corporate-wide metric and goals that are designed to be stretch goals; and |

| • | Individual Performance Factors for each NEO, which are based on organization-specific metrics and goals that are designed to be stretch goals. |

The metrics and goals for the Corporate and Individual Performance Factors are set annually, depending on the business environment and the Company’s annual objectives and strategies, and are not automatically carried forward from year-to-year or determined based on past results. This is intended

| Lam Research Corp. | Page 2 of 6 | |

to ensure that they are stretch goals regardless of changes in the business environment, which can vary significantly from year-to-year in our industry. Accordingly, as business conditions improve, goals are set to require better performance, and if business conditions deteriorate, goals are set to require stretch performance under more difficult conditions. We believe that the metrics and goals set under this program have been highly effective to motivate our NEOs and the organizations they lead, and to achieve pay-for-performance results.

For calendar year 2018, as for prior years, the metric for the Corporate Performance Factor was set as non-GAAP operating income as a percentage of revenue. As shown in Figure 1, over the past five years, we have steadily raised the Corporate Performance Factor target, as our outlook and the industry have improved year over year. In February 2018, looking at our business outlook—which considers our served available market (SAM), our market share goals, and our operational targets—the Compensation Committee set a Corporate Performance Factor goal for calendar year 2018 of 27% non-GAAP operating income as a percentage of revenue. This was significantly higher than the goal for calendar year 2017 (22%) or for any other recent year, and was a stretch goal in the context of our business outlook at that time. We are pleased that the Company outperformed relative to that goal, achieving an actual result of non-GAAP operating income as a percentage of revenue of 29.6%.

Figure 1

| Corporate Performance Factor1 |

Calendar 2013 |

Calendar 2014 |

Calendar 2015 |

Calendar 2016 |

Calendar 2017 |

Calendar 2018 |

||||||||||||||||||

| Op Inc Target |

18.0 | % | 18.0 | % | 19.0 | % | 20.0 | % | 22.0 | % | 27.0 | % | ||||||||||||

| Op Inc Actual |

14.9 | % | 19.4 | % | 21.6 | % | 22.9 | % | 28.7 | % | 29.6 | % | ||||||||||||

For calendar year 2018, as for prior years, the performance metrics and goals for each NEO’s Individual Performance Factor are set on an annual basis. The Company does not disclose the specific performance metrics and goals for each NEO’s Individual Performance Factor because they relate to specific strategic, operational, and organizational activities that the Company regards as competitively sensitive. However, all such goals are based on specific strategic, operational, and organizational performance objectives, are designed to be stretch goals, and are intended to deliver business results and create stockholder value. For all NEOs other than our CEO, Individual Performance Factors for calendar year

| 1 | Op Inc Target and Actual represent non-GAAP Operating Income as a percentage of revenue. Non-GAAP operating income is derived from GAAP results, with charges and credits in the following line items excluded from GAAP results for applicable quarters during fiscal years 2013 through 2019: acquisition-related inventory fair-value impact; acquisition-related costs; amortization related to intangible assets acquired in certain business acquisitions; cost associated with business process reengineering; costs associated with campus consolidation; costs associated with rationalization of certain product configurations; costs associated with disposition of business; gain on sale of assets, net associated exit costs; goodwill impairment; impairment of long-lived assets; integration-related costs; litigation settlement; product rationalization; restructuring charges; and synthetic lease impairment. |

| Lam Research Corp. | Page 3 of 6 | |

2018 were based on strategic, operational, and organizational performance goals specific to the organizations they managed. The Individual Performance Factor for our CEO for calendar year 2018 was based on the average of the Individual Performance Factors of all the executive and senior vice presidents reporting to him, subject to discretion based on the Company’s performance to business, strategic, and operational objectives.

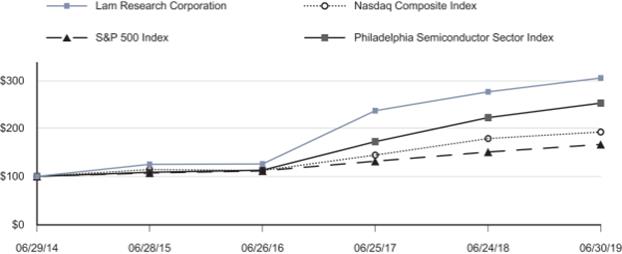

| • | We believe that both the design of our AIP, and the goals and objectives set for our executives in calendar year 2018 under that program, were well-aligned with our goals of achieving outstanding financial, strategic, and operational performance, and were effective at producing pay-for-performance results. Our total stockholder return over the last five years, as shown in Figure 2 below, demonstrates our track record of outperforming against our peers and the overall market in delivering value to our stockholders. |

Figure 2

COMPARISON OF CUMULATIVE FIVE-YEAR TOTAL RETURN *

Among the Company, the Nasdaq Company Index,

the S&P 500 Index and the Philadelphia Semiconductor Sector Index

| * | $100 invested on June 29, 2014 in stock or June 30, 2014 in index, including reinvestment of dividends. Indexes calculated on month-end basis. |

©2019 Standard & Poor’s, a division of S&P Global. All rights reserved.

ISS Concern:

ISS has expressed concern that our CEO received a time-based equity award in connection with his promotion and that our CFO was awarded a time-based retention grant. ISS also expressed the view that both grants vest over a relatively short period, which ISS believes limits their retentive value. We would like to take this opportunity both to provide some background regarding the leadership transition and to share with you our perspective regarding these awards.

| Lam Research Corp. | Page 4 of 6 | |

Response:

As you know, on December 5, 2018, we announced that our Board of Directors had accepted the resignation of our former CEO and appointed Tim Archer as President and CEO and a member of the Board of Directors. This occurred as an independent committee of our Board investigated allegations of misconduct in the workplace and conduct inconsistent with our core values. No financial misconduct was involved, nor were there issues relating to the integrity of the Company’s financial systems or controls.

At this sensitive time, the independent members of the Board believed that consistency and stability in the Company’s leadership was key to maintaining internal and external stakeholder confidence. The business outlook at the time indicated that the Company faced a challenging environment in the semiconductor equipment industry in 2019. In addition, the independent members of the Board believed that intense competition for proven technology company CEOs and CFOs heightened retention risks for the Company’s leadership.

As a result, the independent members of the Board immediately implemented the Company’s existing CEO succession plan. The independent members of the Board believed not only that Mr. Archer was the right person for the CEO role, but that retaining and promoting him into the CEO role would provide important stability for our stockholders and other stakeholders, including employees, customers and suppliers.

The independent members of the Board also took steps to retain the Company’s CFO, Douglas Bettinger and, in the absence of a chief operating officer, asked him to assume additional operational responsibilities. The independent members of the Board considered Mr. Bettinger’s retention to be important not only to support Mr. Archer in his new role, but also to provide continuity at the Company’s interface with its stockholders, and to send a clear message of stability to the Company’s internal and external stakeholders.

Special equity awards were granted to Messrs. Archer and Bettinger. The amounts and vesting schedules for the awards were determined in consultation with the Compensation Committee’s compensation consultant, and are consistent with prevailing market practice for awards of this type, including the four-year vesting schedule.

The independent members of the Board granted Mr. Archer a $5,000,000 equity award, consisting of 50% service-based restricted stock units (RSUs) and 50% stock options. The award had a four-year vesting schedule, a year longer than the Company’s normal three-year vesting schedule for long-term incentive awards, to further incentivize retention. This special award was made in recognition of Mr. Archer’s promotion and of the importance to retain Mr. Archer’s services at a time of unanticipated CEO

| Lam Research Corp. | Page 5 of 6 | |

turnover which happened to coincide with a challenging business environment. At the time, no adjustment was made to his annual base salary or to his target award opportunities under the Company’s incentive programs. Later, as part of the normal annual compensation review in February, 2019, these compensation components were adjusted to be competitive with other CEOs in our peer group.

The Compensation Committee granted Mr. Bettinger a one-time $8,000,000 service-based RSU award with a four-year vesting schedule, a year longer than the Company’s normal three-year vesting schedule for long-term incentive awards, to further incentivize retention. This special award was made in recognition of the importance of retaining Mr. Bettinger’s services at a time of unanticipated CEO turnover which happened to coincide with a challenging business environment and intense competition in the technology industry for proven CFO talent. Mr. Bettinger also assumed additional operational responsibilities within the Company.

The Board believes that the special equity awards made to Messrs. Archer and Bettinger were in the best long-term interests of the Company and its stockholders. They served to effectively stabilize the Company’s leadership structure, maintain the Company’s focus on execution to its plans, and avoid potential disruption and distraction at a critical time.

Summary:

We are firmly committed to a pay for performance philosophy, take our responsibilities as directors and as members of the Compensation and Human Resources Committee seriously, and make our decisions with the advice of our committee’s independent compensation consultant and with the best long-term interests of the Company and its stockholders in mind. We are disappointed to have received a negative Say on Pay recommendation from ISS for the first time this year. We firmly believe that our executive compensation program deserves your support and hope that we can count on it.

We strongly encourage you to vote FOR Proposal #2, our Say on Pay proposal.

We appreciate your continued support.

Sincerely,

| Abhijit Y. Talwalkar |

Catherine P. Lego | |

| Lead Independent Director |

Chair, Compensation and | |

| Member, Compensation and |

Human Resources Committee | |

| Human Resources Committee |

| Lam Research Corp. | Page 6 of 6 | |