Form 6-K ASML HOLDING NV For: Sep 29

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

______________________

FORM 6-K

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For October 16, 2019

______________________

ASML Holding N.V.

De Run 6501

5504 DR Veldhoven

The Netherlands

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If ‘‘Yes’’ is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

EXHIBITS 99.1 AND 99.3 TO THIS REPORT ON FORM 6-K ARE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-116337), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-126340), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-136362), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-141125), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-142254), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-144356), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-147128), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-153277), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-162439), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-170034), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-188938), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-190023), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-192951), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-203390), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-219442) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-227464) OF ASML HOLDING N.V. AND IN THE OUTSTANDING PROSPECTUSES CONTAINED IN SUCH REGISTRATION STATEMENTS.

Exhibits

99.1 | “ASML reports EUR 3.0 billion sales at 43.7% gross margin in Q3. 23 EUV orders reiterate customers' manufacturing plans in Logic and Memory", press release dated October 16, 2019 |

99.2 | “ASML reports EUR 3.0 billion sales at 43.7% gross margin in Q3. 23 EUV orders reiterate customers' manufacturing plans in Logic and Memory", presentation dated October 16, 2019 |

99.3 | Summary US GAAP Consolidated Financial Statements |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ASML HOLDING N.V. (Registrant)

Date: October 16, 2019 By: /s/ Peter T.F.M. Wennink

Peter T.F.M. Wennink

Chief Executive Officer

Exhibit 99.1

ASML reports EUR 3.0 billion sales at 43.7% gross margin in Q3

23 EUV orders reiterate customers' manufacturing plans in Logic and Memory

VELDHOVEN, the Netherlands, October 16, 2019 - today ASML Holding N.V. (ASML) publishes its 2019 third-quarter results.

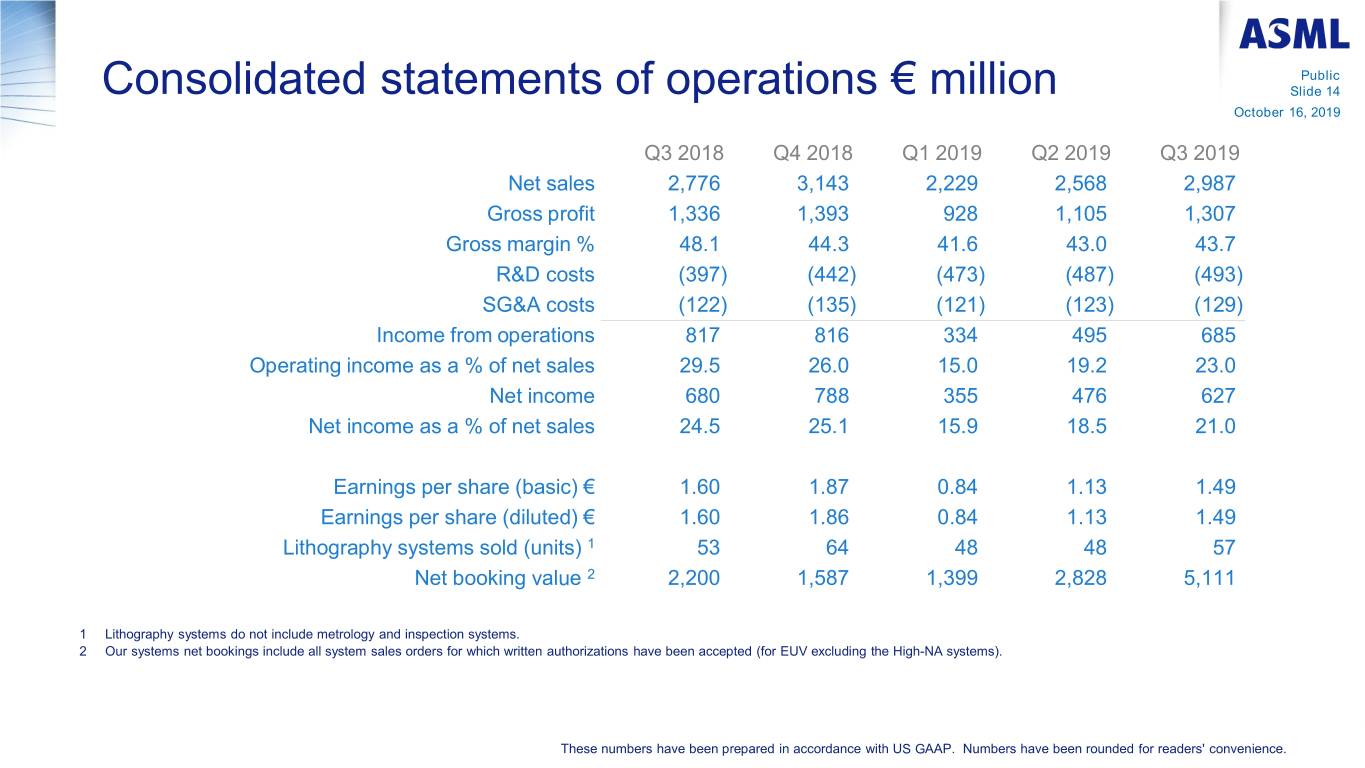

• | Q3 net sales of EUR 3.0 billion, net income of EUR 627 million, gross margin 43.7% |

• | Q3 net bookings of EUR 5.1 billion |

• | ASML expects Q4 2019 net sales of around EUR 3.9 billion and a gross margin between 48% and 49% |

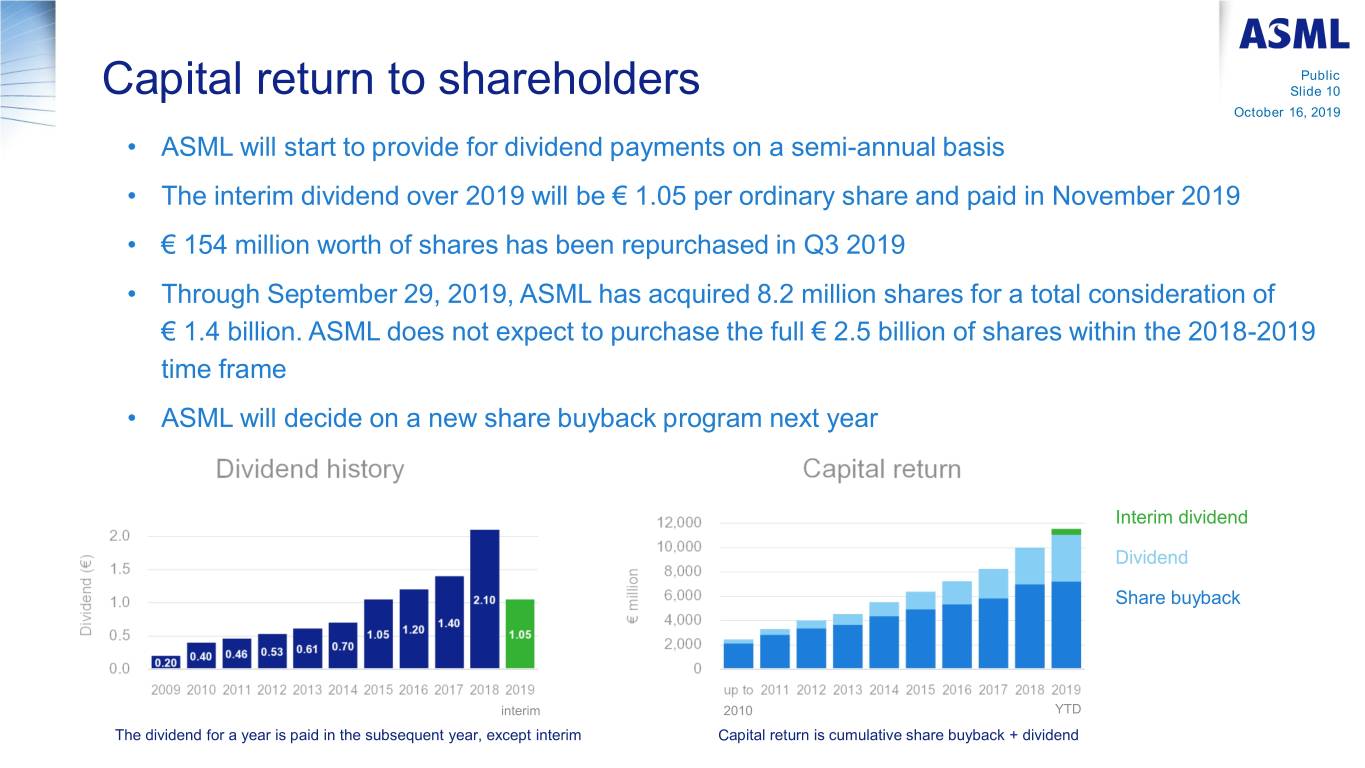

• | ASML revises its capital return policy to provide for dividend payments on a semi-annual basis, and announces an interim dividend for 2019 of EUR 1.05 per ordinary share |

(Figures in millions of euros unless otherwise indicated) | Q2 2019 | Q3 2019 |

Net sales | 2,568 | 2,987 |

...of which Installed Base Management sales 1 | 717 | 661 |

New lithography systems sold (units) | 41 | 52 |

Used lithography systems sold (units) | 7 | 5 |

Net bookings | 2,828 | 5,111 |

Gross profit | 1,105 | 1,307 |

Gross margin (%) | 43.0 | 43.7 |

Net income | 476 | 627 |

EPS (basic; in euros) | 1.13 | 1.49 |

End-quarter cash and cash equivalents and short-term investments | 2,335 | 2,070 |

(1) Installed Base Management sales equals our net service and field option sales.

Numbers have been rounded for readers' convenience. A complete summary of US GAAP Consolidated Statements of Operations is published on www.asml.com

CEO statement and outlook

"Our third-quarter sales and the gross margin came in at guidance.

"For the remainder of the year, we expect Logic to continue to be strong, driven by the leading-edge nodes supporting end-market technology and applications such as 5G and artificial intelligence. The timing of Memory recovery remains uncertain.

"We continue to make solid progress in EUV. Customers have introduced their first EUV manufactured devices and we have seen EUV mentioned in product announcements. In the third quarter, we shipped seven EUV systems, three of which were NXE:3400C, our higher productivity model. We received 23 EUV orders in the third quarter which contributes to our highest ever value of bookings in one quarter. This strong order flow confirms the adoption of EUV in high volume manufacturing for Logic and Memory.

"Our overall view for 2019 is essentially unchanged as we continue to see 2019 as a growth year," said ASML President and Chief Executive Officer Peter Wennink.

For the fourth quarter of 2019, ASML expects net sales of around EUR 3.9 billion, and a gross margin between 48% and 49%. ASML also expects R&D costs of around EUR 500 million and SG&A costs of around EUR 135 million. Our estimated annualized effective tax rate is around 7% for 2019.

1

Interim-dividend

ASML announces that it has revised its capital return policy to provide for dividend payments on a semi-annual basis. ASML's dividend proposals will continue to be subject to the availability of distributable profits or retained earnings and other factors, such as future liquidity requirements.

The interim dividend over 2019 will be EUR 1.05 per ordinary share. The ex-dividend date as well as the fixing date for the EUR/USD conversion will be November 4, 2019 and the record date will be November 5, 2019. The dividend will be made payable on November 15, 2019.

Update share buyback program

In January 2018, ASML announced its intention to purchase up to EUR 2.5 billion of shares, to be executed within the 2018–2019 time frame. ASML intends to cancel these shares after repurchase, with the exception of up to 2.4 million shares, which will be used to cover employee share plans.

Through September 29, 2019, ASML has acquired 8.2 million shares under this program for a total consideration of EUR 1.4 billion. ASML does not expect to purchase the full EUR 2.5 billion of shares within the 2018-2019 time frame.

In line with our policy to return excess cash to shareholders through growing annualized dividends and regularly timed share buybacks, we will decide on a new share buyback program next year.

The current program may be suspended, modified or discontinued at any time. All transactions under this program are published on ASML’s website (www.asml.com/investors) on a weekly basis.

Media Relations contacts | Investor Relations contacts |

Monique Mols +31 6 5284 4418 | Skip Miller +1 480 235 0934 |

Sander Hofman +31 6 2381 0214 | Marcel Kemp +31 40 268 6494 |

Brittney Wolff Zatezalo +1 408 483 3207 | Peter Cheang +886 3 659 6771 |

Quarterly video interview, investor and media conference call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the Q3 2019 results. This can be viewed on www.asml.com.

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Roger Dassen on October 16, 2019 at 15:00 Central European Time / 09:00 US Eastern Time. To register for the call and to receive dial-in information, go to www.asml.com/qresultscall. Listen-only access is also available via www.asml.com.

About ASML

ASML is one of the world’s leading manufacturers of chip-making equipment. Our vision is a world in which semiconductor technology is everywhere and helps to tackle society’s toughest challenges. We contribute to this goal by creating products and services that let chipmakers define the patterns that integrated circuits are made of. We continuously raise the capabilities of our products, enabling our customers to increase the value and reduce the cost of chips. By helping to make chips cheaper and more powerful, we help to make semiconductor technology more attractive for a larger range of products and services, which in turn enables progress in fields such as healthcare, energy, mobility and entertainment. ASML is a multinational company with offices in more than 60 cities in 16 countries, headquartered in Veldhoven, the Netherlands. We employ more than 24,700 people on payroll and flexible contracts (expressed in full time equivalents). ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. More information about ASML, our products and technology, and career opportunities is available on www.asml.com.

2

US GAAP Financial Reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting principles generally accepted in the United States of America. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets are available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of September 29, 2019, the related consolidated statements of operations and consolidated statements of cash flows for the quarter and nine months ended September 29, 2019 as presented in this press release are unaudited.

Regulated Information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

3

Forward Looking Statements

This document contains statements that are forward-looking, including statements with respect to expected trends, outlook, bookings, financial results and effective tax rate, annual revenue opportunity in 2020 and through 2025 and growth opportunity, expected trends in end markets, products and segments, including memory and logic, expected industry and business environment trends, the expected continuation of Moore’s law and the expectation that EUV will continue to enable Moore’s law and drive long term value for ASML and statements with respect to plans regarding dividends and share buybacks, including the intention to continue to return excess cash to shareholders through a combination of share buybacks and growing annualized dividends and the expected interim dividend and plan to pay any dividend on a semi-annual basis and intention to decide on a new share buyback program in 2020. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "target", and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions; product demand and semiconductor equipment industry capacity; worldwide demand and manufacturing capacity utilization for semiconductors; the impact of general economic conditions on consumer confidence and demand for our customers’ products; performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products; the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, production capacity for our systems including delays in system production; our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation; availability of raw materials, critical manufacturing equipment and qualified employees; trade environment; changes in exchange and tax rates; available liquidity, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of the share repurchase programs and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

4

Exhibit 99.2 Public ASML reports € 3.0 billion sales at 43.7% gross margin in Q3 23 EUV orders reiterate customers’ manufacturing plans in Logic and Memory ASML 2019 Third-Quarter Results Veldhoven, the Netherlands October 16, 2019

Public Slide 2 October 16, 2019 Agenda • Investor key messages • Business summary • Outlook • Financial statements

Public Slide 3 October 16, 2019 Investor key messages

Public Investor key messages Slide 4 October 16, 2019 • Current macroeconomic environment creates end market volatility resulting in industry uncertainty. Memory customers continue to digest capacity additions in a weaker demand environment while Logic customers accelerate ramp of their new leading edge nodes each of them in different stages • Long term growth opportunity remains, driven by end markets growth enabled by major innovation in semiconductors • Shrink is a key industry driver supporting innovation and providing long term industry growth • Holistic Lithography enables affordable shrink and therefore delivers compelling value for our customers • DUV, EUV and Application products are highly differentiated solutions that provide unique value drivers for our customers and ASML • EUV will enable continuation of Moore’s Law and will drive long term value for ASML well into the next decade • ASML modeled an annual revenue opportunity of € 13 billion in 2020 under a moderate market scenario and an annual revenue between € 15 – 24 billion through 2025 • We expect to continue to return significant amounts of cash to our shareholders through a combination of share buybacks and growing annualized dividends

Public Slide 5 October 16, 2019 Business summary

Public Q3 results summary Slide 6 October 16, 2019 • Net sales of € 2,987 million, net systems sales of € 2,326 million, Installed Base Management* sales of € 661 million • Gross margin of 43.7% • Operating margin of 23.0% • Net income as a percentage of net sales of 21.0% • Net bookings of € 5,111 million, including 23 EUV systems * Installed Base Management equals our service and field upgrades sales

Public Net system sales breakdown Slide 7 October 16, 2019 Q3’19 total sales € 2,326 million Q2’19 total sales € 1,851 million

Public Total net sales € million by End-use Slide 8 October 16, 2019 Installed Base Management Logic Memory As of January 1, 2018, ASML has adopted the new Revenue Recognition Standard (ASC 606) and Lease Standard (ASC 842). The comparative numbers 2015 - 2017 presented above have not been adjusted to reflect these changes in accounting policy.

Public Litho systems bookings activity by End-use Slide 9 October 16, 2019 Lithography systems Q3’19 total value New Used € 5,111 million Units 78 3 Lithography systems New Used Q2’19 total value Units 50 11 € 2,828 million Our systems net bookings include all system sales orders for which written authorizations have been accepted (for EUV excluding the High-NA systems). Our Q3 2019 systems net bookings include 1 DUV system shipped in Q3 2019 to collaborative Research Center (Imec). This system is not recognized in revenue.

Public Capital return to shareholders Slide 10 October 16, 2019 • ASML will start to provide for dividend payments on a semi-annual basis • The interim dividend over 2019 will be € 1.05 per ordinary share and paid in November 2019 • € 154 million worth of shares has been repurchased in Q3 2019 • Through September 29, 2019, ASML has acquired 8.2 million shares for a total consideration of € 1.4 billion. ASML does not expect to purchase the full € 2.5 billion of shares within the 2018-2019 time frame • ASML will decide on a new share buyback program next year Interim dividend Dividend Share buyback interim 2010 YTD The dividend for a year is paid in the subsequent year, except interim Capital return is cumulative share buyback + dividend

Public Slide 11 October 16, 2019 Outlook

Public Q4 Outlook Slide 12 October 16, 2019 • Q4 2019 net sales of around € 3.9 billion, including ◦ 8 EUV systems with net system sales of around € 950 million ◦ Installed Base Management sales of around € 850 million • Gross margin between 48% and 49% • R&D costs of around € 500 million • SG&A costs of around € 135 million • Estimated annualized effective tax rate of around 7% for 2019

Public Slide 13 October 16, 2019 Financial statements

Public Consolidated statements of operations € million Slide 14 October 16, 2019 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Net sales 2,776 3,143 2,229 2,568 2,987 Gross profit 1,336 1,393 928 1,105 1,307 Gross margin % 48.1 44.3 41.6 43.0 43.7 R&D costs (397) (442) (473) (487) (493) SG&A costs (122) (135) (121) (123) (129) Income from operations 817 816 334 495 685 Operating income as a % of net sales 29.5 26.0 15.0 19.2 23.0 Net income 680 788 355 476 627 Net income as a % of net sales 24.5 25.1 15.9 18.5 21.0 Earnings per share (basic) € 1.60 1.87 0.84 1.13 1.49 Earnings per share (diluted) € 1.60 1.86 0.84 1.13 1.49 Lithography systems sold (units) 1 53 64 48 48 57 Net booking value 2 2,200 1,587 1,399 2,828 5,111 1 Lithography systems do not include metrology and inspection systems. 2 Our systems net bookings include all system sales orders for which written authorizations have been accepted (for EUV excluding the High-NA systems). These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Consolidated statements of cash flows € million Slide 15 October 16, 2019 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Cash and cash equivalents, beginning of period 2,326 2,203 3,121 2,253 1,661 Net cash provided by (used in) operating activities 487 1,646 (481) 100 69 Net cash provided by (used in) investing activities (239) (383) (342) 208 (7) Net cash provided by (used in) financing activities (366) (353) (48) (896) (142) Effect of changes in exchange rates on cash (4) 8 3 (4) 5 Net increase (decrease) in cash and cash equivalents (123) 918 (868) (592) (75) Cash and cash equivalents, end of period 2,203 3,121 2,253 1,661 1,586 Short-term investments 744 913 1,022 673 484 Cash and cash equivalents and short-term investments 2,948 4,034 3,275 2,335 2,070 Purchases of property, plant and equipment and intangible assets (134) (205) (234) (140) (197) Free cash flow 1 352 1,442 (714) (41) (128) 1 Free cash flow is defined as net cash provided by (used in) operating activities minus purchases of Property, plant and equipment and intangible assets), see US GAAP Consolidated Financial Statements. These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Consolidated balance sheets € million Slide 16 October 16, 2019 Assets Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Cash & cash equivalents and short-term investments 2,948 4,034 3,275 2,335 2,070 Net accounts receivable and finance receivables 2,794 2,384 2,523 2,664 3,274 Contract assets 117 96 104 190 288 Inventories, net 3,403 3,440 3,765 3,914 3,895 Other assets 1,557 1,579 1,637 1,771 1,767 Tax assets 303 316 654 647 649 Equity method investments 985 916 934 950 969 Goodwill 4,541 4,541 4,541 4,541 4,541 Other intangible assets 1,109 1,104 1,158 1,141 1,123 Property, plant and equipment 1,572 1,589 1,622 1,670 1,818 Right-of-use assets 129 138 148 211 305 Total assets 19,458 20,137 20,361 20,034 20,699 Liabilities and shareholders' equity Current liabilities 3,546 3,792 3,721 3,693 3,712 Non-current liabilities 4,758 4,704 4,674 4,796 4,916 Shareholders' equity 11,154 11,641 11,966 11,545 12,071 Total liabilities and shareholders' equity 19,458 20,137 20,361 20,034 20,699 These numbers have been prepared in accordance with US GAAP. Numbers have been rounded for readers' convenience.

Public Forward looking statements Slide 17 October 16, 2019 This document contains statements that are forward-looking, including statements with respect to expected trends, outlook, bookings, financial results and effective tax rate, annual revenue opportunity in 2020 and through 2025 and growth opportunity, expected trends in end markets, products and segments, including memory and logic, expected industry and business environment trends, the expected continuation of Moore’s law and the expectation that EUV will continue to enable Moore’s law and drive long term value for ASML and statements with respect to plans regarding dividends and share buybacks, including the intention to continue to return excess cash to shareholders through a combination of share buybacks and growing annualized dividends and the expected interim dividend and plan to pay any dividend on a semi-annual basis and intention to decide on a new share buyback program in 2020. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "target", and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions; product demand and semiconductor equipment industry capacity; worldwide demand and manufacturing capacity utilization for semiconductors; the impact of general economic conditions on consumer confidence and demand for our customers’ products; performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products; the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, production capacity for our systems including delays in system production; our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation; availability of raw materials, critical manufacturing equipment and qualified employees; trade environment; changes in exchange and tax rates; available liquidity, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of the share repurchase programs and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit 99.3

ASML - Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | Nine months ended, | ||||||||||||

Sep 30, | Sep 29, | Sep 30, | Sep 29, | ||||||||||

2018 | 2019 | 2018 | 2019 | ||||||||||

(in millions EUR, except per share data) | |||||||||||||

Net system sales | 2,080.6 | 2,325.6 | 5,834.8 | 5,865.5 | |||||||||

Net service and field option sales | 695.5 | 660.9 | 1,966.7 | 1,918.1 | |||||||||

Total net sales | 2,776.1 | 2,986.5 | 7,801.5 | 7,783.6 | |||||||||

Total cost of sales | (1,440.2 | ) | (1,680.1 | ) | (4,165.2 | ) | (4,443.9 | ) | |||||

Gross profit | 1,335.9 | 1,306.4 | 3,636.3 | 3,339.7 | |||||||||

Research and development costs | (396.3 | ) | (492.3 | ) | (1,133.5 | ) | (1,452.6 | ) | |||||

Selling, general and administrative costs | (121.8 | ) | (128.5 | ) | (353.4 | ) | (372.9 | ) | |||||

Income from operations | 817.8 | 685.6 | 2,149.4 | 1,514.2 | |||||||||

Interest and other, net | (8.1 | ) | (5.4 | ) | (20.8 | ) | (20.1 | ) | |||||

Income before income taxes | 809.7 | 680.2 | 2,128.6 | 1,494.1 | |||||||||

Benefit from (provision for) income taxes | (129.6 | ) | (65.0 | ) | (311.5 | ) | (67.2 | ) | |||||

Income after income taxes | 680.1 | 615.2 | 1,817.1 | 1,426.9 | |||||||||

Profit (loss) related to equity method investments | 0.3 | 11.6 | (13.0 | ) | 31.3 | ||||||||

Net income | 680.4 | 626.8 | 1,804.1 | 1,458.2 | |||||||||

Basic net income per ordinary share | 1.60 | 1.49 | 4.24 | 3.46 | |||||||||

Diluted net income per ordinary share 3 | 1.60 | 1.49 | 4.22 | 3.46 | |||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | |||||||||||||

Basic | 424.3 | 420.9 | 425.8 | 421.0 | |||||||||

Diluted 3 | 425.9 | 421.7 | 427.4 | 421.8 | |||||||||

ASML - Ratios and Other Data 1,2

Three months ended, | Nine months ended, | ||||||||||||

Sep 30, | Sep 29, | Sep 30, | Sep 29, | ||||||||||

2018 | 2019 | 2018 | 2019 | ||||||||||

(in millions EUR, except otherwise indicated) | |||||||||||||

Gross profit as a percentage of net sales | 48.1 | % | 43.7 | % | 46.6 | % | 42.9 | % | |||||

Income from operations as a percentage of net sales | 29.5 | % | 23.0 | % | 27.6 | % | 19.5 | % | |||||

Net income as a percentage of net sales | 24.5 | % | 21.0 | % | 23.1 | % | 18.7 | % | |||||

Income taxes as a percentage of income before income taxes | 16.0 | % | 9.6 | % | 14.6 | % | 4.5 | % | |||||

Shareholders’ equity as a percentage of total assets | 57.3 | % | 58.3 | % | 57.3 | % | 58.3 | % | |||||

Sales of lithography systems (in units) 4 | 53 | 57 | 160 | 153 | |||||||||

Value of booked systems (EUR millions) 5 | 2,200 | 5,111 | 6,594 | 9,338 | |||||||||

Net bookings lithography systems (in units) 4, 5, 6 | 67 | 81 | 188 | 176 | |||||||||

Number of payroll employees in FTEs | 19,041 | 22,805 | 19,041 | 22,805 | |||||||||

Number of temporary employees in FTEs | 3,378 | 1,913 | 3,378 | 1,913 | |||||||||

ASML - Summary US GAAP Consolidated Balance Sheets 1,2

Dec 31, | Sep 29, | |||||

2018 | 2019 | |||||

(in millions EUR) | ||||||

ASSETS | ||||||

Cash and cash equivalents | 3,121.1 | 1,586.1 | ||||

Short-term investments | 913.3 | 483.8 | ||||

Accounts receivable, net | 1,498.2 | 2,100.7 | ||||

Finance receivables, net | 611.1 | 584.9 | ||||

Current tax assets | 79.7 | 339.6 | ||||

Contract assets | 95.9 | 287.8 | ||||

Inventories, net | 3,439.5 | 3,895.0 | ||||

Other assets | 772.6 | 816.2 | ||||

Total current assets | 10,531.4 | 10,094.1 | ||||

Finance receivables, net | 275.1 | 588.2 | ||||

Deferred tax assets | 236.3 | 309.2 | ||||

Other assets | 806.1 | 951.2 | ||||

Equity method investments | 915.8 | 969.0 | ||||

Goodwill | 4,541.1 | 4,541.1 | ||||

Other intangible assets, net | 1,104.0 | 1,122.8 | ||||

Property, plant and equipment, net | 1,589.5 | 1,817.9 | ||||

Right-of-use assets - Operating | 137.6 | 227.2 | ||||

Right-of-use assets - Finance | — | 78.5 | ||||

Total non-current assets | 9,605.5 | 10,605.1 | ||||

Total assets | 20,136.9 | 20,699.2 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||

Total current liabilities | 3,791.9 | 3,712.5 | ||||

Long-term debt | 3,026.5 | 3,170.0 | ||||

Deferred and other tax liabilities | 251.2 | 203.6 | ||||

Contract liabilities | 1,224.6 | 1,276.5 | ||||

Accrued and other liabilities | 201.7 | 265.5 | ||||

Total non-current liabilities | 4,704.0 | 4,915.6 | ||||

Total liabilities | 8,495.9 | 8,628.1 | ||||

Total shareholders’ equity | 11,641.0 | 12,071.1 | ||||

Total liabilities and shareholders’ equity | 20,136.9 | 20,699.2 | ||||

ASML - Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | Nine months ended, | |||||||||||

Sep 30, | Sep 29, | Sep 30, | Sep 29, | |||||||||

2018 | 2019 | 2018 | 2019 | |||||||||

(in millions EUR) | ||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||

Net income | 680.4 | 626.8 | 1,804.1 | 1,458.2 | ||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||

Depreciation and amortization | 110.0 | 112.4 | 312.3 | 325.6 | ||||||||

Impairment | 1.2 | 2.0 | 5.8 | 4.7 | ||||||||

Loss on disposal of property, plant and equipment | 0.1 | 0.3 | 3.5 | 2.3 | ||||||||

Share-based payments | 16.6 | 18.0 | 38.0 | 45.4 | ||||||||

Allowance for obsolete inventory | 45.5 | 46.1 | 146.2 | 167.3 | ||||||||

Deferred income taxes | (40.2 | ) | 22.5 | (1.6 | ) | (119.1 | ) | |||||

Equity method investments | (5.8 | ) | (18.6 | ) | 29.0 | (50.9 | ) | |||||

Changes in assets and liabilities | (321.1 | ) | (740.1 | ) | (879.0 | ) | (2,145.4 | ) | ||||

Net cash provided by (used in) operating activities | 486.7 | 69.4 | 1,426.3 | (311.9 | ) | |||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||

Purchase of property, plant and equipment | (129.1 | ) | (185.8 | ) | (383.9 | ) | (461.1 | ) | ||||

Purchase of intangible assets | (5.2 | ) | (11.2 | ) | (21.1 | ) | (109.6 | ) | ||||

Purchase of short-term investments | (214.8 | ) | (100.3 | ) | (398.6 | ) | (389.1 | ) | ||||

Maturity of short-term investments | 124.9 | 290.0 | 683.7 | 818.7 | ||||||||

Cash from (used for) derivative financial instruments | (20.2 | ) | — | 6.9 | — | |||||||

Loans issued and other investments | (0.3 | ) | — | (0.9 | ) | — | ||||||

Repayment on loans | 5.4 | — | 5.4 | — | ||||||||

Net cash provided by (used in) investing activities | (239.3 | ) | (7.3 | ) | (108.5 | ) | (141.1 | ) | ||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||

Dividend paid | — | — | (597.1 | ) | (884.4 | ) | ||||||

Purchase of shares | (370.0 | ) | (148.4 | ) | (789.8 | ) | (218.4 | ) | ||||

Net proceeds from issuance of shares | 4.3 | 7.4 | 17.4 | 20.0 | ||||||||

Repayment of debt | (0.2 | ) | (1.0 | ) | (1.8 | ) | (2.9 | ) | ||||

Net cash provided by (used in) financing activities | (365.9 | ) | (142.0 | ) | (1,371.3 | ) | (1,085.7 | ) | ||||

Net cash flows | (118.5 | ) | (79.9 | ) | (53.5 | ) | (1,538.7 | ) | ||||

Effect of changes in exchange rates on cash | (4.0 | ) | 4.9 | (2.3 | ) | 3.7 | ||||||

Net increase (decrease) in cash and cash equivalents | (122.5 | ) | (75.0 | ) | (55.8 | ) | (1,535.0 | ) | ||||

Cash and cash equivalents at beginning of the period | 2,325.7 | 1,661.1 | 2,259.0 | 3,121.1 | ||||||||

Cash and cash equivalents at end of the period | 2,203.2 | 1,586.1 | 2,203.2 | 1,586.1 | ||||||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Operations 1,2

Three months ended, | |||||||||||||||

Sep 30, | Dec 31, | Mar 31, | June 30, | Sep 29, | |||||||||||

2018 | 2018 | 2019 | 2019 | 2019 | |||||||||||

(in millions EUR, except per share data) | |||||||||||||||

Net system sales | 2,080.6 | 2,424.3 | 1,689.0 | 1,850.8 | 2,325.6 | ||||||||||

Net service and field option sales | 695.5 | 718.2 | 540.1 | 717.1 | 660.9 | ||||||||||

Total net sales | 2,776.1 | 3,142.5 | 2,229.1 | 2,567.9 | 2,986.5 | ||||||||||

Total cost of sales | (1,440.2 | ) | (1,749.6 | ) | (1,301.1 | ) | (1,462.7 | ) | (1,680.1 | ) | |||||

Gross profit | 1,335.9 | 1,392.9 | 928.0 | 1,105.2 | 1,306.4 | ||||||||||

Research and development costs | (396.3 | ) | (442.4 | ) | (472.7 | ) | (487.4 | ) | (492.3 | ) | |||||

Selling, general and administrative costs | (121.8 | ) | (134.6 | ) | (121.0 | ) | (123.5 | ) | (128.5 | ) | |||||

Income from operations | 817.8 | 815.9 | 334.3 | 494.3 | 685.6 | ||||||||||

Interest and other, net | (8.1 | ) | (7.5 | ) | (7.9 | ) | (6.9 | ) | (5.4 | ) | |||||

Income before income taxes | 809.7 | 808.4 | 326.4 | 487.4 | 680.2 | ||||||||||

Benefit from (provision for) income taxes | (129.6 | ) | (40.1 | ) | 17.0 | (19.1 | ) | (65.0 | ) | ||||||

Income after income taxes | 680.1 | 768.3 | 343.4 | 468.3 | 615.2 | ||||||||||

Profit (loss) related to equity method investments | 0.3 | 19.2 | 12.0 | 7.7 | 11.6 | ||||||||||

Net income | 680.4 | 787.5 | 355.4 | 476.0 | 626.8 | ||||||||||

Basic net income per ordinary share | 1.60 | 1.87 | 0.84 | 1.13 | 1.49 | ||||||||||

Diluted net income per ordinary share 3 | 1.60 | 1.86 | 0.84 | 1.13 | 1.49 | ||||||||||

Weighted average number of ordinary shares used in computing per share amounts (in millions): | |||||||||||||||

Basic | 424.3 | 422.2 | 421.1 | 421.1 | 420.9 | ||||||||||

Diluted 3 | 425.9 | 423.6 | 422.5 | 421.8 | 421.7 | ||||||||||

ASML - Quarterly Summary Ratios and other data 1,2

Sep 30, | Dec 31, | Mar 31, | June 30, | Sep 29, | |||||||||||

2018 | 2018 | 2019 | 2019 | 2019 | |||||||||||

(in millions EUR, except otherwise indicated) | |||||||||||||||

Gross profit as a percentage of net sales | 48.1 | % | 44.3 | % | 41.6 | % | 43.0 | % | 43.7 | % | |||||

Income from operations as a percentage of net sales | 29.5 | % | 26.0 | % | 15.0 | % | 19.2 | % | 23.0 | % | |||||

Net income as a percentage of net sales | 24.5 | % | 25.1 | % | 15.9 | % | 18.5 | % | 21.0 | % | |||||

Income taxes as a percentage of income before income taxes | 16.0 | % | 5.0 | % | (5.2 | )% | 3.9 | % | 9.6 | % | |||||

Shareholders’ equity as a percentage of total assets | 57.3 | % | 57.8 | % | 58.8 | % | 57.6 | % | 58.3 | % | |||||

Sales of lithography systems (in units) 4 | 53 | 64 | 48 | 48 | 57 | ||||||||||

Value of booked systems (EUR millions) 5 | 2,200 | 1,587 | 1,399 | 2,828 | 5,111 | ||||||||||

Net bookings lithography systems (in units) 4, 5, 6 | 67 | 53 | 34 | 61 | 81 | ||||||||||

Number of payroll employees in FTEs | 19,041 | 20,044 | 21,461 | 22,125 | 22,805 | ||||||||||

Number of temporary employees in FTEs | 3,378 | 3,203 | 2,395 | 2,157 | 1,913 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Balance Sheets 1,2

Sep 30, | Dec 31, | Mar 31, | June 30, | Sep 29, | |||||||||||

2018 | 2018 | 2019 | 2019 | 2019 | |||||||||||

(in millions EUR) | |||||||||||||||

ASSETS | |||||||||||||||

Cash and cash equivalents | 2,203.2 | 3,121.1 | 2,253.0 | 1,661.1 | 1,586.1 | ||||||||||

Short-term investments | 744.3 | 913.3 | 1,022.1 | 673.5 | 483.8 | ||||||||||

Accounts receivable, net | 1,679.1 | 1,498.2 | 1,589.3 | 1,637.7 | 2,100.7 | ||||||||||

Finance receivables, net | 921.1 | 611.1 | 534.6 | 620.1 | 584.9 | ||||||||||

Current tax assets | 193.4 | 79.7 | 373.3 | 320.9 | 339.6 | ||||||||||

Contract assets | 116.7 | 95.9 | 103.5 | 190.4 | 287.8 | ||||||||||

Inventories, net | 3,402.7 | 3,439.5 | 3,764.8 | 3,914.1 | 3,895.0 | ||||||||||

Other assets | 652.6 | 772.6 | 755.7 | 877.5 | 816.2 | ||||||||||

Total current assets | 9,913.1 | 10,531.4 | 10,396.3 | 9,895.3 | 10,094.1 | ||||||||||

Finance receivables, net | 193.5 | 275.1 | 399.4 | 406.3 | 588.2 | ||||||||||

Deferred tax assets | 109.5 | 236.3 | 280.7 | 326.6 | 309.2 | ||||||||||

Other assets | 904.5 | 806.1 | 881.1 | 893.3 | 951.2 | ||||||||||

Equity method investments | 985.2 | 915.8 | 933.6 | 949.9 | 969.0 | ||||||||||

Goodwill | 4,541.2 | 4,541.1 | 4,541.1 | 4,541.1 | 4,541.1 | ||||||||||

Other intangible assets, net | 1,108.7 | 1,104.0 | 1,158.5 | 1,140.8 | 1,122.8 | ||||||||||

Property, plant and equipment, net | 1,572.4 | 1,589.5 | 1,621.8 | 1,669.8 | 1,817.9 | ||||||||||

Right-of-use assets - Operating | 129.5 | 137.6 | 148.1 | 154.8 | 227.2 | ||||||||||

Right-of-use assets - Finance | — | — | — | 56.0 | 78.5 | ||||||||||

Total non-current assets | 9,544.5 | 9,605.5 | 9,964.3 | 10,138.6 | 10,605.1 | ||||||||||

Total assets | 19,457.6 | 20,136.9 | 20,360.6 | 20,033.9 | 20,699.2 | ||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||

Total current liabilities | 3,546.1 | 3,791.9 | 3,721.2 | 3,692.5 | 3,712.5 | ||||||||||

Long-term debt | 2,985.9 | 3,026.5 | 3,082.5 | 3,132.4 | 3,170.0 | ||||||||||

Deferred and other tax liabilities | 363.1 | 251.2 | 218.6 | 199.6 | 203.6 | ||||||||||

Contract liabilities | 1,140.7 | 1,224.6 | 1,190.0 | 1,280.2 | 1,276.5 | ||||||||||

Accrued and other liabilities | 267.8 | 201.7 | 182.6 | 183.9 | 265.5 | ||||||||||

Total non-current liabilities | 4,757.5 | 4,704.0 | 4,673.7 | 4,796.1 | 4,915.6 | ||||||||||

Total liabilities | 8,303.6 | 8,495.9 | 8,394.9 | 8,488.6 | 8,628.1 | ||||||||||

Total shareholders’ equity | 11,154.0 | 11,641.0 | 11,965.7 | 11,545.3 | 12,071.1 | ||||||||||

Total liabilities and shareholders’ equity | 19,457.6 | 20,136.9 | 20,360.6 | 20,033.9 | 20,699.2 | ||||||||||

ASML - Quarterly Summary US GAAP Consolidated Statements of Cash Flows 1,2

Three months ended, | |||||||||||||||

Sep 30, | Dec 31, | Mar 31, | June 30, | Sep 29, | |||||||||||

2018 | 2018 | 2019 | 2019 | 2019 | |||||||||||

(in millions EUR) | |||||||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||

Net income | 680.4 | 787.5 | 355.4 | 476.0 | 626.8 | ||||||||||

Adjustments to reconcile net income to net cash flows from operating activities: | |||||||||||||||

Depreciation and amortization | 110.0 | 110.4 | 104.8 | 108.4 | 112.4 | ||||||||||

Impairment | 1.2 | 9.6 | 2.7 | — | 2.0 | ||||||||||

Loss on disposal of property, plant and equipment | 0.1 | 0.1 | 0.6 | 1.4 | 0.3 | ||||||||||

Share-based payments | 16.6 | 8.3 | 14.9 | 12.5 | 18.0 | ||||||||||

Allowance for obsolete inventory | 45.5 | 72.0 | 72.1 | 49.1 | 46.1 | ||||||||||

Deferred income taxes | (40.2 | ) | (236.9 | ) | (76.5 | ) | (65.1 | ) | 22.5 | ||||||

Equity method investments | (5.8 | ) | 64.6 | (17.0 | ) | (15.3 | ) | (18.6 | ) | ||||||

Changes in assets and liabilities | (321.1 | ) | 830.8 | (937.8 | ) | (467.5 | ) | (740.1 | ) | ||||||

Net cash provided by (used in) operating activities | 486.7 | 1,646.4 | (480.8 | ) | 99.5 | 69.4 | |||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||

Purchase of property, plant and equipment | (129.1 | ) | (190.1 | ) | (147.0 | ) | (128.3 | ) | (185.8 | ) | |||||

Purchase of intangible assets | (5.2 | ) | (14.4 | ) | (86.7 | ) | (11.7 | ) | (11.2 | ) | |||||

Purchase of short-term investments | (214.8 | ) | (519.5 | ) | (288.1 | ) | (0.7 | ) | (100.3 | ) | |||||

Maturity of short-term investments | 124.9 | 350.4 | 179.4 | 349.3 | 290.0 | ||||||||||

Cash from (used for) derivative financial instruments | (20.2 | ) | (9.3 | ) | — | — | — | ||||||||

Loans issued and other investments | (0.3 | ) | (0.1 | ) | — | — | — | ||||||||

Repayment on loans | 5.4 | — | — | — | — | ||||||||||

Net cash provided by (used in) investing activities | (239.3 | ) | (383.0 | ) | (342.4 | ) | 208.6 | (7.3 | ) | ||||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||

Dividend paid | — | — | — | (884.4 | ) | — | |||||||||

Purchase of shares | (370.0 | ) | (356.4 | ) | (52.6 | ) | (17.4 | ) | (148.4 | ) | |||||

Net proceeds from issuance of shares | 4.3 | 4.4 | 5.2 | 7.4 | 7.4 | ||||||||||

Repayment of debt | (0.2 | ) | (1.0 | ) | (0.7 | ) | (1.2 | ) | (1.0 | ) | |||||

Net cash provided by (used in) financing activities | (365.9 | ) | (353.0 | ) | (48.1 | ) | (895.6 | ) | (142.0 | ) | |||||

Net cash flows | (118.5 | ) | 910.4 | (871.3 | ) | (587.5 | ) | (79.9 | ) | ||||||

Effect of changes in exchange rates on cash | (4.0 | ) | 7.5 | 3.2 | (4.4 | ) | 4.9 | ||||||||

Net increase (decrease) in cash and cash equivalents | (122.5 | ) | 917.9 | (868.1 | ) | (591.9 | ) | (75.0 | ) | ||||||

Cash and cash equivalents at beginning of the period | 2,325.7 | 2,203.2 | 3,121.1 | 2,253.0 | 1,661.1 | ||||||||||

Cash and cash equivalents at end of the period | 2,203.2 | 3,121.1 | 2,253.0 | 1,661.1 | 1,586.1 | ||||||||||

Notes to the Summary US GAAP Consolidated Financial Statements

Basis of preparation

The accompanying Summary Consolidated Financial Statements are stated in millions of euros unless indicated otherwise. The accompanying Summary Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("US GAAP").

For further details on our Summary of Significant Accounting Policies refer to the Notes to the Consolidated Financial Statements as recorded in our 2018 Integrated Report based on US GAAP which is available on www.asml.com. Further disclosures, as required under US GAAP in annual reports, are not included in the Summary Consolidated Financial Statements.

1 | These financial statements are unaudited. |

2 | Numbers have been rounded for readers' convenience. |

3 | The calculation of diluted net income per ordinary share assumes the exercise of options issued under ASML stock option plans and the issuance of shares under ASML share plans for periods in which exercises or issuances would have a dilutive effect. The calculation of diluted net income per ordinary share does not assume exercise of such options when such exercises would be anti-dilutive. |

4 | Lithography systems do not include metrology and inspection systems. |

5 | Our systems net bookings include all system sales orders for which written authorizations have been accepted (for EUV excluding the High-NA systems). |

6 | Our Q3 2018 systems net bookings include 1 EUV system shipped in Q4 2018 and our Q3 2019 systems net bookings include 1 DUV system shipped in Q3 2019, both shipped to collaborative Research Center (Imec). These systems are not recognized in revenue. |

This document contains statements that are forward-looking, including statements with respect to expected trends, outlook, bookings, financial results and effective tax rate, annual revenue opportunity in 2020 and through 2025 and growth opportunity, expected trends in end markets, products and segments, including memory and logic, expected industry and business environment trends, the expected continuation of Moore’s law and the expectation that EUV will continue to enable Moore’s law and drive long term value for ASML and statements with respect to plans regarding dividends and share buybacks, including the intention to continue to return excess cash to shareholders through a combination of share buybacks and growing annualized dividends and the expected interim dividend and plan to pay any dividend on a semi-annual basis and intention to decide on a new share buyback program in 2020. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "target", and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions; product demand and semiconductor equipment industry capacity; worldwide demand and manufacturing capacity utilization for semiconductors; the impact of general economic conditions on consumer confidence and demand for our customers’ products; performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products; the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, production capacity for our systems including delays in system production; our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation; availability of raw materials, critical manufacturing equipment and qualified employees; trade environment; changes in exchange and tax rates; available liquidity, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of the share repurchase programs and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.