Form 8-K AMERICAN SHARED HOSPITAL For: Sep 24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

| Date of report (Date of earliest event reported): September 24, 2019 |

| AMERICAN SHARED HOSPITAL SERVICES |

| (Exact name of registrant as specified in charter) |

| California | 1-08789 | 94-2918118 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Two Embarcadero Center, Suite 410, San Francisco, CA 94111

(Address of principal executive offices)

Registrant’s telephone number, including area code 415-788-5300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

|

American Shared Hospital Services Common Stock, No Par Value |

AMS | NYSE AMERICAN |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

American Shared Hospital Services (the “Company”) has announced that Chairman & Chief Executive Officer Ernest A. Bates, M.D. and Chief Operating & Financial Officer Craig K. Tagawa will present at the Sidoti & Company Fall 2019 Conference on September 25, 2019. The Company intends to use the presentation furnished as Exhibit 99.1 to this Form 8-K at the conference and other investor meetings taking place on September 24 and 25, 2019. The slides from the presentation are attached hereto as Exhibit 99.1 and are hereby incorporated by reference.

Certain Information

The information in this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to this Item 7.01 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit 99.1 | Presentation material from the Sidoti & Company Fall 2019 Conference, dated September 25, 2019 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| American Shared Hospital Services | |||||

| Date: | September 24, 2019 | By: | /s/ Craig K. Tagawa | ||

| Name: | Craig K. Tagawa | ||||

| Title: | Senior Vice President | ||||

| Chief Operating and Financial Officer | |||||

Exhibit 99.1

American Shared Hospital Services Making the Best Healthcare Technology Accessible September 2019 NYSE American: AMS

Safe Harbor Statement This presentation may be deemed to contain certain forward - looking statements with respect to the financial condition, results of operations and future plans of American Shared Hospital Services (including statements regarding the expected continued growth in volume of the MEVION S 250 system, the expansion of the Company's proton therapy business, and the timing of treatments by new Gamma Knife systems) which involve risks and uncertainties including, but not limited to, the risks of variability of financial results between quarters, the risks of the Gamma Knife and radiation therapy businesses, and the risks of the timing, financing, and operations of the Company’s proton therapy business . Further information on potential factors that could affect the financial condition, results of operations and future plans of American Shared Hospital Services is included in the filings of the Company with the Securities and Exchange Commission, including the Company's Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and the definitive Proxy Statement for the Annual Meeting of Shareholders . NYSE American: AMS 2

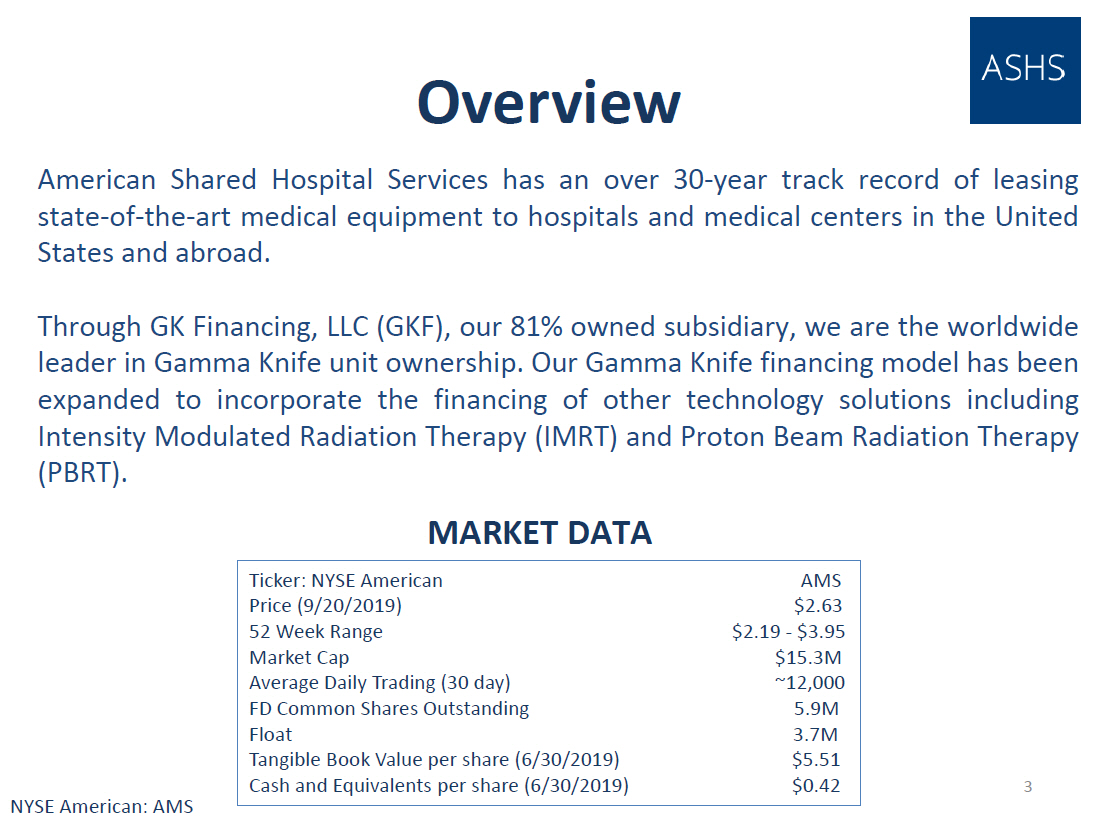

Overview 3 American Shared Hospital Services has an over 30 - year track record of leasing state - of - the - art medical equipment to hospitals and medical centers in the United States and abroad . Through GK Financing, LLC (GKF), our 81 % owned subsidiary, we are the worldwide leader in Gamma Knife unit ownership . Our Gamma Knife financing model has been expanded to incorporate the financing of other technology solutions including Intensity Modulated Radiation Therapy (IMRT) and Proton Beam Radiation Therapy (PBRT) . Ticker: NYSE American AMS Price (9/20/2019) $2.63 52 Week Range $2.19 - $3.95 Market Cap $15.3M Average Daily Trading (30 day) ~12,000 FD Common Shares Outstanding 5.9M Float 3.7M Tangible Book Value per share (6/30/2019) $5.51 Cash and Equivalents per share (6/30/2019) $0.42 MARKET DATA NYSE American: AMS

Investment Highlights 4 NYSE American: AMS + Pioneer in single room Proton Beam Radiation Therapy (PBRT) services + World leading supplier of Gamma Knife services + Long - standing alliances with premier cancer centers + Large market opportunities Proton Therapy has low market penetration Advanced radiation therapy devices + Proven business model Operating profitability for 20 of last 21 years + Respected management team with deep experience

Respected Management Team With Deep Experience 5 MANAGEMENT TEAM Years of Healthcare Experience Ernest A. Bates, M.D. Founder, Chairman and CEO 30+ Craig K. Tagawa COO and CFO 30+ Ernest R. Bates V.P., Sales and Business Development 10+ Alexis Wallace Controller 10+ NYSE American: AMS

Highly Regarded Customers* 6 + UC San Francisco Medical Center + Methodist Hospital: San Antonio, TX + Johns Hopkins Medical Center: Baltimore, MD + Yale - New Haven Hospital: New Haven, CT + Kettering Medical Center: Kettering, OH + Lovelace Medical Center: Albuquerque, NM + Northern Westchester Hospital: Mt. Kisco , NY + Tufts Medical Center: Boston, MA + University of Arkansas for Medical Sciences: Little Rock, AR + Merit Health Central: Jackson, MS + OSF St. Francis Medical Center: Peoria, IL + PeaceHealth: Eugene: OR + USC University Hospital: Los Angeles, CA * Selected list NYSE American: AMS

Proven Business Model 7 + Structured as an alternative leasing company + Offer Innovative financing features not available from traditional finance companies + Long Term Agreements Typically 10 years + Revenue Sharing or Fee Per Use No minimum volume guarantees ASHS’ RESPONSIBILITIES + Acquire equipment + Equipment - related operating expenses + Jointly fund marketing HOSPITAL ’ S RESPONSIBILITIES + Site costs + Non - equipment - related operating expenses + Jointly fund marketing NYSE American: AMS

Current Business Status 8 + Identifying healthcare technology investment opportunities with long term growth potential + In negotiations for 2 additional PBRT installations + Gamma Knife Completed first Icon upgrade + Identifying additional international opportunities NYSE American: AMS

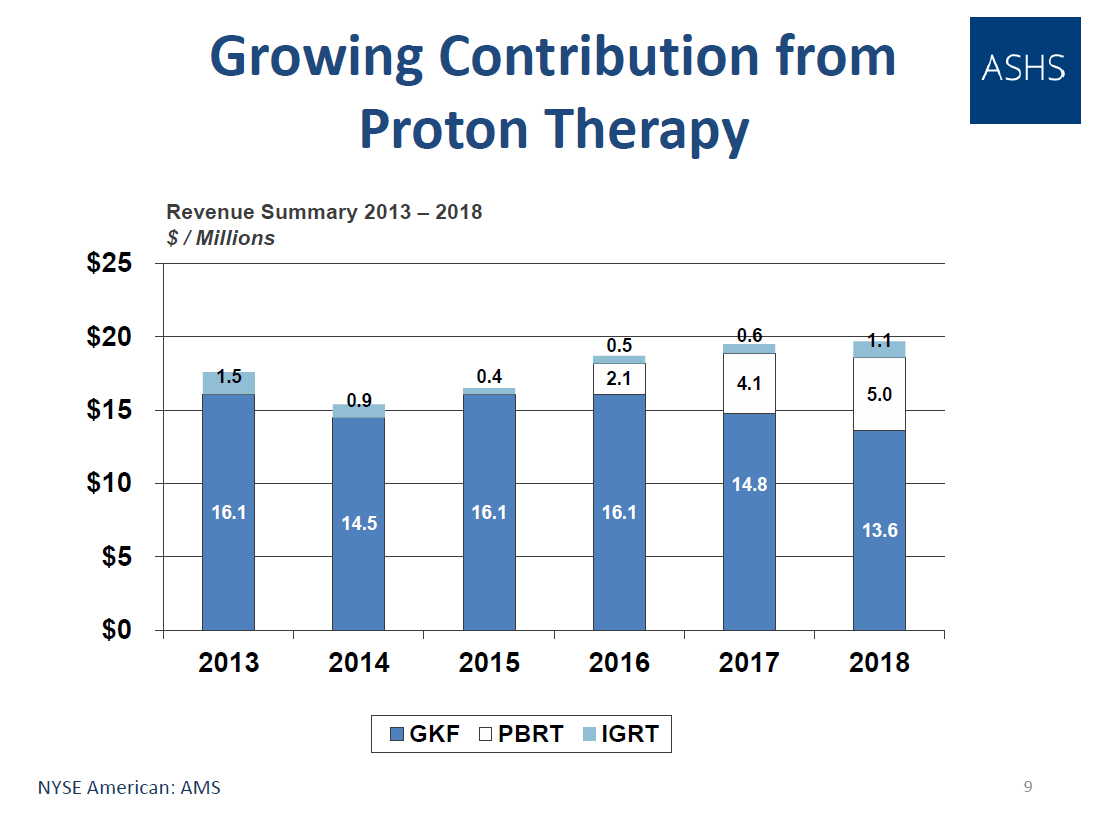

Growing Contribution from Proton Therapy 9 16.1 14.5 16.1 16.1 14.8 13.6 2.1 4.1 5.0 1.5 0.9 0.4 0.5 0.6 1.1 $0 $5 $10 $15 $20 $25 2013 2014 2015 2016 2017 2018 GKF PBRT IGRT Revenue Summary 2013 – 2018 $ / Millions NYSE American: AMS

Expansion Opportunities + Develop single and two room proton beam radiation therapy centers with major hospitals + MR Guided Linac + Community Hospitals + International + Latin America initially 10 NYSE American: AMS

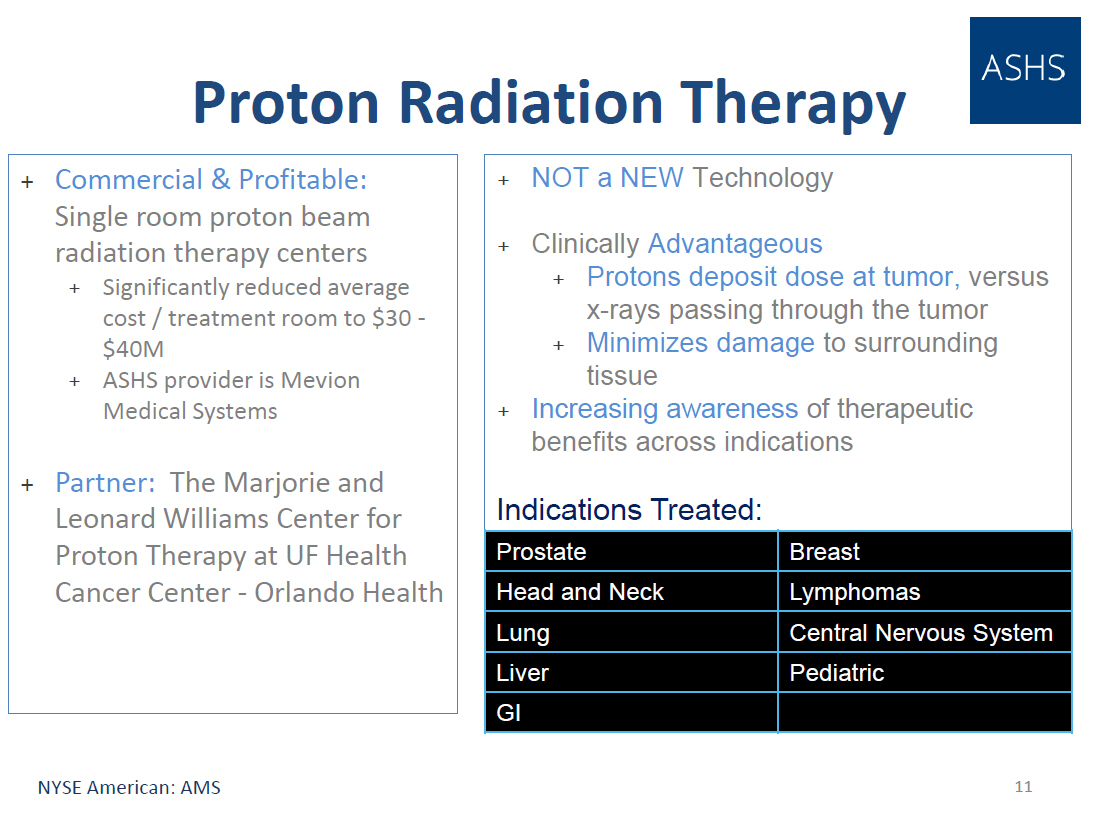

Proton Radiation Therapy 11 + Commercial & Profitable: Single room proton beam radiation therapy centers + Significantly reduced average cost / treatment room to $30 - $40M + ASHS provider is Mevion Medical Systems + Partner: The Marjorie and Leonard Williams Center for Proton Therapy at UF Health Cancer Center - Orlando Health + NOT a NEW Technology + Clinically Advantageous + Protons deposit dose at tumor , versus x - rays passing through the tumor + Minimizes damage to surrounding tissue + Increasing awareness of therapeutic benefits across indications Indications Treated: Prostate Breast Head and Neck Lymphomas Lung Central Nervous System Liver Pediatric GI NYSE American: AMS

Photon vs. Proton 12 Pediatric Medulloblastoma Photon Beam Delivery Proton Beam Delivery PBRT Delivers a Full, Even Dose % Dose Recommended NYSE American: AMS

PBRT U.S. Market Opportunity 13 + Currently only 30 PBRT centers* Current capacity ~90 rooms + 4 PBRT centers under construction or in development* + Only 7% to 14% of projected capacity is currently available for treatment ASHS projected capacity required - 635 – 1,270 rooms** + Each additional treatment room offers potential for substantial incremental Revenue and EBITDA * Source: The National Association for Proton Therapy, 2019 ** Assumes 15% - 30% of 1.1 million patients eligible for radiation therapy annually receive PBRT, see slide 14 NYSE American: AMS

Low Market Penetration 14 PBRT CAPTURE RATE 15% 2 30% 3 Number of radiation therapy patients annually in the U.S. 1 1,057,470 1,057,470 Percent of radiation therapy patients eligible for PBRT 15% 30% Number of potential PBRT patients in the U.S. 158,600 317,241 Potential PBRT room market* 635 1,270 Current PBRT rooms in operation 4 30 *Assumed 250 patients treated annually per PBRT room (1The American Cancer Society indicates that 1,762,450 people in the United States will be diagnosed with cancer in 2019. App rox imately 60% of these people will receive radiation treatment. (2) “Number of Patients Potentially Eligible for Proton Therapy,” Acta Oncologica 2005; 44; 836 - 849; Bengt Glimelius, Anders Ask , Et. Al. (3) “Evaluation of Potential Proton Therapy Utilization in a Market Based Environment,” Tomas Dvorak, M.D. and David E. Wazer , M .D. (4) The National Association for Proton Therapy, 2019 NYSE American: AMS

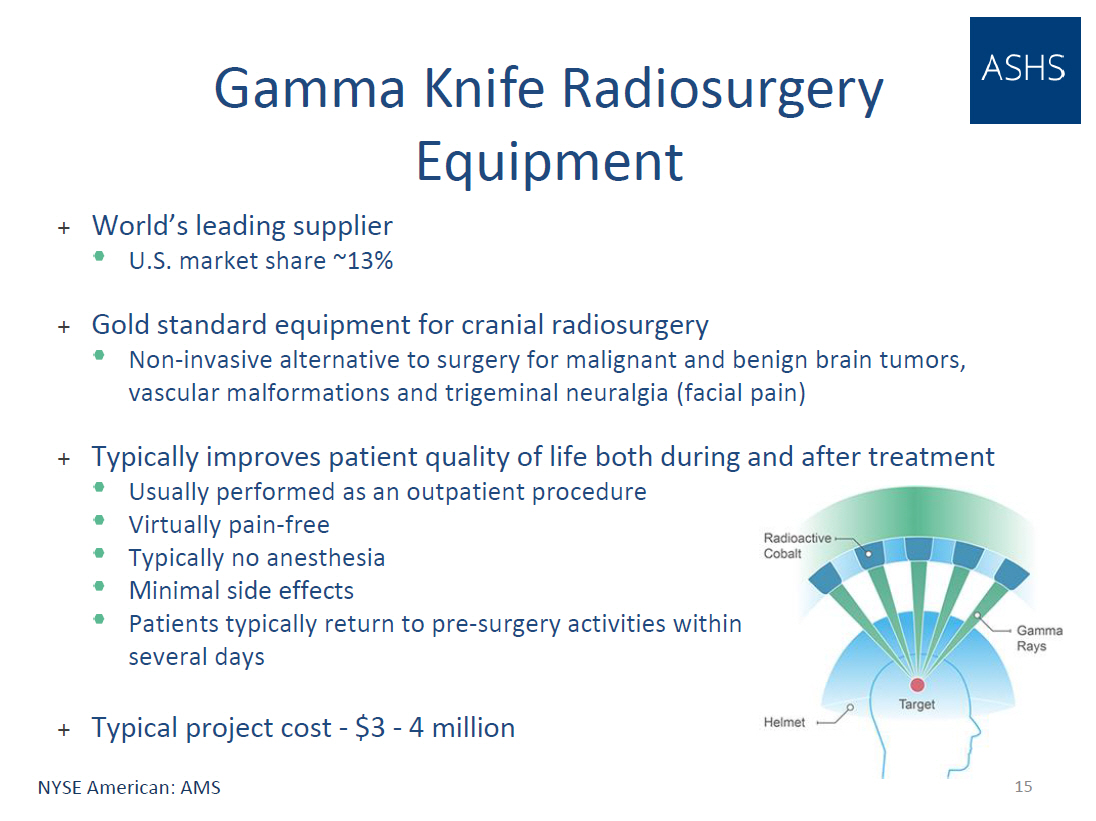

Gamma Knife Radiosurgery Equipment 15 + World’s leading supplier U.S. market share ~13% + Gold standard equipment for cranial radiosurgery Non - invasive alternative to surgery for malignant and benign brain tumors, vascular malformations and trigeminal neuralgia (facial pain) + Typically improves patient quality of life both during and after treatment Usually performed as an outpatient procedure Virtually pain - free Typically no anesthesia Minimal side effects Patients typically return to pre - surgery activities within several days + Typical project cost - $3 - 4 million NYSE American: AMS

Key Takeaways 16 + Pioneer in single room Proton Beam Radiation Therapy (PBRT) services + World leading supplier of Gamma Knife services + Long - standing alliances with premier cancer centers + Large market opportunities Proton Therapy has low market penetration Advanced radiation therapy devices + Proven business model Operating profitability for 20 of last 21 years NYSE American: AMS

Thank You! 17 For Further Information Contact: Craig Tagawa COO and CFO [email protected] (415) 788 - 5300 www.ashs.com NYSE American: AMS American Shared Hospital Services Making the Best Healthcare Technology Accessible