Form S-3ASR VERIZON COMMUNICATIONS

Table of Contents

As filed with the Securities and Exchange Commission on September 4, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VERIZON COMMUNICATIONS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 23-2259884 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1095 Avenue of the Americas

New York, New York 10036

(212) 395-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Scott Krohn

Senior Vice President and Treasurer

Verizon Communications Inc.

1095 Avenue of the Americas, 8th Floor

New York, New York 10036

(212) 395-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Audrey E. Prashker, Esq. Vice President and General Counsel—Capital Markets Verizon Communications Inc. One Verizon Way Basking Ridge, New Jersey 07920 (908) 559-5430 |

Paul E. Denaro Milbank LLP 55 Hudson Yards New York, New York 10001-2163 (212) 530-5431 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of the Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

||||||||||||||||

| Title of each class of securities to be registered |

Amount to be |

Proposed maximum offering price per unit (1) |

Proposed maximum aggregate offering price (1) |

Amount of registration fee (2) |

||||||||||||

| Common Stock, par value $0.10 per share, of Verizon Communications Inc. |

||||||||||||||||

| Preferred Stock, par value $0.10 per share, of Verizon Communications Inc. |

||||||||||||||||

| Debt Securities of Verizon Communications Inc. |

||||||||||||||||

|

|

||||||||||||||||

| (1) | An unspecified amount of securities to be offered at indeterminate prices is being registered pursuant to this registration statement. Separate consideration may or may not be received for securities that are issuable upon conversion or exchange of other securities. |

| (2) | The registrant is deferring payment of the registration fee pursuant to Rule 456(b) and is excluding this information in reliance on Rule 456(b) and Rule 457(r). |

Table of Contents

PROSPECTUS

Verizon Communications Inc.

Common Stock

Preferred Stock

Debt Securities

Verizon Communications Inc. may offer at one or more times common stock, preferred stock and debt securities. To the extent provided in the applicable prospectus supplement, the preferred stock and the debt securities may be convertible into, or exchangeable for, shares of any class or classes of stock, or securities or property, of Verizon Communications Inc. We will provide the specific terms of any securities to be offered in a supplement to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest.

Verizon Communications Inc. may offer and sell these securities on a continuous or delayed basis directly, through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. The names of any underwriters, dealers or agents involved in the sale of any securities and any applicable commissions or discounts will be set forth in the prospectus supplement covering the sales of those securities.

The common stock of Verizon Communications Inc. is listed on the New York Stock Exchange and the NASDAQ Global Select Market under the symbol “VZ.”

Investing in our securities involves risks. See the “Risk Factors” on page 3 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

September 4, 2019

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

Table of Contents

This prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process. Under this shelf process, we may, from time to time, sell any combination of the common stock, preferred stock or debt securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement and, in some cases, a pricing supplement, that will contain specific information about the terms of that offering. The prospectus supplement or pricing supplement may also add, update or change information in this prospectus. The information in this prospectus is accurate as of the date of this prospectus. Please carefully read this prospectus, any prospectus supplement and any pricing supplement together with additional information described under the heading “WHERE YOU CAN FIND MORE INFORMATION.” Unless otherwise specified in this prospectus, the terms “we,” “us,” “our” and “Verizon Communications” refer to Verizon Communications Inc.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Filings that we make with the SEC also can be found on our website at http://www.verizon.com. The information contained on or accessible through our corporate website or any other website that we may maintain is not incorporated by reference herein and is not part of this prospectus or the registration statement of which this prospectus is a part.

The SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the following documents we have filed with the SEC and the future filings we make with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (excluding any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report on Form 8-K):

| • | our Annual Report on Form 10-K for the year ended December 31, 2018; |

| • | our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, and June 30, 2019; |

| • | our Current Reports on Form 8-K filed on February 8, 2019, February 11, 2019, February 20, 2019, February 27, 2019, April 8, 2019, May 8, 2019, May 9, 2019, and August 8, 2019 (two reports), and amended Current Report on Form 8-K/A filed on February 8, 2019; and |

| • | the description of our Common Stock contained in the registration statement on Form 8-A filed on March 12, 2010, under Section 12(b) of the Exchange Act, including any amendment or report filed for the purpose of updating that description. |

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon such person’s written or oral request, a copy of any or all documents referred to above that have been or may be incorporated by reference into this prospectus excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You may make your request by contacting us at:

Investor Relations

Verizon Communications Inc.

One Verizon Way

Basking Ridge, New Jersey 07920

Telephone: (212) 395-1525

1

Table of Contents

You should rely only on the information incorporated by reference or provided in this prospectus, any supplement or any pricing supplement. We have not authorized anyone else to provide you with different information, and we take no responsibility for any information that others may give you.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains both historical and forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. These forward-looking statements are not historical facts, but only predictions and generally can be identified by use of statements that include phrases such as “will,” “may,” “should,” “continue,” “anticipate,” “believe,” “expect,” “plan,” “appear,” “project,” “estimate,” “intend,” or other words or phrases of similar import. Similarly, statements that describe our objectives, plans or goals also are forward-looking statements. These forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Potential investors and other readers are urged to consider these risks and uncertainties carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this prospectus are made only as of the date of this prospectus, and we undertake no obligation to update publicly these forward-looking statements to reflect new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events might or might not occur. We cannot assure you that projected results or events will be achieved.

2

Table of Contents

Verizon Communications is a holding company that, acting through its subsidiaries, is one of the world’s leading providers of communications, information and entertainment products and services to consumers, businesses and governmental agencies. With a presence around the world, we offer voice, data and video services and solutions on our networks that are designed to meet customers’ demand for mobility, reliable network connectivity, security and control. In November 2018, we announced a strategic reorganization of our business. We transitioned to a new segment reporting structure as of April 1, 2019. Our two new reportable segments are Verizon Consumer Group and Verizon Business Group. Our Consumer segment provides consumer-focused wireless and wireline communications services and products. Our wireless services are provided across one of the most extensive wireless networks in the United States under the Verizon Wireless brand and through wholesale and other arrangements. Our wireline services are provided in nine states in the Mid-Atlantic and Northeastern United States, as well as Washington D.C., over our 100% fiber-optic network under the Fios brand and over a traditional copper-based network to customers who are not served by Fios. Our Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long distance voice services and network access to deliver various IoT services and products. We provide these products and services to businesses, government customers and wireless and wireline carriers across the U.S. and select products and services to customers around the world.We have a highly diverse workforce of approximately 135,900 employees as of June 30, 2019. We generated consolidated operating revenues of $64.2 billion for the six months ended June 30, 2019.

Our principal executive offices are located at 1095 Avenue of the Americas, New York, New York 10036, and our telephone number is (212) 395-1000.

Your investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. You should not purchase the securities described in this prospectus unless you understand and know you can bear all the investment risks involved.

Unless otherwise provided in the applicable prospectus supplement, we will use the net proceeds from the sale of the securities for repaying debt, making capital investments, funding working capital requirements or other general corporate purposes, including financing acquisitions and refinancing existing indebtedness.

3

Table of Contents

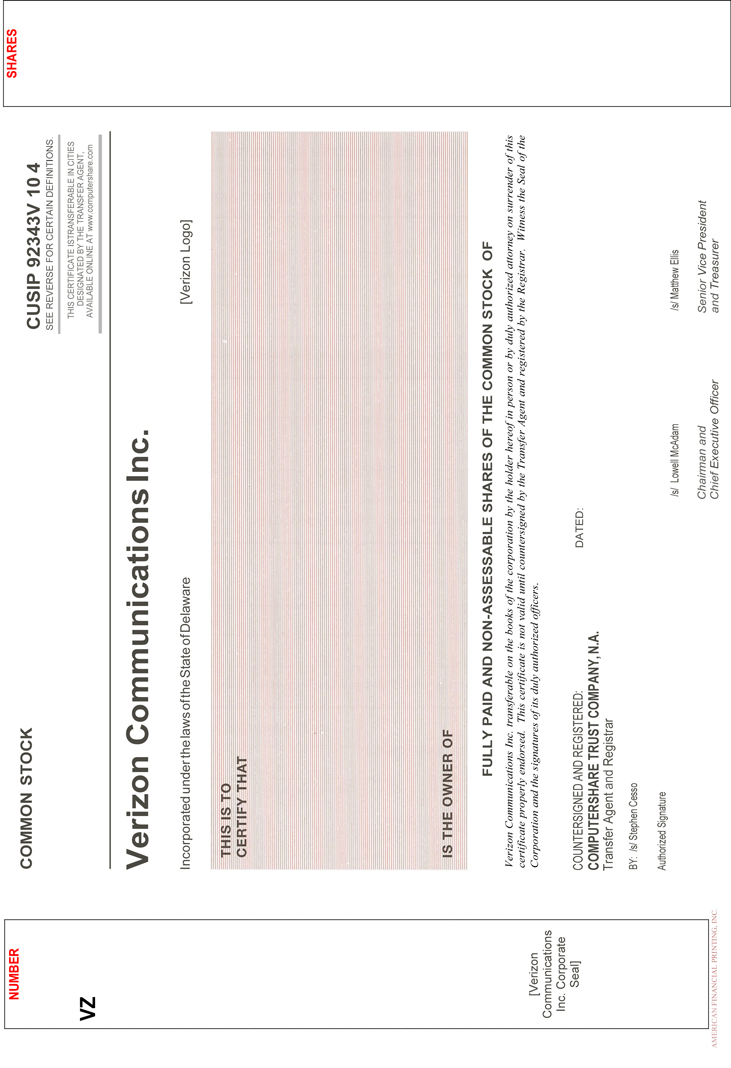

Authorized Capital Stock

Our restated certificate of incorporation provides authority to issue up to 6,500,000,000 shares of stock of all classes, of which 6,250,000,000 are shares of common stock, $0.10 par value per share, and 250,000,000 are shares of preferred stock, $0.10 par value per share.

Common Stock

Subject to any preferential rights of the preferred stock, holders of shares of our common stock are entitled to receive dividends on that stock out of assets legally available for distribution when, as and if authorized and declared by the board of directors and to share ratably in assets legally available for distribution to our shareholders in the event of our liquidation, dissolution or winding-up. We may not pay any dividend or make any distribution of assets on shares of common stock until cumulative dividends on shares of preferred stock then outstanding, if any, having dividend or distribution rights senior to the common stock have been paid.

Holders of common stock are entitled to one vote per share on all matters voted on generally by the shareholders, including the election of directors. In addition, the holders of common stock possess all voting power except as otherwise required by law or except as provided for by any series of preferred stock. Our restated certificate of incorporation does not provide for cumulative voting for the election of directors.

Preferred Stock

Our board of directors is authorized at any time to provide for the issuance of all or any shares of our preferred stock in one or more classes or series, and to fix for each class or series voting powers, full or limited, or no voting powers, and distinctive designations, preferences and relative, participating, optional or other special rights and any qualifications, limitations or restrictions, as shall be stated and expressed in the resolution or resolutions adopted by the board of directors providing for the issuance of the preferred stock and to the fullest extent as may be permitted by Delaware law. This authority includes, but is not limited to, the authority to provide that any class or series be:

| • | subject to redemption at a specified time or times and at a specified price or prices; |

| • | entitled to receive dividends (which may be cumulative or non-cumulative) at specified rates, on specified conditions and at specified times, and payable in preference to, or in relation to, the dividends payable on any other class or classes or any other series; |

| • | entitled to rights upon the dissolution of, or upon any distribution of the assets of, Verizon Communications; or |

| • | convertible into, or exchangeable for, shares of any class or classes of our stock, or our other securities or property, at a specified price or prices or at specified rates of exchange and with any specified adjustments. |

As of the date of this prospectus, no shares of preferred stock are outstanding.

Preemptive Rights

No holder of any shares of any class of our stock has any preemptive or preferential right to acquire or subscribe for any unissued shares of any class of stock or any authorized securities convertible into or carrying any right, option or warrant to subscribe for or acquire shares of any class of stock.

Transfer Agent and Registrar

The principal transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

4

Table of Contents

DESCRIPTION OF THE DEBT SECURITIES

General

We will issue debt securities under an indenture between us and U.S. Bank National Association (as successor to Wachovia Bank, National Association, formerly known as First Union National Bank), as trustee, dated as of December 1, 2000, as amended. To the extent provided in the applicable prospectus supplement, the debt securities may be convertible into, or exchangeable for, shares of any class or classes of our stock, or our other securities or property.

We have summarized material provisions of the indenture and the debt securities below. This summary does not describe all exceptions and qualifications contained in the indenture or the debt securities. In the summary below, we have included references to article and section numbers of the indenture so that you can easily locate these provisions.

The debt securities will be unsecured and will rank equally with all of our senior unsecured debt. The indenture does not limit the amount of debt securities that may be issued, and each series of debt securities may differ as to its terms.

A supplement to the indenture, board resolution or officers’ certificate will designate the specific terms relating to any new series of debt securities. (SECTION 301) These terms will be described in a prospectus supplement and, in some cases, a pricing supplement, and will include the following:

| • | title of the series; |

| • | total principal amount of the series; |

| • | maturity date or dates of the series; |

| • | interest rate and interest payment dates of the series; |

| • | any redemption dates, prices, obligations and restrictions of the series; |

| • | any provisions permitting the series of debt securities to be convertible into, or exchangeable for, shares of any class or classes of our stock, or our other securities or property, at a specified price or prices or at specified rates of exchange and with any specified adjustments; and |

| • | any other material terms of the series. |

Form and Exchange

The debt securities normally will be denominated in U.S. dollars, in which case we will pay principal, interest and any premium in U.S. dollars. We may, however, denominate any series of debt securities in another currency or composite currency. In those cases, payment of principal, interest and any premium on such series would be in that currency or composite currency and not U.S. dollars.

Book-Entry Only Form

The debt securities normally will be issued in book-entry only form, which means that they will be represented by one or more permanent global securities registered in the name of The Depository Trust Company, New York, New York (“DTC”), or its nominee. We will refer to this form here and in the prospectus supplement as “book-entry only.”

In the event that debt securities are issued in book-entry only form, DTC will keep a computerized record of its participants (for example, your broker) whose clients have purchased the securities. Each participant will then keep a record of its clients who purchased the securities. A global security may not be transferred, except that DTC, its nominees and their successors may transfer an entire global security to one another.

5

Table of Contents

In the case of book-entry only debt securities, we will wire principal and interest payments to DTC’s nominee. We and the trustee will treat DTC’s nominee as the owner of the global securities for all purposes. Accordingly, neither we nor the trustee will have any direct responsibility or liability to pay amounts due on the debt securities to owners of beneficial interests in the global securities.

Under book-entry only form, we will not issue physical certificates representing beneficial interests in the global securities to individual holders of the debt securities. Beneficial interests in global securities will be shown on, and transfers of global securities will be made only through, records maintained by DTC and its participants. Debt securities represented by a global security will be exchangeable for debt securities in certificated form with the same terms in authorized denominations only if:

| • | DTC notifies us that it is unwilling or unable to continue as depository; |

| • | DTC ceases to be a clearing agency registered under applicable law and a successor depository is not appointed by us within 90 days; or |

| • | We instruct the trustee that the global security is exchangeable for debt securities in certificated form. |

Certificated Form

Alternatively, we may issue the debt securities in certificated form registered in the name of the debt security holder. Under these circumstances, holders may receive physical certificates representing the debt securities. Debt securities in certificated form will be transferable without charge except for reimbursement of taxes, if any. We will refer to this form in the prospectus supplement as “certificated.”

Redemption Provisions, Sinking Fund and Defeasance

The prospectus supplement relating to a series of debt securities will describe the circumstances, if any, under which we may redeem such series of debt securities. If a series of debt securities is subject to a sinking fund, the prospectus supplement will describe those terms. (ARTICLES ELEVEN and TWELVE)

The indenture permits us to discharge or defease certain of our obligations on any series of debt securities at any time. We may defease such obligations relating to a series of debt securities by depositing with the trustee sufficient cash or government securities to pay all sums due on that series of debt securities. (ARTICLE FOUR)

Liens on Assets

The debt securities will not be secured. However, if at any time we mortgage, pledge or subject to any lien any of our property or assets, the indenture requires us to secure the debt securities equally and ratably with the debt or obligations secured by such mortgage, pledge or lien for as long as such debt or obligations remain secured. Exceptions to this requirement include the following:

| • | purchase-money mortgages or liens; |

| • | liens on any property or asset that existed at the time when we acquired that property or asset; |

| • | any deposit or pledge to secure public or statutory obligations; |

| • | any deposit or pledge with any governmental agency required to qualify us to conduct any part of our business, to entitle us to maintain self-insurance or to obtain the benefits of any law relating to workmen’s compensation, unemployment insurance, old age pensions or other social security; or |

| • | any deposit or pledge with any court, board, commission or governmental agency as security for the proper conduct of any proceeding before it. (SECTION 1004) |

6

Table of Contents

The indenture does not prevent any of our affiliates from mortgaging, pledging or subjecting to any lien, any property or asset, even if the affiliate acquired that property or asset from us.

We may issue or assume an unlimited amount of debt under the indenture. As a result, the indenture does not prevent us from significantly increasing our unsecured debt levels, which may negatively affect the resale of the debt securities. (SECTION 301)

Changes to the Indenture

The indenture may be changed with the consent of holders owning more than 50% of the principal amount of the outstanding debt securities of each series affected by the change. However, we may not change your principal or interest payment terms or the percentage required to change other terms of the indenture without your consent and the consent of others similarly affected. (SECTION 902)

We may enter into supplemental indentures for other specified purposes, including the creation of any new series of debt securities, without the consent of any holder of debt securities. (SECTION 901)

Consolidation, Merger or Sale

The indenture provides that we may not merge with another company or sell, transfer or lease all or substantially all of our property to another company unless:

| • | the successor corporation expressly assumes: |

| • | payment of principal, interest and any premium on the debt securities; and |

| • | performance and observance of all covenants and conditions in the indenture; |

| • | after giving effect to the transaction, there is no default under the indenture; |

| • | we have delivered to the trustee an officers’ certificate and opinion of counsel stating that such transaction complies with the conditions set forth in the indenture; and |

| • | if as a result of the transaction, our property would become subject to a lien that would not be permitted by the asset lien restriction, we secure the debt securities equally and ratably with, or prior to, all indebtedness secured by that lien. (ARTICLE EIGHT) |

Events of Default

An event of default means, for any series of debt securities, any of the following:

| • | failure to pay interest on that series of debt securities for 90 days after payment is due; |

| • | failure to pay principal or any premium on that series of debt securities when due; |

| • | failure to perform any other covenant relating to that series of debt securities for 90 days after notice to us; |

| • | certain events of bankruptcy, insolvency and reorganization; and |

| • | any other event of default provided for in the supplement to the indenture, board resolution or officers’ certificate designating the specific terms of such series of debt securities. |

An event of default for a particular series of debt securities does not necessarily impact any other series of debt securities issued under the indenture. (SECTION 501)

If an event of default for any series of debt securities occurs and continues, the trustee or the holders of at least 25% of the outstanding principal amount of the debt securities of such series may declare the entire

7

Table of Contents

principal of all the debt securities of that series to be due and payable immediately. If this happens, subject to certain conditions, the holders of a majority of the outstanding principal amount of the debt securities of that series can rescind the declaration if there has been deposited with the trustee a sum sufficient to pay all matured installments of interest, principal and any premium. (SECTION 502)

The holders of more than 50% of the outstanding principal amount of any series of the debt securities, may, on behalf of the holders of all of the debt securities of that series, control any proceedings resulting from an event of default or waive any past default except a default in the payment of principal, interest or any premium. (SECTION 512) We are required to file an annual certificate with the trustee stating whether we are in compliance with all of the conditions and covenants under the indenture. (SECTION 704)

Concerning the Trustee

Within 90 days after a default occurs with respect to a particular series of debt securities, the trustee must notify the holders of the debt securities of such series of all defaults known to the trustee if we have not remedied them (default is defined to mean any event which is, or after notice or lapse of time or both would become, an event of default with respect to such series of debt securities as specified above under “—Events of Default”). If a default described in the third bullet point under “—Events of Default” occurs, the trustee will not give notice to the holders of the series until at least 60 days after the occurrence of that default. The trustee may withhold notice to the holders of the debt securities of any default (except in the payment of principal, interest or any premium) if it in good faith believes that withholding this notice is in the interest of the holders. (SECTION 602)

Prior to an event of default, the trustee is required to perform only the specific duties stated in the indenture, and after an event of default, must exercise the same degree of care as a prudent individual would exercise in the conduct of his or her own affairs. (SECTION 601) The trustee is not required to take any action permitted by the indenture at the request of holders of the debt securities, unless those holders protect the trustee against costs, expenses and liabilities. (SECTION 603) The trustee is not required to spend its own funds or become financially liable when performing its duties if it reasonably believes that it will not be adequately protected financially. (SECTION 601)

U.S. Bank National Association, the trustee, and its affiliates have commercial banking relationships with us and some of our affiliates and serves as trustee or paying agent under indentures relating to debt securities issued by us and some of our affiliates.

8

Table of Contents

The following discussion pertains to debt securities that are issued in book-entry only form.

The Clearing Systems

In the event that the debt securities are issued in book-entry only form, the debt securities may be settled through DTC. In the event that the prospectus supplement to this prospectus so provides, debt securities in book-entry only form also may be settled through accounts maintained at Clearstream Banking S.A., Luxembourg, commonly known as Clearstream, or the Euroclear System, commonly known as Euroclear. In this case, links will be established among DTC, Clearstream and Euroclear to facilitate the issuance of the debt securities and cross-market transfers of interests in the debt securities associated with secondary market trading. DTC is linked indirectly to Clearstream and Euroclear through the depositary accounts of their respective U.S. depositaries. The descriptions of the operations and procedures of DTC, Clearstream and Euroclear described below are provided solely as a matter of convenience. These operations and procedures are solely within the control of these settlement systems and are subject to change by them from time to time. Neither we, the trustee, nor any underwriter, dealer, agent or purchaser takes any responsibility for these operations or procedures, and investors are urged to contact the relevant system or its participants directly to discuss these matters.

The clearing systems have advised us as follows:

DTC

DTC is a limited-purpose trust company organized under the New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a member of the U.S. Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered under Section 17A of the Exchange Act. DTC holds securities that its participants, known as DTC participants, deposit with DTC. DTC also facilitates the settlement among DTC participants of sales and other securities transactions in deposited securities, through computerized book-entry transfers and pledges between DTC participants’ accounts. This eliminates the need for physical movement of securities certificates. DTC participants include U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations.

DTC’s book-entry system is also used by other organizations such as U.S. and non-U.S. securities brokers and dealers, banks, trust companies and clearing corporations that clear through or maintain a custodial relationship with a DTC participant, either directly or indirectly. The rules that apply to DTC and its participants are on file with the SEC.

Upon receipt of any payment of principal or interest, DTC will credit DTC participants’ accounts on the payment date according to such participants’ respective holdings of beneficial interests in the global securities as shown on DTC’s records. In addition, it is DTC’s current practice to assign any consenting or voting rights to DTC participants whose accounts are credited with securities on a record date, by using an omnibus proxy. Payments by DTC participants to owners of beneficial interests in the global securities, and voting by DTC participants, will be governed by standing instructions and customary practices between the DTC participants and owners of beneficial interests, as is the case with securities held for the accounts of customers registered in “street name.” However, these payments will be the responsibility of the DTC participants and not of DTC, the trustee, any paying agent, if applicable, or us.

Clearstream

Clearstream is a société anonyme incorporated under the laws of Luxembourg as a professional depositary. Clearstream holds securities for its participating organizations, known as Clearstream participants, and facilitates

9

Table of Contents

the clearance and settlement of securities transactions between Clearstream participants through electronic book-entry changes in accounts of Clearstream participants, thereby eliminating the need for physical movement of certificates. Clearstream provides to Clearstream participants, among other things, services for safekeeping, administration, clearance and settlement of internationally traded securities and securities lending and borrowing. Clearstream interfaces with domestic markets in several countries. As a registered bank in Luxembourg, Clearstream is subject to regulation by the Commission for the Supervision of the Financial Sector (Commission de Surveillance du Secteur Financier). Clearstream participants are recognized financial institutions around the world, including underwriters, securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations and may include an underwriter, dealer, agent or purchaser engaged by us to sell the debt securities. Indirect access to Clearstream is also available to others, such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a Clearstream participant either directly or indirectly. Clearstream has established an electronic bridge with Euroclear to facilitate settlement of trades between Clearstream and Euroclear.

Distributions with respect to interests in the debt securities held beneficially through Clearstream will be credited to cash accounts of Clearstream participants in accordance with its rules and procedures, to the extent received by the U.S. depositary for Clearstream.

Euroclear

Euroclear was created in 1968 to hold securities for its participants, known as Euroclear participants, and to clear and settle transactions between Euroclear participants and between Euroclear participants and participants of certain other securities intermediaries through simultaneous electronic book-entry delivery against payment, thereby eliminating the need for physical movement of certificates and any risk from lack of simultaneous transfers of securities and cash. Euroclear is owned by Euroclear Holding SA, a societe anonyme incorporated in Belgium, and operated through a license agreement by Euroclear Bank SA/NV, known as the Euroclear operator. The Euroclear operator provides Euroclear participants, among other things, with safekeeping, administration, clearance and settlement, securities lending and borrowing and related services. Euroclear participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries and may include an underwriter, dealer, agent or purchaser engaged by us to sell the debt securities.

Indirect access to Euroclear is also available to others that clear through or maintain a custodial relationship with a Euroclear participant, either directly or indirectly.

The Euroclear operator is a Belgian bank regulated by the Belgian Financial Services and Markets Authority and is overseen as the operator of a securities settlement system by the National Bank of Belgium.

Securities clearance accounts and cash accounts with the Euroclear operator are governed by the Terms and Conditions Governing Use of Euroclear, any supplementary terms and conditions, the related Operating Procedures of the Euroclear System, other applicable Euroclear documentation and applicable Belgian law, collectively referred to as the “terms and conditions.” The terms and conditions govern transfers of securities and cash within Euroclear, withdrawals of securities and cash from Euroclear, and receipts of payments with respect to securities in Euroclear. All securities in Euroclear are held on a fungible basis without attribution of specific certificates to specific securities clearance accounts. The Euroclear operator acts under the terms and conditions only on behalf of Euroclear participants, and has no record of or relationship with persons holding through Euroclear participants.

Distributions with respect to debt securities held beneficially through Euroclear will be credited to the cash accounts of Euroclear participants in accordance with the terms and conditions, to the extent received by the U.S. depositary for Euroclear.

10

Table of Contents

Global Clearance and Settlement Procedures

Initial settlement for the debt securities will be made in U.S. dollars, in same-day funds, unless otherwise specified in the prospectus supplement. Secondary market trading between DTC participants will occur in the ordinary way in accordance with DTC rules and will be settled in same-day funds using DTC’s Same-Day Funds Settlement System. In the event that the prospectus supplement to this prospectus provides that the debt securities also may be settled through Clearstream and Euroclear, secondary market trading between Clearstream participants and/or Euroclear participants will occur in the ordinary way in accordance with the applicable rules and operating procedures of Clearstream and Euroclear and will be settled using the procedures applicable to conventional eurobonds in same-day funds.

Cross-market transfers between persons holding directly or indirectly through DTC participants, on the one hand, and directly or indirectly through Clearstream or Euroclear participants, on the other, will be effected in DTC in accordance with DTC rules on behalf of the applicable European international clearing system by its U.S. depositary; however, these cross-market transactions will require delivery of instructions to such European international clearing system by the counterparty in that system in accordance with its rules and procedures and within its established deadlines (European time). The European international clearing system will, if a transaction meets its settlement requirements, deliver instructions to its U.S. depositary to take action to effect final settlement on its behalf by delivering or receiving interests in the debt securities in DTC, and making or receiving payment in accordance with normal procedures for settlement in DTC. Clearstream participants and Euroclear participants may not deliver instructions directly to the respective U.S. depositary for Clearstream or Euroclear.

Because of time-zone differences, credits of debt securities received in Clearstream or Euroclear as a result of a transaction with a DTC participant will be made during subsequent securities settlement processing and dated the business day following the DTC settlement date. The credits or any transactions in the debt securities settled during this processing will be reported to the Clearstream or Euroclear participants on the same business day. Cash received in Clearstream or Euroclear as a result of sales of the debt securities by or through a Clearstream participant or a Euroclear participant to a DTC participant will be received with value on the DTC settlement date but will be available in the Clearstream or Euroclear cash account only as of the business day following settlement in DTC.

Although DTC, Clearstream and Euroclear are expected to follow these procedures in order to facilitate transfers of interests in securities among participants of DTC, Clearstream and Euroclear, they will be under no obligation to perform or continue to perform these procedures, and these procedures may be changed or discontinued at any time by any of them. Neither we, the trustee nor any paying agent, if applicable, will have any responsibility for the performance of DTC, Euroclear or Clearstream or their respective participants or indirect participants of their respective obligations under the rules and procedures governing their operations.

11

Table of Contents

We may sell any of the securities:

| • | through underwriters or dealers; |

| • | through agents; or |

| • | directly to one or more purchasers. |

The prospectus supplement or pricing supplement will include:

| • | the initial public offering price; |

| • | the names of any underwriters and, if known to us, any dealers or agents; |

| • | any amounts underwritten and, if known to us, any amounts offered through dealers or agents; |

| • | the purchase price of the securities; |

| • | our proceeds from the sale of the securities; |

| • | any underwriting discounts or agency fees and other underwriters’ or agents’ compensation; |

| • | any discounts or concessions allowed or reallowed, or commissions paid, to dealers; |

| • | any option by the underwriters to purchase additional securities; and |

| • | a brief description of any passive market making that any underwriter or any selling group members intend to engage in and any transactions that any underwriter intends to conduct that stabilizes, maintains or otherwise affects the market price of the securities. |

If underwriters are used in the sale, they will buy the securities for their own account. The underwriters may then resell the securities in one or more transactions, at any time or times, at a fixed public offering price or at varying prices.

This prospectus should not be considered an offer of the securities in states where prohibited by law.

If there is a default by one or more of the underwriters affecting 10% or less of the total number of shares of capital stock or principal amount of debt securities offered, the non-defaulting underwriters must purchase the securities agreed to be purchased by the defaulting underwriters. If the default affects more than 10% of the total number of shares of capital stock or principal amount of the debt securities, we may, at our option, sell less than all the securities offered.

Underwriters, dealers and agents that participate in the distribution of the securities may be underwriters as defined in the Securities Act. Any discounts or commission that we pay them and any profit that they receive from the resale of the securities by them may be treated as underwriting discounts and commissions under the Securities Act. We may have agreements with underwriters, dealers and agents to indemnify them against certain civil liabilities, including liabilities under the Securities Act, or to contribute with respect to payments which they may be required to make.

Underwriters, dealers and agents may be customers of us or our affiliates, may engage in transactions with us or our affiliates or perform services for us or our affiliates in the ordinary course of business.

12

Table of Contents

The consolidated financial statements of Verizon Communications Inc. (Verizon Communications) as of December 31, 2018 and 2017 and for each of the three years in the period ended December 31, 2018 appearing in its Current Report on Form 8-K dated August 8, 2019, the effectiveness of Verizon Communications’ internal control over financial reporting as of December 31, 2018, incorporated by reference in its Annual Report (Form 10-K) for the year ended December 31, 2018, and the financial statement schedule of Verizon Communications appearing in its Form 10-K for the year ended December 31, 2018, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, included or incorporated by reference therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

William L. Horton, Jr., Senior Vice President, Deputy General Counsel and Corporate Secretary of Verizon Communications, will issue an opinion about the validity of any common stock, preferred stock or debt securities offered pursuant to this prospectus and any applicable prospectus supplement. As of August 26, 2019, Mr. Horton beneficially owns, or has the right to acquire, an aggregate of less than 0.001% of the shares of Verizon Communications common stock.

Milbank LLP of New York, New York will issue an opinion on certain legal matters for the agents or underwriters. Milbank LLP from time to time represents Verizon Communications and its affiliates in connection with matters unrelated to the offering of the securities.

13

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution |

| Registration fee |

$ * | |||

| Rating agency fees |

** | |||

| Trustee and transfer agent fees |

** | |||

| Costs of printing |

** | |||

| Accounting fees |

** | |||

| Legal fees |

** | |||

| Miscellaneous fees |

** | |||

|

|

|

|||

| Total |

$ ** | |||

|

|

|

| * | Excluded because payment of the SEC registration fee is being deferred pursuant to Rule 456(b) and Rule 457(r). |

| ** | The applicable prospectus supplement will set forth the estimated aggregate amount of expenses payable with respect to any offering of securities. |

| Item 15. | Indemnification of Directors and Officers |

Section 145 of the Delaware General Corporation Law (“DGCL”) permits a corporation to indemnify any of its directors or officers who was or is a party or is threatened to be made a party to any third-party action, suit or proceeding by reason of the fact that such person is or was a director or officer of the corporation, against expenses (including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe that such person’s conduct was unlawful. In a derivative action, i.e., one by or in the right of the corporation, the corporation is permitted to indemnify directors and officers against expenses (including attorney’s fees) actually and reasonably incurred by them in connection with the defense or settlement of an action or suit if they acted in good faith and in a manner that they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation, unless and only to the extent that the Delaware Court of Chancery or the court in which the action or suit was brought shall determine upon application that the defendant directors or officers are fairly and reasonably entitled to indemnity for such expenses despite such adjudication of liability.

In addition, Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit.

Article 7 of the Verizon Communications’ restated certificate of incorporation makes mandatory the indemnification expressly authorized under Section 145 of the DGCL, except that the restated certificate of incorporation only provides for indemnification in derivative actions, suits or proceedings initiated by a director or officer if the initiation of such action, suit or proceeding was authorized by the board of directors.

The restated certificate of incorporation of Verizon Communications provides that, consistent with Section 145(e) of the DGCL, expenses incurred by an officer, director or other designated authorized

II-1

Table of Contents

representative of the corporation in defending any such action, suit or proceeding shall be paid by the corporation, provided that, if required by the DGCL, such expenses shall be advanced only upon delivery to the corporation of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the corporation. Expenses incurred by other employees or agents of the corporation may be advanced upon such terms and conditions as the board of directors deems appropriate.

The restated certificate of incorporation of Verizon Communications limits the personal liability of directors to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director to the fullest extent permitted by the DGCL.

The directors and officers of Verizon Communications are insured against certain liabilities, including certain liabilities arising under the Securities Act, which might be incurred by them in such capacities and against which they cannot be indemnified by Verizon Communications.

Verizon Communications may also enter into indemnification agreements with underwriters providing that underwriters have to indemnify and hold harmless Verizon Communications, each of its directors, each officer who signed the registration statement and any person who controls it within the meaning of the Securities Act, from and against certain civil liabilities, including liabilities under the Securities Act.

| Item 16. | Exhibits |

II-2

Table of Contents

| * | To be filed by amendment or incorporated by reference herein prior to the issuance of common stock. |

| ** | To be filed by amendment or incorporated by reference herein prior to the issuance of preferred stock. |

| *** | Filed herewith. |

II-3

Table of Contents

| Item 17. | Undertakings |

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933 (the “Securities Act”);

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (i), (ii) and (iii) shall not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

II-4

Table of Contents

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to any charter provision, bylaw or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-5

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Verizon Communications Inc. certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on September 4, 2019.

| VERIZON COMMUNICATIONS INC. | ||

| By: | /s/ Scott Krohn | |

| Scott Krohn | ||

| (Senior Vice President and Treasurer) | ||

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated:

| Signature | Title | Date | ||

| * |

Director | September 4, 2019 | ||

| Shellye L. Archambeau | ||||

| * |

Director | September 4, 2019 | ||

| Mark T. Bertolini | ||||

| * |

Director | September 4, 2019 | ||

| Vittorio Colao | ||||

| * |

Director | September 4, 2019 | ||

| Melanie L. Healey | ||||

| * |

Director | September 4, 2019 | ||

| Clarence Otis, Jr. | ||||

| * Daniel H. Schulman |

Director | September 4, 2019 | ||

| * Rodney E. Slater |

Director | September 4, 2019 | ||

| * Kathryn A. Tesija |

Director | September 4, 2019 | ||

| * Hans E. Vestberg |

Chairman and Chief Executive Officer (principal executive officer) | September 4, 2019 | ||

| * Gregory G. Weaver |

Director | September 4, 2019 | ||

| * Matthew D. Ellis |

Executive Vice President and Chief Financial Officer (principal financial officer) |

September 4, 2019 | ||

II-6

Table of Contents

| Signature | Title | Date | ||

| * Anthony T. Skiadas |

Senior Vice President and Controller (principal accounting officer) | September 4, 2019 | ||

| * By: | /s/ Scott Krohn | |

| Scott Krohn, | ||

| as Attorney-in-Fact | ||

II-7

EXHIBIT 1.3

[FORM OF PURCHASE AGREEMENT FOR DEBT SECURITIES]

VERIZON COMMUNICATIONS INC.

PURCHASE AGREEMENT

Verizon Communications Inc., a Delaware corporation (the “Company”), proposes to issue and sell [$/€/£] ,000 aggregate principal amount of its [ % Notes due ] [Floating Rate Notes due ] (the “Notes”). The Notes will have the terms and provisions that are summarized in the General Disclosure Package (as defined in the Standard Debt Securities Purchase Agreement Provisions ( Edition) (the “Standard Purchase Agreement Provisions”) attached hereto as Annex A) relating to the offering of the Notes. [The Company will apply to have the Notes listed on the [insert name of applicable exchange].]1 Subject to the terms and conditions set forth or incorporated by reference herein, the Company agrees to sell, and the purchasers named in Schedule A attached hereto (the “Purchasers”) severally agree to purchase, the Notes at % of their principal amount plus[, in each case,] accrued interest, if any, from , to the date of payment and delivery thereof. The Notes will be initially reoffered to the public at % of their principal amount plus[, in each case,] accrued interest, if any, from , to the date of payment and delivery thereof.2

| 1 | Include if applicable. |

| 2 | Replace this paragraph with the following if application will be made to list the Notes on the Taipei Exchange: |

Verizon Communications Inc., a Delaware corporation (the “Company”), having its principal executive offices at 1095 Avenue of the Americas, New York, New York 10036, proposes to issue and sell $ ,000 aggregate principal amount of its [ % Notes due ] [Floating Rate Notes due ] (the “Notes”). The Notes will have the terms and provisions that are summarized in the General Disclosure Package (as defined in the Standard Debt Securities Purchase Agreement Provisions ( Edition) (the “Standard Purchase Agreement Provisions”) attached hereto as Annex A) relating to the offering of the Notes. Among the Purchasers (as defined below), , is appointed by the Company as the lead manager (the “Lead Manager”). Notwithstanding anything to the contrary in this Purchase Agreement, the Notes are intended to be listed on the Taipei Exchange (the “TPEx”) in the Republic of China (“ROC”) and application will be made to the TPEx for listing of, and permission to deal in, the Notes by way of debt issues to “professional institutional investors,” as defined under Paragraph 2, Article 4 of the Financial Consumer Protection Act of the ROC, which currently include: (i) overseas or domestic banks, securities firms, futures firms and insurance companies (excluding insurance agencies, insurance brokers and insurance surveyors), the foregoing as further defined in more detail in Paragraph 3 of Article 2 of the Organization Act of the Financial Supervisory Commission of the ROC; (ii) overseas or domestic fund management companies, government investment institutions, government funds, pension funds, mutual funds, unit trusts, and funds managed by financial service enterprises pursuant to the ROC Securities Investment Trust and Consulting Act, the ROC Future Trading Act or the ROC Trust Enterprise Act or investment assets mandated and delivered by or transferred for trust by financial consumers; and (iii) other institutions recognized by the Financial Supervisory Commission of the ROC. The pricing date of the Notes is , . Subject to the terms and conditions set forth or incorporated by reference herein, the Company agrees to sell, and the purchasers named in Schedule A attached hereto (the “Purchasers”) severally agree to purchase, on a firm commitment basis, the Notes in the principal amounts set forth opposite such Purchasers’ names in Schedule A, at the Public Purchase Price (as defined below) plus accrued interest, if any, from , to the date of payment and delivery thereof and net of the applicable Underwriting Commission (as defined below). The Notes will be initially reoffered to the public at 100% of their principal amount (the “Public Purchase Price”), plus accrued interest, if any, from , to the date of payment and delivery thereof.

The Purchasers have advised the Company that they propose to offer the Notes on the terms and conditions set forth herein and in the General Disclosure Package. All of the provisions contained in the Standard Purchase Agreement Provisions shall be deemed to be a part of this Purchase Agreement to the same extent as if such provisions had been set forth in full herein. For the avoidance of doubt, the provisions herein will supersede any provisions in the Standard Purchase Agreement Provisions where there may be a conflict. Unless otherwise defined herein, terms used in this Purchase Agreement that are defined in the Standard Purchase Agreement Provisions have the meanings set forth in the Standard Purchase Agreement Provisions. [For purposes of this Purchase Agreement, “Representatives” as used in the Standard Purchase Agreement Provisions means all of the Purchasers.]3

CONDITIONS TO PURCHASERS’ OBLIGATIONS:

The obligation of each Purchaser to purchase the Notes on the Closing Date (as defined below) as provided herein is subject to the performance by the Company of its covenants and other obligations specified [hereunder and] in Article IV of the Standard Purchase Agreement Provisions[./and to the following additional condition[s]:]

[(a) The Notes shall have been deemed eligible for clearance and settlement through the facilities of Euroclear Bank SA/NV, as operator of the Euroclear System (“Euroclear”), and Clearstream Banking S.A. (“Clearstream”) and the Company shall have appointed U.S. Bank National Association (as successor to Wachovia Bank, National Association, formerly known as First Union National Bank), as trustee, or its affiliates, as applicable, to act as registrar, transfer agent and paying agent with respect to the Notes as contemplated in the General Disclosure Package.]4

[(b) The Purchasers shall have received on the Closing Date the opinion of Lee and Li, Attorneys-at-Law, special Taiwanese counsel to the Company, dated the Closing Date, in a form satisfactory to the Company and the Purchasers;

(c) The Taiwan Securities Association (the “TSA”) shall have granted its approval for recordation of submission of this Purchase Agreement; and

(d) The approval of the TPEx for the listing of the Notes on the TPEx shall have been granted (or the Purchasers have been reasonably satisfied that such approval will be granted).]5

In consideration of the agreement by the Purchasers to purchase the Notes as provided in the preceding paragraph, the Company shall pay to each Purchaser the underwriting commission set forth opposite such Purchaser’s name in Schedule A (collectively, the “Underwriting Commission”). The Underwriting Commission of each Purchaser shall be deducted from the Gross Proceeds (as defined below) of the Notes purchased by such Purchaser on the Closing Date (as defined below) prior to the payment of such Gross Proceeds to the Company. “Gross Proceeds” means, with respect to any Purchaser, the amount equal to the product of (i) the Public Purchase Price and (ii) the principal amount of the Notes to be purchased by such Purchaser as set forth opposite such Purchaser’s name in Schedule A.

| 3 | Include if application will be made to list the Notes on the Taipei Exchange. |

| 4 | Include if the Notes will clear and settle exclusively through Euroclear and Clearstream or through accounts maintained with them. |

| 5 | Include if application will be made to list the Notes on the Taipei Exchange. |

[COVENANTS OF THE COMPANY:

In addition to the covenants contained in Article VI of the Standard Purchase Agreement Provisions, the Company covenants to the several Purchasers as follows:

(a) The Company will cooperate with the Purchasers to cause the Notes to be eligible for clearance and settlement through Euroclear and Clearstream.]6

[(b) The Company agrees to use its commercially reasonable efforts to accomplish the listing of the Notes on the TPEx;

(c) The Company agrees that it will pay or cause to be paid all fees and expenses incurred with respect to the listing, trading or quotation of the Notes by the TPEx or any other listing authority, stock exchange or quotation system as contemplated in the following paragraph;

(d) In connection with the application to the TPEx for the listing of, and permission to deal in, the Notes, the Company agrees that it will furnish from time to time any and all documents, instruments, information and undertakings and publish all advertisements or other material that may be necessary in order to effect such listing and will maintain such listing until none of the Notes is outstanding or until such time as payment of principal, premium, if any, and interest in respect of the Notes then outstanding has been duly provided for, whichever is earlier; provided, however, that if the Company can no longer reasonably maintain such listing in circumstances including, but not limited to, where obtaining or the maintenance of such listing would require preparation of financial statements in accordance with accounting standards other than U.S. GAAP in a manner that, in the Company’s opinion, is burdensome, it will consider obtaining and maintaining the quotation for, or listing of, the Notes by such other listing authority, stock exchange and/or quotation system as the Purchasers shall reasonably request. However, if such an alternative listing is not available to the Company or is, in the Company’s opinion, burdensome, an alternative listing for the Notes need not be considered by the Company. In addition, for so long as the Notes are admitted to listing, trading and/or quotation by a listing authority, stock exchange and/or quotation system, and such listing authority, stock exchange and/or quotation system requires the existence of a paying agent in a particular location, the Company will maintain a paying agent as required; and

(e) The Company will supply to the Purchasers such copies of the General Disclosure Package and the Prospectus as may be reasonably requested by the Purchasers on or before the Closing Date.]7

[PURCHASERS’ REPRESENTATIONS

In addition to the representations and warranties contained in Article II of the Standard Purchase Agreement Provisions, each Purchaser severally and not jointly represents and warrants that:

(A) All licenses, consents, approvals, authorizations, orders and clearances of all regulatory authorities required by it, including without limitation, the TPEx and TSA, for or in connection with the purchase and/or distribution and/or underwriting of the Notes in the ROC and the compliance by it with the terms of any of the foregoing have been obtained and are in full force and effect, and each Purchaser agrees that, without the prior written consent of the Company, it will not offer or sell the Notes outside the ROC;

(B) It has been and will be solely responsible for assessing the identity and qualifications of the prospective investors in the Notes that purchase Notes from it and ensuring that the Pricing Prospectus is delivered to such investors, in each case prior to the Applicable Time; and

(C) It has complied with and will comply with all applicable ROC laws and regulations in the purchase, underwriting or distribution of the Notes.

PURCHASERS’ COVENANTS

(A) Each Purchaser severally and not jointly undertakes that:

1. It shall deliver the General Disclosure Package and the Prospectus in sufficient copies to the potential investors in the Notes on or before , ;

| 6 | Include if the Notes will clear and settle exclusively through Euroclear and Clearstream or through accounts maintained with them. |

| 7 | Include if application will be made to list the Notes on the Taipei Exchange. |

2. The Underwriting Commission payable to it may not be repaid or refunded by it by any means or in any form to the Company or its related parties or their designated persons; and

3. It shall pay such stamp duties as are payable under the laws of the ROC in connection with the execution and delivery of this Purchase Agreement if this Purchase Agreement is executed in the ROC.

(B) [Insert name of the applicable Purchaser], undertakes that:

1. [Insert name of the applicable Purchaser], shall act as the liquidity provider for the purpose of providing quotations for the Company in respect of the Notes in accordance with Article 24-1 of the Taipei Exchange Rules Governing Management of Foreign Currency Denominated International Bonds (the “TPEx Rules”) and the relevant regulations; and

2. [Insert name of the applicable Purchaser], represents and undertakes that it has obtained, or will before the Closing Date obtain, all licenses, consents, approvals, authorizations, orders and clearances of all regulatory authorities required for it to perform the undertaking specified in subparagraph 1. of this paragraph (B).

LEAD MANAGER’S COVENANTS

The Lead Manager undertakes that:

(A) The Lead Manager shall act as the filing agent for the Company and assist the Company in making the required reporting to the Central Bank of the Republic of China (Taiwan) and the TPEx in connection with the issue and offering of the Notes and making an application (including submitting to the TPEx a photocopy of this Purchase Agreement being executed by all the parties hereto together with other documents as required by the applicable laws and regulations of the TPEx) to the TPEx for the listing and trading of the Notes on the TPEx, on or about the day as separately agreed by the Company and the Lead Manager, but in no event later than four business days prior to the Closing Date;

(B) The Lead Manager shall submit to the TSA an original copy of this Purchase Agreement being executed by all the parties hereto, together with other documents as required by the applicable laws and regulations of the TSA, on or about the day as separately agreed by the Company and the Lead Manager, but in no event later than four business days prior to the Closing Date; and

(C) The Lead Manager shall complete an underwriting announcement in connection with the issue and offering of the Notes in form and substance as required by the applicable laws and regulations on the website of the TSA on or about the day as separately agreed by the Company and the Lead Manager, but no later than one day prior to the Closing Date.]8

| 8 | Include if application will be made to list the Notes on the Taipei Exchange. |

[DENOMINATION OF THE NOTES:

The Notes shall be in the form of one or more Global Notes which shall represent, and shall be denominated in an amount equal to the aggregate principal amount of, the Notes and shall be deposited with and registered in the name of the common depositary or its nominee, in respect of interests held through Euroclear and Clearstream.]9

CLOSING: