Form 8-K ORACLE CORP For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2019

Oracle Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-35992 | 54-2185193 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

500 Oracle Parkway, Redwood City, California 94065

(Address of principal executive offices) (Zip Code)

(650) 506-7000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.01 per share 2.25% senior notes due January 2021 3.125% senior notes due July 2025 |

ORCL | New York Stock Exchange New York Stock Exchange New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 7 – Regulation FD

| Item 7.01 | Regulation FD Disclosure |

Certain information not previously made publicly available is set forth in the presentation furnished herewith and is being made available to investors.

Section 9 – Financial Statements and Exhibits

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation dated July 31, 2019 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ORACLE CORPORATION | ||||||

| Dated: July 31, 2019 | By: | /s/ Brian S. Higgins | ||||

| Name: | Brian S. Higgins | |||||

| Title: | Vice President, Associate General Counsel and Corporate Secretary | |||||

Investor Presentation July 31, 2019 2019, Exhibit 99.1

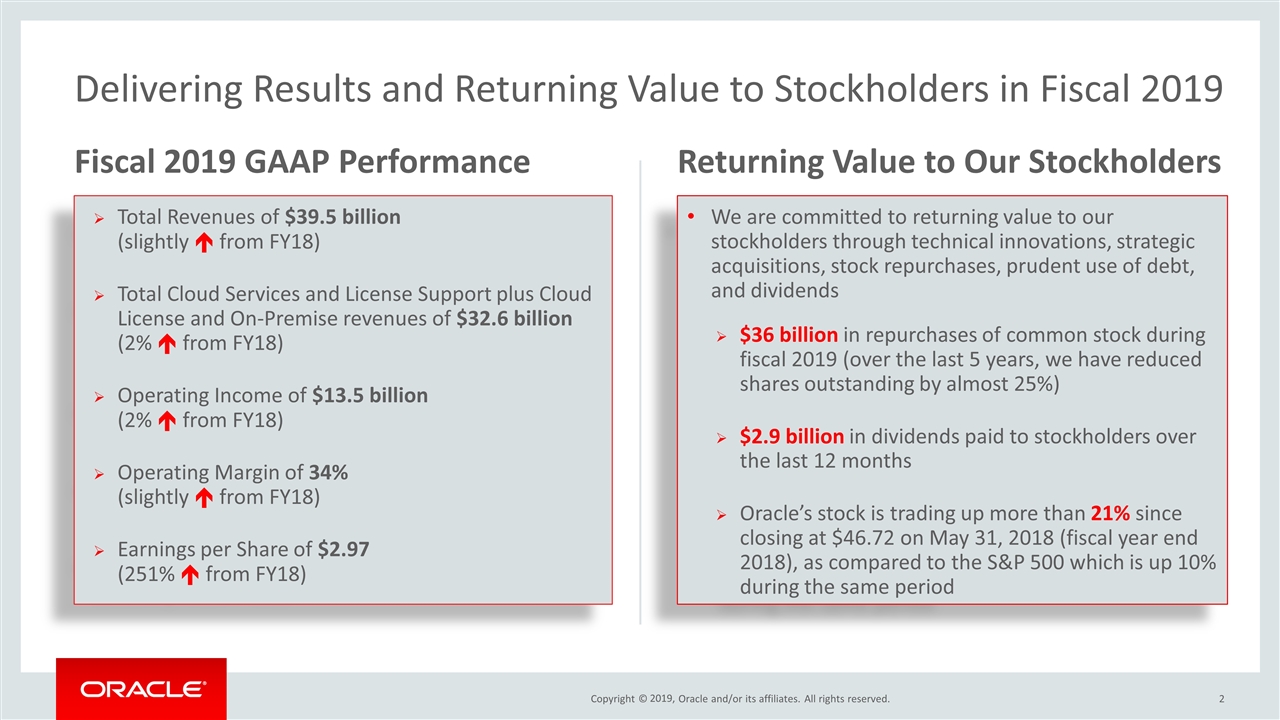

Fiscal 2019 GAAP Performance Total Revenues of $39.5 billion (slightly é from FY18) Total Cloud Services and License Support plus Cloud License and On-Premise revenues of $32.6 billion (2% é from FY18) Operating Income of $13.5 billion (2% é from FY18) Operating Margin of 34% (slightly é from FY18) Earnings per Share of $2.97 (251% é from FY18) Returning Value to Our Stockholders We are committed to returning value to our stockholders through technical innovations, strategic acquisitions, stock repurchases, prudent use of debt, and dividends $36 billion in repurchases of common stock during fiscal 2019 (over the last 5 years, we have reduced shares outstanding by almost 25%) $2.9 billion in dividends paid to stockholders over the last 12 months Oracle’s stock is trading up more than 21% since closing at $46.72 on May 31, 2018 (fiscal year end 2018), as compared to the S&P 500 which is up 10% during the same period Delivering Results and Returning Value to Stockholders in Fiscal 2019 2019,

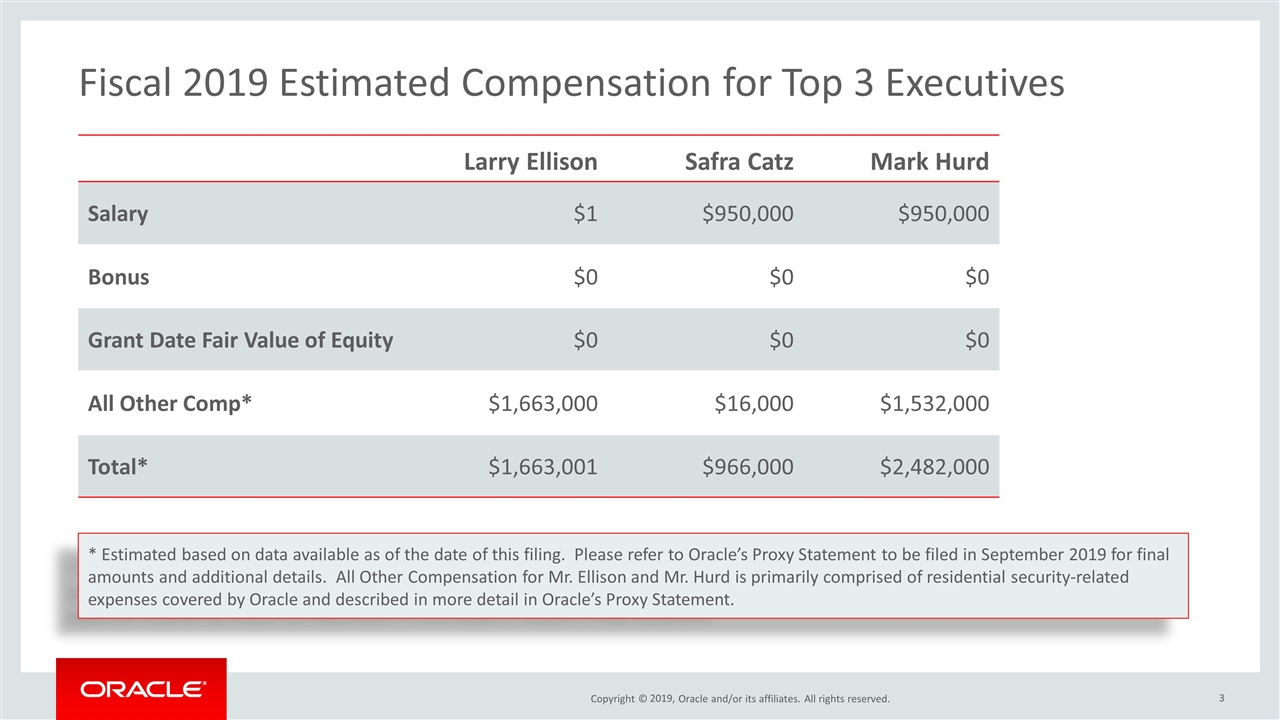

Fiscal 2019 Estimated Compensation for Top 3 Executives 2019, * Estimated based on data available as of the date of this filing. Please refer to Oracle’s Proxy Statement to be filed in September 2019 for final amounts and additional details. All Other Compensation for Mr. Ellison and Mr. Hurd is primarily comprised of residential security-related expenses covered by Oracle and described in more detail in Oracle’s Proxy Statement. Larry Ellison Safra Catz Mark Hurd Salary $1 $950,000 $950,000 Bonus $0 $0 $0 Grant Date Fair Value of Equity $0 $0 $0 All Other Comp* $1,663,000 $16,000 $1,532,000 Total* $1,663,001 $966,000 $2,482,000

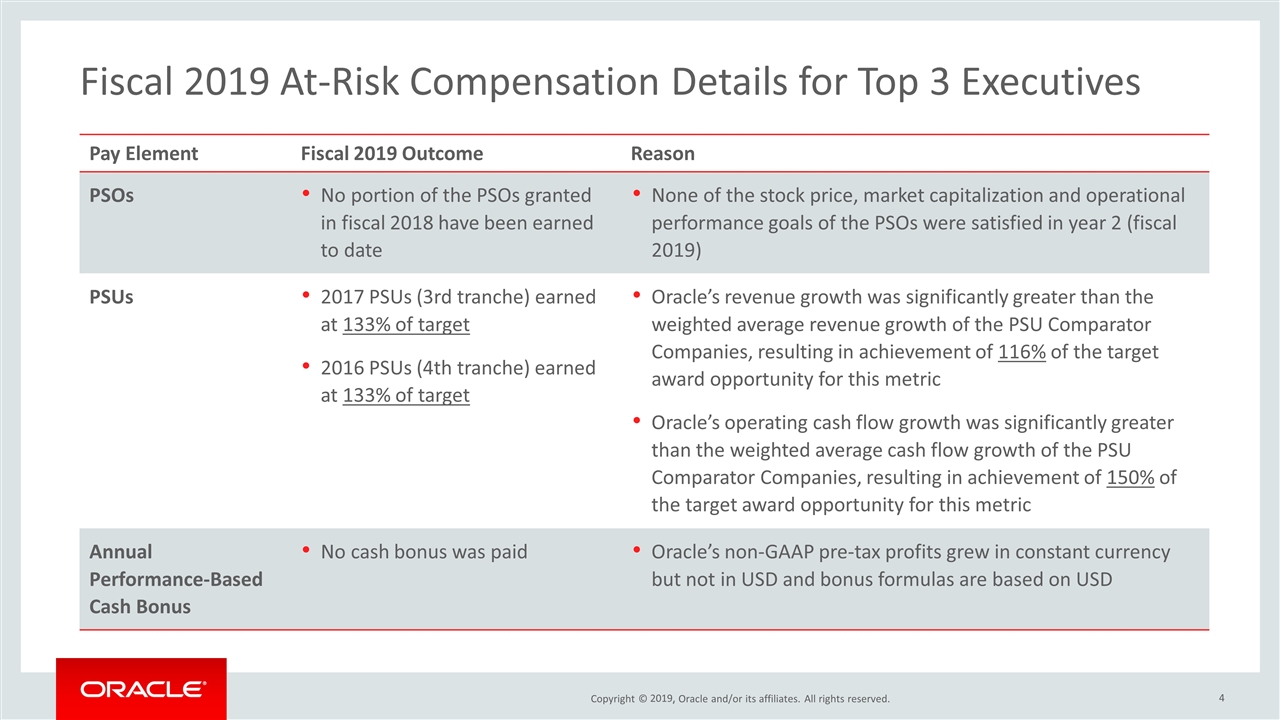

Fiscal 2019 At-Risk Compensation Details for Top 3 Executives 2019, Pay Element Fiscal 2019 Outcome Reason PSOs No portion of the PSOs granted in fiscal 2018 have been earned to date None of the stock price, market capitalization and operational performance goals of the PSOs were satisfied in year 2 (fiscal 2019) PSUs 2017 PSUs (3rd tranche) earned at 133% of target 2016 PSUs (4th tranche) earned at 133% of target Oracle’s revenue growth was significantly greater than the weighted average revenue growth of the PSU Comparator Companies, resulting in achievement of 116% of the target award opportunity for this metric Oracle’s operating cash flow growth was significantly greater than the weighted average cash flow growth of the PSU Comparator Companies, resulting in achievement of 150% of the target award opportunity for this metric Annual Performance-Based Cash Bonus No cash bonus was paid Oracle’s non-GAAP pre-tax profits grew in constant currency but not in USD and bonus formulas are based on USD

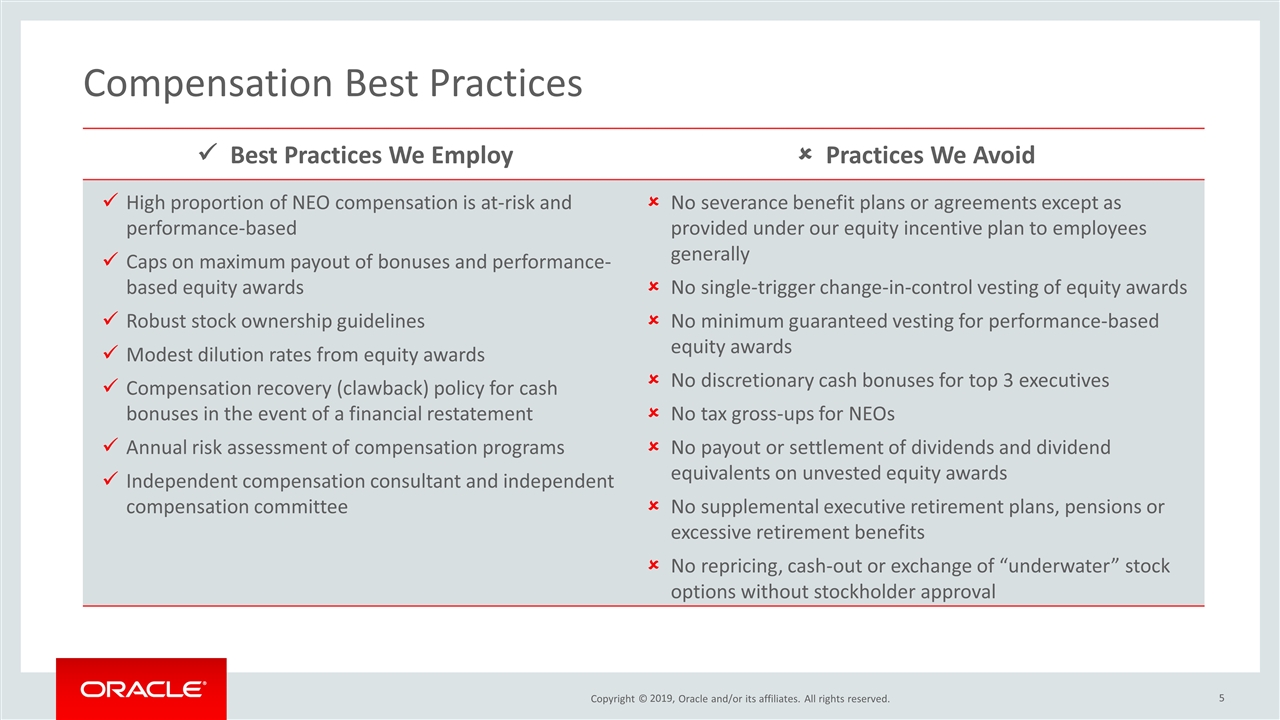

Compensation Best Practices 2019, ü Best Practices We Employ û Practices We Avoid High proportion of NEO compensation is at-risk and performance-based Caps on maximum payout of bonuses and performance-based equity awards Robust stock ownership guidelines Modest dilution rates from equity awards Compensation recovery (clawback) policy for cash bonuses in the event of a financial restatement Annual risk assessment of compensation programs Independent compensation consultant and independent compensation committee No severance benefit plans or agreements except as provided under our equity incentive plan to employees generally No single-trigger change-in-control vesting of equity awards No minimum guaranteed vesting for performance-based equity awards No discretionary cash bonuses for top 3 executives No tax gross-ups for NEOs No payout or settlement of dividends and dividend equivalents on unvested equity awards No supplemental executive retirement plans, pensions or excessive retirement benefits No repricing, cash-out or exchange of “underwater” stock options without stockholder approval

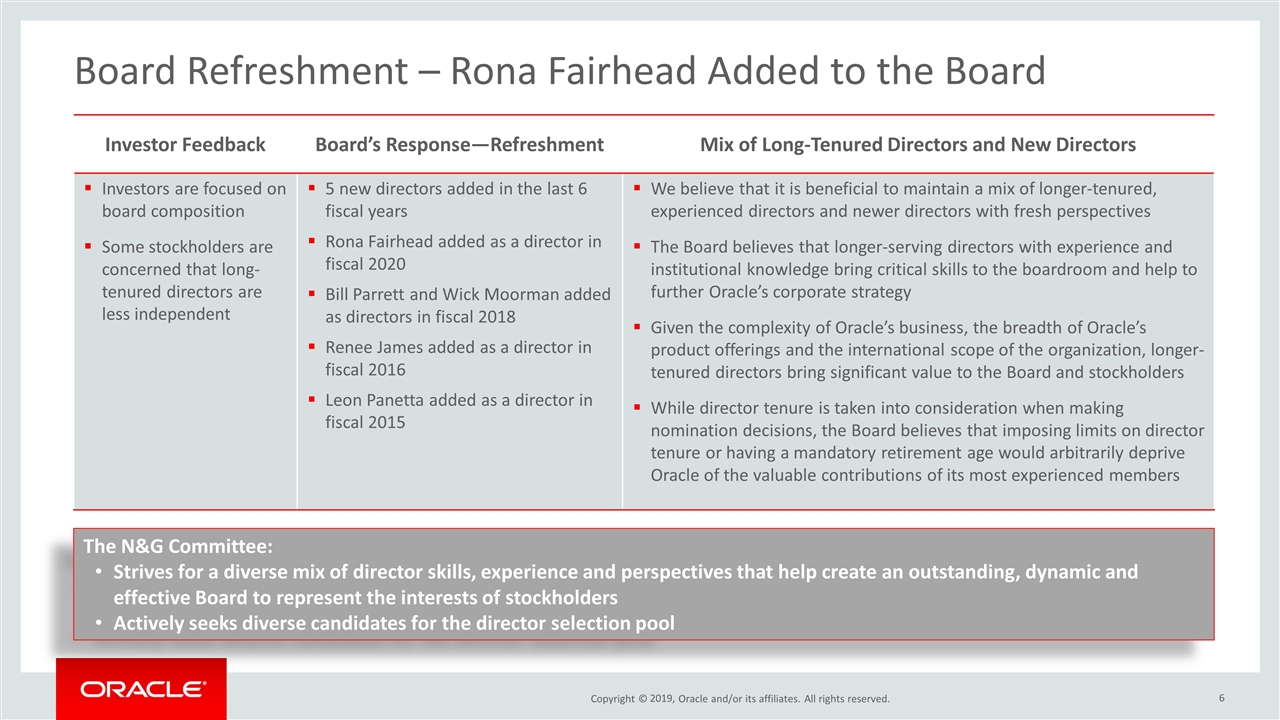

Board Refreshment – Rona Fairhead Added to the Board The N&G Committee: Strives for a diverse mix of director skills, experience and perspectives that help create an outstanding, dynamic and effective Board to represent the interests of stockholders Actively seeks diverse candidates for the director selection pool Investor Feedback Board’s Response—Refreshment Mix of Long-Tenured Directors and New Directors Investors are focused on board composition Some stockholders are concerned that long-tenured directors are less independent 5 new directors added in the last 6 fiscal years Rona Fairhead added as a director in fiscal 2020 Bill Parrett and Wick Moorman added as directors in fiscal 2018 Renee James added as a director in fiscal 2016 Leon Panetta added as a director in fiscal 2015 We believe that it is beneficial to maintain a mix of longer-tenured, experienced directors and newer directors with fresh perspectives The Board believes that longer-serving directors with experience and institutional knowledge bring critical skills to the boardroom and help to further Oracle’s corporate strategy Given the complexity of Oracle’s business, the breadth of Oracle’s product offerings and the international scope of the organization, longer-tenured directors bring significant value to the Board and stockholders While director tenure is taken into consideration when making nomination decisions, the Board believes that imposing limits on director tenure or having a mandatory retirement age would arbitrarily deprive Oracle of the valuable contributions of its most experienced members 6 2019,

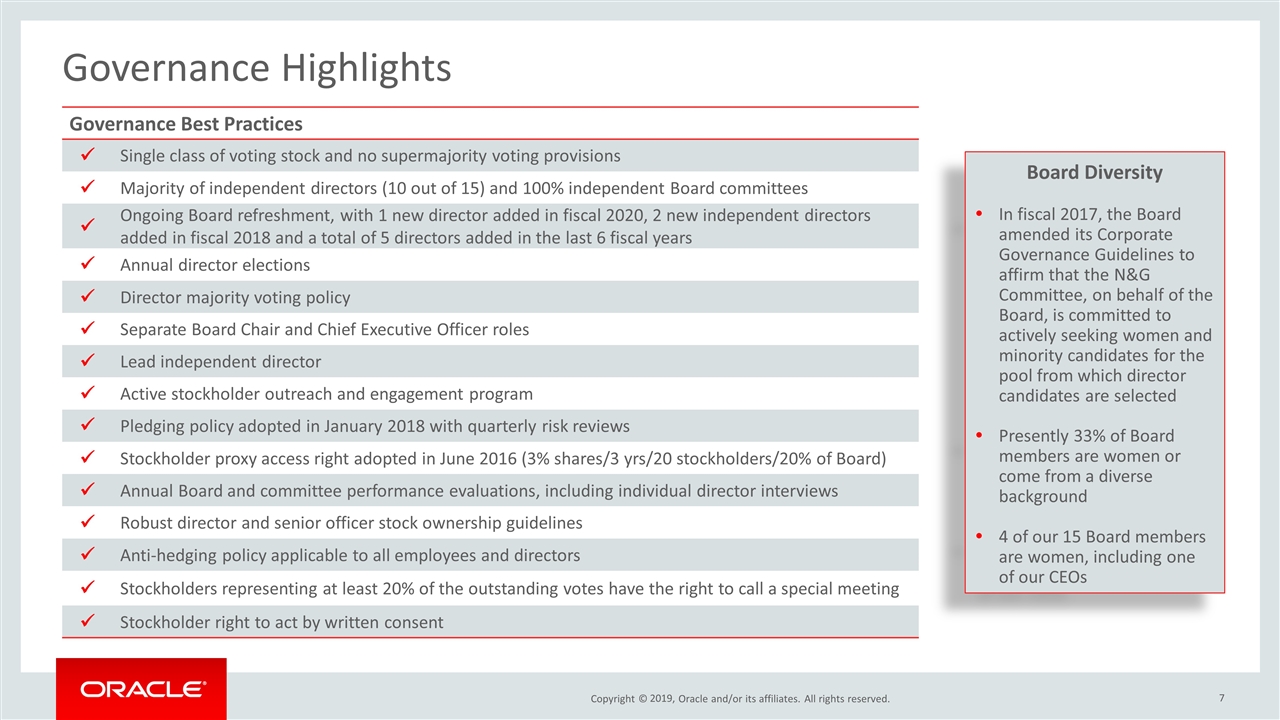

Governance Highlights 2019, Governance Best Practices ü Single class of voting stock and no supermajority voting provisions ü Majority of independent directors (10 out of 15) and 100% independent Board committees ü Ongoing Board refreshment, with 1 new director added in fiscal 2020, 2 new independent directors added in fiscal 2018 and a total of 5 directors added in the last 6 fiscal years ü Annual director elections ü Director majority voting policy ü Separate Board Chair and Chief Executive Officer roles ü Lead independent director ü Active stockholder outreach and engagement program ü Pledging policy adopted in January 2018 with quarterly risk reviews ü Stockholder proxy access right adopted in June 2016 (3% shares/3 yrs/20 stockholders/20% of Board) ü Annual Board and committee performance evaluations, including individual director interviews ü Robust director and senior officer stock ownership guidelines ü Anti-hedging policy applicable to all employees and directors ü Stockholders representing at least 20% of the outstanding votes have the right to call a special meeting ü Stockholder right to act by written consent Board Diversity In fiscal 2017, the Board amended its Corporate Governance Guidelines to affirm that the N&G Committee, on behalf of the Board, is committed to actively seeking women and minority candidates for the pool from which director candidates are selected Presently 33% of Board members are women or come from a diverse background 4 of our 15 Board members are women, including one of our CEOs

Statements in this presentation relating to Oracle’s future plans, expectations, beliefs, intentions and prospects are “forward-looking statements” and are subject to material risks and uncertainties. A detailed discussion of these factors and other risks that affect our business is contained in our SEC filings, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Copies of these filings are available on the SEC’s website (www.sec.gov), on Oracle’s Investor Relations website (www.oracle.com/investor) or by contacting Oracle Corporation’s Investor Relations Department at (650) 506-4073. All information set forth in this presentation is current as of July 31, 2019. Oracle undertakes no duty to update any statement in light of new information or future events. Safe Harbor Statement 2019,