Form 8-K Elevate Credit, Inc. For: Jul 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 29, 2019

____________________________________________________________________

ELEVATE CREDIT, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________________

Delaware | 001-37680 | 46-4714474 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

4150 International Plaza, Suite 300

Fort Worth, Texas 76109

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code (817) 928-1500

Not Applicable

(Former name or former address, if changed since last report.)

____________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 2.02 | Results of Operations and Financial Condition. |

On July 29, 2019, Elevate Credit, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended June 30, 2019. The full text of the press release, along with the slide presentation to be used during the earnings call on July 29, 2019, are furnished herewith as Exhibits 99.1 and 99.2, respectively.

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Chief Executive Officer

On July 25, 2019, the Board of Directors of the Company accepted the resignation of Kenneth E. Rees as Chief Executive Officer of the Company, with such resignation to be effective on July 31, 2019. Mr. Rees will remain a director of the Company but has resigned as Chairman of the Board of Directors. Also on July 25, 2019, Mr. Rees and Elevate Credit Service, LLC (“ECS”), a wholly owned subsidiary of the Company, entered into a resignation and release of claims agreement, which, among other matters, provides for a severance payment to Mr. Rees equal to $1,260,000, a bonus payment to Mr. Rees equal to $315,000, and the payment to Mr. Rees of a net amount equal to twenty-four times the monthly premiums that would be payable to maintain certain health benefits for Mr. Rees and his eligible dependents, and revises the definition of “Competing Business” under Mr. Rees’ employment agreements with ECS to provide that such term shall not include any (i) business(es) involving loan or credit products that are offered, marketed or sold on terms that are less than sixty percent (60%) effective annual percentage rate or (ii) other work that ECS agrees is not encompassed by the term Competing Business, which agreement by ECS shall not be unreasonably withheld. The foregoing description of the resignation and release of claims agreement does not purport to be complete and is subject to, and qualified in its entirety by the full text of the resignation and release of claims agreement, a copy of which will be filed as an exhibit to the Company’s quarterly report on Form 10-Q for the quarterly period ended June 30, 2019.

Appointment of Chairman of the Board

On July 25, 2019, the Board of Directors of the Company appointed Saundra Schrock as Chairman of the Board of Directors. Ms. Schrock has been a member of the Board of Directors since May 2016 and is the Chairman of the Compensation Committee and a member of the Risk Committee. Ms. Schrock brings to Elevate more than 35 years of experience in consumer financial services and advises on various regulatory and consumer lending issues. Ms. Schrock spent over twenty years at JPMorgan Chase where she successfully managed over 3,000 bank branches and 30,000 employees, as well as their Consumer Lending Division. Since her time at JPMorgan Chase, Ms. Schrock has focused on executive coaching and leadership development most currently serving as the Chief Executive Officer and founder of Mindful Planet, LLC, a mobile learning company that focuses on leadership content development for individuals and companies.

Appointment of Interim Chief Executive Officer

Effective July 31, 2019, Jason Harvison, age 43, who is currently also the Company’s Chief Operating Officer, will assume the role of Interim Chief Executive Officer. The Board of Directors of the Company approved a bonus of $10,000 per month for Mr. Harvison until a permanent Chief Executive Officer for the Company is selected.

Mr. Harvison has served as the Company’s Chief Operating Officer since 2014. He was a member of the Board of Directors from 2014 to January 2018 and a member of the Risk Committee through July 2016. Mr. Harvison served as the Company’s Chief Financial Officer from May 2014 to December 2014, as well as the Chief Product Officer from May 2014 to October 2014. He joined Think Finance (“TFI”) as Senior Vice President in 2003 where he was first promoted to Executive Vice President in 2011 and then to Chief Product Officer in 2013. He served as the Chief Product Officer until 2014 when he joined Elevate Credit, Inc. Mr. Harvison continued to serve on the Board of Directors of TFI from 2003 until August 21, 2015. Prior to joining TFI, Mr. Harvison served as the Assistant Vice President at Guaranty Bank.

Mr. Harvison was not appointed pursuant to any arrangement or understanding between Mr. Harvison and any other person. There are no family relationships between Mr. Harvison and any director or executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer. Neither the Company nor any of its subsidiaries has entered into any transactions with Mr. Harvison described in Item 404(a) of Regulation S-K.

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit No. | Description |

99.1 | |

99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Elevate Credit, Inc. | |||

Date: | July 29, 2019 | By: | /s/ Christopher Lutes |

Christopher Lutes | |||

Chief Financial Officer | |||

ELEVATE CREDIT ANNOUNCES SECOND QUARTER 2019 RESULTS

Elevate Credit announces strong second quarter earnings growth

Names Jason Harvison as Interim CEO

FORT WORTH, TX - July 29, 2019 - Elevate Credit, Inc. (NYSE: ELVT) (“Elevate” or the “Company”), a leading tech-enabled provider of innovative and responsible online credit solutions for non-prime consumers, today announced results for the second quarter ended June 30, 2019. The Company grew year-over-year net income by approximately 87%, primarily due to improved credit quality and lower customer acquisition costs. Additionally, the Company announced the resignation of CEO Ken Rees. Jason Harvison has been named as interim CEO, and Saundra Schrock as Chairman of the Board of Directors. Ken Rees will remain on the Elevate Board.

“Elevate continues to deliver strong earnings growth as a result of new underwriting models and strategies that have significantly reduced both fraud and credit losses” said outgoing CEO Ken Rees. “We remain on track to double net income for the second straight year. On a personal note, I have decided now is a good time to step aside as CEO. I am very proud to have led Elevate during this period of growth and transformation alongside Jason Harvison and the rest of the incredible leadership team. I look forward to continuing to serve on the Elevate Board of Directors.”

“On behalf of the Board and the Company, I want to thank Ken for his contributions to Elevate’s success,” said Saundra Schrock, Chairman of the Board. “I am confident the leadership transition will be seamless. The world-class leadership at Elevate, led by interim CEO Jason Harvison, is well-positioned to achieve even greater levels of earnings growth and shareholder value.”

“I am honored to have the opportunity to lead Elevate and build on the successes of the past few years as a public company,” said interim CEO Jason Harvison. “Thus far in 2019, we have delivered excellent performance with net income significantly higher than all of 2018. In the second half of the year, we intend to continue our focus on building a strong foundation for measured growth, further improving credit quality, and delivering value to our shareholders.”

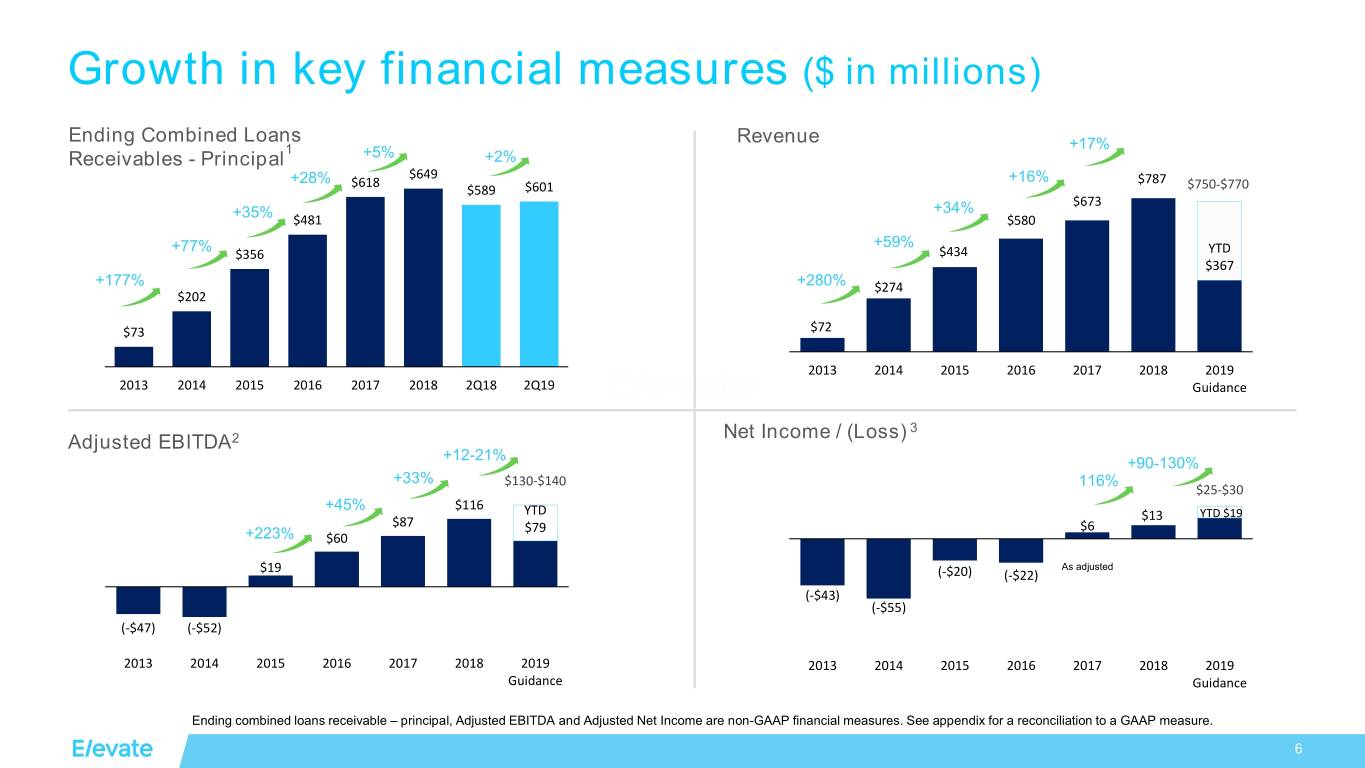

Second Quarter 2019 Financial Highlights1

• | Net income: Net income for the three months ended June 30, 2019 totaled $5.8 million, up $2.7 million, or 87.1%, compared to $3.1 million in the second quarter of 2018. Fully diluted earnings per share for the second quarter of 2019 was $0.13, an increase from $0.07 per fully diluted share a year ago. |

• | Revenue: Revenues decreased 3.6% for the second quarter of 2019 totaling $177.8 million compared to $184.4 million for the second quarter of 2018 due to a decline in the effective APR of the combined loans receivable. Revenues less net charge-offs totaled $98.2 million for the second quarter of 2019, an increase of 6.0% from $92.6 million in the second quarter of 2018. |

__________________________

1 Adjusted EBITDA, Adjusted EBITDA margin, combined loans receivable - principal, combined loans receivable, and combined loan loss reserve are non-GAAP financial measures. These terms are defined elsewhere in this release. Please see the schedules appearing later in this release for reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

1

• | Combined loans receivable - principal: Combined loans receivable - principal totaled $601.2 million, an increase of $11.7 million, or 2.0%, from $589.5 million for the prior-year quarter. |

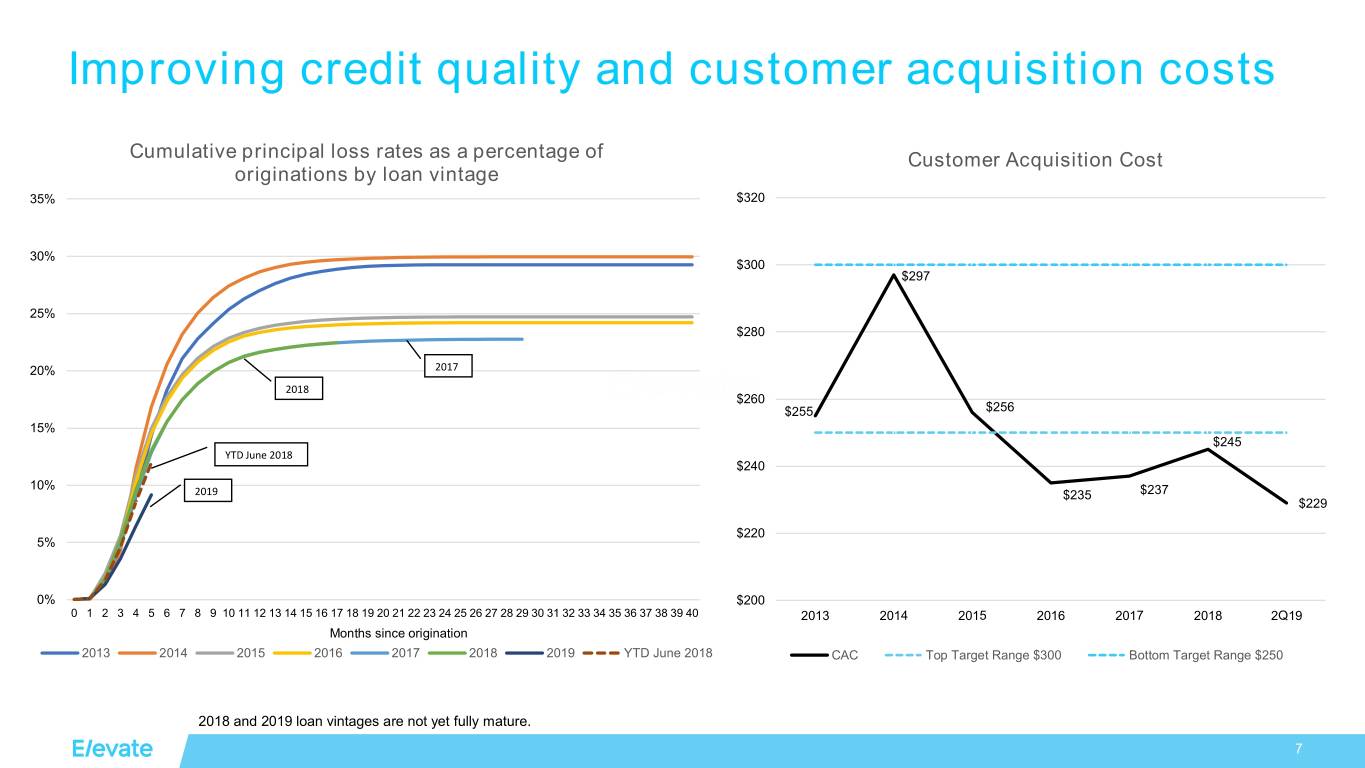

• | Improving credit quality: The ending combined loan loss reserve, as a percentage of combined loans receivable, was 12.3%, lower than 12.9% reported for the prior-year period due to an improvement in credit quality and the continued maturation of the loan portfolio. |

• | Customer acquisition cost: The average customer acquisition cost was $229 in the second quarter of 2019, which is lower than the targeted range of $250-$300 and lower than $260 for the prior-year quarter. The total number of new customer loans decreased from approximately 85,000 in the second quarter of 2018 to 71,000 in the second quarter of 2019. |

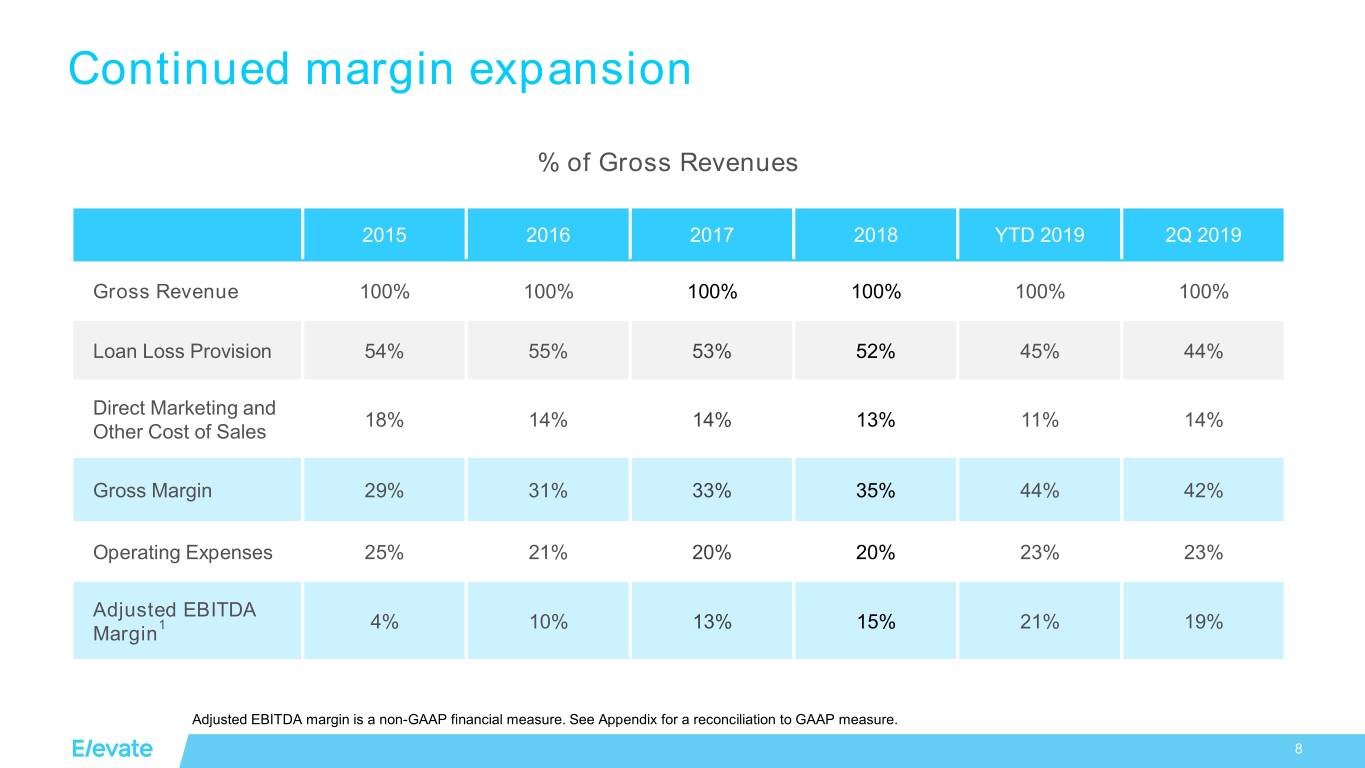

• | Adjusted EBITDA margin: Adjusted EBITDA increased to $33.9 million, up 18.0% from $28.7 million in the second quarter of 2018. The Adjusted EBITDA margin for the second quarter of 2019 was 19.0%, up from 15.6% in the prior-year quarter. |

Year-to-date 2019 Financial Highlights1

• | Net income: Net income for the six months ended June 30, 2019 totaled $19.1 million, up $6.5 million, or 51.6%, compared to $12.6 million in the first half of 2018. Fully diluted earnings per share was $0.43, an increase from $0.29 fully diluted per share a year ago. |

• | Revenue: Revenues decreased 2.8% for the first half of 2019 totaling $367.3 million compared to $377.9 million for the first half of 2018 due to a decline in the effective APR of the combined loans receivable. Revenues less net charge-offs totaled $183.7 million for the first six months of 2019, down slightly from $184.1 million for the first six months of 2018. |

• | Customer acquisition cost: The average customer acquisition cost was $226 in the first half of 2019, which is lower than the targeted range of $250-$300 and lower than $276 for the first half of 2018. The total number of new customer loans decreased from approximately 155,000 in the first half of 2018 to 121,000 in the first half of 2019. |

• | Adjusted EBITDA margin: Adjusted EBITDA increased to $78.5 million, up 19.6% from $65.7 million in the first half of 2018. The Adjusted EBITDA margin for the first half of 2019 was 21.4%, up from 17.4% in the prior-year. |

Liquidity and Capital Resources

The Company repaid $17.0 million in subordinated debt early during the second quarter of 2019. As previously disclosed in a press release issued on February 11, 2019, the Company announced amendments to the credit facilities for its four products with Victory Park Capital.

Additionally, the Company's Board of Directors authorized a share repurchase program providing for the repurchase of up to $10 million of our common stock through July 31, 2024. Repurchases will be made in accordance with applicable securities laws from time-to-time in the open market and/or in privately negotiated transactions at our discretion, subject to market conditions and other factors. The stock buyback plan does not require the purchase of any minimum number of shares and may be implemented, modified, suspended or discontinued in whole or in part at any time without further notice. Any repurchased shares will be available for use in connection with equity plans and for other corporate purposes.

__________________________

1 Adjusted EBITDA, Adjusted EBITDA margin, combined loans receivable - principal and combined loans receivable are non-GAAP financial measures. These terms are defined elsewhere in this release. Please see the schedules appearing later in this release for reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

2

Financial Outlook

The Company is revising the full year 2019 revenue guidance down while leaving the net income, diluted earnings per share and Adjusted EBITDA guidance unchanged. For the full year 2019, the Company expects total revenue of $750 million to $770 million, net income of $25 million to $30 million, or $0.55 to $0.65 in diluted earnings per share, and Adjusted EBITDA of $130 million to $140 million.

Conference Call

The Company will host a conference call to discuss its second quarter 2019 financial results on Monday, July 29th at 4:00pm Central Time / 5:00pm Eastern Time. Interested parties may access the conference call live over the phone by dialing 1-877-407-0792 (domestic) or 1-201-689-8263 (international) and requesting the Elevate Credit Second Quarter 2019 Earnings Conference Call. Participants are asked to dial in a few minutes prior to the call to register for the event. The conference call will also be webcast live through Elevate’s website at http://www.elevate.com/investors.

An audio replay of the conference call will be available approximately three hours after the conference call until 11:59 pm ET on August 12, 2019, and can be accessed by dialing 1-844-512-2921 (domestic) or 1-412-317-6671 (international), and providing the passcode 13692053, or by accessing Elevate’s website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as "may," "will," "might," "expect," "believe," "anticipate," "could," "would," "estimate," "continue," "pursue," or the negative thereof or comparable terminology, and may include (without limitation) information regarding the Company's expectations, goals or intentions regarding future performance. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning. The forward-looking statements include statements regarding: our expectations of future financial performance including our outlook for full fiscal year 2019 (including all statements under the heading "Financial Outlook"); our potential to drive long-term earnings growth; our expectation of continued strong earnings through 2019 and that we will see the added benefit from new credit models and reduced cost of capital; and the Company’s targeted customer acquisition cost range of $250-$300. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. These risks and uncertainties include, but are not limited to: the Company’s limited operating history in an evolving industry; new laws and regulations in the consumer lending industry in many jurisdictions that could restrict the consumer lending products and services the Company offers, impose additional compliance costs on the Company, render the Company’s current operations unprofitable or even prohibit the Company’s current operations; scrutiny by regulators and payment processors of certain online lenders’ access to the Automated Clearing House system to disburse and collect loan proceeds and repayments; a lack of sufficient debt financing at acceptable prices or disruptions in the credit markets; the impact of competition in our industry and innovation by our competitors; our ability to prevent security breaches, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service loans; and other risks related to litigation, compliance and regulation. Additional factors that could cause actual results to differ are discussed under the heading "Risk Factors" and in other sections of the Company's most recent Annual Report on Form 10-K, and in the Company's other current and periodic reports filed from time to time with the SEC. All forward-looking statements in this press release are made as of the date hereof, based on information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement.

3

About Elevate

Elevate (NYSE: ELVT), together with its bank partners, has originated $7.4 billion in non-prime credit to more than 2.3 million non-prime consumers to date and has saved its customers more than $5.6 billion versus the cost of payday loans. Its responsible, tech-enabled online credit solutions provide immediate relief to customers today and help them build a brighter financial future. The company is committed to rewarding borrowers’ good financial behavior with features like interest rates that can go down over time, free financial training and free credit monitoring. Elevate’s suite of groundbreaking credit products includes RISE, Elastic, Sunny and Today Card. For more information, please visit http://www.elevate.com.

Investor Relations:

Solebury Trout

Sloan Bohlen, (817) 928-1646

or

Media Inquiries:

Vested

Ishviene Arora, (917) 765-8720

4

Elevate Credit, Inc. and Subsidiaries

Condensed Consolidated Income Statements

(Unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

(Dollars in thousands, except share and per share amounts) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Revenues | $ | 177,760 | $ | 184,377 | $ | 367,264 | $ | 377,914 | ||||||||

Cost of sales: | ||||||||||||||||

Provision for loan losses | 78,025 | 88,598 | 165,456 | 180,740 | ||||||||||||

Direct marketing costs | 16,194 | 22,180 | 27,348 | 42,875 | ||||||||||||

Other cost of sales | 8,562 | 6,566 | 13,622 | 12,895 | ||||||||||||

Total cost of sales | 102,781 | 117,344 | 206,426 | 236,510 | ||||||||||||

Gross profit | 74,979 | 67,033 | 160,838 | 141,404 | ||||||||||||

Operating expenses: | ||||||||||||||||

Compensation and benefits | 25,638 | 23,380 | 51,348 | 45,807 | ||||||||||||

Professional services | 8,860 | 8,374 | 18,559 | 16,686 | ||||||||||||

Selling and marketing | 2,205 | 2,403 | 4,051 | 5,355 | ||||||||||||

Occupancy and equipment | 5,179 | 4,630 | 10,231 | 8,749 | ||||||||||||

Depreciation and amortization | 4,324 | 2,962 | 8,590 | 5,677 | ||||||||||||

Other | 1,710 | 1,568 | 3,017 | 2,785 | ||||||||||||

Total operating expenses | 47,916 | 43,317 | 95,796 | 85,059 | ||||||||||||

Operating income | 27,063 | 23,716 | 65,042 | 56,345 | ||||||||||||

Other expense: | ||||||||||||||||

Net interest expense | (17,947 | ) | (19,263 | ) | (37,166 | ) | (38,476 | ) | ||||||||

Foreign currency transaction loss | (710 | ) | (1,231 | ) | (97 | ) | (475 | ) | ||||||||

Non-operating loss | — | — | — | (38 | ) | |||||||||||

Total other expense | (18,657 | ) | (20,494 | ) | (37,263 | ) | (38,989 | ) | ||||||||

Income before taxes | 8,406 | 3,222 | 27,779 | 17,356 | ||||||||||||

Income tax expense | 2,634 | 94 | 8,649 | 4,745 | ||||||||||||

Net income | $ | 5,772 | $ | 3,128 | $ | 19,130 | $ | 12,611 | ||||||||

Basic income per share | $ | 0.13 | $ | 0.07 | $ | 0.44 | $ | 0.30 | ||||||||

Diluted income per share | $ | 0.13 | $ | 0.07 | $ | 0.43 | $ | 0.29 | ||||||||

Basic weighted average shares outstanding | 43,681,159 | 42,561,403 | 43,514,862 | 42,386,660 | ||||||||||||

Diluted weighted average shares outstanding | 44,291,816 | 44,239,007 | 44,142,947 | 43,937,066 | ||||||||||||

5

Elevate Credit, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(Dollars in thousands) | June 30, 2019 | December 31, 2018 | ||||||

ASSETS | ||||||||

Cash and cash equivalents* | $ | 63,399 | $ | 58,313 | ||||

Restricted cash | 2,491 | 2,591 | ||||||

Loans receivable, net of allowance for loan losses of $75,896 and $91,608, respectively* | 535,405 | 561,694 | ||||||

Prepaid expenses and other assets* | 11,990 | 11,418 | ||||||

Operating lease right of use assets | 11,858 | — | ||||||

Receivable from CSO lenders | 10,246 | 16,183 | ||||||

Receivable from payment processors* | 27,129 | 21,716 | ||||||

Deferred tax assets, net | 13,605 | 21,628 | ||||||

Property and equipment, net | 47,629 | 41,579 | ||||||

Goodwill | 16,027 | 16,027 | ||||||

Intangible assets, net | 1,462 | 1,712 | ||||||

Derivative assets, net* | — | 412 | ||||||

Total assets | $ | 741,241 | $ | 753,273 | ||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

Accounts payable and accrued liabilities* | $ | 41,445 | $ | 44,950 | ||||

Operating lease liabilities | 16,160 | — | ||||||

State and other taxes payable | 1,222 | 681 | ||||||

Deferred revenue* | 15,246 | 28,261 | ||||||

Notes payable, net* | 527,237 | 562,590 | ||||||

Total liabilities | 601,310 | 636,482 | ||||||

COMMITMENTS, CONTINGENCIES AND GUARANTEES | ||||||||

STOCKHOLDERS’ EQUITY | ||||||||

Preferred stock | — | — | ||||||

Common stock | 18 | 18 | ||||||

Additional paid-in capital | 187,521 | 183,244 | ||||||

Accumulated deficit | (47,395 | ) | (66,525 | ) | ||||

Accumulated other comprehensive income (loss) | (213 | ) | 54 | |||||

Total stockholders’ equity | 139,931 | 116,791 | ||||||

Total liabilities and stockholders’ equity | $ | 741,241 | $ | 753,273 | ||||

* These balances include certain assets and liabilities of variable interest entities (“VIEs”) that can only be used to settle the liabilities of that respective VIE. All assets of the Company are pledged as security for the Company’s outstanding debt, including debt held by the VIEs.

6

Non-GAAP Financial Measures

This press release and the attached financial tables contain certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA margin, combined loans receivable - principal, combined loans receivable and combined loan loss reserve.

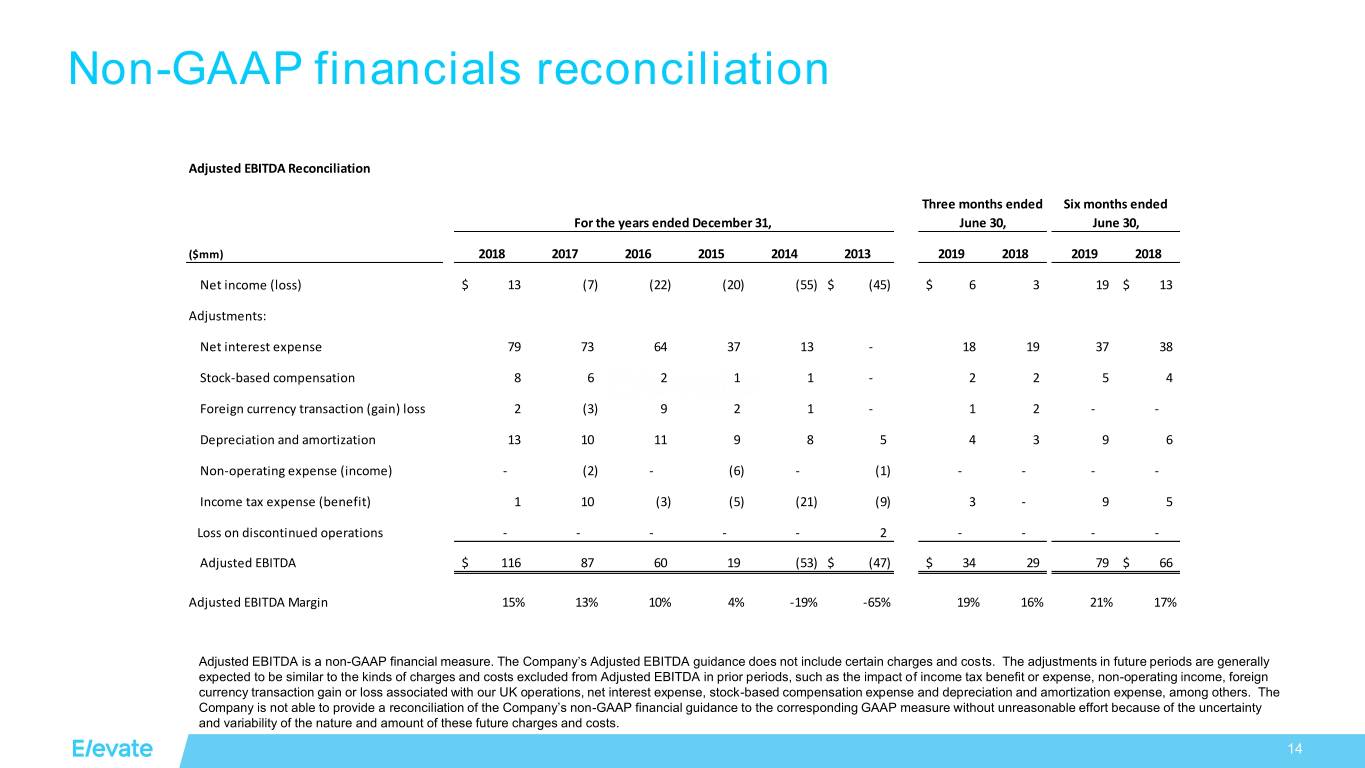

Adjusted EBITDA and Adjusted EBITDA margin

In addition to net income determined in accordance with GAAP, Elevate uses certain non-GAAP measures such as “Adjusted EBITDA” and "Adjusted EBITDA margin" in assessing its operating performance. Elevate believes these non-GAAP measures are appropriate measures to be used in evaluating the performance of its business.

Elevate defines Adjusted EBITDA as net income excluding the impact of income tax expense, non-operating loss, foreign currency transaction loss associated with our UK operations, net interest expense, share-based compensation expense and depreciation and amortization expense. Elevate defines Adjusted EBITDA margin as Adjusted EBITDA divided by revenue.

Management believes that Adjusted EBITDA and Adjusted EBITDA margin are useful supplemental measures to assist management and investors in analyzing the operating performance of the business and provide greater transparency into the results of operations of our core business. Management uses this non-GAAP financial measure frequently in its decision-making because it provides supplemental information that facilitates internal comparisons to the historical operating performance of prior periods and gives an additional indication of Elevate’s core operating performance. Elevate includes this non-GAAP financial measure in its earnings announcement in order to provide transparency to its investors and enable investors to better compare its operating performance with the operating performance of its competitors.

Adjusted EBITDA and Adjusted EBITDA margin should not be considered as alternatives to net income or any other performance measure derived in accordance with GAAP. Management's use of Adjusted EBITDA and Adjusted EBITDA margin has limitations as an analytical tool, and investors should not consider it in isolation or as a substitute for analysis of the Company's results as reported under GAAP. Some of these limitations are:

• | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect expected cash capital expenditure requirements for such replacements or for new capital assets; |

• | Adjusted EBITDA does not reflect changes in, or cash requirements for, the Company's working capital needs; and |

• | Adjusted EBITDA does not reflect interest associated with notes payable used for funding customer loans, for other corporate purposes or tax payments that may represent a reduction in cash available to the Company. |

Additionally, Elevate’s definition of Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior periods. The Company is not able to provide a reconciliation of the Company’s non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs.

7

The following table presents a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin to Elevate’s net income for the three and six months ended June 30, 2019 and 2018:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

(Dollars in thousands) | 2019 | 2018 | 2019 | 2018 | ||||||||||||

Net income | $ | 5,772 | $ | 3,128 | $ | 19,130 | $ | 12,611 | ||||||||

Adjustments: | ||||||||||||||||

Net interest expense | 17,947 | 19,263 | 37,166 | 38,476 | ||||||||||||

Share-based compensation | 2,476 | 2,010 | 4,911 | 3,647 | ||||||||||||

Foreign currency transaction loss | 710 | 1,231 | 97 | 475 | ||||||||||||

Depreciation and amortization | 4,324 | 2,962 | 8,590 | 5,677 | ||||||||||||

Non-operating loss | — | — | — | 38 | ||||||||||||

Income tax expense | 2,634 | 94 | 8,649 | 4,745 | ||||||||||||

Adjusted EBITDA | $ | 33,863 | $ | 28,688 | $ | 78,543 | $ | 65,669 | ||||||||

Adjusted EBITDA margin | 19.0 | % | 15.6 | % | 21.4 | % | 17.4 | % | ||||||||

8

Supplemental Schedules

9

Revenue by Product

Three Months Ended June 30, 2019 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US)(1) | Elastic (US)(2) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Average combined loans receivable – principal(3) | $ | 287,073 | $ | 243,691 | $ | 530,764 | $ | 50,173 | $ | 580,937 | ||||||||||

Effective APR | 126 | % | 98 | % | 113 | % | 219 | % | 122 | % | ||||||||||

Finance charges | $ | 90,384 | $ | 59,317 | $ | 149,701 | $ | 27,330 | $ | 177,031 | ||||||||||

Other | 387 | 288 | 675 | 54 | 729 | |||||||||||||||

Total revenue | $ | 90,771 | $ | 59,605 | $ | 150,376 | $ | 27,384 | $ | 177,760 | ||||||||||

Three Months Ended June 30, 2018 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US)(1) | Elastic (US) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Average combined loans receivable – principal(3) | $ | 277,281 | $ | 244,583 | $ | 521,864 | $ | 52,092 | $ | 573,956 | ||||||||||

Effective APR | 137 | % | 97 | % | 118 | % | 226 | % | 128 | % | ||||||||||

Finance charges | $ | 94,716 | $ | 59,298 | $ | 154,014 | $ | 29,380 | $ | 183,394 | ||||||||||

Other | 435 | 460 | 895 | 88 | 983 | |||||||||||||||

Total revenue | $ | 95,151 | $ | 59,758 | $ | 154,909 | $ | 29,468 | $ | 184,377 | ||||||||||

(1) | Includes loans originated by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

(2) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

(3) | Average combined loans receivable - principal is calculated using daily principal balances. See the "Combined Loan Information" section for a reconciliation of this non-GAAP measure to the most comparable GAAP measure. |

10

Revenue by Product, Continued

Six Months Ended June 30, 2019 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US)(1) | Elastic (US)(2) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Average combined loans receivable – principal(3) | $ | 288,941 | $ | 254,980 | $ | 543,921 | $ | 51,254 | $ | 595,174 | ||||||||||

Effective APR | 129 | % | 98 | % | 115 | % | 223 | % | 124 | % | ||||||||||

Finance charges | $ | 185,269 | $ | 124,050 | $ | 309,319 | $ | 56,701 | $ | 366,020 | ||||||||||

Other | 738 | 384 | 1,122 | 122 | 1,244 | |||||||||||||||

Total revenue | $ | 186,007 | $ | 124,434 | $ | 310,441 | $ | 56,823 | $ | 367,264 | ||||||||||

Six Months Ended June 30, 2018 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US)(1) | Elastic (US) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Average combined loans receivable – principal(3) | $ | 289,565 | $ | 244,980 | $ | 534,545 | $ | 51,970 | $ | 586,515 | ||||||||||

Effective APR | 138 | % | 97 | % | 119 | % | 231 | % | 129 | % | ||||||||||

Finance charges | $ | 197,924 | $ | 118,201 | $ | 316,125 | $ | 59,527 | $ | 375,652 | ||||||||||

Other | 1,265 | 825 | 2,090 | 172 | 2,262 | |||||||||||||||

Total revenue | $ | 199,189 | $ | 119,026 | $ | 318,215 | $ | 59,699 | $ | 377,914 | ||||||||||

(1) | Includes loans originated by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

(2) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

(3) | Average combined loans receivable - principal is calculated using daily principal balances. See the "Combined Loan Information" section for a reconciliation of this non-GAAP measure to the most comparable GAAP measure. |

11

Loan Loss Reserve by Product

Three Months Ended June 30, 2019 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US) | Elastic (US)(1) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Combined loan loss reserve(2): | ||||||||||||||||||||

Beginning balance | $ | 39,350 | $ | 28,341 | $ | 67,691 | $ | 12,008 | $ | 79,699 | ||||||||||

Net charge-offs | (40,970 | ) | (27,130 | ) | (68,100 | ) | (11,509 | ) | (79,609 | ) | ||||||||||

Provision for loan losses | 43,013 | 25,268 | 68,281 | 9,744 | 78,025 | |||||||||||||||

Effect of foreign currency | — | — | — | (236 | ) | (236 | ) | |||||||||||||

Ending balance | $ | 41,393 | $ | 26,479 | $ | 67,872 | $ | 10,007 | $ | 77,879 | ||||||||||

Combined loans receivable(2)(3) | $ | 324,620 | $ | 258,200 | $ | 582,820 | $ | 51,852 | $ | 634,672 | ||||||||||

Combined loan loss reserve as a percentage of ending combined loans receivable | 13 | % | 10 | % | 12 | % | 19 | % | 12 | % | ||||||||||

Net charge-offs as a percentage of revenues | 45 | % | 46 | % | 45 | % | 42 | % | 45 | % | ||||||||||

Provision for loan losses as a percentage of revenues | 47 | % | 42 | % | 45 | % | 36 | % | 44 | % | ||||||||||

Three Months Ended June 30, 2018 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US) | Elastic (US) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Combined loan loss reserve(2): | ||||||||||||||||||||

Beginning balance | $ | 44,209 | $ | 28,098 | $ | 72,307 | $ | 11,939 | $ | 84,246 | ||||||||||

Net charge-offs | (49,494 | ) | (28,490 | ) | (77,984 | ) | (13,772 | ) | (91,756 | ) | ||||||||||

Provision for loan losses | 46,081 | 29,786 | 75,867 | 12,731 | 88,598 | |||||||||||||||

Effect of foreign currency | — | — | — | (557 | ) | (557 | ) | |||||||||||||

Ending balance | $ | 40,796 | $ | 29,394 | $ | 70,190 | $ | 10,341 | $ | 80,531 | ||||||||||

Combined loans receivable(2)(3) | $ | 305,674 | $ | 265,959 | $ | 571,633 | $ | 52,128 | $ | 623,761 | ||||||||||

Combined loan loss reserve as a percentage of ending combined loans receivable | 13 | % | 11 | % | 12 | % | 20 | % | 13 | % | ||||||||||

Net charge-offs as a percentage of revenues | 52 | % | 48 | % | 50 | % | 47 | % | 50 | % | ||||||||||

Provision for loan losses as a percentage of revenues | 48 | % | 50 | % | 49 | % | 43 | % | 48 | % | ||||||||||

(1) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

(2 | Not a financial measure prepared in accordance with GAAP. See the "Combined Loan Information" section for a reconciliation of this non-GAAP measure to the most comparable GAAP measure. |

(3) | Includes loans originated by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

12

Loan Loss Reserve by Product, Continued

Six Months Ended June 30, 2019 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US) | Elastic (US)(1) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Combined loan loss reserve(2): | ||||||||||||||||||||

Beginning balance | $ | 50,597 | $ | 36,050 | $ | 86,647 | $ | 9,405 | $ | 96,052 | ||||||||||

Net charge-offs | (98,010 | ) | (64,401 | ) | (162,411 | ) | (21,183 | ) | (183,594 | ) | ||||||||||

Provision for loan losses | 88,806 | 54,830 | 143,636 | 21,820 | 165,456 | |||||||||||||||

Effect of foreign currency | — | — | — | (35 | ) | (35 | ) | |||||||||||||

Ending balance | $ | 41,393 | $ | 26,479 | $ | 67,872 | $ | 10,007 | $ | 77,879 | ||||||||||

Combined loans receivable(2)(3) | $ | 324,620 | $ | 258,200 | $ | 582,820 | $ | 51,852 | $ | 634,672 | ||||||||||

Combined loan loss reserve as a percentage of ending combined loans receivable | 13 | % | 10 | % | 12 | % | 19 | % | 12 | % | ||||||||||

Net charge-offs as a percentage of revenues | 53 | % | 52 | % | 52 | % | 37 | % | 50 | % | ||||||||||

Provision for loan losses as a percentage of revenues | 48 | % | 44 | % | 46 | % | 38 | % | 45 | % | ||||||||||

Six Months Ended June 30, 2018 | ||||||||||||||||||||

(Dollars in thousands) | Rise (US) | Elastic (US) | Total Domestic | Sunny (UK) | Total | |||||||||||||||

Combined loan loss reserve(2): | ||||||||||||||||||||

Beginning balance | $ | 55,867 | $ | 28,870 | $ | 84,737 | $ | 9,052 | $ | 93,789 | ||||||||||

Net charge-offs | (112,941 | ) | (58,175 | ) | (171,116 | ) | (22,682 | ) | (193,798 | ) | ||||||||||

Provision for loan losses | 97,870 | 58,699 | 156,569 | 24,171 | 180,740 | |||||||||||||||

Effect of foreign currency | — | — | — | (200 | ) | (200 | ) | |||||||||||||

Ending balance | $ | 40,796 | $ | 29,394 | $ | 70,190 | $ | 10,341 | $ | 80,531 | ||||||||||

Combined loans receivable(2)(3) | $ | 305,674 | $ | 265,959 | $ | 571,633 | $ | 52,128 | $ | 623,761 | ||||||||||

Combined loan loss reserve as a percentage of ending combined loans receivable | 13 | % | 11 | % | 12 | % | 20 | % | 13 | % | ||||||||||

Net charge-offs as a percentage of revenues | 57 | % | 49 | % | 54 | % | 38 | % | 51 | % | ||||||||||

Provision for loan losses as a percentage of revenues | 49 | % | 49 | % | 49 | % | 40 | % | 48 | % | ||||||||||

(1) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

(2) | Not a financial measure prepared in accordance with GAAP. See the "Combined Loan Information" section for a reconciliation of this non-GAAP measure to the most comparable GAAP measure. |

(3) | Includes loans originated by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

13

Customer Loan Data by Product

Three Months Ended June 30, 2019 | ||||||||||||||||||||

Rise (US) | Elastic (US)(1) | Total Domestic | Sunny (UK) | Total | ||||||||||||||||

Beginning number of combined loans outstanding | 125,021 | 145,760 | 270,781 | 93,898 | 364,679 | |||||||||||||||

New customer loans originated | 30,177 | 13,826 | 44,003 | 26,647 | 70,650 | |||||||||||||||

Former customer loans originated | 18,850 | 18 | 18,868 | — | 18,868 | |||||||||||||||

Attrition | (38,277 | ) | (17,043 | ) | (55,320 | ) | (27,659 | ) | (82,979 | ) | ||||||||||

Ending number of combined loans outstanding | 135,771 | 142,561 | 278,332 | 92,886 | 371,218 | |||||||||||||||

Customer acquisition cost | $ | 243 | $ | 271 | $ | 252 | $ | 192 | $ | 229 | ||||||||||

Average customer loan balance | $ | 2,253 | $ | 1,738 | $ | 1,989 | $ | 512 | $ | 1,620 | ||||||||||

Three Months Ended June 30, 2018 | ||||||||||||||||||||

Rise (US) | Elastic (US) | Total Domestic | Sunny (UK) | Total | ||||||||||||||||

Beginning number of combined loans outstanding | 127,263 | 138,555 | 265,818 | 86,791 | 352,609 | |||||||||||||||

New customer loans originated | 27,149 | 26,305 | 53,454 | 31,692 | 85,146 | |||||||||||||||

Former customer loans originated | 22,816 | 127 | 22,943 | — | 22,943 | |||||||||||||||

Attrition | (46,331 | ) | (15,847 | ) | (62,178 | ) | (25,928 | ) | (88,106 | ) | ||||||||||

Ending number of combined loans outstanding | 130,897 | 149,140 | 280,037 | 92,555 | 372,592 | |||||||||||||||

Customer acquisition cost | $ | 307 | $ | 234 | $ | 271 | $ | 243 | $ | 260 | ||||||||||

Average customer loan balance | $ | 2,187 | $ | 1,711 | $ | 1,934 | $ | 519 | $ | 1,582 | ||||||||||

(1) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

14

Customer Loan Data by Product, Continued

Six Months Ended June 30, 2019 | ||||||||||||||||||||

Rise (US) | Elastic (US)(1) | Total Domestic | Sunny (UK) | Total | ||||||||||||||||

Beginning number of combined loans outstanding | 142,758 | 166,397 | 309,155 | 89,449 | 398,604 | |||||||||||||||

New customer loans originated | 47,542 | 18,664 | 66,206 | 54,920 | 121,126 | |||||||||||||||

Former customer loans originated | 36,641 | 27 | 36,668 | — | 36,668 | |||||||||||||||

Attrition | (91,170 | ) | (42,527 | ) | (133,697 | ) | (51,483 | ) | (185,180 | ) | ||||||||||

Ending number of combined loans outstanding | 135,771 | 142,561 | 278,332 | 92,886 | 371,218 | |||||||||||||||

Customer acquisition cost | $ | 276 | $ | 277 | $ | 276 | $ | 165 | $ | 226 | ||||||||||

Six Months Ended June 30, 2018 | ||||||||||||||||||||

Rise (US) | Elastic (US) | Total Domestic | Sunny (UK) | Total | ||||||||||||||||

Beginning number of combined loans outstanding | 140,790 | 140,672 | 281,462 | 80,510 | 361,972 | |||||||||||||||

New customer loans originated | 49,414 | 47,185 | 96,599 | 58,682 | 155,281 | |||||||||||||||

Former customer loans originated | 38,199 | 216 | 38,415 | — | 38,415 | |||||||||||||||

Attrition | (97,506 | ) | (38,933 | ) | (136,439 | ) | (46,637 | ) | (183,076 | ) | ||||||||||

Ending number of combined loans outstanding | 130,897 | 149,140 | 280,037 | 92,555 | 372,592 | |||||||||||||||

Customer acquisition cost | $ | 318 | $ | 252 | $ | 286 | $ | 260 | $ | 276 | ||||||||||

(1) | Includes immaterial balances related to the Today Card, which expanded its test launch in November 2018. |

15

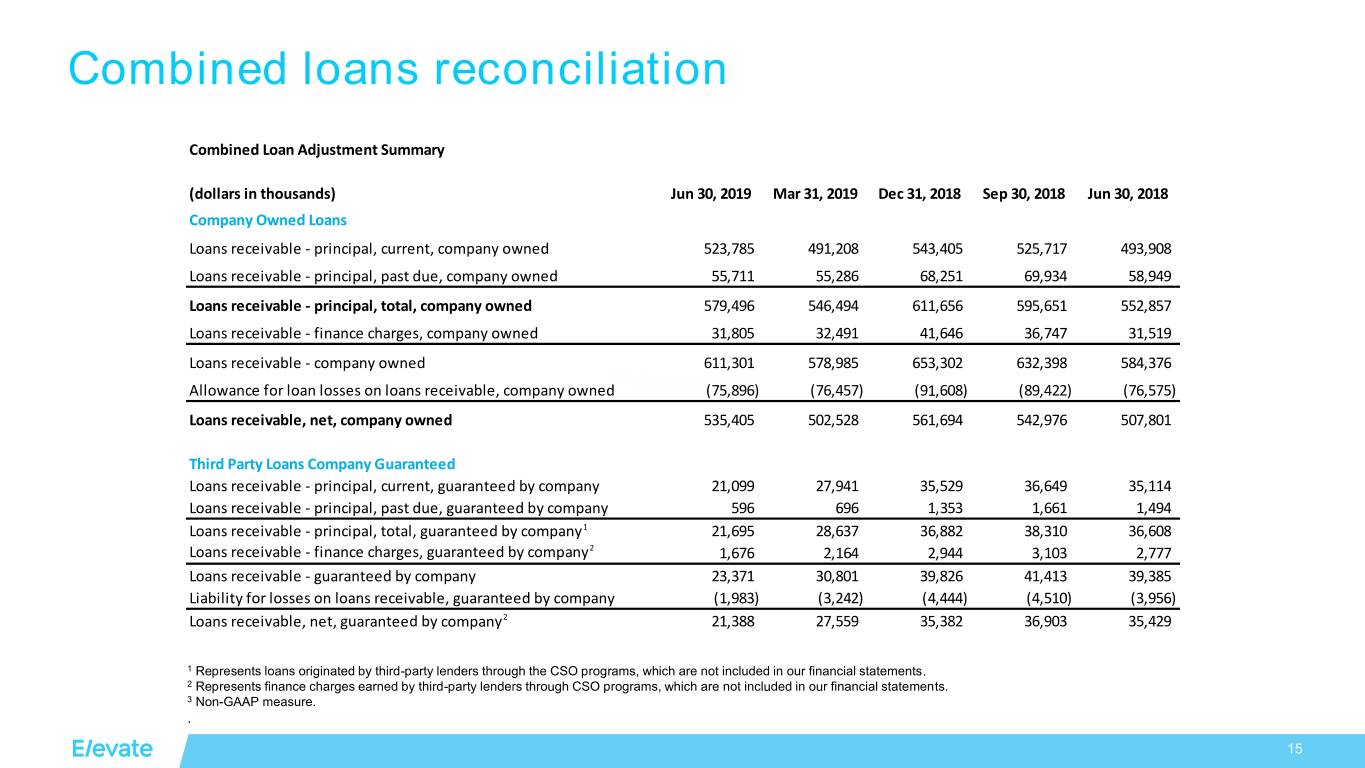

Combined Loan Information

The Elastic line of credit product is originated by a third party lender, Republic Bank, which initially provides all of the funding for that product. Republic Bank retains 10% of the balances of all of the loans originated and sells a 90% loan participation in the Elastic lines of credit to a third party SPV, Elastic SPV, Ltd. Elevate is required to consolidate Elastic SPV, Ltd. as a variable interest entity under GAAP and the condensed consolidated financial statements include revenue, losses and loans receivable related to the 90% of Elastic lines of credit originated by Republic Bank and sold to Elastic SPV, Ltd.

Beginning in the fourth quarter of 2018, the Company also licenses its Rise installment loan brand to a third party lender, FinWise Bank, which originates Rise installment loans in nineteen states. FinWise Bank initially provides all of the funding and retains 5% of the balances of all of the loans originated and sells a 95% loan participation in those Rise installment loans to a third party SPV, EF SPV, Ltd. Elevate is required to consolidate EF SPV, Ltd. as a variable interest entity under GAAP and the condensed consolidated financial statements include revenue, losses and loans receivable related to the 95% of Rise installment loans originated by FinWise Bank and sold to EF SPV, Ltd.

Elevate defines combined loans receivable - principal as loans owned by the Company plus loans originated and owned by third-party lenders pursuant to our CSO programs. In Texas, the Company does not make Rise loans directly, but rather acts as a Credit Services Organization (which is also known as a Credit Access Business), or, “CSO,” and the loans are originated by an unaffiliated third party. There are no new loan originations in Ohio commencing in April 2019, but the Company continues to have obligations as the CSO until the wind-down of this portfolio is complete. Elevate defines combined loan loss reserve as the loan loss reserve for loans owned by the Company plus the loan loss reserve for loans originated and owned by third-party lenders and guaranteed by the Company. The information presented in the tables below on a combined basis are non-GAAP measures based on a combined portfolio of loans, which includes the total amount of outstanding loans receivable that the Company owns and that are on the Company's condensed consolidated balance sheets plus outstanding loans receivable originated and owned by third parties that the Company guarantees pursuant to CSO programs in which the Company participates.

The Company believes these non-GAAP measures provide investors with important information needed to evaluate the magnitude of potential loan losses and the opportunity for revenue performance of the combined loan portfolio on an aggregate basis. The Company also believes that the comparison of the combined amounts from period to period is more meaningful than comparing only the amounts reflected on the Company's condensed consolidated balance sheets since both revenues and cost of sales as reflected in the Company's condensed consolidated financial statements are impacted by the aggregate amount of loans the Company owns and those CSO loans the Company guarantees.

The Company's use of total combined loans and fees receivable has limitations as an analytical tool, and investors should not consider it in isolation or as a substitute for analysis of the Company's results as reported under GAAP. Some of these limitations are:

• | Rise CSO loans are originated and owned by a third party lender; and |

• | Rise CSO loans are funded by a third party lender and are not part of the VPC Facility. |

As of each of the period ends indicated, the following table presents a reconciliation of:

• | Loans receivable, net, Company owned (which reconciles to the Company's condensed consolidated balance sheets included elsewhere in this press release); |

• | Loans receivable, net, guaranteed by the Company; |

• | Combined loans receivable (which the Company uses as a non-GAAP measure); and |

• | Combined loan loss reserve (which the Company uses as a non-GAAP measure). |

16

2018 | 2019 | |||||||||||||||||||||||

(Dollars in thousands) | March 31 | June 30 | September 30 | December 31 | March 31 | June 30 | ||||||||||||||||||

Company Owned Loans: | ||||||||||||||||||||||||

Loans receivable – principal, current, company owned | $ | 471,996 | $ | 493,908 | $ | 525,717 | $ | 543,405 | $ | 491,208 | $ | 523,785 | ||||||||||||

Loans receivable – principal, past due, company owned | 60,876 | 58,949 | 69,934 | 68,251 | 55,286 | 55,711 | ||||||||||||||||||

Loans receivable – principal, total, company owned | 532,872 | 552,857 | 595,651 | 611,656 | 546,494 | 579,496 | ||||||||||||||||||

Loans receivable – finance charges, company owned | 31,181 | 31,519 | 36,747 | 41,646 | 32,491 | 31,805 | ||||||||||||||||||

Loans receivable – company owned | 564,053 | 584,376 | 632,398 | 653,302 | 578,985 | 611,301 | ||||||||||||||||||

Allowance for loan losses on loans receivable, company owned | (80,497 | ) | (76,575 | ) | (89,422 | ) | (91,608 | ) | (76,457 | ) | (75,896 | ) | ||||||||||||

Loans receivable, net, company owned | $ | 483,556 | $ | 507,801 | $ | 542,976 | $ | 561,694 | $ | 502,528 | $ | 535,405 | ||||||||||||

Third Party Loans Guaranteed by the Company: | ||||||||||||||||||||||||

Loans receivable – principal, current, guaranteed by company | $ | 33,469 | $ | 35,114 | $ | 36,649 | $ | 35,529 | $ | 27,941 | $ | 21,099 | ||||||||||||

Loans receivable – principal, past due, guaranteed by company | 1,123 | 1,494 | 1,661 | 1,353 | 696 | 596 | ||||||||||||||||||

Loans receivable – principal, total, guaranteed by company(1) | 34,592 | 36,608 | 38,310 | 36,882 | 28,637 | 21,695 | ||||||||||||||||||

Loans receivable – finance charges, guaranteed by company(2) | 2,612 | 2,777 | 3,103 | 2,944 | 2,164 | 1,676 | ||||||||||||||||||

Loans receivable – guaranteed by company | 37,204 | 39,385 | 41,413 | 39,826 | 30,801 | 23,371 | ||||||||||||||||||

Liability for losses on loans receivable, guaranteed by company | (3,749 | ) | (3,956 | ) | (4,510 | ) | (4,444 | ) | (3,242 | ) | (1,983 | ) | ||||||||||||

Loans receivable, net, guaranteed by company(3) | $ | 33,455 | $ | 35,429 | $ | 36,903 | $ | 35,382 | $ | 27,559 | $ | 21,388 | ||||||||||||

Combined Loans Receivable(3): | ||||||||||||||||||||||||

Combined loans receivable – principal, current | $ | 505,465 | $ | 529,022 | $ | 562,366 | $ | 578,934 | $ | 519,149 | $ | 544,884 | ||||||||||||

Combined loans receivable – principal, past due | 61,999 | 60,443 | 71,595 | 69,604 | 55,982 | 56,307 | ||||||||||||||||||

Combined loans receivable – principal | 567,464 | 589,465 | 633,961 | 648,538 | 575,131 | 601,191 | ||||||||||||||||||

Combined loans receivable – finance charges | 33,793 | 34,296 | 39,850 | 44,590 | 34,655 | 33,481 | ||||||||||||||||||

Combined loans receivable | $ | 601,257 | $ | 623,761 | $ | 673,811 | $ | 693,128 | $ | 609,786 | $ | 634,672 | ||||||||||||

Combined Loan Loss Reserve(3): | ||||||||||||||||||||||||

Allowance for loan losses on loans receivable, company owned | $ | (80,497 | ) | $ | (76,575 | ) | $ | (89,422 | ) | $ | (91,608 | ) | $ | (76,457 | ) | $ | (75,896 | ) | ||||||

Liability for losses on loans receivable, guaranteed by company | (3,749 | ) | (3,956 | ) | (4,510 | ) | (4,444 | ) | (3,242 | ) | (1,983 | ) | ||||||||||||

Combined loan loss reserve | $ | (84,246 | ) | $ | (80,531 | ) | $ | (93,932 | ) | $ | (96,052 | ) | $ | (79,699 | ) | $ | (77,879 | ) | ||||||

Combined loans receivable – principal, past due(3) | $ | 61,999 | $ | 60,443 | $ | 71,595 | $ | 69,604 | $ | 55,982 | $ | 56,307 | ||||||||||||

Combined loans receivable – principal(3) | 567,464 | 589,465 | 633,961 | 648,538 | 575,131 | 601,191 | ||||||||||||||||||

Percentage past due | 11 | % | 10 | % | 11 | % | 11 | % | 10 | % | 9 | % | ||||||||||||

Combined loan loss reserve as a percentage of combined loans receivable(3)(4) | 14 | % | 13 | % | 14 | % | 14 | % | 13 | % | 12 | % | ||||||||||||

Allowance for loan losses as a percentage of loans receivable – company owned | 14 | % | 13 | % | 14 | % | 14 | % | 13 | % | 12 | % | ||||||||||||

(1) | Represents loans originated by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

(2) | Represents finance charges earned by third-party lenders through the CSO programs, which are not included in the Company's condensed consolidated financial statements. |

(3) | Non-GAAP measure. |

(4) | Combined loan loss reserve as a percentage of combined loans receivable is determined using period-end balances. |

17

Second Quarter 2019 Earnings Call July 2019

Forward-Looking Statements This presentation and responses to various questions contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements present our current expectations and projections relating to our business, financial condition and results of operations, and do not refer to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning. The forward-looking statements include statements regarding: our future financial performance including our outlook for full fiscal year 2019; our expectation that our new credit models will be rolled out in 2019 and that our partner credit models and strategies will be rolled out in 2019; our perspectives on 2019, including our expectations regarding revenue, growth rate of revenue, net charge-offs, gross margin, operating expenses, operating margins, Adjusted EBITDA, net income, loan loss provision, direct marketing and other cost of sales and Adjusted EBITDA margin; our expectations regarding regulatory trends; our expectations regarding the cumulative loss rate as a percentage of originations for the 2018 vintage; our growth strategies and our ability to effectively manage that growth; anticipated key marketing and underwriting initiatives; new and expanded products like a lower-priced installment product in the UK; our expectations regarding the future expansion of the states in which our products are offered; the cost of customer acquisition, new customer originations, the efficacy and cost of our marketing efforts, our plan to maintain our UK portfolio balances through the second half of 2019 in advance of regulatory clarity on complaints; expanded marketing channels and new and growing marketing partnerships; continued growth and investment in data science and analytics; and additional bank partnerships. Forward‐looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. These risks and uncertainties include, but are not limited to: the Company’s limited operating history in an evolving industry; new laws and regulations in the consumer lending industry in many jurisdictions that could restrict the consumer lending products and services the Company offers, impose additional compliance costs on the Company, render the Company’s current operations unprofitable or even prohibit the Company’s current operations; scrutiny by regulators and payment processors of certain online lenders’ access to the Automated Clearing House system to disburse and collect loan proceeds and repayments; a lack of sufficient debt financing at acceptable prices or disruptions in the credit markets; the impact of competition in our industry and innovation by our competitors; our ability to prevent security breaches, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service loans; customer complaints or negative public perception could harm our business and other risks related to litigation, compliance and regulation. Additional factors that could cause actual results to differ are discussed under the heading "Risk Factors" and in other sections of the most recent Form 10-Q and in the Company's other current and periodic reports filed from time to time with the SEC. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements regarding risks and uncertainties that are included in our public communications. You should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties. Neither we nor any of our respective agents, employees or advisors intend or have any duty or obligation to supplement, amend, update or revise any of the forward- looking statements contained in this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. The information and opinions contained in this presentation are provided as of the date of this presentation and are subject to change without notice. This presentation has not been approved by any regulatory or supervisory agency. See Appendix for additional information and definitions. 2

Elevate is reinventing non-prime credit with online products that provide financial relief today, and help people build a brighter financial future. So far, we’ve originated $7.4 billion to 2.3 million customers1 and saved them more than $5.6 billion over payday loans2 33

Second Quarter 2019 Highlights • 87% YoY increase in Net Income • Strong credit quality – Near-record low past due loan balances – Annual 2019 charge-off curve is best in history • Low CAC of $229 – 12% lower than Q2 2018 • Continued Adjusted EBITDA margin expansion1 • Revenue and loans receivable-principal approximately flat with Q2 2018 4

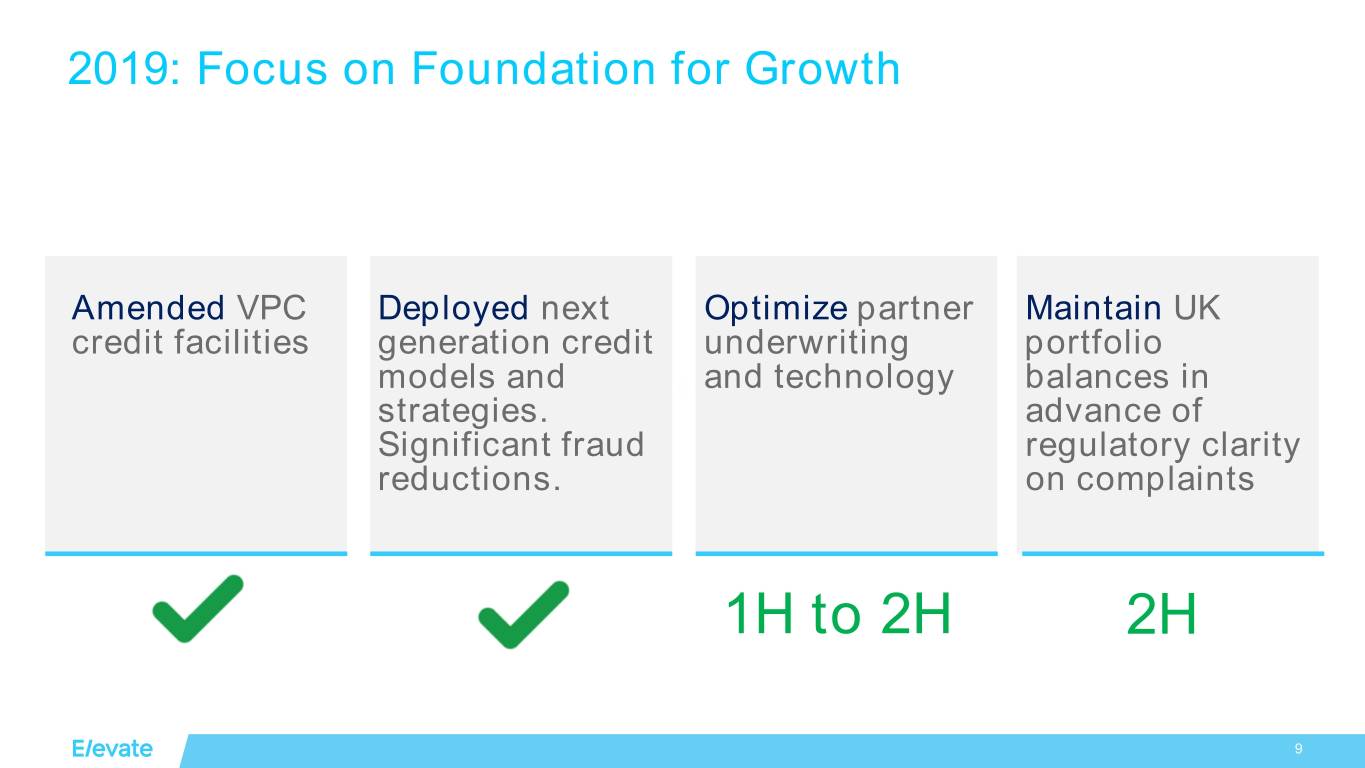

Business Update Strategy priority 2019 Impact • Deployment of enhanced credit models complete Dedication to strong credit • YTD net charge-offs as a % of revenues are down to 45% from 50% a year ago • Driven by lower charge-off’s, lower CAC, and cost of capital reduction Margin expansion • Adjusted EBITDA1, Net Income and EPS guidance unchanged despite lowered revenue growth • New approach to measured growth in conjunction with confirming data from our credit models Measured growth • Addressable market opportunity remains significant 5

Growth in key financial measures ($ in millions) Ending Combined Loans Revenue 1 +17% Receivables - Principal +5% +2% $649 +28% $618 +16% $787 $589 $601 $750-$770 $673 +35% +34% $481 $580 +77% +59% $356 $434 YTD $367 +177% +280% $274 $202 $73 $72 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2Q18 2Q19 Guidance Net Income / (Loss) 3 Adjusted EBITDA2 +12-21% +90-130% +33% $130-$140 116% $25-$30 +45% $116 YTD $13 YTD $19 $87 $79 $6 +223% $60 $19 As adjusted (-$20) (-$22) (-$43) (-$55) (-$47) (-$52) 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2019 Guidance Guidance Ending combined loans receivable – principal, Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures. See appendix for a reconciliation to a GAAP measure. 6

Improving credit quality and customer acquisition costs Cumulative principal loss rates as a percentage of Customer Acquisition Cost originations by loan vintage 35% $320 30% $300 $297 25% $280 20% 2017 2018 $260 $255 $256 15% $245 YTD June 2018 $240 10% 2019 $235 $237 $229 $220 5% 0% $200 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 2013 2014 2015 2016 2017 2018 2Q19 Months since origination 2013 2014 2015 2016 2017 2018 2019 YTD June 2018 CAC Top Target Range $300 Bottom Target Range $250 2018 and 2019 loan vintages are not yet fully mature. 7

Continued margin expansion % of Gross Revenues 2015 2016 2017 2018 YTD 2019 2Q 2019 Gross Revenue 100% 100% 100% 100% 100% 100% Loan Loss Provision 54% 55% 53% 52% 45% 44% Direct Marketing and 18% 14% 14% 13% 11% 14% Other Cost of Sales Gross Margin 29% 31% 33% 35% 44% 42% Operating Expenses 25% 21% 20% 20% 23% 23% Adjusted EBITDA 1 4% 10% 13% 15% 21% 19% Margin Adjusted EBITDA margin is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure. 8

2019: Focus on Foundation for Growth Amended VPC Deployed next Optimize partner Maintain UK credit facilities generation credit underwriting portfolio models and and technology balances in strategies. advance of Significant fraud regulatory clarity reductions. on complaints 1H to 2H 2H 9

Regulatory update • California – AB539 continues to move through CA legislature, which would limit interest rates on loans from $2,500 to $10,000 – Elevate can offer alternatives, without CA rate cap provision via multiple bank partners and products 10

We believe everyone deserves a lift. 1111

Appendix 12

Footnotes Page 3: 1 Originations and customers from 2002-June 2019, attributable to the combined current and predecessor direct and branded products. 2 For the period from 2013 to June 30, 2019. Based on the average effective APR of 124% for the six months ended June 30, 2019. This estimate, which has not been independently confirmed, is based on our internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or the "CFPB.“ Page 4: 1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income (loss), adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility, EF SPV Facility, and ESPV Facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; non-operating income (loss); share-based compensation expense and income tax expense (benefit). See the Appendix for a reconciliation to GAAP net income (loss). Page 5: 1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income (loss), adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility, EF SPV Facility, and ESPV Facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; non-operating income (loss); share-based compensation expense and income tax expense (benefit). See the Appendix for a reconciliation to GAAP net income (loss). Page 6: 1 Ending combined loans receivable - principal is a non-GAAP financial measure. See appendix for a reconciliation to a GAAP measure. 2 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income (loss), adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility, EF SPV Facility, and ESPV Facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; loss on discontinued operations, non-operating income (loss); share-based compensation expense and income tax expense (benefit). See the Appendix for a reconciliation to GAAP net income (loss). 3 2017 adjusted net income of $5.5 million is not a financial measures prepared in accordance with GAAP. Adjusted net income for 2017 represents our $6.9 million net loss for the year ended December 31, 2017, adjusted to exclude the impact of $12.5 million in tax expense incurred during the fourth quarter of 2017 due to the enactment of the Tax Cuts and Jobs Act. Page 8: 1 Adjusted EBITDA margin is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Adjusted EBITDA represents our net income (loss), adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility, EF SPV Facility, and ESPV Facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; loss on discontinued operations; non-operating income (loss); share-based compensation expense and income tax expense (benefit). See the Appendix for a reconciliation to GAAP net income (loss). 13

Non-GAAP financials reconciliation Adjusted EBITDA Reconciliation Three months ended Six months ended For the years ended December 31, June 30, June 30, ($mm) 2018 2017 2016 2015 2014 2013 2019 2018 2019 2018 Net income (loss) $ 13 (7) (22) (20) (55) $ (45) $ 6 3 19 $ 13 Adjustments: Net interest expense 79 73 64 37 13 - 18 19 37 38 Stock-based compensation 8 6 2 1 1 - 2 2 5 4 Foreign currency transaction (gain) loss 2 (3) 9 2 1 - 1 2 - - Depreciation and amortization 13 10 11 9 8 5 4 3 9 6 Non-operating expense (income) - (2) - (6) - (1) - - - - Income tax expense (benefit) 1 10 (3) (5) (21) (9) 3 - 9 5 Loss on discontinued operations - - - - - 2 - - - - Adjusted EBITDA $ 116 87 60 19 (53) $ (47) $ 34 29 79 $ 66 Adjusted EBITDA Margin 15% 13% 10% 4% -19% -65% 19% 16% 21% 17% Adjusted EBITDA is a non-GAAP financial measure. The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior periods, such as the impact of income tax benefit or expense, non-operating income, foreign currency transaction gain or loss associated with our UK operations, net interest expense, stock-based compensation expense and depreciation and amortization expense, among others. The Company is not able to provide a reconciliation of the Company’s non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. 14

Combined loans reconciliation Combined Loan Adjustment Summary (dollars in thousands) Jun 30, 2019 Mar 31, 2019 Dec 31, 2018 Sep 30, 2018 Jun 30, 2018 Company Owned Loans Loans receivable - principal, current, company owned 523,785 491,208 543,405 525,717 493,908 Loans receivable - principal, past due, company owned 55,711 55,286 68,251 69,934 58,949 Loans receivable - principal, total, company owned 579,496 546,494 611,656 595,651 552,857 Loans receivable - finance charges, company owned 31,805 32,491 41,646 36,747 31,519 Loans receivable - company owned 611,301 578,985 653,302 632,398 584,376 Allowance for loan losses on loans receivable, company owned (75,896) (76,457) (91,608) (89,422) (76,575) Loans receivable, net, company owned 535,405 502,528 561,694 542,976 507,801 Third Party Loans Company Guaranteed Loans receivable - principal, current, guaranteed by company 21,099 27,941 35,529 36,649 35,114 Loans receivable - principal, past due, guaranteed by company 596 696 1,353 1,661 1,494 Loans receivable - principal, total, guaranteed by company1 21,695 28,637 36,882 38,310 36,608 Loans receivable - finance charges, guaranteed by company2 1,676 2,164 2,944 3,103 2,777 Loans receivable - guaranteed by company 23,371 30,801 39,826 41,413 39,385 Liability for losses on loans receivable, guaranteed by company (1,983) (3,242) (4,444) (4,510) (3,956) Loans receivable, net, guaranteed by company2 21,388 27,559 35,382 36,903 35,429 1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial statements. 2 Represents finance charges earned by third-party lenders through CSO programs, which are not included in our financial statements. 3 Non-GAAP measure. . 15

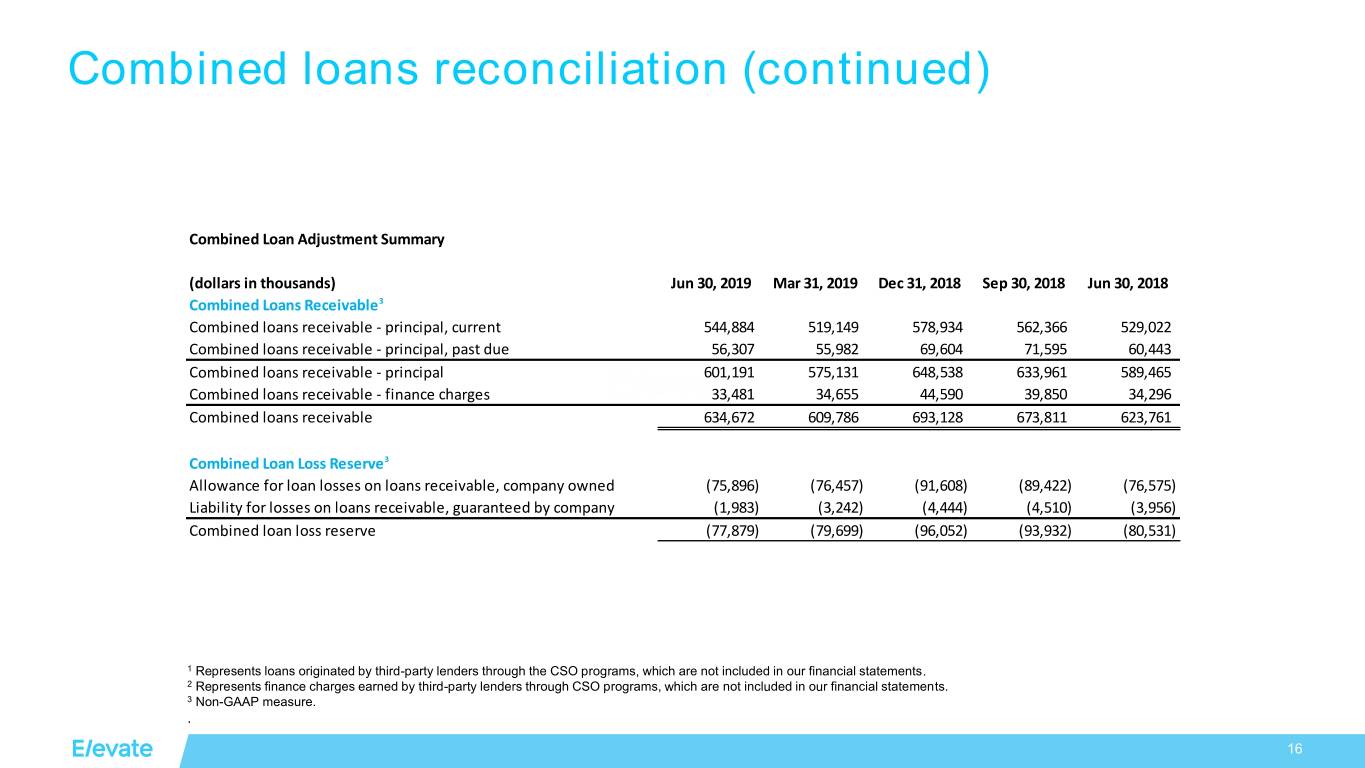

Combined loans reconciliation (continued) Combined Loan Adjustment Summary (dollars in thousands) Jun 30, 2019 Mar 31, 2019 Dec 31, 2018 Sep 30, 2018 Jun 30, 2018 Combined Loans Receivable3 Combined loans receivable - principal, current 544,884 519,149 578,934 562,366 529,022 Combined loans receivable - principal, past due 56,307 55,982 69,604 71,595 60,443 Combined loans receivable - principal 601,191 575,131 648,538 633,961 589,465 Combined loans receivable - finance charges 33,481 34,655 44,590 39,850 34,296 Combined loans receivable 634,672 609,786 693,128 673,811 623,761 Combined Loan Loss Reserve3 Allowance for loan losses on loans receivable, company owned (75,896) (76,457) (91,608) (89,422) (76,575) Liability for losses on loans receivable, guaranteed by company (1,983) (3,242) (4,444) (4,510) (3,956) Combined loan loss reserve (77,879) (79,699) (96,052) (93,932) (80,531) 1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial statements. 2 Represents finance charges earned by third-party lenders through CSO programs, which are not included in our financial statements. 3 Non-GAAP measure. . 16

© 2017 Elevate. All Rights Reserved.