Form PRE 14A LOGITECH INTERNATIONAL For: Sep 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X] | ||

Filed by a Party other than the Registrant [ ] | ||

Check the appropriate box: | ||

[X] | Preliminary Proxy Statement | |

[ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

[ ] | Definitive Proxy Statement | |

[ ] | Definitive Additional Materials | |

[ ] | Soliciting Material Pursuant to §240.14a-12 | |

Logitech International S.A. | ||

(Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||||

[X] | No fee required. | |||

[ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

1) | Title of each class of securities to which transaction applies: | |||

2) | Aggregate number of securities to which transaction applies: | |||

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

4) | Proposed maximum aggregate value of transaction: | |||

5) | Total fee paid: | |||

[ ] | Fee paid previously with preliminary materials. | |||

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

1) | Amount Previously Paid: | |||

2) | Form, Schedule or Registration Statement No.: | |||

3) | Filing Party: | |||

4) | Date Filed: | |||

| July 23, 2019 To our shareholders: You are cordially invited to attend Logitech’s 2019 Annual General Meeting. The meeting will be held on Wednesday, September 4, 2019 at 2:00 p.m. at the SwissTech Convention Center, EPFL, in Lausanne, Switzerland. Enclosed is the Invitation and Proxy Statement for the meeting, which includes an agenda and discussion of the items to be voted on at the meeting, instructions on how you can exercise your voting rights, information concerning Logitech’s compensation of its Board members and executive officers, and other relevant information. Whether or not you plan to attend the Annual General Meeting, your vote is important. Thank you for your continued support of Logitech.  Guerrino De Luca Chairman of the Board | ||

LOGITECH INTERNATIONAL S.A.

Invitation to the Annual General Meeting

Wednesday, September 4, 2019

2:00 p.m. (registration starts at 1:30 p.m.)

SwissTech Convention Center, EPFL – Lausanne, Switzerland

Invitation to the Annual General Meeting

Wednesday, September 4, 2019

2:00 p.m. (registration starts at 1:30 p.m.)

SwissTech Convention Center, EPFL – Lausanne, Switzerland

*****

AGENDA

A. | Reports |

Report on Operations for the fiscal year ended March 31, 2019

B. | Proposals |

1. | Approval of the Annual Report, the consolidated financial statements and the statutory financial statements of Logitech International S.A. for fiscal year 2019 |

2. | Advisory vote to approve executive compensation |

3. | Appropriation of retained earnings and declaration of dividend |

4. | Release of the Board of Directors and Executive Officers from liability for activities during fiscal year 2019 |

5. | Elections to the Board of Directors |

5.A. | Re-election of Dr. Patrick Aebischer |

5.B. | Re-election Ms. Wendy Becker |

5.C. | Re-election of Dr. Edouard Bugnion |

5.D. | Re-election of Mr. Bracken Darrell |

5.E. | Re-election of Mr. Guerrino De Luca |

5.F. | Re-election of Mr. Didier Hirsch |

5.G. | Re-election of Dr. Neil Hunt |

5.H. | Re-election of Ms. Marjorie Lao |

5.I. | Re-election of Ms. Neela Montgomery |

5.J. | Election of Mr. Guy Gecht |

5.K. | Election of Mr. Michael Polk |

6. | Election of the Chairperson of the Board |

7. | Elections to the Compensation Committee |

7.A. | Re-election of Dr. Edouard Bugnion |

7.B. | Re-election of Dr. Neil Hunt |

7.C. | Election of Mr. Michael Polk |

8. | Approval of Compensation for the Board of Directors for the 2019 to 2020 Board Year |

9. | Approval of Compensation for the Group Management Team for fiscal year 2021 |

10. | Re-election of KPMG AG as Logitech’s auditors and ratification of the appointment of KPMG LLP as Logitech’s independent registered public accounting firm for fiscal year 2020 |

11. | Re-election of Etude Regina Wenger & Sarah Keiser-Wüger as Independent Representative |

Apples, Switzerland, July 23, 2019

The Board of Directors

Questions and Answers about The Logitech 2019 Annual General Meeting |

General Information for All Shareholders

WHY AM I RECEIVING THIS “INVITATION AND PROXY STATEMENT”? | This document is designed to comply with both Swiss corporate law and U.S. proxy statement rules. Outside of the U.S. and Canada, this Invitation and Proxy Statement will be made available to registered shareholders with certain portions translated into French and German. We made copies of this Invitation and Proxy Statement available to shareholders beginning on July 23, 2019. The Response Coupon is requested on behalf of the Board of Directors of Logitech for use at Logitech’s Annual General Meeting. The meeting will be held on Wednesday, September 4, 2019 at 2:00 p.m. at the SwissTech Convention Center, EPFL, in Lausanne, Switzerland. | |

WHO IS ENTITLED TO VOTE AT THE MEETING? | Shareholders registered in the Share Register of Logitech International S.A. (including in the sub-register maintained by Logitech’s U.S. transfer agent, Computershare) on Thursday, August 29, 2019 have the right to vote. No shareholders will be entered in the Share Register between August 29, 2019 and the day following the meeting. As of June 30, 2019, there were 92,332,471 shares registered and entitled to vote out of a total of 166,464,628 Logitech shares outstanding. The actual number of registered shares that will be entitled to vote at the meeting will vary depending on how many more shares are registered, or deregistered, between June 30, 2019 and August 29, 2019. For information on the criteria for the determination of the U.S. and Canadian “street name” beneficial owners who may vote with respect to the meeting, please refer to “Further Information for U.S. and Canadian “Street Name” Beneficial Owners” below. | |

WHO IS A REGISTERED SHAREHOLDER? | If your shares are registered directly in your name with us in the Share Register of Logitech International S.A., or in our sub-register maintained by our U.S. transfer agent, Computershare, you are considered a registered shareholder, and this Invitation and Proxy Statement and related materials are being sent or made available to you by Logitech. | |

1

WHO IS A BENEFICIAL OWNER WITH SHARES REGISTERED IN THE NAME OF A CUSTODIAN, OR “STREET NAME” OWNER? | Shareholders that have not requested registration on our Share Register directly, and hold shares through a broker, trustee or nominee or other similar organization that is a registered shareholder, are beneficial owners of shares registered in the name of a custodian. If you hold your Logitech shares through a U.S. or Canadian broker, trustee or nominee or other similar organization (also called holding in “street name”), which is the typical practice of our shareholders in the U.S. and Canada, the organization holding your account is considered the registered shareholder for purposes of voting at the meeting, and this Invitation and Proxy Statement and related materials are being sent or made available to you by them. You have the right to direct that organization on how to vote the shares held in your account. | |

WHY IS IT IMPORTANT FOR ME TO VOTE? | Logitech is a public company and certain key decisions can only be made by shareholders. Whether or not you plan to attend, your vote is important so that your shares are represented. | |

HOW MANY REGISTERED SHARES MUST BE PRESENT OR REPRESENTED TO CONDUCT BUSINESS AT THE MEETING? | There is no quorum requirement for the meeting. Under Swiss law, public companies do not have specific quorum requirements for shareholder meetings, and our Articles of Incorporation do not otherwise provide for a quorum requirement. | |

WHERE ARE LOGITECH’S PRINCIPAL EXECUTIVE OFFICES? | Logitech’s principal executive office in Switzerland is at EPFL – Quartier de l’Innovation, Daniel Borel Innovation Center 1015 Lausanne, Switzerland, and our principal executive office in the United States is at 7700 Gateway Boulevard, Newark, California 94560. Logitech’s main telephone number in Switzerland is +41-(0)21-863-5111 and our main telephone number in the United States is +1-510-795-8500. | |

HOW CAN I OBTAIN LOGITECH’S PROXY STATEMENT, ANNUAL REPORT AND OTHER ANNUAL REPORTING MATERIALS? | A copy of our 2019 Annual Report to Shareholders, this Invitation and Proxy Statement and our Annual Report on Form 10-K for fiscal year 2019 filed with the U.S. Securities and Exchange Commission (the “SEC”) are available on our website at http://ir.logitech.com. Shareholders also may request free copies of these materials at our principal executive offices in Switzerland or the United States, at the addresses and phone numbers above. | |

WHERE CAN I FIND THE VOTING RESULTS OF THE MEETING? | We intend to announce voting results at the meeting and issue a press release promptly after the meeting. We will also file the results on a Current Report on Form 8-K with the SEC by Tuesday, September 10, 2019. A copy of the Form 8-K will be available on our website at http://ir.logitech.com. | |

2

IF I AM NOT A REGISTERED SHAREHOLDER, CAN I ATTEND AND VOTE AT THE MEETING? | You may not attend the meeting and vote your shares in person at the meeting unless you either become a registered shareholder by August 29, 2019 or you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. If you hold your shares through a non-U.S. or non-Canadian broker, trustee or nominee, you may become a registered shareholder by contacting our Share Registrar at Logitech International S.A., c/o Devigus Shareholder Services, Birkenstrasse 47, CH-6343 Rotkreuz, Switzerland, and following their registration instructions or, in certain countries, by requesting registration through the bank or brokerage through which you hold your shares. If you hold your shares through a U.S. or Canadian broker, trustee or nominee, you may become a registered shareholder by contacting your broker, trustee or nominee, and following their registration instructions. | |

Further Information for Registered Shareholders | ||

HOW CAN I VOTE IF I DO NOT PLAN TO ATTEND THE MEETING? | If you do not plan to attend the meeting, you may appoint the Independent Representative, Etude Regina Wenger & Sarah Keiser-Wüger , to represent you at the meeting. Please provide your voting instructions by marking the applicable boxes beside the agenda items on the Internet voting site for registered shareholders, gvmanager.ch/logitech for shareholders on the Swiss share register or www.proxyvote.com for shareholders on the U.S. share register, or on the Response Coupon or Proxy Card, as applicable. | |

SWISS SHARE REGISTER – INTERNET VOTING – Go to the Internet voting site gvmanager.ch/logitech and log in with your one-time code on the Response Coupon. Please use the menu item “Grant Procuration” and submit your instructions by clicking on the “Send” button. Your code is only valid once; it expires once you have submitted your voting or any other instructions and signed off the portal. As long as you remain signed in to the portal, you may change your voting instructions at your discretion. SWISS SHARE REGISTER – RESPONSE COUPON – Mark the box under Option 3 on the enclosed Response Coupon. Please sign, date and promptly mail your completed Response Coupon to Etude Regina Wenger & Sarah Keiser-Wüger using the appropriate enclosed postage-paid envelope. | ||

U.S. SHARE REGISTER – INTERNET VOTING – Go to the Internet voting site www.proxyvote.com and log in with your 16-digit voting control number printed in the box marked by the arrow on the Notice of Internet Availability of Proxy Materials that you received from us. Please follow the menus to select the Independent Representative, Etude Regina Wenger & Sarah Keiser-Wüger, to represent you at the meeting. U.S. SHARE REGISTER – PROXY CARD – If you have requested a Proxy Card, mark the box “Yes” on the Proxy Card to select the Independent Representative, Etude Regina Wenger & Sarah Keiser-Wüger, to represent you at the meeting. Please sign, date and promptly mail your completed Proxy Card to Broadridge using the enclosed postage-paid envelope. | ||

3

HOW CAN I ATTEND THE MEETING? | If you wish to attend the meeting, you will need to obtain an admission card. You may order your admission card on the Internet voting site for registered shareholders, www.gvmanager.ch/logitech for shareholders on the Swiss share register or www.proxyvote.com for shareholders on the U.S. share register, or on the Response Coupon or Proxy Card, as applicable, and we will send you an admission card for the meeting. If an admission card is not received by you prior to the meeting and you are a registered shareholder as of August 29, 2019, you may attend the meeting by presenting proof of identification at the meeting. | |

SWISS SHARE REGISTER – INTERNET VOTING – Go to the Internet voting site gvmanager.ch/logitech and log in with your one-time code on the Response Coupon. Please use the menu item “Order Admission Card”. Your code is only valid once; it expires as soon as you have ordered an admission card by clicking on the “Send” button or submitted any other instructions and signed off the portal. SWISS SHARE REGISTER – RESPONSE COUPON – Mark the box under Option 1 on the enclosed Response Coupon. Please send the completed, signed and dated Response Coupon to Logitech using the enclosed postage-paid envelope by Thursday, August 29, 2019. | ||

U.S. SHARE REGISTER – INTERNET VOTING – Go to the Internet voting site www.proxyvote.com and log in with your 16-digit voting control number printed in the box marked by the arrow on the Notice of Internet Availability of Proxy Materials that you received from us. Please follow the menus to indicate that you will personally attend the meeting. U.S. SHARE REGISTER – PROXY CARD – If you have requested a Proxy Card, mark the box “Yes” on the Proxy Card to indicate that you will personally attend the meeting. Please sign, date and promptly mail your completed Proxy Card to Broadridge using the enclosed postage-paid envelope by Thursday, August 29, 2019. | ||

CAN I HAVE ANOTHER PERSON REPRESENT ME AT THE MEETING? | Yes. If you would like someone other than the Independent Representative to represent you at the meeting, please mark Option 2 on the Response Coupon (for shareholders on the Swiss share register) or, if you requested a Proxy Card (for shareholders on the U.S. share register), mark the box on the Proxy Card to authorize the person you name on the reverse side of the Proxy Card. On either the Response Coupon or the Proxy Card, please provide the name and address of the person you want to represent you. Please return the completed, signed and dated Response Coupon to Logitech or Proxy Card to Broadridge, using the enclosed postage-paid envelope by August 29, 2019. We will send an admission card for the meeting to your representative. If the name and address instructions you provide are not clear, Logitech will send the admission card to you, and you must forward it to your representative. If you requested and received an admission card to attend the meeting, you can also authorize someone other than the Independent Representative to represent you at the meeting on the admission card and provide that signed, dated and completed admission card to your representative, together with your voting instructions. | |

4

CAN I SELL MY SHARES BEFORE THE MEETING IF I HAVE VOTED? | Logitech does not block the transfer of shares before the meeting. However, if you sell your Logitech shares before the meeting and Logitech’s Share Registrar is notified of the sale, your votes with those shares will not be counted. Any person who purchases shares after the Share Register closes on Thursday, August 29, 2019 will not be able to register them until the day after the meeting and so will not be able to vote the shares at the meeting. | |

IF I VOTE BY PROXY, CAN I CHANGE MY VOTE AFTER I HAVE VOTED? | You may change your vote by Internet or by mail through August 29, 2019. You may also change your vote by attending the meeting and voting in person. For shareholders on the Swiss share register, you may revoke your vote by requesting a new one-time code and providing new voting instructions at gvmanager.ch/logitech, or by requesting and submitting a new Response Coupon from our Swiss Share Register at Devigus Shareholder Services (by telephone at +41-41-798-48-33 or by e-mail at [email protected]). For shareholders on the U.S. share register, you may revoke your vote by providing new voting instructions at www.proxyvote.com, if you voted by Internet, or by requesting and submitting a new Proxy Card. Your attendance at the meeting will not automatically revoke your vote or Response Coupon or Proxy Card unless you vote again at the meeting or specifically request in writing that your prior voting instructions be revoked. | |

SWISS SHARE REGISTER – INTERNET VOTING – After you receive the new one-time code, go to the Internet voting site gvmanager.ch/logitech and log in. Please use the menu item “Grant Procuration”. Follow the directions on the site to complete and submit your new instructions until Thursday, August 29, 2019, 23:59 (Central European Summer Time), or you may attend the meeting and vote in person. SWISS SHARE REGISTER – RESPONSE COUPON – If you request a new Response Coupon and wish to vote again, you may complete the new Response Coupon and return it to us by August 29, 2019, or you may attend the meeting and vote in person. | ||

U.S. SHARE REGISTER – INTERNET VOTING – Go to the Internet voting site www.proxyvote.com and log in with your 16-digit voting control number printed in the box marked by the arrow on the Notice of Internet Availability of Proxy Materials that you received from us. Please follow the menus to submit your new instructions until Thursday, August 29, 2019, 11:59 p.m. (U.S. Eastern Daylight Time), or you may attend the meeting and vote in person. U.S. SHARE REGISTER – PROXY CARD – If you request a new Proxy Card and wish to vote again, you may complete the new Proxy Card and return it to Broadridge by August 29, 2019, or you may attend the meeting and vote in person. | ||

IF I VOTE BY PROXY, WHAT HAPPENS IF I DO NOT GIVE SPECIFIC VOTING INSTRUCTIONS? | SWISS SHARE REGISTER – INTERNET VOTING – If you are a registered shareholder and vote using the Internet voting site, you have to give specific voting instructions for all agenda items before you can submit your instructions. SWISS SHARE REGISTER – RESPONSE COUPON – If you are a registered shareholder and sign and return a Response Coupon without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. | |

U.S. SHARE REGISTER – INTERNET VOTING – If you are a registered shareholder and vote using the Internet voting site without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. U.S. SHARE REGISTER – PROXY CARD – If you are a registered shareholder and sign and return a Proxy Card without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. | ||

5

WHO CAN I CONTACT IF I HAVE QUESTIONS? | If you have any questions or need assistance in voting your shares, please call us at +1-510-713-4220 or e-mail us at [email protected]. | |

Further Information for U.S. or Canadian “Street Name” Beneficial Owners

WHY DID I RECEIVE A ONE-PAGE NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? | We have provided access to our proxy materials over the Internet to beneficial owners holding their shares in “street name” through a U.S. or Canadian broker, trustee or nominee. Accordingly, such brokers, trustees or nominees are forwarding a Notice of Internet Availability of Proxy Materials (the “Notice”) to such beneficial owners. All such shareholders will have the ability to access the proxy materials on a website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found on the Notice. In addition, beneficial owners holding their shares in street name through a U.S. or Canadian broker, trustee or nominee may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. | |

HOW CAN I GET ELECTRONIC ACCESS TO THE PROXY MATERIALS? | The Notice will provide you with instructions regarding how to: • View our proxy materials for the meeting on the Internet; and • Instruct us to send our future proxy materials to you electronically by email. Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our annual shareholders’ meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it. | |

WHO MAY PROVIDE VOTING INSTRUCTIONS FOR THE MEETING? | For purposes of U.S. or Canadian beneficial shareholder voting, shareholders holding shares through a U.S. or Canadian broker, trustee or nominee organization on July 11, 2019 may direct the organization on how to vote. Logitech has made arrangements with a service company to U.S. and Canadian brokers, trustees and nominee organizations for that service company to provide a reconciliation of share positions of U.S. and Canadian “street name” beneficial owners between July 11, 2019 and August 23, 2019, which Logitech determined is the last practicable date before the meeting for such a reconciliation. These arrangements are intended to result in the following adjustments: If a U.S. or Canadian “street name” beneficial owner as of July 11, 2019 votes but subsequently sells their shares before August 23, 2019, their votes will be cancelled. A U.S. or Canadian “street name” beneficial owner as of July 11, 2019 that has voted and subsequently increases or decreases their shareholdings but remains a beneficial owner as of August 23, 2019 will have their votes increased or decreased to reflect their shareholdings as of August 23, 2019. If you acquire Logitech shares in “street name” after July 11, 2019 through a U.S. or Canadian broker, trustee or nominee, and wish to vote at the meeting or provide voting instructions by proxy, you must become a registered shareholder. You may become a registered shareholder by contacting your broker, trustee or nominee, and following their registration instructions. In order to allow adequate time for registration, for proxy materials to be sent or made available to you, and for your voting instructions to be returned to us before the meeting, please begin the registration process as far before August 29, 2019 as possible. | |

6

IF I AM A U.S. OR CANADIAN “STREET NAME” BENEFICIAL OWNER, HOW DO I VOTE? | If you are a beneficial owner of shares held in “street name” and you wish to vote in person at the meeting, you must obtain a valid proxy from the organization that holds your shares. If you do not wish to vote in person, you may vote by proxy. You may vote by proxy over the Internet, by mail or by telephone by following the instructions provided in the Notice or on the Proxy Card. | |

WHAT HAPPENS IF I DO NOT GIVE SPECIFIC VOTING INSTRUCTIONS? | If you are a beneficial owner of shares held in “street name” in the United States or Canada and do not provide your broker, trustee or nominee with specific voting instructions, then under the rules of various national and regional securities exchanges, your broker, trustee or nominee may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, your shares will not be voted on such matter and will not be considered votes cast on the applicable Proposal. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice. We believe the following Proposals will be considered non-routine: Proposal 2 (Advisory vote to approve executive compensation), Proposal 3 (Appropriation of retained earnings and declaration of dividend), Proposal 4 (Release of the Board of Directors and Executive Officers from liability for activities during fiscal year 2019), Proposal 5 (Elections to the Board of Directors), Proposal 6 (Election of the Chairperson), Proposal 7 (Elections to the Compensation Committee), Proposal 8 (Approval of Compensation for the Board of Directors for the 2019 to 2020 Board Year), Proposal 9 (Approval of Compensation for the Group Management Team for fiscal year 2021), Proposal 11 (Election of the Independent Representative). All other Proposals involve matters that we believe will be considered routine. Any “broker non-votes” on any Proposals will not be considered votes cast on the Proposal. | |

WHAT IS THE DEADLINE FOR DELIVERING MY VOTING INSTRUCTIONS? | If you hold your shares through a U.S. or Canadian bank or brokerage or other custodian, you have until 11:59 pm (U.S. Eastern Daylight Time) on Thursday, August 29, 2019 to deliver your voting instructions. | |

CAN I CHANGE MY VOTE AFTER I HAVE VOTED? | You may revoke your proxy and change your vote at any time before the final vote at the meeting. You may vote again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the meeting will be counted), or by signing and returning a new proxy card with a later date, or by attending the meeting and voting in person if you have a “legal proxy” that allows you to attend the meeting and vote. However, your attendance at the Annual General Meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your prior proxy be revoked. | |

7

HOW DO I OBTAIN A SEPARATE SET OF PROXY MATERIALS OR REQUEST A SINGLE SET FOR MY HOUSEHOLD IN THE UNITED STATES? | We have adopted a procedure approved by the SEC called “householding” for shareholders in the United States. Under this procedure, shareholders who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our proxy statement and annual report unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure reduces our printing costs and postage fees. Each U.S. shareholder who participates in householding will continue to be able to access or receive a separate Proxy Card. If you wish to receive a separate proxy statement and annual report at this time, please request the additional copy by contacting our mailing agent, Broadridge, by telephone at +1-866-540-7095 or by e-mail at [email protected]. If any shareholders in your household wish to receive a separate proxy statement and annual report in the future, they may call our investor relations group at +1-510-713-4220 or write to Investor Relations, 7700 Gateway Boulevard, Newark, California 94560. They may also send an email to our investor relations group at [email protected]. Other shareholders who have multiple accounts in their names or who share an address with other stockholders can authorize us to discontinue mailings of multiple proxy statements and annual reports by calling or writing to our investor relations group. | |

Further Information for Shareholders with Shares Registered Through a Bank or Brokerage as Custodian (Outside the U.S. or Canada) |

HOW DO I VOTE BY PROXY IF MY SHARES ARE REGISTERED THROUGH MY BANK OR BROKERAGE AS CUSTODIAN? | Your broker, trustee or nominee should have enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares. If you did not receive such instructions you must contact your bank or brokerage for their voting instructions. | |

WHAT IS THE DEADLINE FOR DELIVERING MY VOTING INSTRUCTIONS IF MY LOGITECH SHARES ARE REGISTERED THROUGH MY BANK OR BROKERAGE AS CUSTODIAN? | Banks and brokerages typically set deadlines for receiving instructions from their account holders. Outside of the U.S. and Canada, this deadline is typically two to three days before the deadline of the company holding the general meeting. This is so that the custodians can collect the voting instructions and pass them on to the company holding the meeting. If you hold Logitech shares through a bank or brokerage outside the U.S. or Canada, please check with your bank or brokerage for their specific voting deadline and submit your voting instructions to them as far before that deadline as possible. | |

8

Other Meeting Information

Meeting Proposals

There are no other matters that the Board intends to present, or has reason to believe others will present, at the Annual General Meeting.

If you are a registered shareholder:

SWISS SHARE REGISTER | INTERNET VOTING – If you are a registered shareholder and vote using the Internet voting site, you have to give specific voting instructions to all agenda items before you can submit your instructions. RESPONSE COUPON – If you are a registered shareholder and sign and return a Response Coupon without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. | |

U.S. SHARE REGISTER | INTERNET VOTING – If you are a registered shareholder and vote using the Internet voting site without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. PROXY CARD – If you are a registered shareholder and sign and return a Proxy Card without giving specific voting instructions for some or all agenda items, you thereby give instructions to the Independent Representative to vote your shares in accordance with the recommendations of the Board of Directors for such agenda items as well as for new and amended proposals that could be formulated during the course of the meeting. | |

If you are a beneficial owner of shares held in “street name” in the United States or Canada, if other matters are properly presented for voting at the meeting and you have provided discretionary voting instructions on a voting instruction card or through the Internet or other permitted voting mechanisms or have not provided voting instructions, your shares will be voted in accordance with the recommendations of the Board of Directors at the meeting on such matters.

Proxy Solicitation

We do not expect to retain a proxy solicitation firm. Certain of our directors, officers and other employees, without additional compensation, may contact shareholders personally or in writing, by telephone, e-mail or otherwise in connection with the proposals to be made at the meeting. In the United States, we are required to request that brokers and nominees who hold shares in their names furnish our proxy material to the beneficial owners of the shares, and we must reimburse such brokers and nominees for the expenses of doing so in accordance with certain U.S. statutory fee schedules.

9

Tabulation of Votes

Representatives of at least two Swiss banks will serve as scrutineers of the vote tabulations at the meeting. As is typical for Swiss companies, our Share Registrar will tabulate the voting instructions of registered shareholders that are provided in advance of the meeting.

Shareholder Proposals and Nominees

Shareholder Proposals for 2019 Annual General Meeting

Under our Articles of Incorporation, one or more registered shareholders who together represent shares representing at least the lesser of (i) one percent of our issued share capital or (ii) an aggregate par value of one million Swiss francs may demand that an item be placed on the agenda of a meeting of shareholders. Any such proposal must be included by the Board in our materials for the meeting. A request to place an item on the meeting agenda must be in writing and describe the proposal. With respect to the 2019 Annual General Meeting, the deadline to receive proposals for the agenda was July 6, 2019. In addition, under Swiss law registered shareholders, or persons holding a valid proxy from a registered shareholder, may propose alternatives to items on the 2019 Annual General Meeting agenda before or at the meeting.

Shareholder Proposals for 2020 Annual General Meeting

We anticipate holding our 2020 Annual General Meeting on or about September 9, 2020. One or more registered shareholders who satisfy the minimum shareholding requirements in the Company’s Articles of Incorporation may demand that an item be placed on the agenda for our 2020 Annual General Meeting of shareholders by delivering a written request describing the proposal to the Secretary of Logitech at our principal executive office in either Switzerland or the United States no later than July 10, 2020. In addition, if you are a registered shareholder and satisfy the shareholding requirements under Rule 14a-8 of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”), you may submit a proposal for consideration by the Board of Directors for inclusion in the 2020 Annual General Meeting agenda by delivering a request and a description of the proposal to the Secretary of Logitech at our principal executive office in either Switzerland or the United States no later than March 25, 2020. The proposal will need to comply with Rule 14a-8 of the Exchange Act, which lists the requirements for the inclusion of shareholder proposals in company-sponsored proxy materials under U.S. securities laws. Under the Company’s Articles of Incorporation only registered shareholders are recognized as Logitech shareholders. As a result, if you are not a registered shareholder you may not make proposals for the 2020 Annual General Meeting.

Nominations of Director Candidates

Nominations of director candidates by registered shareholders must follow the rules for shareholder proposals above.

Provisions of Articles of Incorporation

The relevant provisions of our Articles of Incorporation regarding the right of one or more registered shareholders who together represent shares representing at least the lesser of (i) one percent of our issued share capital or (ii) an aggregate par value of one million Swiss francs to demand that an item be placed on the agenda of a meeting of shareholders are available on our website at http://ir.logitech.com. You may also contact the Secretary of Logitech at our principal executive office in either Switzerland or the United States to request a copy of the relevant provisions of our Articles of Incorporation.

10

Agenda Proposals and Explanations |

A. Reports

Report on Operations for the Fiscal Year Ended March 31, 2019

Senior management of Logitech International S.A. will provide the Annual General Meeting with a presentation and report on operations of the Company for fiscal year 2019.

B. Proposals

Proposal 1

Approval of the Annual Report, the Consolidated Financial Statements and the Statutory Financial Statements of Logitech International S.A. for Fiscal Year 2019

Approval of the Annual Report, the Consolidated Financial Statements and the Statutory Financial Statements of Logitech International S.A. for Fiscal Year 2019

Proposal

The Board of Directors proposes that the Annual Report, the consolidated financial statements and the statutory financial statements of Logitech International S.A. for fiscal year 2019 be approved.

Explanation

The Logitech consolidated financial statements and the statutory financial statements of Logitech International S.A. for fiscal year 2019 are contained in Logitech’s Annual Report, which was made available to all registered shareholders on or before the date of this Invitation and Proxy Statement. The Annual Report also contains the reports of Logitech’s auditors on the consolidated financial statements and on the statutory financial statements, Logitech’s Remuneration Report prepared in compliance with the Swiss Ordinance Against Excessive Compensation by Public Corporations (the so-called “Minder Ordinance”) as well as the report of the statutory auditors on the Remuneration Report, additional information on the Company’s business, organization and strategy, and information relating to corporate governance as required by the SIX Swiss Exchange directive on corporate governance. Copies of the Annual Report are available on the Internet at http://ir.logitech.com.

Under Swiss law, the annual report and financial statements of Swiss companies must be submitted to shareholders for approval or disapproval at each annual general meeting. In the event of a negative vote on this proposal by shareholders, the Board of Directors will call an extraordinary general meeting of shareholders for reconsideration of this proposal by shareholders.

Approval of this proposal does not constitute approval or disapproval of any of the individual matters referred to in the Annual Report or the consolidated or statutory financial statements for fiscal year 2019.

KPMG AG, as Logitech auditors, issued an unqualified recommendation to the Annual General Meeting that the consolidated and statutory financial statements of Logitech International S.A. be approved. KPMG AG expressed their opinion that the consolidated financial statements for the year ended March 31, 2019 present fairly, in all material respects, the financial position, the results of operations and the cash flows in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP) and comply with Swiss law. They further expressed their opinion and confirmed that the statutory financial statements and the proposed appropriation of available earnings comply with Swiss law and the Articles of Incorporation of Logitech International S.A. and the Remuneration Report contains the information required by Swiss law.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” approval of the Annual Report, the consolidated financial statements and the statutory financial statements of Logitech International S.A. for fiscal year 2019.

11

Proposal 2

Advisory Vote to Approve Executive Compensation

Advisory Vote to Approve Executive Compensation

Proposal

The Board of Directors proposes that shareholders approve, on an advisory basis, the compensation of Logitech’s named executive officers disclosed in Logitech’s Compensation Report for Fiscal Year 2019.

Explanation

Since 2009, the Logitech Board of Directors has asked shareholders each year to approve Logitech’s compensation philosophy, policies and practices, as set out in the “Compensation Discussion and Analysis” section of the Compensation Report, in a proposal commonly known as a “say-on-pay” proposal. Beginning with the 2011 Annual General Meeting, a say-on-pay advisory vote was required for all public companies, including Logitech, that are subject to the applicable U.S. proxy statement rules. Shareholders have been supportive of our compensation philosophy, policies and practices in each of those years.

At the 2017 Annual General Meeting, shareholders approved a proposal to take the say-on-pay vote annually. Accordingly, the Board of Directors is asking shareholders to approve, on an advisory basis, the compensation of Logitech’s named executive officers disclosed in the Compensation Report, including the “Compensation Discussion and Analysis,” the Summary Compensation table and the related compensation tables, notes, and narrative. This vote is not intended to address any specific items of compensation or any specific named executive officer, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in the Compensation Report.

This say-on-pay vote is advisory and therefore is not binding. It is carried out as a best practice and to comply with applicable U.S. proxy statement rules, and is consequently independent from, and comes in addition to, the binding vote on the Approval of Compensation of the Board of Directors for the 2019 to 2020 Board Year contemplated in Proposal 8 below and the binding vote on the Approval of Compensation for the Group Management Team for fiscal year 2021 contemplated in Proposal 9 below. However, the say-on-pay vote will provide information to us regarding shareholder views about our executive compensation philosophy, policies and practices, which the Compensation Committee of the Board will be able to consider when determining future executive compensation. The Committee will seek to determine the causes of any significant negative voting result.

As discussed in the Compensation Discussion and Analysis section of Logitech’s Compensation Report for Fiscal Year 2019, Logitech has designed its compensation programs to:

• | provide compensation sufficient to attract and retain the level of talent needed to create and manage an innovative, high-growth, global company in highly competitive and rapidly evolving markets; |

• | support a performance-oriented culture; |

• | maintain a balance between fixed and variable compensation and place a significant portion of total compensation at risk based on the Logitech’s performance, while maintaining controls over inappropriate risk-taking by factoring in both annual and long-term performance; |

• | provide a balance between short-term and long-term objectives and results; |

• | align executive compensation with shareholders’ interests by tying a significant portion of compensation to increasing share value; and |

• | reflect an executive’s role and past performance through base salary and short-term cash incentives, and his or her potential for future contribution through long-term equity incentive awards. |

12

While compensation is a central part of attracting, retaining and motivating the best executives and employees, we believe it is not the sole or exclusive reason why exceptional executives or employees choose to join and stay at Logitech, or why they work hard to achieve results for shareholders. In this regard, both the Compensation Committee and management believe that providing a working environment and opportunities in which executives and employees can develop, express their individual potential, and make a difference, are also a key part of Logitech’s success in attracting, motivating and retaining executives and employees.

The Compensation Committee of the Board has developed a compensation program that is described more fully in the Compensation Report included in this Invitation and Proxy Statement. Logitech’s compensation philosophy, compensation program risks and design, and compensation paid during fiscal year 2019 are also set out in the Compensation Report for Fiscal Year 2019.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” approval of the following advisory resolution:

“Resolved, that the compensation paid to Logitech’s named executive officers as disclosed in the Compensation Report for Fiscal Year 2019, including the “Compensation Discussion and Analysis,” the "Summary Compensation Table for Fiscal Year 2019" and the related compensation tables, notes, and narrative discussion, is hereby approved.”

13

Proposal 3

Appropriation of Retained Earnings and Declaration of Dividend

Appropriation of Retained Earnings and Declaration of Dividend

Proposal

The Board of Directors proposes that CHF 940,854,750 (approximately USD 945,205,253 based on the exchange rate on March 31, 2019) of retained earnings be appropriated as follows:

Year ended March 31, 2019 | ||

Retained earnings available at the | ||

end of fiscal year 2019 | CHF | 940,854,750 |

Proposed dividends | CHF | (121,838,830) |

Balance of retained earnings to be | ||

carried forward | CHF | 819,015,920 |

The Board of Directors approved and proposes distribution of a gross aggregate dividend of CHF 121,838,830 (approximately USD 122,401,878 based on the exchange rate on March 31, 2019), or approximately CHF 0.7346 per share (approximately USD 0.7380 per share).*

No distribution shall be made on shares held in treasury by the Company and its subsidiaries.

If the proposal of the Board of Directors is approved, the dividend payment of approximately CHF 0.7346 per share (or approximately CHF 0.4775 per share after deduction of 35% Swiss withholding tax whenever required) will be made on or about September 20, 2019 to all shareholders on record as of the record date (which will be on or about September 19, 2019). We expect that the shares will be traded ex-dividend as of approximately September 18, 2019. For payments made in U.S. dollars, we expect to use the currency exchange rate as of the date of the meeting, September 4, 2019.

Explanation

Under Swiss law, the use of retained earnings must be submitted to shareholders for approval or disapproval at each annual general meeting. The retained earnings at the disposal of Logitech shareholders at the 2019 Annual General Meeting are the earnings of Logitech International S.A., the Logitech parent holding company.

The proposal of the Board of Directors to distribute a gross dividend of approximately CHF 0.7346 per share represents an increase of approximately 10% over the prior year, following another year of strong cash flow from operations, and is an indication of the Board of Directors’ confidence in the future of the Company. Since fiscal year 2013, the Board of Directors decided on a recurring annual gross dividend and not on an occasional one. As a consequence, the Company expects to propose such a dividend to the shareholders of the Company every year (subject to the approval of the Company’s statutory auditors in the applicable year).

Other than the distribution of the dividend, the Board of Directors proposes the carry-forward of retained earnings based on the Board’s belief that it is in the best interests of Logitech and its shareholders to retain Logitech’s earnings for future investment in the growth of Logitech’s business, for share repurchases, and for the possible acquisition of other companies or lines of business.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” approval of the proposed appropriation of retained earnings with respect to fiscal year 2019, including the payment of a dividend to shareholders in an aggregate amount of CHF 121,838,830.

* | The per share approximations are based on 165,862,887 shares outstanding, net of treasury shares, as of March 31, 2019. Distribution-bearing shares are all shares issued except for treasury shares held by Logitech International S.A. on the day preceding the payment of the distribution. |

14

Proposal 4

Release of the Board of Directors and Executive Officers from Liability for Activities during Fiscal Year 2019

Proposal

The Board of Directors proposes that shareholders release the members of the Board of Directors and Executive Officers from liability for activities during fiscal year 2019.

Explanation

As is customary for Swiss corporations and in accordance with Article 698, subsection 2, item 5 of the Swiss Code of Obligations, shareholders are requested to release the members of the Board of Directors and the Executive Officers from liability for their activities during fiscal year 2019 that have been disclosed to shareholders. This release from liability exempts members of the Board of Directors or Executive Officers from liability claims brought by the Company or its shareholders on behalf of the Company against any of them for activities carried out during fiscal year 2019 relating to facts that have been disclosed to shareholders. Shareholders that do not vote in favor of the proposal, or acquire their shares after the vote without knowledge of the approval of this resolution, are not bound by the result for a period ending six months after the vote.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions and not counting the votes of any member of the Board of Directors or of any Logitech executive officers.

Recommendation

The Board of Directors recommends a vote “FOR” the proposal to release the members of the Board of Directors and Executive Officers from liability for activities during fiscal year 2019.

15

Proposal 5

Elections to the Board of Directors

Elections to the Board of Directors

Our Board of Directors is presently composed of ten members. Each director was elected for a one-year term ending at the closing of the 2019 Annual General Meeting. Until June 2019, our Board of Directors was composed of eleven members. Mr. Dimitri Panayotopoulos, having served the Company as a member of the Board for five years, resigned due to personal reasons in June 2019.

At the recommendation of the Nominating Committee, the Board has nominated the eleven individuals below to serve as directors for a one-year term, beginning in each case as of the Annual General Meeting on September 4, 2019. Nine of the nominees currently serve as members of the Board of Directors. Their current terms expire upon the closing of the Annual General Meeting on September 4, 2019. The other nominees were recommended by the Nominating Committee of the Board and approved by the Board in July 2019 as nominees for election to the Board. The candidacies of Mr. Guy Gecht and Mr. Michael Polk as nominees were recommended by Russell Reynolds Associates, a search firm that we engaged to identify director candidates. Mr. Lung Yeh, having served the Company as a member of the Board for four years, decided not to stand for re-election.

The term of office ends at the closing of the next Annual General Meeting. There will be a separate vote on each nominee.

Under Swiss law, Board members may only be appointed by shareholders. If the individuals below are elected, the Board will be composed of eleven members again. The Board has no reason to believe that any of our nominees will be unwilling or unable to serve if elected as a director.

For further information on the Board of Directors, including the current members of the Board, the Committees of the Board, the means by which the Board exercises supervision of Logitech’s executive officers, and other information, please see “Corporate Governance and Board of Directors Matters” below.

5.A Re-election of Dr. Patrick Aebischer

Proposal: The Board of Directors proposes that Dr. Patrick Aebischer be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Dr. Aebischer, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 28.

5.B Re-election of Ms. Wendy Becker

Proposal: The Board of Directors proposes that Ms. Wendy Becker be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Ms. Becker, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 28.

5.C Re-election of Dr. Edouard Bugnion

Proposal: The Board of Directors proposes that Dr. Edouard Bugnion be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Dr. Bugnion, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 29.

5.D Re-election of Mr. Bracken Darrell

Proposal: The Board of Directors proposes that the Company’s President and Chief Executive Officer, Mr. Bracken Darrell, be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Mr. Darrell, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 29.

5.E Re-election of Mr. Guerrino De Luca

Proposal: The Board of Directors proposes that Mr. Guerrino De Luca be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Mr. De Luca, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 29.

5.F Re-election of Mr. Didier Hirsch

16

Proposal: The Board of Directors proposes that Mr. Didier Hirsch be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Mr. Hirsch, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 30.

5.G Re-election of Dr. Neil Hunt

Proposal: The Board of Directors proposes that Dr. Neil Hunt be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Dr. Hunt, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 30.

5.H Re-election of Ms. Marjorie Lao

Proposal: The Board of Directors proposes that Ms. Marjorie Lao be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Ms. Lao, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 31.

5.I Re-election of Ms. Neela Montgomery

Proposal: The Board of Directors proposes that Ms. Neela Montgomery be re-elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Ms. Montgomery, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 31.

5.J Election of Mr. Guy Gecht

Proposal: In accordance with the recommendation of the Nominating Committee, the Board of Directors proposes that Mr. Guy Gecht be elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

Guy Gecht is the former Chief Executive Officer of Electronics for Imaging, Inc. (EFI), an international company specializing in digital printing technology, a position he held from January 2000 to October 2018. He served EFI as President from May 2012 to October 2018 and from July 1999 to January 2000, as Vice President and General Manager of Fiery products from January 1999 to July 1999, and as Director of Software Engineering from October 1995 to January 1999. Prior to joining EFI, Mr. Gecht was Director of Engineering at Interro Systems, Inc., a diagnostic technology company, from 1993 to 1995, Software Manager of ASP Computer Products, Inc., a networking company, from 1991 to 1993, and Manager of Networking Systems in Israel for Apple Inc. from 1990 to 1991. Mr. Gecht serves on the Boards of Check Point Software Technology Ltd., a multinational provider of software and combined hardware and software products for IT security, and EFI. He holds a BS degree in Computer Science and Mathematics from Ben Gurion University in Israel. Mr. Gecht is 54 years old and an Israeli and U.S. national.

Mr. Gecht brings senior leadership as well as technology and cybersecurity expertise and strategy, M&A and international experience to the Board, having led the transformation and growth of EFI into a global leader in digital imaging.

The Board of DIrectors has determined that he will be an independent Director.

5.K Election of Mr. Michael Polk

Proposal: In accordance with the recommendation of the Nominating Committee, the Board of Directors proposes that Mr. Michael Polk be elected to the Board for a one-year term ending at the closing of the 2020 Annual General Meeting.

Michael Polk is the former President and Chief Executive Officer of Newell Brands Inc., a multinational consumer goods company, a position he held from July 2011 to June 2019. From 2003 to 2011, Mr. Polk held a series of executive positions at Unilever, a Dutch-Anglo multi-national consumer goods company, including President, Global Foods, Home & Personal Care from March 2010 to June 2011, President, Unilever Americas from March 2007 to February 2010, President, Unilever USA from October 2005 to February 2007, and Senior Vice President, Marketing and Chief Operating Officer, Unilever Foods North America from July 2003 to September 2005. In his last two roles at Unilever, Mr. Polk reported to the Group Chief Executive Officer and was a member of the Unilever Global Executive Board. Prior to joining Unilever, he spent sixteen years at Kraft Foods Inc., a consumer foods company, from 1987 to 2003. At Kraft Foods, Mr. Polk was a member of the Kraft Foods Management Committee and served in executive and management positions, including Group Vice President Kraft Foods North America and President, Nabisco Biscuit and Snacks from 2001 to 2003, Group Vice President Kraft Foods International and President, Asia Pacific Region from 1999 to 2001, and Executive Vice President and General Manager, Post Cereal Division from 1998 to 1999. Mr. Polk started his career at Procter & Gamble Company, a consumer

17

brand company, where he spent three years in paper products manufacturing and R&D from 1982 to 1985. Mr. Polk serves on the Board of Colgate-Palmolive Company, a worldwide consumer products company. He holds a BS degree in Operations Research and Industrial Engineering from Cornell University and an MBA from Harvard University. Mr. Polk is 58 years old and a U.S. national.

Mr. Polk brings senior leadership, global marketing, consumer innovation, brand and customer development, operations, M&A and international experience to the Board from his leadership and governance roles at consumer and brand-focused multi-national companies such as Newell Brands, Unilever, Kraft Foods and Colgate-Palmolive.

The Board of DIrectors has determined that he will be an independent Director.

Voting Requirement to Approve Proposals

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” the election to the Board of each of the above nominees.

18

Proposal 6

Election of the Chairperson of the Board

Election of the Chairperson of the Board

Pursuant to the so-called “Minder Ordinance”, Swiss law requires that the Chairperson of the Board of Directors be elected on the occasion of each Annual General Meeting for a one-year term ending at the closing of the following Annual General Meeting. Mr. Guerrino De Luca, the current Executive Chairman, has decided not to stand for re-election as Chairperson. Mr. De Luca, in alignment with the Board of Directors, has identified the 2019 Annual General Meeting as the right time for a transition of the Chairperson role and intends to continue to serve the Company as an executive member of the Board of Directors. In line with current corporate governance best practices, the Board of Directors has selected Ms. Wendy Becker as its nominee to lead the Board of Directors as an independent Chairperson. Ms. Becker has been a non-executive member of the Board of Directors since September 2017, is the current Chair of the Company's Compensation Committee and serves on the Company's Nominating Committee. As noted in her biographical information and qualifications in "Corporate Governance and Board of Directors Matters - Members of the Board of Directors" on page 28, Ms. Becker has extensive senior leadership experience as well as broad and diverse experience with boards of directors and trustee positions.

Proposal

The Board of Directors proposes that Ms. Wendy Becker be elected as Chairperson of the Board of Directors for a one-year term ending at the closing of the 2020 Annual General Meeting.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” the election of Ms. Wendy Becker as Chairperson of the Board of Directors.

19

Proposal 7

Elections to the Compensation Committee

Elections to the Compensation Committee

Our Compensation Committee is presently composed of three members, all of whom are standing for re-election to the Board of Directors and two of whom are standing for re-election to the Compensation Committee. Given her nomination as Chairperson of the Board, Ms. Wendy Becker is not standing for re-election to the Compensation Committee at the 2019 Annual General Meeting. Until June 2019, when Mr. Dimitri Panayotopoulos resigned from the Board of Directors, our Compensation Committee was composed of four members. Following the amendment to the Swiss corporate law on January 1, 2014, the members of the Compensation Committee are to be elected annually and individually by the shareholders. Only members of the Board of Directors can be elected as members of the Compensation Committee.

At the recommendation of the Nominating Committee, the Board of Directors has nominated the three individuals below to serve as members of the Compensation Committee for a term of one year. Two of the nominees currently serve as members of the Compensation Committee and, as required by our Compensation Committee charter, all of the nominees are independent in accordance with the requirements of the listing standards of the Nasdaq Stock Market, the outside director definition of Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, the definition of a “non-employee director” for purposes of Rule 16b-3 promulgated by the U.S. Securities and Exchange Commission, and Rule 10C-1(b)(1) of the U.S. Securities Exchange Act of 1934, as amended.

The term of office ends at the closing of the next Annual General Meeting. There will be a separate vote on each nominee.

7.A Re-election of Dr. Edouard Bugnion

Proposal: The Board of Directors proposes that Dr. Edouard Bugnion be re-elected to the Compensation Committee for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Dr. Bugnion, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 29.

7.B Re-election of Dr. Neil Hunt

Proposal: The Board of Directors proposes that Dr. Neil Hunt be re-elected to the Compensation Committee for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Dr. Hunt, please refer to “Corporate Governance and Board of Directors Matters – Members of the Board of Directors” on page 30.

7.C Election of Mr. Michael Polk

Proposal: The Board of Directors proposes that Mr. Michael Polk be elected to the Compensation Committee for a one-year term ending at the closing of the 2020 Annual General Meeting.

For biographical information and qualifications of Mr. Polk, please refer to Proposal 5, “Elections to the Board of Directors”, on page 17. Also, please note that Mr. Polk has experience with compensation matters and compensation committee responsibilities as Chairman of the Personnel and Organization Committee at Colgate-Palmolive Company.

Voting Requirement to Approve Proposals

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

Our Board of Directors recommends a vote “FOR” the election to the Compensation Committee of each of the above nominees.

20

Proposal 8

Approval of Compensation for the Board of Directors for the 2019 to 2020 Board Year

Approval of Compensation for the Board of Directors for the 2019 to 2020 Board Year

Proposal

The Board of Directors proposes that the shareholders approve a maximum aggregate amount of the compensation of the Board of Directors of CHF 4,900,000 for the term of office from the 2019 Annual General Meeting until the 2020 Annual General Meeting (the “2019 – 2020 Board Year”), subject to adjustment for certain changes in the applicable currency exchange rate.*

Explanation

Pursuant to the so-called “Minder Ordinance”, the compensation of the Board of Directors must be subject each year to a binding shareholder vote, in the manner contemplated by Logitech’s Articles of Incorporation. Article 19 quarter, paragraph 1(a) of Logitech’s Articles of Incorporation allows shareholders to approve the maximum aggregate amount of the compensation of the Board of Directors for the period up to the next Annual General Meeting.

Under the Company’s Articles of Incorporation, the compensation of the members of the Board of Directors who do not have management responsibilities consists of cash payments and shares or share equivalents. The value of cash compensation and shares or share equivalents corresponds to a fixed amount, which reflects the functions and responsibilities assumed. The value of shares or share equivalents is calculated at market value at the time of grant.

Pursuant to Article 19 bis, paragraph 2 of the Company’s Articles of Incorporation, the compensation of the members of the Board of Directors who have management responsibilities (i.e., executive members of the Board of Directors) is structured similarly to the compensation of the members of the Group Management Team.

The proposed maximum amount of CHF 4,900,000 has been determined based on continuation of nine non-executive members of the Board of Directors and on the following non-binding assumptions:

With respect to the nine non-executive members of the Board of Directors:

• | Cash payments of a maximum of approximately CHF 950,000. Cash payments for non-executive members of the Board of Directors include annual retainers for Board and committee service and, starting in the 2019 - 2020 Board Year, an annual retainer for a non-executive Chairperson. |

• | Share or share equivalent awards of a maximum of approximately CHF 1,800,000. The value of share or share equivalent awards corresponds to a fixed amount and the number of shares granted will be calculated at market value at the time of their grant. |

• | Other payments, including accrual of the Company's estimated contributions to social security, of a maximum of approximately CHF 250,000. |

* | For each decrease of 0.01 in the exchange rate of the Swiss Franc against the U.S. Dollar below the assumed level of USD 1.0111 to CHF 1.00, if any, the maximum aggregate amount of the compensation of the Board of Directors will increase by CHF 20,000 for the 2019 – 2020 Board Year. This adjustment reflects the fact that the compensation of Mr. De Luca, our current Executive Chairman and proposed executive member of the Board of Directors, which is included in the maximum aggregate amount of the compensation for the Board of Directors, is set in U.S. Dollars. |

21

With respect to executive members of the Board of Directors:

• | Gross base compensation of a maximum of CHF 500,000.** |

• | Performance-based cash compensation of a maximum of CHF 800,000.** Performance-based cash compensation in the form of incentive cash payments may be earned under the Logitech Management Performance Bonus Plan (the “Bonus Plan”) or other cash bonuses approved by the Compensation Committee. Payout under the Bonus Plan is variable, and is based on the achievement of the Company’s, individual employees’ or other performance goals. The assumption regarding maximum amount of the performance-based bonus assumes maximum achievement of all performance goals. |

• | Equity incentive awards of a maximum of CHF 500,000.** Long-term equity incentive awards are anticipated to be granted in the form of time-based restricted stock units, or RSUs. As in past years, the value of RSUs or other financial instruments granted as equity incentive awards, and included in the compensation reported in our Compensation Report, is calculated based on estimated fair value at the time of their grant. |

• | Other compensation of a maximum of CHF 100,000.** Other compensation may include tax preparation services and related expenses, 401(k) savings plan matching contributions, premiums for group term life insurance and long-term disability insurance, employer’s contribution to medical premiums, relocation or extended business travel-related expenses, defined benefit pension plan employment contributions, accrual of estimated employer's contribution to social security and Medicare, and other awards. The Company generally does not provide all of these components of other compensation to all executives each year, but the proposed maximum amount of compensation has been formulated to provide flexibility to cover these compensation components as applicable. |

The executive member of the Board of Directors to whom the assumption regarding compensation referred to above applies is Mr. Guerrino De Luca, the Company’s current Executive Chairman who will continue as an executive officer of the Company and, subject to re-election by the shareholders, as an executive member of the Board of Directors. As set forth in the Compensation Report in this Invitation and Proxy Statement, Mr. De Luca’s compensation structure matches the compensation structure of members of the Group Management Team, and the increase in the maximum equity incentive award assumption from previous budgets matches the increase described in the explanation for Proposal 9 below. In his capacity as a member of the Group Management Team, Mr. Bracken Darrell is not entitled to compensation for his services on the Company’s Board of Directors.

Shareholders are approving the maximum aggregate amount of compensation set forth in the proposal. The assumptions set forth in this explanation are based on the Company’s current expectations about future compensation plans and decisions. The Company may redesign its compensation plans or make alternative compensation decisions within the maximum aggregate amount of compensation approved by shareholders. The actual compensation awarded to the members of the Board of Directors for the 2019 - 2020 Board Year will be disclosed in the Compensation Report in the Invitation and Proxy Statement for the 2021 Annual General Meeting.

In the event of a negative vote on this proposal by shareholders, the Board of Directors will submit an alternative proposal to the same or a subsequent general meeting.

Voting Requirement to Approve Proposal

The affirmative “FOR” vote of a majority of the votes cast in person or by proxy at the Annual General Meeting, not counting abstentions.

Recommendation

The Board of Directors recommends a vote “FOR” the approval of the maximum aggregate amount of the compensation of the members of the Board of Directors of CHF 4,900,000 for the term of office from the 2019 Annual General Meeting until the 2020 Annual General Meeting, subject to adjustment as set forth in the proposal.

** | Mr. De Luca’s compensation is set in U.S. Dollars. The estimated amounts in U.S. Dollars used in these assumptions were converted using an assumed exchange rate of 1 Swiss Franc to 1.0111 U.S. Dollars based on the 12 month (April 2018 to March 2019) average exchange rate. |

22

Proposal 9

Approval of Compensation for the Group Management Team for Fiscal Year 2021

Approval of Compensation for the Group Management Team for Fiscal Year 2021

Proposal

The Board of Directors proposes that the shareholders approve a maximum aggregate amount of the compensation of the Group Management Team of USD 28,600,000 for fiscal year 2021, subject to adjustment for certain changes in the applicable currency exchange rate.*

Explanation

Pursuant to the so-called “Minder Ordinance”, the compensation of the Company’s Group Management Team must be subject each year to a binding shareholder vote, in the manner contemplated by Logitech’s Articles of Incorporation. Article 19 quarter, paragraph 1(b) of Logitech’s Articles of Incorporation allows shareholders to approve the maximum aggregate amount of the compensation of the Group Management Team for the next fiscal year. As the 2019 Annual General Meeting takes place in the middle of Logitech’s fiscal year 2020, the applicable next fiscal year is fiscal year 2021. This required, binding vote on the compensation of the Group Management Team is independent from, and comes in addition to, the non-binding, advisory say-on-pay vote contemplated in Proposal 2.

Logitech’s Group Management Team currently consists of Mr. Bracken Darrell, President and Chief Executive Officer. Mr. Vincent Pilette, former Chief Financial Officer, resigned from the Group Management Team effective as of May 17, 2019; Marcel Stolk, former Executive Chairman, Logitech Europe S.A. and Senior Vice President, Business Model Innovation, resigned from the Group Management Team effective as of March 31, 2019; and L. Joseph Sullivan, former Senior Vice President, Worldwide Operations, resigned from the Group Management Team effective as of May 2, 2018. The Company is currently searching for a full-time replacement for Mr. Pilette as Chief Financial Officer and expects that role to be filled and the new Chief Financial Officer to be appointed to the Group Management Team during the current fiscal year. The Board of Directors is also considering up to two additional appointments to the Group Management Team prior to or during fiscal year 2021.

Logitech’s compensation philosophy, compensation program risks and design, and compensation paid during fiscal year 2019 are set forth in the Compensation Report.

The proposed maximum amount of USD 28,600,000 has been determined based on the following non-binding assumptions for Logitech’s Group Management Team as an aggregate group:

• | The Group Management Team will include four members (assuming the addition of the new Chief Financial Officer and two other executives prior to or during fiscal year 2021). |

• | Gross base salaries of a maximum of USD 2,800,000. |

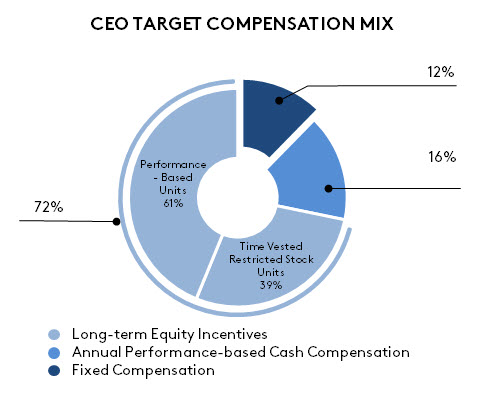

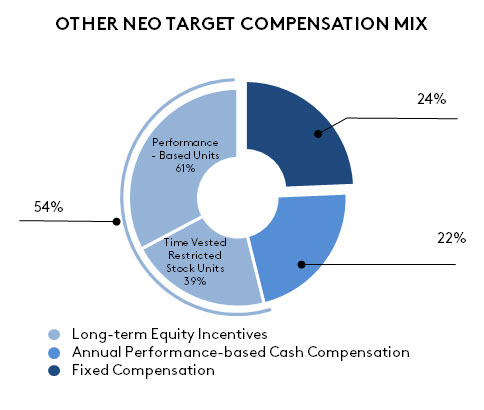

• | Performance-based cash compensation of a maximum of USD 5,630,000. Performance-based cash compensation in the form of incentive cash payments may be earned under the Logitech Management Performance Bonus Plan (the “Bonus Plan”) or other cash bonuses approved by the Compensation Committee. Payout under the Bonus Plan is variable, and is based on the achievement of the Company’s, individual executives’ or other performance goals, and for fiscal year 2021 is expected to continue to range from 0% to 200% of the executive’s target incentive. The assumption regarding maximum amount of the performance-based bonus for fiscal year 2021 assumes maximum achievement of all performance goals. |