Form SC14D9C AEROHIVE NETWORKS, INC Filed by: AEROHIVE NETWORKS, INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

under Section 14(d)(4) of the Securities Exchange Act of 1934

Aerohive Networks, Inc.

(Name of Subject Company)

Aerohive Networks, Inc.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

007786106

(CUSIP Number of Class of Securities)

David K. Flynn

President and Chief Executive Officer

Aerohive Networks, Inc.

1011 McCarthy Boulevard

Milpitas, California 95035

(408) 510-6100

(Name, address and telephone number of person authorized to receive notices and communications

on behalf of the person(s) filing statement)

With copies to:

| Mark Baudler & Robert Ishii Wilson Sonsini Goodrich & Rosati, Professional Corporation One Market Plaza, Spear Tower Suite 3300 San Francisco, California 94105 (415) 947-2000 |

Steve Debenham Vice President, General Counsel & Secretary Aerohive Networks, Inc. 1011 McCarthy Boulevard Milpitas, California 95035 (408) 510-6100 |

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

On June 26, 2019, Aerohive Networks, Inc., a Delaware corporation (“Aerohive”), issued a press release announcing the execution of an Agreement and Plan of Merger (the “Merger Agreement”) with Extreme Networks, Inc., a Delaware corporation (“Extreme”), and Clover Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Extreme (the “Purchaser”), pursuant to which the Purchaser will commence a tender offer (the “Offer”) to acquire all of the outstanding shares of Aerohive’s common stock, par value $0.001 per share (the “Shares”), at a price of $4.45 per share in cash (the “Offer Price”), without interest and subject to any applicable withholding taxes, on the terms and subject to the conditions set forth in the Merger Agreement. As soon as practicable following the consummation of the Offer, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, the Purchaser will merge with and into Aerohive, with Aerohive surviving as a wholly-owned subsidiary of Extreme, pursuant to the provisions of Section 251(h) of the General Corporation Law of the State of Delaware, with no stockholder approval required to consummate the Merger (the “Merger”).

This Schedule 14D-9 filing consists of the following documents related to the proposed Offer and Merger:

| (i) | Email sent to Aerohive employees, first used on June 26, 2019 (Exhibit 99.1); |

| (ii) | Presentation materials for all hands meeting with Aerohive employees, first used on June 26, 2019 (Exhibit 99.2); |

| (iii) | Form of letter sent to Aerohive employees, first used on June 26, 2019 (Exhibit 99.3); |

| (iv) | Form of letter sent to Aerohive partners, first used on June 26, 2019 (Exhibit 99.4); |

| (v) | Form of letter sent to Aerohive customers, first used on June 26, 2019 (Exhibit 99.5); and |

| (vi) | Frequently Asked Questions sent to Aerohive employees, first used on June 26, 2019 (Exhibit 99.6). |

The information set forth under Items 1.01, 8.01 and 9.01 of the Current Report on Form 8-K filed by Aerohive on June 26, 2019 (including all exhibits attached thereto) is incorporated herein by reference.

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive”) by Extreme Networks, Inc. (“Extreme”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme (the “Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive, nor is it a substitute for the tender offer materials that Extreme and the Purchaser will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Extreme and the Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE’S STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Aerohive’s stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive by contacting Aerohive at [email protected] or by phone at 1-408-769-6720, or by visiting Aerohive’s website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE’S STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward Looking Statements

This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive, Extreme, and the Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”,

“target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive and others following announcement of the definitive agreement entered into with Extreme and the Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive’s control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management’s expectations or otherwise, except as may be required by law.

Exhibit Index

| Exhibit Number |

Description | |

| 99.1 | Email sent to Aerohive employees, first used on June 26, 2019 | |

| 99.2 | Presentation materials for all hands meeting with Aerohive employees, first used on June 26, 2019 | |

| 99.3 | Form of letter sent to Aerohive employees, first used on June 26, 2019 | |

| 99.4 | Form of letter sent to Aerohive partners, first used on June 26, 2019 | |

| 99.5 | Form of letter sent to Aerohive customers, first used on June 26, 2019 | |

| 99.6 | Frequently Asked Questions sent to Aerohive employees, first used on June 26, 2019 | |

Exhibit 99.1

Wednesday, June 26, 2019 at 4:24:01 AM Pacific Daylight Time

| Subject: | Extreme Networks to Acquire Aerohive Networks | |

| Date: | Wednesday, June 26, 2019 at 2:09:43 AM Pacific Daylight Time | |

| From: | David Flynn | |

| To: | All Employees | |

| Attachments: | Extr-Aero-AH-Employee-Letter_v1.pdf, Extreme Networks-Aerohive Joint Announcement vFINAL.pdf |

I am pleased to announce a major milestone for Aerohive. This morning Aerohive and Extreme Networks issued the attached press release announcing that we have entered into a definitive agreement for Extreme to acquire Aerohive for a price of $4.45 per share. I am excited about the opportunity to bring together our industry leading Cloud-Managed Networking solution with Extreme’s extensive end-to-end networking portfolio to enable the full potential of our technology and product offering, and about the expanded reach and scale that we will have going to market as part of a >$1B company that is a Top 3 Enterprise Networking vendor and a Leader in the Gartner Magic Quadrant for Wired & Wireless LAN.

The attached press release includes an overview of the news and dial in details for the joint announcement call scheduled for 8:30 AM Eastern time.

We will hold a worldwide All Hands Meeting at 11 AM Pacific at which we will discuss the announcement and what it means to everyone at Aerohive. Extreme’s CEO Ed Meyercord will join the meeting via video, and several of Extreme’s executives will be in the room. Shihlin will send out an Outlook meeting invite shortly.

In addition to the all hands meeting, Ed Meyercord asked me to forward his attached into letter and to invite you to join him for an in person All Hands meeting at Aerohive on July 8.

While this is a big milestone and a big announcement, it is very important for everyone to realize that this announcement does NOT mean that the acquisition is complete. We are targeting to Close the acquisition in August and until the Close of the acquisition Aerohive is an independent company that we need to keep running as an independent company. So keep your eye on the ball, reassure customers and partners of Extreme’s commitment to continue to invest in our products and drive to a strong finish for Q2 and a fast start to Q3.

Looking forward to updating you all at 11 AM.

/Dave

Attachments:

| • | Press Release |

| • | Welcome Letter from Ed Meyercord, CEO of Extreme |

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive”) by Extreme Networks, Inc. (“Extreme”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme (“Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive, nor is it a substitute for the tender offer materials that Extreme and Purchaser will file with the SEC upon commencement of the tender offer. At the time that the

Page 1 of 2

tender offer is commenced, Extreme and Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE’S STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Aerohive’s stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive by contacting Aerohive at [email protected] or by phone at 1-408-769-6720, or by visiting Aerohive’s website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE’S STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward Looking Statements

This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive, Extreme, and Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”, “target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive and others following announcement of the definitive agreement entered into with Extreme and Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive’s control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management’s expectations or otherwise, except as may be required by law.

Page 2 of 2

David flynn CEO All hands meeting June 26, 2019 Exhibit 99.2

Important Additional Information and Where to Find It In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive Networks”) by Extreme Networks, Inc. (“Extreme Networks”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme Networks (“Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive Networks. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive Networks, nor is it a substitute for the tender offer materials that Extreme Networks and Purchaser will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Extreme Networks and Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive Networks will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE NETWORKS’ STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Aerohive Networks’ stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive Networks by contacting Aerohive Networks at [email protected] or by phone at 1-408-769-6720, or by visiting Aerohive Networks’ website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE NETWORKS’ STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward-Looking Statements This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive Networks, Extreme Networks, and Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive Networks; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”, “target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive Networks and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive Networks and others following announcement of the definitive agreement entered into with Extreme Networks and Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive Networks’ control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive Networks believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive Networks cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive Networks does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management's expectations or otherwise, except as may be required by law.

The News Ed Meyercord, CEO Extreme Networks Timeline, transitions and implications Nabil Bukhari (Products), Erik Broockman (CTO), and Dean Chabrier (People) Next steps Agenda

Today Extreme Networks and Aerohive Networks announced that they have signed a definitive agreement for Extreme to acquire Aerohive Adds critical Cloud-Management and edge capabilities to Extreme’s portfolio of end-to-end, edge to cloud networking solutions Provides a strong subscription revenue stream Strengthens the company’s position in wireless LAN at a critical technology transition to Wi-Fi 6 Consideration: $4.45 per share, $272M purchase price Acquisition targeted to Close in August The news

Ed meyercord CEO, Extreme networks

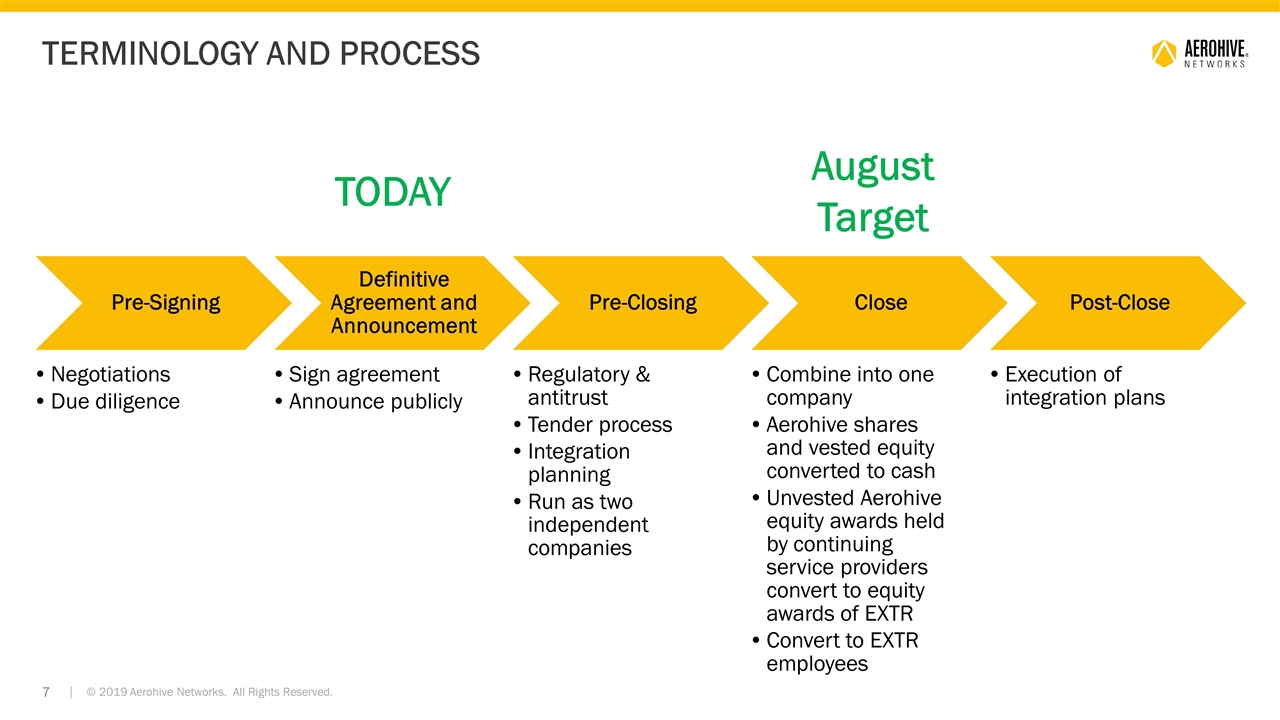

Terminology and process TODAY August Target Pre-Signing Definitive Agreement and Announcement Pre-Closing Close Post-Close Negotiations Due diligence Sign agreement Announce publicly Regulatory & antitrust Tender process Integration planning Combine into one company Run as two independent companies Execution of integration plans Aerohive shares and vested equity converted to cash Unvested Aerohive equity awards held by continuing service providers convert to equity awards of EXTR Convert to EXTR employees

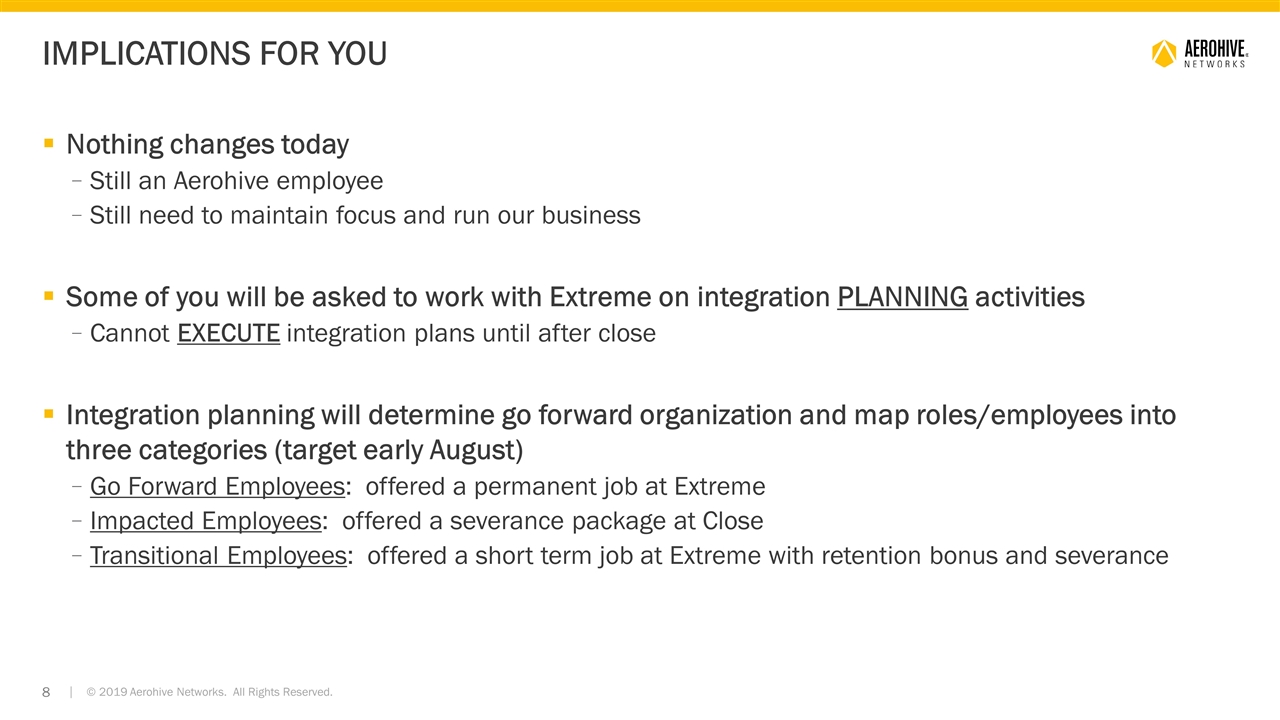

Nothing changes today Still an Aerohive employee Still need to maintain focus and run our business Some of you will be asked to work with Extreme on integration PLANNING activities Cannot EXECUTE integration plans until after close Integration planning will determine go forward organization and map roles/employees into three categories (target early August) Go Forward Employees: offered a permanent job at Extreme Impacted Employees: offered a severance package at Close Transitional Employees: offered a short term job at Extreme with retention bonus and severance Implications for you

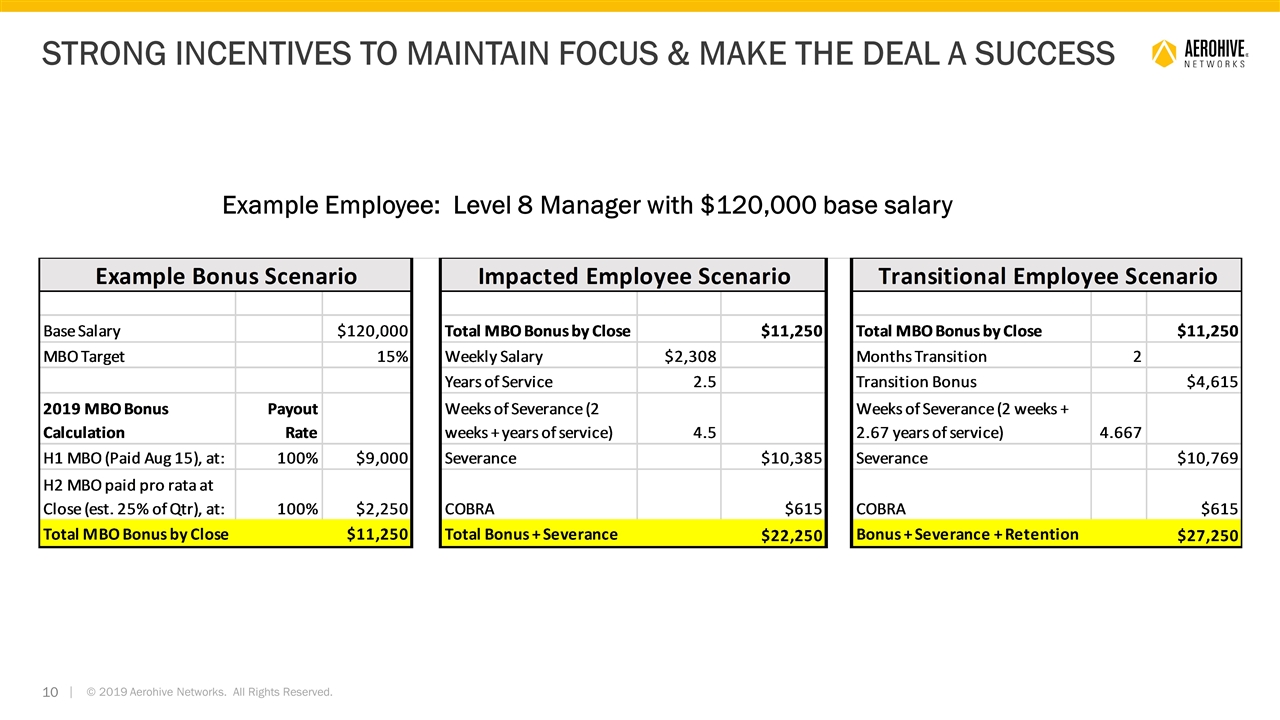

All employees on bonus program eligible for 1H MBO bonus: payout by Aug 15 (at 100% funding) 2H MBO bonus: pro rata payout at Close (at 100% funding) ESPP continues through July 31 Continuing employees Opportunity to realize the full potential of our technology Cloud-Management platform for complete networking portfolio >$1B company that is a Leader in the Wired+Wireless Gartner MQ Impacted employees: strong severance package Transitional employees: severance + retention bonus of 1 week per month worked post-close Strong incentives to maintain focus & make the deal a success MIN MAX Formula Level 9 - 4 weeks 3 months 2 weeks + 1 week/year of service Level 10+ 5 weeks 4 months 4 weeks + 1 week/year of service

Strong incentives to maintain focus & make the deal a success Example Employee: Level 8 Manager with $120,000 base salary

Nabil Bukhari (Products) Eric Broockman (CTO) Dean chabrier (People) Extreme networks

Strong finish to Q2. Let’s make it a great quarter! Keep running the business – we are still Aerohive until the Close Reach out to customers, partners and suppliers to update them on the exciting news Reassure them as to Extreme’s commitment to our product offering and the potential for the combined company Join us for a live All Hands and Q&A with Ed Meyercord at Aerohive on July 8 Submit any questions to Valerie and we will answer what we can either there or via email Going forward

Exhibit 99.3

|

6480 Via Del Oro / San Jose, CA 95119 / +1-408-579-2800 / ExtremeNetworks.com |

June 26, 2019

Good morning all,

We are thrilled about joining forces with Aerohive! We are a customer-driven company with significant pent-up demand for cloud-managed solutions within our large base of enterprise customers and partners around the globe. Our plan is to invest in the technology you’ve pioneered over the last thirteen years and to leverage this platform for our customers. And, we plan on bringing our end-to-end networking solutions from the edge to campus core and cloud datacenter to the Aerohive customer and partner community.

For those who don’t know Extreme well, we are a software-driven networking company with more than 30,000 customers, including half of the Fortune 50, with some of the most demanding network environments in the world. We are a pioneer in the networking industry with a reputation for high quality and high-performance networks and the fun fact of being the first to deliver 1gig, 10gig and 40gig ethernet switches. We are a global company operating in every major industry. We have 100% insourced customer service that is consistently ranked #1 versus our larger competitors by independent third-party analysts like Gartner and gives us a higher level of customer intimacy.

At Extreme we have a successful track record of acquiring and integrating strategic company assets. We look forward to helping you grow with an organization where networking technology is matched with values including teamwork, curiosity, transparency, candor and ownership.

I look forward to meeting you virtually later today via webcast along with a few members of our executive team who will be in the Milpitas office. I will be there on July 8th to hold a town hall meeting with all employees. Looking forward to this!

Best regards,

Ed Meyercord

President & CEO

Extreme Networks

Additional Information and Where to Find It

The description contained herein is for informational purposes only and is not a recommendation, an offer to buy or the solicitation of an offer to sell any shares of Aerohive’s common stock. The tender offer for the outstanding shares of Aerohive’s common stock described in this report has not commenced. At the time the tender offer is commenced, Extreme will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and Aerohive will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Aerohive’s stockholders at no expense to them. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

|

6480 Via Del Oro / San Jose, CA 95119 / +1-408-579-2800 / ExtremeNetworks.com |

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this communication may constitute “forward-looking statements”. Forward-looking statements may be typically identified by such words as “may,” “will,” “could,” “should,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. Although Extreme and Aerohive believe that the expectations reflected in the forward-looking statements are reasonable, any or all of such forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Extreme, Aerohive or their respective businesses or operations.

Factors which could cause actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that Purchaser may not receive sufficient number of shares tendered from Aerohive stockholders to complete the tender offer; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each of Aerohive and Extreme to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of Aerohive or Extreme; (5) the ability of Aerohive to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) Extreme’s ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating Aerohive with its existing businesses; and (10) legislative, regulatory and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Aerohive’s recent Quarterly Report on Form 10-Q, Extreme’s most recent Quarterly Report on Form 10-Q, and Aerohive’s and Extreme’s more recent reports filed with the SEC. Aerohive and Extreme can give no assurance that the conditions to the transaction will be satisfied. Neither Aerohive nor Extreme or its subsidiaries undertakes any intent or obligation to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Aerohive is responsible for information in this Current Report on Form 8-K concerning Aerohive, and Extreme is responsible for information in this Current Report on Form 8-K concerning Extreme or its subsidiaries.

Extreme’s Quarterly Report on Form 10-Q filed on May 10, 2019 and other filings with the SEC (which may be obtained for free at the SEC’s website at http://www.sec.gov) discuss some of the important risk factors that may affect Extreme’s business, results of operations and financial condition. Extreme undertakes no intent or obligation to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Exhibit 99.4

AUDIENCE: AEROHIVE PARTNERS

TO BE SENT ON JUNE 26 AT 4:45AM

Subject line: Extreme Agrees to Acquire Aerohive

Good morning,

We are excited to announce that we have entered into a definitive agreement under which Extreme will acquire Aerohive. Our industry-leading Cloud-Management platform combined with Extreme’s extensive solutions portfolio and continued investment in software and AI for automation will give you and your customers the most advanced digital experiences on the market. Together, we will push networking into a new era – making infrastructure smarter, more autonomous, and the driver of business value.

As your customers’ networks evolve, you will be in a position to offer them better network management and security from the cloud with more intelligence and automation across a full stack of innovative network options, all at cloud-speed. We’ll continue to build and grow our advanced cloud-based network management platform driven by an ISO27001 certified microservices cloud architecture with Native ML/AI that includes proactive problem resolution and 3D topology view of the Access Network. Learn more and access the partner FAQ here.

As you know, we are a partner-led company, as is Extreme. We appreciate our partnership and are committed to finding more ways for us to win together. We anticipate closing in Extreme’s first quarter of the fiscal year 2020 and look forward to introducing our expanded range of solutions in the near future.

As always, thank you for your support. We appreciate that your network is critical to your success. And, we appreciate the opportunity to be your trusted partner.

Best regards,

Aerohive Networks

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive Networks”) by Extreme Networks, Inc. (“Extreme Networks”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme Networks (“Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive Networks. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive Networks, nor is it a substitute for the tender offer materials that Extreme Networks and Purchaser will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Extreme Networks and Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive Networks will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE NETWORKS’ STOCKHOLDERS BEFORE ANY

DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Aerohive Networks’ stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive Networks by contacting Aerohive Networks at [email protected] or by phone at 1-408-769-6720, or by visiting Aerohive Networks’ website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE NETWORKS’ STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward-Looking Statements

This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive Networks, Extreme Networks, and Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive Networks; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”, “target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive Networks and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive Networks and others following announcement of the definitive agreement entered into with Extreme Networks and Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive Networks’ control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive Networks believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive Networks cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive Networks does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management’s expectations or otherwise, except as may be required by law.

Exhibit 99.5

AUDIENCE: AEROHIVE CUSTOMERS

TO BE SENT ON JUNE 26 AT 4:45AM

Subject line: Extreme Agrees to Acquire Aerohive

Good morning,

We are excited to share the news that Extreme will acquire Aerohive. Our industry-leading Cloud-Management platform combined with Extreme’s extensive solutions portfolio and continued investment in software and AI for automation will give you the most advanced digital experiences on the market. Together, we will push networking into a new era – making infrastructure smarter, more autonomous, and the driver of business value.

As your network evolves, we will be in a position to offer you even better network management and security from the cloud, along with more intelligence and automation at speed and scale. We’ll continue to build and grow the most advanced cloud-based network management driven by an ISO27001 certified microservices Cloud architecture with Native ML/AI and a near term roadmap that includes ML/AI-driven proactive problem resolution and 3D topology view of the Access Network.

We anticipate closing the acquisition in August. Throughout this process, we remain committed to your success, delivering the highest level of customer support. We look forward to sharing the new capabilities we will deliver with this acquisition, as together we continue to innovate at cloud-speed, building and growing the best cloud platform in the industry.

As always, thank you for your support. We appreciate that your network is critical to your success. And, we appreciate the opportunity to be your trusted provider.

Best regards,

Aerohive Networks

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Aerohive Networks, Inc. (“Aerohive Networks”) by Extreme Networks, Inc. (“Extreme Networks”), Clover Merger Sub, Inc., a wholly-owned subsidiary of Extreme Networks (“Purchaser”) will commence a tender offer for all of the outstanding shares of Aerohive Networks. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Aerohive Networks, nor is it a substitute for the tender offer materials that Extreme Networks and Purchaser will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Extreme Networks and Purchaser will file tender offer materials on Schedule TO with the SEC, and Aerohive Networks will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AEROHIVE NETWORKS’ STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the

solicitation/recommendation statement will be made available to Aerohive Networks’ stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Aerohive Networks by contacting Aerohive Networks at [email protected] or by phone at 1-408-769-6720, or by visiting Aerohive Networks’ website (https://ir.aerohive.com/inforequest). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. AEROHIVE NETWORKS’ STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward-Looking Statements

This communication may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to any statements regarding or relating to the transaction between Aerohive Networks, Extreme Networks, and Purchaser; any statements of expectation or belief; any statement regarding the future financial performance of Aerohive Networks; and any statements of assumptions underlying any of the foregoing. When used in this communication, the words “anticipate”, “believe”, “estimate”, “expect”, “expectation”, “goal”, “should”, “would”, “project”, “plan”, “predict”, “intend”, “target” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to Aerohive Networks and are subject to a number of risks, uncertainties and other factors that could cause results to differ from expectations include, but are not limited to: (i) uncertainties as to the timing of the tender offer and the merger; (ii) uncertainties as to how many of the holders of shares will tender their shares into the tender offer; (iii) the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived; (iv) legal proceedings that may be instituted against Aerohive Networks and others following announcement of the definitive agreement entered into with Extreme Networks and Purchaser; (v) other business effects, including the effects of industrial, economic or political conditions outside of Aerohive Networks’ control; (vi) transaction costs and/or actual or contingent liabilities; and (vii) other risks and uncertainties. Although Aerohive Networks believes that the expectations reflected in the forward-looking statements are reasonable, Aerohive Networks cannot guarantee future results, performance or achievements and no assurance can be given that the actual results will be consistent with these forward-looking statements. Aerohive Networks does not intend to update any of the forward-looking statements after the date of this communication to conform these statements to actual results, to changes in management’s expectations or otherwise, except as may be required by law.

Exhibit 99.6

|

|

Aerohive Employee FAQ

| 1. | What kind of work environment will Aerohive employees be entering into? |

Extreme Networks is an environment that encourages open, inclusive, transparent communication coupled with an action-oriented approach with the sole purpose of providing a world-class experience for our customers – including 50% of the Fortune 50. Extreme is a global company full of individuals who are excited to work and grow together. Extreme employees welcome Aerohive employees with our core values of candor, transparency, teamwork, curiosity, and ownership.

| 2. | What are the growth opportunities at Extreme for new employees? |

Extreme is a top global networking company serving the largest brands operating the most sophisticated networks in the world – with expanded growth opportunities. Extreme Networks is 100% committed to leading our customers through consistent innovation across its edge-to-cloud, software-driven technology portfolio, and employees joining us from Aerohive will be a crucial part of that journey.

| 3. | When are Aerohive employees expected to start on Extreme’s payroll? |

Subject to the satisfaction of customary closing conditions, the transaction is expected to close in Extreme’s first quarter of fiscal year 2020 (i.e., Aerohive’s third quarter of fiscal year 2019). While integration planning is ongoing, we currently expect most employees to transition to Extreme and be covered by its payroll at closing. Until that time, employees will continue to be employed by Aerohive.

| 4. | Where will I be working? |

Extreme is headquartered in San Jose. After closing, Extreme will evaluate the consolidation of facilities on a long-term basis based on company plans and customer needs.

| 5. | How does Extreme plan to integrate and operate Aerohive following the acquisition? |

Determining the right organizational structure to optimize the performance of the combined companies is a critical part of the integration and will be done as part of the integration planning that has already begun with the management teams of both Extreme and Aerohive.

| 6. | Will my current base pay and target bonus be honored at Extreme if I continue my employment following the closing? Aerohive employees who continue employment following the closing will initially maintain their current base pay and target bonus. If there is a change in the scope of an employee’s responsibilities in the employee’s new role at Extreme, subsequent changes to base pay and/or target bonus will be considered. |

1

Do not share any internal Extreme Networks internal communications outside of the company.

|

|

| 7. | If I continue employment with Extreme, what will happen to my current health insurance coverage? |

Outside of the US, Aerohive employees will stay on their current healthcare plans in the near term and may transition to the Extreme plans sometime after the closing of the transaction. For US employees, Extreme and Aerohive will work during integration planning to determine the appropriate timing to move everyone to the Extreme benefits plans. Our HR teams are working together to try to ensure a smooth transition.

| 8. | What happens to my 401(k)? |

The Aerohive 401(k) plan will terminate prior to the closing and employees will be given the opportunity to join the Extreme 401(k) plan as soon as administratively possible following the closing.

| 9. | Will I get my 1H 2019 bonus? |

1H bonuses will be paid at 100% of target to employees who remain employed by Aerohive through the earlier of August 15 or the closing.

| 10. | Will I get any bonus for 2H 2019? |

A prorated portion of 2H bonuses will be paid at 100% of target to employees who remain employed by Aerohive through the earlier of August 15 or the closing. 2H bonuses will be prorated for the time worked between July 1, 2019, and the earlier of August 15 or the closing.

| 11. | What happens to our ESPP? |

Under our ESPP, the current, ongoing offering periods will continue to run through July 31, 2019. This provides all current ESPP participants with an opportunity to benefit from the stock price increase. Participants will not be permitted to increase their contributions, and the current offering periods are closed to new participants.

| 12. | What will happen to my Aerohive equity awards at closing? |

Each vested option will be cancelled at the closing in exchange for a cash payment calculated by multiplying the number of shares subject to the vested option times the positive difference, if any, between (a) $4.45, the price Extreme is paying for each share of Aerohive common stock outstanding at the closing, and (b) the exercise price per share of the option. If the exercise price per share of the option is greater than or equal to $4.45, the vested option will be cancelled for no consideration.

Each vested award of restricted stock units and performance stock units will be cancelled at the closing in exchange for a cash payment calculated by multiplying the number of shares of Aerohive common stock underlying the award times $4.45.

2

Do not share any internal Extreme Networks internal communications outside of the company.

|

|

Cash payments made to current and former employees will be paid through payroll and subject to applicable withholding taxes.

Extreme will assume unvested equity awards held by employees who continue with the combined organization following the closing and convert them into Extreme equity awards that remain subject to substantially the same terms and conditions, including vesting, except that the number of shares of Extreme common stock that will be subject to the equity awards and any exercise price will be adjusted in a manner intended to maintain the aggregate value of the equity award as of immediately following the closing. Extreme will provide additional information regarding the assumption of your equity awards following the closing.

| 13. | Will Extreme continue Aerohive’s severance practices following the closing? |

Extreme has committed to maintaining Aerohive’s severance guidelines for at least 12 months following the closing.

| 14. | If I’m asked to work a short transition period post-close, what can I expect in terms of severance and retention? |

Extreme has committed to honor Aerohive’s severance guidelines for at least 12 months following the closing.

| 15. | When will you know which employees Extreme wishes to retain and which employees will be let go? |

No decisions have been made at this point. Extreme and Aerohive management teams are actively working together on integration planning. As part of this integration planning, we will communicate with those impacted by employment decisions.

| 16. | Can we trade in our company stock? |

Prior to closing, you will continue to be subject to Aerohive’s insider trading policy. If you have questions, please contact Aerohive’s legal department.

| 17. | Where will I fit in with the new Extreme organization? |

We will communicate to employees impacted by employment decisions made during the integration planning as those decisions are finalized, which is currently expected to occur no later than August 1, 2019.

| 18. | What does the future look like for Extreme? |

Extreme Networks has been in business for more than 20 years. In that time, we have succeeded in acquiring and bringing together companies and strategic assets that support and expand our core business. As we increase the breadth of our portfolio and scale of our organization to serve our 30,000 customers, we continually optimize all areas of our business to maximize efficiencies and strengthen our competitive position.

3

Do not share any internal Extreme Networks internal communications outside of the company.

|

|

The acquisition of Aerohive adds critical new cloud management and edge capabilities (Elements) to our portfolio. This makes Extreme a leader in the large and growing Wi-Fi market at a critical technology transition to Wi-Fi 6, and will accelerate our scale in a market segment which is growing at 9% annually.

Overall, Extreme is a Top-3 player in enterprise networking (up from #13 in 2013). This acquisition strengthens Extreme’s position in WLAN and makes us a leader in the Cloud-Managed WLAN Services revenue. It also strengthens our position the company’s in key vertical markets, such as state and local, education, healthcare and retail. The combined company will provide customers and partners with more choice – expanding our end-to-end portfolio to include both cloud and on-prem wired and wireless solutions, supported by industry leading in-sourced customer service for our collective customers.

| 19. | Can I share this news on my personal social media networks? (i.e. blogs, LinkedIn, Twitter, YouTube or Facebook) |

No. Certain communications related to the transaction must be filed with the SEC. These communications may include email and personal social media posts, whether you create a personal post or link to or reference another post or media article. Please do not make any communications regarding the transaction on social media, in other online accounts or otherwise comment publicly on the transaction. Your cooperation is critical to enable Extreme and Aerohive to comply with SEC rules and to ensure we can successfully close this transaction.

Aerohive Sales Employees

| 20. | How does this acquisition change the sales proposition for Aerohive? |

Overall, Extreme is a Top-3 player in enterprise networking (up from #13 in 2013). This acquisition strengthens Extreme’s position in WLAN, giving Extreme a leading market share overall and in Cloud-Managed WLAN Services revenue. It also strengthens our position in key vertical markets, such as state and local, education, healthcare and retail – verticals Aerohive already has a strong presence in. The combined company will provide customers and partners with more choice – giving Aerohive customers access to an end-to-end portfolio and offering a single source for both cloud and on-prem wired and wireless solutions, supported by industry leading in-sourced customer service.

| 21. | What new verticals will Aerohive be able to target as a result of this acquisition? |

In joining Extreme, Aerohive sellers will see dramatically increased market share in key verticals, including education, healthcare, state and local, and retail. They will have access to a large, edge-cloud portfolio of edge-cloud network solutions that enables greater opportunities for cross-sell and upsell.

4

Do not share any internal Extreme Networks internal communications outside of the company.

|

|

| 22. | What type of training will be given to Aerohive team members? |

All sellers will train on new technology with Extreme Product Management and Sales Enablement leaders via webinar and Extreme’s Dojo training program to ensure a smooth transition.

###

Additional Information and Where to Find It

The description contained herein is for informational purposes only and is not a recommendation, an offer to buy or the solicitation of an offer to sell any shares of Aerohive’s common stock. The tender offer for the outstanding shares of Aerohive’s common stock described in this report has not commenced. At the time the tender offer is commenced, Extreme will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and Aerohive will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Aerohive’s stockholders at no expense to them. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this communication may constitute “forward-looking statements”. Forward-looking statements may be typically identified by such words as “may,” “will,” “could,” “should,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. Although Extreme and Aerohive believe that the expectations reflected in the forward-looking statements are reasonable, any or all of such forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Extreme, Aerohive or their respective businesses or operations.

Factors which could cause actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that Purchaser may not receive sufficient number of shares tendered from Aerohive stockholders to complete the tender

5

Do not share any internal Extreme Networks internal communications outside of the company.

|

|

offer; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each of Aerohive and Extreme to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of Aerohive or Extreme; (5) the ability of Aerohive to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) Extreme’s ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating Aerohive with its existing businesses; and (10) legislative, regulatory and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Aerohive’s recent Quarterly Report on Form 10-Q, Extreme’s most recent Quarterly Report on Form 10-Q, and Aerohive’s and Extreme’s more recent reports filed with the SEC. Aerohive and Extreme can give no assurance that the conditions to the transaction will be satisfied. Neither Aerohive nor Extreme or its subsidiaries undertakes any intent or obligation to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Aerohive is responsible for information in this Current Report on Form 8-K concerning Aerohive, and Extreme is responsible for information in this Current Report on Form 8-K concerning Extreme or its subsidiaries.

Extreme’s Quarterly Report on Form 10-Q filed on May 10, 2019 and other filings with the SEC (which may be obtained for free at the SEC’s website at http://www.sec.gov) discuss some of the important risk factors that may affect Extreme’s business, results of operations and financial condition. Extreme undertakes no intent or obligation to publicly update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

###

6

Do not share any internal Extreme Networks internal communications outside of the company.