Form 8-K METLIFE INC For: May 24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 24, 2019

METLIFE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 1-15787 | 13-4075851 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 200 Park Avenue, New York, New York | 10166-0188 | |||

| (Address of Principal Executive Offices) | (Zip Code) |

212-578-9500

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

| ||

| Common Stock, par value $0.01

|

MET

|

New York Stock Exchange

| ||

| Floating Rate Non-Cumulative Preferred Stock, Series A, par value $0.01

|

MET PRA

|

New York Stock Exchange

| ||

| Depositary Shares each representing a 1/1000th interest in a share of 5.625% Non-Cumulative Preferred Stock, Series E

|

MET PRE

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On May 24, 2019, MetLife, Inc. issued a fact sheet setting forth its total assets under management at March 31, 2019 (the “Total AUM Fact Sheet”), a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing description of the Total AUM Fact Sheet is not complete and is qualified in its entirety by reference to the Total AUM Fact Sheet, which is filed as Exhibit 99.1, and is incorporated herein by reference.

| Item 8.01 | Other Events. |

The text under Item 2.02 above is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

| 99.1 | MetLife, Inc. total assets under management fact sheet at March 31, 2019 | |

2

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| METLIFE, INC. | ||

| By: | /s/ Tamara Schock | |

| Name: Tamara Schock | ||

| Title: Executive Vice President and Chief Accounting Officer | ||

Date: May 24, 2019

3

Exhibit 99.1

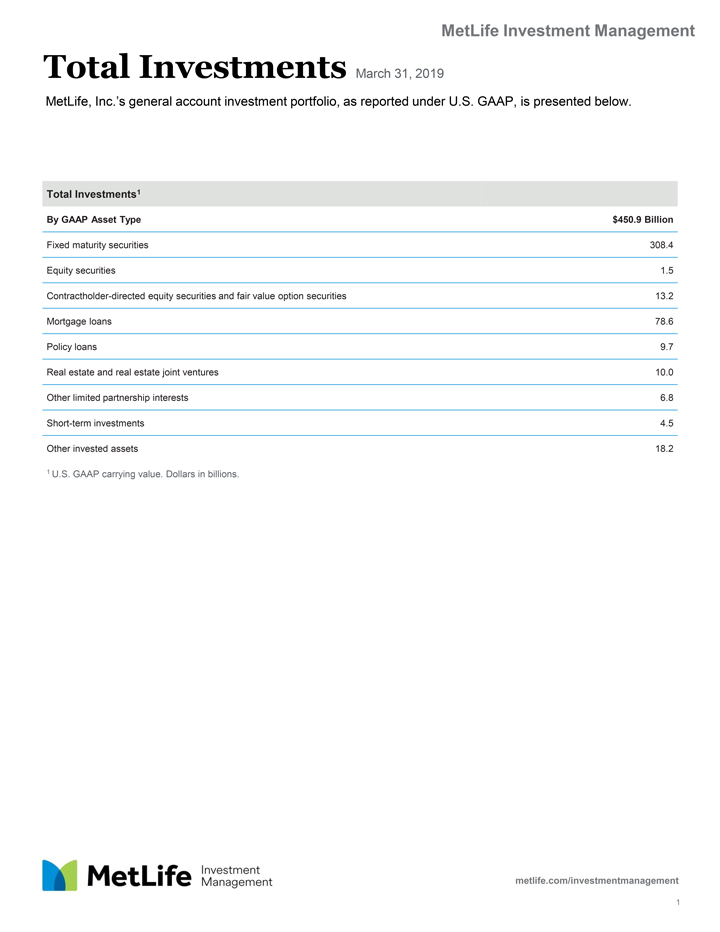

MetLife Investment Management Total Investments March 31, 2019 MetLife, Inc.’s general account investment portfolio, as reported under U.S. GAAP, is presented below. Total Investments1 By GAAP Asset Type $450.9 Billion Fixed maturity securities 308.4 Equity securities 1.5 Contractholder-directed equity securities and fair value option securities 13.2 Mortgage loans 78.6 Policy loans 9.7 Real estate and real estate joint ventures 10.0 Other limited partnership interests 6.8 Short-term investments 4.5 Other invested assets 18.2 1 U.S. GAAP carrying value. Dollars in billions. Investment Management Metlife.com/investmentmanagement 1

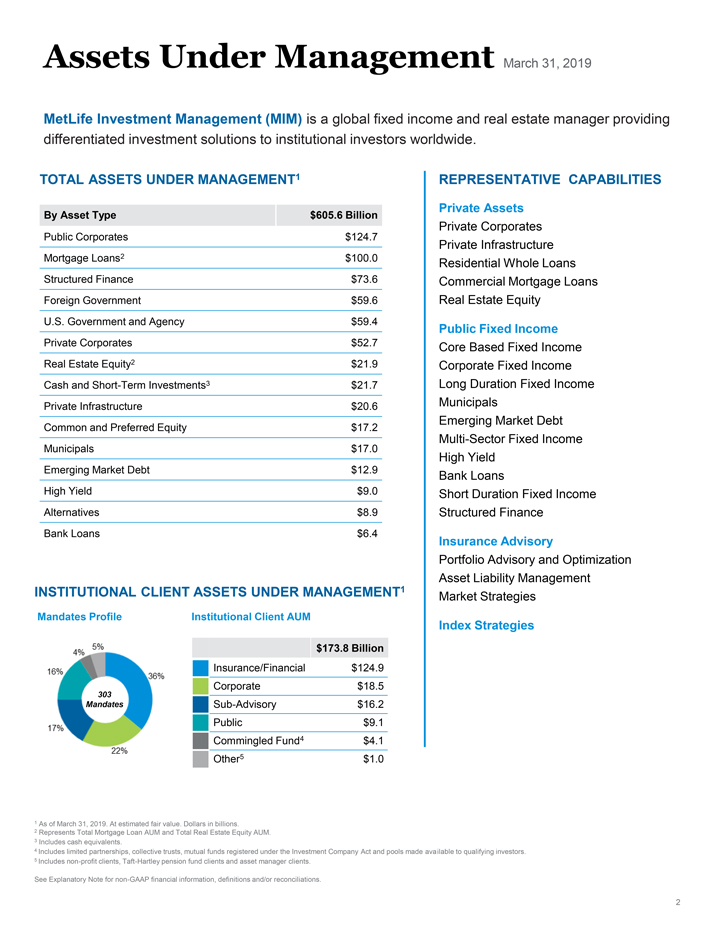

Assets Under Management March 31, 2019 MetLife Investment Management (MIM) is a global fixed income and real estate manager providing differentiated investment solutions to institutional investors worldwide. Total Assets Under Management1 By Asset Type $605.6 Billion Public Corporates $124.7 Mortgage Loans2 $100.0 Structured Finance $73.6 Foreign Government $59.6 U.S. Government and Agency $59.4 Private Corporates $52.7 Real Estate Equity2 $21.9 Cash and Short-Term Investments3 $21.7 Private Infrastructure $20.6 Common and Preferred Equity $17.2 Municipals $17.0 Emerging Market Debt $12.9 High Yield $9.0 Alternatives $8.9 Bank Loans $6.4 Institutional Client Assets Under Management1 Mandates Profile Institutional Client AUM 303 Mandates $173.8 Billion Insurance/Financial $124.9 Corporate $18.5 Sub-Advisory $16.2 Public $9.1 Commingled Fund4 $4.1 Other5 $1.0 Representative Capabilities Private Assets Private Corporates Private Infrastructure Residential Whole Loans Commercial Mortgage Loans Real Estate Equity Public Fixed Income Core Based Fixed Income Corporate Fixed Income Long Duration Fixed Income Municipals Emerging Market Debt Multi-Sector Fixed Income High Yield Bank Loans Short Duration Fixed Income Structured Finance Insurance Advisory Portfolio Advisory and Optimization Asset Liability Management Market Strategies Index Strategies 1 As of March 31, 2019. At estimated fair value. Dollars in billions. 2 Represents Total Mortgage Loan AUM and Total Real Estate Equity AUM. 3 Includes cash equivalents. 4 Includes limited partnerships, collective trusts, mutual funds registered under the Investment Company Act and pools made available to qualifying investors. 5 Includes non-profit clients, Taft-Hartley pension fund clients and asset manager clients. See Explanatory Note for non-GAAP financial information, definitions and/or reconciliations.

Explanatory Note on Non-GAAP Financial Information In this Fact Sheet, MetLife presents certain measures relating to its assets under management (“AUM”) that are not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). MetLife believes that these non-GAAP financial measures enhance the understanding of the depth and breadth of its investment management services on behalf of its general account (“GA”) investment portfolio, separate account (“SA”) investment portfolios and unaffiliated/third party clients. MetLife uses these measures to evaluate its asset management business. The following non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP: Non-GAAP financial measures: Comparable GAAP financial measures: (i) Total AUM (i) Total Investments (ii) GA AUM (ii) Total Investments (iii) Total Mortgage Loan AUM (iii) Mortgage Loans (iv) GA Mortgage Loan AUM (iv) Mortgage Loans (v) Total Real Estate Equity AUM; and (v) Real Estate and Real Estate Joint Ventures; and (vi) GA Real Estate Equity AUM (vi) Real Estate and Real Estate Joint Ventures Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are set forth in the tables below. Our definitions of non-GAAP and other financial measures discussed herein may differ from those used by other companies. Total Assets Under Management, General Account Assets Under Management, Gross Market Value of Commercial Real Estate Under Management and related measures: Total Assets Under Management (“Total AUM”) (as well as all other measures based on Total AUM, such as Total Mortgage Loan AUM, Total Commercial Mortgage Loan AUM, Total Agricultural Mortgage Loan AUM and Total Real Estate Equity AUM) are comprised of GA AUM (or the respective measure based on GA AUM) plus Institutional Client AUM (or the respective measure based on Institutional Client AUM) (each, as defined below). General Account Assets Under Management (“GA AUM”) (as well as other measures based on GA AUM, such as GA Mortgage Loan AUM, GA Commercial Mortgage Loan AUM, GA Agricultural Mortgage Loan AUM, GA Residential Mortgage Loan AUM and GA Real Estate Equity AUM) are used by MetLife to describe assets in its GA investment portfolio which are actively managed and stated at estimated fair value. MetLife believes the use of GA AUM (as well as the other measures based on GA AUM) enhances the understanding and comparability of its GA investment portfolio. GA AUM are comprised of GA Total Investments and cash and cash equivalents, excluding policy loans, other invested assets, contractholder-directed equity securities and fair value option securities, as substantially all of these assets are not actively managed in MetLife’s GA investment portfolio. Mortgage loans and real estate and real estate joint ventures included in GA AUM (at net asset value, net of deduction for encumbering debt), have been adjusted from carrying value to estimated fair value. Classification of GA AUM by sector is based on the nature and characteristics of the underlying investments which can vary from how they are classified under GAAP. Accordingly, the underlying investments within certain real estate and real estate joint ventures that are primarily commercial mortgage loans (at net asset value, net of a deduction of encumbering debt) have been reclassified to exclude them from GA Real Estate Equity AUM and include them in both GA Mortgage Loan AUM and GA Commercial Mortgage Loan AUM. Gross Market Value of Commercial Real Estate Assets Under Management (“Gross Commercial Real Estate AUM”) are comprised of Gross Market Value of Commercial Mortgage Loan AUM (“Gross Commercial Mortgage Loan AUM”) plus Gross Market Value of Real Estate Equity AUM (“Gross Real Estate Equity AUM”). Gross Commercial Mortgage Loan AUM and Gross Real Estate Equity AUM are comprised of Total Commercial Mortgage Loan AUM and Total Real Estate Equity AUM, respectively, each plus an adjustment to state at gross market value. For Gross Commercial Mortgage Loan AUM, this adjustment is the amount of encumbering debt related to the joint venture investments, with the underlying investments primarily in commercial mortgage loans (at net asset value, before deduction for encumbering debt) included in both GA Commercial Mortgage Loan AUM and Total Commercial Mortgage Loan AUM. For Gross Real Estate Equity AUM, this adjustment is the amount of encumbering debt related to Total Real Estate Equity AUM. The following additional information is relevant to an understanding of our assets under management: Institutional Client Assets Under Management (“Institutional Client AUM”) (as well as other measures based on Institutional Client AUM, such as Institutional Client Mortgage Loan AUM and Institutional Real Estate Equity AUM) are comprised of the respective portion of each of SA AUM and TP AUM (each, as defined below). MIM manages Institutional Client AUM in accordance with client contractual investment strategy guidelines (“Mandates”). Separate Account Assets Under Management (“SA AUM”) (as well as other measures based on SA AUM, such as SA Mortgage Loan AUM and SA Real Estate Equity AUM) are comprised of the respective portion of separate account investment portfolios, which are managed by MetLife and stated at estimated fair value. SA AUM (as well as the other measures based on SA AUM) are the respective portions of the separate account assets of MetLife insurance companies which are included in MetLife, Inc.’s consolidated financial statements at estimated fair value. Investment Management One MetLife Way Whippany, New Jersey 07981 2019 METLIFE, INC.

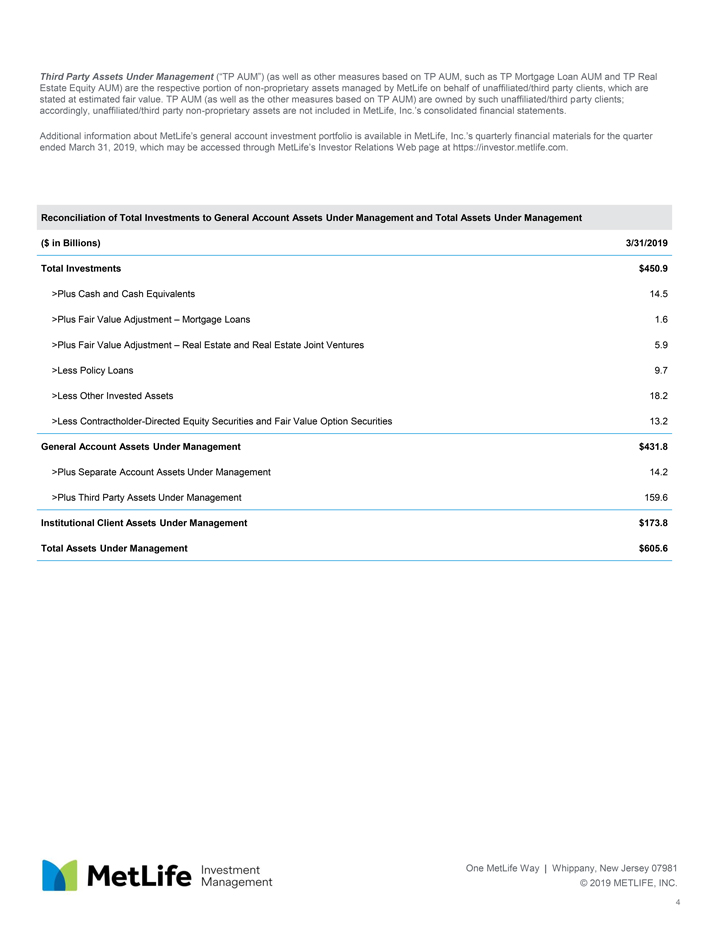

Third Party Assets Under Management (“TP AUM”) (as well as other measures based on TP AUM, such as TP Mortgage Loan AUM and TP Real Estate Equity AUM) are the respective portion of non-proprietary assets managed by MetLife on behalf of unaffiliated/third party clients, which are stated at estimated fair value. TP AUM (as well as the other measures based on TP AUM) are owned by such unaffiliated/third party clients; accordingly, unaffiliated/third party non-proprietary assets are not included in MetLife, Inc.’s consolidated financial statements. Additional information about MetLife’s general account investment portfolio is available in MetLife, Inc.’s quarterly financial materials for the quarter ended March 31, 2019, which may be accessed through MetLife’s Investor Relations Web page at https://investor.metlife.com. Reconciliation of Total Investments to General Account Assets Under Management and Total Assets Under Management ($ in Billions) 3/31/2019 Total Investments $450.9 >Plus Cash and Cash Equivalents 14.5 >Plus Fair Value Adjustment – Mortgage Loans 1.6 >Plus Fair Value Adjustment – Real Estate and Real Estate Joint Ventures 5.9 >Less Policy Loans 9.7 >Less Other Invested Assets 18.2 >Less Contractholder-Directed Equity Securities and Fair Value Option Securities 13.2 General Account Assets Under Management $431.8 >Plus Separate Account Assets Under Management 14.2 >Plus Third Party Assets Under Management 159.6 Institutional Client Assets Under Management $173.8 Total Assets Under Management $605.6 Investment Management One MetLife Way Whippany, New Jersey 07981 2019 METLIFE, INC.

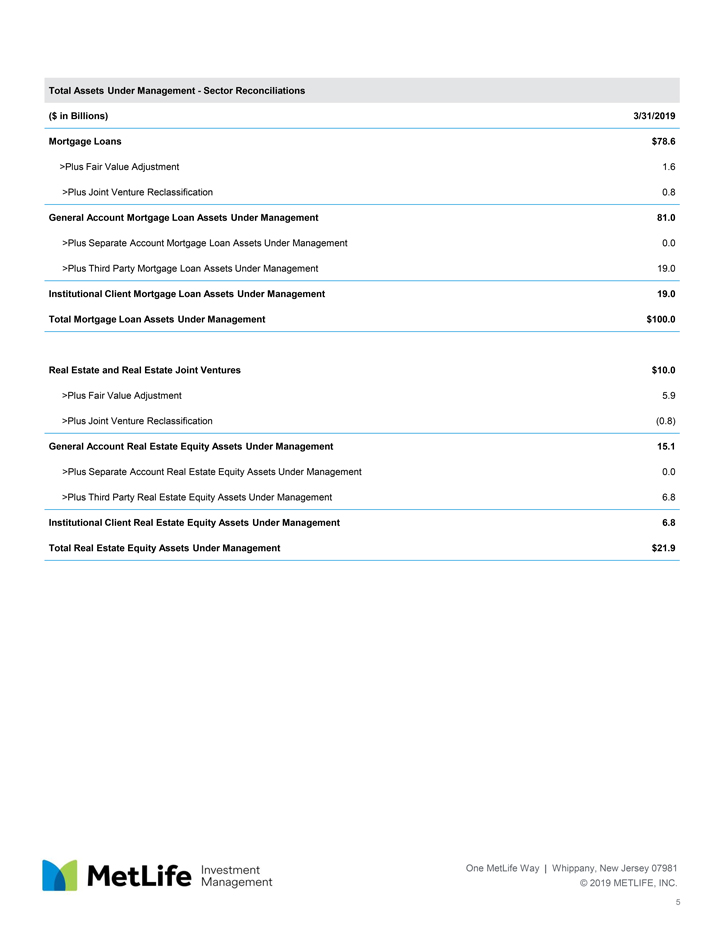

Total Assets Under Management - Sector Reconciliations ($ in Billions) 3/31/2019 Mortgage Loans $78.6 >Plus Fair Value Adjustment 1.6 >Plus Joint Venture Reclassification 0.8 General Account Mortgage Loan Assets Under Management 81.0 >Plus Separate Account Mortgage Loan Assets Under Management 0.0 >Plus Third Party Mortgage Loan Assets Under Management 19.0 Institutional Client Mortgage Loan Assets Under Management 19.0 Total Mortgage Loan Assets Under Management $100.0 Real Estate and Real Estate Joint Ventures $10.0 >Plus Fair Value Adjustment 5.9 >Plus Joint Venture Reclassification (0.8) General Account Real Estate Equity Assets Under Management 15.1 >Plus Separate Account Real Estate Equity Assets Under Management 0.0 >Plus Third Party Real Estate Equity Assets Under Management 6.8 Institutional Client Real Estate Equity Assets Under Management 6.8 Total Real Estate Equity Assets Under Management $21.9 Investment Management One MetLife Way Whippany, New Jersey 07981 2019 METLIFE, INC.