Form 8-K LATTICE SEMICONDUCTOR For: May 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2019

Lattice Semiconductor Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 000-18032 | 93-0835214 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

5555 NE Moore Court

Hillsboro, OR 97124

(Address of principal executive offices, including zip code)

(503) 268-8000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each Class) |

(Trading Symbol(s)) |

(Name of each exchange on which registered) | ||

| Common Stock, $.01 par value | LSCC | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 or the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On May 20, 2019, Lattice Semiconductor Corporation (“Lattice”) held a previously announced meeting with investors and analysts in New York (“Financial Analyst Day”), and made the Financial Analyst Day meeting publicly available via webcast for investors and the general public. At Financial Analyst Day, management made presentations concerning Lattice’s strategy, markets, products, customers, and financial performance and targets, among other topics.

Attached as an exhibit is the Financial Analyst Day presentation. The presentation and a recording of the webcast may also be found on Lattice’s Investor Relations website, http://ir.latticesemi.com/events/event-details/lattice-2019-financial-analyst-day.

The presentation also includes forward-looking statements and cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The information in Item 7.01 of this report is furnished and shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

| Item 9.01 | Financial Statements and Exhibits |

| (d) | Exhibits. |

| Exhibit |

Description | |

| 99.1 | 2019 Financial Analyst Day Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| LATTICE SEMICONDUCTOR CORPORATION | ||||||

| Date: May 20, 2019 | By: | /s/ Byron W. Milstead | ||||

| Byron W. Milstead Corporate Vice President and General Counsel | ||||||

Exhibit 99.1 The Low Power Programmable Leader 2019 FINANCIAL ANALYST DAY NEW YORK NASDAQ: LSCC 1 -Exhibit 99.1 The Low Power Programmable Leader 2019 FINANCIAL ANALYST DAY NEW YORK NASDAQ: LSCC 1 -

Safe Harbor This presentation contains forward-looking statements that involve estimates, assumptions, risks and uncertainties, including statements relating to our expectations about the growth of our end markets, our belief that we will launch new products over the next 12 months, that we will accelerate profitable revenue growth, that we will expand our position in servers, that our SAM will grow to $3 billion in 2022, that growth acceleration will be driven by our new platform, and our expectations regarding achievable results under the heading “Financial Priorities,” including revenue growth, OpEx discipline, gross margin expansion, cash generation, profit expansion and leverage. Factors that may cause actual results to differ materially from the forward-looking statements in this presentation include those risks more fully described in Lattice’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 29, 2018 and quarterly filings. You should not unduly rely on forward-looking statements because actual results could differ materially from those expressed in any forward-looking statements. In addition, any forward-looking statement applies only as of the date on which it is made. The Company does not intend to update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. NASDAQ: LSCC 2 -Safe Harbor This presentation contains forward-looking statements that involve estimates, assumptions, risks and uncertainties, including statements relating to our expectations about the growth of our end markets, our belief that we will launch new products over the next 12 months, that we will accelerate profitable revenue growth, that we will expand our position in servers, that our SAM will grow to $3 billion in 2022, that growth acceleration will be driven by our new platform, and our expectations regarding achievable results under the heading “Financial Priorities,” including revenue growth, OpEx discipline, gross margin expansion, cash generation, profit expansion and leverage. Factors that may cause actual results to differ materially from the forward-looking statements in this presentation include those risks more fully described in Lattice’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 29, 2018 and quarterly filings. You should not unduly rely on forward-looking statements because actual results could differ materially from those expressed in any forward-looking statements. In addition, any forward-looking statement applies only as of the date on which it is made. The Company does not intend to update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. NASDAQ: LSCC 2 -

Agenda 1 Overview Jim Anderson 2 Markets Esam Elashmawi 3 Products Steve Douglass 4 Customers Mark Nelson 5 Financials Sherri Luther 6 Q & A All 7 Wrap Up Jim Anderson NASDAQ: LSCC 3 -Agenda 1 Overview Jim Anderson 2 Markets Esam Elashmawi 3 Products Steve Douglass 4 Customers Mark Nelson 5 Financials Sherri Luther 6 Q & A All 7 Wrap Up Jim Anderson NASDAQ: LSCC 3 -

Overview NASDAQ: LSCC 4 -Overview NASDAQ: LSCC 4 -

LATTICE 2019 FINANCIAL ANALYST DAY OVERVIEW JIM ANDERSON PRESIDENT & CEO The Low Power Programmable LeaderLATTICE 2019 FINANCIAL ANALYST DAY OVERVIEW JIM ANDERSON PRESIDENT & CEO The Low Power Programmable Leader

Lattice Opportunity GROWING HIGH-GROWTH BROAD CUSTOMER DIFFERENTIATED PROFIT END MARKETS APPLICATIONS RELATIONSHIPS TECHNOLOGY GROWTH Large Growing TAM Lowest Power Edge AI & Compute Position in Top OEMs Strong Business Model New Usage Models Smallest Size 5G Infrastructure Multi-generational Above Market Growth High Value Solutions Easy to Use Platform Security Diverse Customer Base Margin Expansion NASDAQ: LSCC 6 -Lattice Opportunity GROWING HIGH-GROWTH BROAD CUSTOMER DIFFERENTIATED PROFIT END MARKETS APPLICATIONS RELATIONSHIPS TECHNOLOGY GROWTH Large Growing TAM Lowest Power Edge AI & Compute Position in Top OEMs Strong Business Model New Usage Models Smallest Size 5G Infrastructure Multi-generational Above Market Growth High Value Solutions Easy to Use Platform Security Diverse Customer Base Margin Expansion NASDAQ: LSCC 6 -

Changes to Position Lattice for Success STRONGER ROADMAP FOCUSED STRATEGY STABLE GROWTH Sustainable, Multi-year Faster Cadence; 100% Focus on FPGA Revenue Streams System Solutions REVITALIZED CULTURE FINANCIAL DISCIPLINE RE-ENERGIZED TEAM Consistent Profitability and New Leadership with Fast, Accountable, Cash Flow Expansion Deep Industry Expertise Performance Driven NASDAQ: LSCC 7 -Changes to Position Lattice for Success STRONGER ROADMAP FOCUSED STRATEGY STABLE GROWTH Sustainable, Multi-year Faster Cadence; 100% Focus on FPGA Revenue Streams System Solutions REVITALIZED CULTURE FINANCIAL DISCIPLINE RE-ENERGIZED TEAM Consistent Profitability and New Leadership with Fast, Accountable, Cash Flow Expansion Deep Industry Expertise Performance Driven NASDAQ: LSCC 7 -

Our Mission The Low Power Programmable Leader NASDAQ: LSCC 8 -Our Mission The Low Power Programmable Leader NASDAQ: LSCC 8 -

Positioned in Growing End Markets COMMUNICATIONS COMPUTE INDUSTRIAL AUTOMOTIVE CONSUMER Smart Home 5G Wireless Industrial IoT ADAS Servers Wearables Switches/Routers Factory Automation Infotainment Client Large $3B SAM with Multiple Secular Growth Drivers NASDAQ: LSCC 9 -Positioned in Growing End Markets COMMUNICATIONS COMPUTE INDUSTRIAL AUTOMOTIVE CONSUMER Smart Home 5G Wireless Industrial IoT ADAS Servers Wearables Switches/Routers Factory Automation Infotainment Client Large $3B SAM with Multiple Secular Growth Drivers NASDAQ: LSCC 9 -

Lattice Product Portfolio BROAD FAMILY OF LOW POWER FPGAs GENERAL PURPOSE Addresses a broad range of applications across multiple markets FPGA FAMILIES TAILORED FOR SPECIFIC NEEDS VIDEO CONNECTIVITY ULTRA LOW POWER CONTROL & SECURITY Optimized for high World’s lowest power Optimized for platform speed video and FPGAs; Optimized management & sensor applications for small form factor security applications NASDAQ: LSCC 10 -Lattice Product Portfolio BROAD FAMILY OF LOW POWER FPGAs GENERAL PURPOSE Addresses a broad range of applications across multiple markets FPGA FAMILIES TAILORED FOR SPECIFIC NEEDS VIDEO CONNECTIVITY ULTRA LOW POWER CONTROL & SECURITY Optimized for high World’s lowest power Optimized for platform speed video and FPGAs; Optimized management & sensor applications for small form factor security applications NASDAQ: LSCC 10 -

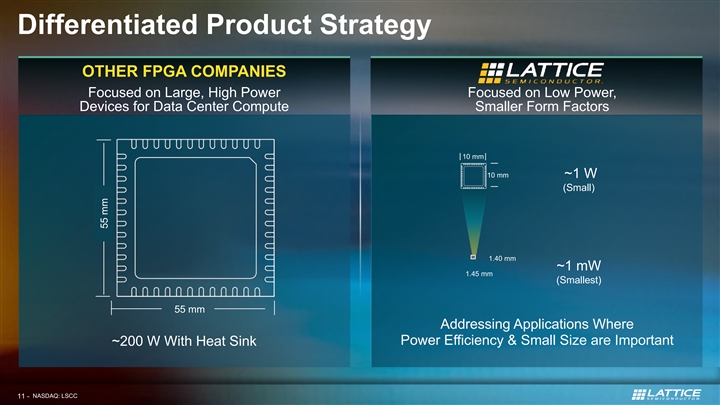

Differentiated Product Strategy OTHER FPGA COMPANIES Focused on Large, High Power Focused on Low Power, Devices for Data Center Compute Smaller Form Factors 10 mm 10 mm ~1 W (Small) 1.40 mm ~1 mW 1.45 mm (Smallest) 55 mm Addressing Applications Where Power Efficiency & Small Size are Important ~200 W With Heat Sink NASDAQ: LSCC 11 - 55 mmDifferentiated Product Strategy OTHER FPGA COMPANIES Focused on Large, High Power Focused on Low Power, Devices for Data Center Compute Smaller Form Factors 10 mm 10 mm ~1 W (Small) 1.40 mm ~1 mW 1.45 mm (Smallest) 55 mm Addressing Applications Where Power Efficiency & Small Size are Important ~200 W With Heat Sink NASDAQ: LSCC 11 - 55 mm

Solving Problems at the Edge AI & IoT AI Inferencing at the Edge VIDEO 10 mm Embedded Vision 10 mm ~1 W (Small) SECURITY Hardware Platform Security 1.40 mm ~1 mW 1.45 mm 5G INFRASTRUCTURE (Smallest) Control & Management AUTOMATION Precision Robotic Motor Control NASDAQ: LSCC 12 -Solving Problems at the Edge AI & IoT AI Inferencing at the Edge VIDEO 10 mm Embedded Vision 10 mm ~1 W (Small) SECURITY Hardware Platform Security 1.40 mm ~1 mW 1.45 mm 5G INFRASTRUCTURE (Smallest) Control & Management AUTOMATION Precision Robotic Motor Control NASDAQ: LSCC 12 -

Strong and Diversified Sales Channels STRONG POSITION WITH LEADING OEMS DIVERSE CUSTOMER BASE VIA DISTRIBUTION Diversified Global Footprint with Opportunity to Expand NASDAQ: LSCC 13 -Strong and Diversified Sales Channels STRONG POSITION WITH LEADING OEMS DIVERSE CUSTOMER BASE VIA DISTRIBUTION Diversified Global Footprint with Opportunity to Expand NASDAQ: LSCC 13 -

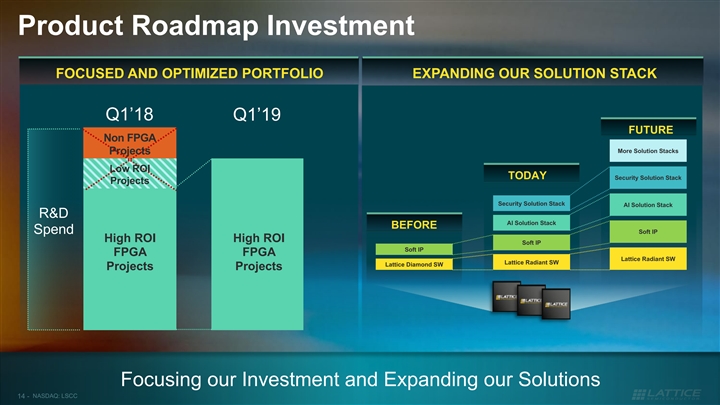

Product Roadmap Investment FOCUSED AND OPTIMIZED PORTFOLIO EXPANDING OUR SOLUTION STACK Q1’18 Q1’19 FUTURE Non FPGA More Solution Stacks Projects Low ROI TODAY Security Solution Stack Projects Security Solution Stack AI Solution Stack R&D AI Solution Stack BEFORE Spend Soft IP High ROI High ROI Soft IP Soft IP FPGA FPGA Lattice Radiant SW Lattice Radiant SW Lattice Diamond SW Projects Projects Focusing our Investment and Expanding our Solutions NASDAQ: LSCC 14 -Product Roadmap Investment FOCUSED AND OPTIMIZED PORTFOLIO EXPANDING OUR SOLUTION STACK Q1’18 Q1’19 FUTURE Non FPGA More Solution Stacks Projects Low ROI TODAY Security Solution Stack Projects Security Solution Stack AI Solution Stack R&D AI Solution Stack BEFORE Spend Soft IP High ROI High ROI Soft IP Soft IP FPGA FPGA Lattice Radiant SW Lattice Radiant SW Lattice Diamond SW Projects Projects Focusing our Investment and Expanding our Solutions NASDAQ: LSCC 14 -

New Products Over the Next 12 Months CrossLinkPlus sensAI 2.0 MachXO3D Next Generation Enhanced New AI Robust Platform Next Generation Video Bridging Capabilities Security FPGA Platform Sampling in H2 2019 Launching Today Launching Today Sampling early 2020 NASDAQ: LSCC 15 -New Products Over the Next 12 Months CrossLinkPlus sensAI 2.0 MachXO3D Next Generation Enhanced New AI Robust Platform Next Generation Video Bridging Capabilities Security FPGA Platform Sampling in H2 2019 Launching Today Launching Today Sampling early 2020 NASDAQ: LSCC 15 -

Revenue Growth by End Markets Revenue Single Digit Growth Double Digit Growth SEGMENT DRIVERS 5G Infrastructure Deployments Servers in Cloud and Enterprise $386M $399M Client Compute Platforms Comms / 29% 31% Compute Industrial IoT Factory Automation Industrial 35% 39% / Auto Automotive Electronics Consumer 28% 25% Smart Home Prosumer 8% 5% IP 2017 2018 Next 2 years 3 – 4 years Accelerating Profitable Revenue Growth NASDAQ: LSCC 16 -Revenue Growth by End Markets Revenue Single Digit Growth Double Digit Growth SEGMENT DRIVERS 5G Infrastructure Deployments Servers in Cloud and Enterprise $386M $399M Client Compute Platforms Comms / 29% 31% Compute Industrial IoT Factory Automation Industrial 35% 39% / Auto Automotive Electronics Consumer 28% 25% Smart Home Prosumer 8% 5% IP 2017 2018 Next 2 years 3 – 4 years Accelerating Profitable Revenue Growth NASDAQ: LSCC 16 -

Gross Margin Expansion EXPANSION STRATEGIES GROSS MARGIN Over 62% Pricing Optimization 58.6% 57.2% Product Cost Improvement 56.3% Mix Shift 50% 2017 2018 Q1’19 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 17 -Gross Margin Expansion EXPANSION STRATEGIES GROSS MARGIN Over 62% Pricing Optimization 58.6% 57.2% Product Cost Improvement 56.3% Mix Shift 50% 2017 2018 Q1’19 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 17 -

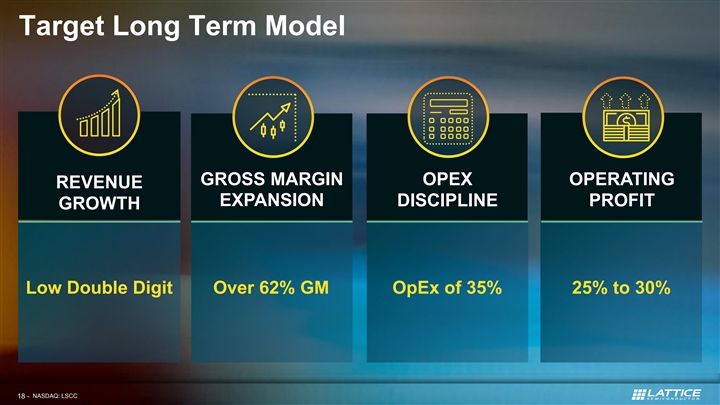

Target Long Term Model GROSS MARGIN OPEX OPERATING REVENUE EXPANSION DISCIPLINE PROFIT GROWTH Low Double Digit Over 62% GM OpEx of 35% 25% to 30% NASDAQ: LSCC 18 -Target Long Term Model GROSS MARGIN OPEX OPERATING REVENUE EXPANSION DISCIPLINE PROFIT GROWTH Low Double Digit Over 62% GM OpEx of 35% 25% to 30% NASDAQ: LSCC 18 -

Positioned for Success GROWING HIGH-GROWTH BROAD CUSTOMER DIFFERENTIATED PROFIT END MARKETS APPLICATIONS RELATIONSHIPS TECHNOLOGY GROWTH NASDAQ: LSCC 19 -Positioned for Success GROWING HIGH-GROWTH BROAD CUSTOMER DIFFERENTIATED PROFIT END MARKETS APPLICATIONS RELATIONSHIPS TECHNOLOGY GROWTH NASDAQ: LSCC 19 -

Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 20 -Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 20 -

Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 21 -Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 21 -

LATTICE 2019 FINANCIAL ANALYST DAY MARKETS ESAM ELASHMAWI MARKETING & STRATEGY The Low Power Programmable LeaderLATTICE 2019 FINANCIAL ANALYST DAY MARKETS ESAM ELASHMAWI MARKETING & STRATEGY The Low Power Programmable Leader

FPGA Value Proposition Faster Time to Market Programmability and Tuning Personalization Supply Chain Flexibility Evolving Standards Parallel Processing NASDAQ: LSCC 23 -FPGA Value Proposition Faster Time to Market Programmability and Tuning Personalization Supply Chain Flexibility Evolving Standards Parallel Processing NASDAQ: LSCC 23 -

FPGA Market Overview FPGA MARKET FORECAST 2018 FPGA TAM 1.4X SMALL FPGA FPGA Growth LOW POWER 8% CAGR 1.2X $1.6B $4B Other 1.0X FPGAs Semi Growth (Non-memory) 4% CAGR 0.8X LARGE FPGA 2018 2019 2020 2021 2022 HIGH POWER Source: IHS Q1’19 NASDAQ: LSCC 24 -FPGA Market Overview FPGA MARKET FORECAST 2018 FPGA TAM 1.4X SMALL FPGA FPGA Growth LOW POWER 8% CAGR 1.2X $1.6B $4B Other 1.0X FPGAs Semi Growth (Non-memory) 4% CAGR 0.8X LARGE FPGA 2018 2019 2020 2021 2022 HIGH POWER Source: IHS Q1’19 NASDAQ: LSCC 24 -

Lattice SAM Expansion LATTICE SAM DOUBLES TO $3B SAM 2022 SAM BY MARKETS NEW APPLICATIONS AI INDUSTRIAL & $0.8B AUTOMOTIVE SAM Security Embedded Vision 42% TRADITIONAL APPLICATIONS 28% 5G Infrastructure 30% Factory Automation $2.2B Server and Client $1.6B SAM SAM Automotive Prosumer COMMS & CONSUMER COMPUTE 2022 2018 NASDAQ: LSCC 25 -Lattice SAM Expansion LATTICE SAM DOUBLES TO $3B SAM 2022 SAM BY MARKETS NEW APPLICATIONS AI INDUSTRIAL & $0.8B AUTOMOTIVE SAM Security Embedded Vision 42% TRADITIONAL APPLICATIONS 28% 5G Infrastructure 30% Factory Automation $2.2B Server and Client $1.6B SAM SAM Automotive Prosumer COMMS & CONSUMER COMPUTE 2022 2018 NASDAQ: LSCC 25 -

5G Industry Impact COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Change Our Connected Drive Infrastructure Drive Re-fresh of Experience Content Connected Devices NASDAQ: LSCC 26 -5G Industry Impact COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Change Our Connected Drive Infrastructure Drive Re-fresh of Experience Content Connected Devices NASDAQ: LSCC 26 -

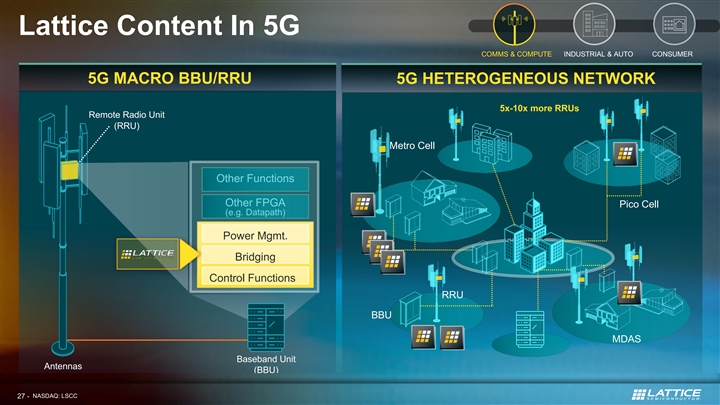

Lattice Content In 5G COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER 5G MACRO BBU/RRU 5G HETEROGENEOUS NETWORK 5x-10x more RRUs Remote Radio Unit (RRU) Metro Cell Other Functions Other FPGA Pico Cell (e.g. Datapath) Power Mgmt. Bridging Control Functions RRU BBU MDAS Baseband Unit Antennas (BBU) NASDAQ: LSCC 27 -Lattice Content In 5G COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER 5G MACRO BBU/RRU 5G HETEROGENEOUS NETWORK 5x-10x more RRUs Remote Radio Unit (RRU) Metro Cell Other Functions Other FPGA Pico Cell (e.g. Datapath) Power Mgmt. Bridging Control Functions RRU BBU MDAS Baseband Unit Antennas (BBU) NASDAQ: LSCC 27 -

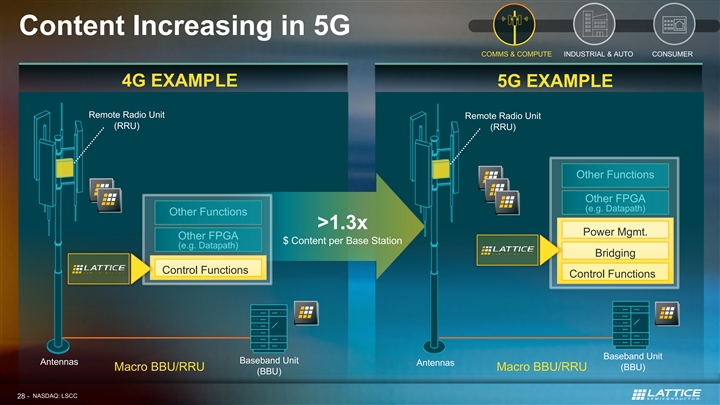

Content Increasing in 5G COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER 4G EXAMPLE 5G EXAMPLE Remote Radio Unit Remote Radio Unit (RRU) (RRU) Other Functions Other FPGA (e.g. Datapath) Other Functions >1.3x Power Mgmt. Other FPGA $ Content per Base Station (e.g. Datapath) Bridging Control Functions Control Functions Baseband Unit Baseband Unit Antennas Antennas (BBU) Macro BBU/RRU Macro BBU/RRU (BBU) NASDAQ: LSCC 28 -Content Increasing in 5G COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER 4G EXAMPLE 5G EXAMPLE Remote Radio Unit Remote Radio Unit (RRU) (RRU) Other Functions Other FPGA (e.g. Datapath) Other Functions >1.3x Power Mgmt. Other FPGA $ Content per Base Station (e.g. Datapath) Bridging Control Functions Control Functions Baseband Unit Baseband Unit Antennas Antennas (BBU) Macro BBU/RRU Macro BBU/RRU (BBU) NASDAQ: LSCC 28 -

Datacenter Market COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER CLOUD BIG DATA Age of Data and Hyperscaler Datacenter Driving Change Processing Build-out NASDAQ: LSCC 29 -Datacenter Market COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER CLOUD BIG DATA Age of Data and Hyperscaler Datacenter Driving Change Processing Build-out NASDAQ: LSCC 29 -

Expanding Position In Servers COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER PRIOR SERVER PLATFORM CURRENT SERVER PLATFORM NEXT GEN SERVER PLATFORM (Ramping Down) (Ramping Now) (In Design Now) Other FPGA, Accelerator Accelerator Accelerator GPUs, etc. Memory Memory Memory CPU CPU CPU Chipset Chipset Chipset Security Security Security Syst. Status Monitoring Syst. Status Monitoring Basic Peripheral Ctrl I/O Enhanced Peripheral Ctrl I/O Enhanced Peripheral Ctrl I/O Basic Power Mgmt. Full Power Mgmt. Full Power Mgmt. ATTACH 25% RATE >80% >80% TARGET ASP 1X 2X 3X NASDAQ: LSCC Increasing Attach Rate & ASP 30 -Expanding Position In Servers COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER PRIOR SERVER PLATFORM CURRENT SERVER PLATFORM NEXT GEN SERVER PLATFORM (Ramping Down) (Ramping Now) (In Design Now) Other FPGA, Accelerator Accelerator Accelerator GPUs, etc. Memory Memory Memory CPU CPU CPU Chipset Chipset Chipset Security Security Security Syst. Status Monitoring Syst. Status Monitoring Basic Peripheral Ctrl I/O Enhanced Peripheral Ctrl I/O Enhanced Peripheral Ctrl I/O Basic Power Mgmt. Full Power Mgmt. Full Power Mgmt. ATTACH 25% RATE >80% >80% TARGET ASP 1X 2X 3X NASDAQ: LSCC Increasing Attach Rate & ASP 30 -

Industrial & Automotive COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Factory Machine Robotics Connected Autonomous Electrification Automation Vision NASDAQ: LSCC 31 -Industrial & Automotive COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Factory Machine Robotics Connected Autonomous Electrification Automation Vision NASDAQ: LSCC 31 -

Content Increasing In Industrial COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Programmable Logic Controller Industrial Networking Predictive Maintenance Motor Control Package Detection Functional Safety Machine Vision Collision Avoidance Sensor Bridging Current revenue drivers Future revenue drivers NASDAQ: LSCC 32 -Content Increasing In Industrial COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Programmable Logic Controller Industrial Networking Predictive Maintenance Motor Control Package Detection Functional Safety Machine Vision Collision Avoidance Sensor Bridging Current revenue drivers Future revenue drivers NASDAQ: LSCC 32 -

Content Increasing In Automotive COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER EV CAR Motor Control IGBT Protection ADAS E-MIRROR Image Sensor Bridging INFOTAINMENT De-Fog and Aggregation Driver Monitoring Audio Bridging ISP Radar Sensor Bridging Display Bridging 360° Surround View and Aggregation Current revenue drivers Future revenue drivers NASDAQ: LSCC 33 -Content Increasing In Automotive COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER EV CAR Motor Control IGBT Protection ADAS E-MIRROR Image Sensor Bridging INFOTAINMENT De-Fog and Aggregation Driver Monitoring Audio Bridging ISP Radar Sensor Bridging Display Bridging 360° Surround View and Aggregation Current revenue drivers Future revenue drivers NASDAQ: LSCC 33 -

Consumer COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Prosumer Smart Home Wearables NASDAQ: LSCC 34 -Consumer COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Prosumer Smart Home Wearables NASDAQ: LSCC 34 -

Consumer COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Drones Residential Security Smart Light High end Projectors Smart Thermostat AR / VR Smart Appliances Sound Bars Smart Speakers Current revenue drivers Future revenue drivers NASDAQ: LSCC 35 -Consumer COMMS & COMPUTE INDUSTRIAL & AUTO CONSUMER Drones Residential Security Smart Light High end Projectors Smart Thermostat AR / VR Smart Appliances Sound Bars Smart Speakers Current revenue drivers Future revenue drivers NASDAQ: LSCC 35 -

The Low Power Programmable Leader $3B LATTICE SAM IN 2022 GROWTH POTENTIAL INDUSTRIAL & $3B SAM Opportunity AUTOMOTIVE 42% END MARKETS Fast Growing Applications 28% 30% VALUED SOLUTIONS FPGA Proliferation COMMS & CONSUMER COMPUTE NASDAQ: LSCC 36 -The Low Power Programmable Leader $3B LATTICE SAM IN 2022 GROWTH POTENTIAL INDUSTRIAL & $3B SAM Opportunity AUTOMOTIVE 42% END MARKETS Fast Growing Applications 28% 30% VALUED SOLUTIONS FPGA Proliferation COMMS & CONSUMER COMPUTE NASDAQ: LSCC 36 -

Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 37 -Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 37 -

LATTICE 2019 FINANCIAL ANALYST DAY PRODUCTS STEVE DOUGLASS RESEARCH & DEVELOPMENT The Low Power Programmable LeaderLATTICE 2019 FINANCIAL ANALYST DAY PRODUCTS STEVE DOUGLASS RESEARCH & DEVELOPMENT The Low Power Programmable Leader

R&D Strategy STRENGTHS CHALLENGES STRATEGY Talented, Dedicated Team Focus on FPGA Too Many Projects Customer Driven Roadmap Multiple FPGA Architectures Platform Based Design Differentiated Products Growing System Complexity Expand System Solutions NASDAQ: LSCC 39 -R&D Strategy STRENGTHS CHALLENGES STRATEGY Talented, Dedicated Team Focus on FPGA Too Many Projects Customer Driven Roadmap Multiple FPGA Architectures Platform Based Design Differentiated Products Growing System Complexity Expand System Solutions NASDAQ: LSCC 39 -

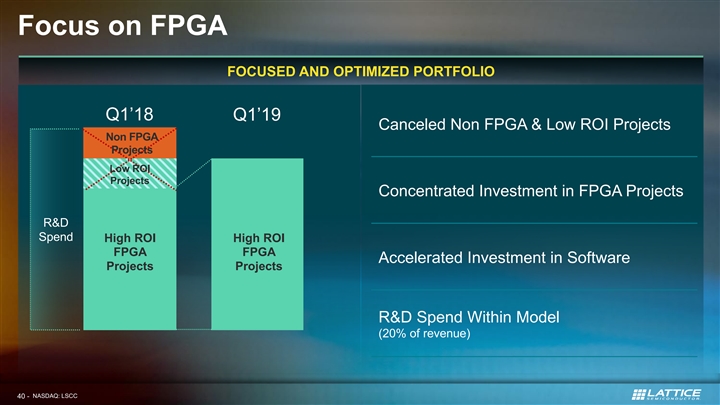

Focus on FPGA FOCUSED AND OPTIMIZED PORTFOLIO Q1’18 Q1’19 Canceled Non FPGA & Low ROI Projects Non FPGA Projects Low ROI Projects Concentrated Investment in FPGA Projects R&D Spend High ROI High ROI FPGA FPGA Accelerated Investment in Software Projects Projects R&D Spend Within Model (20% of revenue) NASDAQ: LSCC 40 -Focus on FPGA FOCUSED AND OPTIMIZED PORTFOLIO Q1’18 Q1’19 Canceled Non FPGA & Low ROI Projects Non FPGA Projects Low ROI Projects Concentrated Investment in FPGA Projects R&D Spend High ROI High ROI FPGA FPGA Accelerated Investment in Software Projects Projects R&D Spend Within Model (20% of revenue) NASDAQ: LSCC 40 -

Platform Based Design PRIOR METHOD Product 3 Product 1 Product 2 Lack of Reuse and Scale NEW METHOD PLATFORM 1 PLATFORM 2 Product 2A Product 1A Maximizes Design Reuse Lower Development Cost Product 2B Product 1B Faster Time to Market Product 2C Product 1C NASDAQ: LSCC 41 -Platform Based Design PRIOR METHOD Product 3 Product 1 Product 2 Lack of Reuse and Scale NEW METHOD PLATFORM 1 PLATFORM 2 Product 2A Product 1A Maximizes Design Reuse Lower Development Cost Product 2B Product 1B Faster Time to Market Product 2C Product 1C NASDAQ: LSCC 41 -

Expand System Solutions FUTURE More Solution Stacks TODAY Security Solution Stack Security Solution Stack AI Solution Stack AI Solution Stack BEFORE Soft IP Soft IP Soft IP Lattice Radiant SW Lattice Radiant SW Lattice Diamond SW Bringing Additional Value to Our Customers NASDAQ: LSCC 42 -Expand System Solutions FUTURE More Solution Stacks TODAY Security Solution Stack Security Solution Stack AI Solution Stack AI Solution Stack BEFORE Soft IP Soft IP Soft IP Lattice Radiant SW Lattice Radiant SW Lattice Diamond SW Bringing Additional Value to Our Customers NASDAQ: LSCC 42 -

New Products Over the Next 12 Months sensAI 2.0 MachXO3D CrossLinkPlus Next Generation Enhanced New AI Robust Platform Next Generation Video Bridging Capabilities Security FPGA Platform Launching Today Launching Today Sampling in H2 2019 Sampling early 2020 NASDAQ: LSCC 43 -New Products Over the Next 12 Months sensAI 2.0 MachXO3D CrossLinkPlus Next Generation Enhanced New AI Robust Platform Next Generation Video Bridging Capabilities Security FPGA Platform Launching Today Launching Today Sampling in H2 2019 Sampling early 2020 NASDAQ: LSCC 43 -

Accelerating AI at the Edge NASDAQ: LSCC 44 -Accelerating AI at the Edge NASDAQ: LSCC 44 -

Lattice sensAI 2.0: Low Power Inferencing sensAI 2.0 High Performance Inferencing Under 1W Lowest power, smallest form factor solutions 10X faster real time image processing Expanded Machine Learning Capability Quantized training for faster development time Adding Keras framework support for broader adoption New AI Capabilities Complete Solution Enablement Presence detection, object counting Launching Today Increased partner ecosystem NASDAQ: LSCC 45 -Lattice sensAI 2.0: Low Power Inferencing sensAI 2.0 High Performance Inferencing Under 1W Lowest power, smallest form factor solutions 10X faster real time image processing Expanded Machine Learning Capability Quantized training for faster development time Adding Keras framework support for broader adoption New AI Capabilities Complete Solution Enablement Presence detection, object counting Launching Today Increased partner ecosystem NASDAQ: LSCC 45 -

sensAI 2.0 Customer Example: IoT Security Camera ALWAYS-ON HUMAN PRESENCE DETECTION PERFORMANCE 5 fps 5x FASTER 1 fps MCU POWER Lattice iCE40 UltraPlus Data Sensors SRAM Sensor 14x (weights / activations) Interface LOWER 100mW Results Neural Network Accelerators MCU 7mW MCU NASDAQ: LSCC 46 - LAUNCHING TODAYsensAI 2.0 Customer Example: IoT Security Camera ALWAYS-ON HUMAN PRESENCE DETECTION PERFORMANCE 5 fps 5x FASTER 1 fps MCU POWER Lattice iCE40 UltraPlus Data Sensors SRAM Sensor 14x (weights / activations) Interface LOWER 100mW Results Neural Network Accelerators MCU 7mW MCU NASDAQ: LSCC 46 - LAUNCHING TODAY

Introducing MachXO3D NASDAQ: LSCC 47 -Introducing MachXO3D NASDAQ: LSCC 47 -

Lattice MachXO3D MachXO3D Secure Hardware Root of Trust capability First on, last off for maximum security Designed for NIST Compliance Protect, Detect AND Recover Secures multiple firmware images Robust Platform Security Customer Samples Delivered Top server OEMs and Hyperscalers Launching Today NASDAQ: LSCC 48 -Lattice MachXO3D MachXO3D Secure Hardware Root of Trust capability First on, last off for maximum security Designed for NIST Compliance Protect, Detect AND Recover Secures multiple firmware images Robust Platform Security Customer Samples Delivered Top server OEMs and Hyperscalers Launching Today NASDAQ: LSCC 48 -

MachXO3D Customer Example: Hyperscaler Server REDUCES POWER AND SYSTEM COST FPGA CPU / FPGA CPU / BMC BMC Accelerator PCH Accelerator PCH SWITCH SWITCH SWITCH SWITCH SWITCH SWITCH SPI SPI SPI SPI SPI SPI Memory Memory Memory Memory Memory Memory PROTECT & CONTROL PLD Integrated into a single device RoT MCU NASDAQ: LSCC 49 - LAUNCHING TODAYMachXO3D Customer Example: Hyperscaler Server REDUCES POWER AND SYSTEM COST FPGA CPU / FPGA CPU / BMC BMC Accelerator PCH Accelerator PCH SWITCH SWITCH SWITCH SWITCH SWITCH SWITCH SPI SPI SPI SPI SPI SPI Memory Memory Memory Memory Memory Memory PROTECT & CONTROL PLD Integrated into a single device RoT MCU NASDAQ: LSCC 49 - LAUNCHING TODAY

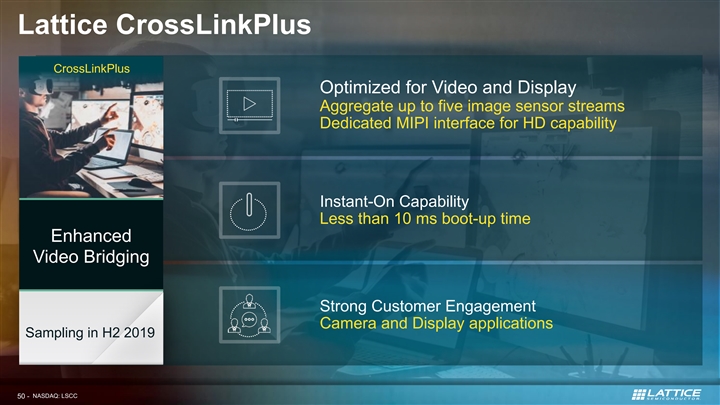

Lattice CrossLinkPlus CrossLinkPlus Optimized for Video and Display Aggregate up to five image sensor streams Dedicated MIPI interface for HD capability Instant-On Capability Less than 10 ms boot-up time Enhanced Video Bridging Strong Customer Engagement Q2 2019 Camera and Display applications Sampling in H2 2019 Sampling in H2 2019 NASDAQ: LSCC 50 -Lattice CrossLinkPlus CrossLinkPlus Optimized for Video and Display Aggregate up to five image sensor streams Dedicated MIPI interface for HD capability Instant-On Capability Less than 10 ms boot-up time Enhanced Video Bridging Strong Customer Engagement Q2 2019 Camera and Display applications Sampling in H2 2019 Sampling in H2 2019 NASDAQ: LSCC 50 -

CrossLinkPlus Customer Example: Display Application CUSTOM ASIC REQUIRED FOR EACH LATTICE SINGLE DEVICE SOLUTION DISPLAY TYPE DISPLAY 4 DISPLAY 4 DISPLAY 1 DISPLAY 3 DISPLAY 1 DISPLAY 3 DISPLAY 2 DISPLAY 2 ASIC 1 ASIC 2 ASIC 3 ASIC 4 Application Application Application Application Application Application Application Application Processor Processor Processor Processor Processor Processor Processor Processor Customers Need Flexible Programmable Solution as Display Sizes and Resolution Vary by Application NASDAQ: LSCC 51 - SAMPLING H2 2019CrossLinkPlus Customer Example: Display Application CUSTOM ASIC REQUIRED FOR EACH LATTICE SINGLE DEVICE SOLUTION DISPLAY TYPE DISPLAY 4 DISPLAY 4 DISPLAY 1 DISPLAY 3 DISPLAY 1 DISPLAY 3 DISPLAY 2 DISPLAY 2 ASIC 1 ASIC 2 ASIC 3 ASIC 4 Application Application Application Application Application Application Application Application Processor Processor Processor Processor Processor Processor Processor Processor Customers Need Flexible Programmable Solution as Display Sizes and Resolution Vary by Application NASDAQ: LSCC 51 - SAMPLING H2 2019

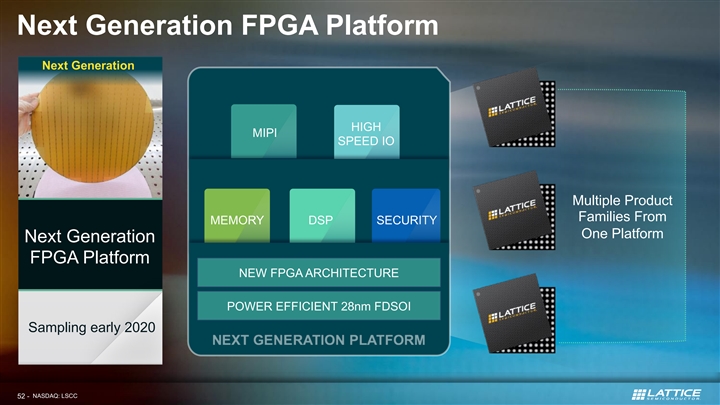

Next Generation FPGA Platform Next Generation FASTER CONNECTIVITY HIGH MIPI SPEED IO Doubled MIPI performance 2x faster DDR3 OPTIMIZED FOR AI Multiple Product INFERENCING Enhanced Families From MEMORY DSP SECURITY One Platform DSP Capability Next Generation 8x More On-Chip Memory FPGA Platform NEW FPGA ARCHITECTURE ADVANCED HW SECURITY POWER EFFICIENT 28nm FDSOI Secure Root of Trust Sampling early 2020 NASDAQ: LSCC 52 -Next Generation FPGA Platform Next Generation FASTER CONNECTIVITY HIGH MIPI SPEED IO Doubled MIPI performance 2x faster DDR3 OPTIMIZED FOR AI Multiple Product INFERENCING Enhanced Families From MEMORY DSP SECURITY One Platform DSP Capability Next Generation 8x More On-Chip Memory FPGA Platform NEW FPGA ARCHITECTURE ADVANCED HW SECURITY POWER EFFICIENT 28nm FDSOI Secure Root of Trust Sampling early 2020 NASDAQ: LSCC 52 -

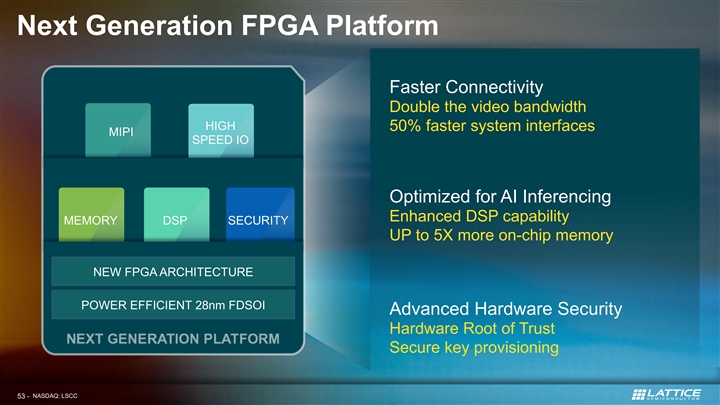

Next Generation FPGA Platform Faster Connectivity Double the video bandwidth HIGH 50% faster system interfaces MIPI SPEED IO Optimized for AI Inferencing Enhanced DSP capability MEMORY DSP SECURITY UP to 5X more on-chip memory NEW FPGA ARCHITECTURE POWER EFFICIENT 28nm FDSOI Advanced Hardware Security Hardware Root of Trust Secure key provisioning NASDAQ: LSCC 53 -Next Generation FPGA Platform Faster Connectivity Double the video bandwidth HIGH 50% faster system interfaces MIPI SPEED IO Optimized for AI Inferencing Enhanced DSP capability MEMORY DSP SECURITY UP to 5X more on-chip memory NEW FPGA ARCHITECTURE POWER EFFICIENT 28nm FDSOI Advanced Hardware Security Hardware Root of Trust Secure key provisioning NASDAQ: LSCC 53 -

Architecture Optimized for Power Efficiency OTHER FPGA COMPANIES 10 mm 10 mm LUT6 M M M M M M M M M M M M M M M M LUT4 M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M 55 mm M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M Faster Performance, 2X Larger Area Half the Power, Half the Area NASDAQ: LSCC 54 - 55 mmArchitecture Optimized for Power Efficiency OTHER FPGA COMPANIES 10 mm 10 mm LUT6 M M M M M M M M M M M M M M M M LUT4 M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M 55 mm M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M M Faster Performance, 2X Larger Area Half the Power, Half the Area NASDAQ: LSCC 54 - 55 mm

..... ..... Expanding Low Power Leadership HALF THE POWER AT THE SAME FDSOI PERFORMANCE Fully Depleted Channel (Low Leakage) 50% Lower power Ultra-thin Buried Oxide Insulator Bulk FDSOI Built on Innovative FDSOI Technology NASDAQ: LSCC 55 - SAMPLING 2020 Relative Power..... ..... Expanding Low Power Leadership HALF THE POWER AT THE SAME FDSOI PERFORMANCE Fully Depleted Channel (Low Leakage) 50% Lower power Ultra-thin Buried Oxide Insulator Bulk FDSOI Built on Innovative FDSOI Technology NASDAQ: LSCC 55 - SAMPLING 2020 Relative Power

Accelerating Innovation Focus on FPGA HIGH MIPI SPEED IO MEMORY DSP SECURITY Platform Based Design NEW FPGA ARCHITECTURE POWER EFFICIENT 28nm FDSOI Expand System Level Solutions NASDAQ: LSCC 56 -Accelerating Innovation Focus on FPGA HIGH MIPI SPEED IO MEMORY DSP SECURITY Platform Based Design NEW FPGA ARCHITECTURE POWER EFFICIENT 28nm FDSOI Expand System Level Solutions NASDAQ: LSCC 56 -

Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 57 -Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 57 -

LATTICE 2019 FINANCIAL ANALYST DAY CUSTOMERS MARK NELSON SALES The Low Power Programmable LeaderLATTICE 2019 FINANCIAL ANALYST DAY CUSTOMERS MARK NELSON SALES The Low Power Programmable Leader

Voice of Our Customers “We have known the Lattice “I want to give Lattice more “Your competitors are only FAE for years and we trust business…. We would like focused on data center compute him.” to influence your roadmap.” acceleration…we need FPGAs for our business.” System Architect, Prosumer Product Company Sourcing VP, Design Engineering Manager, Leading Wireless Company Large Industrial Automation Customer “Security discussions are “Low power is critical in our systems happening weekly and we could and we are happy that you are leverage your solution across keeping your focus on power.” platforms.” Central Engineering, Business Unit Executive, Global Tier One Automotive Supplier Server & Enterprise Client Leader Customers Like Our Focus and Want to Expand their Business with Us NASDAQ: LSCC 59 -Voice of Our Customers “We have known the Lattice “I want to give Lattice more “Your competitors are only FAE for years and we trust business…. We would like focused on data center compute him.” to influence your roadmap.” acceleration…we need FPGAs for our business.” System Architect, Prosumer Product Company Sourcing VP, Design Engineering Manager, Leading Wireless Company Large Industrial Automation Customer “Security discussions are “Low power is critical in our systems happening weekly and we could and we are happy that you are leverage your solution across keeping your focus on power.” platforms.” Central Engineering, Business Unit Executive, Global Tier One Automotive Supplier Server & Enterprise Client Leader Customers Like Our Focus and Want to Expand their Business with Us NASDAQ: LSCC 59 -

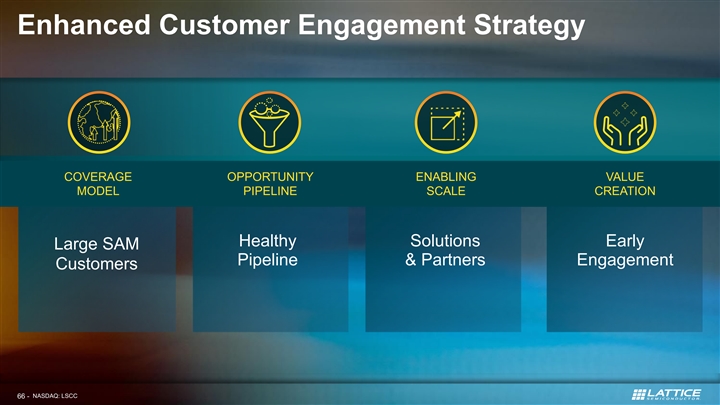

Enhanced Customer Engagement Strategy SALES OPPORTUNITY ENABLING VALUE MODEL PIPELINE SCALE CREATION NASDAQ: LSCC 60 -Enhanced Customer Engagement Strategy SALES OPPORTUNITY ENABLING VALUE MODEL PIPELINE SCALE CREATION NASDAQ: LSCC 60 -

Restructured Sales Team Business Business Unit 1 Unit 2 Sales 1 Sales 2 Fragmented sales force Unified regional sales team Complex compensation structure Simple compensation structure Siloed knowledgeable talent Collaborative and disciplined NASDAQ: LSCC 61 -Restructured Sales Team Business Business Unit 1 Unit 2 Sales 1 Sales 2 Fragmented sales force Unified regional sales team Complex compensation structure Simple compensation structure Siloed knowledgeable talent Collaborative and disciplined NASDAQ: LSCC 61 -

New Focused Coverage Model LATTICE $3B SAM BREAKDOWN IMPROVED COVERAGE MODEL TOP 20 CUSTOMERS Focused coverage 50% NEXT 200 CUSTOMERS 30% Leverage partners BROAD BASE CUSTOMERS 20% Scale with distribution NASDAQ: LSCC 62 -New Focused Coverage Model LATTICE $3B SAM BREAKDOWN IMPROVED COVERAGE MODEL TOP 20 CUSTOMERS Focused coverage 50% NEXT 200 CUSTOMERS 30% Leverage partners BROAD BASE CUSTOMERS 20% Scale with distribution NASDAQ: LSCC 62 -

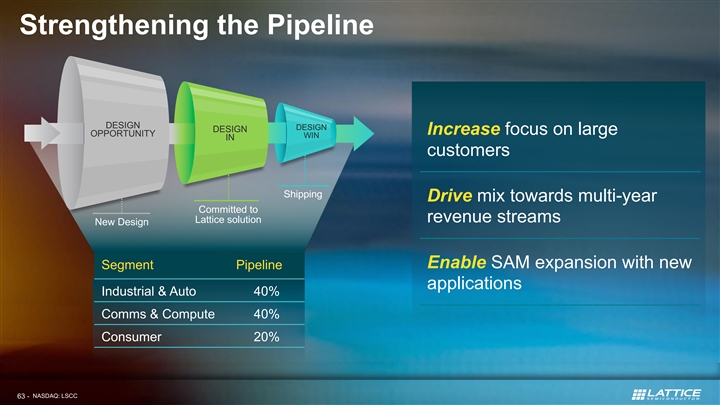

Strengthening the Pipeline DESIGN DESIGN DESIGN Increase focus on large OPPORTUNITY WIN IN customers Shipping Drive mix towards multi-year Committed to Lattice solution revenue streams New Design Enable SAM expansion with new Segment Pipeline applications Industrial & Auto 40% Comms & Compute 40% Consumer 20% NASDAQ: LSCC 63 -Strengthening the Pipeline DESIGN DESIGN DESIGN Increase focus on large OPPORTUNITY WIN IN customers Shipping Drive mix towards multi-year Committed to Lattice solution revenue streams New Design Enable SAM expansion with new Segment Pipeline applications Industrial & Auto 40% Comms & Compute 40% Consumer 20% NASDAQ: LSCC 63 -

Enabling Scale DEMO BOARDS REFERENCE DESIGNS JOINT MARKETING (e.g. Vehicle Classification) (e.g. Package Detection) PROGRAMS DDR SPI Memory Memory SPI to DDR Loader NN Accelerators IPS 8 Engines Engine Counting & Overlay Engine ECP5- 85 Accelerating Time to Market for Broad Set of Customers NASDAQ: LSCC 64 -Enabling Scale DEMO BOARDS REFERENCE DESIGNS JOINT MARKETING (e.g. Vehicle Classification) (e.g. Package Detection) PROGRAMS DDR SPI Memory Memory SPI to DDR Loader NN Accelerators IPS 8 Engines Engine Counting & Overlay Engine ECP5- 85 Accelerating Time to Market for Broad Set of Customers NASDAQ: LSCC 64 -

New Value Creation Opportunities EARLY ARCHITECTURAL DRIVING GREATER VALUE BASED ENGAGEMENT WITH SOFTWARE CONTENT INTO SELLING CUSTOMERS SOLUTIONS Market segment pricing Differentiated products System level approach Advanced pricing analytics Outstanding support Solution selling NASDAQ: LSCC 65 -New Value Creation Opportunities EARLY ARCHITECTURAL DRIVING GREATER VALUE BASED ENGAGEMENT WITH SOFTWARE CONTENT INTO SELLING CUSTOMERS SOLUTIONS Market segment pricing Differentiated products System level approach Advanced pricing analytics Outstanding support Solution selling NASDAQ: LSCC 65 -

Enhanced Customer Engagement Strategy COVERAGE OPPORTUNITY ENABLING VALUE MODEL PIPELINE SCALE CREATION Healthy Solutions Early Large SAM Pipeline & Partners Engagement Customers NASDAQ: LSCC 66 -Enhanced Customer Engagement Strategy COVERAGE OPPORTUNITY ENABLING VALUE MODEL PIPELINE SCALE CREATION Healthy Solutions Early Large SAM Pipeline & Partners Engagement Customers NASDAQ: LSCC 66 -

Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 67 -Lattice Executive Leadership Team Jim Anderson Esam Elashmawi Steve Douglass CEO Marketing & Strategy Research & Development Overview Markets Products Mark Nelson Sherri Luther Glenn O’Rourke Sales CFO Operations Customers Financials Q&A NASDAQ: LSCC 67 -

LATTICE 2019 FINANCIAL ANALYST DAY FINANCIALS SHERRI LUTHER CFO The Low Power Programmable LeaderLATTICE 2019 FINANCIAL ANALYST DAY FINANCIALS SHERRI LUTHER CFO The Low Power Programmable Leader

Financial Priorities PROFIT REVENUE GROSS MARGIN EXPANSION GROWTH EXPANSION OPEX CASH BALANCE DISCIPLINE GENERATION SHEET STRENGTH NASDAQ: LSCC 69 -Financial Priorities PROFIT REVENUE GROSS MARGIN EXPANSION GROWTH EXPANSION OPEX CASH BALANCE DISCIPLINE GENERATION SHEET STRENGTH NASDAQ: LSCC 69 -

2018 Accomplishments REVENUE ($M) GROSS MARGIN EARNING PER SHARE $399 3% 57.2% $0.33 $386 +90 bps 3X 56.3% $0.11 2017 2018 2017 2018 2017 2018 OPEX FREE CASH FLOW ($M) DEBT LEVERAGE RATIO 47.2% $43 5.2X +68% -670 bps $26 3X 40.5% 2017 2018 2017 2018 2017 2018 NASDAQ: LSCC 70 - Note: Non-GAAP, Free Cash Flow is before debt payment2018 Accomplishments REVENUE ($M) GROSS MARGIN EARNING PER SHARE $399 3% 57.2% $0.33 $386 +90 bps 3X 56.3% $0.11 2017 2018 2017 2018 2017 2018 OPEX FREE CASH FLOW ($M) DEBT LEVERAGE RATIO 47.2% $43 5.2X +68% -670 bps $26 3X 40.5% 2017 2018 2017 2018 2017 2018 NASDAQ: LSCC 70 - Note: Non-GAAP, Free Cash Flow is before debt payment

Revenue Growth by End Markets Revenue Single Digit Growth Double Digit Growth SEGMENT DRIVERS 5G Infrastructure Deployments Servers in Cloud and Enterprise $386M $399M Client Compute Platforms Comms / 29% 31% Compute Industrial IoT Factory Automation Industrial 35% 39% / Auto Automotive Electronics Consumer 28% 25% Smart Home Prosumer 8% 5% IP 2017 2018 Next 2 years 3 – 4 years Accelerating Profitable Revenue Growth NASDAQ: LSCC 71 -Revenue Growth by End Markets Revenue Single Digit Growth Double Digit Growth SEGMENT DRIVERS 5G Infrastructure Deployments Servers in Cloud and Enterprise $386M $399M Client Compute Platforms Comms / 29% 31% Compute Industrial IoT Factory Automation Industrial 35% 39% / Auto Automotive Electronics Consumer 28% 25% Smart Home Prosumer 8% 5% IP 2017 2018 Next 2 years 3 – 4 years Accelerating Profitable Revenue Growth NASDAQ: LSCC 71 -

Gross Margin Expansion EXPANSION STRATEGIES GROSS MARGIN Over 62% Pricing Optimization 58.6% 57.2% Product Cost Improvement 56.3% Mix Shift 50% 2017 2018 Q1’19 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 72 -Gross Margin Expansion EXPANSION STRATEGIES GROSS MARGIN Over 62% Pricing Optimization 58.6% 57.2% Product Cost Improvement 56.3% Mix Shift 50% 2017 2018 Q1’19 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 72 -

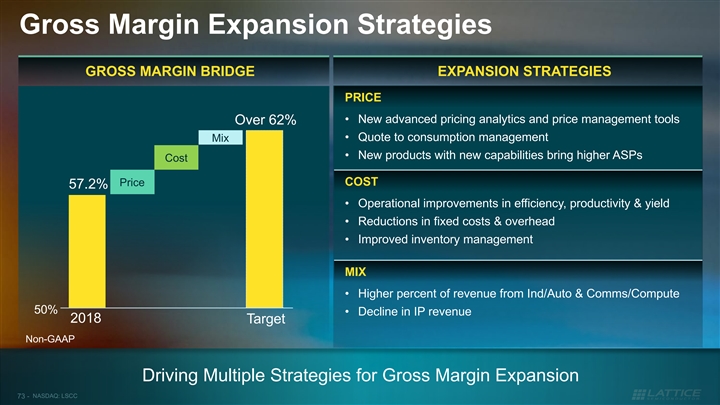

Gross Margin Expansion Strategies GROSS MARGIN BRIDGE EXPANSION STRATEGIES PRICE • New advanced pricing analytics and price management tools Over 62% • Quote to consumption management Mix • New products with new capabilities bring higher ASPs Cost Price COST 57.2% • Operational improvements in efficiency, productivity & yield • Reductions in fixed costs & overhead • Improved inventory management MIX • Higher percent of revenue from Ind/Auto & Comms/Compute 50% • Decline in IP revenue 2018 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 73 -Gross Margin Expansion Strategies GROSS MARGIN BRIDGE EXPANSION STRATEGIES PRICE • New advanced pricing analytics and price management tools Over 62% • Quote to consumption management Mix • New products with new capabilities bring higher ASPs Cost Price COST 57.2% • Operational improvements in efficiency, productivity & yield • Reductions in fixed costs & overhead • Improved inventory management MIX • Higher percent of revenue from Ind/Auto & Comms/Compute 50% • Decline in IP revenue 2018 Target Non-GAAP Driving Multiple Strategies for Gross Margin Expansion NASDAQ: LSCC 73 -

OpEx Strategy OPERATING EXPENSES ($M) EXPENSE MANAGEMENT 47% SG&A 41% • Site consolidation 39% • IT and Infrastructure efficiency 35% 22% SG&A • Greater leverage of low cost geos • Operational leverage as revenue grows 21% 20% 15% R&D • Continue portfolio optimization for better ROI 25% R&D 20% 20% 19% • Expand investment toward software and solutions • Scale with revenue and invest in roadmap 2017 2018 Q1’19 Target Non-GAAP NASDAQ: LSCC 74 -OpEx Strategy OPERATING EXPENSES ($M) EXPENSE MANAGEMENT 47% SG&A 41% • Site consolidation 39% • IT and Infrastructure efficiency 35% 22% SG&A • Greater leverage of low cost geos • Operational leverage as revenue grows 21% 20% 15% R&D • Continue portfolio optimization for better ROI 25% R&D 20% 20% 19% • Expand investment toward software and solutions • Scale with revenue and invest in roadmap 2017 2018 Q1’19 Target Non-GAAP NASDAQ: LSCC 74 -

Capital Structure DEBT BALANCE & LEVERAGE RATIO CASH ALLOCATION 5.2 Maintain cash balance above $100M Excess cash used to pay down debt 3.0 Drive leverage ratio below 2.0 Consider other options for cash after leverage ($M) ratio is met < 2.0 $301 $57 $260 $88 Additional $25M discretionary debt payment made to date in Q2’19 2017 2018 Target Debt Balance TTM EBITDA Leverage Ratio Note: Non-GAAP, Free Cash Flow is before debt payment Significant Progress on Balance Sheet De-lever NASDAQ: LSCC 75 -Capital Structure DEBT BALANCE & LEVERAGE RATIO CASH ALLOCATION 5.2 Maintain cash balance above $100M Excess cash used to pay down debt 3.0 Drive leverage ratio below 2.0 Consider other options for cash after leverage ($M) ratio is met < 2.0 $301 $57 $260 $88 Additional $25M discretionary debt payment made to date in Q2’19 2017 2018 Target Debt Balance TTM EBITDA Leverage Ratio Note: Non-GAAP, Free Cash Flow is before debt payment Significant Progress on Balance Sheet De-lever NASDAQ: LSCC 75 -

Debt Refinance DEBT INTEREST RATE DEBT REFINANCE DETAILS L+425 Reduced interest rate and improved terms L+175 Interest rate dropped by 250 bps; Further step downs as leverage declines OLD CURRENT Extended maturity by 3 years to May 2024 BALLOON PAYMENT SCHEDULE Greater flexibility allowing stock buy backs Old Balloon Current Balloon Payment Date Payment Date Includes $75 million revolver Refer to 8K filing for additional details Now March 2021 May 2024 NASDAQ: LSCC 76 -Debt Refinance DEBT INTEREST RATE DEBT REFINANCE DETAILS L+425 Reduced interest rate and improved terms L+175 Interest rate dropped by 250 bps; Further step downs as leverage declines OLD CURRENT Extended maturity by 3 years to May 2024 BALLOON PAYMENT SCHEDULE Greater flexibility allowing stock buy backs Old Balloon Current Balloon Payment Date Payment Date Includes $75 million revolver Refer to 8K filing for additional details Now March 2021 May 2024 NASDAQ: LSCC 76 -

Financial Target Model 2018 Q1‘19 Target Model (3 – 4 Yrs.) Revenue Growth (YoY) +3% Flat Low Double Digits Gross Margin* 57.2% 58.6% Over 62% OpEx* 41% 39% 35% Operating Income* 17% 20% 25% - 30% *Non-GAAP NASDAQ: LSCC 77 -Financial Target Model 2018 Q1‘19 Target Model (3 – 4 Yrs.) Revenue Growth (YoY) +3% Flat Low Double Digits Gross Margin* 57.2% 58.6% Over 62% OpEx* 41% 39% 35% Operating Income* 17% 20% 25% - 30% *Non-GAAP NASDAQ: LSCC 77 -

Financial Priorities PROFIT EXPANSION REVENUE GROSS MARGIN 25% to 30% GROWTH EXPANSION OpInc Low Double Digit Over 62% OPEX CASH DISCIPLINE GENERATION BALANCE SHEET 35% Pay Down Debt STRENGTH Leverage <2.0 NASDAQ: LSCC 78 -Financial Priorities PROFIT EXPANSION REVENUE GROSS MARGIN 25% to 30% GROWTH EXPANSION OpInc Low Double Digit Over 62% OPEX CASH DISCIPLINE GENERATION BALANCE SHEET 35% Pay Down Debt STRENGTH Leverage <2.0 NASDAQ: LSCC 78 -

Q&A NASDAQ: LSCC 79 -Q&A NASDAQ: LSCC 79 -

Wrap Up MARKETS PRODUCTS INDUSTRIAL & AUTOMOTIVE HIGH MIPI 42% SPEED IO 28% MEMORY DSP SECURITY 30% CONSUMER NEW FPGA ARCHITECTURE COMMS & POWER EFFICIENT 28nm FDSOI COMPUTE $3B LATTICE SAM IN 2022 ACCELERATING INNOVATION CUSTOMERS FINANCIALS PROFIT EXPANSION REVENUE GROSS MARGIN 25% to 30% GROWTH EXPANSION OpInc Low Double Digit Over 62% DESIGN DESIGN DESIGN OPPORTUNITY WIN IN OPEX CASH DISCIPLINE GENERATION BALANCE SHEET 35% Pay Down Debt STRENGTH Leverage <2.0 EXPANDING CUSTOMER FOOTPRINT NASDAQ: LSCC 80 -Wrap Up MARKETS PRODUCTS INDUSTRIAL & AUTOMOTIVE HIGH MIPI 42% SPEED IO 28% MEMORY DSP SECURITY 30% CONSUMER NEW FPGA ARCHITECTURE COMMS & POWER EFFICIENT 28nm FDSOI COMPUTE $3B LATTICE SAM IN 2022 ACCELERATING INNOVATION CUSTOMERS FINANCIALS PROFIT EXPANSION REVENUE GROSS MARGIN 25% to 30% GROWTH EXPANSION OpInc Low Double Digit Over 62% DESIGN DESIGN DESIGN OPPORTUNITY WIN IN OPEX CASH DISCIPLINE GENERATION BALANCE SHEET 35% Pay Down Debt STRENGTH Leverage <2.0 EXPANDING CUSTOMER FOOTPRINT NASDAQ: LSCC 80 -

The Low Power Programmable Leader 2019 FINANCIAL ANALYST DAY NEW YORK NASDAQ: LSCC 81 -The Low Power Programmable Leader 2019 FINANCIAL ANALYST DAY NEW YORK NASDAQ: LSCC 81 -

Appendix NASDAQ: LSCC 82 -Appendix NASDAQ: LSCC 82 -

Operating Expenses Reconciliation (Thousands except percentages) Q1 2019 2018 2017 GAAP Operating expenses $ 45,176 $ 222,559 $ 264,199 % of Revenue 46.1% 55.8% 68.5% Amortization of acquired intangible assets (3,389) (17,690) (31,340) Restructuring charges (1,341) (17,349) (7,196) Acquisition related charges - (1,531) (3,781) Impairment of acquired intangible assets 1,023 (11,686) (32,431) Stock-based compensation expense (3,484) (12,706) (11,755) Gain on sale of building - - 4,624 Non-GAAP Operating expenses $ 37,985 $ 161,597 $ 182,320 % of Revenue 38.7% 40.5% 47.2% NASDAQ: LSCC 83 -Operating Expenses Reconciliation (Thousands except percentages) Q1 2019 2018 2017 GAAP Operating expenses $ 45,176 $ 222,559 $ 264,199 % of Revenue 46.1% 55.8% 68.5% Amortization of acquired intangible assets (3,389) (17,690) (31,340) Restructuring charges (1,341) (17,349) (7,196) Acquisition related charges - (1,531) (3,781) Impairment of acquired intangible assets 1,023 (11,686) (32,431) Stock-based compensation expense (3,484) (12,706) (11,755) Gain on sale of building - - 4,624 Non-GAAP Operating expenses $ 37,985 $ 161,597 $ 182,320 % of Revenue 38.7% 40.5% 47.2% NASDAQ: LSCC 83 -

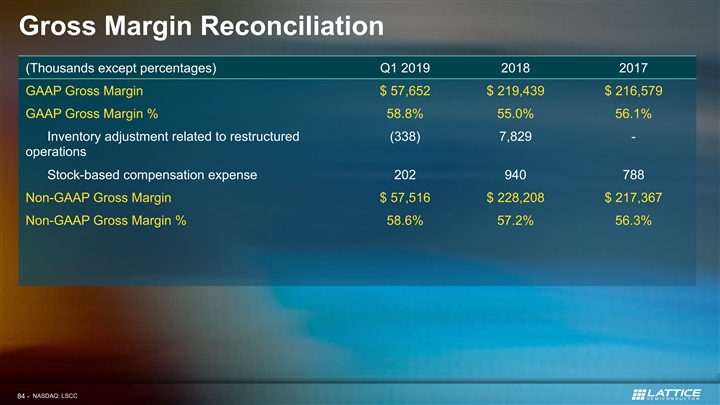

Gross Margin Reconciliation (Thousands except percentages) Q1 2019 2018 2017 GAAP Gross Margin $ 57,652 $ 219,439 $ 216,579 GAAP Gross Margin % 58.8% 55.0% 56.1% Inventory adjustment related to restructured (338) 7,829 - operations Stock-based compensation expense 202 940 788 Non-GAAP Gross Margin $ 57,516 $ 228,208 $ 217,367 Non-GAAP Gross Margin % 58.6% 57.2% 56.3% NASDAQ: LSCC 84 -Gross Margin Reconciliation (Thousands except percentages) Q1 2019 2018 2017 GAAP Gross Margin $ 57,652 $ 219,439 $ 216,579 GAAP Gross Margin % 58.8% 55.0% 56.1% Inventory adjustment related to restructured (338) 7,829 - operations Stock-based compensation expense 202 940 788 Non-GAAP Gross Margin $ 57,516 $ 228,208 $ 217,367 Non-GAAP Gross Margin % 58.6% 57.2% 56.3% NASDAQ: LSCC 84 -

Earnings Per Share Reconciliation Q1 2019 2018 2017 GAAP net loss per share - diluted 0.05 (0.21) (0.58) Inventory adjs related to restructured operations (0.00) 0.06 - Amortization of acquired intangible assets 0.03 0.14 0.25 Restructuring charges 0.00 0.13 0.06 Acquisition related charges - 0.01 0.03 Impairment of acquired intangible assets 0.01 0.09 0.26 Stock-based compensation expense 0.03 0.11 0.10 Gain on sale of building - - (0.03) Loss on sale of assets and business units - - 0.02 Non-GAAP Operating expenses 0.11 0.33 0.11 NASDAQ: LSCC 85 -Earnings Per Share Reconciliation Q1 2019 2018 2017 GAAP net loss per share - diluted 0.05 (0.21) (0.58) Inventory adjs related to restructured operations (0.00) 0.06 - Amortization of acquired intangible assets 0.03 0.14 0.25 Restructuring charges 0.00 0.13 0.06 Acquisition related charges - 0.01 0.03 Impairment of acquired intangible assets 0.01 0.09 0.26 Stock-based compensation expense 0.03 0.11 0.10 Gain on sale of building - - (0.03) Loss on sale of assets and business units - - 0.02 Non-GAAP Operating expenses 0.11 0.33 0.11 NASDAQ: LSCC 85 -