Form DEF 14A VEEVA SYSTEMS INC For: Jun 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒

|

Filed by a party other than the Registrant o

|

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under Rule 14a-12 |

VEEVA SYSTEMS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

$

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

May 9, 2019

Dear Fellow Stockholders:

Please join me and the Board of Directors at our 2019 Annual Meeting of Stockholders on Thursday, June 20, 2019 at 12:00 p.m. Pacific Time, at our headquarters in Pleasanton, California.

Details regarding our Annual Meeting and the business to be conducted at the meeting are described in the attached Notice of 2019 Annual Meeting of Stockholders and Proxy Statement. We are pleased to furnish proxy materials to our stockholders over the Internet. We believe providing these materials electronically expedites stockholder receipt of them and lowers the cost and reduces the environmental impact of our Annual Meeting. We encourage you to read this information carefully.

Your vote is important to us. We hope you will vote as soon as possible. You may vote over the Internet, by telephone, by mailing a proxy card (if you have requested one), or in person at the Annual Meeting. Voting over the Internet, by telephone, or by mail will ensure your representation at the Annual Meeting regardless of whether you attend in person. Please review the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail regarding your voting options.

Thank you for your ongoing support of Veeva.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

|

|

|

Peter P. Gassner

Chief Executive Officer and Director |

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

Thursday, June 20, 2019

12:00 p.m. Pacific Time

Veeva Systems Inc. Headquarters

4280 Hacienda Drive, Pleasanton, California 94588

Items of Business

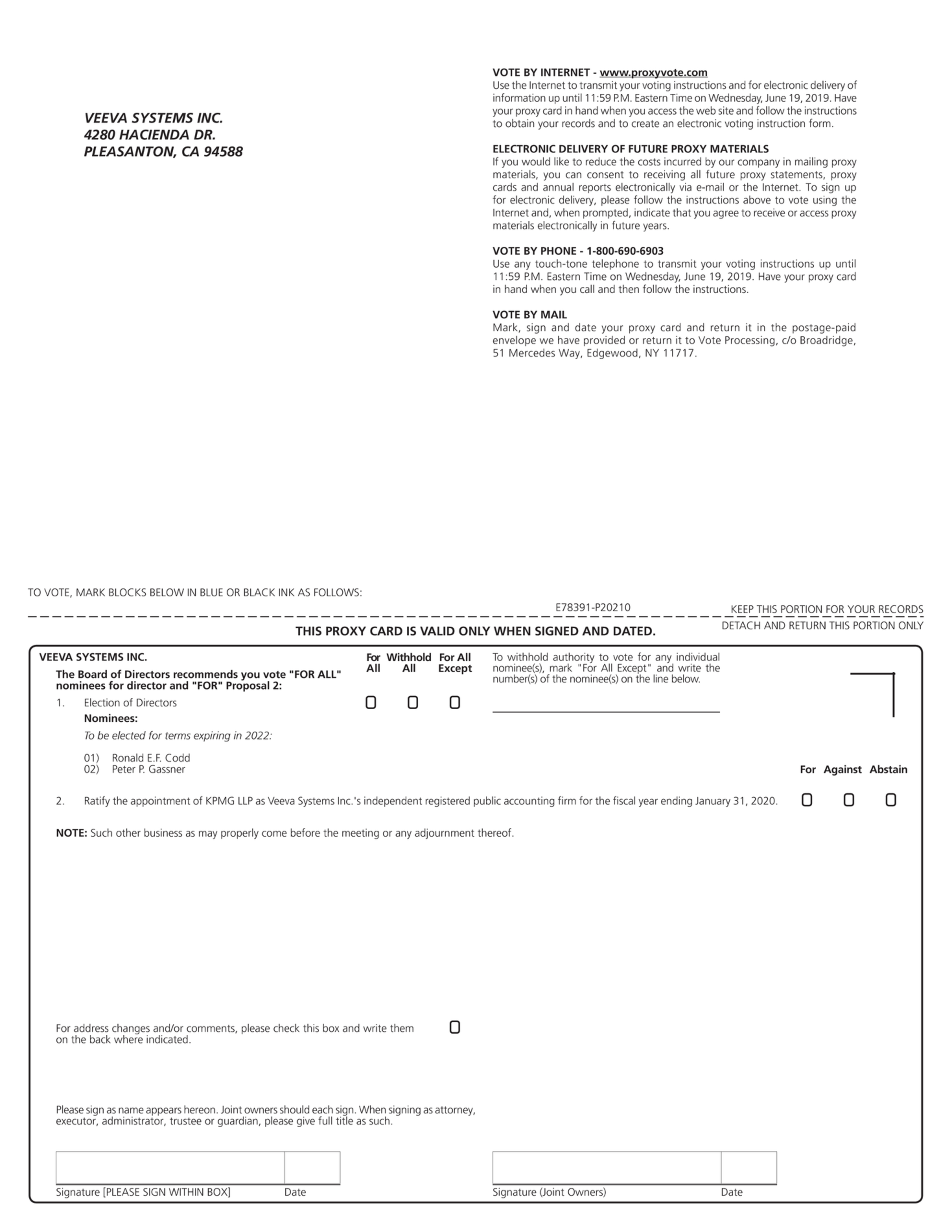

| (1) | Elect for three-year terms the two directors named in the Proxy Statement accompanying this notice to serve as Class III directors until 2022 or until their successors are duly elected and qualified; |

| (2) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2020; and |

| (3) | Transact such other business as may properly come before the meeting. |

Adjournments and Postponements

Any action on the items of business described above may be considered at the Annual Meeting or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Record Date

You can vote if you were a stockholder of record as of the close of business on April 26, 2019 (the “Record Date”).

Voting

Your vote is very important. We encourage you to read the Proxy Statement and vote your shares over the Internet, by telephone, by mail, or in person at the Annual Meeting. For specific instructions on how to vote your shares, please see “Frequently Asked Questions and Answers” in the Proxy Statement.

On or about May 9, 2019, a Notice of Internet Availability of Proxy Materials (the “Notice”) has been mailed to stockholders of record as of the Record Date. The Notice contains instructions on how to access our Proxy Statement for our 2019 Annual Meeting of Stockholders and our fiscal 2019 Annual Report (together, the proxy materials). The Notice also provides instructions on how to vote and includes instructions on how to receive a paper copy of proxy materials by mail. The proxy materials can be accessed directly at the following Internet address: www.proxyvote.com.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Josh Faddis

SVP, General Counsel and Corporate Secretary May 9, 2019 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 20, 2019: The Notice, Proxy Statement, and 2019 Annual Report is available to stockholders at www.proxyvote.com.

|

Veeva Systems Inc. | 2019 Proxy Statement

|

This Proxy Statement is furnished in connection with solicitation of proxies by the Board of Directors (the “Board”) of Veeva Systems Inc. for use at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 12:00 p.m. Pacific Time on Thursday, June 20, 2019 and at any postponements or adjournments thereof. The Annual Meeting will be held at our principal executive offices located at 4280 Hacienda Drive, Pleasanton, California 94588. On or about May 9, 2019, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials. As used in this Proxy Statement, the terms “Veeva,” “the Company,” “we,” “us,” and “our” mean Veeva Systems Inc. and its subsidiaries unless the context indicates otherwise.

PROXY SUMMARY

This proxy summary highlights certain information in this Proxy Statement and does not contain all the information you should consider in voting your shares. Please review the entire Proxy Statement and our 2019 Annual Report carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Proposals Which Require Your Vote

|

Proposal

|

|

More

Information |

Board

Recommendation |

Broker Non-

Votes |

Abstentions

|

Votes Required

for Approval |

|

One

|

Elect for three-year terms Ronald E.F. Codd and Peter P. Gassner to serve as Class III directors until 2022 or until their successors are duly elected and qualified

|

Page 3

|

FOR all nominees

|

Will not count in nominee’s favor

|

Will not count in nominee’s favor

|

Plurality of votes voted at the Annual Meeting

|

|

Two

|

Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2020

|

Page 41

|

FOR

|

Do not impact outcome

|

Do not impact outcome

|

Majority in voting power of the votes cast

|

Eligibility to Vote (page 44)

You can vote if you were a stockholder of record as of the close of business on April 26, 2019 (the “Record Date”).

How to Vote (page 45)

Your vote is important to us. Please exercise your right to vote as soon as possible. You can vote by any of the following methods:

Stockholders of Record

| • | Internet: www.proxyvote.com until 11:59 p.m. Eastern Time on Wednesday, June 19, 2019; |

| • | Telephone: 1-800-690-6903 until 11:59 p.m. Eastern Time on Wednesday, June 19, 2019; |

| • | Mail: Sign, date, and mail your proxy card; or |

| • | In person: By attending the Annual Meeting and submitting a ballot. |

Beneficial Owners of Shares Held in Street Name

| • | Internet, Telephone, or Mail: Please refer to the voting instructions provided to you by your broker, trustee, or other nominee that holds your shares. |

| • | In person: You must obtain a legal proxy from the broker, trustee, or other nominee that holds your shares giving you the right to vote the shares in person at the Annual Meeting. |

|

Veeva Systems Inc. | 2019 Proxy Statement 1

|

Proxy Summary

Board Nominees (page 3)

There are two nominees for election to the Board.

|

Name

|

Age

|

Veeva Director Since

|

Independent

|

Committee Membership

|

|

Ronald E.F. Codd

|

63

|

2012

|

Yes

|

Audit Committee & Compensation

Committee |

|

Peter P. Gassner

|

54

|

2007

|

Yes

|

None

|

Corporate Governance (page 14)

We regularly review our current corporate governance practices against best practices and peer benchmarks. Over the past year, we have taken the following steps, which are described in more detail elsewhere in this Proxy Statement:

| • | In March 2019, we reviewed and made changes to our overall compensation program (for both executive officers and employees) with a view toward retention and stockholder alignment (see “Executive Compensation” for more details). We also adopted stock ownership guidelines for directors and executive officers. |

| • | In 2018, the Board adopted a qualified diverse candidate pool policy, which codifies the Board’s effort since 2014 to recruit female candidates for Board membership (see “Considerations in Evaluating Director Nominees and Board Diversity” for more details). |

| • | In 2018, we initiated our first broad-based stockholder engagement program to elicit the views of our investors on corporate governance and executive compensation matters (see “Fiscal 2019 Stockholder Engagement on Corporate Governance Matters” for more details) and publicly posted a Corporate Citizenship statement to our website. |

Executive Compensation (page 25)

Since our initial public offering (“IPO”) in October 2013, our Board and Compensation Committee have maintained a simple structure for our executive compensation programs. We pay our NEOs cash compensation that is below the cash compensation levels paid by our peers, we do not offer them a short-term cash incentive program, and we place heavy emphasis on our long-term equity compensation program, generally in the form of stock options and restricted stock units (“RSUs”). In fiscal 2019, all of our NEOs were paid identical annual base salaries, none received short-term cash incentive bonuses, and none received any new equity awards although all NEOs continued to vest in and receive significant value from equity awards granted to them in prior fiscal years.

Our Board and Compensation Committee have adhered to this executive compensation approach since our IPO because this program, with its unique long-term focus, has been effective at incentivizing and retaining our senior executives through fiscal 2019 and aligning the interests of our senior management team with those of our stockholders.

Because several of the equity awards granted to our NEOs before our IPO are or will soon be fully vested, we began a process in fiscal 2019 to evaluate and restructure our executive compensation program for the future. Our Compensation Committee, after considering feedback from our stockholder outreach program conducted during fiscal 2019 and with our Board’s approval, implemented a new executive compensation program in early fiscal 2020. Although these actions did not occur during fiscal 2019, we summarize our new executive compensation program below in “Other Compensation Information and Policies—Recent Fiscal 2020 Executive Compensation Decisions.”

|

2 Veeva Systems Inc. | 2019 Proxy Statement

|

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board unanimously recommends a vote “FOR ALL” Class III nominees.

Our Board may establish the authorized number of directors from time to time by resolution. Our Board is currently comprised of seven members who are divided into three classes with staggered three-year terms. Six of our directors qualify as independent in accordance with New York Stock Exchange (“NYSE”) listing standards. A director serves in office until his respective successor is duly elected and qualified or until his earlier death, resignation, or removal. Our restated certificate of incorporation (“Certificate”) and amended and restated bylaws (“Bylaws”) that are currently in effect authorize only our Board to fill vacancies on our Board until the next annual meeting of stockholders. Any additional directorships resulting from an increase in the authorized number of directors would be distributed among the three classes so that, as nearly as possible, each class would consist of one-third of the authorized number of directors. You cannot vote for a greater number of persons than the number of nominees named in this Proxy Statement.

Information About Nominees and Continuing Directors

Nominees for Election at the Annual Meeting (Class III)

Two Class III directors have been nominated for election at the Annual Meeting for three-year terms, each expiring in 2022. Upon the recommendation of our Nominating and Governance Committee, our Board has nominated Ronald E.F. Codd and Peter P. Gassner for election as Class III directors. The term of office of each person elected as director will continue until such director’s term expires in 2022, or until such director’s successor has been duly elected and qualified.

|

Ronald E.F. Codd

Age: 63 Director since 2012 Independent Director Financial Expert Committees Audit (Chair) Compensation |

Qualifications

Our Board determined that Mr. Codd should serve as a director based on his management and software industry experience, including his experience in finance, which gives him a breadth of knowledge and valuable understanding of our industry. Career Experience Mr. Codd has been an independent business consultant since April 2002. From January 1999 to April 2002, Mr. Codd served as President, Chief Executive Officer, and a director of Momentum Business Applications, Inc., an enterprise software company. From September 1991 to December 1998, Mr. Codd served as Senior Vice President of Finance and Administration and Chief Financial Officer of PeopleSoft, Inc., a provider of enterprise application software. Board Experience Mr. Codd has served on the board of directors of a number of information technology companies, including FireEye, Inc. since July 2012; ServiceNow, Inc. since February 2012, Rocket Fuel Inc. from February 2012 to September 2017; DemandTec, Inc. from February 2007 to February 2012; Data Domain, Inc. from October 2006 to July 2009; Interwoven, Inc. from July 1999 to April 2009; and Agile Software Corporation from August 2003 to July 2007. Education Mr. Codd holds a Bachelor of Science degree in Accounting from the University of California, Berkeley and a Master of Management in Finance and Management Information Systems degree from the Kellogg Graduate School of Management at Northwestern University. |

|

Veeva Systems Inc. | 2019 Proxy Statement 3

|

Proposal One

|

Peter P. Gassner

Age: 54 Director since 2007 Committees None |

Qualifications

Our Board determined that Mr. Gassner should serve as a director based on his position as one of our founders and as our Chief Executive Officer, his extensive experience in general management, as a technologist focused on software and platform development, and his experience in the software industry. Career Experience Mr. Gassner is one of our founders and has served as our Chief Executive Officer since January 2007. Prior to joining Veeva, Mr. Gassner was Senior Vice President of Technology at salesforce.com, inc., a provider of enterprise cloud computing solutions, from July 2003 to June 2005, where he led the development effort to extend the Salesforce Platform to the enterprise. Prior to his time with salesforce.com, Mr. Gassner was with PeopleSoft from January 1995 to June 2003. At PeopleSoft, he served as Chief Architect and General Manager responsible for development, strategy, marketing and deployment of PeopleTools, the architecture underlying PeopleSoft’s application suite. Mr. Gassner began his career with International Business Machines Corporation (IBM). At IBM, Mr. Gassner conducted research and development on relational database technology, including the DB2 database. Board Experience Mr. Gassner has served on the board of directors of Guidewire Software, Inc. since June 2015 and Zoom Video Communications, Inc. since November 2015. Education Mr. Gassner earned a Bachelor of Science degree in Computer Science from Oregon State University. |

|

4 Veeva Systems Inc. | 2019 Proxy Statement

|

Proposal One

Directors Whose Terms Expire at the 2020 Annual Meeting (Class I)

|

Paul E. Chamberlain

Age: 55 Director since 2015 Independent Director Financial Expert Committees Audit |

Qualifications

Our Board determined that Mr. Chamberlain should serve as a director based on his extensive experience working with high technology and high growth firms, his leadership experience, and his financial expertise. Career Experience Since January 2015, Mr. Chamberlain has operated his own strategic and financial advisory firm, PEC Ventures. From July 1990 to January 2015, Mr. Chamberlain worked at Morgan Stanley, during which time he served as Managing Director for 18 years and as the Co-Head of Global Technology Banking for ten of those years. He also served as a member of the Investment Banking Division’s Operating Committee. Mr. Chamberlain spent the majority of his Morgan Stanley career in the firm’s Menlo Park, California office where he led account teams on financing and strategic transactions for its technology clients. Board Experience Mr. Chamberlain serves on the board of directors of ServiceNow, Inc. since October 2016 and TriNet Group, Inc. since December 2015. He also serves as Chair of the Strategic Advisory Committee of JobTrain, a non-profit organization based in Menlo Park, California that provides vocational and life skills training, and has served on its board of directors for over ten years. Education Mr. Chamberlain earned a Bachelor of Arts in History, magna cum laude, from Princeton University and a Master of Business Administration from Harvard Business School. |

|

Veeva Systems Inc. | 2019 Proxy Statement 5

|

Proposal One

|

Mark Carges

Age: 57 Director since 2017 Independent Director Committees None |

Qualifications

Our Board determined that Mr. Carges should serve as a director based on his extensive enterprise and internet software experience and his experience as a senior technology executive. Career Experience Mr. Carges previously served as the Chief Technology Officer of eBay Inc., an e-commerce company, from September 2009 to September 2014. From September 2009 to November 2013, he served as eBay’s Senior Vice President, Global Products, Marketplaces. From September 2008 to September 2009, he served as eBay’s Senior Vice President, Technology. Prior to joining eBay Inc., Mr. Carges served in a succession of senior technology leadership roles, including most recently as Executive Vice President, Products and General Manager of the Business Interaction Division, at BEA Systems, Inc., a provider of enterprise application infrastructure software, which was acquired by Oracle Corporation. Since September 2017, Mr. Carges also serves as Senior Advisor at Generation Investment Management, an investment management firm focused on sustainable companies. Board Experience Mr. Carges serves on the board of directors of Splunk Inc. since September 2014 and Magnet Systems, Inc., a private mobile engagement software company, since September 2012. Mr. Carges previously served on the board of directors of Rally Software Development Corp., which was acquired by CA Technologies, from November 2011 to July 2015. Education Mr. Carges received his Bachelor of Arts degree in Computer Science from the University of California at Berkeley and his Master of Science degree from New York University. |

|

6 Veeva Systems Inc. | 2019 Proxy Statement

|

Proposal One

|

Paul Sekhri

Age: 61 Director since 2014 Independent Director Committees Nominating and Governance |

Qualifications

Our Board determined that Mr. Sekhri should serve as a director based on his extensive experience as an executive and investor in the life sciences industry as well as his experience on numerous boards of directors for life sciences companies. Career Experience In January 2019, Mr. Sekhri was appointed President and CEO of eGenesis, Inc., a biotechnology company focused on transplantation. Prior to joining eGenesis, Mr. Sekhri served as President and CEO of Lycera Corp., a biopharmaceutical company, from February 2015 to January 2019. From February 2016 to May 2017, Mr. Sekhri was Operating Partner at Highline Therapeutics, a biotech incubator launched by Versant Ventures. Mr. Sekhri was Senior Vice President, Integrated Care at Sanofi S.A., a multinational pharmaceutical company headquartered in France, from April 2014 to January 2015. From May 2013 to March 2014, Mr. Sekhri was Group Executive Vice President, Global Business Development and Chief Strategy Officer at Teva Pharmaceutical Industries, Ltd., a global pharmaceuticals company focusing on the manufacture of generic and proprietary pharmaceutical products headquartered in Israel. From January 2009 to May 2013, Mr. Sekhri was Operating Partner and Head, Biotech Ops Group at TPG Biotech, the life sciences venture arm of the global private investment firm TPG Capital, where he was responsible for a portfolio of more than 50 life sciences companies. From December 2004 to January 2009, Mr. Sekhri was President and CEO of Cerimon Pharmaceuticals, Inc., a pharmaceutical company focusing on auto-immune diseases and pain management. Board Experience Mr. Sekhri has served as a director of numerous private and public company boards, including Ipsen S.A. since May 2018, Compugen Ltd. since October 2017, Alpine Immune Sciences, Inc. since July 2017 following its acquisition of Nivalis Therapeutics, Inc., where Mr. Sekhri served as a director since February 2016, Pharming N.V. since April 2015, Enumeral Biomedical Holdings, Inc. from December 2014 to September 2017, Tandem Diabetes Care Inc. from May 2012 to May 2013, MacroGenics, Inc. from January 2010 to May 2013 and Intercept Pharmaceuticals, Inc. from January 2008 to September 2012. Education Mr. Sekhri completed post-graduate studies in clinical anatomy and neuroscience at the University of Maryland, School of Medicine and received a Bachelor of Science degree in Zoology from the University of Maryland. |

|

Veeva Systems Inc. | 2019 Proxy Statement 7

|

Proposal One

Directors Whose Terms Expire at the 2021 Annual Meeting (Class II)

|

Timothy C. Barabe

Age: 66 Director since 2015 Independent Director Financial Expert Committees Nominating and Governance (Chair) Audit |

Qualifications

Our Board determined that Mr. Barabe should serve as a director based on his extensive executive experience in the life sciences industry and his experience as a finance executive. Career Experience Mr. Barabe retired in 2013 as Executive Vice President and Chief Financial Officer of Affymetrix, Inc. Previously, from July 2006 until March 2010, he was Senior Vice President and Chief Financial Officer of Human Genome Sciences, Inc. Mr. Barabe served as Chief Financial Officer of Regent Medical Limited, a U.K.-based, privately owned, surgical supply company, from 2004 to 2006. He was with Novartis AG from 1982 through August 2004, where he served in a succession of senior executive positions in finance and general management, most recently as the Chief Financial Officer of Sandoz GmbH, the generic pharmaceutical subsidiary of Novartis. Board Experience Mr. Barabe serves on the board of directors of ArQule, Inc. since November 2001, and Selecta Biosciences, Inc. since July 2016 and served on the board of directors of Opexa Therapeutics from March 2014 to September 2017. Mr. Barabe also serves on the board of directors of Vigilant Biosciences, a private medical device company, since November 2014 and Project Open Hand, a non-profit organization, since April 2014. Education Mr. Barabe received his Bachelor of Business Administration degree in Finance from the University of Massachusetts (Amherst) and his Master of Business Administration from the University of Chicago. |

|

8 Veeva Systems Inc. | 2019 Proxy Statement

|

Proposal One

|

Gordon Ritter

Age: 54 Director since 2008 Chairman of the Board Independent Director Committees Compensation (Chair) |

Qualifications

Our Board determined that Mr. Ritter should serve as a director based on his extensive business experience in the software and web services industries, his experience in venture capital, and his service as a director of numerous private companies. Career Experience Mr. Ritter has been a General Partner at Emergence Capital Partners, a venture capital firm he founded, since June 2002. Prior to founding Emergence, Mr. Ritter was co-founder and Chief Executive Officer of Software As Service, Inc., a web services platform company. Prior to founding Software As Service, Mr. Ritter served as Vice President of the IBM Global Small Business division. Prior to IBM, Mr. Ritter was co-founder and President of Whistle Communications, Inc., an internet appliance and services platform for small and medium-sized businesses, which was acquired by IBM. Before Whistle, Mr. Ritter was co-founder and President of Tribe, Inc., a networking infrastructure company. Prior to Tribe, Mr. Ritter was Vice President of Capital Markets at Credit Suisse First Boston Inc. Board Experience Mr. Ritter currently serves on the boards of directors of numerous private technology companies. Education Mr. Ritter earned a Bachelor of Arts degree in Economics from Princeton University. |

On February 22, 2019, the Board appointed Matt Wallach to serve as a member of the Board, to be effective as of January 1, 2020. Mr. Wallach will serve as a Class II director until the annual meeting of stockholders in 2021 or until his successor is duly elected and qualified. In addition, the Board increased the size of the Board by one member, to be effective as of January 1, 2020. Mr. Wallach informed the Board on February 22, 2019 of his retirement from his role as President, effective June 3, 2019.

There are no family relationships among any of our directors or executive officers.

|

Veeva Systems Inc. | 2019 Proxy Statement 9

|

Proposal One

Board and Committee Meeting Attendance

Our Board met six times during our fiscal year ended January 31, 2019 (“fiscal 2019”). No director attended fewer than 75%, in the aggregate, of the total number of meetings of the Board and the total number of committee meetings of which he was a member during fiscal 2019. It is our policy to invite and encourage our directors to attend our annual meetings of stockholders and have scheduled our Annual Meeting on the same day as a regularly scheduled Board meeting in order to facilitate their attendance. Last year, all but one of our directors attended our 2018 annual meeting of stockholders. The membership of each standing committee and number of meetings held during fiscal 2019 are identified in the table below.

Name |

Audit |

Compensation |

Governance |

||||||

Peter P. Gassner |

|||||||||

Timothy C. Barabe |

✔ |

Chair |

|||||||

Mark Carges |

|||||||||

Paul E. Chamberlain |

✔ |

||||||||

Ronald E.F. Codd |

Chair |

✔ |

|||||||

Gordon Ritter |

Chair |

||||||||

Paul Sekhri |

✔ |

||||||||

Number of meetings held during fiscal 2019 |

9 |

5 |

4 |

||||||

Our Board has established an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. Our Board and its committees conduct scheduled meetings throughout the year and also hold special meetings and act by written consent from time to time, as appropriate. Our Board has delegated various responsibilities and authority to its committees as generally described below. The committees regularly report on their activities and actions to the full Board. Each member of each committee of our Board qualifies as an independent director in accordance with NYSE listing standards.

Audit Committee

Our Audit Committee assists our Board in its oversight of the quality and integrity of our reported financial statements, our compliance with legal and regulatory requirements, our accounting and financial management processes and the effectiveness of our internal controls over financial reporting, our enterprise risk management and compliance programs, the quality and integrity of the annual audit of our financial statements, and the performance of our internal audit function. Our Audit Committee also discusses the scope and results of the audit with our independent registered public accounting firm, reviews with our management and our independent registered public accounting firm our interim and year-end operating results, and, as appropriate, initiates inquiries into aspects of our financial affairs. Our Audit Committee is responsible for establishing procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls, or auditing matters and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. In addition, our Audit Committee has sole and direct responsibility for the appointment, retention, compensation, and oversight of the work of our independent registered public accounting firm, including approving services and fee arrangements. Significant related party transactions will be approved by our Audit Committee before we enter into them, as required by applicable rules and NYSE listing standards.

The members of our Audit Committee are independent, non-employee members of our Board and qualify as independent under Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) and related NYSE listing standards, as determined by our Board. Each member can read and understand fundamental financial statements. Our Board has determined that all members of our Audit Committee qualify as audit committee financial experts within the meaning of regulations of the Securities and

|

10 Veeva Systems Inc. | 2019 Proxy Statement

|

Proposal One

Exchange Commission (the “SEC”) and meet the financial sophistication requirements of the NYSE. The designation does not impose on them any duties, obligations, or liabilities that are greater than are generally imposed on any other member of our Board.

Compensation Committee

The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to executive compensation policies and programs, including reviewing, evaluating, recommending, and approving executive officer compensation arrangements, plans, policies, and programs. Among other things, specific responsibilities of our Compensation Committee include evaluating the performance of our Chief Executive Officer and determining our Chief Executive Officer’s compensation. The Compensation Committee also determines the compensation of our other executive officers in consultation with our Chief Executive Officer. In addition, our Compensation Committee administers our equity-based compensation plans, including granting equity awards and approving modifications of such awards. Our Compensation Committee also reviews and approves various other compensation policies and matters and has both the authority to engage its own advisors to assist it in carrying out its function and the responsibility to assess the independence of such advisors in accordance with SEC rules and NYSE listing standards. Our Chief Executive Officer, Chief Financial Officer, and General Counsel assist our Compensation Committee in carrying out its functions, although they do not participate in deliberations or decisions with respect to their own compensation.

Our Compensation Committee has delegated to the non-executive equity committee, consisting of our Chief Executive Officer, the authority to approve routine equity award grants to newly hired employees who are not direct reports of our Chief Executive Officer, as well as promotional and refresh equity award grants to employees who are not direct reports of our Chief Executive Officer, all within certain share parameters established and reviewed from time to time by the Compensation Committee.

During fiscal 2019, our Compensation Committee engaged the services of Compensia, Inc., a compensation consulting firm, to advise it regarding the amount and types of compensation that we provide to our executive officers and directors and how our compensation practices compared to the compensation practices of our peer companies. Compensia reports directly to the Compensation Committee. Compensia does not provide any services to us other than the services provided to the Compensation Committee. Our Compensation Committee believes that Compensia does not have any conflicts of interest in advising the Compensation Committee under applicable SEC rules or NYSE listing standards.

The members of our Compensation Committee are “non-employee” directors under Rule 16b-3 of the Exchange Act, “outside directors” under applicable tax rules, and qualify as independent under Rule 10C of the Exchange Act and related NYSE listing standards, as determined by our Board.

Nominating and Governance Committee

The Nominating and Governance Committee oversees the nomination of directors, including, among other things, identifying, considering, and nominating candidates to our Board. Our Nominating and Governance Committee also recommends corporate governance guidelines and policies and advises the Board on corporate governance and Board performance matters, including recommendations regarding the structure and composition of the Board and the Board’s committee. In addition, it oversees the annual evaluation of our Board and individual directors and advises the Board on matters that may involve members of the Board or our executive officers and that may involve a conflict of interest or taking of a corporate opportunity. Our Nominating and Governance Committee also evaluates potential candidates for our Board on an ongoing basis.

|

Veeva Systems Inc. | 2019 Proxy Statement 11

|

Proposal One

The members of our Nominating and Governance Committee are non-employee members of our Board and are independent under the listing standards of the NYSE applicable to Nominating and Governance Committee members.

Compensation Committee Interlocks and Insider Participation

During fiscal 2019, our Compensation Committee consisted of Messrs. Codd and Ritter. None of our executive officers serves, or served during fiscal 2019, as a member of the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of our Board or our Compensation Committee.

The following table sets forth information about the compensation of the non-employee members of our Board who served as a director during fiscal 2019. Other than as set forth in the table and described more fully below, during fiscal 2019, we did not pay any fees to, make any equity awards or non-equity awards to or pay any other compensation to the non-employee member of our Board. Mr. Gassner, our Chief Executive Officer, receives no compensation for his service as a director and, therefore, is not included in the table below.

|

Name

|

Fees Earned

or Paid in Cash ($) (1) |

Stock Awards

($) (2)(3)(4) |

Total

($) |

|

Timothy C. Barabe

|

50,000

|

237,496

|

287,496

|

|

Mark Carges

|

50,000

|

199,928

|

249,928

|

|

Paul E. Chamberlain

|

50,000

|

224,919

|

274,919

|

|

Ronald E.F. Codd

|

50,000

|

262,487

|

312,487

|

|

Gordon Ritter

|

50,000

|

274,983

|

324,983

|

|

Paul Sekhri

|

50,000

|

204,992

|

254,992

|

| (1) | Represents the annual cash retainers paid to each director. |

| (2) | Represents the aggregate grant date fair value of RSUs and stock options granted to the director during fiscal 2019, computed in accordance with FASB ASC Topic No. 718. See note 9 of the notes to our consolidated financial statements included in our annual report on Form 10-K filed on March 28, 2019 for a discussion of the assumptions made by us in determining the grant date fair values of our equity awards. |

| (3) | As of January 31, 2019, the above-listed non-employee directors held outstanding options to purchase shares of our Class A common stock as follows: Mr. Barabe — 0; Mr. Carges — 0; Mr. Chamberlain — 0; Mr. Codd — 40,000; Mr. Ritter — 0; and Mr. Sekhri — 20,000. As of January 31, 2019, Mr. Codd also held an outstanding option to purchase 119,250 shares of Class B common stock which represents the unexercised and vested portion of an option granted in March 2012 for 312,500 shares of Class B common stock. |

| (4) | As of January 31, 2019, the above-listed non-employee directors held outstanding RSUs under which the following number of shares of our Class A common stock were issuable upon vesting: Mr. Barabe — 1,454; Mr. Carges — 1,224; Mr. Chamberlain — 1,377; Mr. Codd — 1,607; Mr. Ritter — 1,683; and Mr. Sekhri — 1,255. |

Non-Employee Director Compensation Plan

Effective June 13, 2018 and in consultation with Compensia, the Board approved the following changes to non-employee director compensation: (1) increased the value of the annual grant of RSUs from $150,000 to $200,000 and (2) created additional grants of RSUs to members and the chair of the Nominating and Governance Committee. All other components of the non-employee director compensation program remained unchanged.

Each non-employee member of the Board receives an annual cash retainer of $50,000, paid in quarterly installments.

|

12 Veeva Systems Inc. | 2019 Proxy Statement

|

Proposal One

Non-employee members of the Board also receive grants of RSUs under our 2013 Equity Incentive Plan on the date of our annual meeting of stockholders. Such annual grants are valued on the date of grant and vest quarterly over one year. On the date of each annual meeting of stockholders, each non-employee director who is serving on the Board as of such date will be issued RSUs valued at $200,000 of our Class A common stock. In addition, the non-executive chairman or lead independent director will receive an additional issuance of RSUs valued at $50,000 of our Class A common stock.

Non-employee members of the Audit Committee, Compensation Committee, and Nominating and Governance Committee are granted additional RSUs as follows.

| • | Audit Committee |

| ○ | Members: RSUs valued at $25,000 |

| ○ | Chair: RSUs valued at $50,000 |

| • | Compensation Committee |

| ○ | Members: RSUs valued at $12,500 |

| ○ | Chair: RSUs valued at $25,000 |

| • | Nominating and Governance Committee |

| ○ | Members: RSUs valued at $5,000 |

| ○ | Chair: RSUs valued at $12,500 |

New directors will receive cash and equity compensation on a pro-rated basis to coincide with our annual director compensation period, which begins in the month of our annual meeting of stockholders.

We also have a policy of reimbursing directors for their reasonable out-of-pocket expenses incurred in attending Board and committee meetings.

To further align the interests of our directors and executive officers with those of our stockholders and based on recommendations from our stockholders during our fiscal 2019 engagement, our Board recently adopted stock ownership guidelines. Under these guidelines, each director must own Veeva stock with a value of three times the annual cash retainer for Board service. Our directors are required to achieve these ownership levels within three years of the later of March 19, 2019 (the date our Board adopted stock ownership guidelines) or the date of such director’s election or appointment.

The guidelines may be satisfied by ownership of shares of our Class A or Class B common stock or vested and unexercised stock options.

As of the end of the first quarter of fiscal 2020, all of our directors were in compliance with these guidelines.

See “Executive Compensation—Compensation Discussion and Analysis—Other Compensation-Related Policies—Stock Ownership Guidelines” for information about the guidelines applicable to our executive officers.

|

Veeva Systems Inc. | 2019 Proxy Statement 13

|

CORPORATE GOVERNANCE

Overview of Our Corporate Governance Program and Recent Actions

The highlights of our corporate governance program are as follows:

| • | Majority independent Board |

| • | Completely independent committees |

| • | Separate Chairman and CEO positions |

| • | All members of Audit Committee are “financial experts” |

| • | Independent directors meet without management present |

| • | Annual Board evaluation (led by third party) |

| • | Members of management other than executive officers regularly attend and present at Board meetings |

| • | Qualified diverse candidate pool policy in our Corporate Governance Guidelines* |

| • | Automatic sunset of our dual class structure in October 2023 |

| • | Code of Conduct applicable to directors and executive officers |

| • | Corporate Citizenship statement posted to our website* |

| • | Anti-hedging and pledging policies in our Insider Trading Policy |

| • | Our 10b5-1 trading plan guidelines follow best practices |

| • | Stock ownership guidelines for directors and executive officers* |

| • | Change in circumstances with director resignation policy in our Corporate Governance Guidelines |

| • | Annual review of committee charters and corporate governance policies |

| • | Board continuing education program |

| * | Implemented during fiscal 2019 and fiscal 2020. |

We regularly review our current corporate governance practices against best practices and peer benchmarks. Over the past several years, we have taken the following steps, which are described in more detail elsewhere in this Proxy Statement:

| • | In March 2019, we reviewed and made changes to our overall compensation program (for both executive officers and employees) with a view toward retention and stockholder alignment (see “Executive Compensation” for more details). We also adopted stock ownership guidelines for directors and executive officers. |

| • | In 2018, the Board adopted a qualified diverse candidate pool policy, which codifies the Board’s effort since 2014 to recruit female candidates for Board membership (see “Considerations in Evaluating Director Nominees and Board Diversity” for more details). |

| • | In 2018, we initiated our first broad-based stockholder engagement program to elicit the views of our investors on corporate governance and executive compensation matters (see “Fiscal 2019 Stockholder Engagement on Corporate Governance Matters” for more details) and publicly posted a Corporate Citizenship statement to our website. |

| • | In 2018, we added proxy statement disclosure regarding Board evaluations and the Director Education Policy, which we adopted to assist our directors in staying abreast of developments in corporate governance and other matters relevant to board service (see “Director On-Boarding and Continuing Education” for more details). |

| • | In 2017, we increased the frequency and duration of Nominating and Governance Committee meetings as a commitment to ongoing Board candidate recruitment and improvement of our corporate governance practices. |

| • | In 2017, we significantly enhanced proxy statement readability and presentation by increasing wayfinding language and hyperlinks, adding summary sections, and combining the proxy statement and annual report. |

|

14 Veeva Systems Inc. | 2019 Proxy Statement

|

Corporate Governance

Fiscal 2019 Stockholder Engagement on Corporate Governance Matters

In 2018, we initiated our first broad-based stockholder engagement program to gather direct feedback from stockholders on corporate governance matters. As part of this new program, we proactively reached out to the top 15 holders of our Class A common stock and other investors with which we have engaged on these matters in the past, representing approximately 54% of our outstanding Class A common stock. We met with 11 of our stockholders, representing approximately 40% of our outstanding Class A common stock individually to discuss executive compensation and corporate governance matters.

We believe the meetings with our stockholders were informative and productive. The meetings were predominantly focused upon the following topics: (1) board diversity; (2) executive compensation; (3) corporate social responsibility matters; and (4) other corporate governance matters.

We reviewed with our Board the key discussion points from these meetings with the goal of being responsive to stockholder feedback and continuing to improve our corporate governance practices. We plan to continue this practice.

Our Board has adopted a Code of Conduct that applies to all of our directors, employees, and officers, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Code of Conduct is posted on our website. Each committee of our Board has a written charter approved by our Board. Copies of each charter are also posted on our website. On an annual basis, our Board and its committees review our Corporate Governance Guidelines, the written charters for each of the Board’s committees, and our Code of Conduct against best practices and peer benchmarks. We will disclose any future amendments to, or waiver of, our Code of Conduct, on our website.

Our Class A common stock is listed on the NYSE. The listing standards of the NYSE generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing standards of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the listing standards of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has determined that none of our non-employee directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the listing standards of the NYSE. The independent members of our Board hold separate regularly scheduled executive session meetings at which only independent directors are present.

Considerations in Evaluating Director Nominees and Board Diversity

Our Nominating and Governance Committee reviews on at least an annual basis, the composition of the Board, including character, judgment, diversity, independence, expertise, corporate experience, length of service, other commitments, and the like. Our Nominating and Governance Committee considers all aspects of each candidate’s qualifications and skills in the context of the needs of Veeva with a view toward creating a Board with a diversity of experience and perspectives, including diversity with respect to race, gender, geography, and areas of expertise. Accordingly, as set forth in our Corporate Governance Guidelines, when evaluating candidates for nomination as new directors, our Nominating and Governance Committee will consider a set of candidates that includes candidates of different genders.

|

Veeva Systems Inc. | 2019 Proxy Statement 15

|

Corporate Governance

Diversity is important to us, and we have always had diversity within our management team and across the company. Currently, one-third of our executive team, which is comprised of our Chief Executive Officer and his direct reports, are women. We have also had female representation on our Board for much of our history (i.e., from our inception in January 2007 until July 2014). Since that time, while identifying and recruiting director candidates, our Chief Executive Officer and other Board members have targeted and interviewed several qualified female candidates. In keeping with our qualified diverse candidate pool policy, our Chief Executive Officer and Board members engaged a number of female candidates simultaneously with the Board’s consideration of Mr. Wallach’s appointment, which is effective January 1, 2020. Our Nominating and Governance Committee and Board as a whole remain focused on increasing the diversity of our Board in the near term.

Pursuant to our Corporate Governance Guidelines, our Board may separate or combine the roles of the Chairman of the Board and Chief Executive Officer when and if it deems it advisable and in our best interests and in the best interests of our stockholders to do so. We currently separate the roles of Chairman and Chief Executive Officer. Our Board is currently chaired by Mr. Ritter. Separating the roles of Chief Executive Officer and Chairman allows our Chief Executive Officer to focus on our day-to-day business while allowing the Chairman to lead our Board in its fundamental role of providing independent advice to, and oversight of, management. Our Board believes that having an independent director serve as Chairman is the appropriate leadership structure for us at this time, and the Board will periodically consider the Board’s leadership structure. Mr. Ritter, as our Chairman, presides over separate regularly scheduled executive session meetings at which only independent directors are present. Our Corporate Governance Guidelines are posted on our website.

Our business affairs are managed under the direction of our Board, which is currently composed of seven members. Six of our directors are independent within the meaning of the NYSE listing standards. Our Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, directors in a particular class will be elected for three-year terms at the annual meeting of stockholders in the year in which their terms expire. As a result, only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term continues until the election and qualification of his or her successor, or the earlier of his or her death, resignation, or removal. The classification of our Board may have the effect of delaying or preventing changes in our control or management.

Stockholders and other interested parties wishing to communicate with our Board or with an individual member of our Board may do so by writing to the Board or to the particular member of the Board, care of the Corporate Secretary by mail to our principal executive offices, Attention: Corporate Secretary. The envelope should indicate that it contains a stockholder or interested party communication. All such communications will be forwarded to the director or directors to whom the communications are addressed.

|

16 Veeva Systems Inc. | 2019 Proxy Statement

|

Corporate Governance

Board and Committee Evaluations

Pursuant to its charter, the Nominating and Governance Committee oversees the self-evaluation of the Board, and since 2015, we have engaged outside counsel to conduct interviews with each director regarding, among other things, Board and Board committee membership, structure, performance, and areas for improvement. These meetings take place during the summer and are reported on during the first cycle of Board meetings in the fall. The purpose of the evaluation is to assess the Board as a whole, and we believe that this process allows Board members to:

| • | Gain a better understanding of what it means to be an effective Board, including identifying strategies to enhance Board performance; |

| • | Evaluate overall Board composition; |

| • | Assess Board and committee roles and responsibilities; |

| • | Provide anonymous feedback on peers; |

| • | Clarify the expectations that directors have of themselves and of each other; |

| • | Foster effective communications among directors and between the Board and management; |

| • | Identify and discuss areas for potential improvement; and |

| • | Identify Board goals and objectives for the coming year. |

Following the interviews, the results are discussed with the Nominating and Governance Committee, the Chairman of the Board, and, where relevant, with management, and presented to and discussed with the full Board during executive session. Where appropriate, further action is taken consistent with these Board discussions.

One of the key functions of our Board is informed oversight of our risk management process. Our Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities. Our Board is responsible for assuring that an appropriate culture of risk management exists within Veeva, monitoring and assessing strategic risk exposure, and focusing on how we address specific risks, such as cybersecurity and technology risks, brand and reputation risks, strategic and competitive risks, operational risks, financial risks, and legal and compliance risks. Our executive officers are responsible for the day-to-day management of the material risks we face. On a regular basis, our Board administers its oversight function directly as well as through its various standing committees that address the risks inherent in their respective areas of oversight. For example, our Audit Committee is responsible for overseeing the management of risks associated with our financial reporting, accounting, and auditing matters as well as overseeing our internal audit function and our enterprise risk management and compliance programs; our Compensation Committee oversees the management of risks associated with our compensation policies and programs; and our Nominating and Governance Committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our Board, and director succession planning.

Board’s Role in Human Capital Management

Our Board believes that human capital management is an important component of our continued growth and success. Our Board has regular involvement in talent retention and development and succession planning, and the Board provides input on important decisions in each of these areas. The Board has primary responsibility for Chief Executive Officer succession planning and monitors management’s succession plans for other key executives. The Board believes that the establishment of a strong management team is the best way to prepare for an unanticipated executive departure.

In addition, members of our Board regularly engage with employees at all levels of the organization, including through periodic visits to Veeva’s headquarters in Pleasanton, California and attendance at employee and customer events, to gain insight into a broad range of human capital management topics,

|

Veeva Systems Inc. | 2019 Proxy Statement 17

|

Corporate Governance

including corporate culture, diversity, employee development, and compensation and benefits. Our Board and management consider employee feedback in evaluating employee programs and benefits and in monitoring our current practices for potential areas of improvement.

In particular, our Compensation Committee administers and provides oversight of our cash- and equity-based compensation programs and reviews with management our major compensation-related risks, including as they relate to retention of our key executives and employees. Our general compensation philosophy is that we pay at market for a location based on contribution. In order to foster an ownership culture amongst our employees, management, in consultation with our Board and Compensation Committee, established a new equity compensation program for our employees other than our Chief Executive Officer in late fiscal 2019. Our new compensation program consists of three primary components: total cash compensation (base salary and, in some cases, variable cash compensation), a “stock bonus” in the form of an annual RSU grant, and long-term equity incentives in the form of stock options. We believe that this combination of cash compensation, RSUs, and stock options attract, fairly compensate, appropriately incentivize, and retain our employees in a manner that aligns their long-term interests with those of our stockholders.

Director On-Boarding and Continuing Education

Upon joining our Board, directors are provided with an orientation about us, which includes introductions to members of our senior management and information about our operations, performance, strategic plans, and corporate governance practices.

Our Board believes that our stockholders are best served by a Board comprised of individuals who are up to date on corporate governance and other matters relevant to board service. To encourage those efforts, our Board has adopted a Director Education Policy that encourages all directors to pursue ongoing education and development on topics that they deem relevant given their individual backgrounds and committee assignments on our Board. Our directors are encouraged and provided with opportunities to attend educational sessions on subjects that would assist them in discharging their duties. Pursuant to the Director Education Policy, we will reimburse directors up to $12,000 each fiscal year to pursue education and development. In addition and in order to facilitate ongoing education, our management provides to our directors on a periodic basis pertinent articles and information relating to our business, our competitors, and corporate governance and regulatory issues.

Stockholder Recommendations for Nominations to the Board

Our Nominating and Governance Committee has adopted Policies and Procedures for Director Candidates. Stockholder recommendations for candidates to our Board must be received by December 31st of the year prior to the year in which the recommended candidates will be considered for nomination must be directed in writing to our principal executive offices, Attention: Corporate Secretary; and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between us and the candidate within the last three years, and evidence of the recommending person’s ownership of our capital stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on the Board, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that our executive officers and directors and persons who own more than 10% of our common stock, file reports of ownership and changes of ownership with the SEC. Such directors, executive officers, and 10% stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

|

18 Veeva Systems Inc. | 2019 Proxy Statement

|

Corporate Governance

SEC regulations require us to identify in this Proxy Statement anyone who filed a required report late during the most recent fiscal year. Based on our review of forms we received, or written representations from reporting persons, we believe that during fiscal 2019, all Section 16(a) filing requirements were satisfied on a timely basis.

Certain Relationships and Related Party Transactions

In addition to the compensation arrangements with our directors and executive officers described elsewhere in this Proxy Statement, the following is a description of each transaction since February 1, 2018 and each currently proposed transaction in which:

| • | we have been or are to be a participant; |

| • | the amount involved exceeds or will exceed $120,000; and |

| • | any of our directors, executive officers, or holders of more than 5% of our capital stock, or any immediate family member of or person sharing the household with any of these individuals (other than tenants or employees), had or will have a direct or indirect material interest. |

Employment Arrangements with Immediate Family Members of Our Executive Officers and Directors

Theodore Wallach, a brother of Matthew J. Wallach, our President, has been employed by us since September 2010. Theodore Wallach serves as a senior product manager. During fiscal 2019, Theodore Wallach had total cash compensation of $179,649, which included a payout of accrued PTO that resulted when we ceased permitting PTO accrual.

Lisa Halsey, a sister-in-law of Timothy S. Cabral, our Chief Financial Officer, has been employed by us since August 2015. Ms. Halsey serves as a director on our employee success team. During fiscal 2019, Ms. Halsey had total cash compensation of $139,479.

The compensation level for each of Theodore Wallach and Ms. Halsey was comparable to the compensation paid to employees in similar positions that were not related to our executive officers. While neither Theodore Wallach nor Ms. Halsey received equity awards in fiscal 2019, they were eligible for equity awards on the same general terms and conditions as other employees in similar positions who were not related to our executive officers.

Indemnification Agreements

We have entered into indemnification agreements with our directors, executive officers, and other key employees. The indemnification agreements provide that we indemnify each of our directors, executive officers, and key employees to the fullest extent permitted by Delaware law, our Certificate, and our Bylaws against expenses incurred by that person because of his or her status as one of our directors, executive officers, or key employees. In addition, the indemnification agreements provide that, to the fullest extent permitted by Delaware law, we will advance all expenses incurred by our directors, executive officers, and other key employees in connection with a legal proceeding.

Policies and Procedures for Related Party Transactions

Pursuant to our Code of Conduct and Audit Committee charter, any related party transaction or series of transactions with an executive officer, director, or any of such person’s immediate family members or affiliates, in which the amount, either individually or in the aggregate, involved exceeds $120,000 must be presented to our Audit Committee for review, consideration, and approval. All of our directors and executive officers are required to report to our Audit Committee any such related party transaction. In approving or rejecting the proposed transactions, our Audit Committee shall consider the relevant facts and circumstances available and deemed relevant to the Audit Committee, including, but not limited to the

|

Veeva Systems Inc. | 2019 Proxy Statement 19

|

Corporate Governance

risks, costs, and benefits to us, the terms of the transaction, the availability of other sources for comparable services or products and, if applicable, the impact on a director’s independence. Our Audit Committee shall approve only those transactions that, in light of known circumstances, are not inconsistent with Veeva’s best interests, as our Audit Committee determines in the good faith exercise of its discretion.

|

20 Veeva Systems Inc. | 2019 Proxy Statement

|

EXECUTIVE OFFICERS

The following table provides information concerning our executive officers as of May 9, 2019.

|

Name

|

Age

|

Position(s)

|

|

Peter P. Gassner

|

54

|

Chief Executive Officer and Director

|

|

Matthew J. Wallach

|

46

|

President

|

|

Timothy S. Cabral

|

51

|

Chief Financial Officer

|

|

E. Nitsa Zuppas

|

49

|

Chief Marketing Officer

|

|

Alan V. Mateo

|

57

|

Executive Vice President, Global Sales

|

|

Josh Faddis

|

47

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

Frederic Lequient

|

50

|

Senior Vice President, Global Customer Services

|

Peter P. Gassner. See biographical information set forth under “Proposal One — Nominees for Election at the Annual Meeting (Class III).”

Matthew J. Wallach is one of our founders and has served in various senior executive roles since joining Veeva in March 2007. He currently serves as our President and prior to that served as our Chief Strategy Officer from September 2010 to August 2013. Between April 2005 and March 2007, Mr. Wallach served as Chief Marketing Officer at Health Market Science, Inc., a supplier of healthcare data solutions. From January 2004 to December 2004, Mr. Wallach served as Vice President of Marketing and Product Management at IntelliChem, Inc., a provider of scientific content management solutions. Mr. Wallach was previously the General Manager of the Pharmaceuticals & Biotechnology division at Siebel Systems, Inc., a customer relationship management software company, from August 1998 to December 2003. Mr. Wallach serves on the board of directors of HealthVerity, Inc., a private healthcare data company. Mr. Wallach earned a Bachelor of Arts degree in Economics from Yale University and a Master of Business Administration from the Harvard Business School. Effective June 3, 2019, Mr. Wallach will retire from his role as President.

Timothy S. Cabral has served as our Chief Financial Officer since February 2010. Prior to joining Veeva, Mr. Cabral served as Chief Financial Officer and Chief Operations Officer for Modus Group, LLC, a wireless solutions and services company, from February 2008 to February 2010 and served as Chief Financial Officer and Vice President of Operations for Agistics, Inc., an employee management services company, from March 2005 to June 2007. Mr. Cabral previously spent more than seven years at PeopleSoft, beginning in November 1997, where he held various positions, including Vice President of Products & Technology Finance and Senior Director of Corporate FP&A. Mr. Cabral served on the board of directors of Apttus Corporation, a private software provider, from October 2017 to October 2018, when it was acquired by Thomas Bravo. Mr. Cabral earned a Bachelor of Science degree in Finance from Santa Clara University and a Master of Business Administration from the Leavey School of Business at Santa Clara University.

E. Nitsa Zuppas has served as our Chief Marketing Officer since March 2013. Prior to joining Veeva, Ms. Zuppas served as Chief Marketing Officer for First Virtual Group, a diversified holding company with global interests in real estate, agribusiness, philanthropy, and global financial asset management, and Executive Director of the Siebel Foundation from February 2006 to March 2013. From March 1998 to January 2006, Ms. Zuppas served in a number of executive roles at Siebel Systems, including Director, Product Marketing, Senior Director, Investor Relations, General Manager, Siebel Retail, and Vice President, Marketing. Ms. Zuppas earned a Bachelor of Arts degree in Art History from California State University.

Alan V. Mateo has served as our Executive Vice President, Global Sales since April 2015. Prior to joining Veeva, Mr. Mateo served in various executive roles at Medidata Solutions, Inc., a provider of a platform of cloud-based solutions for life sciences, from March 2005 to February 2015, including as Executive Vice President of Field Operations from January 2014 to February 2015. Before Medidata, Mr. Mateo spent 11 years at PeopleSoft, where his responsibilities included product lines sales, sales operations and the integration of JD Edwards into PeopleSoft’s global sales organization. Prior to PeopleSoft, Mr. Mateo was

|

Veeva Systems Inc. | 2019 Proxy Statement 21

|

Executive Officers

northeast sales director for Red Pepper Software Co., a provider of supply chain management planning application software, and a major account executive at JD Edwards. Mr. Mateo earned a Bachelor of Science in both Computer Science and Marketing from Juniata College.

Josh Faddis has served as our Senior Vice President since April 2016 and General Counsel since September 2012. Mr. Faddis has also served as our Corporate Secretary since May 2013. Prior to joining Veeva, Mr. Faddis served in various roles at Taleo Corporation, a software-as-a-service provider of human capital management solutions, beginning in June 2001 through April 2012, including Senior Vice President, General Counsel, and Corporate Secretary. Prior to joining Taleo, Mr. Faddis conducted intellectual property and business litigation at Fulbright & Jaworski LLP and served as a Judicial Clerk for the Honorable Justice Craig Enoch, Supreme Court of the State of Texas. Mr. Faddis earned a Bachelor of Science in Agricultural Economics from Texas A&M University, magna cum laude, and a Juris Doctor degree from the Georgetown University Law Center.

Frederic Lequient has served as our Senior Vice President, Global Customer Services since February 2016. Prior to joining Veeva, Mr. Lequient served as Vice President, Customer Success at PubMatic, Inc., a marketing automation software platform company, from April 2015 to December 2015. From April 2014 to January 2015, Mr. Lequient served as Senior Vice President, Customer Success at FollowAnalytics, Inc., a provider of a mobile marketing automation and engagement platform. From April 2012 to April 2014, Mr. Lequient served as Group Vice President, Consulting at Oracle Corporation, an enterprise software company. From September 1999 to April 2012, Mr. Lequient served in various roles at Taleo, including as Vice President, Field Solutions and Business Development. Mr. Lequient earned a Bachelor of Engineering in Industrial Engineering from Université de Montréal — Ecole polytechnique de Montréal.

|

22 Veeva Systems Inc. | 2019 Proxy Statement

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 31, 2019 for:

| • | each of our named executive officers; |

| • | each of our directors; |

| • | all of our executive officers and directors as a group; and |

| • | each stockholder known by us to be the beneficial owner of more than 5% of our outstanding shares of Class A common stock or Class B common stock. |

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of Class A common stock or Class B common stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership is based on 127,651,159 shares of Class A common stock and 19,187,638 shares of Class B common stock outstanding at March 31, 2019. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of common stock subject to options and RSUs held by that person or entity that are currently exercisable or releasable or that will become exercisable or releasable within 60 days of March 31, 2019. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Veeva Systems Inc., 4280 Hacienda Drive, Pleasanton, California 94588.

Shares Beneficially Owned |

% Total Voting Power (1) |

||||||||||||||

Class A |

Class B |

||||||||||||||

Name of Beneficial Owner |

Shares |

% |

Shares |

% |

|||||||||||

Named Executive Officers and Directors: |

|||||||||||||||

Timothy C. Barabe |

9,346 | * |

— | — | * |

||||||||||

Timothy S. Cabral (2) |

— | — | 494,494 | 2.6 | 1.5 |

||||||||||

Mark Carges |

4,239 | * |

— | — | * |

||||||||||

Paul E. Chamberlain |

13,135 | * |

— | — | * |

||||||||||

Ronald E.F. Codd (3) |

52,091 | * |

210,500 | 1.1 | * |

||||||||||

Josh Faddis (4) |

1,073 | * |

11,417 | * |

* |

||||||||||

Peter P. Gassner (5) |

— | — | 16,041,666 | 72.8 | 46.1 |

||||||||||

Frederic Lequient (6) |

29,827 | * |

— | — | * |

||||||||||

Alan V. Mateo (7) |

119,849 | * |

— | — | * |

||||||||||

Gordon Ritter (8) |

545,506 | * |

2,450,000 | 12.8 | 7.8 |

||||||||||

Paul Sekhri (9) |

36,468 | * |

— | — | * |

||||||||||

Matthew J. Wallach (10) |

— | — | 1,026,054 | 5.3 | 3.2 |

||||||||||

E. Nitsa Zuppas (11) |

27,205 | * |

37,200 | * |

* |

||||||||||

All Executive Officers and Directors as a Group (13 persons) (12) |

838,739 | * |

20,271,331 | 89.9 | 57.6 |

||||||||||

5% Stockholders: |

|||||||||||||||

The Vanguard Group (13) |

11,605,165 | 9.1 | — | — | * |

||||||||||

Morgan Stanley (14) |

10,894,349 | 8.5 | — | — | 3.3 |

||||||||||

BlackRock, Inc. (15) |

6,991,634 | 5.5 | — | — | 1.9 |

||||||||||

Artisan Partners Limited Partnership (16) |

6,475,746 | 5.1 | — | — | 1.8 |

||||||||||

| * | Less than 1 percent. |

|

Veeva Systems Inc. | 2019 Proxy Statement 23

|

Security Ownership of Certain Beneficial Owners and Management

| (1) | Percentage of total voting power represents voting power with respect to all shares of our Class A and Class B common stock, as a single class. Holders of our Class B common stock are entitled to ten votes per share, and holders of our Class A common stock are entitled to one vote per share. Each share of Class B common stock is convertible, at any time at the option of the holder, into one share of Class A common stock. |

| (2) | Includes (i) 10,000 shares of Class B common stock held by Mr. Cabral and Julia Cabral as community property, (ii) 335,934 shares of Class B common stock held by The Cabral Family Trust dated April 17, 2001, and (iii) 148,560 shares of Class B common stock issuable to Mr. Cabral pursuant to options exercisable within 60 days of March 31, 2019. |

| (3) | Includes (i) 12,091 shares of Class A common stock held by Mr. Codd, (ii) 40,000 shares of Class A common stock issuable to Mr. Codd pursuant to options exercisable within 60 days of March 31, 2019, (iii) 104,250 shares of Class B common stock held by the Codd Revocable Trust dated March 6, 1998, and (iv) 106,250 shares of Class B common stock issuable to Mr. Codd pursuant to an option exercisable within 60 days of March 31, 2019. |

| (4) | Includes (i) 1,073 shares of Class A common stock held by Mr. Faddis, (ii) 9,750 shares of Class B common stock held by Mr. Faddis, and (iii) 1,667 shares of Class B common stock issuable to Mr. Faddis pursuant to options exercisable within 60 days of March 31, 2019. |