Form 8-K INTEL CORP For: May 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2019

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-06217 | 94-1672743 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 2200 Mission College Blvd., Santa Clara, California | 95054-1549 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (408) 765-8080

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common stock, $0.001 par value | INTC | The Nasdaq Global Select Market |

| Item 7.01 | Regulation FD Disclosure. |

On May 8, 2019, Intel Corporation (“Intel”) held a publicly available webcast meeting for investors and the general public (the “Investor Meeting”). At the Investor Meeting, presentations discussing Intel’s strategy, financial performance, and product roadmap, among other topics, were given by (1) Robert H. Swan, Chief Executive Officer; (2) Venkata S.M. (“Murthy”) Renduchintala, Executive Vice President; Group President, Technology, Systems Architecture and Client Group, and Chief Engineering Officer; (3) Navin Shenoy, Executive Vice President; General Manager, Data Center Group; (4) Gregory M. Bryant, Senior Vice President; General Manager, Client Computing Group; and (5) George S. Davis, Executive Vice President; Chief Financial Officer. These presentations are attached as exhibits to this report.

These presentations and a recording of the webcast may also be found on Intel’s Investor Relations website, www.intc.com.

The presentations contain forward-looking statements relating to Intel’s financial plan as well as other statements that refer to future plans and expectations, including with respect to Intel’s future technologies and the expected benefits of such technologies. Such statements involve a number of risks and uncertainties. Words such as “anticipates,” “expects,” “intends,” “goals,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” “will,” “would,” “should,” “could,” and variations of such words and similar expressions are intended to identify forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on current expectations and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company’s expectations are set forth in Intel’s most recent earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the Securities and Exchange Commission (“SEC”) on such date. Additional information regarding these and other factors that could affect Intel’s results is included in Intel’s Annual Report on Form 10-K for the year ended December 29, 2018, filed with the SEC on February 1, 2019.

The information in Item 7.01 of this report is furnished and shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| INTEL CORPORATION | ||||||

| (Registrant) | ||||||

| Date: May 9, 2019 | /s/ Steven R. Rodgers | |||||

| Steven R. Rodgers | ||||||

| Executive Vice President and General Counsel | ||||||

Exhibit 99.1 CHIEF EXECUTIVE OFFICERExhibit 99.1 CHIEF EXECUTIVE OFFICER

This presentation contains non-GAAP financial measures. You can find the reconciliation of these measures to the most directly comparable GAAP financial measure in the Appendix at the end of this presentation. The non-GAAP financial measures disclosed by Intel should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP. Please refer to “Explanation of Non-GAAP Measures” in Intel's quarterly earnings release for a detailed explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures and the reasons why management believes the non-GAAP measures provide investors with useful supplemental information. Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10- K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.This presentation contains non-GAAP financial measures. You can find the reconciliation of these measures to the most directly comparable GAAP financial measure in the Appendix at the end of this presentation. The non-GAAP financial measures disclosed by Intel should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP. Please refer to “Explanation of Non-GAAP Measures” in Intel's quarterly earnings release for a detailed explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures and the reasons why management believes the non-GAAP measures provide investors with useful supplemental information. Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10- K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.

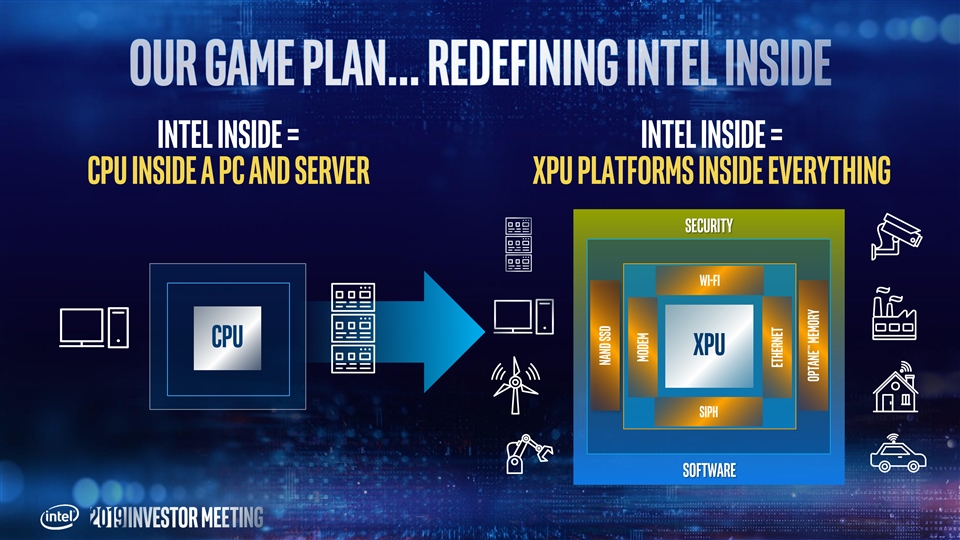

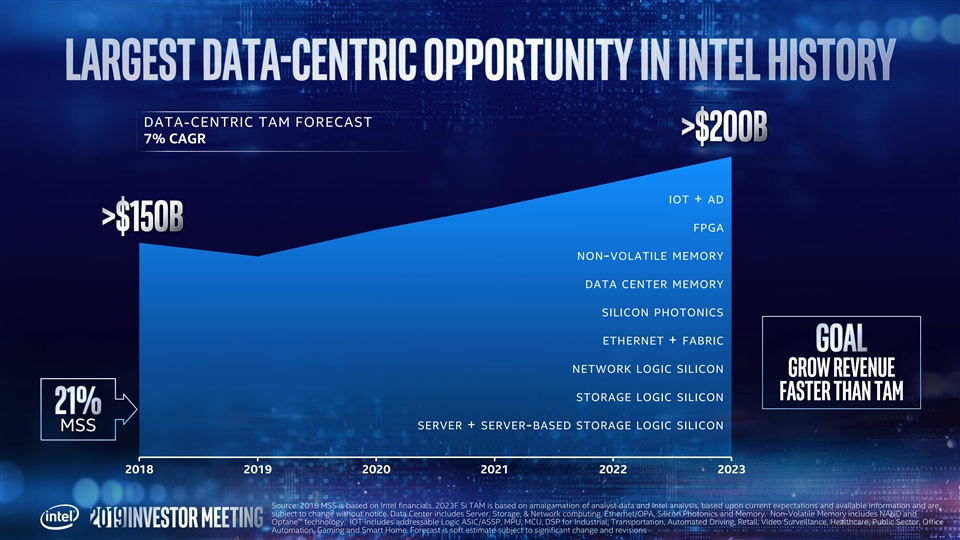

We’ve expanded our TAM… ACCELERATING TRANSFORMATION TO A DATA-CENTRIC COMPANY Extend product leadership advantage… FROM CPU TO XPU Improve execution… accelerate innovation… evolve culture Disciplined investment... Profitable growth... Attractive capital returnsWe’ve expanded our TAM… ACCELERATING TRANSFORMATION TO A DATA-CENTRIC COMPANY Extend product leadership advantage… FROM CPU TO XPU Improve execution… accelerate innovation… evolve culture Disciplined investment... Profitable growth... Attractive capital returns

We exceeded Q1 expectations… but lowered outlook 1 1 Revenue Operating Margin EPS Down Down Down $2.5B 2pts $0.25 1 Non-GAAP. Refer to the Appendix for a reconciliation of these non-GAAP measures.We exceeded Q1 expectations… but lowered outlook 1 1 Revenue Operating Margin EPS Down Down Down $2.5B 2pts $0.25 1 Non-GAAP. Refer to the Appendix for a reconciliation of these non-GAAP measures.

Top Priorities for 2017 Growth in Data strong & healthy Client growth flawlessly execute in Center & Adjacencies business in IoT & devices Memory & FPGAS 29Top Priorities for 2017 Growth in Data strong & healthy Client growth flawlessly execute in Center & Adjacencies business in IoT & devices Memory & FPGAS 29

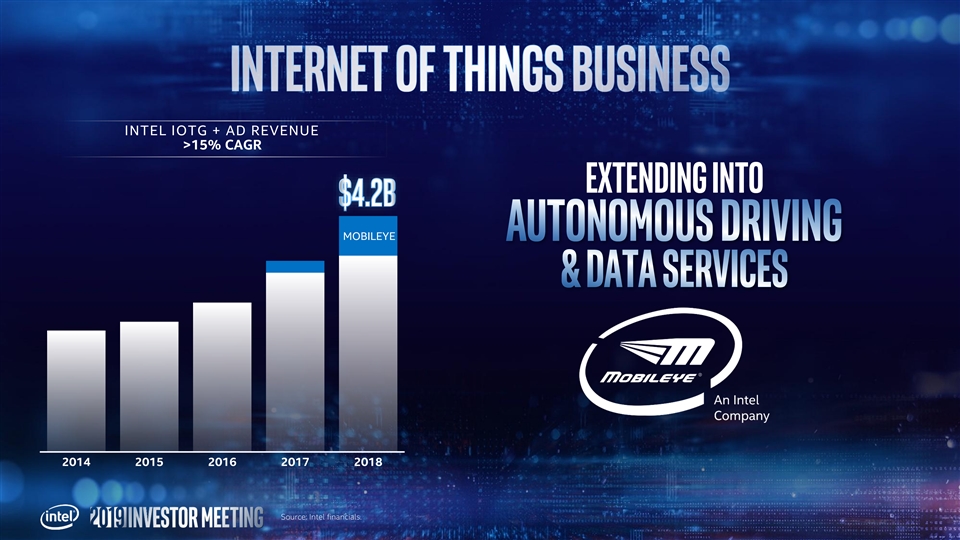

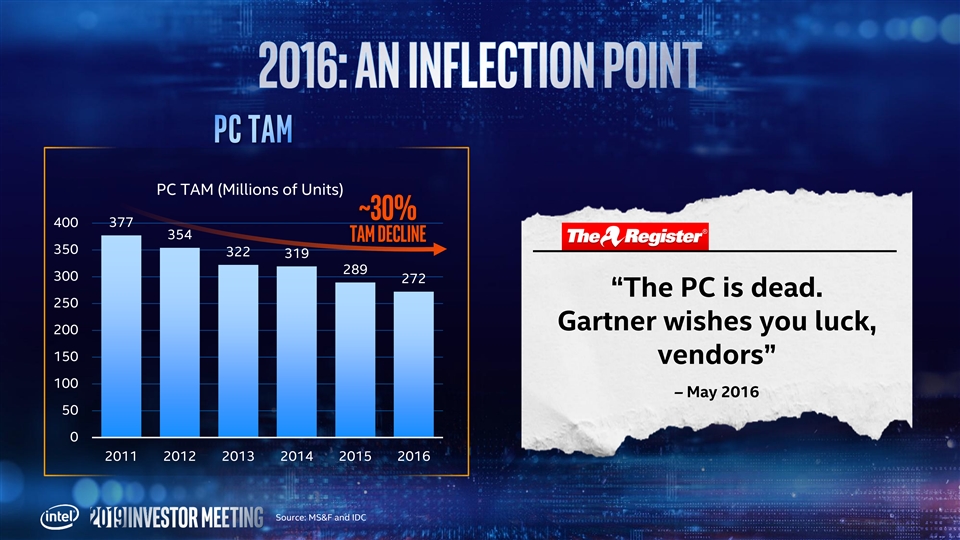

Data-centric Increased revenue by $9B since ‘16 PC-Centric Record profitability in declining market Significant FCF Vs 3-yr guide Beat revenue by $6.7B and EPS by $1.27 Over the 3 years… added ~$12B in revenue… on lower spending… with ~64% increase in EPS 1 Data-centric businesses include DCG, IOTG, Mobileye, NSG, PSG and All Other. Growth from 2016 to 2019 outlook excludes $2.5B of revenue from McAfee and Wind River which have been divested in 2017 and 2018, respectively. EPS is non-GAAPData-centric Increased revenue by $9B since ‘16 PC-Centric Record profitability in declining market Significant FCF Vs 3-yr guide Beat revenue by $6.7B and EPS by $1.27 Over the 3 years… added ~$12B in revenue… on lower spending… with ~64% increase in EPS 1 Data-centric businesses include DCG, IOTG, Mobileye, NSG, PSG and All Other. Growth from 2016 to 2019 outlook excludes $2.5B of revenue from McAfee and Wind River which have been divested in 2017 and 2018, respectively. EPS is non-GAAP

transformations …but it won’t be easytransformations …but it won’t be easy

Make the world’s best semiconductors Lead the AI, 5g, and Autonomous revolution Be the leading end to end platform provider for the new data world Relentless focus on operational excellence & efficiency Continue to hire, develop and retain the best, most diverse & inclusive talentMake the world’s best semiconductors Lead the AI, 5g, and Autonomous revolution Be the leading end to end platform provider for the new data world Relentless focus on operational excellence & efficiency Continue to hire, develop and retain the best, most diverse & inclusive talent

2021 & beyond Middle of a Journey Intel Powers the World 2017-2021 Data-Centric 2013 A PC-Centric Company2021 & beyond Middle of a Journey Intel Powers the World 2017-2021 Data-Centric 2013 A PC-Centric Company

Data-Centric Businesses PC-centric Business Growth Cash Flow/ ScaleData-Centric Businesses PC-centric Business Growth Cash Flow/ Scale

Data is growing exponentially Global Digital Data Created Data Centers Edge/Endpoints Real-time Source: IDC Data Age 2025 (2018) Data Created (ZB)Data is growing exponentially Global Digital Data Created Data Centers Edge/Endpoints Real-time Source: IDC Data Age 2025 (2018) Data Created (ZB)

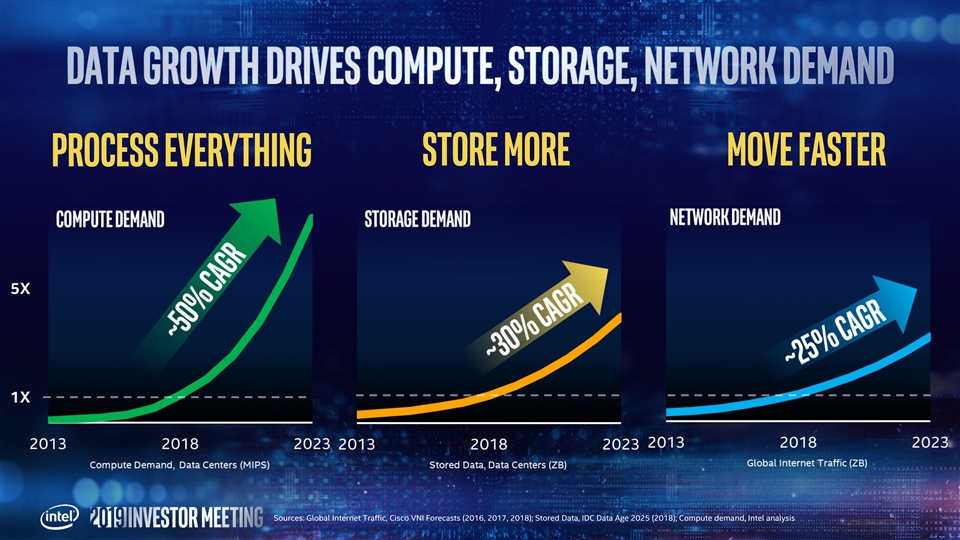

process everything store more Move faster Sources: Global Internet Traffic, Cisco VNI Forecasts (2016, 2017, 2018); Stored Data, IDC Data Age 2025 (2018); Compute demand, Intel analysisprocess everything store more Move faster Sources: Global Internet Traffic, Cisco VNI Forecasts (2016, 2017, 2018); Stored Data, IDC Data Age 2025 (2018); Compute demand, Intel analysis

Source: 2018 Intel Revenue is based on Intel financials. 2018 Si TAM is based on amalgamation of analyst data and Intel analysis. PC and Server include CPU and Chipsets revenue. Source: 2018 Intel Revenue is based on Intel financials. 2018 Si TAM is based on amalgamation of analyst data and Intel analysis. PC and Server include CPU and Chipsets revenue.

2023F TAM is based on an amalgamation of analyst data and Intel analysis, based upon current expectations and available information and is subject to change without notice. PC-Centric includes CPU & Chipsets, Connectivity (including modems other than 5G smartphone), Gateways, Gaming Consoles, Memory and Discrete Graphics. Data-Centric includes Data Center and Networking Compute, Memory, Storage and Connectivity, and IOT addressable Logic ASIC/ASSP, MPU, MCU, DSP for Industrial, Transportation, Automated Driving, Retail, Video Surveillance, Healthcare, Public Sector, Office Automation, Gaming and Smart Home. IOT also includes MaaS and intelligent transportation enabled data opportunities. 2023F TAM is based on an amalgamation of analyst data and Intel analysis, based upon current expectations and available information and is subject to change without notice. PC-Centric includes CPU & Chipsets, Connectivity (including modems other than 5G smartphone), Gateways, Gaming Consoles, Memory and Discrete Graphics. Data-Centric includes Data Center and Networking Compute, Memory, Storage and Connectivity, and IOT addressable Logic ASIC/ASSP, MPU, MCU, DSP for Industrial, Transportation, Automated Driving, Retail, Video Surveillance, Healthcare, Public Sector, Office Automation, Gaming and Smart Home. IOT also includes MaaS and intelligent transportation enabled data opportunities.

• Lead technology inflections • Extend product leadership… redefine Intel Inside • Make big bets… with attractive returns • Focus on execution • Evolve our culture • Lead CSR and D&I• Lead technology inflections • Extend product leadership… redefine Intel Inside • Make big bets… with attractive returns • Focus on execution • Evolve our culture • Lead CSR and D&I

Artificial intelligence 5G Autonomous systems Autonomous systems AI unlocks value from 5G transforms the require real-time data, enables new network, increases analysis of data flows, business models and consumption of data- drive new compute, experiences rich experiences network architecturesArtificial intelligence 5G Autonomous systems Autonomous systems AI unlocks value from 5G transforms the require real-time data, enables new network, increases analysis of data flows, business models and consumption of data- drive new compute, experiences rich experiences network architectures

WORKLOAD-OPTIMIZED PLATFORMS, EFFORTLESS CUSTOMER & DEVELOPER INNOVATIONWORKLOAD-OPTIMIZED PLATFORMS, EFFORTLESS CUSTOMER & DEVELOPER INNOVATION

Intel Inside = Intel Inside = CPU inside a PC and server XPU platforms inside everything Security Wi-Fi CPU XPU siph Software Nand SSD Modem ethernet Optane™ MemoryIntel Inside = Intel Inside = CPU inside a PC and server XPU platforms inside everything Security Wi-Fi CPU XPU siph Software Nand SSD Modem ethernet Optane™ Memory

extend 14nm ramp 10nm Accelerate to 7nm Client Systems on Build Capacity Shelf for 2019 Production and to Support Holiday Season Launch in 2021 Customer Growth Server in 1H’20 vs. tsmc 10nm vs. tsmc 7nm vs. tsmc 5nm world class packaging technology complements process leadershipextend 14nm ramp 10nm Accelerate to 7nm Client Systems on Build Capacity Shelf for 2019 Production and to Support Holiday Season Launch in 2021 Customer Growth Server in 1H’20 vs. tsmc 10nm vs. tsmc 7nm vs. tsmc 5nm world class packaging technology complements process leadership

our investments must… …Address the leading edge of a technology inflection… …Allow us to play a larger role in the success of our customers… …Offer a clear path to profitability/attractive returns… …with regular evaluationour investments must… …Address the leading edge of a technology inflection… …Allow us to play a larger role in the success of our customers… …Offer a clear path to profitability/attractive returns… …with regular evaluation

Influencing and shaping 5G standards Inflections World class 5G modem IP ready for 2020 industry ramp Customer Built momentum and won share at 4G/LTE High customer concentration Impact Unprofitable despite share and scale Profit Evaluating options to maintain modem capabilities for PC/IOT Significant outside interest in our modem team, technology, and IP and ReturnInfluencing and shaping 5G standards Inflections World class 5G modem IP ready for 2020 industry ramp Customer Built momentum and won share at 4G/LTE High customer concentration Impact Unprofitable despite share and scale Profit Evaluating options to maintain modem capabilities for PC/IOT Significant outside interest in our modem team, technology, and IP and Return

Memory storage High-density 3D NAND for Optane™ offers ~performance of storage transition to NVM Inflections DRAM, persistence of NAND Industry leading density #2 DC SSD provider 3+ years Customer Optane™ + Xeon® = breakthrough Challenging tech transitions platform-level innovation impacted execution Impact Aggressive capacity build + Profit Significant potential for Optane™ market conditions slowed Systems challenges slow ramp progress & limited returns and ReturnMemory storage High-density 3D NAND for Optane™ offers ~performance of storage transition to NVM Inflections DRAM, persistence of NAND Industry leading density #2 DC SSD provider 3+ years Customer Optane™ + Xeon® = breakthrough Challenging tech transitions platform-level innovation impacted execution Impact Aggressive capacity build + Profit Significant potential for Optane™ market conditions slowed Systems challenges slow ramp progress & limited returns and Return

1 ADAS penetration rising globally, growing from 30% to 70% by ‘23 L4/5 AV designs on track for 2021, enabling a MaaS opportunity Inflections Data services such as REM present new adjacent opportunities >60% global ADAS market segment share Customer L2+ designs w OEMs representing >50% of global vehicle production Real-time crowdsourced map tech, customers launching new data svcs Impact Profit 2 Revenue up ~2x in 2 yrs ; positive OM contribution, in line w/deal thesis and Return 1 Internal analysis 2 2017 revenue compared to 2019 revenue; 2017 revenue includes revenue prior to acquisition in Aug'17.1 ADAS penetration rising globally, growing from 30% to 70% by ‘23 L4/5 AV designs on track for 2021, enabling a MaaS opportunity Inflections Data services such as REM present new adjacent opportunities >60% global ADAS market segment share Customer L2+ designs w OEMs representing >50% of global vehicle production Real-time crowdsourced map tech, customers launching new data svcs Impact Profit 2 Revenue up ~2x in 2 yrs ; positive OM contribution, in line w/deal thesis and Return 1 Internal analysis 2 2017 revenue compared to 2019 revenue; 2017 revenue includes revenue prior to acquisition in Aug'17.

Recoup Process Leadership deliver with predictability Meet Customer Demand Leadership products 10nm products Ensure Supply on schedule on shelves Investing to ensure we don’t On track to full-year 10nm Ice Lake and Lakefield for client constrain growth shipment goals Cascade Lake, AgileX™, Teton Glacier for data-centricRecoup Process Leadership deliver with predictability Meet Customer Demand Leadership products 10nm products Ensure Supply on schedule on shelves Investing to ensure we don’t On track to full-year 10nm Ice Lake and Lakefield for client constrain growth shipment goals Cascade Lake, AgileX™, Teton Glacier for data-centric

Relentless focus on things that matter mostRelentless focus on things that matter most

From To Build the best products… customers will come Listen to customers & enable their growth Nearly $300B TAM… Low MSS... growth mode $52B TAM… MSS >90%… protect & defend Very capable competition has high MSS Competition has <10% MSS… compete internally Product leadership trumps all IDM advantage/process lead trumps all AN INCREDIBLE 50 YEARS AN INCREDIBLE OPPORTUNITYFrom To Build the best products… customers will come Listen to customers & enable their growth Nearly $300B TAM… Low MSS... growth mode $52B TAM… MSS >90%… protect & defend Very capable competition has high MSS Competition has <10% MSS… compete internally Product leadership trumps all IDM advantage/process lead trumps all AN INCREDIBLE 50 YEARS AN INCREDIBLE OPPORTUNITY

2727

We are a recognized leader in corporate responsibility and take action to advance progress in environmental sustainability, supply chain responsibility, and social impact. #1 Scores 4B KWH ENERGY SAVED >20 years For our environmental & since 2012, resulting in Of TRANSPARENCY & PROACTIVE social disclosure quality by >$500M in cost SAVINGS ENGAGEMENT WITH INVESTORS ON ESG ISS Ethix ISSUES +500 SUPPLIER AUDITS 90% recycle RATE 17.4M square feet Completed since 2014 as part of for NON-HAZARDOUS WASTE in OF LEED CERTIFIED SPACE in our supply chain responsibility our global operations support of our green programs buildings goal www.intel.com/responsibility We are a recognized leader in corporate responsibility and take action to advance progress in environmental sustainability, supply chain responsibility, and social impact. #1 Scores 4B KWH ENERGY SAVED >20 years For our environmental & since 2012, resulting in Of TRANSPARENCY & PROACTIVE social disclosure quality by >$500M in cost SAVINGS ENGAGEMENT WITH INVESTORS ON ESG ISS Ethix ISSUES +500 SUPPLIER AUDITS 90% recycle RATE 17.4M square feet Completed since 2014 as part of for NON-HAZARDOUS WASTE in OF LEED CERTIFIED SPACE in our supply chain responsibility our global operations support of our green programs buildings goal www.intel.com/responsibility

INNOVATIVE & INCLUSIVE TALENT Innovative supply chain Comprehensive workforce pay $1B annually 2 years Early Equity for global gender pay global initiative to spend with met our 2020 U.S. worKforce CLOSED THE GAP OF Average PAY BETWEEN Diverse-owned businesses by 2020 to diversity goal EMPLOYEES OF DIFFERENT GENDERS IN SIMILAR generate an Inclusive supply chain ROLES creating inclusive workplace www.intel.com/diversityINNOVATIVE & INCLUSIVE TALENT Innovative supply chain Comprehensive workforce pay $1B annually 2 years Early Equity for global gender pay global initiative to spend with met our 2020 U.S. worKforce CLOSED THE GAP OF Average PAY BETWEEN Diverse-owned businesses by 2020 to diversity goal EMPLOYEES OF DIFFERENT GENDERS IN SIMILAR generate an Inclusive supply chain ROLES creating inclusive workplace www.intel.com/diversity

Revenue growth Operating efficiency Earnings/FCF Low-single digit growth, $76B-$78B Operating Margin ~32% EPS growth in line with revenue Data-Centric businesses Gross Margins declines high-single digit growth offset by spending FCF growing faster leverage and 5G than earnings PC-Centric business smartphone modem exit ~flat to slightly down Closing FCF/Earnings gap (>80%)… ATTRACTIVE capital RETURNS Operating margin, gross margin, EPS, and FCF are non-GAAP. Forecasts are Intel estimates, based upon current expectations and available information and are subject to change without notice.Revenue growth Operating efficiency Earnings/FCF Low-single digit growth, $76B-$78B Operating Margin ~32% EPS growth in line with revenue Data-Centric businesses Gross Margins declines high-single digit growth offset by spending FCF growing faster leverage and 5G than earnings PC-Centric business smartphone modem exit ~flat to slightly down Closing FCF/Earnings gap (>80%)… ATTRACTIVE capital RETURNS Operating margin, gross margin, EPS, and FCF are non-GAAP. Forecasts are Intel estimates, based upon current expectations and available information and are subject to change without notice.

EPS presented on a non-GAAP basis. Refer to the Appendix for a reconciliation of this non-GAAP measure Forecasts are Intel estimates, based upon current expectations and available information and are subject to change without noticeEPS presented on a non-GAAP basis. Refer to the Appendix for a reconciliation of this non-GAAP measure Forecasts are Intel estimates, based upon current expectations and available information and are subject to change without notice

Speaker Topic Murthy Renduchintala Product Leadership Walk-on: Raja Koduri Navin Shenoy The Data-Centric Opportunity Walk-On: Sandra Rivera Gregory Bryant The Transformation of the PC Sector George Davis A Focus on PerformanceSpeaker Topic Murthy Renduchintala Product Leadership Walk-on: Raja Koduri Navin Shenoy The Data-Centric Opportunity Walk-On: Sandra Rivera Gregory Bryant The Transformation of the PC Sector George Davis A Focus on Performance

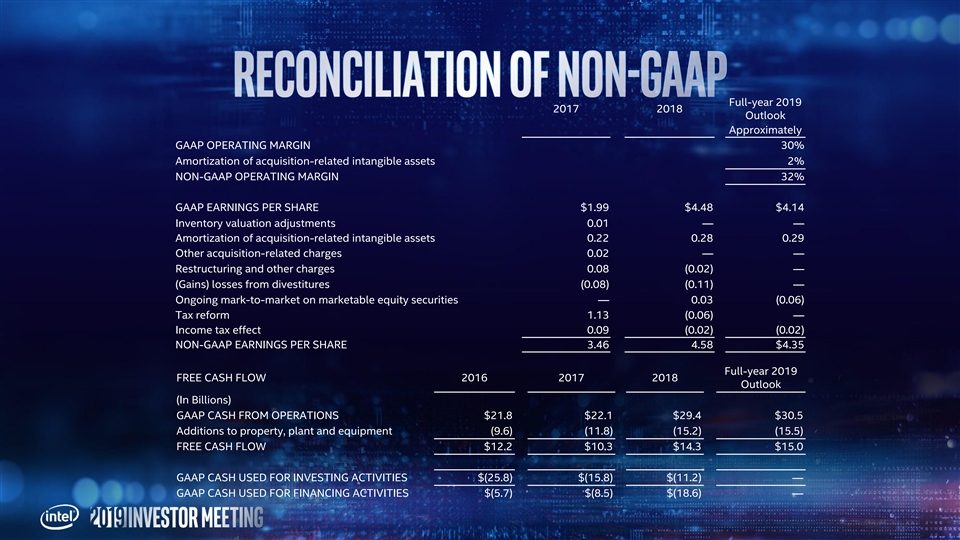

Full-year 2019 2018 Outlook Approximately GAAP OPERATING MARGIN 33% 30% Amortization of acquisition-related intangible assets 2% 2% NON-GAAP OPERATING MARGIN 35% 32% GAAP EARNINGS PER SHARE $4.48 $4.14 Inventory valuation adjustments — — Amortization of acquisition-related intangible assets 0.28 0.29 Other acquisition-related charges — — Restructuring and other charges (0.02) — (Gains) losses from divestitures (0.11) — Ongoing mark-to-market on marketable equity securities 0.03 (0.06) Tax reform (0.06) — Income tax effect (0.02) (0.02) NON-GAAP EARNINGS PER SHARE 4.58 $4.35 Forward-looking non-GAAP measures relating to fiscal years 2020 and beyond represent targets and are based on internal forecasts subject to significant uncertainty. We are unable to provide a full reconciliation of such measures to GAAP measures without unreasonable efforts as we cannot predict the amount or timing of certain elements that are included in reported GAAP results and that may significantly affect GAAP results, including acquisition-related adjustments, ongoing mark-to-market adjustments on marketable equity securities, and other non-recurring events or transactions. In addition, certain comparable GAAP measures such as net cash provided by operating activities are difficult to accurately estimate for such time frames and are dependent on future events. We believe such a reconciliation would also imply a degree of precision that could be confusing or inappropriate for these forward-looking measures. Full-year 2019 2018 Outlook Approximately GAAP OPERATING MARGIN 33% 30% Amortization of acquisition-related intangible assets 2% 2% NON-GAAP OPERATING MARGIN 35% 32% GAAP EARNINGS PER SHARE $4.48 $4.14 Inventory valuation adjustments — — Amortization of acquisition-related intangible assets 0.28 0.29 Other acquisition-related charges — — Restructuring and other charges (0.02) — (Gains) losses from divestitures (0.11) — Ongoing mark-to-market on marketable equity securities 0.03 (0.06) Tax reform (0.06) — Income tax effect (0.02) (0.02) NON-GAAP EARNINGS PER SHARE 4.58 $4.35 Forward-looking non-GAAP measures relating to fiscal years 2020 and beyond represent targets and are based on internal forecasts subject to significant uncertainty. We are unable to provide a full reconciliation of such measures to GAAP measures without unreasonable efforts as we cannot predict the amount or timing of certain elements that are included in reported GAAP results and that may significantly affect GAAP results, including acquisition-related adjustments, ongoing mark-to-market adjustments on marketable equity securities, and other non-recurring events or transactions. In addition, certain comparable GAAP measures such as net cash provided by operating activities are difficult to accurately estimate for such time frames and are dependent on future events. We believe such a reconciliation would also imply a degree of precision that could be confusing or inappropriate for these forward-looking measures.

Exhibit 99.2 DR. MURTHY RENDUCHINTALA Chief Engineering Officer, Intel Group President, TSCGExhibit 99.2 DR. MURTHY RENDUCHINTALA Chief Engineering Officer, Intel Group President, TSCG

Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10-K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10-K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.

33

CAGR (17-25) PB 2 ZB 15 ZB 160 ZB 20% COMPUTE DIVERSITY PRODUCTIVITY DATA BROADCAST MEDIA Scalar, vector, spatial - AI, graphics, media, analytics NETWORK CLOUDIFICATION Compute & storage distributed across WEB / MOBILE core, access, and edge networks 35% INTELLIGENT AGENTS IOT / ANALYTICS Proliferation of autonomous / AI-enabled devices, things, and edge gateways Outbound/ Inbound/ Unstructured/ Structured Latency Sensitive Source: Analyst reports, tech press, industry interviews 4CAGR (17-25) PB 2 ZB 15 ZB 160 ZB 20% COMPUTE DIVERSITY PRODUCTIVITY DATA BROADCAST MEDIA Scalar, vector, spatial - AI, graphics, media, analytics NETWORK CLOUDIFICATION Compute & storage distributed across WEB / MOBILE core, access, and edge networks 35% INTELLIGENT AGENTS IOT / ANALYTICS Proliferation of autonomous / AI-enabled devices, things, and edge gateways Outbound/ Inbound/ Unstructured/ Structured Latency Sensitive Source: Analyst reports, tech press, industry interviews 4

DATA CENTRIC: ~$220B PC CENTRIC: ~$68B High growth segments 2018-23 growth relative to aggregate TAM COMPUTE DIVERSITY 10x+ NETWORK CLOUDIFICATION INTELLIGENT AGENTS 5x 2x DATACENTER Network IOT PC AND ADJACENCIES + + Source: Intel calculated 2023 TAM and growth rates derived from analyst forecasts and Intel TAM model 5 DC FPGA AI NVMe SSD NFV / SDN 5G Edge Comp. ADAS/AD Gaming Modern Notebook ChromeDATA CENTRIC: ~$220B PC CENTRIC: ~$68B High growth segments 2018-23 growth relative to aggregate TAM COMPUTE DIVERSITY 10x+ NETWORK CLOUDIFICATION INTELLIGENT AGENTS 5x 2x DATACENTER Network IOT PC AND ADJACENCIES + + Source: Intel calculated 2023 TAM and growth rates derived from analyst forecasts and Intel TAM model 5 DC FPGA AI NVMe SSD NFV / SDN 5G Edge Comp. ADAS/AD Gaming Modern Notebook Chrome

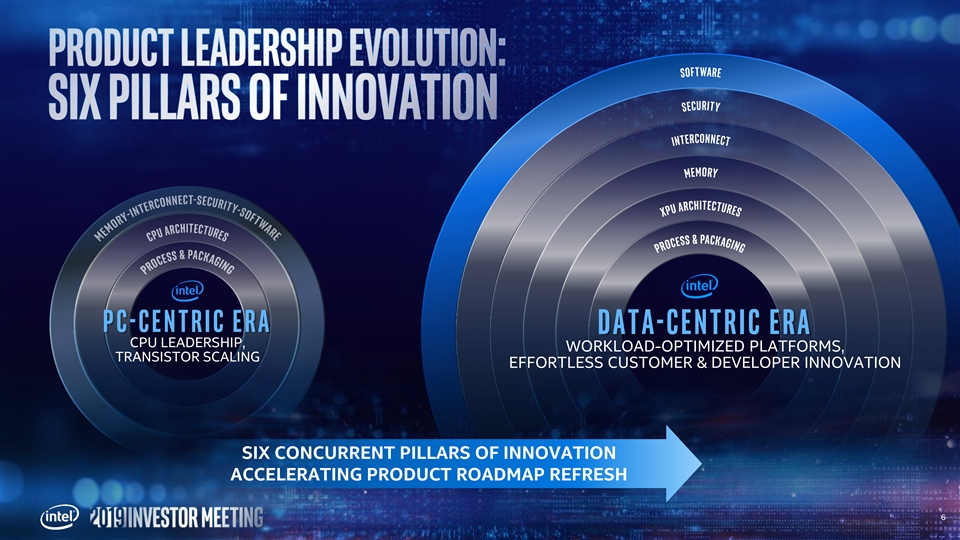

pc - c e n t r i c E R A D a t a - c e n t r i c E R A CPU LEADERSHIP, WORKLOAD-OPTIMIZED PLATFORMS, TRANSISTOR SCALING EFFORTLESS CUSTOMER & DEVELOPER INNOVATION SIX CONCURRENT PILLARS OF INNOVATION ACCELERATING PRODUCT ROADMAP REFRESH 6pc - c e n t r i c E R A D a t a - c e n t r i c E R A CPU LEADERSHIP, WORKLOAD-OPTIMIZED PLATFORMS, TRANSISTOR SCALING EFFORTLESS CUSTOMER & DEVELOPER INNOVATION SIX CONCURRENT PILLARS OF INNOVATION ACCELERATING PRODUCT ROADMAP REFRESH 6

SW portability, reusability and performance grows in value with compute diversity Confidentiality, integrity and resiliency become increasingly critical Increased data movement makes interconnects critical to the platform Memory bandwidth/latency/cost critical to handle data Data-centric workloads require scalar, vector, matrix and spatial compute: xPUs Compute diversity benefits from process and packaging diversity D a t a - c e n t r i c E R A WORKLOAD-OPTIMIZED PLATFORMS, EFFORTLESS CUSTOMER & DEVELOPER INNOVATION 7SW portability, reusability and performance grows in value with compute diversity Confidentiality, integrity and resiliency become increasingly critical Increased data movement makes interconnects critical to the platform Memory bandwidth/latency/cost critical to handle data Data-centric workloads require scalar, vector, matrix and spatial compute: xPUs Compute diversity benefits from process and packaging diversity D a t a - c e n t r i c E R A WORKLOAD-OPTIMIZED PLATFORMS, EFFORTLESS CUSTOMER & DEVELOPER INNOVATION 7

TRANSISTOR SCALING & MONOLITHIC INTEGRATION HETEROGENEOUS PROCESSES & INTEGRATION One process design point for all products Multiple processes optimized for individual IPs Monolithic integration Multi-chip integration with advanced packaging Product restricted by reticle Product unconstrained by reticle 8TRANSISTOR SCALING & MONOLITHIC INTEGRATION HETEROGENEOUS PROCESSES & INTEGRATION One process design point for all products Multiple processes optimized for individual IPs Monolithic integration Multi-chip integration with advanced packaging Product restricted by reticle Product unconstrained by reticle 8

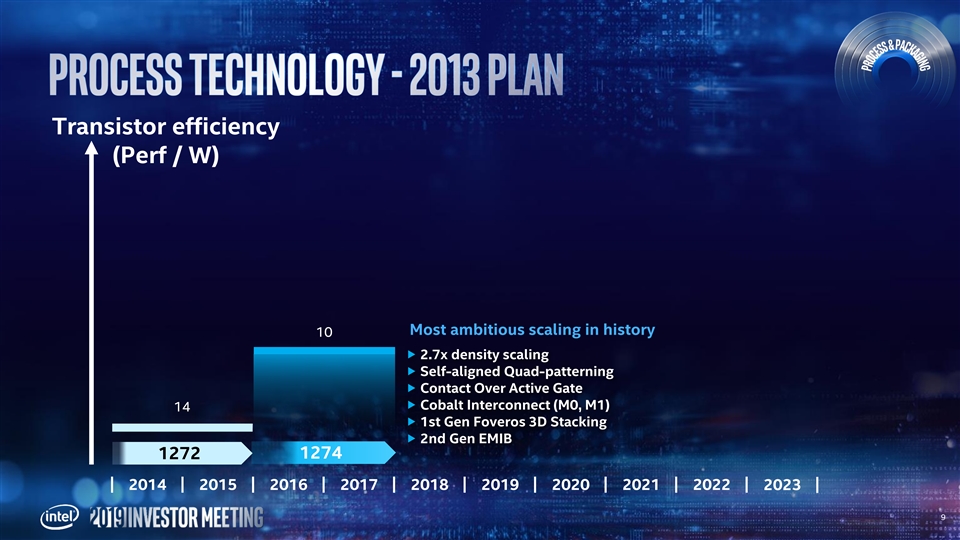

Transistor efficiency (Perf / W) Most ambitious scaling in history 10 u 2.7x density scaling u Self-aligned Quad-patterning u Contact Over Active Gate u Cobalt Interconnect (M0, M1) 14 u 1st Gen Foveros 3D Stacking u 2nd Gen EMIB 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 9Transistor efficiency (Perf / W) Most ambitious scaling in history 10 u 2.7x density scaling u Self-aligned Quad-patterning u Contact Over Active Gate u Cobalt Interconnect (M0, M1) 14 u 1st Gen Foveros 3D Stacking u 2nd Gen EMIB 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 9

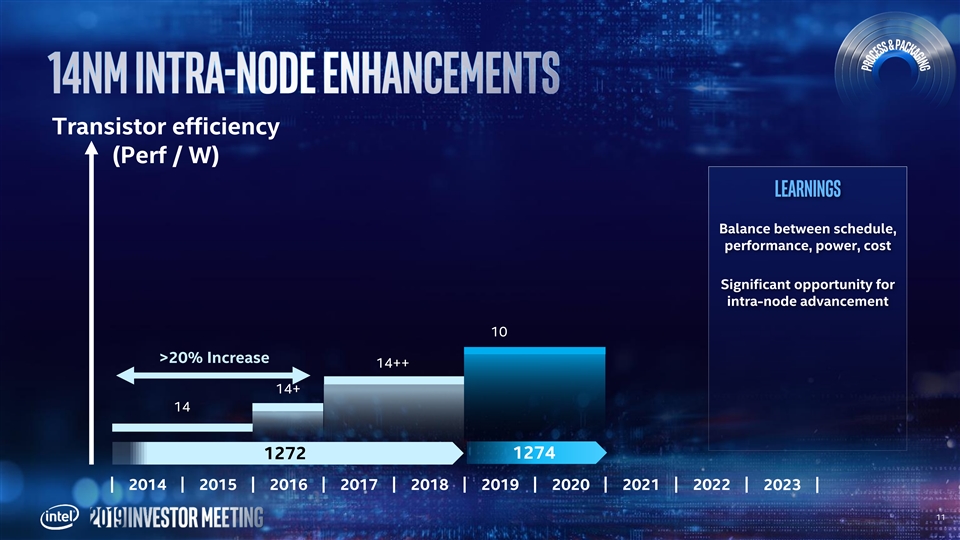

Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost 10 14 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 10Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost 10 14 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 10

Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost Significant opportunity for intra-node advancement 10 >20% Increase 14++ 14+ 14 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 11Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost Significant opportunity for intra-node advancement 10 >20% Increase 14++ 14+ 14 1272 1274 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 11

Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost 10++ Significant opportunity for intra-node advancement 10+ 10 Value in maintaining mix of nodes 14++ Ease-of-design accelerates 14+ innovation 14 1274 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 12Transistor efficiency (Perf / W) LEARNINGS Balance between schedule, performance, power, cost 10++ Significant opportunity for intra-node advancement 10+ 10 Value in maintaining mix of nodes 14++ Ease-of-design accelerates 14+ innovation 14 1274 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 12

Transistor efficiency (Perf / W) 7++ 7+ 7 u 2x scaling 10++ u Planned intra-node optimizations 10+u 4x Reduction in design rules u EUV 10 u Next-gen Foveros & EMIB packaging 14++ 14+ 1276 14 1274 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 13Transistor efficiency (Perf / W) 7++ 7+ 7 u 2x scaling 10++ u Planned intra-node optimizations 10+u 4x Reduction in design rules u EUV 10 u Next-gen Foveros & EMIB packaging 14++ 14+ 1276 14 1274 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 13

Transistor efficiency (Perf / W) One ML of scaling & performance start of node + one ML performance intra-node 7++ 7+ Multi-chip SoC construction for non-compromise performance 7 10++ Radical design simplification 10+ accelerates innovation 10 10nm shipping in June, multiple 14++ products through 2019 and 2020 14+ 1276 14 7nm progressing to plan 1274 Lead product launch in 2021 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 14Transistor efficiency (Perf / W) One ML of scaling & performance start of node + one ML performance intra-node 7++ 7+ Multi-chip SoC construction for non-compromise performance 7 10++ Radical design simplification 10+ accelerates innovation 10 10nm shipping in June, multiple 14++ products through 2019 and 2020 14+ 1276 14 7nm progressing to plan 1274 Lead product launch in 2021 1272 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 14

IPU R Core Core I DISPLAY D N D G Core Core R Shipping in June Approx. Graphics Performance 2X TYPE C AI Performance 2.5X – 3x GT Video Encode 2x Wireless Speeds 3x OPIO Disclaimer: Results are approximate and have been estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling Graphics and video – Next Gen Graphics Iris Plus Experience Wireless – Intel’s Wi-Fi 6 (GIG+) vs typical competitive 11AC design AI – AIXPRT Community 2 Preview; OpenVINO 2018.R5, Max Throughput 15W WHL to 15W ICL projection 15 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure.IPU R Core Core I DISPLAY D N D G Core Core R Shipping in June Approx. Graphics Performance 2X TYPE C AI Performance 2.5X – 3x GT Video Encode 2x Wireless Speeds 3x OPIO Disclaimer: Results are approximate and have been estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling Graphics and video – Next Gen Graphics Iris Plus Experience Wireless – Intel’s Wi-Fi 6 (GIG+) vs typical competitive 11AC design AI – AIXPRT Community 2 Preview; OpenVINO 2018.R5, Max Throughput 15W WHL to 15W ICL projection 15 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure.

Shipping in June IPU R Multiple Product Launches Core Core I DISPLAY D Across Entire Portfolio Through 2019 and 2020 N D G Core Core R AI Inference Xeon CPU GP-GPU TYPE C FPGA 5G/Networking… GT OPIO 16Shipping in June IPU R Multiple Product Launches Core Core I DISPLAY D Across Entire Portfolio Through 2019 and 2020 N D G Core Core R AI Inference Xeon CPU GP-GPU TYPE C FPGA 5G/Networking… GT OPIO 16

e X Architecture-Based GP-GPU using Foveros for Datacenter AI & HPC Launch in 2021 17e X Architecture-Based GP-GPU using Foveros for Datacenter AI & HPC Launch in 2021 17

For every order of magnitude performance from new hardware, there is >2 orders of magnitude unlocked by software Raja Koduri Chief Architect, SVP Intel Architecture, Graphics and Software 18For every order of magnitude performance from new hardware, there is >2 orders of magnitude unlocked by software Raja Koduri Chief Architect, SVP Intel Architecture, Graphics and Software 18

Example 1: Java runtime optimizations 6X 6 x 4X 2X 1 x 0X JDK9 JDK8 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 19 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.Example 1: Java runtime optimizations 6X 6 x 4X 2X 1 x 0X JDK9 JDK8 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 19 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.

Example 2: Persistent memory complete stack optimizations 8X 8.1 x 6X 4X 2X 1 x 0X SSD Storage Intel Optane™ DCPMM +software For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 20 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.Example 2: Persistent memory complete stack optimizations 8X 8.1 x 6X 4X 2X 1 x 0X SSD Storage Intel Optane™ DCPMM +software For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 20 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.

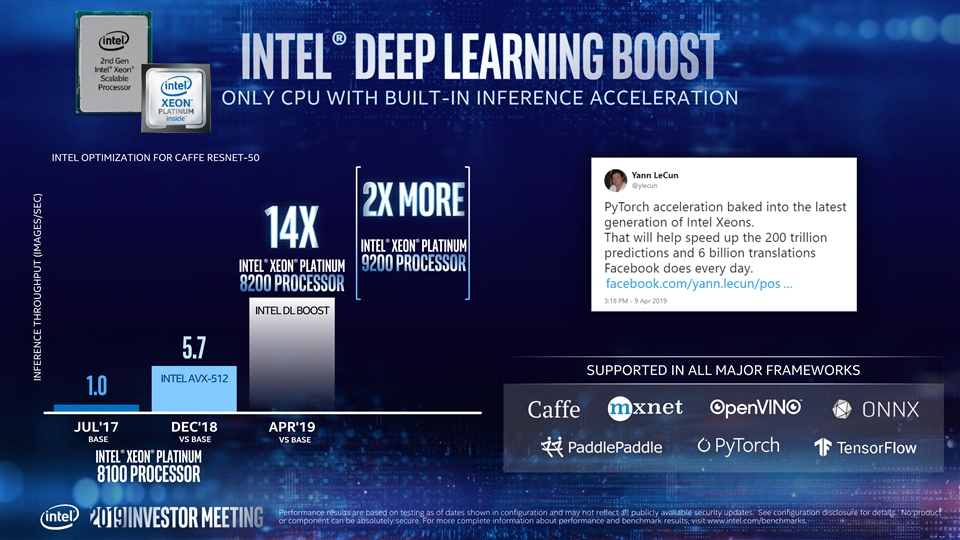

Example 3: Deep Learning Boost 28 x 20X 15X 10X 5X 1 x 0X Hardware + Software Base Hardware For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure. 21Example 3: Deep Learning Boost 28 x 20X 15X 10X 5X 1 x 0X Hardware + Software Base Hardware For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure. 21

Per core performance advantage Data Analytics Java (1.9x) Web (2.1x) Browsing (1.7x) High Performance Compute Networking (1.9x) (2.0x) Productivity (1.6x) Deep Learning Gaming Content (1.4x) Creation (10.3x) (2.5x) For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 22 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.Per core performance advantage Data Analytics Java (1.9x) Web (2.1x) Browsing (1.7x) High Performance Compute Networking (1.9x) (2.0x) Productivity (1.6x) Deep Learning Gaming Content (1.4x) Creation (10.3x) (2.5x) For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 22 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.

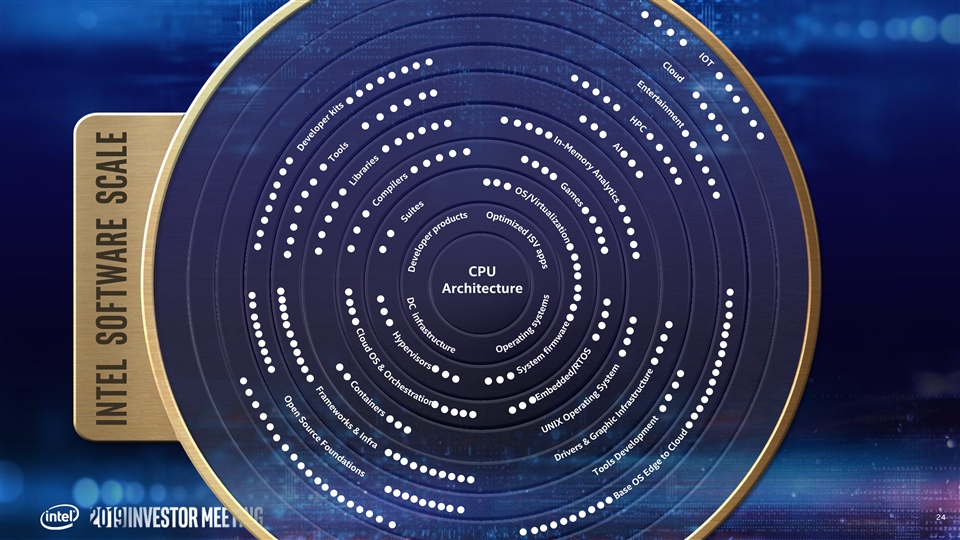

>15,000 software engineers #1 contributor to Linux kernel; >1/2 million lines of code modified each year > 100 operating systems optimized top three contributors to Chromium OS >10,000 high touch customer deployments top 10 contributor to Openstack >12 million developers For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 23 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.>15,000 software engineers #1 contributor to Linux kernel; >1/2 million lines of code modified each year > 100 operating systems optimized top three contributors to Chromium OS >10,000 high touch customer deployments top 10 contributor to Openstack >12 million developers For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of dates shown in 23 configuration and may not reflect all publicly available security updates. No product or component can be absolutely secure.

CPU Architecture 24 Intel Software scaleCPU Architecture 24 Intel Software scale

One Architecture 12 million developers 25One Architecture 12 million developers 25

Cloud One GPU AI Architecture Native 8 million 1 million 100K developers developers developers 12 million developers 26Cloud One GPU AI Architecture Native 8 million 1 million 100K developers developers developers 12 million developers 26

One GPU AI Architecture 27One GPU AI Architecture 27

“The future is a diverse mix of Scalar, Vector, Matrix and Spatial CPU GPU architectures deployed in CPU, GPU, FPGA and Accelerator AI FPGA sockets…” Intel Arch day, Dec ‘2018 28“The future is a diverse mix of Scalar, Vector, Matrix and Spatial CPU GPU architectures deployed in CPU, GPU, FPGA and Accelerator AI FPGA sockets…” Intel Arch day, Dec ‘2018 28

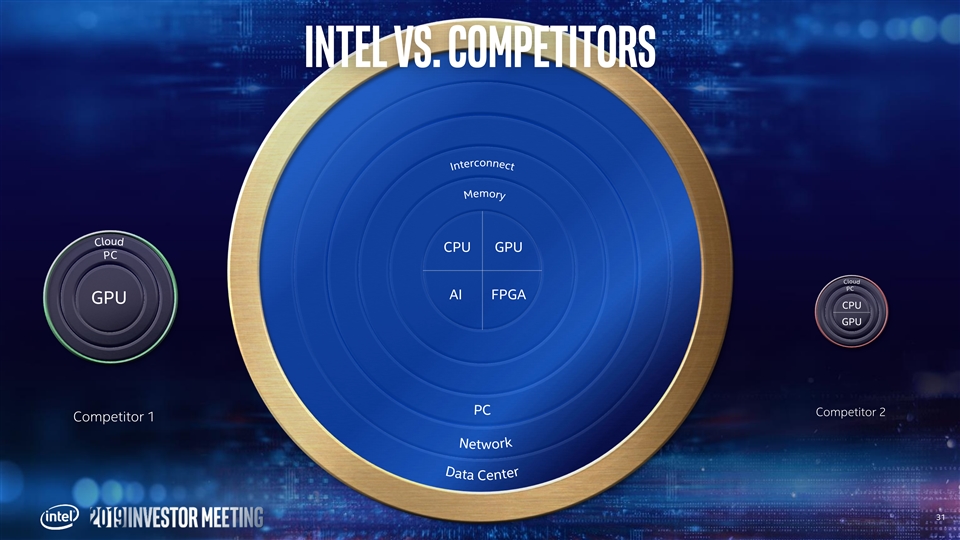

CPU GPU GPU AI AI FPGA 29CPU GPU GPU AI AI FPGA 29

CPU GPU AI FPGA 30CPU GPU AI FPGA 30

CPU GPU AI FPGA GPU CPU GPU Competitor 2 Competitor 1 31CPU GPU AI FPGA GPU CPU GPU Competitor 2 Competitor 1 31

simple and scalable open one developer experience 32simple and scalable open one developer experience 32

Coming soon to a developer near you in Q4 2019 33Coming soon to a developer near you in Q4 2019 33

Data Center Network Intelligent Agents 34Data Center Network Intelligent Agents 34

COMPUTE DIVERSITY Intel® MKL-DNN OpenVINO SPDK (Storage) Intel® Security (AI) (AI) DPDK (Network) Libraries - DC software Intel® Threat Intel® Security Detection Tech SGX Card Memory Encryption Ultra Path Interconnect Interconnect Highest Native Memory DDR Bandwidth Intel® Intel® Speed Intel® Workload XPU Architectures Optimized SKUs AVX-512 Select DL Boost PROCESS & Packaging 14nm Scaling 56C MCP Up to 28X AI performance Up to 56 core per socket, 112 core in two socket 200GB/s bandwidth per socket Up to 36TB addressable memory AI Performance: In AP configuration Memory bandwidth: 1-node, 2x Intel® Xeon® Platinum 9282 cpu on Walker Pass with 768 GB (24x 32GB 2933) total memory, ucode 0x400000A on RHEL7.6, 3.10.0-957.el7.x86_65, IC19u1, AVX512, HT off, Turbo on, Stream Triad 35 score=407 GB/s, test by Intel on 2/16/2019 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure.COMPUTE DIVERSITY Intel® MKL-DNN OpenVINO SPDK (Storage) Intel® Security (AI) (AI) DPDK (Network) Libraries - DC software Intel® Threat Intel® Security Detection Tech SGX Card Memory Encryption Ultra Path Interconnect Interconnect Highest Native Memory DDR Bandwidth Intel® Intel® Speed Intel® Workload XPU Architectures Optimized SKUs AVX-512 Select DL Boost PROCESS & Packaging 14nm Scaling 56C MCP Up to 28X AI performance Up to 56 core per socket, 112 core in two socket 200GB/s bandwidth per socket Up to 36TB addressable memory AI Performance: In AP configuration Memory bandwidth: 1-node, 2x Intel® Xeon® Platinum 9282 cpu on Walker Pass with 768 GB (24x 32GB 2933) total memory, ucode 0x400000A on RHEL7.6, 3.10.0-957.el7.x86_65, IC19u1, AVX512, HT off, Turbo on, Stream Triad 35 score=407 GB/s, test by Intel on 2/16/2019 For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure.

INTELLIGENT AGENTS software Security Interconnect Memory XPU Architectures PROCESS & Packaging 36INTELLIGENT AGENTS software Security Interconnect Memory XPU Architectures PROCESS & Packaging 36

INTELLIGENT AGENTS PC in Mobile form factor – 12x12x1 37INTELLIGENT AGENTS PC in Mobile form factor – 12x12x1 37

INTELLIGENT AGENTS Chipset PACKAGE Power Delivery Ultra low power logic - P1222 38INTELLIGENT AGENTS Chipset PACKAGE Power Delivery Ultra low power logic - P1222 38

INTELLIGENT AGENTS Scalable 3D silicon interconnect BASE Ultra low-power: 0.15 pico Joules / bit High bandwidth: 2-3X 2.5D interposer PACKAGE Scalable power delivery: 3W-1KW High yield process for die stacking 39INTELLIGENT AGENTS Scalable 3D silicon interconnect BASE Ultra low-power: 0.15 pico Joules / bit High bandwidth: 2-3X 2.5D interposer PACKAGE Scalable power delivery: 3W-1KW High yield process for die stacking 39

INTELLIGENT AGENTS 10 nm process compute foveros Hybrid architecture: Core + Atom Thermal solution to enable 3D stacking BASE PACKAGE 40INTELLIGENT AGENTS 10 nm process compute foveros Hybrid architecture: Core + Atom Thermal solution to enable 3D stacking BASE PACKAGE 40

INTELLIGENT AGENTS POP DRAM integration with 1 mm Z-height COMPUTE foveros BASE PACKAGE 41INTELLIGENT AGENTS POP DRAM integration with 1 mm Z-height COMPUTE foveros BASE PACKAGE 41

INTELLIGENT AGENTS OpenVINO software POP DRAM UFS Inline Boot from UFS VBS Security Encryption COMPUTE UFS 3.0 USB 3.0 MIPI CSI2 Interconnect foveros POP DRAM Memory BASE H y b R I d A R C H I T E C T U R E XPU Architectures GEN11 Graphics Sunny Cove CPU Tremont CPU PACKAGE Foveros 3D Integration PROCESS & Packaging 10nm Compute Die, Low Power Base Die A Standby SOC Power Improvement Results have been estimated or simulated as of April, 2019 using internal Intel 10X analysis or architecture simulation or modeling vs. AML product P Disclaimer: Results are approximate and have been estimated or simulated as of April 2019 Active SOC Power Improvement using Intel internal analysis or architecture simulation or modeling 1.5 – 2X P For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and R may not reflect all publicly available security updates. See configuration disclosure for details. Graphics Performance 2X No product or component can be absolutely secure. O 42 PCB Area Reduction 2X XINTELLIGENT AGENTS OpenVINO software POP DRAM UFS Inline Boot from UFS VBS Security Encryption COMPUTE UFS 3.0 USB 3.0 MIPI CSI2 Interconnect foveros POP DRAM Memory BASE H y b R I d A R C H I T E C T U R E XPU Architectures GEN11 Graphics Sunny Cove CPU Tremont CPU PACKAGE Foveros 3D Integration PROCESS & Packaging 10nm Compute Die, Low Power Base Die A Standby SOC Power Improvement Results have been estimated or simulated as of April, 2019 using internal Intel 10X analysis or architecture simulation or modeling vs. AML product P Disclaimer: Results are approximate and have been estimated or simulated as of April 2019 Active SOC Power Improvement using Intel internal analysis or architecture simulation or modeling 1.5 – 2X P For more complete information about performance and benchmark results, visit www.intel.com/benchmarks. Performance results are based on testing as of date specified and R may not reflect all publicly available security updates. See configuration disclosure for details. Graphics Performance 2X No product or component can be absolutely secure. O 42 PCB Area Reduction 2X X

Data drives extraordinary opportunities for growth Intel products & methods targeted to win data-centric growth with six pillar innovation model You will see this in our product leadership 43Data drives extraordinary opportunities for growth Intel products & methods targeted to win data-centric growth with six pillar innovation model You will see this in our product leadership 43

Performance results are based on testing as of dates shown in configuration and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure. Software and workloads used in performance tests may have been optimized for performance only on Intel microprocessors. Performance tests, such as SYSmark and MobileMark, are measured using specific computer systems, components, software, operations and functions. Any change to any of those factors may cause the results to vary. You should consult other information and performance tests to assist you in fully evaluating your contemplated purchases, including the performance of that product when combined with other products. For more complete information visit www.intel.com/benchmarks. Approx. 3x Ice Lake Wireless Speeds: 802.11ax 2x2 160MHz enables 2402Mbps maximum theoretical data rates, ~3X (2.8X) faster than standard 802.11ac 2x2 80MHz (867Mbps) as documented in IEEE 802.11 wireless standard specifications, and require the use of similarly configured 802.11ax wireless network routers. Approx. 2x Ice Lake Video Encode: Based on 4k HEVC to 4k HEVC transcode (8bit). Intel preproduction system, ICL 15w compared to WHL 15w. Measured by Intel as of April 2019. Approx. 2x Ice Lake Graphics Performance: Workload: 3DMark11 v 1.0.132. Intel PreProduction ICL U4+2 15W Configuration (Assumptions):, Processor: Intel® Core™ i7 (ICL-U 4+2) PL1=15W TDP, 4C8T, Memory: 2x8GB LPDDR4-3733 2Rx8, Storage: Intel® 760p m.2 PCIe NVMe SSD with AHCI Microsoft driver, Display Resolution: 3840x2160 eDP Panel 12.5”, OS: Windows* 10 RS5-17763.316, Graphics driver: PROD-H-RELEASES_ICL-PV-2019-04-09-1006832. Vs config – Intel PreProduction WHL U4+2 15W Configuration (Measured), Processor: Intel® Core™ i7-8565U (WHL-U4+2) PL1=15W TDP, 4C8T, Turbo up to 4.6Ghz, Memory: 2x8GB DDR4-2400 2Rx8, Storage: Intel® 760p m.2 PCIe NVMe SSD with AHCI Microsoft driver, Display Resolution: 3840x2160 eDP Panel 12.5”, OS: Windows* 10 RS4-17134.112. ,Graphics driver: 100.6195. Measured by Intel as of April 2019. Approx. 2.5x-3x Ice Lake AI Performance: Workload: images per second using AIXPRT Community Preview 2 with Int8 precision on ResNet-50 and SSD-Mobilenet-v1 models. Intel preproduction system, ICL-U, PL1 15w, 4C/8T, Turbo TBD, Intel Gen11 Graphics, GFX driver preproduction, Memory 8GB LPDDR4X-3733, Storage Intel SSD Pro 760P 256GB, OS Microsoft Windows 10, RS5 Build 475, preprod bios. Vs. Config – HP spectre x360 13t 13-ap0038nr, Intel® Core™ i7-8565U, PL1 20w, 4C/8T, Turbo up to 4.6Ghz, Intel UHD Graphics 620, Gfx driver 26.20.100.6709, Memory 16GB DDR4-2400, Storage Intel SSD 760p 512GB, OS – Microsoft Windows 10 RS5 Build 475 Bios F.26. Measured by Intel as of April 2019.Performance results are based on testing as of dates shown in configuration and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure. Software and workloads used in performance tests may have been optimized for performance only on Intel microprocessors. Performance tests, such as SYSmark and MobileMark, are measured using specific computer systems, components, software, operations and functions. Any change to any of those factors may cause the results to vary. You should consult other information and performance tests to assist you in fully evaluating your contemplated purchases, including the performance of that product when combined with other products. For more complete information visit www.intel.com/benchmarks. Approx. 3x Ice Lake Wireless Speeds: 802.11ax 2x2 160MHz enables 2402Mbps maximum theoretical data rates, ~3X (2.8X) faster than standard 802.11ac 2x2 80MHz (867Mbps) as documented in IEEE 802.11 wireless standard specifications, and require the use of similarly configured 802.11ax wireless network routers. Approx. 2x Ice Lake Video Encode: Based on 4k HEVC to 4k HEVC transcode (8bit). Intel preproduction system, ICL 15w compared to WHL 15w. Measured by Intel as of April 2019. Approx. 2x Ice Lake Graphics Performance: Workload: 3DMark11 v 1.0.132. Intel PreProduction ICL U4+2 15W Configuration (Assumptions):, Processor: Intel® Core™ i7 (ICL-U 4+2) PL1=15W TDP, 4C8T, Memory: 2x8GB LPDDR4-3733 2Rx8, Storage: Intel® 760p m.2 PCIe NVMe SSD with AHCI Microsoft driver, Display Resolution: 3840x2160 eDP Panel 12.5”, OS: Windows* 10 RS5-17763.316, Graphics driver: PROD-H-RELEASES_ICL-PV-2019-04-09-1006832. Vs config – Intel PreProduction WHL U4+2 15W Configuration (Measured), Processor: Intel® Core™ i7-8565U (WHL-U4+2) PL1=15W TDP, 4C8T, Turbo up to 4.6Ghz, Memory: 2x8GB DDR4-2400 2Rx8, Storage: Intel® 760p m.2 PCIe NVMe SSD with AHCI Microsoft driver, Display Resolution: 3840x2160 eDP Panel 12.5”, OS: Windows* 10 RS4-17134.112. ,Graphics driver: 100.6195. Measured by Intel as of April 2019. Approx. 2.5x-3x Ice Lake AI Performance: Workload: images per second using AIXPRT Community Preview 2 with Int8 precision on ResNet-50 and SSD-Mobilenet-v1 models. Intel preproduction system, ICL-U, PL1 15w, 4C/8T, Turbo TBD, Intel Gen11 Graphics, GFX driver preproduction, Memory 8GB LPDDR4X-3733, Storage Intel SSD Pro 760P 256GB, OS Microsoft Windows 10, RS5 Build 475, preprod bios. Vs. Config – HP spectre x360 13t 13-ap0038nr, Intel® Core™ i7-8565U, PL1 20w, 4C/8T, Turbo up to 4.6Ghz, Intel UHD Graphics 620, Gfx driver 26.20.100.6709, Memory 16GB DDR4-2400, Storage Intel SSD 760p 512GB, OS – Microsoft Windows 10 RS5 Build 475 Bios F.26. Measured by Intel as of April 2019.

nd 2 Gen Intel® Xeon Scalable Processors up to 28X AI Performance: Based on Intel internal testing: 28x performance improvement based on Intel® Optimization for Café ResNet-50 inference throughput performance on Intel® Xeon® Scalable Processor. 28x inference throughput improvement on Intel® Xeon® Platinum 9282 processor with Intel® DL Boost: Tested by Intel as of 2/26/2019. Platform: Dragon rock 2 socket Intel® Xeon® Platinum 9282(56 cores per socket), HT ON, turbo ON, Total Memory 768 GB (24 slots/ 32 GB/ 2933 MHz), BIOS:SE5C620.86B.0D.01.0241.112020180249, Centos 7 Kernel 3.10.0-957.5.1.el7.x86_64, Deep Learning Framework: Intel® Optimization for Caffe version: https://github.com/intel/caffe d554cbf1, ICC 2019.2.187, MKL DNN version: v0.17 (commit hash: 830a10059a018cd2634d94195140cf2d8790a75a), model: https://github.com/intel/caffe/blob/master/models/intel_optimized_models/int8/resnet50_int8_full_conv.prototxt, BS=64, No datalayer syntheticData:3x224x224, 56 instance/2 socket, Datatype: INT8 vs. Tested by Intel as of July 11th 2017: 2S Intel® Xeon® Platinum 8180 CPU @ 2.50GHz (28 cores), HT disabled, turbo disabled, scaling governor set to “performance” via intel_pstate driver, 384GB DDR4-2666 ECC RAM. CentOS Linux release 7.3.1611 (Core), Linux kernel 3.10.0-514.10.2.el7.x86_64. SSD: Intel® SSD DC S3700 Series (800GB, 2.5in SATA 6Gb/s, 25nm, MLC).Performance measured with: Environment variables: KMP_AFFINITY='granularity=fine, compact‘, OMP_NUM_THREADS=56, CPU Freq set with cpupower frequency-set -d 2.5G -u 3.8G -g performance. Caffe: (http://github.com/intel/caffe/), revision f96b759f71b2281835f690af267158b82b150b5c. Inference measured with “caffe time --forward_only” command, training measured with “caffe time” command. For “ConvNet” topologies, synthetic dataset was used. For other topologies, data was stored on local storage and cached in memory before training. Topology specs from https://github.com/intel/caffe/tree/master/models/intel_optimized_models (ResNet-50). Intel C++ compiler ver. 17.0.2 20170213, Intel MKL small libraries version 2018.0.20 Performance results are based on testing as of 2/26/2019 (28x) and may not reflect all publically available security updates. No product can be absolutely secure. See configuration disclosure for details.nd 2 Gen Intel® Xeon Scalable Processors up to 28X AI Performance: Based on Intel internal testing: 28x performance improvement based on Intel® Optimization for Café ResNet-50 inference throughput performance on Intel® Xeon® Scalable Processor. 28x inference throughput improvement on Intel® Xeon® Platinum 9282 processor with Intel® DL Boost: Tested by Intel as of 2/26/2019. Platform: Dragon rock 2 socket Intel® Xeon® Platinum 9282(56 cores per socket), HT ON, turbo ON, Total Memory 768 GB (24 slots/ 32 GB/ 2933 MHz), BIOS:SE5C620.86B.0D.01.0241.112020180249, Centos 7 Kernel 3.10.0-957.5.1.el7.x86_64, Deep Learning Framework: Intel® Optimization for Caffe version: https://github.com/intel/caffe d554cbf1, ICC 2019.2.187, MKL DNN version: v0.17 (commit hash: 830a10059a018cd2634d94195140cf2d8790a75a), model: https://github.com/intel/caffe/blob/master/models/intel_optimized_models/int8/resnet50_int8_full_conv.prototxt, BS=64, No datalayer syntheticData:3x224x224, 56 instance/2 socket, Datatype: INT8 vs. Tested by Intel as of July 11th 2017: 2S Intel® Xeon® Platinum 8180 CPU @ 2.50GHz (28 cores), HT disabled, turbo disabled, scaling governor set to “performance” via intel_pstate driver, 384GB DDR4-2666 ECC RAM. CentOS Linux release 7.3.1611 (Core), Linux kernel 3.10.0-514.10.2.el7.x86_64. SSD: Intel® SSD DC S3700 Series (800GB, 2.5in SATA 6Gb/s, 25nm, MLC).Performance measured with: Environment variables: KMP_AFFINITY='granularity=fine, compact‘, OMP_NUM_THREADS=56, CPU Freq set with cpupower frequency-set -d 2.5G -u 3.8G -g performance. Caffe: (http://github.com/intel/caffe/), revision f96b759f71b2281835f690af267158b82b150b5c. Inference measured with “caffe time --forward_only” command, training measured with “caffe time” command. For “ConvNet” topologies, synthetic dataset was used. For other topologies, data was stored on local storage and cached in memory before training. Topology specs from https://github.com/intel/caffe/tree/master/models/intel_optimized_models (ResNet-50). Intel C++ compiler ver. 17.0.2 20170213, Intel MKL small libraries version 2018.0.20 Performance results are based on testing as of 2/26/2019 (28x) and may not reflect all publically available security updates. No product can be absolutely secure. See configuration disclosure for details.

Approx. 10x Lakefield Standby SoC Power Improvement: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Vs. Amber Lake. Approx. 1.5x-2x Lakefield Active SoC Power Improvement: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Workload: 1080p video playback. Vs. Amber Lake next-gen product. Approx. 2x Lakefield Graphics Performance: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Workload: GfxBENCH. LKF 5W & 7W Configuration (Assumptions):,Processor: LKF PL1=5W & 7W TDP, 5C5T, Memory: 2X4GB LPDDR4x - 4267MHz, Storage: Intel® 760p m.2 PCIe NVMe SSD; LKF Optimized Power configuration uses UFS, Display Resolution: 1920x1080 for Performance; 25x14 eDP 13.3” and 19x12 MIPI 8.0” for Power, OS: Windows* 10 RS5. Power policy set to AC/Balanced mode for all benchmarks except SYSmark 2014 SE which is measured in AC/BAPCo mode for Performance. Power policy set to DC/Balanced mode for power. All benchmarks run in Admin mode., Graphics driver: X.X Vs. Configuration Data: Intel® Core™ AML Y2+2 5W measurements: Processor: Intel® Core™ i7-8500Y processor, PL1=5.0W TDP, 2C4T, Turbo up to 4.2GHz/3.6GHz, Memory: 2x4GB LPDDR3- 1866MHz, Storage: Intel® 760p m.2 PCIe NVMe SSD, Display Resolution: 1920x1080 for Performance; 25x14 eDP 13.3” for Power, OS: Windows 10 Build RS3 17134.112. SYSmark 2014 SE is measured in BAPCo power plan. Power policy set to DC/Balanced mode for power. All benchmarks run in Admin mode, Graphics driver: driver:whl.1006167-v2. Approx. 10x Lakefield Standby SoC Power Improvement: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Vs. Amber Lake. Approx. 1.5x-2x Lakefield Active SoC Power Improvement: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Workload: 1080p video playback. Vs. Amber Lake next-gen product. Approx. 2x Lakefield Graphics Performance: Estimated or simulated as of April 2019 using Intel internal analysis or architecture simulation or modeling. Workload: GfxBENCH. LKF 5W & 7W Configuration (Assumptions):,Processor: LKF PL1=5W & 7W TDP, 5C5T, Memory: 2X4GB LPDDR4x - 4267MHz, Storage: Intel® 760p m.2 PCIe NVMe SSD; LKF Optimized Power configuration uses UFS, Display Resolution: 1920x1080 for Performance; 25x14 eDP 13.3” and 19x12 MIPI 8.0” for Power, OS: Windows* 10 RS5. Power policy set to AC/Balanced mode for all benchmarks except SYSmark 2014 SE which is measured in AC/BAPCo mode for Performance. Power policy set to DC/Balanced mode for power. All benchmarks run in Admin mode., Graphics driver: X.X Vs. Configuration Data: Intel® Core™ AML Y2+2 5W measurements: Processor: Intel® Core™ i7-8500Y processor, PL1=5.0W TDP, 2C4T, Turbo up to 4.2GHz/3.6GHz, Memory: 2x4GB LPDDR3- 1866MHz, Storage: Intel® 760p m.2 PCIe NVMe SSD, Display Resolution: 1920x1080 for Performance; 25x14 eDP 13.3” for Power, OS: Windows 10 Build RS3 17134.112. SYSmark 2014 SE is measured in BAPCo power plan. Power policy set to DC/Balanced mode for power. All benchmarks run in Admin mode, Graphics driver: driver:whl.1006167-v2.

Software and workloads used in performance tests may have been optimized for performance only on Intel microprocessors. Performance tests, such as SYSmark and MobileMark, are measured using specific computer systems, components, software, operations and functions. Any change to any of those factors may cause the results to vary. You should consult other information and performance tests to assist you in fully evaluating your contemplated purchases, including the performance of that product when combined with other products. For more information go to www.intel.com/benchmarks. Performance results are based on testing as of date specified in the Configuration Disclosure and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure. Optimization Notice: Intel's compilers may or may not optimize to the same degree for non-Intel microprocessors for optimizations that are not unique to Intel microprocessors. These optimizations include SSE2, SSE3, and SSSE3 instruction sets and other optimizations. Intel does not guarantee the availability, functionality, or effectiveness of any optimization on microprocessors not manufactured by Intel. Microprocessor- dependent optimizations in this product are intended for use with Intel microprocessors. Certain optimizations not specific to Intel microarchitecture are reserved for Intel microprocessors. Please refer to the applicable product User and Reference Guides for more information regarding the specific instruction sets covered by this notice. Intel technologies’ features and benefits depend on system configuration and may require enabled hardware, software or service activation. Performance varies depending on system configuration. Check with your system manufacturer or retailer or learn more at intel.com. Intel, the Intel logo, Intel Agilex, Intel Optane, Intel Xeon, and OpenVINO are trademarks of Intel Corporation or its subsidiaries in the U.S. and/or other countries. *Other names and brands may be claimed as the property of others. © Intel Corporation.Software and workloads used in performance tests may have been optimized for performance only on Intel microprocessors. Performance tests, such as SYSmark and MobileMark, are measured using specific computer systems, components, software, operations and functions. Any change to any of those factors may cause the results to vary. You should consult other information and performance tests to assist you in fully evaluating your contemplated purchases, including the performance of that product when combined with other products. For more information go to www.intel.com/benchmarks. Performance results are based on testing as of date specified in the Configuration Disclosure and may not reflect all publicly available security updates. See configuration disclosure for details. No product or component can be absolutely secure. Optimization Notice: Intel's compilers may or may not optimize to the same degree for non-Intel microprocessors for optimizations that are not unique to Intel microprocessors. These optimizations include SSE2, SSE3, and SSSE3 instruction sets and other optimizations. Intel does not guarantee the availability, functionality, or effectiveness of any optimization on microprocessors not manufactured by Intel. Microprocessor- dependent optimizations in this product are intended for use with Intel microprocessors. Certain optimizations not specific to Intel microarchitecture are reserved for Intel microprocessors. Please refer to the applicable product User and Reference Guides for more information regarding the specific instruction sets covered by this notice. Intel technologies’ features and benefits depend on system configuration and may require enabled hardware, software or service activation. Performance varies depending on system configuration. Check with your system manufacturer or retailer or learn more at intel.com. Intel, the Intel logo, Intel Agilex, Intel Optane, Intel Xeon, and OpenVINO are trademarks of Intel Corporation or its subsidiaries in the U.S. and/or other countries. *Other names and brands may be claimed as the property of others. © Intel Corporation.

Exhibit 99.3 EXECUTIVE VICE PRESIDENT & GENERAL MANAGER DATA CENTER GROUPExhibit 99.3 EXECUTIVE VICE PRESIDENT & GENERAL MANAGER DATA CENTER GROUP

Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10-K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.Statements in this presentation that refer to business outlook, future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as anticipates, expects, intends, goals, plans, believes, seeks, estimates, continues, may, will, “would,” should, “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to total addressable market (TAM) or market opportunity, future products and the expected availability and benefits of such products, and anticipated trends in our businesses or the markets relevant to them, also identify forward-looking statements. Such statements are based on management's expectations as of May 8, 2019, unless an earlier date is indicated, and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company's expectations are set forth in Intel's earnings release dated April 25, 2019, which is included as an exhibit to Intel’s Form 8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q. Copies of Intel's Form 10-K, 10-Q and 8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC's website at www.sec.gov. All information in this presentation reflects management’s views as of May 8, 2019, unless an earlier date is indicated. Intel does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.