Form 8-K BEACON ROOFING SUPPLY For: May 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2019

BEACON ROOFING SUPPLY, INC.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware |

000-50924 |

36-417337 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

505 Huntmar Park Drive, Suite 300, Herndon, VA 20170

(Address of Principal Executive Offices) (Zip Code)

(571) 323-3939

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

|

|

|

|

|

|

|

Common Stock, $0.01 par value |

|

BECN |

|

NASDAQ Global Select Market |

On May 7, 2019, Beacon Roofing Supply, Inc. (the “Company”) issued a press release providing information regarding earnings for the second quarter ended March 31, 2019. A copy of the press release is attached hereto as Exhibit 99.1.

On May 7, 2019, the Company delivered a presentation as part of the webcast for the earnings conference call for the second quarter ended March 31, 2019. A copy of the presentation is attached hereto as Exhibit 99.2.

The information including Exhibit 99.1 and Exhibit 99.2 in this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, except as shall otherwise be expressly set forth by specific reference in such filing.

|

Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

|

Exhibit Index |

||

|

Exhibit Number |

|

Description |

|

99.1 |

|

|

|

99.2 |

|

Beacon Roofing Supply, Inc. FY 2019 second quarter earnings presentation dated May 7, 2019 |

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

BEACON ROOFING SUPPLY, INC. |

|

|

|

|

|

|

|

Date: May 7, 2019 |

|

By: |

/s/ JOSEPH M. NOWICKI |

|

|

|

|

JOSEPH M. NOWICKI |

|

|

|

|

Executive Vice President & Chief Financial Officer |

Exhibit 99.1

Beacon Roofing Supply Reports Second Quarter 2019 Results

|

|

• |

Record second quarter net sales of $1.43 billion |

|

|

• |

Existing market daily sales growth of 1.2% year-over-year |

|

|

• |

Second quarter net income (loss) of $(68.1) million vs. $(66.7) million in the prior year; Adjusted Net Income (Loss) of $(30.9) million vs. $(23.5) million in the prior year |

|

|

• |

Second quarter EPS of $(1.08) vs. $(1.07) in the prior year; Adjusted EPS of $(0.45) vs. $(0.35) in the prior year |

|

|

• |

Opened four greenfield locations in the second quarter (five total in fiscal 2019 to-date) |

HERNDON, VA.—(BUSINESS WIRE)—May 7, 2019—Beacon Roofing Supply, Inc. (Nasdaq: BECN) (“Beacon” or the “Company”) announced results today for its second quarter and six-month period ended March 31, 2019 (“2019”).

Paul Isabella, the Company's President and Chief Executive Officer, stated: “We produced positive organic sales growth, highlighted by a daily sales increase of nearly 5% in residential roofing, despite the harsh weather adversely impacting quarterly demand (as noted in our March 25 press release). In an effort to help mitigate the challenging weather patterns, we were able to implement more aggressive late-quarter cost controls to match the unusually soft seasonal environment. We once again exhibited attractive price-cost performance in the second quarter, as we have done in each of the past four quarters. Importantly, the winter is now behind us and existing market sales accelerated the last several weeks of March, and that momentum has continued into April. Through key initiatives, including digital, private label, and complementary products, coupled with new branch openings, we are continuing to expand our competitive advantage in the marketplace. We remain firmly committed to reaching our long-term sales and margin objectives.”

Second Quarter

Net sales increased 0.2% to $1.43 billion in 2019, a level similar to 2018. Residential roofing product sales increased 2.9%, non-residential roofing product sales decreased 5.7% and complementary product sales increased 1.1% over the prior year. Existing markets net sales decreased 0.4% compared to the prior year period, primarily due to weather related events; however, sales by business day increased by 1.2% compared to the prior year period. The second quarter of fiscal years 2019 and 2018 had 63 and 64 business days, respectively.

Net income (loss) attributable to common shareholders was $(74.1) million, compared to $(72.7) million in 2018. Net income (loss) per share (“EPS”) was $(1.08), compared to $(1.07) in 2018. Second quarter results were positively impacted by strong sales in geographies less impacted by the unfavorable weather and lower operating expense. Second quarter results were negatively impacted by lower gross margins.

Adjusted Net Income (Loss) was $(30.9) million, compared to $(23.5) million in 2018. Adjusted EPS was $(0.45), compared to $(0.35) in 2018. Adjusted EBITDA was $27.4 million, compared to $31.7 million in 2018. (Please see the included financial tables for a reconciliation of “Adjusted” financial measures to the most directly comparable GAAP financial measures as well as further detail on the components driving the net changes over the comparative periods).

Six Months

Net sales increased 23.7% to $3.15 billion, up from $2.55 billion in the comparative 2018 period. Residential roofing product sales increased 13.5%, non-residential roofing product sales increased 10.7% and complementary product sales increased 52.0% over the prior year. Existing markets net sales increased 0.8% compared to the prior year period, primarily due to price gains across all product lines. The first six months of fiscal years 2019 and 2018 each had 125 business days.

Net income (loss) attributable to common shareholders was $(81.0) million, compared to $(5.1) million in 2018. Net income (loss) per share (“EPS”) was $(1.18), compared to $(0.07) in 2018. The six-month results were positively impacted by price gains across all product lines and improved gross margin performance. The six-month results were negatively impacted by higher operating expenses and increase in interest expense and preferred dividend payments that were both related to the acquisition of Allied. In addition, 2018 results include a $48.0 million non-recurring net tax benefit resulting from the enactment of the Tax Cuts and Jobs Act of 2017.

Adjusted Net Income (Loss) was $9.6 million, compared to $23.2 million in 2018. Adjusted EPS was $0.14, compared to $0.34 in 2018. Adjusted EBITDA was $149.1 million, compared to $117.6 million in 2018. (Please see the included financial tables for a reconciliation of “Adjusted” financial measures to the most directly comparable GAAP financial measures as well as further detail on the components driving the net changes over the comparative periods).

The Company will host a webcast and conference call today at 5:00 p.m. ET to discuss these results. The webcast link and call-in details are as follows:

|

What: |

Beacon Roofing Supply Second Quarter 2019 Earnings Conference Call |

|

When |

Tuesday, May 7, 2019 |

|

Time: |

5:00 p.m. ET |

|

Webcast: |

http://ir.beaconroofingsupply.com/events.cfm (live and replay) |

|

Live Call: |

720-634-9063; Conf. ID #6843668 |

To assure timely access, conference call participants should dial in prior to the 5:00 p.m. ET start time.

Forward-Looking Statements:

This release contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10-K. In addition, the forward-looking statements included in this press release represent the Company's views as of the date of this press release and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this press release.

About Beacon Roofing Supply

Founded in 1928, Beacon Roofing Supply, Inc. is the largest publicly traded distributor of residential and commercial roofing materials and complementary building products, operating over 500 branches throughout all 50 states in the U.S. and 6 provinces in Canada. To learn more about Beacon and its family of regional brands, please visit www.becn.com.

Beacon Roofing Supply, Inc.

Joseph Nowicki, Executive VP & CFO

571-323-3939

[email protected]

Consolidated Statements of Operations

(Unaudited; In thousands, except share and per share amounts)

|

|

Three Months Ended March 31, |

|

|

Six Months Ended March 31, |

|

||||||||||||||||||||||||||

|

|

2019 |

|

|

% of Net Sales |

|

|

2018 |

|

|

% of Net Sales |

|

|

2019 |

|

|

% of Net Sales |

|

|

2018 |

|

|

% of Net Sales |

|

||||||||

|

Net sales |

$ |

1,429,037 |

|

|

|

100.0 |

% |

|

$ |

1,425,625 |

|

|

|

100.0 |

% |

|

$ |

3,150,713 |

|

|

|

100.0 |

% |

|

$ |

2,547,604 |

|

|

|

100.0 |

% |

|

Cost of products sold |

|

1,094,049 |

|

|

|

76.6 |

% |

|

|

1,087,248 |

|

|

|

76.3 |

% |

|

|

2,380,156 |

|

|

|

75.5 |

% |

|

|

1,939,474 |

|

|

|

76.1 |

% |

|

Gross profit |

|

334,988 |

|

|

|

23.4 |

% |

|

|

338,377 |

|

|

|

23.7 |

% |

|

|

770,557 |

|

|

|

24.5 |

% |

|

|

608,130 |

|

|

|

23.9 |

% |

|

Operating expense1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

320,408 |

|

|

|

22.4 |

% |

|

|

341,587 |

|

|

|

24.0 |

% |

|

|

648,101 |

|

|

|

20.6 |

% |

|

|

535,340 |

|

|

|

21.0 |

% |

|

Depreciation |

|

17,447 |

|

|

|

1.2 |

% |

|

|

17,120 |

|

|

|

1.2 |

% |

|

|

35,048 |

|

|

|

1.1 |

% |

|

|

25,829 |

|

|

|

1.0 |

% |

|

Amortization |

|

51,763 |

|

|

|

3.6 |

% |

|

|

37,068 |

|

|

|

2.6 |

% |

|

|

103,784 |

|

|

|

3.3 |

% |

|

|

55,263 |

|

|

|

2.2 |

% |

|

Total operating expense |

|

389,618 |

|

|

|

27.2 |

% |

|

|

395,775 |

|

|

|

27.8 |

% |

|

|

786,933 |

|

|

|

25.0 |

% |

|

|

616,432 |

|

|

|

24.2 |

% |

|

Income (loss) from operations |

|

(54,630 |

) |

|

|

(3.8 |

%) |

|

|

(57,398 |

) |

|

|

(4.1 |

%) |

|

|

(16,376 |

) |

|

|

(0.5 |

%) |

|

|

(8,302 |

) |

|

|

(0.3 |

%) |

|

Interest expense, financing costs, and other2 |

|

40,452 |

|

|

|

2.8 |

% |

|

|

39,570 |

|

|

|

2.8 |

% |

|

|

78,813 |

|

|

|

2.5 |

% |

|

|

62,138 |

|

|

|

2.4 |

% |

|

Income (loss) before provision for income taxes |

|

(95,082 |

) |

|

|

(6.6 |

%) |

|

|

(96,968 |

) |

|

|

(6.9 |

%) |

|

|

(95,189 |

) |

|

|

(3.0 |

%) |

|

|

(70,440 |

) |

|

|

(2.7 |

%) |

|

Provision for (benefit from) income taxes |

|

(26,996 |

) |

|

|

(1.8 |

%) |

|

|

(30,313 |

) |

|

|

(2.2 |

%) |

|

|

(26,210 |

) |

|

|

(0.8 |

%) |

|

|

(71,381 |

) |

|

|

(2.7 |

%) |

|

Net income (loss) |

|

(68,086 |

) |

|

|

(4.8 |

%) |

|

|

(66,655 |

) |

|

|

(4.7 |

%) |

|

|

(68,979 |

) |

|

|

(2.2 |

%) |

|

|

941 |

|

|

|

0.0 |

% |

|

Dividends on preferred shares3 |

|

6,000 |

|

|

|

0.4 |

% |

|

|

6,000 |

|

|

|

0.4 |

% |

|

|

12,000 |

|

|

|

0.4 |

% |

|

|

6,000 |

|

|

|

0.2 |

% |

|

Net income (loss) attributable to common shareholders |

$ |

(74,086 |

) |

|

|

(5.2 |

%) |

|

$ |

(72,655 |

) |

|

|

(5.1 |

%) |

|

$ |

(80,979 |

) |

|

|

(2.6 |

%) |

|

$ |

(5,059 |

) |

|

|

(0.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

68,451,920 |

|

|

|

|

|

|

|

68,019,300 |

|

|

|

|

|

|

|

68,348,850 |

|

|

|

|

|

|

|

67,922,276 |

|

|

|

|

|

|

Diluted |

|

68,451,920 |

|

|

|

|

|

|

|

68,019,300 |

|

|

|

|

|

|

|

68,348,850 |

|

|

|

|

|

|

|

67,922,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share4: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.08 |

) |

|

|

|

|

|

$ |

(1.07 |

) |

|

|

|

|

|

$ |

(1.18 |

) |

|

|

|

|

|

$ |

(0.07 |

) |

|

|

|

|

|

Diluted |

$ |

(1.08 |

) |

|

|

|

|

|

$ |

(1.07 |

) |

|

|

|

|

|

$ |

(1.18 |

) |

|

|

|

|

|

$ |

(0.07 |

) |

|

|

|

|

______________________________________________

|

1 |

Operating expense for the three months ended March 31, 2019 and 2018 includes non-recurring acquisition costs of $6.7 million ($4.7 million, net of taxes) and $28.3 million ($20.0 million, net of taxes), respectively. Operating expense for the six months ended March 31, 2019 and 2018 includes non-recurring acquisition costs of $15.6 million ($11.4 million, net of taxes) and $33.9 million ($23.9 million, net of taxes), respectively. |

|

2 |

Interest expense, financing costs, and other for the three months ended March 31, 2019 and 2018 includes non-recurring acquisition costs of $3.0 million ($2.2 million, net of taxes) and $6.3 million ($4.5 million, net of taxes), respectively. Interest expense, financing costs, and other for the six months ended March 31, 2019 and 2018 includes non-recurring acquisition costs of $6.1 million ($4.4 million, net of taxes) and $18.6 million ($13.2 million, net of taxes), respectively. |

|

3 |

Amounts for the three months ended March 31, 2019 and the three and six months ended March 31, 2018 are composed of $5.0 million in undeclared cumulative Preferred Stock dividends, as well as an additional $1.0 million of Preferred Stock dividends that had been declared and paid as of period end. Six months ended March 31, 2019 amount is composed of $5.0 million in undeclared cumulative Preferred Stock dividends, as well as an additional $7.0 million of Preferred Stock dividends that had been declared and paid as of period end. |

|

4 |

Basic net income (loss) per share is calculated by dividing net income (loss) attributable to common shareholders by the weighted-average number of common shares outstanding during the period, without consideration for common share equivalents or the conversion of Preferred Stock. Common share equivalents consist of the incremental common shares issuable upon the exercise of stock options and vesting of restricted stock unit awards. Diluted net income (loss) per common share is calculated by dividing net income (loss) attributable to common shareholders by the fully diluted weighted-average number of common shares outstanding during the period. The following table presents the components and calculations of basic and diluted net income (loss) per share for each period presented (in thousands, except share and per share amounts): |

|

|

Three Months Ended March 31, |

|

|

Six Months Ended March 31, |

|

||||||||||

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||

|

Net income (loss) |

$ |

(68,086 |

) |

|

$ |

(66,655 |

) |

|

$ |

(68,979 |

) |

|

$ |

941 |

|

|

Dividends on preferred shares |

|

6,000 |

|

|

|

6,000 |

|

|

|

12,000 |

|

|

|

6,000 |

|

|

Net income (loss) attributable to common shareholders |

$ |

(74,086 |

) |

|

$ |

(72,655 |

) |

|

$ |

(80,979 |

) |

|

$ |

(5,059 |

) |

|

Undistributed income allocated to participating securities |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net income (loss) attributable to common shareholders - basic and diluted |

$ |

(74,086 |

) |

|

$ |

(72,655 |

) |

|

$ |

(80,979 |

) |

|

$ |

(5,059 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding - basic |

|

68,451,920 |

|

|

|

68,019,300 |

|

|

|

68,348,850 |

|

|

|

67,922,276 |

|

|

Effect of common share equivalents |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Weighted-average common shares outstanding - diluted |

|

68,451,920 |

|

|

|

68,019,300 |

|

|

|

68,348,850 |

|

|

|

67,922,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share - basic |

$ |

(1.08 |

) |

|

$ |

(1.07 |

) |

|

$ |

(1.18 |

) |

|

$ |

(0.07 |

) |

|

Net income (loss) per share - diluted |

$ |

(1.08 |

) |

|

$ |

(1.07 |

) |

|

$ |

(1.18 |

) |

|

$ |

(0.07 |

) |

Consolidated Balance Sheets

(Unaudited; In thousands)

|

|

March 31, |

|

|

September 30, |

|

|

March 31, |

|

|||

|

|

2019 |

|

|

2018 |

|

|

2018 |

|

|||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

645 |

|

|

$ |

129,927 |

|

|

$ |

16,000 |

|

|

Accounts receivable, net |

|

869,760 |

|

|

|

1,090,533 |

|

|

|

832,823 |

|

|

Inventories, net |

|

1,031,183 |

|

|

|

936,047 |

|

|

|

1,005,577 |

|

|

Prepaid expenses and other current assets |

|

332,100 |

|

|

|

244,360 |

|

|

|

240,315 |

|

|

Total current assets |

|

2,233,688 |

|

|

|

2,400,867 |

|

|

|

2,094,715 |

|

|

Property and equipment, net |

|

271,022 |

|

|

|

280,407 |

|

|

|

294,222 |

|

|

Goodwill |

|

2,490,326 |

|

|

|

2,491,779 |

|

|

|

2,381,620 |

|

|

Intangibles, net |

|

1,229,949 |

|

|

|

1,334,366 |

|

|

|

1,410,302 |

|

|

Other assets, net |

|

1,243 |

|

|

|

1,243 |

|

|

|

1,511 |

|

|

Total assets |

$ |

6,226,228 |

|

|

$ |

6,508,662 |

|

|

$ |

6,182,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

510,434 |

|

|

$ |

880,872 |

|

|

$ |

593,559 |

|

|

Accrued expenses |

|

453,889 |

|

|

|

611,539 |

|

|

|

348,050 |

|

|

Current portions of long-term debt/obligations |

|

19,988 |

|

|

|

19,661 |

|

|

|

19,597 |

|

|

Total current liabilities |

|

984,311 |

|

|

|

1,512,072 |

|

|

|

961,206 |

|

|

Borrowings under revolving lines of credit, net |

|

416,614 |

|

|

|

92,442 |

|

|

|

424,528 |

|

|

Long-term debt, net |

|

2,494,673 |

|

|

|

2,494,725 |

|

|

|

2,493,889 |

|

|

Deferred income taxes, net |

|

110,064 |

|

|

|

106,994 |

|

|

|

91,101 |

|

|

Long-term obligations under equipment financing and other, net |

|

8,527 |

|

|

|

13,639 |

|

|

|

18,313 |

|

|

Other long-term liabilities |

|

5,702 |

|

|

|

5,290 |

|

|

|

10,617 |

|

|

Total liabilities |

|

4,019,891 |

|

|

|

4,225,162 |

|

|

|

3,999,654 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible preferred stock |

|

399,195 |

|

|

|

399,195 |

|

|

|

399,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

684 |

|

|

|

681 |

|

|

|

680 |

|

|

Undesignated preferred stock |

|

- |

|

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

1,073,243 |

|

|

|

1,067,040 |

|

|

|

1,056,248 |

|

|

Retained earnings |

|

752,855 |

|

|

|

833,834 |

|

|

|

743,127 |

|

|

Accumulated other comprehensive income (loss) |

|

(19,640 |

) |

|

|

(17,250 |

) |

|

|

(16,534 |

) |

|

Total stockholders' equity |

|

1,807,142 |

|

|

|

1,884,305 |

|

|

|

1,783,521 |

|

|

Total liabilities and stockholders' equity |

$ |

6,226,228 |

|

|

$ |

6,508,662 |

|

|

$ |

6,182,370 |

|

Consolidated Statements of Cash Flows

(Unaudited; In thousands)

|

|

Six Months Ended March 31, |

|

|||||

|

|

2019 |

|

|

2018 |

|

||

|

Operating Activities |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(68,979 |

) |

|

$ |

941 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

138,832 |

|

|

|

81,092 |

|

|

Stock-based compensation |

|

8,264 |

|

|

|

7,835 |

|

|

Certain interest expense and other financing costs |

|

6,051 |

|

|

|

3,987 |

|

|

Beneficial lease amortization |

|

1,145 |

|

|

|

- |

|

|

Loss on debt extinguishment |

|

- |

|

|

|

1,725 |

|

|

Gain on sale of fixed assets |

|

(1,172 |

) |

|

|

(319 |

) |

|

Deferred income taxes |

|

3,086 |

|

|

|

(47,260 |

) |

|

Changes in operating assets and liabilities, net of the effects of businesses acquired in the period: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

219,740 |

|

|

|

186,170 |

|

|

Inventories |

|

(96,052 |

) |

|

|

(131,789 |

) |

|

Prepaid expenses and other assets |

|

(85,320 |

) |

|

|

67,425 |

|

|

Accounts payable and accrued expenses |

|

(368,154 |

) |

|

|

(130,695 |

) |

|

Other liabilities |

|

415 |

|

|

|

854 |

|

|

Net cash provided by (used in) operating activities |

|

(242,144 |

) |

|

|

39,966 |

|

|

|

|

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(26,320 |

) |

|

|

(24,833 |

) |

|

Acquisition of businesses, net |

|

(163,973 |

) |

|

|

(2,726,561 |

) |

|

Proceeds from the sale of assets |

|

1,428 |

|

|

|

413 |

|

|

Net cash provided by (used in) investing activities |

|

(188,865 |

) |

|

|

(2,750,981 |

) |

|

|

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

|

|

|

|

Borrowings under revolving lines of credit |

|

1,880,684 |

|

|

|

1,530,667 |

|

|

Repayments under revolving lines of credit |

|

(1,557,615 |

) |

|

|

(1,097,463 |

) |

|

Borrowings under term loan |

|

- |

|

|

|

970,000 |

|

|

Repayments under term loan |

|

(4,850 |

) |

|

|

(441,000 |

) |

|

Borrowings under senior notes |

|

- |

|

|

|

1,300,000 |

|

|

Payment of debt issuance costs |

|

- |

|

|

|

(67,723 |

) |

|

Repayments under equipment financing facilities and other |

|

(2,642 |

) |

|

|

(5,643 |

) |

|

Proceeds from issuance of convertible preferred stock |

|

- |

|

|

|

400,000 |

|

|

Payment of stock issuance costs |

|

- |

|

|

|

(1,279 |

) |

|

Payment of dividends on preferred stock |

|

(12,000 |

) |

|

|

(978 |

) |

|

Proceeds from issuance of common stock related to equity awards |

|

1,559 |

|

|

|

5,317 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(3,617 |

) |

|

|

(3,933 |

) |

|

Net cash provided by (used in) financing activities |

|

301,519 |

|

|

|

2,587,965 |

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

208 |

|

|

|

800 |

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(129,282 |

) |

|

|

(122,250 |

) |

|

Cash and cash equivalents, beginning of period |

|

129,927 |

|

|

|

138,250 |

|

|

Cash and cash equivalents, end of period |

$ |

645 |

|

|

$ |

16,000 |

|

BEACON ROOFING SUPPLY, INC.

Consolidated Sales by Product Line

(Unaudited; In thousands)

|

Consolidated Sales by Product Line |

|

||||||||||||||||||||||

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

598,917 |

|

|

|

42.0 |

% |

|

$ |

581,834 |

|

|

|

40.8 |

% |

|

$ |

17,083 |

|

|

|

2.9 |

% |

|

Non-residential roofing products |

|

313,626 |

|

|

|

21.9 |

% |

|

|

332,690 |

|

|

|

23.3 |

% |

|

|

(19,064 |

) |

|

|

(5.7 |

%) |

|

Complementary building products |

|

516,494 |

|

|

|

36.1 |

% |

|

|

511,101 |

|

|

|

35.9 |

% |

|

|

5,393 |

|

|

|

1.1 |

% |

|

|

$ |

1,429,037 |

|

|

|

100.0 |

% |

|

$ |

1,425,625 |

|

|

|

100.0 |

% |

|

$ |

3,412 |

|

|

|

0.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Market1 Sales by Product Line |

|

||||||||||||||||||||||

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

598,795 |

|

|

|

42.2 |

% |

|

$ |

581,834 |

|

|

|

40.9 |

% |

|

$ |

16,961 |

|

|

|

2.9 |

% |

|

Non-residential roofing products |

|

313,591 |

|

|

|

22.1 |

% |

|

|

332,651 |

|

|

|

23.3 |

% |

|

|

(19,060 |

) |

|

|

(5.7 |

%) |

|

Complementary building products |

|

506,602 |

|

|

|

35.7 |

% |

|

|

510,622 |

|

|

|

35.8 |

% |

|

|

(4,020 |

) |

|

|

(0.8 |

%) |

|

|

$ |

1,418,988 |

|

|

|

100.0 |

% |

|

$ |

1,425,107 |

|

|

|

100.0 |

% |

|

$ |

(6,119 |

) |

|

|

(0.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Market1 Sales By Business Day2 |

|

||||||||||||||||||||||

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

9,505 |

|

|

|

42.2 |

% |

|

$ |

9,091 |

|

|

|

40.9 |

% |

|

$ |

414 |

|

|

|

4.6 |

% |

|

Non-residential roofing products |

|

4,978 |

|

|

|

22.1 |

% |

|

|

5,198 |

|

|

|

23.3 |

% |

|

|

(220 |

) |

|

|

(4.2 |

%) |

|

Complementary building products |

|

8,041 |

|

|

|

35.7 |

% |

|

|

7,978 |

|

|

|

35.8 |

% |

|

|

63 |

|

|

|

0.8 |

% |

|

|

$ |

22,524 |

|

|

|

100.0 |

% |

|

$ |

22,267 |

|

|

|

100.0 |

% |

|

$ |

257 |

|

|

|

1.2 |

% |

__________________________________________________

|

1 |

Excludes acquired branches that have not been under ownership for at least four fiscal quarters prior to the start of the second quarter of fiscal year 2019. |

|

2 |

There were 63 and 64 business days in the quarters ended March 31, 2019 and 2018, respectively. |

Consolidated Sales by Product Line

(Unaudited; In thousands)

|

Consolidated Sales by Product Line |

|

||||||||||||||||||||||

|

|

Six Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

1,323,780 |

|

|

|

42.0 |

% |

|

$ |

1,166,361 |

|

|

|

45.8 |

% |

|

$ |

157,419 |

|

|

|

13.5 |

% |

|

Non-residential roofing products |

|

729,939 |

|

|

|

23.2 |

% |

|

|

659,431 |

|

|

|

25.9 |

% |

|

|

70,508 |

|

|

|

10.7 |

% |

|

Complementary building products |

|

1,096,994 |

|

|

|

34.8 |

% |

|

|

721,812 |

|

|

|

28.3 |

% |

|

|

375,182 |

|

|

|

52.0 |

% |

|

|

$ |

3,150,713 |

|

|

|

100.0 |

% |

|

$ |

2,547,604 |

|

|

|

100.0 |

% |

|

$ |

603,109 |

|

|

|

23.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Market1 Sales by Product Line |

|

||||||||||||||||||||||

|

|

Six Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

971,124 |

|

|

|

52.7 |

% |

|

$ |

945,947 |

|

|

|

51.8 |

% |

|

$ |

25,177 |

|

|

|

2.7 |

% |

|

Non-residential roofing products |

|

524,728 |

|

|

|

28.5 |

% |

|

|

531,956 |

|

|

|

29.1 |

% |

|

|

(7,228 |

) |

|

|

(1.4 |

%) |

|

Complementary building products |

|

345,553 |

|

|

|

18.8 |

% |

|

|

348,509 |

|

|

|

19.1 |

% |

|

|

(2,956 |

) |

|

|

(0.8 |

%) |

|

|

$ |

1,841,405 |

|

|

|

100.0 |

% |

|

$ |

1,826,412 |

|

|

|

100.0 |

% |

|

$ |

14,993 |

|

|

|

0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Market1 Sales By Business Day2 |

|

||||||||||||||||||||||

|

|

Six Months Ended March 31, |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

2019 |

|

|

2018 |

|

|

Change |

|

|||||||||||||||

|

|

Net Sales |

|

|

Mix % |

|

|

Net Sales |

|

|

Mix % |

|

|

$ |

|

|

% |

|

||||||

|

Residential roofing products |

$ |

7,769 |

|

|

|

52.7 |

% |

|

$ |

7,568 |

|

|

|

51.8 |

% |

|

$ |

201 |

|

|

|

2.7 |

% |

|

Non-residential roofing products |

|

4,198 |

|

|

|

28.5 |

% |

|

|

4,256 |

|

|

|

29.1 |

% |

|

|

(58 |

) |

|

|

(1.4 |

%) |

|

Complementary building products |

|

2,764 |

|

|

|

18.8 |

% |

|

|

2,788 |

|

|

|

19.1 |

% |

|

|

(24 |

) |

|

|

(0.8 |

%) |

|

|

$ |

14,731 |

|

|

|

100.0 |

% |

|

$ |

14,612 |

|

|

|

100.0 |

% |

|

$ |

119 |

|

|

|

0.8 |

% |

__________________________________________________

|

1 |

Excludes acquired branches that have not been under ownership for at least four fiscal quarters prior to the start of fiscal year 2019. |

|

2 |

There were 125 business days in each of the six month periods ended March 31, 2019 and 2018. |

Adjusted Net Income (Loss) and Adjusted EPS1

(Unaudited; In thousands, except per share amounts)

|

|

Three Months Ended March 31, |

|

|

Six Months Ended March 31, |

|

||||||||||||||||||||||||||

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||||||||||||||||||

|

|

Amount |

|

|

Per Share2 |

|

|

Amount |

|

|

Per Share2 |

|

|

Amount |

|

|

Per Share3 |

|

|

Amount |

|

|

Per Share3 |

|

||||||||

|

Net income (loss) |

$ |

(68,086 |

) |

|

$ |

(0.99 |

) |

|

$ |

(66,655 |

) |

|

$ |

(0.98 |

) |

|

$ |

(68,979 |

) |

|

$ |

(1.01 |

) |

|

$ |

941 |

|

|

$ |

0.01 |

|

|

Dividends on preferred shares |

|

6,000 |

|

|

|

0.09 |

|

|

|

6,000 |

|

|

|

0.09 |

|

|

|

12,000 |

|

|

|

0.18 |

|

|

|

6,000 |

|

|

|

0.08 |

|

|

Net income (loss) attributable to common shareholders |

$ |

(74,086 |

) |

|

$ |

(1.08 |

) |

|

$ |

(72,655 |

) |

|

$ |

(1.07 |

) |

|

$ |

(80,979 |

) |

|

$ |

(1.18 |

) |

|

$ |

(5,059 |

) |

|

$ |

(0.07 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition costs4 |

|

43,664 |

|

|

|

0.64 |

|

|

|

50,604 |

|

|

|

0.74 |

|

|

|

91,057 |

|

|

|

1.33 |

|

|

|

76,237 |

|

|

|

1.12 |

|

|

Effects of tax reform5 |

|

(462 |

) |

|

|

(0.01 |

) |

|

|

(1,491 |

) |

|

|

(0.02 |

) |

|

|

(462 |

) |

|

|

(0.01 |

) |

|

|

(47,983 |

) |

|

|

(0.71 |

) |

|

Adjusted Net Income (Loss) |

$ |

(30,884 |

) |

|

$ |

(0.45 |

) |

|

$ |

(23,542 |

) |

|

$ |

(0.35 |

) |

|

$ |

9,616 |

|

|

$ |

0.14 |

|

|

$ |

23,195 |

|

|

$ |

0.34 |

|

____________________________________________

|

1 |

Adjusted Net Income (Loss) is defined as net income that excludes non-recurring acquisition costs, the amortization of intangibles, business restructuring costs, and the non-recurring effects of tax reform. Adjusted net income (loss) per share or "Adjusted EPS" is calculated by dividing the Adjusted Net Income (Loss) for the period by the weighted-average diluted shares outstanding for the period. |

|

2 |

The weighted-average share count utilized in the calculation of Adjusted EPS for the three months ended March 31, 2019 is 68,451,920. The weighted-average share count utilized in the calculation of Adjusted EPS for the three months ended March 31, 2018 is 68,019,300. |

|

3 |

The weighted-average share count utilized in the calculation of Adjusted EPS for the six months ended March 31, 2019 is 68,348,850. The weighted-average share count utilized in the calculation of Adjusted EPS for the six months ended March 31, 2018 is 67,922,276. |

|

4 |

Three months ended March 31, 2019 amount is composed of $9.7 million of non-recurring acquisition costs ($6.9 million, net of tax) and $51.8 million of amortization expense related to intangibles ($36.8 million, net of tax). Three months ended March 31, 2018 amount is composed of $34.6 million of non-recurring acquisition costs ($24.4 million, net of tax) and $37.1 million of amortization expense related to intangibles ($26.2 million, net of tax). Six months ended March 31, 2019 amount is composed of $21.7 million of non-recurring acquisition costs ($15.7 million, net of tax) and $103.8 million of amortization expense related to intangibles ($75.3 million, net of tax). Six months ended March 31, 2018 amount is composed of $52.5 million of non-recurring acquisition costs ($37.1 million, net of tax) and $55.3 million of amortization expense related to intangibles ($39.1 million, net of tax). |

|

5 |

Impact of the Tax Cuts and Jobs Act of 2017. |

We use Adjusted Net Income (Loss) and Adjusted EPS to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources.

We believe that Adjusted Net Income (Loss) and Adjusted EPS are useful measures because they permit investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments.

While we believe Adjusted Net Income (Loss) and Adjusted EPS are useful to investors when evaluating our business, they are not prepared and presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), and therefore should be considered supplemental in nature. You should not consider Adjusted Net Income (Loss) or Adjusted EPS in isolation or as a substitute for net income and net income per share or diluted earnings per share calculated in accordance with GAAP. In addition, Adjusted Net Income (Loss) and Adjusted EPS may have material limitations and may differ from similarly titled measures presented by other companies.

Adjusted EBITDA1

(Unaudited; In thousands)

|

|

Three Months Ended March 31, |

|

|

Six Months Ended March 31, |

|

||||||||||

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||

|

Net income (loss) |

$ |

(68,086 |

) |

|

$ |

(66,655 |

) |

|

$ |

(68,979 |

) |

|

$ |

941 |

|

|

Acquisition costs2 |

|

6,687 |

|

|

|

28,301 |

|

|

|

15,605 |

|

|

|

33,870 |

|

|

Interest expense, net |

|

41,815 |

|

|

|

41,763 |

|

|

|

81,631 |

|

|

|

65,279 |

|

|

Income taxes |

|

(26,996 |

) |

|

|

(30,313 |

) |

|

|

(26,210 |

) |

|

|

(71,381 |

) |

|

Depreciation and amortization |

|

69,210 |

|

|

|

54,188 |

|

|

|

138,832 |

|

|

|

81,092 |

|

|

Stock-based compensation |

|

4,807 |

|

|

|

4,376 |

|

|

|

8,264 |

|

|

|

7,835 |

|

|

Adjusted EBITDA |

$ |

27,437 |

|

|

$ |

31,660 |

|

|

$ |

149,143 |

|

|

$ |

117,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA as a % of net sales |

|

1.9 |

% |

|

|

2.2 |

% |

|

|

4.7 |

% |

|

|

4.6 |

% |

__________________________________________________

|

1 |

Adjusted EBITDA is defined as net income plus interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, non-recurring acquisition costs, and business restructuring costs. EBITDA is a measure commonly used in the distribution industry, and we present Adjusted EBITDA to enhance your understanding of our operating performance. |

|

2 |

Represents non-recurring acquisition costs (excluding the impact of tax) that are included in operating expense and not embedded in other balances of the table. |

We use Adjusted EBITDA to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources.

We believe that Adjusted EBITDA is a useful measure because it permits investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments.

While we believe Adjusted EBITDA is useful to investors when evaluating our business, it is not prepared and presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), and therefore should be considered supplemental in nature. Adjusted EBITDA should not be considered in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, Adjusted EBITDA may have material limitations and may differ from similarly titled measures presented by other companies.

2019 Second Quarter Earnings Call Exhibit 99.2

Disclosure notice This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10-K. In addition, the forward-looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation. This presentation contains references to certain financial measures that are not presented in accordance with United States Generally Accepted Accounting Principles (“GAAP"). The Company uses non-GAAP financial measures to evaluate financial performance, analyze underlying business trends and establish operational goals and forecasts that are used when allocating resources. The Company believes these non-GAAP financial measures permit investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments. While the Company believes these measures are useful to investors when evaluating performance, they are not presented in accordance with GAAP, and therefore should be considered supplemental in nature. The Company’s non-GAAP financial measures should not be considered in isolation or as a substitute for any items calculated in accordance with GAAP. In addition, these non-GAAP measures may have material limitations and may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure can be found in the Appendix as well as Company’s latest Form 8-K, filed with the SEC on May 7, 2019. | www.becn.com

Company Strategy Update Paul Isabella, President & Chief Executive Officer Q2 Results and Outlook Joe Nowicki, Executive Vice President & CFO Q&A Closing Remarks Paul Isabella, President & Chief Executive Officer Conference Call Agenda | www.becn.com

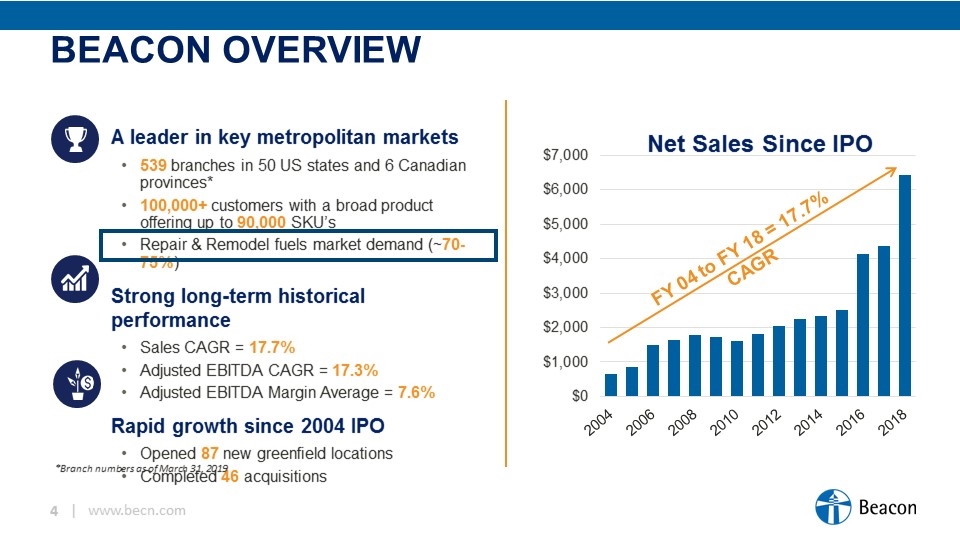

Beacon overview | www.becn.com A leader in key metropolitan markets 539 branches in 50 US states and 6 Canadian provinces* 100,000+ customers with a broad product offering up to 90,000 SKU’s Repair & Remodel fuels market demand (~70-75%) Strong long-term historical performance Sales CAGR = 17.7% Adjusted EBITDA CAGR = 17.3% Adjusted EBITDA Margin Average = 7.6% Rapid growth since 2004 IPO Opened 87 new greenfield locations Completed 46 acquisitions FY 04 to FY 18 = 17.7% CAGR *Branch numbers as of March 31, 2019

Allied integration update | www.becn.com Synergy realization remains on track for $100M realization in FY19 and $120M in total Network rationalization progressing well…>40 total branches to-date with remaining consolidations to occur over the next few quarters RSA service model implementation underway – activities remain focused on improving customer service and profitability Systems conversions complete Integrating best practices across entire branch network, including Allied talent

Second quarter 2019 highlights | www.becn.com Record Q2 net sales of $1.43B Existing market daily sales growth of 1.2% over prior year Attractive price-cost realization for four consecutive quarters Generated $80 million in free cash flow in quarter and paid down over $75 million in debt Existing market adj. operating expenses down ~$2 million and 10 bps over prior year Opened four greenfield locations (five total in fiscal 2019) See Appendix for reconciliation Free cash flow for the quarter ended March 31, 2019 of $80.1M equaled net cash provided by operating activities of $94.7M less purchases of property and equipment of $14.6M

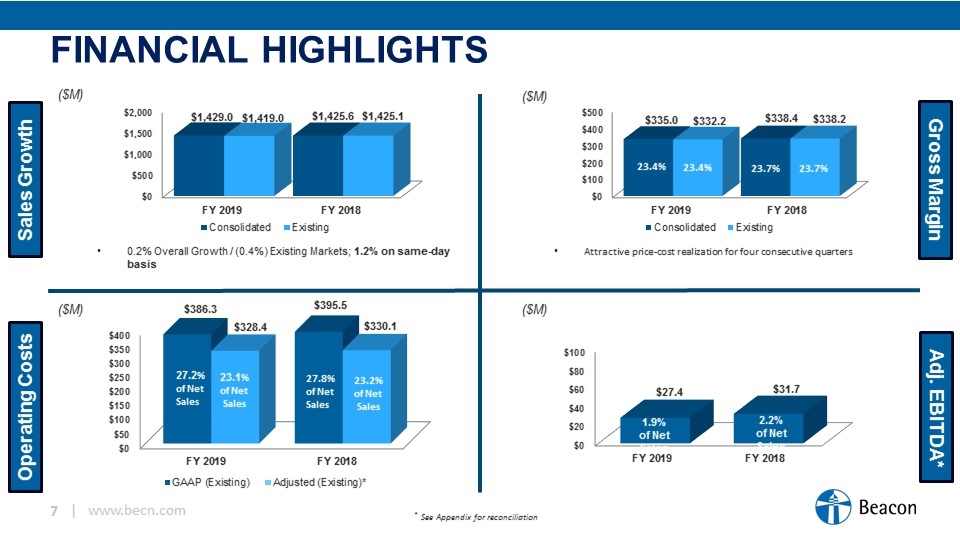

Financial highlights | www.becn.com Sales Growth Operating Costs Gross Margin Adj. EBITDA* 0.2% Overall Growth / (0.4%) Existing Markets; 1.2% on same-day basis 23.4% 23.7% 23.4% 23.7% Attractive price-cost realization for four consecutive quarters ($M) 1.9% of Net Sales 2.2% of Net Sales ($M) ($M) ($M) * See Appendix for reconciliation

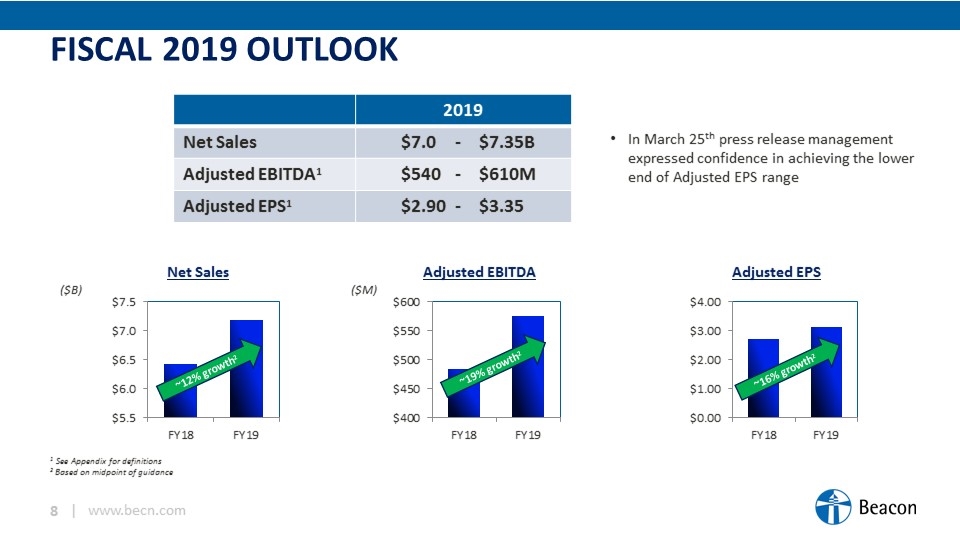

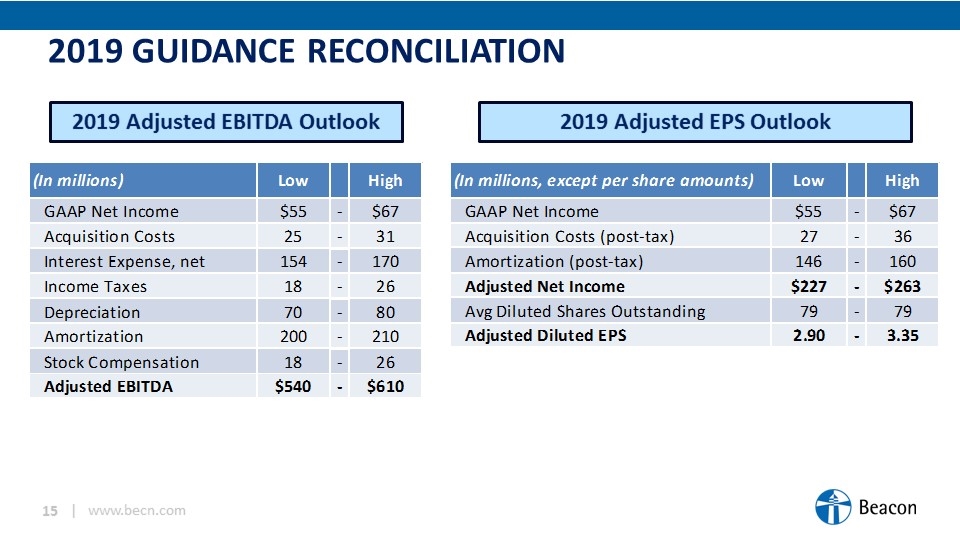

Fiscal 2019 outlook | www.becn.com 1 See Appendix for definitions 2 Based on midpoint of guidance 2019 Net Sales $7.0- $7.35B Adjusted EBITDA1 $540-$610M Adjusted EPS1 $2.90-$3.35 Net Sales ($B) Adjusted EBITDA Adjusted EPS ($M) ~12% growth2 ~19% growth2 ~16% growth2 In March 25th press release management expressed confidence in achieving the lower end of Adjusted EPS range

summary | www.becn.com Record Q2 net sales of $1.43B in historically toughest quarter Highly attractive market with steady repair & remodel (historically 70-75% of net sales) Guided to lower end of Adjusted EPS and Adjusted EBITDA range Remain focused on organic growth with several growth initiatives Investments in our people Technology investments Expanded product breadth and depth New customers and markets Continuation of successful Allied integration Commitment to de-leveraging…available free cash flow to pay down debt

Appendix | www.becn.com

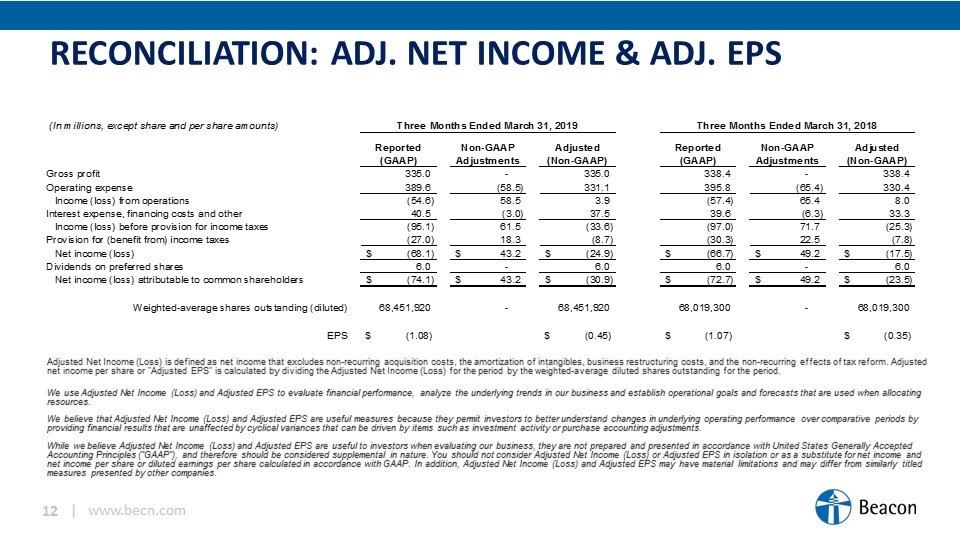

Reconciliation: Adj. Net Income & Adj. EPS | www.becn.com Adjusted Net Income (Loss) is defined as net income that excludes non-recurring acquisition costs, the amortization of intangibles, business restructuring costs, and the non-recurring effects of tax reform. Adjusted net income per share or "Adjusted EPS" is calculated by dividing the Adjusted Net Income (Loss) for the period by the weighted-average diluted shares outstanding for the period. We use Adjusted Net Income (Loss) and Adjusted EPS to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We believe that Adjusted Net Income (Loss) and Adjusted EPS are useful measures because they permit investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments. While we believe Adjusted Net Income (Loss) and Adjusted EPS are useful to investors when evaluating our business, they are not prepared and presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), and therefore should be considered supplemental in nature. You should not consider Adjusted Net Income (Loss) or Adjusted EPS in isolation or as a substitute for net income and net income per share or diluted earnings per share calculated in accordance with GAAP. In addition, Adjusted Net Income (Loss) and Adjusted EPS may have material limitations and may differ from similarly titled measures presented by other companies.

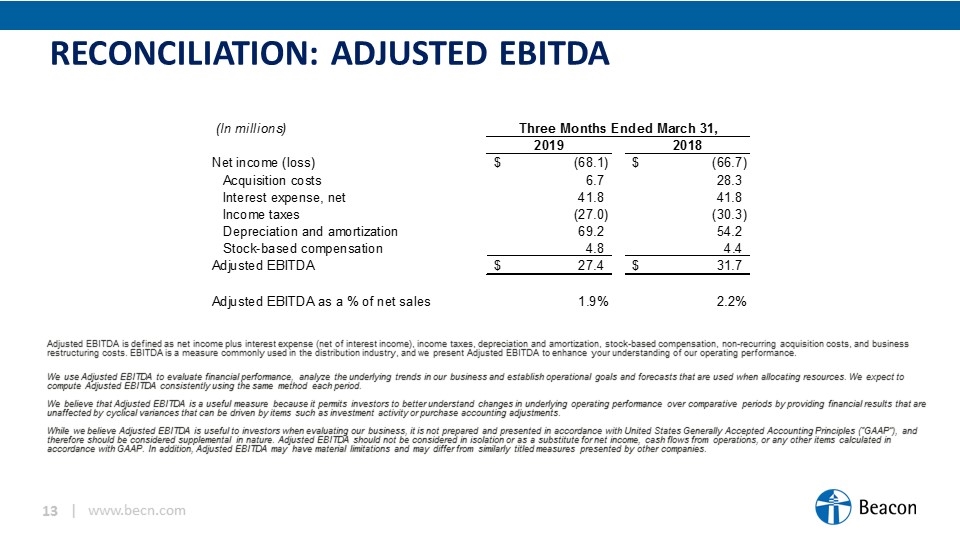

Reconciliation: AdjUSTED EBITDA | www.becn.com Adjusted EBITDA is defined as net income plus interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, non-recurring acquisition costs, and business restructuring costs. EBITDA is a measure commonly used in the distribution industry, and we present Adjusted EBITDA to enhance your understanding of our operating performance. We use Adjusted EBITDA to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We expect to compute Adjusted EBITDA consistently using the same method each period. We believe that Adjusted EBITDA is a useful measure because it permits investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments. While we believe Adjusted EBITDA is useful to investors when evaluating our business, it is not prepared and presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), and therefore should be considered supplemental in nature. Adjusted EBITDA should not be considered in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, Adjusted EBITDA may have material limitations and may differ from similarly titled measures presented by other companies.

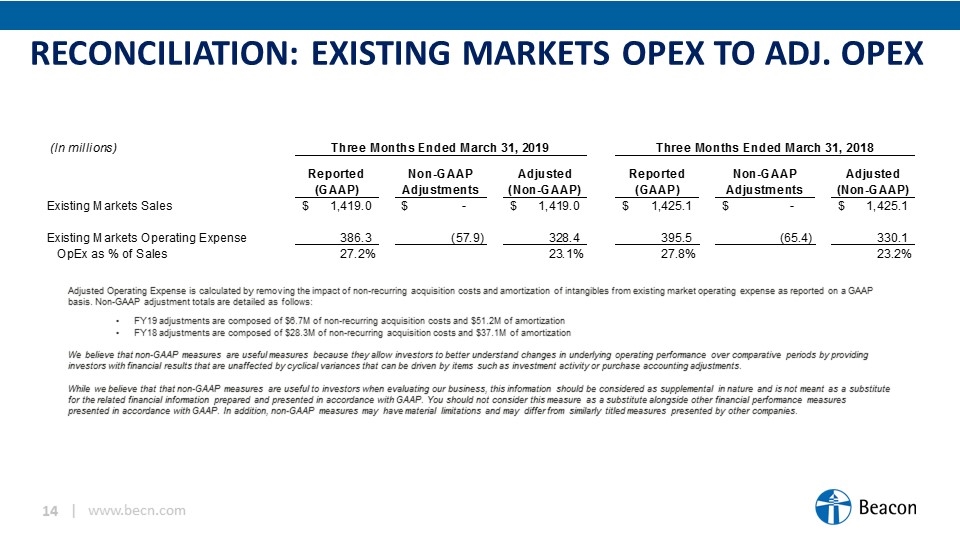

Reconciliation: Existing Markets OpEx to Adj. OpEx | www.becn.com Adjusted Operating Expense is calculated by removing the impact of non-recurring acquisition costs and amortization of intangibles from existing market operating expense as reported on a GAAP basis. Non-GAAP adjustment totals are detailed as follows: FY19 adjustments are composed of $6.7M of non-recurring acquisition costs and $51.2M of amortization FY18 adjustments are composed of $28.3M of non-recurring acquisition costs and $37.1M of amortization We believe that non-GAAP measures are useful measures because they allow investors to better understand changes in underlying operating performance over comparative periods by providing investors with financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments. While we believe that that non-GAAP measures are useful to investors when evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP. You should not consider this measure as a substitute alongside other financial performance measures presented in accordance with GAAP. In addition, non-GAAP measures may have material limitations and may differ from similarly titled measures presented by other companies.

2019 Guidance Reconciliation | www.becn.com 2019 Adjusted EBITDA Outlook 2019 Adjusted EPS Outlook