Form S-1 YETI Holdings, Inc.

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIALS

As filed with the Securities and Exchange Commission on May 6, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

YETI Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3949 (Primary Standard Industrial Classification Code Number) |

45-5297111 (I.R.S. Employer Identification Number) |

7601 Southwest Parkway

Austin, Texas 78735

(512) 394-9384

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Matthew J. Reintjes

President and Chief Executive Officer, Director

7601 Southwest Parkway

Austin, Texas 78735

(512) 394-9384

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

Timothy R. Curry Andrew C. Thomas Jones Day 901 Lakeside Avenue Cleveland, Ohio 44114 (216) 586-3939 |

Bryan C. Barksdale Senior Vice President, General Counsel and Secretary YETI Holdings, Inc. 7601 Southwest Parkway Austin, Texas 78735 (512) 394-9384 |

Michael Benjamin Adam J. Gelardi Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable, after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(2) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share |

10,925,000 | $30.94 | $338,019,500 | $40,967.96 | ||||

|

||||||||

- (1)

- Includes

1,425,000 shares of common stock that may be sold if the underwriters' option to purchase additional shares granted by the selling stockholders is

exercised.

- (2)

- Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(c) of the Securities Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price are based on the average high and low sales prices of the registrant's common stock on May 2, 2019 as reported on the New York Stock Exchange.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion, Dated May 6, 2019

PROSPECTUS

9,500,000 Shares

Common Stock

The selling stockholders identified in this prospectus are offering 9,500,000 shares of common stock of YETI Holdings, Inc. We are not selling any shares of our common stock under this prospectus, and we will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol "YETI." The last reported sale price of our common stock on May 3, 2019 was $31.50 per share.

We are an "emerging growth company" under the federal securities laws and, as such, are subject to reduced public company reporting requirements. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

After the completion of this offering, Cortec Group Fund V, L.P. and its affiliates will continue to control a majority of the voting power of our common stock with respect to the election of our directors. As a result, we will remain a "controlled company" within the meaning of the New York Stock Exchange listing standards. See "Management—Controlled Company Exemption."

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 16 of this prospectus.

|

||||

| |

Per share |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds, before expenses, to the selling stockholders |

$ | $ | ||

|

||||

- (1)

- See "Underwriting" for additional information regarding total underwriter compensation.

The underwriters may also exercise their option to purchase up to an additional 1,425,000 shares from the selling stockholders, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2019.

| BofA Merrill Lynch | Jefferies | Morgan Stanley | ||

| Goldman Sachs & Co. LLC | Citigroup | |||

| Baird | Piper Jaffray | |||

| Stifel | William Blair | KeyBanc Capital Markets | ||

| Raymond James | Academy Securities |

, 2019

You should rely only on the information contained in this prospectus and in any related free writing prospectus prepared by or on behalf of us and the selling stockholders. Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide you with information different from, or in addition to, the information contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

For Investors Outside the United States

Neither we, the selling stockholders, nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Trademarks, Trade Names, and Service Marks

We use various trademarks, trade names, and service marks in our business, including, without limitation, YETI®, Tundra®, Hopper®, Hopper Flip®, YETI TANK®, Rambler®, Colster®, Roadie®, BUILT FOR THE WILD®, LOAD-AND-LOCK®, YETI Authorized™, YETI PRESENTS™, YETI Custom Shop™, Panga™, LoadOut™, Camino™, Hondo™, SideKick®, SideKick Dry™, Silo™, YETI ICE™, EasyBreathe™, FlexGrid™, PermaFrost™, T-Rex™, Haul™, NeverFlat™, StrongArm™, Vortex™, SteadySteel™, Hopper BackFlip™, ThickSkin™, DryHaul™, SureStrong™, LipGrip™, No Sweat™,

i

Boomer™, Tocayo™, Lowlands™, TripleGrip™, TripleHaul™, Over-the-Nose™, FatLid™, MagCap™, DoubleHaul™, HydroLok™, ColdCell™, Wildly Stronger! Keep Ice Longer!®, YETI Coolers™, LoadOut GoBox™, YETI Hopper®, YETI Rambler Colster®, Rambler On®, YETI Rambler®, YETI Brick®, Flip™, Tundra Haul™, and Color Inspired By True Events™. YETI also uses trade dress for its distinctive product designs. For convenience, we may not include the ® or ™ symbols in this prospectus, but such omission is not meant to and does not indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names, or service marks referred to in this registration statement and the prospectus that are not owned by us are the property of their respective owners.

Industry, Market, and Other Data

This prospectus includes estimates, projections, and other information concerning our industry and market data, including data regarding the estimated size of the market, projected growth rates, and perceptions and preferences of consumers. We obtained this data from industry sources, third-party studies, including market analyses and reports, and internal company surveys. Industry sources generally state that the information contained therein has been obtained from sources believed to be reliable. Although we are responsible for all of the disclosure contained in this prospectus, and we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate.

Effective January 1, 2017, we converted our fiscal year end from a calendar year ending December 31 to a "52- 53-week" year ending on the Saturday closest in proximity to December 31, such that each quarterly period will be 13 weeks in length, except during a 53 week year when the fourth quarter will be 14 weeks. This did not have a material effect on our consolidated financial statements and, therefore, we did not retrospectively adjust our financial statements. References herein to "2018" relate to the 52 weeks ended December 29, 2018, "2017" relate to the 52 weeks ended December 30, 2017, and references herein to "2016" and "2015" relate to the years ended December 31, 2016 and December 31, 2015, respectively. The first quarter of 2019 ended on March 30, 2019, and the first quarter of 2018 ended on March 31, 2018. In this prospectus, unless otherwise noted, when we compare a metric between one period and a "prior period," we are comparing it to the corresponding period from the prior fiscal year.

ii

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read the entire prospectus, including the consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Unless the context requires otherwise, the words "YETI," "we," "company," "us," and "our" refer to YETI Holdings, Inc. and its subsidiaries, as applicable.

YETI: Built for the Wild

We believe that by consistently designing and marketing innovative and outstanding outdoor products, we make an active lifestyle more enjoyable and cultivate a growing group of passionate and loyal customers.

Our Founders, Roy and Ryan Seiders, are avid outdoorsmen who were frustrated with equipment that could not keep pace with their interests in hunting and fishing. By utilizing forward-thinking designs and advanced manufacturing techniques, they developed a nearly indestructible hard cooler with superior ice retention. Our original cooler not only delivered exceptional performance, it anchored an authentic, passionate, and durable bond among customers and our company.

Today, we are a growing designer, marketer, retailer, and distributor of a variety of innovative, branded, premium products to a wide-ranging customer base. Our mission is to ensure that each YETI product delivers exceptional performance and durability in any environment, whether in the remote wilderness, at the beach, or anywhere else life takes our customers. By consistently delivering high-performing products, we have built a following of engaged brand loyalists throughout the United States, Canada, Japan, Australia, and elsewhere, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. Our relationship with customers continues to thrive and deepen as a result of our innovative new product introductions, expansion and enhancement of existing product families, and multifaceted branding activities.

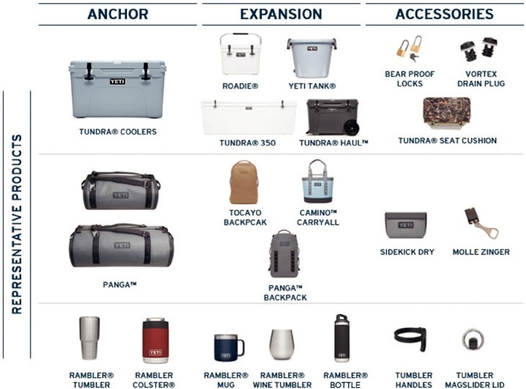

Our diverse product portfolio includes:

1

We bring our products to market through a diverse omni-channel strategy, comprised of our select group of national, regional, and independent retail partners and our direct-to-consumer and corporate sales, or DTC, channel. Our DTC channel is comprised of YETI.com, au.YETI.com, YETIcustomshop.com, YETI Authorized on the Amazon Marketplace, corporate sales, and our first retail store and corporate store in Austin, Texas. Our DTC channel provides authentic, differentiated brand experiences, customer engagement, and expedited customer feedback, enhancing the product development cycle while providing diverse avenues for growth.

The broadening demand for our innovative and distinctive products is evidenced by our net sales growth from $89.9 million in 2013 to $778.8 million in 2018, representing a compound annual growth rate, or CAGR, of 54%. Over the same period, operating income grew from $15.2 million to $102.2 million, representing a CAGR of 46%, net income grew from $7.3 million to $57.8 million, representing a CAGR of 51%, adjusted operating income grew from $16.3 million to $124.2 million, representing a CAGR of 50%, adjusted net income grew from $8.0 million to $75.7 million, representing a CAGR of 57%, and our adjusted EBITDA increased from $21.8 million to $149.0 million, representing a CAGR of 47%.

See "—Summary Consolidated Financial and Other Data" for a reconciliation of adjusted operating income, adjusted net income, and adjusted EBITDA, each a non-GAAP (as defined below) measure, to operating income, net income, and net income, respectively.

How is YETI different?

We believe the following strengths fundamentally differentiate us from our competitors and drive our success:

Influential, Growing Brand with Passionate Following. The YETI brand stands for innovation, performance, uncompromising quality, and durability. We believe these attributes have made us the preferred choice of a wide variety of customers, from professional outdoors people to those who simply appreciate product excellence. Our products are used in and around an expanding range of pursuits, such as fishing, hunting, camping, climbing, snow sports, surfing, barbecuing, tailgating, ranch and rodeo, and general outdoors, as well as in life's daily activities. We support and build our brand through a multifaceted strategy, which includes innovative digital, social, television, and print media, our YETI Dispatch magalog, with a circulation of 2.4 million during 2018, and several grass-roots initiatives that foster customer engagement. Our brand is embodied and personified by our YETI Ambassadors, a diverse group of men and women from throughout the United States and select international markets, comprised of world-class anglers, hunters, rodeo cowboys, barbecue pitmasters, surfers, and outdoor adventurers who embody our brand. The success of our brand-building strategy is partially demonstrated by our approximately 1.8 million new customers to YETI.com since 2013 and approximately 1.2 million Instagram followers as of March 30, 2019. In 2018 and during the three months ended March 30, 2019, we added approximately 0.5 million and 0.1 million new customers to YETI.com, respectively.

Our loyal customers act as brand advocates. YETI owners often purchase and proudly wear YETI apparel and display YETI banners and decals. As evidenced by the respondents to our most recently completed YETI owner study, 95% say they have proactively recommended our products to their friends, family, and others through social media or by word-of-mouth. Their brand advocacy, coupled with our varied marketing efforts, has consistently extended our appeal to the broader YETI Nation. As we have expanded our product lines, extended our YETI Ambassador base, and broadened our marketing messaging, we have cultivated an audience of both men and women living throughout the United States and, increasingly, in international markets. Based on our annual owner studies, from 2015 to 2018 our customer base has evolved from 9% female to 34%, and from 64% aged 45 and under to 70%. While we have continued to invest in and remain true to our heritage hunting and fishing communities, our customer base evolved from 69% hunters to 38% during that same time period as our appeal broadened beyond those heritage communities. Further, based on our periodic Brand Tracking Study, our unaided brand

2

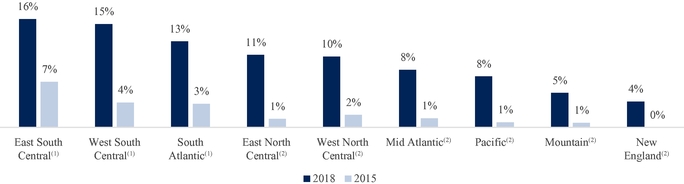

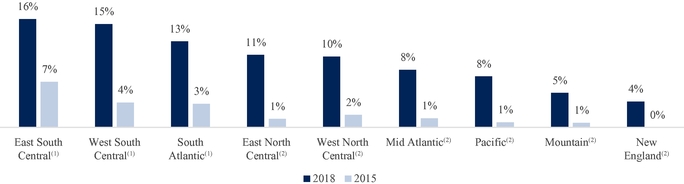

awareness in the premium outdoor company and brand markets in the United States has grown from 2% in October 2015 to 10% in July 2018, indicating strong growth and that there may be significant opportunity for future expansion, particularly in more densely populated United States markets, which we have entered more recently.

Superior Design Capabilities and Product Development. At YETI, product is at our core and innovation fuels us. By employing an uncompromising approach to product performance and functionality, we have expanded on our original hard cooler offering and extended beyond our hunting and fishing heritage by introducing innovative new products, including soft coolers, drinkware, travel bags, backpacks, multipurpose buckets, outdoor chairs, blankets, dog bowls, apparel, and accessories. We believe that our new products appeal to our long-time customers as well as customers first experiencing our brand. We carefully design and rigorously test all new products, both in our innovation center and in the field, consistent with our commitment to delivering outstanding functional performance.

We believe our products continue to set new performance standards in their respective categories. Our expansive team of in-house engineers and designers develops our products using a comprehensive stage-gate process that ensures quality control and optimizes speed-to-market. We use our purpose-built, state-of-the-art research and development center to rapidly generate design prototypes and test performance. Our global supply chain group, with offices in Austin, Texas and mainland China, sources and partners with qualified suppliers to manufacture our products to meet our rigorous specifications. As a result, we control the innovation process from concept through design, production, quality assurance, and launch. To ensure we benefit from the significant investment we make in product innovation, we actively manage and aggressively protect our intellectual property. We have a history of developing innovative products, including new products in existing product families, product line expansions, and accessories, as well as products that bring us into new categories. Our current product portfolio gives customers access to our brand at multiple price points, ranging from a $20 Rambler tumbler to a $1,300 Tundra hard cooler. We expand our existing product families and enter new product categories by creating solutions grounded in consumer insights and relevant market knowledge. We believe our product families, extensions, variations, and colorways, in addition to new product launches, result in repeat purchases by existing customers and consistently attract new customers to YETI.

Balanced, Omni-Channel Distribution Strategy. We distribute our products through a balanced omni-channel platform, consisting of our wholesale and DTC channels. In our wholesale channel, we sell our products through select national and regional accounts and an assemblage of independent retail partners throughout the United States and, more recently, Australia, Canada, and Japan. We carefully evaluate and select retail partners that have an image and approach that are consistent with our premium brand and pricing. Our domestic national, and regional specialty retailers include Dick's Sporting Goods, REI, Academy Sports + Outdoors, Bass Pro Shops / Cabela's, and Ace Hardware. As of March 30, 2019, we also sold through a diverse base of approximately 4,700 independent retail partners, including outdoor specialty, hardware, sporting goods, and farm and ranch supply stores, among others. Our DTC channel consists primarily of online and inside sales, and has grown from 8% of our net sales in 2015 to 37% in 2018. On YETI.com and at both our first retail and our corporate store, we showcase the entirety of our extensive product portfolio. Through YETIcustomshop.com and our corporate sales programs, we offer customers and businesses the ability to customize many of our products with licensed marks and original artwork. Our DTC channel enables us to directly interact with our customers, more effectively control our brand experience, better understand consumer behavior and preferences, and offer exclusive products, content, and customization capabilities. We believe our control over our DTC channel provides our customers the highest level of brand engagement and further builds customer loyalty, while generating attractive margins. As part of our commitment to premium positioning, we maintain supply discipline, consistently enforce our minimum advertised pricing, or MAP, policy across our wholesale and DTC channels, and sell primarily through one-step distribution.

3

Scalable Infrastructure to Support Growth. As we have grown, we have worked diligently and invested significantly to further build our information technology capabilities, while improving business process effectiveness. This robust infrastructure facilitates our ability to manage our global manufacturing base, optimize complex distribution logistics, and effectively serve our consistently expanding customer base. We believe our global team, sophisticated technology backbone, and extensive experience provide us with the capabilities necessary to support our future growth.

Experienced Management Team. Our senior management team, led by our President and Chief Executive Officer, or CEO, Matthew J. Reintjes, is comprised of experienced executives from large global product and services businesses and publicly listed companies. They have proven track records of scaling businesses, leading innovation, expanding distribution, and managing expansive global operations. Our culture is an embodiment of the values of our Founders who continue to advise our product development team and help to identify new opportunities.

Our Growth Strategies

We plan to continue growing our customer base by driving YETI brand awareness, introducing new and innovative products, entering new product categories, accelerating DTC sales, and expanding our international presence.

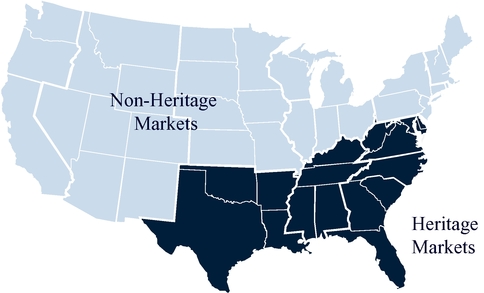

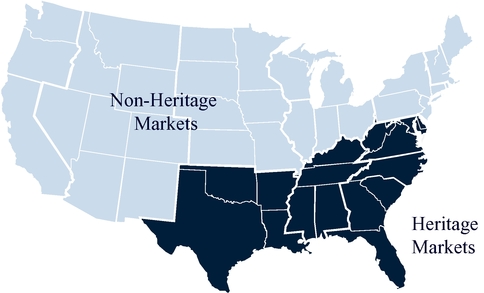

Expand Our Brand Awareness and Customer Base. Creating brand awareness among new customers and in new geographies has been, and remains, central to our growth strategy. We drive our brand through multilayered marketing programs, word-of-mouth referral, experiential brand events, YETI Ambassador reach, and product use. We have significantly invested in increasing brand awareness, spending $206.9 million on marketing initiatives from 2013 to 2018, including $50.4 million in 2018. This growth is illustrated by the increase in our gross sales derived from outside our heritage markets, which have increased significantly since 2013. We define our heritage markets as the South Atlantic, East South Central, and West South Central, as defined by the U.S. Census Bureau.

While we have meaningfully grown and expanded our brand reach throughout the United States and developed an emerging international presence, according to our periodic brand study, unaided brand awareness, or consumers' awareness of our brand without prompt, in non-heritage markets remains meaningfully below unaided brand awareness in heritage markets. We believe our sales growth will be driven, in part, by continuing to grow YETI's brand awareness in non-heritage markets. For example, based on our most recent Brand Tracking Study, our unaided brand awareness among premium outdoor

4

companies and brands in the United States grew from 2% in October 2015 to 10% in July 2018, indicating there may be significant opportunity for future expansion, particularly in more densely populated United States markets. Our unaided brand awareness among premium outdoor companies and brands by region as of October 2015 and as of July 2018 is set forth below based on this Brand Tracking Study:

Domestic Unaided Brand Awareness by Region

- (1)

- Heritage

market region.

- (2)

- Non-heritage market region.

Introduce New and Innovative Products. We have a track record of consistently broadening our high performance, premium-priced product portfolio to meet our expanding customer base and their evolving pursuits. Our culture of innovation and success in identifying customer needs and wants drives our robust product pipeline. We typically enter a product line by introducing anchor products, followed by product expansions, such as additional sizes and colorways, and then accessories, as exemplified by our current product portfolio. In 2017, we expanded our Drinkware line to new colorways, launched our Hopper Two soft cooler, and added new Hopper Flip sizes and colors. We added to our Coolers & Equipment offering with the introductions of our Panga submersible duffel and LoadOut multipurpose bucket. In 2018, we introduced our Camino Carryall bag, Hondo base camp chair, Hopper BackFlip backpack, Rambler wine tumblers, Haul wheeled cooler, Silo water cooler, Panga submersible backpack, Tocayo backpack, Boomer dog bowl, and Lowlands blanket. In 2019, we introduced our 24 oz. Rambler mug, LoadOut GoBox, and new colorways for Drinkware, hard and soft coolers, and our Camino Carryall. We have also meaningfully enhanced our customization capabilities through YETIcustomshop.com, which offers a broad assortment of custom logo Drinkware and coolers to individual and corporate clients.

As we have done historically, we have identified several opportunities in new, adjacent product categories where we believe we can redefine performance standards and offer superior quality and design to customers. We believe these new opportunities will further bridge the connection between indoor and outdoor life and are consistent with our objective to have YETI products travel with customers wherever they go.

Increase Direct-to-Consumer and Corporate Sales. DTC represents our fastest growing sales channel, with net sales increasing from $14.1 million in 2013 to $287.4 million in 2018. Our DTC channel provides customers and businesses ready access to our brand, branded content, and full product assortment. We intend to continue to drive direct sales to our varied customers through: YETI.com; au.YETI.com; YETIcustomshop.com; YETI Authorized on the Amazon Marketplace; our corporate sales initiatives; increasing the number of our own retail stores; and our international YETI websites. In 2018, we had nearly 40 million visits to YETI.com and YETIcustomshop.com, of which 21.7 million were unique visitors and we processed 0.9 million transactions. We believe we will continue to grow visitors to YETI.com and convert a portion of them to our customers. With YETIcustomshop.com, we believe there are significant

5

opportunities to expand our licensing portfolio in sports and entertainment, along with numerous opportunities to further drive customized consumer and corporate sales. We began selling through YETI Authorized on the Amazon Marketplace in late 2016 and have enjoyed rapid reach expansion and sales growth since that time. In 2017 and 2018, respectively, we opened our first retail store and our first corporate store in Austin, which serve not only as profitable retail locations, but also as showrooms for our extensive and growing product offering and, in the case of our retail store, an event space. Sales from these stores have continued to grow since their respective openings. We plan to open additional retail stores in Chicago and Charleston in 2019. Additionally, in March 2019, we entered into a lease for a new retail location in Denver, but have not yet committed to an opening date for this store. In the future, we intend to continue to open additional stores in select locations across the United States to showcase our full product assortment, build brand awareness, and drive growth.

Increasing sales through these various DTC channels enables us to control our product offering and how it is communicated to new and existing customers, fosters customer engagement, provides rapid feedback on new product launches, and enhances our demand forecasting. Further, our DTC channels provide customers an immersive and YETI-only experience, which we believe strengthens our brand.

Expand into International Markets. We believe we have the opportunity to continue to diversify and grow sales into existing and new international markets. In 2017, we successfully entered Canada and Australia, and 2018 net sales have continued to grow in both of these countries. In 2018, we successfully entered Japan. Our focus is on driving brand awareness, dealer expansion, and our DTC channel in these new markets. We believe there are meaningful growth opportunities by expanding into additional international markets, such as Europe and Asia, including China, as many of the market dynamics and premium, performance-based consumer needs that we have successfully identified domestically are also valued in these markets.

Our Market

Our premium products are designed for use in a wide variety of activities, from professional to recreational and outdoor to indoor, and can be used all year long. As a result, the markets we serve are broad as well as deep, including, for example, outdoor, housewares, home and garden, outdoor living, industrial, and commercial. While our product reach extends into numerous and varied markets, we currently primarily serve the United States outdoor recreation market. The outdoor recreation products market is a large, growing, and diverse economic sector, which includes consumers of all genders, ages, ethnicities, and income levels. According to the Outdoor Industry Association's Outdoor Recreation Economy Reports, which are published every five years, outdoor recreation product sales in the United States grew from a total of approximately $120.7 billion in 2011 to a total of approximately $184.5 billion in 2016, representing a 9% CAGR.

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this prospectus summary. Some of these principal risks include the following:

- •

- our business depends on maintaining and strengthening our brand and generating and maintaining ongoing demand for our products, and a

significant reduction in demand could harm our results of operations;

- •

- if we are unable to successfully design and develop new products, our business may be harmed;

- •

- our business could be harmed if we are unable to accurately forecast our results of operations and growth rate;

- •

- we may not be able to effectively manage our growth;

6

- •

- our growth depends in part on expanding into additional consumer markets, and we may not be successful in doing so;

- •

- our plans for international expansion may not be successful;

- •

- the markets in which we compete are highly competitive and include numerous other brands and retailers that offer a wide variety of products

that compete with our products; if we fail to compete effectively, we could lose our market position;

- •

- we rely on third-party contract manufacturers and problems with, or loss of, our suppliers or an inability to obtain raw materials could harm

our business and results of operations;

- •

- fluctuations in the cost and availability of raw materials, equipment, labor, and transportation could cause manufacturing delays or increase

our costs;

- •

- a significant portion of our sales are to independent retailers, national, and regional retail partners and our business could be harmed if

these retail partners decide to emphasize products from our competitors, to redeploy their retail floor space to other product categories, to take other actions that reduce their purchases of our

products, or if they are disproportionately affected by economic conditions;

- •

- our future success depends on the continuing efforts of our management and key employees and our ability to attract and retain highly-skilled

personnel and senior management;

- •

- our indebtedness may limit our ability to invest in the ongoing needs of our business and if we are unable to comply with the covenants in the

Credit Agreement, dated as of May 19, 2016, by and among YETI Holdings, Inc., the lenders from time to time party thereto and Bank of America, N.A., as administrative agent, as amended,

which we refer to as the Credit Facility, our liquidity and results of operations could be harmed; and

- •

- we will remain a "controlled company" and, as a result, we continue to rely on exemptions from certain corporate governance requirements.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

- •

- an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting;

- •

- an exemption from compliance with any requirement that the Public Company Accounting Oversight Board, or PCAOB, may adopt regarding mandatory

audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

- •

- reduced disclosure about our executive compensation arrangements;

- •

- an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or any golden parachute arrangements;

- •

- extended transition periods for complying with new or revised accounting standards; and

- •

- the ability to present more limited financial data, including presenting only three years of selected financial data in this registration statement, of which this prospectus is a part.

7

We will remain an emerging growth company until the earliest to occur of: (i) the end of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (ii) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (iv) the end of the fiscal year during which the fifth anniversary of our IPO (as defined below) occurs. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act.

We have elected to take advantage of all of the exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you invest.

Our Sponsor

Cortec Group Fund V, L.P. and its affiliates, or Cortec, has been our principal stockholder since its initial investment in 2012.

After the closing of this offering, Cortec will own approximately 46.3% of our outstanding common stock (or approximately 45.3% if the underwriters exercise their option to purchase additional shares in full). In addition, Cortec has the right to vote in the election of our directors the shares of common stock held by Roy Seiders, Ryan Seiders, and their respective affiliates, pursuant to a voting agreement, or the Voting Agreement, that was entered into in connection with our IPO. As a result, the group formed by the Voting Agreement controls, and will control upon the completion of this offering, more than 50% of the total voting power of our common stock with respect to the election of our directors.

Corporate Information

We were founded in 2006 by brothers Roy and Ryan Seiders in Austin, Texas, and were subsequently incorporated as YETI Coolers, Inc., a Texas corporation, in 2010. In 2012, Cortec became our principal stockholder. In connection with Cortec's investment in YETI in 2012, YETI Coolers, Inc. was converted into YETI Coolers, LLC, a Delaware limited liability company, and subsequently YETI Coolers, LLC was acquired by an indirect subsidiary of YETI Holdings, Inc., a Delaware corporation incorporated in 2012 by Cortec. Thereafter, through two subsequent mergers, YETI Coolers, LLC became a wholly owned subsidiary of YETI Holdings, Inc. As part of the acquisition of YETI Coolers, LLC, our Founders, and certain other equity holders exchanged a portion of their proceeds from the sale of YETI Coolers, LLC for equity in YETI Holdings, Inc. As a result, YETI Holdings, Inc. was majority owned by Cortec, with the remaining ownership being shared by our Founders, certain other management equity holders, and select investors.

On October 29, 2018, we completed our initial public offering, or IPO, of 16,000,000 shares of our common stock at a public offering price of $18.00 per share, which included 2,500,000 shares of our common stock sold by us and 13,500,000 shares of our common stock sold by selling stockholders. On November 28, 2018, the underwriters purchased an additional 918,830 shares of our common stock from the selling stockholders at the public offering price, less the underwriting discount, pursuant to a partial exercise of their option to purchase additional shares of common stock. See "Initial Public Offering."

Our principal executive and administrative offices are located at 7601 Southwest Parkway, Austin, Texas 78735, and our telephone number is (512) 394-9384. Our website address is YETI.com. The information on, or that can be accessed through, our website is not incorporated by reference into this prospectus and should not be considered to be a part of this prospectus.

8

Common stock offered by the selling stockholders |

9,500,000 shares (10,925,000 shares if the underwriters exercise their option to purchase additional shares in full) | |

Underwriters' option to purchase additional shares from the selling stockholders |

The underwriters have a 30-day option to purchase up to 1,425,000 additional shares of our common stock from the selling stockholders at the public offering price less estimated underwriting discounts and commissions. |

|

Common stock to be outstanding after this offering |

84,242,651 shares |

|

Use of proceeds |

The selling stockholders will receive all of the net proceeds from this offering. See "Use of Proceeds." |

|

Controlled company |

Pursuant to the Voting Agreement, upon the closing of this offering, Cortec will continue to control more than 50% of the total voting power of our common stock with respect to the election of our directors. As a result, we will remain a "controlled company" within the meaning of the New York Stock Exchange, or NYSE, listing standards, and therefore will be exempt from certain NYSE corporate governance requirements. |

|

Risk factors |

Investing in shares of our common stock involves a high degree of risk. See "Risk Factors" beginning on page 16 and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. |

|

NYSE symbol |

"YETI" |

The number of shares of our common stock that will be outstanding after this offering is based on 84,196,079 shares of our common stock outstanding as of March 30, 2019, and excludes:

- •

- 2,127,126 shares of our common stock issuable upon the exercise of outstanding but unexercised options, of which 1,733,302 are vested, to

purchase shares of our common stock as of March 30, 2019 under the YETI Holdings, Inc. 2012 Equity and Performance Incentive Plan, as amended and restated June 20, 2018, or the

2012 Plan, with a weighted average exercise price of $2.47 per share;

- •

- 1,301,983 shares of our common stock issuable upon the exercise of outstanding but unexercised options, none of which are vested, to purchase

shares of our common stock as of March 30, 2019 under the YETI Holdings, Inc. 2018 Equity and Incentive Compensation Plan, or the 2018 Plan, with a weighted average exercise price of

$20.01 per share;

- •

- 1,349,736 shares of our common stock issuable upon the settlement of restricted stock units outstanding as of March 30, 2019 under the

2012 Plan, with an estimated grant date fair value of $31.74 per share;

- •

- 278,877 shares of our common stock issuable upon the settlement of employee restricted stock units outstanding as of March 30, 2019 under the 2018 Plan, with a grant date fair value of $22.84 per share;

9

- •

- 14,117 shares of our common stock issuable upon the settlement of non-employee deferred stock units outstanding and unvested as of

March 30, 2019 under the 2018 Plan, with a fair value of $30.25 per share;

- •

- 9,614 shares of our common stock issuable upon the settlement of non-employee restricted stock units outstanding as of March 30, 2019

under the 2018 Plan, with a fair value of $30.25 per share; and

- •

- 3,220,391 shares of our common stock reserved for future issuance pursuant to awards under the 2018 Plan.

Except as otherwise indicated, all information in this prospectus assumes or reflects:

- •

- no exercise of the underwriters' option to purchase additional shares from the selling stockholders; and

- •

- no exercise or settlement of outstanding stock options.

10

Summary Consolidated Financial and Other Data

The following tables set forth a summary of our historical summary consolidated financial data for the periods and at the dates indicated. Effective January 1, 2017, we converted our fiscal year end from a calendar year ending December 31 to a "52- to 53- week" year ending on the Saturday closest in proximity to December 31, such that each quarterly period will be 13 weeks in length, except during a 53-week year when the fourth quarter will be 14 weeks. This did not have a material effect on our consolidated financial statements and, therefore, we did not retrospectively adjust our financial statements. Fiscal years 2018 and 2017 included 52 weeks. The first three months of fiscal 2019 and 2018 included 13 weeks. Our consolidated financial data as of December 29, 2018 and December 30, 2017 and for 2018, 2017, and 2016 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated financial data as of and for the three months ended March 30, 2019 and for the three months ended March 31, 2018 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. In the opinion of management, our unaudited condensed consolidated financial statements were prepared on the same basis as our audited consolidated financial statements and include all adjustments necessary for a fair presentation of this information. The consolidated financial data as of December 31, 2016 and December 31, 2015 and for 2015 have been derived from our audited condensed consolidated financial statements not included in this prospectus. The percentages below indicate the statement of operations data as a percentage of net sales. You should read this data together with our audited financial statements and related notes appearing elsewhere in this prospectus and the information included under the caption "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our historical results are not necessarily indicative of our future results.

11

| |

Three Months Ended | Fiscal Year Ended | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands, except per share data)

|

March 30, 2019 |

March 31, 2018 |

December 29, 2018 |

December 30, 2017 |

December 31, 2016 |

December 31, 2015 |

|||||||||||||||||||||||||||||||

Statement of Operations |

|||||||||||||||||||||||||||||||||||||

Net sales |

$ | 155,353 | 100 | % | $ | 135,257 | 100 | % | $ | 778,833 | 100 | % | $ | 639,239 | 100 | % | $ | 818,914 | 100 | % | $ | 468,946 | 100 | % | |||||||||||||

Cost of goods sold |

78,726 | 51 | % | 78,068 | 58 | % | 395,705 | 51 | % | 344,638 | 54 | % | 404,953 | 49 | % | 250,245 | 53 | % | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit |

76,627 | 49 | % | 57,189 | 42 | % | 383,128 | 49 | % | 294,601 | 46 | % | 413,961 | 51 | % | 218,701 | 47 | % | |||||||||||||||||||

Selling, general and administrative expenses |

67,843 | 44 | % | 53,945 | 40 | % | 280,972 | 36 | % | 230,634 | 36 | % | 325,754 | 40 | % | 90,791 | 19 | % | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income |

8,784 | 6 | % | 3,244 | 2 | % | 102,156 | 13 | % | 63,967 | 10 | % | 88,207 | 11 | % | 127,910 | 27 | % | |||||||||||||||||||

Interest expense |

(6,067 | ) | 4 | % | (8,126 | ) | 6 | % | (31,280 | ) | 4 | % | (32,607 | ) | 5 | % | (21,680 | ) | 3 | % | (6,075 | ) | 1 | % | |||||||||||||

Other income (expense) |

63 | 0 | % | (18 | ) | 0 | % | (1,261 | ) | 0 | % | 699 | 0 | % | (1,242 | ) | 0 | % | (6,474 | ) | 1 | % | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes |

2,780 | 2 | % | (4,900 | ) | 4 | % | 69,615 | 9 | % | 32,059 | 5 | % | 65,285 | 8 | % | 115,361 | 25 | % | ||||||||||||||||||

Income tax (expense) benefit |

(613 | ) | 0 | % | 1,639 | 1 | % | (11,852 | ) | 2 | % | (16,658 | ) | 3 | % | (16,497 | ) | 2 | % | (41,139 | ) | 9 | % | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 2,167 | 1 | % | $ | (3,261 | ) | 2 | % | $ | 57,763 | 7 | % | $ | 15,401 | 2 | % | $ | 48,788 | 6 | % | $ | 74,222 | 16 | % | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to noncontrolling interest |

— | — | — | — | — | — | — | 0 | % | (811 | ) | 0 | % | — | 0 | % | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) to YETI Holdings, Inc. |

$ | 2,167 | 1 | % | $ | (3,261 | ) | 2 | % | 57,763 | 7 | % | 15,401 | 2 | % | 47,977 | 6 | % | 74,222 | 16 | % | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted operating income(1) |

14,680 | 9 | % | 7,748 | 6 | % | 124,203 | 16 | % | 76,003 | 12 | % | 220,208 | 27 | % | 136,043 | 29 | % | |||||||||||||||||||

Adjusted net income(1) |

6,619 | 4 | % | 261 | 0 | % | 75,690 | 10 | % | 23,126 | 4 | % | 134,559 | 16 | % | 79,484 | 17 | % | |||||||||||||||||||

Adjusted EBITDA(1) |

$ | 21,282 | 14 | % | $ | 13,433 | 10 | % | $ | 149,049 | 19 | % | $ | 97,471 | 15 | % | $ | 231,862 | 28 | % | $ | 137,101 | 29 | % | |||||||||||||

Net income (loss) to YETI Holdings, Inc. per share |

|||||||||||||||||||||||||||||||||||||

Basic |

$ | 0.03 | $ | (0.04 | ) | $ | 0.71 | $ | 0.19 | $ | 0.59 | $ | 0.93 | ||||||||||||||||||||||||

Diluted |

$ | 0.03 | $ | (0.04 | ) | $ | 0.69 | $ | 0.19 | $ | 0.58 | $ | 0.92 | ||||||||||||||||||||||||

Adjusted net income per share(1) |

|||||||||||||||||||||||||||||||||||||

Diluted |

$ | 0.08 | $ | 0.00 | $ | 0.91 | $ | 0.28 | $ | 1.63 | $ | 0.99 | |||||||||||||||||||||||||

Weighted average common shares outstanding |

|||||||||||||||||||||||||||||||||||||

Basic |

84,196 | 81,419 | 81,777 | 81,479 | 81,097 | 79,775 | |||||||||||||||||||||||||||||||

Diluted |

85,857 | 81,419 | 83,519 | 82,972 | 82,755 | 80,665 | |||||||||||||||||||||||||||||||

(dollars in thousands)

|

As of March 30, 2019 |

|||

|---|---|---|---|---|

Balance Sheet and Other Data |

||||

Inventory |

$ | 164,299 | ||

Property and equipment, net |

78,221 | |||

Total assets |

495,786 | |||

Long-term debt including current maturities |

317,463 | |||

Total stockholders' equity |

35,471 | |||

Purchases of property and equipment |

8,380 | |||

- (1)

- We

define adjusted operating income and adjusted net income as operating income and net income, respectively, adjusted for non-cash stock-based compensation expense,

asset impairment charges, investments in new retail locations and international market expansion, transition to Cortec majority ownership, transition to the ongoing senior management team, and

transition to a public company, and, in the case of adjusted net income, also adjusted for accelerated amortization of deferred financing fees and the loss from early extinguishment of debt resulting

from early prepayments of debt, and the tax impact of such adjustments. Adjusted net income per share is calculated using adjusted net income, as defined above, and diluted weighted average shares

outstanding. We define adjusted EBITDA as net income before interest expense, net, provision (benefit) for income taxes and depreciation and amortization, adjusted for the impact of certain other

items, including: non-cash stock-based compensation expense; asset impairment charges; accelerated amortization of deferred financing fees and loss from early extinguishment of debt resulting from the

early prepayment of debt; investments in new retail locations and international market expansion; transition to Cortec majority ownership; transition to the ongoing senior management team; and

transition to a public company. The expenses incurred related to these transitional events include: management fees and contingent consideration related to the transition to Cortec majority ownership;

severance, recruiting, and relocation costs related to the transition to our ongoing senior management team; consulting fees, recruiting fees, salaries and travel costs related to members of our Board

of Directors, fees associated with Sarbanes-Oxley Act compliance, and incremental audit and legal fees in connection with our transition to a public company. All of these transitional costs are

reported in selling, general, and administrative, or SG&A, expenses.

Adjusted operating income, adjusted net income, adjusted net income per diluted share, and adjusted EBITDA are not defined by accounting principles generally accepted in the United States, or GAAP, and may not be comparable to similarly titled measures reported by other entities. We use these non-GAAP measures, along with GAAP measures, as a measure of profitability. These measures help us compare our performance to other companies by removing the impact of our capital structure; the effect of operating in different tax jurisdictions; the impact of our asset base, which can vary depending on the book value of assets and methods used to compute depreciation and amortization; the effect of non-cash stock-based compensation expense, which can vary based on plan design, share price, share price volatility, and the expected lives of equity instruments granted; as well as certain expenses related to what we believe are events of a transitional nature. We also disclose adjusted operating income, adjusted net income, and adjusted EBITDA as a percentage of net sales to provide a measure of relative profitability.

12

We believe that these non-GAAP measures, when reviewed in conjunction with GAAP financial measures, and not in isolation or as substitutes for analysis of our results of operations under GAAP, are useful to investors as they are widely used measures of performance and the adjustments we make to these non-GAAP measures provide investors further insight into our profitability and additional perspectives in comparing our performance to other companies and in comparing our performance over time on a consistent basis. Adjusted operating income, adjusted net income, and adjusted EBITDA have limitations as profitability measures in that they do not include the interest expense on our debts, our provisions for income taxes, and the effect of our expenditures for capital assets and certain intangible assets. In addition, all of these non-GAAP measures have limitations as profitability measures in that they do not include the effect of non-cash stock-based compensation expense, the effect of asset impairments, the effect of investments in new retail locations and international market expansion, and the impact of certain expenses related to transitional events that are settled in cash. Because of these limitations, we rely primarily on our GAAP results.

In the future, we may incur expenses similar to those for which adjustments are made in calculating adjusted operating income, adjusted net income, and adjusted EBITDA. Our presentation of these non-GAAP measures should not be construed as a basis to infer that our future results will be unaffected by extraordinary, unusual, or non-recurring items.

13

The following table reconciles operating income to adjusted operating income, net income to adjusted net income, and net income to adjusted EBITDA for the periods presented.

| |

Three Months Ended | Fiscal Year Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(dollars in thousands)

|

March 30, 2019 |

March 31, 2018 |

December 29, 2018 |

December 30, 2017 |

December 31, 2016 |

|||||||||||

Operating income |

$ | 8,784 | $ | 3,244 | $ | 102,156 | $ | 63,967 | $ | 88,207 | ||||||

Adjustments: |

||||||||||||||||

Non-cash stock-based compensation expense(a) |

4,005 | 3,010 | 13,247 | 13,393 | 118,415 | |||||||||||

Long-lived asset impairment(a) |

94 | — | 1,236 | — | — | |||||||||||

Investments in new retail locations and international market expansion(a)(b) |

228 | 240 | 795 | — | — | |||||||||||

Transition to Cortec majority ownership(a)(c) |

— | 750 | 750 | 750 | 750 | |||||||||||

Transition to the ongoing senior management team(a)(d) |

100 | 466 | 1,822 | 90 | 2,824 | |||||||||||

Transition to a public company(a)(e) |

1,469 | 38 | 4,197 | (2,197 | ) | 10,012 | ||||||||||

| | | | | | | | | | | | | | | | | |

Adjusted operating income |

$ | 14,680 | $ | 7,748 | $ | 124,203 | $ | 76,003 | $ | 220,208 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 2,167 | $ | (3,261 | ) | $ | 57,763 | $ | 15,401 | $ | 48,788 | |||||

Adjustments: |

||||||||||||||||

Non-cash stock-based compensation expense(a) |

4,005 | 3,010 | 13,247 | 13,393 | 118,415 | |||||||||||

Long-lived asset impairment(a) |

94 | — | 1,236 | — | — | |||||||||||

Loss on early extinguishment of debt and accelerated amortization of deferred financing fees(f) |

— | — | 1,330 | — | 1,221 | |||||||||||

Investments in new retail locations and international market expansion(a)(b) |

228 | 240 | 795 | — | — | |||||||||||

Transition to Cortec majority ownership(a)(c) |

— | 750 | 750 | 750 | 750 | |||||||||||

Transition to the ongoing senior management team(a)(d) |

100 | 466 | 1,822 | 90 | 2,824 | |||||||||||

Transition to a public company(a)(e) |

1,469 | 38 | 4,197 | (2,197 | ) | 10,012 | ||||||||||

Tax impact of adjusting items(g) |

(1,444 | ) | (982 | ) | (5,450 | ) | (4,311 | ) | (47,451 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Adjusted net income |

$ | 6,619 | $ | 261 | $ | 75,690 | $ | 23,126 | $ | 134,559 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 2,167 | $ | (3,261 | ) | $ | 57,763 | $ | 15,401 | $ | 48,788 | |||||

Adjustments: |

||||||||||||||||

Interest expense |

6,067 | 8,126 | 31,280 | 32,607 | 21,680 | |||||||||||

Income tax expense (benefit) |

613 | (1,639 | ) | 11,852 | 16,658 | 16,497 | ||||||||||

Depreciation and amortization expense(h) |

6,539 | 5,703 | 24,777 | 20,769 | 11,675 | |||||||||||

Non-cash stock-based compensation expense(a) |

4,005 | 3,010 | 13,247 | 13,393 | 118,415 | |||||||||||

Long-lived asset impairment(a) |

94 | — | 1,236 | — | 1,221 | |||||||||||

Loss on early extinguishment of debt and accelerated amortization of deferred financing fees(f) |

— | — | 1,330 | — | — | |||||||||||

Investments in new retail locations and international market expansion(a)(b) |

228 | 240 | 795 | — | — | |||||||||||

Transition to Cortec majority ownership(a)(c) |

— | 750 | 750 | 750 | 750 | |||||||||||

Transition to the ongoing senior management team(a)(d) |

100 | 466 | 1,822 | 90 | 2,824 | |||||||||||

Transition to a public company(a)(e) |

1,469 | 38 | 4,197 | (2,197 | ) | 10,012 | ||||||||||

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 21,282 | $ | 13,433 | $ | 149,049 | $ | 97,471 | $ | 231,862 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net sales |

$ | 155,353 | $ | 135,257 | $ | 778,833 | $ | 639,239 | $ | 818,914 | ||||||

Operating income as a % of net sales |

5.7 | % | 2.4 | % | 13.1 | % | 10.0 | % | 10.8 | % | ||||||

Adjusted operating income as a % of net sales |

9.4 | % | 5.7 | % | 15.9 | % | 11.9 | % | 26.9 | % | ||||||

Net income (loss) as a % of net sales |

1.4 | % | (2.4 | )% | 7.4 | % | 2.4 | % | 6.0 | % | ||||||

Adjusted net income as a % of net sales |

4.3 | % | 0.2 | % | 9.7 | % | 3.6 | % | 16.4 | % | ||||||

Adjusted EBITDA as a % of net sales |

13.7 | % | 9.9 | % | 9.1 | % | 15.2 | % | 28.3 | % | ||||||

Net income (loss) per diluted share |

$ | 0.03 | $ | (0.04 | ) | $ | 0.69 | $ | 0.19 | $ | 0.59 | |||||

Adjusted net income per diluted share |

$ | 0.08 | $ | 0.00 | $ | 0.91 | $ | 0.28 | $ | 1.63 | ||||||

Weighted average common shares outstanding—diluted |

85,857 | 81,419 | 83,519 | 82,972 | 82,755 | |||||||||||

- (a)

- These

costs are reported in SG&A expenses.

- (b)

- Represents

retail store pre-opening expenses and costs for expansion into new international markets.

- (c)

- Represents

management service fees paid to Cortec, our majority stockholder. The management services agreement with Cortec was terminated immediately following the

completion of our IPO.

- (d)

- Represents

severance, recruiting, and relocation costs related to the transition to our ongoing senior management team.

- (e)

- Represents fees and expenses in connection with our transition to, and prior to our becoming, a public company, including consulting fees, recruiting fees, salaries, and travel costs related to members of our Board of Directors, fees associated with Sarbanes-Oxley Act compliance, and incremental audit and legal fees associated with being a public company. The 2017 activity primarily consists of the reversal of a previously recognized consulting fee that was contingent upon the completion of our IPO attempt during 2016.

14

- (f)

- Represents

the loss on extinguishment of debt of $0.7 million and accelerated amortization of deferred financing fees of $0.6 million resulting from

the voluntary repayments and prepayments of the term loans under our Credit Facility. During the fourth quarter of fiscal 2018, we voluntarily repaid in full the $47.6 million outstanding

balance of the Term Loan B (as defined below) and made a voluntary repayment of $2.4 million to the Term Loan A (as defined below). During the third quarter of fiscal 2018, we made a voluntary

prepayment of $30.1 million to the Term Loan B. As a result of the voluntary repayment of the Term Loan B prior to its maturity on May 19, 2022, we recorded a loss from extinguishment of

debt relating to the write-off of unamortized financing fees associated with the Term Loan B.

- (g)

- Represents

the tax impact of adjustments calculated at 24.5% and 21.8% expected statutory tax rate for the three months ended March 30, 2019 and

March 31, 2018, respectively. For fiscal 2018, 2017, and 2016, the statutory tax rate used to calculate the tax impact of adjustments was 23%, 36%, and 36%, respectively.

- (h)

- Depreciation and amortization expenses are reported in SG&A expenses and cost of goods sold.

15

Investing in our common stock involves a high degree of risk. These risks include, but are not limited to, those material risks described below, each of which may be relevant to an investment decision. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including, but not limited to, the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes, before deciding whether to invest in shares of our common stock. Our business, financial condition, and operating results can be affected by a number of factors, whether currently known or unknown, including, but not limited to, those described below, any one or more of which could, directly or indirectly, cause our actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect our business, financial condition, operating results, and stock price. If any of the following risks or other risks actually occur, our business, financial condition, results of operations, and future prospects could be materially harmed. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

The following discussion of risk factors contains forward-looking statements. Because of the following factors, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to Our Business and Industry

Our business depends on maintaining and strengthening our brand to generate and maintain ongoing demand for our products, and a significant reduction in such demand could harm our results of operations.

The YETI name and premium brand image are integral to the growth of our business, as well as to the implementation of our strategies for expanding our business. Our success depends on the value and reputation of our brand, which, in turn, depends on factors such as the quality, design, performance, functionality, and durability of our products, the image of our e-commerce platform and retail partner floor spaces, our communication activities, including advertising, social media, and public relations, and our management of the customer experience, including direct interfaces through customer service. Maintaining, promoting, and positioning our brand are important to expanding our customer base, and will depend largely on the success of our marketing and merchandising efforts and our ability to provide consistent, high-quality customer experiences. We intend to make substantial investments in these areas in order to maintain and enhance our brand, and such investments may not be successful. Ineffective marketing, negative publicity, product diversion to unauthorized distribution channels, product or manufacturing defects, counterfeit products, unfair labor practices, and failure to protect the intellectual property rights in our brand are some of the potential threats to the strength of our brand, and those and other factors could rapidly and severely diminish customer confidence in us. Furthermore, these factors could cause our customers to lose the personal connection they feel with the YETI brand. We believe that maintaining and enhancing our brand image in our current markets and in new markets where we have limited brand recognition is important to expanding our customer base. If we are unable to maintain or enhance our brand in current or new markets, our growth strategy and results of operations could be harmed.

If we are unable to successfully design and develop new products, our business may be harmed.

To maintain and increase sales we must continue to introduce new products and improve or enhance our existing products. The success of our new and enhanced products depends on many factors, including anticipating consumer preferences, finding innovative solutions to consumer problems, differentiating our products from those of our competitors, and maintaining the strength of our brand. The design and

16

development of our products is costly, and we typically have several products in development at the same time. Problems in the design or quality of our products, or delays in product introduction, may harm our brand, business, financial condition, and results of operations.

Our business could be harmed if we are unable to accurately forecast our results of operations and growth rate.

We may not be able to accurately forecast our results of operations and growth rate. Forecasts may be particularly challenging as we expand into new markets and geographies and develop and market new products. Our historical sales, expense levels, and profitability may not be an appropriate basis for forecasting future results.

Failure to accurately forecast our results of operations and growth rate could cause us to make poor operating decisions and we may not be able to adjust in a timely manner. Consequently, actual results could be materially lower than anticipated. Even if the markets in which we compete expand, we cannot assure you that our business will grow at similar rates, if at all.

We may not be able to effectively manage our growth.

As we grow our business, slower growing or reduced demand for our products, increased competition, a decrease in the growth rate of our overall market, failure to develop and successfully market new products, or the maturation of our business or market could harm our business. We expect to make significant investments in our research and development and sales and marketing organizations, expand our operations and infrastructure both domestically and internationally, design and develop new products, and enhance our existing products. In addition, in connection with operating as a public company, we will incur significant additional legal, accounting, and other expenses that we did not incur as a private company. If our sales do not increase at a sufficient rate to offset these increases in our operating expenses, our profitability may decline in future periods.

We have expanded our operations rapidly since our inception. Our employee headcount and the scope and complexity of our business have increased substantially over the past several years. We have only a limited history operating our business at its current scale. Our management team does not have substantial tenure working together. Consequently, if our operations continue to grow at a rapid pace, we may experience difficulties in managing this growth and building the appropriate processes and controls. Continued growth may increase the strain on our resources, and we could experience operating difficulties, including difficulties in sourcing, logistics, recruiting, maintaining internal controls, marketing, designing innovative products, and meeting consumer needs. If we do not adapt to meet these evolving challenges, the strength of our brand may erode, the quality of our products may suffer, we may not be able to deliver products on a timely basis to our customers, and our corporate culture may be harmed.

Our marketing strategy of associating our brand and products with activities rooted in passion for the outdoors may not be successful with existing and future customers.

We believe that we have been successful in marketing our products by associating our brand and products with activities rooted in passion for the outdoors. To sustain long-term growth, we must continue to successfully promote our products to consumers who identify with or aspire to these activities, as well as to individuals who simply value products of uncompromising quality and design. If we fail to continue to successfully market and sell our products to our existing customers or expand our customer base, our sales could decline, or we may be unable to grow our business.

If we fail to attract new customers, or fail to do so in a cost-effective manner, we may not be able to increase sales.

Our success depends, in part, on our ability to attract customers in a cost-effective manner. In order to expand our customer base, we must appeal to and attract customers ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. We have

17

made, and we expect that we will continue to make, significant investments in attracting new customers, including through the use of YETI Ambassadors, traditional, digital, and social media, original YETI films, and participation in, and sponsorship of, community events. Marketing campaigns can be expensive and may not result in the cost-effective acquisition of customers. Further, as our brand becomes more widely known, future marketing campaigns may not attract new customers at the same rate as past campaigns. If we are unable to attract new customers, our business will be harmed.

Our growth depends, in part, on expanding into additional consumer markets, and we may not be successful in doing so.

We believe that our future growth depends not only on continuing to reach our current core demographic, but also continuing to broaden our retail partner and customer base. The growth of our business will depend, in part, on our ability to continue to expand our retail partner and customer bases in the United States, as well as into international markets, including Canada, Australia, Europe, Japan, and China. In these markets, we may face challenges that are different from those we currently encounter, including competitive, merchandising, distribution, hiring, and other difficulties. We may also encounter difficulties in attracting customers due to a lack of consumer familiarity with or acceptance of our brand, or a resistance to paying for premium products, particularly in international markets. We continue to evaluate marketing efforts and other strategies to expand the customer base for our products. In addition, although we are investing in sales and marketing activities to further penetrate newer regions, including expansion of our dedicated sales force, we cannot assure you that we will be successful. If we are not successful, our business and results of operations may be harmed.

Our net sales and profits depend on the level of customer spending for our products, which is sensitive to general economic conditions and other factors; during a downturn in the economy, consumer purchases of discretionary items are affected, which could materially harm our sales, profitability, and financial condition.

Our products are discretionary items for customers. Therefore, the success of our business depends significantly on economic factors and trends in consumer spending. There are a number of factors that influence consumer spending, including actual and perceived economic conditions, consumer confidence, disposable consumer income, consumer credit availability, unemployment, and tax rates in the markets where we sell our products. Consumers also have discretion as to where to spend their disposable income and may choose to purchase other items or services if we do not continue to provide authentic, compelling, and high-quality products at appropriate price points. As global economic conditions continue to be volatile and economic uncertainty remains, trends in consumer discretionary spending also remain unpredictable and subject to declines. Any of these factors could harm discretionary consumer spending, resulting in a reduction in demand for our premium products, decreased prices, and harm to our business and results of operations. Moreover, consumer purchases of discretionary items tend to decline during recessionary periods when disposable income is lower or during other periods of economic instability or uncertainty, which may slow our growth more than we anticipate. A downturn in the economies in markets in which we sell our products, particularly in the United States, may materially harm our sales, profitability, and financial condition.

The markets in which we compete are highly competitive and include numerous other brands and retailers that offer a wide variety of products that compete with our products; if we fail to compete effectively, we could lose our market position.

The markets in which we compete are highly competitive, with low barriers to entry. Numerous other brands and retailers offer a wide variety of products that compete with our cooler, drinkware, and other products, including our bags, storage, and outdoor lifestyle products and accessories. Competition in these product markets is based on a number of factors including product quality, performance, durability, styling, brand image and recognition, and price. We believe that we are one of the market leaders in both the U.S.

18