Form 6-K SHOPIFY INC. For: Apr 17

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of | April | 2019 | |

Commission File Number | 001-37400 | ||

Shopify Inc. | |||

(Translation of registrant’s name into English) | |||

150 Elgin Street, 8th Floor Ottawa, Ontario, Canada K2P 1L4 | |||

(Address of principal executive offices) | |||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | Form 40-F | X | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

DOCUMENTS INCLUDED AS PART OF THIS REPORT

Exhibit

99.1 | Shopify Inc. – 2018 Year In Review |

99.2 | Shopify Inc. – Financial Statements for the year ended December 31, 2018 |

99.3 | Shopify Inc. – Management’s Discussion and Analysis for the year ended December 31, 2018 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Shopify Inc. | |||||

(Registrant) | |||||

Date: | April 17, 2019 | By: | /s/ Joseph A. Frasca | ||

Name: Joseph A. Frasca Title: Chief Legal Officer and Corporate Secretary | |||||

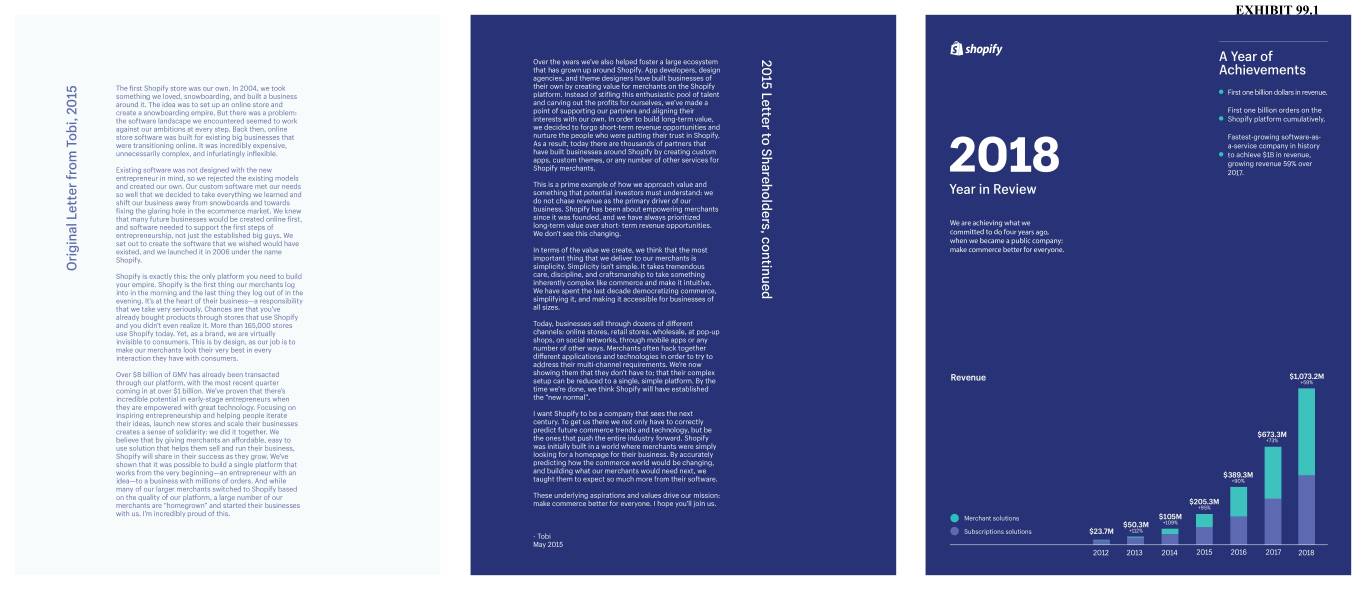

EXHIBIT 99.1 Over the years we’ve also helped foster a large ecosystem 2015 Letter to Shareholders, continued A Year of that has grown up around Shopify. App developers, design Achievements agencies, and theme designers have built businesses of The irst Shopify store was our own. In 2004, we took their own by creating value for merchants on the Shopify First one billion dollars in revenue. something we loved, snowboarding, and built a business platform. Instead of sti ling this enthusiastic pool of talent around it. The idea was to set up an online store and and carving out the pro its for ourselves, we’ve made a create a snowboarding empire. But there was a problem: point of supporting our partners and aligning their First one billion orders on the the software landscape we encountered seemed to work interests with our own. In order to build long-term value, Shopify platform cumulatively. against our ambitions at every step. Back then, online we decided to forgo short-term revenue opportunities and store software was built for existing big businesses that nurture the people who were putting their trust in Shopify. Fastest-growing software-as- were transitioning online. It was incredibly expensive, As a result, today there are thousands of partners that a-service company in history unnecessarily complex, and infuriatingly in lexible. have built businesses around Shopify by creating custom to achieve $1B in revenue, apps, custom themes, or any number of other services for growing revenue 59% over Shopify merchants. Existing software was not designed with the new 2017. entrepreneur in mind, so we rejected the existing models 2018 and created our own. Our custom software met our needs This is a prime example of how we approach value and so well that we decided to take everything we learned and something that potential investors must understand: we Year in Review shift our business away from snowboards and towards do not chase revenue as the primary driver of our ixing the glaring hole in the ecommerce market. We knew business. Shopify has been about empowering merchants that many future businesses would be created online irst, since it was founded, and we have always prioritized We are achieving what we and software needed to support the irst steps of long-term value over short- term revenue opportunities. entrepreneurship, not just the established big guys. We We don’t see this changing. committed to do four years ago, set out to create the software that we wished would have when we became a public company: existed, and we launched it in 2006 under the name In terms of the value we create, we think that the most make commerce better for everyone. Shopify. important thing that we deliver to our merchants is simplicity. Simplicity isn’t simple. It takes tremendous Original Letter from Tobi, 2015 Tobi, from Original Letter Shopify is exactly this: the only platform you need to build care, discipline, and craftsmanship to take something your empire. Shopify is the irst thing our merchants log inherently complex like commerce and make it intuitive. into in the morning and the last thing they log out of in the We have spent the last decade democratizing commerce, evening. It’s at the heart of their business—a responsibility simplifying it, and making it accessible for businesses of that we take very seriously. Chances are that you’ve all sizes. already bought products through stores that use Shopify and you didn’t even realize it. More than 165,000 stores Today, businesses sell through dozens of di

erent use Shopify today. Yet, as a brand, we are virtually channels: online stores, retail stores, wholesale, at pop-up invisible to consumers. This is by design, as our job is to shops, on social networks, through mobile apps or any make our merchants look their very best in every number of other ways. Merchants often hack together interaction they have with consumers. di

erent applications and technologies in order to try to address their multi-channel requirements. We’re now showing them that they don’t have to; that their complex Over $8 billion of GMV has already been transacted Revenue $1,073.2M through our platform, with the most recent quarter setup can be reduced to a single, simple platform. By the +59% coming in at over $1 billion. We’ve proven that there’s time we’re done, we think Shopify will have established incredible potential in early-stage entrepreneurs when the “new normal”. they are empowered with great technology. Focusing on inspiring entrepreneurship and helping people iterate I want Shopify to be a company that sees the next their ideas, launch new stores and scale their businesses century. To get us there we not only have to correctly predict future commerce trends and technology, but be creates a sense of solidarity: we did it together. We $673.3M believe that by giving merchants an a

ordable, easy to the ones that push the entire industry forward. Shopify +73% use solution that helps them sell and run their business, was initially built in a world where merchants were simply Shopify will share in their success as they grow. We’ve looking for a homepage for their business. By accurately shown that it was possible to build a single platform that predicting how the commerce world would be changing, and building what our merchants would need next, we works from the very beginning—an entrepreneur with an $389.3M idea—to a business with millions of orders. And while taught them to expect so much more from their software. +90% many of our larger merchants switched to Shopify based on the quality of our platform, a large number of our These underlying aspirations and values drive our mission: make commerce better for everyone. I hope you’ll join us. $205.3M merchants are “homegrown” and started their businesses +95% with us. I’m incredibly proud of this. Merchant solutions $105M $50.3M +109% Subscriptions solutions $23.7M +112% - Tobi May 2015 2012 2013 2014 2015 2016 2017 2018

Taking the Path that Leads to More Entrepreneurs cohort o

setscohort thedeclineinrevenue from merchants leaving theplatform. model: theincrease inrevenue from remaining merchants growing withina growth comingfrom illustratesthestrength eachcohort ofourbusiness platformthe Shopify atdi

erent inourhistory. times Theconsistent revenue The above displays chart theannualrevenue for merchant thatjoined cohorts Revenue By AnnualCohort Monthly Recurring Revenue Merchant Growth Count By In2018 Continent Global Growth Africa 45% 2015 $1.1M 2012 Q1 48% Asia 2016 2013 Q1 Europe 44% 2017 2014 America Q1 North 31% 2018 70% CAGR Oceania 2015 Q1 27% America Pre-2016 2016 2017 2018 2016 South 69% Q1 2017 Q1 December31, 2018 * Revenue andmerchants asat for ourmerchants. objectivesaccomplish these -- are undertaken to partnerships, orinacquisitions platform development, in -- whetherinproduct and Allofourinvestmentsbusiness. and grow ontheir sales operate,making iteasiertostart, empowering merchants, by better for everyone by We are makingcommerce room for learnings. these modelmakesand ourbusiness something thatdidn’t work, discoverythe successful of failure canalsobeviewed as At Shopify, we know that on theirjourney to success. failoften -more thanonce- entrepreneurssuccessful come great but success, With entrepreneurship can We encourage entrepreneurship. USA Canada W Rest ofthe 24% Merchants 12% Reven ue 55% Merchants 70% Revenue 7% Merchants 7% Revenue orld 2018 Q1 $40.9M 7% Merchants 4% Revenue 8% Merchants 6% Revenue Australia UK Simplifying Merchant Operations Orders OnShopify New Products AndFeatures 2018 As ofDecember31, 2018 Portugese. andBrazilian Japanese, German, Italian, * Languagesinclude:French, Spanish, Dashboard Marketing Mobile Languages* 66% +6 methods Payment Local Locations Desktop 34% Protect Fraud 2019 into acompetitive advantage. all helpmerchants turn mobile card reader andmobilephone, in-person payments with a sale (POS) app, whichenables andourpointof businesses; for(AR) accessible small selling withAugmented Reality AR,Shopify whichmakes Pay, ApplePay andGooglePay accelerators suchasShopify since. Ourintegrated checkout to track aheadof the industry desktop, andhave continued devices surpassedthosefrom to merchants from mobile devices. Inearly2016, orders their storefronts viamobile easy for merchants tomanage app in2010, whichmakes it We Mobile launchedtheShopify playbook for nearlyadecade. ofShopify’s part important Mobile deviceshave beenan and securingworking capital. accepting payments, shipping, commonly require, including functionality merchants the broad array ofother Merchant Solutionsaddress platform. Inaddition,our fromaccessible withinthe anddomainseasily themes, also makes apps,custom in-person, Shopify’s platform channels, marketplaces, and social other onlinespaces, over anonlinestore, blogsand mobile, andenablingselling merchants, optimized for feature-rich platform. Builtfor running onanincredibly merchants togetupand subscription packagesenable they love. Shopify’s that aspects oftheirbusiness resources tofocus onthe they canfree upmore time, money, ande

ort, so platform tosave merchants continually improving the Central toourmissionis ; Catalyzing Merchants’ Sales Buyers From Stores Shopify online shoppers 163 millionin2017 to218millionin2018. merchants’ stores grew onShopify 34% from The numberofconsumers buying from GMV 28 million 2014 $0.7B 2012 online shoppers 57 million 2015 $1.6B +128% 2013 online shoppers 100 million 2016 $3.8B +133% 2014 online shoppers 163 million 2017 $7.7B +105% 2015 online shoppers 218 million 2018 $15.4B +99% 2016 among entrepreneurs. and community-building for education, engagement, new spaceinLos built Angeles Shop Classprograms, andour communityforums,Shopify through blogs, Shopify their brands and businesses our merchants onhow togrow plans. Assuch,we educate and upgrade their Shopify growth Capital, withShopify Shipping,fundtheir Shopify ship more products with process more transactions, revenue we generate asthey on ourplatform, themore The more ourmerchants sell with thoseofourmerchants. Our goalsare closelyaligned $26.3B 2017 +71% $41.1B +56% 2018

EXHIBIT 99.2

Consolidated Financial Statements

December 31, 2018

Management's Annual Report on Internal Control Over Financial Reporting

Management of the Company, under the supervision of the Chief Executive Officer and the Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over the Company's financial reporting. Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with United States generally accepted accounting principles.

We, including the Chief Executive Officer and Chief Financial Officer, have assessed the effectiveness of the Company's internal control over financial reporting in accordance with Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on this assessment, we, including the Chief Executive Officer and Chief Financial Officer, have determined that the Company's internal control over financial reporting was effective as at December 31, 2018. Additionally, based on our assessment, we determined that there were no material weaknesses in the Company's internal control over financial reporting as at December 31, 2018.

The effectiveness of the Company's internal control over financial reporting as at December 31, 2018 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report included herein.

February 12, 2019

/s/ Tobias Lütke |

Tobias Lütke |

Chief Executive Officer |

/s/ Amy Shapero |

Amy Shapero |

Chief Financial Officer |

2

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Shopify Inc.

Opinions on the Financial Statements and Internal Control over Financial Reporting

We have audited the accompanying consolidated balance sheets of Shopify Inc. and its subsidiaries, (the “Company”) as of December 31, 2018 and 2017, and the related consolidated statements of operations and comprehensive loss, changes in shareholders' equity and cash flows for the years then ended, including the related notes (collectively referred to as the “consolidated financial statements”). We also have audited the Company's internal control over financial reporting as of December 31, 2018, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2018, based on criteria established in Internal Control - Integrated Framework (2013) issued by the COSO.

Change in Accounting Principle

As discussed in Note 3 to the consolidated financial statements, the Company changed the manner in which it accounts for revenues from contracts with customers in 2018.

Basis for Opinions

The Company's management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Annual Report on Internal Control over Financial Reporting. Our responsibility is to express opinions on the Company’s consolidated financial statements and on the Company's internal control over financial reporting based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was maintained in all material respects.

Our audits of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions

3

are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ PricewaterhouseCoopers LLP

Chartered Professional Accountants, Licensed Public Accountants

Ottawa, Canada

February 12, 2019

We have served as the Company’s auditor since 2011, which includes periods before the Company became subject to SEC reporting requirements.

4

Shopify Inc.

Consolidated Balance Sheets

Expressed in US $000’s except share amounts

As at | |||||||

December 31, 2018 | December 31, 2017 | ||||||

Note | $ | $ | |||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | 4 | 410,683 | 141,677 | ||||

Marketable securities | 5 | 1,558,987 | 796,362 | ||||

Trade and other receivables, net | 6 | 41,347 | 21,939 | ||||

Merchant cash advances and loans receivable, net | 7 | 91,873 | 47,101 | ||||

Other current assets | 8 | 26,192 | 18,598 | ||||

2,129,082 | 1,025,677 | ||||||

Long-term assets | |||||||

Property and equipment, net | 9 | 61,612 | 50,360 | ||||

Intangible assets, net | 10 | 26,072 | 17,210 | ||||

Goodwill | 11 | 38,019 | 20,317 | ||||

125,703 | 87,887 | ||||||

Total assets | 2,254,785 | 1,113,564 | |||||

Liabilities and shareholders’ equity | |||||||

Current liabilities | |||||||

Accounts payable and accrued liabilities | 12 | 96,956 | 62,576 | ||||

Current portion of deferred revenue | 13 | 39,180 | 30,694 | ||||

Current portion of lease incentives | 14 | 2,552 | 1,484 | ||||

138,688 | 94,754 | ||||||

Long-term liabilities | |||||||

Deferred revenue | 13 | 1,881 | 1,352 | ||||

Lease incentives | 14 | 22,316 | 14,970 | ||||

Deferred tax liability | 20 | 1,132 | 1,388 | ||||

25,329 | 17,710 | ||||||

Commitments and contingencies | 16 | ||||||

Shareholders’ equity | |||||||

Common stock, unlimited Class A subordinate voting shares authorized, 98,081,889 and 87,067,604 issued and outstanding; unlimited Class B multiple voting shares authorized, 12,310,800 and 12,810,084 issued and outstanding | 17 | 2,215,936 | 1,077,477 | ||||

Additional paid-in capital | 74,805 | 43,392 | |||||

Accumulated other comprehensive income (loss) | 18 | (12,216 | ) | 3,435 | |||

Accumulated deficit | (187,757 | ) | (123,204 | ) | |||

Total shareholders’ equity | 2,090,768 | 1,001,100 | |||||

Total liabilities and shareholders’ equity | 2,254,785 | 1,113,564 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

On Behalf of the Board:

"/s/ Tobias Lütke" | "/s/ Steven Collins" |

Tobias Lütke | Steven Collins |

Chairman, Board of Directors | Chairman, Audit Committee |

5

Shopify Inc.

Consolidated Statements of Operations and Comprehensive Loss

Expressed in US $000’s, except share and per share amounts

Years ended | |||||||||

December 31, 2018 | December 31, 2017 | ||||||||

Note | $ | $ | |||||||

Revenues | |||||||||

Subscription solutions | 21 | 464,996 | 310,031 | ||||||

Merchant solutions | 21 | 608,233 | 363,273 | ||||||

1,073,229 | 673,304 | ||||||||

Cost of revenues | |||||||||

Subscription solutions | 100,990 | 61,267 | |||||||

Merchant solutions | 375,972 | 231,784 | |||||||

476,962 | 293,051 | ||||||||

Gross profit | 596,267 | 380,253 | |||||||

Operating expenses | |||||||||

Sales and marketing | 350,069 | 225,694 | |||||||

Research and development | 230,674 | 135,997 | |||||||

General and administrative | 107,444 | 67,719 | |||||||

Total operating expenses | 688,187 | 429,410 | |||||||

Loss from operations | (91,920 | ) | (49,157 | ) | |||||

Other income | |||||||||

Interest income, net | 29,436 | 7,850 | |||||||

Foreign exchange gain (loss) | (2,069 | ) | 1,312 | ||||||

27,367 | 9,162 | ||||||||

Net loss | (64,553 | ) | (39,995 | ) | |||||

Other comprehensive income (loss), net of tax | |||||||||

Unrealized gain (loss) on cash flow hedges | 18 | (15,651 | ) | 5,253 | |||||

Comprehensive loss | (80,204 | ) | (34,742 | ) | |||||

Basic and diluted net loss per share attributable to shareholders | 19 | $ | (0.61 | ) | $ | (0.42 | ) | ||

Weighted average shares used to compute basic and diluted net loss per share attributable to shareholders | 19 | 105,671,839 | 95,774,897 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

Shopify Inc.

Statements of Changes in Shareholders’ Equity

Expressed in US $000’s except share amounts

Common Stock | Additional Paid-In Capital $ | Accumulated Other Comprehensive Income (Loss) $ | Accumulated Deficit $ | Total $ | ||||||||||||||||

Note | Shares | Amount $ | ||||||||||||||||||

As at December 31, 2016 | 89,405,480 | 468,494 | 27,009 | (1,818 | ) | (83,209 | ) | 410,476 | ||||||||||||

Exercise of stock options | 3,322,993 | 24,959 | (10,185 | ) | — | — | 14,774 | |||||||||||||

Stock-based compensation | — | — | 50,535 | — | — | 50,535 | ||||||||||||||

Vesting of restricted share units | 824,215 | 23,967 | (23,967 | ) | — | — | — | |||||||||||||

Issuance of Class A subordinate voting shares, net of offering costs of $15,518 | 17 | 6,325,000 | 560,057 | — | — | — | 560,057 | |||||||||||||

Net loss and comprehensive loss for the year | — | — | — | 5,253 | (39,995 | ) | (34,742 | ) | ||||||||||||

As at December 31, 2017 | 99,877,688 | 1,077,477 | 43,392 | 3,435 | (123,204 | ) | 1,001,100 | |||||||||||||

Exercise of stock options | 2,179,999 | 48,408 | (17,914 | ) | — | — | 30,494 | |||||||||||||

Stock-based compensation | — | — | 97,690 | — | — | 97,690 | ||||||||||||||

Vesting of restricted share units | 935,002 | 48,363 | (48,363 | ) | — | — | — | |||||||||||||

Issuance of Class A subordinate voting shares, net of offering costs of $16,312 | 17 | 7,400,000 | 1,041,688 | — | — | — | 1,041,688 | |||||||||||||

Net loss and comprehensive loss for the year | — | — | — | (15,651 | ) | (64,553 | ) | (80,204 | ) | |||||||||||

As at December 31, 2018 | 110,392,689 | 2,215,936 | 74,805 | (12,216 | ) | (187,757 | ) | 2,090,768 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

Shopify Inc.

Consolidated Statements of Cash Flows

Expressed in US $000’s

Years ended | |||||||

December 31, 2018 | December 31, 2017 | ||||||

Note | $ | $ | |||||

Cash flows from operating activities | |||||||

Net loss for the year | (64,553) | (39,995) | |||||

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Amortization and depreciation | 27,052 | 23,382 | |||||

Stock-based compensation | 95,720 | 49,163 | |||||

Provision for uncollectible receivables related to merchant cash advances and loans receivable | 7 | 5,922 | 2,606 | ||||

Unrealized foreign exchange (gain) loss | 1,272 | (1,604) | |||||

Changes in operating assets and liabilities: | |||||||

Trade and other receivables | (32,649) | (13,037) | |||||

Merchant cash advances and loans receivable | (50,694) | (37,811) | |||||

Other current assets | (10,816) | (3,706) | |||||

Accounts payable and accrued liabilities | 20,641 | 15,428 | |||||

Deferred revenue | 9,015 | 10,960 | |||||

Lease incentives | 8,414 | 2,515 | |||||

Net cash provided by operating activities | 9,324 | 7,901 | |||||

Cash flows from investing activities | |||||||

Purchase of marketable securities | (2,447,955) | (1,129,263) | |||||

Maturity of marketable securities | 1,698,264 | 642,073 | |||||

Acquisitions of property and equipment | (27,950) | (20,043) | |||||

Acquisitions of intangible assets | (13,595) | (4,219) | |||||

Acquisition of businesses, net of cash acquired | 22 | (19,397) | (15,718) | ||||

Net cash used by investing activities | (810,633) | (527,170) | |||||

Cash flows from financing activities | |||||||

Proceeds from the exercise of stock options | 30,494 | 14,774 | |||||

Proceeds from public offering, net of issuance costs | 17 | 1,041,688 | 560,057 | ||||

Net cash provided by financing activities | 1,072,182 | 574,831 | |||||

Effect of foreign exchange on cash and cash equivalents | (1,867) | 2,102 | |||||

Net increase in cash and cash equivalents | 269,006 | 57,664 | |||||

Cash and cash equivalents – Beginning of Year | 141,677 | 84,013 | |||||

Cash and cash equivalents – End of Year | 410,683 | 141,677 | |||||

Non-cash investing activities: | |||||||

Acquired property and equipment remaining unpaid | 1,931 | 1,764 | |||||

Acquired intangible assets remaining unpaid | 322 | — | |||||

Capitalized stock-based compensation | 1,970 | 1,372 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

8

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

1. | Nature of Business |

Shopify Inc. (“Shopify” or the “Company”) was incorporated as a Canadian corporation on September 28, 2004. The Company’s mission is to make commerce better for everyone. Shopify is the leading cloud-based, multi-channel commerce platform. The Company builds web- and mobile-based software and lets merchants easily set up beautiful online storefronts that are rich with retail functionality. Merchants use the Company's software to run their business across all of their sales channels, including web and mobile storefronts, physical retail locations, social media storefronts, and marketplaces. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships, source products, leverage analytics and reporting, and access financing, all from one integrated back office.

The Company’s headquarters and principal place of business are in Ottawa, Canada.

2. | Basis of Presentation and Consolidation |

These consolidated financial statements include the accounts of the Company and its directly and indirectly wholly owned subsidiaries including, but not limited to: Shopify Payments (Canada) Inc., incorporated in Canada; Shopify International Limited, incorporated in Ireland; Shopify Capital Inc., incorporated in the state of Virginia in the United States; and Shopify LLC, Shopify Payments (USA) Inc. and Shopify Holdings (USA) Inc., incorporated in the state of Delaware in the United States. All intercompany accounts and transactions have been eliminated upon consolidation.

These consolidated financial statements of the Company have been presented in United States dollars (USD) and have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP), including the applicable rules and regulations of the Securities and Exchange Commission (SEC) regarding financial reporting.

3. | Significant Accounting Policies |

Use of Estimates

The preparation of consolidated financial statements, in accordance with U.S. GAAP, requires management to make estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates, judgments and assumptions in these consolidated financial statements include: key judgments related to revenue recognition in determining whether the Company is the principal or an agent to the arrangements with merchants, and the estimated period over which contract costs should be amortized; provision for uncollectible receivables related to merchant cash advances and loans; recoverability of deferred tax assets; and fair value of acquired intangible assets. Actual results may differ from the estimates made by management.

Revenue Recognition

The Company's sources of revenue consist of subscription solutions and merchant solutions. The Company principally generates subscription solutions revenue through the sale of subscriptions to the platform. The Company also generates additional subscription solutions revenues from the sale of themes and apps, the registration of domain names, and the collection of variable platform fees. The Company generates merchant solutions revenue by providing additional services to merchants to increase their use of the platform. The majority of the Company's merchant solutions revenue is from fees earned from merchants based on their customer orders processed through Shopify Payments. The Company also earns merchant solutions revenue relating to Shopify Shipping, Shopify Capital, other transaction services and referral fees, as well as from the sale of Point-of-Sale (POS) hardware. Arrangements with merchants do not provide the merchants with the right to take possession of the software supporting the Company’s hosting platform at any time and are therefore

9

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

accounted for as service contracts. The Company’s subscription service contracts do not provide for refunds or any other rights of return to merchants in the event of cancellations.

The Company recognizes revenue to depict the transfer of promised services to merchants in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those services by applying the following steps:

•Identify the contract with a merchant;

•Identify the performance obligations in the contract;

•Determine the transaction price;

•Allocate the transaction price; and

•Recognize revenue when, or as, the Company satisfies a performance obligation.

The Company follows the guidance provided in ASC 606-10, Principal versus Agent Considerations, for determining whether the Company should recognize revenue based on the gross amount billed to a merchant or the net amount retained. This determination is a matter of judgment that depends on the facts and circumstances of each arrangement. The Company recognizes revenue from Shopify Shipping and the sales of apps on a net basis as the Company is not primarily responsible for the fulfillment and does not have control of the promised service, and therefore is the agent in the arrangement with merchants. All other revenue is reported on a gross basis, as the Company has determined it is the principal in the arrangement.

Sales taxes collected from merchants and remitted to government authorities are excluded from revenue.

The Company's arrangements with merchants can include multiple services or performance obligations, which may consist of some or all of the Company's subscription solutions. When contracts involve various performance obligations, the Company evaluates whether each performance obligation is distinct and should be accounted for as a separate unit of accounting under Topic 606. In the case of subscription solutions, the Company has determined that merchants can benefit from the service on its own, and that the service being provided to the merchant is separately identifiable from other promises in the contract. Specifically, the Company considers the distinct performance obligations to be the subscription solution, custom themes, feature-enhancing apps and unique domain names. The total transaction price is determined at the inception of the contract and allocated to each performance obligation based on their relative standalone selling prices. In the case of merchant solutions, the transaction price for each performance obligation is based on an observable standalone selling price that is never bundled, therefore the relative allocation is not required.

The Company determined the standalone selling price by considering its overall pricing objectives and market conditions. Significant pricing practices taken into consideration for our subscription solutions include discounting practices, the size and volume of our transactions, the customer demographic, the geographic area where services are sold, price lists, our go-to-market strategy, historical standalone sales and contract prices. The determination of standalone selling prices is made through consultation with and approval by our management, taking into consideration our go-to-market strategy. As the Company's go-to-market strategies evolve, the Company may modify its pricing practices in the future, which could result in changes in relative standalone selling prices.

The Company generally receives payment from its merchants at the time of invoicing. In all other cases, payment terms and conditions vary by contract type, although terms generally include a requirement for payment within 30 days of the invoice date. In instances where timing of revenue recognition differs from the timing of invoicing and subsequent payment, we have determined our contracts generally do not include a significant financing component.

10

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

Subscription Solutions

Subscription revenue is recognized over time on a ratable basis over the contractual term. The contract terms are monthly, annual or multi-year subscription terms. Revenue recognition begins on the date that the Company’s service is made available to the merchant. Certain subscription contracts have a transaction price that includes a variable component that is based on the merchants' volume of sales. In such cases, the Company uses the practical expedient that allows it to determine the transaction price and recognize revenue in the amount to which the Company has a right to invoice. Payments received in advance of services being rendered are recorded as deferred revenue and recognized ratably over time, over the requisite service period.

Revenue from the sale of separately priced themes and apps is recognized at the time of the sale. The right to use domain names is also sold separately and is recognized ratably over time, over the contractual term, which is generally an annual term. Revenue from themes, as well as apps and domains have been classified within subscription solutions on the basis that they are typically sold at the time the merchant enters into the subscription services arrangement or because they are charged on a recurring basis.

Merchant Solutions

Revenues earned from Shopify Payments, Shopify Shipping, other transaction services, and referral fees are recognized at a point in time, at the time of the transaction. For the sale of POS hardware, revenue is recognized at a point in time, based on when ownership passes to the merchant, in accordance with the shipping terms. The Company earns revenue from Shopify Capital, a merchant cash advance (MCA) and loan program for eligible merchants. The Company evaluates identified underwriting criteria such as, but not limited to, historical sales data prior to purchasing the eligible merchant's future receivables, or making a loan, to help ensure collectibility. Under Shopify Capital, the Company purchases a designated amount of future receivables at a discount or makes a loan, and the merchant remits a fixed percentage of their daily sales to the Company, until the outstanding balance has been fully remitted. For Shopify Capital MCA's, the Company applies a percentage of the remittances collected against the merchant's receivable balance, and a percentage, which is related to the discount, as merchant solutions revenue. For Shopify Capital loans, because there is a fixed maximum repayment term, the Company calculates an effective interest rate based on the merchant's expected future payment volume to determine how much of a merchant's repayment to recognize as revenue and how much to apply against the merchant's receivable balance.

Capitalized Contract Costs

As part of obtaining contracts with certain merchants, the Company incurs upfront costs such as sales commissions. The Company capitalizes these contract costs, which are subsequently amortized on a systematic basis consistent with the pattern of the transfer of the good or service to which the contract asset relates, which is generally on a straight-line basis over the estimated life of the merchant relationship. In some instances, the Company applies the practical expedient that allows it to determine this estimate for a portfolio of contracts that have similar characteristics in terms of type of service, contract term and pricing. This estimate is reviewed by management at the end of each reporting period as additional information becomes available. For certain contracts where the amortization period of the contract costs would have been one year or less, the Company uses the practical expedient that allows it to recognize the incremental costs of obtaining those contracts as an expense when incurred and not consider the time value of money.

Cost of Revenues

The Company’s cost of revenues consists of payments for Themes and Domain registration, credit card fees, third-party infrastructure and hosting costs, an allocation of costs incurred by both the operations and support functions, and amortization of capitalized software development costs. In addition, included in the cost of merchant solutions are costs associated with credit card processing, and the cost of POS hardware.

11

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

Software Development Costs

Research and development costs are generally expensed as incurred. These costs primarily consist of personnel and related expenses, contractor and consultant fees, stock-based compensation, and corporate overhead allocations, including depreciation.

The Company capitalizes certain development costs incurred in connection with its internal use software. These capitalized costs are related to the development of its software platform that is hosted by the Company and accessed by its merchants on a subscription basis as well as material internal infrastructure software. Costs incurred in the preliminary stages of development are expensed as incurred. The Company capitalizes all direct and incremental costs incurred during the application development phase, until such time when the software is substantially complete and ready for its intended use. Capitalization ceases upon completion of all substantial testing.

The Company also capitalizes costs related to specific upgrades and enhancements when it is probable the expenditures will result in additional features and functionality. Capitalized costs are recorded as part of intangible assets in the consolidated balance sheets and are amortized on a straight-line basis over their estimated useful lives of two or three years. Maintenance costs are expensed as incurred.

Advertising Costs

Advertising costs are expensed as incurred. Advertising costs included in sales and marketing expenses during the years ended December 31, 2018 and 2017 were $131,434 and $92,031 respectively.

Operating Leases

The total payments and costs associated with operating leases, including leases that contain lease inducements and uneven payments, are aggregated and amortized on a straight-line basis over the expected lease term of each respective agreement.

Stock-Based Compensation

The accounting for stock-based awards is based on the fair value of the award measured at the grant date. Accordingly, stock-based compensation cost is recognized in the Consolidated Statements of Operations and Comprehensive Loss as an operating expense over the requisite service period.

The fair value of stock options is determined using the Black-Scholes option-pricing model, single option approach. An estimate of forfeitures is applied when determining compensation expense. The Company determines the fair value of stock option awards on the date of grant using assumptions regarding expected term, share price volatility over the expected term of the awards, risk-free interest rate, and dividend rate. All shares issued under the Company's Fourth Amended and Restated Stock Option Plan (Legacy Option Plan), the Amended and Restated Stock Option Plan (Stock Option Plan), and the Amended and Restated Long Term Incentive Plan (Long Term Incentive Plan) are from treasury.

The fair value of restricted share units (RSUs) is measured using the fair value of the Company's shares as if the RSUs were vested and issued on the grant date. An estimate of forfeitures is applied when determining compensation expense. All shares issued under the Company's Long Term Incentive Plan (LTIP) are from treasury.

Income Taxes

Deferred tax assets and liabilities are determined based on the difference between the financial statement carrying amounts and the tax bases of assets and liabilities using enacted tax rates in effect for the year in

12

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amounts that are more likely than not to be realized.

The Company evaluates tax positions taken or expected to be taken in the course of preparing tax returns to determine whether the tax positions have met a “more-likely-than-not” threshold of being sustained by the applicable tax authority. Tax benefits related to tax positions not deemed to meet the “more-likely-than-not” threshold are not permitted to be recognized in the consolidated financial statements.

Earnings Per Share

Basic earnings per share are calculated by dividing net earnings attributable to common equity holders of the Company by the weighted average number of shares of common stock outstanding during the year.

Diluted earnings per share are calculated by dividing net earnings attributable to common equity holders of the Company by the weighted average number of shares of common stock outstanding during the year, plus the effect of dilutive potential common stock outstanding during the year. This method requires that diluted earnings per share be calculated (using the treasury stock method) as if all dilutive potential common stock had been exercised at the latest of the beginning of the year or on the date of issuance, as the case may be, and that the funds obtained thereby (plus an amount equivalent to the unamortized portion of related stock-based compensation costs) be used to purchase common stock of the Company at the average fair value of the common stock during the year.

Foreign Currency Transactions

The functional and reporting currency of the Company and its subsidiaries is the USD. Monetary assets and liabilities denominated in foreign currencies are re-measured to USD using the exchange rates at the consolidated balance sheet dates. Non-monetary assets and liabilities denominated in foreign currencies are measured in USD using historical exchange rates. Revenues and expenses are measured using the actual exchange rates prevailing on the dates of the transactions. Gains and losses resulting from re-measurement are recorded in the Company’s Consolidated Statements of Operations and Comprehensive Loss as Foreign exchange gain (loss), with the exception of foreign exchange forward contracts used for hedging which are re-measured in Other Comprehensive Income (Loss) and the gain (loss) is then reclassified into earnings to either cost of revenue or operating expenses in the same period, or period, during which the hedged transaction affects earnings.

Cash and Cash Equivalents

The Company considers all short term highly liquid investments purchased with original maturities at their acquisition date of three months or less to be cash equivalents.

Marketable Securities

The Company’s marketable securities consist of U.S. and Canadian federal agency bonds, U.S. term deposits, corporate bonds and money market funds, and mature within 12 months from the date of purchase. Marketable securities are classified as held-to-maturity at the time of purchase and this classification is re-evaluated as of each consolidated balance sheet date. Held-to-maturity securities represent those securities that the Company has both the intent and ability to hold to maturity and are carried at amortized cost, which approximates their fair market value. Interest on these securities, as well as amortization/accretion of premiums/discounts, are included in interest income. All investments are assessed as to whether any unrealized loss positions are other than temporarily impaired. Impairments are considered other than temporary if they are related to deterioration in credit risk or if it is likely the Company will sell the securities before the recovery of their cost basis. Realized gains and losses and declines in value determined to be other than temporary are determined based on the specific identification method and are reported in other income (expense) in the Consolidated Statements of Operations and Comprehensive Loss.

13

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

Fair Value Measurements

The carrying amounts for cash and cash equivalents, marketable securities, trade and other receivables, merchant cash advances receivable, loans, foreign exchange contracts, trade accounts payable and accruals, and employee related accruals approximate fair value due to the short-term maturities of these instruments.

The Company measures the fair value of its financial assets and liabilities using a fair value hierarchy. A financial instrument’s classification within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs may be used to measure fair value.

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation.

Derivatives and Hedging

The majority of the Company's derivative products are foreign exchange forward contracts, which are designated as cash flow hedges of foreign currency forecasted expenses. By their nature, derivative financial instruments involve risk, including the credit risk of non-performance by counter parties. The Company may hold foreign exchange forward contracts to mitigate the risk of future foreign exchange rate volatility related to future Canadian dollar (CAD) denominated costs and current and future obligations.

The Company's foreign currency forward contracts generally have maturities of twelve months or less. The critical terms match method is used when the key terms of the hedging instrument and that of the hedged item are aligned; therefore, the changes in fair value of the forward contracts are recorded in accumulated other comprehensive income (AOCI). The effective portion of the gain or loss on each forward contract is reported as a component of AOCI and reclassified into earnings to either cost of revenue or operating expense in the same period, or periods, during which the hedged transaction affects earnings. The ineffective portion of the gains or losses, if any, is recorded immediately in other income (expense).

For hedges that do not qualify for the critical terms match method of accounting, a formal assessment is performed to verify that derivatives used in hedging transactions continue to be highly effective in offsetting the changes in fair value or cash flows of the hedged item. Hedge accounting is discontinued if a derivative ceases to be highly effective, matures, is terminated or sold, if a hedged forecasted transaction is no longer probable of occurring, or if the Company removes the derivative's hedge designation. For discontinued cash flow hedges, the accumulated gain or loss on the derivative remains in AOCI and is reclassified into earnings in the period in which the previously hedged forecasted transaction impacts earnings or is no longer probable of occurring.

In addition, the Company has a master netting agreement with each of the Company's counterparties, which permits net settlement of multiple, separate derivative contracts with a single payment. The Company presents its derivative instruments on a net basis in the consolidated financial statements.

14

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

Provision for Uncollectible Receivables Related to Merchant Cash Advances and Loans

Merchant cash advance receivables and loans represent the aggregate amount of Shopify Capital related receivables owed by merchants as of the consolidated balance sheet date, net of an allowance for uncollectible amounts. The Company estimates the allowance based on an assessment of various factors, including historical trends, merchants' gross merchandise volume, and other factors that may affect the merchants' ability to make future payments on the receivables. Additions to the allowance are reflected in current operating results, while charges against the allowance are made when losses are incurred. These additions are classified within general and administrative expenses on the Consolidated Statements of Operations and Comprehensive Loss. Recoveries are reflected as a reduction in the allowance for uncollectible receivables related to merchant cash advances and loans when the recovery occurs.

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation. Depreciation is calculated using the straight-line method over the estimated useful lives of the related assets. Computer equipment is depreciated over the shorter of three years or their estimated useful lives while office furniture and equipment are depreciated over four years. Leasehold improvements are amortized on a straight-line basis over the shorter of their estimated useful lives or the term of their associated leases, which range from three to fifteen years.

The carrying values of property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amounts of such assets may not be recoverable. The determination of whether any impairment exists includes a comparison of estimated undiscounted future cash flows anticipated to be generated over the remaining life of the asset to the net carrying value of the asset. If the estimated undiscounted future cash flows associated with the asset are less than the carrying value, an impairment loss will be recorded based on the estimated fair value.

Intangible Assets

Intangible assets are stated at cost, less accumulated amortization. Amortization is calculated using the straight-line method over the estimated useful lives of the related assets. Purchased software, acquired technology, acquired customer relationships, and capitalized software development costs are amortized into cost of revenues and operating expenses over a two or three year period, depending on the nature of the asset.

The carrying values of intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amounts of such assets may not be recoverable. The determination of whether any impairment exists includes a comparison of estimated undiscounted future cash flows anticipated to be generated over the remaining life of the asset to the net carrying value of the asset. If the estimated undiscounted future cash flows associated with the asset are less than the carrying value, an impairment loss will be recorded based on the estimated fair value.

Goodwill

Goodwill represents the excess of the purchase price over the estimated fair value of net assets of a business acquired in a business combination. Goodwill is not amortized, but instead tested for impairment at least annually. Should certain events or indicators of impairment occur between annual impairment tests, the Company will perform the impairment test as those events or indicators occur. Examples of such events or circumstances include the following: a significant decline in the Company’s expected future cash flows; a sustained, significant decline in the Company’s fair value; a significant adverse change in the business climate; and slower growth rates.

Goodwill is tested for impairment at the reporting unit level by first performing a qualitative assessment to determine whether it is more likely than not that the fair value of the reporting unit is less than its carrying value. The qualitative assessment considers the following factors: macroeconomic conditions, industry and

15

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

market considerations, cost factors, overall company financial performance, events affecting the reporting unit, and changes in the Company’s fair value. If the reporting unit does not pass the qualitative assessment, the Company carries out a quantitative test for impairment of goodwill. This is done by comparing the fair value of the reporting unit with the carrying value of its net assets. If the fair value of the reporting unit is greater than its carrying value, no impairment results. If the fair value of the reporting unit is less than its carrying value, an impairment loss would be recognized in the Consolidated Statements of Operations and Comprehensive Loss in an amount equal to that difference, limited to the total amount of goodwill allocated to that reporting unit. The Company has one reporting unit and evaluates goodwill for impairment at the entity level.

Business Combinations

The Company follows the acquisition method to account for business combinations in accordance with ASC 805, Business Combinations. The acquisition method of accounting requires that assets acquired and liabilities assumed be recorded at their estimated fair values on the date of a business acquisition. The excess of the purchase price over the estimated fair value is recorded as goodwill. Upon the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments would be recorded in the consolidated statements of operations and comprehensive loss.

Segment Information

The Company’s chief operating decision maker (CODM) is a function comprised of two executives, specifically the Chief Executive Officer and the Chief Financial Officer. The CODM is the highest level of management responsible for assessing Shopify’s overall performance, and making operational decisions such as resource allocations related to operations, product prioritization, and delegations of authority. Management has determined that the Company operates in a single operating and reportable segment.

Concentration of Credit Risk

The Company’s cash and cash equivalents, marketable securities, trade and other receivables, merchant cash advances and loans receivable, and foreign exchange derivative products subject the Company to concentrations of credit risk. Management mitigates this risk associated with cash and cash equivalents by making deposits and entering into foreign exchange derivative products only with large banks and financial institutions that are considered to be highly credit worthy. Management mitigates the risks associated with marketable securities by adhering to its investment policy, which stipulates minimum rating requirements, maximum investment exposures and maximum maturities. Due to the Company’s diversified merchant base, there is no particular concentration of credit risk related to the Company’s trade and other receivables and merchant cash advances and loans receivable. Trade and other receivables and merchant cash advances and loans receivable are monitored on an ongoing basis to ensure timely collection of amounts. The Company has mitigated some of the risks associated with Shopify Capital by entering into an agreement with a third party to insure merchant cash advances offered by Shopify Capital. There are no receivables from individual merchants accounting for 10% or more of revenues or receivables.

Interest Rate Risk

Certain of the Company’s cash, cash equivalents and marketable securities earn interest. The Company’s trade and other receivables, accounts payable and accrued liabilities and lease liabilities do not bear interest. The Company is not exposed to material interest rate risk.

Foreign Exchange Risk

The Company’s exposure to foreign exchange risk is primarily related to fluctuations between the CAD and the USD. The Company is exposed to foreign exchange fluctuations on the revaluation of foreign currency

16

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

assets and liabilities. The Company uses foreign exchange derivative products to manage the impact of foreign exchange fluctuations. By their nature, derivative financial instruments involve risk, including the credit risk of non-performance by counter parties.

While the majority of the Company's revenues and cost of revenues are denominated in USD, a significant portion of operating expenses are incurred in CAD. As a result, earnings are adversely affected by an increase in the value of the CAD relative to the USD.

The following table summarizes the effects on revenues, cost of revenues, operating expenses, and loss from operations of a 10% strengthening(1) of the CAD versus the USD without considering the impact of the Company's hedging activities and without factoring in any potential changes in demand for the Company's solutions as a result of changes in the CAD to USD exchange rates:

Years ended | |||||||||||||||||||

December 31, 2018 | December 31, 2017 | ||||||||||||||||||

GAAP Amounts As Reported $ | Exchange Rate Effect (2) $ | At 10% Stronger CAD Rate (3) $ | GAAP Amounts As Reported $ | Exchange Rate Effect (2) $ | At 10% Stronger CAD Rate (3) $ | ||||||||||||||

(in thousands) | |||||||||||||||||||

Revenues | $ | 1,073,229 | $ | 1,857 | $ | 1,075,086 | $ | 673,304 | $ | 1,104 | $ | 674,408 | |||||||

Cost of revenues | (476,962 | ) | (3,302 | ) | (480,264 | ) | (293,051 | ) | (2,131 | ) | (295,182 | ) | |||||||

Operating expenses | (688,187 | ) | (30,275 | ) | (718,462 | ) | (429,410 | ) | (19,068 | ) | (448,478 | ) | |||||||

Loss from operations | $ | (91,920 | ) | $ | (31,720 | ) | $ | (123,640 | ) | $ | (49,157 | ) | $ | (20,095 | ) | $ | (69,252 | ) | |

(1) A 10% weakening of the CAD versus the USD would have an equal and opposite impact on our revenues, cost of revenues, operating expenses and loss from operations as presented in the table.

(2) Represents the increase or decrease in GAAP amounts reported resulting from a 10% strengthening in the CAD-USD foreign exchange rates.

(3) Represents the outcome that would have resulted had the CAD-USD rates in those periods been 10% stronger than they actually were, excluding the impact of our hedging program and without factoring in any potential changes in demand for the Company's solutions as a result of changes in the CAD-USD exchange rates.

Accounting Pronouncements Adopted in the Year

In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers. The new accounting standards update requires an entity to apply a five step model to recognize revenue to depict the transfer of promised goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services, as well as a cohesive set of disclosure requirements that would result in an entity providing comprehensive information about the nature, timing, and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. In March 2016, the Financial Accounting Standards Board issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606), Principal versus Agent Considerations (Reporting Revenue Gross versus Net), updating the implementation guidance on principal versus agent considerations in the new revenue recognition standard. This update clarifies that an entity is a principal if it controls the specified good or service before that good or service is transferred to a customer. The update also includes indicators to assist an entity in determining whether it controls a specified good or service before it is transferred to the customer. In May 2016, the FASB issued ASU 2016-12, Narrow-Scope Improvements and Practical Expedients, which provides clarification on how to assess collectibility, present sales taxes, treat non-cash consideration, and account for completed and modified contracts at the time of transition. ASU 2016-12 also clarifies that an entity retrospectively applying the guidance in Topic 606 is not required to disclose the effect of the accounting change in the period of adoption.

17

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

The Company adopted this new revenue standard effective January 1, 2018, using the full retrospective method. There was no impact on previously reported results.

The most significant impact of adoption of the new revenue standard in the current year relates to the Company's accounting for incremental costs of obtaining a contract. Specifically, the Company is required to recognize as an asset the incremental sales commission costs of obtaining a contract with a merchant, if the Company expects to recover these costs. The contract assets are subsequently amortized on a systematic basis consistent with the pattern of the transfer of the good or service to which the asset relates to, which in the Company's case, is on a straight-line basis over the estimated life of the related merchant relationship. The adoption of the new revenue standard did not have an impact on the timing and amount of revenue recognition, or on cash from or used in operating, investing, or financing activities.

In January 2017, the Financial Accounting Standards Board issued ASU No. 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment, which simplifies the subsequent measurement of goodwill and eliminates Step 2 from the goodwill impairment test. The standard is effective for annual periods beginning after December 15, 2019 but the Company opted for early adoption for the goodwill impairment test that was completed as of September 30, 2018. The adoption of this standard did not have an impact on the Company's annual goodwill impairment test because the estimated fair value of the reporting unit was greater than its carrying amount.

Recent Accounting Pronouncements Not Yet Adopted

In February 2016, the Financial Accounting Standards Board issued ASU No. 2016-02, Leases, which requires a lessee to record a right-of-use asset and a corresponding lease liability, initially measured at the present value of the lease payments, on the balance sheet for all leases with terms longer than 12 months, as well as the disclosure of key information about leasing arrangements. The standard requires recognition in the statement of operations of a single lease cost, calculated so that the cost of the lease is allocated over the lease term, generally on a straight-line basis. This standard also requires classification of all cash payments within operating activities in the statement of cash flows. In July 2018, the Financial Accounting Standards Board issued ASU No. 2018-11, Leases - Targeted Improvements, which provides an additional transition method. The Company will adopt the standard effective January 1, 2019 using a modified retrospective approach and applying the transition method that does not require adjustments to comparative periods nor require modified disclosures in the comparative periods. The Company will elect the package of practical expedients to not reassess whether a contract is or contains a lease, lease classification and initial direct costs for contracts that expired or existed prior to the effective date. As the lessee to material operating leases, the standard will have a material impact on the Company's consolidated balance sheets, but will not have an impact on its consolidated statements of operations. While the adoption remains in progress, the Company expects that the most significant impact will be the recognition of right-of-use assets and lease liabilities for the Company's operating leases. The Company has completed its process to identify the population of lease arrangements and it is nearing the completion of applying the new leasing standard to each arrangement. The Company has also determined the incremental borrowing rate for each arrangement.

In June 2016, the Financial Accounting Standards Board issued ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments, which will replace the incurred loss impairment methodology with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates on loans, trade and other receivables, held-to-maturity debt securities, and other instruments. The update is effective for annual periods beginning after December 15, 2019 including interim periods within those periods. Early adoption is permitted. The Company is currently assessing the impact of this new standard.

In August 2018, the Financial Accounting Standards Board issued ASU No. 2018-15, Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-

18

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

use software. The update is effective for annual periods beginning after December 15, 2019 including interim periods within those periods and can be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. Early adoption is permitted. The Company does not expect the adoption of this standard to have a material impact on its consolidated financial statements.

4. | Cash and Cash Equivalents |

As at December 31, 2018 and 2017, the Company’s cash and cash equivalents balance was $410,683 and $141,677, respectively. These balances included $292,290 and $61,263, respectively, of money market funds, repurchase agreements and commercial paper.

5. | Financial Instruments |

As at December 31, 2018, the carrying amount and fair value of the Company’s financial instruments were as follows:

Level 1 $ | Level 2 $ | Level 3 $ | ||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||

Assets: | ||||||||||||||

Cash equivalents: | ||||||||||||||

Commercial paper | — | — | 4,994 | 4,994 | — | — | ||||||||

Repurchase agreements | — | — | 60,000 | 60,005 | — | — | ||||||||

Marketable securities: | ||||||||||||||

U.S. term deposits | 127,500 | 128,241 | — | — | — | — | ||||||||

U.S. federal bonds | 230,898 | 231,299 | — | — | — | — | ||||||||

Canadian federal bonds | 19,967 | 19,962 | — | — | — | — | ||||||||

Corporate bonds and commercial paper | — | — | 1,180,622 | 1,182,437 | — | — | ||||||||

Liabilities: | ||||||||||||||

Derivative liabilities: | ||||||||||||||

Foreign exchange forward contracts | — | — | 12,216 | 12,216 | — | — | ||||||||

The fair values above include accrued interest of $5,109, which is excluded from the carrying amounts. The accrued interest is included in Trade and other receivables in the Consolidated Balance Sheets.

19

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

As at December 31, 2017, the carrying amount and fair value of the Company’s financial instruments were as follows:

Level 1 $ | Level 2 $ | Level 3 $ | ||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||

Assets: | ||||||||||||||

Cash equivalents: | ||||||||||||||

Corporate bonds and commercial paper | — | — | 9,965 | 9,965 | — | — | ||||||||

Marketable securities: | ||||||||||||||

U.S. term deposits | 65,000 | 65,284 | — | — | — | — | ||||||||

U.S. federal bonds | 119,074 | 119,057 | — | — | — | — | ||||||||

Canadian federal bonds | 19,945 | 19,940 | — | — | — | — | ||||||||

Corporate bonds and commercial paper | — | — | 592,343 | 593,554 | — | — | ||||||||

Derivative assets: | ||||||||||||||

Foreign exchange forward contracts | — | — | 4,503 | 4,503 | — | — | ||||||||

Liabilities: | ||||||||||||||

Derivative liabilities: | ||||||||||||||

Foreign exchange forward contracts | — | — | 795 | 795 | — | — | ||||||||

The fair values above include accrued interest of $2,015, which is excluded from the carrying amounts. The accrued interest is included in Trade and other receivables in the Consolidated Balance Sheets.

All cash equivalents and marketable securities mature within one year of the consolidated balance sheet date.

As at December 31, 2018 the Company held foreign exchange forward contracts to convert USD into CAD, with a total notional value of $276,696 (December 31, 2017 - $182,464), to fund a portion of its operations. The foreign exchange forward contracts have maturities of twelve months or less. The fair value of foreign exchange forward contracts and corporate bonds was based upon Level 2 inputs, which included period-end mid-market quotations for each underlying contract as calculated by the financial institution with which the Company has transacted. The quotations are based on bid/ask quotations and represent the discounted future settlement amounts based on current market rates. There were no transfers between Levels 1, 2 and 3 during the years ended December 31, 2018 and December 31, 2017.

Derivative Instruments and Hedging

The Company has a hedging program to mitigate the impact of foreign currency fluctuations on future cash flows and earnings. Under this program the Company has entered into foreign exchange forward contracts with certain financial institutions and designated those hedges as cash flow hedges. As of December 31, 2018, $12,216 of unrealized losses related to changes in the fair value of foreign exchange forward contracts designated as cash flow hedges were included in accumulated other comprehensive loss and current liabilities, on the consolidated balance sheet. This amount is expected to be reclassified into earnings over the next twelve months. In the year ended December 31, 2018, $4,170 of realized losses (December 31, 2017 - realized gains of $3,398) related to the maturity of foreign exchange forward contracts designated as cash flow hedges were included in operating expenses. Under the current hedging program, the Company is hedging cash flows associated with payroll and facility costs.

20

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

6. Trade and Other Receivables

December 31, 2018 $ | December 31, 2017 $ | December 31, 2016 $ | |||||

Unbilled revenues | 12,653 | 7,616 | 2,293 | ||||

Trade receivables | 11,191 | 7,073 | 2,818 | ||||

Accrued interest | 5,109 | 2,015 | 896 | ||||

Leasehold incentives receivable | 4,411 | 1,607 | 1,452 | ||||

Other receivables | 7,983 | 3,628 | 2,140 | ||||

41,347 | 21,939 | 9,599 | |||||

Unbilled revenues represent amounts not yet billed to merchants related to subscription fees for Plus merchants, transaction fees and shipping charges, as at the Consolidated Balance Sheet date.

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in our unbilled revenues and trade receivables accounts. The Company determined the allowance based on historical experience and other currently available evidence. Activity in the allowance for doubtful accounts was as follows:

Years ended | |||||

December 31, 2018 $ | December 31, 2017 $ | ||||

Balance, beginning of the year | 1,642 | 113 | |||

Provision for uncollectible receivables | 1,355 | 1,529 | |||

Write-offs | (1,974 | ) | — | ||

Balance, end of the year | 1,023 | 1,642 | |||

7. Merchant Cash Advances and Loans Receivable

December 31, 2018 | December 31, 2017 | December 31, 2016 | ||||||

$ | $ | $ | ||||||

Merchant cash advances and loans receivable, gross | 94,612 | 49,143 | 12,924 | |||||

Allowance for uncollectible merchant cash advances and loans receivable | (2,739 | ) | (2,042 | ) | (1,028 | ) | ||

Merchant cash advances and loans receivable, net | 91,873 | 47,101 | 11,896 | |||||

The following table summarizes the activities of the Company’s allowance for uncollectible merchant cash advances and loans receivable:

Years ended | |||||

December 31, 2018 | December 31, 2017 | ||||

$ | $ | ||||

Balance, beginning of the year | 2,042 | 1,028 | |||

Provision for uncollectible merchant cash advances and loans receivable | 5,922 | 2,606 | |||

Merchant cash advances and loans receivable charged off, net of recoveries | (5,225 | ) | (1,592 | ) | |

Balance, end of the year | 2,739 | 2,042 | |||

21

Shopify Inc.

Notes to the Consolidated Financial Statements

Expressed in US $000's except share and per share amounts

8. Other Current Assets

December 31, 2018 $ | December 31, 2017 $ | ||||

Prepaid expenses | 12,912 | 7,239 | |||

Deposits | 9,599 | 5,240 | |||

Other current assets | 3,681 | 1,616 | |||

Foreign exchange contracts | — | 4,503 | |||

26,192 | 18,598 | ||||

9. | Property and Equipment |

December 31, 2018 | ||||||||

Cost $ | Accumulated depreciation $ | Net book value $ | ||||||