Form 6-K SHOPIFY INC. For: Apr 17

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of | April | 2019 | |

Commission File Number | 001-37400 | ||

Shopify Inc. | |||

(Translation of registrant’s name into English) | |||

150 Elgin Street, 8th Floor Ottawa, Ontario, Canada K2P 1L4 | |||

(Address of principal executive offices) | |||

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | Form 40-F | X | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

DOCUMENTS INCLUDED AS PART OF THIS REPORT

Exhibit

99.1 SHOPIFY INC. - NOTICE OF ANNUAL GENERAL MEETING AND MANAGEMENT INFORMATION CIRCULAR

99.2 SHOPIFY INC. - PROXY FORM

99.3 SHOPIFY INC. - NOTICE OF AVAILBILITY

Exhibit 99.1 of this Report on Form 6-K is incorporated by reference into the Registration Statement on Form F-10 of the Registrant, which was originally filed with the Securities and Exchange Commission on July 30, 2018 (File No. 333‐226444), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on May 29, 2015 (File No. 333-204568) and the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on May 12, 2016 (File No. 333-211305).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Shopify Inc. | |||||

(Registrant) | |||||

Date: | April 17, 2019 | By: | /s/ Joseph A. Frasca | ||

Name: Joseph A. Frasca Title: Chief Legal Officer and Corporate Secretary | |||||

EXHIBIT 99.1

NOTICE OF MEETING AND

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL GENERAL MEETING

OF SHAREHOLDERS OF SHOPIFY INC.

TO BE HELD MAY 29, 2019

April 17, 2019

NOTICE OF ANNUAL GENERAL MEETING

OF SHAREHOLDERS OF

SHOPIFY INC.

To the shareholders of Shopify Inc.:

Notice is hereby given of the annual general meeting (the "Meeting") of the holders (the "Shareholders") of Class A subordinate voting shares and Class B multiple voting shares in the capital of Shopify Inc. (collectively, the "Shares").

Date: | May 29, 2019 |

Time: | 10 a.m. (Eastern Time) |

Place: | Lord Elgin Hotel, Pearson Room 100 Elgin Street Ottawa, Ontario K1P 5K8 Canada |

Business of the Meeting: | (a) receiving our financial statements for the year ended December 31, 2018, including the auditor’s report thereon; |

(b) electing six (6) directors to our Board of Directors, who will serve until the end of the next annual shareholder meeting or until their successors are elected or appointed; | |

(c) re-appointing PricewaterhouseCoopers LLP as our auditors and authorizing the Board of Directors to fix their remuneration; | |

(d) considering an advisory, non-binding resolution on our approach to executive compensation; and | |

(e) to transact any other business that may properly come before the Meeting and any postponement(s) or adjournment(s) thereof. | |

Conference Call: | Details on how you may listen in and follow the proceedings can be found on our website at investors.shopify.com |

You are entitled to receive notice of, and vote at, the Meeting or any postponement(s) or adjournment(s) thereof if you were a Shareholder on April 12, 2019 (the "Record Date").

Meeting Materials

Accompanying this Notice is the related management information circular (the "Circular") of Shopify Inc. ("Shopify") which provides information relating to the matters to be addressed at the Meeting. Also accompanying this notice is a form of proxy (the "Form of Proxy") to vote your shares. Any adjourned or postponed meeting resulting from an adjournment or postponement of the Meeting will be held at a time and place to be specified either by Shopify before the Meeting or by the Chair at the Meeting.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR i

We are using notice-and-access (as defined in National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101") to deliver this Circular and our annual consolidated financial statements to both our registered and non-registered shareholders. This means that this Circular and our annual consolidated financial statements are being posted online for shareholders to access, instead of being mailed out. Notice-and-access gives shareholders more choice, reduces our printing and mailing costs, and is more environmentally friendly as it reduces materials and energy consumption. You may still receive a form of proxy or a voting instruction form in the mail so you can vote your shares but, instead of receiving a paper copy of this Circular and our annual consolidated financial statements, you will receive a notice with instructions indicating how you can access those documents electronically, as well as how to request a paper copy. This Circular and our annual consolidated financial statements are each available at http://www.envisionreports.com/ZSHQ18documents19, on our website at https://investors.shopify.com, on SEDAR at sedar.com, and on EDGAR at sec.gov.

You may request a paper copy of this Circular and/or our annual consolidated financial statements, at no cost to you, up to one year from the date this Circular was filed on SEDAR. You may make such a request at any time prior to the meeting by contacting our transfer agent, Computershare Investor Services Inc. ("Computershare") via their website https://www-us.computershare.com/Investor/Contact/Enquiry, by mail Computershare Investor Services Inc., 100 University Ave., 8th Floor, North Tower, Toronto, Ontario, M5J 2Y1, or by phone 1-877-373-6374 (U.S., Canada) or 1-781- 575-2879 (all other countries). After the meeting, requests may be made via our website https://investors.shopify.com/Resources/Request-Information, by email [email protected], or by phone 1-888-746-7439 ext. 302.

You will need to register with Computershare before entering the Meeting if you choose to attend in person. Shopify has made arrangements to provide a live teleconference of the Meeting. However, Shareholders will not be permitted to vote or otherwise participate in the Meeting through the teleconference facility. Details on how you may listen to and follow the proceedings can be found on our website at investors.shopify.com.

Proxy instructions must be received by Computershare by 5:00 p.m. (EDT) on May 27, 2019 (or, if the meeting is adjourned or postponed, by 5:00 p.m. (EDT) two (2) business days before the day on which the meeting is reconvened). Shopify reserves the right to accept late proxies and to waive the proxy cut-off, with or without notice. If you are a non-registered Shareholder, please refer to Section 1 - Voting Information in the Circular under the heading "Beneficial (Non-Registered) Shareholders" for information on how to vote your Shares. Beneficial (non-registered) Shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary should carefully follow the instructions of their intermediary to ensure that their Shares are voted at the Meeting in accordance with their instructions.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR ii

Dated at Ottawa, Ontario, April 17, 2019.

BY ORDER OF THE BOARD OF DIRECTORS

Joseph A. Frasca

Chief Legal Officer and Corporate Secretary

Shopify Inc.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR iii

Summary

This Summary contains highlights of some of the important information contained in this Circular. This Summary does not contain all of the information that you should consider. You should read this entire Circular before voting.

Shareholder Voting Matters

Voting Matter | Board Recommendation | For more information see pages |

Election of Directors | FOR each nominee | 11 - 18 |

Appointing PricewaterhouseCoopers LLP as auditors | FOR | 19 - 20 |

Advisory vote on executive compensation | FOR | |

1. Election of Directors

(see Section 2(1) - Election of Directors)

Name | Age | Independent | Director Since | Position | Committees | Board and Committee Attendance in 2018 | Other Public Boards | Votes FOR in 2018 |

Tobias Lütke | 38 | No | 2004 | CEO, Shopify | none | 100% | 0 | 99.72% |

Robert Ashe | 60 | Yes | 2014 | Corporate Director | - Lead Independent Director - Audit - Compensation (Chair) - Nominating and Corporate Governance | 100% | 2 | 99.29% |

Gail Goodman | 58 | Yes | 2016 | Corporate Director | - Audit - Compensation - Nominating and Corporate Governance | 100% | 0 | 99.35% |

Colleen Johnston | 60 | Yes | 2019 | Corporate Director | - Audit | N/A | 1 | N/A |

Jeremy Levine | 45 | Yes | 2011 | Partner at Bessemer Venture Partners | - Nominating and Corporate Governance | 100% | 0 | 99.57% |

John Phillips | 68 | Yes | 2010 | CEO, Klister Credit Corp. | - Compensation - Nominating and Corporate Governance (Chair) | 100% | 0 | 98.88% |

Steven Collins is currently a director and the chair of the audit committee, but is not standing for re-election at the annual general meeting of shareholders. Steven Collins attended 100% of board and audit committee meetings in 2018, sits on one other public board and had 99.86% votes FOR in 2018.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR iv

2. Appointing PricewaterhouseCoopers LLP as Auditors

(see Section 2(2) - Appointment of Auditors)

PricewaterhouseCoopers LLP Chartered Professional Accountants ("PWC"), the present auditors of the Company, have acted as the Company’s auditors since August 2011. In 2018, 99.78% of votes cast were in favour of appointing PWC as the Company's auditors.

3. Advisory Vote on Executive Compensation

(see Section 2(3) - Advisory Resolution on Executive Compensation)

Shopify will present a non-binding advisory vote on the Board of Director’s approach to executive compensation as part of our process of shareholder engagement. Since this is an advisory vote, the results will not be binding upon the Board of Directors. However, the Board and, in particular, the Compensation Committee, will take the results of the vote into account when considering future compensation policies, procedures and decisions and in determining whether there is a need to increase their engagement with Shareholders on compensation and related matters. In 2018, 94.79% of votes cast were in favour of our Board of Director's approach to executive compensation.

Please also see "Section 3: Compensation of Executives" of this Circular for more information about our executive compensation.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR v

TABLE OF CONTENTS

SHOPIFY MANAGEMENT INFORMATION CIRCULAR vi

MANAGEMENT INFORMATION CIRCULAR

INTRODUCTION

This management information circular (the "Circular") is furnished in connection with the solicitation of proxies by and on behalf of the management of Shopify Inc. (the "Company" or "Shopify") for use at the annual general meeting of shareholders of Shopify (the "Shareholders") to be held on May 29, 2019 (the "Meeting") at the Lord Elgin Hotel, Pearson Room, 100 Elgin Street, Ottawa, Ontario, K1P 5K8, commencing at 10:00 a.m. (Ottawa time), or at any adjournment(s) or postponement(s) thereof, at the time and place and for the purposes set forth in the accompanying notice of annual general meeting of shareholders of Shopify (the "Notice of Meeting").

No person has been authorized to give any information or make any representation in connection with the matters to be considered at the Meeting other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

Information Contained in this Circular

All information in this Circular is presented as of April 12, 2019, unless otherwise indicated.

Unless the context requires otherwise, references in this Circular to "Shopify", "we", "us", "our", or "the Company" include Shopify and all of its subsidiaries. Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders.

Information contained on, or that can be accessed through, our website does not constitute a part of this Circular and is not incorporated by reference herein.

Presentation of Financial Information

We prepare and report our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). Our reporting currency is U.S. dollars.

Currency and Exchange Rate

We express all amounts in this Circular in U.S. dollars, except where otherwise indicated. References to "$", "US$", "USD" or "U.S. dollars" are to United States of America dollars and references to "C$" or "CAD" are to Canadian dollars. Unless otherwise indicated, the exchange rate used is based on the December 31, 2018 Bank of Canada daily average exchange rate for the conversion of U.S. dollars into Canadian dollars which was US$1.00 = C$1.3642.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 1

The following table sets forth the closing, high, low and average exchange rates for one (1) U.S. dollar in terms of Canadian dollars for fiscal years ended December 31, 2018, 2017 and 2016 and for the three-month period ended March 31, 2019, as reported by the Bank of Canada. Periods prior to April 1, 2018 are based on the noon rate published by the Bank of Canada. Periods from and after April 1, 2018 are based on the daily average exchange rate published by the Bank of Canada.

Year ended December 31 (CAD) | Three-month Period ended March 31 (CAD) | |||

2018 | 2017 | 2016 | 2019 | |

Rate at end of Period | 1.3642 | 1.2545 | 1.3427 | 1.3363 |

Average rate during Period(1) | 1.2957 | 1.2986 | 1.3248 | 1.3295 |

High during Period | 1.3642 | 1.3743 | 1.4589 | 1.3600 |

Low during Period | 1.2288 | 1.2128 | 1.2544 | 1.3095 |

1 Calculated as an average of the daily noon rates or daily average rates for each period, as applicable.

On April 12, 2019, the Bank of Canada daily average exchange rate for the conversion of U.S. dollars into Canadian dollars was US$1.00 = C$1.3329.

Principal Shareholders

The following table sets forth the only persons who, to the knowledge of the directors and executive officers of the Company, directly or indirectly beneficially own or exercise control or direction over more than 10% of any class of shares, the approximate number of shares owned, controlled or directed by each such person and the percentage of the class of shares so owned, controlled or directed as of April 12, 2019:

Name of Shareholder | Number of Class A Subordinate Voting Shares Owned, Controlled or Directed | Percentage of Outstanding Class A Subordinate Voting Shares Owned, Controlled or Directed | Number of Class B Multiple Voting Shares Owned, Controlled or Directed | Percentage of Outstanding Class B Multiple Voting Shares Owned, Controlled or Directed | Percentage of Votes Attaching to all Outstanding Shares Owned, Controlled or Directed | |||

Tobias Lütke(1) | 174,112 | 0.17 | % | 8,261,852 | 57.34 | % | 33.82 | % |

Klister Credit Corp.(2) | - | - | 4,000,000 | 27.76 | % | 16.34 | % | |

Entities affiliated with Fidelity(3) | 10,130,349 | 10.06 | % | - | - | 4.14 | % | |

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 2

1 Consists of 7,099,875 Class B multiple voting shares and 145,000 Class A subordinate voting shares held by 7910240 Canada Inc., which Tobias Lütke is deemed to beneficially own, 758,629 Class B multiple voting shares and 104 Class A subordinate voting shares held directly by Tobias Lütke, and 23,551 stock options that are exercisable into Class A subordinate voting shares within 60 days after April 12, 2019, 5,457 Restricted Share Units that will vest as Class A subordinate voting shares within 60 days after April 12, 2019, and 403,348 stock options that are exercisable into Class B multiple voting shares within 60 days after April 12, 2019.

2 One of our directors, John Phillips, is the Chief Executive Officer of Klister Credit Corp. ("Klister"), and directly or indirectly beneficially owns 50% of Klister and accordingly is considered to indirectly beneficially own 50% of the Shares owned by Klister. Mr. Phillips' wife, Dr. Catherine Phillips, owns the remaining 50% of Klister.

3 Based on Form 13G filed on February 13, 2019. Reflects shares held, in the aggregate, by FIAM LLC, Fidelity Institutional Asset Management Trust Company, Fidelity Management & Research Company, FMR Co., Inc., and Strategic Advisers, Inc.

All directors and officers as a group (14 persons) owned beneficially or exercised control or direction over 591,189 Class A subordinate voting shares, or 0.59% of that class, and 12,770,728 Class B multiple voting shares, or 88.64% of that class, representing 11.61% of all shares and 52.41% of all votes as of April 12, 2019. The Class A subordinate voting shares amount consists of 300,042 Class A subordinate voting shares beneficially owned by our directors and executive officers, 248,233 Class A subordinate voting shares issuable pursuant to outstanding stock options which are exercisable within 60 days after April 12, 2019, 42,352 Class A subordinate voting shares issuable pursuant to outstanding RSUs which will vest within 60 days after April 12, 2019, and 562 Deferred Share Units. The Class B multiple voting shares amount consists of 11,858,504 Class B multiple voting shares beneficially owned by our directors and executive officers and 912,224 Class B multiple voting shares issuable pursuant to outstanding stock options which are exercisable within 60 days after April 12, 2019. These amounts include 100% of the shares held by Klister Credit Corp., which is 50% owned by John Phillips (see footnote 2, above).

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 3

NOTICE TO UNITED STATES SHAREHOLDERS

Shopify is a corporation organized under the laws of Canada and is a foreign private issuer within the meaning of Rule 3b-4 under the Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act"). The solicitation of proxies for the Meeting is not subject to the proxy requirements of Section 14(a) of the U.S. Exchange Act, and Regulation 14A thereunder, by virtue of an exemption available to proxy solicitations by foreign private issuers. Accordingly, the solicitation contemplated herein is being made to United States Shareholders only in accordance with Canadian corporate and securities laws and this Circular has been prepared solely in accordance with disclosure requirements applicable in Canada. United States Shareholders should be aware that such requirements are different from those of the United States applicable to proxy statements under the U.S. Exchange Act. Specifically, information contained or incorporated by reference herein has been prepared in accordance with Canadian disclosure standards, which are not comparable in all respects to United States disclosure standards.

The financial statements and other financial information included or incorporated by reference in this Circular have been presented in U.S. dollars except where otherwise noted, and were prepared in accordance with accounting principles generally accepted in the United States, but are subject to Canadian auditing and auditor independence standards, which differ from United States auditing and auditor independence standards in certain material respects, and thus may not be comparable to financial statements of United States companies.

The enforcement by Shareholders of civil liabilities under the United States federal and state securities laws may be affected adversely by the fact that the Company is incorporated or organized outside the United States, that some or all of its officers and directors and the experts named herein are residents of a country other than the United States, and that all or a substantial portion of the assets of the Company and such persons are located outside the United States. As a result, it may be difficult or impossible for the United States Shareholders to effect service of process within the United States upon the Company, its officers and directors or the experts named herein, or to realize against them upon judgments of courts of the United States predicated upon civil liabilities under the federal securities laws of the United States or any state securities laws. In addition, the United States Shareholders should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the federal securities laws of the United States or any state securities laws, or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the federal securities laws of the United States or any state securities laws.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 4

SECTION 1: VOTING INFORMATION

What will I be voting on?

You will be voting on:

a) | the election of directors of the Company, who will serve until the end of the next annual shareholder meeting or until their successors are elected or appointed (see page 11); |

b) | the appointment of PricewaterhouseCoopers LLP as the auditors of the Company and authorizing the directors to fix their remuneration (see page 19); |

c) | an advisory, non-binding resolution in respect of Shopify’s approach to executive compensation (see page 21); and |

d) | any other business that may properly come before the Meeting. |

The Company's Board of Directors and management recommends that you vote FOR each of the proposed nominees for election as directors of the Corporation; FOR the appointment of PricewaterhouseCoopers LLP as the auditors of the Company and authorizing the directors to fix their remuneration; and FOR the advisory, non-binding resolution in respect of Shopify's approach to executive compensation.

Who is soliciting my proxy?

The management of Shopify is soliciting your proxy. The Company's management requests that you sign and return the Form of Proxy so that your votes are exercised at the Meeting. The solicitation of proxies will be primarily by mail. However, the directors, officers and employees of the Company may also solicit proxies by telephone, by fax, by internet, in writing, or in person. The Company may also use the services of outside firms to solicit proxies. The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokers, custodians, nominees and other fiduciaries for their reasonable charges and expenses incurred in forwarding proxy material to beneficial owners of shares.

Who is entitled to vote and how many shares are eligible to vote?

The holders of Class A subordinate voting shares and Class B multiple voting shares as at the close of business on April 12, 2019 or their duly appointed proxyholders or representatives are entitled to vote.

The Company has two classes of shares currently issued. The Company’s Class A subordinate voting shares are listed on the New York Stock Exchange ("NYSE") (NYSE: SHOP) and on the Toronto Stock Exchange ("TSX") (TSX: SHOP). The Company also has Class B multiple voting shares issued which are not listed on any exchange, but which can be converted at any time at the option of the holder for Class A subordinate voting shares on a 1:1 basis.

On April 12, 2019 the number of Class A subordinate voting shares outstanding was 99,291,160, which represents 44.8% of the aggregate voting rights attaching to all of the Company’s outstanding

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 5

shares, and the number of Class B multiple voting shares outstanding was 12,251,272, which represents 55.2% of the aggregate voting rights attaching to all of the Company’s outstanding shares.

How many votes do I have?

Holders of the Company’s Class A subordinate voting shares have one vote for every share owned and holders of the Company’s Class B multiple voting shares have ten votes for every share owned.

What are the voting requirements?

The election of directors, the appointment of auditors, and the approval of an advisory, non-binding resolution on the Company’s approach to executive compensation will each be determined by a majority of votes cast at the meeting by proxy or in person. For details concerning Shopify’s majority voting policy with respect to the election of its directors, please refer to "Majority Voting Policy" in Section 4 "Corporate Governance Policies and Practices" of this Circular.

What are the quorum requirements?

A quorum is present at the Meeting if the holders of at least 25% of the shares entitled to vote at the Meeting are present in person or represented by proxy, and at least two persons entitled to vote at the Meeting are actually present at the Meeting or represented by proxy. A quorum need not be present throughout the Meeting provided that a quorum is present at the opening of the Meeting. If a quorum is not present at the time appointed for the opening of the Meeting or within a reasonable time after, the Shareholders present or represented by proxy may adjourn the Meeting to a fixed time and place but may not transact any other business.

How do I know if I am a registered shareholder or a non-registered (beneficial) shareholder?

You are a registered shareholder if your shares are registered directly in your name with our transfer agent, Computershare Investor Services Inc. ("Computershare").

You are a non-registered shareholder (also called a beneficial shareholder) if your shares are held in the name of a nominee (also called an intermediary), such as a securities broker, trustee or other financial institution. For more information, see the instructions below under the heading "Beneficial (Non-Registered) Shareholders".

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 6

How do I vote if I am a registered shareholder?

If you are a registered shareholder, you can exercise your right to vote by attending and voting your shares in person at the Meeting, or you can vote by telephone, internet or mail. To vote your shares in person, attend the Meeting in person where your vote will be taken and counted. To vote by internet at http://www.envisionreports.com/ZSHQ18documents19 or to vote by telephone, follow the instructions provided on the form of proxy by no later than 5:00 p.m. (EDT) on May 27, 2019. To vote by mail, complete, sign, date and return your form of proxy to Computershare in the envelope provided, which must be received no later than 5:00 p.m. (EDT) on May 27, 2019. If the Meeting is adjourned or postponed, Computershare must receive the form of proxy at least 48 hours, excluding Saturdays, Sundays and holidays, before the rescheduled meeting.

How do I vote by proxy?

Whether or not you attend the Meeting, you can appoint someone else to vote for you as your proxyholder. You can use the enclosed Form of Proxy, or any other proper form of proxy, to appoint your proxyholder. The persons named in the enclosed Form of Proxy are officers of the Company. Each shareholder has the right to appoint a person other than the persons designated in the enclosed Form of Proxy, who need not be a shareholder, to attend and act on such shareholder's behalf at the Meeting. Such right may be exercised by striking out the printed names on the enclosed Form of Proxy and by inserting in the space provided above the name of the person or company to be appointed, or by completing another form of proxy.

How will my proxy be voted?

On the Form of Proxy, you can indicate how you want your proxyholder to vote your shares, or you can let your proxyholder decide for you.

If you have specified on the Form of Proxy how you want your shares to be voted on a particular issue (by marking FOR or WITHHOLD or FOR or AGAINST, as applicable), then your proxyholder must vote your shares accordingly.

Unless contrary instructions are provided, the Shares represented by proxies received by management will be voted:

•FOR the election, as a director, of each of the six (6) proposed nominees whose name is set out on the following pages (see page 11);

•FOR the appointment of PricewaterhouseCoopers LLP as auditors, and authorizing the directors to fix their remuneration (see page 19); and

•FOR the advisory, non-binding resolution in respect of Shopify’s approach to executive compensation (see page 21).

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 7

What if there are amendments or if other matters are brought before the Meeting?

The enclosed Form of Proxy gives the persons named on it authority to use their discretion in voting on amendments or variations to matters identified in the Notice or on any matter that may properly come before the Meeting or at any adjournment(s) or postponement(s) of the Meeting.

As of the date of this Circular, management is not aware that any other matter is to be presented for action at the Meeting. If, however, other matters properly come before the Meeting, the persons named on the enclosed Form of Proxy will vote on them in accordance with their judgment, pursuant to the discretionary authority conferred by the Form of Proxy.

What if I change my mind and want to take back my proxy after I've given it?

You can revoke your proxy before it is acted upon. You can do this by stating clearly, in writing, that you want to revoke your proxy and by delivering this written statement to the head office of the Company (Shopify, ATTN: Chief Legal Officer, 150 Elgin Street, 8th Floor, Ottawa, ON K2P 1L4, Canada) not later than the last business day before the day of the Meeting or to the Chair of the Meeting on the day of the Meeting or any adjournment.

Who counts the votes?

Votes are counted and tabulated by Computershare Investor Services Inc., the transfer agent of the Company in Canada.

Is my vote confidential?

The transfer agent preserves the confidentiality of individual shareholder votes, except (a) where the shareholder clearly intends to communicate his or her individual position to management, (b) where the validity of the form is in question, or (c) as necessary to comply with legal requirements.

Beneficial (Non-Registered) Shareholders

If your Shares are not registered in your own name, they will be held on your behalf in the name of an intermediary (an "Intermediary"), such as brokers, dealers, banks, trust companies and trustees or administrators of self-administered registered retirement savings plans, registered retirement income funds, and registered educational savings plans, and similar plans, or in the name of a clearing agency of which the Intermediary is a participant.

In accordance with National Instrument 54-101 - Communications with Beneficial Owners of Securities of a Reporting Issuer, the Company has distributed copies of the Notice of Meeting, this Circular and the Form of Proxy to the Intermediaries or clearing agencies of which an Intermediary is a participant for onward distribution to non-registered Shareholders. Applicable regulatory policy requires Intermediaries to seek voting instructions from non-registered Shareholders in advance of shareholders’ meetings unless a non-registered Shareholder has waived the right to receive Meeting materials. If you are a non-registered owner, and the issuer or its agent has sent these materials

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 8

directly to you, your name and address and information about your holdings of Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf.

Only registered Shareholders or duly appointed proxyholders are permitted to attend and vote at the Meeting. Non-registered Shareholders, that is Shareholders who do not hold their Shares in their own name, are advised that only proxies from Shareholders of record can be recognized and voted at the Meeting.

I am a non-registered Shareholder, how do I vote?

Your Intermediary is required to seek your instructions as to how to vote your Shares. For that reason, you have received this Circular from your Intermediary, together with a Voting Instruction Form. Every Intermediary provides its own signing and return instructions and deadlines, which you should follow carefully so that your Shares will be voted at the Meeting.

The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. ("Broadridge"). Broadridge typically mails its own Voting Instruction Form. Non-registered Shareholders can call a toll-free telephone number or access a website to vote their Shares, as provided by Broadridge in its Voting Instruction Form. Alternatively, non-registered Shareholders will be requested to complete and return the Voting Instruction Form to Broadridge by mail or facsimile. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at a meeting. A non-registered Shareholder receiving a Voting Instruction Form from Broadridge cannot use that Voting Instruction Form to vote Shares directly at the Meeting, as the Voting Instruction Form must be returned as directed by Broadridge in advance of the Meeting in order to have the Shares voted.

If you are a non-registered Shareholder who has voted and you want to change your vote, contact your Intermediary to find out what procedure to follow.

I am a non-registered Shareholder, how do I vote in person at the Meeting?

If you are a non-registered Shareholder and wish to vote in person at the Meeting, strike out the names of the management proxyholders and insert your own name in the space provided on the Voting Instruction Form sent to you by your Intermediary. By doing so, you are instructing your Intermediary to appoint you as proxyholder. Then, follow the signing and return instructions provided by your Intermediary. Do not otherwise complete the form, as you will be voting at the Meeting. Since the Company may not have access to the names of its non-registered Shareholders, if you attend the Meeting without following the above instructions to have your Intermediary appoint you as proxyholder, the Company will have no record of your shareholdings or of your entitlement to vote.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 9

Who should I contact if I have questions?

If you have questions regarding the information contained in this Circular, you may contact Shopify's Director, Investor Relations, by mail, 150 Elgin Street, 8th Floor, Ottawa, Ontario, Canada K2P 1L4, by phone, 1-888-746-7439 ext. 302, or by email, [email protected].

If you require assistance in completing the Form of Proxy you may contact our transfer agent via their website https://www-us.computershare.com/Investor/Contact/Enquiry, by mail Computershare Investor Services Inc., 100 University Ave., 8th Floor, North Tower

Toronto, Ontario, M5J 2Y1, or by phone 1-877-373-6374 (U.S., Canada) or 1-781- 575-2879 (all other countries).

Toronto, Ontario, M5J 2Y1, or by phone 1-877-373-6374 (U.S., Canada) or 1-781- 575-2879 (all other countries).

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 10

SECTION 2: BUSINESS OF THE MEETING

Report of the Directors and Consolidated Financial Statements

The Company is using notice-and-access to deliver its audited consolidated financial statements for the fiscal year ended December 31, 2018 to its registered and non-registered shareholders. The audited consolidated financial statements for the fiscal year ended December 31, 2018, the management’s discussion and analysis and the report of the auditors are included with the Company’s annual report, which is accessible on SEDAR at sedar.com, on EDGAR at sec.gov, or on our website at investors.shopify.com. Shareholders may request to receive paper copies of the financial statements at no cost by following the instructions on the notice-and-access notice.

1. Election of Directors

Our current Board of Directors consists of seven directors, Tobias Lütke, Robert Ashe, Steven Collins, Gail Goodman, Colleen Johnston, Jeremy Levine, and John Phillips. Tobias Lütke, Robert Ashe, Steven Collins, Jeremy Levine and John Phillips were elected by our shareholders at our first annual general meeting post-Initial Public Offering ("IPO") on June 8, 2016 and have been re-elected at every subsequent annual meeting. Gail Goodman was appointed to the Board of Directors on November 2, 2016, and was subsequently elected by our shareholders at our annual general meeting, held June 7, 2017 and re-elected by our shareholders at our annual general meeting, held May 30, 2018. Colleen Johnston was appointed to the Board of Directors on January 24, 2019.

Six of our seven currently serving directors are standing for election at the Meeting. Steven Collins will not be standing for re-election in 2019. Steven Collins attended 100% of board and committee meetings in 2018.

Pursuant to the Canada Business Corporations Act ("CBCA"), at least 25% of our directors must be resident Canadians. Furthermore, under the CBCA, no business may be transacted at a meeting of our Board of Directors unless 25% of the directors present are resident Canadians. The minimum number of directors we may have is one and the maximum number we may have is ten, as set out in our articles of incorporation. The CBCA provides that any amendment to our articles to increase or decrease the minimum or maximum number of our directors requires the approval of our shareholders by a special resolution.

Under the CBCA, a director may be removed with or without cause by a resolution passed by a majority of the votes cast by shareholders present in person or by proxy at a special meeting and who are entitled to vote. The directors are elected at the annual general meeting of shareholders and the term of office for each of the directors will expire at the time of our next annual shareholders meeting. Our restated articles of incorporation provide that, between annual general meetings of our shareholders, the directors may appoint one or more additional directors, but the number of additional directors may not at any time exceed one-third of the number of directors who held office at the expiration of the last meeting of our shareholders.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 11

Set forth below are the names of the six persons, five of whom are independent, who currently serve as directors and who are proposed as nominees for election as directors of the Company to be elected to serve until the next annual general meeting of shareholders, or until their successors are duly elected or appointed. The resolution to elect directors will be voted upon by shareholders, voting together as a single class, present in person or represented by proxy at the Meeting.

Unless authority is withheld, the management nominees named in the enclosed Form of Proxy intend to vote FOR the election of each of the nominees proposed below, all of whom are on the date of the Meeting serving as directors of the Company.

If any nominee is, for any reason, unavailable to serve as a director, proxies in favour of management nominees will be voted for another properly qualified nominee at their discretion unless authority has been withheld in the Form of Proxy.

Shopify has adopted a majority voting policy, see "Majority Voting Policy" in Section 4 - Corporate Governance Policies and Practices.

| Tobias Lütke co-founded Shopify in September 2004. Mr. Lütke has served as our Chief Executive Officer since April 2008. Prior to that, Mr. Lütke acted as our Chief Technology Officer between September 2004 and April 2008. Mr. Lütke worked on the core team of the Ruby on Rails framework and has created many popular open source libraries such as Active Merchant. | ||||

Board and Committee Attendance | |||||

Mr. Lütke is Chair of our Board. Mr. Lütke does not sit on any Board committees. He attended every Board meeting held in 2018. | |||||

Current Public Directorships | |||||

Mr. Lütke has no other public directorships. | |||||

Share, Option and RSU Holdings | |||||

Shares: 7,858,504 Class B multiple voting shares are currently held by Tobias Lütke and by 7910240 Canada Inc., which Tobias Lütke is deemed to beneficially own. 145,104 Class A subordinate voting shares are currently held by Mr. Lütke and by 7910240 Canada Inc. This represents 35.50% of votes attaching to all outstanding Shares. | |||||

Tobias Lütke | Options: Mr. Lütke also currently holds 250,031 options to purchase Class A subordinate voting shares under our Stock Option Plan, and 403,348 options to purchase Class B multiple voting shares under our Legacy Option Plan. | ||||

38 | |||||

Ontario, Canada | |||||

Director since 2004 | RSUs: Mr. Lütke currently holds 43,664 Restricted Share Units (RSUs) under our Long Term Incentive Plan. | ||||

Non-Independent | |||||

2018 Annual Meeting Votes | |||||

Mr. Lütke received 99.72% of all votes cast at our 2018 Annual General Meeting. | |||||

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 12

| Robert Ashe held a variety of positions over 24 years with increasing responsibility at Cognos Incorporated, a business intelligence and performance management software company. Mr. Ashe ultimately served as Chief Executive Officer of Cognos Incorporated from 2005 to 2008 before the company was acquired by IBM. Mr. Ashe remained with IBM as a general manager of business analytics from 2008 to 2012. Mr. Ashe holds a Bachelor of Commerce from the University of Ottawa and is a Fellow of the Institute of Chartered Accountants of Ontario. | ||||

Board and Committee Attendance | |||||

Mr. Ashe is our Lead Independent Director, is Chair of our Compensation Committee and is a member of our Audit Committee and our Nominating and Corporate Governance Committee. He attended every Board and Committee meeting held in 2018. | |||||

Current Public Directorships | |||||

Mr. Ashe currently serves on the Board of Directors of ServiceSource International (NASDAQ) and MSCI Inc. (NYSE). | |||||

Share, Option and RSU Holdings | |||||

Robert Ashe | Shares: Mr. Ashe currently owns 28,825 Class A subordinate voting shares. This represents less than 1% of votes attaching to all outstanding Shares. | ||||

60 | |||||

Ontario, Canada | Options: Mr. Ashe currently holds 75,000 options for Class B multiple voting shares under our Legacy Option Plan, which options were granted on December 17, 2014 prior to our becoming a public company. Mr. Ashe currently holds 1,624 options to purchase Class A subordinate voting shares under our Stock Option Plan. | ||||

Director since 2014 | |||||

Independent | |||||

RSUs: Mr. Ashe currently holds 836 Restricted Share Units (RSUs) under our Long Term Incentive Plan. | |||||

DSUs: Mr. Ashe currently holds 562 Deferred Share Units (DSUs) under our Long Term Incentive Plan. | |||||

2018 Annual Meeting Votes | |||||

Mr. Ashe received 99.29% of all votes cast at our 2018 Annual General Meeting. | |||||

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 13

| Gail Goodman served as President and Chief Executive Officer of Constant Contact, a software company providing small businesses with online marketing tools to grow their businesses, for over 16 years. Over that time Ms. Goodman served as a director and chairwoman of the board and led Constant Contact through its initial public offering and for eight years as a publicly traded company, until its acquisition by Endurance International Group Holdings, Inc. (NASDAQ) in February 2016. Ms. Goodman holds a B.A. from the University of Pennsylvania and an M.B.A. from The Tuck School of Business at Dartmouth College. | ||||

Board and Committee Attendance | |||||

Ms. Goodman is a member of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. She attended every Board and Committee meeting held in 2018. | |||||

Current Public Directorships | |||||

None. | |||||

Share, Option and RSU Holdings | |||||

Shares: Ms. Goodman currently owns 1,364 Class A subordinate voting shares. This represents less than 1% of votes attaching to all outstanding Shares. | |||||

Gail Goodman | Options: Ms. Goodman currently holds 9,802 options to purchase Class A subordinate voting shares under our Stock Option Plan. | ||||

58 | |||||

Massachusetts, United States | RSUs: Ms. Goodman currently holds 2,750 Restricted Share Units (RSUs) under our Long Term Incentive Plan. | ||||

Director since 2016 | |||||

Independent | 2018 Annual Meeting Votes | ||||

Ms. Goodman received 99.35% of all votes cast at our 2018 Annual General Meeting. | |||||

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 14

| Colleen Johnston is the former Chief Financial Officer of Toronto-Dominion Bank. Prior to her retirement in 2018 Colleen spent 14 years at TD, ten of which she spent as Group Head, Finance, Sourcing, Corporate Communications and Chief Financial Officer. Prior to TD, Ms. Johnston held senior leadership roles at Scotiabank over the course of 15 years, including as CFO of Scotia Capital. Ms. Johnston currently serves on the board of directors of WestJet (TSX), McCain Foods, Unity Health Toronto, and the Shaw Festival Theatre. Ms. Johnston holds a Bachelor of Business Administration from York University’s Schulich School of Business and is a Fellow of the Institute of Chartered Accountants of Ontario. | ||||

Board and Committee Attendance | |||||

Ms. Johnston was appointed to our Audit Committee in January 2019. | |||||

Current Public Directorships | |||||

Ms. Johnston currently serves on the board of directors of WestJet (TSX). | |||||

Share, Option and RSU Holdings | |||||

RSUs: Ms. Johnston currently holds 2,218 Restricted Share Units (RSUs) under our Long Term Incentive Plan. | |||||

Colleen Johnston | |||||

60 | 2018 Annual Meeting Votes | ||||

Ontario, Canada | N/A | ||||

Director since 2019 | |||||

Independent | |||||

| Jeremy Levine has been a Partner at Bessemer Venture Partners since January 2007, a venture capital firm he joined in May 2001. Prior to joining Bessemer, Mr. Levine was Vice President of Operations at Dash.com Inc., an internet software publisher, from 1999 to 2001. Prior to that, Mr. Levine was an Associate at AEA Investors, a management buyout firm, where he specialized in consumer products and light industrials, from 1997 to 1999. Mr. Levine was with McKinsey & Company as a management consultant from 1995 to 1997. Mr. Levine holds a B.S. degree in Computer Science from Duke University. | ||||

Board and Committee Attendance | |||||

Mr. Levine is a member of our Nominating and Corporate Governance Committee. He attended every Board and Nominating and Corporate Governance Committee meeting held in 2018. | |||||

Current Public Directorships | |||||

None. | |||||

Share, Option and RSU Holdings | |||||

Shares: Mr. Levine currently owns 110,052 Class A subordinate voting shares. This represents less than 1% of votes attaching to all outstanding shares. | |||||

Jeremy Levine | 2018 Annual Meeting Votes | ||||

45 | Mr. Levine received 99.57% of all votes cast at our 2018 Annual General Meeting. | ||||

New York, United States | |||||

Director since 2011 | |||||

Independent | |||||

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 15

| John Phillips is currently Chief Executive Officer with Klister Credit Corp., an investment and consulting company, a position he has held since 1993. Mr. Phillips had a career in the legal profession working in private practice at Blake, Cassels & Graydon LLP for 20 years and as general counsel at Clearnet Communications Inc. for nearly six years. Mr. Phillips currently serves on the Board of Directors of a number of privately held companies and previously had served on the Board of Directors of Clearnet Communications Inc. and Redknee Solutions Inc., both then public companies. Mr. Phillips holds a B.A. from Trinity College, University of Toronto and an L.L.B./J.D. from the Faculty of Law, University of Toronto. | ||||

Board and Committee Attendance | |||||

Mr. Phillips is chair of our Nominating and Corporate Governance Committee and is a member of our Compensation Committee. He attended every Board, Compensation Committee and Nominating and Corporate Governance Committee meeting held in 2018. | |||||

Current Public Directorships | |||||

John Phillips | None. | ||||

68 | Share, Option and RSU Holdings | ||||

Ontario, Canada | Shares: Mr. Phillips, is the Chief Executive Officer of Klister Credit Corp. ("Klister"), and directly or indirectly beneficially owns 50% of Klister and accordingly is considered to indirectly beneficially own 50% of our Shares owned by Klister. Mr. Phillips’ wife, Dr. Catherine Phillips, owns the remaining 50% of Klister. Klister currently owns 4,000,000 Class B multiple voting shares. This represents 18.03% of votes attaching to all outstanding Shares. | ||||

Director since 2010 | |||||

Independent | |||||

2018 Annual Meeting Votes | |||||

Mr. Phillips received 98.88% of all votes cast at our 2018 Annual General Meeting. | |||||

Corporate Cease Trade Orders or Bankruptcy

To the knowledge of Shopify, none of the proposed directors (a) is at the date hereof or has been, in the last 10 years before the date hereof, a director, Chief Executive Officer ("CEO") or Chief Financial Officer ("CFO") of any company, including Shopify, that (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemptions under securities legislation, that was in effect for a period of more than 30 consecutive days (an "Order") that was issued while the proposed director was acting in such capacity; or, (ii) was subject to an Order that was issued after the proposed director ceased to be a director, CEO or CFO and which resulted from an event that occurred while that person was acting in the capacity as director, CEO or CFO.

To the knowledge of Shopify, none of the proposed directors is at the date hereof or has been in the 10 years before the date hereof, a director or executive officer of a company, including Shopify that, while that person was acting in that capacity or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 16

insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, except for Jeremy Levine, who, until June 4, 2018, was a board member of Onestop Internet Inc., a corporation that made an assignment for the benefit of creditors on June 4, 2018. The sale of assets has been completed, and the liquidation is in process.

To the knowledge of Shopify, none of the proposed directors has, within the last 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his or her assets.

Director Independence

Under the NYSE listing standards, independent directors must comprise a majority of a listed company’s Board of Directors within a specified period after the closing of its IPO. For purposes of the NYSE rules, an independent director means a person who, in the opinion of our Board of Directors, has no material relationship with our company. Under National Instrument 58-101 – Disclosure of Governance Practices adopted by the Canadian Securities Administrators ("NI 58-101"), a director is considered to be independent if he or she is independent within the meaning of Section 1.4 of National Instrument 52-110—Audit Committees ("NI 52-110").

Pursuant to our Board Charter, our Board of Directors shall be comprised of a majority of independent directors within the meaning of the applicable listing standards of the NYSE and National Policy 58-201 – Corporate Governance Guidelines adopted by the Canadian Securities Administrators ("NP 58-201").

Our Board of Directors has undertaken a review of the independence of each director. Based on information provided by each director concerning their background, employment and affiliations, our Board of Directors has determined that Messrs. Ashe, Collins (who is not standing for re-election), Levine, and Phillips and Mses. Goodman and Johnston are "independent" as that term is defined under the listing standards of the NYSE and NI 58-101. The majority of the current board (six out of seven) and the director nominees (five out of six) are independent. In making this determination, our Board of Directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our Shares by each non-employee director. Mr. Lütke is not independent by reason of the fact that he is our Chief Executive Officer.

Director Interlocks

Members of our Board of Directors are also members of the Boards of other public companies, as listed in their biographies above. An interlock occurs when two Board members also serve together on the board of another company. Pursuant to Shopify’s Corporate Governance Guidelines, there shall be no more than two board interlocks at any given time. There are no current interlocks between our Board members.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 17

Committee Composition

Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

Steven Collins (Chair)(1) | Robert Ashe (Chair) | John Phillips (Chair) |

Robert Ashe | Gail Goodman | Robert Ashe |

Gail Goodman | John Phillips | Gail Goodman |

Colleen Johnston | Jeremy Levine | |

1 | Steven Collins is currently the chair of the audit committee, but is not standing for re-election at the annual general meeting of shareholders. The Board of Directors plans to appoint Ms. Johnston as audit committee chair. |

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 18

2. Appointment of Auditors

PricewaterhouseCoopers LLP Chartered Professional Accountants ("PWC") has acted as the Company’s auditors since August 2011. In order to be effective, the resolution to reappoint PWC as the Company’s auditors and to authorize the Board of Directors to fix their remuneration must be approved by a majority or votes cast by shareholders, voting together as a single class, present in person or represented by proxy at the Meeting. In 2018, 99.78% of votes cast were in favour of appointing PWC as the Company's auditors.

Unless authority is withheld, the management nominees named in the enclosed Form of Proxy intend to vote FOR the reappointment of PricewaterhouseCoopers LLP Chartered Professional Accountants, the present auditor of the Company, as the auditor of the Company, to hold office until the next annual meeting of shareholders and to authorize the Board of Directors to fix their remuneration.

Auditor Evaluation

The Audit Committee reviews, with senior financial management and the auditors, on an annual basis, the performance of the auditors and auditor independence and rotation.

Auditor Fees

The aggregate amounts paid or accrued by the Company with respect to fees payable to PWC for audit (including separate audits of wholly-owned and non-wholly owned entities, financings, regulatory reporting requirements and U.S. Sarbanes-Oxley Act related services), audit-related, tax and other services in the years ended December 31, 2018 and 2017 were as follows:

Fees | 2018 | 2017 |

Audit | $764,000 | $600,000 |

Audit-Related | $0 | $0 |

Tax | $0 | $0 |

Other | $2,000 | $2,000 |

Total | $766,000 | $602,000 |

Audit fees relate to the audit of our annual consolidated financial statements, the review of our quarterly condensed consolidated financial statements and services in connection with our registration statement on Form F-10 (related to our 2018 public offerings of Class A subordinate voting shares).

Audit-related fees consist of aggregate fees for accounting consultations and other services that were reasonably related to the performance of audits or reviews of our consolidated financial statements and were not reported above under "Audit Fees".

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 19

Tax Fees relate to assistance with tax compliance, expatriate tax return preparation, tax planning and various tax advisory services.

Other Fees are any additional amounts for products and services provided by the principal accountants other than the services reported above under "Audit Fees", "Audit-Related Fees" and "Tax Fees".

Audit Committee Pre-Approval Policies and Procedures

From time to time, management recommends to and requests approval from the Audit Committee for audit and non-audit services to be provided by the Company's auditors. The Audit Committee considers such requests, if applicable, on a quarterly basis, and if acceptable, pre-approves such audit and non-audit services. During such deliberations, the Audit Committee assesses, among other factors, whether the services requested would be considered "prohibited services" as contemplated by the U.S. Securities and Exchange Commission (the "SEC"), and whether the services requested and the fees related to such services could impair the independence of the auditors.

The Audit Committee considered and agreed that the fees paid to the Company's auditors in the years ended December 31, 2018 and 2017 were compatible with maintaining the independence of the Company's auditors. The Audit Committee determined that, in order to ensure the continued independence of the auditors, only limited non-audit services will be provided to the Company by PWC.

Since the implementation of the Audit Committee pre-approval process in November 2015, all audit and non-audit services rendered by our auditors have been pre-approved by the Audit Committee.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 20

3. Advisory Resolution on Executive Compensation

Shopify will present a non-binding advisory vote on the Board of Director’s approach to executive compensation as part of our process of shareholder engagement.

Shopify is committed to ensuring that Shareholders fully understand the objectives, philosophy and principles the Board of Directors has used in its approach to executive compensation decisions, and to providing Shareholders with executive compensation disclosure that is clear and comprehensive.

Shopify endeavors to maintain an executive compensation program that aligns the interests of our executives with our Shareholder’s interests, so that we may attract, motivate and retain executives who will continue to create sustainable, long-term value for our shareholders. Please see Section 3 - Compensation of Executives for more information about our executive compensation. In 2018, 94.79% of votes cast were in favour of our Board of Director's approach to executive compensation.

The management nominees named in the enclosed Form of Proxy intend to vote FOR the following advisory, non-binding resolution in respect of Shopify’s approach to executive compensation:

"BE IT RESOLVED THAT, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors, the shareholders accept the approach to executive compensation disclosed in the Corporation’s management proxy circular delivered in advance of the 2019 annual meeting of shareholders."

Approval of this resolution will require an affirmative vote of a majority of the votes cast by Shareholders, voting together as a single class, present in person or represented by proxy at the Meeting. Since this is an advisory vote, the results will not be binding upon the Board of Directors. However, the Board and, in particular, the Compensation Committee, will take the results of the vote into account when considering future compensation policies, procedures and decisions and in determining whether there is a need to increase their engagement with Shareholders on compensation and related matters.

In the event that a significant number of Shareholder votes oppose the resolution, the Board of Directors will consult with Shareholders, particularly those who are known to have voted against it, in order to understand their concerns and will review the Company’s approach to compensation in the context of those concerns. Shareholders who have voted against the resolution will be encouraged to contact the Board of Directors to discuss their specific concerns. See "Shareholder Communications with the Board" in Section 4 - Corporate Governance Policies and Practices of this Circular.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 21

Shareholder Proposals

There are no shareholder proposals to be considered at the Meeting.

Shareholder proposals to be considered for inclusion in next year’s Management Proxy Circular for the Company’s 2020 Annual Meeting of Shareholders must be submitted no later than January 18, 2020, subject to adjournment or postponement of the Meeting, and must comply with section 137 of the CBCA.

We have adopted an advance notice by-law that provides that shareholders seeking to nominate candidates for election as directors must provide timely written notice to our Corporate Secretary. See "Advance Notice Requirements for Director Nominations" in Section 4 - Corporate Governance Policies and Practices.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 22

SECTION 3: COMPENSATION DISCUSSION AND ANALYSIS

Compensation of Executives

Introduction

This section provides an overview of our executive compensation philosophy, objectives, policies and practices that apply to the compensation paid to our Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO") and other executive officers. In this section, we also describe the key factors considered in making executive compensation decisions and how these decisions align with our strategy. Our CEO, CFOs and three other most highly compensated policy-making executives who served as executive officers for the year ended December 31, 2018, were:

Tobias Lütke | Chief Executive Officer |

Russell Jones1 | Chief Financial Officer (former) |

Amy Shapero2 | Chief Financial Officer |

Craig Miller | Chief Product Officer |

Jeffrey Weiser | Chief Marketing Officer |

Harley Finkelstein | Chief Operating Officer |

1 | Within fiscal year 2018 Mr. Jones was Chief Financial Officer from January 1, 2018 to April 1, 2018. Subsequently, Mr. Jones was a Special Advisor until he retired on September 30, 2018. |

2 | Ms. Shapero commenced as Chief Financial Officer on April 2, 2018. |

(collectively, the "Named Executive Officers" or "NEOs").

Full year compensation is presented in the summary compensation table below.

Fiscal 2018 Business Highlights

2018 was another year of rapid growth, enabling Shopify to offer more value to more merchants. Key business highlights for fiscal year 2018 were:

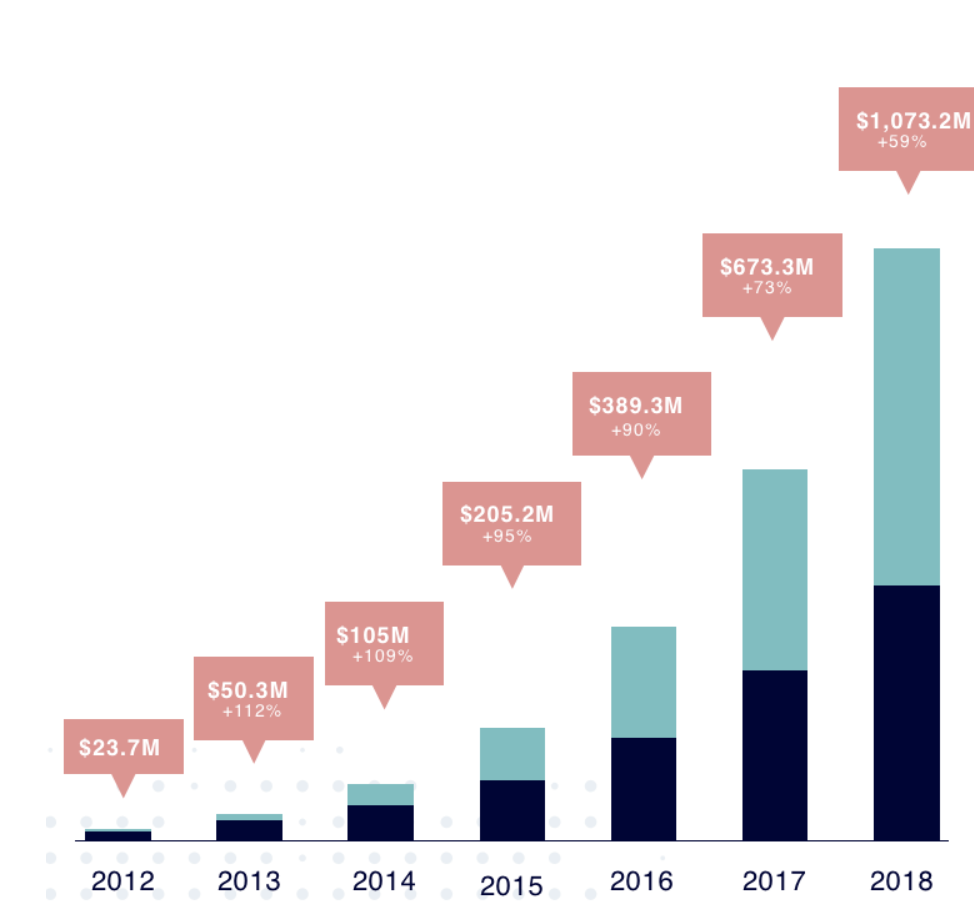

Growth | Our mission is to make commerce better for everyone, and we believe we can help merchants of nearly all sizes, from aspirational entrepreneurs to large enterprises, and all retail verticals realize their potential at all stages of their business life cycle. Our merchant population continued to grow, gaining 211,000 net new merchants, ending off 2018 with over 820,000 merchants from approximately 175 countries using our platform. Total revenue for the full year grew 59% to $1,073.2 million. |

Strategy | In 2018, we focused our investment efforts on international growth, Shopify Plus, and core platform growth and product development. Our growth strategy is driven by our mission: make commerce better for everyone. Key elements of our strategy include: growing our merchant base; growing our merchants’ revenue; continuous innovation and expansion of our platform; continuing to grow and develop our ecosystem; continuing to expand our referral partner programs; and continuing to build for the long-term. |

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 23

People & Culture | We grew our employee population by approximately 40% in 2018, ending the year off with more than 4,000 employees and contractors worldwide. We are intentional in building a culture and environment that empowers care and growth in high-impact people. Shopify is consistently among Glassdoor's Best Places to Work as rated by employees. We have a high focus on continuous learning and personal development. We encourage employees to map their personal learning journey through our "Own Your Own Development" program. We deeply value innovation and experimentation. Every few months we take a break from our regular work for “Hack Days”, three full days when we encourage our employees to step out of their ‘day jobs’ to tackle a new problem or project that inspires them and adds value to Shopify. |

Innovation | In 2018, our innovations focused on adding more value to our merchants, striving to not just keep pace in this dynamic environment, but to bring to market new and better selling and buying experiences by leveraging what technology and connectivity have made possible. We look to do this for smaller merchants by simplifying their user experience and arming them with new and innovative ways to compete with larger, better-funded competitors, as well as for larger merchants seeking technology and support for higher volumes and global reach. Some of the new product launches included: Fraud Protect, a chargeback protection product available to merchants using Shopify Payments that automates order reviews and covers chargeback costs on eligible orders; Shopify’s first-ever-brick and mortar space in Los Angeles serving as a hub where merchants can visit to receive support, inspiration, and education to help grow their business; Locations, a multi-location inventory platform that enables merchants to update and track inventory quantities across multiple locations from their Shopify account; a new Shopify App Store that prioritizes discovery of apps through personalized recommendation, enabling merchants to make better and faster decisions for their businesses; and Shopify AR, making selling with Augmented Reality (AR) accessible for small businesses. |

Revenue

We have executed well on our growth strategy, as demonstrated by the consistent and strong expansion of revenue for the past several years.

For more information regarding our key business highlights for fiscal year 2018, please refer to our audited consolidated financial statements and the management's discussion and analysis for the fiscal

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 24

year ended December 31, 2018, which are accessible on SEDAR at sedar.com, on EDGAR at sec.gov, or on our website at investors.shopify.com.

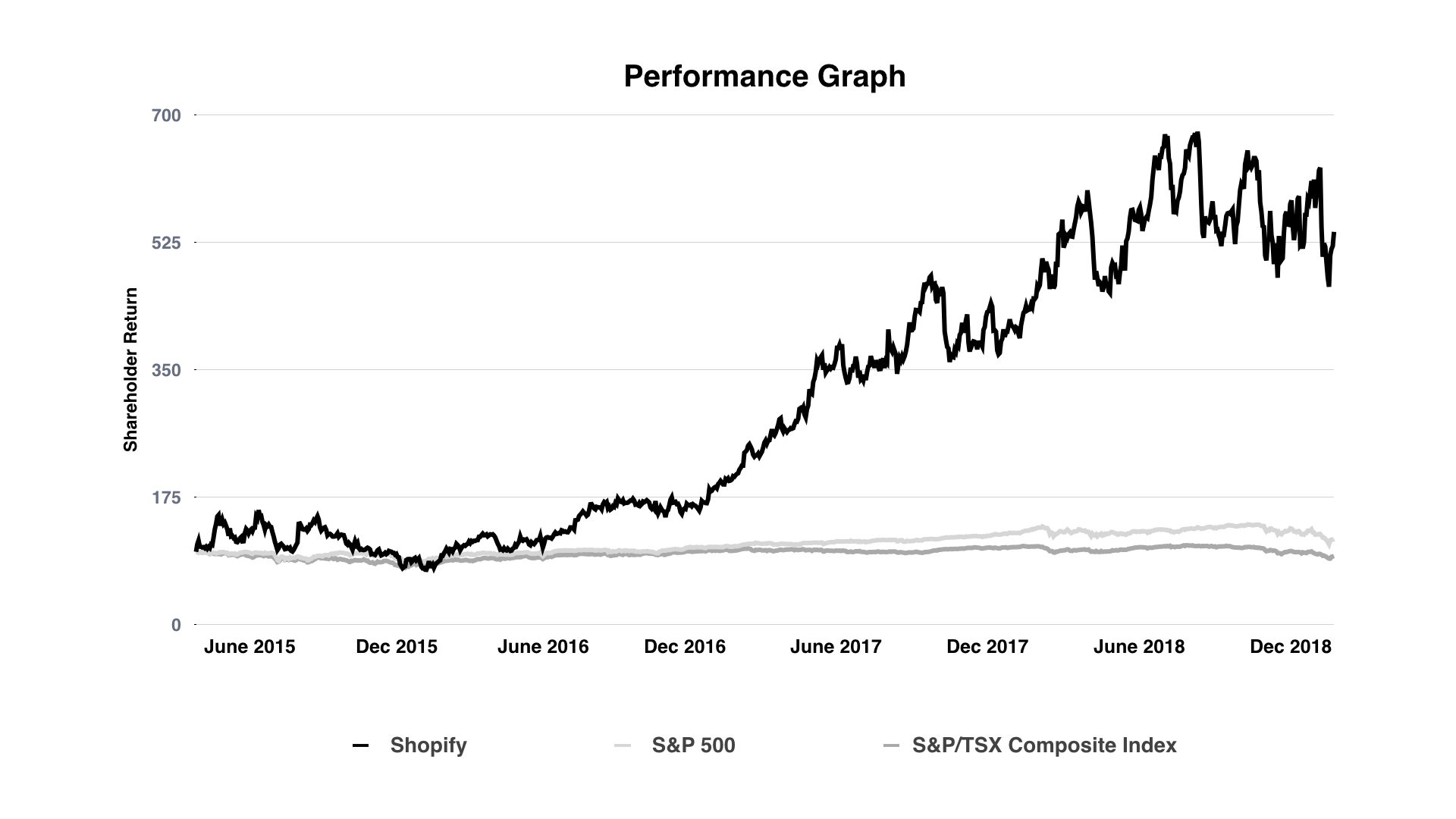

Shareholder Return Performance Graph

The above graph compares the total shareholder return on a US$100 investment in Shopify’s Class A subordinate voting shares to the same investment in the S&P 500 Index and the S&P/TSX Composite Index over the same period. In 2018 our stock outperformed both the broader market as reflected by the S&P 500 index and the S&P/TSX Composite Index. The above graph shows how a US$100 investment in Shopify on May 21, 2015 (the date of our IPO), with a closing stock price of US$25.68 on such date, would have grown to US$539.14 on December 31, 2018, with a closing stock price of US$138.45 on such date.

Our compensation program is aimed to ensure that the compensation we pay to our executive officers, including our NEOs, is related to factors that influence shareholder value. In order to align the interests of our executive officers with those of Shopify, a meaningful portion of compensation paid to our executive officers is in the form of long-term equity-based incentives such that the overall value of compensation paid to our NEOs is directly affected by our stock price, which grew by 37% between December 29, 2017 and December 31, 2018 and by 439% from May 21, 2015 (the date of our IPO) to December 31, 2018.There is therefore a strong correlation between the growth trend shown in the stock performance graph above and the compensation we have paid to NEOs under the same period. Stock price performance however is not the only predictor or outcome of the success of our leadership team, especially in the short term. It is one of many considerations that influence our decisions around NEO compensation.

Executive Compensation Philosophy

Our compensation program is designed to allow us to attract, retain and motivate a highly talented executive team, allowing Shopify to succeed in this rapidly evolving environment and achieve our business and financial objectives. We expect our team to possess and demonstrate strong leadership and

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 25

management capabilities, as well as nurture our company culture, which is the foundation of our success and remains a pivotal part of our everyday operations. We believe compensation should be structured to ensure that a significant portion of an executive's compensation opportunity is at risk, and related to factors that influence shareholder value.

Objectives

Our executive compensation program is designed to achieve the following objectives:

• | Provide market-competitive compensation opportunities to attract and retain talented, high-performing and experienced executive officers, whose knowledge, skills and level of impact are critical to our success. |

• | Motivate these executive officers to deliver outstanding outcomes. |

• | Align the interests of our executive officers with those of Shopify by providing long term incentives that tie directly to the long-term value and growth of our business. |

• | Provide long-term incentives that encourage appropriate levels of risk-taking by the executive team. |

Compensation Governance

Our Board of Directors has adopted a written charter for the Compensation Committee that establishes the Compensation Committee’s purpose and its responsibilities with respect to executive compensation. This charter provides that the Compensation Committee shall, among other things, assist the Board of Directors in its oversight of executive compensation, management development and succession, Board member compensation and executive compensation disclosure. The full text of the charter can be found at investors.shopify.com.

In 2018 our Compensation Committee and the Board of Directors considered many factors in determining adjustments to the cash and equity compensation of our executives, including our NEOs. The Compensation Committee considered the need to retain executive talent, the highly competitive market for executive talent, and the market analysis and observations provided by the Compensation Committee’s compensation consultant, discussed below.

Our Compensation Committee currently consists of Robert Ashe (Chair), Gail Goodman, and John Phillips, each of whom is considered by the Board to be independent. For more information on the skills and experience of our Compensation Committee members please see their biographies in Section 2 - Business of the Meeting - 1. Election of Directors.

Compensia, a compensation consulting firm which provides independent advice on executive compensation and related governance issues, provided services exclusively to the Compensation Committee in connection with executive compensation matters for 2018, including the following:

• | assisted in reviewing the competitiveness and design of our recommended cash and equity compensation arrangements for our executives and board members; |

• | assisted in designing the size and structure of new equity awards for our executives; |

• | reviewed and advised on our comparator group composed of industry-related, public companies with comparable revenue, market capitalization and employee populations; |

• | conducted executive and board compensation assessments against compensation for similarly situated executives and board members at our comparator group companies; and |

• | attended and supported all compensation committee meetings. |

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 26

Executive Compensation-Related Fees

For the services rendered in 2018, aggregate professional service fees were $105,652. Compensia did not provide any services to Shopify other than directly to the Compensation Committee or as approved and overseen by the Compensation Committee.

Year | Consulting Firm | Executive Compensation Consulting-Related Fees ($) | All Other Fees | Total Fees ($) | Currency | ||

2018 | Compensia | 105,652 | - | 105,652 | USD | ||

2017 | Compensia | 122,525 | - | 122,525 | USD | ||

Comparator Group

The fiscal 2018 compensation comparator group was developed in 2017 by Compensia our Compensation Committee’s independent compensation consultant, and reviewed and approved by our Compensation Committee. Generally, the comparator group consisted of similar industry public companies with comparable revenue, revenue growth, market capitalization and employee populations to Shopify.

The compensation comparator group that was used to inform compensation decisions in terms of level of pay and pay mix for fiscal 2018 consisted of the following companies:

Atlassian Corp. CoStar Group Etsy GrubHub Guidewire Software HubSpot LogMeIn | Paycom Software Proofpoint ServiceNow Splunk Square Tableau Software The Ultimate Software Group | Tyler Technologies Veeva Systems Workday Yelp Zendesk Zillow Group |

The Compensation Committee reviews and updates these peer companies on at least an annual basis if changes in market position and company size, including our own, suggest more representative comparator group companies.

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 27

Program Design

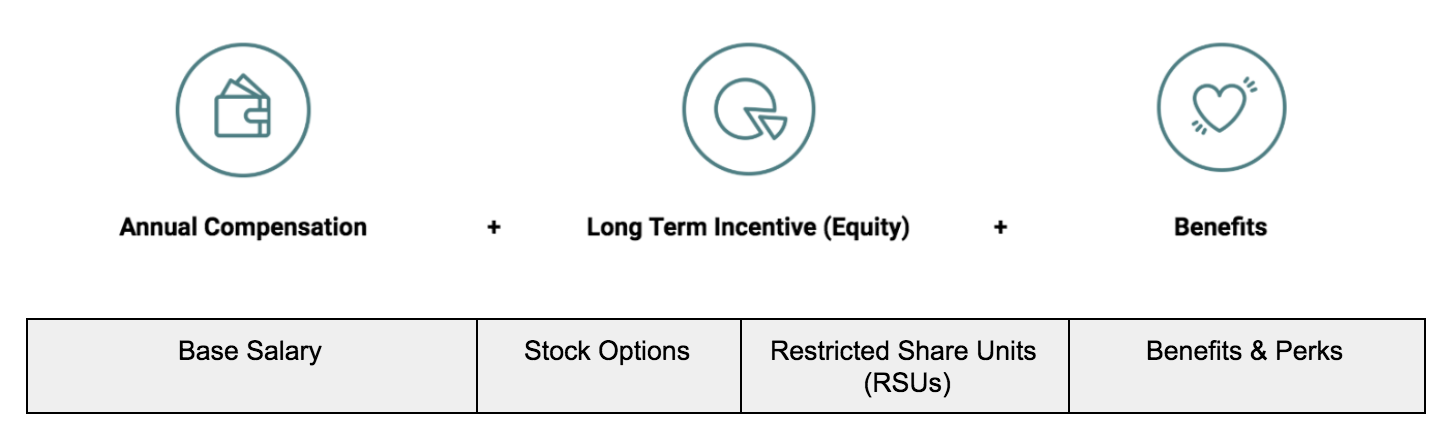

In 2018, our compensation program consisted of the following elements:

SHOPIFY MANAGEMENT INFORMATION CIRCULAR 28

Component | Form | Rationale | Review Process | Award Determination |

Base Salary | Cash | Provided as a fixed source of compensation | Reviewed annually Adjustments may be warranted throughout the year | Established based on the scope of the executive officer’s responsibilities, impact, internal fairness, criticality and market data. Takes into consideration: -Total compensation opportunity - Individual level of impact - Promotions or other changes in the scope or breadth of role or responsibilities - Desired positioning relative to market - Shopify performance on key business measures - Internal fairness |

Long Term Incentive (Equity) | Stock Options and Restricted Share Units (RSUs) | Serves as an effective retention tool and focuses the executive officers on creating long term value over time | Reviewed annually Prior to November 2017, equity awards were subject to time-based vesting at a rate of 25% on the first anniversary of the vesting start date, the remainder vesting in equal quarterly installments over the next three years. After November 2017, equity awards are subject to time-based vesting at a rate of 33.33% on the first anniversary of the vesting start date, the remainder vesting in equal quarterly installments over the next two years. | Size and frequency of equity awards are based on: - Total compensation opportunity - Attraction and retention - Market competitiveness - CEO’s recommendations for his direct reports - Individual level of impact - Increased scope of role / level of impact - Existing equity award holdings (including the unvested portion of such awards) - Internal fairness -Our available equity plan funding / dilution limitations -Review of market practices related to aggregate equity dilution metrics such as burn rate and compensation expense |

Component | Form | Rationale | Review Process | Award Determination |

Employee Benefits & Perks | Flexible vacation, benefits and Perks | Attraction and retention of key talent | Ongoing | - Benefits include health, dental, life, disability insurance benefits - Voluntary perquisites include catered meals, flexible vacation and a flexible spending allowance - Same benefits and perks are offered to all Shopify employees |

Fiscal 2018 Base Salaries

The Compensation Committee determined the fiscal 2018 base salary of each of our NEOs after considering market data and the recommendations of our CEO, other than with respect to his own base salary. At the beginning of fiscal 2018, the Compensation Committee adjusted the base salaries for Mr. Finkelstein and Mr. Miller based on review of the factors noted above. In addition our compensation committee determined that it was appropriate to maintain Mr. Lütke's base salary.

The table below sets forth the annual base salaries for our NEOs for fiscal 2018 including the percentage increase from 2017.

Fiscal 2018 Base Salaries

Name | Base Salary ($US) | Increase (%) |

Tobias Lütke | 586,400 | 0% |

Russell Jones1 | 384,825 | 0% |

Amy Shapero2 | 513,100 | n/a |

Craig Miller | 403,150 | 5% |

Jeffrey Weiser3 | 500,000 | n/a |

Harley Finkelstein | 403,150 | 5% |