Form 8-K RADIANT LOGISTICS, INC For: Mar 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) March 27, 2019

RADIANT LOGISTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

001-35392 |

|

04-3625550 |

|

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

405 114th Avenue, S.E., Third Floor, Bellevue, WA 98004

(Address of Principal Executive Offices) (Zip Code)

(425) 943-4599

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 27, 2019 Radiant Logistics, Inc. (the “Company,” “we,” “us” or “our”) released presentation materials (the “Presentation Materials”) that management intends to use from time to time in presentations about our operations and performance. We may use the Presentation Materials in presentations to current and potential investors, professionals within the securities industry, lenders, creditors, insurers, vendors, customers, employees and others with an interest in us and our business.

The information contained in the Presentation Materials is summary information that should be considered in the context of our filings with the Securities and Exchange Commission and other public announcements that we may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K (this “Report”). While we may elect to update the Presentation Materials in the future to reflect events and circumstances occurring or existing after the date of this Report, we specifically disclaim any obligation to do so. The Presentation Materials are furnished as Exhibit 99.1 to this Report and are incorporated herein by this reference.

The information referenced under Item 7.01 (including Exhibit 99.1 referenced in Item 9.01 below) of this Report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Report. This Report shall not be deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits

|

(d) |

Exhibits. |

|

No. |

|

Description |

|

|

|

|

|

99.1 |

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Radiant Logistics, Inc. |

||

|

|

|

|

|

||

|

Date: March 27, 2019 |

|

|

By: |

|

/s/ Todd Macomber |

|

|

|

|

|

|

Todd Macomber |

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

(NYSE American: RLGT) GLOBAL TRANSPORTATION & LOGISTICS It’s the network that delivers! Exhibit 99.1

Disclaimer This presentation and discussion includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. All statements, other than statements of historical fact, including without limitation statements regarding the financial position, strategic plan and other plans, projections, future industry characteristics, growth expectations, future ability to identify, consummate, and integrate acquisitions, and objectives for our future operations, are forward-looking statements. Such statements may be identified by their use of terms or phrases such as “may,” “could,” “expects,” “estimates,” “projects,” “believes,” “anticipates,” “plans,” “intends,” and similar terms and phrases. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Although we believe that such forward-looking statements are based on reasonable assumptions, we give no assurance that our expectations will in fact occur. For examples of risks, uncertainties, and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements, see “Risk Factors” in the prospectus to which this offering relates and the documents incorporated by reference therein. Existing and prospective investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except for the extent required by applicable securities laws. This presentation may include the use of net revenues, EBITDA, and adjusted EBITDA, which are financial measures that are not in accordance with generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. We define net revenues as revenues less directly related operations and expenses attributed to the company’s services. We define EBITDA to exclude the effects of preferred stock dividends, interest and taxes, and excludes the “non-cash” effects of depreciation and amortization on long-term assets. Companies have some discretion as to which elements of depreciation and amortization are excluded in the EBITDA calculation. We exclude all depreciation charges related to furniture and equipment, all amortization charges, including amortization of leasehold improvements and other intangible assets. We define adjusted EBITDA to exclude changes in contingent consideration, expenses specifically attributable to acquisitions, severance and lease termination costs, F/X gains and losses, extraordinary items, share-based compensation expense, non-recurring litigation expenses, and other non-cash charges. Our presentation of net revenues, EBITDA, and adjusted EBITDA should not be construed as an inference that our results will be unaffected by unusual or non-recurring items. Our computations of net revenue, EBITDA, and adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Reconciliations of our non-GAAP financial measures presented to our GAAP-based financial measures are included on the last slide of this presentation. FORWARD-LOOKING STATEMENT NON-GAAP FINANCIAL DATA

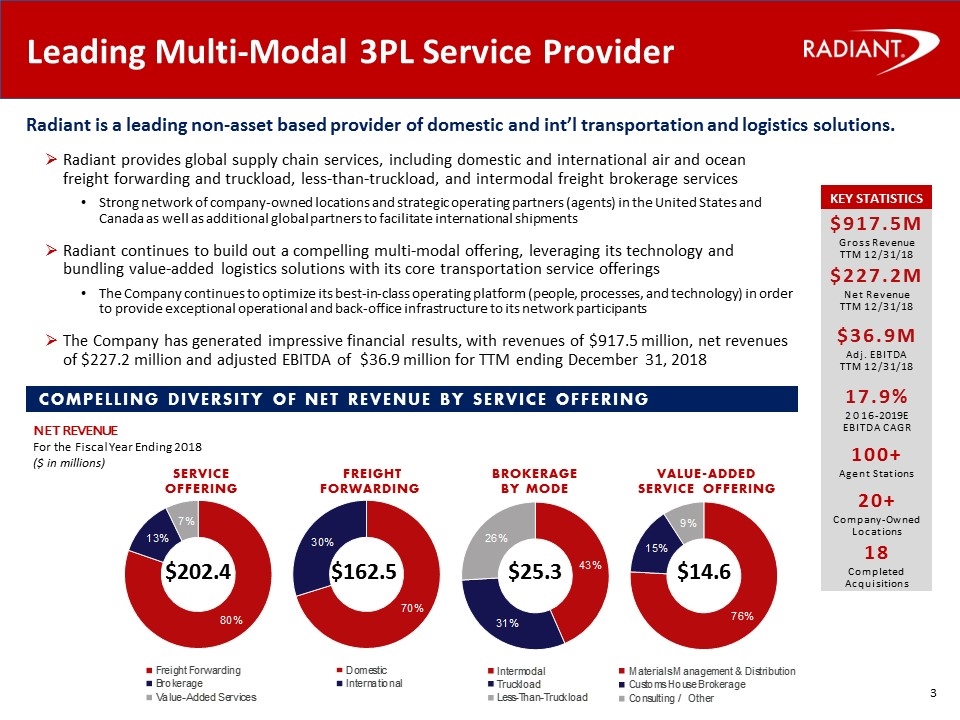

Leading Multi-Modal 3PL Service Provider Radiant provides global supply chain services, including domestic and international air and ocean freight forwarding and truckload, less-than-truckload, and intermodal freight brokerage services Strong network of company-owned locations and strategic operating partners (agents) in the United States and Canada as well as additional global partners to facilitate international shipments Radiant continues to build out a compelling multi-modal offering, leveraging its technology and bundling value-added logistics solutions with its core transportation service offerings The Company continues to optimize its best-in-class operating platform (people, processes, and technology) in order to provide exceptional operational and back-office infrastructure to its network participants The Company has generated impressive financial results, with revenues of $917.5 million, net revenues of $227.2 million and adjusted EBITDA of $36.9 million for TTM ending December 31, 2018 Radiant is a leading non-asset based provider of domestic and int’l transportation and logistics solutions. Compelling diversity of Net revenue by SERVICE OFFERING Service Offering Freight Forwarding Brokerage BY MODe Value-Added Service Offering Net Revenue For the Fiscal Year Ending 2018 ($ in millions) Key Statistics $917.5M Gross Revenue TTM 12/31/18 $227.2M Net Revenue TTM 12/31/18 $36.9M Adj. EBITDA TTM 12/31/18 17.9% 2016-2019E EBITDA CAGR 100+ Agent Stations 20+ Company-Owned Locations 18 Completed Acquisitions Leading Multi-Modal 3PL Service Provider $202.4 $162.5 $25.3 $14.6 13% 7 $ 202.4 162.5 25.3 14.6 80 30 70 26 43 31 15 9 76 Freight Forwarding Brokerage Value-Added Services Domestic International Intermodeal truckload less-than-truckload materials management & distribution customs house brokerage consulting/other service offering freight forwarding brokerage by mode value-added services offering

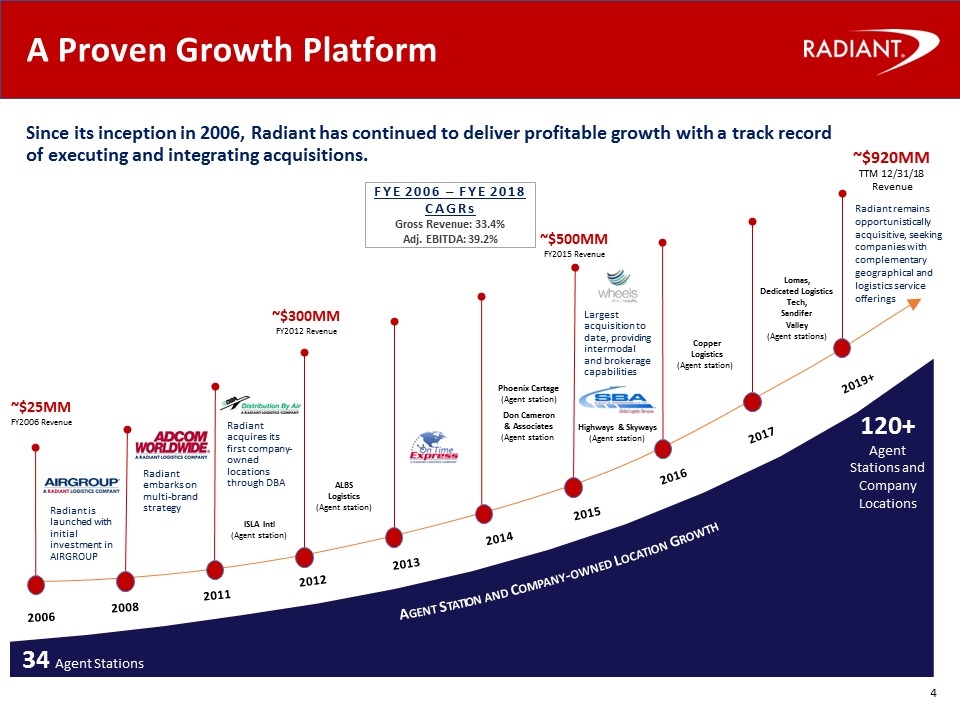

120+ Agent Stations and Company Locations Agent Station and Company-owned Location Growth 34 Agent Stations 2015 ~$920MM TTM 12/31/18 Revenue Radiant is launched with initial investment in AIRGROUP ISLA Intl (Agent station) Phoenix Cartage (Agent station) ALBS Logistics (Agent station) Highways & Skyways (Agent station) Copper Logistics (Agent station)) Lomas, Dedicated Logistics Tech, Sandifer Valley (Agent stations) 2013 Radiant acquires its first company-owned locations through DBA 2014 Largest acquisition to date, providing intermodal and brokerage capabilities Radiant remains opportunistically acquisitive, seeking companies with complementary geographical and logistics service offerings Don Cameron & Associates (Agent station) ~$300MM FY2012 Revenue FYE 2006 – FYE 2018 CAGRs Gross Revenue: 33.4% Adj. EBITDA: 39.2% 2006 2015 2008 2017 2011 2012 2013 2014 2016 2019+ Radiant embarks on multi-brand strategy ~$500MM FY2015 Revenue ~$25MM FY2006 Revenue A Proven Growth Platform Since its inception in 2006, Radiant has continued to deliver profitable growth with a track record of executing and integrating acquisitions.

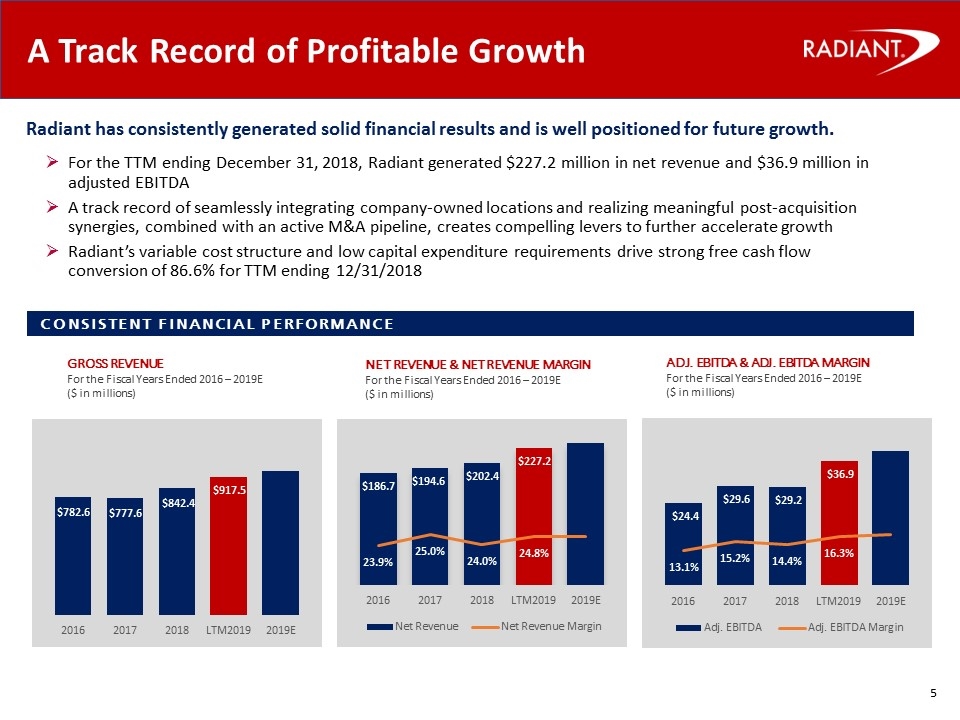

For the TTM ending December 31, 2018, Radiant generated $227.2 million in net revenue and $36.9 million in adjusted EBITDA A track record of seamlessly integrating company-owned locations and realizing meaningful post-acquisition synergies, combined with an active M&A pipeline, creates compelling levers to further accelerate growth Radiant’s variable cost structure and low capital expenditure requirements drive strong free cash flow conversion of 86.6% for TTM ending 12/31/2018 A Track Record of Profitable Growth Radiant has consistently generated solid financial results and is well positioned for future growth. Consistent financial performance Gross Revenue For the Fiscal Years Ended 2016 – 2019E ($ in millions) NET Revenue & NET REVENUE MARGIN For the Fiscal Years Ended 2016 – 2019E ($ in millions) ADJ. EBITDA & ADJ. EBITDA MARGIN For the Fiscal Years Ended 2016 – 2019E ($ in millions) $ 782.6 777.6 842.4 917.5 186.7 194.6 202.4 227.2 24.4 29.6 29.2 36.9 23.9 % 25.0 24.0 24.8 13.1 15.2 14.4 16.3 2016 2017 2018 LMT2019 2019 Net revenue margin adj. EBITDA margin

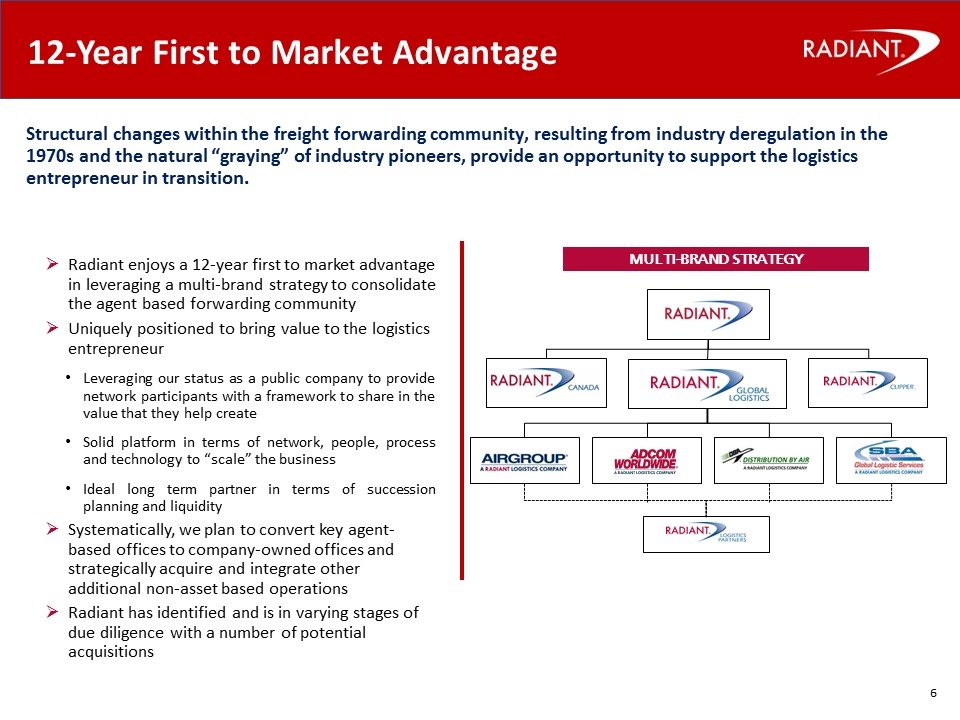

Radiant enjoys a 12-year first to market advantage in leveraging a multi-brand strategy to consolidate the agent based forwarding community Uniquely positioned to bring value to the logistics entrepreneur Leveraging our status as a public company to provide network participants with a framework to share in the value that they help create Solid platform in terms of network, people, process and technology to “scale” the business Ideal long term partner in terms of succession planning and liquidity Systematically, we plan to convert key agent-based offices to company-owned offices and strategically acquire and integrate other additional non-asset based operations Radiant has identified and is in varying stages of due diligence with a number of potential acquisitions 12-Year First to Market Advantage Structural changes within the freight forwarding community, resulting from industry deregulation in the 1970s and the natural “graying” of industry pioneers, provide an opportunity to support the logistics entrepreneur in transition. MULTI-BRAND STRATEGY

Diversified Customer Base Over 12,000 individual customers No single agency station accounts for more than 5% of net revenues Top 5 agency stations account for less than 15% of net revenues Top 10 customers account for less than 10% of net revenues No single customer accounts for more than 2% of net revenues Radiant provides customized time critical domestic and international transportation and logistics solutions to a diversified customer base of manufacturers, distributors and retailers. For FYE2018 and $ in millions HIGHLY DIVERSIFIED CUSTOMER BASE (1) NET REVENUE BY STATION TYPE (1) INDUSTRIES SERVED Military & Government Manufacturing & Consumer Goods Medical, Healthcare & Pharmaceuticals Electronics & High Tech Oil & Gas/Energy Trade Shows, Events & Advertising Retail Aviation & Automotive Industrial & Farm $202.4

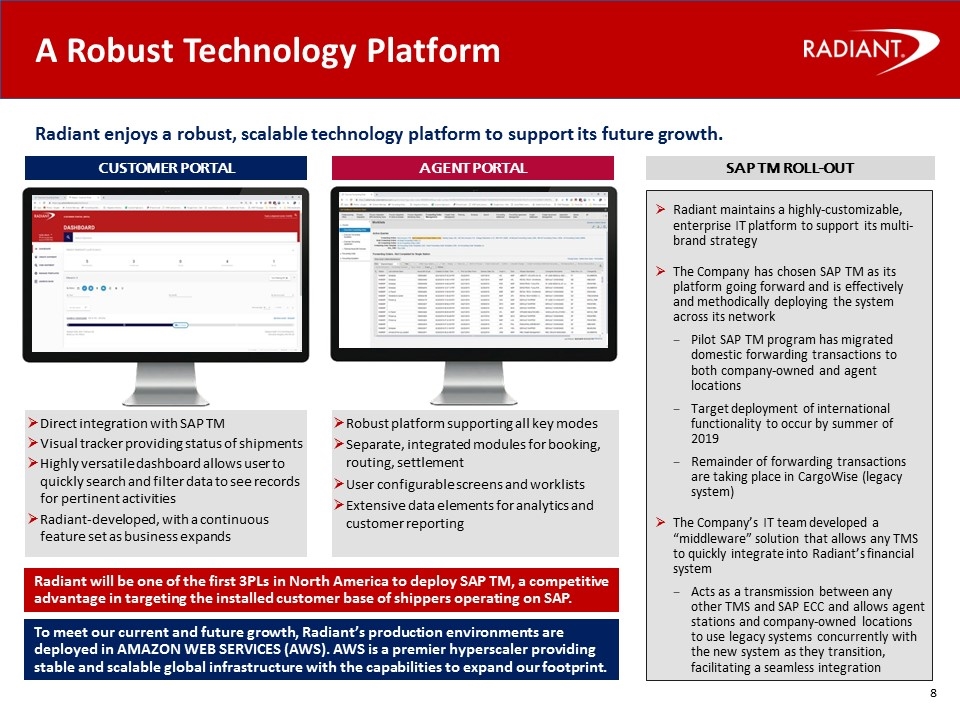

A Robust Technology Platform Radiant enjoys a robust, scalable technology platform to support its future growth. Radiant maintains a highly-customizable, enterprise IT platform to support its multi-brand strategy The Company has chosen SAP TM as its platform going forward and is effectively and methodically deploying the system across its network Pilot SAP TM program has migrated domestic forwarding transactions to both company-owned and agent locations Target deployment of international functionality to occur by summer of 2019 Remainder of forwarding transactions are taking place in CargoWise (legacy system) The Company’s IT team developed a “middleware” solution that allows any TMS to quickly integrate into Radiant’s financial system Acts as a transmission between any other TMS and SAP ECC and allows agent stations and company-owned locations to use legacy systems concurrently with the new system as they transition, facilitating a seamless integration AGENT PORTAL CUSTOMER PORTAL SAP TM ROLL-OUT Radiant will be one of the first 3PLs in North America to deploy SAP TM, a competitive advantage in targeting the installed customer base of shippers operating on SAP. Robust platform supporting all key modes Separate, integrated modules for booking, routing, settlement User configurable screens and worklists Extensive data elements for analytics and customer reporting Direct integration with SAP TM Visual tracker providing status of shipments Highly versatile dashboard allows user to quickly search and filter data to see records for pertinent activities Radiant-developed, with a continuous feature set as business expands To meet our current and future growth, Radiant’s production environments are deployed in AMAZON WEB SERVICES (AWS). AWS is a premier hyperscaler providing stable and scalable global infrastructure with the capabilities to expand our footprint.

Built-in acquisition pipeline Opportunity to continue to selectively convert agent stations to company-owned operations Conversions can be executed at attractive valuations and typically structured with earn-outs Incremental cost synergies available at the station level Best-in-class technology Have utilized SAP ERP since inception, providing robust analytics and functionality One of the first 3PLs in North America to implement SAP TM, which will provide seamless integration with the vast universe of shippers operating on SAP Unique Multi-Brand Strategy Radiant has maintained the brands from its agent network acquisitions including AIRGROUP (2006), ADCOM (2008), Distribution by Air (2011), and SBA (2015) Provides multiple on-ramps for agents to join the network while centralizing back-office operations and creating a pipeline of attractive tuck-in acquisitions Company-owned locations operate as Radiant Global Logistics, including agency locations as they convert to company-owned stores Scalable infrastructure Scalable platform with infrastructure and team in place to support a much larger organization Track record of on-boarding acquisitions and capturing significant synergies through absorption of back-office functions Uniquely Positioned in the Marketplace

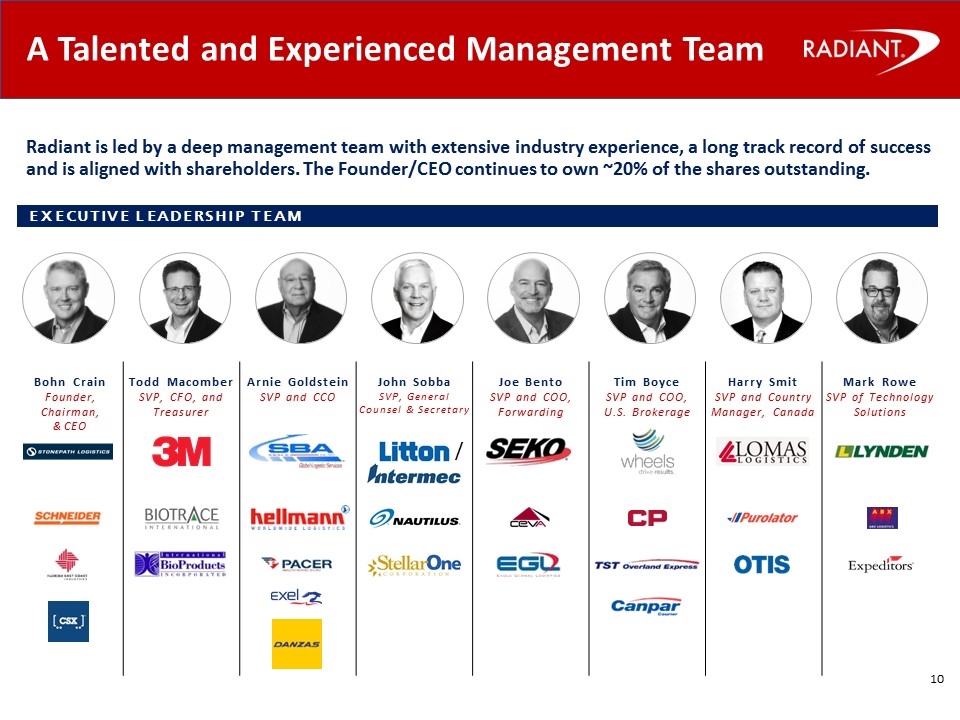

Bohn Crain Founder, Chairman, & CEO Todd Macomber SVP, CFO, and Treasurer Arnie Goldstein SVP and CCO John Sobba SVP, General Counsel & Secretary Joe Bento SVP and COO, Forwarding Tim Boyce SVP and COO, U.S. Brokerage Harry Smit SVP and Country Manager, Canada Mark Rowe SVP of Technology Solutions Executive Leadership Team A Talented and Experienced Management Team Radiant is led by a deep management team with extensive industry experience, a long track record of success and is aligned with shareholders. The Founder/CEO continues to own ~20% of the shares outstanding. / Stonepath logistics Schneider csx Florida east coast industries 3m biotrace international international bioproducts incorporated SBA global logistic services hellmann worldwide logistics pacer exel danzas Litton intermec nautilus stellarone corporation seko ceva EGL wheels drive results cp tst overland express canpar lomas logistics purolator Otis lynden expeditors

Multiple Opportunities for Future Growth Strong, Consistent Record of Organic Growth Vertical Specialization Service Offering expansion New Agent Onboarding Internal and external M&A Strong Free Cash Flow and Financial flexibility Entrepreneurial characteristics of the leading agent-based network, underpinned by Management’s focus on increasing company-owned same-store-sales, provides consistent organic growth Recent investment in Salesforce platform is expected to drive continued organic growth momentum Recent investment in X-suite driving productivity gains in the back-office and margin expansion (adj. EBITDA as a function of gross margin) Recently initiated vertical strategy focusing on key end markets such as military & government, healthcare & life sciences, and humanitarian / NGO, reaping early rewards Former operators in respective industries serve as vertical experts, providing deep institutional knowledge to agents and internal sales force Vertical experts typically bring an existing book of business with them when joining Radiant, bolstering organic revenue growth Leveraging competencies gained through Wheels, Management continues to build out freight brokerage, intermodal, and value-added services to enhance and deepen customer relationships Continuing to focus on growing through a strategy of bundling value-added logistics solutions with its core transportation service offering Significant opportunity exists to cross-sell services to existing customers only utilizing one or two service offerings Radiant’s multi-brand strategy provides a number of ways to add new agent stations / locations into the network The Company’s three Regional Vice Presidents are each charged with recruiting agents to the Radiant platform. Incremental cost of supporting the next agent station is very small Continuing to replenish a pipeline of potential tuck-in acquisitions as agent stations ultimately convert Active M&A pipeline, with out-of-network opportunities currently in progress 100+ agent stations provide embedded pipeline of potential acquisition targets Opportunity to consolidate operations into one of 20+ company-owned locations provides additional synergy potential U.S. Forwarding, U.S. Brokerage and Canada provide three discreet platforms to support M&A efforts Through the six months ended December 31, 2018, Radiant generated a record $16.4 million in cash from operations December 2018, Radiant redeemed $21.0 million preferred stock Low leverage with $36.0M of availability at 12/31/18 on $75 million revolver, not including access to an additional $50.0 million accordion feature to support our future M&A activities $100M Equity Shelf declared effective and available SCALABLE PLATFORM World-class IT system, corporate infrastructure, and multi-brand strategy provide ability to efficiently add new agents to the network, grow existing locations and agents organically, and realize significant back-office synergies from acquisitions

FYE 2006 – FYE 2018 CAGRs Gross Revenue: 33.4% ü Leading Multi-Modal 3PL Service Provider a platform for growth with a proven track record of profitable growth through a network of 120+ agent and company-owned locations ü 12-Year First to market Advantage and Uniquely Positioned in the marketplace The preferred partner for logistics entrepreneurs with a robust service offering and built-in exit strategy from its Multi-Brand Platform ü Highly Diversified Customer Base Significant long-standing customer relationships across the platform – no one customer represents more than 2% of FY2018 Net Revenue ü Robust IT Platform Meaningful investments in IT infrastructure to support scale and enhance operational execution and efficiencies ü Talented and Experienced Management Team with Significant equity ownership Management has deep experience and aligned with shareholders (founder/CEO owns ~20% of the shares outstanding) is committed to continuing to grow the platform ü Multiple Opportunities for Future Growth and Margin Expansion scalable platform in terms of people, process and technology with financial flexibility (low leverage and $100M equity shelf) to support M&A Attractive growth Trajectory Gross Revenue For the Fiscal Years Ending 2006 – 2019E ($ in millions) INVESTMENT HIGHLIGHTS Key Investment Highlights $ 26 76 100 137 147 204 297 311 349 503 245 538 554 224 233 609 688 230 918 842 778 783 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 ltm 2019 12

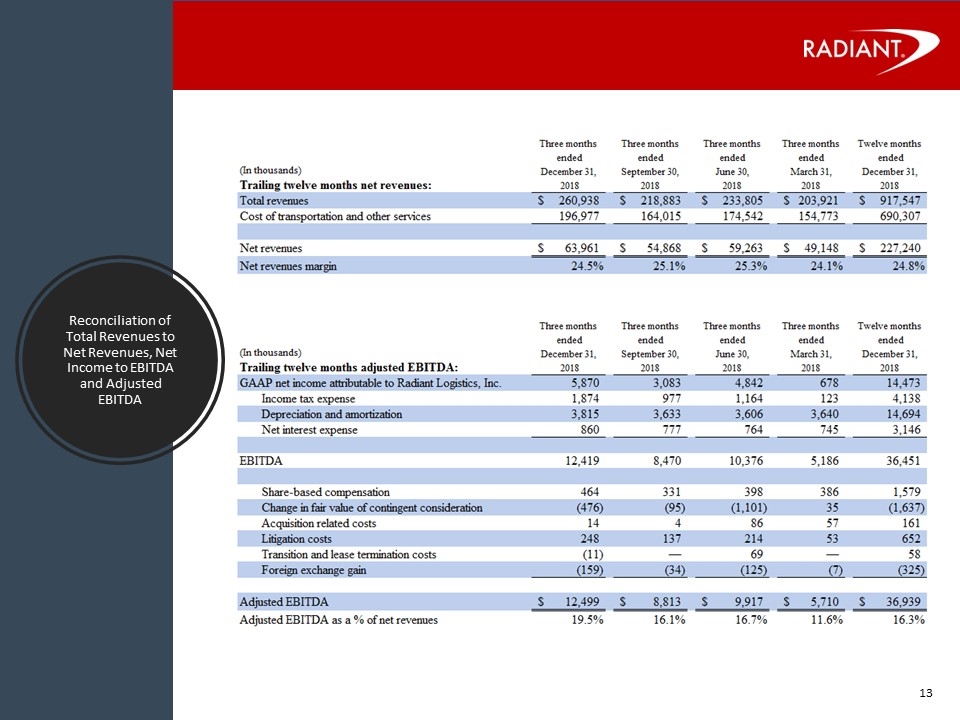

Reconciliation of Total Revenues to Net Revenues, Net Income to EBITDA and Adjusted EBITDA Three month ended December 31, 2018 Three month ended September 30, 2018 Three month ended June 30, 2018 Three month ended March 31, 2018 Twelve months ended December 31, 2018 (in thousands) Trailing twelve months net revenues: Total revenues Cos of transportation and other services net revenues net revenues margin (in thousands) GAAP net income attributable to Radiant Logistics, inc. Income tax expense depreciation and amortization net interest expense EBITDA Share-based compensation Change in fair value of contingent consideration Acquisition related costs Litigation costs Transition and lease termination costs Foreign exchange gain Adjusted EBITDA Adjusted EBITDA as a % of net revenues $ 260,938 218,883 233,805 203,921 917,547 196,977 164,015 174,542 154,773 690,307 63,961 54,868 59,263 49,148 227,240 24.5% 25.1 25.3 24.1 24.8 5,870 3,083 4,842 678 14,473 1,874 977 1,164 123 4,138 3,815 3,633 3,606 3,640 14,694 860 777 764 745 3,146 12,419 8,470 10,376 5,186 36,451 464 331 398 386 1,579 (476) 137 214 53 652 (11) — 69 — 58 (159) (34) (125) (7) (325) 12,499 8,813 9,917 5,710 36,939 19.5% 16.1% 16.7% 11.6% 16.3% 13 Radiant

THANK YOU It’s the Network that Delivers!®