Form 8-K Celsius Holdings, Inc. For: Mar 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 12, 2019

CELSIUS HOLDINGS, INC.

(Exact name of registrant as specified in charter)

Nevada

(State or other jurisdiction of incorporation)

| 000-55663 | 20-2745790 | |

| (Commission File Number) | (IRS Employer Identification No.) |

2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431

(Address of principal executive offices and zip code)

| (561) 276-2239 |

| (Registrant’s telephone number including area code) |

| Former Name or Former Address (If Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

When used in this Current Report on Form 8-K, unless otherwise indicated, the terms “the Company,” “Celsius,” “we,” “us” and “our” refer to Celsius Holdings, Inc. and its subsidiaries.

| Item 7.01 | Regulation FD Disclosure. |

| (a) | Participation in ROTH Conference |

On March 12, 2019, Celsius issued a press release announcing that John Fieldly, our Chief Executive Officer, and Edwin Negron-Carballo, our Chief Financial Officer, will conduct one-on-one meetings at the 31st Annual Roth Conference on Monday, March 18 and Tuesday, March 19, 2019 in Orange County, California.

A copy of the press release is included as Exhibit 99.1 to this report.

| (b) | Investor Presentation |

On March 14, 2019, Celsius posted an investor presentation to its website and it is available in the Financial Information section of the Company’s website at https://www.celsiusholdingsinc.com/.

The Company intends to use the presentation in upcoming investor conferences including the aforementioned Roth Conference. The furnishing of the information in this report is not intended to, and does not, constitute a determination by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company. The information in the materials is presented as of March 14, 2019, and the Company does not assume any obligation to update such information in the future.

A copy of the investor presentation is included as Exhibit 99.2 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 7.01, and including Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits |

| Exhibit No | Description | |

|

|

Press Release dated March 12, 2019

Celsius Holdings Inc. Investor Presentation dated March 14, 2019 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CELSIUS HOLDINGS, INC. | |||

| Date: March 15, 2019 | By: | /s/ John Fieldly | |

| John Fieldly, President and Chief Executive Officer | |||

Exhibit 99.1

FOR IMMEDIATE RELEASE

Celsius Holdings, Inc. to Attend 31st Annual Roth Conference on March 18-19

BOCA RATON, FL, March 12, 2019 /PRNewswire/ -- Celsius Holdings, Inc., (Nasdaq: CELH), maker of the leading global fitness drink, CELSIUS®, today announced that John Fieldly, Chief Executive Officer, and Edwin Negron-Carballo, Chief Financial Officer, will conduct one-on-one meetings at the 31st Annual Roth Conference on Monday, March 18 and Tuesday, March 19, 2019.

A copy of the investor presentation that will be provided to conference participants will be made available in the Financial Information section of the company’s website at https://www.celsiusholdingsinc.com/.

The conference will be held March 17-19, 2019 at The Ritz Carlton, Laguna Niguel in Orange County, CA and is by invitation only. For more information or to request a one-on-one meeting, please contact [email protected] or your ROTH representative at (800) 678-9147.

About Celsius Holdings, Inc.

Celsius Holdings, Inc. (CELH), founded in April 2004, is a global company that has a branded portfolio consisting of two beverage lines; each offering proprietary, functional, healthy-energy formulas that are clinically-proven to offer significant health benefits to its users.* The CELSIUS® Original Line comes in nine delicious sparkling and non-carbonated flavors in sleek 12oz cans and is also available in single-serve powder packets in four on-the-go, enjoyable flavors. The CELSIUS® Stevia Line is an extension of the original line offering naturally-caffeinated and naturally-sweetened and is available in five refreshing sparkling and non-sparkling flavors.

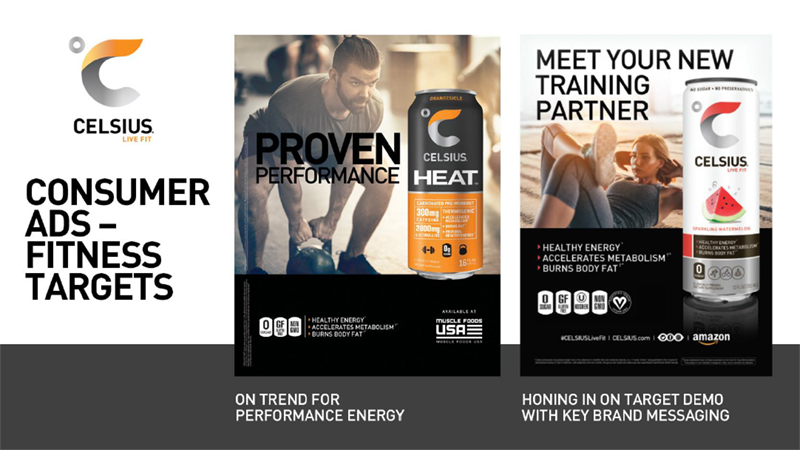

New to the portfolio is CELSIUS HEAT™, which offers an additional 100mg of caffeine than the Original and Stevia extension, for a total of 300mg per can. It also contains 2,000mg of L-citrulline, a vasodilator. CELSIUS HEAT™ is sold in 16oz cans, is available in five carbonated flavors and was developed for those seeking a bolder version of the Original and Stevia line extension – which are sold in 12oz cans and appeal to the masses as an active lifestyle brand. As with all CELSIUS® products, CELSIUS HEAT™ is a thermogenic and is an ideal 16oz energy drink given it is proven-to-function and is healthier than competitive 16oz traditional energy drinks with high sugar content. CELSIUS HEAT™ targets millennial fitness enthusiasts, avid gym goers, professional trainers, competitive athletes, the military and first responders.

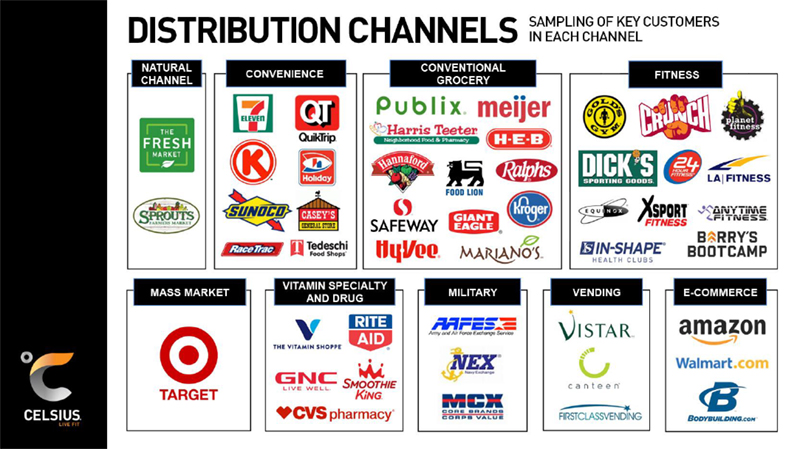

CELSIUS® has zero sugar, no preservatives, no aspartame, no high fructose corn syrup, and is non-GMO, with no artificial flavors or colors. The CELSIUS® line of products is Certified Kosher and Vegan. CELSIUS® is also soy and gluten-free and contains very little sodium. CELSIUS® is sold nationally through leading fitness channel distributors and retailers, The Vitamin Shoppe, GNC, Amazon.com, Walmart.com, Target, 7- Eleven, Sprouts, The Fresh Market and other key regional retailers such as HEB, Publix, Winn-Dixie, Harris Teeter, Shaw’s, Food Lion, CVS and many more.

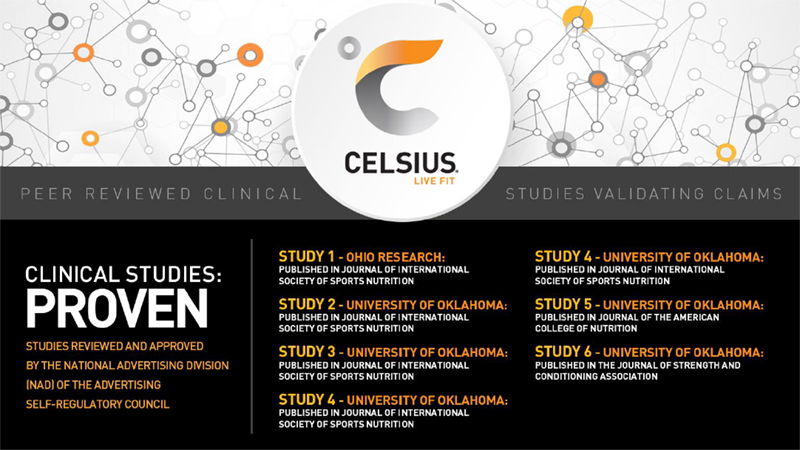

*CELSIUS®’ functional claims are backed by six published university studies. The first study was conducted in 2005 and additional studies from the University of Oklahoma were conducted over the next five years. The studies were published in peer-reviewed journals and validate the unique benefits that CELSIUS® provides.

For more information, please visit the brand websites: www.celsius.com, www.celsiusheat.com and investor site www.celsiusholdingsinc.com.

Investor

Relations:

Cameron Donahue

(651) 653-1854

[email protected]

Exhibit 99.2

CELSIUS HOLDINGS, INC. MARCH 2019 INVESTOR PRESENTATION

This presentation may contain statements that are not historical facts and are considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of Celsius Holdings’ future results of operations and/or financial position, or state other forward-looking information. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” or similar words. You should not rely on forward-looking statements since Celsius Holdings’ actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include, but are not limited to: general economic and business conditions; our business strategy for expanding our presence in our industry; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the Securities and Exchange Commission. Celsius Holdings does not intend to and undertakes no duty to update the information contained in this presentation. This document includes certain non-GAAP financial measures. Management considers GAAP financial measures as well as such non-GAAP financial information in its evaluation of the Company’s financial statements and believes these non-GAAP measures provide useful supplemental information to assess the Company’s operating performance and financial position. These measures should be viewed in addition to, and not in lieu of, the Company’s diluted earnings per share, operating performance and financial measures as calculated in accordance with GAAP.

Celsius Holdings, Inc. (Nasdaq: CELH), founded in April, 2004, is a global company, with a proprietary, clinically proven formula for flagship brand CELSIUS®. Our mission - to become the global leader of a branded portfolio which is proprietary, clinically proven or innovative in its category, and offers significant health benefits.

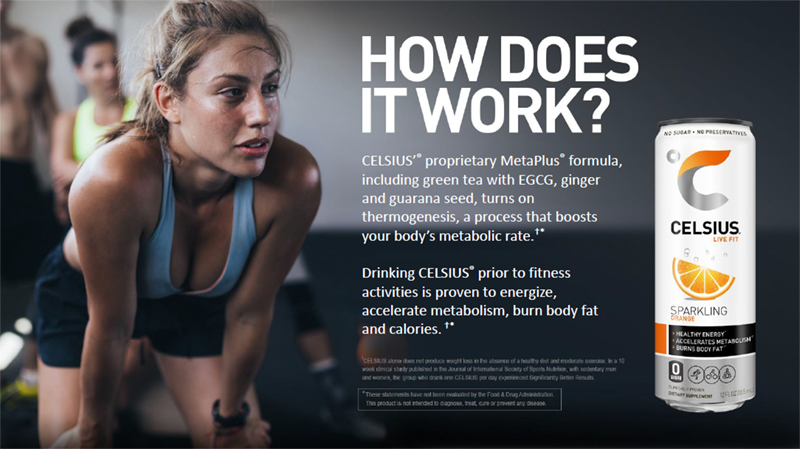

CELSIUS’® proprietary MetaPlus® formula, including green tea with EGCG, ginger and guarana seed, turns on thermogenesis, a process that boosts your body’s metabolic rate.†* Drinking CELSIUS® prior to fitness activities is proven to energize, accelerate metabolism, burn body fat and calories. †*

CELSIUS HEATTM is a Carbonated, Proven To Perform, Thermogenic with METAPLUS®. HEAT provides 100mg more caffeine than the original line, + 2,000mg L-Citruline.

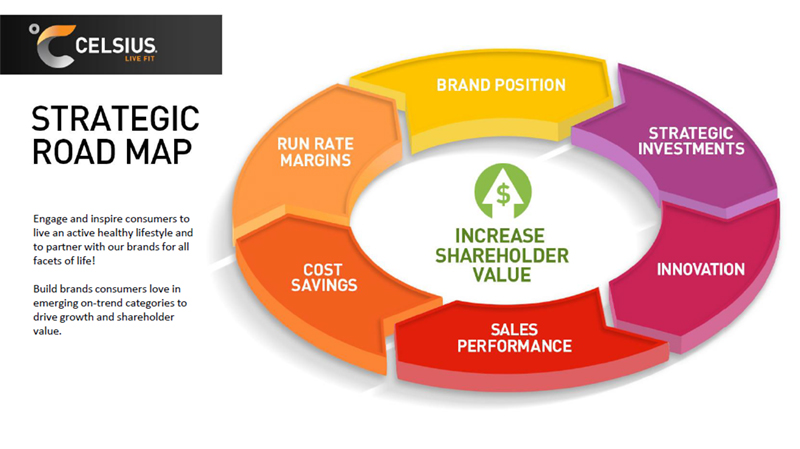

Engage and inspire consumers to live an active healthy lifestyle and to partner with our brands for all facets of life! Build brands consumers love in emerging on-trend categories to drive growth and shareholder value.

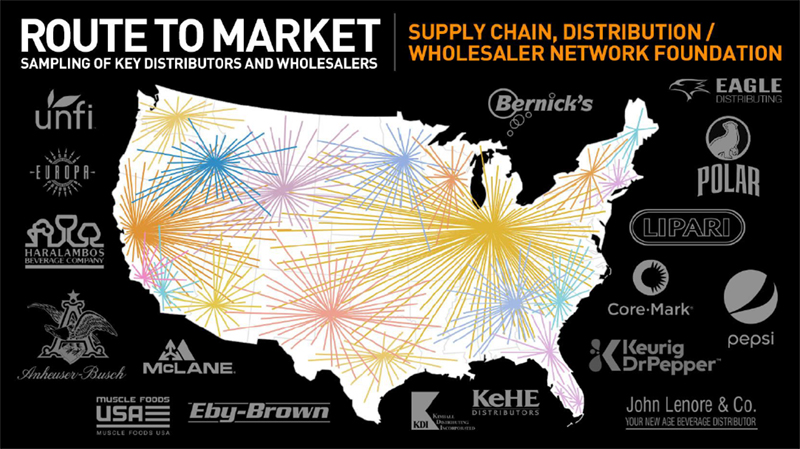

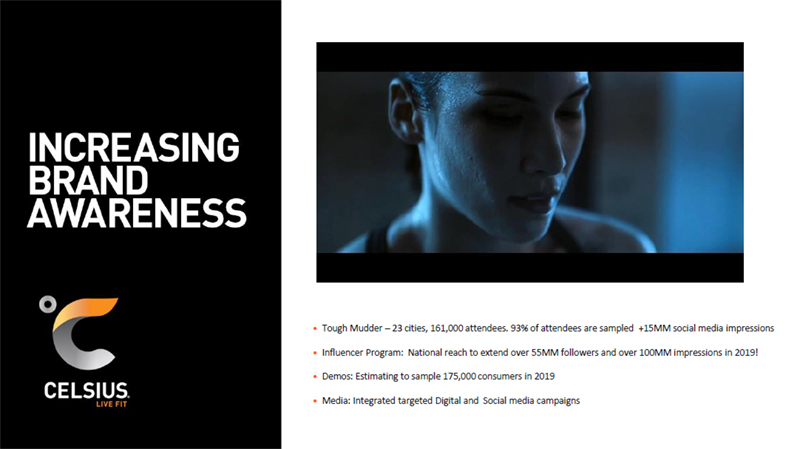

Tough Mudder 23 cities, 161,000 attendees. 93% of attendees are sampled +15MM social media impressions Influencer Program: National reach to extend over 55MM followers and over 100MM impressions in 2019! Demos: Estimating to sample 175,000 consumers in 2019 Media: Integrated targeted Digital and Social media campaigns

PARTNERS WITH DEFINED TERRITORIES WHICH CURRENTLY PROVIDE MARKETING AND SALES SUPPORT WITHIN THEIR TERRITORY. Established: Sweden - Top selling FITNESS drink in Sweden Finland expansion launched in 2016 adds incremental growth Norway launch announced February of 2018 Additional international opportunities with identified distribution partners

PARTNERS WITH DEFINED TERRITORIES WHICH CURRENTLY PROVIDE MARKETING AND SALES SUPPORT WITHIN THEIR TERRITORY. Established: Hong Kong launched through A.S. Watson Water distributors in 2017 China market launched with nationwide distribution through partnership with Qifeng Food Technology (Beijing) Co. Ltd., A national wholesale distributor of foods and beverages in 2017 Effective January 1st 2019, a royalty license and repayment of investment agreement was established, creating a risk-mitigated method of capturing market share in China. ADDITIONAL OPPORTUNITIES WITH IDENTIFIED DISTRIBUTION PARTNERS

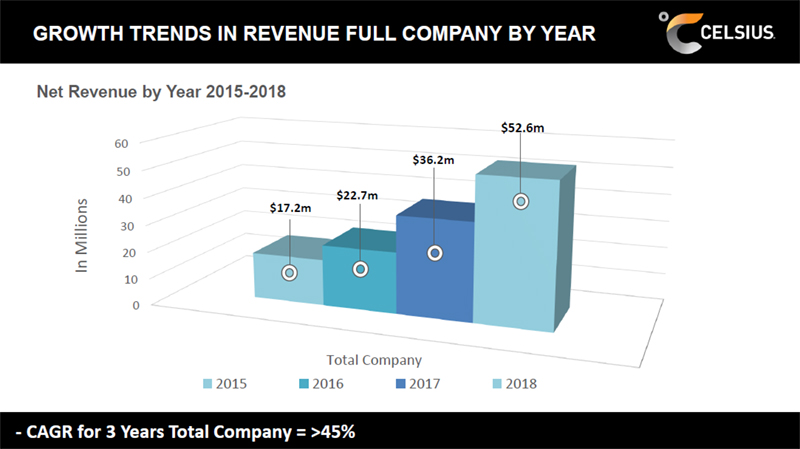

GROWTH TRENDS IN REVENUE FULL COMPANY BY YEAR Net Revenue by Year 2015-2018 $52.6m 60 $36.2m 50 40 $22.7m $17.2m 30 In Millions 20 10 0 Total Company 2015 2016 2017 2018 - CAGR for 3 Years Total Company = >45%

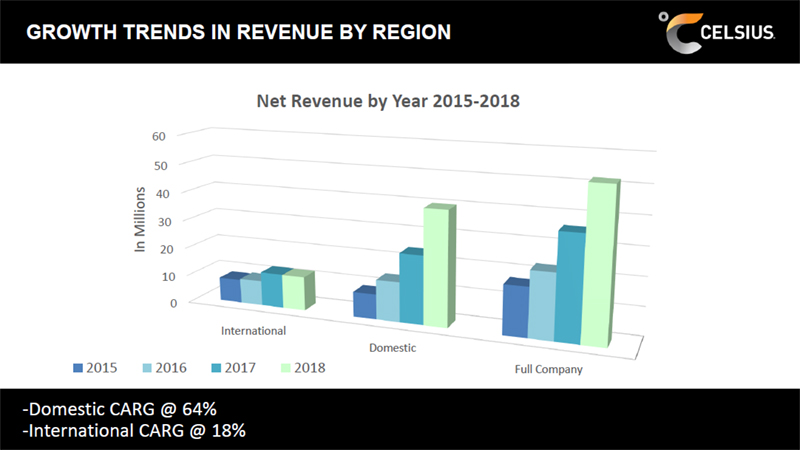

GROWTH TRENDS IN REVENUE BY REGION Net Revenue by Year 2015-2018 60 50 40 In Millions 30 20 10 0 International Domestic 2015 2016 2017 2018 Full Company -Domestic CARG @ 64% -International CARG @ 18%

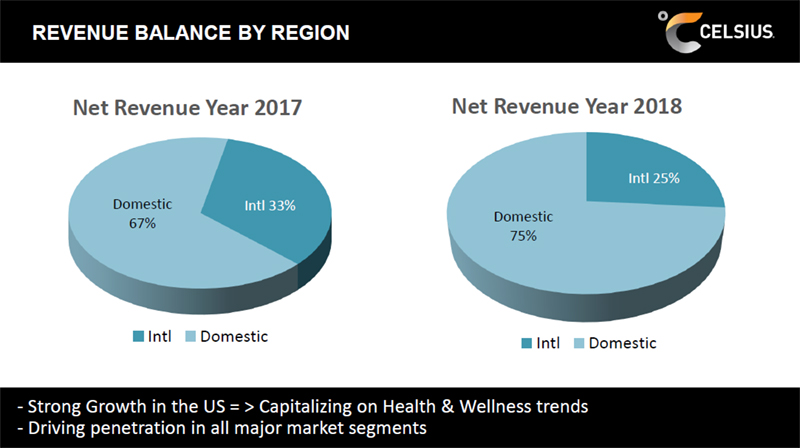

REVENUE BALANCE BY REGION Net Revenue Year 2017 Net Revenue Year 2018 Intl 25% Domestic Intl 33% Domestic 67% 75% Intl Domestic Intl Domestic - Strong Growth in the US = > Capitalizing on Health & Wellness trends - Driving penetration in all major market segments

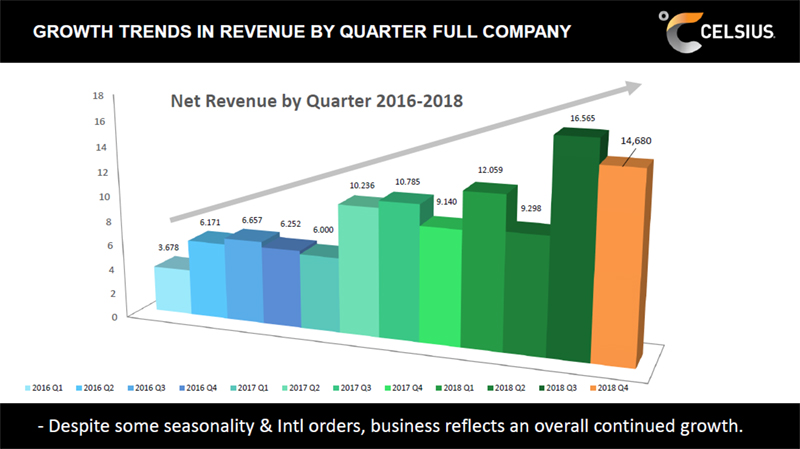

GROWTH TRENDS IN REVENUE BY QUARTER FULL COMPANY 18 Net Revenue by Quarter 2016-2018 16 16.565 14,680 14 12 12.059 10.785 10.236 10 9.140 9.298 8 6.171 6.657 6.252 6.000 6 3.678 4 2 0 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 - Despite some seasonality & Intl orders, business reflects an overall continued growth.

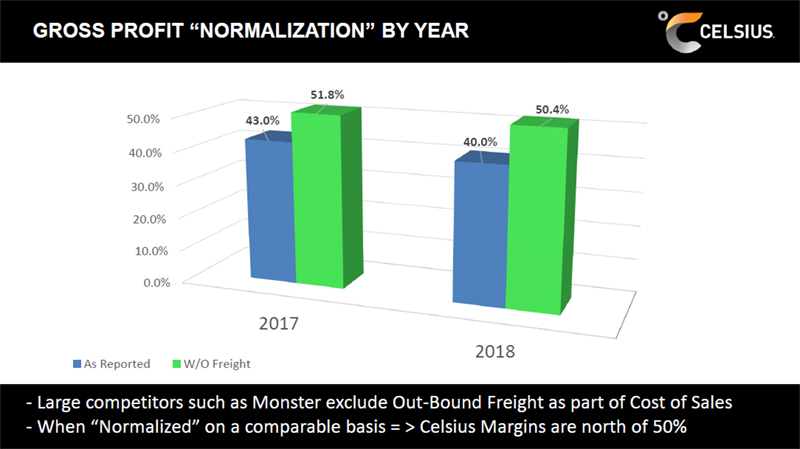

GROSS PROFIT “NORMALIZATION” BY YEAR 51.8% 50.4% 50.0% 43.0% 40.0% 40.0% 30.0% 20.0% 10.0% 0.0% 2017 2018 As Reported W/O Freight - Large competitors such as Monster exclude Out-Bound Freight as part of Cost of Sales - When “Normalized” on a comparable basis = > Celsius Margins are north of 50%

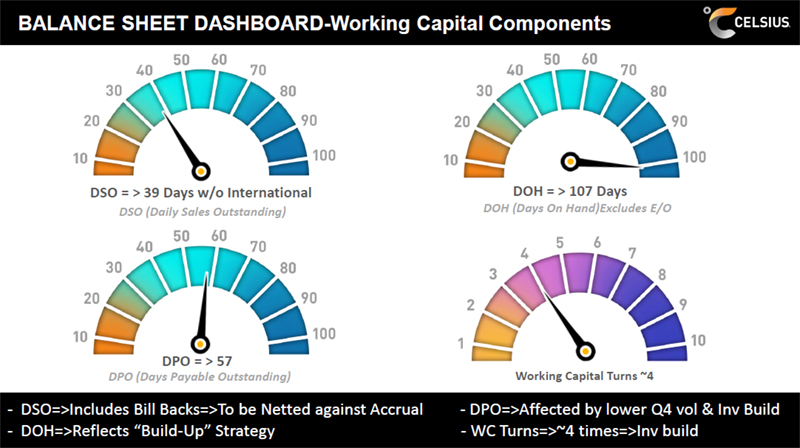

BALANCE SHEET DASHBOARD-Working Capital Components DSO = > 39 Days w/o International DOH = > 107 Days DSO (Daily Sales Outstanding) DOH (Days On Hand)Excludes E/O DPO (Days Payable Outstanding) Working Capital Turns ~4 - DSO=>Includes Bill Backs=>To be Netted against Accrual - DPO=>Affected by lower Q4 vol & Inv Build - DOH=>Reflects “Build-Up” Strategy - WC Turns=>~4 times=>Inv build

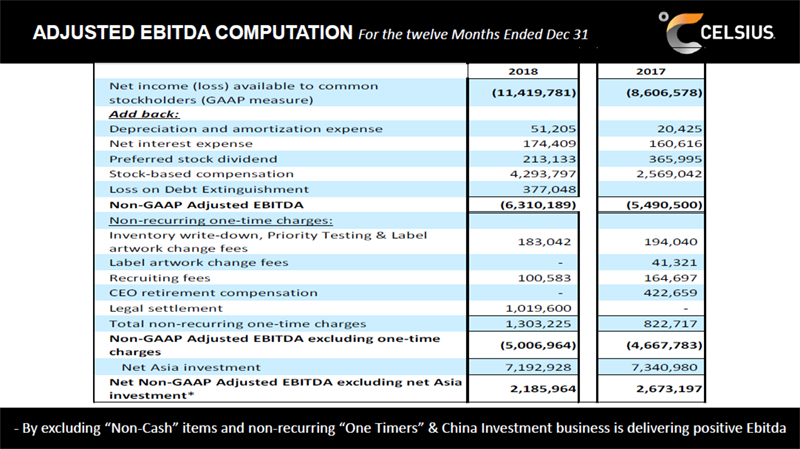

ADJUSTED EBITDA COMPUTATION For the twelve Months Ended Dec 31 Twelve months ended Dec 31, 2018 2017 Net income (loss) available to common (11,419,781) (8,606,578) stockholders (GAAP measure) Add back: Depreciation and amortization expense 51,205 20,425 Net interest expense 174,409 160,616 Preferred stock dividend 213,133 365,995 Stock-based compensation 4,293,797 2,569,042 Loss on Debt Extinguishment 377,048 Non-GAAP Adjusted EBITDA (6,310,189) (5,490,500) Non-recurring one-time charges: Inventory write-down, Priority Testing & Label 183,042 194,040 artwork change fees Label artwork change fees - 41,321 Recruiting fees 100,583 164,697 CEO retirement compensation - 422,659 Legal settlement 1,019,600 - Total non-recurring one-time charges 1,303,225 822,717 Non-GAAP Adjusted EBITDA excluding one-time (5,006,964) (4,667,783) charges Net Asia investment 7,192,928 7,340,980 Net Non-GAAP Adjusted EBITDA excluding net Asia 2,185,964 2,673,197 investment* - By excluding “Non-Cash” items and non-recurring “One Timers” & China Investment business is delivering positive Ebitda

Horizon Ventures: Former Founder and Celebrity & business investment arm of Chairman of ReXall mogul (several Mr. Li Ka-Shing. Asia’s Sundown Inc. which he companies), powerful wealthiest individual. built into the world’s brand builder & Assets include over leading nutritional influencer 15,000 health & beauty supplement supplier, sold retail locations for $1.8 billion in 2000

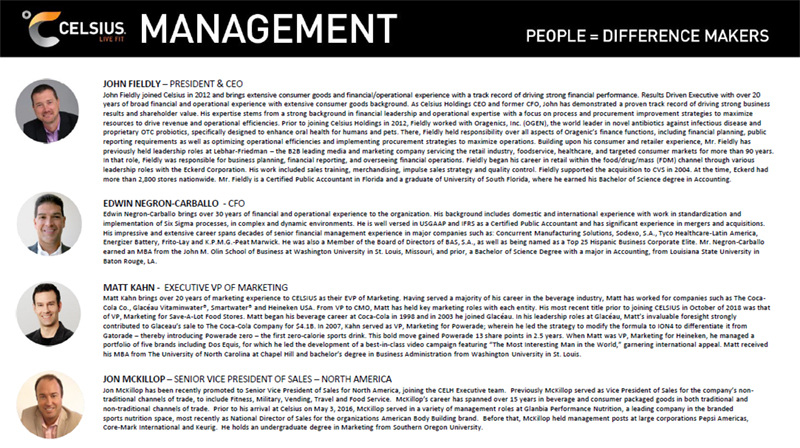

JOHN FIELDLY PRESIDENT & CEO John Fieldly joined Celsius in 2012 and brings extensive consumer goods and financial/operational experience with a track record of driving strong financial performance. Results Driven Executive with over 20 years of broad financial and operational experience with extensive consumer goods background. As Celsius Holdings CEO and former CFO, John has demonstrated a proven track record of driving strong business results and shareholder value. His expertise stems from a strong background in financial leadership and operational expertise with a focus on process and procurement improvement strategies to maximize resources to drive revenue and operational efficiencies. Prior to joining Celsius Holdings in 2012, Fieldly worked with Oragenics, Inc. (OGEN), the world leader in novel antibiotics against infectious disease and proprietary OTC probiotics, specifically designed to enhance oral health for humans and pets. There, Fieldly held responsibility over all aspects of Oragenic’s finance functions, including financial planning, public reporting requirements as well as optimizing operational efficiencies and implementing procurement strategies to maximize operations. Building upon his consumer and retailer experience, Mr. Fieldly has previously held leadership roles at Lebhar-Friedman the B2B leading media and marketing company servicing the retail industry, foodservice, healthcare, and targeted consumer markets for more than 90 years. In that role, Fieldly was responsible for business planning, financial reporting, and overseeing financial operations. Fieldly began his career in retail within the food/drug/mass (FDM) channel through various leadership roles with the Eckerd Corporation. His work included sales training, merchandising, impulse sales strategy and quality control. Fieldly supported the acquisition to CVS in 2004. At the time, Eckerd had more than 2,800 stores nationwide. Mr. Fieldly is a Certified Public Accountant in Florida and a graduate of University of South Florida, where he earned his Bachelor of Science degree in Accounting. EDWIN NEGRON-CARBALLO - CFO Edwin Negron-Carballo brings over 30 years of financial and operational experience to the organization. His background includes domestic and international experience with work in standardization and implementation of Six Sigma processes, in complex and dynamic environments. He is well versed in USGAAP and IFRS as a Certified Public Accountant and has significant experience in mergers and acquisitions. His impressive and extensive career spans decades of senior financial management experience in major companies such as: Concurrent Manufacturing Solutions, Sodexo, S.A., Tyco Healthcare-Latin America, Energizer Battery, Frito-Lay and K.P.M.G.-Peat Marwick. He was also a Member of the Board of Directors of BAS, S.A., as well as being named as a Top 25 Hispanic Business Corporate Elite. Mr. Negron-Carballo earned an MBA from the John M. Olin School of Business at Washington University in St. Louis, Missouri, and prior, a Bachelor of Science Degree with a major in Accounting, from Louisiana State University in Baton Rouge, LA. MATT KAHN - EXECUTIVE VP OF MARKETING Matt Kahn brings over 20 years of marketing experience to CELSIUS as their EVP of Marketing. Having served a majority of his career in the beverage industry, Matt has worked for companies such as The Coca-Cola Co., Glacéau Vitaminwater®, Smartwater® and Heineken USA. From VP to CMO, Matt has held key marketing roles with each entity. His most recent title prior to joining CELSIUS in October of 2018 was that of VP, Marketing for Save-A-Lot Food Stores. Matt began his beverage career at Coca-Cola in 1998 and in 2003 he joined Glaceau. In his leadership roles at Glaceau, Matt’s invaluable foresight strongly contributed to Glaceau’s sale to The Coca-Cola Company for $4.1B. In 2007, Kahn served as VP, Marketing for Powerade; wherein he led the strategy to modify the formula to ION4 to differentiate it from Gatorade thereby introducing Powerade zero the first zero-calorie sports drink. This bold move gained Powerade 13 share points in 2.5 years. When Matt was VP, Marketing for Heineken, he managed a portfolio of five brands including Dos Equis, for which he led the development of a best-in-class video campaign featuring “The Most Interesting Man in the World,” garnering international appeal. Matt received his MBA from The University of North Carolina at Chapel Hill and bachelor’s degree in Business Administration from Washington University in St. Louis. JON MCKILLOP SENIOR VICE PRESIDENT OF SALES NORTH AMERICA Jon McKillop has been recently promoted to Senior Vice President of Sales for North America, joining the CELH Executive team. Previously McKillop served as Vice President of Sales for the company’s non-traditional channels of trade, to include Fitness, Military, Vending, Travel and Food Service. McKillop’s career has spanned over 15 years in beverage and consumer packaged goods in both traditional and non-traditional channels of trade. Prior to his arrival at Celsius on May 3, 2016, McKillop served in a variety of management roles at Glanbia Performance Nutrition, a leading company in the branded sports nutrition space, most recently as National Director of Sales for the organizations American Body Building brand. Before that, McKillop held management posts at large corporations Pepsi Americas, Core-Mark International and Keurig. He holds an undergraduate degree in Marketing from Southern Oregon University.

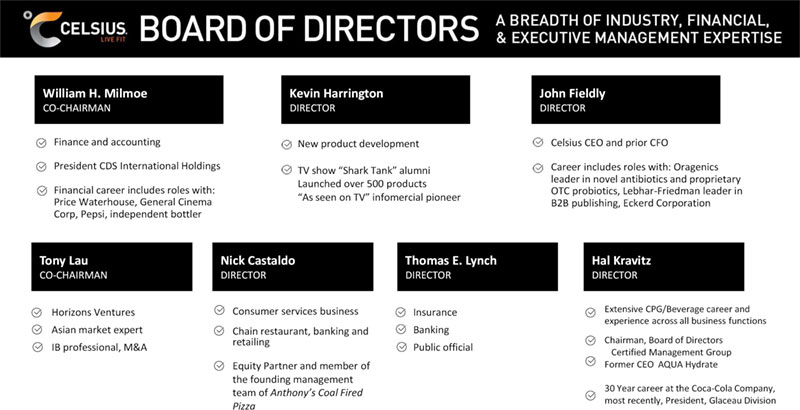

William H. Milmoe Kevin Harrington John Fieldly CO-CHAIRMAN DIRECTOR DIRECTOR Finance and accounting New product development Celsius CEO and prior CFO President CDS International Holdings Career includes roles with: Oragenics TV show “Shark Tank” alumni leader in novel antibiotics and proprietary Launched over 500 products Financial career includes roles with: OTC probiotics, Lebhar-Friedman leader in “As seen on TV” infomercial pioneer Price Waterhouse, General Cinema B2B publishing, Eckerd Corporation Corp, Pepsi, independent bottler Tony Lau Nick Castaldo Thomas E. Lynch Hal Kravitz CO-CHAIRMAN DIRECTOR DIRECTOR DIRECTOR Horizons Ventures Consumer services business Insurance Extensive CPG/Beverage career and experience across all business functions Asian market expert Chain restaurant, banking and Banking retailing Chairman, Board of Directors IB professional, M&A Public official Certified Management Group Equity Partner and member of Former CEO AQUA Hydrate the founding management team of Anthony’s Coal Fired 30 Year career at the Coca-Cola Company, most recently, President, Glaceau Division Pizza

CELSIUS HOLDINGS, INC. C O M PA N Y C O N TA C T S I N V E S T O R R E L AT I O N S John Fieldly, CEO Cameron Donahue, Partner Celsius Holdings, Inc. Hayden IR 561.276. 223 9 651.653. 185 4 jfieldly@celsiu s. co m cameron @hay d enir. co m VISIT OUR NEW INVESTOR Edwin Negron, CFO WEBSITE: Celsius Holdings, Inc. CELSIUSHoldin gsI N C. COM 561.900. 235 1 [email protected]

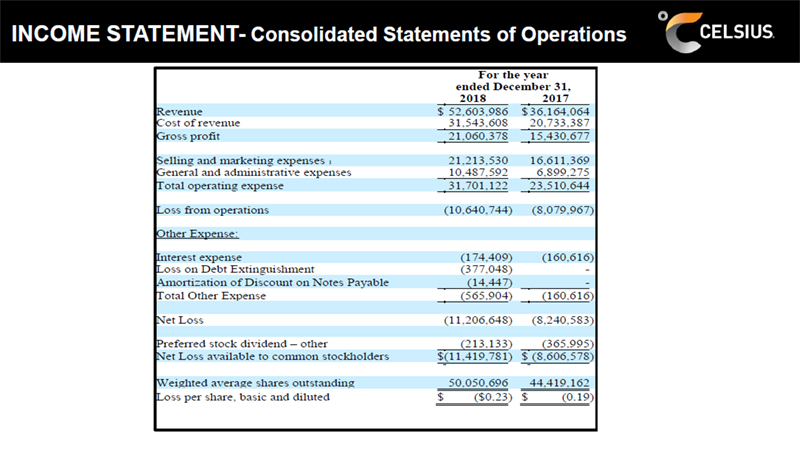

INCOME STATEMENT- Consolidated Statements of Operations For the year ended December 31, 2018 2017 Revenue $ 52,603,986 $ 36,164,064 Cost of revenue 31,543,608 20,733,387 Gross profit 21,060,378 15,430,677 Selling and marketing expenses 1 21,213,530 16,611,369 General and administrative expenses 10,487,592 6,899,275 Total operating expense 31,701,122 23,510,644 Loss from operations (10,640,744) (8,079,967) Other Expense: Interest expense (174,409) (160,616) Loss on Debt Extinguishment (377,048) - Amortization of Discount on Notes Payable (14,447) - Total Other Expense (565,904) (160,616) Net Loss (11,206,648) (8,240,583) Preferred stock dividend other (213,133) (365,995) Net Loss available to common stockholders $(11,419,781) $ (8,606,578) Weighted average shares outstanding 50,050,696 44,419,162 Loss per share, basic and diluted $ ($0.23) $ (0.19)

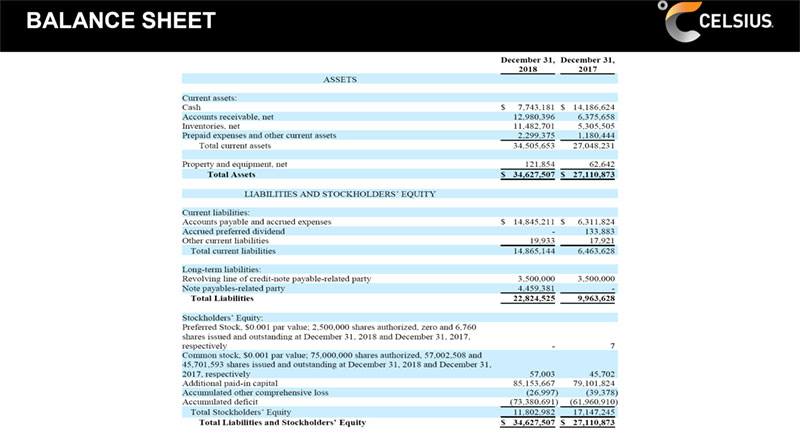

BALANCE SHEET December 31, December 31, 2018 2017 ASSETS Current assets: Cash $ 7,743,181 $ 14,186,624 Accounts receivable, net 12,980,396 6,375,658 Inventories, net 11,482,701 5,305,505 Prepaid expenses and other current assets 2,299,375 1,180,444 Total current assets 34,505,653 27,048,231 Property and equipment, net 121,854 62,642 Total Assets $ 34,627,507 $ 27,110,873 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable and accrued expenses $ 14,845,211 $ 6,311,824 Accrued preferred dividend - 133,883 Other current liabilities 19,933 17,921 Total current liabilities 14,865,144 6,463,628 Long-term liabilities: Revolving line of credit-note payable-related party 3,500,000 3,500,000 Note payables-related party 4,459,381 - Total Liabilities 22,824,525 9,963,628 Stockholders’ Equity: Preferred Stock, $0.001 par value; 2,500,000 shares authorized, zero and 6,760 shares issued and outstanding at December 31, 2018 and December 31, 2017, respectively - 7 Common stock, $0.001 par value; 75,000,000 shares authorized, 57,002,508 and 45,701,593 shares issued and outstanding at December 31, 2018 and December 31, 2017, respectively 57,003 45,702 Additional paid-in capital 85,153,667 79,101,824 Accumulated other comprehensive loss (26,997) (39,378) Accumulated deficit (73,380,691) (61,960,910) Total Stockholders’ Equity 11,802,982 17,147,245 Total Liabilities and Stockholders’ Equity $ 34,627,507 $ 27,110,873