Form 10-K TRECORA RESOURCES For: Dec 31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 10-K

(MARK ONE)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Fiscal Year Ended December 31, 2018 OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Transition Period from ___________ to ________ |

Commission File Number 1-33926

TRECORA RESOURCES

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 75-1256622 (I.R.S. Employer Identification No.) |

1650 Hwy 6 S, Suite 190 Sugar Land, TX (Address of principal executive offices) | 77478 (Zip code) |

Registrant's telephone number, including area code: (281) 980-5522

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | Name of exchange on which registered |

Common stock, par value $0.10 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

_____________________

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ý |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

Emerging growth company ☐ | |

If emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ☐ No ý

The aggregate market value on June 30, 2018, of the registrant's voting securities held by non-affiliates was approximately $254 million.

Number of shares of registrant's Common Stock, par value $0.10 per share, outstanding as of March 4, 2019 (excluding 7,540 shares of treasury stock): 24,686,830.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive proxy statement for the registrant's Annual Meeting of Stockholders to be held on or about May 15, 2019.

TABLE OF CONTENTS

Item Number and Description

1 | ||

1 | ||

1 | ||

3 | ||

3 | ||

4 | ||

4 | ||

4 | ||

4 | ||

8 | ||

ITEM 1A. RISK FACTORS | 8 | |

ITEM 1B. UNRESOLVED STAFF COMMENTS | 15 | |

16 | ||

20 | ||

20 | ||

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 21 | |

22 | ||

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

23 | ||

24 | ||

24 | ||

25 | ||

29 | ||

38 | ||

39 | ||

42 | ||

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 42 | |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 43 | |

ITEM 9A. CONTROLS AND PROCEDURES | 43 | |

ITEM 9B. OTHER INFORMATION | 46 | |

46 | ||

46 | ||

46 | ||

46 | ||

46 | ||

46 | ||

PART I

Item 1. Business.

General

Trecora Resources (the "Company") was incorporated in the State of Delaware in 1967. The Company's principal business activities are the manufacturing of various specialty petrochemical products and synthetic waxes and the provision of custom processing services. Unless the context requires otherwise, references to "we," "us," "our," and the "Company" are intended to mean consolidated Trecora Resources and its subsidiaries.

The Company owns a 33% interest in Al Masane Al Kobra Mining Company ("AMAK"), a Saudi Arabian closed joint stock mining company, which is engaged in the commercial production of copper and zinc concentrates and silver and gold doré. The Company also has a 55% interest in Pioche Ely Valley Mines, Inc. ("PEVM"), a Nevada mining corporation, which presently does not conduct any substantial business activity but owns undeveloped properties in the United States.

This document includes the following abbreviations:

(1) | TREC – Trecora Resources |

(2) | TOCCO – Texas Oil & Chemical Co. II, Inc. – Wholly owned subsidiary of TREC and parent of SHR and TC |

(3) | SHR – South Hampton Resources, Inc. – Specialty petrochemical segment and parent of GSPL |

(4) | GSPL – Gulf State Pipe Line Co, Inc. – Pipeline support for the specialty petrochemical segment |

(5) | TC – Trecora Chemical, Inc. – Specialty wax segment |

Business Segments

We operate in two business segments; the manufacturing of various specialty petrochemical products and the manufacturing of specialty synthetic waxes.

Our specialty petrochemical products segment is conducted through SHR, a Texas corporation. SHR owns and operates a specialty petrochemical facility near Silsbee, Texas which produces high purity hydrocarbons and other petroleum based products including isopentane, normal pentane, isohexane and hexane. These products are used in the production of polyethylene, packaging, polypropylene, expandable polystyrene, poly-iso/urethane foams, crude oil from the Canadian tar sands, and in the catalyst support industry. Our specialty petrochemical products are typically transported to customers by rail car, tank truck, iso-container, and by ship. SHR owns all of the capital stock of GSPL, a Texas corporation, which owns and operates pipelines that connect the SHR facility to a natural gas line, to SHR's truck and rail loading terminal and to a major petroleum products pipeline owned by an unaffiliated third party. SHR also provides custom processing services.

Our specialty synthetic wax segment is conducted through TC, a Texas corporation, located in Pasadena, Texas which produces specialty polyethylene and poly alpha olefin waxes and provides custom processing services. The specialty polyethylene waxes are used in markets from paints and inks to adhesives, coatings, and PVC lubricants. The highly specialized synthetic poly alpha olefin waxes are used in applications such as toner in printers and as additives for candles. These waxes are sold in solid form as pastilles or, for large adhesive companies, in bulk liquid form.

See Note 17 to the Consolidated Financial Statements for more information.

United States Specialty Petrochemical Operations

SHR's specialty petrochemical facility is located in Silsbee, Texas approximately 30 miles north of Beaumont and 90 miles east of Houston. The facility consists of eight operating units which, while interconnected, make distinct products through differing processes: (i) a Penhex Unit; (ii) a Reformer Unit; (iii) a Cyclo-pentane Unit; (iv) an Advanced Reformer unit; (v) an Aromatics Hydrogenation Unit; (vi) a White Oil Fractionation Unit; (vii) a Hydrocarbon Processing Demonstration Unit; and (viii) a P-Xylene Unit. All of these units are currently in operation. The Penhex Unit currently has the permitted capacity to process approximately 11,000 barrels per day of fresh feed. The Reformer Unit, the Advanced Reformer unit, and the Cyclo-Pentane Unit further process streams produced by the Penhex Unit. The Aromatics Hydrogenation Unit was taken out of service and decommissioned in 2018 with the start up of the new Advanced Reformer unit. The White Oils Fractionation Unit has a capacity of approximately 3,000 barrels per day. The Hydrocarbon Processing Demonstration Unit has a capacity of approximately 300 gallons per day. The P-Xylene Unit has a capacity of approximately 20,000 pounds per year. The facility generally consists of equipment commonly found in most petrochemical facilities such as fractionation towers and hydrogen treaters except the facility is adapted to produce specialized products that are high purity and very consistent with precise specifications that are utilized in the petrochemical industry as solvents, additives, blowing agents and cooling agents. We produce eight distinct product streams and market several combinations of blends as needed in various customer applications. We do not produce motor fuel products or any other products commonly sold directly to retail consumers or outlets.

1

We believe we are positioned to benefit from capital investments that we have recently completed. We now have sufficient pentane capacity to maintain our share of market growth for the foreseeable future. We believe that the Advanced Reformer unit will contribute to increased revenue and gross margin over time and as we improve reliability. While petrochemical prices are volatile on a short-term basis, and volumes depend on the demand of our customers' products and overall customer efficiency, our investment decisions are based on our long-term business strategy and outlook.

During 2015, we constructed a new unit which is part of the Penhex Unit, D Train, which began production in the fourth quarter of 2015. The D Train expansion increased our capacity by approximately 6,000 barrels per day of fresh feed. Our present total capacity is 13,000 barrels per day of fresh feed; however, we are currently only permitted to process 11,000 barrels per day. During 2018, we constructed a 4,000 barrels per day Advanced Reformer unit to increase our capability to upgrade byproducts produced from the PenHex Unit and to provide security of hydrogen supply to the plant.

Products from the Penhex Unit, Reformer Unit, Advanced Reformer unit, and Cyclo-pentane Unit are marketed directly to the customer by our marketing personnel. The Penhex Unit had a utilization rate during 2018 of approximately 56% based upon 11,000 barrels per day of capacity. The Penhex Unit had a utilization rate during 2017 of approximately 53% based upon 11,000 barrels per day of capacity. The Penhex Unit had a utilization rate during 2016 of approximately 48% based upon 11,000 barrels per day.

Penhex Unit capacity is now configured in three independent process units. The three unit configuration improves reliability by reducing the amount of total down time due to mechanical and other factors. This configuration also allows us to use spare capacity for new product development. The Advanced Reformer and Reformer units are operated as needed to support the Penhex and Cyclo-pentane Units. Consequently, utilization rates of these units are driven by production from the Penhex Unit. Operating utilization rates are affected by product demand, raw material composition, mechanical integrity, and unforeseen natural occurrences, such as weather events. The nature of the petrochemical process demands periodic shut-downs for de-coking and other mechanical repairs.

In February 2018, while attempting to commission the new Advanced Reformer unit, the unit overheated and ignited a fire. There was damage to all six heaters in the unit, and the damaged equipment had to be replaced. The total repair cost was approximately $3.5 million. Our insurers covered costs over our $1 million deductible. On July 9, 2018, we announced the safe and successful start up of the Advanced Reformer unit. In mid-September 2018 the Silsbee facility suffered a power outage causing a shutdown of the plant, including the Advanced Reformer unit. In October 2018, after extensive engineering review and consultations with the technology licensor of the Unit it was determined that the unit's catalyst required replacement. We completed the catalyst replacement and successfully restarted the Unit in December 2018. The cost of the catalyst replacement was approximately $3 million. During the time the Advanced Reformer unit was not operation due to the catalyst replacement work, we incurred losses as a result of sales of byproducts at prices well below the cost of feedstock.

In support of the specialty petrochemical operation, we own approximately 100 storage tanks with total capacity approaching 285,000 barrels, and 127 acres of land at the plant site, 92 acres of which are developed. We also own a truck and railroad loading terminal consisting of storage tanks, nine rail spurs, and truck and tank car loading facilities on approximately 63 acres of which 33 acres are developed. As a result of various expansion programs and the toll processing contracts, essentially all of the standing equipment at SHR is operational. We have various surplus equipment stored on-site which may be used in the future to assemble additional processing units as needs arise.

We obtain our feedstock requirements from a sole supplier. The agreement is primarily a logistics arrangement. The supplier buys or contracts for material and utilizes their tank and pipeline connections to transport into our pipeline. The supplier's revenue above feed cost is primarily related to the cost and operation of the tank, pipelines, and equipment. A contract was signed in August 2015 with a seven year term with subsequent one year renewals unless canceled by either party with 180 days' notice. In 2015, a pipeline connection to the supplier's dock was added to give alternative means of receiving feedstock.

GSPL owns and operates three 8-inch diameter pipelines and five 4-inch diameter pipelines, aggregating approximately 70 miles in length connecting SHR's facility to (1) a natural gas line, (2) SHR's truck and rail loading terminal and (3) a major petroleum products pipeline system owned by an unaffiliated third party. All pipelines are operated within Texas Railroad Commission and DOT regulations for maintenance and integrity.

We sell our products predominantly to large domestic and international companies. Products are marketed via personal contact and through continued long term relationships. Sales personnel visit customer facilities regularly and also attend various petrochemical conferences throughout the world. We also have a website with information about our products and services. We utilize both formula and non-formula based pricing depending upon a customer's requirements. Under formula pricing the price charged to the customer is primarily based on a formula which includes as a component the average cost of feedstock over the prior month. With this pricing mechanism, product prices move in conjunction with feedstock prices. However, because the formulas use an average feedstock price from the prior month, the movement of prices will trail the movement of costs, and formula prices may or may not reflect our actual feedstock cost for the month during which the product is actually sold. In addition, while

2

formula pricing can reduce product margins during periods of increasing feedstock costs, during periods of decreasing feedstock costs formula pricing will follow feed costs down but will retain higher margins during the period by trailing the movement of costs by approximately 30 days. During 2018 and 2017, sales to one customer exceeded 10% of our consolidated revenues. During 2018 and 2017, sales to ExxonMobil and their affiliates were 17% and 20% of total revenues, respectively. These sales represented multiple products sold to multiple facilities.

United States Specialty Synthetic Wax Operations

TC is a leading manufacturer of specialty synthetic waxes and also provides custom processing services from its 27.5 acre plant located in Pasadena, Texas. TC provides custom manufacturing, hydrogenation, distillation, blending, forming and packaging of finished and intermediate products and wax products for coatings, hot melt adhesives and lubricants. Situated near the Houston Ship Channel, the facility allows for easy access to international shipping and direct loading to rail or truck. The location is within reach of major chemical pipelines and on-site access to a steam pipeline and dedicated hydrogen line create a platform for expansion of both wax production capacity and custom processing capabilities. We manufacture a variety of hard, high melting point, low to medium viscosity polyethylene wax products along with a wide range of other waxes and lubricants. These products are used in a variety of applications including: performance additives for hot melt adhesives; penetration and melting point modifiers for paraffin and microcrystalline waxes; lubrication and processing aides for plastics, PVC, rubber; and dry stir-in additives for inks. In oxidized forms, applications also include use in textile emulsions.

TC also provides turnkey custom manufacturing services including quality assurance, transportation and process optimization. The plant has high vacuum distillation capability for the separation of temperature sensitive materials. We have a fully equipped laboratory and pilot plant facility and a highly trained, technically proficient team of engineers and chemists suited to handle the rapid deployment of new custom processes and development of new wax products. TC's custom manufacturing services provide a range of specialized capabilities to chemical and industrial customer including synthesis, hydrogenation, distillation, forming and propoxylation in addition to a number of other chemical processes.

United States Mineral Interests

Our only mineral interest in the United States is our 55% ownership interest in an inactive corporation, PEVM. PEVM's properties include 48 patented and 5 unpatented claims totaling approximately 1,500 acres. All of the claims are located in Lincoln County, NV.

At this time, neither we nor PEVM have plans to develop the mining assets near Pioche, NV. Periodically proposals are received from outside parties who are interested in developing or using certain assets. We do not anticipate making any significant domestic mining capital expenditures.

Environmental

Matters pertaining to the environment are discussed in Part I, Item 1A. Risk Factors, Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and Notes 2 and 14 to the Consolidated Financial Statements.

In 1993 during remediation of a small spill area, the Texas Commission on Environmental Quality ("TCEQ") required SHR to drill a well to check for groundwater contamination under the spill area. Two pools of hydrocarbons were discovered to be floating on the groundwater at a depth of approximately 25 feet. One pool is under the site of a former gas processing plant owned and operated by Sinclair, Arco and others before its purchase by SHR in 1981. Analysis of the material indicates it entered the ground prior to SHR's acquisition of the property. The other pool is under the original SHR facility and analysis indicates the material was deposited decades ago. Tests conducted have determined that the hydrocarbons are contained on the property and not migrating in any direction. The recovery process was initiated in June 1998 and approximately $53,000 was spent setting up the system. The recovery is proceeding as planned and is expected to continue for many years until the pools are reduced to acceptable levels. Expenses of recovery and periodic migration testing are being recorded as normal operating expenses. Expenses for future recovery are expected to stabilize and be less per annum than the initial set up cost, although there is no assurance of this effect. The light hydrocarbon recovered from the former gas plant site is compatible with our normal Penhex feedstock and is accumulated and transferred into the Penhex feedstock tank. The material recovered from under the original SHR site is accumulated and sold as a by-product. Approximately 144, 80, and 70 barrels were recovered during 2018, 2017, and 2016, respectively. The recovered material had a value of approximately $5,800, $4,200, and $3,200 during 2018, 2017, and 2016, respectively. Consulting engineers estimate that as much as 20,000 barrels of recoverable material may be available to us for use in our process or for sale. The final volume present and the ability to recover it are both highly speculative issues due to the area over which it is spread and the fragmented nature of the pockets of hydrocarbon. We have drilled additional wells periodically to further delineate the boundaries of the pools and to ensure that migration has not taken place. These tests confirmed that no migration of the hydrocarbon pools has occurred. The TCEQ has deemed the current action plan acceptable and reviews the plan on a semi-annual basis.

3

Personnel

The number of our regular, U.S. based employees was approximately 280, 324, and 310 for the years ended December 31, 2018, 2017, and 2016, respectively. Of these employees, none are covered by collective bargaining agreements. Regular employees are defined as active executive, management, professional, technical and wage employees who work full time or part time for the Company and are covered by our benefit plans and programs. Our workforce has decreased primarily due to completion of capital projects at our facilities including a workforce downsizing at SHR in December 2018.

Competition

The specialty petrochemical, specialty wax, and mining industries are highly competitive. There is competition within the industries and also with other industries in supplying the chemical and mineral needs of both industrial and individual consumers. We compete with other firms in the sale or purchase of needed goods and services and employ all methods of competition which are lawful and appropriate for such purposes. See further discussion in Part I, Item 1A. Risk Factors.

Investment in AMAK

As of December 31, 2018, we owned a 33.4% interest in AMAK.

Location, Access and Transportation.

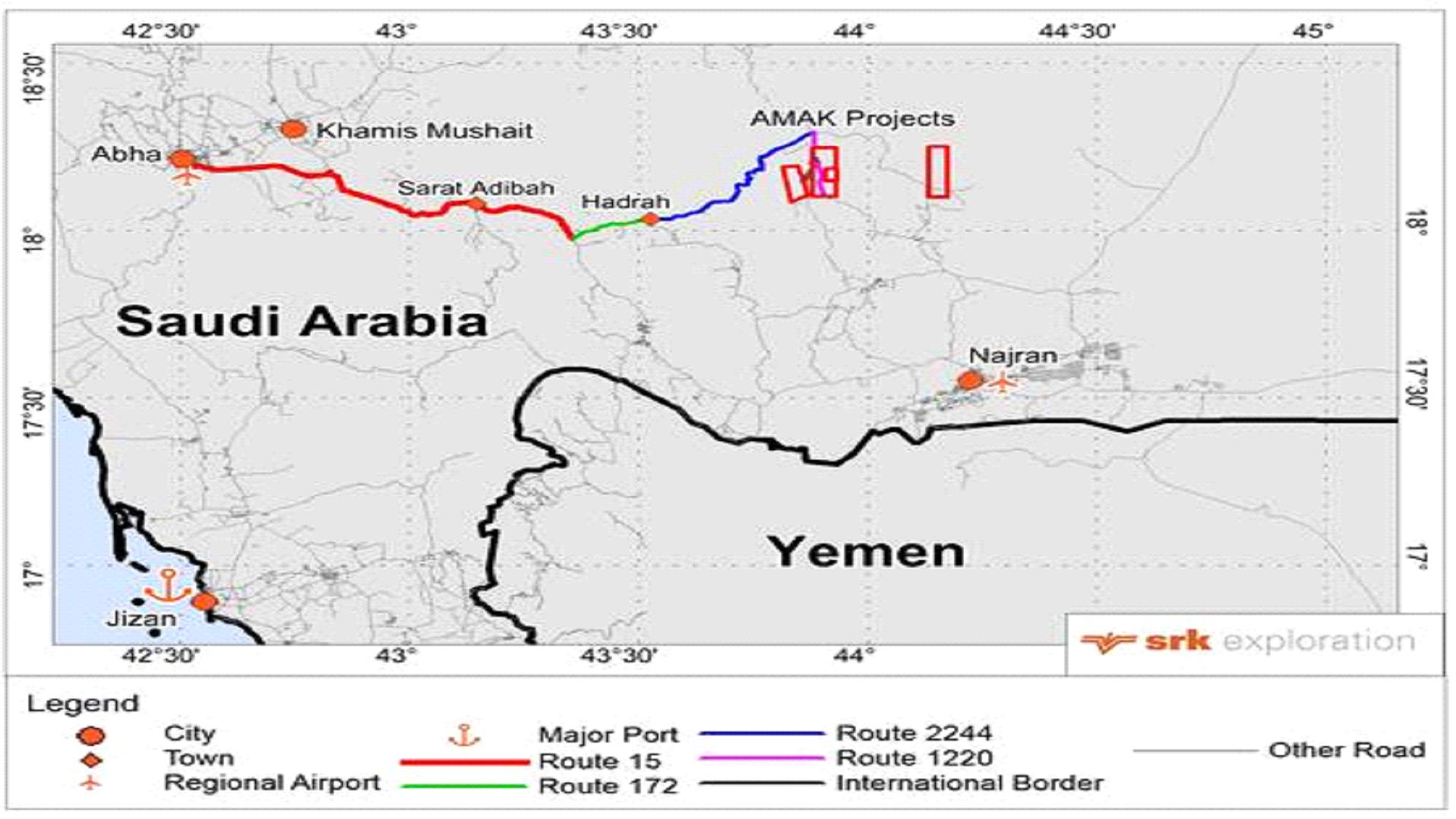

The facility site is located in Najran province in southwestern Saudi Arabia. Najran, the capital of the province of the same name, is approximately 700 km southeast of Jeddah. The site is located 145 km northwest of Najran, midway between the outpost of Rihab and the district town of Sufah. A modern, paved highway extends from Najran through the town of Habuna passing by the project site and on to Sufah. Another modern, paved highway extends west from the town of Tirima about 30 km to the Asir provincial line, becomes a four-lane divided highway, and intersects with a highway leading to Khamis Mushait and Abha. A joining highway then extends down the western slope of the Sarawat mountains to the coastal highway which follows the coast south to the Port of Jazan. The latter is the route AMAK's trucks carry concentrate to the port for export.

Conditions to Retain Title.

The Saudi government granted the Company a mining lease for the Al Masane area comprising approximately 44 square kilometers or approximately 10,870 acres on May 22, 1993 (the "Lease") under Royal Decree No. M/17. The Lease was assigned to AMAK in December 2008. The initial term of the Lease is thirty years beginning May 22, 1993, with AMAK having the option to renew or extend the term of the Lease for additional periods not to exceed twenty years. Under the Lease, AMAK is obligated to pay advance surface rental in the amount of 10,000 Saudi riyals (approximately $2,667 at the current exchange rate) per square kilometer per year (approximately $117,300 annually) during the term of the Lease. In addition, AMAK must pay income tax in accordance with the laws of Saudi Arabia and pay all infrastructure costs. The Lease gives the Saudi Arabian government priority to purchase any gold production from the project, as well as the right to purchase up to 10% of the annual production of other minerals on the same terms and conditions then available to other similar buyers and at current prices then prevailing in the free market. Furthermore, the Lease contains provisions requiring that preferences be given to Saudi Arabian suppliers and contractors and that AMAK employ Saudi Arabian citizens and provide training to Saudi Arabian personnel. In November 2015 AMAK received notification of final approval for additional licenses and leases. The approval includes an additional 151 square kilometers ("km2") of territory contiguous to AMAK's current 44 km2 mine. The new territory comprises the Guyan and Qatan exploration licenses covering 151 km2, and within the Guyan exploration license, a 10 km2 mining lease, which has potential for significant gold recovery. Under the new leases, AMAK is required to pay surface rental of SR 110,000 (approximately $29,333) for a period of 20 years expiring in 2035.

Rock Formations and Mineralization.

Three mineralized zones, the Saadah, Al Houra and Moyeath, have been outlined by diamond drilling. The Saadah and Al Houra zones occur in a volcanic sequence that consists of two mafic-felsic sequences with interbedded exhalative cherts and metasedimentary rocks. The Moyeath zone was discovered after the completion of underground development in 1980. It is located along an angular unconformity with underlying felsic volcanics and shales. The principle sulphide minerals in all of the zones are pyrite, sphalerite, and chalcopyrite. The precious metals occur chiefly in tetrahedrite and as tellurides and electrum.

4

Description of Current Property Condition.

The AMAK facility includes an underground mine, ore-treatment plant and related infrastructures. The ore-treatment plant is comprised of primary crushing, ore storage, SAG milling and pebble crushing, secondary ball milling, pre-flotation, copper and zinc flotation, concentrate thickening, tailings filtration, cyanide leaching, reagent handling, tailings dam and utilities. Related infrastructure includes a 300 man capacity camp for single status accommodation for expatriates and Saudi Arabian employees, an on-site medical facility, a service building for 300 employees, on-site diesel generation of 15 megawatts, potable water supply primarily from an underground aquifer, sewage treatment plant and an assay laboratory. The facilities at the Port of Jazan are comprised of unloading facilities, concentrate storage and reclamation and ship loading facilities. The above-ground ore processing facility became fully operational during the second half of 2012. Late in the fourth quarter of 2015, AMAK temporarily closed the operation to preserve the assets in the ground while initiating steps to improve efficiencies and optimize operations. The plant resumed operation in the fourth quarter of 2016 and operating rates, metal recoveries and concentrate quality has continued to improve throughout 2017 and 2018.

AMAK shipped approximately 58,000, 28,000, and 16,000 metric tons of copper and zinc concentrate to outside smelters during 2018, 2017, and 2016, respectively. In 2014 AMAK initiated operation of its precious metal recovery circuit at the mill and produced gold and silver doré intermittently through 2014 and 2015. The precious metals circuit was recommissioned in the fourth quarter of 2017 and produced commercial quantities of gold and silver bearing doré in 2018.

5

Saudi Industrial Development Fund ("SIDF") Loan and Guarantee

On October 24, 2010, we executed a limited guarantee in favor of the SIDF guaranteeing up to 41% of the SIDF loan to AMAK in the principal amount of 330,000,000 Saudi Riyals (US$88,000,000) (the "Loan"). As a condition of the Loan, SIDF required all shareholders of AMAK to execute personal or corporate guarantees totaling 162.55% of the overall Loan amount. As ownership percentages have changed over time, the loan guarantee allocation has not changed. The other AMAK shareholders provided personal guarantees. We were the only AMAK shareholder providing a corporate guarantee. The loan was required in order for AMAK to fund construction of the underground and above-ground portions of its mining project in southwest Saudi Arabia and to provide working capital for commencement of operations. See Note 14 to the Consolidated Financial Statements.

6

Accounting Treatment of Investment in AMAK.

We have significant influence over the operating and financial policies of AMAK and therefore, account for it using the equity method. We have one representative on the Executive Committee of the Board of Directors of AMAK. We also have one director who serves as Chair on the Commercial Committee of AMAK. AMAK is effectively self-operating under a new, experienced management team. See Note 10 to the Notes to the Consolidated Financial Statements.

We assess our investment in AMAK for impairment when events are identified, or there are changes in circumstances that indicate that the carrying amount of the investment might not be recoverable. We consider recoverable ore reserves, mineral prices,

7

operational costs, and the amount and timing of the cash flows to be generated by the production of those reserves, as well as recent equity transactions within AMAK.

Available Information

We will provide paper copies of this Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports, all as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), free of charge upon written or oral request to Trecora Resources, 1650 Hwy 6 S, Suite 190, Sugar Land, TX 77478, (281) 980-5522. These reports are also available free of charge on our website, www.trecora.com, as soon as reasonably practicable after they are filed electronically with the U.S. Securities and Exchange Commission ("SEC"). SHR also has a website at www.southhamptonr.com, TC has a website at www.trecchem.com, and AMAK has a website at www.amak.com.sa. These websites and the information contained on or connected to them are not incorporated by reference herein to the SEC filings.

Item 1A. Risk Factors.

We are subject to a variety of risks inherent in the global specialty petrochemical, specialty wax and mining (due to our investment in AMAK) businesses. Many of these risk factors are not within our control and could adversely affect our business, results of operations or our financial condition.

We rely on a limited number of customers, including one customer that represented more than 10% of our consolidated revenue in 2018. A significant change in customer relationships or in customer demand for our products could materially adversely affect our results of operations, financial position and cash flows.

We rely on a limited number of customers. Our largest customer, ExxonMobil and its affiliates, represented approximately 17.0% of our consolidated revenues in 2018. A significant reduction in sales to any of our other key customers could materially adversely affect our results of operations, financial position and cash flows, and could result from our key customers further diversifying their product sourcing, experiencing financial difficulty or undergoing consolidation.

Our industry is highly competitive, and we may lose market share to other producers of specialty petrochemicals, specialty waxes or other products that can be substituted for our products, which may adversely affect our results of operations, financial position and cash flows.

Our industry is highly competitive, and we face significant competition from both large international producers and from smaller regional competitors. Our competitors may improve their competitive position in our core markets by successfully introducing new products, improving their manufacturing processes or expanding their capacity or manufacturing facilities. Further, some of our competitors benefit from advantageous cost positions that could make it increasingly difficult for us to compete in certain markets. If we are unable to keep pace with our competitors' product and manufacturing process innovations, cost position or alternative value proposition, it could have a material adverse effect on our results of operations, financial condition and cash flows.

In addition, we face increased competition from companies that may have greater financial resources and different cost structures, alternative values or strategic goals than us. We have a portfolio of businesses across which we must allocate our available resources, while competing companies may specialize in only certain of our product lines. As a result, we may invest less in certain areas of our business than our competitors, and such competitors may have greater financial, technical and marketing resources available to them. Industry consolidation may also affect competition by creating larger, more homogeneous and stronger competitors in the markets in which we compete, and competitors also may affect our business by entering into exclusive arrangements with existing or potential customers or suppliers. We may have to lower the prices of many of our products and services to stay competitive, while at the same time, trying to maintain or improve revenue and gross margin.

Loss of key employees, our inability to attract and retain new qualified employees or our inability to keep our employees focused on our strategies and goals could have an adverse impact on our operations.

In order to be successful, we must attract, retain and motivate executives and other key employees including those in managerial, technical, safety, sales and marketing positions. We must also keep employees focused on our strategies and goals. The failure to hire, or loss of, key employees in a competitive industry could have a significant adverse impact on our operations. In addition, an important component of our competitive performance is our ability to operate safely and efficiently, including our ability to manage expenses and minimize the production of low margin products on an on-going basis. This requires continuous management focus, including technological improvements, safe operations, cost control and productivity enhancements. The extent to which we manage these factors will impact our performance relative to competition.

8

We do not control the activities of AMAK and are dependent on AMAK's management and board of directors.

Although we believe that we have influence over the operating and financial policies of AMAK, we do not control AMAK's activities. The extent to which we are able to influence specific operating and financial decisions depends on our ability to persuade other AMAK board members and management regarding these policies. Our ability to persuade them may be adversely affected by cultural differences, differing accounting and management practices and differing governmental laws and regulations. In addition, we rely upon AMAK's management and board of directors to direct the operations of AMAK, including employing various engineering and financial advisors to assist in the development and evaluation of the mining projects in Saudi Arabia. We also rely on management of AMAK to provide timely, accurate financial information required for inclusion with our reports filed with the SEC.

There can be no assurance that our investment in AMAK will not be negatively impacted by the decisions made by AMAK's management and board of directors regarding AMAK's activities, including with respect to the selection and use of consultants and experienced personnel to manage the operation in Saudi Arabia.

Maintenance, expansion and refurbishment of our facilities and the development and implementation of new manufacturing processes involve significant risks which may adversely affect our business, results of operations, financial condition and cash flows.

Our facilities require periodic maintenance, upgrading, expansion, refurbishment or improvement. Any unexpected operational or mechanical failure, including failure associated with breakdowns and forced outages, could reduce our facilities' production capacity below expected levels which would reduce our revenues and profitability. Unanticipated expenditures associated with maintaining, upgrading, expanding, refurbishing or improving our facilities may also reduce profitability.

If we make any major modifications to our facilities, such modifications likely would result in substantial additional capital expenditures and may prolong the time necessary to bring the facility on line. We may also choose to refurbish or upgrade our facilities based on our assessment that such activity will provide adequate financial returns. However, such activities require time for development before commencement of commercial operations, and key assumptions underpinning a decision to make such an investment may prove incorrect, including assumptions regarding construction costs, demand growth and timing which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Finally, we may not be successful or efficient in developing or implementing new production processes. Innovation in production processes involves significant expense and carries inherent risks, including difficulties in designing and developing new process technologies, development and production timing delays, lower than anticipated manufacturing yields, and product defects. Disruptions in the production process can also result from errors, defects in materials, delays in obtaining or revising operating permits and licenses, returns of product from customers, interruption in our supply of materials or resources and disruptions at our facilities due to accidents, maintenance issues, or unsafe working conditions, all of which could affect the timing of production ramps and yields. Production issues can lead to increased costs and may affect our ability to meet product demand, which could adversely impact our business, results of operations, financial condition and cash flows.

The covenants in the instruments that govern our outstanding indebtedness may limit our operating and financial flexibility.

The covenants in the instruments that govern our outstanding indebtedness limit our ability to, among other things:

• | incur indebtedness and liens; |

• | make loans and investments; |

• | prepay, redeem or repurchase debt; |

• | engage in acquisitions, consolidations, asset dispositions, sale-leaseback transactions and affiliate transactions; |

• | change our business; |

• | amend some of our debt agreements; and |

• | grant negative pledges to other creditors. |

In addition, the ARC Agreement also has financial covenants that require TOCCO to maintain a maximum Consolidated Leverage Ratio and minimum Consolidated Fixed Charge Coverage Ratio (each as defined in the ARC Agreement). See Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Credit Agreement.

A failure by us or our subsidiaries to comply with the covenants and restrictions contained in the agreements governing our indebtedness could result in an event of default under such indebtedness, which could adversely affect our ability to respond to changes in our business and manage our operations. Upon the occurrence of an event of default under any of the agreements

9

governing our indebtedness, the lenders could elect to declare all amounts outstanding to be due and payable and exercise other remedies as set forth in the agreements. Further, an event of default or acceleration of indebtedness under one instrument may constitute an event of default under another instrument. If any of our indebtedness were to be accelerated, there can be no assurance that our assets would be sufficient to repay this indebtedness in full, which could have a material adverse effect on our ability to continue to operate as a going concern.

Our substantial indebtedness could limit cash flow available for our operations and could adversely affect our ability to service debt or obtain additional financing if necessary.

As of December 31, 2018, we had $18 million in borrowings outstanding under our revolving credit facility (the "Revolving Facility") and $84.5 million in borrowings outstanding under our term loan facility (the "Term Loan Facility" and, together with the Revolving Facility, the "Credit Facilities"). Pursuant to the terms of the amended and restated credit agreement (as amended to the date hereof, the "ARC Agreement") governing the Credit Facilities, we also have the option, at any time, to request an increase to the commitment under the Revolving Facility and/or the Term Loan Facility by an additional amount of up to $50.0 million in the aggregate, subject to lenders acceptance of the increased commitment and other conditions.

Although the agreements governing our existing indebtedness contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of important exceptions, and additional indebtedness that we may incur from time to time to finance projects or for other reasons in compliance with these restrictions could be substantial. If we incur significant additional indebtedness, the related risks that we face could increase.

Our current, or any future, indebtedness could:

• | limit our flexibility in planning for, or reacting to, changes in the markets in which we compete; |

• | place us at a competitive disadvantage relative to our competitors with less indebtedness; |

• | limit our ability to reinvest in our business; |

• | render us more vulnerable to general adverse economic, regulatory and industry conditions; and |

• | require us to dedicate a substantial portion of our cash flow to service our indebtedness. |

Our ability to meet our cash requirements, including our debt service obligations, is dependent upon our ability to maintain our operating performance, which will be subject to general economic and competitive conditions and to financial, business and other factors, many of which are beyond our control. We cannot provide assurance that our business will generate sufficient cash flow from operations to fund our cash requirements and debt service obligations.

Conditions in the global economy may adversely affect our results of operations, financial condition and cash flows.

The demand for our products have historically correlated closely with general economic growth rates. The occurrence of recessions or other periods of low or negative growth will typically have a direct adverse impact on our results of operations, financial condition and cash flows. Other factors that affect general economic conditions in the world or in a major region, such as changes in population growth rates or periods of civil unrest, also impact the demand for our products. Economic conditions that impair the functioning of financial markets and financial institutions also pose risks to us, including risks to the safety of our financial assets and to the ability of our partners and customers to fulfill their commitments to us.

In addition, the revenue and profitability of our operations have historically been subject to fluctuation, which makes future financial results less predictable. Our revenue, gross margin and profit vary among our products, customer groups and geographic markets. Overall gross margins and profitability in any given period are dependent partially on the product, customer and geographic mix reflected in that period's net revenue. In addition, newer geographic markets may be relatively less profitable due to investments associated with entering those markets and local pricing pressures. Market trends, competitive pressures, increased raw material or shipping costs, regulatory impacts and other factors may result in reductions in revenue or pressure on gross margins of certain segments in a given period which may necessitate adjustments to our operations.

To service our current, and any future, indebtedness, we will require a significant amount of cash, which may adversely affect our future results.

Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations

10

could harm our business, results of operations and financial condition. Our ability to make payments on and to refinance our indebtedness, and to fund working capital needs and planned capital expenditures, will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, business, legislative, regulatory and other factors that are beyond our control.

If our business does not generate sufficient cash flow from operations or if future borrowings are not available to us in an amount sufficient to enable us to pay our indebtedness, or to fund our other liquidity needs, we may need to refinance all or a portion of our indebtedness (or otherwise seek amendment or relief from the terms of our indebtedness), on or before the maturity thereof, sell assets, reduce or delay capital investments or seek to raise additional capital, any of which could have a material adverse effect on our operations. We might not generate sufficient cash flow to repay indebtedness as currently anticipated. In addition, we may not be able to effect any of these actions, if necessary, on commercially reasonable terms or at all. Our ability to restructure or refinance our indebtedness, will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments may limit or prevent us from taking any of these actions. Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance or restructure our obligations on commercially reasonable terms or at all, would have a material adverse effect on our business, results of operations and financial conditions.

There are certain hazards and risks inherent in our operations that could adversely affect those operations and results of operations and financial condition.

As a manufacturer and distributor of diversified chemical products, our business is subject to operating risks inherent in chemical manufacturing, storage, handling and transportation. These risks include, but are not limited to, fires, explosions, severe weather and natural disasters, mechanical failure, unscheduled downtime, loss of raw materials or our products, transportation interruptions, remediation, chemical spills, terrorist acts or war, discharges or releases of toxic or hazardous substances or gases. These hazards can cause personal injury and loss of life, severe damage to, or destruction of, property and equipment and environmental contamination. In addition, our suppliers are also subject to similar risks that may adversely impact our production capabilities. A significant limitation on our ability to manufacture products due to disruption of manufacturing operations or related infrastructure could have a material adverse effect on our results of operations and financial condition.

While we adapt our manufacturing and distribution processes and controls to minimize the inherent risk of our operations, to promote workplace safety and to minimize the potential for human error, we cannot completely eliminate the risk of accidental contamination or injury from hazardous or regulated materials, including injury of our employees, individuals who handle our products or goods treated with our products, or others who claim to have been exposed to our products, nor can we completely eliminate the unanticipated interruption or suspension of operations at our facilities due to such events. We may be held liable for significant damages or fines in the event of contamination or injury, and such assessed damages or fines could have a material adverse effect on our results of operations and financial conditions. Our property, business interruption and casualty insurance may not fully insure us against all potential hazards incidental to our business.

Increases in the costs of our raw materials could have an adverse effect on our financial condition and results of operations if those costs cannot be passed onto our customers.

Our results of operations are directly affected by the cost of raw materials. Since the cost of these primary raw materials comprise a significant amount of our total cost of goods sold, the selling prices for our products and therefore our total revenue is impacted by movements in these raw material costs, as well as the cost of other inputs. In the past we have experienced erratic and significant changes in the costs of these raw materials, the cost of which has generally correlated with changes in energy prices, supply and demand factors, and prices for natural gas and crude oil. In addition, product mix can have an impact on our overall unit selling prices, since we provide an extensive product offering and therefore experience a wide range of unit selling prices. Because of the significant portion of our cost of goods sold represented by these raw materials, our gross profit margins could be adversely affected by changes in the cost of these raw materials if we are unable to pass the increases on to our customers.

Due to volatile raw material prices, there can be no assurance that we can continue to recover raw material costs or retain customers in the future. For example, our logistics costs have increased substantially within the past three years, narrowing our profit margins. This may force us to increase our pricing, which could cause customers to consider competitors' products, some of which may be available at a lower cost. Significant loss of customers could result in a material adverse effect on our results of operations, financial condition and cash flows.

11

If the availability of our raw materials is limited, we may be unable to produce some of our products in quantities sufficient to meet customer demand or on favorable economic terms, which could have an adverse effect on our results of operations, financial condition and cash flows.

We use polyethylene waxes in our specialty synthetic wax segment and use additional non-primary raw materials in the production of our products in the specialty petrochemical segment and synthetic wax segment. Suppliers may not be able to meet our raw material requirements and we may not be able to obtain substitute supplies from alternative suppliers in sufficient quantities, on economic terms, or in a timely manner. A lack of timely availability of our raw materials in the quantities we require to produce our products could result in our inability to meet customer demand and could have a material adverse effect on our results of operations, financial condition and cash flows.

Certain activist stockholders actions could cause us to incur expense and hinder execution of our strategy.

While we seek to actively engage with our stockholders and consider their views on business and strategy, we could be subject to actions or proposals from our stockholders that do not align with our business strategies or the interests of our other stockholders. Responding to these stockholders could be costly and time-consuming, disrupt our business and operations and divert the attention of our management. Furthermore, uncertainties associated with such activities could negatively impact our ability to execute our strategic plan, retain customers and skilled employees and affect long-term growth. In addition, such activities may cause our stock price to fluctuate based on temporary or speculative market perceptions that do not necessarily reflect our business operations.

We expect to continue to incur capital expenditures and operating costs as a result of our compliance with existing and future environmental laws and regulations.

Our industry is subject to extensive laws and regulations related to the protection of the environment. These laws and regulations continue to increase in both number and complexity and affect our operations with respect to, among other things: the discharge of pollutants into the environment; emissions into the atmosphere (including greenhouse gas emissions); and restrictions, liabilities and obligations in connection with storage, transportation, treatment and disposal of hazardous substances and waste. We are also subject to laws and regulations that require us to operate and maintain our facilities to the satisfaction of applicable regulatory authorities. In addition, failure to comply with these laws or regulations, or failure to obtain required permits from applicable regulatory authorities, may expose us to fines, penalties or interruptions in operations. To the extent these capital expenditures or operating costs are not ultimately reflected in the prices of our products and services, or that we are subject to fines, penalties or other interruptions in our operations, our business, results of operations, financial position and cash flows may be adversely affected.

If we are unable to access third-party transportation for our raw materials and finished products, we may not be able to fulfill our obligations to our customers in a timely manner, which could have a material adverse effect on our results of operations, financial condition and cash flows.

We rely upon transportation provided by third parties (including common carriers, rail companies and trans-ocean cargo companies) to receive raw materials used in the production of our products and to deliver finished products to our customers. While we attempt to offset the risks associated with third-party transportation issues, including by managing our supplies of raw materials, such mitigation efforts may not be successful. If we are unable to access third-party transportation at economically attractive rates, or at all, or if there is any other significant disruption in the availability of third-party transportation, we may not be able to obtain sufficient quantities of raw materials (on favorable terms, or at all) to match the pace of production and/or we may not be able to fulfill our obligations to our customers in a timely manner, which could have a material adverse effect on our results of operations, financial condition and cash flows.

If we are not able to continue the technological innovation and successful commercial introduction of new products, our customers may turn to other producers to meet their requirements, which may adversely affect our results of operations, financial position and cash flows.

Our industry and the markets into which we sell our products experience periodic technological change and ongoing product improvements. In addition, our customers may introduce new generations of their own products, adopt new or different risk profiles, or require new technological and increased performance specifications that would require us to develop customized products. Our future growth and profitability will depend on our ability to maintain or enhance technological capabilities, develop and market products and applications that meet changing customer requirements and successfully anticipate or respond to technological changes in a cost effective and timely manner. Our inability to maintain a technological edge, innovate and improve our products could cause a decline in the demand and sales of our products and adversely affect our results of operations, financial position and cash flows.

12

We are subject to numerous regulations that could require us to modify our current business practices and incur increased costs.

We are subject to numerous regulations, including customs and international trade laws, export control, data privacy, antitrust laws and zoning and occupancy laws that regulate manufacturers generally and/or govern the importation, promotion and sale of our products, the operation of our facilities and our relationship with our customers, suppliers and competitors. In addition, we face risk associated with trade protection laws, policies and measures and other regulatory requirements affecting trade and investment, including loss or modification of exemptions for taxes and tariffs, imposition of new tariffs and duties and import and export licensing requirements. If these laws or regulations were to change or were violated by our management, employees, suppliers, buying agents or trading companies, the costs of certain goods could increase, or we could experience delays in shipments of our goods, be subject to fines or penalties, or suffer reputational harm, which could reduce demand for our products and hurt our business and negatively impact our results of operations. In addition, changes in federal and state minimum wage laws and other laws relating to employee benefits could cause us to incur additional wage and benefits costs, which could negatively impact our profitability.

Legal requirements are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effects on our operations. We may be required to make significant expenditures or modify our business practices to comply with existing or future laws and regulations, which may increase our costs and materially limit our ability to operate our business.

Failure to successfully consummate extraordinary transactions, including the integration of other businesses, assets, products or technologies, or realize the financial and strategic goals that were contemplated at the time of any such transaction may adversely affect our future business, results of operations and financial condition.

As part of our business strategy, we from time to time explore possible investments, acquisitions, strategic alliances, joint ventures, divestitures and outsourcing transactions (collectively, "extraordinary transactions") in order to further our business objectives. To pursue this strategy successfully, we must identify suitable candidates for, and successfully complete, extraordinary transactions, some of which may be large and complex, and manage post-closing issues such as the integration of acquired businesses or employees. The expense and effort incurred in exploring and consummating extraordinary transactions, the time it takes to integrate an acquisition or our failure to integrate businesses successfully, could result in additional and/or unexpected expenses and losses. We also may not be successful in negotiating the terms of any potential extraordinary transactions, conducting thorough due diligence, financing an extraordinary transaction or effectively integrating the acquired business, product or technology into our existing business and operations. Our due diligence may fail to identify all of the problems, liabilities or other shortcomings or challenges of an acquired business, product or technology. Moreover, we may incur significant expenses whether or not a contemplated extraordinary transaction is ultimately consummated.

Additionally, in connection with any extraordinary transaction we consummate, we many not fully realize all of the anticipated synergies and other benefits we expect to achieve (on our expected timeframe, or at all), and we may incur unanticipated expenses, write-downs, impairment charges or unforeseen liabilities that could negatively affect our business, financial condition and results of operations, disrupt relationships with current and new employees, customers and vendors, incur significant debt or have to delay or not proceed with announced transactions. Further, managing extraordinary transactions requires varying levels of management and employee resources, which may divert our attention from other business operations.

The adoption of climate change legislation or regulation could result in increased operating costs and reduced demand for our products.

The nature of our operations could make us subject to legislation or regulations affecting the emission of greenhouse gases. The U.S. Environmental Protection Agency has promulgated (and may in the future promulgate) regulations applicable to projects involving greenhouse gas emissions above a certain threshold, and the U.S. and certain states within the U.S. have enacted, or are considering, limitations on greenhouse gas emissions. Jurisdictions outside the U.S. are also addressing greenhouse gases by legislation or regulation. In addition, efforts have been made and continue to be made at the international level toward the adoption of international treaties or protocols that would address global greenhouse gas emissions. These limitations may include the adoption of cap and trade regimes, carbon taxes, restrictive permitting, increased efficiency standards and incentives or mandates for renewable energy. Any such requirements could make our products more expensive, lengthen project implementation times and reduce demand for hydrocarbons, as well as shift hydrocarbon demand toward relatively lower-carbon sources. Such legislation, regulation, treaties or protocols may also increase our compliance costs, such as for monitoring or sequestering emissions.

13

Adverse results of legal proceedings could materially adversely affect us.

We are subject to and may in the future be subject to a variety of legal proceedings and claims that arise out of the ordinary conduct of our business, including legal proceedings brought in non-U.S. jurisdictions. Results of legal proceedings cannot be predicted with certainty. Irrespective of its merits, litigation may be both lengthy and disruptive to our operations and may cause significant expenditure and diversion of management attention. We may be faced with significant monetary damages or injunctive relief against us that could have an adverse impact on our business and results of operations should we fail to prevail in certain matters.

Cost pressures could negatively impact AMAK's operating margins and expansion plans.

Cost pressures may continue to occur across the resources industry. As the prices for AMAK's products are determined by the global commodity markets in which it operates, AMAK does not generally have the ability to offset these cost pressures through corresponding price increases, which can adversely affect its operating margins or require changes in operations, including, but not limited to, temporary planned shutdowns. Notwithstanding AMAK's efforts to reduce costs, and a number of key cost inputs being commodity price-linked, the inability to reduce costs and a timing lag may adversely impact AMAK's operating margins for an extended period.

An impairment of goodwill could negatively impact our results of operations.

At least annually, we assess goodwill for impairment. If an initial qualitative assessment identifies that it is more likely than not that the carrying value of a reporting unit exceeds its estimated fair value, additional quantitative testing is performed. We may also elect to skip the qualitative testing and proceed directly to quantitative testing. If the quantitative testing indicates that goodwill is impaired, the carrying value of goodwill is written down to fair value with a charge against earnings. Since we utilize a discounted cash flow methodology to calculate the fair value of our operating units, continued weak demand for a specific product line or business could result in an impairment charge. Accordingly, any determination requiring the write-off of a significant portion of goodwill could negatively impact our results of operations.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under the Credit Facilities are, and additional borrowings in the future may be, at variable rates of interest that expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness will increase even though the amount borrowed will remain the same, and our net income and cash flows, including cash available for servicing our indebtedness, will correspondingly decrease. We may in the future enter into, interest rate swaps for our variable rate debt whereby we exchange floating for fixed rate interest payments in order to reduce exposure to interest rate volatility. However, any interest rate swaps into which we enter may not fully mitigate our interest rate risk.

We are exposed to local business risks in different countries, which could have a material adverse effect on our financial condition and results of operations.

Although we do not have production operations and assets outside of the U.S., we do have a global portfolio of customers and thus we are subject to a variety of international market risks including, but not limited to:

• | ongoing instability or changes in a country's or region's economic or political conditions, including inflation, recession, interest rate fluctuations, civil unrest and actual or anticipated military or political conflicts (including the potential impact of continued hostilities and conflict in Yemen on the operations of AMAK); |

• | longer accounts receivable cycles and financial instability or credit risk among customers and distributors; |

• | trade regulations and procedures and actions affecting production, pricing and marketing of products, including domestic and foreign customs and tariffs or other trade barriers; |

• | regulations favoring local contractors or requiring foreign contractors to employ citizens of, or purchase supplies from, a local jurisdiction; |

• | local labor conditions and regulations and the geographical dispersion of the workforce; |

• | changes in the regulatory or legal environment; |

• | differing technology standards or customer requirements; |

• | import, export or other business licensing requirements or requirements relating to making foreign direct investments, which could affect our ability to obtain favorable terms for labor and raw materials or lead to penalties or restrictions; |

• | data privacy regulations; |

• | risk of non-compliance with the U.S. Foreign Corrupt Practices Act or similar anti-bribery legislation in other countries by agents or other third-party representatives; |

14

• | risk of nationalization of private enterprises by foreign governments (including the risk that AMAK's mining and exploration leases may be terminated by the Saudi Ministry of Petroleum and Minerals); |

• | foreign currency exchange restrictions and fluctuations; |

• | difficulties associated with repatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; and |

• | fluctuations in freight costs and disruptions in the transportation and shipping infrastructure at important geographic points of exit and entry for our products and shipments. |

Such economic and political uncertainties may materially and adversely affect our business, financial condition or results of operations in ways that cannot be predicted at this time. Although it is impossible to predict the occurrences or consequences of any such events, they could result in a decrease in demand for our products, make it difficult or impossible to deliver products to our customers or to receive raw materials from our suppliers and create delays and inefficiencies in our supply chain. We are also predominantly uninsured for losses and interruptions caused by terrorist acts, conflicts and wars.

We may have additional tax liabilities, which may adversely affect our financial position.

We are subject to income taxes and state taxes in the U.S. Significant judgment is required in determining our provision for income taxes. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe our tax estimates are reasonable, the final determination of tax audits and any related litigation could be materially different to that which is reflected in our consolidated financial statements. Should any tax authority take issue with our estimates, our results of operations, financial position and cash flows could be adversely affected.

The U.S. Tax Cuts and Jobs Act ("TCJA") was enacted on December 22, 2017, and introduces significant changes to U.S. income tax law. Accounting Standards Codification 740, Accounting for Income Taxes, requires companies to recognize the effects of tax law changes in the period of enactment. Effective in 2018, the TCJA made a number changes, such as reducing the U.S. statutory tax rate from 35% to 21%, creating new taxes on certain foreign sourced earnings and certain related-party payments, which are referred to as the global intangible low taxed income tax and the base erosion tax, respectively, establishing a dividends received deduction for dividends paid by foreign subsidiaries to the U.S., the elimination or limitation of certain deductions, and imposing a mandatory tax on previously unrepatriated earnings accumulated offshore. Due to the timing of the new tax law provided in the TCJA and the substantial changes it brings, the Staff of the SEC issued Staff Accounting Bulletin No. 118, which provides registrants with a measurement period to report the impact of the new US tax law. As a result, the recorded and estimated impacts of the TCJA may change in future periods, which may adversely affect our estimates, our results of operations, financial position and cash flows.

AMAK is also subject to various taxes in Saudi Arabia. While AMAK currently benefits from certain tax credits that reduce its overall tax liability, there can be no assurance that relevant tax authorities will continue to maintain such credits. In addition, there can be no assurances that future changes in tax law in Saudi Arabia will not result in increased tax liability to AMAK. A material increase in tax liability could have an adverse effect on AMAK's results of operations and financial condition, which may in turn have an adverse effect on our investment in AMAK.

We from time to time are subject to contingent liabilities. If any contingent liabilities become actual liabilities, our financial condition may be adversely affected.

We are subject to various contingent liabilities that may affect our liquidity and our ability to meet our obligations, including our limited corporate guarantee to SIDF in connection with AMAK's Loan to fund mining operations. To the extent any of our current or future contingent liabilities become actual liabilities, it may have an adverse effect on our financial condition.

We may be unable to recover our investment in AMAK, which could adversely affect our results of operations and financial condition.

We will only recover our investment in AMAK through the receipt of distributions or future share repurchases from AMAK or the sale of part or all of our interest in AMAK. If AMAK does not continue to be profitable, our ability to recover our investment will be adversely affected. Moreover, if AMAK continues to be profitable, there can be no assurance that the board of directors of AMAK will determine that it is in the best interests of AMAK and its shareholders to make distributions to its shareholders or to initiate additional share repurchases. In addition, we understand that AMAK is required to sell a portion of its equity to the public once AMAK has been profitable for two years. While the proceeds of such a sale might allow us to recover our investment in AMAK, there is no assurance that the market conditions for any such public sale will be favorable enough to allow us to recover our investment or that some or all of our shares in AMAK will be include in any such sale. To the extent we are unable to recover our investments in AMAK, our results of operations and financial condition may be adversely affected.

15

AMAK may have fewer mineral reserves than its estimates indicate.

Fluctuations in the price of commodities, variation in production costs or different recovery rates could result in AMAK's estimated reserves being revised in the future. If such a revision were to indicate a substantial reduction in proven or probable reserves at one or more of AMAK's projects, it could adversely affect our investment in AMAK.

Domestic or international terrorist attacks may disrupt our operations or otherwise have an adverse impact on our business.

It is possible that further acts of terrorism may be directed against the U.S. domestically or abroad, and such acts of terrorism could be directed against our investment in those locations. Moreover, chemical related assets, and U.S. corporations such as ours, may be at a greater risk of future terrorist attacks than other possible targets. The resulting damage from such an event could include loss of life, property damage or site closure. Any, or a combination, of these factors could adversely impact our results of operations, financial position and cash flows.

Increased information systems security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products and services.

Increased information systems security threats and more sophisticated, targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability, and integrity of our data, operations, and communications. While we attempt to mitigate these risks by employing a number of measures, including security measures, employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, if these measures prove inadequate, we could be adversely affected by, among other things, loss or damage of intellectual property, proprietary and confidential information, and communications or customer data, having our business operations interrupted and increased costs to prevent, respond to, or mitigate these cyber security threats. Any significant disruption or slowdown of our systems could cause customers to cancel orders or standard business processes to become inefficient or ineffective, which could adversely affect our results of operations, financial position and cash flows.

Implementation of changes to our enterprise resource planning ("ERP") system may adversely affect our business and results of operations or the effectiveness of internal controls over financial reporting.

During 2017, we implemented a new ERP system at our specialty petrochemical facility in order to better manage our business, and we continue to implement additional improvements to the system. ERP implementations are complex and time-consuming projects that involve substantial expenditures on system software and implementation activities over a significant period of time. If we do not effectively implement changes to ERP system, or if the system does not operate as intended, it could adversely affect our financial reporting systems and our ability to produce financial reports, the effectiveness of internal controls over financial reporting (including our disclosure controls and procedures), and our business and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

United States Specialty Petrochemical Facility

SHR owns and operates a specialty petrochemical facility near Silsbee, Texas which is approximately 30 miles north of Beaumont, Texas, and 90 miles east of Houston. The facility consists of eight operating units which, while interconnected, make distinct products through different processes: (i) a Penhex Unit; (ii) a Reformer; (iii) a Cyclo-pentane Unit; (iv) an Advanced Reformer unit; (v) an Aromatics Hydrogenation Unit; (vi) a White Oil Fractionation Unit; (vii) a Hydrocarbon Processing Demonstration Unit, and (viii) a P-Xylene Unit. All of these units are currently in operation. Our new 4,000 barrel per day Advanced Reformer unit successfully re-started in December 2018. This unit will provide security of hydrogen supply for Penhex and custom processing projects as well as increase the value of our by-products.

GSPL owns and operates three 8-inch diameter pipelines and five 4-inch diameter pipelines aggregating approximately 70 miles in length connecting SHR's facility to (1) a natural gas line, (2) SHR's truck and rail loading terminal and (3) a major petroleum products pipeline system owned by an unaffiliated third party. All pipelines are operated within Texas Railroad Commission and DOT regulations for maintenance and integrity.

16

United States Specialty Polyethylene Wax Facility