Form 8-K Global Medical REIT Inc. For: Mar 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 7, 2019 (March 5, 2019)

Global

Medical REIT Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 001-37815 | 46-4757266 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

2 Bethesda Metro Center, Suite 440 Bethesda, MD 20814 |

||

| (Address of Principal Executive Offices) (Zip Code) |

||

| (202) 524-6851 | ||

| (Registrant’s Telephone Number, Including Area Code) | ||

Not Applicable

(Former name or former address, if changed since last report)

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On March 6, 2019, the Company announced its financial position as of December 31, 2018 and operating results for the three months and year ended December 31, 2018 and other related information by posting its Fourth Quarter and Year End 2018 Earnings Results and Operating Information package (the “Package”) to the Company’s website at www.globalmedicalreit.com. A copy of the Package has been furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information included in this Item 2.02 of this Current Report on Form 8-K, including the Package furnished as Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Entry into Material Contract with Named Executive Officer and Compensatory Arrangements of Certain Officers.

2019 Annual Equity Incentive Awards

On March 5, 2019, the Board of Directors (the “Board”) of the Company approved the recommendations of the Compensation Committee of the Board with respect to the 2019 Annual Performance-Based, Long-Term Incentive Plan (“LTIP”) Awards (the “Annual Awards”), which may be granted to the executive officers of the Company and other employees of the external manager of the Company (the “Manager”) who perform services for the Company. The Annual Awards will be granted pursuant to the Company’s 2016 Equity Incentive Plan (the “2016 Plan”).

The Annual Awards that may be granted to the named executive officers of the Company are described below.

| Name | Title | 2019 Annual Award Target |

Number of Target Annual Award Units(1) |

|||||||

| Jeffrey Busch | Chief Executive Officer, Chairman of the Board & President | $ | 180,000 | 17,875 | ||||||

| Alfonzo Leon | Chief Investment Officer | $ | 150,000 | 14,896 | ||||||

| Robert Kiernan | Chief Financial Officer and Treasurer | $ | 150,000 | 14,896 | ||||||

| Jamie Barber | General Counsel and Secretary | $ | 120,000 | 11,917 | ||||||

| Allen Webb | SVP, SEC Reporting and Technical Accounting | $ | 110,000 | 10,924 | ||||||

| (1) | The number of target LTIP Units comprising each Annual Award is based on the closing price of the Company’s common stock reported on the New York Stock Exchange on the date of approval (March 5, 2019), rounded to the next highest whole LTIP Unit to eliminate fractional units. |

The Annual Awards will be subject to the terms and conditions of LTIP Annual Award Agreements (“LTIP Annual Award Agreements”) between the Company and each grantee in the form attached hereto as Exhibit 99.2, which is incorporated herein by reference. Terms not otherwise defined herein have the meanings assigned to them in the LTIP Annual Award Agreements.

The Compensation Committee established performance goals for calendar year 2019 (the “Annual Performance Period”) as set forth in Exhibit A to the LTIP Annual Award Agreements (the “Performance Goals”) that will be used to determine the number of LTIP Units earned by each grantee under each LTIP Annual Award Agreement. As soon as reasonably practicable following the last day of the Annual Performance Period, the Compensation Committee will determine the extent to which the Company has achieved each of the Performance Goals (expressed as a percentage) and, based on such determination, will calculate the number of Earned LTIP Units that each grantee is entitled to receive based on the applicable Performance Percentages described in Exhibit A to the LTIP Annual Award Agreement. Any Annual Award LTIP Units that are not earned will not be granted, and the grantee will have no right in or to any such unearned LTIP Units after it is determined that they were not earned.

The number of Earned LTIP Units issuable to each grantee under the LTIP Annual Award Agreement will be determined by dividing the total number of Annual Award Target LTIP Units into four performance areas as shown in the table below (each a “Component”) and multiplying the number of Target Annual Award LTIP Units allocated to each Component by the applicable Performance Percentage described underneath the table below based on the extent to which the Performance Goal for each such Component is achieved.

| Target No. of LTIP Units |

Component | Performance Goal | ||

| 25% of total Target LTIP Units | Acquisitions including (i) closed acquisitions during 2019 and (ii) acquisitions placed under definitive purchase contract on or before December 31, 2019 and closed by February 28, 2020. |

Threshold: $100 million

Target: $150 million

Maximum: $200 million | ||

| 25% of total Target LTIP Units | AFFO per share for the year ended December 31, 2019, as reported by the Company in its year-end earnings announcement for the year ended December 31, 2019. |

Threshold: $0.78 per share

Target: $0.80 per share

Maximum: $0.84 per share

| ||

| 25% of total Target LTIP Units | Average quarterly Consolidated Leverage Ratio (as defined in the Company’s Amended and Restated Credit Agreement) (based on each fiscal quarter end). |

Threshold: 54.99%

Target: 52.50%

Maximum: 49.99% | ||

| 25% of total Target LTIP Units | Discretionary Component | Entirely at the discretion of the Committee based on the Committee’s assessment of the grantee’s individual performance in areas the Committee deems in its discretion to be important based on the grantee’s job duties and position within the organization. |

Performance Percentages

| (i) | If the Company does not achieve the Threshold Goal in a particular Component in the above table, all of the Annual Award LTIP Units for that Component will be forfeited. |

| (ii) | If the Company achieves the Threshold Goal in a particular Component in the above table, the number of Earned LTIP Units in that Component will be equal to 50% of the number of Target Annual Award LTIP Units for that Component. |

| (iii) | If the Company achieves the Target Goal in a particular Component in the above table, the number of Earned LTIP Units in that Component will be equal to 100% of the number of Target Annual Award LTIP Units for that Component. |

| (iv) | If the Company achieves or exceeds the Maximum Goal in a particular Component in the above table, the number of Earned LTIP Units for that Component will be equal to 150% of the number of Target Annual Award LTIP Units for that Component. |

For achievement of a Performance Goal at an intermediate point between the Threshold Goal and the Target Goal or between the Target Goal and the Maximum Goal for any Component, the number of Earned LTIP Units for that Component will be interpolated on a straight-line basis between 50% and 100% or between 100% and 150%, respectively, of the target number of Annual Award LTIP Units allocated to that Component. Fractional LTIP Units will be rounded to the next highest whole LTIP Unit.

LTIP Units that have been earned based on performance as described above are subject to forfeiture restrictions that will lapse (“vesting”) in the following amounts and on the following vesting dates subject to the continuous service of the grantee through and on the applicable vesting date:

(i) 50% of the Earned LTIP Units will become vested, and cease to be subject to forfeiture, as of the date in 2020 on which the Board approves the number of Earned LTIP Units to be awarded pursuant to the Components listed above (the “Annual Award Valuation Date”); and

(ii) 50% of the Earned LTIP Units become vested, and cease to be subject to forfeiture, on the first anniversary of the Annual Award Valuation Date.

Vesting will accelerate in the event of a termination of the executive’s position without Cause or for Good Reason, as a result of death or Disability, or as a result of the grantee’s Retirement or upon a Change of Control. Unvested LTIP Awards will be forfeited in the event of any other termination event.

Distributions

Pursuant to the LTIP Annual Award Agreements, distributions equal to the dividends declared and paid by the Company will accrue during the applicable period on the maximum number of LTIP Units that the grantee could earn (if applicable) and are paid with respect to all of the Earned LTIP Units at the conclusion of the applicable period, in cash or by the issuance of additional LTIP Units at the discretion of the Compensation Committee.

The foregoing summary of the LTIP Annual Award Agreement is qualified in its entirety by reference to the form of agreement filed herewith as Exhibit 99.2.

Long-Term Awards

On March 5, 2019, the Board approved the recommendations of the Compensation Committee of the Board with respect to the granting of 2019 Long-Term Performance-Based Incentive LTIP Awards (the “Long-Term Performance Awards”) and Long-Term Time-Based Incentive LTIP Awards (the “Long-Term Time-Based Awards” and, together with the Long-Term Performance Awards, the “Long-Term Awards”) to the executive officers of the Company and other employees of the Manager who perform services for the Company. The Awards were granted pursuant to the 2016 Plan.

The Awards granted are described below.

| Name | Title | 2019 Long-Term Performance Award Target |

Number of Target Long-Term Performance Award Units |

2019 Long- Term Time- Based Award |

Number of Long-Term Time- Based Award Units |

|||||||||||

| Jeffrey Busch | Chief Executive Officer, Chairman of the Board & President |

$ | 138,000 | 13,849 | $ | 92,000 | 9,136 | |||||||||

| Alfonzo Leon | Chief Investment Officer | $ | 126,000 | 12,645 | $ | 84,000 | 8,342 | |||||||||

| Robert Kiernan | Chief Financial Officer | $ | 96,000 | 9,634 | $ | 64,000 | 6,356 | |||||||||

| Jamie Barber | General Counsel and Secretary | $ | 84,000 | 8,430 | $ | 56,000 | 5,561 | |||||||||

| Allen Webb | SVP, SEC Reporting and Technical Accounting |

$ | 78,000 | 7,828 | $ | 52,000 | 5,164 | |||||||||

The number of target LTIP Units comprising each Long-Term Performance-Based Award is based on the fair value of the Long-Term Performance-Based Awards as determined by an independent valuation consultant, in each case rounded to the next whole LTIP Unit to eliminate fractional units.

The Long-Term Performance-Based Awards will be subject to the terms and conditions of LTIP Long-Term Performance-Based Award Agreements (“LTIP Long-Term Performance-Based Award Agreements”) between the Company and each grantee in the form attached hereto as Exhibit 99.3, which is incorporated herein by reference. Terms not otherwise defined herein have the meanings assigned to them in the LTIP Long-Term Performance-Based Award Agreements.

The number of Earned LTIP Units that each grantee is entitled to receive under the LTIP Long-Term Performance-Based Award Agreements will be determined following the conclusion of a three-year performance period (the “Long-Term Performance Period”) based on the Company’s Total Shareholder Return (“TSR”) on both an absolute basis (“Absolute TSR Component”) (representing 75% of the target Long-Term Performance-Based Award) and relative to the companies comprising the SNL U.S. Healthcare REIT Index (“Relative TSR Component”) (representing 25% of the target Long-Term Performance-Based Award) during the Long-Term Performance Period. Grantees will not be entitled to receive any LTIP Units except to the extent they are earned upon the end of the Long-Term Performance Period in accordance with the terms and conditions of the LTIP Long-Term Performance-Based Award Agreements. Long-Term Performance-Based Award LTIP Units that are not earned will be forfeited and cancelled and unvested Earned LTIP Units will be subject to forfeiture prior to vesting as set forth below.

The number of LTIP Units earned under the Absolute TSR Component of the Long-Term Performance-Based Awards will be determined as soon as reasonably practicable following the earlier of (a) the calendar day immediately preceding the third anniversary of March 5, 2019, or (b) the date upon which a Change of Control occurs (the “Long-Term Valuation Date”), by multiplying the total target number of Long-Term Performance-Based Award LTIP Units by 75% and then multiplying such product by the applicable Percentage of Absolute TSR Component Earned based on the Company’s Total Shareholder Return as shown below:

| TSR | Percentage

of Absolute TSR Component Earned | |||||

| 21 | % | 50 | % | |||

| 27 | % | 100 | % | |||

| 33 | % | 200 | % | |||

The Absolute TSR Component will be forfeited in its entirety if the TSR is less than 21%. If the TSR is between 21% and 27%, or between 27% and 33%, the percentage of the Absolute TSR Component earned will be determined using linear interpolation as between those tiers, respectively.

The number of Long-Term Performance-Based Award LTIP Units earned under the Relative TSR Component will be determined as soon as reasonably practicable following the Long-Term Valuation Date by multiplying the number of Award LTIP Units by 25% and then multiplying such product by the applicable Percentage of Relative TSR Component Earned based on the Company’s Relative Performance as shown below:

| Relative Performance | Percentage of Relative TSR Component Earned | |||

TSR equal to the 35th percentile of Peer Companies | 50 | % | ||

TSR equal to the 55th percentile of Peer Companies | 100 | % | ||

TSR equal to or greater than the 75th percentile of Peer Companies | 200 | % | ||

The Relative TSR Component will be forfeited in its entirety if the Relative Performance is below the 35th percentile of Peer Companies. If the Relative Performance is between the 35th percentile and 55th percentile of Peer Companies, or between the 55th percentile and 75th percentile of Peer Companies, the percentage of the Relative TSR Component earned will be determined using linear interpolation as between those tiers, respectively.

As soon as practicable following the Long-Term Valuation Date, the Compensation Committee will determine the number of LTIP Units earned by each grantee under both the Absolute TSR Component and the Relative TSR Component. Any Award LTIP Units that are not earned as set forth above will be forfeited, and the grantee will have no right in or to any such unearned and unissued LTIP Units after it is determined that they were not earned.

Units that have been earned based on performance as provided above are subject to forfeiture restrictions that vest in the following amounts and on the following vesting dates subject to the continuous service of the grantee through and on the applicable vesting date:

(i) 50% of the Earned LTIP Units become vested, and cease to be subject to forfeiture, as of the Long-Term Valuation Date; and

(ii) 50% of the Earned LTIP Units become vested, and cease to be subject to forfeiture, on the first anniversary of the Long-Term Valuation Date.

Vesting will accelerate in the event of a termination of the executive’s position without Cause or for Good Reason, as a result of death or Disability, or as a result of the grantee’s Retirement or upon a Change of Control. Unvested LTIP Awards will be forfeited in the event of any other termination event.

Long-Term Time-Based Awards

The Long-Term Time-Based Awards will be subject to the terms and conditions of LTIP Unit Award Agreements (“LTIP Unit Award Agreements,” and, together with the LTIP Long-Term Performance-Based Award Agreements, the “Award Agreements”) between the Company and each grantee in the form filed as exhibit herewith as Exhibit 99.4, which is incorporated herein by reference. Long-Term Time-Based Awards become vested, and cease to be subject to forfeiture, in equal one-third increments on each of the first, second and third anniversaries of the date of grant (March 5, 2019).

Distributions

Pursuant to the LTIP Long-Term Performance-Based Award Agreements, distributions equal to the dividends declared and paid by the Company will accrue during the applicable period on the maximum number of LTIP Units that the grantee could earn (if applicable) and are paid with respect to all of the Earned LTIP Units at the conclusion of the applicable period, in cash or by the issuance of additional LTIP Units at the discretion of the Compensation Committee.

The foregoing summaries of the LTIP Long-Term Performance-Based Award Agreements are qualified in their entirety by reference to the forms of agreement filed herewith as Exhibits 99.3 and 99.4.

Director Compensation

On March 5, 2019, the Board also approved the following annual compensation amounts for its independent directors for the year beginning with the 2019 annual meeting of the Company’s stockholders:

|

Independent Director Compensation | ||

| Annual Cash Retainer | $40,000, payable quarterly in arrears | |

| Annual Equity Award | $40,000, granted on the date of the annual meeting upon election of the grantee as a director and payable as a number of LTIP Units based on the average closing price of the Company’s common stock as reported on the NYSE during the 10 trading days preceding the date of the annual meeting and subject to forfeiture restrictions that will lapse on the first anniversary of the grant date subject to continued service as a director through such vesting date. | |

|

Independent Committee Member Compensation | ||

| Annual Cash Retainer |

Audit Committee: $7,500 Compensation Committee: $5,000 Nominating & Corporate Governance Committee: $3,500 Investment Committee: $7,500

All payable quarterly in arrears | |

| Annual Cash Retainer for Chair |

Audit Committee Chair: $15,000 Compensation Committee Chair: $10,000 Nominating & Corporate Governance Committee Chair: $7,000 Investment Committee Chair: $15,000

All payable quarterly in arrears | |

|

Lead Independent Director Compensation | ||

| Annual Cash Retainer | $15,000, payable quarterly in arrears | |

| Item 8.01 | Other Events. |

On March 6, 2019, the Company announced the declaration of:

| · | a cash dividend for the first quarter of 2019 of $0.20 per share of common stock to stockholders of record as of March 26, 2019, to be paid on April 10, 2019; and |

| · | a cash dividend of $0.46875 per share to holders of its Series A Cumulative Redeemable Preferred Stock, $0.001 par value per share (the “Series A Preferred Stock”), of record as of April 15, 2019, to be paid on April 30, 2019. This dividend represents the Company’s quarterly dividend on its Series A Preferred Stock for the period from January 31, 2019 through April 29, 2019. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

*Furnished herewith

** Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Global Medical REIT Inc. | ||

| By: | /s/ Jamie A. Barber | |

| Jamie A. Barber | ||

| Secretary and General Counsel | ||

Dated: March 7, 2019

Exhibit 99.1

Fourth Quarter 2018 Earnings Results and Operating Information Three Months and Year Ended December 31, 2018 www.globalmedicalreit.com NYSE: GMRE

2 Table of Contents Financial Highlights 3 Financial Review 5 Consolidated Balance Sheets 6 Consolidated Statements of Operations 7 Consolidated Statements of Cash Flows 8 Reconciliation of Non - GAAP Measures for Funds from Operations (FFO) and Adjusted Funds From Operations (AFFO) 9 Acquisitions 10 Operating Metrics 11 Top 10 Tenant Profiles 12 Real Estate Portfolio 13 About Global Medical REIT Inc. (NYSE: GMRE) 15 Disclosures 16 Forward - Looking Statements Certain statements contained herein may be considered “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , and it is the Company’s intent that any such statements be protected by the safe harbor created thereby . These forward - looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "plan," "predict," "project," "will," "continue" and other similar terms and phrases, including references to assumptions and forecasts of future results . Except for historical information, the statements set forth herein including, but not limited to, any statements regarding our earnings, expected financial performance (including future cash flows associated with new tenants), future dividends or other financial items ; any other statements concerning our plans, strategies, objectives and expectations for future operations, our pipeline of acquisition opportunities and expected acquisition activity, including the timing and/or successful completion of any acquisitions and expected rent receipts on these properties ; facility sale or expected sale activity, including the timing and/or successful completion of any sales and expected proceeds and tax impact of the sales, and any statements regarding future economic conditions or performance are forward - looking statements . These forward - looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties . Although the Company believes that the expectations, estimates and assumptions reflected in its forward - looking statements are reasonable, actual results could differ materially from those projected or assumed in any of the Company’s forward - looking statements . Additional information concerning us and our business, including additional factors that could materially and adversely affect our financial results, include, without limitation, the risks described under Part I, Item 1 A - Risk Factors, in our Annual Report on Form 10 - K, our Quarterly Reports on Form 10 - Q, and in our other filings with the United States Securities and Exchange Commission (“SEC”) . You are cautioned not to place undue reliance on forward - looking statements . The Company does not intend, and undertakes no obligation, to update any forward - looking statement . Fourth Quarter 2018 Earnings Call and Webcast Date Thursday, March 7, 2019 Time 9:00 a.m. Eastern Time Dial - In 1 - 877 - 407 - 3948: Domestic / 201 - 389 - 0865: International / Reference: Global Medical REIT Inc. Webcast Located on the “Investor Relations” section of the Company’s website at www.globalmedicalreit.com or by clicking on the conference call link: https://78449.themediaframe.com/dataconf/productusers/gmre/mediaframe/28752/indexl.html Replay An audio replay of the conference call will be posted on the Company’s website. 4Q & YE 2018 | Earnings Results and Operating Information

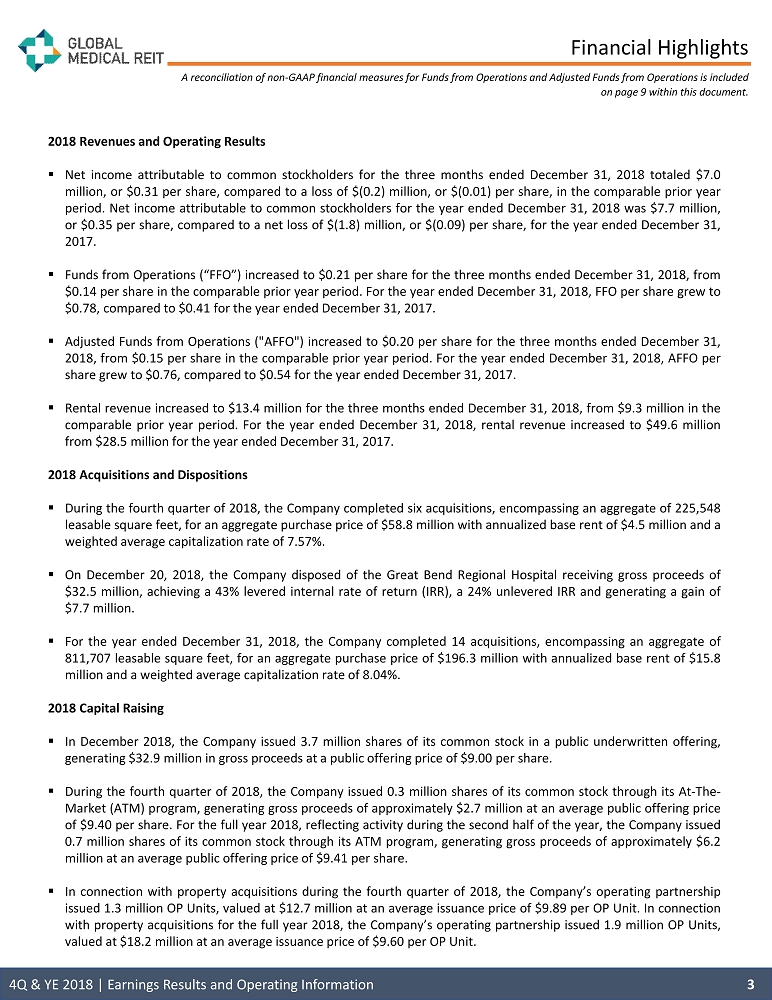

Financial Highlights A reconciliation of non - GAAP financial measures for Funds from Operations and Adjusted Funds from Operations is included on page 9 within this document. 3 4Q & YE 2018 | Earnings Results and Operating Information 2018 Revenues and Operating Results ▪ Net income attributable to common stockholders for the three months ended December 31 , 2018 totaled $ 7 . 0 million, or $ 0 . 31 per share, compared to a loss of $ ( 0 . 2 ) million, or $ ( 0 . 01 ) per share, in the comparable prior year period . Net income attributable to common stockholders for the year ended December 31 , 2018 was $ 7 . 7 million, or $ 0 . 35 per share, compared to a net loss of $ ( 1 . 8 ) million, or $ ( 0 . 09 ) per share, for the year ended December 31 , 2017 . ▪ Funds from Operations (“FFO”) increased to $ 0 . 21 per share for the three months ended December 31 , 2018 , from $ 0 . 14 per share in the comparable prior year period . For the year ended December 31 , 2018 , FFO per share grew to $ 0 . 78 , compared to $ 0 . 41 for the year ended December 31 , 2017 . ▪ Adjusted Funds from Operations ("AFFO") increased to $ 0 . 20 per share for the three months ended December 31 , 2018 , from $ 0 . 15 per share in the comparable prior year period . For the year ended December 31 , 2018 , AFFO per share grew to $ 0 . 76 , compared to $ 0 . 54 for the year ended December 31 , 2017 . ▪ Rental revenue increased to $ 13 . 4 million for the three months ended December 31 , 2018 , from $ 9 . 3 million in the comparable prior year period . For the year ended December 31 , 2018 , rental revenue increased to $ 49 . 6 million from $ 28 . 5 million for the year ended December 31 , 2017 . 2018 Acquisitions and Dispositions ▪ During the fourth quarter of 2018 , the Company completed six acquisitions, encompassing an aggregate of 225 , 548 leasable square feet, for an aggregate purchase price of $ 58 . 8 million with annualized base rent of $ 4 . 5 million and a weighted average capitalization rate of 7 . 57 % . ▪ On December 20 , 2018 , the Company disposed of the Great Bend Regional Hospital receiving gross proceeds of $ 32 . 5 million, achieving a 43 % levered internal rate of return (IRR), a 24 % unlevered IRR and generating a gain of $ 7 . 7 million . ▪ For the year ended December 31 , 2018 , the Company completed 14 acquisitions, encompassing an aggregate of 811 , 707 leasable square feet, for an aggregate purchase price of $ 196 . 3 million with annualized base rent of $ 15 . 8 million and a weighted average capitalization rate of 8 . 04 % . 2018 Capital Raising ▪ In December 2018 , the Company issued 3 . 7 million shares of its common stock in a public underwritten offering, generating $ 32 . 9 million in gross proceeds at a public offering price of $ 9 . 00 per share . ▪ During the fourth quarter of 2018 , the Company issued 0 . 3 million shares of its common stock through its At - The - Market (ATM) program, generating gross proceeds of approximately $ 2 . 7 million at an average public offering price of $ 9 . 40 per share . For the full year 2018 , reflecting activity during the second half of the year, the Company issued 0 . 7 million shares of its common stock through its ATM program, generating gross proceeds of approximately $ 6 . 2 million at an average public offering price of $ 9 . 41 per share . ▪ In connection with property acquisitions during the fourth quarter of 2018 , the Company’s operating partnership issued 1 . 3 million OP Units, valued at $ 12 . 7 million at an average issuance price of $ 9 . 89 per OP Unit . In connection with property acquisitions for the full year 2018 , the Company’s operating partnership issued 1 . 9 million OP Units, valued at $ 18 . 2 million at an average issuance price of $ 9 . 60 per OP Unit .

Financial Highlights 4 4Q & YE 2018 | Earnings Results and Operating Information Common Stock and Preferred Stock Dividends ▪ In December 2018 , the Board of Directors declared a cash dividend of $ 0 . 20 per share of common stock, bringing the total yearly dividend to $ 0 . 80 per share of common stock . Additionally, in December 2018 , the Board of Directors declared a $ 0 . 46875 per share cash dividend on its Series A Cumulative Redeemable Preferred Stock (the “Series A Preferred Stock”) . These dividends were paid in January 2019 . ▪ On March 5 , 2019 , the Board of Directors declared a $ 0 . 20 per share cash dividend to common stockholders of record as of March 26 , 2019 , which will be paid on April 10 , 2019 . This dividend represents the Company’s first quarter 2019 dividend payment to its common stockholders . ▪ Additionally, on March 5 , 2019 , the Board of Directors declared a $ 0 . 46875 per share cash dividend to holders of record as of April 15 , 2019 of its Series A Preferred Stock, to be paid on April 30 , 2019 . This dividend represents the Company’s quarterly dividend on its Series A Preferred Stock for the period from January 31 , 2019 through April 29 , 2019 . Dividend Reinvestment and Stock Purchase Plan ▪ In December 2018 , the Company implemented a dividend reinvestment and direct stock purchase plan, which offers existing and prospective common stockholders the opportunity to reinvest their common dividends in the Company’s common stock, while providing new investors an opportunity to make an initial investment in our common stock . 2019 Annual Meeting ▪ On March 5 , 2019 , the Board of Directors approved the meeting and record dates for the Company’s 2019 Annual Stockholders’ Meeting . The Meeting will be held on Wednesday, May 29 , 2019 . Shareholders of record as of April 4 , 2019 will be eligible to vote at the Meeting . CEO Commentary Jeff Busch, the Company’s Chief Executive Officer, commented, “I am pleased with our operating and financial results, which are derived from a strong balance sheet, disciplined underwriting and prudent leasing strategies . During 2018 , we grew our portfolio from $ 471 . 5 million to $ 647 . 6 million . We believe the underlying cash flows generated by our portfolio are essential to creating a sustainable dividend and long - term stockholder value . As a result of our focused strategy, we successfully issued $ 57 million of equity through a traditional common stock offering, our ATM Program and OP Unit - structured acquisitions, which created liquidity to bolster our growth strategy as well as strengthened our balance sheet . 2018 was a great year for GMRE and we believe we are well - positioned to continue to create value in 2019 . ” A reconciliation of non - GAAP financial measures for Funds from Operations and Adjusted Funds from Operations is included on page 9 within this document.

Financial Review Fourth Quarter ▪ Rental revenue for the three months ended December 31 , 2018 increased to $ 13 . 4 million, compared to $ 9 . 3 million for the comparable prior year period . This increase was primarily the result of the Company’s larger property portfolio compared to the prior year period . ▪ Total expenses for the three months ended December 31 , 2018 were $ 12 . 5 million, compared to $ 8 . 6 million for the comparable prior year period . This increase was primarily the result of the Company’s larger portfolio compared to the prior year period . ▪ General and administrative expenses increased to $ 1 . 4 million in the fourth quarter, compared to $ 1 . 1 million in the comparable prior year period . The increase results from an increase in non - cash LTIP compensation expense . LTIP compensation expense was $ 0 . 7 million for the three months ended December 31 , 2018 , compared to $ 0 . 3 million for the same period in 2017 . ▪ Interest expense for the three months ended December 31 , 2018 was $ 4 . 3 million, compared to $ 2 . 2 million for the comparable prior year period . This increase is primarily due to higher average borrowings during the quarter compared to the same quarter last year, the proceeds of which were used to finance our property acquisitions, and also reflects higher interest rates . ▪ On December 20 , 2018 , the Company disposed of the Great Bend Regional Hospital receiving gross proceeds of $ 32 . 5 million, resulting in a gain of approximately $ 7 . 7 million . Full Year ▪ Rental revenue for the year ended December 31 , 2018 increased to $ 49 . 6 million, compared to $ 28 . 5 million for the prior year . The year - over - year growth in rental revenue was largely driven by the significantly increased size of the Company’s property portfolio . ▪ Total expenses for the year ended December 31 , 2018 were $ 46 . 3 million, compared with $ 30 . 4 million in the prior year . The year - over - year growth in total expenses was largely driven by the significantly increased size of the Company’s property portfolio . ▪ General and administrative expenses were $ 5 . 5 million for the year ended December 31 , 2018 , which was unchanged from the prior year . An increase in non - cash LTIP compensation expense was offset by a decrease in public company costs and other professional fees . LTIP compensation expense was $ 2 . 7 million for the year ended December 31 , 2018 , compared to $ 1 . 8 million for the same period in 2017 . ▪ Interest expense for the year ended December 31 , 2018 was $ 15 . 0 million, compared to $ 7 . 4 million for the prior year . This increase is primarily due to higher average borrowings during the 2018 period compared to the prior year, the proceeds of which were used to finance our property acquisitions, and also reflects higher interest rates . Balance Sheet Summary ▪ Cash and cash equivalents were $ 3 . 6 million as of December 31 , 2018 , compared to $ 5 . 1 million as of December 31 , 2017 . ▪ Gross investment in real estate as of December 31 , 2018 was $ 647 . 6 million, compared to $ 471 . 5 million as of December 31 , 2017 . ▪ Total debt, which includes outstanding borrowings on the credit facility and notes payable (both net of unamortized deferred financing costs), was $ 315 . 0 million as of December 31 , 2018 , compared to $ 200 . 7 million as of December 31 , 2017 . ▪ The weighted average interest rate and term of our debt was 4 . 64 % and 4 . 24 years, respectively, at December 31 , 2018 . 4Q & YE 2018 | Earnings Results and Operating Information 5 A reconciliation of non - GAAP financial measures for Funds from Operations and Adjusted Funds from Operations is included on page 9 within this document.

Consolidated Balance Sheets In thousands, except par values 6 As of December 31, 2018 December 31, 2017 Assets Investment in real estate: Land $ 63,710 $ 42,701 Building 518,451 384,338 Site improvements 6,880 4,808 Tenant improvements 15,357 8,010 Acquired lease intangible assets 43,152 31,650 647,550 471,507 Less: accumulated depreciation and amortization (30,625) (13,594) Investment in real estate, net 616,925 457,913 Cash and cash equivalents 3,631 5,109 Restricted cash 1,212 2,005 Tenant receivables 2,905 704 Escrow deposits 1,752 1,638 Deferred assets 9,352 3,993 Other assets 322 459 Total assets $ 636,099 $ 471,821 Liabilities and Stockholders’ Equity Liabilities: Revolving credit facility, net of unamortized discount of $3,922 and $2,750 at December 31, 2018 and 2017, respectively $ 276,353 $ 162,150 Notes payable, net of unamortized discount of $799 and $930 at December 31, 2018 and 2017, respectively 38,654 38,545 Accounts payable and accrued expenses 3,664 2,020 Dividends payable 6,981 5,638 Security deposits and other 4,152 2,128 Due to related parties, net 1,030 1,036 Derivative liability 3,487 - Acquired lease intangible liability, net 2,028 1,291 Total liabilities 336,349 212,808 Stockholders' equity: Preferred stock, $0.001 par value, 10,000 shares authorized; 3,105 issued and outstanding at December 31, 2018 and 2017, respectively (liquidation preference of $77,625 at December 31, 2018 and 2017, respectively) 74,959 74,959 Common stock, $0.001 par value, 500,000 shares authorized; 25,944 shares and 21,631 shares issued and outstanding at December 31, 2018 and 2017, respectively 26 22 Additional paid - in capital 243,038 205,788 Accumulated deficit (45,007) (34,434) Accumulated other comprehensive loss (3,721) - Total Global Medical REIT Inc. stockholders' equity 269,295 246,335 Noncontrolling interest 30,455 12,678 Total stockholders’ equity 299,750 259,013 Total liabilities and stockholders' equity $ 636,099 $ 471,821 4Q & YE 2018 | Earnings Results and Operating Information

Consolidated Statements of Operations In thousands, except per share amounts 7 Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Revenue Rental revenue $ 13,385 $ 9,293 $ 49,565 $ 28,511 Expense recoveries 963 571 3,573 1,712 Other income 28 10 54 121 Total revenue 14,376 9,874 53,192 30,344 Expenses General and administrative 1,368 1,071 5,537 5,489 Operating expenses 992 626 3,720 1,860 Management fees – related party 1,142 1,064 4,422 3,123 Depreciation expense 3,680 2,557 13,644 7,929 Amortization expense 981 746 3,625 2,072 Interest expense 4,294 2,168 14,975 7,435 Acquisition fees 90 393 383 2,523 Total expenses 12,547 8,625 46,306 30,431 Income (loss) before gain on sale of investment property 1,829 1,249 6,886 (87) Gain on sale of investment property 7,675 - 7,675 - Net income (loss) $ 9,504 $ 1,249 $ 14,561 $ (87) Less: Preferred stock dividends (1,455) (1,456) (5,822) (1,714) Less: Net (income) loss attributable to noncontrolling interest (1,013) 14 (1,071) 49 Net income (loss) attributable to common stockholders $ 7,036 $ (193) $ 7,668 $ (1,752) Net income (loss) attributable to common stockholders per share – basic and diluted $ 0.31 $ (0.01) $ 0.35 $ (0.09) Weighted average shares outstanding – basic and diluted 22,815 21,631 21,971 19,617 4Q & YE 2018 | Earnings Results and Operating Information

Consolidated Statements of Cash Flows In thousands 8 Year Ended December 31, 2018 2017 Operating activities Net income (loss) $ 14,561 $ (87) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation expense 13,644 7,929 Amortization of acquired lease intangible assets 3,625 2,072 Amortization of above (below) market leases, net 688 129 Amortization of deferred financing costs and other 1,640 1,224 Stock - based compensation expense 2,671 1,796 Capitalized acquisition costs charged to expense 110 19 Advisory expense settled in OP Units - 232 Gain on sale of investment property (7,675) - Changes in operating assets and liabilities: Tenant receivables (2,201) (492) Deferred assets (5,811) (3,288) Other assets (40) (144) Accounts payable and accrued expenses 1,519 1,355 Security deposits and other 2,024 1,408 Accrued management fees due to related party 79 443 Net cash provided by operating activities 24,834 12,596 Investing activities Purchase of land, buildings, and other tangible and intangible assets and liabilities (180,837) (252,220) Net proceeds from sale of investment property 31,629 - Escrow deposits for purchase of properties 174 (352) Loans repayments (made to) from related party (85) 21 Payments for tenant improvements (2,535) - Pre - acquisition costs for purchase of properties, net 36 (102) Net cash used in investing activities (151,618) (252,653) Financing activities Net proceeds received from preferred stock offering - 74,959 Net proceeds received from common equity offerings 37,307 33,795 Escrow deposits required by third party lenders (288) (74) Loans repaid to related party - (9) Repayment of notes payable from acquisitions (22) - Repayment of note payable from related party - (421) Proceeds from revolving credit facility 186,100 244,200 Repayment of revolving credit facility borrowings (70,725) (107,000) Payments of debt issuance costs (2,811) (2,915) Redemption of LTIP Units (263) - Dividends paid to common stockholders, and OP Unit and LTIP Unit holders (18,964) (15,231) Dividends paid to preferred stockholders (5,821) (745) Net cash provided by financing activities 124,513 226,559 Net decrease in cash and cash equivalents and restricted cash (2,271) (13,498) Cash and cash equivalents and restricted cash — beginning of period 7,114 20,612 Cash and cash equivalents and restricted cash — end of period $ 4,843 $ 7,114 4Q & YE 2018 | Earnings Results and Operating Information

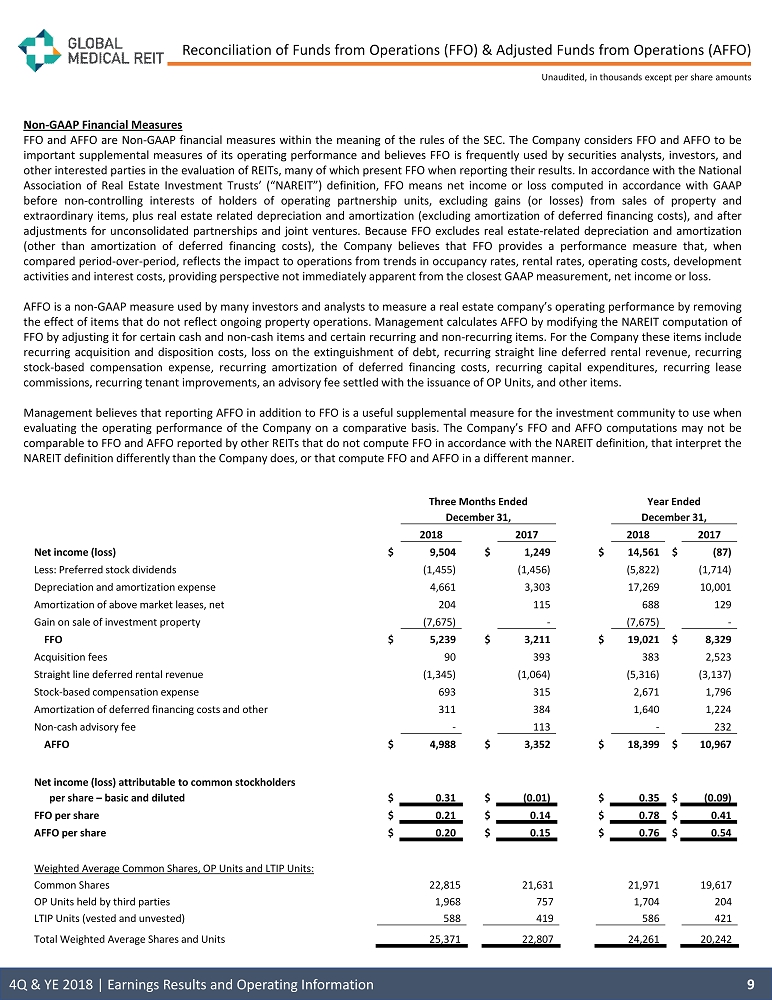

Reconciliation of Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO) Unaudited, in thousands except per share amounts Non - GAAP Financial Measures FFO and AFFO are Non - GAAP financial measures within the meaning of the rules of the SEC . The Company considers FFO and AFFO to be important supplemental measures of its operating performance and believes FFO is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results . In accordance with the National Association of Real Estate Investment Trusts’ (“NAREIT”) definition, FFO means net income or loss computed in accordance with GAAP before non - controlling interests of holders of operating partnership units, excluding gains (or losses) from sales of property and extraordinary items, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs), and after adjustments for unconsolidated partnerships and joint ventures . Because FFO excludes real estate - related depreciation and amortization (other than amortization of deferred financing costs), the Company believes that FFO provides a performance measure that, when compared period - over - period, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from the closest GAAP measurement, net income or loss . AFFO is a non - GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations . Management calculates AFFO by modifying the NAREIT computation of FFO by adjusting it for certain cash and non - cash items and certain recurring and non - recurring items . For the Company these items include recurring acquisition and disposition costs, loss on the extinguishment of debt, recurring straight line deferred rental revenue, recurring stock - based compensation expense, recurring amortization of deferred financing costs, recurring capital expenditures, recurring lease commissions, recurring tenant improvements, an advisory fee settled with the issuance of OP Units, and other items . Management believes that reporting AFFO in addition to FFO is a useful supplemental measure for the investment community to use when evaluating the operating performance of the Company on a comparative basis . The Company’s FFO and AFFO computations may not be comparable to FFO and AFFO reported by other REITs that do not compute FFO in accordance with the NAREIT definition, that interpret the NAREIT definition differently than the Company does, or that compute FFO and AFFO in a different manner . 9 Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Net income (loss) $ 9,504 $ 1,249 $ 14,561 $ (87) Less: Preferred stock dividends (1,455) (1,456) (5,822) (1,714) Depreciation and amortization expense 4,661 3,303 17,269 10,001 Amortization of above market leases, net 204 115 688 129 Gain on sale of investment property (7,675) - (7,675) - FFO $ 5,239 $ 3,211 $ 19,021 $ 8,329 Acquisition fees 90 393 383 2,523 Straight line deferred rental revenue (1,345) (1,064) (5,316) (3,137) Stock - based compensation expense 693 315 2,671 1,796 Amortization of deferred financing costs and other 311 384 1,640 1,224 Non - cash advisory fee - 113 - 232 AFFO $ 4,988 $ 3,352 $ 18,399 $ 10,967 Net income (loss) attributable to common stockholders per share – basic and diluted $ 0.31 $ (0.01) $ 0.35 $ (0.09) FFO per share $ 0.21 $ 0.14 $ 0.78 $ 0.41 AFFO per share $ 0.20 $ 0.15 $ 0.76 $ 0.54 Weighted Average Common Shares, OP Units and LTIP Units: Common Shares 22,815 21,631 21,971 19,617 OP Units held by third parties 1,968 757 1,704 204 LTIP Units (vested and unvested) 588 419 586 421 Total Weighted Average Shares and Units 25,371 22,807 24,261 20,242 4Q & YE 2018 | Earnings Results and Operating Information

(1) Represents contractual purchase price. (2) Monthly base rent as of December 31, 2018 multiplied by 12. (3) Capitalization rate is calculated based on current lease terms and does not give effect to future rent escalations. (4) Monthly base rent in the month closed or placed under contract multiplied by 12. Acquisitions At December 31 , 2018 , GMRE owned and operated 83 purpose - built healthcare buildings that are primarily leased on a triple - net basis, contain over 2 . 1 million net leasable square feet and generate approximately $ 50 . 2 million in annualized base rent, and represent an approximate weighted average cap rate of 7 . 87 % . The portfolio was 100 % occupied and leased to 48 high - quality tenants with a weighted average lease term of approximately 10 . 1 years . 10 2019 Completed Acquisitions and Properties Under Contract Summary information about our 2019 completed acquisition and property under contract from January 1 , 2019 through March 1 , 2019 is presented in the table below : 4Q & YE 2018 | Earnings Results and Operating Information We are currently in the due diligence period for the East Valley transaction. If we identify problems with the property or th e o perator of the property during our due diligence review, we may not close the transaction on a timely basis or we may terminate the purchase agreement and n ot close the transaction. Property City Leasable Square Feet Purchase Price (1) (in 000’s) Annualized Base Rent (4) (in 000’s) Capitalization Rate (3) Status AMG Specialty Hospital Zachary, LA 12,424 $4,500 $403 8.96% Completed East Valley Gastroenterology Chandler, AZ 39,165 $16,100 $1,166 7.24% Under Contract Totals/Weighted Average 51,589 $20,600 $1,569 7.62% Property City Leasable Square Feet Purchase Price (1) (in 000’s) Annualized Base Rent (2) (in 000’s) Capitalization Rate (3) Quad City Kidney Center Moline, IL 27,173 $6,706 $548 8.17% NOMS Fremont, OH 25,893 8,286 608 7.34% Gainesville Eye Gainesville, GA 34,020 10,400 776 7.46% City Hospital of White Rock Dallas, TX 236,314 23,000 2,230 9.70% Orlando Health Orlando, FL 59,644 16,200 1,355 8.36% First Quarter Total 383,044 $64,592 $5,518 8.54% Memorial Health System Belpre, OH 155,600 $64,200 $5,112 7.96% Second Quarter Total 155,600 $64,200 $5,112 7.96% Valley ENT McAllen, TX 30,811 $5,325 $439 8.25% Rock Surgery Center Derby, KS 16,704 3,392 255 7.51% Third Quarter Total 47,515 $8,717 $694 7.96% Foot and Ankle Specialists Bountiful, UT 22,335 $ 4,700 $ 380 8.08% TriHealth Cincinnati, OH 18,820 3,900 313 8.03% Cancer Center of Brevard Melbourne, FL 19,074 7,800 623 7.99% Heartland Women’s Healthcare Southern IL 64,966 14,287 1,158 8.10% Prospect ECHN Vernon, CT 58,550 10,900 774 7.10% Citrus Valley Medical Assoc. Corona, CA 41,803 17,200 1,204 7.00% Fourth Quarter Total 225,548 $58,787 $4,452 7.57% 2018 Totals/Weighted Average 811,707 $196,296 $15,776 8.04% 2018 Acquisitions For the year ended December 31 , 2018 , the Company completed 14 acquisitions, encompassing an aggregate of 811 , 707 leasable square feet for a total purchase price of $ 196 . 3 million with annualized base rent of $ 15 . 8 million at a weighted average cap rate of 8 . 04 % .

Operating Metrics (1) Monthly base rent as of December 31, 2018 multiplied by 12 Lease Expiration Schedule (% of Portfolio SF) and Annualized Base Rent (ABR) ($ in millions) Tenant Affiliation or Property Location Category By Rent (A) On Campus or Adjacent 28% (B) Health System Affiliated 50% (C) On Campus or Affiliated 59% (D) Medical Office Park 23% (E) Retail Center 30% (F) National Surgical Operator 15% (A), (B), (D), (E) or (F) 85% Tenant Description ABR Rent Coverage Ratio Hospital Tenants 36% 3.8x Physician Group Tenants 34% 6.5x Tenants with Credit Rating 23% N/A Other Tenants 7% N/A See page 16 for additional information 11 $0 $0.5 $0 $3.9 $0.6 $3.6 $4.4 $0.1 $5.4 $6.8 $1.5 $4.9 $18.5 ABR 4Q & YE 2018 | Earnings Results and Operating Information 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030+ % of Portfolio % of Portfolio SF Expiring by Year Encompass 11% Memorial Health 10% OCOM 7% Kindred Health 6% Carrus Hospital 5% Pipeline Health 4% Select Medical 4% Prospect Health 4% Orlando Health 3% NOMS 3% All Others 43% % of Annualized Base Rent by Tenant (1) TX 23% OH 14% PA 12% FL 8% OK 7% IL 5% TN 5% AZ 4% NE 4% CA 2% All Others 16% % of Annualized Base Rent by State (1)

Top 10 Tenant Profiles Encompass Health (Ba 3 ) (NYSE : EHC), headquartered in Birmingham, AL is a national leader in post - acute care, offering both facility - based and homebased patient care through its network of inpatient rehabilitation hospitals, home health agencies and hospice agencies . With a national footprint that spans 130 hospitals and 278 home health & hospice locations in 36 states and Puerto Rico, Encompass Health is committed to delivering high - quality, cost - effective care across the post - acute continuum . Encompass Health is the result of the union between HealthSouth Corporation and Encompass Home Health & Hospice, and is ranked as one of Fortune's 100 Best Companies to Work For, as well as Modern Healthcare's Best Places to Work . Marietta Memorial Health System (MMH), (BB - ) is headquartered in Marietta, OH, and is the largest health system in the Parkersburg - Marietta - Vienna MSA . The largest employer in Washington County, MMH comprises (i) two hospitals, Marietta Memorial Hospital ( 154 - bed) and Selby General Hospital ( 25 - bed) critical access hospital ; (ii) the Belpre Campus ; (iii) ten clinic outpatient service sites ; and (iv) five imaging locations, and has over 2 , 500 employees and 211 accredited physicians . Oklahoma Center for Orthopedic & Multi - Specialty Surgery, LLC (OCOM) is based Oklahoma City, OK and affiliated with USPI and INTEGRIS, and is a leading hospital for orthopedic specialists . OCOM operates a surgical hospital with nine operating rooms and a physical therapy department, an ancillary surgery center, and multiple imaging centers in throughout Oklahoma City . Kindred Healthcare, LLC (B 2 ) is a healthcare services company based in Louisville, KY with annual revenues of approximately $ 3 . 4 billion . At March 31 , 2018 , Kindred through its subsidiaries had approximately 38 , 300 employees providing healthcare services in 1 , 831 locations in 45 states, including 75 LTAC hospitals, 19 inpatient rehabilitation hospitals ( 22 as of July 12 , 2018 ), 13 sub - acute units, 98 inpatient rehabilitation units (hospital - based) and contract rehabilitation service businesses which served 1 , 626 non - affiliated sites of service . Ranked as one of Fortune magazine’s Most Admired Healthcare Companies for nine years . Carrus Hospital is located in Sherman, TX and provides acute rehabilitative care and long term acute care . Accredited with The Joint Commission’s Gold Seal of Approval, Carrus Hospital serves Sherman, Durant, Denison, Gainesville, Denton, McKinney, Plano, Bonham, Lewisville, Carrollton, Fort Worth, Dallas, Oklahoma City and beyond . Pipeline Health is based in Manhattan Beach, CA and has a portfolio of affiliated health care companies that have evolved over the past couple of decades from the challenging California market . Pipeline includes : Emergent Medical Associates, a leading provider of ER serving 20 + hospital sites and 900 , 000 patients annually ; Integrated Anesthesia Medical Group, with 100 providers performing 15 , 000 procedures annually ; Avanti Hospitals, a Los Angeles health system with four hospitals, 400 + beds and 55 , 000 ER visits annually ; Cloudbreak , a telemedicine company with 75 , 000 monthly encounters in 700 hospitals ; Pacific Healthworks, a physician practice management company ; and Benchmark Hospitalists . Select Medical (B 1 ) is headquartered in Mechanicsburg, PA and one of the largest operators of critical illness recovery hospitals (previously referred to as long term acute care hospitals), rehabilitation hospitals (previously referred to as inpatient rehabilitation facilities), outpatient rehabilitation clinics, and occupational health centers in the U . S . based on the number of facilities . As of December 31 , 2018 , Select Medical operated 96 critical illness recovery hospitals in 27 states, 26 rehabilitation hospitals in 11 states, and 1 , 662 outpatient rehabilitation clinics in 41 states . Select Medical’s joint venture subsidiary Concentra operated 524 occupational health centers in 41 states . Prospect Medical Holdings (B 2 ) was Established in 1996 , and has grown into a significant provider of coordinated regional healthcare services in Southern California, Connecticut, New Jersey, Pennsylvania, Rhode Island and South Central Texas . In addition to their medical groups, they also own 20 acute and behavioral hospitals that are located in diverse areas within Southern California, Connecticut, New Jersey, Pennsylvania, Rhode Island and South Central Texas and maintain competitive market positions in the areas they serve . All of their facilities aim to provide a comprehensive range of services tailored to their specific communities, including partnerships with other area hospitals, physicians and health plans . Orlando Health (A 2 ) is based in Central Florida, Orlando and is a $ 3 . 8 billion not - for - profit healthcare organization and a community - based network of hospitals, physician practices and outpatient care centers across Central Florida . The organization is home to the area’s only Level One Trauma Centers for adults and pediatrics and is a statutory teaching hospital system that offers both specialty and community hospitals . More than 3 , 000 physicians have privileges across the system, which is also one of the area’s largest employers with more than 23 , 000 employees who serve nearly 155 , 000 inpatients, more than 3 million outpatients, and more than 10 , 000 international patients each year . Additionally, Orlando Health provides more than $ 345 million in support of community health needs . Northern Ohio Medical Specialists (NOMS) Healthcare is a multi - specialty physician group with over 220 providers, 31 specialties, 43 cities and growing . NOMS Healthcare is committed to superior patient satisfaction . NOMS is committed to taking an active role in the betterment of its community, particularly related to healthcare matters affecting its fellow citizens . NOMS develops and supports health care practices recognized for exceeding patient expectations, thereby setting the standard for excellence in Northern Ohio . 12 4Q & YE 2018 | Earnings Results and Operating Information

Real Estate Portfolio As of December 31, 2018, see page 16 for footnotes 13 Property Location # of Bldgs Facility Type Net Leasable Square Feet Lease Years Remaining Annualized Rent (1) ($ in 000’s) Annualized Rent Per Square Foot (1) Tenant/ Guarantor (2) Citrus Valley Medical Associates Corona, CA 1 MOB 41,803 12 $1,204 $28.80 Citrus Valley Medical Associates Prospect Medical Vernon, CT 2 MOB/Dialysis/ Administrative 58,550 12.7 $774 $13.22 Prospect ECHN / Prospect Medical Holdings, Inc. Heartland Women's Healthcare Southern IL 6 MOB 64,966 9.1 $1,158 $17.82 Heartland Women's Healthcare / USA OBGYN Management Cancer Center of Brevard Melbourne, FL 1 Cancer Center 19,074 4.5 $623 $32.67 Brevard Radiation Oncology / Vantage Oncology TriHealth Cincinnati, OH 1 MOB 18,820 7 $313 $16.64 TriHealth Foot and Ankle Specialists Bountiful, UT 1 MOB 22,335 14.8 $380 $17.00 Foot and Ankle Specialists of Utah / physician guaranty Rock Surgery Center Derby, KS 1 ASC 16,704 8.4 $255 $15.25 Rock Surgery Center/Rock Medical Assets Valley ENT McAllen, TX 1 MOB 30,811 10.7 $439 $14.25 Valley ENT Memorial Health System Belpre, OH 4 MOB/Img/ER/ASC 155,600 12.2 $5,112 $32.85 Marietta Memorial Orlando Health Orlando, FL 5 MOB 59,644 3.9 $1,355 $22.71 Orlando Health City Hospital at White Rock Dallas, TX 1 Acute Hospital 236,314 19.2 $2,230 $9.44 Pipeline East Dallas Gainesville Eye Gainesville, GA 1 MOB/ASC 34,020 11.2 $776 $22.82 SCP Eyecare Services Northern Ohio Medical Specialists Fremont, OH 1 MOB 25,893 11.1 $608 $23.50 Northern Ohio Medical Specialists Fresenius Kidney Care Moline, IL 2 MOB 27,173 12.7 $548 $20.17 Quad City Nephrology/Fresenius Medical Care Holdings Zion Eye Institute St. George, UT 1 MOB/ASC 16,000 11 $400 $25.00 Zion Eye Institute Respiratory Specialists Wyomissing, PA 1 MOB 17,598 9 $405 $23.00 Berks Respiratory Amarillo Bone & Joint Clinic Amarillo, TX 1 MOB 23,298 11 $594 $25.50 Amarillo Bone & Joint Clinic Kansas City Cardiology Lee’s Summit, MO 1 MOB 12,180 6 $275 $22.58 Kansas City Cardiology Texas Digestive Fort Worth, TX 1 MOB 18,084 9.5 $442 $24.45 Texas Digestive Disease Consultants Albertville Medical Building Albertville, MN 1 MOB 21,486 10 $489 $22.78 Stellis Health Heartland Clinic Moline, IL 1 MOB/ASC 34,020 14.5 $910 $26.76 Heartland Clinic Central Texas Rehabilitation Clinic Austin, TX 1 IRF 59,258 8.3 $2,971 $50.14 CTRH, LLC / Kindred Health Conrad Pearson Clinic Germantown, TN 1 MOB/ASC 33,777 5.4 $1,488 $44.06 Urology Center of the South/Physician guarantees Cardiologists of Lubbock Lubbock, TX 1 MOB 27,280 10.7 $612 $22.44 Lubbock Heart Hospital/Surgery Partners, Inc. Carrus Specialty Hospital Sherman, TX 1 IRF/LTACH 69,352 (3) 18.5 $2,581 $37.21 SDB Partners, LLC Lonestar Endoscopy Flower Mound, TX 1 ASC 10,062 7.8 $300 $29.82 Lonestar Endoscopy Center, LLC Unity Family Medicine Brockport, NY 1 MOB 29,497 11.9 $621 $21.04 Unity Hospital of Rochester 4Q & YE 2018 | Earnings Results and Operating Information

Real Estate Portfolio 14 Property Location # of Bldgs Facility Type Net Leasable Square Feet Lease Years Remaining Annualized Rent (1) ($ in 000’s) Annualized Rent Per Square Foot (1) Tenant/ Guarantor (2) Oklahoma Center for Orthopedic & Multi - Specialty Surgery Oklahoma City, OK 3 Surgical Hospital/ Physical Therapy/ASC 97,406 14.4 $3,595 $36.91 OCOM/INTEGRIS; USPI; physician guaranty Southlake Heart & Vascular Institute Clermont, FL 1 MOB 18,152 3.9 $380 $20.93 Orlando Health, Southlake Hospital, Vascular Specialists of Central Florida Thumb Butte Medical Center Prescott, AZ 1 MOB 12,000 8.2 $382 $31.83 Thumb Butte Medical Center/Physician Guaranty Las Cruces Orthopedic Las Cruces, NM 1 MOB 15,761 10.1 $362 $22.95 Las Cruces Orthopedic Associates Geisinger Specialty Care Lewisburg, PA 1 MOB/ Img 28,480 4.3 $548 $19.24 Geisinger Health Southwest Florida Neurological & Rehab Cape Coral, FL 1 MOB 25,814 8.1 $540 $20.91 Southwest Florida Neurosurgical Associates Encompass Mechanicsburg Mechanicsburg, PA 1 IRF 78,836 2.4 $1,923 $24.40 Encompass Encompass Altoona Altoona, PA 1 IRF 70,007 2.4 $1,713 $24.47 Encompass Encompass Mesa Mesa, AZ 1 IRF 51,903 5.8 $1,815 $34.97 Encompass Piedmont Healthcare Ellijay, GA 3 MOB 44,162 7.5 $375 $8.49 Piedmont Mountainside Hospital, Inc. Carson Medical Group Clinic Carson City, NV 2 MOB 20,632 4.8 $365 $17.69 Carson Medical Group Northern Ohio Medical Specialists Sandusky, OH 8 MOB 55,760 8.8 $885 $15.87 Northern Ohio Medical Specialists Brown Clinic Watertown, SD 3 MOB/Img 48,132 12.8 $736 $15.29 Brown Clinic East Orange General Hospital East Orange, NJ 1 MOB 60,442 7.8 $981 $16.23 Prospect Medical Holdings, Inc. Berks Physicians & Surgeons Wyomissing, PA 1 MOB 17,000 7.6 $463 $27.23 Berks Eye Physicians & Surgeons Berks Eye Surgery Center Wyomissing, PA 1 ASC 6,500 7.6 $248 $38.12 Berkshire Eye Marina Towers Melbourne, FL 1 MOB/ Img 75,899 7.2 $1,127 $14.85 Marina Towers, LLC/First Choice Healthcare Solutions, Inc. Surgical Institute of Michigan Detroit, MI 1 MOB/ASC 15,018 7.2 $399 $26.58 Surgical Institute of Michigan/Surgical Management Professionals Star Medical Center Plano, TX 1 Surgical Hospital 24,000 17.1 $1,310 $54.58 Star Medical Center/ Lumin Health Gastro One Memphis, TN 6 MOB/ASC 52,266 9 $1,323 $25.31 Gastroenterology Center of the MidSouth Associates in Ophthalmology West Mifflin, PA 1 MOB/ASC 27,193 11.7 $799 $29.39 Associates Surgery Centers, LLC, Associates in Ophthalmology, Ltd. Orthopedic Surgery Center of Asheville Asheville, NC 1 ASC 8,840 3.2 $245 $27.69 Orthopedic Surgery Center of Ashville/Surgery Partners Select Medical Hospital Omaha, NE 1 LTACH 41,113 4.6 $1,815 $44.16 Select Specialty Hospital – Omaha, Inc./Select Medical Corporation Total Portfolio/Average 83 2,078,915 10.1 $50,192 $24.14 4Q & YE 2018 | Earnings Results and Operating Information As of December 31, 2018, see page 16 for footnotes

About GMRE Executive Team Jeffrey Busch Chief Executive Officer, Chairman and President Alfonzo Leon Chief Investment Officer Danica Holley Chief Operating Officer Bob Kiernan Chief Financial Officer Jamie Barber General Counsel and Corporate Secretary Allen Webb Senior VP, SEC Reporting and Technical Accounting Board of Directors Jeffrey Busch Chief Executive Officer, Chairman and President Henry Cole Lead Independent Director Paula Crowley Director Matthew Cypher Investment Committee Chair Zhang Huiqi Director Zhang Jingguo Director Ronald Marston Nominating and Corporate Governance Committee Chair Dr. Roscoe Moore Compensation Committee Chair Lori Wittman Audit Committee Chair Sell - Side Coverage Firm Name Email Phone Baird Drew T. Babin [email protected] 610.238.6634 B. Riley FBR Bryan Maher [email protected] 646.885.5423 Boenning & Scattergood Merill Ross [email protected] 610.862.5328 D.A. Davidson Barry Oxford Jr., CFA [email protected] 212.240.9871 Janney Robert Stevenson [email protected] 646.448.3028 The equity analysts listed above have published research material on the Company and are listed as covering the Company . Any opinions, estimates, or forecasts regarding the Company’s performance made by these analysts do not represent the opinions, estimates, or forecasts of the Company or its management and do not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations made by any of such analysts . Interested persons may obtain copies of analysts' reports on their own – we do not distribute these reports . Several of these firms may, from time to time, own our stock and/or hold other long or short positions on our stock, and may provide compensated services to us . 15 Corporate Headquarters Investor Contact Global Medical REIT Inc. 2 Bethesda Metro Center, Suite 440 Bethesda, MD 20814 202.524.6851 www.globalmedicalreit.com Mary Jensen 202.524.6869 [email protected] 4Q & YE 2018 | Earnings Results and Operating Information Global Medical REIT Inc . (the “Company”) is net - lease medical office real estate investment trust (REIT) that acquires purpose - built specialized healthcare facilities and leases those facilities to strong healthcare systems and physician groups with leading market share . The Company’s real estate portfolio is comprised of 84 healthcare assets, which are primarily leased on a triple - net basis and contains 2 . 1 million net leasable square feet . These assets are concentrated in secondary and tertiary markets across the United States . The Company’s management team has significant healthcare, real estate and REIT experience and has long - established relationships with a wide range of healthcare providers .

Disclosures 2018 Acquisitions and Dispositions Internal Rate of Return (IRR) Calculation (see page 3 ) Our unlevered IRR on our Great Bend Regional Hospital investment is the compound annual rate of return calculated based on the timing and amount of : (i) the gross purchase price of the property plus any direct acquisition costs ; (ii) total revenues earned during the Company’s ownership period and (iii) the gross sales price of the property net of selling costs . Each of the items (i) through (iii) is calculated in accordance with GAAP . Our levered IRR on our Great Bend Regional Hospital investment is the compound annual rate of return calculated based on the timing and amount of : (i) the gross purchase price of the property plus any direct acquisition and financing costs ; (ii) total revenues earned during the Company’s ownership period less interest expense (assuming an annual interest rate of 4 . 00 % and a debt - to - assets ratio of 50 % ) and (iii) the gross sales price of the property net of loan repayment and selling costs . Each of the items (i) through (iii) is calculated in accordance with GAAP . The calculation of IRR does not include an adjustment for the Company’s general and administrative expenses or other corporate overhead amounts . Additionally, no adjustments were made with respect to property operating expenses or capital expenditures as the property was leased on a triple - net basis and no capital expenditures were incurred on the property . The IRRs achieved on the property as cited in this release should not be viewed as an indication of the gross value created with respect to other properties owned by the Company, and the Company does not represent that it will achieve similar IRRs upon the disposition of other properties . Rent Coverage (see page 11 ) For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded medical office buildings and other non - hospital tenants that are themselves credit rated or are subsidiaries of credit - rated health systems . Based on available information only . Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information is accurate or complete . Certain tenants are excluded from the calculation due to lack of available financial information (approximately 3 % of our portfolio) or, with respect to our City Hospital at White Rock acquisition, a lack of relevant operating history with a new tenant operator . Additionally, certain components of our Rent Coverage Ratio include management assumptions to adjust for differences in tenant businesses, accounting and reporting practices, including, but not limited to, adjustments ( i ) for non - cash charges, (ii) for physician distributions and compensation, (iii) for differences in fiscal year, (iv) for changes in financial statement presentation and (v) for straight - line rent . Management believes that all adjustments are reasonable and necessary . Real Estate Portfolio (see pages 13 and 14 ) Data as of December 31, 2018. (1) Monthly base rent at December 31, 2018 multiplied by 12 . Accordingly, this methodology produces an annualized amount as of a point in time but does not take into account future contractual rental rate increases. (2) Certain lease guarantees are for less than 100% of the contractual rental payments. (3) Carrus Specialty Hospital does not include 12,000 square feet of shell space. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC . You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13 (a) or 15 (d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www . globalmedicalreit . com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC . The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into, this Earnings Results and Operating Information Package . You also can review these SEC filings and other information by accessing the SEC’s website at http : //www . sec . gov . Certain information contained in this release, including, but not limited to, information contained in our Top 10 tenant profiles is derived from publicly - available third - party sources . The Company has not independently verified this information and there can be no assurance that such information is accurate or complete . 4Q and YE 2018 | Earnings Results and Operating Information | Reporting Definitions and Disclosures 16 As of December 31, 2018

www.globalmedicalreit.com NYSE: GMRE 2 Bethesda Metro Center, Suite 440 Bethesda, MD 20814 (202) 524 - 6851

Exhibit 99.2

GLOBAL MEDICAL REIT INC.

2016 EQUITY INCENTIVE PLAN

LTIP UNIT AWARD AGREEMENT

Annual Award (Performance-Based with Time-Vesting)

| Name of Grantee: | ________________ |

| Number of LTIP Units: | ________________ |

| Grant Date (Closing Date): | March 5, 2019 |

| Final Acceptance Date: | ___________, ____ |

Pursuant to the Global Medical REIT Inc. 2016 Equity Incentive Plan, as amended from time to time (the “Plan”), and the Agreement of Limited Partnership, dated as of March 14, 2016 (as amended from time to time, the “Partnership Agreement”), of Global Medical REIT L.P., a Delaware limited partnership (“GMR OP”), Global Medical REIT Inc., a Maryland real estate investment trust (the “Company”) and the sole member of Global Medical REIT GP LLC, a Delaware limited liability company, the general partner of GMR OP (the “General Partner”), and for the provision of services to or for the benefit of GMR OP in a partner capacity or in anticipation of being a partner, hereby grants, and agrees to cause GMR OP to issue, to the Grantee named above a number of LTIP Units (which constitute Other Equity Based Awards under the Plan) to be determined following the conclusion of the Performance Period (defined herein) based on (i) the number of Award LTIP Units shown above (the “Award LTIP Units”) and (ii) the extent to which the Performance Goals (as defined herein) are achieved during the Performance Period as provided in further detail herein (such number of LTIP Units that are earned and issued to the Grantee, the “Earned LTIP Units”) having the rights, voting powers, restrictions, limitations as to distributions, qualifications and terms and conditions of redemption and conversion set forth herein and in the Partnership Agreement (the “Award”). Upon acceptance of this LTIP Unit Award Agreement (this “Agreement”), the Grantee shall become entitled to receive the Earned LTIP Units to the extent earned in accordance with, and subject to, the terms and conditions contained herein, in the Plan and in the Partnership Agreement, the terms of which are hereby incorporated by reference. Capitalized terms used but not defined herein have the meanings assigned to such terms in the Partnership Agreement, attached hereto as Annex A, or the Plan, as applicable, unless a different meaning is specified herein. In addition, as used herein:

“Board Meeting Date” means the date in 2020 on which the Board (defined below) approves the recommendation of the Committee (defined below) with respect to the number of Earned LTIP Units to issue based on the level of achievement of the Performance Goals.

“Cause” means any of the following events:

(a) the Grantee’s conviction for (or pleading guilty or nolo contendere to) any felony, or a misdemeanor involving moral turpitude;

(b) the Grantee’s indictment for any felony or misdemeanor involving moral turpitude, if such indictment is not discharged or otherwise resolved within eighteen (18) months;

(c) the Grantee’s commission of an act of fraud, theft, dishonesty or breach of fiduciary duty related to the Company or any of its affiliates;

(d) the continuing failure or habitual neglect by the Grantee to perform the Grantee’s duties as an officer of the Company or as an employee of the Manager with respect to the Company, except that, if such failure or neglect is curable, the Grantee shall have thirty (30) days from his receipt of a notice of such failure or neglect to cure such condition and, if the Grantee does so to the reasonable satisfaction of the Company (such cure opportunity being available only once), then such failure or neglect shall not constitute Cause hereunder; or

(e) any material breach by the Grantee of this Agreement, any other agreement between the Company and the Grantee, or any written policy or written code of conduct established by the Company or any of its affiliates and applicable to the Grantee.

“Continuous Service” means the Grantee’s continuous service to the Company and its Affiliates, without interruption or termination, in any capacity. Continuous Service shall not be considered interrupted in the case of: (a) any approved leave of absence; (b) transfers among the Company and its Affiliates, or any successor; or (c) any change in status as long as the individual remains in the service of the Company and its Affiliates. An approved leave of absence shall include sick leave, military leave, or any other authorized personal leave.

“Disability” means the long-term disability of the Grantee such that the Grantee becomes eligible for disability benefits under the Company’s long-term disability plans and arrangements; provided, that it is reasonably certain, based on the opinion of a qualified physician reasonably acceptable to both parties, that the Grantee will not be able to resume his duties on a regular full-time basis within one hundred eighty (180) days of the date that the notice of termination as a result of the Grantee’s Disability is delivered.

“Good Reason” means: (i) a material diminution in the Grantee’s base salary; (ii) a material diminution or adverse change in the Grantee’s title, duties or authority; (iii) a material breach by the Company or GMR OP of any of its covenants or obligations under this Agreement; or (iv) the relocation of the geographic location of the Grantee’s principal place of employment by more than 50 miles from the location of the Grantee’s principal place of employment as of the Grant Date; provided that, in the case of the Grantee’s allegation of Good Reason, (A) the condition described in the foregoing clauses must have arisen without the Grantee’s consent; (B) the Grantee must provide written notice to GMR OP of such condition in accordance with the Agreement within 45 days of the initial existence of the condition; (C) the condition specified in such notice must remain uncorrected for 30 days after receipt of such notice by GMR OP; and (D) the Grantee’s date of termination must occur within 60 days after such notice is received by GMR OP.

“Partial Service Factor” means a factor carried out to the sixth decimal to be used in calculating the number of LTIP Units earned pursuant to Section 3(a) hereof in the event of a Qualified Termination of the Grantee’s Continuous Service prior to the Valuation Date, determined by dividing (a) the number of calendar days that have elapsed since January 1, 2019 to and including the date of the Grantee’s Qualified Termination by (b) the number of calendar days from January 1, 2019 to and including the Valuation Date.

“Performance Period” means the period beginning on January 1, 2019 and ending on February 28, 2020.

“Valuation Date” means the earlier of (a) the Board Meeting Date or (b) the date upon which a Change of Control shall occur.

1. Acceptance of Agreement. The Grantee shall have no rights under this Agreement unless he or she shall have accepted this Agreement prior to the close of business on the Final Acceptance Date specified above by signing and delivering to GMR OP a copy of this Agreement. Furthermore, unless the Grantee is already a Limited Partner of GMR OP as of the Final Acceptance Date shown above, the Grantee shall not be entitled to receive the Earned LTIP Units unless the Grantee signs, as a Limited Partner, and delivers to GMR OP on or prior to the Final Acceptance Date a counterpart signature page to the Partnership Agreement attached hereto as Annex B. Thereupon, the Grantee shall have all the rights of a Limited Partner with respect to the number of Award LTIP Units specified above, as set forth in the Partnership Agreement, subject, however, to the restrictions and conditions specified herein. Upon receipt of the Earned LTIP Units to which the Grantee becomes entitled hereunder, the Partnership Agreement shall be amended to reflect the issuance to the Grantee of such Earned LTIP Units, effective as of the Valuation Date, and the Grantee shall have all of the rights of a Limited Partner with respect to the number of Earned LTIP Units issued to the Grantee, as set forth in the Partnership Agreement, subject, however, to the restrictions and conditions specified herein.

2. Restrictions and Conditions.

(a) The records of GMR OP evidencing the Award LTIP Units granted hereby and the Earned LTIP Units issued pursuant hereto shall bear an appropriate legend, as determined by GMR OP in its sole discretion, to the effect that such LTIP Units are subject to restrictions as set forth herein and in the Partnership Agreement.

(b) Award LTIP Units may not be sold, transferred, pledged, exchanged, hypothecated or otherwise disposed of by the Grantee in any respect. Earned LTIP Units may not be sold, transferred, pledged, exchanged, hypothecated or otherwise disposed of by the Grantee prior to vesting as contemplated in Section 3 and Section 4 of this Agreement, and then only to the extent permitted under the Partnership Agreement.