Form 10-K COMPASS MINERALS INTERNA For: Dec 31

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 001-31921

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 36-3972986 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

9900 West 109th Street, Suite 100 | 66210 | |

Overland Park, Kansas | (Zip Code) | |

(Address of principal executive offices) | ||

Registrant’s telephone number, including area code:

(913) 344-9200

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common stock, par value $0.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes þ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ☐ | Emerging growth company ☐ | |||

Non-accelerated filer ☐ | Smaller reporting company ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of June 30, 2018, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,225,660,644, based on the closing sale price of $65.75 per share, as reported on the New York Stock Exchange.

The number of shares outstanding of the registrant’s $0.01 par value common stock at February 25, 2019 was 33,873,836 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Document | Parts into which Incorporated | |

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 9, 2019 | Part III, Items 10, 11, 12, 13 and 14 | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

TABLE OF CONTENTS

PART I | Page No. | |

PART II | ||

PART III | ||

PART IV | ||

Item 16. | ||

1 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this annual report on Form 10-K (this “report”), including without limitation our or management’s beliefs, expectations or opinions; statements regarding future events or future financial performance; our plans, objectives and strategies; our outlook, including expected sales volumes and EBITDA; existing or potential capital expenditures and investments, including at our Goderich mine and our Utah facility; the industry and our competition; projected sources of cash flow; potential legal liability; proposed legislation and regulatory action; the seasonal distribution of working capital requirements; our reinvestment of foreign earnings outside the U.S.; repatriation of foreign earnings to the U.S.; our ability to optimize cash accessibility and minimize tax expense; the impact of the U.S. Tax Cuts and Jobs Act; our debt service requirements; our liquidity needs; outcomes of matters with taxing authorities; and the seasonality of our business, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. We use words such as “may,” “would,” “could,” “should,” “will,” “likely,” “expect,” “anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,” “project,” “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements or forward-looking information. These statements are based on our current expectations and involve risks and uncertainties that could cause our actual results to differ materially. In evaluating these statements, you should carefully consider various risks, uncertainties and factors including, but not limited to, those listed under “Risk Factors” and elsewhere in this report. Forward-looking statements are only predictions and are subject to certain risks and uncertainties that may cause our actual results to differ materially from the forward-looking statements expressed or implied in this report as a result of factors, risks, and uncertainties, over many of which we do not have control.

Although we believe that the expectations reflected in the forward-looking statements are reasonable as of the date of this report, we cannot guarantee future results, levels of activity, performance or achievements. We do not undertake, and hereby disclaim any obligation or duty, unless otherwise required to do so by applicable securities laws, to update any forward-looking statement after the date of this report regardless of any new information, future events or other factors. The inclusion of any statement in this report does not constitute our admission that the events or circumstances described in such statement are material to us.

Factors that could cause actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to, the following:

• | risks related to our mining and industrial operations; |

• | geological conditions; |

• | dependency on a limited number of key production and distribution facilities and critical equipment; |

• | weather conditions; |

• | strikes, other forms of work stoppage or slowdown or other union activities; |

• | the inability to fund necessary capital expenditures or successfully complete capital projects; |

• | supply constraints or price increases for energy and raw materials used in our production processes; |

• | our indebtedness and ability to pay our indebtedness; |

• | restrictions in our debt agreements that may limit our ability to operate our business or require accelerated debt payments; |

• | tax liabilities; |

• | financial assurance requirements; |

• | the inability of our customers to access credit or a default by our customers of trade credit extended by us or financing we have guaranteed; |

• | our payment of any dividends; |

• | the impact of competition on the sales of our products; |

2 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

• | risks associated with our international operations and sales; |

• | the impact of anticipated changes in plant nutrition product prices and customer application rates; |

• | conditions in the agricultural sector and supply and demand imbalances for competing plant nutrition products; |

• | increasing costs or a lack of availability of transportation services; |

• | the seasonal demand for our products; |

• | our rights and governmental authorizations to mine and operate our properties; |

• | compliance with foreign and U.S. laws and regulations applicable to our international operations; |

• | compliance with environmental, health and safety laws and regulations; |

• | environmental liabilities; |

• | misappropriation or infringement claims relating to intellectual property; |

• | product liability claims and product recalls; |

• | inability to obtain required product registrations or increased regulatory requirements; |

• | changes in industry standards and regulatory requirements; |

• | our ability to successfully implement our strategies; |

• | the loss of key personnel; |

• | if our computer systems, information technology or operations technology are compromised or the inability to protect confidential or proprietary data; |

• | our ability to expand our business through acquisitions, integrate acquired businesses and realize anticipated benefits from acquisitions; |

• | climate change; |

• | domestic and international general business and economic conditions; and |

• | other risk factors included in this report or reported from time to time in our filings with the Securities and Exchange Commission (the “SEC”). See “Where You Can Find More Information.” |

MARKET AND INDUSTRY DATA AND FORECASTS

This report includes market share and industry data and forecasts that we obtained from publicly available information and industry publications, surveys, market research, internal company surveys and consultant surveys. Industry publications and surveys, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy and completeness of such information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal company surveys, industry forecasts and market research, which we believe to be reliable based upon management’s knowledge of the industry, have not been verified by any independent sources. Except where otherwise noted, references to North America include only the continental United States (“U.S.”) and Canada, references to the United Kingdom (“U.K.”) include only England, Scotland and Wales, and statements as to our position relative to our competitors or as to market share refer to the most recent available data. Statements concerning (a) North American consumer and industrial salt and highway deicing salt markets are generally based on historical sales volumes, (b) U.K. highway deicing salt sales are generally based on historical production capacity, and (c) sulfate of potash are generally based on historical sales volumes. Except where otherwise noted, all references to tons refer to “short tons” and all amounts are in U.S. dollars. One short ton equals 2,000 pounds.

3 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the SEC and our SEC filings are available at the SEC’s website at www.sec.gov. Copies of these documents are also available on our website, www.compassminerals.com. The information on these websites is not part of this report and is not incorporated by reference into this report. Further, our references to website URLs are intended to be inactive textual references only.

You may also request a copy of any of our filings, at no cost, by writing or telephoning:

Investor Relations

Compass Minerals International, Inc.

9900 West 109th Street, Suite 100

Overland Park, Kansas 66210

For general inquiries concerning us, please call (913) 344-9200.

Unless the context requires otherwise, references in this annual report to the “Company,” “Compass Minerals,” “CMP,” “we,” “us” and “our” refer to Compass Minerals International, Inc. (“CMI,” the parent holding company) and its consolidated subsidiaries collectively.

ITEM 1. | BUSINESS |

COMPANY OVERVIEW

Compass Minerals is a leading provider of essential minerals that solve nature’s challenges, including salt for winter roadway safety and other consumer, industrial and agricultural uses; specialty plant nutrition products that improve the quality and yield of crops; and specialty chemicals for water treatment and other industrial processes. As of December 31, 2018, we operated 22 production and packaging facilities, including:

• | The largest rock salt mine in the world in Goderich, Ontario, Canada; |

• | The largest dedicated rock salt mine in the U.K. in Winsford, Cheshire; |

• | A solar evaporation facility located near Ogden, Utah, which is both the largest sulfate of potash specialty fertilizer (“SOP”) production site and the largest solar salt production site in the Western Hemisphere; |

• | Several mechanical evaporation facilities producing consumer and industrial salt; and |

• | Multiple facilities producing essential agricultural nutrients and specialty chemicals in Brazil. |

Our salt business provides highway deicing salt to customers in North America and the U.K. as well as consumer deicing and water conditioning products, ingredients used in consumer and commercial food preparation and other salt-based products for consumer, agricultural and industrial applications in North America. In the U.K., we operate a records management business utilizing excavated areas of our Winsford salt mine with one other location in London, England.

Our plant nutrition business produces and markets specialty plant nutrition products worldwide to distributors and retailers of crop inputs, as well as growers. Our principal plant nutrition product in our Plant Nutrition North America segment is SOP, which we market under the trade name Protassium+. We also sell various premium specialty plant nutrient products under our Wolf Trax and ProAcqua brands.

In October 2016, we significantly expanded our plant nutrition business with the acquisition of Produquímica Indústria e Comércio S.A. (“Produquímica,” which is now known as Compass Minerals América do Sul Indústria e Comércio S.A.), which constitutes our Plant Nutrition South America segment. The Plant Nutrition South America segment operates two primary businesses in Brazil—agricultural productivity, which manufactures and distributes a broad offering of specialty plant nutrition solution-based products, and chemical solutions, which manufactures and markets specialty chemicals, primarily for the water treatment industry and for use in other industrial processes.

We sell our salt and plant nutrition products primarily in the U.S., Canada, Brazil, the U.K. and the European Union (“EU”). See Note 15 to our Consolidated Financial Statements for financial information relating to our operations by geographic areas.

SALT SEGMENT

Overview

Salt is indispensable and enormously versatile with thousands of reported uses. In addition, there are no known cost-effective alternatives for most high-volume uses. Through the use of effective mining techniques and efficient production processes, we leverage our high-grade salt deposits, which are among the most extensive in the world. Further, many of our Salt assets are in

4 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

locations that are logistically favorable to our core markets. Our strategy for this business is to focus on driving profitability from every ton we produce through cost efficiency as well as commercial and operational execution.

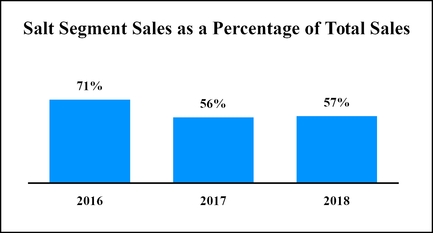

Through our Salt segment, we produce, market and sell salt (sodium chloride) and magnesium chloride in North America and sodium chloride in the U.K. Our Salt products include rock salt, mechanically-evaporated salt, solar-evaporated salt, brine magnesium chloride and flake magnesium chloride. While we also purchase potassium chloride (“KCl”) and calcium chloride to sell as finished products or to blend with sodium chloride to produce specialty products, sodium chloride represents the vast majority of the products we produce, market and sell. In 2018, the Salt segment accounted for approximately 57% of our gross sales (see Note 15 to our Consolidated Financial Statements for segment financial information). Salt segment sales as a percentage of our total sales has declined in recent years primarily as a result of investments in our plant nutrition business.

Our Salt products are used in a wide variety of applications, including as a deicer for roadways, consumer and professional use, as an ingredient in chemical production, for water treatment, human and animal nutrition and for a variety of other consumer and industrial uses.

The demand for salt has historically remained relatively stable during periods of rising prices and through a variety of economic cycles due to its relatively low cost and a diverse number of end uses. As a result, our cash flows from our Salt segment are not materially impacted by economic cycles. However, demand for deicing salt products is primarily affected by the number and intensity of snow events and temperatures in our service territories.

Salt Industry Overview

In our primary markets, we estimate that the consumption of highway deicing rock salt in North America, including rock salt used in chemical manufacturing processes, is approximately 36 million tons per year, assuming average winter weather conditions, while the consumer and industrial market is approximately 10 million tons per year. In the U.K., we estimate that the consumption of highway deicing salt is approximately 2 million tons per year, assuming average winter weather conditions. According to the latest available data from the U.S. Geological Survey (“USGS”), during the 30-year period ending in 2016, salt production in the U.S. has increased at a historical average rate of approximately 1% per year, although there have been recent fluctuations above and below this average driven primarily by winter weather variability.

Salt prices vary according to purity, end use and variations in refining and packaging processes. According to the latest USGS data, during the 30-year period ending in 2016, salt prices in the U.S. have increased at a historical average rate of approximately 3% - 4% per year, although there have been recent fluctuations above and below this average. Due to salt’s relatively low production cost, transportation and handling costs tend to be a significant component of the total delivered cost, which makes logistics management and customer service key competitive factors in the industry. The high relative cost associated with transportation of salt tends to favor producers located nearest to customers.

Processing Methods

As of December 31, 2018, salt mining, other production activities and packaging are conducted at 12 of our facilities. The three processing methods we use to produce salt are described below.

Underground Rock Salt Mining - We produce most of the salt we sell through underground mining. In North America, we use a combination of continuous mining and drill and blast techniques. At our Winsford, U.K. mine, we utilize continuous mining techniques. We introduced continuous mining at our Goderich, Ontario mine in 2012 and shifted all of our Goderich mine production to this technology at the end of 2017. Mining machinery moves salt from the salt face to conveyor belts, which transport the salt to the mill center where it is crushed and screened. It is then hoisted to the surface where the processed salt is loaded onto shipping

5 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

vessels, railcars or trucks. The primary power sources for each of our rock salt mines are electricity and diesel fuel. Rock salt is sold in our highway deicing product line and for numerous applications in our consumer and industrial product lines.

Mechanical Evaporation - Mechanical evaporation involves creating salt-saturated brine from brine wells in underground salt deposits and subjecting this salt-saturated brine to vacuum pressure and heat to precipitate and crystallize salt. The primary power sources used for this process are natural gas and electricity. The resulting product has a high purity and uniform physical shape. Mechanically evaporated salt is primarily sold through our consumer and industrial salt product lines.

Solar Evaporation - Solar evaporation is used in areas of the world where high-salinity brine is available and weather conditions provide for a high natural evaporation rate. Salt-saturated brine is pumped into a series of large open ponds where sun and wind evaporate the water and crystallize the salt, which is then mechanically harvested and processed through washing, drying and screening. We produce solar salt at the Great Salt Lake near Ogden, Utah and sell it through both our consumer and industrial and our highway deicing product lines. We also produce magnesium chloride using solar evaporation. After sodium chloride and potassium-rich salts precipitate from brine, a concentrated magnesium chloride brine solution remains, which becomes the raw material we use to produce several magnesium chloride products. We primarily sell these products in our Salt segment through our consumer and industrial and highway deicing product lines.

Operations and Facilities

Canada - We produce finished Salt products at four locations in Canada. Rock salt mined at our Goderich mine serves highway deicing markets and consumer and industrial markets in Canada and the Great Lakes region of the U.S., principally through a series of depots located around the Great Lakes and through our packaging facilities. Mechanically evaporated salt used for our consumer and industrial product lines is produced at three of our facilities strategically located throughout Canada: Amherst, Nova Scotia in Eastern Canada; Goderich, Ontario in Central Canada; and Unity, Saskatchewan in Western Canada.

United States - We produce finished Salt products at three locations in the U.S. Our Cote Blanche, Louisiana rock salt mine primarily serves highway deicing customers through a series of depots located along the Mississippi and Ohio rivers (and their major tributaries) and chemical and agricultural customers in the Southern and Midwestern U.S. Our solar evaporation facility located near Ogden, Utah principally serves the Midwestern and Western U.S. consumer and industrial markets, provides salt for highway deicing and chemical applications and produces magnesium chloride, which is used in deicing, dust control and unpaved road surface stabilization applications. The production capacity for solar-evaporated salt at our Utah facility is currently only limited by demand. Mechanically evaporated salt for our U.S. consumer and industrial customers is produced at our Lyons, Kansas plant. We also operate four salt packaging facilities located in Illinois, Minnesota, New York and Wisconsin.

United Kingdom - Our Winsford rock salt mine in Northwest England, near Manchester, serves the U.K. highway deicing market, primarily in England and Wales.

6 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

Our current production capacity is approximately 15.6 million tons of salt per year. The following table shows the annual production capacity and type of salt produced at each of our owned or leased production locations as of December 31, 2018:

Location | Annual Production Capacity(a) (tons) | Product Type |

North America | ||

Goderich, Ontario Mine | 8,000,000 | Rock Salt |

Cote Blanche, Louisiana Mine | 3,000,000 | Rock Salt |

Utah Plant: | ||

Salt(b) | 1,500,000 | Solar Salt |

Magnesium Chloride(c) | 750,000 | Magnesium Chloride |

Lyons, Kansas Plant | 450,000 | Evaporated Salt |

Unity, Saskatchewan Plant | 160,000 | Evaporated Salt |

Goderich, Ontario Plant | 140,000 | Evaporated Salt |

Amherst, Nova Scotia Plant | 130,000 | Evaporated Salt |

United Kingdom | ||

Winsford, Cheshire Mine | 1,500,000 | Rock Salt |

(a) Annual production capacity is our estimate of the tons that can be produced assuming a normal amount of scheduled down time and operation of our facilities under normal working conditions, including staffing levels, based on actual historical production rates. As we continue our efforts to optimize and refine our production methods, such as continuous mining at our Goderich salt mine, we will update our estimates if necessary as new production data become available.

(b) Solar salts deposited annually substantially exceed the amount converted into finished products. The amount presented here represents an approximate average amount produced based on recent market demand.

(c) The magnesium chloride amount includes both brine and flake.

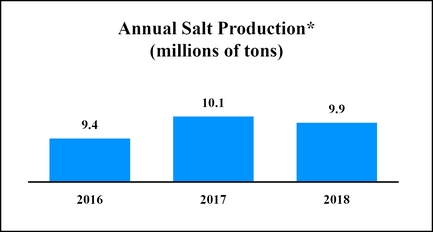

Actual annual Salt production volume levels may vary from the annual production capacity shown in the table above due to a number of factors, including variations in the winter weather conditions, which impact demand for highway and consumer deicing products, the quality of the reserves and the nature of the geologic formation that we are mining at a particular time, unplanned downtime due to safety concerns, incidents and mechanical failures, and other operating conditions. The chart below shows annual Salt production volumes, including magnesium chloride, at our owned and leased production locations:

* Excludes solar salt harvested at our Utah facility that is not converted into finished product and salt processed at our packaging facilities.

Our production facilities have access to vast mineral deposits. At all of our production locations, we estimate the recoverable salt reserves to last at least several more decades at current production rates and capacities. Our rights to extract those minerals may be contractually limited by geographic boundaries or time. We believe that we will be able to continue extending these agreements, as we have in the past, at commercially reasonable terms without incurring substantial costs or material modifications to the existing lease terms and conditions, thereby allowing us to fully utilize our existing mineral rights.

Our underground mines in Canada (Goderich, Ontario), the U.S. (Cote Blanche, Louisiana) and the U.K. (Winsford, Cheshire) make up 84% of our salt production capacity as of December 31, 2018. Each of these mines is operated with modern mining equipment and utilizes subsurface improvements, such as vertical shaft lift systems, milling and crushing facilities, maintenance and repair shops and extensive raw materials handling systems.

We own the mine site at Goderich, Ontario and maintain a mineral lease for mineral reserves with the provincial government, which grants us the right to mine salt at this site. This mineral lease expires in 2022, and we have an option to renew the lease until

7 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

2043 after demonstrating to the lessor that the mine’s useful life is greater than the term of the lease. The Cote Blanche mine is operated under land and mineral leases with third-party landowners who grant us the right to mine salt. The mine site and salt reserves at the Winsford mine are owned. We regularly perform mineral reserve studies at our mines to confirm the remaining mineral reserves. The table below reflects current information about our mines:

Mine | Years in operation | Remaining reserve* | Remaining mine life* |

Goderich | 59 years | 553.1 million tons | 84 years |

Cote Blanche | 53 years | 308.5 million tons | 102 years |

Winsford | 173 years | 29.4 million tons | 29 years |

*Based upon the average rates of production used in the latest mineral study.

Our mineral interests are amortized on an individual mine basis over estimated useful lives not exceeding 99 years primarily using the units-of-production method. Our mineral reserve estimates of the remaining tons are derived from periodic reserve studies completed by third-party geological engineering firms. Our mineral reserve estimates and the third-party reserve studies are based on many factors, including the area and volume covered by our mining rights, assumptions regarding our extraction rates based upon an expectation of operating the mines on a long-term basis and the quality of in-place reserves. Established criteria for proven and probable reserves are primarily applicable to mining deposits of discontinuous metal, where both the presence of ore and its variable grade need to be precisely identified. However, the massive continuous nature of evaporative deposits, such as salt deposits, requires proportionately less data for the same degree of confidence in mineral reserves, both in terms of quantity and quality. Reserve studies performed by third-party geological engineering firms suggest that most of our mineral reserves are characterized as probable mineral reserves, with smaller quantities as proven mineral reserves. We have classified our mineral reserves as probable reserves.

In 2012, we acquired mining rights to approximately 100 million tons of salt reserves in the Chilean Atacama Desert. This reserve estimate is based upon an initial report. We will need to complete a feasibility study before we proceed with the development of this project to ensure our salt reserves are probable. The development of this project will require significant infrastructure to establish extraction and logistics capabilities.

We package our Salt products at four additional Company-owned and operated facilities. We estimate that our annual combined packaging capacity at these four facilities is 485,000 tons. Our packaging capacity is based on our estimate of the tons that can be packaged at these facilities assuming a normal amount of scheduled down-time and operation of our facilities under normal working conditions, including staffing levels. We have the capability to significantly increase our annual packaging capacity by increasing our staffing levels in response to demand.

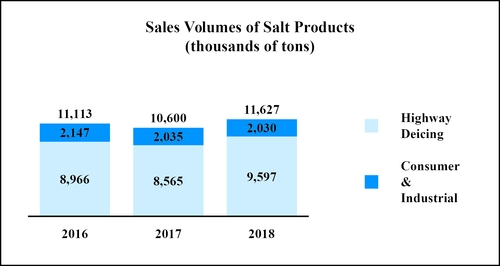

Products and Sales

We sell our Salt products through our highway deicing product line (which includes brine magnesium chloride as well as rock salt treated with this mineral) and our consumer and industrial product line (which includes salt as well as products containing magnesium chloride and calcium chloride in both pure form and blended with salt).

Highway deicing, including salt sold to chemical customers, constituted 62% of our 2018 Salt segment gross sales. Our principal customers are states, provinces, counties, municipalities and road maintenance contractors that purchase bulk deicing salt, both treated and untreated, for ice control on public roadways. Highway deicing salt in North America is sold primarily through an annual tendered bid contract process with governmental entities, as well as through multi-year contracts, with price, product quality and delivery capabilities as the primary competitive market factors. Some sales also occur through negotiated sales contracts with third-party customers, particularly in the U.K. Since transportation costs are a relatively large portion of the cost to deliver products to customers, locations of salt sources and distribution networks also play a significant role in the ability of suppliers to cost-effectively serve customers. We have an extensive network of approximately 80 depots for storage and distribution of highway deicing salt in North America. The majority of these depots are located on the Great Lakes and the Mississippi River and Ohio River systems. Deicing salt product from our Utah facility supplies customers in the Western and upper Midwest regions of the U.S. Treated rock salt, which is typically rock salt with magnesium chloride brine and organic materials that enhance the salt’s performance, is sold throughout our markets.

We believe our production capability at our Winsford, Cheshire, U.K. mine and favorable logistics position enhance our ability to meet the U.K.’s winter demands. Due to our strong position, we are viewed as a key supplier by the U.K.’s Highways Agency. In the U.K., approximately 75% of our highway deicing customers have multi-year contracts.

Winter weather variability is the most significant factor affecting salt sales for deicing applications, because mild winters reduce the need for salt used in ice and snow control. On average, over the last three years, approximately two-thirds of our deicing product sales occurred during the North American and European winter months of November through March. The vast majority of our North American deicing sales are made in Canada and the Midwestern U.S. where inclement weather during the winter months causes dangerous road conditions. In keeping with industry practice, we stockpile salt to meet estimated requirements for the next winter season. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” for more information on the seasonality of our Salt segment results.

8 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

Our principal chemical customers are producers of intermediate chemical products used in the production of vinyls and other chemicals, pulp and paper, as well as water treatment and a variety of other industrial uses. We typically have multi-year supply agreements with these customers. Price, service, product quality and security of supply are the major competitive market factors.

Sales of our consumer and industrial products accounted for 38% of our 2018 Salt segment gross sales. We are the third largest producer of consumer and industrial salt products in North America. These products include commercial and consumer applications, such as water conditioning, consumer and professional ice control, food processing, agricultural applications, table salt and a variety of industrial applications. We believe we are among the largest private-label producers of water conditioning salt in North America and of table salt in Canada. Our Sifto brand encompasses a full line of salt products, which are well recognized in Canada.

Our consumer and industrial business has broad product lines with both private-label and Company brands. Our consumer and industrial product line is distributed through many channels including retail, agricultural, industrial, janitorial and sanitation, and resellers. These consumer and industrial products are channeled from our plants and third-party warehouses to our customers using a combination of direct sales personnel, contract personnel and a network of brokers or manufacturers’ representatives.

The chart below shows our annual sales volumes of Salt products:

Competition

We face strong competition in each of the markets in which we operate. In North America, other large, nationally and internationally recognized companies compete with our Salt products. In addition, there are also several smaller regional producers of salt. There are several importers of salt into North America, which mostly impact the East Coast and West Coast of the U.S. where we have minimal market presence. Two competitors serve the highway deicing salt market in the U.K., one in Northern England and one in Northern Ireland. Typically, there are not significant imports of highway deicing salt into the U.K.

Salt is a commodity, which limits the potential for product differentiation and increases competition. Additionally, low barriers to entry in the consumer and industrial markets increase competition. Our advantageous geographical locations, superior assets and distribution network strengthen our competitive position.

PLANT NUTRITION

Overview

Fertilizers are critical for efficient crop production using the limited arable land resources available around the world. The nutrients needed to ensure plant health can be divided into three categories:

• | macro nutrients - the traditional NPK fertilizers (nitrogen (N), phosphorus (P) and potassium (K)), |

• | secondary nutrients - calcium, magnesium and sulfur, and |

• | specialty plant nutrients - trace elements of iron, manganese, copper, boron, zinc, molybdenum, chlorine and nickel. |

In addition, a wide range of nutritional and functional enhancers, biostimulants and adjuvants are critical for a plant’s metabolic processes and overall stress and disease resistance. The application and necessity of essential nutritional supplements is based on Liebig’s Law of the Minimum, which is the principle that only by increasing the amount of the scarcest nutrient can the growth of a plant or crop be enhanced, despite the plentiful presence of other nutrients. In parallel, the increased adoption of technologically advanced seeds (both conventional and genetically modified) has driven farmers around the globe to address the higher nutritional demands of crops and to apply essential nutritional supplements to unlock the yield potential embedded in these seeds.

Our plant nutrition business focuses on higher-value plant nutrients including SOP, specialty formulations of macro fertilizers and a wide range of high-value specialty products incorporating secondary nutrients, specialty plant nutrients and nutritional and

9 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

functional enhancers. Our products contribute to improved overall plant-metabolism, nutrient uptake and fixing, stress resistance, plant defense mechanisms, energy conversion, cell division, root enhancement and leaf, flower and fruit formation, among other benefits. The yield-enhancing properties of these supplements have been shown to provide significant farm productivity gains. Our plant nutrition strategy is based upon maximizing the profitability of our current product portfolio, innovating new technology-driven products and robust commercialization of these technologies globally.

Factors influencing the plant nutrition market include world grain and food supply, currency fluctuations, weather and climate change, grower incomes, changes in consumer diets, general levels of economic activity, government food programs, governmental agriculture and energy policies in the U.S. and around the world, and the amount or type of crop grown in certain locations, or the type or amount of fertilizer product used. In addition, our plant nutrition results can be impacted by seasonality (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” for more information).

In October 2016, we completed the acquisition of Produquímica, which expanded our ability to serve growers in Brazil and significantly expanded the number of our specialty plant nutrition products. See Note 4 to our Consolidated Financial Statements for further discussion of this acquisition. As a result of this acquisition, in the fourth quarter of 2016 we added a new reporting segment, Plant Nutrition South America, which is the acquired Produquímica business.

We have begun selling Produquímica products in North America, including the ProAcqua brand. The introduction of the Produquímica products in North America expands the geographic reach of our Produquímica sales, increases our portfolio of products in our Plant Nutrition North America business and creates sales synergies between our businesses. As we continue to build synergies, we will be better positioned to meet our customer’s dynamic demands with excellence.

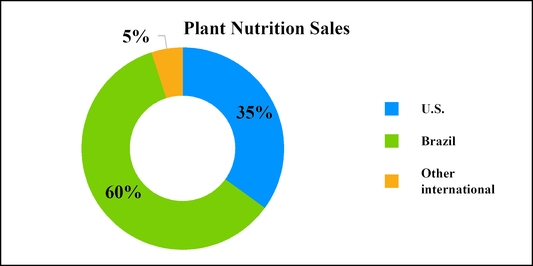

In 2018, our plant nutrition business, on a combined basis, accounted for 42% of our gross sales (see Note 15 to our Consolidated Financial Statements for segment financial information). The chart below shows our 2018 plant nutrition gross sales by geography:

PLANT NUTRITION NORTH AMERICA SEGMENT

Industry Overview

Our Plant Nutrition North America segment includes sales of SOP and specialty plant nutrients. The average annual worldwide consumption of all potash fertilizers is approximately 82 million tons, with muriate of potash (“MOP” or “KCl”) accounting for approximately 86% of all potash used in fertilizer production based upon the most recent industry data published by CRU International in 2017. SOP represents approximately 9% of all potash production. The remainder is supplied in forms containing varying concentrations of potassium (expressed as potassium oxide) along with different combinations of co-nutrients. There are two major forms of potassium-based fertilizer, SOP, a specialty form of potassium which also provides plant-ready sulfur and MOP. SOP (which contains the equivalent of approximately 50% potassium oxide) maintains a price premium over MOP which contains a higher concentration of potassium oxide. Many high-value or chloride-sensitive crops experience improved yields and quality when SOP is applied instead of MOP, and SOP is also a more cost-effective alternative to other forms of specialty potash.

Our North American SOP sales are concentrated in the Western and Southeastern U.S. where the crops and soil conditions favor the use of low-chloride potassium nutrients. Consequently, weather patterns and field conditions in these locations can impact Plant Nutrition North America sales volumes.

While long-term global consumption of potash has increased in response to growing populations and the need for additional food supplies, the market has been challenged over the last few years due to a downturn in the broader crop market which has pressured grower incomes. We expect the long-term demand for potassium nutrients to continue to grow as arable land per capita decreases, thereby encouraging improved crop yields. Additionally, as the broader agricultural market rebounds, increases in grower incomes are expected to also improve the demand for our products.

10 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

While used in small prescriptive amounts, specialty plant nutrients play important roles in plant development, and nutrient deficient soils must be replenished to obtain higher crop yields. Growth rates in North America for the specialty plant nutrient market have slowed recently in response to the drop in commodity crop prices.

We expect our future growth to stem from building a market-leading specialty plant nutrition business through the innovation and commercialization of our products as well as strategic partnerships and collaborations designed to enhance differentiation and provide more technology-driven solutions that growers demand in this market.

Approximately 91% of our Plant Nutrition North America sales in 2018 were made to U.S. customers, who include retail fertilizer dealers and distributors of agricultural products as well as professional turf care customers. In some cases, these dealers and distributors combine or blend our Plant Nutrition North America products with other fertilizers and minerals to produce fertilizer blends tailored to individual requirements.

Operations and Facilities

We produce SOP at two facilities, both located in North America, namely at our Utah facility on the Great Salt Lake, and our Wynyard, Saskatchewan, Canada facility on Big Quill Lake. Our Utah facility is the largest SOP production site in North America and one of only four large-scale solar brine evaporation operations for SOP in the world. The facility operates approximately 55,000 acres of solar evaporation ponds to produce SOP and salt, including magnesium chloride, from the Great Salt Lake’s naturally occurring brine. The facility is located on land that is both owned and leased under renewable leases from the State of Utah. We believe that our property and operating equipment are maintained in good working condition. This facility has the capability to produce up to 320,000 tons of solar pond-based SOP, approximately 750,000 tons of magnesium chloride and 1.5 million tons of salt annually when weather conditions are typical.

These recoverable minerals exist in vast quantities in the Great Salt Lake. We believe the recoverable minerals exceed 100 years of reserves at current production rates and capacities and the lake quantities are so vast that they will not be significantly impacted by our production. While our rights to extract these minerals are contractually limited, we believe we will be able to extend our lease agreements, as we have in the past, at commercially reasonable terms, without incurring substantial costs or incurring material modifications to the existing lease terms and conditions.

Initially, we draw mineral-rich lake water, or brine, from the Great Salt Lake into our solar evaporation ponds. The brine moves through a series of solar evaporation ponds over a two- to three-year production cycle. As the water evaporates and the mineral concentration increases, some of those minerals naturally precipitate out of the brine and are deposited on the pond floors. These deposits provide the minerals necessary for processing into SOP, salt and magnesium chloride. The evaporation process is dependent upon sufficient lake brine levels and hot, arid summer weather conditions. The potassium-bearing salts are mechanically harvested out of the solar evaporation ponds and refined to high-purity SOP in our production facility.

We also have a unique ability to use KCl and other potassium-rich minerals as a raw material feedstock to supplement our solar harvest to help meet demand when it is economically feasible.

We have invested to increase the efficiency and expand the capacity of our Utah facility through upgrades to our processing plant and our solar evaporation ponds. These investments have included modifications to our existing solar evaporation ponds to increase the annual solar harvest and the extraction yield from the harvest and processing capacity of our SOP plant. In 2017, we completed a project to further expand our SOP production capacity by augmenting our ability to convert KCl into SOP. As a result, our annual SOP production capacity at our Utah facility is currently approximately 550,000 tons, including amounts produced with both solar-pond based feedstock and supplemental KCl feedstock.

We also own our Wynyard, Saskatchewan facility, which contributes 40,000 tons to our annual SOP capacity and is Canada’s only SOP production facility. At this facility, we combine sulfate-rich brine with sourced potassium chloride to create SOP through ion exchange and glaserite processes. This product is high purity and is used in crop nutrient applications as well as specialty, non-agricultural applications.

We hold numerous environmental and mineral extraction permits, water rights and other permits, licenses and approvals from governmental authorities authorizing operations at each of our facilities.

Products and Sales

We currently generate most of our revenue and earnings in our Plant Nutrition North America business through the production and sale of SOP. Our SOP is sold in various grades under our Protassium+ brand. Our Protassium+ product line consists of different grades sized for use in broadcast spreaders, direct application and liquid fertilizer solutions. Our turf product line consists of grades sized for use by the turf and ornamental markets and for blends used on golf course greens. We also provide an organic product line with grades sized for a wide range of applications.

In the fourth quarter of 2017, we launched our water-soluble product line, ProAcqua, in North America. ProAcqua products are made with high-quality ingredients and agronomic blends that are uniquely formulated to complement the way growers manage their nutritional programs. ProAcqua products provide plants with nutrients via fertigation and seasonal foliar applications and are designed to maximize yield potential. We also develop and distribute specialty plant nutrients under the Wolf Trax brand. These innovative products are based upon proprietary and patented technologies and are focused on improving application efficiency by increasing root interception points in order to provide accessible plant nutrition at key developmental stages. Our Wolf Trax and

11 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

ProAcqua products contain specialty plant nutrients that are essential to a wide range of crops, including commodity row crops, with different plants and soil conditions requiring different specialty plant nutrients.

Protassium+, Wolf Trax and ProAcqua product lines are generally sold to crop input distributors and dealers who then sell our product to farmers and growers. Our commercial efforts focus on educating and selling the agronomic benefits of SOP as a source of potassium nutrients and various specialty plant nutrients to plant health.

Competition

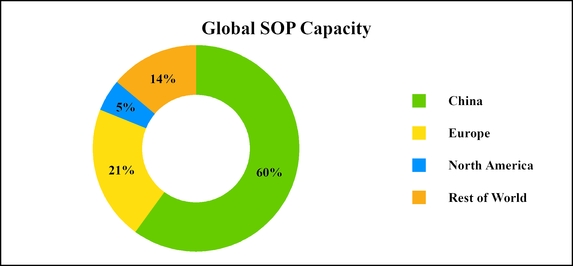

SOP is a global market with approximately 60% of the world’s 12 million tons of capacity located in China.

Source: 2017 industry data published by CRU International

We are the leading SOP producer and marketer in North America and we also market SOP products internationally, depending on market conditions. Our major competition for SOP sales in North America includes imports from the EU. Fluctuations in the values of foreign currencies in relation to the U.S. dollar coupled with Baltic freight rates impact the level of international competition we face. As the only SOP producer with production facilities in North America, and as a result of our logistically favorable production site near Ogden, Utah, we estimate that our share of the North American market is sizable. In addition to imported SOP, there is functional competition between SOP and other forms of potassium crop nutrients, such as MOP. The specialty plant nutrient market is highly fragmented. Commodity and specialty crops require specialty plant nutrients in varying degrees depending on the crop and soil conditions. While sales of Wolf Trax products have historically been concentrated in North America, we also sell our specialty plant nutrient products globally, primarily in the EU, Central America, South America and the Caribbean. We expect that the ProAcqua brand of soluble specialty plant nutrient products will enhance our position in the North American specialty plant nutrient market.

PLANT NUTRITION SOUTH AMERICA SEGMENT

Industry Overview

Our Plant Nutrition South America segment manufactures, distributes and markets a wide array of specialty plant nutrients and supplements developed and formulated from essential primary and secondary nutrients, specialty plant nutrients and biostimulants. These products consist of different chemical molecules, chemical compositions and production processes than conventional NPK fertilizers. This specific category of plant nutrients offers a diversity of delivery mechanisms, low environmental impact, low dosages per acre, reflecting a high degree of innovation and product development. These products also require more marketing than conventional NPK fertilizers, among other differences. Brazilian soils are naturally deficient in nutrients such as zinc, manganese and boron, among others. We estimate that Brazilian farmers, on average, only use approximately 25% of the optimal prescription of essential nutritional supplements. During 2018, 76% of sales generated by Plant Nutrition South America were derived from the manufacturing and marketing of these agricultural products. We believe we are one of the market leaders in Brazil and offer a more comprehensive range of products and brands compared to our competitors.

In addition to agriculture products, this segment produces water and wastewater treatment chemicals in Brazil for cleaning, decontaminating and purifying water as well as process chemicals for industrial use. This business benefits from the rapidly expanding focus on, and increased investment in, improving standards for drinking water purification and wastewater treatment. Our water treatment customers include state and municipal entities, wastewater treatment companies and manufacturing companies that treat their own wastewater. Our chemical solutions business also benefits from growth in Brazilian industrial sectors that use our products, including the oil and gas exploration, mining, pulp and paper production and ethanol production industries. Our involvement in both businesses allows us to benefit from greater purchasing power with suppliers given that a significant portion

12 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

of the mineral inputs for both businesses are identical. In 2018, 24% of sales generated by Plant Nutrition South America were derived from our chemical solutions business.

Our strategy for Plant Nutrition South America is to leverage our innovative product portfolio and direct-to-farmer sales platform. We expect to continue to drive market growth by increasing the adoption rate and acre penetration of nutritional supplements. Our plan is to reinforce the use of these supplements as a profitable tool to enhance crop productivity. We use a three-pronged approach to deliver under our strategy, consisting of (1) our specialized agronomic research teams, (2) our technical in-the-field agronomic sales force, and (3) continuous innovation.

We expect to increase sales through new product introductions and growth in direct-to-farmer distribution channels. We continually invest in the development of new products and new generations of existing products that meet the specific needs of our customers. As a result of these efforts, our direct-to-end-customer sales to large farmers have increased as a proportion of total agriculture productivity revenues. Additionally, our Plant Nutrition South America segment provides geographic diversification for our combined plant nutrition business.

Operations and Facilities

We operate nine production facilities throughout Brazil, including a property we jointly operate with a third-party. Our production facilities are located in the Southeast and Northeast parts of Brazil. Our Plant Nutrition South America production facility network has a significant level of integration. While some production facilities are focused on producing chemical and physical transformation of ingredients, such as our Jacareí I production facility with sulfur derivatives, others are specialized in transforming these ingredients into final products for our customers by mixing them with other ingredients produced in different or the same production facilities. We also use by-products from one production facility as a raw material for another production facility where possible.

The table below shows our Plant Nutrition South America production facilities by product line:

Production Facility | |||||||||

Suzano I | Suzano II | Igarassu | Mauá | Uberlândia | Fermavi(a) | Reluz Nordeste | Jacareí I | Jacareí II | |

Agriculture Productivity | X | X | X | X | X | X | X | ||

Chemical Solutions | X | X | X | X | |||||

(a) We hold a 50% ownership interest through a joint venture with Fermavi Eletroquímica Ltda.

Our products are produced through a series of chemical and physical transformations in automated reactors, granulators, grinders and mixers. Our equipment is capable of processing both primary and secondary sources of raw materials, thus enabling us to rapidly remodel our production process to deal with variations in element concentration in raw material feeds. This also allows us flexibility with regard to raw material purchasing opportunities, allowing us to purchase products that are less expensive on a percentage-contained-metal-basis.

Products and Sales

As of December 31, 2018, our total Plant Nutrition South America portfolio consisted of approximately 950 products, including approximately 725 in agriculture productivity and 225 in chemical solutions. The agriculture productivity products may be applied for different stages of a plant’s life cycle, different soil and other growing conditions, different crop types and using different delivery mechanisms. We also provide value-added services to our customers such as soil analysis programs, technical trainings and conferences, crop field test and research, sales support and specialized technical support, which allow us to tailor our Plant Nutrition South America products and sales to a wide variety of customers, diverse types of crops and multiple regions. Through our chemical solutions business, we manufacture, market and supply water treatment products and chemicals for industrial processes. Our water treatment products have many different uses including algae control, alkalinity control, disinfection control, odor and corrosion control, water filtration and water clarification.

Competition

Agricultural Productivity - The Brazilian market for nutritional supplements is highly fragmented with hundreds of market participants. Competitors typically focus their product offerings on specific product categories and delivery mechanisms, geographic regions and selected crops. As a result, we have different competitors for different market situations. The international competitive landscape is also fragmented. We estimate there are approximately 15 international competitors present in Brazil, mainly from the EU.

Market consolidation is likely to continue in the future, as players are challenged to keep up with demands for product innovation, increasingly specialized agronomic and technical skills, the effect of specific legislation, licensing and product registration procedures, cost pressures from economies of scale and other industry trends. Many competitors have limited production capabilities and can better be characterized as resellers, mixers and marketing companies, rather than producers. We differentiate ourselves by innovation, a broad market presence using a large technical sales force, an extensive network of point-of-sales distributors,

13 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

resellers and cooperatives and direct sales to large farmers and industrial customers. This presence enhances our new product placement capabilities, thereby driving market growth.

Chemical Solutions - We believe we are one of the largest manufacturers of water treatment chemicals in Brazil. We have a strong presence in the Northeast and Southeast regions of Brazil, which allows us to take advantage of efficient logistics due to proximity to raw materials and customers. We estimate that there are approximately five companies that account for approximately two-thirds of the Brazilian water treatment market. However, as the water treatment market is highly regional by nature, average market shares do not reflect the actual competitive strength for each company by geography, product and customer type. Our strategy is to focus on the regions in which our production facilities are located and where our product’s attributes give us a naturally strong market positions.

In the case of public customers, suppliers of water treatment chemicals compete through a pre-qualification and public bidding process. Barriers to market entry are therefore related to low cost of production (strongly influenced by access to low raw material costs, reduced logistics and large production scale), consistency of product quality and specification, existing customer relationships and previous supply experience.

We believe we are among the seven primary producers of caustic soda, chlorine and bleach in Brazil. Our market position is substantially stronger in the North and Northeast regions of Brazil where we operate.

OTHER

DeepStore is our records management business in the U.K. that utilizes portions of previously excavated space in our salt mine in Winsford, Cheshire, for secure underground document storage and one warehouse location in London, England. Currently, DeepStore does not have a significant share of the document storage market in the U.K., and it is not material in comparison to our Salt, Plant Nutrition North America and Plant Nutrition South America segments.

INTELLECTUAL PROPERTY

To protect our intellectual property, we rely on a combination of patents, trademarks, copyrights, trade secret protection, employee and third-party non-disclosure agreements, license arrangements and domain name registrations. These protections are important to our business and we believe that our success is at least partly dependent on the acquisition and maintenance of these rights. However, we rely primarily on the innovative skills, technical competence, operational knowledge and marketing abilities required by our business in order to succeed.

We sell many of our products under a number of registered trademarks that we believe are widely recognized in the industry. Our trademarks registered pursuant to applicable intellectual property laws include COMPASS MINERALS, PROTASSIUM+, WOLF TRAX (and design), NU-TRAX, PROAQUA, KELLUS, PROFOL, AMERICAN STOCKMAN, FREEZGARD, SAFE STEP, SIFTO and SURE PAWS.

Any issued patents, trademarks or copyrights on our proprietary technology may not provide us with substantial protection or be commercially beneficial to us. The issuance of a patent is not conclusive as to its validity or its enforceability. Competitors may challenge our patent rights. If our patents are held unenforceable, our competitors could commercialize our patented technology.

With respect to proprietary know-how, we rely on trade secret protection and confidentiality agreements. Monitoring the unauthorized use of our technology is difficult, and we may not be able to prevent unauthorized use of our technology. The disclosure or misappropriation of our intellectual property could harm our ability to protect our rights and our competitive position. See “Risk Factors—Our intellectual property may be misappropriated or subject to claims of infringement.” for more information.

EMPLOYEES

As of December 31, 2018, we had 3,071 employees, of which 1,278 are located in Brazil, 961 are located in the U.S., 656 are located in Canada and 176 are located in the U.K. Approximately 50% of our workforce in the U.S., Canada and the U.K. and approximately 30% of our global workforce is represented by collective bargaining agreements. Of our 13 collective bargaining agreements in effect on January 1, 2019, five will expire in 2019, four will expire in 2020, three will expire in 2021 and one will expire in 2027. In addition, trade union membership is mandatory in Brazil, where approximately 40% of our global workforce is located.

14 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

PROPERTIES

We have leases for packaging facilities and other facilities, which are not individually material to our business. The table below sets forth our principal properties as of December 31, 2018:

Land and Related Surface Rights | Mineral Reserves | |||||||||

Name, Location | Use | Owned/ Leased | Expiration of Lease | Owned/ Leased | Expiration of Lease | |||||

Cote Blanche, Louisiana | Rock salt production facility | Leased | 2060(1) | Leased | 2060(1) | |||||

Lyons, Kansas | Evaporated salt production facility | Owned | N/A | Owned | N/A | |||||

Utah | SOP, solar salt and magnesium chloride production facility | Owned | N/A | Leased | (2) | |||||

Wynyard, Saskatchewan, Canada | SOP production facility | Owned(3) | N/A | Leased | 2020(4) | |||||

Amherst, Nova Scotia, Canada | Evaporated salt production facility | Owned | N/A | Leased | 2023(5) | |||||

Goderich, Ontario, Canada | Rock salt production facility | Owned | N/A | Leased | 2022(5) | |||||

Goderich, Ontario, Canada | Evaporated salt production facility | Owned | N/A | Owned | N/A | |||||

Unity, Saskatchewan, Canada | Evaporated salt production facility | Owned | N/A | Leased | 2037/2030(6) | |||||

Winsford, Cheshire, United Kingdom | Rock salt production facility; records management | Owned | N/A | Owned | N/A | |||||

London, United Kingdom | Records management | Leased | 2028 | N/A | N/A | |||||

Suzano I, São Paulo, Brazil | Nutritional supplements and other chemicals production facility | Owned | N/A | N/A | N/A | |||||

Suzano II, São Paulo, Brazil | Nutritional supplements packaging facility | Owned | N/A | N/A | N/A | |||||

Igarassu, Pernambuco, Brazil | Various chemicals production facility | Owned | N/A | N/A | N/A | |||||

Mauá, São Paulo, Brazil | Nutritional supplements production facility | Owned | N/A | N/A | N/A | |||||

Uberlândia, Minas Gerais, Brazil | Mineral supplements for beef cattle and milk | Owned | N/A | N/A | N/A | |||||

Fermavi, Minas Gerais, Brazil(7) | Nutritional supplements, water treatment, and other chemicals production facility | Owned | N/A | N/A | N/A | |||||

Reluz Nordeste, Alagoas, Brazil | Water treatment and other chemicals production facility | Owned | N/A | N/A | N/A | |||||

Jacareí I, São Paulo, Brazil | Nutritional supplements production facility | Owned | N/A | N/A | N/A | |||||

Jacareí II, São Paulo, Brazil | Nutritional supplements production and warehouse | Leased | 2030 | N/A | N/A | |||||

Overland Park, Kansas | Corporate headquarters | Leased | 2020 | N/A | N/A | |||||

Paulista, Pernambuco, Brazil | Produquímica headquarters | Leased | 2019-2022(8) | N/A | N/A | |||||

(1) | The Cote Blanche lease includes two 25-year renewal options. |

(2) | The Utah lease renews on an annual basis. |

(3) | The Wynyard location also has leases expiring in 2026 for two parcels of land. |

(4) | The Wynyard mineral lease may be renewed for additional 20-year periods. |

(5) | Subject to our right of renewal through 2043. |

(6) | Consists of a lease expiring in 2037 and a lease expiring in 2030 subject to our right of renewal through 2051. |

(7) | Held through a 50% ownership interest in a joint venture with Fermavi Eletroquímica Ltda. |

(8) | Consists of several leases for different portions of leased space expiring between 2019 and 2022. |

15 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

With respect to each facility at which we produce salt, brine or SOP, permits, licenses and approvals are obtained as needed in the normal course of business based on our mine plans and federal, state, provincial and local regulatory provisions regarding mine permitting and licensing. Based on our historical permitting experience, we expect to be able to continue to obtain necessary mining permits and approvals to support historical rates of production.

Our mineral leases have varying terms. Some will expire after a set term of years, while others continue indefinitely. Many of these leases provide for a royalty payment to the lessor based on a specific amount per ton of minerals extracted or as a percentage of revenue. In addition, we own a number of properties and are party to non-mining leases that permit us to perform activities that are ancillary to our mining operations, such as surface use leases for storage at depots and warehouse leases. We believe that all of our leases were entered into at market terms.

16 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

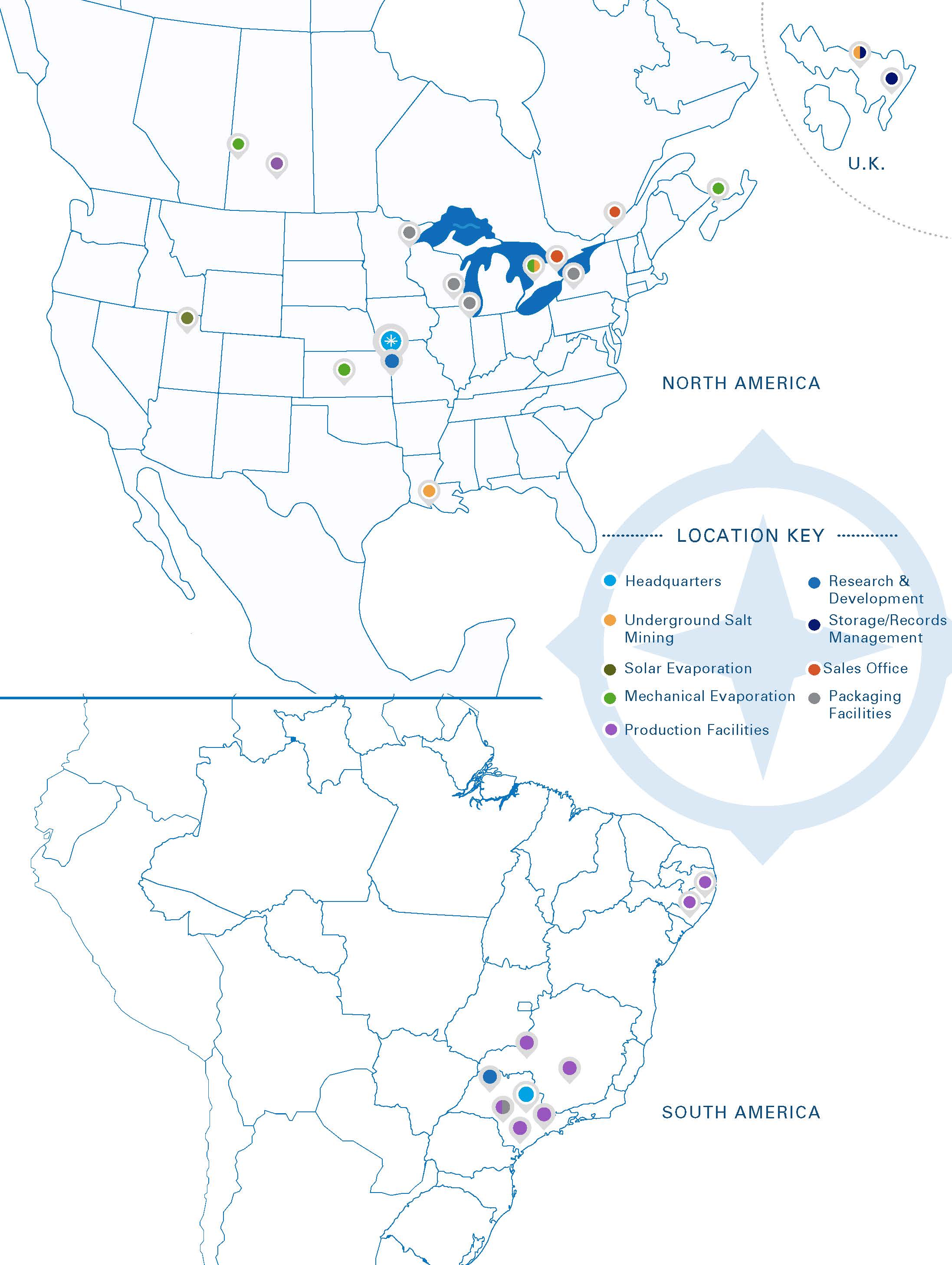

The following map shows the locations of our principal operating facilities as of December 31, 2018:

17 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

ENVIRONMENTAL, HEALTH AND SAFETY MATTERS

Our operations subject us to an evolving set of international, federal, national, foreign, state, provincial and local environmental, health and safety (“EHS”) laws and regulations. These EHS laws and regulations regulate, or propose to regulate, the conduct of our mining and production operations, including safety procedures and process safety management; management and handling of raw and in-process materials and finished products; air and water quality impacts from our facilities; management of hazardous and solid wastes; remediation of contamination at our facilities and third-party sites; and post-mining land reclamation.

The Environment, Health and Safety Committee of our Board of Directors works closely with our management to provide oversight of EHS matters impacting us, with the aim of putting in place appropriate strategies and processes to ensure safe and compliant operations and to promote a culture that prioritizes safety and environmental stewardship. The committee monitors our EHS performance against our targets. We have adopted a five-year environmental strategy plan focused on (i) verifying compliance through a combination of internal and third-party audits, (ii) adopting operational excellence tools and associated efficiencies, and (iii) enhancing our focus on sustainable operations. We also employ and consult with environmental specialists to assess and ensure our compliance with EHS laws and regulations.

Costs of compliance with EHS laws and regulations, including management effort, time and resources, have been and are expected to continue to be significant. New or proposed EHS regulatory programs, as well as future interpretations and enforcement of existing EHS laws and regulations, may require modification to our facilities, substantial increases in equipment and operating costs or interruptions, modifications or a termination of operations, the extent to which we cannot predict and which may involve significant capital costs or increases in operating costs. Anticipating future compliance obligations, implementing compliance plans and estimating future costs can be particularly challenging while EHS laws and regulations are under development and have not been adopted.

While a number of our capital projects indirectly result in environmental improvements, we estimate that our 2018 environmental-specific capital expenditures were $3.9 million. We expect to have approximately the same level of environmental capital expenditures in 2019. However, future capital expenditures are subject to a number of uncertainties, including changes to environmental laws and regulations, changes to our operations or unforeseen remediation requirements, and these expenditures could exceed our expectations.

As of December 31, 2018, we had recorded $2.2 million of accruals for contingent environmental liabilities. We accrue for contingent environmental liabilities when we believe it is probable that we will be responsible, in whole or in part, for environmental investigation or remediation activities and the expenditures for these activities are reasonably estimable. However, the extent and costs of any environmental investigation or remediation activities are inherently uncertain and difficult to estimate and could exceed our expectations, which could materially affect our financial condition and operating results.

Operating Requirements and Impacts

Our operations require permits for extraction of salt and brine, air emissions, surface water discharges of process material and wastes, waste generation, injection of brine and wastewater into subsurface wells and other activities. As a result, we hold numerous environmental and mineral extraction permits, water rights and other permits, licenses and approvals from governmental authorities authorizing operations at each of our facilities. These permits, licenses and approvals are typically subject to renewals and reissuances. Expansion of our operations or production capacity, or preservation of existing rights in some cases, is also predicated upon securing any necessary permits, licenses and approvals. The terms and conditions of future EHS laws and regulations, permits, licenses and approvals may be more stringent and may require increased expenditures on our part. In addition, although we do not engage in hydraulic fracturing (commonly known as “fracking”), laws and regulations targeting fracking could lead to increased permit requirements and compliance costs for non-fracking operations, including our salt operations, which require permitted wastewater disposal wells.

Our Cote Blanche mine, an underground salt mine located in St. Mary Parish, Louisiana, is subject to regulation by the Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977, as amended (the “Mine Act”). MSHA is required to regularly inspect the Cote Blanche mine and issue a citation, or take other enforcement action, if an inspector or authorized representative believes that a violation of the Mine Act or MSHA’s standards or regulations has occurred. As required by MSHA, these operations are regularly inspected by MSHA personnel. See “Mine Safety Disclosures” and Exhibit 95 to this report for information concerning mine safety violations and other regulatory matters required by SEC rules. The cost of compliance and penalties for violations of the Mine Act have been and are expected to continue to be substantial. Our underground salt mines located in Goderich, Canada and Winsford, UK are subject to similar regulations regarding health and safety, and the cost of compliance with these regulations also have been and are expected to be substantial.

We have post-closure reclamation obligations, primarily arising under our mining permits or by agreement. Many of these obligations include requirements to maintain financial surety bonds to fund reclamation and site cleanup following the ultimate closure of our mines or certain other facilities. As a result, we maintain financial surety bonds to satisfy these obligations.

We are also impacted by the U.S. Clean Air Act (the “Clean Air Act”) and other EHS laws and regulations that regulate air emissions. These regulatory programs may require us to make capital expenditures (for example, by installing expensive emissions abatement equipment), modify our operational practices, obtain additional permits or make other expenditures, which could be significant. Pursuant to the Clean Air Act, the Environmental Protection Agency reclassified the Salt Lake area as a “serious” non-

18 | 2018 FORM 10-K | |

COMPASS MINERALS INTERNATIONAL, INC. | ||

attainment area in May 2017 due to the presence of certain air pollutants. Because our Utah facility is located in this area, this re-classification could lead to new regulations that could require us to make significant expenditures or require us to modify our operational practices. In addition, we could incur fines or penalties for violations of the Clean Air Act or other EHS laws and regulations that regulate air emissions.

In August 2017, the Brazilian government ratified the United Nations Minamata Convention on Mercury, which commits signatories to compel chlor-alkali facilities to phase out the use of mercury cell facilities by 2025, to ensure that mercury from these facilities is disposed of in an environmentally sound manner and to subject these facilities to record keeping and reporting requirements. As the Brazil government adopts regulations limiting the use of mercury pursuant to the convention’s requirements or otherwise, our Igarassu, Brazil facility which operates a mercury cell facility could be impacted. We cannot predict the timing or content of the final regulations, or its ultimate cost to, or impact on us. To support transitioning away from mercury use at our Igarassu facility, we have invested in, and plan to continue to invest in, non-mercury technology as well as waste water and storm water treatment improvement projects.

From time to time, we have received notices from governmental agencies that we are not in compliance with certain EHS laws, regulations, permits or approvals. Upon receipt of these notices, we evaluate the matter and take all appropriate corrective actions.

Remedial Activities

Many of our past and present facilities have been in operation for decades. Operations at these facilities have historically involved the use and handling of regulated chemical substances, salt, salt byproducts and process tailings by us and our predecessors.

At many of these facilities, releases and disposal of regulated substances have occurred and could occur in the future, which could require us to investigate, undertake or pay for remediation activities under the U.S. Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and other similar EHS laws and regulations. These laws and regulations may impose “no fault” liability on past and present owners and operators of facilities associated with the release or disposal of hazardous substances, regardless of fault or the legality of the original actions. Additionally, one past or present owner or operator may be required to bear more than its proportional share of liability if payments cannot be obtained from other responsible parties.

In addition, third parties have alleged in the past and could allege in the future that our operations have resulted in contamination to neighboring off-site areas or third-party facilities, including third-party disposal facilities for regulated substances generated by our operations, which could result in liability for us under CERCLA or other EHS laws and regulations.