Form 8-K A10 Networks, Inc. For: Feb 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 8-K

____________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 7, 2019

____________________________________________________________________________

A10 NETWORKS, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________________________

Delaware | 001-36343 | 20-1446869 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||

3 West Plumeria Drive

San Jose, CA 95134

(Address of principal executive offices, including zip code)

(408) 325-8668

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company | x | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | x | ||||

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2019, A10 Networks, Inc. (the “Company”) issued a press release regarding financial results for the fourth quarter and the year ended December 31, 2018. The Company also posted on its website (www.a10networks.com) slides with accompanying prepared remarks regarding such financial results. Copies of the press release and slides with accompanying prepared remarks by the Company are attached as Exhibits 99.1 and 99.2, respectively, and the information in Exhibits 99.1 and 99.2 are incorporated herein by reference.

The information in Item 2.02 and Item 9.01 in this Current Report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Exhibit | Description |

99.1 | |

99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 7, 2019

A10 NETWORKS, INC. | |

By: /s/ Tom Constantino | |

Tom Constantino | |

Executive Vice President and Chief Financial Officer (Principal Accounting and Financial Officer) | |

EXHIBIT 99.1

A10 Networks Reports Fourth Quarter and Year 2018 Financial Results

SAN JOSE, Calif., Feb. 7, 2019 -- A10 Networks, Inc. (NYSE: ATEN), a leading provider of intelligent and automated cybersecurity solutions, today announced financial results for its fourth quarter and year ended Dec. 31, 2018.

Fourth Quarter 2018 Financial Summary

• | Revenue increased 11 percent to $61.8 million, compared with $55.5 million in fourth quarter 2017 |

• | GAAP gross margin of 77.7 percent, non-GAAP gross margin of 78.2 percent |

• | GAAP operating margin of (3.9) percent, non-GAAP operating margin of 5.3 percent |

• | GAAP net loss of $1.6 million, or $0.02 per basic and diluted share, non-GAAP net income of $4.1 million, or $0.05 per diluted share |

Year 2018 Financial Summary

• | Revenue of $232.2 million, compared with $235.4 million in 2017 |

• | GAAP gross margin of 77.7 percent, non-GAAP gross margin of 78.3 percent |

• | GAAP operating margin of (11.9) percent, non-GAAP operating margin of 0.4 percent |

• | GAAP net loss of $27.6 million, or $0.38 per basic and diluted share, non-GAAP net income of $0.9 million, or $0.01 per diluted share |

• | Ended the year with $128.4 million in cash, cash equivalents and marketable securities |

A reconciliation between GAAP and non-GAAP information is contained in the financial statements below.

“We are building solid momentum in the market with our advanced suite of 5G, security and multi-cloud solutions. Revenue increased 11 percent year-over-year to $61.8 million and our security product revenue grew to reach 38 percent of product revenue for the year, achieving our goal for the year. We also continue to make good progress with our sales transformation initiative and drove double-digit year-over-year product revenue growth in North America, Japan, APAC and Latin America,” said Lee Chen, president and chief executive officer of A10 Networks. “Our technology vision and differentiated platform is resonating with customers and we remain committed to increasing our pace of innovation, refining our go-to-market engine and improving our sales productivity. Our strategy is clear, our team is energized and we believe we are on the right path to maximize our opportunities in the fast-growing areas of security, 5G and multi-cloud.”

Prepared Materials and Conference Call Information

A10 Networks has made available a presentation with management’s prepared remarks on its fourth quarter and year 2018 financial results. These materials are accessible from the “Investor Relations” section of the A10 Networks website at investors.a10networks.com.

A10 Networks will host a conference call today at 4:30 p.m. Eastern time / 1:30 p.m. Pacific time for analysts and investors to discuss its fourth quarter and year 2018 financial results and outlook for its first quarter 2019. Open to the public, investors may access the call by dialing +1-844-792-3728 or +1-412-317-5105. A live audio webcast of the conference call will be accessible from the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. The webcast will be archived for a period of one year. A telephonic replay of the conference call will be available two hours after the call, will run for five business days, and may be accessed by dialing +1-877-344-7529 or +1-412-317-0088 and entering the passcode 10127435. The press release and supplemental financials will be accessible from the “Investor Relations” section of the A10 Networks website prior to the commencement of the conference call.

Forward-Looking Statements

This press release contains “forward-looking statements,” including statements regarding our projections for our future operating results, the pace of growth in the market for our solutions, our sales transformation initiative, our pace of innovation, the refining of our go-to-market engine, improving our sales productivity, our belief that we are on the right path, and our ability to maximize our opportunities. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on assumptions that may prove to be incorrect, which could cause actual results to differ materially from those expected or implied by the forward-looking statements. Factors that may cause actual results to differ include execution risks related to closing key deals and improving our execution, the continued market adoption of our products, our ability to successfully anticipate market needs and opportunities, our timely development of new products and features, our ability to achieve or maintain profitability, any loss or delay of expected purchases by our largest end-customers, our ability to attract and retain new end-customers, our ability to maintain and enhance our brand and reputation, continued growth in markets relating to network security, the success of any future acquisitions or investments in complementary companies, products, services or technologies, the ability of our sales team to execute well, our ability to shorten our close cycles, the ability of our channel partners to sell our products, variations in product mix or geographic locations of our sales and risks associated with our presence in international markets.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release and the accompanying table contain certain non-GAAP financial measures, including non-GAAP net income (loss), non-GAAP gross profit and non-GAAP operating income (loss). Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies.

A10 Networks considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used by the company's management for that purpose. We define non-GAAP net income (loss) as our GAAP net income (loss) excluding: (i) stock-based compensation, (ii) amortization expense related to acquisition and (iii) non-recurring expenses associated with the litigation and internal investigation. We define non-GAAP gross profit as our GAAP gross profit excluding stock-based compensation. We define non-GAAP operating income (loss) as our GAAP income (loss) from operations excluding (i) stock-based compensation, (ii) amortization expense related to acquisition and (iii) non-recurring expenses associated with the litigation and internal investigation.

We have included our non-GAAP net income (loss), non-GAAP gross profit and non-GAAP operating income (loss) in this press release. Non-GAAP financial measures are presented for supplemental informational purposes only for understanding the company's operating results. The non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from non-GAAP financial measures presented by other companies.

Please see the reconciliation of non-GAAP financial measures to the most directly comparable GAAP measure attached to this release.

About A10 Networks

A10 Networks (NYSE: ATEN) is a provider of intelligent and automated cybersecurity solutions, providing a portfolio of high-performance secure application solutions that enable intelligent automation with machine learning to ensure business-critical applications are secure and always available. Founded in 2004, A10 Networks is based in San Jose, Calif., and serves customers in more than 80 countries with offices worldwide. For more information, visit: www.a10networks.com and @A10Networks.

The A10 logo, A10 Networks, A10 Thunder and A10 5G-GiLAN are trademarks or registered trademarks of A10 Networks, Inc. in the United States and other countries. All other trademarks are the property of their respective owners.

Investor Contact:

Maria Riley & Chelsea Lish

The Blueshirt Group

415-217-7722

Source: A10 Networks, Inc.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share amounts)

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenue: | |||||||||||||||

Products | $ | 39,044 | $ | 32,973 | $ | 144,682 | $ | 149,903 | |||||||

Services | 22,781 | 22,544 | 87,541 | 85,526 | |||||||||||

Total revenue | 61,825 | 55,517 | 232,223 | 235,429 | |||||||||||

Cost of revenue: | |||||||||||||||

Products | 9,087 | 8,145 | 34,066 | 36,269 | |||||||||||

Services | 4,724 | 3,763 | 17,830 | 17,049 | |||||||||||

Total cost of revenue | 13,811 | 11,908 | 51,896 | 53,318 | |||||||||||

Gross profit | 48,014 | 43,609 | 180,327 | 182,111 | |||||||||||

Operating expenses: | |||||||||||||||

Sales and marketing | 25,983 | 22,606 | 103,214 | 101,360 | |||||||||||

Research and development | 15,283 | 13,462 | 65,157 | 62,991 | |||||||||||

General and administrative | 9,171 | 6,688 | 39,635 | 28,132 | |||||||||||

Total operating expenses | 50,437 | 42,756 | 208,006 | 192,483 | |||||||||||

Income (loss) from operations | (2,423 | ) | 853 | (27,679 | ) | (10,372 | ) | ||||||||

Non-operating income (expense): | |||||||||||||||

Interest expense | (30 | ) | (34 | ) | (129 | ) | (162 | ) | |||||||

Interest and other income (expense), net | 1,267 | 210 | 1,273 | 989 | |||||||||||

Total non-operating income (expense), net | 1,237 | 176 | 1,144 | 827 | |||||||||||

Income (loss) before income taxes | (1,186 | ) | 1,029 | (26,535 | ) | (9,545 | ) | ||||||||

Provision for income taxes | 422 | 243 | 1,082 | 1,206 | |||||||||||

Net income (loss) | $ | (1,608 | ) | $ | 786 | $ | (27,617 | ) | $ | (10,751 | ) | ||||

Net income (loss) per share: | |||||||||||||||

Basic | $ | (0.02 | ) | $ | 0.01 | $ | (0.38 | ) | $ | (0.15 | ) | ||||

Diluted | $ | (0.02 | ) | $ | 0.01 | $ | (0.38 | ) | $ | (0.15 | ) | ||||

Weighted-average shares used in computing net income (loss) per share: | |||||||||||||||

Basic | 73,865 | 71,145 | 72,882 | 70,053 | |||||||||||

Diluted | 73,865 | 74,559 | 72,882 | 70,053 | |||||||||||

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Continued)

(unaudited, in thousands, except per share amounts)

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

GAAP net income (loss) | $ | (1,608 | ) | $ | 786 | $ | (27,617 | ) | $ | (10,751 | ) | ||||

Stock-based compensation | 3,983 | 3,379 | 17,038 | 17,203 | |||||||||||

Amortization expense related to acquisition | 252 | 252 | 1,010 | 1,010 | |||||||||||

Litigation and investigation expense | 1,465 | — | 10,496 | — | |||||||||||

Non-GAAP net income | $ | 4,092 | $ | 4,417 | $ | 927 | $ | 7,462 | |||||||

Non-GAAP net income per share: | |||||||||||||||

Basic | $ | 0.06 | $ | 0.06 | $ | 0.01 | $ | 0.11 | |||||||

Diluted | $ | 0.05 | $ | 0.06 | $ | 0.01 | $ | 0.10 | |||||||

Weighted average shares used in computing non-GAAP net income per share: | |||||||||||||||

Basic | 73,865 | 71,145 | 72,882 | 70,053 | |||||||||||

Diluted | 75,737 | 74,559 | 75,222 | 74,270 | |||||||||||

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands)

December 31, 2018 | December 31, 2017 | ||||||

ASSETS | |||||||

Current Assets: | |||||||

Cash and cash equivalents | $ | 40,621 | $ | 46,567 | |||

Marketable securities | 87,754 | 84,567 | |||||

Accounts receivable, net of allowances | 53,972 | 48,266 | |||||

Inventory | 17,930 | 17,577 | |||||

Prepaid expenses and other current assets | 14,662 | 6,825 | |||||

Total current assets | 214,939 | 203,802 | |||||

Property and equipment, net | 7,262 | 9,913 | |||||

Goodwill | 1,307 | 1,307 | |||||

Intangible assets | 3,748 | 5,190 | |||||

Other non-current assets | 8,620 | 4,646 | |||||

Total Assets | $ | 235,876 | $ | 224,858 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current Liabilities: | |||||||

Accounts payable | $ | 8,202 | $ | 9,033 | |||

Accrued liabilities | 25,291 | 21,835 | |||||

Deferred revenue | 63,874 | 61,858 | |||||

Total current liabilities | 97,367 | 92,726 | |||||

Deferred revenue, non-current | 34,092 | 32,779 | |||||

Other non-current liabilities | 534 | 967 | |||||

Total liabilities | 131,993 | 126,472 | |||||

Stockholders’ Equity: | |||||||

Common stock and additional paid-in-capital | 376,273 | 355,534 | |||||

Accumulated other comprehensive loss | (144 | ) | (123 | ) | |||

Accumulated deficit (1) | (272,246 | ) | (257,025 | ) | |||

Total Stockholders' Equity | 103,883 | 98,386 | |||||

Total Liabilities and Stockholders' Equity | $ | 235,876 | $ | 224,858 | |||

(1) | The adoption of ASU 2014-09, Revenue from Contracts with Customers (Topic 606) in the first quarter of 2018 resulted in a reduction to the accumulated deficit balance of $12.4 million as of January 1, 2018. |

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Years Ended December 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (27,617 | ) | $ | (10,751 | ) | |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | |||||||

Depreciation and amortization | 7,880 | 8,511 | |||||

Stock-based compensation | 17,038 | 17,203 | |||||

Provision for doubtful accounts and sales returns | 212 | 1,147 | |||||

Other non-cash items | (68 | ) | (422 | ) | |||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | (6,119 | ) | 12,362 | ||||

Inventory | (1,529 | ) | (4,669 | ) | |||

Prepaid expenses and other assets | (2,434 | ) | (2,399 | ) | |||

Accounts payable | (603 | ) | (942 | ) | |||

Accrued and other liabilities | 3,116 | (8,868 | ) | ||||

Deferred revenue | 7,331 | 3,018 | |||||

Other | 99 | 124 | |||||

Net cash (used in) provided by operating activities | (2,694 | ) | 14,314 | ||||

Cash flows from investing activities: | |||||||

Proceeds from sales of marketable securities | 32,720 | 27,901 | |||||

Proceeds from maturities of marketable securities | 51,024 | 60,138 | |||||

Purchases of marketable securities | (86,823 | ) | (87,447 | ) | |||

Purchase of investment | (1,000 | ) | — | ||||

Purchases of property and equipment | (2,797 | ) | (5,734 | ) | |||

Net cash used in investing activities | (6,876 | ) | (5,142 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from issuance of common stock under employee equity incentive plans | 3,701 | 12,244 | |||||

Repurchases and retirement of common stock | — | (3,071 | ) | ||||

Payment of contingent consideration | — | (650 | ) | ||||

Other | (77 | ) | (103 | ) | |||

Net cash provided by financing activities | 3,624 | 8,420 | |||||

Net (decrease) increase in cash and cash equivalents | (5,946 | ) | 17,592 | ||||

Cash and cash equivalents - beginning of period | 46,567 | 28,975 | |||||

Cash and cash equivalents - end of period | $ | 40,621 | $ | 46,567 | |||

A10 NETWORKS, INC.

RECONCILIATION OF GAAP GROSS PROFIT TO NON-GAAP GROSS PROFIT

(unaudited, in thousands, except percentages)

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

GAAP gross profit | $ | 48,014 | $ | 43,609 | $ | 180,327 | $ | 182,111 | |||||||

GAAP gross margin | 77.7 | % | 78.6 | % | 77.7 | % | 77.4 | % | |||||||

Non-GAAP adjustments: | |||||||||||||||

Stock-based compensation | 325 | 294 | 1,602 | 1,362 | |||||||||||

Non-GAAP gross profit | $ | 48,339 | $ | 43,903 | $ | 181,929 | $ | 183,473 | |||||||

Non-GAAP gross margin | 78.2 | % | 79.1 | % | 78.3 | % | 77.9 | % | |||||||

RECONCILIATION OF GAAP OPERATING INCOME (LOSS) TO NON-GAAP OPERATING INCOME

(unaudited, in thousands, except percentages)

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

GAAP income (loss) from operations | $ | (2,423 | ) | $ | 853 | $ | (27,679 | ) | $ | (10,372 | ) | ||||

GAAP operating margin | (3.9 | )% | 1.5 | % | (11.9 | )% | (4.4 | )% | |||||||

Non-GAAP adjustments: | |||||||||||||||

Stock-based compensation | 3,983 | 3,379 | 17,038 | 17,203 | |||||||||||

Amortization expense related to acquisition | 252 | 252 | 1,010 | 1,010 | |||||||||||

Litigation and investigation expense | 1,465 | — | 10,496 | — | |||||||||||

Non-GAAP operating income | $ | 3,277 | $ | 4,484 | $ | 865 | $ | 7,841 | |||||||

Non-GAAP operating margin | 5.3 | % | 8.1 | % | 0.4 | % | 3.3 | % | |||||||

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 1 | Page

Maria Riley, Investor Relations Thank you all for joining us today. This call is being recorded and webcast live and may be accessed for one year via the A10 Networks website, www.a10networks.com. Members of A10's management team joining me today are, Lee Chen, Founder & CEO; Tom Constantino, CFO; and Chris White, EVP of worldwide sales. Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its fourth quarter and year 2018 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 2 | Page

During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our future operating results, the capabilities of our sales team, our expectations regarding future opportunities and our ability to execute on those opportunities, our commitment to innovation and bringing new solutions to market, our expectations for future revenue and market growth, the development and performance of our products, our current and future strategies, our beliefs relating to our competitive advantages, our expectations with respect to the 5G market, responses to new security threats, our partnerships with key technology providers, our ability to penetrate certain markets, anticipated customer benefits from use of our products, the refining of our marketing engine, improvements in productivity, our priorities relating to 5G, growth in our security solutions, expected product launches and adoption of recent new product or software releases, the general growth of our business, and our ability to incrementally grow operating margin annually and timeline to achieve our target operating margin. These statements are based on current expectations and beliefs as of today, February 7th, 2019. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially and you should not rely on them as predictions of future events. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. For a more detailed description of these risks and uncertainties, please refer to our most recent 10-Q and 10-K. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 3 | Page

Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. The non-GAAP financial measures are not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP, and may be different from non-GAAP financial measures presented by other companies. A reconciliation between GAAP and non- GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the first quarter of 2019, as well as our long-term model, on a non- GAAP basis. However, we are unable to make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Now I would like to turn the call over to Lee Chen, Founder and CEO of A10 Networks. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 4 | Page

Lee Chen, Founder & CEO Thank you, Maria and thank you all for joining us to discuss our fourth quarter and year 2018 results. We delivered a solid quarter and are pleased with our continued momentum in security, 5G and multi- cloud. Revenue increased 11 percent year-over-year to 61.8 million dollars, we maintained a healthy non-GAAP gross margin of 78.2 percent, and generated non-GAAP EPS of 5 cents. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 5 | Page

We have been investing in security and believe we are building momentum in the market with our highly scalable and intelligent automation driven software-based security solutions. We believe our performance, scalability and software-based solutions position us to grow in the hyper-scale converged security, 5G and multi-cloud world. In the quarter, we delivered a strong quarter for our security solutions, which included some nice wins for our CFW and SSLi offerings. For the year, our security product revenue grew 36 percent year-over-year to reach 38 percent of product revenue as customers continue to focus on security. Our holistic approach has resonated with our customers, and we remain committed to innovating and bringing new solutions to market. In TPS, we recently released a new version of software to include dynamic pattern recognition, enhanced detection analytic engine, intrusion prevention system, and support a new 220G high-end appliance. A10 continues to deliver on its mission of intelligent automation to reduce costs for our customers and we believe our solution stands out among the competition. We also enhanced our analytics and management software for TPS and CFW, and introduced a new multi-cloud secure service mesh solution for applications deployed in open-source Kubernetes container environments. This solution provides teams deploying micro-services applications with an easy, automated way to integrate enterprise-grade security and load-balancing with comprehensive application visibility and analytics. We believe these new solutions demonstrate our commitment to helping customers navigate the evolving multi-cloud threat landscape efficiently and affordably. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 6 | Page

5G is an exciting market opportunity for our security solutions. We believe our stronghold in the service provider segment and the high-performance and scalability of our solutions position us extremely well to meet the evolving security and performance needs of our 5G customers. Building upon our technology strengths, we have developed a robust suite of solutions to help mobile carriers meet the significant capacity, performance and security demands in the age of 5G. Our Thunder CFW, with integrated carrier firewall, multi-vector DDoS protection, Carrier Grade NAT, application visibility and traffic steering capabilities, is a great example of our product advances in this space. This differentiated high- performance solution provides a consolidated and secure 5G solution for an effective defense against attacks. We have been hard at work innovating across our entire product portfolio and our early bets on 5G have been paying off. We secured three additional 5G security wins, which build on the two we announced in the third quarter. These five operators are deploying A10’s 5G Gi-LAN solution in a variety of form factors, and plan to launch their first commercial 5G services in the first half of 2019. A10 has a long and successful relationship with these operators and we believe our design wins demonstrate our ability to gain share in this large and growing opportunity. As 5G adoption is still early, and related standards continue to evolve, we anticipate operators will experience a new set of challenges. Network architectures will require a full spectrum of physical, virtual, and containerized offerings that can handle multi-terabit scale with reliability, high agility and automated security. Additionally, big data and cutting-edge predictive analytics through AI and machine learning will emerge as key priorities in order to cope with the exploding scale of new security threats, such as IoT attacks. A10’s strength in high performance, rich carrier security offerings and network visibility position us well for 5G. Our Harmony Controller provides the necessary visibility and keeps the operator informed and in control of their networks. As a result, network operators will be able to scale and protect their network in real-time, and manage it from a single pane of glass. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 7 | Page

We have partnered with key technology providers to develop a product roadmap that will expand the capabilities of our 5G solutions to further propel our point position in this large and growing opportunity. In the fourth quarter, we expanded our partnership with NEC to now include the integration of A10’s CFW solution into NEC’s 5G SDN/NFV orchestration infrastructure. NEC was looking for a partner who could seamlessly consolidate security and application layer networking into NEC’s innovative mobile and fixed network solution offering. This partnership will help provide service providers with continuous protection from security challenges and help them to achieve the scale needed to rapidly commercialize their 5G services. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 8 | Page

I’m also excited to announce that we have partnered with Microsoft Azure to provide our cloud-native ADC solution, including our Harmony Controller vThunder ADC and Lightning ADC on the Microsoft Azure Marketplace. The flexibility and convenience of multi-cloud comes with its challenges, and our Harmony Controller solution, with its prescriptive data analysis and machine learning helps alleviate these issues. Harmony Controller is one of our growing number of products offered on a subscription basis and is driving more software subscription revenue. We believe this is a unique offering in the market today and is a large part of the discussion with our customers. Harmony Controller is also gaining industry recognition as it was recently named a finalist in the 2018 CRN Tech Innovator Awards and took top honors in the Business Intelligence and Analytics category. We are very excited about the market’s response to the many significant advancements we have made to our solutions. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 9 | Page

I would now like to spend a moment on our sales transformation, which was a major priority for us in 2018. We made good progress during the quarter. We improved sales productivity by 7 percent year- over-year and were pleased to see double-digit product revenue growth in North America, Japan, APAC and Latin America. We are also encouraged to see our pipeline of security opportunities increase 31 percent year-over-year. While it is still early in our sales transformation, we are pleased with the early results and believe we are on the right path. As we enter the new year, we have several changes taking effect to help further incentivize the sales team to drive new product sales with both new and existing accounts. We are also expanding our go-to-market technical leadership with the recent appointment of Ravi Raj Bhat as senior vice president and global field sales CTO. Ravi joins A10 from Ericsson where he was vice president of engineering. We believe his extensive service provider expertise will be instrumental in helping A10 capture share in 5G and expand our global alliances. We just wrapped up our annual Sales Kick off and I have to tell you that the energy level and enthusiasm was dynamic. Our partners, our product teams, our field personnel, and all of us at A10, are energized. Together, we will build on this momentum. We have a very clear vision, a line of sight to what we will accomplish and our salesforce is eager to monetize the company’s growth opportunities in security, 5G and multi-cloud. We have subscription only platforms set to grow, we have innovative products set to arrive and all this is being led by new sales leaders eager to win. With clarity of vision and focus on execution, we are excited about what we can achieve this year and beyond. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 10| Page

We are building a strong funnel of opportunities for our security, 5G and multi-cloud solutions. Our win rate remains high and in total we added 162 new customers in the quarter. Let me share with you some recent customer engagements: • A multinational retailer based in the U.S. looking to redesign the perimeter of its network and replace the incumbent’s proxy solution has standardized on A10’s Thunder SSLi solution globally. This A10 customer will deploy Thunder SSLi to decrypt outbound traffic and provide visibility and control over traffic management. This win is an expansion of a new logo that we won earlier in 2018, and we are pleased with our continued traction with this customer. • A federal executive department replaced an incumbent solution with A10’s Thunder SSLi solution and Harmony controller to reduce the load on its existing firewall assets and provide a single decryption architecture. The key to winning this new customer was A10’s superior SSLi performance, analytics and engineering support. • Alongside our partner, Ericsson, we secured a new service provider customer in Latin America. This customer will deploy our CGN solution in Brazil, Colombia and Argentina as part of its virtual evolved packet core. A10 provided the most affordable and comprehensive set of features, which were key selling points for this customer. Moreover, the customer saw immense value in our partnership and integrated offerings with Ericsson. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 11 | Page

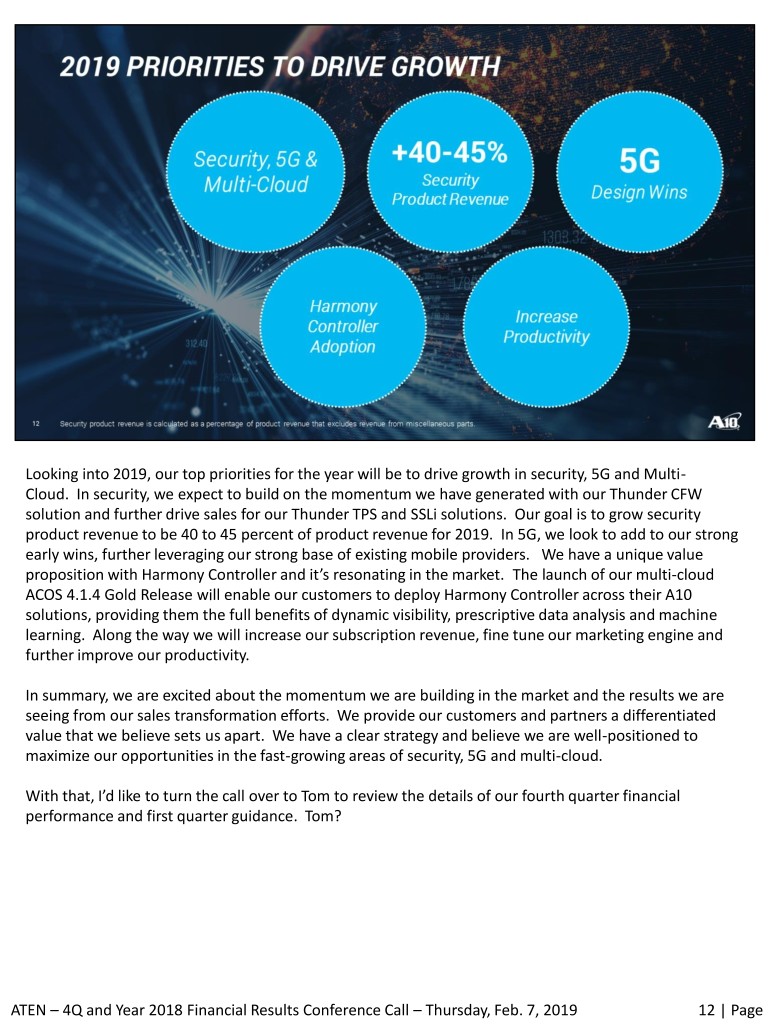

Looking into 2019, our top priorities for the year will be to drive growth in security, 5G and Multi- Cloud. In security, we expect to build on the momentum we have generated with our Thunder CFW solution and further drive sales for our Thunder TPS and SSLi solutions. Our goal is to grow security product revenue to be 40 to 45 percent of product revenue for 2019. In 5G, we look to add to our strong early wins, further leveraging our strong base of existing mobile providers. We have a unique value proposition with Harmony Controller and it’s resonating in the market. The launch of our multi-cloud ACOS 4.1.4 Gold Release will enable our customers to deploy Harmony Controller across their A10 solutions, providing them the full benefits of dynamic visibility, prescriptive data analysis and machine learning. Along the way we will increase our subscription revenue, fine tune our marketing engine and further improve our productivity. In summary, we are excited about the momentum we are building in the market and the results we are seeing from our sales transformation efforts. We provide our customers and partners a differentiated value that we believe sets us apart. We have a clear strategy and believe we are well-positioned to maximize our opportunities in the fast-growing areas of security, 5G and multi-cloud. With that, I’d like to turn the call over to Tom to review the details of our fourth quarter financial performance and first quarter guidance. Tom? ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 12 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 13 | Page

Tom Constantino, CFO Thank you Lee. Fourth quarter revenue increased 11 percent year-over-year to 61.8 million dollars, compared with 55.5 million dollars in the same period last year. For the year, we generated revenue of 232.2 million dollars, compared with 235.4 million dollars in 2017. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 14 | Page

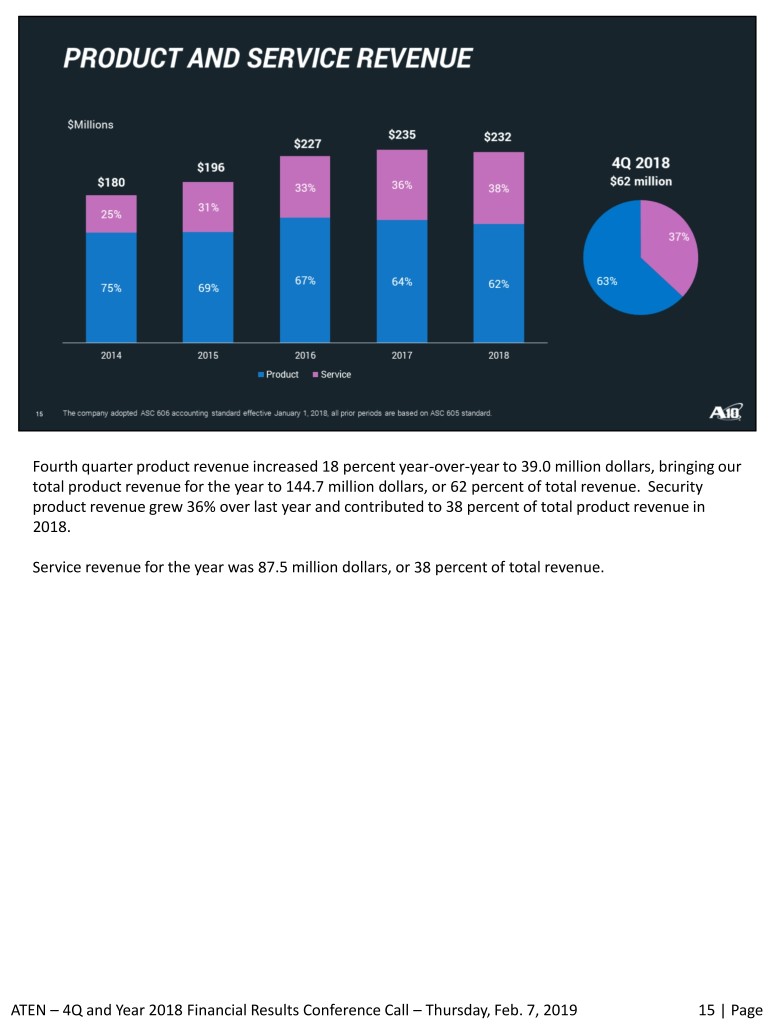

Fourth quarter product revenue increased 18 percent year-over-year to 39.0 million dollars, bringing our total product revenue for the year to 144.7 million dollars, or 62 percent of total revenue. Security product revenue grew 36% over last year and contributed to 38 percent of total product revenue in 2018. Service revenue for the year was 87.5 million dollars, or 38 percent of total revenue. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 15 | Page

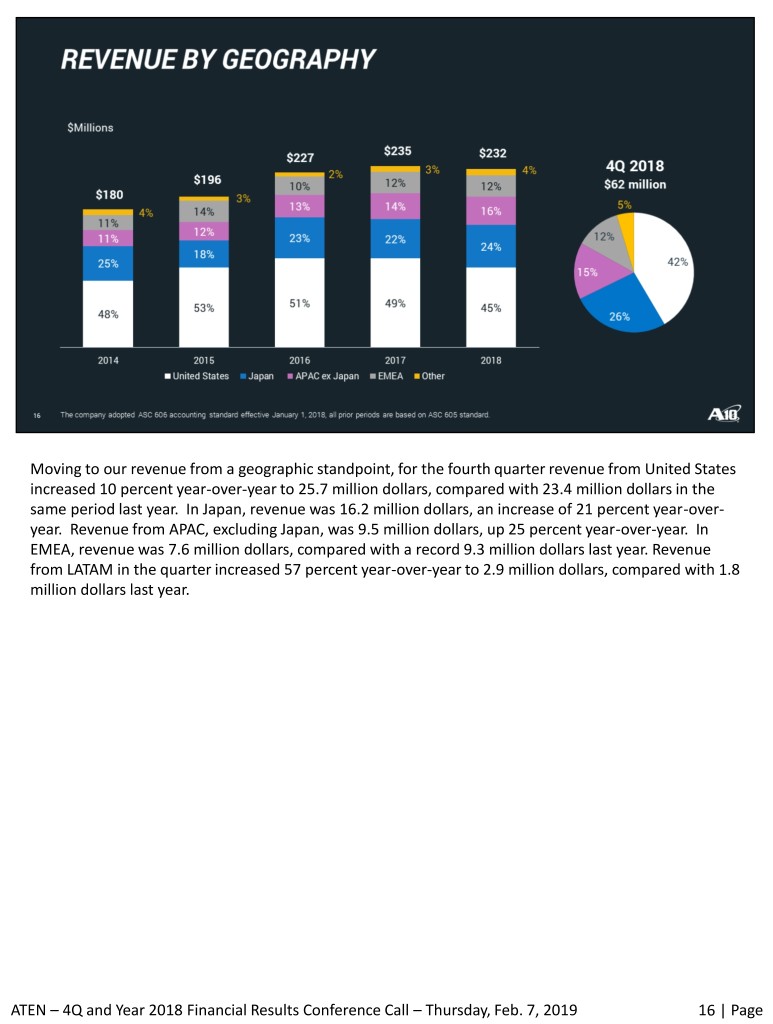

Moving to our revenue from a geographic standpoint, for the fourth quarter revenue from United States increased 10 percent year-over-year to 25.7 million dollars, compared with 23.4 million dollars in the same period last year. In Japan, revenue was 16.2 million dollars, an increase of 21 percent year-over- year. Revenue from APAC, excluding Japan, was 9.5 million dollars, up 25 percent year-over-year. In EMEA, revenue was 7.6 million dollars, compared with a record 9.3 million dollars last year. Revenue from LATAM in the quarter increased 57 percent year-over-year to 2.9 million dollars, compared with 1.8 million dollars last year. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 16 | Page

We are changing the way we disclose our revenue by customer vertical in order to provide more transparency into our exposure to Web Giant and Cloud customer revenue, which was previously primarily accounted for in Enterprise revenue. We will now report three customer verticals: Service Provider, Enterprise and Web Giant. Service provider revenue in the quarter increased 28 percent year-over-year to 28.1 million dollars, or 45 percent of revenue. For the year, Service Provider revenue was 99.5 million dollars, or 43 percent of revenue. Enterprise revenue in the quarter declined 11 percent year-over-year to reach 24.1 million dollars, bringing our total Enterprise revenue to 91.1 million for the year, or 39 percent of revenue. Our Web Giant revenue grew 46 percent year-over-year to 9.6 million in the quarter, and was 41.6 million for the year, or 18 percent of revenue. As we move beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless stated otherwise. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 17 | Page

We delivered fourth quarter total gross margin of 78.2 percent, and our total gross margin for the year was 78.3 percent, an increase of 40 basis points from last year. Fourth quarter product gross margin was 76.8 percent, an increase of 140 basis points from Q4 of 2017. Our year-over-year improvement in product gross margin was driven by a higher mix of software and security revenue. Services gross margin in the quarter came in at 80.6 percent, compared to 84.5 percent in Q4 of 2017. We ended the quarter with headcount of 860 compared with 875 at the end of last quarter. The decrease in headcount was primarily in international sales as our new leaders transform their teams in preparation for 2019. Non-GAAP operating expenses in Q4 came in at 45.1 million dollars, which is well-below our guidance, and was flat compared to the prior quarter. Non-GAAP operating income was 3.3 million dollars, compared with 2.5 million dollars in the prior quarter. Non-GAAP net income for the quarter was 4.1 million dollars, or 5 cents per diluted share, compared with 4.4 million dollars, or 6 cents per diluted share in Q4 of last year. Diluted shares used for computing non-GAAP EPS for the fourth quarter were approximately 75.7 million shares. Moving to the balance sheet, average days sales outstanding were 80 days, up from 78 in the prior quarter. At December 31, 2018 we had 128.4 million dollars in total cash and marketable securities, compared with 123.6 million dollars at the end of September. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 18 | Page

Before moving to our outlook for the first quarter, I would like to make a couple comments regarding our long-term model and path to achieve it. We will continue to focus on the growth areas of our market: security, 5G and multi-cloud; further improvements in our go-to-market transformation and continued disciplined focus on expense control. With these efforts, we expect to be able to deliver incremental operating margin each year and to progress to our target operating margin of 20 percent or greater within 3 to 5 years. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 19 | Page

Moving on to our outlook for the first quarter. We currently expect first quarter revenue to be in the range of 49 million to 53 million dollars. We expect gross margin to be in the 77 to 79 percent range and operating expenses to be between 44 million and 45 million dollars. We expect our non-GAAP bottom line results to be between a loss of 10 cents and a loss of 3 cents per share using a share count of approximately 74.5 million basic shares. Operator, you can now open the call up for questions. ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 20 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 21 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 22 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 23 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 24 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 25 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 26 | Page

ATEN – 4Q and Year 2018 Financial Results Conference Call – Thursday, Feb. 7, 2019 27 | Page