Form 8-K ADVANCED MICRO DEVICES For: Jan 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 28, 2019

Date of Report (Date of earliest event reported)

ADVANCED MICRO DEVICES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-07882 | 94-1692300 | ||

(State of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||

2485 Augustine Drive

Santa Clara, California 95054

(Address of principal executive offices) (Zip Code)

(408) 749-4000

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement

Seventh Amendment to the Wafer Supply Agreement

On January 28, 2019, Advanced Micro Devices, Inc. (the “Company”) entered into a seventh amendment (the “Seventh Amendment”) to the Wafer Supply Agreement with GLOBALFOUNDRIES Inc. (“GF”). The Seventh Amendment modifies certain purchase commitments, pricing and other terms of the Wafer Supply Agreement applicable to wafer purchases at the 12 nm technology node and above by the Company for the period commencing on January 1, 2019 and continuing through March 1, 2024.

The Seventh Amendment also provides the Company with full flexibility to contract with any wafer foundry with respect to all products manufactured using 7nm and smaller technology nodes without any one-time payments or royalties by the Company to GF.

Further, the Company and GF agreed to modify the annual wafer purchase targets previously agreed to in the sixth amendment to the Wafer Supply Agreement for years 2019 and 2020. The parties also agreed to an annual wafer purchase target for 2021 and agreed to pricing for wafers purchased for years 2019, 2020 and 2021. If the Company does not meet the annual wafer purchase target for any of these years, the Company will be required to pay to GF a portion of the difference between the actual wafer purchases and the wafer purchase target for that year. The Company expects that its future purchases from GF will be material under the Wafer Supply Agreement, which is in place until 2024.

The foregoing description is not complete and is qualified in its entirety by reference to the Seventh Amendment, a copy of which will be filed with a Quarterly Report on Form 10-Q.

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

The information in this report furnished pursuant to Items 2.02 and 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically references the information furnished pursuant to Items 2.02 and 7.01 of this report.

On January 29, 2019, the Company announced its financial position and results of operations as of and for its fiscal quarter and fiscal year ended December 29, 2018 in a press release that is attached hereto as Exhibit 99.1. Attached hereto as Exhibit 99.2 is a presentation regarding the Company's fiscal quarter and fiscal year ended December 29, 2018.

The Company will hold a conference call on January 29, 2019 at 2:30 p.m. PT (5:30 p.m. ET) to discuss its fiscal quarter and fiscal year ended December 29, 2018 financial results and forward-looking financial guidance.

To supplement the Company’s financial results presented on a U.S. Generally Accepted Accounting Principles (“GAAP”) basis, the Company’s earnings press release contains non-GAAP financial measures, including non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP earnings (loss) per share, Adjusted EBITDA and free cash flow. The Company believes that the supplemental non-GAAP financial measures assist investors in comparing the Company's core performance by excluding items that it believes are not indicative of the Company’s underlying operating performance. The Company cautions investors to carefully evaluate the financial results calculated in accordance with GAAP and the supplemental non-GAAP financial measures and reconciliations. The Company’s non-GAAP financial measures are not intended to be considered in isolation and are not a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Forward Looking Statements

This Current Report on Form 8-K contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements reflect current expectations and projections about future events and thus involve uncertainty and risk. It is possible that future events may differ from expectations due to a variety of risks and other factors such as those described in the Company's Quarterly Report on Form 10-Q for the quarter ended September 29, 2018, as filed with the U.S. Securities and Exchange Commission. It is not possible to foresee or identify all such factors. Any forward-looking statements in this Current Report on Form 8-K are based on certain assumptions and analyses made in light of AMD’s experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. AMD does not intend to update any particular forward-looking statements contained in this Current Report on Form 8-K.

EXHIBIT INDEX | ||

Exhibit No. | Description | |

99.1 | ||

99.2 | ||

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 29, 2019 | ADVANCED MICRO DEVICES, INC. | ||

By: | /s/ Devinder Kumar | ||

Name: | Devinder Kumar | ||

Title: | Senior Vice President, Chief Financial Officer & Treasurer | ||

NEWS RELEASE

Media Contact:

Drew Prairie

AMD Communications

512-602-4425

Investor Contact

Laura Graves

AMD Investor Relations

408-749-5467

AMD Reports Fourth Quarter and Annual 2018 Financial Results

- Annual revenue grew by more than $1.2 billion with highest profitability in 7 years -

SANTA CLARA, Calif. - Jan. 29, 2019 - AMD (NASDAQ: AMD) today announced revenue for fiscal year 2018 of $6.48 billion, operating income of $451 million, net income of $337 million and diluted earnings per share of $0.32. On a non-GAAP(1) basis, operating income was $633 million, net income was $514 million and diluted earnings per share was $0.46.

For the fourth quarter of 2018, the Company reported revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. On a non-GAAP(1) basis, operating income was $109 million, net income was $87 million and diluted earnings per share was $0.08.

Annual Financial Results

GAAP | Non-GAAP | |||||

2018 | 2017 | Y/Y | 2018 | 2017 | Y/Y | |

Revenue ($B) | $6.48 | $5.25 | Up 23% | $6.48 | $5.25 | Up 23% |

Gross margin | 38% | 34% | Up 4 pp | 39% | 34% | Up 5 pp |

Operating expense ($M) | $1,996 | $1,712 | Up $284 | $1,863 | $1,617 | Up $246 |

Operating income ($M) | $451 | $127 | Up $324 | $633 | $224 | Up $409 |

Net income (loss) ($M) | $337 | $(33) | Up $370 | $514 | $103 | Up $411 |

Earnings (loss) per share | $0.32 | $(0.03) | Up $0.35 | $0.46 | $0.10 | Up $0.36 |

GAAP Quarterly Financial Results

Q4 2018 | Q4 2017 | Y/Y | Q3 2018 | Q/Q | |

Revenue ($B) | $1.42 | $1.34 | Up 6% | $1.65 | Down 14% |

Gross margin | 38% | 34% | Up 4 pp | 40% | Down 2 pp |

Operating expense ($M) | $509 | $454 | Up $55 | $511 | Down $2 |

Operating income (loss) ($M) | $28 | $(2) | Up $30 | $150 | Down $122 |

Net income (loss) ($M) | $38 | $(19) | Up $57 | $102 | Down $64 |

Earnings (loss) per share | $0.04 | $(0.02) | Up $0.06 | $0.09 | Down $0.05 |

1

Non-GAAP(1) Quarterly Financial Results

Q4 2018 | Q4 2017 | Y/Y | Q3 2018 | Q/Q | |

Revenue ($B) | $1.42 | $1.34 | Up 6% | $1.65 | Down 14% |

Gross margin | 41% | 34% | Up 7 pp | 40% | Up 1 pp |

Operating expense ($M) | $474 | $433 | Up $41 | $476 | Down $2 |

Operating income ($M) | $109 | $19 | Up $90 | $186 | Down $77 |

Net income ($M) | $87 | $8 | Up $79 | $150 | Down $63 |

Earnings per share | $0.08 | $0.01 | Up $0.07 | $0.13 | Down $0.05 |

"In 2018 we delivered our second straight year of significant revenue growth, market share gains, expanded gross margin and improved profitability based on our high-performance products. Importantly, we more than doubled our EPYC processor shipments sequentially and delivered record GPU datacenter revenue in the quarter," said Dr. Lisa Su, AMD president and CEO. “Despite near-term graphics headwinds, 2019 is shaping up to be another exciting year driven by the launch of our broadest and most competitive product portfolio ever with our next-generation 7nm Ryzen, Radeon, and EPYC products.”

2018 Annual Results

• | Revenue of $6.48 billion was up 23 percent year-over-year primarily driven by higher revenue in the Computing and Graphics segment. |

• | Gross margin was 38 percent compared to 34 percent for the prior year. Non-GAAP(1) gross margin was 39 percent compared to 34 percent in the prior year. Gross margin expansion was primarily driven by our new Ryzen TM, EPYC TM and Radeon TM products. |

• | Operating income was $451 million compared to $127 million in the prior year. Non-GAAP operating income was $633 million compared to $224 million in the prior year. The operating income improvement was primarily due to higher revenue and gross margin expansion partially offset by higher operating expenses. |

• | Net income was $337 million compared to a net loss of $33 million in the prior year. Non-GAAP net income was $514 million compared to $103 million in the prior year. |

• | Diluted earnings per share was $0.32 compared to a loss per share of $0.03 in 2017. Non-GAAP diluted earnings per share was $0.46 compared to $0.10 in the prior year. |

• | Cash, cash equivalents and marketable securities were $1.16 billion at the end of the year, down slightly from $1.18 billion at the end of 2017. |

• | Free cash flow was negative $129 million for the year due to higher inventory related to new products and to the timing of collections. |

Q4 2018 Results

• | Revenue of $1.42 billion was up 6 percent year-over-year primarily driven by the Computing and Graphics segment. Revenue was down 14 percent compared to the prior quarter as a result of |

2

lower revenue in the Enterprise, Embedded and Semi-Custom segment. Third quarter 2018 included approximately $125 million of IP-related revenue.

• | Gross margin was 38 percent compared to 34 percent a year ago and 40 percent in the prior quarter. Fourth quarter gross margin included a $45 million charge related to older technology licenses that are no longer being used. Non-GAAP gross margin was 41 percent compared to 34 percent a year ago and 40 percent in the prior quarter. Gross margin improvements were primarily driven by Ryzen and EPYC processor sales. |

• | Operating income was $28 million compared to an operating loss of $2 million a year ago and operating income of $150 million in the prior quarter. On a non-GAAP basis, operating income was $109 million compared to $19 million a year ago and $186 million in the prior quarter. The year-over-year improvement was primarily due to the ramp of higher margin products in the Computing and Graphics segment. The decrease compared to the prior quarter was primarily due to seasonally lower Enterprise, Embedded and Semi-Custom segment revenue and the absence of IP-related revenue, partially offset by the benefit of new Ryzen, EPYC and Radeon products. |

• | Net income was $38 million compared to a net loss of $19 million a year ago and net income of $102 million in the prior quarter. On a non-GAAP basis, net income was $87 million compared to $8 million a year ago and $150 million in the prior quarter. |

• | Diluted earnings per share was $0.04 compared to a loss per share of $0.02 a year ago and diluted earnings per share of $0.09 in the prior quarter. On a non-GAAP basis, diluted earnings per share was $0.08 compared to $0.01 a year ago and $0.13 in the prior quarter. |

• | Cash, cash equivalents and marketable securities were $1.16 billion at the end of the quarter as compared to $1.06 billion at the end of the prior quarter. |

• | Free cash flow was $79 million for the quarter. |

Quarterly Financial Segment Summary

• | Computing and Graphics segment revenue was $986 million, up 9 percent year-over-year and 5 percent compared to the prior quarter driven by strong sales of Ryzen processors. |

• | Operating income was $115 million compared to $33 million a year ago and $100 million in the prior quarter. The year-over-year improvement was primarily driven by the ramp of Ryzen processors. The improvement compared to the prior quarter was primarily driven by Ryzen processors and datacenter GPUs, which more than offset the benefit of IP-related revenue in the third quarter of 2018. |

• | Client processor average selling price (ASP) was up year-over-year and sequentially driven by Ryzen processor sales. |

• | GPU ASP was up year-over-year and sequentially primarily due to higher datacenter GPU sales. |

3

• | Enterprise, Embedded and Semi-Custom segment revenue was $433 million, flat year-over-year. Revenue declined 39 percent compared to the prior quarter driven by seasonally lower semi-custom sales, partially offset by strong EPYC datacenter processor sales. |

• | Operating loss was $6 million compared to an operating loss of $13 million a year ago and operating income of $86 million in the prior quarter. The year-over-year improvement was primarily due to higher EPYC datacenter processor revenue partially offset by lower semi-custom sales and server-related investments. The decrease compared to the prior quarter was due to seasonally lower semi-custom sales, partially offset by higher EPYC datacenter processor revenue. |

• | All Other operating loss was $81 million compared to operating losses of $22 million year-over-year and $36 million in the prior quarter, primarily due to the $45 million charge related to older technology licenses. |

Wafer Supply Agreement Update

Today AMD announced it entered into a seventh amendment to its wafer supply agreement with GLOBALFOUNDRIES Inc. (GF). GF continues to be a long-term strategic partner to AMD for the 12nm node and above and the amendment establishes purchase commitments and pricing at 12 nm and above for the years 2019 through 2021. The amendment provides AMD full flexibility for wafer purchases from any foundry at the 7nm node and beyond without any one-time payments or royalties.

Recent PR Highlights

• | At CES 2019, AMD highlighted leaps in computing, gaming and visualization technologies expected this year based on a combination of the advanced computing and graphics designs and leading-edge 7nm manufacturing. |

• | AMD unveiled the Radeon™ VII graphics card, the world’s first 7nm gaming GPU, which features 2X the memory and 2.1X the memory bandwidth and is designed to deliver up to 29 percent higher gaming performance and up to 36 percent higher content creation performance compared to the previous generation. It is expected to be available February 2019. |

• | AMD delivered the first public demonstration of its 3rd Generation AMD Ryzen™ processor, a high performance and highly efficient desktop processor expected to be available in mid-2019. |

• | AMD announced a comprehensive notebook processor line up that further expands the company’s footprint in this growing PC market segment: |

• | 2nd Gen AMD Ryzen™ 3000 Series Mobile Processors for ultrathin notebooks |

• | AMD Athlon™ 300 Series Mobile Processors for mainstream notebooks based on the “Zen” core architecture |

4

• | AMD 7th Generation A-Series processors, the company’s first-ever solutions targeting the growing Chromebook market. Acer and HP both launched products based on these new processors at the tradeshow. |

• | AMD also demonstrated the next generation AMD EPYC processors, delivering a significant increase in datacenter processing performance compared to current server processors. The next generation AMD EPYC processor is on track to start shipping in mid-2019. |

• | AMD joined the NASDAQ-100® Index composed of the 100 largest non-financial companies listed on The NASDAQ Stock Market® based on market capitalization. |

• | At AMD’s Next Horizon event in November, the Company demonstrated 7nm compute and graphics products delivering datacenter innovation: |

• | AMD launched the world’s first 7nm datacenter GPUs, the AMD Radeon Instinct™ MI60 and MI50 accelerators, designed for deep learning, HPC, cloud computing and rendering workloads. |

• | AMD shared new details on its upcoming “Zen 2” processor core architecture, including its revolutionary chiplet-based x86 CPU design which leverages AMD Infinity Fabric interconnect to link separate pieces of silicon within a single processor package. AMD provided the first public demonstration of the “Zen 2” core with its upcoming next-generation AMD EPYC processor, offering up to 64-cores per socket and revolutionary I/O. |

• | AMD announced ROCm 2.0, a new version of its open-source software platform that allows customers to deploy high-performance, energy-efficient heterogeneous computing systems in an open environment. |

• | New datacenter design wins and deployments demonstrate the power of AMD EPYC and AMD Radeon Instinct products for high-performance computing applications: |

• | Amazon Web Services announced the availability of the first EPYC processor-based instances on Amazon Elastic Compute Cloud. |

• | Lawrence Livermore National Laboratories and the High-Performance Computing Center of the University of Stuttgart selected AMD EPYC CPUs and AMD Radeon Instinct™ GPUs to power their new supercomputers. |

• | The Department of Energy announced the new AMD EPYC processor-powered NERSC-9 supercomputer, “Perlmutter,” scheduled for delivery in 2020. |

• | AMD further expanded the number one selling high-end desktop processor family with the availability of new AMD Ryzen™ Threadripper™ processors, powering the ultimate computing experiences for gamers, creators and enthusiasts. AMD also introduced new AMD Athlon™ processors with Radeon™ Vega graphics. |

• | AMD provided gamers and creators with powerful new graphics and software solutions: |

5

• | AMD unveiled AMD Radeon™ Vega Mobile graphics processors, including the AMD Radeon™ Pro Vega 20 and Radeon™ Pro Vega 16 graphics, which are available in Apple’s 15-inch MacBook Pro. Radeon Vega Mobile graphics enable creators with amazing performance in creative applications and deliver stunning 1080p HD gaming. |

• | AMD introduced the Radeon™ RX 590, an advanced 12nm GPU powered by the AMD “Polaris” architecture, delivering amazing gaming experiences and outstanding performance for the latest AAA, esports and VR game titles. |

• | AMD released the next generation of its consumer-focused software suite for Radeon GPUs, AMD Radeon™ Software Adrenalin 2019 Edition, delivering up to 15 percent average higher performance for some of today’s top game titles compared to the previous version, and new features such as device-independent wireless PC-to-VR streaming. |

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement” below.

For the first quarter of 2019, AMD expects revenue to be approximately $1.25 billion, plus or minus $50 million, a decrease of approximately 12 percent sequentially and 24 percent year-over-year. The sequential decrease is expected to be primarily driven by continued softness in the graphics channel and seasonality across the business. The year-over-year decrease is expected to be primarily driven by lower graphics sales due to excess channel inventory, the absence of blockchain-related GPU revenue and lower memory sales. In addition, semi-custom revenue is expected to be lower year-over-year while Ryzen, EPYC and Radeon datacenter GPU product sales are expected to increase. AMD expects non-GAAP gross margin to be approximately 41 percent in the first quarter of 2019. In addition, the Company expects to record a $60 million IP licensing gain which will be a benefit to operating income and recorded on the licensing gain line of the P&L.

For full year 2019, AMD expects high single digit percentage revenue growth driven by Ryzen, EPYC and Radeon datacenter GPU product sales as the Company ramps 7nm products throughout the year. AMD expects non-GAAP gross margin to be greater than 41 percent for 2019.

AMD Teleconference

AMD will hold a conference call for the financial community at 2:30 p.m. PT (5:30 p.m. ET) today to discuss its fourth quarter and fiscal year 2018 financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its website at www.amd.com. The webcast will be available for 12 months after the conference call.

6

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | ||||||||||||||||||||

(In millions, except per share data) | Three Months Ended | Year Ended | ||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||

GAAP gross margin | $ | 537 | $ | 661 | $ | 452 | $ | 2,447 | $ | 1,787 | ||||||||||

GAAP gross margin % | 38 | % | 40 | % | 34 | % | 38 | % | 34 | % | ||||||||||

Impairment of technology licenses | 45 | — | — | 45 | — | |||||||||||||||

Stock-based compensation | 1 | 1 | — | 4 | 2 | |||||||||||||||

Non-GAAP gross margin | $ | 583 | $ | 662 | $ | 452 | $ | 2,496 | $ | 1,789 | ||||||||||

Non-GAAP gross margin % | 41 | % | 40 | % | 34 | % | 39 | % | 34 | % | ||||||||||

GAAP operating expenses | $ | 509 | $ | 511 | $ | 454 | $ | 1,996 | $ | 1,712 | ||||||||||

Stock-based compensation | 35 | 35 | 21 | 133 | 95 | |||||||||||||||

Non-GAAP operating expenses | $ | 474 | $ | 476 | $ | 433 | $ | 1,863 | $ | 1,617 | ||||||||||

GAAP operating income (loss) | $ | 28 | $ | 150 | $ | (2 | ) | $ | 451 | $ | 127 | |||||||||

Impairment of technology licenses | 45 | — | — | 45 | — | |||||||||||||||

Stock-based compensation | 36 | 36 | 21 | 137 | 97 | |||||||||||||||

Non-GAAP operating income | $ | 109 | $ | 186 | $ | 19 | $ | 633 | $ | 224 | ||||||||||

Three Months Ended | Year Ended | |||||||||||||||||||||||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||||||||||||||||||||||

GAAP net income (loss) / earnings (loss) per share | $ | 38 | $ | 0.04 | $ | 102 | $ | 0.09 | $ | (19 | ) | $ | (0.02 | ) | $ | 337 | $ | 0.32 | $ | (33 | ) | $ | (0.03 | ) | ||||||||||||||||

Loss on debt redemption | 5 | — | 6 | — | 3 | — | 12 | 0.01 | 12 | 0.01 | ||||||||||||||||||||||||||||||

Non-cash interest expense related to convertible debt | 6 | 0.01 | 6 | 0.01 | 5 | — | 24 | 0.02 | 22 | 0.02 | ||||||||||||||||||||||||||||||

Stock-based compensation | 36 | 0.03 | 36 | 0.03 | 21 | 0.02 | 137 | 0.11 | 97 | 0.09 | ||||||||||||||||||||||||||||||

Gain on sale of 85% of ATMP | — | — | — | — | (3 | ) | — | — | — | (3 | ) | — | ||||||||||||||||||||||||||||

Tax provision related to sale of 85% of ATMP JV | — | — | — | — | 1 | — | — | — | 1 | — | ||||||||||||||||||||||||||||||

Impairment of technology licenses | 45 | 0.04 | — | — | — | — | 45 | 0.04 | — | — | ||||||||||||||||||||||||||||||

Equity loss in investee | — | — | — | — | — | — | 2 | — | 7 | 0.01 | ||||||||||||||||||||||||||||||

Withholding tax refund including interest | (43 | ) | (0.04 | ) | — | — | — | — | (43 | ) | (0.04 | ) | — | — | ||||||||||||||||||||||||||

Non-GAAP net income / earnings per share | $ | 87 | $ | 0.08 | $ | 150 | $ | 0.13 | $ | 8 | $ | 0.01 | $ | 514 | $ | 0.46 | $ | 103 | $ | 0.10 | ||||||||||||||||||||

Shares used and net income adjustment in earnings (loss) per share calculation | ||||||||||||||||||||||||||||||||||||||||

Shares used in per share calculation (GAAP) (1) | 1,079 | 1,076 | 965 | 1,064 | 952 | |||||||||||||||||||||||||||||||||||

Interest expense add-back to GAAP net income | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||||||||||

Shares used in per share calculation (Non-GAAP) | 1,180 | 1,177 | 1,037 | 1,165 | 1,039 | |||||||||||||||||||||||||||||||||||

Interest expense add-back to Non-GAAP net income (2) | $ | 5 | $ | 4 | $ | — | $ | 18 | $ | — | ||||||||||||||||||||||||||||||

(1) The three months and year ended December 30, 2017 GAAP net loss per share is calculated using basic shares. | ||||||||||||||||||||||||||||||||||||||||

(2) The three months and year ended December 30, 2017 do not include 100.6 million shares related to the conversion of the Company’s 2026 Convertible Notes and the interest expense add-back to Non-GAAP net income because their inclusion would have been anti-dilutive under the "if-converted' method. | ||||||||||||||||||||||||||||||||||||||||

7

About AMD

For nearly 50 years, AMD has driven innovation in high-performance computing, graphics and visualization technologies - the building blocks for gaming, immersive platforms and the datacenter. Hundreds of millions of consumers, leading Fortune 500 businesses and cutting-edge scientific research facilities around the world rely on AMD technology daily to improve how they live, work and play. AMD employees around the world are focused on building great products that push the boundaries of what is possible. For more information about how AMD is enabling today and inspiring tomorrow, visit the AMD (NASDAQ: AMD) website, blog, Facebook and Twitter pages.

8

Cautionary Statement

This document contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD) such as the features, functionality, availability, timing and expected benefits of AMD’s future products and technologies including, Radeon™ VII graphics processors, AMD’s 3rd Generation AMD Ryzen™ processors, and the next generation AMD EPYC™ processors, codenamed “Rome”; AMD’s expected first quarter 2019 and fiscal 2019 financial outlook including, revenue along with the expected drivers of such revenue, and non-GAAP gross margin; and expected IP licensing gain, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements are commonly identified by words such as "would," "may," "expects," "believes," "plans," "intends," "projects" and other terms with similar meaning. Investors are cautioned that the forward-looking statements in this document are based on current beliefs, assumptions and expectations, speak only as of the date of this document and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD's control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: Intel Corporation’s dominance of the microprocessor market and its aggressive business practices may limit AMD’s ability to compete effectively; AMD has a wafer supply agreement with GF with obligations to purchase all of its microprocessor and APU product requirements, and a certain portion of its GPU product requirements from GF with limited exceptions. If GF is not able to satisfy AMD’s manufacturing requirements, AMD’s business could be adversely impacted; AMD relies on third parties to manufacture its products, and if they are unable to do so on a timely basis in sufficient quantities and using competitive technologies, AMD’s business could be materially adversely affected; failure to achieve expected manufacturing yields for AMD’s products could negatively impact its financial results; the success of AMD’s business is dependent upon its ability to introduce products on a timely basis with features and performance levels that provide value to its customers while supporting and coinciding with significant industry transitions; if AMD cannot generate sufficient revenue and operating cash flow or obtain external financing, it may face a cash shortfall and be unable to make all of its planned investments in research and development or other strategic investments; the loss of a significant customer may have a material adverse effect on AMD; AMD’s receipt of revenue from its semi-custom SoC products is dependent upon its technology being designed into third-party products and the success of those products; AMD’s products may be subject to security vulnerabilities that could have a material adverse effect on AMD; data breaches and cyber-attacks could compromise AMD’s intellectual property or other sensitive information, be costly to remediate and cause significant damage to its business and reputation; AMD’s operating results are subject to quarterly and seasonal sales patterns; global economic uncertainty may adversely impact AMD’s business and operating results; AMD may not be able to generate sufficient cash to service its debt obligations or meet its working capital requirements; AMD has a large amount of indebtedness which could adversely affect its financial position and prevent it from implementing its strategy or fulfilling its contractual obligations; the agreements governing AMD’s notes and the Secured Revolving Line of Credit impose restrictions on AMD that may adversely affect AMD’s ability to operate its business; the markets in which AMD’s products are sold are highly competitive; AMD’s worldwide operations are subject to political, legal and economic risks and natural disasters, which could have a material adverse effect on it; AMD’s issuance to West Coast Hitech L.P. (WCH) of warrants to purchase 75 million shares of its common stock, if and when exercised, will dilute the ownership interests of AMD’s existing stockholders, and the conversion of the 2.125% Convertible Senior Notes due 2026 (2.125% Notes) may dilute the ownership interest of AMD’s existing stockholders, or may otherwise depress the price of its common stock; uncertainties involving the ordering and shipment of AMD’s products could materially adversely affect it; the demand for AMD’s products depends in part on the market conditions in the industries into which they are sold. Fluctuations in demand for AMD’s products or a market decline in any of these industries could have a material adverse effect on its results of operations; AMD’s ability to design and introduce new products in a timely manner is dependent upon third-party intellectual property; AMD depends on third-party companies for the design, manufacture and supply of motherboards, software and other computer platform components to support its business; if AMD loses Microsoft Corporation’s support for its products or other software vendors do not design and develop software to run on AMD’s products, its ability to sell its products could be materially adversely affected; AMD’s reliance on third-party distributors and add-in-board (AIB) partners subjects it to certain risks; AMD may incur future impairments of goodwill and technology license purchases; AMD’s inability to continue to attract and retain qualified personnel may hinder its business; in the event of a change of control, AMD may not be able to repurchase its outstanding debt as required by the applicable indentures and its Secured Revolving Line of Credit, which would result in a default under the indentures and its Secured Revolving Line of Credit; the semiconductor industry is highly cyclical and has experienced severe downturns that have materially adversely affected, and may continue to

9

materially adversely affect its business in the future; acquisitions, divestitures and/or joint ventures could disrupt its business, harm its financial condition and operating results or dilute, or adversely affect the price of, its common stock; AMD’s business is dependent upon the proper functioning of its internal business processes and information systems and modification or interruption of such systems may disrupt its business, processes and internal controls; if essential equipment, materials or manufacturing processes are not available to manufacture its products, AMD could be materially adversely affected; if AMD’s products are not compatible with some or all industry-standard software and hardware, it could be materially adversely affected; costs related to defective products could have a material adverse effect on AMD; if AMD fails to maintain the efficiency of its supply chain as it responds to changes in customer demand for its products, its business could be materially adversely affected; AMD outsources to third parties certain supply-chain logistics functions, including portions of its product distribution, transportation management and information technology support services; AMD’s stock price is subject to volatility; worldwide political conditions may adversely affect demand for AMD’s products; unfavorable currency exchange rate fluctuations could adversely affect AMD; AMD’s inability to effectively control the sales of its products on the gray market could have a material adverse effect on it; if AMD cannot adequately protect its technology or other intellectual property in the United States and abroad, through patents, copyrights, trade secrets, trademarks and other measures, it may lose a competitive advantage and incur significant expenses; AMD is a party to litigation and may become a party to other claims or litigation that could cause it to incur substantial costs or pay substantial damages or prohibit it from selling its products; AMD’s business is subject to potential tax liabilities; and AMD is subject to environmental laws, conflict minerals-related provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act as well as a variety of other laws or regulations that could result in additional costs and liabilities. Investors are urged to review in detail the risks and uncertainties in AMD's Securities and Exchange Commission filings, including but not limited to AMD's Quarterly Report on Form 10-Q for the quarter ended September 29, 2018.

1. | In this earnings press release, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross margin, non-GAAP operating expense, non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP earnings (loss) per share. These non-GAAP financial measures reflect certain adjustments as presented in the tables in this earnings press release. AMD also provided adjusted EBITDA and free cash flow as supplemental non-GAAP measures of its performance. These items are defined in the footnotes to the selected corporate data tables provided at the end of this earnings press release. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance and for the other reasons described in the footnotes to the selected data tables. Refer to the data tables at the end of this earnings press release. |

-30-

AMD, the AMD Arrow logo, EPYC, Radeon, Ryzen, Threadripper and combinations thereof, are trademarks of Advanced Micro Devices, Inc. Other names are for informational purposes only and used to identify companies and products and may be trademarks of their respective owner.

10

ADVANCED MICRO DEVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Millions except per share amounts and percentages)

Three Months Ended | Year Ended | |||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||

Net revenue | $ | 1,419 | $ | 1,653 | $ | 1,340 | $ | 6,475 | $ | 5,253 | ||||||||||

Cost of sales | 882 | 992 | 888 | 4,028 | 3,466 | |||||||||||||||

Gross margin | 537 | 661 | 452 | 2,447 | 1,787 | |||||||||||||||

Gross margin % | 38 | % | 40 | % | 34 | % | 38 | % | 34 | % | ||||||||||

Research and development | 371 | 363 | 320 | 1,434 | 1,196 | |||||||||||||||

Marketing, general and administrative | 138 | 148 | 134 | 562 | 516 | |||||||||||||||

Licensing gain | — | — | — | — | (52 | ) | ||||||||||||||

Operating income (loss) | 28 | 150 | (2 | ) | 451 | 127 | ||||||||||||||

Interest expense | (29 | ) | (30 | ) | (31 | ) | (121 | ) | (126 | ) | ||||||||||

Other income (expense), net | 4 | (6 | ) | 2 | — | (9 | ) | |||||||||||||

Income (loss) before equity loss and income taxes | 3 | 114 | (31 | ) | 330 | (8 | ) | |||||||||||||

Provision (benefit) for income taxes | (35 | ) | 12 | (12 | ) | (9 | ) | 18 | ||||||||||||

Equity loss in investee | — | — | — | (2 | ) | (7 | ) | |||||||||||||

Net Income (loss) | $ | 38 | $ | 102 | $ | (19 | ) | $ | 337 | $ | (33 | ) | ||||||||

Earnings (loss) per share | ||||||||||||||||||||

Basic | $ | 0.04 | $ | 0.10 | $ | (0.02 | ) | $ | 0.34 | $ | (0.03 | ) | ||||||||

Diluted | $ | 0.04 | $ | 0.09 | $ | (0.02 | ) | $ | 0.32 | $ | (0.03 | ) | ||||||||

Shares used in per share calculation | ||||||||||||||||||||

Basic | 1,002 | 987 | 965 | 982 | 952 | |||||||||||||||

Diluted | 1,079 | 1,076 | 965 | 1,064 | 952 | |||||||||||||||

11

ADVANCED MICRO DEVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Millions)

December 29, 2018 | December 30, 2017 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 1,078 | $ | 1,185 | ||||

Marketable securities | 78 | — | ||||||

Accounts receivable, net | 1,235 | 454 | ||||||

Inventories, net | 845 | 694 | ||||||

Prepayment and receivables - related parties | 52 | 33 | ||||||

Prepaid expenses | 57 | 77 | ||||||

Other current assets | 195 | 191 | ||||||

Total current assets | 3,540 | 2,634 | ||||||

Property and equipment, net | 348 | 261 | ||||||

Goodwill | 289 | 289 | ||||||

Investment: equity method | 58 | 58 | ||||||

Other assets | 321 | 310 | ||||||

Total Assets | $ | 4,556 | $ | 3,552 | ||||

Liabilities and Stockholders' Equity | ||||||||

Current liabilities: | ||||||||

Short-term debt | $ | 136 | $ | 70 | ||||

Accounts payable | 528 | 384 | ||||||

Payables to related parties | 533 | 412 | ||||||

Accrued liabilities | 763 | 555 | ||||||

Other current liabilities | 24 | 92 | ||||||

Total current liabilities | 1,984 | 1,513 | ||||||

Long-term debt, net | 1,114 | 1,325 | ||||||

Other long-term liabilities | 192 | 118 | ||||||

Stockholders' equity: | ||||||||

Capital stock: | ||||||||

Common stock, par value | 10 | 9 | ||||||

Additional paid-in capital | 8,750 | 8,464 | ||||||

Treasury stock, at cost | (50 | ) | (108 | ) | ||||

Accumulated deficit | (7,436 | ) | (7,775 | ) | ||||

Accumulated other comprehensive income (loss) | (8 | ) | 6 | |||||

Total Stockholders' equity | $ | 1,266 | $ | 596 | ||||

Total Liabilities and Stockholders' Equity | $ | 4,556 | $ | 3,552 | ||||

12

ADVANCED MICRO DEVICES, INC.

SELECTED CASH FLOW INFORMATION

(Millions)

Three Months Ended | Year Ended | |||||||

December 29, 2018 | December 29, 2018 | |||||||

Net cash provided by (used in) | ||||||||

Operating activities | $ | 120 | $ | 34 | ||||

Investing activities | $ | (88 | ) | $ | (170 | ) | ||

Financing activities | $ | — | $ | 28 | ||||

In 2018, the Company adopted Accounting Standards Update (ASU) 2016-15, Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments which reclassified certain cash receipts from operating activities to investing activities, with retrospective application. All periods presented conform to the classification requirements of the standard. The adoption of this standard does not reflect a change in the underlying business or activities and had no material impact on the Company's consolidated statements of cash flows. | ||||

SELECTED CORPORATE DATA

(Millions)

Three Months Ended | Year Ended | |||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||

Segment and Category Information | ||||||||||||||||||||

Computing and Graphics (1) | ||||||||||||||||||||

Net revenue | $ | 986 | $ | 938 | $ | 908 | $ | 4,125 | $ | 2,977 | ||||||||||

Operating income | $ | 115 | $ | 100 | $ | 33 | $ | 470 | $ | 92 | ||||||||||

Enterprise, Embedded and Semi-Custom (2) | ||||||||||||||||||||

Net revenue | $ | 433 | $ | 715 | $ | 432 | $ | 2,350 | $ | 2,276 | ||||||||||

Operating income (loss) | $ | (6 | ) | $ | 86 | $ | (13 | ) | $ | 163 | $ | 132 | ||||||||

All Other (3) | ||||||||||||||||||||

Net revenue | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

Operating loss | $ | (81 | ) | $ | (36 | ) | $ | (22 | ) | $ | (182 | ) | $ | (97 | ) | |||||

Total | ||||||||||||||||||||

Net revenue | $ | 1,419 | $ | 1,653 | $ | 1,340 | $ | 6,475 | $ | 5,253 | ||||||||||

Operating income (loss) | $ | 28 | $ | 150 | $ | (2 | ) | $ | 451 | $ | 127 | |||||||||

Other Data | ||||||||||||||||||||

Capital expenditures | $ | 41 | $ | 33 | $ | 44 | $ | 163 | $ | 113 | ||||||||||

Adjusted EBITDA (4) | $ | 152 | $ | 227 | $ | 58 | $ | 803 | $ | 368 | ||||||||||

Cash, cash equivalents and marketable securities | $ | 1,156 | $ | 1,056 | $ | 1,185 | $ | 1,156 | $ | 1,185 | ||||||||||

Free cash flow (5) | $ | 79 | $ | 44 | $ | 322 | $ | (129 | ) | $ | (105 | ) | ||||||||

Total assets | $ | 4,556 | $ | 4,347 | $ | 3,552 | $ | 4,556 | $ | 3,552 | ||||||||||

Total debt | $ | 1,250 | $ | 1,303 | $ | 1,395 | $ | 1,250 | $ | 1,395 | ||||||||||

13

(1) | The Computing and Graphics segment primarily includes desktop and notebook processors and chipsets, discrete and integrated graphics processing units (GPUs) and professional GPUs. The Company also licenses portions of its intellectual property portfolio. | |||||||||

(2) | The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom System-on-Chip (SoC) products, development services and technology for game consoles. The Company also licenses portions of its intellectual property portfolio. | |||||||||

(3) | All Other category primarily includes certain expenses and credits that are not allocated to any of the operating segments. Also included in this category is stock-based compensation expense. In addition, the Company also included an impairment of technology licenses in the three months and year ended December 29, 2018. | |||||||||

(4) | Reconciliation of GAAP Operating Income (Loss) to Adjusted EBITDA* | |||||||||

Three Months Ended | Year Ended | |||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||

GAAP operating income (loss) | $ | 28 | $ | 150 | $ | (2 | ) | $ | 451 | $ | 127 | |||||||||

Impairment of technology licenses | 45 | — | — | 45 | — | |||||||||||||||

Stock-based compensation | 36 | 36 | 21 | 137 | 97 | |||||||||||||||

Depreciation and amortization | 43 | 41 | 39 | 170 | 144 | |||||||||||||||

Adjusted EBITDA | $ | 152 | $ | 227 | $ | 58 | $ | 803 | $ | 368 | ||||||||||

(5) | Reconciliation of GAAP Net Cash Provided by Operating Activities to Free Cash Flow** | |||||||||

Three Months Ended | Year Ended | |||||||||||||||||||

December 29, 2018 | September 29, 2018 | December 30, 2017 | December 29, 2018 | December 30, 2017 | ||||||||||||||||

GAAP net cash provided by operating activities | $ | 120 | $ | 77 | $ | 366 | $ | 34 | $ | 8 | ||||||||||

Purchases of property and equipment | (41 | ) | (33 | ) | (44 | ) | (163 | ) | (113 | ) | ||||||||||

Free cash flow | $ | 79 | $ | 44 | $ | 322 | $ | (129 | ) | $ | (105 | ) | ||||||||

* | The Company presents “Adjusted EBITDA” as a supplemental measure of its performance. Adjusted EBITDA for the Company is determined by adjusting operating income for stock-based compensation and depreciation and amortization expense. In addition, the Company also included an impairment of technology licenses in the three months and year ended December 29, 2018. The Company calculates and presents Adjusted EBITDA because management believes it is of importance to investors and lenders in relation to its overall capital structure and its ability to borrow additional funds. In addition, the Company presents Adjusted EBITDA because it believes this measure assists investors in comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company’s calculation of Adjusted EBITDA may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view Adjusted EBITDA as an alternative to the GAAP operating measure of operating income (loss) or GAAP liquidity measures of cash flows from operating, investing and financing activities. In addition, Adjusted EBITDA does not take into account changes in certain assets and liabilities as well as interest income and expense and income taxes that can affect cash flows. | |||||||||

** | The Company also presents free cash flow as a supplemental Non-GAAP measure of its performance. Free cash flow is determined by adjusting GAAP net cash provided by (used in) operating activities for capital expenditures. The Company calculates and communicates free cash flow in the financial earnings press release because management believes it is of importance to investors to understand the nature of these cash flows. The Company’s calculation of free cash flow may or may not be consistent with the calculation of this measure by other companies in the same industry. Investors should not view free cash flow as an alternative to GAAP liquidity measures of cash flows from operating activities. In 2018, the Company adopted Accounting Standards Update (ASU) 2016-15, Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments, which reclassified certain cash receipts from operating activities to investing activities, with retrospective application. All periods presented conform to the classification requirements of the standard. The adoption of this standard does not reflect a change in the underlying business or activities and had no material impact on the Company's consolidated statements of cash flows. | |||||||||

The Company has provided reconciliations within the earnings press release of these non-GAAP financial measures to the most directly comparable GAAP financial measures. | ||||||||||

14

FOURTH QUARTER AND FY 2018 FINANCIAL RESULTS JANUARY 29, 2019 | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

This presentation contains forward-looking statements concerning Advanced Micro Devices, Inc. (AMD) such as AMD’s strategy and focus; AMD’s ability to achieve its long-term financial model; the features, functionality, availability, timing and expected benefits of AMD future products, including AMD’s next generation “Rome” server processor; AMD’s financial outlook for the first quarter of 2019 and fiscal 2019, including revenue, non- GAAP gross margin, licensing gain, non-GAAP operating expenses as a percentage of revenue, non-GAAP interest expense, taxes and other, taxes and diluted share count; and the expected drivers of the first quarter of 2019 revenue, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are commonly identified by words such as "would," "may," "expects," "believes," "plans," "intends," "projects" and other terms with similar meaning. Investors are cautioned that the forward-looking statements in this document are based on current beliefs, assumptions and expectations, speak only as of the date of this document and involve risks and uncertainties that could cause actual results to differ materially from current expectations. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond AMD's control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: Intel Corporation’s dominance of the microprocessor market and its aggressive business practices; the ability of GLOBALFOUNDRIES Inc. to satisfy AMD’s manufacturing requirements; the ability of third party manufacturers to manufacture AMD products on a timely basis in sufficient quantities and using competitive technologies; the ability of third party manufacturers to achieve expected manufacturing yields; AMD’s ability to introduce products on a timely basis with features and performance levels that provide value to its customers; AMD’s ability to generate sufficient revenue and operating cash flow or obtain external financing; the loss of a significant customer; AMD’s ability to generate revenue from its semi-custom SoC products; actual or perceived security vulnerabilities of AMD’s products; potential data breaches and cyber-attacks; quarterly and seasonal sales patterns that may affect AMD’s business; global economic uncertainty; AMD’s ability to generate sufficient cash to service its debt obligations or meet its working capital requirements; AMD’s large amount of indebtedness; restrictions imposed by agreements governing AMD’s debt and its secured revolving line of credit; the competitive nature of the markets in which AMD’s products are sold; political, legal and economic risks and natural disasters; the dilutive effect on shareholders if West Coast Hitech L.P. exercises its warrants to purchase AMD’s common stock, and the conversion of AMD’s 2.125% Convertible Senior Notes due 2026; uncertainties involving the ordering and shipment of AMD’s products; fluctuations in demand or a market decline for AMD’s products; AMD’s reliance on third-party intellectual property to design and introduce new products in a timely manner; AMD’s reliance on third-party companies for the design, manufacture and supply of motherboards, software and other computer platform components; AMD’s reliance on Microsoft Corporation’s support and other software vendors; AMD’s reliance on third-party distributors and AIB partners; future impairments of goodwill and technology license purchases; AMD’s ability to continue to attract and retain qualified personnel; AMD’s ability to repurchase its debt in the event of a change of control; the highly cyclical nature of the semiconductor industry; future acquisitions, divestitures and/or joint ventures that may disrupt AMD’s business; modification or interruption of internal business processes and information systems; availability of essential equipment, materials or manufacturing processes to manufacture AMD’s products; compatibility of AMD’s products with industry-standard software and hardware; costs related to defective products; the efficiency of AMD’s supply chain; AMD’s ability to rely on third parties’ certain supply-chain logistics functions, product distribution, transportation management and information technology support services; stock price volatility; worldwide political conditions; unfavorable currency exchange rate fluctuations; AMD’s ability to effectively control the sales of its products on the gray market; AMD’s ability to protect its technology or intellectual property; current and future litigation; potential tax liabilities; and environmental laws, conflict minerals-related provisions, the Consumer Protection Act, and other laws or regulations that could result in additional costs and liabilities. Investors are urged to review in detail the risks and uncertainties in AMD's Securities and Exchange Commission filings, including but not limited to AMD's Quarterly Report on Form 10-Q for the year ending September 29, 2018. NON-GAAP FINANCIAL MEASURES In this presentation, in addition to GAAP financial results, AMD has provided non-GAAP financial measures including non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP earnings (loss) per share, free cash flow, and Adjusted EBITDA. AMD is providing these financial measures because it believes this non-GAAP presentation makes it easier for investors to compare its operating results for current and historical periods and also because AMD believes it assists investors in comparing AMD’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance and for the other reasons described in the footnotes to the selected data tables at the end of AMD’s earnings press release. The non-GAAP financial measures disclosed in this presentation should be viewed in addition to and not as a substitute for or superior to AMD’s reported results prepared in accordance with GAAP and should be read only in conjunction with AMD’s Consolidated Financial Statements prepared in accordance with GAAP. These non-GAAP financial measures referenced are reconciled to their most directly comparable GAAP financial measures in the Appendices at the end of this presentation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

HIGH-PERFORMANCE GREAT AMBITIOUS FOCUSED TECHNOLOGIES PRODUCTS GOALS EXECUTION | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

OUR STRATEGY AND FOCUS GRAPHICS COMPUTE SOLUTIONS Gaming Compute Virtual & Client Infrastructure Semi- Vertical Partnerships & AI Augmented Systems & Cloud Custom Platforms Reality | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

FINANCIAL ACCOMPLISHMENTS FY 2018(1) ▪ 23% annual revenue growth, up more than $1.2 billion to $6.48 billion Annual Revenue ($M) ▪ 2nd straight year of double digit revenue growth, share gains and improved profits +23% ▪ Gross margin expansion driven by RyzenTM, EPYCTM and RadeonTM products $6,475 ▪ Highest profitability in 7 years $5,253 ▪ Operating income: $451 million, up $324 million Non-GAAP operating income: $633 million, up $409 million ▪ Net income: $337 million, up $370 million Non-GAAP net income: $514 million, up $411 million ▪ Reduced principal debt by $171 million; Gross leverage of 1.9x ▪ EPS of $0.32 up $0.35; Non-GAAP of EPS: $0.46, up $0.36 ▪ Cash, cash equivalents and marketable securities: $1.16 billion 2017 2018 1. See Appendices for GAAP to Non-GAAP reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

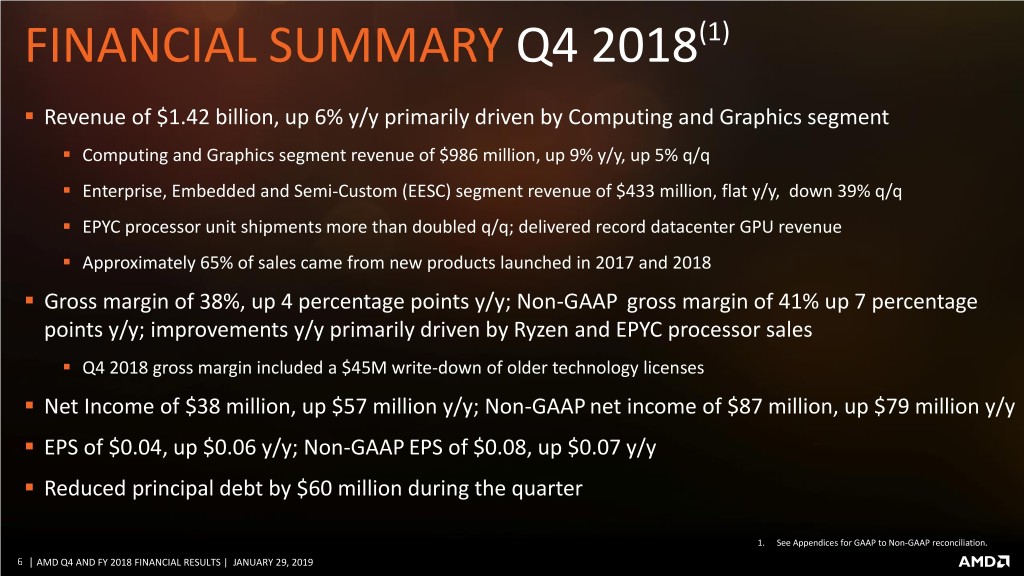

FINANCIAL SUMMARY Q4 2018(1) ▪ Revenue of $1.42 billion, up 6% y/y primarily driven by Computing and Graphics segment ▪ Computing and Graphics segment revenue of $986 million, up 9% y/y, up 5% q/q ▪ Enterprise, Embedded and Semi-Custom (EESC) segment revenue of $433 million, flat y/y, down 39% q/q ▪ EPYC processor unit shipments more than doubled q/q; delivered record datacenter GPU revenue ▪ Approximately 65% of sales came from new products launched in 2017 and 2018 ▪ Gross margin of 38%, up 4 percentage points y/y; Non-GAAP gross margin of 41% up 7 percentage points y/y; improvements y/y primarily driven by Ryzen and EPYC processor sales ▪ Q4 2018 gross margin included a $45M write-down of older technology licenses ▪ Net Income of $38 million, up $57 million y/y; Non-GAAP net income of $87 million, up $79 million y/y ▪ EPS of $0.04, up $0.06 y/y; Non-GAAP EPS of $0.08, up $0.07 y/y ▪ Reduced principal debt by $60 million during the quarter 1. See Appendices for GAAP to Non-GAAP reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

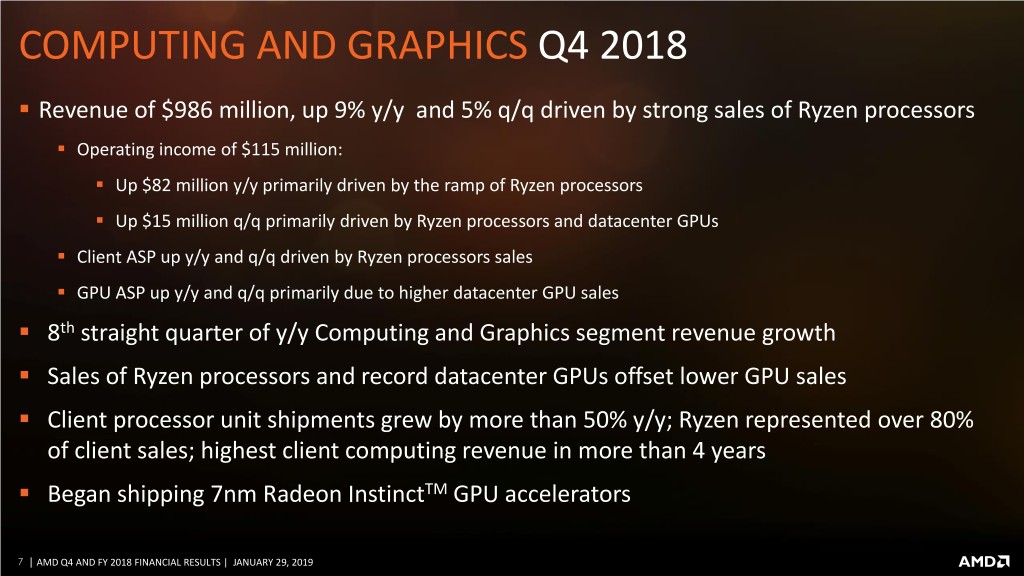

COMPUTING AND GRAPHICS Q4 2018 ▪ Revenue of $986 million, up 9% y/y and 5% q/q driven by strong sales of Ryzen processors ▪ Operating income of $115 million: ▪ Up $82 million y/y primarily driven by the ramp of Ryzen processors ▪ Up $15 million q/q primarily driven by Ryzen processors and datacenter GPUs ▪ Client ASP up y/y and q/q driven by Ryzen processors sales ▪ GPU ASP up y/y and q/q primarily due to higher datacenter GPU sales ▪ 8th straight quarter of y/y Computing and Graphics segment revenue growth ▪ Sales of Ryzen processors and record datacenter GPUs offset lower GPU sales ▪ Client processor unit shipments grew by more than 50% y/y; Ryzen represented over 80% of client sales; highest client computing revenue in more than 4 years ▪ Began shipping 7nm Radeon InstinctTM GPU accelerators | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

ENTERPRISE, EMBEDDED AND SEMI-CUSTOM Q4 2018 ▪ Revenue of $433 million, flat y/y and seasonally down 39% q/q driven by lower-semi- custom sales, as expected ▪ Operating loss of $6 million: ▪ A $7 million improvement y/y primarily due to higher EPYC datacenter processor revenue, partially offset by lower semi-custom revenue and continued engineering and go-to-market investments in the server business ▪ Down $92 million q/q on seasonally lower semi-custom sales, partially offset by higher EPYC datacenter processor revenue ▪ EPYC processor unit shipments more than doubled on a q/q basis ▪ AWS announced new versions of EC2 computing instances powered by EPYC processors ▪ Microsoft Azure announced general availability of EPYC-based storage instances ▪ Customer interest in next generation “Rome” server processor remains high; on track to launch mid-2019 | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

REVENUE TREND ($ IN MILLIONS) $1,756 $1,647 $1,653 $1,584 +6% y/y $1,419 $1,340 $1,178 $1,151 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Revenue up 6% y/y driven by the Computing and Graphics segment | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

GROSS MARGIN(1) TREND (AS A PERCENTAGE OF REVENUE, GAAP AND NON-GAAP)(2) +7pp y/y (Non-GAAP) +4pp y/y (GAAP) 40% 41% 38% 36% 36% 37% 34% 34% 32% Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q4'18 Y/Y improvement primarily driven by Ryzen and EPYC processor sales 1. Gross margin for both GAAP and Non-GAAP are the same for all periods except as indicated for Q4 2018. 2. See Appendices for GAAP to Non-GAAP reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

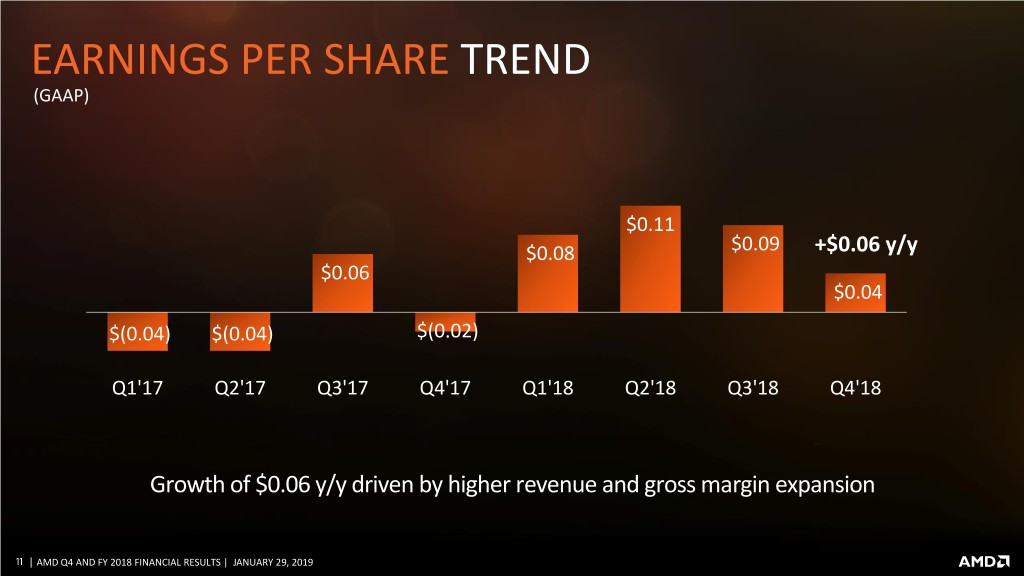

EARNINGS PER SHARE TREND (GAAP) $0.11 $0.08 $0.09 +$0.06 y/y $0.06 $0.04 $(0.04) $(0.04) $(0.02) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Growth of $0.06 y/y driven by higher revenue and gross margin expansion | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

EARNINGS PER SHARE TREND (NON-GAAP)(1) $0.14 $0.13 +$0.07 y/y $0.11 $0.09 $0.08 $0.01 $0.00 $(0.01) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Growth of $0.07 y/y driven by higher revenue and gross margin expansion 1. See Appendices for GAAP to Non-GAAP reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

2018 ANNUAL SUMMARY P&L – GAAP 2018 2017 Y/Y Revenue $6,475M $5,253M Up 23% Gross Margin $2,447M $1,787M Up $660M Gross Margin % 38% 34% Up 4pp Operating Expenses $1,996M $1,712M Up $284M Operating Expense/Revenue % 31% 33% Down 2pp Operating Income $451M $127M Up $324M Net Income (Loss) $337M $(33M) Up $370M Earnings (Loss) Per Share(1) $0.32 $(0.03) Up $0.35 Strong revenue and profit growth 1. See Appendices for share count reference. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

2018 ANNUAL SUMMARY P&L – NON-GAAP(1) 2018 2017 Y/Y Revenue $6,475M $5,253M Up 23% Gross Margin $2,496M $1,789M Up $707M Gross Margin % 39% 34% Up 5pp Operating Expenses $1,863M $1,617M Up $246M Operating Expense/Revenue % 29% 31% Down 2pp Operating Income $633M $224M Up $409M Net Income $514M $103M Up $411M Earnings Per Share(1) $0.46 $0.10 Up $0.36 Significant increase in gross margin 1. See Appendices for GAAP to Non-GAAP reconciliation and references for share count. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

Q4 2018 SUMMARY P&L – GAAP Q4 2018 Q4 2017 Y/Y Q3 2018 Q/Q Revenue $1,419M $1,340M Up 6% $1,653 M Down 14% Gross Margin $537M $452M Up $85M $661M Down $124M Gross Margin % 38% 34% Up 4pp 40% Down 2pp Operating Expenses $509M $454M Up $55M $511M Down $2M Operating Expense/Revenue % 36% 34% Up 2pp 31% Up 5pp Operating Income (Loss) $28M $(2)M Up $30M $150M Down $122M Net Income (Loss) $38M $(19)M Up $57M $102M Down $64M Earnings (Loss) Per Share(1) $0.04 $(0.02) Up $0.06 $0.09 Down $0.05 Improved gross margin and profitability y/y 1. See Appendices for share count reference. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

Q4 2018 SUMMARY P&L – NON-GAAP(1) Q4 2018 Q4 2017 Y/Y Q3 2018 Q/Q Revenue $1,419M $1,340M Up 6% $1,653M Down 14% Gross Margin $583M $452M Up $131M $662M Down $79M Gross Margin % 41% 34% Up 7pp 40% Up 1pp Operating Expenses $474M $433M Up $41M $476M Down $2M Operating Expense/Revenue % 33% 32% Up 1pp 29% Up 4pp Operating Income $109M $19M Up $90M $186M Down $77M Net Income $87M $8M Up $79M $150M Down $63M Earnings Per Share(1) $0.08 $0.01 Up $0.07 $0.13 Down $0.05 Improved gross margin and profitability y/y 1. See Appendices for GAAP to Non-GAAP reconciliation and references for share count. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

Q4 AND FY 2018 SEGMENT RESULTS Q4 2018 Q4 2017 Y/Y Q3 2018 Q/Q 2018 2017 Y/Y Computing and Graphics Net Revenue $986M $908M Up 9% $938M Up 5% $4,125M $2,977M Up 39% Operating Income $115M $33M Up $82M $100M Up $15M $470M $92M Up $378M Enterprise, Embedded and Semi-Custom Net Revenue $433M $432M Flat $715M Down 39% $2,350M $2,276M Up 3% Operating Income (Loss) $(6)M $(13)M Up $7M $86M Down $92M $163M $132M Up $31M All Other Category Operating Income (Loss) $(81)M $(22)M Down $59M $(36)M Down $45M $(182)M $(97)M Down $85M TOTAL Net Revenue $1,419M $1,340M Up 6% $1,653M Down 14% $6,475M $5,253M Up 23% Operating Income (Loss) $28M $(2)M Up $30M $150M Down $122M $451M $127M Up $324M | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

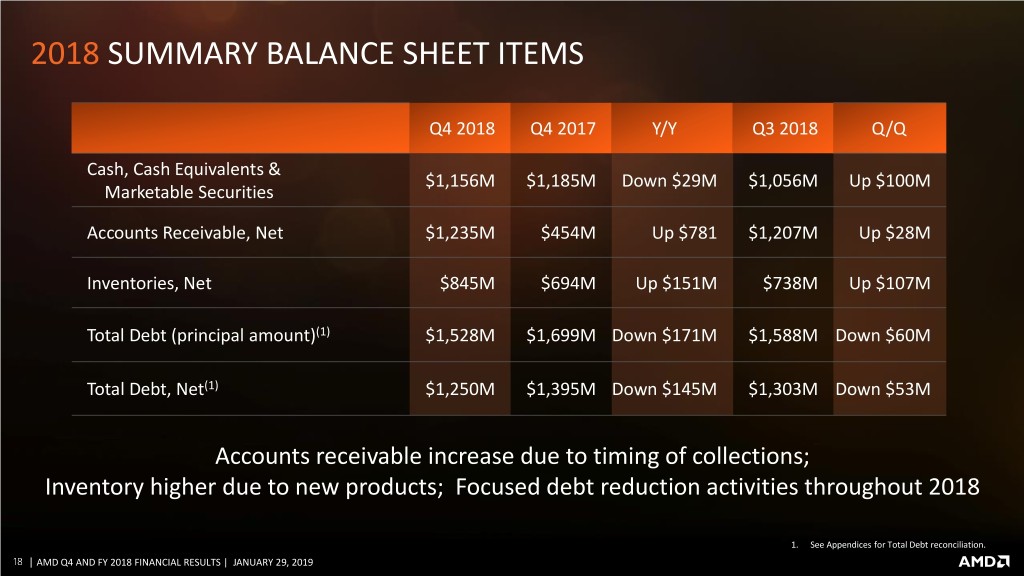

2018 SUMMARY BALANCE SHEET ITEMS Q4 2018 Q4 2017 Y/Y Q3 2018 Q/Q Cash, Cash Equivalents & $1,156M $1,185M Down $29M $1,056M Up $100M Marketable Securities Accounts Receivable, Net $1,235M $454M Up $781 $1,207M Up $28M Inventories, Net $845M $694M Up $151M $738M Up $107M Total Debt (principal amount)(1) $1,528M $1,699M Down $171M $1,588M Down $60M Total Debt, Net(1) $1,250M $1,395M Down $145M $1,303M Down $53M Accounts receivable increase due to timing of collections; Inventory higher due to new products; Focused debt reduction activities throughout 2018 1. See Appendices for Total Debt reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

TOTAL CASH BALANCE(1) ($ IN MILLIONS) $1,185 $1,156 $1,045 $1,056 $943 $983 $844 $879 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Total cash balance above $1 billion 1. Cash, cash equivalents and marketable securities | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

ADJUSTED EBITDA TREND ($ IN MILLIONS, CALCULATED AS TRAILING TWELVE MONTHS)(1) $803 $709 $666 $496 $368 $176 Q4'16 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Business and financial strength driving strong increase in adjusted EBITDA 1. See Appendices for reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

DEBT TREND (PRINCIPAL AMOUNT, $ IN MILLIONS, GROSS LEVERAGE TREND)(1,2) $1,767 $1,699 $1,686 $1,685 10.0x $1,588 $1,528 4.6x 3.4x 2.5x 2.2x 1.9x Q4'16 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Gross leverage reduced below 2.0x 1. See Appendices for reconciliation to Total Debt . 2. Leverage = Current + long-term debt divided by trailing 12 months adjusted EBITDA. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

WAFER SUPPLY AGREEMENT UPDATE ▪ AMD announced today it has entered into a seventh amendment to its wafer supply agreement with GLOBALFOUNDRIES, Inc. ▪ Full flexibility for wafer purchases from any foundry at the 7nm node and beyond without any one-time payments or royalties ▪ GLOBALFOUNDRIES continues to be a long-term strategic partner for AMD at the 12nm node and above ▪ Purchase commitments and pricing at 12nm and above are established for 2019 through 2021 | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

Q1 2019 AND FY 2019 FINANCIAL OUTLOOK – NON GAAP(1) Q1 2019 FY 2019 $1.25 Billion Up high single digit Revenue +/- $50 Million percentage y/y Gross Margin % ~41% >41% Licensing Gain $60 Million $60 Million Operating Expenses ~$480 Million ~29% Operating Expenses/Revenue % Interest Expense, Taxes and Other ~$25 Million - Taxes - ~4% of pre-tax Income Diluted Share Count(2) ~1.185 Billion ~1.197 Billion Q1’19 revenue expected to decrease ~12 q/q and 24% y/y. The q/q decrease is primarily driven by continued softness in the graphics channel and seasonality across the business. The y/y decrease is primarily driven by lower graphics sales due to excess channel inventory, the absence of blockchain related GPU revenue and lower memory sales. Semi-custom revenue is expected to be lower y/y while AMD Ryzen, EPYC and Radeon datacenter GPU sales are expected to increase. Full year 2019 revenue expected to grow driven by Ryzen, EPYC and Radeon datacenter GPU sales and ramp of 7nm products. 1. These are forward looking statements. See Cautionary Statement on Slide 2. AMD’s outlook statements are based on current expectations as of January 29, 2019. AMD undertakes no intent or obligation to publicly update or revise its outlook statements whether as a result of new information, future events or otherwise, except to the extent that disclosure may be required by law. 2. See Slide 31 for Diluted Share Count overview. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

2018 SUMMARY ANNUAL REVENUE GROSS MARGIN HIGHEST ON TRACK TO GROWTH OF 23%, UP 4 PP Y/Y; PROFITABILTY IN LONG-TERM UP MORE THAN NON-GAAP(1) UP 5 PP Y/Y 7 YEARS FINANCIAL MODEL $1.2 BILLION 1. See Appendices for GAAP to Non-GAAP reconciliation. | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

R E D E F I N I N G HIGH PERFORMANCE COMPUTING | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

INVESTOR RELATIONS CONTACTS Laura Graves, Corporate Vice President Phone: 408-749-5467 Email: [email protected] Jason Schmidt, IR Director Phone: 408-749-6688 Email: [email protected] Janice Oh, Sr. IR Analyst Phone: 408-749-2113 Email: [email protected] | AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

APPENDICES Reconciliation of GAAP to Non-GAAP Gross Margin (Millions) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 2017 2018 GAAP gross margin $ 378 $ 386 $ 571 $ 452 $ 597 $ 652 $ 661 $ 537 $ 1,787 $ 2,447 GAAP gross margin % 32% 34% 36% 34% 36% 37% 40% 38% 34% 38% Impairment of technology licenses — — — — — — — 45 — 45 Stock-based compensation — 1 1 — 1 1 1 1 2 4 Non-GAAP gross margin $ 378 $ 387 $ 572 $ 452 $ 598 $ 653 $ 662 $ 583 $ 1,789 $ 2,496 Non-GAAP gross margin % 32% 34% 36% 34% 36% 37% 40% 41% 34% 39% Reconciliation of GAAP to Non-GAAP Operating Expenses (Millions) Q4'18 Q4'17 Q3'18 2018 2017 GAAP operating expenses $ 509 $ 454 $ 511 $ 1,996 $ 1,712 Stock-based compensation 35 21 35 133 95 Non-GAAP operating expenses $ 474 $ 433 $ 476 $ 1,863 $ 1,617 27 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

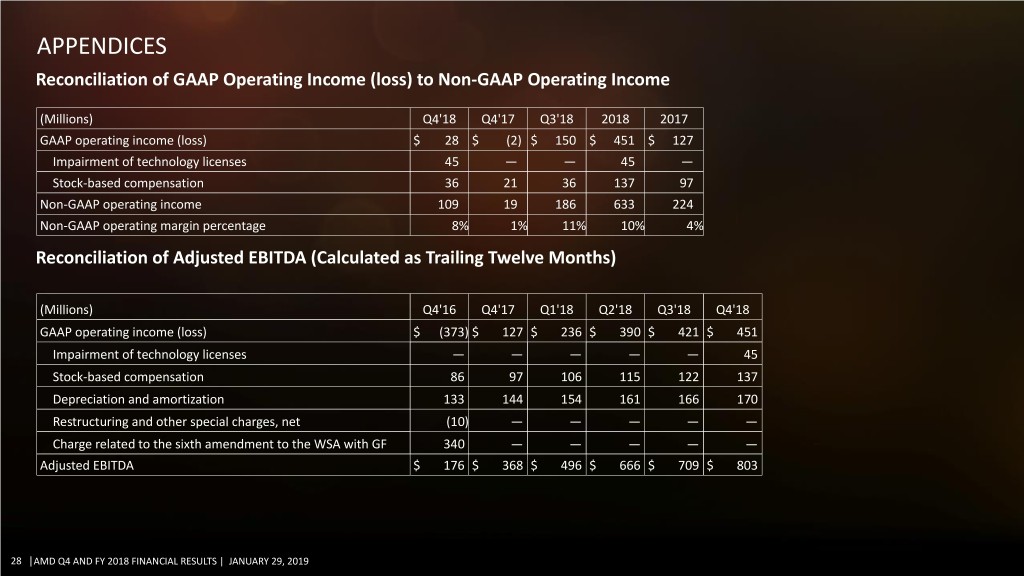

APPENDICES Reconciliation of GAAP Operating Income (loss) to Non-GAAP Operating Income (Millions) Q4'18 Q4'17 Q3'18 2018 2017 GAAP operating income (loss) $ 28 $ (2) $ 150 $ 451 $ 127 Impairment of technology licenses 45 — — 45 — Stock-based compensation 36 21 36 137 97 Non-GAAP operating income 109 19 186 633 224 Non-GAAP operating margin percentage 8% 1% 11% 10% 4% Reconciliation of Adjusted EBITDA (Calculated as Trailing Twelve Months) (Millions) Q4'16 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 GAAP operating income (loss) $ (373) $ 127 $ 236 $ 390 $ 421 $ 451 Impairment of technology licenses — — — — — 45 Stock-based compensation 86 97 106 115 122 137 Depreciation and amortization 133 144 154 161 166 170 Restructuring and other special charges, net (10) — — — — — Charge related to the sixth amendment to the WSA with GF 340 — — — — — Adjusted EBITDA $ 176 $ 368 $ 496 $ 666 $ 709 $ 803 28 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

APPENDICES Reconciliation of GAAP to Non-GAAP Net Income (Loss) / Earnings (Loss) Per Share (Millions, except per share data) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 GAAP net income (loss) / earnings (loss) per share $ (33) $(0.04) $ (42) $(0.04) $ 61 $ 0.06 $ (19) $(0.02) $ 81 $ 0.08 $ 116 $ 0.11 $ 102 $ 0.09 $ 38 $ 0.04 Loss on debt redemption 4 — 3 — 2 — 3 — 1 — — — 6 — 5 — Non-cash interest expense related to convertible debt 6 0.01 5 0.01 6 0.01 5 — 6 — 6 — 6 0.01 6 0.01 Stock-based compensation 23 0.02 24 0.02 29 0.02 21 0.02 32 0.03 33 0.03 36 0.03 36 0.03 Gain on sale of 85% of ATMP — — — — — — (3) — — — — — — — — — Tax provision related to sale of 85% of ATMP JV — — — — — — 1 — — — — — — — — — Impairment of technology licenses — — — — — — — — — — — — — — 45 0.04 Equity loss in investee 2 — 3 — 2 — — — 1 — 1 — — — — — Withholding tax refund including interest — — — — — — — — — — — — — — (43) $(0.04) Non-GAAP net income (loss) / earnings (loss) per share $ 2 $ — $ (7) $(0.01) $ 100 $ 0.09 $ 8 $ 0.01 $ 121 $ 0.11 $ 156 $ 0.14 $ 150 $ 0.13 $ 87 $ 0.08 Shares used and net income adjustment in earnings (loss) per share calculation Shares used in per share calculation (GAAP) (1) 939 945 1,042 965 1,039 1,147 1,076 1,079 Interest expense add-back to GAAP net income $ — $ — $ — $ — $ — $ 11 $ — $ — Shares used in per share calculation (Non-GAAP) 1,031 945 1,143 1,037 1,040 1,147 1,177 1,180 Interest expense add-back to Non-GAAP net income (2) $ — $ — $ 5 $ — $ 4 $ 5 $ 4 $ 5 (1) Q1'17, Q2'17 and Q4'17 GAAP net loss per share are calculated using basic shares. (2) Q1'17, Q2'17 and Q4'17 do not include 100.6 million shares related to the conversion of the Company’s 2026 Convertible Notes and the interest expense add-back to Non-GAAP net income because their inclusion would have been anti-dilutive under the "if-converted' method. 29 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

APPENDICES Reconciliation of GAAP to Non-GAAP Net Income (Loss) / Earnings (Loss) Per Share (Millions, except per share data) 2017 2018 GAAP net income (loss) / earnings (loss) per share $ (33) $ (0.03) $ 337 $ 0.32 Loss on debt redemption 12 0.01 12 0.01 Non-cash interest expense related to convertible debt 22 0.02 24 0.02 Stock-based compensation 97 0.09 137 0.11 Gain on sale of 85% of ATMP (3) — — — Tax provision related to sale of 85% of ATMP JV 1 — — — Impairment of technology licenses — — 45 0.04 Equity loss in investee 7 0.01 2 — Withholding tax refund including interest — — (43) (0.04) Non-GAAP net income / earnings per share $ 103 $ 0.10 $ 514 $ 0.46 Shares used and net income adjustment in earnings (loss) per share calculation Shares used in per share calculation (GAAP) (1) 952 1,064 Interest expense add-back to GAAP net income $ — $ — Shares used in per share calculation (Non-GAAP) 1,039 1,165 Interest expense add-back to Non-GAAP net income (2) $ — $ 18 (1) 2017 GAAP net loss per share is calculated using basic shares. (2) 2017 does not include 100.6 million shares related to the conversion of the Company’s 2026 Convertible Notes and the interest expense add-back to Non-GAAP net income because their inclusion would have been anti-dilutive under the "if- converted' method. 30 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

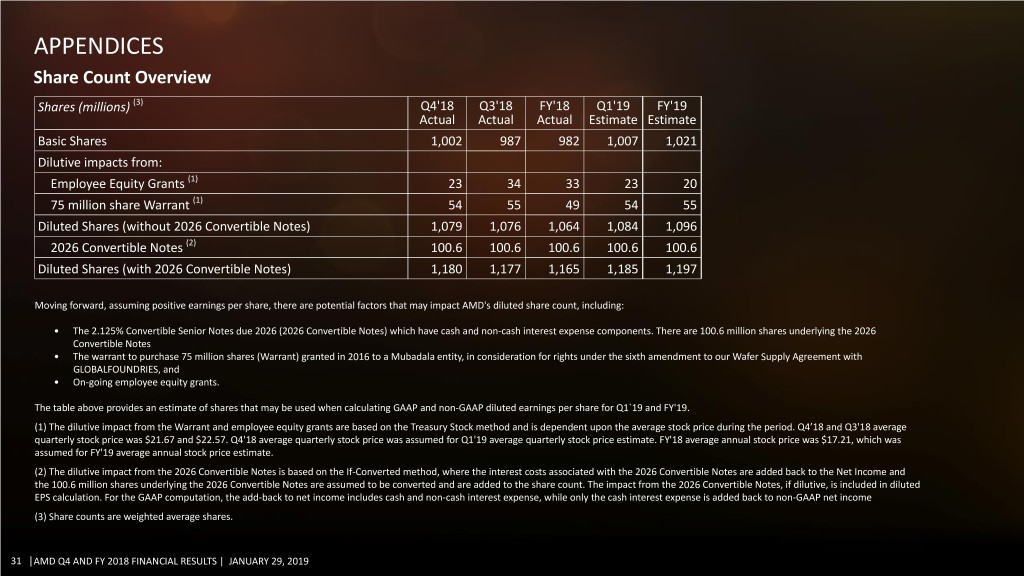

APPENDICES Share Count Overview Shares (millions) (3) Q4'18 Q3'18 FY'18 Q1'19 FY'19 Actual Actual Actual Estimate Estimate Basic Shares 1,002 987 982 1,007 1,021 Dilutive impacts from: Employee Equity Grants (1) 23 34 33 23 20 75 million share Warrant (1) 54 55 49 54 55 Diluted Shares (without 2026 Convertible Notes) 1,079 1,076 1,064 1,084 1,096 2026 Convertible Notes (2) 100.6 100.6 100.6 100.6 100.6 Diluted Shares (with 2026 Convertible Notes) 1,180 1,177 1,165 1,185 1,197 Moving forward, assuming positive earnings per share, there are potential factors that may impact AMD's diluted share count, including: • The 2.125% Convertible Senior Notes due 2026 (2026 Convertible Notes) which have cash and non-cash interest expense components. There are 100.6 million shares underlying the 2026 Convertible Notes • The warrant to purchase 75 million shares (Warrant) granted in 2016 to a Mubadala entity, in consideration for rights under the sixth amendment to our Wafer Supply Agreement with GLOBALFOUNDRIES, and • On-going employee equity grants. The table above provides an estimate of shares that may be used when calculating GAAP and non-GAAP diluted earnings per share for Q1`19 and FY'19. (1) The dilutive impact from the Warrant and employee equity grants are based on the Treasury Stock method and is dependent upon the average stock price during the period. Q4’18 and Q3'18 average quarterly stock price was $21.67 and $22.57. Q4'18 average quarterly stock price was assumed for Q1'19 average quarterly stock price estimate. FY'18 average annual stock price was $17.21, which was assumed for FY'19 average annual stock price estimate. (2) The dilutive impact from the 2026 Convertible Notes is based on the If-Converted method, where the interest costs associated with the 2026 Convertible Notes are added back to the Net Income and the 100.6 million shares underlying the 2026 Convertible Notes are assumed to be converted and are added to the share count. The impact from the 2026 Convertible Notes, if dilutive, is included in diluted EPS calculation. For the GAAP computation, the add-back to net income includes cash and non-cash interest expense, while only the cash interest expense is added back to non-GAAP net income (3) Share counts are weighted average shares. 31 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019

APPENDICES Total Debt (Net) (Millions) Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 6.75% Senior Notes due 2019 $ 196 $ 191 $ 191 $ 191 $ 166 $ 153 $ 153 $ 66 $ 66 7.50% Senior Notes due 2022 350 347 347 347 347 347 347 337 337 7.00% Senior Notes due 2024 416 390 350 324 311 311 310 310 250 2.125% Convertible Senior Notes due 2026 805 805 805 805 805 805 805 805 805 Borrowings from secured revolving line of credit, net — — 42 70 70 70 70 70 70 Total Debt (principal amount) $ 1,767 $ 1,733 $ 1,735 $ 1,737 $ 1,699 $ 1,686 $ 1,685 $ 1,588 $ 1,528 Unamortized debt discount associated with 2.125% Convertible Senior Notes due 2026 (308) (302) (297) (291) (286) (280) (274) (268) (262) Unamortized debt issuance costs (25) (24) (22) (21) (19) (19) (18) (17) (16) Other 1 1 1 1 1 1 — — — Total Debt (net) $ 1,435 $ 1,408 $ 1,417 $ 1,426 $ 1,395 $ 1,388 $ 1,393 $ 1,303 $ 1,250 32 |AMD Q4 AND FY 2018 FINANCIAL RESULTS | JANUARY 29, 2019