Form 8-K BRT Apartments Corp. For: Dec 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 10, 2018

BRT APARTMENTS CORP.

(Exact name of Registrant as specified in charter)

| Maryland | 001-07172 | 13-2755856 | ||||||||||||

| (State or other jurisdiction of incorporation) | (Commission file No.) | (IRS Employer I.D. No.) | ||||||||||||

60 Cutter Mill Road, Suite 303, Great Neck, New York 11021

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code 516-466-3100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

o Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 and Item 7.01. Results of Operations and Financial Condition; Regulation FD Disclosure.

On December 10, 2017, we issued a press release announcing our results of operations for the three months and year ended September 30, 2018. The press release refers to certain supplemental financial information available on our website. The press release and the supplemental financial information are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference. The information in this Item 2.02 and 7.01, including the information included in Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and shall not be incorporated by reference into any registration statement or other document filed under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits relating to Items 2.02 and 7.01 of this Current Report on Form 8-K are intended to be furnished to, not filed with, the SEC.

| Exhibit No. | Description | |||||||

| Press release dated December 10, 2018. | ||||||||

| Supplemental Financial Information. | ||||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BRT APARTMENTS CORP. | ||||||||

| December 10, 2018 | By: /s/ George Zweier | |||||||

| George Zweier, Vice President | ||||||||

| and Chief Financial Officer | ||||||||

BRT APARTMENTS REPORTS FOURTH QUARTER AND

FISCAL YEAR 2018 RESULTS

Great Neck, New York – December 10, 2018 – BRT APARTMENTS CORP. (NYSE:BRT), a real estate investment trust that owns, operates and develops multi-family properties today announced its results of operations for the quarter and fiscal year ended September 30, 2018.

Fiscal Fourth Quarter AND YEAR-END 2018 Highlights:

•Grows rental and other revenues from real estate in the fourth quarter of 2018 by 11.4% over the same period in 2017;

•Improves net income per diluted share to $1.61 in 2018, up 66% from 2017;

•Increases annual FFO (1) per diluted share to $1.03, or 53.7%, from the prior year;

•Improves annual AFFO per diluted share to $0.97, or 10.2%, from the prior year;

•Grows 2018 rental and other revenues by 13.8% over 2017 through select acquisitions;

•Acquires six multi-family properties with 1,921 units for $230.3 million in 2018;

•Sells three multi-family properties with 1,368 units for $170.5 million and a gain of $64.0 million – our share of this gain is $36.4 million, after giving effect to $27.6 million allocated to the non-controlling partners; and

•Buys out the interests of joint venture partners in two properties for an aggregate purchase price of $5.2 million.

Jeffrey A. Gould, President and Chief Executive Officer of BRT commented: “BRT completed a highly productive year that resulted in meaningful year-over-year increases in FFO and AFFO. We created value in 2018 through targeted property sales that generated IRRs ranging from 15.7% to 25% and recycled our share of the net sale proceeds into six value-add properties that we believe have long-term growth potential. We expect to benefit in 2019 from our value-add program and the demographic and economic tailwinds supporting rental housing. Given our extensive JV relationships in high growth southern markets, we anticipate that 2019 will be another productive year in our efforts to generate long-term stockholder value.”

Results for the Three Months Ended September 30, 2018:

Net loss attributable to common stockholders for the fourth quarter of 2018 was $3.1 million, or $0.20 per diluted share, compared to net income attributable to common stockholders of $5.5 million, or $0.39 per diluted share, for the 2017 period. Net income for the 2017 quarter includes $16.8 million, or $1.19 per diluted share, of gain on sale of real estate. The 2018 quarter includes an aggregate $1.3 million, or $0.08 per diluted share, of gains from an insurance recovery and the sale of real estate.

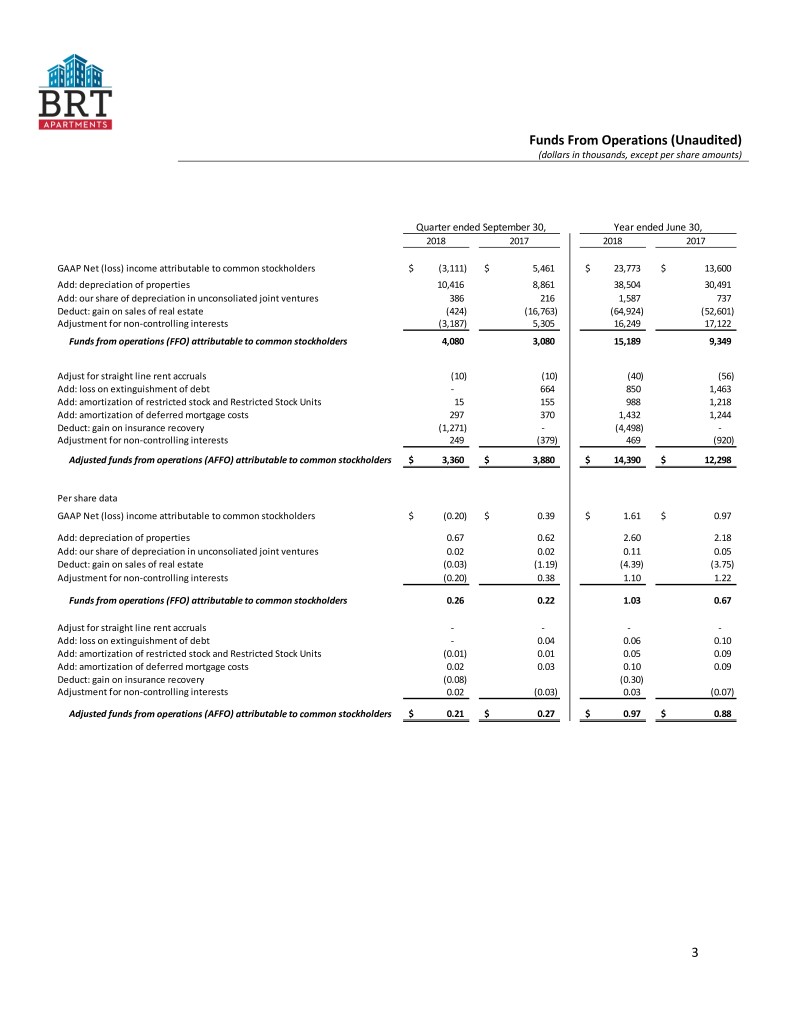

Funds from Operations, or FFO, were $4.1 million or $0.26 per diluted share, in the fourth quarter of 2018, compared to $3.1 million, or $0.22 per diluted share, in the 2017 period. FFO for the 2018 quarter includes $1.3 million, or $0.08 per diluted share, from a gain on an insurance recovery. Adjusted Funds from Operations, or AFFO, were $3.4 million, or $0.21 per diluted share, in the fourth quarter of 2018, compared to AFFO of $3.9 million, or $0.27 per diluted share, in the 2017 quarter.

(1) A reconciliation of GAAP amounts to non-GAAP amounts is presented with the financial information included in this release.

Rental and other revenues from real estate for the three months ended September 30, 2018 grew 11.4% to $31.3 million from $28.1 million for the three months ended September 30, 2017. These revenues increased primarily due to the operations of the multi-family properties acquired in 2018 and 2017, net of such revenues from properties sold in 2018. Total expenses for the current three months increased to $37.0 million from $32.5 million for the three months ended September 30, 2017, due primarily to additional operating expenses, interest expense and depreciation relating to multi-family properties acquired in 2018 and 2017, net of such expenses from properties sold in 2018.

Results for the Year Ended September 30, 2018:

Net income attributable to common stockholders in 2018 was $23.8 million, or $1.61 per diluted share, compared to net income of $13.6 million, or $0.97 per diluted share, in 2017. Net income for 2018 includes $64.9 million, or $4.39 per diluted share, of gain on sale of real estate and $4.5 million, or $0.30 per diluted share, of gain on an insurance recovery. Net income attributable to common stockholders in 2017 includes $52.6 million, or $3.75 per diluted share, of gain on sale of real estate.

FFO was $15.2 million, or $1.03 per diluted share, in 2018, compared to $9.3 million, or $0.67 per diluted share, in 2017. FFO for 2018 includes the $4.5 million gain on an insurance recovery. AFFO was $14.4 million, or $0.97 per diluted share, in 2018, compared to $12.3 million, or $0.88 per diluted share, in 2017.

Diluted per share net income, FFO and AFFO were impacted during the year ended September 30, 2018 by the approximate 761,555 share increase in the weighted average number of shares of common stock outstanding in 2018 due primarily to stock issuances pursuant to BRT’s at-the-market offering program.

Rental and other revenues from real estate properties rose 13.8% to $118.9 million from $104.5 million in 2017. The increase is due primarily to the revenues generated by multi-family properties acquired in 2018 and 2017, net of such revenues from properties sold in 2018.Total expenses increased to $139.8 million from $119.3 million in 2017, due primarily to additional operating expenses, depreciation and interest expense related to the multi-family properties acquired in 2018 and 2017, net of such expenses from properties sold in 2018.

Transaction Activity:

The Company continued to actively manage its portfolio through its opportunistic purchase and sale activities in 2018, completing over $400 million in cumulative transactions. Acquisitions contributed approximately $230.3 million of the total and dispositions of multi-family properties totaling approximately $170.5 million.

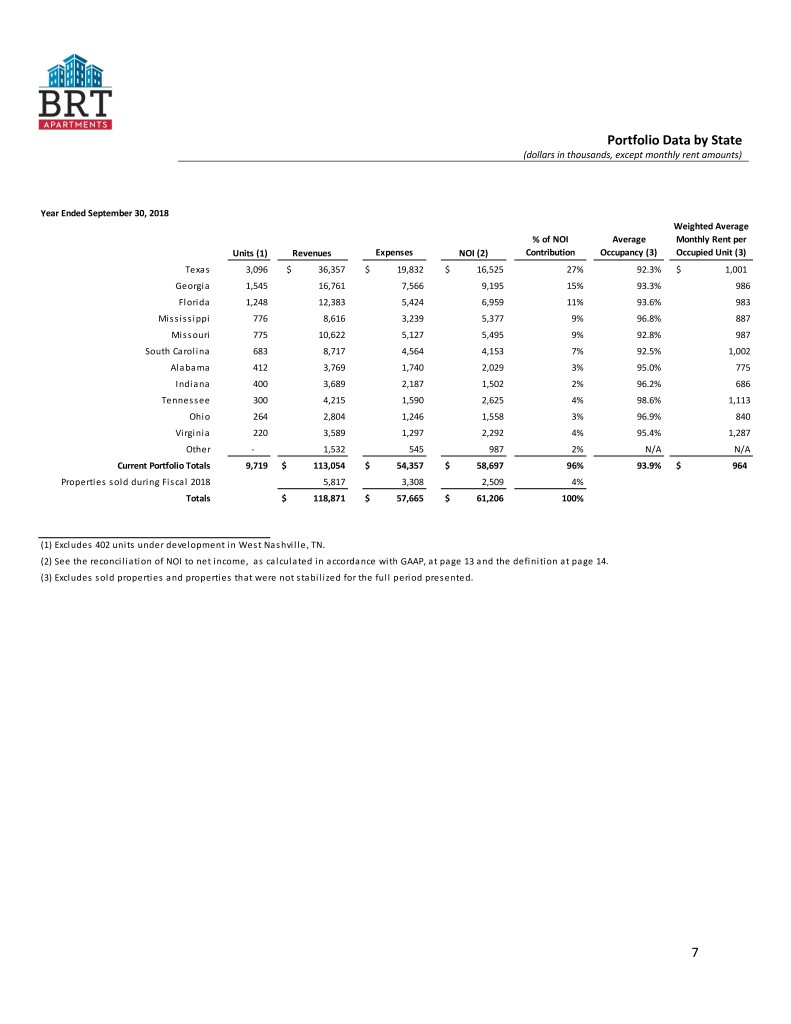

At September 30, 2018, BRT owned 36 multi-family properties with an aggregate of 10,121 units, including 402 units under development. Most of the Company’s properties are located in the Southeast United States and Texas.

Balance Sheet:

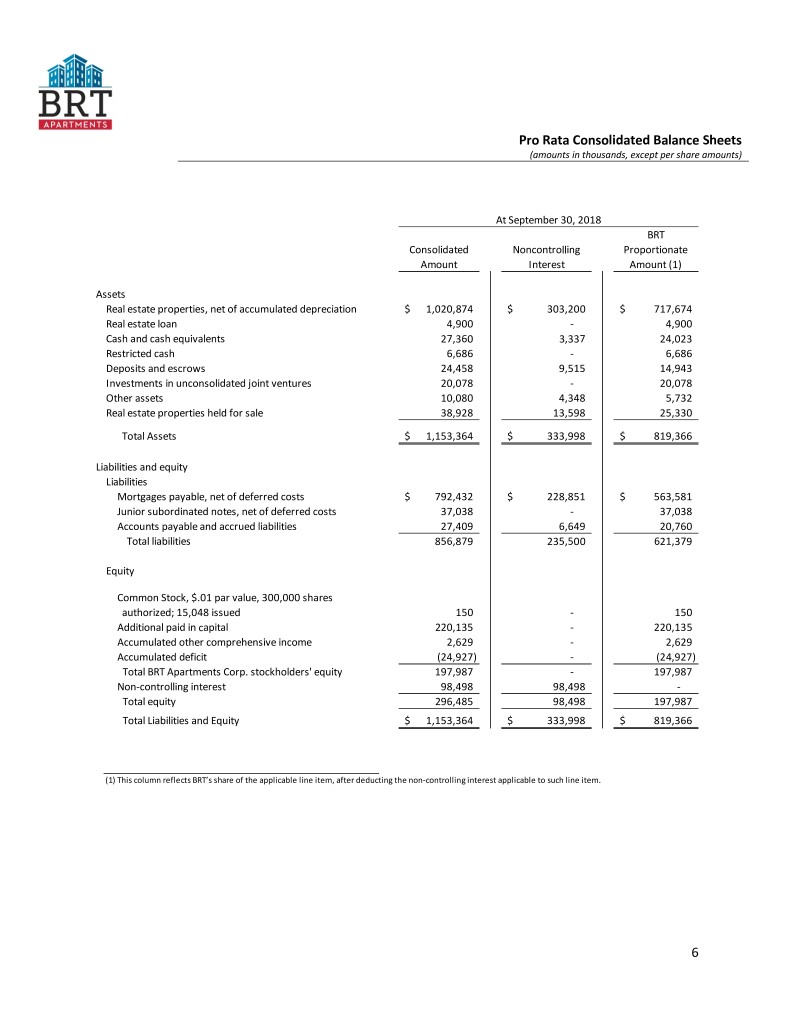

At September 30, 2018, the Company had $27.4 million of cash and cash equivalents, total assets of $1.15 billion, total debt of $829.4 million and total stockholders’ equity of $198.0 million. At November 30, 2018, the Company had approximately $21.6 million of cash and cash equivalents. During the fiscal year, the Company raised approximately $20.5 million of equity on its “At-the-Market” equity sales program, selling 1,590,935 shares at a weighted average share price of $13.15.

Subsequent Events:

On October 30, 2018, BRT, through a joint venture in which it has a 90% ownership interest, purchased Crestmont at Thornblade, a 266-unit value-add multi-family property located in Greenville, South Carolina, for $37.8 million, including a ten year, 4.69% fixed rate mortgage of $26.4 million.

On November 7, 2018, the Company sold Factory at Garco Park, a recently developed multi-family property located in N. Charleston, South Carolina, for a sales price of $51.7 million. The Company estimates that its share of the gain, which will be recognized in the first quarter of fiscal 2019, will be approximately $5.7 million, after giving effect to non-controlling interests of $6.3 million.

We entered into a contract to sell Cedar Lakes--Lake St. Louis, Missouri, for a sales price of $41.3 million. We anticipate that such transaction will close in December 2018 and that if the transaction closes, we will recognize, during the quarter ending December 31, 2018, a gain on the sale of the property of approximately $7.5 million, of which approximately $1.9 million will be allocated to the non-controlling partner.

Supplemental Financial Information:

In an effort to enhance its financial disclosures to investors, BRT has posted a supplemental financial information report which can be accessed on the Company’s website at www.brtapartments.com under the caption “Investor Relations – Financial Statements and SEC Filings.”

Non-GAAP Financial Measures:

BRT discloses FFO and AFFO because it believes that such metrics are widely recognized and appropriate measure of the performance of an equity REIT.

BRT computes FFO in accordance with the "White Paper on Funds from Operations" issued by the National Association of Real Estate Investment Trusts ("NAREIT") and NAREIT's related guidance. FFO is defined in the White Paper as net income (loss) (computed in accordance with generally accepting accounting principles), excluding gains (or losses) from sales of property, plus depreciation and amortization, plus impairment write-downs of depreciable real estate and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect funds from operations on the same basis. In computing FFO, BRT does not add back to net income the amortization of costs in connection with its financing activities or depreciation of non-real estate assets. BRT computes AFFO by adjusting FFO for loss on extinguishment of debt, straight-line rent accruals, and restricted stock and restricted stock unit expense and deferred mortgage costs (including its share of its unconsolidated joint ventures) and gain on insurance recovery. Since the NAREIT White Paper only provides guidelines for computing FFO, the computation of AFFO may vary from one REIT to another.

BRT believes that FFO and AFFO are useful and standard supplemental measures of the operating performance for equity REITs and are used frequently by securities analysts, investors and other interested parties in evaluating equity REITs, many of which present FFO and AFFO when reporting their operating results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization of real estate assets, which assures that the value of real estate assets diminish predictability over time. In fact, real estate values have historically risen and fallen with market conditions. As a result, BRT believes that FFO and AFFO provide a performance measure that when compared year over year, should reflect the impact to operations from trends in occupancy rates, rental rates, operating costs, interest costs and other matters without the inclusion of depreciation and amortization, providing a perspective that may not be necessarily apparent from net income. BRT also considers FFO and AFFO to be useful in evaluating potential property acquisitions.

FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. FFO and AFFO should not be considered to be an alternative to net income as a reliable measure of our operating performance; nor should FFO and AFFO be considered an alternative to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity. FFO and AFFO do not measure whether cash flow is sufficient to fund all of our cash needs, including principal amortization and capital improvements.

Management recognizes that there are limitations in the use of FFO and AFFO. In evaluating BRT’s performance, management is careful to examine GAAP measures such as net income (loss) and cash flows from operating, investing and financing activities. Management also reviews the reconciliation of net income (loss) to FFO and AFFO.

Forward Looking Information:

Certain information contained herein is forward looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. BRT intends such forward looking statements to be covered by the safe harbor provisions for forward looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “apparent,” “experiencing” or similar expressions or variations thereof. Forward looking statements, including statements with respect to BRT’s multi-family property acquisition and ownership activities, involve known and unknown risks, uncertainties and other factors, which, in some cases, are beyond BRT’s control and could materially affect actual results, performance or achievements. Investors are cautioned not to place undue reliance on any forward-looking statements and to carefully review the section entitled “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended September 30, 2018.

Additional information:

BRT is a real estate investment trust that owns, operates and develops multi-family properties. Interested parties are urged to review the Form 10-K filed with the Securities and Exchange Commission for the year ended September 30, 2018 for further details. The Form 10-K can also be linked through the “Investor Relations” section of BRT’s website. For additional information on BRT’s operations, activities and properties, please visit its website at www.brtapartments.com.

Contact: Investor Relations

BRT APARTMENTS CORP.

60 Cutter Mill Road

Suite 303

Great Neck, New York 11021

Telephone (516) 466-3100

Telecopier (516) 466-3132

www.brtapartments.com

BRT APARTMENTS CORP. AND SUBSIDIARIES

CONDENSED BALANCE SHEETS

(Dollars in thousands)

| September 30, 2018 | September 30, 2017 | ||||||||||

| ASSETS | |||||||||||

| Real estate properties, net of accumulated depreciation | $ | 1,020,874 | $ | 902,281 | |||||||

| Real estate loan | 4,900 | 5,500 | |||||||||

| Cash and cash equivalents | 27,360 | 12,383 | |||||||||

| Restricted cash | 6,686 | 6,151 | |||||||||

| Other assets | 54,616 | 58,613 | |||||||||

| Real estate properties held for sale | 38,928 | 8,969 | |||||||||

| Total Assets | $ | 1,153,364 | $ | 993,897 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Mortgages payable, net of deferred costs | $ | 792,432 | $ | 697,826 | |||||||

| Junior subordinated notes, net of deferred costs | 37,038 | 37,018 | |||||||||

| Accounts payable and accrued liabilities | 27,409 | 22,348 | |||||||||

| Total Liabilities | 856,879 | 757,192 | |||||||||

| Total BRT Apartments Corp. stockholders’ equity | 197,987 | 165,996 | |||||||||

| Non-controlling interests | 98,498 | 70,709 | |||||||||

| Total Equity | 296,485 | 236,705 | |||||||||

| Total Liabilities and Equity | $ | 1,153,364 | $ | 993,897 | |||||||

BRT APARTMENTS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

| Three Months Ended September 30, | Twelve Months Ended September 30, | ||||||||||||||||||||||

| 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||

Revenues: | |||||||||||||||||||||||

| Rental and other revenues from real estate properties | $ | 31,283 | $ | 28,073 | $ | 118,872 | $ | 104,477 | |||||||||||||||

| Other income | 198 | 314 | 763 | 1,294 | |||||||||||||||||||

| Total revenues | 31,481 | 28,387 | 119,635 | 105,771 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Real estate operating expenses | 15,661 | 13,641 | 57,665 | 51,279 | |||||||||||||||||||

| Interest expense | 8,966 | 7,902 | 34,389 | 28,171 | |||||||||||||||||||

| General and administrative | 2,002 | 2,100 | 9,210 | 9,396 | |||||||||||||||||||

| Depreciation | 10,416 | 8,861 | 38,504 | 30,491 | |||||||||||||||||||

| Total expenses | 37,045 | 32,504 | 139,768 | 119,337 | |||||||||||||||||||

| Total revenue less total expenses | (5,564) | (4,117) | (20,133) | (13,566) | |||||||||||||||||||

| Equity in loss of unconsolidated joint ventures | (173) | (77) | (388) | (384) | |||||||||||||||||||

| Gain on sale of real estate | 424 | 16,763 | 64,924 | 52,601 | |||||||||||||||||||

| Gain on insurance recovery | 1,271 | — | 4,498 | — | |||||||||||||||||||

| Loss on extinguishment of debt | — | (664) | (850) | (1,463) | |||||||||||||||||||

| (Loss) income from continuing operations | (4,042) | 11,905 | 48,051 | 37,188 | |||||||||||||||||||

| Provision for taxes | 96 | 61 | 50 | 1,560 | |||||||||||||||||||

| (Loss) income from continuing operations, net of taxes | (4,138) | 11,844 | 48,001 | 35,628 | |||||||||||||||||||

| Net (loss) income | (4,138) | 11,844 | 48,001 | 35,628 | |||||||||||||||||||

| Loss (income) attributable to non-controlling interests | 1,027 | (6,383) | (24,228) | (22,028) | |||||||||||||||||||

| Net (loss) income attributable to common stockholders | $ | (3,111) | $ | 5,461 | $ | 23,773 | $ | 13,600 | |||||||||||||||

| Per share amounts attributable to common stockholders: | |||||||||||||||||||||||

| Basic | $ | (.20) | $ | .39 | $ | 1.63 | $ | 0.97 | |||||||||||||||

| Diluted | $ | (.20) | $ | .39 | $ | 1.61 | $ | 0.97 | |||||||||||||||

| Funds from operations - Note 1 | $ | 4,080 | $ | 3,080 | $ | 3,080 | $ | 15,189 | $ | 9,349 | |||||||||||||

| Funds from operations per common share - diluted - Note 2 | $ | 0.26 | $ | 0.22 | $ | 1.03 | $ | 0.67 | |||||||||||||||

| Adjusted funds from operations - Note 1 | $ | 3,360 | $ | 3,880 | 14,390 | $ | 12,298 | ||||||||||||||||

| Adjusted funds from operations per common share - diluted -Note 2 | $ | 0.21 | $ | 0.27 | $ | 0.97 | $ | 0.88 | |||||||||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||||||||

| Basic | 15,635,953 | 14,023,735 | 14,580,398 | 13,993,638 | |||||||||||||||||||

| Diluted | 15,635,953 | 14,123,735 | 14,780,398 | 14,018,843 | |||||||||||||||||||

BRT APARTMENTS CORP. AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| Three Months Ended September 30, | Twelve Months Ended September 30, | ||||||||||||||||||||||

| 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||

| Note 1: | |||||||||||||||||||||||

| Funds from operations is summarized in the following table: | |||||||||||||||||||||||

| Net (loss) income attributable to common stockholders | $ | (3,111) | $ | 5,461 | $ | 23,773 | $ | 13,600 | |||||||||||||||

| Add: depreciation of properties | 10,416 | 8,861 | 38,504 | 30,491 | |||||||||||||||||||

| Add: our share of depreciation in unconsolidated joint ventures | 386 | 216 | 1,587 | 737 | |||||||||||||||||||

| Add: amortization of deferred leasing costs | — | — | — | — | |||||||||||||||||||

| Deduct: gain on sales of real estate and partnership interests | (424) | (16,763) | (64,924) | (52,601) | |||||||||||||||||||

| Adjustment for non-controlling interests | (3,187) | 5,305 | 16,249 | 17,122 | |||||||||||||||||||

| NAREIT Funds from operations attributable to common stockholders | 4,080 | 3,080 | 15,189 | 9,349 | |||||||||||||||||||

| Adjust for: straight-line rent accruals | (10) | (10) | (40) | (56) | |||||||||||||||||||

| Add: loss on extinguishment of debt | — | 664 | 850 | 1,463 | |||||||||||||||||||

| Add: amortization of restricted stock and RSU expense | 15 | 155 | 988 | 1,218 | |||||||||||||||||||

| Add: amortization of deferred mortgage and debt costs | 297 | 370 | 1,432 | 1,244 | |||||||||||||||||||

| Deduct: gain on insurance recovery | (1,271) | — | (4,498) | — | |||||||||||||||||||

| Adjustment for non-controlling interests | 249 | (379) | 469 | (920) | |||||||||||||||||||

| Adjusted funds from operations attributable to common shareholders | $ | 3,360 | $ | 3,880 | $ | 14,390 | $ | 12,298 | |||||||||||||||

| Note 2: | |||||||||||||||||||||||

| Funds from operations per share is summarized in the following table: | |||||||||||||||||||||||

| GAAP Net (loss) income attributable to common shareholders | (0.20) | 0.39 | $ | 1.61 | $ | 0.97 | |||||||||||||||||

| Add: depreciation of properties | 0.67 | 0.62 | 2.60 | 2.18 | |||||||||||||||||||

| Add: our share of depreciation in unconsolidated joint ventures | 0.02 | 0.02 | 0.11 | 0.05 | |||||||||||||||||||

| Add: amortization of deferred leasing costs | — | — | — | — | |||||||||||||||||||

| Deduct: gain on sale of real estate and partnership interests | (0.03) | (1.19) | (4.39) | (3.75) | |||||||||||||||||||

| Adjustments for non-controlling interests | (0.20) | 0.38 | 1.10 | 1.22 | |||||||||||||||||||

| NAREIT Funds from operations per common share basic and diluted | 0.26 | 0.22 | $ | 1.03 | 0.67 | ||||||||||||||||||

| Adjustments for straight line rent accruals | — | — | — | — | |||||||||||||||||||

| Add: loss on extinguishment of debt | — | 0.04 | 0.06 | 0.10 | |||||||||||||||||||

| Add: amortization of restricted stock and restricted stock units | (0.01) | 0.01 | 0.05 | 0.09 | |||||||||||||||||||

| Add: amortization of deferred mortgage and debt costs | 0.02 | 0.03 | 0.10 | 0.09 | |||||||||||||||||||

| Deduct: gain on insurance recovery | (0.08) | — | (0.30) | — | |||||||||||||||||||

| Adjustments for non-controlling interests | 0.02 | (0.03) | 0.03 | (0.07) | |||||||||||||||||||

| Adjusted funds from operations per common share basic and diluted | 0.21 | 0.27 | 0.97 | $ | 0.88 | ||||||||||||||||||

4Q 2018 SUPPLEMENTAL FINANCIAL INFORMATION December 10, 2018 BRT APARTMENTS CORP. 60 Cutter Mill Rd., Great Neck, NY 11021

Forward Looking Statements The information set forth herein contains forward-looking information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking information included herein that is not historical fact is subject to a number of risks and uncertainties, depending upon the risks and uncertainties described in the Company's filings with the Securities and Exchange Commission (SEC), and actual results realized by the Company could differ materially from the forward-looking information included herein. Existing and prospective investors are cautioned not to place undue reliance on this forward-looking information, which speak only as of the date hereof. The Company undertakes no obligation to update or revise the information herein, whether as a result of new information, future events or circumstances, or otherwise. The Company recommends that current and prospective investors review the information set forth in its Annual Report on Form 10-K for the year ended September 30, 2018 to be filed contemporaneously herewith. Our fiscal year ends on September 30 and unless otherwise indicated or the context otherwise requires, all references to a quarter or year refer to the applicable fiscal quarter or year. Units under rehabilitation for which we have received or accrued rental income from business interruption insurance, while not physically occupied, are treated as leased (i.e., occupied) at rental rates in effect at the time of the casualty.

Table of Contents Table of Contents Page Number Financial Highlights 1 Operating Results 2 Funds From Operations 3 Consolidated Balance Sheets 4 Pro Rata Operating Results 5 Pro Rata Balance Sheets 6 Portfolio Data by State 7 Same Store Comparison (First Quarter) 8 Same Store Comparison (Fiscal YTD) 9 Multi-Family Acquisitions and Dispositions 10 Value-Add Information 11 Debt Analysis 12 Non-GAAP Financial Measures, Definitions, and 13-14 Reconciliations Portfolio Table 15

Financial Highlights September 30, 2018 2017 2016 2015 Market Information Market capitalization $ 189,681,411 $ 150,320,535 $ 111,190,680 $ 99,976,487 Shares outstanding 15,754,270 14,022,438 13,898,835 14,101,056 Closing share price $ 12.04 $ 10.72 $ 8.00 $ 7.09 Annual dividends declared per share $ 0.78 $ 0.18 (4) $ - $ - Portfolio Multi-family properties owned 36 33 33 28 Units 10,121 (1) 9,568 (1) 9,420 8,300 Average occupancy (2) 93.69 % 93.80 % 92.80 % 94.50 % Average monthly rental revenue per occupied unit (2) $964 $933 $852 $810 Quarter ended September 30, Year ended September 30, 2018 2017 2018 2017 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Per Share Data Earnings per share (basic) $ (0.20) $ 0.39 $ 1.63 $ 0.97 Earnings per share (diluted) $ (0.20) $ 0.39 $ 1.61 $ 0.97 FFO per share of common stock (diluted) (3) $ 0.26 $ 0.22 $ 1.03 $ 0.67 AFFO per share of common stock (diluted) (3) $ 0.21 $ 0.27 $ 0.97 $ 0.88 (1) Includes 402 units at a property under development. (2) Average includes stabilized properties for the period presented. See definition of stabilized properties on page 14. (3) See the reconciliation of Funds From Operations, or FFO, and Adjusted Funds From Operations, or AFFO, to net income, as calculated in accordance with GAAP, on page 3, and the definitions of such terms at page 14. (4) Dividend of $0.18 was initiated in September 2017. 1

Operating Results (dollars in thousands, except per share amounts) Quarter ended September 30, Year ended September 30, 2018 2017 2018 2017 Revenues Rental and other revenue from real estate properties $ 31,283 $ 28,073 $ 118,872 $ 104,477 Other income 198 314 763 1,294 Total revenues 31,481 28,387 119,635 105,771 Expenses Real estate operating expenses 15,661 13,640 57,665 51,279 Interest expense 8,966 7,902 34,389 28,171 General and administrative 2,002 2,101 9,210 9,396 Depreciation 10,416 8,861 38,504 30,491 Total expenses 37,045 32,504 139,768 119,337 Total revenues less total expenses (5,564) (4,117) (20,133) (13,566) Equity in loss of unconsolidated joint ventures (173) (77) (388) (384) Gain on sale of real estate 424 16,763 64,924 52,601 Gain on insurance recovery 1,271 4,498 - Loss on extinguishment of debt - (664) (850) (1,463) (Loss) income from continuing operations (4,042) 11,905 48,051 37,188 Income tax provision 96 61 50 1,560 (Loss) income from continuing operations, net of taxes (4,138) 11,844 48,001 35,628 Net loss (income) attributable to non-controlling interests 1,027 (6,383) (24,228) (22,028) Net (loss) income attributable to common stockholders $ (3,111) $ 5,461 $ 23,773 $ 13,600 Weighted average number of shares of common stock outstanding: Basic 15,635,953 14,023,735 14,580,398 13,993,638 Diluted 15,635,953 14,123,735 14,780,398 14,018,843 Per share amounts attributable to common stockholders: Basic $ (0.20) $ 0.39 $ 1.63 $ 0.97 Diluted $ (0.20) $ 0.39 $ 1.61 $ 0.97 2

Funds From Operations (Unaudited) (dollars in thousands, except per share amounts) Quarter ended September 30, Year ended June 30, 2018 2017 2018 2017 GAAP Net (loss) income attributable to common stockholders $ (3,111) $ 5,461 $ 23,773 $ 13,600 Add: depreciation of properties 10,416 8,861 38,504 30,491 Add: our share of depreciation in unconsoliated joint ventures 386 216 1,587 737 Deduct: gain on sales of real estate (424) (16,763) (64,924) (52,601) Adjustment for non-controlling interests (3,187) 5,305 16,249 17,122 Funds from operations (FFO) attributable to common stockholders 4,080 3,080 15,189 9,349 Adjust for straight line rent accruals (10) (10) (40) (56) Add: loss on extinguishment of debt - 664 850 1,463 Add: amortization of restricted stock and Restricted Stock Units 15 155 988 1,218 Add: amortization of deferred mortgage costs 297 370 1,432 1,244 Deduct: gain on insurance recovery (1,271) - (4,498) - Adjustment for non-controlling interests 249 (379) 469 (920) Adjusted funds from operations (AFFO) attributable to common stockholders $ 3,360 $ 3,880 $ 14,390 $ 12,298 Per share data GAAP Net (loss) income attributable to common stockholders $ (0.20) $ 0.39 $ 1.61 $ 0.97 Add: depreciation of properties 0.67 0.62 2.60 2.18 Add: our share of depreciation in unconsoliated joint ventures 0.02 0.02 0.11 0.05 Deduct: gain on sales of real estate (0.03) (1.19) (4.39) (3.75) Adjustment for non-controlling interests (0.20) 0.38 1.10 1.22 Funds from operations (FFO) attributable to common stockholders 0.26 0.22 1.03 0.67 Adjust for straight line rent accruals - - - - Add: loss on extinguishment of debt - 0.04 0.06 0.10 Add: amortization of restricted stock and Restricted Stock Units (0.01) 0.01 0.05 0.09 Add: amortization of deferred mortgage costs 0.02 0.03 0.10 0.09 Deduct: gain on insurance recovery (0.08) (0.30) Adjustment for non-controlling interests 0.02 (0.03) 0.03 (0.07) Adjusted funds from operations (AFFO) attributable to common stockholders $ 0.21 $ 0.27 $ 0.97 $ 0.88 3

Consolidated Balance Sheets (amounts in thousands, except per share amounts) At September 30, 2018 2017 2016 2015 Assets Real estate properties, net of accumulated depreciation $ 1,020,874 $ 902,281 $ 759,576 $ 591,727 Real estate loan 4,900 5,500 19,500 - Cash and cash equivalents 27,360 12,383 27,399 15,556 Restricted cash 6,686 6,151 7,383 6,518 Deposits and escrows 24,458 27,839 18,972 12,782 Investments in unconsolidated joint ventures 20,078 21,415 298 - Other assets 10,080 9,359 7,775 6,882 Assets of discontinued operations - - - 163,545 Real estate properties held for sale 38,928 8,969 33,996 23,859 Total Assets $ 1,153,364 $ 993,897 $ 874,899 $ 820,869 Liabilities and equity Liabilities Mortgages payable, net of deferred costs $ 792,432 $ 697,826 $ 588,457 $ 451,159 Junior subordinated notes, net of deferred costs 37,038 37,018 36,998 36,978 Accounts payable and accrued liabilities 27,409 22,348 20,716 14,780 Liabilities of discontinued operations - - - 138,530 Mortgage payable held for sale - - 27,052 19,248 Total liabilities 856,879 757,192 673,223 660,695 Equity Common Stock, $.01 par value, 300,000 shares authorized; 15,048 and 13,333 Issued at September 30, 2018 and 2017 150 133 - - Shares of beneficial interest, $3 par value per share - - 39,696 40,285 Additional paid in capital 220,135 201,910 161,321 161,842 Accumulated other comprehensive income (loss) 2,629 1,000 (1,602) (58) Accumulated deficit (24,927) (37,047) (48,125) (79,414) Total BRT Apartments Corp. stockholders' equity 197,987 165,996 151,290 122,655 Non-controlling interests 98,498 70,709 50,386 37,519 Total Equity 296,485 236,705 201,676 160,174 Total Liabilities and Equity $ 1,153,364 $ 993,897 $ 874,899 $ 820,869 4

Pro Rata Operating Results (dollars in thousands) Three Months ended September 30, 2018 Consolidated Noncontrolling BRT Proportionate Amount Interest Amount (1) Revenues Rental and other revenue from real estate properties $ 31,283 $ 8,582 $ 22,701 Other income 198 - 198 Total revenues 31,481 8,582 22,899 Expenses Real estate operating expenses 15,661 4,315 11,346 Interest expense 8,966 2,417 6,549 General and administrative 2,002 - 2,002 Depreciation 10,416 3,195 7,221 Total expenses 37,045 9,927 27,118 Total revenues less total expenses (5,564) (1,345) (4,219) Equity in loss of unconsolidated joint ventures (173) - (173) Gain on sale of real estate 424 - 424 Gain on insurance recovery 1,271 318 953 Loss on extinguishment of debt - - - Loss from continuing operations (4,042) (1,027) (3,015) Income Tax Provision 96 - 96 Net loss $ (4,138) $ (1,027) $ (3,111) Year ended September 30, 2018 Consolidated Noncontrolling BRT Proportionate Amount Interest Amount (1) Revenues Rental and other revenue from real estate properties $ 118,872 $ 31,843 $ 87,029 Other income 763 - 763 Total revenues 119,635 31,843 87,792 Expenses Real estate operating expenses 57,665 15,502 42,163 Interest expense 34,389 9,092 25,297 General and administrative 9,210 - 9,210 Depreciation 38,504 11,446 27,058 Total expenses 139,768 36,040 103,728 Total revenues less total expenses (20,133) (4,197) (15,936) Equity in loss of unconsolidated joint ventures (388) - (388) Gain on sale of real estate 64,924 27,645 37,279 Gain on insurance recovery 4,498 1,125 3,373 Loss on extinguishment of debt (850) (345) (505) Income from continuing operations 48,051 24,228 23,823 Income tax (benefit) provision 50 - 50 Net income $ 48,001 $ 24,228 $ 23,773 (1) This column reflects BRT’s share of the applicable line item, after deducting the non-controlling interest applicable to such line item. Except with respect to the gain on sale of real estate and loss on extinguishment of debt, the impact of the non-controlling interest on such line item was calculated based on each joint venture partner’s percentage equity interest in the applicable joint venture. Gain on sale of real estate and loss on extinguishment of debt were calculated in accordance with the allocation/distribution provisions of the joint venture operating agreement with respect to the properties sold. Generally, in the event of the sale of a multi-family property owned by a joint venture, as a result of allocation/distribution provisions of the applicable joint venture operating agreement, the allocation and distribution of cash and profits to BRT will be less than that implied by BRT's percentage equity interest in the property. 5

Pro Rata Consolidated Balance Sheets (amounts in thousands, except per share amounts) At September 30, 2018 BRT Consolidated Noncontrolling Proportionate Amount Interest Amount (1) Assets Real estate properties, net of accumulated depreciation $ 1,020,874 $ 303,200 $ 717,674 Real estate loan 4,900 - 4,900 Cash and cash equivalents 27,360 3,337 24,023 Restricted cash 6,686 - 6,686 Deposits and escrows 24,458 9,515 14,943 Investments in unconsolidated joint ventures 20,078 - 20,078 Other assets 10,080 4,348 5,732 Real estate properties held for sale 38,928 13,598 25,330 Total Assets $ 1,153,364 $ 333,998 $ 819,366 Liabilities and equity Liabilities Mortgages payable, net of deferred costs $ 792,432 $ 228,851 $ 563,581 Junior subordinated notes, net of deferred costs 37,038 - 37,038 Accounts payable and accrued liabilities 27,409 6,649 20,760 Total liabilities 856,879 235,500 621,379 Equity Common Stock, $.01 par value, 300,000 shares authorized; 15,048 issued 150 - 150 Additional paid in capital 220,135 - 220,135 Accumulated other comprehensive income 2,629 - 2,629 Accumulated deficit (24,927) - (24,927) Total BRT Apartments Corp. stockholders' equity 197,987 - 197,987 Non-controlling interest 98,498 98,498 - Total equity 296,485 98,498 197,987 Total Liabilities and Equity $ 1,153,364 $ 333,998 $ 819,366 (1) This column reflects BRT’s share of the applicable line item, after deducting the non-controlling interest applicable to such line item. 6

Portfolio Data by State (dollars in thousands, except monthly rent amounts) Year Ended September 30, 2018 Weighted Average % of NOI Average Monthly Rent per Units (1) Revenues Expenses NOI (2) Contribution Occupancy (3) Occupied Unit (3) Texas 3,096 $ 36,357 $ 19,832 $ 16,525 27% 92.3% $ 1,001 Georgia 1,545 16,761 7,566 9,195 15% 93.3% 986 Florida 1,248 12,383 5,424 6,959 11% 93.6% 983 Mississippi 776 8,616 3,239 5,377 9% 96.8% 887 Missouri 775 10,622 5,127 5,495 9% 92.8% 987 South Carolina 683 8,717 4,564 4,153 7% 92.5% 1,002 Alabama 412 3,769 1,740 2,029 3% 95.0% 775 Indiana 400 3,689 2,187 1,502 2% 96.2% 686 Tennessee 300 4,215 1,590 2,625 4% 98.6% 1,113 Ohio 264 2,804 1,246 1,558 3% 96.9% 840 Virginia 220 3,589 1,297 2,292 4% 95.4% 1,287 Other - 1,532 545 987 2% N/A N/A Current Portfolio Totals 9,719 $ 113,054 $ 54,357 $ 58,697 96% 93.9% $ 964 Properties sold during Fiscal 2018 5,817 3,308 2,509 4% Totals $ 118,871 $ 57,665 $ 61,206 100% (1) Excludes 402 units under development in West Nashville, TN. (2) See the reconciliation of NOI to net income, as calculated in accordance with GAAP, at page 13 and the definition at page 14. (3) Excludes sold properties and properties that were not stabilized for the full period presented. 7

Same Store Comparisons Quarter Ended September 30, 2018 and 2017 (dollars in thousands, except monthly rent amounts) Quarter ended September 30, 2018 Revenues Property Operating Expenses NOI (1) Units Q4 2018 Q4 2017 Growth Q4 2018 Q4 2017 Growth Q4 2018 Q4 2017 Growth Texas 2,427 $ 7,773 $ 7,500 3.6% $ 4,336 $ 4,106 5.6% $ 3,437 $ 3,394 1.3% Georgia 959 3,004 2,900 3.6% 1,431 1,288 11.1% 1,573 1,612 (2.4%) Mississippi 776 2,216 2,117 4.7% 873 855 2.1% 1,343 1,262 6.4% Missouri 601 1,947 1,947 (0.0%) 1,043 1,082 (3.7%) 904 865 4.6% South Carolina 412 1,330 1,324 0.4% 760 686 10.8% 570 639 (10.8%) Indiana 400 955 935 2.2% 583 562 3.8% 372 373 (0.3%) Tennessee 300 1,076 1,020 5.5% 434 345 25.5% 642 675 (4.9%) Florida 276 922 829 11.2% 391 370 5.6% 531 459 15.8% Ohio 264 711 680 4.5% 332 291 14.1% 379 389 (2.6%) Virginia 220 899 904 (0.5%) 381 325 17.2% 518 579 (10.5%) Alabama 208 530 489 8.6% 235 237 (0.7%) 295 252 17.0% Totals 6,843 $ 21,363 $ 20,645 3.5% $ 10,799 $ 10,147 6.4% $ 10,564 $ 10,498 0.6% Quarter ended September 30, 2018 Weighted Average Occupancy Weighted Average Monthly Rent per Occupied Unit Q4 2018 Q4 2017 Growth Q4 2018 Q4 2017 Growth Texas 92.3% 92.7% (0.3%) $ 1,014 $ 984 3.1% Georgia 94.3% 96.0% (1.8%) 978 939 4.1% Mississippi 96.8% 97.4% (0.6%) 909 868 4.8% Missouri 95.7% 94.2% 1.5% 980 997 (1.7%) South Carolina 93.1% 92.8% 0.4% 1,019 1,004 1.5% Indiana 97.8% 97.7% 0.1% 707 682 3.8% Tennessee 99.0% 97.7% 1.3% 1,122 1,077 4.2% Florida 97.7% 94.2% 3.7% 1,020 967 5.5% Ohio 96.3% 96.9% (0.6%) 858 827 3.8% Virginia 96.8% 94.8% 2.1% 1,287 1,262 2.1% Alabama 95.1% 96.3% (1.2%) 785 702 11.8% Totals 94.72% 94.46% 0.28% $ 977 $ 946 3.3% (1) Generally, negative variances in NOI are, among other things, due to higher turnover, changes in occupancy and/or rental rates, increases in real estate taxes, and/or increases in insurance expense. With regards to taxes, when a property is re-assessed at a higher value, we generally appeal the re-assessment if we feel that we can obtain a reduction in the taxes - if successful, the reduction will typically be reflected in the following year. See definition of Same Store on page 14 8

Same Store Comparisons Year ended September 30, 2018 and 2017 (dollars in thousands, except monthly rent amounts) 2018 Results Revenues Property Operating Expenses NOI (1) Units 2018 2017 Growth 2018 2017 Growth 2018 2017 Growth Texas 1,918 $ 22,912 $ 22,102 3.7% $ 12,911 (2) $ 12,428 3.9% $ 10,001 $ 9,674 3.4% Georgia 959 11,720 11,251 4.2% 5,198 5,198 0.0% 6,522 6,053 7.7% Mississippi 776 8,616 8,310 3.7% 3,239 3,248 (0.3%) 5,377 5,062 6.2% Missouri 420 4,518 4,328 4.4% 2,344 2,022 15.9% 2,174 2,306 (5.7%) South Carolina 412 5,199 5,296 (1.8%) 2,913 2,722 7.0% 2,286 2,574 (11.2%) Indiana 400 3,689 3,418 7.9% 2,187 2,082 5.0% 1,502 1,336 12.4% Tennessee 300 4,216 3,991 5.6% 1,590 1,562 1.8% 2,626 2,429 8.1% Florida 276 3,362 3,219 4.4% 1,438 1,507 (4.6%) 1,924 1,712 12.4% Ohio 264 2,804 2,671 5.0% 1,246 1,220 2.1% 1,558 1,451 7.4% Alabama 208 1,991 1,898 4.9% 892 862 3.5% 1,099 1,036 6.1% Totals 5,933 $ 69,027 $ 66,484 3.8% $ 33,958 $ 32,851 3.4% $ 35,069 $ 33,633 4.3% Weighted Average Monthly Rent per Occupied 2018 Results Weighted Average Occupancy Unit 2018 2017 Growth 2018 2017 Growth Texas 93.4% 91.8% 1.7% $ 936 $ 923 1.4% Georgia 93.5% 94.7% (1.2%) 967 927 4.4% Mississippi 96.8% 96.5% 0.3% 887 858 3.4% Missouri 95.5% 92.9% 2.8% 782 789 (0.9%) South Carolina 92.5% 94.1% (1.7%) 1,001 1,003 (0.2%) Indiana 96.2% 92.0% 4.6% 686 652 5.3% Tennessee 98.6% 97.3% 1.3% 1,113 1,066 4.3% Florida 91.9% 90.9% 1.1% 997 969 2.9% Ohio 96.9% 96.8% 0.1% 840 801 4.8% Alabama 94.3% 95.9% (1.7%) 743 690 7.6% Totals 94.5% 93.7% 0.8% $ 912 $ 889 2.6% (1) Generally, negative variances in NOI are, among other things, due to higher turnover, changes in occupancy and/or rental rates, increases in real estate taxes, and/or increases in insurance expense. With regards to taxes, when a property is re-assessed at a higher value, we generally appeal the re-assessment if we feel that we can obtain a reduction in the taxes - if successful, the reduction will typically be reflected in the following year. 9

Acquisitions and Dispositions Year Ended September 30, 2018 (dollars in thousands) 10

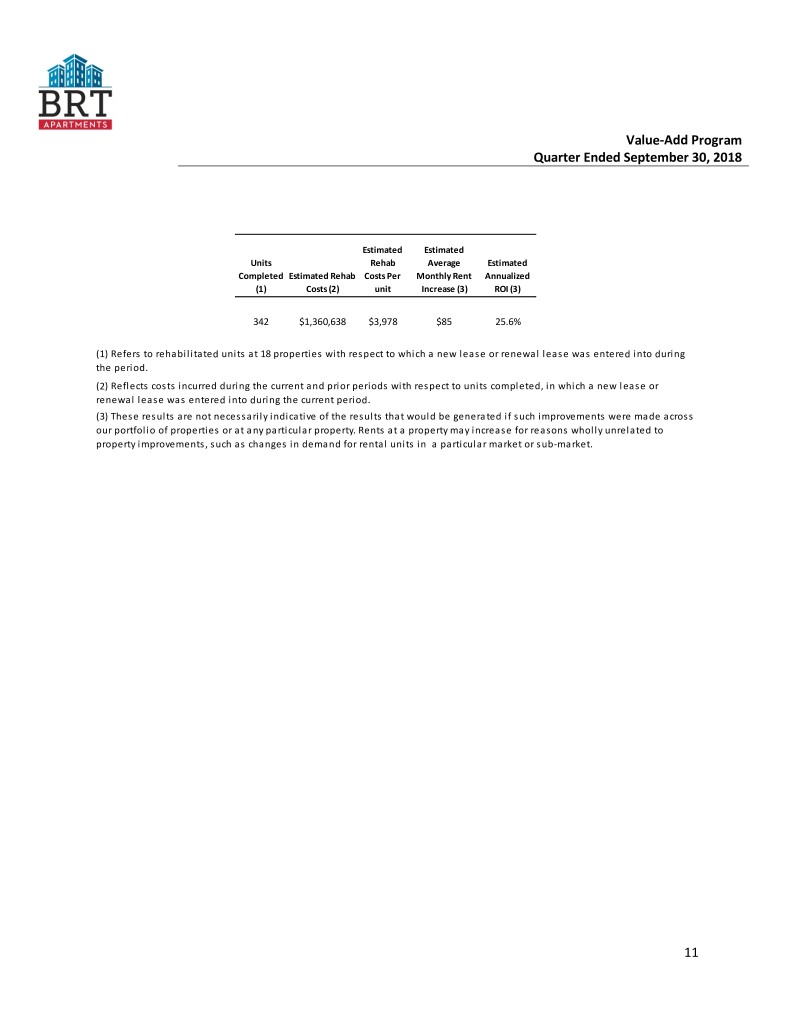

Value-Add Program Quarter Ended September 30, 2018 Estimated Estimated Units Rehab Average Estimated Completed Estimated Rehab Costs Per Monthly Rent Annualized (1) Costs (2) unit Increase (3) ROI (3) 342 $1,360,638 $3,978 $85 25.6% (1) Refers to rehabilitated units at 18 properties with respect to which a new lease or renewal lease was entered into during the period. (2) Reflects costs incurred during the current and prior periods with respect to units completed, in which a new lease or renewal lease was entered into during the current period. (3) These results are not necessarily indicative of the results that would be generated if such improvements were made across our portfolio of properties or at any particular property. Rents at a property may increase for reasons wholly unrelated to property improvements, such as changes in demand for rental units in a particular market or sub-market. 11

Debt Analysis As of September 30, 2018 (dollars in thousands) Mortgage Debt Percent of Total Principal Principal Weighted Total Principal Scheduled Payments Due at Payments Due Average Interest Year Payments Amortization Maturity At Maturity Rate (1) 2019 34,819 5,819 29,000 4% 4.68% 2020 62,621 6,877 55,744 8% 3.74% 2021 22,622 8,620 14,002 2% 4.29% 2022 59,496 8,767 50,729 7% 4.63% 2023 92,478 8,557 83,921 12% 3.95% Thereafter 526,769 37,712 489,057 67% 4.17% Total $ 798,805 $ 76,352 $ 722,453 100% Weighted Average Remaining Term to Maturity 6.7 years Weighted Average Interest Rate 4.14% Debt Service Coverage Ratio for the quarter ended September 30, 2018 (2) 1.42 (1) Based on balloon payments at maturity. (2) See definition on page 14. Junior Subordinated Notes Principal Balance $37,400 Interest Rate 3 month LIBOR + 2.00% (i.e, 4.34% at 9/30/2018) Maturity April 30, 2036 12

NON-GAAP FINANCIAL MEASURES DEFINITIONS AND RECONCILIATIONS (dollars in thousands) We define NOI as total property revenues less total property operating expenses. Property operating expenses exclude, among other things, depreciation and interest expense on the related property. Other REIT’s may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REIT’s. We believe NOI provides an operating perspective not immediately apparent from GAAP operating income or net (loss) income. NOI is one of the measures we use to evaluate our performance because it (i) measures the core operations of property performance by excluding corporate level expenses and other items unrelated to property operating performance and (ii) captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of our financial performance. The following table provides a reconciliation of NOI to net income attributable to common stock holders as computed in accordance with GAAP for the periods presented: Three Months ended September 30, 2018 2017 GAAP Net loss attributable to common stockholders $ (3,111) $ 5,461 Less: Other Income (198) (314) Add: Interest expense 8,965 7,902 General and administrative 2,003 2,101 Depreciation 10,416 8,861 Less: Gain on sale of real estate (424) (16,763) Gain on insurance proceeds (1,271) Add: Loss on extinguishment of debt - 664 Equity in loss of unconsolidated joint ventures 173 77 Provision for taxes 96 61 Add: Net income attributable to non-controlling interests (1,027) 6,383 Net Operating Income $ 15,622 $ 14,433 Year ended September 30, 2018 2017 GAAP Net loss attributable to common stockholders $ 23,773 $ 13,600 Less: Other Income (763) (1,294) Add: Interest expense 34,389 28,171 General and administrative 9,210 9,396 Depreciation 38,504 30,491 Less: Gain on sale of real estate (64,924) (52,601) Gain on insurance proceeds (4,498) - Add: Loss on extinguishment of debt 850 1,463 Equity in loss of unconsolidated joint ventures 388 384 Provision for taxes 50 1,560 Add: Net income attributable to non-controlling interests 24,228 22,028 Net Operating Income $ 61,207 $ 53,198 13

NON-GAAP FINANCIAL MEASURES DEFINITIONS AND RECONCILIATIONS (dollars in thousands) Funds from Operations (FFO) FFO is a non-GAAP financial performance measure defined by the National Association of Real Estate Investment Trusts and is widely recognized by investors and analysts as one measure of operating performance of a REIT. The FFO calculation excludes items such as real estate depreciation and amortization, gains and losses on the sale of real estate assets and impairment on depreciable assets. Historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, it is management’s view, and we believe the view of many industry investors and analysts, that the presentation of operating results for a REIT using the historical accounting for depreciation is insufficient. FFO excludes gains and losses from the sale of real estate, which we believe provides management and investors with a helpful additional measure of the performance of our real estate portfolio, as it allows for comparisons, year to year, that reflect the impact on operations from trends in items such as occupancy rates, rental rates, operating costs, general, administrative and other expenses, and interest expenses. Adjusted Funds from Operations (AFFO) AFFO, as defined by us, excludes from FFO straight line rent adjustments, loss on extinguishment of debt, amortization of restricted stock and RSU expense, amortization of deferred mortgage costs and gain on insurance recovery. Management believes that excluding acquisition-related expenses from AFFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management and provides investors a view of the performance of our portfolio over time, including after the time we cease to acquire properties on a frequent and regular basis. We believe that AFFO enables investors to compare the performance of our portfolio with other REITs that have not recently engaged in acquisitions, as well as a comparison of our performance with that of other non-traded REITs, as AFFO, or an equivalent measure is routinely reported by non-traded REITs, and we believe often used by analysts and investors for comparison purposes. Debt Service Coverage Ratio Debt service coverage ratio is net operating income ("NOI") divided by total debt service. Total Debt Service Total debt service is the cash required to cover the repayment of interest and principal on a debt for a particular period. Total debt service is used in the calculation of the debt service coverage ratio which is used to determine the borrower’s ability to make debt service payments. Stabilized Properties For all periods presented, stabilized properties include all our consolidated properties, other than those in lease-up or development, and for the three and nine months ended June 30, 2018, also excludes a Katy, Texas property that was damaged by Hurricane Harvey. Same Store Same store refers to stabilized properties that we and our consolidated joint ventures owned and operated for the entirety of both periods being compared. 14

Portfolio Table As of 12/10/2018 2018 Avg Year Property 2018 Average Rent per Occ. % Property City State Year BuiltAcquired Age No. of Units Occupancy Unit Ownership Silvana Oaks North Charleston SC 2010 2012 9 208 94.5% $ 1,135 100% Avondale Station Decatur GA 1950 2012 69 212 95.2% 1,038 100% Stonecrossing Houston TX 1978 2013 41 240 93.4% 874 91% Pathway Houston TX 1979 2013 40 144 92.9% 909 91% Brixworth at Bridgestreet Huntsville AL 1985 2013 34 208 94.3% 743 80% Newbridge Commons Columbus OH 1999 2013 20 264 96.9% 840 100% Waterside at Castleton Indianapolis IN 1983 2014 36 400 96.2% 686 80% Crossings of Bellevue Nashville TN 1985 2014 34 300 98.6% 1,113 80% Kendall Manor Houston TX 1981 2014 38 272 93.6% 819 80% Avalon Pensacola FL 2008 2014 11 276 91.9% 997 100% Parkway Grande San Marcos TX 2014 2015 5 192 93.5% 1,064 80% Cedar Lakes Lake St. Louis MO 1985 2015 34 420 95.5% 782 80% Woodland Trails LaGrange GA 2010 2015 9 236 95.5% 929 100% Retreat at Cinco Ranch Katy TX 2008 2016 11 268 97.1% 1,012 75% Grove at River Place Macon GA 1988 2016 31 240 93.9% 707 80% Civic Center 1 Southaven MS 2002 2016 17 392 97.0% 862 60% Verandas at Shavano Park San Antonio TX 2014 2016 5 288 95.1% 1,004 65% Chatham Court and Reflections Dallas TX 1986 2016 33 494 92.3% 920 50% Waters Edge at Harbison Columbia SC 1996 2016 23 204 90.5% 860 80% Pointe at Lenox Park Atlanta GA 1989 2016 30 271 90.2% 1,184 74% Civic Center 2 Southaven MS 2005 2016 14 384 96.6% 913 60% Verandas at Alamo Ranch San Antonio TX 2015 2016 4 288 93.3% 988 72% Kilburn Crossing Fredericksburg VA 2005 2016 14 220 95.4% 1,287 100% OPOP Towers St. Louis MO 2014 2017 5 128 85.8% 1,544 76% OPOP Lofts St. Louis MO 2014 2017 5 53 88.5% 1,435 76% Vanguard Heights Creve Coeur MO 2016 2017 3 174 88.0% 1,534 78% Mercer Crossing Dallas TX 2014/2016 2017 5 509 88.1% 1,277 50% Jackson Square Tallahassee FL 1996 2017 23 242 92.0% 1,000 80% Magnolia Pointe Madison AL 1991 2017 28 204 95.8% 815 80% Woodland Apartments Boerne TX 2007 2017 12 120 91.6% 946 80% The Avenue Ocoee FL 1998 2018 21 522 95.7% 986 50% Parc at 980 Lawrenceville GA 1997 2018 22 586 92.6% 1,037 50% Anatole Apartments Daytona Beach FL 1986 2018 33 208 95.3% 885 80% Landings of Carrier Parkway Grand Prairie (Dallas)TX 2001 2018 18 281 93.9% 964 50% Crestmont at Thornblade Greenville SC 1998 2018 21 266 N/A N/A 90% Total/Weighted Average 22.1 9,714 Development Projects Bell's Bluff Nashville TN N/A N/A 402 N/A N/A 58% Total (Including Development Projects) 10,116 Property Unconsolidated Joint Ventures City State Year Built Age No. of Units% Ownership Canalside Sola (1) Columbia SC N/A N/A 338 46% Canalside Lofts Columbia SC 2008/2013 11 374 32% Gateway Oaks Forney TX 2016 3 313 50% Total 1,025 (1) Development project 15