Form 425 Hortonworks, Inc. Filed by: Hortonworks, Inc.

Filed by Hortonworks, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Hortonworks, Inc.

Commission File No. 001-36780

This filing relates to the proposed merger of Hortonworks, Inc., a Delaware corporation (“Hortonworks”), with Surf Merger Corporation (“Merger Sub”), a Delaware corporation and a directly, wholly owned subsidiary of Cloudera, Inc., a Delaware corporation (“Cloudera”), pursuant to the terms of that certain Agreement and Plan of Merger, dated as of October 3, 2018, by and among Hortonworks, Merger Sub and Cloudera.

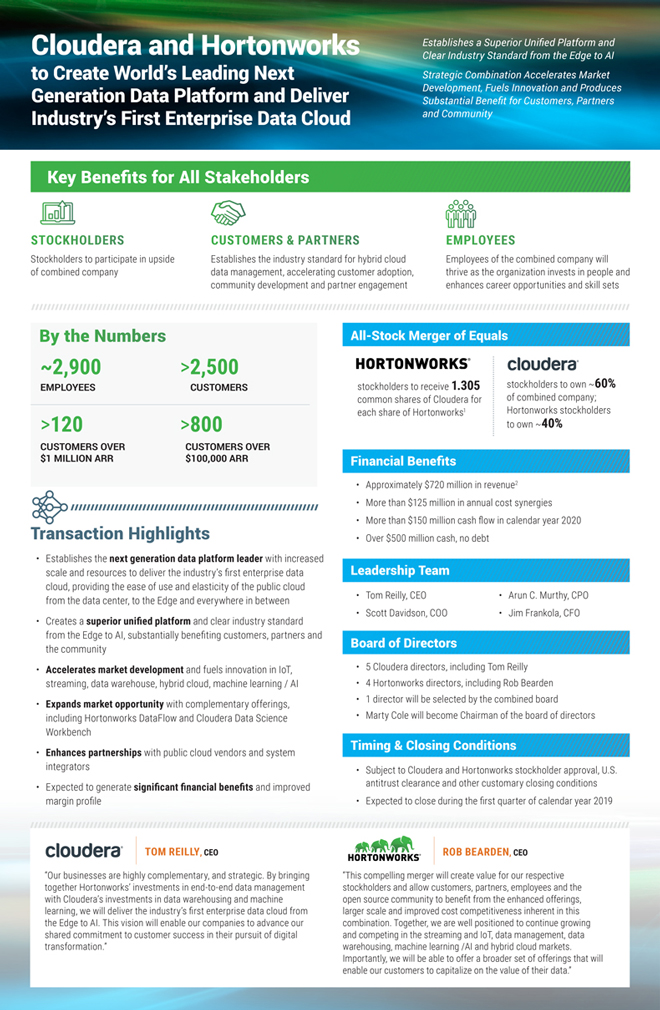

Cloudera and Hortonworks Establishes a Superior Unified Platform and Clear Industry Standard from the Edge to AI to Create World’s Leading Next Strategic Combination Accelerates Market Generation Data Platform and Deliver Development, Fuels Innovation and Produces Substantial Benefit for Customers, Partners Industry’s First Enterprise Data Cloud and Community Key Benefits for All Stakeholders STOCKHOLDERS Stockholders to participate in upside of combined company CUSTOMERS & PARTNERS Establishes the industry standard for hybrid cloud data management, accelerating customer adoption, community development and partner engagement EMPLOYEES Employees of the combined company will thrive as the organization invests in people and enhances career opportunities and skill sets By the Numbers ~2,900 >2,500 EMPLOYEES CUSTOMERS >120 >800 CUSTOMERS OVER CUSTOMERS OVER $1 MILLION ARR $100,000 ARR Transaction Highlights • Establishes the next generation data platform leader with increased scale and resources to deliver the industry’s first enterprise data cloud, providing the ease of use and elasticity of the public cloud from the data center, to the Edge and everywhere in between • Creates a superior unified platform and clear industry standard from the Edge to AI, substantially benefiting customers, partners and the community • Accelerates market development and fuels innovation in IoT, streaming, data warehouse, hybrid cloud, machine learning / AI • Expands market opportunity with complementary offerings, including Hortonworks DataFlow and Cloudera Data Science Workbench • Enhances partnerships with public cloud vendors and system integrators • Expected to generate significant financial benefits and improved margin profile TOM REILLY, CEO “Our businesses are highly complementary, and strategic. By bringing together Hortonworks’ investments in end-to-end data management with Cloudera’s investments in data warehousing and machine learning, we will deliver the industry’s first enterprise data cloud from the Edge to AI. This vision will enable our companies to advance our shared commitment to customer success in their pursuit of digital transformation.” All-Stock Merger of Equals stockholders to receive 1.305 common shares of Cloudera for each share of Hortonworks1 stockholders to own ~60% of combined company; Hortonworks stockholders to own ~40% Financial Benefits Approximately $720 million in revenue2 More than $125 million in annual cost synergies More than $150 million cash flow in calendar year 2020 Over $500 million cash, no debt Leadership Team • Tom Reilly, CEO • Arun C. Murthy, CPO • Scott Davidson, COO • Jim Frankola, CFO Board of Directors • 5 Cloudera directors, including Tom Reilly • 4 Hortonworks directors, including Rob Bearden • 1 director will be selected by the combined board • Marty Cole will become Chairman of the board of directors Timing & Closing Conditions • Subject to Cloudera and Hortonworks stockholder approval, U.S. antitrust clearance and other customary closing conditions • Expected to close during the first quarter of calendar year 2019 “This compelling merger will create value for our respective stockholders and allow customers, partners, employees and the open source community to benefit from the enhanced offerings, larger scale and improved cost competitiveness inherent in this combination. Together, we are well positioned to continue growing and competing in the streaming and IoT, data management, data warehousing, machine learning /AI and hybrid cloud markets. Importantly, we will be able to offer a broader set of offerings that will enable our customers to capitalize on the value of their data.”

1 Based on the 10-day average exchange ratio of the two companies’ prices through October 1 2 For the twelve month period Q2 CY18 and Q2 FY19 Additional Information and Where to Find It In connection with the proposed merger between Cloudera and Hortonworks, Cloudera intends to file a registration statement on Form S-4 containing a joint proxy statement/ prospectus of Cloudera and Hortonworks and other documents concerning the proposed merger with the SEC. The definitive proxy statement will be mailed to the stockholders of Cloudera and Hortonworks in advance of the special meeting. BEFORE MAKING ANY VOTING DECISION, CLOUDERA’S AND HORTONWORKS’ RESPECTIVE STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY EACH OF CLOUDERA AND HORTONWORKS WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a free copy of the joint proxy statement/prospectus and other documents containing important information about Cloudera and Hortonworks, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Cloudera and Hortonworks make available free of charge at www.cloudera.com and www.hortonworks.com, respectively (in the “Investor Relations” section), copies of materials they file with, or furnish to, the SEC. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus. Participants in the Solicitation This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Cloudera, Hortonworks and their respective directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the stockholders of Cloudera and Hortonworks in connection with the proposed merger. Information regarding the special interests of these directors and executive officers in the proposed merger will be included in the joint proxy statement/prospectus referred to above. Security holders may also obtain information regarding the names, affiliations and interests of Cloudera’s directors and executive officers in Cloudera’s Annual Report on Form 10-K for the fiscal year ended January 31, 2018, which was filed with the SEC on April 4, 2018, and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on May 16, 2018. Security holders may obtain information regarding the names, affiliations and interests of Hortonworks’ directors and executive officers in Hortonworks’ Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on March 15, 2018, and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on April 24, 2018. To the extent the holdings of Cloudera securities by Cloudera’s directors and executive officers or the holdings of Hortonworks securities by Hortonworks’ directors and executive officers have changed since the amounts set forth in Cloudera’s or Hortonworks’ respective proxy statement for its 2018 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed merger will be included in the joint proxy statement/prospectus relating to the proposed merger when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov, Cloudera’s website at www.cloudera.com and Hortonworks’ website at www.hortonworks.com. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus. Forward-Looking Statements This document contains forward-looking statements within the meaning of the federal securities law that are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Such forward looking statements include the belief that the combination will create the standard for modern data management and accelerate customer adoption, ecosystem development and partner engagement; the belief that the combination will create a comprehensive solution-set for our large enterprise customers who want to perform traditional data analytics as well as machine learning [and AI], from one platform on shared data in a secure, governed and compliant manner; the anticipated benefits described under the heading “Transaction Highlights”; [the expected synergies to be achieved and anticipated impact on non-GAAP earnings]; the belief that the combined company will have enhanced capabilities, larger scale and improved cost competitiveness and that these will better position it for the market opportunity ahead; and the anticipated timing for completion of the merger. Such statements are subject to risks and uncertainties that include, but are not limited to: (i) Cloudera or Hortonworks may be unable to obtain stockholder approval as required for the merger; (ii) other conditions to the closing of the merger may not be satisfied; (iii) the merger may involve unexpected costs, liabilities or delays; (iv) the effect of the announcement of the merger on the ability of Cloudera or Hortonworks to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Cloudera or Hortonworks does business, or on Cloudera’s or Hortonworks’ operating results and business generally; (v) Cloudera’s or Hortonworks’ respective businesses may suffer as a result of uncertainty surrounding the merger and disruption of management’s attention due to the merger; (vi) the outcome of any legal proceedings related to the merger; (vii) Cloudera or Hortonworks may be adversely affected by other economic, business, and/or competitive factors; (viii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (ix) risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; (x) the risk that Cloudera or Hortonworks may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; and (xi) other risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect the future results of Cloudera and Hortonworks are set forth in their respective filings with the Securities and Exchange Commission (SEC), including each of Cloudera’s and Hortonworks’ most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, which are available on the SEC’s website at www.sec.gov. See in particular Item 1A of Part II of Cloudera’s Quarterly Report on Form 10-Q for the quarter ended July 31, 2018 under the heading “Risk Factors” and Item 1A of Part II of Hortonworks’ Quarterly Report on Form 10-Q for the quarter ended June 30, 2018 under the heading “Risk Factors.” The risks and uncertainties described above and in Cloud-era’s most recent Quarterly Report on Form 10-Q and Hortonworks’ most recent Quarterly Report on Form 10-Q are not exclusive and further information concerning Cloudera and Hortonworks and their respective businesses, including factors that potentially could materially affect its business, financial condition or operating results, may emerge from time to time. Readers are urged to consider these factors carefully in evaluating these forward-looking statements. Readers should also carefully review the risk factors described in other documents that Cloudera and Hortonworks file from time to time with the SEC. The forward-looking statements in this document speak only as of the date of this document. Except as required by law, Cloudera and Hortonworks assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.