Form SC TO-I GAIN Capital Holdings, Filed by: GAIN Capital Holdings, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

GAIN Capital Holdings, Inc.

(Name Of Subject Company (Issuer) And Filing Person (Offeror))

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

36268W100

(CUSIP Number of Common Stock)

Glenn H. Stevens

President and Chief Executive Officer

GAIN Capital Holdings, Inc.

Bedminster One

135 Route 202/206

Bedminster, NJ 07921

Telephone: (908) 731-0700

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

With a copy to:

Leonard Kreynin

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

CALCULATION OF FILING FEE

|

Transaction Valuation*

|

Amount Of Filing Fee**

|

||

|

$50,000,000

|

$

|

6,060.00

|

|

| * | The transaction value is estimated only for purposes of calculating the filing fee. This amount is based on the offer to purchase up to $50 million in value of shares of the common stock, par value $0.00001 per share. |

| ** | The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, equals $121.20 per million dollars of the value of the transaction. |

| o | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

Amount Previously Paid:

|

N/A

|

Filing Party:

|

N/A

|

|

Form or Registration No.:

|

N/A

|

Date Filed:

|

N/A

|

| o | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| o | third-party tender offer subject to Rule 14d-1. |

| ☒ | issuer tender offer subject to Rule 13e-4. |

| o | going-private transaction subject to Rule 13e-3. |

| o | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| o | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| o | Rule 14d-1(d) (Cross-Border Third Party Tender Offer) |

SCHEDULE TO

This Tender Offer Statement on Schedule TO relates to the offer by GAIN Capital Holdings, Inc., a Delaware corporation (“GAIN” or the “Company”), to purchase up to $50 million in value of shares of its common stock, $0.00001 par value per share (the “Shares”), at a price not greater than $7.94 nor less than $7.24 per Share, to the seller in cash, less any applicable withholding taxes and without interest. The Company’s offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase dated October 9, 2018 (the “Offer to Purchase”) and in the related Letter of Transmittal, copies of which are attached to this Tender Offer Statement on Schedule TO as Exhibits (a)(1)(i) and (a)(1)(ii), respectively (which together, as they may be amended or supplemented from time to time, constitute the “Offer”). This Tender Offer Statement on Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended.

The information in the Offer to Purchase and the related Letter of Transmittal are incorporated by reference in answer to Items 1 through 11 in this Tender Offer Statement on Schedule TO.

| ITEM 1. | SUMMARY TERM SHEET |

The information set forth in the section captioned “Summary Term Sheet” of the Offer to Purchase is incorporated herein by reference.

| ITEM 2. | SUBJECT COMPANY INFORMATION |

| (a) | Name and Address: The name of the subject company is GAIN Capital Holdings, Inc. The address of its principal executive offices are located at Bedminster One, 135 Route 202/206, Bedminster, New Jersey 07921 and its telephone number is (908) 731-0700. The information set forth in Section 10 (“Certain Information Concerning Us”) of the Offer to Purchase is incorporated herein by reference. |

| (b) | Securities: The information set forth in the section of the Offer to Purchase captioned “Introduction” is incorporated herein by reference. |

| (c) | Trading Market and Price: The information set forth in the section captioned “Introduction” of the Offer to Purchase is incorporated herein by reference. The information set forth in Section 8 (“Price Range of Shares; Dividends”) of the Offer to Purchase is incorporated herein by reference. |

| ITEM 3. | IDENTITY AND BACKGROUND OF FILING PERSON |

| (a) | Name and Address: The name of the filing person is GAIN Capital Holdings, Inc. The address of its principal executive offices are located at Bedminster One, 135 Route 202/206, Bedminster, New Jersey 07921 and its telephone number is (908) 731-0700. The information set forth in Section 10 (“Certain Information Concerning Us”) and Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference. |

| ITEM 4. | TERMS OF THE TRANSACTION |

| (a) | Material Terms: The information set forth in the sections of the Offer to Purchase captioned “Introduction” and “Summary Term Sheet” is incorporated herein by reference. The information set forth in Section 1 (“Number of Shares; Proration”), Section 2 (“Purpose of the Offer; Certain Effects of the Offer”), Section 3 (“Procedures for Tendering Shares”), Section 4 (“Withdrawal Rights”), Section 5 (“Purchase of Shares and Payment of Purchase Price”), Section 6 (“Conditional Tender of Shares”), Section 7 (“Conditions of the Offer”), Section 9 (“Source and Amount of Funds”), Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”), Section 13 (“Material U.S. Federal Income Tax Consequences”), Section 14 (“Extension of the Offer; Termination; Amendment”) and Section 16 (“Miscellaneous”) of the Offer to Purchase is incorporated herein by reference. |

| (b) | Purchases: The information set forth in the sections of the Offer to Purchase captioned “Introduction” and “Summary Term Sheet” is incorporated herein by reference. The information set forth in Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference. |

1

| ITEM 5. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

Agreements Involving the Subject Company’s Securities: The information set forth in Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 6. | PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS |

| (a) | Purposes: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” is incorporated herein by reference. The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the Offer”) of the Offer to Purchase is incorporated herein by reference. |

| (b) | Use of the Securities Acquired: The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the Offer”) of the Offer to Purchase is incorporated herein by reference. |

| (c) | Plans: The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the Offer”) of the Offer to Purchase is incorporated herein by reference. |

| ITEM 7. | SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| (a) | Source of Funds: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” is incorporated herein by reference. The information set forth in Section 9 (“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference. |

| (b) | Conditions: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” is incorporated herein by reference. The information set forth in Section 9 (“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference. |

| (d) | Borrowed Funds: Not applicable. |

| ITEM 8. | INTEREST IN SECURITIES OF THE SUBJECT COMPANY |

| (a) | Securities Ownership: The information set forth in Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference. |

| (b) | Securities Transactions: The information set forth in Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference. |

| ITEM 9. | PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED |

Solicitations or Recommendations: The information set forth in Section 15 (“Fees and Expenses”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 10. | FINANCIAL STATEMENTS |

| (a) | Financial Information: Not applicable. |

| (b) | Pro Forma Information: Not applicable. |

| ITEM 11. | ADDITIONAL INFORMATION |

| (a) | Agreements, Regulatory Requirements and Legal Proceedings: The information set forth in Section 11 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) and Section 12 (“Certain Legal Matters; Regulatory Approvals”) of the Offer to Purchase is incorporated herein by reference. |

| (c) | Other Material Information: The information in the Offer to Purchase and the related Letter of Transmittal are incorporated herein by reference. |

2

| ITEM 12. | EXHIBITS |

|

Exhibit No.

|

Description

|

|

(a)(1)(i)

|

Offer to Purchase dated October 9, 2018.

|

|

|

|

|

(a)(1)(ii)

|

Letter of Transmittal.

|

|

|

|

|

(a)(1)(iii)

|

Notice of Guaranteed Delivery.

|

|

|

|

|

(a)(1)(iv)

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

|

|

|

(a)(1)(v)

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

|

|

|

(a)(2)

|

Not applicable.

|

|

|

|

|

(a)(3)

|

Not applicable.

|

|

|

|

|

(a)(4)

|

Not applicable.

|

|

|

|

|

(a)(5)

|

Press Release, dated October 9, 2018.

|

|

|

|

|

(b)

|

Not applicable.

|

|

|

|

|

(d)(1)*

|

Investor Rights Agreement, dated January 11, 2008, by and among the Company, the Investors and the Founding Stockholders, as defined therein (incorporated by reference to Exhibit 4.2 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(2)*

|

Rights Agreement, dated as of April 9, 2013, between GAIN Capital Holdings, Inc. and Broadridge Corporate Issuer Solutions, Inc., as Rights Agent (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed on April 10, 2013, No. 001-35008).

|

|

|

|

|

(d)(3)*

|

Amendment to Investor Rights Agreement, dated as of November 18, 2013, by and among the Company, the Investors named therein and the Founding Stockholder, as defined therein (incorporated by reference to Exhibit 4.3 of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2013, as filed on March 17, 2014, No. 001-35008).

|

|

|

|

|

(d)(4)*

|

Indenture, dated as of November 27, 2013, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed on November 27, 2013, No. 001-35008).

|

|

|

|

|

(d)(5)*

|

Indenture, dated as of April 1, 2015, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to Exhibit 4.11 of the Registrant’s Registration Statement on Form S-3, as amended, No. 333-208175).

|

|

|

|

|

(d)(6)*

|

Indenture, dated as of August 22, 2017, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to exhibit 4.1 of the Registrant’s Current Report on Form 8-K, filed on August 23, 2017, No. 001-35008).

|

|

|

|

|

(d)(7)*

|

Form of 5.00% Convertible Senior Notes due 2022 (included in Exhibit (d)(6)).

|

|

|

|

3

|

Exhibit No.

|

Description

|

|

(d)(8)*

|

2015 Omnibus Incentive Compensation Plan (incorporated by reference to Annex A of the Registrant’s Definitive Proxy Statement on Schedule 14A, filed on October 15, 2015, No. 001-35008).

|

|

|

|

|

(d)(9)*

|

2010 Omnibus Incentive Compensation Plan (incorporated by reference to Exhibit 10.2 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(10)*

|

2011 Employee Stock Purchase Plan (incorporated by reference to Exhibit 10.3 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(11)*

|

Form of Incentive Stock Option Agreement (incorporated by reference to Exhibit 10.4 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(12)*

|

Form of Nonqualified Stock Option Agreement (incorporated by reference to Exhibit 10.5 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(13)*

|

Form of Restricted Stock Agreement (incorporated by reference to Exhibit 10.6 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(14)*

|

Form of Restricted Stock Unit Agreement (Time Vesting) (incorporated by reference to Exhibit 10.7 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(15)*

|

Form of Restricted Stock Unit Agreement (Performance Vesting) (incorporated by reference to Exhibit 10.8 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(16)*

|

Form of Indemnification Agreement with the Company’s Non-Employee Directors (incorporated by reference to Exhibit 10.10 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(17)*

|

Amended and Restated 2006 Equity Compensation Plan, effective December 31, 2006 (incorporated by reference to Exhibit 10.60 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(18)*

|

Amendment No. 2007-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.61 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(19)*

|

Amendment No. 2008-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.62 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(20)*

|

Amendment No. 2010-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.63 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

(d)(21)*

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Glenn Stevens (incorporated by reference to Exhibit 10.1 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

4

|

Exhibit No.

|

Description

|

|

(d)(22)*

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Samantha Roady (incorporated by reference to Exhibit 10.2 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

|

(d)(23)*

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Diego Rotsztain (incorporated by reference to Exhibit 10.3 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

|

(d)(24)*

|

Service Agreement, dated as of March 9, 2011, by and between City Index Limited and Nigel Rose (incorporated by reference to Exhibit 10.31 of the Registrant's Annual Report on Form 1-K for the year ended December 31, 2015, filed on March 17, 2016, No. 001-35008).

|

|

|

|

|

(d)(25)*

|

Stockholders’ Agreement, dated as of April 24, 2013, by and among GAIN Capital Holdings, Inc. and Gary J. Tilkin (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 10-Q for the quarter ended March 31, 2013, filed on May 10, 2013, No. 001-35008).

|

|

|

|

|

(d)(26)*

|

Amended and Restated Stockholders’ Agreement, dated as of September 24, 2013, by and between GAIN Capital Holdings, Inc. and Gary J. Tilkin (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 10-Q for the quarter ended September 30, 2013, filed on November 12, 2013, No. 001- 35008).

|

|

|

|

|

(d)(27)*

|

Stockholders' Agreement, effective as of October 31, 2014, among GAIN Capital Holdings, Inc., City Index Group Limited and the other parties identified as "Stockholders" therein (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K/A, filed on January 12, 2015, No. 001-35008).

|

|

|

|

|

(d)(28)*

|

Form of Registration Rights Agreement among GAIN Capital Holdings, Inc., City Index Group Limited, INCAP Gaming B.V. and the other parties identified as "Investors" therein (incorporated by reference to Exhibit 10.2 of the Registrant's Current Report on Form 8-K/A, filed on January 12, 2015, No. 001-35008).

|

|

|

|

|

(d)(29)*

|

Executive Employment Agreement, dated November 7, 2017, by and between GAIN Capital UK Ltd. and Alastair Hine.

|

|

|

|

|

(g)

|

Not applicable.

|

|

|

|

|

(h)

|

Not applicable.

|

| * | Previously filed. |

| ITEM 13. | INFORMATION REQUIRED BY SCHEDULE 13E-3 |

Not applicable.

5

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule TO is true, complete and correct.

|

|

GAIN CAPITAL HOLDINGS, INC.

|

|

|

|

|

|

|

Dated: October 9, 2018

|

By:

|

/s/ Diego Rotsztain

|

|

|

Name:

|

Diego Rotsztain

|

|

|

Title:

|

EVP and General Counsel

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

Offer to Purchase dated October 9, 2018.

|

|

|

|

|

|

Letter of Transmittal.

|

|

|

|

|

|

Notice of Guaranteed Delivery.

|

|

|

|

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

|

|

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

|

|

|

|

(a)(2)

|

Not applicable.

|

|

|

|

|

(a)(3)

|

Not applicable.

|

|

|

|

|

(a)(4)

|

Not applicable.

|

|

|

|

|

Press Release, dated October 9, 2018.

|

|

|

|

|

|

(b)

|

Not applicable.

|

|

|

|

|

Investor Rights Agreement, dated January 11, 2008, by and among the Company, the Investors and the Founding Stockholders, as defined therein (incorporated by reference to Exhibit 4.2 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Rights Agreement, dated as of April 9, 2013, between GAIN Capital Holdings, Inc. and Broadridge Corporate Issuer Solutions, Inc., as Rights Agent (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed on April 10, 2013, No. 001-35008).

|

|

|

|

|

|

Amendment to Investor Rights Agreement, dated as of November 18, 2013, by and among the Company, the Investors named therein and the Founding Stockholder, as defined therein (incorporated by reference to Exhibit 4.3 of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2013, as filed on March 17, 2014, No. 001-35008).

|

|

|

|

|

|

Indenture, dated as of November 27, 2013, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed on November 27, 2013, No. 001-35008).

|

|

|

|

|

|

Indenture, dated as of April 1, 2015, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to Exhibit 4.11 of the Registrant’s Registration Statement on Form S-3, as amended, No. 333-208175).

|

|

|

|

|

|

Indenture, dated as of August 22, 2017, between GAIN Capital Holdings, Inc. and The Bank of New York Mellon (incorporated by reference to exhibit 4.1 of the Registrant’s Current Report on Form 8-K, filed on August 23, 2017, No. 001-35008).

|

|

|

|

|

|

Form of 5.00% Convertible Senior Notes due 2022 (included in Exhibit (d)(6)).

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

2015 Omnibus Incentive Compensation Plan (incorporated by reference to Annex A of the Registrant’s Definitive Proxy Statement on Schedule 14A, filed on October 15, 2015, No. 001-35008).

|

|

|

|

|

|

2010 Omnibus Incentive Compensation Plan (incorporated by reference to Exhibit 10.2 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

2011 Employee Stock Purchase Plan (incorporated by reference to Exhibit 10.3 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Incentive Stock Option Agreement (incorporated by reference to Exhibit 10.4 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Nonqualified Stock Option Agreement (incorporated by reference to Exhibit 10.5 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Restricted Stock Agreement (incorporated by reference to Exhibit 10.6 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Restricted Stock Unit Agreement (Time Vesting) (incorporated by reference to Exhibit 10.7 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Restricted Stock Unit Agreement (Performance Vesting) (incorporated by reference to Exhibit 10.8 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Form of Indemnification Agreement with the Company’s Non-Employee Directors (incorporated by reference to Exhibit 10.10 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Amended and Restated 2006 Equity Compensation Plan, effective December 31, 2006 (incorporated by reference to Exhibit 10.60 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Amendment No. 2007-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.61 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Amendment No. 2008-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.62 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Amendment No. 2010-1 to the GAIN Capital Holdings, Inc. 2006 Equity Compensation Plan (incorporated by reference to Exhibit 10.63 of the Registrant’s Registration Statement on Form S-1, as amended, No. 333-161632).

|

|

|

|

|

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Glenn Stevens (incorporated by reference to Exhibit 10.1 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Samantha Roady (incorporated by reference to Exhibit 10.2 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

|

|

Executive Employment Agreement, dated May 5, 2015, by and between GAIN Capital Holdings, Inc. and Diego Rotsztain (incorporated by reference to Exhibit 10.3 of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2015, filed on August 10, 2015, No. 001-35008).

|

|

|

|

|

|

Service Agreement, dated as of March 9, 2011, by and between City Index Limited and Nigel Rose (incorporated by reference to Exhibit 10.31 of the Registrant's Annual Report on Form 1-K for the year ended December 31, 2015, filed on March 17, 2016, No. 001-35008).

|

|

|

|

|

|

Stockholders’ Agreement, dated as of April 24, 2013, by and among GAIN Capital Holdings, Inc. and Gary J. Tilkin (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 10-Q for the quarter ended March 31, 2013, filed on May 10, 2013, No. 001-35008).

|

|

|

|

|

|

Amended and Restated Stockholders’ Agreement, dated as of September 24, 2013, by and between GAIN Capital Holdings, Inc. and Gary J. Tilkin (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 10-Q for the quarter ended September 30, 2013, filed on November 12, 2013, No. 001- 35008).

|

|

|

|

|

|

Stockholders' Agreement, effective as of October 31, 2014, among GAIN Capital Holdings, Inc., City Index Group Limited and the other parties identified as "Stockholders" therein (incorporated by reference to Exhibit 10.1 of the Registrant's Current Report on Form 8-K/A, filed on January 12, 2015, No. 001-35008).

|

|

|

|

|

|

Form of Registration Rights Agreement among GAIN Capital Holdings, Inc., City Index Group Limited, INCAP Gaming B.V. and the other parties identified as "Investors" therein (incorporated by reference to Exhibit 10.2 of the Registrant's Current Report on Form 8-K/A, filed on January 12, 2015, No. 001-35008).

|

|

|

|

|

|

Executive Employment Agreement, dated November 7, 2017, by and between GAIN Capital UK Ltd. and Alastair Hine.

|

|

|

|

|

|

(g)

|

Not applicable.

|

|

|

|

|

(h)

|

Not applicable.

|

| * | Previously filed. |

Exhibit (a)(1)(i)

Offer to Purchase

by

GAIN Capital Holdings, Inc.

Up to $50 Million in Value of Shares of Its Common Stock

At a Cash Purchase Price Not Greater than $7.94 per Share Nor Less than $7.24 per Share

|

THE OFFER, PRORATION PERIOD AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON NOVEMBER 6, 2018, UNLESS THE OFFER IS EXTENDED (SUCH DATE AND TIME, AS THEY MAY BE EXTENDED, THE “EXPIRATION DATE”).

|

GAIN Capital Holdings, Inc., a Delaware corporation (the “Company,” “GAIN,” “we,” “us” or “our”), invites our stockholders to tender up to $50 million in value of shares of our common stock, $0.00001 par value per share (the “Shares”), for purchase by us at a price not greater than $7.94 nor less than $7.24 per Share, to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions described in this Offer to Purchase and in the related Letter of Transmittal (the “Letter of Transmittal,” which together with this Offer to Purchase, as they may be amended or supplemented from time to time, constitute the “Offer”).

Upon the terms and subject to the conditions of the Offer, we will determine a single per Share price that we will pay for Shares properly tendered and not properly withdrawn from the Offer, taking into account the total number of Shares tendered and the prices specified, or deemed specified, by tendering stockholders. We will select the lowest single purchase price, not greater than $7.94 nor less than $7.24 per Share, that will allow us to purchase $50 million in value of Shares, or a lower amount depending on the number of Shares properly tendered and not properly withdrawn (such purchase price, the “Final Purchase Price”). Upon the terms and subject to the conditions of the Offer, if, based on the Final Purchase Price, Shares having an aggregate value of less than or equal to $50 million are properly tendered and not properly withdrawn, we will buy all Shares properly tendered and not properly withdrawn. All Shares acquired in the Offer will be acquired at the Final Purchase Price, including those Shares tendered at a price lower than the Final Purchase Price. Only Shares properly tendered at prices at or below the Final Purchase Price, and not properly withdrawn, will be purchased. We may not purchase all of the Shares tendered at or below the Final Purchase Price if, based on the Final Purchase Price, Shares having an aggregate value in excess of $50 million are properly tendered and not properly withdrawn, because of proration, “Odd Lot” priority and conditional tender provisions described in this Offer to Purchase. Shares not purchased in the Offer will be returned to the tendering stockholders promptly after the Expiration Date. We reserve the right, in our sole discretion, to change the per Share purchase price range and to increase or decrease the value of Shares sought in the Offer, subject to applicable law. In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we may increase the number of Shares accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Offer. See Section 1.

At the maximum Final Purchase Price of $7.94 per Share, we could purchase 6,297,229 Shares if the Offer is fully subscribed, which would represent approximately 14.2% of our issued and outstanding Shares as of October 8, 2018. At the minimum Final Purchase Price of $7.24 per Share, we could purchase 6,906,077 Shares if the Offer is fully subscribed, which would represent approximately 15.6% of our issued and outstanding Shares as of October 8, 2018.

THE OFFER IS NOT CONDITIONED ON THE RECEIPT OF FINANCING OR ANY MINIMUM NUMBER OF SHARES BEING TENDERED. THE OFFER IS, HOWEVER, SUBJECT TO CERTAIN OTHER CONDITIONS. SEE SECTION 7.

The Shares are listed and traded on the New York Stock Exchange (“NYSE”) under the trading symbol “GCAP.” On October 8, 2018, the last full trading day prior to the commencement of the Offer, the last reported sale price of the Shares was $6.91 per Share. Stockholders are urged to obtain current market quotations for the Shares before deciding whether and at what purchase price or purchase prices to tender their Shares. See Section 8.

OUR BOARD OF DIRECTORS HAS AUTHORIZED US TO MAKE THE OFFER. HOWEVER, NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, JEFFERIES LLC (THE “DEALER MANAGER”), D.F. KING & CO., INC., THE INFORMATION AGENT FOR THE OFFER (THE “INFORMATION AGENT”), OR BROADRIDGE CORPORATE ISSUER SOLUTIONS, INC., THE DEPOSITARY FOR THE OFFER (THE “DEPOSITARY”), MAKES ANY RECOMMENDATION TO YOU AS TO WHETHER YOU SHOULD TENDER OR REFRAIN FROM TENDERING YOUR SHARES OR AS TO THE PURCHASE PRICE OR PURCHASE PRICES AT WHICH YOU MAY CHOOSE TO TENDER YOUR SHARES. NEITHER WE NOR ANY MEMBER OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION WITH RESPECT TO THE OFFER. YOU MUST MAKE YOUR OWN DECISION AS TO WHETHER TO TENDER YOUR SHARES AND, IF SO, HOW MANY SHARES TO TENDER AND THE PURCHASE PRICE OR PURCHASE PRICES AT WHICH YOU WILL TENDER THEM. WE RECOMMEND THAT YOU CONSULT YOUR OWN FINANCIAL AND TAX ADVISORS, AND READ CAREFULLY AND EVALUATE THE INFORMATION IN THIS OFFER TO PURCHASE AND IN THE RELATED LETTER OF TRANSMITTAL, INCLUDING OUR REASONS FOR MAKING THE OFFER, BEFORE TAKING ANY ACTION WITH RESPECT TO THE OFFER. SEE SECTION 2.

THE OFFER HAS NOT BEEN APPROVED BY THE SEC OR ANY STATE SECURITIES COMMISSION NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THE OFFER OR UPON THE ACCURACY OF THE INFORMATION CONTAINED IN THIS OFFER TO PURCHASE AND ANY RELATED DOCUMENTS, AND ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL AND MAY BE A CRIMINAL OFFENSE.

If you have questions or need assistance, you should contact the Information Agent or the Dealer Manager at their respective addresses and telephone numbers set forth on the back cover of this Offer to Purchase. If you require additional copies of this Offer to Purchase, the Letter of Transmittal, the Notice of Guaranteed Delivery or other related materials, you should contact the Information Agent.

The Information Agent for the Offer is:

D.F. King & Co., Inc.

The Dealer Manager for the Offer is:

Jefferies

Offer to Purchase dated October 9, 2018

2

IMPORTANT

If you want to tender all or part of your Shares, you must do one of the following before the Offer expires at 5:00 P.M., New York City time, on Tuesday, November 6, 2018 (unless the Offer is extended):

| • | if your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and request that the nominee tender your Shares for you. Beneficial owners should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadlines for participation in the Offer. Accordingly, beneficial owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer; |

| • | if you hold certificates registered in your own name, complete and sign a Letter of Transmittal according to its Instructions, and deliver it, together with any required signature guarantees, the certificates for your Shares and any other documents required by the Letter of Transmittal, to the Depositary for the Offer; |

| • | if you are an institution participating in The Depository Trust Company, which we call the “Book-Entry Transfer Facility” in this Offer to Purchase, tender your Shares according to the procedure for book-entry transfer described in Section 3; |

| • | if you are a holder of vested options, you may exercise your vested options and tender any of the Shares issued upon exercise. You must exercise your options sufficiently in advance of the Expiration Date to receive your Shares in order to tender them in the Offer. An exercise of an option cannot be revoked even if Shares received upon the exercise thereof and tendered in the Offer are not purchased in the Offer for any reason; |

| • | if you are a holder of restricted stock units (whether performance-based or time-based, collectively, “RSUs”), you may only tender Shares that you have acquired through vesting of RSUs. Tenders of unvested RSUs will not be accepted; or |

| • | if you are a participant in the 2011 Employee Stock Purchase Plan (the “ESPP”), you may tender Shares that you have purchased through the ESPP. If you have purchased Shares through the ESPP up to and including the purchase period that ended June 30, 2018, and hold such Shares at Morgan Stanley (the administrator of our ESPP), contact Morgan Stanley and request that Morgan Stanley tender such Shares. |

If you want to tender your Shares, but: (a) the certificates for your Shares are not immediately available or cannot be delivered to the Depositary by the Expiration Date; (b) you cannot comply with the procedure for book-entry transfer by the Expiration Date; or (c) your other required documents cannot be delivered to the Depositary by the Expiration Date, you can still tender your Shares if you comply with the guaranteed delivery procedures described in Section 3.

If you wish to maximize the chance that your Shares will be purchased in the Offer, you should check the box in the section of the Letter of Transmittal captioned “Shares Tendered At Price Determined Under The Offer.” If you agree to accept the purchase price determined in the Offer, your Shares will be deemed to be tendered at the minimum price of $7.24 per Share for purposes of determining the Final Purchase Price. You should understand that this election may lower the Final Purchase Price and could result in your Shares being purchased at the minimum price of $7.24 per Share.

3

Following an authorization by our Board of Directors on April 24, 2018 to increase our previously authorized share repurchase program by an additional $25 million, we have approximately $26.3 million available under our share repurchase program as of October 8, 2018, which does not include the Shares to be purchased in this Offer. On October 5, 2018, our Board of Directors authorized this Offer. Following the completion or termination of the Offer, we intend to, from time to time, continue to repurchase Shares. The amount of Shares we buy and timing of any such repurchases depends on a number of factors, including our stock price, the availability of cash and/or financing on acceptable terms, the amount and timing of dividend payments and blackout periods in which we are restricted from repurchasing Shares as well as any decision to use cash for other strategic objectives. Rule 13e-4 under the Exchange Act generally prohibits us and our affiliates from purchasing any Shares, other than in the Offer, until at least ten business days after the Expiration Date, except pursuant to certain limited exceptions provided in Exchange Act Rule 14e-5. Following that time, we expressly reserve the absolute right, in our sole discretion from time to time in the future, to purchase Shares, whether or not any Shares are purchased pursuant to the Offer, through open market purchases, privately negotiated transactions, accelerated share repurchases, tender offers, exchange offers or otherwise, upon the same terms or on terms that are more or less favorable to the selling stockholders in those transactions than the terms of the Offer. We cannot assure you as to which, if any, of these alternatives, or combinations thereof, we might pursue.

We are not making the Offer to, and will not accept any tendered Shares from, stockholders in any jurisdiction where it would be illegal to do so. However, we may, at our discretion, take any actions necessary for us to make the Offer to stockholders in any such jurisdiction.

You may contact the Information Agent, the Dealer Manager or your broker, dealer, commercial bank, trust company or other nominee for assistance. The contact information for the Information Agent and the Dealer Manager is set forth on the back cover of this Offer to Purchase.

OUR BOARD OF DIRECTORS HAS AUTHORIZED US TO MAKE THE OFFER. HOWEVER, NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS MADE ANY RECOMMENDATION AS TO WHETHER YOU SHOULD TENDER OR NOT TENDER YOUR SHARES IN THE OFFER. NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER YOU SHOULD TENDER OR NOT TENDER YOUR SHARES IN THE OFFER. NONE OF THE COMPANY, THE MEMBERS OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY HAS AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION IN CONNECTION WITH THE OFFER OTHER THAN THOSE CONTAINED IN THIS OFFER TO PURCHASE OR IN THE RELATED LETTER OF TRANSMITTAL. YOU SHOULD NOT RELY ON ANY RECOMMENDATION, OR ANY SUCH REPRESENTATION OR INFORMATION, AS HAVING BEEN AUTHORIZED BY US, ANY MEMBER OF OUR BOARD OF DIRECTORS, THE DEALER MANAGER, THE INFORMATION AGENT OR THE DEPOSITARY.

THE STATEMENTS MADE IN THIS OFFER TO PURCHASE ARE MADE AS OF THE DATE ON THE COVER PAGE AND THE STATEMENTS INCORPORATED BY REFERENCE ARE MADE AS OF THE DATE OF THE DOCUMENTS INCORPORATED BY REFERENCE. THE DELIVERY OF THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL SHALL NOT UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN OR INCORPORATED BY REFERENCE IS CORRECT AS OF A LATER DATE OR THAT THERE HAS NOT BEEN ANY CHANGE IN SUCH INFORMATION OR IN OUR AFFAIRS SINCE SUCH DATES.

4

We are providing this summary term sheet for your convenience. This summary highlights certain material information in this Offer to Purchase, but it does not describe all of the details of the Offer to the same extent described elsewhere in this Offer to Purchase. To understand the Offer fully and for a more complete description of the terms of the Offer, we urge you to read carefully this entire Offer to Purchase, the Letter of Transmittal and the other documents that constitute part of the Offer. We have included references to the sections of this Offer to Purchase where you will find a more complete description of the topics in this summary.

Who is offering to purchase my Shares?

The issuer of the Shares, GAIN Capital Holdings Inc., a Delaware corporation, is offering to purchase the Shares. See Section 1.

What is GAIN offering to purchase?

We are offering to purchase up to $50 million in value of Shares. See Section 1.

What is the purpose of the Offer?

We believe that the Offer is a prudent use of our financial resources given our available liquidity and the current market price of our common stock. The Offer expresses our confidence in the Company’s business, our market position and the long-term growth potential of our industry. The Offer is an element of our overall plan to return capital to our stockholders and enhance stockholder value.

We believe that the modified Dutch auction tender offer set forth in this Offer to Purchase represents an efficient mechanism to provide our stockholders with the opportunity to tender all or a portion of their Shares and thereby receive a return of some or all of their investment in the Company if they so elect. The Offer provides stockholders with an opportunity to obtain liquidity with respect to all or a portion of their Shares without the potential disruption to the Share price.

The Offer also provides our stockholders with an efficient way to sell their Shares potentially without incurring brokerage fees or commissions associated with open market sales.

If we complete the Offer, stockholders who do not participate in the Offer will automatically increase their relative percentage ownership interest in the Company and our future operations at no additional cost to them. See Section 2.

How many Shares will we purchase in the Offer?

Upon the terms and subject to the conditions of the Offer, we will purchase up to $50 million in value of Shares in the Offer or a lower amount depending on the number of Shares properly tendered and not properly withdrawn pursuant to the Offer. Because the Final Purchase Price will be determined after the Expiration Date, the exact number of Shares that will be purchased will not be known until after that time.

As of October 8, 2018, we had 44,273,583 issued and outstanding Shares. As of October 1, 2018, an aggregate of approximately 3.5 million Shares remained available for future awards under the GAIN Capital Holdings, Inc. 2015 Omnibus Incentive Compensation Plan (the “2015 Plan”), further described in Section 11, with approximately 1,037,335 Shares subject to outstanding stock options and 1,810,672 RSUs outstanding that, in each case, were awarded under the 2015 Plan and prior plans.

At the maximum Final Purchase Price of $7.94 per Share, we could purchase 6,297,229 Shares if the Offer is fully subscribed, which would represent approximately 14.2% of our issued and outstanding Shares as of October 8, 2018. At the minimum Final Purchase Price of $7.24 per Share, we could purchase 6,906,077 Shares if the Offer is fully subscribed, which would represent approximately 15.6% of our issued and outstanding Shares as of October 8, 2018. If, based on the Final Purchase Price, more than $50 million in value of Shares are properly tendered and not properly withdrawn, we will purchase all Shares tendered at or below the Final Purchase Price on a pro rata basis.

We expressly reserve the right to purchase additional Shares in the Offer, subject to applicable law. See Section 1. The Offer is not conditioned on the receipt of financing or any minimum number of Shares being

6

tendered but is subject to certain other conditions. See Section 7. In accordance with the rules of the SEC, we may increase the number of Shares accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Offer. See Section 1.

What will be the purchase price for the Shares and what will be the form of payment?

We are conducting the Offer through a procedure commonly called a “modified Dutch auction.” This procedure allows you to select the price, within a price range specified by us, at which you are willing to tender your Shares. The price range for the Offer is $7.24 to $7.94 per Share. We will select the single lowest purchase price (in increments of $0.05), not greater than $7.94 nor less than $7.24 per Share, that will allow us to purchase up to $50 million in value of Shares at such price, based on the number of Shares tendered, or, if fewer Shares are properly tendered, all Shares that are properly tendered and not properly withdrawn. We will purchase all Shares at the Final Purchase Price, even if you have selected a purchase price lower than the Final Purchase Price, but we will not purchase any Shares tendered at a price above the Final Purchase Price.

If you wish to maximize the chance that we will purchase your Shares, you should check the box in the section entitled “Shares Tendered At Price Determined Under The Offer” in the section of the Letter of Transmittal captioned “Price (In Dollars) Per Share At Which Shares Are Being Tendered,” indicating that you will accept the Final Purchase Price. If you agree to accept the purchase price determined in the Offer, your Shares will be deemed to be tendered at the minimum price of $7.24 per Share for purposes of determining the Final Purchase Price. You should understand that this election may have the effect of lowering the Final Purchase Price and could result in your Shares being purchased at the minimum price of $7.24 per Share, a price that could be below the last reported sale price of the Shares on the NYSE on the Expiration Date.

If we purchase your Shares in the Offer, we will pay you the Final Purchase Price in cash, less any applicable withholding taxes and without interest, promptly after the Expiration Date. Under no circumstances will we pay interest on the Final Purchase Price, even if there is a delay in making payment. See the Introduction, Section 1 and Section 3.

Stockholders are urged to obtain current market quotations for the Shares before deciding whether and at what price or prices to tender their Shares. See Section 8.

How will we pay for the Shares?

The maximum value of Shares purchased in the Offer will be $50 million. We expect that the maximum aggregate cost of this purchase, including all fees and expenses applicable to the Offer, will be approximately $51 million. We intend to pay for the Shares with existing cash resources. The Offer is not subject to a financing condition. See Section 9.

In accordance with the rules of the SEC, we may increase the number of Shares accepted for payment in the Offer by no more than 2% of the outstanding Shares without extending the Offer. See Section 1.

How long do I have to tender my Shares?

You may tender your Shares until the Offer expires on the Expiration Date. The Offer will expire at 5:00 P.M., New York City time, on Tuesday, November 6, 2018, unless we extend the Offer. See Section 1. We may choose to extend the Offer at any time and for any reason. We cannot assure you, however, that we will extend the Offer or, if we extend it, for how long. See Section 1 and Section 14. If a broker, dealer, commercial bank, trust company or other nominee holds your Shares, it may have an earlier deadline for accepting the Offer. We urge you to contact the broker, dealer, commercial bank, trust company or other nominee that holds your Shares to find out its deadline. See Section 3.

Beneficial owners holding their Shares through a broker, dealer, commercial bank, trust company or other nominee should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadlines for participation in the Offer. Accordingly, beneficial owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer.

7

Can the Offer be extended, amended or terminated, and if so, under what circumstances?

Yes. We can extend or amend the Offer in our sole discretion at any time, subject to applicable laws. We may, however, decide not to extend the Expiration Date for the Offer. If we extend the Expiration Date for the Offer, we cannot indicate, at this time, the length of any extension that we may provide. In any event, if we extend the Expiration Date for the Offer, we will delay the acceptance of any Shares that have been tendered. See Section 14. We can also amend or terminate the Offer under certain circumstances and subject to applicable law. See Section 7.

How will I be notified if you extend the Offer or amend the terms of the Offer?

If we extend the Offer, we will issue a press release not later than 9:00 a.m., New York City time, on the first business day after the previously scheduled Expiration Date. If we extend the Offer, you may withdraw your Shares until the Expiration Date, as extended. We will announce any amendment to the Offer by making a public announcement of the amendment. In the event that the terms of the Offer are amended, we will file an amendment to our Offer on Schedule TO-I describing the amendment. See Section 14.

Are there any conditions to the Offer?

Yes. Our obligation to accept for payment and pay for your tendered Shares depends upon a number of conditions that must be satisfied in our reasonable judgment or waived on or prior to the Expiration Date, including, among others:

| • | no legal action shall have been threatened, pending or taken that might, in our reasonable judgment, adversely affect the Offer; |

| • | no general suspension of trading in, or general limitation on prices for, securities on any national securities exchange or in the over-the-counter markets in the United States or the declaration of a banking moratorium or any suspension of payments in respect of banks in the United States shall have occurred; |

| • | no decrease of more than 10% in the market price of the Shares or in the general level of market prices for equity securities in the United States or the New York Stock Exchange Index, the Dow Jones Industrial Average, the NASDAQ Global Market Composite Index or Standard & Poor’s Composite Index of 500 Industrial Companies measured from the close of trading on October 8, 2018, the last full trading day prior to the commencement of the Offer, shall have occurred; |

| • | no commencement of a war, armed hostilities or other similar national or international calamity, including, but not limited to, an act of terrorism, directly or indirectly involving the United States shall have occurred on or after October 9, 2018 nor shall any material escalation of any war or armed hostilities which had commenced prior to October 9, 2018 have occurred; |

| • | no limitation, whether or not mandatory, by any governmental, regulatory or administrative agency or authority on, or any event that, in our reasonable judgment, could materially affect, the extension of credit by banks or other lending institutions in the United States; no changes in the general political, market, economic or financial conditions, domestically or internationally, that are reasonably likely to materially and adversely affect our business or the trading in the Shares shall have occurred; no change in law or in the official interpretation or administration of law, or relevant position or policy of a governmental authority with respect to any laws, applicable to the Offer; |

| • | no person shall have filed a Notification and Report Form under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended or shall have proposed, announced or taken certain actions that could lead to the acquisition of us or a change of control transaction; no material adverse change in our business, condition (financial or otherwise), assets, income, operations or prospects shall have occurred during the Offer; |

| • | any approval, permit, authorization, favorable review or consent of any governmental entity required to be obtained in connection with the Offer shall have been obtained on terms satisfactory to us in our reasonable discretion; and |

8

| • | we shall not have determined that as a result of the consummation of the Offer and the purchase of Shares that there will be a reasonable likelihood that the Shares either (1) will be held of record by fewer than 300 persons or (2) will be delisted from the NYSE or be eligible for deregistration under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

For a more detailed discussion of these and other conditions to the Offer, please see Section 7.

How do I tender my Shares?

If you want to tender all or part of your Shares, you must do one of the following by 5:00 P.M., New York City time, on Tuesday, November 6, 2018, or any later time and date to which the Offer may be extended:

| • | if your Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, contact the nominee and request that the nominee tender your Shares for you. Beneficial owners should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadlines for participation in the Offer. Accordingly, beneficial owners wishing to participate in the Offer should contact their broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer; |

| • | if you hold certificates registered in your own name, complete and sign a Letter of Transmittal according to its instructions, and deliver it, together with any required signature guarantees, the certificates for your Shares and any other documents required by the Letter of Transmittal, to the Depositary at the address appearing on the back cover page of this Offer to Purchase; |

| • | if you are an institution participating in Book-Entry Transfer Facility, tender your Shares according to the procedure for book-entry transfer described in Section 3; |

| • | if you are a holder of vested options, you may exercise your vested options and tender any of the Shares issued upon exercise. You must exercise your options sufficiently in advance of the Expiration Date to receive your Shares in order to tender them in the Offer. An exercise of an option cannot be revoked even if Shares received upon the exercise thereof and tendered in the Offer are not purchased in the Offer for any reason; |

| • | if you are a holder of RSUs, you may only tender Shares that you have acquired through vesting of RSUs. Tenders of unvested RSUs will not be accepted; or |

| • | if you are a participant in the ESPP, you may tender Shares that you have purchased through the ESPP. |

If you want to tender your Shares, but: (a) the certificates for your Shares are not immediately available or cannot be delivered to the Depositary by the Expiration Date; (b) you cannot comply with the procedure for book-entry transfer by the Expiration Date; or (c) your other required documents cannot be delivered to the Depositary by the Expiration Date, you can still tender your Shares if you comply with the guaranteed delivery procedures described in Section 3.

We are not making the Offer to, and will not accept any tendered Shares from, stockholders in any jurisdiction where it would be illegal to do so. However, we may, at our discretion, take any actions necessary for us to make the Offer to stockholders in any such jurisdiction.

You may contact the Information Agent, the Dealer Manager or your broker, dealer, commercial bank, trust company or other nominee for assistance. The contact information for the Information Agent and the Dealer Manager is set forth on the back cover of this Offer to Purchase. See Section 3 and the Instructions to the Letter of Transmittal.

Once I have tendered Shares in the Offer, may I withdraw my tendered Shares?

Yes. You may withdraw any Shares you have tendered at any time prior to 5:00 P.M., New York City time, on Tuesday, November 6, 2018, or any later Expiration Date, if the Offer is extended. If after 12:00 midnight, New York City time, at the end of the day on December 3, 2018 we have not accepted for payment the Shares you have tendered to us, you may also withdraw your Shares at any time thereafter. See Section 4.

9

How do I withdraw Shares I previously tendered?

To properly withdraw Shares, you must deliver on a timely basis a written notice of your withdrawal to the Depositary at one of the addresses appearing on the back cover of this Offer to Purchase. Your notice of withdrawal must specify your name, the number of Shares to be withdrawn and the name of the registered holder of the Shares. Some additional requirements apply if the certificates for Shares to be withdrawn have been delivered to the Depositary or if your Shares have been tendered under the procedure for book-entry transfer set forth in Section 3.

In what order will you purchase the tendered Shares?

We will purchase Shares on the following basis:

| • | first, we will purchase all Odd Lots (as defined in Section 1) of less than 100 Shares at the Final Purchase Price from stockholders who properly tender all of their Shares at or below the Final Purchase Price and who do not properly withdraw them before the Expiration Date (tenders of less than all of the Shares owned, beneficially or of record, by such Odd Lot Holder (as defined in Section 1) will not qualify for this preference); |

| • | second, after purchasing all the Odd Lots that were properly tendered at or below the Final Purchase Price, subject to the conditional tender provisions described in Section 6 (whereby a holder may specify a minimum number of such holder’s Shares that must be purchased if any such Shares are purchased), we will purchase all Shares properly tendered at or below the Final Purchase Price on a pro rata basis with appropriate adjustment to avoid purchases of fractional Shares; and |

| • | third, only if necessary to permit us to purchase $50 million in value of Shares (or such greater amount as we may elect to pay, subject to applicable law), we will purchase Shares conditionally tendered (for which the condition was not initially satisfied) at or below the Final Purchase Price, by random lot, to the extent feasible. To be eligible for purchase by random lot, stockholders whose Shares are conditionally tendered must have tendered all of their Shares. |

Therefore, we may not purchase all of the Shares that you tender even if you tender them at or below the Final Purchase Price. See Section 1 and Section 6.

If I own fewer than 100 Shares and I tender all of my Shares, will I be subject to proration?

If you own, beneficially or of record, fewer than 100 Shares in the aggregate, you properly tender all of these Shares at or below the Final Purchase Price and do not properly withdraw them before the Expiration Date, and you complete the section entitled “Odd Lots” in the Letter of Transmittal (if you are a registered holder) and, if applicable, in the Notice of Guaranteed Delivery, we will purchase all of your Shares without subjecting them to the proration procedure. See Section 1.

Has the Company or its Board of Directors adopted a position on the Offer?

Our Board of Directors has authorized us to make the Offer. However, none of the Company, the members of our Board of Directors, the Dealer Manager, the Depositary or the Information Agent makes any recommendation to you as to whether you should tender or refrain from tendering your Shares or as to the purchase price or purchase prices at which you may choose to tender your Shares. We cannot predict how our stock will trade after the Expiration Date, and it is possible that our stock price will trade above the Final Purchase Price after the Expiration Date. You must make your own decision as to whether to tender your Shares and, if so, how many Shares to tender and the purchase price or purchase prices at which you will tender them. We recommend that you read carefully the information in this Offer to Purchase and in the related Letter of Transmittal, including our reasons for making the Offer, before taking any action with respect to the Offer. See Section 2. You should discuss whether to tender your Shares with your broker or other financial or tax advisors.

Will the Company’s directors and executive officers tender Shares in the Offer?

The Company believes that none of its directors, executive officers, and/or affiliates will tender any of their Shares in the Offer. See Section 11.

10

Does the Company intend to repurchase any Shares other than pursuant to the Offer during or after the Offer?

Following an authorization by our Board of Directors on April 24, 2018 to increase our previously authorized share repurchase program by an additional $25 million, we have approximately $26.3 million available under our share repurchase program as of October 8, 2018, which does not include the Shares to be purchased in this Offer. On October 5, 2018, our Board of Directors authorized this Offer. Following the completion or termination of the Offer, we intend to, from time to time, continue to repurchase Shares. The amount of Shares we buy and timing of any such repurchases depends on a number of factors, including our stock price, the availability of cash and/or financing on acceptable terms, the amount and timing of dividend payments and blackout periods in which we are restricted from repurchasing Shares as well as any decision to use cash for other strategic objectives. Rule 13e-4 under the Exchange Act generally prohibits us and our affiliates from purchasing any Shares, other than in the Offer, until at least ten business days after the Expiration Date, except pursuant to certain limited exceptions provided in Exchange Act Rule 14e-5. Following that time, we expressly reserve the absolute right, in our sole discretion from time to time in the future, to purchase Shares, whether or not any Shares are purchased pursuant to the Offer, through open market purchases, privately negotiated transactions, accelerated stock repurchases, tender offers, exchange offers or otherwise, upon the same terms or on terms that are more or less favorable to the selling stockholders in those transactions than the terms of the Offer. We cannot assure you as to which, if any, of these alternatives, or combinations thereof, we might pursue.

If I decide not to tender, how will the Offer affect my Shares?

If we complete the Offer, stockholders who decide not to tender will own a greater percentage interest in the outstanding Shares following the consummation of the Offer. See Section 2.

What is the accounting treatment of the Offer?

The accounting for the purchase of Shares pursuant to the Offer will result in a reduction of our stockholders’ equity in an amount equal to the aggregate purchase price, including transaction fees, of the Shares we purchase and a corresponding reduction in cash and cash equivalents. See Section 5.

Following the Offer, will you continue as a public company?

Yes. We believe that the Shares will continue to be authorized for quotation on the NYSE and that we will continue to be subject to the periodic reporting requirements of the Exchange Act. See Section 2.

When and how will you pay me for the Shares I tender?

We will pay the Final Purchase Price to the seller, in cash, less applicable withholding taxes and without interest, for the Shares we purchase in the Offer promptly after the Expiration Date. We will announce the preliminary results of the Offer, including price and preliminary information about any expected proration, on the business day following the Expiration Date. We do not expect, however, to announce the final results of any proration or the Final Purchase Price and begin paying for tendered Shares until after the Expiration Date. We will pay for the Shares accepted for purchase by depositing the aggregate purchase price with the Depositary, promptly after the Expiration Date. The Depositary will act as your agent and will transmit to you the payment for all of your Shares accepted for payment. See Section 1 and Section 5.

If I am a holder of vested stock options, how do I participate in the Offer?

We are not offering to purchase any outstanding stock options as part of the Offer and any tenders of stock options will not be accepted. If you are a holder of vested options, you may exercise your vested options and tender any Shares issued upon such exercise. You must exercise your options sufficiently in advance of the Expiration Date to receive your Shares in order to tender. An exercise of an option cannot be revoked, even if Shares received upon the exercise thereof and tendered in the Offer are not purchased in the Offer for any reason. See Section 3.

If I am a holder of RSUs, how do I participate in the Offer?

If you are a holder of RSUs, you may only tender Shares that you have acquired through vesting of RSUs. We are not offering to purchase unvested RSUs, which have not been earned and paid out, as part of the Offer, and tenders of such RSUs will not be accepted. See Section 3.

11

If I am a participant in the Employee Stock Purchase Plan, how do I participate in the Offer?

If you are a participant in the ESPP, you may tender Shares that you have purchased through the ESPP. If you have purchased Shares through the ESPP up to and including the purchase period that ended June 30, 2018, and hold such Shares at Morgan Stanley (the administrator of the ESPP), contact Morgan Stanley and request that Morgan Stanley tender such Shares. See Section 3.

What is the recent market price of my Shares?

On October 8, 2018, the last full trading day before the commencement of the Offer, the last reported sale price of the Shares on the NYSE was $6.91 per Share. You are urged to obtain current market quotations for the Shares before deciding whether and at what purchase price or purchase prices to tender your Shares. See Section 8.

Will I have to pay brokerage commissions if I tender my Shares?

If you are a registered stockholder and you tender your Shares directly to the Depositary, you will not incur any brokerage commissions. If you hold Shares through a broker, dealer, commercial bank, trust company or other nominee, we urge you to consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any transaction costs are applicable. See the Introduction and Section 3.

Will I have to pay stock transfer tax if I tender my Shares?

If you instruct the Depositary in the Letter of Transmittal to make the payment for the Shares to the registered holder, you will not incur any stock transfer tax. If you give special instructions to the Depositary in connection with your tender of Shares, then stock transfer taxes may apply. See Section 5.

What are the U.S. federal income tax consequences if I tender my Shares?

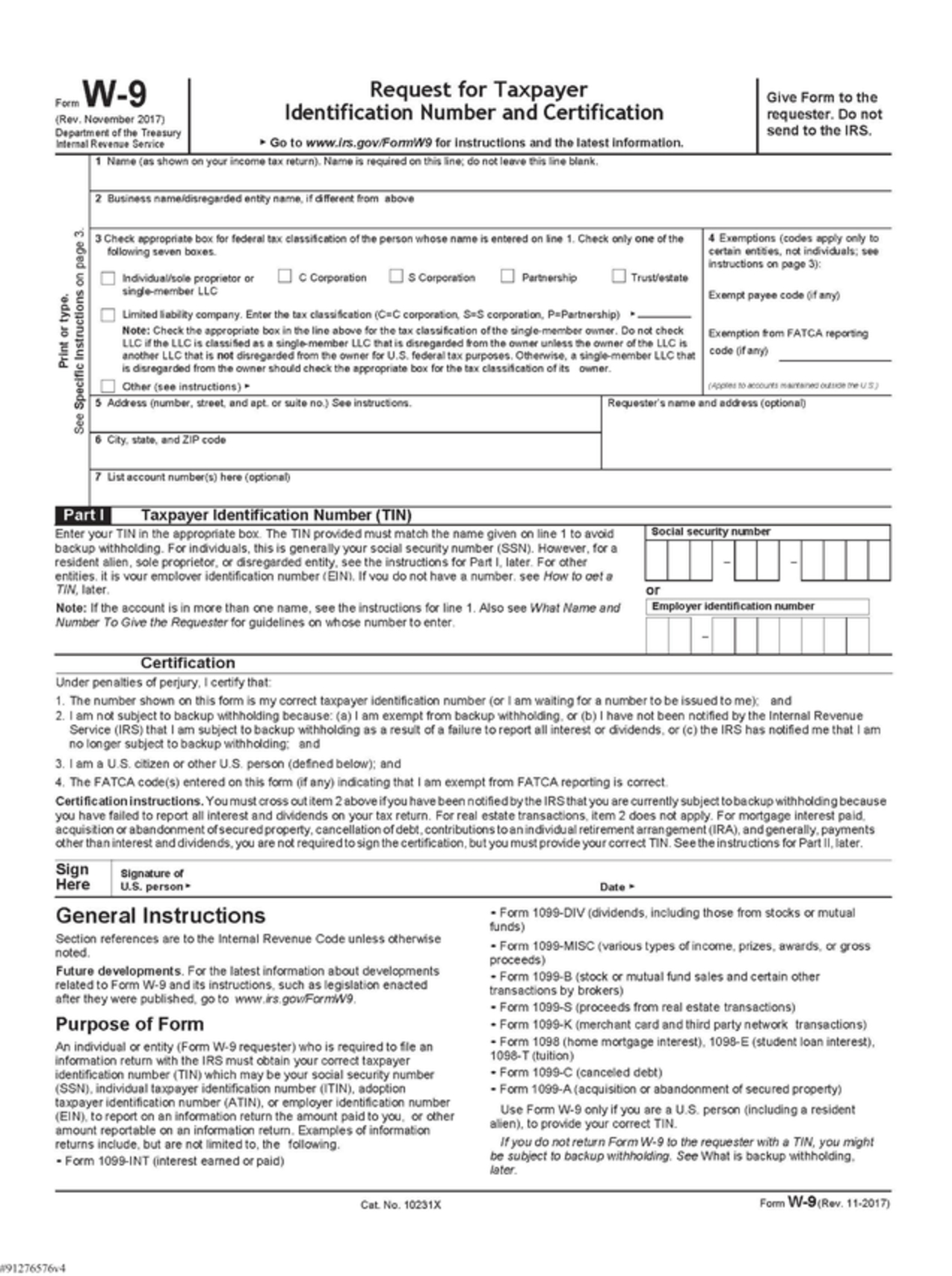

Generally, if you are a U.S. Holder (as defined in Section 13), your receipt of cash from us in exchange for the Shares you tender will be a taxable transaction for U.S. federal income tax purposes. The cash you receive for your tendered Shares will generally be treated for U.S. federal income tax purposes either as consideration received in respect of a sale or exchange of the Shares purchased by us or as a distribution from us in respect of Shares. See Section 13 for a more detailed discussion of the tax treatment of the Offer. We recommend that you consult your tax advisor as to the particular tax consequences to you of the Offer. If you are a non-U.S. Holder (as defined in Section 13), because it is unclear whether the cash you receive in connection with the Offer will be treated (i) as proceeds of a sale or exchange or (ii) as a distribution, the Depositary or other applicable withholding agent may treat such payment as a dividend distribution for withholding purposes. Accordingly, if you are a non-U.S. Holder, you may be subject to withholding on payments to you at a rate of 30% of the gross proceeds paid, unless you establish an entitlement to a reduced rate of withholding by timely completing, under penalties of perjury, the applicable Internal Revenue Service (“IRS”) Form W-8. See Section 13 for a more detailed discussion of the tax treatment of the Offer. We recommend that non-U.S. Holders consult their tax advisors regarding the application of U.S. federal income tax withholding and backup withholding, including eligibility for a withholding tax reduction or exemption and the refund procedure.

12

Who should I contact with questions about the Offer?

The Information Agent or the Dealer Manager can help answer your questions. The Information Agent is D.F. King & Co., Inc. and the Dealer Manager is Jefferies LLC. Their contact information is set forth below.

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

Banks & Brokers Call: (212) 269-5550

All Others Call Toll-Free: (800) 735-3591

Email: [email protected]

Jefferies

Jefferies LLC

520 Madison Avenue

New York, NY 10022

Toll-Free: 1-877-547-6340

13

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Offer to Purchase and the information incorporated or deemed to be incorporated herein and therein by reference contain forward-looking statements within the meaning of the Exchange Act and the Securities Act, including, but not limited to, statements about our strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements that are not historical facts. Forward-looking statements are generally identified by words such as “expects,” “believes,” “anticipates,” “projects,” “estimates,” “guidance” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements in this Offer to Purchase and the information incorporated or deemed to be incorporated herein and therein by reference.

Actual results may differ materially from those referred to in the forward-looking statements for various reasons including the risks we face, which are more fully described under “Risk Factors” in this Offer to Purchase and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, which is incorporated herein by reference. The following factors, among others, could cause our actual results to differ materially from those described in the forward-looking statements:

| • | our ability to complete the Offer; |

| • | the price and time at which we may make any additional Share repurchases following completion of the Offer and the number of Shares acquired in such repurchases; |

| • | the influence of trading volume and currency volatility on our revenue and profitability; |

| • | the effectiveness of our risk management policies and procedures; |

| • | any disruption or corruption of our proprietary technology or other systems failures; |

| • | our ability to develop an adopt new technologies in a timely fashion; |

| • | security breaches and other disruptions that could compromise our information; |

| • | technology, regulatory and financial risks associated with our products linked to cryptocurrencies; |

| • | the enforcement and protection of our intellectual property rights; |

| • | attrition of customer accounts and failure to attract new accounts in a cost-effective manner; |

| • | litigation and regulatory sanction risks; |

| • | potential identity theft and credit card fraud of our customer accounts; |

| • | potential loss of key employees; |

| • | our indebtedness; |

| • | global, regional or local economic conditions that impact the online financial services industry as a whole or the forex industry or the other industries in which we operate; |

| • | our ability to attract and retain qualified employees; |

| • | the execution of our growth strategy; |

| • | any failure to respond to customers’ demands for new services and products; |

| • | cultural, regulatory and other challenges associated with expanding our business into new markets; |

| • | strategic acquisitions, transactions and investments; |

| • | existing, new or amended laws, regulations, policies and standards to which we are subject; |

| • | potential tax liabilities; |

| • | any loss of access to our prime brokers and other liquidity providers that could render us unable to provide competitive trading services; |

| • | risk of default by financial institutions that hold our funds and our customers’ funds; |

| • | systemic market events that impact the various market participants with whom we interact; |

14

| • | risk that a customer’s losses may exceed the amount of cash in their account; |

| • | failure of third-party systems or service and software providers upon which we rely; |

| • | failure to maintain relationships with introducing brokers who direct new customers to us; |

| • | broker misconduct or errors; |

| • | fluctuations in our stock price, earnings and the fair value of our investments; |

| • | foreign currency fluctuations; |

| • | adverse rulings in government investigations or other proceedings; and |

| • | completion of the Offer. |