Form 424B5 Azure Power Global Ltd

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-227164

PROSPECTUS SUPPLEMENT

(To prospectus dated September 10, 2018)

14,800,000 Equity Shares

Azure Power Global Limited

We are offering 14,800,000 of our equity shares.

Three of our shareholders, CDPQ Infrastructure Asia Pte Ltd., IFC GIF Investment Company I and International Finance Corporation, have each indicated its intention to purchase approximately 8,000,000, 3,200,000 and 800,000, respectively, of our equity shares in this offering at the public offering price as described under “Underwriting” in this prospectus supplement.

Our equity shares are listed on the New York Stock Exchange, or the NYSE, under the symbol “AZRE.” On September 18, 2018, the last reported sale price of the equity shares on NYSE was $15.00 per share.

We are an “emerging growth company” as that term is defined under the federal securities laws of the United States and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus supplement and future filings.

Investing in our equity shares involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement as well as those contained in the other documents that are incorporated by reference into this prospectus supplement or the accompanying prospectus.

| Per Equity Share |

Total | |||

| Public Offering Price |

$12.50 | $185,000,000.00 | ||

| Underwriting Discounts and Commissions(1)(2) |

$0.65625 | $1,837,500.00 | ||

| Proceeds to Azure (before expenses)(2) |

$12.37584 | $183,162,500.00 |

| (1) | See “Underwriting” in this prospectus supplement for additional information regarding underwriting compensation and estimated offering expenses. |

| (2) | The underwriters will not receive any underwriting discount or commission on any sale of the 8,000,000, 3,200,000 and 800,000 equity shares in this offering to CDPQ Infrastructure Asia Pte Ltd., IFC GIF Investment Company I and International Finance Corporation, respectively. |

We have granted the underwriters an option, for 30 days from and including the date of this prospectus supplement, to purchase up to an aggregate of 1,200,000 additional equity shares from us at the public offering price, less underwriting discounts and commissions.

Neither the United States Securities and Exchange Commission nor any U.S. state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the equity shares to purchasers on or about October 10, 2018.

| Credit Suisse | Barclays | HSBC | ||||

| SOCIETE GENERALE |

| JMP Securities | Roth Capital Partners | Janney Montgomery Scott |

The date of this prospectus supplement is October 4, 2018.

Table of Contents

Portfolio of over 3 GW under various stages across 23 states Climate Bond Certified Azure Power // $ www.azurepower.com POWERING UTILITIES Developed India’s first private utility scale solar project in 2009 37 operational utility scale projects Integrated project development, EPC, financing, O&M services AZURE ROOF POWER Developed India’s first distributed MW scale rooftop solar project in 2013 150+ operational rooftop sites Solar tariffs in most states are already at grid parity AZURE M POWER Rural electrification through mini and micro grids I -500 households electrified Alternative to conventional transmission grids

Table of Contents

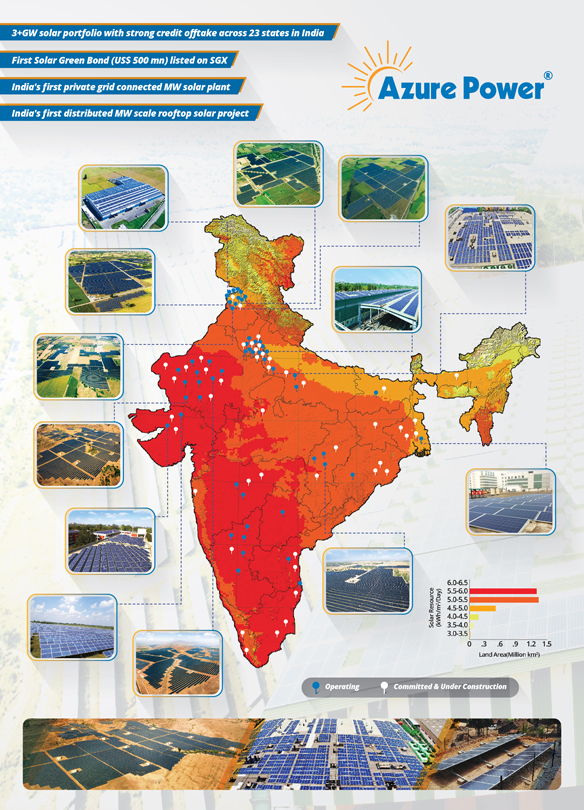

3 GW solar portfolio with strong credit offtake across 23 states in India First Solar Green Bond (USS 500 mn) listed on SGX India’s first private grid connected MW solar plant Azure Power India’s first distributed MW scale rooftop solar project 6.0-6.5 5.5-6.01 5.0-5.5 4.5-5.0 4.0-4.5 3.5-4.0 3.0-3.5 Solar Resource (Kwh/m2/Day) 0 .3 .6 .9 1.2 1.5 Land Area (Million km2)

Table of Contents

| Page | ||||

| S-ii | ||||

| S-iii | ||||

| S-1 | ||||

| S-6 | ||||

| S-9 | ||||

| S-10 | ||||

| S-28 | ||||

| S-29 | ||||

| S-31 | ||||

| S-32 | ||||

| S-33 | ||||

| S-34 | ||||

| S-36 | ||||

| S-40 | ||||

| S-49 | ||||

| S-50 | ||||

| S-50 | ||||

| S-50 | ||||

| S-51 | ||||

| Page | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell equity shares and seeking offers to buy equity shares only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of our equity shares.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of equity shares and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated September 10, 2018, provides more general information about our equity shares. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or the documents incorporated by reference, you should rely on the information in this prospectus supplement. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined.

The rules of the Securities and Exchange Commission, or SEC, allow us to incorporate by reference information into this prospectus supplement. The information incorporated by reference is considered to be a part of this prospectus supplement, and information that we file later with the SEC, to the extent incorporated by reference, will automatically update and supersede this information. It is important for you to read and consider all the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus when making your investment decision. You should also read and consider the information contained in the documents to which we have referred you to in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement and “Where You Can Find Additional Information About Us” in the accompanying prospectus.

In this prospectus supplement, unless otherwise specified or the context otherwise requires, all amounts are expressed in Indian rupees or INR and /or “U.S. dollars”, “$” or “US$”, lawful currency of the Republic of India and the United States, respectively. Unless otherwise indicated, all financial information included in this prospectus supplement and the accompanying prospectus is determined using U.S. generally accepted accounting principles, or U.S. GAAP. Unless the context otherwise requires, all references in this prospectus supplement and the accompanying prospectus to “Azure”, the “Company”, the “Corporation”, “we”, “us” and “our” mean Azure Power Global Limited and its subsidiaries.

For investors outside the United States: We have not done anything that would permit the offering or possession or distribution of this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities described herein and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

S-ii

Table of Contents

TRADEMARKS

We have rights to trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product names and website names. Other trademarks and trade names appearing in this prospectus supplement and the accompanying prospectus are the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this prospectus supplement and the accompanying prospectus are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks and trade names.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus contain forward-looking statements about our current expectations and views of future events. All statements, other than statements of historical facts, contained in this prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus, including statements about our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and future megawatt goals of management, are forward looking statements. These statements relate to events that involve known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views about future events and are not a guarantee of future performance. All statements in this document that are not statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

| • | the pace of government-sponsored auctions; |

| • | changes in auction rules; |

| • | the government’s willingness to enforce Renewable Purchase Obligations; |

| • | permitting, development and construction of our project pipeline according to schedule; |

| • | solar radiation in the regions in which we operate; |

| • | developments in, or changes to, laws, regulations, governmental policies, incentives and taxation affecting our operations; |

| • | adverse changes or developments in the industry in which we operate; |

| • | our ability to maintain and enhance our market position; |

| • | our ability to successfully implement any of our business strategies, including acquiring other companies; |

| • | our ability to enter into power purchasing agreements, or PPAs, on acceptable terms, the occurrence of any event that may expose us to certain risks under our PPAs and the willingness and ability of counterparties to our PPAs to fulfill their obligations; |

| • | our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; |

| • | our ability to establish and operate new solar projects; |

S-iii

Table of Contents

| • | our ability to compete against traditional and renewable energy companies; |

| • | the loss of one or more members of our senior management or key employees; |

| • | political and economic conditions in India; |

| • | material changes in the costs of solar panels and other equipment required for our operations; |

| • | fluctuations in inflation, interest rates and exchange rates; and |

| • | other risks and uncertainties, including those referred to under the caption “Risk Factors.” |

The forward-looking statements made in this prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus relate only to events or information as of the date on which the statements in each of those documents were made in such documents. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements were made or to reflect the occurrence of unanticipated events. You should read this prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus also contain statistical data and estimates, including those relating to the solar industry and our competition from market research, analyst reports and other publicly available sources. These publications include forward-looking statements being made by the authors of such reports. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

S-iv

Table of Contents

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference in this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus, including the information referred to under the heading “Risk Factors” in this prospectus supplement beginning on page S-6, the information incorporated by reference in this prospectus supplement and the accompanying prospectus, and the information included in any free writing prospectus that we have authorized for use in connection with this offering before making an investment decision.

Azure Power Global Limited

Overview

We are a leading independent solar power producer in India. Our mission is to be the lowest-cost power producer in the world. We sell solar power in India on long-term fixed-price contracts to our customers, at prices which in many cases are at or below prevailing alternatives for these customers. We are also developing micro-grid applications for the highly fragmented and underserved electricity market in India. Since 2011, we have achieved an 85% reduction in total solar project cost, which includes a significant decrease in balance of systems costs due in part to our in-house value engineering, design and procurement efforts.

Indian solar capacity installed reached approximately 23 GW at the end of July 2018 with a target to achieve 100 GW of installed solar capacity by 2022. Solar power is a cleaner, faster-to-build and cost-effective alternative energy solution to coal and diesel-based power, the economic and climate costs of which continue to increase every year.

We developed India’s first utility-scale solar project in 2009. As of August 31, 2018, we operated 37 utility scale projects and several commercial rooftop projects with a combined rated capacity of 1,011 MW, which represents a compound annual growth rate, or CAGR, of 89%, since March 2012. As of such date we were also constructing projects with a combined rated capacity of 333 MW and had an additional 1,709 MW committed, bringing our total portfolio capacity to 3,053 MW. As of August 31, 2018, we have 2,848 MW utility-scale projects, 205 MW of commercial and industrial, or C&I projects, and more than 500 households that have been powered through Azure M Power which provides rural electrification through mini-grids. We have a geographically well diversified project portfolio, and we had a presence in 23 states and union territories in India as of August 31, 2018. Of the projects in our pipeline, 86% have off-takers with high domestic credit ratings and 61% was contracted with Government of India sovereign-backed entities. 89% of our rooftop projects in our pipeline was contracted with Indian government-owned entities as of August 31, 2018. Megawatts committed represents the aggregate megawatt rated capacity of solar power plants pursuant to customer power purchase agreements, or PPAs, signed or allotted but not yet commissioned and operational as of the reporting date.

Our ability to achieve these goals will depend on, among other things, our ability to acquire the required land for the new capacity (on lease or direct purchase), raising adequate project financing and working capital, the growth of the Indian power market in line with current government targets, our ability to maintain our market share of India’s installed capacity as competition increases, the need to further strengthen our operations team to execute the increased capacity, and the need to further strengthen our systems and processes to manage the ensuing growth opportunities, as well as the other risks and challenges discussed under “Risk Factors” in this prospectus supplement and the information incorporated by reference in this prospectus supplement and the accompanying prospectus.

S-1

Table of Contents

Utility-scale solar projects are typically awarded through government auctions. We believe the strong demand for our solar power is a result of the following:

| • | Low levelized cost of energy. Our in-house engineering, procurement and construction, or EPC, expertise, purely solar focus, advanced in-house operations and maintenance, or O&M, capability and efficient financial strategy allow us to offer low-cost solar power solutions. |

| • | Strong value proposition for our customers. We manage the entire development and operation process, providing customers with long-term fixed-price PPAs in addition to high levels of plant availability and service. This helps us win repeat business. We had a 18.5% share in terms of aggregate MW auctioned in the auctions we participated in between March 2016 to August 2018, with a 70%-win rate for utility project auctions and an 83%-win rate for rooftop project auctions. |

| • | Our integrated profile and experience supports growth. Our integrated profile affords us greater control over project development, construction and operation, which provides us with greater insight and certainty on our construction costs and timelines. As of July 31, 2018, we have developed 8,076 acres of land, of which 4,308 acres were leased, 3,762 acres were freehold and the remainder was held under a right-to-use contract. In addition, we have developed 301 kilometers of transmission across eight states as of such date. We have procured a large part of our project supplies from Tier 1 suppliers, and since the commencement of our operations until June 30, 2018, we have procured more than US$800 million from all of our suppliers to construct our projects. |

| • | Strong community partnerships. Our ability to build long term community relationships allows us to improve our time of completion, further reducing project development risk. |

| • | We take a leading role in policy initiatives. We provided input to the government to help it design an auction process supporting multiple winners at differentiated price points and implementing a transparent bidding process open to all participants. For example, we suggested that the government include compulsorily convertible debentures in the calculation of a bidder’s net worth for the purposes of tender qualification, which was ultimately adopted by the government. |

We generate revenue from a mix of leading government utilities and commercial entities. Because we have our own EPC and O&M capabilities, we retain the profit margins associated with those services that other project developers may need to pay to third-party providers.

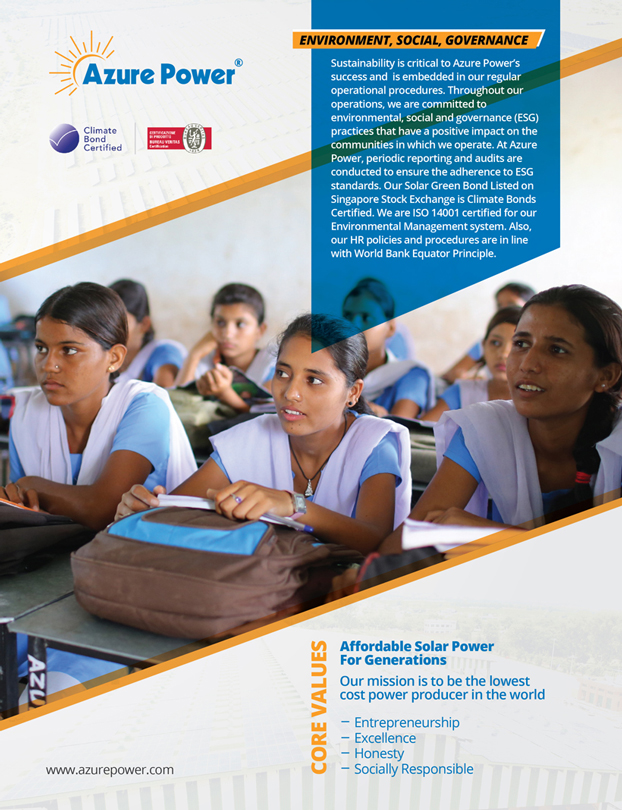

Environmental, Social and Governance

Sustainability is critical to our success and is embedded in our regular operational procedures. Throughout our operations, we are committed to environmental, social and governance, or ESG, practices that have a positive impact on the communities in which we operate. We strive to minimize the environmental impact of our operations and improve our efficient use of resources over time. Periodic reporting and audits are conducted in the Company to ensure the adherence to ESG standards. In 2017, we issued a US$500 million Solar Green Bond, maturing in 2022, which has been certified by Climate Bonds Initiative as a green bond and is the first solar green bond to be offered by a company with only solar power assets out of India. We are also ISO 14001 certified for our environmental management systems. In addition, our HR policies & procedures are in line with World Bank Equator Principles.

We hire from local communities, creating over nine thousand jobs in local communities since we commenced operations, and generally attempt to lease land that has few alternative uses, providing local communities with a stream of discretionary cash flow without displacing alternative businesses. As a result, we are able to build long-term community relationships that have a lasting social impact. Our Azure M Power solutions electrify rural villages, which helps replace kerosene and leads to health benefits and reduced air pollution.

S-2

Table of Contents

Corporate Information

We are a public company limited by shares incorporated in Mauritius on January 30, 2015. Our registered office is located at c/o AAA Global Services Ltd., 1st Floor, The Exchange 18 Cybercity, Ebene, Mauritius. Our principal executive offices are located at Azure Power, 3rd Floor, Asset 301-304 and 307, WorldMark 3, Aerocity, New Delhi – 110037, India, and our telephone number at this location is (91-11) 49409800. Our principal website address is www.azurepower.com. The information contained on our website does not form part of this prospectus supplement. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, 13th Floor, New York, NY 10011.

Our equity shares are listed on the NYSE under the symbol “AZRE.”

S-3

Table of Contents

THE OFFERING

The offering terms are summarized below solely for your convenience. For a more complete description of the terms of our equity shares, see “Description of Share Capital” in the accompanying prospectus.

| Equity shares offered by us |

14,800,000 equity shares, $0.000625 par value per share. |

| Underwriters’ option to purchase additional equity shares |

We have granted the underwriters an option to purchase up to an aggregate of 1,200,000 additional equity shares, at the price set forth on the cover page of this prospectus supplement, for 30 days after the date of this prospectus supplement. |

| Equity shares outstanding immediately after completion of this offering(1) |

40,823,790 equity shares (or 42,023,790 equity shares if the underwriters exercise their option to purchase additional equity shares in full). |

| NYSE symbol |

“AZRE” |

| Indications of Interest |

Three of our shareholders, CDPQ Infrastructure Asia Pte Ltd., IFC GIF Investment Company I and International Finance Corporation, have each indicated an interest in purchasing approximately 8,000,000, 3,200,000 and 800,000, respectively, of our equity shares in this offering at the public offering price as described under “Underwriting” in this prospectus supplement. Because indications of interest are not binding agreements or commitments to purchase, CDPQ Infrastructure Asia Pte Ltd., IFC GIF Investment Company I and International Finance Corporation may each determine to purchase a smaller amount or not to purchase any equity shares in this offering. |

| Risk factors |

Investing in our equity shares involves risks. Potential investors are urged to read and consider the specific factors relating to an investment in our equity shares as set forth under the section entitled “Risk Factors” beginning on page S-6 of this prospectus supplement and in our Annual Report on Form 20-F for the fiscal year ended March 31, 2018, or the Annual Report on Form 20-F, incorporated by reference in this prospectus supplement and the accompanying prospectus. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses, will be approximately $181.9 million (or $196.1 million if the underwriters exercise their option to purchase additional equity shares in full), based on a public offering price of $12.50 per equity share. We currently intend to use the net proceeds from this offering to fund the purchase by Azure Power Global Limited, or APGL, of equity shares to be issued by Azure Power India Private Limited, or AZI, and Azure Power Rooftop Private Limited, or APRPL), and to fund operating expenses of APGL. To the extent the underwriters exercise their option to purchase additional equity shares, the net proceeds from the sale of the additional equity |

S-4

Table of Contents

| shares will be used to purchase additional equity shares of AZI or APRPL. Net proceeds to be received by AZI and APRPL from APGL as described above are intended to be used for our growth capital requirement, for new project development and other general corporate purposes. AZI and APRPL currently intend to hold the proceeds from the purchase of its equity shares by APGL in short-term, interest-bearing debt instruments or demand deposits from time to time. See “Use of Proceeds” in this prospectus supplement. |

| (1) | We had 25,996,932 equity shares issued and outstanding as of June 30, 2018. Subsequent to June 30, 2018, we issued 26,858 equity shares to our employees, pursuant to our Employee Stock Option Plan 2015 and our Equity Incentive Plan 2016 (as amended in 2017), resulting in 26,023,790 equity shares issued and outstanding as of August 31, 2018. Unless otherwise indicated, all information contained in this prospectus supplement assumes no exercise by the underwriters of their option to purchase additional equity shares. |

S-5

Table of Contents

An investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, you should carefully consider the risk factors incorporated by reference from Part I, Item 3.D. of our most recent Annual Report on Form 20-F and the other information contained in this prospectus supplement and the accompanying prospectus, as updated by those subsequent filings with the SEC under the Exchange Act, that are incorporated herein by reference. These risks could materially affect our business, results of operations or financial condition and cause the value of our securities to decline, in which case you may lose all or part of your investment. For more information, see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

Risks Related to Operations in India

Imposition of anti-dumping or safeguard duties on solar equipment imports may increase our costs and affect our margins.

The Ministry of Finance of the Government of India recently imposed a 25% safeguard duty on import of solar panels from July 30, 2018 to July 29, 2019, which will be lowered to 20% for the ensuing six months and 15% for the six months thereafter. While certain solar power producers approached the High Court of Orissa and obtained an interim stay in July 2018, the Supreme Court of India overturned this order on September 11, 2018, and accordingly the safeguard duty continues to be in effect.

Our PPAs typically contain change-in-law provisions which permit us to pass on such increases to our offtakers with an upward revision of tariff by obtaining an order to this effect from the relevant electricity regulatory commissions. While we have commenced submitting change-in-law petitions before relevant electricity regulatory commissions, we cannot assure you the electricity regulatory commissions will revise tariffs sufficiently or at all. To the extent we are unable to pass on the impact of the imposition of safeguard duty to our offtakers, in part or in whole, under any of our PPAs, our increased costs of purchase of solar panels could adversely affect our operating results, cash flows and financial condition.

Risks Related to This Offering

We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to certain U.S. investors of our equity shares.

We believe that we were not a passive foreign investment company (“PFIC”) for our taxable year ending March 31, 2018 and that, based on the present composition of our income and assets and the manner in which we conduct our business, we will not be a PFIC in our current taxable year or in the foreseeable future. Whether we are a PFIC is a factual determination made annually, and our status could change depending, among other things, upon changes in the composition and amount of our gross income and the relative quarterly average value of our assets. In particular, if we generate a small amount of gross income that is attributable to passive income in a taxable year, then there is a risk that we may be a PFIC for that year. If we were a PFIC for any taxable year in which you hold our equity shares, you generally would be subject to additional taxes on certain distributions and any gain realized from the sale or other taxable disposition of our equity shares regardless of whether we continued to be a PFIC in any subsequent year, unless you mark your equity shares to market for tax purposes on an annual basis. You are encouraged to consult your own tax advisor as to our status as a PFIC and the tax consequences to you of such status. See “Material Income Tax Considerations—U.S. Federal Income Tax Considerations” in this prospectus supplement.

S-6

Table of Contents

Future issuances of any equity securities may cause a dilution in your shareholding, decrease the trading price of our equity shares, and restrictions agreed to as part of debt financing arrangements may place restrictions on our operations.

Any issuance of equity securities after this offering could dilute the interests of our shareholders and could substantially decrease the trading price of our equity shares. We may issue equity or equity-linked securities in the future for a number of reasons, including to finance our operations and business strategy (including in connection with acquisitions and other transactions), to adjust our ratio of debt to equity, to satisfy our obligations upon the exercise of then-outstanding options or other equity-linked securities, if any, or for other reasons. Issuance of such additional securities may significantly dilute the equity interests of investors in this offering who will not have pre-emptive rights with respect to such an issuance, subordinate the rights of holders of equity shares if preferred shares are issued with rights senior to those afforded to our equity shares, or harm prevailing market prices for our equity shares.

Concentration of ownership of our equity shares among our existing executive officers, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

As of March 31, 2018, our executive officers and directors, combined with our shareholders who owned more than 5% of our outstanding common stock and their affiliates in the aggregate, beneficially own equity shares representing approximately 84% of our equity shares. In addition, certain of our existing principal shareholders have indicated an intention to purchase from the underwriters an aggregate of 12,000,000 equity shares in this offering at the public offering price. As a result, if these shareholders were to choose to act together, they would be able to control all matters submitted to our shareholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, would control the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of ownership control may:

| • | delay, defer or prevent a change in control; |

| • | entrench our management or the board of directors; or |

| • | impede a merger, consolidation, takeover or other business combination involving us that other shareholders may desire. |

Some of these persons or entities may have interests different than yours. For example, because many of these shareholders purchased their equity shares at prices substantially below the current market price and have held their equity shares for a longer period, they may be more interested in selling our company to an acquirer than other investors or they may want us to pursue strategies that deviate from the interests of other shareholders.

Management will have considerable discretion as to the use of the net proceeds to be received by us from this offering.

Our allocation of the net proceeds from this offering, including net proceeds to be received by AZI and APRPL after this offering, is based on current plans and business conditions. The amounts and timing of any expenditure will vary depending on the amount of cash generated by our operations and our success in future auctions. Accordingly, our management will have considerable discretion in the application of the net proceeds received by us. You will not have the opportunity, as part of your investment decision, to assess whether proceeds are being used appropriately. You must rely on the judgment of our management regarding the application of the net proceeds of this offering. The net proceeds may be used for corporate purposes that do not improve our results of operations or increase our share price. The net proceeds from this offering, pending investment in operating assets or solar projects, may be placed in investments that do not produce income or that lose value, which will cause the price of our equity shares to decline.

S-7

Table of Contents

If a United States person is treated as owning at least 10% of our equity shares, the holder may be required to include amounts in its U.S. taxable income even if we do not make distributions to our shareholders.

If a United States person is treated as owning (directly, indirectly, or constructively) at least 10% of the value or voting power of our equity shares, that person may be required to include certain amounts in its U.S. taxable income even if we make no distributions to our shareholders. A United States person that is treated as owning (directly, indirectly, or constructively) at least 10% of the value or voting power of our equity shares will be treated as a “United States shareholder” with respect to each “controlled foreign corporation” in our group. As a result of tax legislation enacted in 2017, it is not certain under what circumstances our non-U.S. subsidiaries will be treated as controlled foreign corporations. However, because our group includes U.S. subsidiaries, our non-U.S. subsidiaries could be treated as controlled foreign corporations with respect to any United States shareholders (regardless of whether or not we are treated as a controlled foreign corporation). A United States shareholder of a controlled foreign corporation in our group would be required to report annually and include in its U.S. taxable income its pro rata share of “Subpart F income”, “global intangible low-taxed income,” and investments in United States property, if any, related to that controlled foreign corporation, regardless of whether we make any distributions. An individual that is a United States shareholder with respect to a controlled foreign corporation generally would not be allowed certain tax deductions or foreign tax credits that would be allowed to a United States shareholder that is a U.S. corporation. Failure to comply with these reporting obligations may subject a United States shareholder to significant monetary penalties and may prevent the statute of limitations with respect to such shareholder’s U.S. federal income tax return for the year for which reporting was due from starting. Because we do not maintain U.S. tax books and records, we do not expect to be able to furnish to any United States shareholders the information that may be necessary to comply with the shareholder’s reporting and taxpaying obligations under these rules. A U.S. investor should consult its advisors regarding the potential application of these rules to an investment in our equity shares, including the possibility that the investor may be treated as a “United States shareholder” as a result of direct, indirect or constructive ownership of our equity shares.

S-8

Table of Contents

The consolidated financial statements and other financial data included in this prospectus supplement or incorporated by reference herein are presented in Indian rupees. Azure Power Global Limited’s functional currency is the U.S. dollar, and its reporting currency is the Indian rupee. Azure Power Energy Limited is incorporated in Mauritius; it is a subsidiary of Azure Power Global Limited’s functional currency is U.S. dollar. Further, Azure Power India Limited, or AZI, and Azure Power Rooftop Private Limited, or APRPL, and their respective subsidiaries have their local country currencies as the functional currency. The translation from the applicable foreign currencies of AZI’s subsidiaries and Azure Power Energy Limited into Indian rupees is performed for balance sheet accounts using the exchange rate in effect as of the balance sheet date except for shareholders’ equity, preferred shares and certain debt, which are translated at the historical rates in effect at the dates of the underlying transactions. Revenue, expense and cash flow items are translated using average exchange rates for the respective period. U.S. dollar balances have been translated from Indian rupee amounts solely for the convenience of the readers.

The following table sets forth, for each of the periods indicated, the low, average, high and period-end noon buying rates in The City of New York for cable transfers, in Indian rupees per U.S. dollar, as certified for customs purposes by the Federal Reserve Bank of New York. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in preparation of our consolidated financial statements or elsewhere in this prospectus supplement or will use in the preparation of our periodic reports or any other information to be provided to you. We make no representation that any Indian rupee or U.S. dollar amounts referred to in this prospectus supplement could have been or could be converted into U.S. dollars or Indian rupees, as the case may be, at any particular rate or at all.

The following table sets forth information concerning exchange rates between INR and the US$ for the periods indicated:

| INR PER US$ NOON BUYING RATE | ||||||||||||||||

| Period |

Period End | Average(1) | Low | High | ||||||||||||

| 2012 |

54.86 | 53.41 | 48.65 | 57.13 | ||||||||||||

| 2013 |

61.92 | 58.91 | 52.99 | 68.80 | ||||||||||||

| 2014 |

63.04 | 61.21 | 58.30 | 63.67 | ||||||||||||

| 2015 |

66.15 | 64.15 | 61.41 | 67.10 | ||||||||||||

| 2016 |

67.92 | 67.16 | 66.05 | 68.86 | ||||||||||||

| 2017 |

63.83 | 65.07 | 63.64 | 68.39 | ||||||||||||

| 2018 |

||||||||||||||||

| January |

63.58 | 63.65 | 63.38 | 64.01 | ||||||||||||

| February |

65.20 | 64.43 | 63.93 | 65.20 | ||||||||||||

| March |

65.11 | 65.05 | 64.83 | 65.24 | ||||||||||||

| April |

66.50 | 65.67 | 64.92 | 66.92 | ||||||||||||

| May |

67.40 | 67.51 | 66.52 | 68.38 | ||||||||||||

| June |

68.46 | 67.79 | 66.87 | 68.81 | ||||||||||||

| July |

68.54 | 68.69 | 68.42 | 69.01 | ||||||||||||

| August |

71.00 | 69.63 | 68.37 | 71.00 | ||||||||||||

| September (through September 14, 2018) |

71.87 | 72.03 | 71.58 | 72.69 | ||||||||||||

Source: Federal Reserve Statistical Release

| (1) | Averages for a period other than one month are calculated by using the average of the noon buying rate at the end of each month during the period. Monthly averages are calculated by using the average of the daily noon buying rates during the relevant month. |

S-9

Table of Contents

In July 2018, we won a 600 megawatt (MW) solar power project through an auction conducted by Solar Energy Corporation of India, or SECI, a Government of India enterprise. The project is the largest solar auction in India to date, and it is also the first Interstate Transmission System grid-connected solar PV project to have been auctioned by SECI. Pursuant to the terms of our bid, we have received the letter of award and expect to sign a 25-year PPA with SECI to supply power at a tariff of INR 2.53 (~US$3.7 cents) per kWh. This project can be developed outside a solar park anywhere in India and is expected to be commissioned by 2020.

In August 2018, we won bids for the following projects:

| • | A 5 MW rooftop solar power project in an auction conducted by New & Renewable Energy Development Corporation of Andhra Pradesh Ltd. Pursuant to the terms of our bid, we have received the letter of award for this project with a tariff of INR 3.64 and a list of additional eligible incentives. We expect to sign a 25-year PPA to provide power to various government buildings in Andhra Pradesh. We qualify for a capital incentive that would result in a weighted average levelized tariff of INR 4.57 (~US$6.7 cents) per kWh for this project. |

| • | A 300 MW Interstate Transmission System grid-connected solar PV project in an auction conducted by NTPC Limited, the Government of India’s largest power utility company, at a tariff of INR 2.59 (~US 3.8 cents) per kWh for 25 years. We have not yet received the letter of award for this project as of September 20, 2018. This project can be located anywhere in India, will likely be outside a solar park, and is expected to be completed in 2019. |

| • | 11.2 MW and 600 KW rooftop solar power projects in auctions conducted by Madhya Pradesh Urja Vikas Nigam Limited (“MPUVNL”) and Indraprastha Power Generation Company Ltd. (“IPGCL”), respectively. Pursuant to the terms of our bid, we have received the letter of intent for the IPGCL project that listed a levelised tariff of INR 4.89, but have not yet received the letter of award for the MPUVNL project as of September 20, 2018 where we were announced as having won the bid with a tariff of INR 2.27. We expect to sign a 25-year power purchase agreement for these two projects to provide power to various government establishments in Madhya Pradesh and Delhi across approximately 600 project sites. We qualify for capital incentives that would result in a weighted average levelized tariff of INR 4.50 (~US$6.6 cents) per kWh for the MPUVNL project and a weighted average levelized tariff of INR 5.91 (~US$8.6 cents) per kWh for the IPGCL project. |

Unaudited Condensed Financial Information

The following is a summary of our unaudited condensed consolidated statement of operations data for the three months ended June 30, 2017 and 2018, a summary of our unaudited condensed consolidated balance sheet data as of March 31, 2018 and June 30, 2018 and a summary of our unaudited condensed consolidated cash flow data for the three months ended June 30, 2017 and 2018. We have prepared this unaudited condensed consolidated financial information on the same basis as our audited consolidated financial statements and in accordance with United States generally accepted accounting principles. Results for the first quarter of our fiscal year ending March 31, 2019 may not be indicative of our full-year results for our full fiscal year or for future quarterly periods. See “Operating and Financial Review and Prospects” included in our Annual Report on Form 20-F and filed with the SEC on June 15, 2018, incorporated by reference in this prospectus supplement, for information regarding trends and other factors that may influence our results of operations.

S-10

Table of Contents

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

| Three Months ended June 30, | ||||||||||||

| 2017 | 2018 | 2018 | ||||||||||

| INR | INR | US$(1) | ||||||||||

| (Unaudited) | ||||||||||||

| (in thousands, except per share data) | ||||||||||||

| Operating revenues: |

||||||||||||

| Sale of power |

1,877,932 | 2,422,539 | 35,386 | |||||||||

| Operating costs and expenses: |

||||||||||||

| Cost of operations (exclusive of depreciation and amortization shown separately below) |

173,524 | 218,230 | 3,188 | |||||||||

| General and administrative |

235,073 | 248,650 | 3,632 | |||||||||

| Depreciation and amortization |

419,738 | 533,609 | 8,087 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating costs and expenses |

828,335 | 1,020,489 | 14,907 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

1,049,597 | 1,402,050 | 20,479 | |||||||||

|

|

|

|

|

|

|

|||||||

| Other expenses: |

||||||||||||

| Interest expense, net |

839,639 | 1,073,440 | 15,680 | |||||||||

| Loss/(gain) on foreign currency exchange, net |

(4,758 | ) | 204,226 | 2,983 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total other expenses |

834,881 | 1,277,666 | 18,663 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income before income tax |

214,716 | 124,384 | 1,816 | |||||||||

| Income tax benefit/(expense) |

(7,859 | ) | (94,581 | ) | (1,382 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

206,857 | 29,803 | 434 | |||||||||

|

|

|

|

|

|

|

|||||||

| Less: Net (loss)/income attributable to non-controlling interest |

36,746 | 21,780 | 318 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to APGL |

170,111 | 8,023 | 116 | |||||||||

|

|

|

|

|

|

|

|||||||

| Accretion to redeemable non-controlling interests |

(10,988 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to APGL equity shareholders |

159,123 | 8,023 | 116 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income per share attributable to APGL shareholders |

||||||||||||

| Basic |

6.14 | 0.31 | — | |||||||||

| Diluted |

6.00 | 0.30 | — | |||||||||

| Weighted average number of equity shares |

||||||||||||

| Basic |

25,936,050 | 25,996,932 | ||||||||||

| Diluted |

26,502,283 | 26,910,175 | ||||||||||

| Supplement information: |

||||||||||||

| Adjusted EBITDA(2) |

1,469,335 | 1,955,659 | 28,566 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Translation of balances from INR to US$ in the condensed consolidated statement of operations is for the convenience of the reader and was calculated using a rate of US$1.00 = INR 68.46, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 29, 2018. |

| (2) | Adjusted EBITDA is a non-GAAP financial measure. We present Adjusted EBITDA as a supplemental measure of our performance. This measurement is not recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance. The presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. |

S-11

Table of Contents

Adjusted EBITDA

We define Adjusted EBITDA as net loss (income) plus (a) income tax expense, (b) interest expense, net, (c) depreciation and amortization and (d) loss (income) on foreign currency exchange. We believe Adjusted EBITDA is useful to investors in assessing our ongoing financial performance and provides improved comparability between periods through the exclusion of certain items that management believes are not indicative of our operational profitability and that may obscure underlying business results and trends. However, this measure should not be considered in isolation or viewed as a substitute for net income or other measures of performance determined in accordance with U.S. GAAP. Moreover, Adjusted EBITDA as used herein is not necessarily comparable to other similarly titled measures of other companies due to potential inconsistencies in the methods of calculation.

Our management believes this measure is useful to compare general operating performance from period to period and to make certain related management decisions. Adjusted EBITDA is also used by securities analysts, lenders and others in their evaluation of different companies because it excludes certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be highly dependent on a company’s capital structure, debt levels and credit ratings. Therefore, the impact of interest expense on earnings can vary significantly among companies. In addition, the tax positions of companies can vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the various jurisdictions in which they operate. As a result, effective tax rates and tax expense can vary considerably among companies.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations include:

| • | it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; |

| • | it does not reflect changes in, or cash requirements for, working capital; |

| • | it does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on our outstanding debt; |

| • | it does not reflect payments made or future requirements for income taxes; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA does not reflect cash requirements for such replacements or payments. |

Investors are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis.

The table below sets forth a reconciliation of our Net income to Adjusted EBITDA for the periods indicated:

| Unaudited Three Months ended June 30, | ||||||||||||

| 2017 | 2018 | 2018 | ||||||||||

| INR | INR | US$(a) | ||||||||||

| (in thousands) | ||||||||||||

| Net income |

206,857 | 29,803 | 434 | |||||||||

| Income tax (benefit)/expense |

7,859 | 94,581 | 1,382 | |||||||||

| Interest expense, net |

839,639 | 1,073,440 | 15,680 | |||||||||

| Depreciation & amortization |

419,738 | 553,609 | 8,087 | |||||||||

| Loss/(gain) on foreign currency exchange |

(4,758 | ) | 204,226 | 2,983 | ||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

1,469,335 | 1,955,659 | 28,566 | |||||||||

|

|

|

|

|

|

|

|||||||

| (a) | Refer to note (1) above. |

S-12

Table of Contents

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| As of March 31, | As of June 30, | |||||||||||

| 2018

(INR) |

2018 (INR) |

2018 (US$)(1) |

||||||||||

| (Unaudited) | ||||||||||||

| (in thousands, except per share data) | ||||||||||||

| Assets |

||||||||||||

| Current assets: |

||||||||||||

| Cash and cash equivalents |

8,346,526 | 7,707,137 | 112,579 | |||||||||

| Investments in available for sale securities |

1,383,573 | 3,124,125 | 45,634 | |||||||||

| Restricted cash |

2,406,569 | 2,491,890 | 36,399 | |||||||||

| Accounts receivable, net |

2,223,455 | 2,865,920 | 41,863 | |||||||||

| Prepaid expenses and other current assets |

1,114,482 | 1,134,384 | 16,570 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

15,474,605 | 17,323,456 | 253,045 | |||||||||

| Restricted cash |

329,926 | 235,318 | 3,437 | |||||||||

| Property, plant and equipment, net |

56,580,700 | 58,643,437 | 856,609 | |||||||||

| Software, net |

39,802 | 41,960 | 613 | |||||||||

| Deferred income taxes |

1,052,393 | 1,003,922 | 14,664 | |||||||||

| Investments in held-to-maturity securities |

7,041 | 7,419 | 108 | |||||||||

| Other assets |

499,653 | 3,274,026 | 47,824 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

73,984,120 | 80,529,538 | 1,176,300 | |||||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and shareholders’ equity |

||||||||||||

| Current liabilities: |

||||||||||||

| Short-term debt |

835,000 | 835,000 | 12,197 | |||||||||

| Accounts payable |

1,521,854 | 1,674,257 | 24,456 | |||||||||

| Current portion of long-term debt |

873,883 | 953,516 | 13,928 | |||||||||

| Income taxes payable |

5,878 | 6,981 | 102 | |||||||||

| Interest payable |

1,220,463 | 499,078 | 7,290 | |||||||||

| Deferred revenue |

79,192 | 81,896 | 1,196 | |||||||||

| Other liabilities |

611,598 | 496,757 | 7,256 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

5,147,868 | 4,547,485 | 66,425 | |||||||||

|

|

|

|

|

|

|

|||||||

| Long-term debt |

52,234,940 | 59,340,705 | 866,794 | |||||||||

| Deferred revenue |

1,563,732 | 1,437,922 | 21,004 | |||||||||

| Deferred income taxes |

892,138 | 1,202,995 | 17,572 | |||||||||

| Asset retirement obligations |

356,649 | 397,048 | 5,800 | |||||||||

| Other liabilities |

513,344 | 198,362 | 2,895 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

60,708,671 | 67,124,517 | 980,490 | |||||||||

|

|

|

|

|

|

|

|||||||

| Shareholders’ equity |

||||||||||||

| Equity share (US$0.000625 par value; 25,996,932 and 25,996,932 shares issued and outstanding as of March 31, 2018 and June 30, 2018) |

1,076 | 1,076 | 17 | |||||||||

| Additional paid-in capital |

19,004,604 | 19,024,251 | 277,889 | |||||||||

| Accumulated deficit |

(6,593,471 | ) | (6,367,034 | ) | (93,004 | ) | ||||||

| Accumulated other comprehensive income (loss) |

(294,672 | ) | (432,964 | ) | (6,324 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total APGL shareholders’ equity |

12,117,537 | 12,225,329 | 178,578 | |||||||||

| Non-controlling interest |

1,157,912 | 1,179,692 | 17,232 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total shareholders’ equity |

13,275,449 | 13,405,021 | 195,810 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and shareholders’ equity |

73,984,120 | 80,529,538 | 1,176,300 | |||||||||

|

|

|

|

|

|

|

|||||||

S-13

Table of Contents

| (1) | Translation of balances from INR to US$ in the condensed consolidated balance sheets is for the convenience of the reader and was calculated using a rate of US$1.00 = INR 68.46, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 29, 2018. |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| Three Months ended June 30, | ||||||||||||

| 2017 | 2018 | 2018 | ||||||||||

| INR | INR | US$(1) | ||||||||||

| (Unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Net cash (used)/provided by operating activities |

421,355 | (749,647 | ) | (10,950 | ) | |||||||

| Net cash used in investing activities(2) |

(4,033,396 | ) | (4,195,954 | ) | (61,291 | ) | ||||||

| Net cash provided by financing activities |

2,460,289 | 4,251,738 | 62,105 | |||||||||

| (1) | Translation of balances from INR to US$ in the condensed consolidated statement of cash flow is for the convenience of the reader and was calculated using a rate of US$1.00 = INR 68.46, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 29, 2018. |

| (2) | The Company adopted ASU 2016-18, Statement of Cash Flows effective April 1, 2018 with retrospective transition, which requires a statement of cash flows to present the change in restricted cash during the period as part of cash and cash equivalents and restate each prior reporting period presented. As a result, the Company no longer presents transfers between cash and restricted cash in the statement of cash flows. Cash used in investing activities prior to adoption of the ASU was INR 3,316,910 and INR 4,186,667 (US$61,155) for the three months ended June 30, 2017 and 2018. |

Results of Operations for the Three Months ended June 30, 2018

Compared to the Three Months ended June 30, 2017

Operating Revenues

Operating revenues during the three months ended June 30, 2018 increased by INR 544.6 million, or 29%, to INR 2,422.5 million (US$35.4 million), compared to the same period in 2017. The principal reasons for the increase in revenue were (i) the operation during the entire three month period ended June 30, 2018 of the Andhra Pradesh 2 and Uttar Pradesh 2 solar power projects, which commenced operations on various dates during the comparable period in 2017 that contributed incremental operating revenue of INR 173.1 million, and INR 94.2 million, respectively, and (ii) the operation of Telangana 1 project, which commenced operations during the three months ended March 31, 2018 and contributed incremental operating revenue of INR 210.9 million. In addition, the Uttar Pradesh 3 and Andhra Pradesh 3 projects commenced operations in the three months ended June 30, 2018 and contributed incremental operating revenue of INR 25.3 million and INR 17.0 million, respectively.

In May 2014, the Financial Accounting Standards Board issued revised accounting guidance for revenue recognition from contracts with customers. We adopted this revised accounting guidance for interim and annual reporting periods beginning April 1, 2018 using the modified retrospective method, and as a result our revenue increased by INR 9.4 million (US$1.4 million).

Cost of Operations (Exclusive of Depreciation and Amortization)

Cost of operations during the three months ended June 30, 2018 increased by INR 44.7 million, or 26%, to INR 218.2 million (US$3.2 million), compared to the same period in 2017. The increase was primarily due to increased plant maintenance costs related to newly operational projects of INR 44.6 million.

S-14

Table of Contents

General and Administrative Expenses

General and administrative expenses during the three months ended June 30, 2018 increased by INR 13.6 million, or 6%, to INR 248.7 million (US$3.6 million), compared to the same period in 2017. The general and administrative expenses did not increase significantly because of the economies of scale we achieved in our operations during the three months ended June 30, 2018, as compared to the same period in 2017.

Depreciation and Amortization

Depreciation and amortization expenses during the three months ended June 30, 2018 increased by INR 133.9 million, or 32%, to INR 553.6 million (US$8.1 million), compared to the same period in 2017. The primary reasons for the increase in depreciation were capitalization of the Andhra Pradesh 2 and Uttar Pradesh 2 solar power projects, which commenced operations on various dates during the comparable period in 2017 and resulted in additional depreciation of INR 32.1 million, and INR 21.1 million, respectively, as well as the Telangana 1 project, which commenced operations during the three months ended March 31, 2018 and resulted in an additional depreciation of INR 44.2 million. In addition, the Uttar Pradesh 3 and Andhra Pradesh 3 projects commenced operations in the three months ended June 30, 2018 and resulted in additional depreciation of INR 16.1 million and INR 12.8 million, respectively.

Interest Expense, Net

Net interest expense during the three months ended June 30, 2018 increased by INR 233.8 million, or 28%, to INR 1,073.4 million (US$15.7 million), compared to the same period in 2017.

Interest expense during the three months ended June 30, 2018 increased by INR 291.0 million, or 29%, to INR 1,285.7 million (US$18.8 million). This is primarily on account of an increase of INR 284.1 million in interest expense due to borrowings for newly commissioned projects, particularly the Andhra Pradesh 2, Uttar Pradesh 2, Uttar Pradesh 3, Andhra Pradesh 3, and Telangana 1 solar power projects.

Interest income during the three months ended June 30, 2018 increased by INR 57.2 million, or 37%, to INR 212.3 million (US$3.1 million) compared to the same period in 2017 primarily as a result of an increase in income on term deposits and short-term investments during the period.

Loss/(Gain) on Foreign Currency Exchange (net)

Foreign exchange loss during the three months ended June 30, 2018 amounted to INR 204.2 million (US$3.0 million) compared to a foreign exchange gain of INR 4.8 million (US$ 0.1 million) in the same period in 2017.

The Indian rupee depreciated against the U.S. dollar by INR 3.6 to US$1.00 (5.5%) during the period from March 31, 2018 to June 30, 2018. This depreciation resulted in a foreign exchange loss of INR 204.2 million (US$3.0 million) during the three months ended June 30, 2018, compared to a gain of INR 4.8 million during the same period in 2017. This depreciation resulted in an increase in unrealized foreign exchange loss of INR 210.8 million on foreign currency loans and an unrealized loss of INR 29.2 million on foreign currency option contracts used to hedge our foreign currency exposure. We recorded realized gains on foreign currency option contracts of INR 44.7 million, which was partially offset by a realized loss on foreign currency exchange of INR 8.8 million during the three months ended June 30, 2018.

Income Tax Expense/(Benefit)

Income tax expense during the three months ended June 30, 2018 increased by INR 86.7 million to INR 94.6 million (US$1.4 million) compared to the same period in 2017. Our effective income tax rate for the three

S-15

Table of Contents

months ended June 30, 2018 was 28.78% as compared to 3.66% for the same period in 2017. The increase in our income tax expense and our effective tax rate in the three months ended June 30, 2018 was a result of higher taxable profits generated by AZI, which provides certain engineering, procurement and construction services to its Indian subsidiaries. We pay taxes on taxable profits at the individual entity level, in accordance with the tax rates in the relevant jurisdictions. The taxable profits of AZI and certain of our Indian and non-Indian subsidiaries result from services provided by these entities to our other subsidiaries and are taxed at the applicable tax rates in the jurisdiction of the entity providing the services. These inter-company transactions and profits are eliminated during consolidation, while the related income tax expense is not eliminated. Furthermore, a portion of our Indian operations qualifies for a tax holiday related to their operating income attributable to undertakings, as defined, in operating solar power plants under section 80-IA of the Indian Income Tax Act, 1961. These holidays are available for a period of ten consecutive years out of the 15 years beginning from the year in which the undertaking first generates power (referred to as the tax holiday period). We anticipate that we will claim the aforesaid holidays in the last ten years out of 15 years beginning with the year in which we generate power and when we have taxable income. Accordingly, our current operations are taxable at the normally applicable tax rates. Due to these tax holiday periods, a substantial portion of the temporary differences between the book and tax basis of our assets and liabilities do not have any tax consequences as they are expected to reverse within the applicable tax holiday period.

Liquidity and Capital Resources

Azure Power Global Limited, on a standalone basis, does not generate cash from operations in order to fund its expenses. Restrictions on the ability of our subsidiaries to pay us cash dividends as a result of certain regulatory and contractual restrictions may make it impracticable to use such dividends as a means of funding the expenses of Azure Power Global Limited.

Our principal liquidity requirements are to finance current operations, service our debt and support our growth in India. We will continue to use capital in the future to finance the construction of solar power plants. Our operations largely rely on project-level long-term borrowings, proceeds from issuance of Green Bonds, proceeds from issuance of common stock, compulsorily convertible preferred shares and compulsorily convertible debentures, non-convertible debentures, non-convertible debentures and internally generated cash flows to meet capital expenditure requirements. As a normal part of our business and depending on market conditions, we will from time to time consider opportunities to repay, redeem, repurchase or refinance our indebtedness. Changes in our operating plans, lower than anticipated electricity sales, increased expenses or other events may cause us to seek additional debt or financing in future periods. There can be no guarantee that financing will be available on acceptable terms or at all. Debt financing, if available, could impose additional cash payment obligations, additional covenants and operating restrictions. Future financings could result in the dilution of our existing shareholding. In addition, any of the items discussed in detail under “Risk Factors” in this prospectus supplement and in our Annual Report on Form 20-F may also significantly impact our liquidity.

Liquidity Position

As of June 30, 2018, our liquidity was INR 10,831.3 million (US$158.2 million), which was comprised of cash, cash equivalents and current investments. As of June 30, 2018, we were carrying cash and short-term investments of INR 10,684.4 million (US$156.1 million) held by our subsidiaries, which are not readily available to Azure Power Global Limited.

We also have commitments from financial institutions that we can draw upon in the future once specific funding criteria has been achieved. As of June 30, 2018, we have such undrawn project debt commitments amounting to INR 12,630.0 million (US$184.5 million) under project-level financing arrangements, all which have floating interest rates. In addition to the loan facilities described under “Operating and Financial Review and Prospectus—Liquidity and Capital Resources—Liquidity Position” in our Annual Report on Form 20-F, in

S-16

Table of Contents

May 2018 we obtained a line of credit to finance our solar rooftop projects in an aggregate amount of US$135 million from a consortium of development finance institutions, including the International Finance Corporation, FMO, Société de Promotion et de Participation pour la Coopération Economique and Oesterreichische Entwicklungsbank AG.

Our financing arrangements as of June 30, 2018 consisted of project-level financing arrangements and other borrowings.

The table below summarizes certain terms of our project-level financing arrangements as of June 30, 2018:

| Name of Project |

Outstanding Principal Amount |

Type of Interest | Currency | Maturity Date(2) | ||||||||||||||||

| INR | US$(1) | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Punjab 1 |

174,000 | 2,542 | Fixed | INR | 2022 | |||||||||||||||

| Punjab 2 |

1,699,000 | 24,817 | Fixed | INR | 2022 | |||||||||||||||

| Gujarat 1 |

927,560 | 13,549 | Fixed | INR | 2022 | |||||||||||||||

| Rajasthan 1 |

757,324 | 11,062 | Fixed | US$ | 2028 | |||||||||||||||

| Rajasthan 2 |

3,287,121 | 48,015 | Fixed | US$ | 2031 | |||||||||||||||

| Uttar Pradesh 1 |

453,050 | 6,618 | Fixed | INR | 2022 | |||||||||||||||

| Karnataka 1 |

498,033 | 7,275 | Fixed | INR | 2022 | |||||||||||||||

| Rajasthan 3.1 |

867,000 | 12,664 | Fixed | INR | 2022 | |||||||||||||||

| Rajasthan 3.2 |

1,699,530 | 24,825 | Fixed | INR | 2022 | |||||||||||||||

| Rajasthan 3.3 |

1,774,718 | 25,923 | Fixed | INR | 2022 | |||||||||||||||

| Rajasthan 4 |

236,000 | 3,447 | Fixed | INR | 2022 | |||||||||||||||

| Punjab 3.1 and 3.2 |

1,473,716 | 21,527 | Floating | INR | 2034 | |||||||||||||||

| Chhattisgarh 1.1,1.2 & 1.3 |

1,425,050 | 20,816 | Floating | INR | 2029 | |||||||||||||||

| Bihar 1 |

438,767 | 6,409 | Fixed | INR | 2022 | |||||||||||||||

| Karnataka 2 |

493,258 | 7,205 | Floating | INR | 2032 | |||||||||||||||

| Andhra Pradesh 1 |

2,508,312 | 36,639 | Fixed | INR | 2022 | |||||||||||||||

| Karnataka 3.1 |

6,482,440 | 94,689 | Fixed | INR | 2022 | |||||||||||||||

| Karnataka 3.2 |

1,363,990 | 19,924 | Fixed | INR | 2022 | |||||||||||||||

| Karnataka 3.3 |

1,330,264 | 19,432 | Fixed | INR | 2022 | |||||||||||||||

| Punjab 4 |

5,810,000 | 84,867 | Fixed | INR | 2022 | |||||||||||||||

| Maharashtra 1.1 & 1.2 |

356,625 | 5,209 | Floating | INR | 2032 | |||||||||||||||

| Uttar Pradesh 2 |

2,067,000 | 30,193 | Floating | INR | 2034 | |||||||||||||||

| Telangana 1 |

4,610,000 | 67,339 | Fixed | INR | 2022 | |||||||||||||||

| Andhra Pradesh 2 |

5,661,240 | 82,694 | Floating | INR | 2036 | |||||||||||||||

| Uttar Pradesh 3 |

1,614,100 | 23,577 | Floating | INR | 2034 | |||||||||||||||

| Andhra Pradesh 3 |

2,287,200 | 33,409 | Floating | INR | 2034 | |||||||||||||||

| Gujarat 2 |

4,674,908 | 68,287 | Floating | INR | 2019-21 | |||||||||||||||

| Rooftop Projects(3) |

949,929 | 13,876 | Floating | (4) | INR | 2022-31 | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Total(5) |

55,920,135 | 816,829 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | Translation of INR to US$ is for the convenience of the reader and was calculated using a rate of US$ 1.00 = INR 68.46, which is the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 29, 2018. |

| (2) | These loans are repayable on a quarterly or semi-annual basis. |

| (3) | Rooftop projects includes DLF Ltd. (total), Uttar Pradesh Rooftop 1, Delhi Rooftop 1, Delhi Rooftop 2, Delhi Rooftop, Gujrat Rooftop, Punjab Rooftop 2, Delhi Rooftop 4 and Oberoi Rooftop. |

| (4) | Except for Punjab Rooftop 2, which has a fixed rate of interest, |

S-17

Table of Contents

| (5) | Total project debt includes ancillary cost of borrowings of INR 942.8 million (US$13.8 million), but excludes debt amounting to INR 6,151.9 million (US$89.9 million) of Azure Power India Limited, Azure Power Solar Energy Private Limited and Azure Power Energy Limited that is not related to specific projects. |

Sources of Liquidity

Our ability to meet our debt service obligations and other capital requirements will depend on our future operating performance which, in turn, will be subject to general economic, financial, business, competitive, legislative, regulatory and other conditions, many of which are beyond our control.

Uses of Liquidity

Our principal requirements for liquidity and capital resources can be categorized into investment for developing solar power plants and debt service obligations. Generally, once operational, our solar power generation assets do not require significant capital expenditures to maintain their operating performance.

Capital Expenditures

As of June 30, 2018, we operated 37 utility-scale projects and several commercial rooftop projects with a combined rated capacity of 1,011 MW. As of such date, we were also constructing several projects with a combined rated capacity of 333 MW.

Our capital expenditure requirements consist of:

| (i) | Expansion capital expenditures for new projects; and |

| (ii) | Working capital expenditures for building the pipeline of projects for coming year(s). |

Expansion capital expenditures also include interest expense associated with borrowings used to fund expansion during the construction phase of our projects. We intend to build or acquire new projects after the completion of this offering.

Our capital expenditures comprised addition to property, plant and equipment of INR2,619.0 million (US$38.2 million) during the three months ended June 30, 2018, primarily, for the Uttar Pradesh 3, Andhra Pradesh 3, Gujarat 2, Indian railways rooftop 1 and other commercial rooftop projects.

Cash Flow Discussion

We use traditional measures of cash flow, including net cash provided by operating activities, net cash used in investing activities and net cash provided by financing activities, as well as cash available for distribution to evaluate our periodic cash flow results.

Cash and cash equivalents include cash on hand, demand deposits with banks, term deposits and all other highly liquid investments purchased with an original maturity of three months or less at the date of acquisition and that are readily convertible to cash. It does not include restricted cash, which consists of cash balances restricted as to withdrawal or usage and cash used to collateralize bank letters of credit supporting the purchase of equipment for solar power plants, bank guarantees issued in relation to the construction of the solar power plants within the timelines stipulated in PPAs and for certain debt service reserves required under our loan agreements.

Operating Activities

During the three months ended June 30, 2018, we used INR 749.7 million (US$11.0 million) of cash from operating activities. This cash outflow primarily resulted from changes in operating assets and liabilities,

S-18

Table of Contents

including a decrease in interest payable of INR 721.4 million, primarily due to the repayment of INR 1,412.0 million of interest accrued since August 2017 on the solar green bonds issued by the Company in August 2017, an increase in accounts receivable of INR 642.5 million, an increase in other assets of INR 366.1 million and a decrease in other liabilities of INR 165.5 million. These outflows were partially offset by net income during the three months ended June 30, 2018 of INR 29.8 million (US$0.4 million), increased by non-cash items including depreciation and amortization of INR 553.6 million, the amortization of cashflow hedges of INR 248.0 million and foreign exchange loss of INR 204.2 million.