Form 8-K WALT DISNEY CO/ For: Oct 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 5, 2018

THE WALT DISNEY COMPANY

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 1-11605 | 95-4545390 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

500 South Buena Vista Street Burbank, California 91521

(Address of Principal Executive Offices) (Zip Code)

818 560-1000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

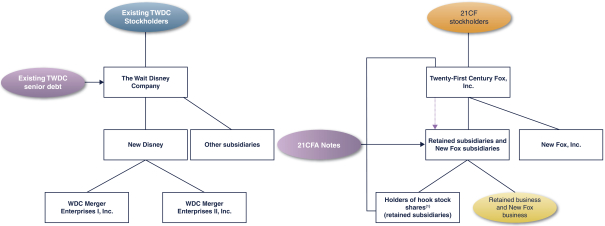

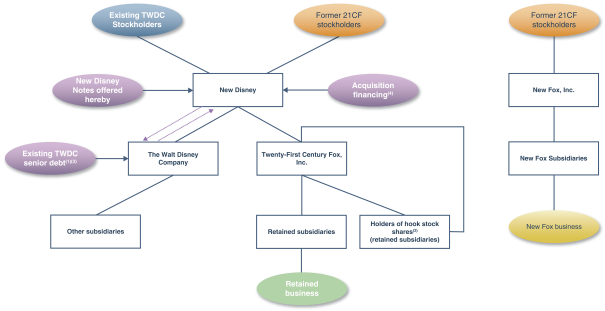

As previously announced, The Walt Disney Company (the “Company”), TWDC Holdco 613 Corp., a Delaware corporation and wholly owned subsidiary of the Company (“New Disney”), and Twenty-First Century Fox, Inc. (“21CF”) have entered into an Amended and Restated Agreement and Plan of Merger, dated as of June 20, 2018 (the “Acquisition Agreement”), providing for New Disney to acquire 21CF (together with the Mergers, the Separation and the Distribution, each as defined below, the “Acquisition”). Pursuant to the terms of the Acquisition Agreement, following the Distribution, (1) WDC Merger Enterprises I, Inc., a Delaware corporation and wholly owned subsidiary of New Disney, will be merged with and into the Company, and the Company will continue as the surviving corporation (the “Disney Merger”), and (2) WDC Merger Enterprises II, Inc., a Delaware corporation and wholly owned subsidiary of New Disney, will be merged with and into 21CF, and 21CF will continue as the surviving corporation (the “21CF Merger” and, together with the Disney Merger, the “Mergers”). As a result of the Mergers, the Company and 21CF will become direct wholly owned subsidiaries of New Disney, which will be renamed “The Walt Disney Company” concurrently with the Mergers.

Prior to the completion of the Mergers, 21CF and a newly-formed subsidiary of 21CF (“New Fox”) will enter into a separation agreement (the “Separation Agreement”), pursuant to which 21CF will, among other things, engage in an internal restructuring (the “Separation”), whereby it will transfer to New Fox a portfolio of 21CF’s news, sports and broadcast businesses, including the Fox News Channel, Fox Business Network, Fox Broadcasting Company, Fox Sports, Fox Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network, and certain other assets, and New Fox will assume from 21CF certain liabilities associated with such businesses. 21CF will retain all assets and liabilities not transferred to New Fox, including the Twentieth Century Fox film and television studios and certain cable and international television businesses (21CF, following the Distribution, is referred to herein as “RemainCo”). Following the Separation and prior to the completion of the 21CF Merger, 21CF will distribute all of the issued and outstanding common stock of New Fox to 21CF stockholders (other than holders that are subsidiaries of 21CF) on a pro rata basis (the “Distribution”), in accordance with terms set forth in the Amended and Restated Distribution Agreement and Plan of Merger, dated as of June 20, 2018, by and between 21CF and 21CF Distribution Merger Sub, Inc. Prior to the Distribution, New Fox will pay to 21CF a dividend in the amount of $8.5 billion.

On June 27, 2018, the Antitrust Division of the U.S. Department of Justice announced that it cleared the Acquisition. The Company, 21CF and the U.S. Department of Justice have entered into a consent decree that allows the Acquisition to proceed, while requiring New Disney and 21CF to sell (the “RSN Divestiture”) 21CF’s Regional Sports Networks (the “RSNs”). Under the consent decree, the Company will have at least 90 days from the date of closing of the Acquisition to complete the RSN Divestiture, with the possibility that the Department of Justice can grant extensions of time up to another 90 days. The decree is subject to the normal court approval process. At separate special meetings of stockholders on July 27, 2018, 21CF’s stockholders adopted the Acquisition Agreement, stockholders of the Company approved the issuance of New Disney common stock to 21CF shareholders in connection therewith, and stockholders of 21CF approved the other proposals voted on at the 21CF special meeting.

On September 22, 2018, the United Kingdom Panel on Takeovers and Mergers conducted an auction process to establish the final prices per share to be offered by Comcast Corporation (“Comcast”) and 21CF in connection with their respective takeover offers for Sky plc (“Sky”). Following that auction, it was announced that Comcast had offered £17.28 per Sky share, higher than 21CF’s offer of £15.67. Comcast subsequently acquired more than 30% of the issued shares in Sky through market purchases and posted its revised offer to Sky shareholders at that price on September 27, 2018. Comcast announced on October 4, 2018 that it had entered into an agreement to acquire the shares in Sky held by 21CF (the “Sky Sale”), meaning that on the completion of such acquisition (which is expected to occur on October 9, 2018), Comcast will hold or have received acceptances in respect of over 75% in aggregate of the issued ordinary share capital of Sky, at which point Comcast’s offer for Sky will become unconditional in all respects.

The consummation of the Acquisition remains subject to various conditions, including among others, (i) the consummation of the Separation, (ii) the receipt of certain tax opinions with respect to the treatment of the Acquisition under U.S. and Australian tax laws, and (iii) the receipt of certain regulatory approvals and governmental consents.

On September 26, 2018, TWDC announced that it expected the net proceeds from 21CF’s sale of its Sky shares, along with the net proceeds from the RSN Divestiture, to reduce the overall cost of the Acquisition. Any financing in connection with the Acquisition could take any of several forms or any combination thereof. Sources of debt financing may include funds drawn by New Disney under a committed bridge facility term loan of up to $35.7 billion or other bridge facilities and/or debt securities such as senior notes and/or commercial paper.

In connection with the Exchange Offers and Consent Solicitations (each as defined below), the Company is disclosing certain information to prospective eligible investors in an offering memorandum and consent solicitation statement dated October 5, 2018 (the “Offering Memorandum”). The Company is furnishing on this Current Report on Form 8-K the following information excerpted from the Offering Memorandum:

| (i) | Unaudited pro forma condensed combined financial data of New Disney giving pro forma effect to the Acquisition, the funding of the cash portion of the 21CF Merger consideration, the RSN Divestiture and related transactions, consisting of the unaudited pro forma condensed combined statement of income for the nine months ended June 30, 2018, the unaudited pro forma condensed combined statement of income for the twelve months ended September 30, 2017 and the unaudited pro forma condensed combined balance sheet as of June 30, 2018, furnished herewith as Exhibit 99.1 and incorporated herein by reference. |

| (ii) | Unaudited pro forma condensed combined financial data of RemainCo giving pro forma effect to the Separation, the Distribution, the Sky Sale and related transactions, consisting of the unaudited pro forma condensed combined statement of operations for the nine months ended March 31, 2018, the unaudited pro forma condensed combined statement of operations for the fiscal years ended June 30, 2017, June 30, 2016 and June 30, 2015 and the unaudited pro forma condensed combined balance sheet as of June 30, 2018, furnished herewith as Exhibit 99.2 and incorporated herein by reference. |

| (iii) | Subsection captioned “Structure” of the section captioned “Summary”, furnished herewith as Exhibit 99.3 and incorporated herein by reference. |

The unaudited pro forma condensed combined financial data are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations of New Disney or RemainCo would have been had the transactions occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 hereto) is being furnished and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or under the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of information pursuant to this Item 7.01 will not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

Item 8.01. Other Events.

On October 5, 2018, the Company announced the commencement, in connection with the Acquisition, of an exchange offer for any and all outstanding notes (the “21CFA Notes”) issued by 21st Century Fox America, Inc. (“21CFA”), for up to $18,128,740,000 aggregate principal amount of new notes (the “New Disney Notes”) and cash. In conjunction with the offers to exchange (each an “Exchange Offer” and collectively, the “Exchange Offers”) the 21CFA Notes, New Disney, on behalf of 21CFA, is concurrently soliciting consents (each, a “Consent Solicitation” and, collectively, the “Consent Solicitations”) to adopt certain proposed amendments to each of the indentures governing the 21CFA Notes to eliminate substantially all of the restrictive covenants in such indentures, release the guarantee provided by 21CF pursuant to such indentures and limit the reporting covenants under such indentures so that 21CFA is only required to comply with the reporting requirements under the Trust Indenture Act of 1939. Each Exchange Offer and Consent Solicitation is conditioned upon the completion of the other Exchange Offers and Consent Solicitations, although New Disney may waive such condition at any time with respect to an Exchange Offer. Any waiver of a condition by New Disney with respect to an Exchange Offer will automatically waive such condition with respect to the corresponding Consent Solicitation, as applicable. Each Exchange Offer and Consent Solicitation is also conditioned upon the closing of the Acquisition, which condition may not be waived by New Disney. The closing of the Acquisition is expected to occur in the first half of calendar year 2019. A copy of the press release is attached hereto as Exhibit 99.4 and is incorporated herein by reference.

This Current Report on Form 8-K does not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of the New Disney Notes in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The New Disney Notes are not registered under the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The New Disney Notes will be offered only to qualified institutional buyers under Rule 144A under the Securities Act and outside the United States in compliance with Regulation S under the Securities Act.

Cautionary Notes on Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act and Section 21E of the Exchange Act. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect”, “anticipate”, “intend”, “plan”, “believe”, “seek”, “see”, “will”, “would”, “target”, similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the Acquisition and the anticipated benefits thereof, expected timing of completion of the Exchange Offers and receipt of requisite consents in the Consent Solicitations. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the Acquisition or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a difference include, but are not limited to the risk: (i) that the completion of the Acquisition may not occur on the anticipated terms and timing or at all, (ii) that the regulatory approvals required for completion of the Acquisition are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the Acquisition or cause the parties to abandon the Acquisition, (iii) that a condition to closing of the Acquisition may not be satisfied (including, but not limited to, the receipt of legal opinions with respect to the treatment of certain aspects of the Acquisition under U.S. and Australian tax laws), (iv) that the anticipated tax treatment of the Acquisition is not obtained, (v) that potential litigation relating to the Acquisition is instituted against 21CF, the Company, New Disney or their respective directors, (vi) of unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of New Disney’s operations after the consummation of the Acquisition and on the other conditions to the completion of the Acquisition, and (vii) of adverse legal and regulatory developments or determinations or adverse changes in, or interpretations of, U.S., Australian or other foreign laws, rules or regulations, including tax laws, rules and regulations, that could delay or prevent completion of the Acquisition or cause the terms of the Acquisition to be modified, as well as management’s response to any of the aforementioned factors.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2017 under Item 1A, “Risk Factors”, in the Company’s Report on Form 10-Q for the quarter ended December 30, 2017 under Item 1A, “Risk Factors”, in the Company’s Report on Form 10-Q for the quarter ended June 30, 2018 under Item 1A, “Risk Factors”, and in subsequent reports.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE WALT DISNEY COMPANY | ||

| By: | /s/ Roger J. Patterson | |

| Name: | Roger J. Patterson | |

| Title: | Associate General Counsel | |

| Registered In-House Counsel | ||

Dated: October 5, 2018

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL DATA OF NEW DISNEY

The following unaudited pro forma condensed combined financial statements of New Disney (the “New Disney Pro Forma Financial Statements”), present TWDC and its subsidiaries combined with RemainCo adjusted to reflect the RSNs as assets to be divested. These pro formas are derived from the historical consolidated financial statements of TWDC and the RemainCo Pro Forma Financial Statements (as defined herein) including historical financial information of the RSNs. The RemainCo Pro Forma Financial Statements present RemainCo on a pro forma basis after giving effect to the Separation, the Distribution and the sale of RemainCo’s existing 39% interest in Sky (see “Unaudited Pro Forma Condensed Combined Financial Data of RemainCo”). The New Disney Pro Forma Financial Statements give effect to (1) the completion of the Acquisition and (2) the use by New Disney of approximately $18.0 billion of RemainCo cash and the issuance by New Disney of approximately $17.7 billion in new indebtedness to fund the cash portion of the 21CF Merger consideration, as if they had been completed on October 2, 2016, for statement of income purposes, and on June 30, 2018, for balance sheet purposes. Additionally, we have presented the RSNs as assets held for sale at June 30, 2018, for balance sheet purposes, and have eliminated their revenues and expenses from the income statements for the year ended September 30, 2017 and nine-months ended June 30, 2018.

TWDC and RemainCo have different fiscal years. The unaudited pro forma condensed combined balance sheet and statements of income have been prepared utilizing period ends that differ by less than 93 days, as permitted by Regulation S-X. The pro forma statement of income information included in the New Disney Pro Forma Financial Statements is based on the following:

| • | With respect to TWDC, the audited consolidated financial statements of TWDC contained in its Annual Report on Form 10-K for the year ended September 30, 2017 and the unaudited consolidated financial statements of TWDC for the nine months ended June 30, 2018; and |

| • | With respect to RemainCo, the RemainCo Pro Forma Financial Statements for the year ended June 30, 2017 and the RemainCo Pro Forma Financial Statements for the nine months ended March 31, 2018. |

The pro forma balance sheet information included in the New Disney Pro Forma Financial Statements is based on the following:

| • | With respect to TWDC, TWDC’s unaudited consolidated historical balance sheet as of June 30, 2018; and |

| • | With respect to RemainCo, the RemainCo Pro Forma Financial Statements as of June 30, 2018. |

TWDC has made certain adjustments to the historical book values of the assets and liabilities of RemainCo to reflect preliminary estimates of their fair values, with the excess of the purchase price over the adjusted historical net assets of RemainCo recorded as goodwill. TWDC has not completed the detailed valuations necessary to arrive at the final estimates of the fair value of RemainCo assets to be acquired and liabilities to be assumed in order to complete the related allocations of purchase price. TWDC is also unable to determine the adjustments necessary, if any, to conform RemainCo to TWDC’s accounting policies. Until the 21CF Merger is completed, TWDC and RemainCo are limited in their ability to share information with each other. Upon completion of the 21CF Merger, New Disney will complete the valuations and any increases or decreases in the fair value adjustments could be materially different than amounts presented in the New Disney Pro Forma Financial Statements. Additionally, the value of the 21CF Merger consideration may fluctuate with the market price of TWDC common stock and, subject to the impact of a collar on the exchange ratio, will be determined based on the average TWDC stock price. The 21CF Merger consideration may also be subject to change based on the tax adjustment amount, which will be based on whether the final estimate of the transaction tax at closing is more than $8.5 billion or less than $6.5 billion. Such adjustment could increase or decrease the 21CF Merger consideration, depending upon whether the final estimate is lower or higher, respectively, than $6.5 billion or $8.5 billion. Additionally, if the final estimate of the tax liabilities is lower than $8.5 billion, TWDC will make a cash payment to New Fox reflecting the difference between such amount and $8.5 billion, up to a maximum cash

payment of $2 billion (the “Cash Payment”). It is likely that the final estimate of the tax liabilities taken into account will differ materially from the amount estimated when the 21CF Merger consideration was negotiated. Accordingly, under certain circumstances, there could be a material adjustment to the 21CF Merger consideration. Because of the method of calculating per share value and the tax adjustment amount, the amount of cash or number of shares of New Disney common stock that 21CF stockholders will receive in the 21CF Merger cannot be determined until immediately prior to completion of the 21CF Merger. Accordingly, there can be no assurance that the final value of the 21CF Merger consideration will not result in a material change to the New Disney Pro Forma Financial Statements. The New Disney Pro Forma Financial Statements have been prepared to reflect adjustments to TWDC’s historical consolidated financial information that are (i) directly attributable to the acquisition of RemainCo and the planned divestiture of the RSNs, (ii) factually supportable and (iii) with respect to the pro forma statements of income, expected to have a continuing impact on New Disney’s results. New Disney expects to apply the proceeds from the planned divestiture of the RSNs to repay certain indebtedness required to fund the cash portion of the 21CF Merger consideration.

The New Disney Pro Forma Financial Statements are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations of New Disney would have been had the acquisition of RemainCo occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position.

The New Disney Pro Forma Financial Statements do not include integration costs expected to result from the Acquisition or the realization of any cost synergies or revenue synergies expected to result from the Acquisition. The New Disney Pro Forma Financial Statements reflect the expected divestiture of the RSNs as agreed to with the Department of Justice, but do not reflect any additional divestitures or other actions that may be required by regulatory or governmental authorities in connection with obtaining approvals and clearances for the Acquisition. The effects of the foregoing excluded items could, individually or in the aggregate, materially impact the New Disney Pro Forma Financial Statements.

The New Disney Pro Forma Financial Statements and accompanying notes should be read in conjunction with the separate historical consolidated financial statements and accompanying notes of TWDC and 21CF, which are incorporated by reference into this offering memorandum and consent solicitation statement, and the RemainCo Pro Forma Financial Statements appearing under the caption “Unaudited Pro Forma Condensed Combined Financial Data of RemainCo”.

TWDC HOLDCO 613 CORP.

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

JUNE 30, 2018

(In Millions)

| TWDC | RemainCo | Pro Forma Adjustments |

Divestiture of RSN (g) |

Combined | ||||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||

| Current assets |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 4,326 | $ | 26,968 | (18,000 | ) | a | $ | (142 | ) | $ | 13,446 | ||||||||||||

| 294 | c2 | |||||||||||||||||||||||

| Receivables |

10,071 | 5,356 | 452 | c2 | (754 | ) | 14,368 | |||||||||||||||||

| (757 | ) | d | ||||||||||||||||||||||

| Inventories |

1,322 | 44 | — | — | 1,366 | |||||||||||||||||||

| Television costs and advances |

1,241 | 2,640 | 967 | c2 | (257 | ) | 4,285 | |||||||||||||||||

| (306 | ) | d | ||||||||||||||||||||||

| Other current assets |

769 | 855 | 86 | c2 | (10 | ) | 1,700 | |||||||||||||||||

| Assets to be divested |

— | — | — | 1,163 | 1,163 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total current assets |

17,729 | 35,863 | (17,264 | ) | — | 36,328 | ||||||||||||||||||

| Film and television costs |

7,684 | 7,399 | (4,248 | ) | b2 | (1,567 | ) | 20,304 | ||||||||||||||||

| 9,616 | b3 | |||||||||||||||||||||||

| 1,509 | c2 | |||||||||||||||||||||||

| (89 | ) | d | ||||||||||||||||||||||

| Investments |

3,155 | 578 | (578 | ) | b2 | — | 4,427 | |||||||||||||||||

| 4,943 | b5 | |||||||||||||||||||||||

| (2,425 | ) | c | ||||||||||||||||||||||

| (1,246 | ) | c | ||||||||||||||||||||||

| Parks, resorts and other property |

29,373 | 787 | 147 | c2 | (85 | ) | 30,222 | |||||||||||||||||

| Intangible assets, net |

6,892 | 3,235 | (3,235 | ) | b2 | (10,460 | ) | 27,242 | ||||||||||||||||

| 29,370 | b4 | |||||||||||||||||||||||

| 1,440 | c1 | |||||||||||||||||||||||

| Goodwill |

31,306 | 7,594 | (7,594 | ) | b2 | (12,138 | ) | 63,011 | ||||||||||||||||

| 35,934 | b | |||||||||||||||||||||||

| 7,909 | c | |||||||||||||||||||||||

| Other assets |

2,653 | 1,680 | 141 | c2 | (8 | ) | 3,972 | |||||||||||||||||

| (494 | ) | d | ||||||||||||||||||||||

| Assets to be divested |

— | — | — | 24,258 | 24,258 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total assets |

$ | 98,792 | $ | 57,136 | $ | 53,836 | $ | — | $ | 209,764 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the New Disney Pro Forma Financial Statements.

TWDC HOLDCO 613 CORP.

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

JUNE 30, 2018

(continued)

(In Millions)

| TWDC | RemainCo | Pro Forma Adjustments |

Divestiture of RSN (g) |

Combined | ||||||||||||||||||||

| LIABILITIES AND EQUITY |

||||||||||||||||||||||||

| Current liabilities |

||||||||||||||||||||||||

| Accounts payable, deferred revenue and other |

$ | 14,222 | $ | 12,930 | $ | (340 | ) | b6 | $ | (74 | ) | $ | 27,982 | |||||||||||

| 1,890 | c2 | |||||||||||||||||||||||

| (883 | ) | d | ||||||||||||||||||||||

| 237 | e7 | |||||||||||||||||||||||

| Current portion of borrowings |

5,992 | 1,054 | 17,700 | a | (31 | ) | 24,735 | |||||||||||||||||

| 20 | b7 | |||||||||||||||||||||||

| Liabilities to be divested |

— | — | — | 105 | 105 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total current liabilities |

20,214 | 13,984 | 18,624 | — | 52,822 | |||||||||||||||||||

| Borrowings |

17,681 | 18,469 | 3,048 | b7 | (1,200 | ) | 38,336 | |||||||||||||||||

| 338 | c2 | |||||||||||||||||||||||

| Deferred income taxes |

3,222 | 858 | 6,634 | b8 | (2,195 | ) | 8,572 | |||||||||||||||||

| 181 | c3 | |||||||||||||||||||||||

| (78 | ) | d | ||||||||||||||||||||||

| (50 | ) | e7 | ||||||||||||||||||||||

| Other long-term liabilities |

6,467 | 2,990 | (150 | ) | b6 | (141 | ) | 9,866 | ||||||||||||||||

| (150 | ) | c | ||||||||||||||||||||||

| 1,240 | c2 | |||||||||||||||||||||||

| (390 | ) | d | ||||||||||||||||||||||

| Liabilities to be divested |

— | — | — | 5,006 | 5,006 | |||||||||||||||||||

| Redeemable noncontrolling interests |

1,137 | 489 | (489 | ) | b1 | (1,470 | ) | 1,912 | ||||||||||||||||

| 1,470 | b9 | |||||||||||||||||||||||

| 775 | c | |||||||||||||||||||||||

| Equity |

50,071 | 20,346 | 35,621 | a | — | 93,250 | ||||||||||||||||||

| (20,346 | ) | b1 | ||||||||||||||||||||||

| 3,040 | b9 | |||||||||||||||||||||||

| 2,575 | c | |||||||||||||||||||||||

| 2,425 | c | |||||||||||||||||||||||

| (295 | ) | d | ||||||||||||||||||||||

| (187 | ) | e7 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities and equity |

$ | 98,792 | $ | 57,136 | $ | 53,836 | $ | — | $ | 209,764 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the New Disney Pro Forma Financial Statements.

TWDC HOLDCO 613 CORP.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE TWELVE MONTHS ENDED SEPTEMBER 30, 2017

(In Millions, Except Per Share Data)

| TWDC | RemainCo | Pro Forma Adjustments |

Divestiture of RSN (h) |

Combined | ||||||||||||||||||

| Revenues |

$ | 55,137 | $ | 19,307 | $ | 1,488 | e1 | $ | (4,037 | ) | $ | 71,352 | ||||||||||

| (543 | ) | e2 | ||||||||||||||||||||

| Operating expenses |

(30,306 | ) | (12,740 | ) | (1,383 | ) | e1 | 2,013 | (42,843 | ) | ||||||||||||

| 472 | e2 | |||||||||||||||||||||

| (899 | ) | e4 | ||||||||||||||||||||

| Selling, general, administrative and other |

(8,176 | ) | (2,444 | ) | (881 | ) | e1 | 126 | (11,306 | ) | ||||||||||||

| 90 | e2 | |||||||||||||||||||||

| (21 | ) | e6 | ||||||||||||||||||||

| Depreciation and amortization |

(2,782 | ) | (388 | ) | (32 | ) | e1 | 1,163 | (4,699 | ) | ||||||||||||

| (2,660 | ) | e5 | ||||||||||||||||||||

| Restructuring and impairment and other |

(20 | ) | (403 | ) | — | 5 | (418 | ) | ||||||||||||||

| Interest expense, net |

(385 | ) | (1,161 | ) | 3 | e1 | 52 | (1,947 | ) | |||||||||||||

| (624 | ) | e3 | ||||||||||||||||||||

| 168 | e3a | |||||||||||||||||||||

| Equity in the income of investees |

320 | (380 | ) | 472 | e1 | — | 412 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

13,788 | 1,791 | (4,350 | ) | (678 | ) | 10,551 | |||||||||||||||

| Income taxes |

(4,422 | ) | (466 | ) | 1,402 | f | 251 | (3,235 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

9,366 | 1,325 | (2,948 | ) | (427 | ) | 7,316 | |||||||||||||||

| Less: Net income attributable to noncontrolling interests |

(386 | ) | (237 | ) | 561 | e1 | 55 | (7 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income attributable to TWDC |

$ | 8,980 | $ | 1,088 | $ | (2,387 | ) | $ | (372 | ) | $ | 7,309 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per share: |

||||||||||||||||||||||

| Diluted |

$ | 5.69 | $ | 0.59 | $ | 3.85 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Basic |

$ | 5.73 | $ | 0.59 | $ | 3.87 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Weighted average number of common and common equivalent shares outstanding: |

||||||||||||||||||||||

| Diluted |

1,578 | 1,856 | 319 | e8 | 1,897 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic |

1,568 | 1,854 | 319 | e8 | 1,887 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the New Disney Pro Forma Financial Statements.

TWDC HOLDCO 613 CORP.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE NINE MONTHS ENDED JUNE 30, 2018

(In Millions, Except Per Share Data)

| TWDC | RemainCo | Pro Forma Adjustments |

Divestiture of RSN (h) |

Combined | ||||||||||||||||||

| Revenues |

$ | 45,127 | $ | 15,170 | $ | 1,414 | e1 | $ | (3,163 | ) | $ | 58,152 | ||||||||||

| (396 | ) | e2 | ||||||||||||||||||||

| Operating expenses |

(24,618 | ) | (10,122 | ) | (1,760 | ) | e1 | 1,558 | (35,248 | ) | ||||||||||||

| 368 | e2 | |||||||||||||||||||||

| (674 | ) | e4 | ||||||||||||||||||||

| Selling, general, administrative and other |

(6,538 | ) | (1,996 | ) | (801 | ) | e1 | 88 | (9,146 | ) | ||||||||||||

| 40 | e2 | |||||||||||||||||||||

| (16 | ) | e6 | ||||||||||||||||||||

| 77 | e7 | |||||||||||||||||||||

| Depreciation and amortization |

(2,217 | ) | (303 | ) | (50 | ) | e1 | 878 | (3,684 | ) | ||||||||||||

| (1,992 | ) | e5 | ||||||||||||||||||||

| Restructuring and impairment and Other |

66 | (276 | ) | — | 4 | (206 | ) | |||||||||||||||

| Interest expense, net |

(415 | ) | (887 | ) | 1 | e1 | 39 | (1,602 | ) | |||||||||||||

| (468 | ) | e3 | ||||||||||||||||||||

| 128 | e3a | |||||||||||||||||||||

| Equity in the income of investees |

122 | (405 | ) | 702 | e1 | — | 419 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

11,527 | 1,181 | (3,427 | ) | (596 | ) | 8,685 | |||||||||||||||

| Income taxes |

(880 | ) | 375 | 733 | f | 179 | 407 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

10,647 | 1,556 | (2,694 | ) | (417 | ) | 9,092 | |||||||||||||||

| Less: Net income attributable to noncontrolling interests |

(371 | ) | (203 | ) | 660 | e1 | 58 | 144 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income attributable to TWDC |

$ | 10,276 | $ | 1,353 | $ | (2,034 | ) | $ | (359 | ) | $ | 9,236 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per share: |

||||||||||||||||||||||

| Diluted |

$ | 6.81 | $ | 0.73 | $ | 5.05 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Basic |

$ | 6.84 | $ | 0.73 | $ | 5.07 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Weighted average number of common and common equivalent shares outstanding: |

||||||||||||||||||||||

| Diluted |

1,510 | 1,855 | 319 | e8 | 1,829 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic |

1,502 | 1,852 | 319 | e8 | 1,821 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the New Disney Pro Forma Financial Statements.

Note 1. Basis of Presentation

On June 20, 2018, TWDC and 21CF entered into the Acquisition Agreement. Pursuant to the Acquisition Agreement, following the Distribution, (1) WDC Merger Enterprises I, Inc. will merge with and into TWDC and (2) WDC Merger Enterprises II, Inc. will merge with and into 21CF. As a result of the Mergers, TWDC and 21CF will become wholly owned subsidiaries of New Disney. TWDC prepares its financial statements in accordance with accounting principles generally accepted in the United States of America. At the time of the Acquisition, New Disney will become the successor to TWDC with no change in accounting basis. The 21CF Merger will be accounted for by New Disney using the acquisition method of accounting. New Disney will be treated as the acquiror for accounting purposes. Prior to the completion of the Mergers, 21CF will transfer to New Fox a portfolio of 21CF’s news, sports and broadcast businesses, including Fox News Channel, Fox Business Network, Fox Broadcasting Company, Fox Sports, Fox Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network and certain other assets, and New Fox will assume from 21CF certain liabilities associated with such businesses. 21CF will retain all of the assets and liabilities not transferred to New Fox, including the Twentieth Century Fox film and television studios and certain cable networks and international TV businesses and proceeds from the planned sale of RemainCo’s existing 39% interest in Sky. Following the Separation and prior to the completion of the Mergers, 21CF will distribute all of the issued and outstanding shares of New Fox common stock to 21CF stockholders (other than holders that are subsidiaries of 21CF) on a pro rata basis. Prior to the Distribution, New Fox will pay to 21CF a dividend in the amount of $8.5 billion. New Fox will incur indebtedness sufficient to fund the dividend, which indebtedness will be reduced after the 21CF Merger by the amount of the Cash Payment.

The transaction tax is an amount that will be estimated by TWDC and 21CF to equal the sum of (a) spin taxes, (b) an amount in respect of divestiture taxes, and (c) the amount of taxes imposed on 21CF and its subsidiaries as a result of the operations of the New Fox business from and after January 1, 2018 through the closing of the Acquisition, but only to the extent such taxes exceed an amount of cash, which will not be less than zero, equal to the New Fox cash amount.

When the 21CF Merger becomes effective, each issued and outstanding share of 21CF common stock (other than (i) shares held in treasury by 21CF that are not held on behalf of third parties, (ii) hook stock shares and (iii) shares held by 21CF stockholders who have not voted in favor of the 21CF Merger and perfected and not withdrawn a demand for appraisal rights pursuant to Delaware law) will be exchanged for the 21CF Merger consideration. The 21CF Merger consideration will consist of an amount, payable in cash or shares of New Disney common stock, equal to the per share value.

Based on the estimated number of shares of 21CF common stock outstanding as of September 27, 2018, and assuming an average TWDC stock price of $111.6013, which was the volume weighted average price of TWDC common stock over the 15-trading day period ending on September 27, 2018, New Disney would be required to issue approximately 319 million shares of New Disney common stock on a fully diluted basis. Based on this price, TWDC has used an estimate of $35.6 billion for the 21CF stock consideration. If the average TWDC stock price is between (or equal to) $93.53 and $114.32 per share, the exchange ratio will be obtained by dividing $38.00 by the average TWDC stock price. If the average TWDC stock price is greater than $114.32, the exchange ratio will be 0.3324. If the average TWDC stock price is less than $93.53, the exchange ratio will be 0.4063. Upon consummation of the 21CF Merger, New Disney will acquire approximately $27.0 billion of 21CF cash and will assume approximately $19.5 billion of 21CF debt. 21CF’s debt had an estimated fair value of approximately $22.6 billion as June 30, 2018. The value at which New Disney will record the 21CF Merger consideration will be based upon the cash paid, which is anticipated to be funded from $18.0 billion of cash acquired from 21CF and $17.7 billion from New Disney borrowings, plus the value of New Disney common stock issued, which will be determined by the number of shares issued and TWDC stock price on the closing date. New Disney will also have a majority interest in Hulu after completion of the Acquisition. Accordingly, the New Disney Pro Forma Financial Statements reflect the consolidation of Hulu’s financial results.

As of the date hereof, 21CF holds approximately 39% of the issued shares of Sky. On September 22, 2018, the United Kingdom Panel on Takeovers and Mergers conducted an auction process to

establish the final prices per share to be offered by Comcast and 21CF in connection with their respective takeover offers for Sky. Following that auction, it was announced that Comcast had offered £17.28 per Sky share, higher than 21CF’s offer of £15.67. Comcast subsequently acquired more than 30% of the issued shares in Sky through market purchases and posted its revised offer to Sky shareholders at that price on September 27, 2018. Comcast announced on October 4, 2018 that it had entered into an agreement to acquire the shares in Sky held by 21CF, meaning that on the completion of such acquisition (which is expected to occur on October 9, 2018), Comcast will hold or have received acceptances in respect of over 75% in aggregate of the issued ordinary share capital of Sky, at which point Comcast’s offer for Sky will become unconditional in all respects. The RemainCo unaudited pro forma condensed consolidated balance sheet reflects the sale of its 39% interest in Sky for £11.6 billion (approximately $15.3 billion). The estimated gain on the sale, including the estimated income tax impacts, has not been reflected in the RemainCo unaudited pro forma condensed consolidated statement of operations as it is considered to be nonrecurring in nature. The RemainCo unaudited pro forma condensed consolidated balance sheet includes the effect of the sale of Sky, including the estimated income tax impacts.

The New Disney Pro Forma Financial Statements have been adjusted to present the RSNs as assets held for sale because TWDC has agreed to divest these networks after closing as part of a resolution of the review of the Acquisition by the Department of Justice. The estimated fair value of the assets and liabilities of the RSNs has been presented in four line items in the New Disney Pro Forma Balance Sheet, “Assets to be divested” and “Liabilities to be divested”, current and non-current. The New Disney Pro Forma Statements of Income have been adjusted to remove the revenues and expenses of the RSNs. The New Disney Pro Forma Financial Statements do not give effect to the use of proceeds from the planned divestiture of the RSNs. New Disney expects to apply such proceeds to repay certain indebtedness required to fund the cash portion of the 21CF Merger consideration. The divestiture of the RSNs is expected to result in a gain for income tax purposes for New Disney.

The accompanying unaudited pro forma condensed combined statements of income for the year ended September 30, 2017 and nine months ended June 30, 2018 (the “New Disney Pro Forma Statements of Income”), and the unaudited pro forma condensed combined balance sheet as of June 30, 2018 (the “New Disney Pro Forma Balance Sheet”), present the results of operations and balance sheet data of TWDC combined with RemainCo adjusted to reflect RSNs as assets to be divested. The combined company information is based upon the TWDC historical financial statements and the RemainCo Pro Forma Financial Statements including historical financial information of the RSNs and gives effect to the Acquisition, the consolidation of Hulu and adjustments described in these footnotes. Additionally, we have presented the RSNs as assets held for sale at June 30, 2018, for balance sheet purposes, and have eliminated their revenues and expenses from the income statements for the year ended September 30, 2017 and nine months ended June 30, 2018.

TWDC has made certain adjustments to the historical book values of the assets and liabilities of RemainCo to reflect preliminary estimates of fair values, with the excess of the purchase price over the adjusted historical net assets of RemainCo recorded as goodwill. TWDC has not completed the detailed valuations necessary to arrive at the final estimates of the fair value of RemainCo assets to be acquired and liabilities to be assumed in order to complete the related allocations of purchase price. TWDC has reviewed the publicly available financial statements of 21CF but is unable to determine the adjustments necessary, if any, to conform RemainCo to TWDC accounting policies. Until the 21CF Merger is completed, TWDC and RemainCo are limited in their ability to share information with each other. Upon completion of the 21CF Merger, New Disney will complete the valuations and any increases or decreases in the fair value adjustments could be materially different than amounts presented in the New Disney Pro Forma Financial Statements. Additionally, the exchange ratio is subject to a collar based on the average TWDC stock price, whereby the exchange ratio may be fixed or floating depending on the average TWDC stock price; thus, the value of the 21CF Merger consideration will be determined based on the price of TWDC common stock at the time of the completion of the 21CF Merger and therefore is subject to change. The 21CF Merger consideration may also be subject to the tax adjustment amount, which will be based on the final estimate of the transaction tax. It is likely that the final estimate of the transaction tax will differ

materially from the initial estimate used to negotiate the 21CF Merger consideration. Accordingly, there can be no assurance that the final value of 21CF Merger consideration will not result in a material change to the New Disney Pro Forma Financial Statements.

The accompanying New Disney Pro Forma Financial Statements are presented for illustrative purposes only and do not include the realization of any cost savings, revenue synergies or costs for the integration of the companies’ operations. The accompanying New Disney Pro Forma Financial Statements have been adjusted to reflect changes to reclassify certain RemainCo financial statement line items to conform to TWDC presentation.

The following RemainCo balance sheet categories have been adjusted or aggregated to conform to TWDC’s presentation: (1) RemainCo’s “Inventories, net” has been bifurcated to include DVDs, Blu-rays and other merchandise in “Inventories” and the remainder as “Television costs and advances” and (2) RemainCo’s non-current “Receivables, net” have been reported as non-current “Other Assets.”

RemainCo’s “Impairment and restructuring charges” and “Other, net” have been aggregated and reported as “Restructuring and impairment and other,” and “Interest expense, net” and “Interest Income” have been aggregated and reported as “Interest expense, net” in the New Disney Pro Forma Statements of Income.

The New Disney Pro Forma Financial Statements have been prepared to reflect adjustments to TWDC’s historical consolidated financial information that are (a) directly attributable to the acquisition of RemainCo, (b) factually supportable and (c) with respect to the pro forma statements of income, expected to have a continuing impact on New Disney’s results.

Note 2. Pro Forma Adjustments

| (a) | The New Disney Pro Forma Balance Sheet has been adjusted to record the purchase price of $71.3 billion. The purchase price consists of $35.7 billion in cash, which is assumed to be funded from $18.0 billion of cash acquired from 21CF and $17.7 billion from New Disney borrowings, and the issuance of approximately 319 million shares of New Disney common stock on a fully diluted basis at a value of approximately $35.6 billion. The value of New Disney common stock is based on the estimated number of shares of 21CF common stock outstanding as of September 27, 2018, and an assumed closing date price of New Disney common stock equal to the volume weighted average price of TWDC common stock for the 15 trading days ended September 27, 2018, which was $111.6013. The purchase price also assumes that the amount of the transaction tax is $6.5 billion (which would result in a Cash Payment of $2.0 billion from New Disney to New Fox and no tax adjustment amount). The collar on the exchange ratio will ensure that the 21CF shareholders will receive a number of shares New Disney common stock equal to $38.00 in value if the average TWDC stock price is between $93.53 per share and $114.32 per share. If the average stock price is greater than $114.32, the exchange ratio will be 0.3324. If the average stock price is less than $93.53, the exchange ratio will be 0.4063. The low and high end of the collar determine the maximum and minimum number of shares of New Disney common stock that can be issued, respectively. The following table shows these amounts and the estimated impact on pro forma EPS. |

| Lower Collar $93.53 |

Upper Collar $114.32 |

|||||||

| Shares issued at lower and upper collar |

381 million | 312 million | ||||||

| EPS increase/(decrease) |

$ | (0.12 | ) | $ | 0.01 | |||

If the share price at closing is outside of the collar, there will be an impact on purchase price. For each 5% that the TWDC stock price at closing is below the lower collar or above the upper collar, the aggregate value of the 21CF Merger consideration will decrease or increase by approximately $1.8 billion, respectively.

The value at which New Disney will record the 21CF Merger consideration will be based upon the cash paid plus the value of the New Disney common stock issued, which will be determined by the number of

shares of New Disney common stock issued and the TWDC stock price on the closing date. The actual number of shares of New Disney common stock to be delivered to 21CF stockholders will be based upon the number of shares of 21CF common stock issued and outstanding when the Acquisition closes and, subject to the collar, the average TWDC stock price.

A change in the purchase price based on these factors would generally result in a corresponding adjustment to goodwill.

The 21CF Merger consideration may also be subject to change based on the tax adjustment amount, which will be based on whether the final estimate of the transaction tax at closing is more than $8.5 billion or less than $6.5 billion. Such adjustment could increase or decrease the 21CF Merger consideration, depending upon whether the final estimate is lower or higher, respectively, than $6.5 billion or $8.5 billion. It is likely that the final estimate of the tax liabilities taken into account will differ materially from the amount estimated when the 21CF Merger consideration was negotiated. Accordingly, there could be a material adjustment to the 21CF Merger consideration. Because of the method of calculating the per share value and the tax adjustment amount, the number of shares of New Disney common stock that 21CF stockholders will receive in the 21CF Merger cannot be determined until immediately prior to completion of the 21CF Merger. Accordingly, there can be no assurance that the final value of the 21CF Merger consideration will not result in a material change to the New Disney Pro Forma Financial Statements.

| (b) | The preliminary allocation of the purchase price to RemainCo’s identifiable net assets acquired is as follows (in millions): |

| Cash | Common Stock | Total | ||||||||||

| Preliminary value of cash and New Disney common stock expected to be issued |

$ | 35,700 | $ | 35,621 | $ | 71,321 | (a) | |||||

| Elimination of historical RemainCo book value: |

||||||||||||

| Redeemable noncontrolling interests |

489 | (bl) | ||||||||||

| Equity |

20,346 | (bl) | ||||||||||

| Goodwill |

(7,594 | )(b2) | ||||||||||

| Intangible assets: finite and indefinite-lived |

(3,235 | )(b2) | ||||||||||

| Investments |

(578 | )(b2) | ||||||||||

| Film and television costs |

(4,248 | )(b2) | ||||||||||

| Record estimated fair value of RemainCo: |

||||||||||||

| Film and television costs |

9,616 | (b3) | ||||||||||

| Intangible assets: finite and indefinite-lived |

29,370 | (b4) | ||||||||||

| 30% investment in Hulu |

2,425 | (b5) | ||||||||||

| Hulu control premium |

1,246 | (b5) | ||||||||||

| Other investments in equity affiliates |

1,272 | (b5) | ||||||||||

| Record estimated fair value adjustments of RemainCo: |

||||||||||||

| Deferred revenue, short and long-term |

490 | (b6) | ||||||||||

| Short and long-term debt |

(3,068 | )(b7) | ||||||||||

| Tax impacts of fair value adjustments |

(6,634 | )(b8) | ||||||||||

| Estimated fair value of redeemable noncontrolling interests |

(1,470 | )(b9) | ||||||||||

| Estimated fair value of noncontrolling interests |

(3,040 | )(b9) | ||||||||||

|

|

|

|||||||||||

| Preliminary fair value of identifiable net assets acquired |

35,387 | |||||||||||

|

|

|

|||||||||||

| Goodwill |

$ | 35,934 | (b) | |||||||||

|

|

|

|||||||||||

The New Disney Pro Forma Financial Statements reflect a preliminary allocation of the purchase price to identifiable assets and liabilities, and unless otherwise noted, historical book values as of June 30, 2018 are assumed to approximate fair values. Significant assets and liabilities where historical book values are assumed to approximate fair values include cash and cash equivalents, accounts receivable, acquired television costs and advances, fixed assets, accounts payable and accrued liabilities. The remaining

unallocated purchase price was allocated to goodwill, which is not deductible for tax purposes. The final purchase price allocations, which will be based on third-party valuations, may result in different allocations for the acquired assets and assumed liabilities than the amounts presented in the New Disney Pro Forma Financial Statements, and those differences could be material.

| (bl) | The New Disney Pro Forma Balance Sheet has been adjusted to eliminate the historical stockholders’ equity and redeemable noncontrolling interest accounts of RemainCo. |

| (b2) | The New Disney Pro Forma Balance Sheet has been adjusted to eliminate RemainCo’s historical goodwill, intangibles assets, investments and film and television production costs. The historical carrying values of acquired television costs and advances are assumed to be at fair value as acquired programming contracts are generally shorter in duration and may include inflationary pricing mechanisms for future years. In addition, the value associated with potential off-market terms may be captured in the estimated fair value of the acquired distribution networks. Therefore, the historical values of the acquired programming rights have not been eliminated. The New Disney Pro Forma Statements of Income have been adjusted to reflect the incremental impact of film and television production cost amortization as a result of adjusting the film and television production cost to preliminary fair value (see footnote e). |

| (b3) | The New Disney Pro Forma Balance Sheet has been adjusted to report the estimated fair value of “Film and television costs.” The historical carrying values of acquired television costs and advances are assumed to be at fair value. Because the cash flows generated from recently released internally produced titles are generally higher in the earlier years following theatrical release, a sum-of-the-years-digits method was used to estimate amortization expense, which results in a larger portion of amortization expense in the early years. The estimated asset lives for recently released titles range from 1 to 10 years with a weighted average of 8 years. The estimated fair value was derived on a portfolio basis rather than an individual title basis. For recently released titles, New Disney expects to use the film forecast method at the individual title level when the detailed information becomes available. The estimated asset lives for library titles range from 7 to 10 years with a weighted average of 9 years. For library titles, a straight line amortization method was used. |

The estimated fair values of these assets are sensitive to input assumptions, which include the magnitude and timing of forecasted cash flows, discount rates, royalty rates, revenue growth rates and useful lives (the “Fair Value Assumptions”). The following table is presented for illustrative purposes and provides the estimated annual impact on the pro forma net income for a $1 billion change in fair value assigned to either recently released titles or film libraries (in millions, expect per share impact).

| Weighted Average Life in years |

Estimated Amortization Expense(1) |

Net income impact |

Per share impact |

|||||||||||||

| Recently Released |

8 | $ | 222 | $ | 176 | $ | 0.09 | |||||||||

| Film Library |

9 | 111 | 88 | 0.05 | ||||||||||||

| (1) | Amortization of recently released titles reflects the sum-of-the-years-digits method over the lives shown and the first year of amortization is displayed. Expense for each year thereafter will decrease. |

| (b4) | The New Disney Pro Forma Financial Statements have preliminarily identified the following intangible assets: distribution networks, trade names, technology and subscriber relationships. Substantially all of these assets are identified as finite-lived intangibles with estimated useful lives that range from 2 to 20 years with assumed straight-line amortization. The New Disney Pro Forma Balance Sheet has been adjusted to report the estimated fair value of RemainCo intangibles as “Intangible assets, net.” The fair values are sensitive to changes in the Fair Value Assumptions. The weighted average estimated life for finite-lived intangibles is 11 years. For illustrative purposes, the estimated annual impact of a $1 billion change in fair value assigned to these intangible assets on annual amortization expense, pro forma net income and earnings per share would be $91 million, $72 million and $0.04, respectively. |

| (b5) | The New Disney Pro Forma Balance Sheet has been adjusted to report RemainCo’s investments in equity affiliates at estimated fair value. |

| (b6) | The New Disney Pro Forma Balance Sheet has been adjusted to report RemainCo’s deferred revenues at estimated fair value, which is based on the estimated cost to perform the remaining services under the contracts plus a normal profit margin. |

| (b7) | The New Disney Pro Forma Balance Sheet has been adjusted by $3.1 billion to adjust the carrying value of RemainCo debt of $19.5 billion to estimated fair value of $22.6 billion as of June 30, 2018. The fair value was primarily determined using third-party pricing sources. |

The following table is presented for illustrative purposes and provides the estimated (decrease)/increase on pro forma borrowings and annual interest expense, net income and earnings per share from the impact of a 100 bps change in interest rates on the RemainCo debt (in millions, except per share impact):

| Change in interest rate |

Fair value of debt |

Estimated Interest Expense |

Net income impact |

Per share impact |

||||||||||||

| +100 bps |

$ | (1,854 | ) | $ | 112 | $ | (88 | ) | $ | (0.05 | ) | |||||

| -100 bps |

2,175 | (138 | ) | 109 | 0.06 | |||||||||||

On October 5, 2018, New Disney commenced an offer to exchange any and all outstanding notes issued by 21CFA for up to $18.129 billion aggregate principal amount of New Disney Notes and cash. Each series of New Disney Notes will have the same interest rate, the same interest payment dates, the same redemption terms and the same maturity date as the corresponding series of 21CFA Notes for which it is being exchanged. The Exchange Offers are subject to certain conditions, including the consummation of the Acquisition. Because the Exchange Offers are not expected to have a material impact on New Disney’s financial position, operating results or liquidity, no pro forma effect of the Exchange Offers has been made in the New Disney Pro Forma Financial Statements.

| (b8) | The New Disney Pro Forma Balance Sheet has been adjusted to reflect the tax effect of estimated valuation adjustments to RemainCo’s assets and liabilities. |

| (b9) | The New Disney Pro Forma Balance Sheet has been adjusted to report the estimated fair value of noncontrolling interests in RemainCo subsidiaries. The redemption of certain noncontrolling interests is outside the control of RemainCo, and these interests are reflected as “Redeemable noncontrolling interests.” |

| (c) | The New Disney Pro Forma Balance Sheet reports the preliminary impact of consolidating Hulu at fair value. Disney and 21CF each currently own 30% of Hulu. |

The estimated fair value of TWDC’s 30% interest in Hulu is $2.425 billion, which is sensitive to the Fair Value Assumptions. The difference between the historical carrying value of TWDC’s interest ($150 million negative investment balance) and the estimated fair value is reported in equity ($2.575 billion) (the “Hulu Gain”). Upon the closing of the Acquisition, the Hulu Gain will be recognized in New Disney’s statement of income, although the New Disney Pro Forma Statement of Income has not been adjusted to reflect the Hulu Gain as it will not have a continuing impact on New Disney’s results. The estimated fair value of RemainCo’s 30% interest is also $2.425 billion. As New Disney would have a combined 60% interest, it will record Hulu at its estimated $9.296 billion fair value, which includes an implied control premium of $1.246 billion. An increase or decrease in the estimated fair value of Hulu would have an impact on the Hulu Gain and goodwill.

The New Disney Pro Forma Balance Sheet has been adjusted for the estimated fair value of the 30% noncontrolling interest ($2.425 billion) and 10% redeemable noncontrolling interest ($775 million) in Hulu.

The New Disney Pro Forma Financial Statements reflect a preliminary allocation of the Hulu purchase price to identifiable assets and liabilities, and unless otherwise noted, historical book values as of June 30, 2018 are assumed to approximate fair values. The remaining unallocated purchase price was allocated to goodwill, which is not deductible for tax purposes. The final purchase price allocations, which will be

based on third-party valuations, may result in different allocations for the acquired assets and assumed liabilities than the amounts presented in the New Disney Pro Forma Financial Statements, and those differences could be material.

The following schedule shows the impact on the New Disney Pro Forma Balance Sheet from consolidating Hulu (in millions):

| Estimated fair value of: |

||||

| New Disney’s 60% interest |

$ | 6,096 | (c) | |

| Hulu equity attributable to noncontrolling interest |

2,425 | (c) | ||

| Hulu equity attributable to redeemable noncontrolling interest |

775 | (c) | ||

|

|

|

|||

| 9,296 | ||||

| Trade name, technology and subscriber list |

1,440 | (c1) | ||

| Other assets and liabilities, net |

128 | (c2) | ||

| Tax impacts of fair value adjustments |

(181 | )(c3) | ||

|

|

|

|||

| Preliminary fair value of identifiable net assets acquired |

1,387 | |||

|

|

|

|||

| Goodwill |

$ | 7,909 | (c) | |

|

|

|

| (c1) | We have preliminarily identified the following intangible assets: trade names, technology and subscriber relationships, which are finite-lived intangible assets with lives that range from 3 to 15 years, with a weighted average of 10 years. The New Disney Pro Forma Balance Sheet includes the estimated fair value of Hulu’s intangibles as “Intangible assets, net.” The intangible asset fair values are sensitive to changes in the Fair Value Assumptions. We have assumed a straight-line amortization method for these assets in the New Disney Pro Forma Financial Statements. For illustrative purposes, the estimated annual impact on pro forma net income for a $500 million change in the fair value assigned to these intangibles asset would be $50 million. |

| (c2) | We have preliminarily recorded certain assets and liabilities, including cash and cash equivalents, receivables, film and television costs, accounts payable, accrued expenses, other long-term liabilities and recently refinanced long-term debt, at Hulu’s historical carrying value, which is assumed to approximate fair value. |

| (c3) | The New Disney Pro Forma Balance Sheet has been adjusted to reflect the tax effect of estimated valuation adjustments to Hulu’s assets and liabilities. |

| (d) | The New Disney Pro Forma Balance Sheet has been adjusted to eliminate transactions between TWDC, RemainCo and Hulu. The balances include receivables and payables for licensing of film and television content, advertising revenues and affiliate fees from distribution of networks. To the extent that the amount of cumulative profit recognized by the selling entity is different than the expense recognized by the purchasing entity, that difference has been eliminated. |

| (e) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the following: |

| (e1) | The New Disney Pro Forma Statements of Income have been adjusted to consolidate the historical financial results of Hulu, net of adjustments to eliminate transactions between Hulu on the one hand and TWDC or RemainCo on the other hand. In addition, the New Disney Pro Forma Statements of Income have been adjusted to eliminate equity losses of Hulu and to record an allocation of Hulu’s losses to noncontrolling interest holders. |

| (e2) | The New Disney Pro Forma Statements of Income have been adjusted to eliminate transactions between TWDC and RemainCo. Transactions include licensing of film and television content and advertising revenue. |

| (e3) | The New Disney Pro Forma Statements of Income have been adjusted to reflect interest expense of $624 million and $468 million for the twelve months ended September 30, 2017 and nine months ended |

| June 30, 2018, respectively, on new New Disney borrowings assuming an estimated weighted average interest rate of 3.6% based on New Disney’s intent to use short-term debt, such as bridge financing and commercial paper borrowings, to finance the 21CF Merger consideration. New Disney expects to refinance such short-term debt in whole or in part with the proceeds from the planned divestiture of the RSNs and/or long-term debt, such as senior notes. The following table is presented for illustrative purposes and provides the estimated impact on annual interest expense, net income and earnings per share for a 100 bps change in interest rates on the additional New Disney debt (in millions, except per share impact): |

| Change in interest rate |

Estimated Interest Expense |

Net income impact |

Per share impact |

|||||||||

| +100 bps |

$ | (177 | ) | $ | (140 | ) | $ | (0.07 | ) | |||

| -100 bps |

177 | 140 | 0.07 | |||||||||

| (e3a) | The New Disney Pro Forma Statements of Income have been adjusted by a benefit of $168 million and $128 million for the twelve months ended September 30, 2017 and nine months ended June 30, 2018, respectively, to reflect lower interest expense using an effective interest method due to the adjustment of RemainCo long-term debt to preliminary fair value. |

| (e4) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the incremental impact of film and television programming and production cost amortization as a result of adjusting these amounts to preliminary fair value. |

| (e5) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the incremental impact of amortization of finite lived intangibles as a result of adjusting these amounts to preliminary fair value. |

| (e6) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the impact of a multi-year executive compensation arrangement that is contingent on the completion of the Mergers. New Disney increased selling, general, administrative and other expense by approximately $21 million and $16 million for the twelve months ended September 30, 2017 and nine months ended June 30, 2018, respectively. |

New Disney stock or equity awards will be issued in exchange for 21CF equity awards in conjunction with the transaction. We do not expect to recognize a material amount of incremental compensation expense associated with the New Disney stock or equity awards exchanged for 21CF equity awards that existed before December 13, 2017.

In February 2018, 21CF made a special grant of restricted stock units (the “Retention RSU Grant”) of 5.8 million units to certain senior executives and established a $110 million cash-based retention program for certain employees. New Disney will be required to record a portion of the fair value of the Retention RSU grant (which fair value will be determined as of the 21CF effective time) and of the cash-based retention program as compensation expense based upon an estimate of the value provided to RemainCo/New Disney. The estimated compensation will be recognized based upon the vesting period of the awards with pre-close vesting recognized as compensation expense at the time of effectiveness of the 21CF Merger and the remainder recognized as compensation expense over the subsequent 15 months for the Retention RSU grant and 10 months for the cash-based retention program, which represents the remaining vesting period. However, because the impact of the Retention RSU grants and cash-based retention program is one-time in nature, the expense has not been included in the New Disney Pro Forma Financial Statements.

| (e7) | The New Disney Pro Forma Statements of Income have been adjusted to eliminate transaction costs incurred in connection with the Acquisition totaling $77 million for the nine months ended June 30, 2018. The New Disney Pro Forma Balance Sheet includes an estimate of investment banking and Acquisition related legal and accounting fees of approximately $237 million. |

| (e8) | The weighted average shares have been increased to reflect the issuance of 319 million shares of New Disney common stock on a fully diluted basis as 21CF Merger consideration, which number of shares, as described in Note a, is based on the estimated number of shares of 21CF common stock outstanding as of |

| September 27, 2018 and assumes that the amount of the transaction tax is $6.5 billion (which results in a Cash Payment of $2.0 billion from TWDC to New Fox and no change to the 21CF Merger consideration pursuant to the tax adjustment amount). |

| (f) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the estimated income tax effect of the aggregate pre-tax pro forma adjustments. The aggregate pre-tax effect of these adjustments is taxed at an estimated rate of 37.0% for the twelve months ended September 30, 2017 and 26.5% for the nine months ended June 30, 2018. The nine month rate reflects the impact of new federal income tax legislation that was signed into law in December 2017. |

| (g) | TWDC has agreed to divest the RSNs after closing of the Acquisition as part of a resolution of the review of the Acquisition by the Department of Justice. Accordingly, the New Disney Pro Forma Balance Sheet has been adjusted to present the assets and liabilities associated with the RSNs at fair value as “Assets to be divested” and “Liabilities to be divested”, both current and non-current. We expect that on the date of closing the following criteria will be fulfilled: |

| • | TWDC management, having the authority to approve the action, has committed to a plan to sell the RSNs; |

| • | The RSNs are available for immediate sale in their present condition, subject only to conditions that are usual and customary for sales of such assets; |

| • | An active program to locate a buyer and other actions required to complete the plan to sell have been initiated; |

| • | The sale of the RSNs is probable and the transfer is expected to qualify for recognition as a completed sale within one year; |

| • | The RSNs are being actively marketed for sale at a price that is reasonable in relation to the current fair value; and |

| • | Actions necessary to complete the plan indicate that it is unlikely significant changes to the plan will be made or that the plan will be withdrawn. |

The assets and liabilities, current and non-current, also include the fair value of intangible assets and borrowings as well as goodwill associated with the RSNs based on an allocation of the preliminary estimated sale price of the RSNs. The historical book values of certain RSN assets and liabilities are assumed to approximate fair values including cash and cash equivalents, accounts receivable, acquired film and television costs and advances, accounts payable, deferred revenue, and other liabilities.

| (h) | The New Disney Pro Forma Statements of Income have been adjusted to reflect the elimination of revenues and expenses of the RSNs and amortization of the fair value of intangible assets associated with the RSNs. |

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL DATA OF REMAINCO

Overview

The unaudited pro forma condensed consolidated financial statements presented below, which we refer to as the RemainCo Pro Forma Financial Statements, are presented to illustrate the estimated effects of (i) the separation and distribution of New Fox and the related net cash dividend from New Fox to 21CF and (ii) the sale of 21CF’s 39% interest in Sky plc, which we refer to as Sky, to Comcast Corporation, which we refer to as Comcast, for approximately £11.6 billion (approximately $15.3 billion), which we refer to as the Sale, which is described in more detail in note 1 to the RemainCo Pro Forma Financial Statements.

The RemainCo Pro Forma Financial Statements have been prepared in accordance with SEC Regulation S-X Article 11 and are not intended to be a complete presentation of 21CF’s financial position or results of operations had the transactions occurred as of and for the periods indicated. In addition, the RemainCo Pro Forma Financial Statements are provided for illustrative and informational purposes only, and are not necessarily indicative of 21CF’s future results of operations or financial condition had the transactions been completed on the dates assumed.

The RemainCo Pro Forma Financial Statements are derived by applying pro forma adjustments to the historical consolidated financial statements of 21CF.

The pro forma adjustments related to the transactions include:

| • | presenting New Fox as discontinued operations in accordance with ASC 205, as defined in the Basis of Presentation in the accompanying notes, as a result of the separation and distribution; |

| • | in connection with the separation and distribution, a dividend in the amount of $8.5 billion to be paid to 21CF by New Fox net of the estimated payment in the amount of $2 billion to be paid from Disney to New Fox one business day after the distribution; and |

| • | estimated impact of the Sale. |

The unaudited pro forma condensed consolidated statements of operations for the nine months ended March 31, 2018 and for the fiscal years ended June 30, 2017, June 30, 2016 and June 30, 2015 reflect 21CF’s results as if the separation and distribution had occurred on July 1, 2014 and the Sale had occurred on July 1, 2016 and does not assume any interest income on cash proceeds. The unaudited pro forma condensed consolidated balance sheet as of June 30, 2018 gives effect to the transactions as if they had occurred on June 30, 2018.

Pro forma adjustments included in the RemainCo Pro Forma Financial Statements are limited to those that are (i) directly attributable to the transactions, (ii) factually supportable, and (iii) with respect to the statements of operations, expected to have a continuing impact on RemainCo’s results.

The RemainCo Pro Forma Financial Statements are subject to the assumptions and adjustments described in the accompanying notes, which should be read together with the RemainCo Pro Forma Financial Statements. 21CF’s management believes that these assumptions and adjustments, based upon the information available at this time, are reasonable under the circumstances.

The unaudited pro forma condensed consolidated statements of operations do not reflect future events that may occur after the closing of the transactions, including, but not limited to, material non-recurring charges subsequent to the closing.

The RemainCo Pro Forma Financial Statements do not reflect any divestitures or any other actions that may be required by regulatory or governmental authorities in connection with obtaining regulatory approvals and clearances for the combination mergers. The effects of the foregoing items could, individually or in the aggregate, materially impact the RemainCo Pro Forma Financial Statements.

The RemainCo Pro Forma Financial Statements should be read in conjunction with the following information:

| • | historical financial statements of 21CF and the related notes included in 21CF’s Annual Report on Form 10-K for the fiscal year ended June 30, 2018 as filed with the SEC on August 13, 2018; and |