Form DEF 14A Presidio, Inc. For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

PRESIDIO, INC. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1)Title of each class of securities to which transaction applies:_______________________________

2)Aggregate number of securities to which transaction applies:______________________________

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

(Set forth the amount on which the filing fee is calculated and state how it was determined):_____

4)Proposed maximum aggregate value of transaction: ______________________________________

5)Total fee paid:____________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) | Amount Previously Paid: __________________________________________________________ |

2) | Form, Schedule or Registration Statement No.: _________________________________________ |

3) | Filing Party:_____________________________________________________________________ |

4) | Date Filed:______________________________________________________________________ |

PRESIDIO, INC.

____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 7, 2018

____________________

The Annual Meeting of Stockholders of Presidio, Inc. will be held at our corporate headquarters located at One Penn Plaza, Suite 2832, New York, New York 10119, at 9:30 a.m. local time on Wednesday, November 7, 2018, for the following purposes:

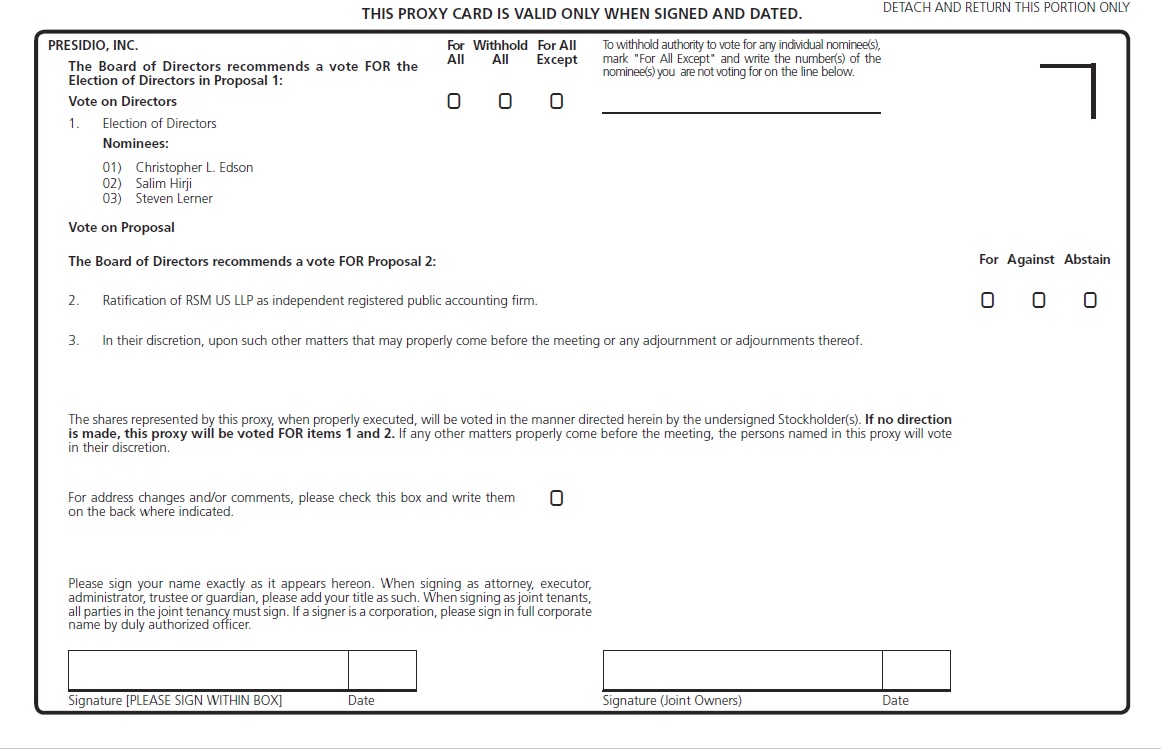

1. | To elect the three Class II directors listed in the accompanying proxy statement to serve for a three-year term expiring at our annual meeting of stockholders in 2021. |

2. | To ratify the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019. |

3. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The items of business are more fully described in the proxy statement accompanying this notice. Only holders of record of our common stock at the close of business on September 12, 2018 are entitled to notice of, and to vote at, the meeting.

By Order of the Board of Directors,

Elliot Brecher

Senior Vice President and General Counsel,

and Secretary

October 2, 2018

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on November 7, 2018: This proxy statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2018, is available at the following website: http://materials.proxyvote.com/74102M. Your vote is important. Whether or not you plan to attend the meeting in person, we would like for your shares to be represented. Please vote as soon as possible. |

PRESIDIO, INC.

____________________

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held

November 7, 2018

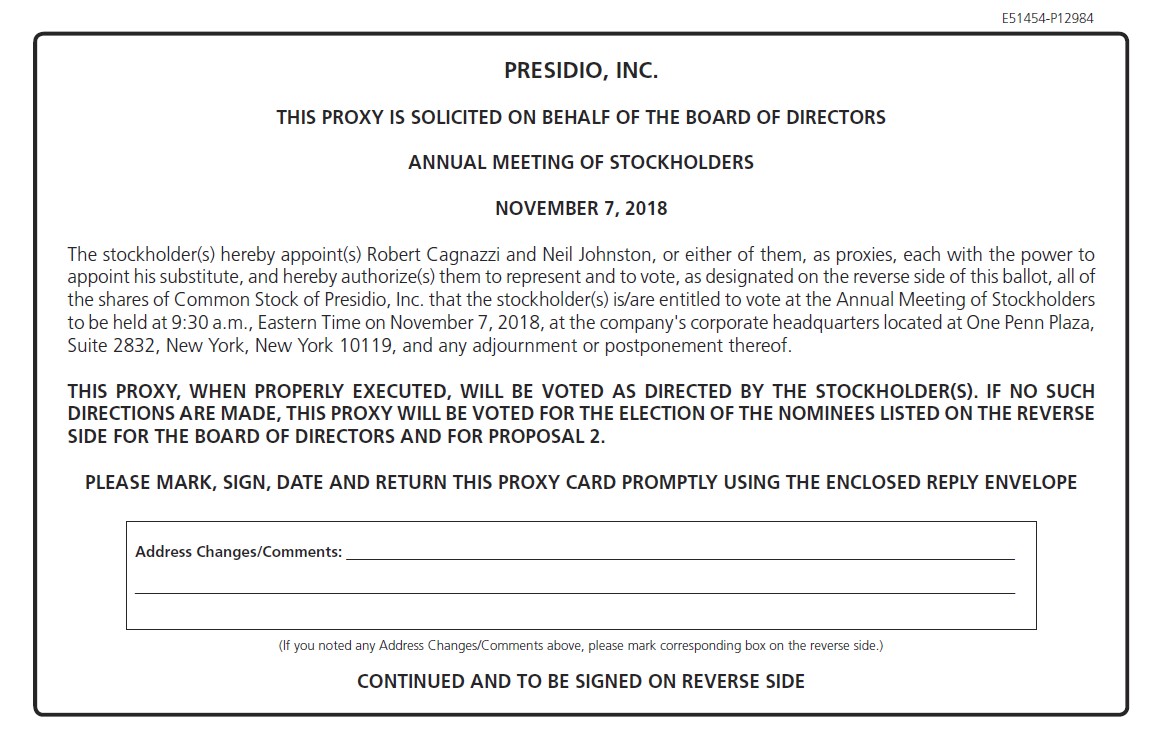

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Presidio, Inc. of proxies in the accompanying form for use at the Annual Meeting of Stockholders to be held at our corporate headquarters located at One Penn Plaza, Suite 2832 New York, New York, 10119, at 9:30 a.m. local time on Wednesday, November 7, 2018, and at all adjournments or postponements thereof.

This proxy statement and the form of proxy are being mailed to stockholders on or about October 2, 2018.

________________________

TABLE OF CONTENTS

Page | |

PROXY SUMMARY | |

BOARD OF DIRECTORS | |

COMPENSATION MATTERS | |

AUDIT MATTERS | |

OTHER MATTERS | |

2

2018 Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

2018 Annual Meeting Information

• | Date and Time: 9:30 a.m. local time on Wednesday, November 7, 2018 |

• | Place: Our corporate headquarters located at One Penn Plaza, Suite 2832, New York, New York 10119 |

• | Voting: Holders of our common stock as of the record date are entitled to one vote per share |

• | Record Date: September 12, 2018 |

Items of Business

Board Recommendation | Page Reference (for more information) | |

1. Election of three directors named in this proxy statement | FOR ALL | 9 |

2. Ratification of RSM US LLP as our independent registered public accounting firm | FOR | 38 |

Election of Directors

The Board of Directors (the “Board”) of Presidio, Inc. (“we,” “our,” “us,” the “Company,” or “Presidio”) is asking you to elect three Directors at our Annual Meeting of Stockholders (the “Annual Meeting”). The table below provides summary information about the Director nominees.

Our bylaws provide for plurality voting for the election of directors. This means that the three director nominees that receive the most votes will be elected to the Board. For more information about the nominees, including information about the qualifications, attributes and skills of the nominees, see page 9.

Name | Age | Director Since | Primary Occupation | Independent | Committee Memberships |

Christopher L. Edson | 35 | 2015 | Partner of Apollo Global Management, LLC | Nominating and Corporate Governance Committee; Compensation Committee; and Executive Committee | |

Salim Hirji | 29 | 2017 | Principal of Apollo Global Management, LLC | ||

Steven Lerner | 63 | 2017 | Founder and Managing Partner of Blue Hill Group | ü | Audit Committee; and Innovation and Technology Committee |

3

Ratify the Appointment of the Independent Registered Public Accounting Firm

The Board is asking you to ratify the selection of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019.

4

Questions and Answers About

the Proxy Materials and the Annual Meeting

Q: | Why am I receiving these materials? |

A: | Our Board has made these materials available to you in connection with the solicitation of proxies for use at the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this proxy statement. |

Q: | What proposals will be voted on at the Annual Meeting? |

A: | Two proposals will be voted on at the Annual Meeting: |

• | The election of the three Class II directors specified in this proxy statement for a three-year term, expiring at our annual meeting of stockholders in 2021; and |

• | The ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019. |

Q: | What are the Board’s recommendations? |

A: | Our Board recommends that you vote: |

• | “FOR” the election of the three nominated Class II directors specified in this proxy statement (Proposal 1); and |

• | “FOR” the ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019 (Proposal 2). |

Q: | What happens if additional matters are presented at the Annual Meeting? |

A: | If any other matters are properly presented for consideration at the Annual Meeting, the persons named as proxy holders, Robert Cagnazzi, our Chief Executive Officer, and Neil Johnston, our Executive Vice President and Chief Financial Officer, or either of them, will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting. |

Q: | Who is entitled to vote? |

A: | Stockholders of record at the close of business on September 12, 2018 (the “record date”) may vote at the Annual Meeting. As of the close of business on the record date, there were 93,040,811 shares of our common stock outstanding. Each share of common stock is entitled to one vote on all matters being considered at the Annual Meeting. There is no cumulative voting. |

Q: | What constitutes a quorum? |

A: | The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the shares of our common stock outstanding and entitled to vote at the Annual Meeting shall constitute a quorum. Both abstentions and broker non-votes (discussed below under “How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?”) are counted for the purpose of determining the presence of a quorum. |

Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

A: | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered the “stockholder of record” with respect to those shares. Stockholders of record received printed proxy materials directly from us. |

5

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name. Your broker, bank or nominee, who is considered the stockholder of record with respect to those shares, forwarded the proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by completing the voting instruction form. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Q: | How do I vote? |

A: | You may vote using any of the following methods: |

By Mail - Stockholders of record may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. If you return your signed proxy but do not indicate your voting preferences, your shares will be voted on your behalf as follows:

• | “FOR” the election of the three nominated Class II directors specified in this proxy statement for a three-year term expiring at our Annual Meeting in 2021 (Proposal 1); and |

• | “FOR” the ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019 (Proposal 2). |

Presidio stockholders who hold shares beneficially in street name may provide voting instructions by mail by completing, signing and dating the voting instruction forms provided by their brokers, banks or other nominees and mailing them in the accompanying pre-addressed envelopes.

By Internet - Stockholders of record of our common stock with internet access may submit proxies by following the internet voting instructions on their proxy cards. Most Presidio stockholders who hold shares beneficially in street name may provide voting instructions by accessing the website specified on the voting instruction forms provided by their brokers, banks or nominees. Please check the voting instruction form for internet voting availability. If you vote electronically on the internet and do not vote on all matters, your shares will be voted on your behalf as shown above.

By Telephone - Stockholders of record of our common stock who live in the United States or Canada may submit proxies by following the telephone voting instructions on their proxy cards. Most Presidio stockholders who hold shares beneficially in street name and live in the United States or Canada may provide voting instructions by telephone by calling the number specified on the voting instruction forms provided by their brokers, banks or nominees. Please check the voting instruction form for telephone voting availability. If you vote by telephone and do not vote on all matters, your shares will be voted on your behalf as shown above.

In Person at the Annual Meeting - Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, bank or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions by mail, telephone, or the internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

Q: | Can I change my vote or revoke my proxy? |

A: | If you are a stockholder of record, you may revoke your proxy at any time prior to the vote at the Annual Meeting. If you submitted your proxy by mail, you must file with the Secretary of the Company a written notice of revocation or deliver, prior to the vote at the Annual Meeting, a valid, later-dated proxy. If you submitted your proxy by telephone or the internet, you may revoke your proxy with a later telephone or internet proxy, as the case may be. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless you give written notice of revocation to the Secretary before the proxy is exercised or you vote by written ballot at the Annual Meeting. If you are a beneficial owner, you may change your vote by submitting new voting instructions to your broker, bank or nominee, or, if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares, by attending the meeting and voting in person. |

6

Q: | What vote is required to approve each item? How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions? |

Item | Vote Required | Broker Discretionary Voting Allowed |

Proposal 1 - The election of Class II directors | Plurality of Votes Cast | No |

Proposal 2 - The ratification of the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019 | Majority of the Shares Present in Person or Represented by Proxy and Entitled to Vote | Yes |

Proposal 1 will be determined based on a plurality of the votes cast. This means that the three director nominees that receive the most votes will be elected to the Board. With respect to Proposal 1, you may vote FOR all nominees, WITHHOLD your vote as to all nominees, or FOR all nominees except those specific nominees from whom you WITHHOLD your vote. The nominees receiving the most FOR votes will be elected. A properly executed proxy marked WITHHOLD with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than three directors and stockholders may not cumulate votes in the election of directors. If you ABSTAIN from voting on Proposal 1, the abstention will have NO EFFECT on the outcome of the vote.

With respect to Proposal 2, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposal 2, the abstention will have the same effect as an AGAINST vote.

If you hold your shares beneficially in street name and do not provide your broker with voting instructions, the brokerage firm has the discretion to vote the shares on your behalf if the proposal is considered a “routine” matter. When a proposal is not a “routine” matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.”

Proposal 1 is not considered a “routine” matter, but the ratification of the appointment of RSM US LLP as our independent registered public accounting firm (Proposal 2) is considered a “routine” matter. In tabulating the voting results for any non-routine proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, while broker non-votes would be counted for the purpose of determining a quorum, they will not affect the outcome of any non-routine matters being voted on at the Annual Meeting.

Q: | What percentage of stock does our largest stockholder own and how does our largest stockholder intend to vote? |

A: | Through our stockholder AP VIII Aegis Holdings, L.P. (“Aegis LP”), investment funds (the “Apollo Funds”) affiliated with or managed by Apollo Global Management, LLC (together with its subsidiaries, “Apollo”) own approximately 62% of our outstanding common stock as of the record date. As a result, Apollo controls a majority of the voting power of our outstanding common stock, and we are a “controlled company” within the meaning of the corporate governance standards of the Nasdaq Global Select Market (the “NASDAQ”). Aegis LP has indicated that it will vote its shares in favor of the director nominees named in our proxy statement, and in favor of Proposal 2. If Aegis LP votes as it has indicated, its vote is sufficient to satisfy the quorum and voting requirements necessary to elect the director nominees and to approve Proposal 2. |

Q: | How are proxies solicited? |

A: | The costs and expenses of soliciting proxies from stockholders will be paid by the Company. Employees, officers and directors of the Company, without additional compensation, may solicit proxies. We do not plan to retain the services of a proxy solicitation firm to assist us in this solicitation. In addition, we will, upon request, reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the beneficial owners of our common stock. |

7

Q: | What is the effect of giving a proxy? |

A: | Proxies are solicited by and on behalf of the Board. Robert Cagnazzi, our Chief Executive Officer, and Neil Johnston, our Executive Vice President and Chief Financial Officer, have been designated as proxy holders by the Board. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting pursuant to our amended and restated bylaws, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above. |

Q: | I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

A: | We have adopted a procedure called “householding,” which the Securities and Exchange Commission (“SEC”) has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing and mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at: Presidio, Inc., One Penn Plaza, Suite 2832, New York, New York 10119, Attention: Corporate Secretary. |

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

Q: | What is the deadline for stockholder proposals for the 2019 annual meeting? |

A: | For your proposal to be considered for inclusion in our proxy statement for the annual meeting of stockholders to be held in 2019, we must receive your written proposal no later than June 4, 2019. In addition, be aware that your proposal must comply with SEC regulations regarding inclusion of stockholder proposals in company-sponsored proxy materials and other applicable laws. Although our Board will consider all proposals, it has the right to omit any proposals it is not required to include. For you to raise a proposal (including director nominations) at next year’s annual meeting that will not be included in our proxy statement, we must receive written notice of the proposal between July 10, 2019 and August 11, 2019 (assuming the meeting is held not more than 30 days before or more than 30 days after November 7, 2019). All notices of proposals by stockholders, whether or not intended to be included in the Company’s proxy materials, should be sent to Presidio, Inc., One Penn Plaza, Suite 2832, New York, New York 10119, Attention: Corporate Secretary. In addition, any proposal must satisfy all of the other requirements set forth in our bylaws and all applicable laws. A copy of our amended and restated bylaws is available on our website at http://www.investors.presidio.com. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. |

8

PROPOSAL I - ELECTION OF DIRECTORS

Our Board currently consists of nine members: Robert Cagnazzi (Chairman of the Board), Heather Berger, Christopher L. Edson, Salim Hirji, Steven Lerner, Matthew H. Nord, Pankaj Patel, Michael A. Reiss and Todd H. Siegel.

In accordance with our certificate of incorporation, our Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the directors of the same class whose terms are then expiring. Our Board is currently divided among the three classes as follows:

• | Mr. Siegel, Ms. Berger and Mr. Reiss are current Class I directors whose terms will expire at the annual meeting of stockholders to be held in 2020; |

• | Messrs. Edson, Hirji and Lerner are the Class II directors whose terms will expire at the Annual Meeting. Each of them has been nominated for election at the Annual Meeting for a three-year term expiring at the annual meeting of stockholders to be held in 2021; and |

• | Messrs. Cagnazzi, Nord and Patel are the Class III directors whose terms expire at the annual meeting of stockholders to be held in 2019. |

Pursuant to our certificate of incorporation, only our Board is able to fill any vacancies on our Board until the next succeeding annual meeting of stockholders. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. Each director's term continues until the election and qualification of such director's successor, or such director's earlier death, resignation or removal. Directors may be removed only for cause and then by the affirmative vote of a majority of the voting power entitled to vote for the election of directors.

It is proposed to elect three Class II directors to serve for a three-year term expiring at our annual meeting of stockholders in 2021. Upon recommendation of our Nominating and Corporate Governance Committee, the Board has nominated Messrs. Edson, Hirji and Lerner for re-election as Class II directors. Biographical information about each of the nominees and each director whose term will continue after the Annual Meeting is contained in the sections below. At the meeting, the persons named in the enclosed form of proxy will vote the shares covered thereby for the election of the nominees named below to our Board unless instructed to the contrary. Each of Messrs. Edson, Hirji and Lerner is currently a Class II director of our company.

9

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING

AT THE 2021 ANNUAL MEETING

Name of Class II Director Nominee | Age | Principal Occupation and Business Experience | ||

Christopher L. Edson | 35 | Mr. Edson joined the board of directors of the predecessor to Presidio upon its formation on November 20, 2014, and continued as a member of the Board following the acquisition of Presidio by investment funds affiliated with Apollo on February 2, 2015. He is currently a partner at Apollo, which he joined in 2008. Prior to that time, Mr. Edson was a member of the Financial Institutions Investment Banking Group of Goldman Sachs in both New York and Chicago. Mr. Edson serves on several boards of directors, including MidCap FinCo Holdings Limited, Dakota Holdings, Inc., Regional Care Hospital Partners Holdings, Inc. and Constellation Club Holdings, Inc. During the past five years, Mr. Edson has also served as a director of Athene Group Ltd., SourceHOV Holdings, Inc. and Novitex Holdings, Inc. Mr. Edson graduated with a B.S. in Finance from Indiana University. Between his work at Apollo and his prior experience in investment banking, Mr. Edson has approximately 13 years of experience analyzing, financing and investing in public and private companies. Mr. Edson’s extensive experience in business and finance qualifies him to serve on our Board. | ||

Salim Hirji | 29 | Mr. Hirji joined the Board on February 10, 2017. He is currently a principal at Apollo, having joined Apollo in 2013. Prior to that time, Mr. Hirji was a member of the Financial Institutions Investment Banking Group of Goldman, Sachs & Co. Mr. Hirji graduated summa cum laude with a B.A. in Economics and Political Science from Columbia University. In addition to serving on the Board, Mr. Hirji serves on the board of Mood Media Corporation. Between his work at Apollo and his prior experience in investment banking, Mr. Hirji has approximately seven years of experience analyzing, financing and investing in public and private companies. Mr. Hirji's extensive experience in business and finance qualifies him to serve on our Board. | ||

Steven Lerner | 63 | Dr. Lerner served as a director of Yadkin Bank and Yadkin Financial Corporation from July 2014 until its sale to F.N.B. Corporation in March 2017. He joined Yadkin following the merger of VantageSouth Bancshares, Inc. and Piedmont Community Bank Holdings, Inc. with Yadkin Financial Corporation. Prior to this merger, Dr. Lerner served as a director of VantageSouth Bancshares, Inc. since November 2011, and as Vice Chairman of Piedmont Community Bank Holdings, Inc. since he co-founded the company in 2009. He has served as the Chairman of FGI Research, a provider of online market research services, since he founded the company in 1981. From 2000 to 2012, Dr. Lerner served as Chairman of Capstrat, Inc., a strategic marketing communication firm, and he was Chairman of Yankelovich, Inc., a consumer research firm, from 2000-2008. Dr. Lerner has spent the last 30 years helping small and medium sized businesses maximize their potential. He has been involved in the formation of a number of companies including Blue Hill Group, and Sterling Cellular prior to its sale in 1993. Dr. Lerner serves on the board of advisors of Bandwidth.com, a provider of next generation communications services. Dr. Lerner served as a member of the University of North Carolina at Chapel Hill board of trustees and as Chairman of its Finance Committee until July 2015. Dr. Lerner’s extensive business experience, as well as his extensive experience in the information technology sector, qualifies him to serve on our Board. Dr. Lerner served on our board of directors prior to our acquisition by the Apollo Funds in February 2015, and joined our Board on February 10, 2017. Mr. Lerner's extensive experience in business qualifies him to serve on our Board. | ||

The Board recommends a vote FOR the election of the nominees herein.

10

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2019 ANNUAL MEETING

Name of Class III Director | Age | Principal Occupation and Business Experience | ||

Robert Cagnazzi | 59 | Mr. Cagnazzi has served as the Chief Executive Officer of the Company since February 29, 2012 and Chairman of the Board since November 2017. Previously, he founded Bluewater Communications LLC in 2006 and served as its Chief Executive Officer until the company was acquired by Presidio in 2012. Prior to that, he served as Chief Executive Officer of North America at Dimension Data Holdings PLC from 2001 to 2006. | ||

Matthew H. Nord | 39 | Mr. Nord joined the board of directors of the predecessor to Presidio upon its formation on November 20, 2014, and continued as a member of the Board following the acquisition of Presidio by the Apollo Funds on February 2, 2015. He is currently a Senior Partner at Apollo, having joined in 2003. Prior to that time, Mr. Nord was a member of the Investment Banking division of Salomon Smith Barney Inc. Mr. Nord serves on the boards of directors of West Corporation, ADT, Exela Technologies and RegionalCare Hospital Partners. Mr. Nord also serves on the Board of Trustees of Montefiore Health System and on the Board of Overseers of the University of Pennsylvania’s School of Design. Mr. Nord previously served on the boards of directors of Affinion Group, Constellium NV, EVERTEC, Hughes Telematics, MidCap Financial, Mobile Satellite Ventures, Noranda Aluminum, Novitex and SourceHOV. Mr. Nord graduated summa cum laude with a BS in Economics from the University of Pennsylvania’s Wharton School of Business. Between his work at Apollo and his prior experience in investment banking, Mr. Nord has extensive experience analyzing, financing and investing in public and private companies, which qualifies him to serve on our Board. | ||

Pankaj Patel | 64 | Mr. Patel joined the Board on May 19, 2016. He served as Executive Vice President and Chief Development Officer at Cisco Systems, Inc., a worldwide leader in IT, from June 2012 to July 2016, creating solutions built on intelligent networks that were designed to solve customers’ challenges. Mr. Patel served as executive advisor to the CEO from July 31, 2016 until his retirement on October 28, 2016. Mr. Patel reported to the CEO as the Engineering head of the company’s product and solution portfolio and drove the business and technology strategy across Cisco’s Routing, Switching, Wireless, Security, Mobility, Video, Collaboration, Data Center and Cloud offerings, where his responsibilities included defining priorities and investment allocation of research and development funds. Prior to Cisco, Mr. Patel launched and ran a successful startup business. Mr. Patel’s extensive business experience, as well as his extensive experience in the North American IT market, qualify him to serve on our Board. | ||

11

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2020 ANNUAL MEETING

Name of Class I Director | Age | Principal Occupation and Business Experience | ||

Heather Berger | 41 | Ms. Berger joined the Board on November 8, 2017. She is currently a partner of Apollo where she oversees marketing, client relations and business development for the firm’s Private Equity business. Ms. Berger has 18 years of marketing experience in the alternative asset industry. Prior to joining Apollo in 2008, Ms. Berger was a member of the Private Fund Group at Credit Suisse Securities (USA), where she was responsible for raising institutional capital for private equity funds. Previously, Ms. Berger was with Capital Z Financial Service Partners, and its affiliate, where she focused on fundraising and investor relationship management. Ms. Berger graduated cum laude from Duke University in 1999 with a BA in Comparative Area Studies and French. She serves on the Alumni Board of Directors of The Spence School in New York. Ms. Berger's extensive marketing experience qualifies her to serve on our Board. | ||

Michael A. Reiss | 34 | Mr. Reiss joined the Board on November 8, 2017. He is currently a partner of Apollo, where he has been employed since 2008. Prior to that time, Mr. Reiss was employed by Deutsche Bank Securities as a Global Finance Analyst in the Financial Sponsors Group. Mr. Reiss previously served on the board of directors of Captain Bidco SAS, the parent of Ascometal SAS. Mr. Reiss has significant experience making and managing private equity investments on behalf of Apollo and has over ten years of experience financing, analyzing and investing in public and private companies, which qualifies him to serve on our Board. He previously served as a director of Affinion Group Holdings, Inc. (“Affinion”) and Affinion Group, Inc. | ||

Todd H. Siegel | 48 | Mr. Siegel joined the Board on February 2, 2015. He was appointed Chief Executive Officer of Affinion and a director of Affinion as of September 20, 2012. Mr. Siegel was formerly Chief Financial Officer of Affinion from November 2008 to September 2012 and served as an Executive Vice President from October 17, 2005. Mr. Siegel also served as General Counsel of Affinion from October 17, 2005 to February 16, 2009. Before that, he served as General Counsel of Trilegiant starting in July 2003 and Cendant Marketing Group starting in January 2004. Mr. Siegel joined Affinion in November 1999 as a member of the Legal Department of the Membership Division of Cendant. From 1997 to 1999, Mr. Siegel was a corporate associate at Skadden, Arps, Slate, Meagher and Flom, LLP. From 1992 until 1994, he was employed as a certified public accountant with Ernst & Young. Mr. Siegel serves on the Board of Directors of Dakota Holdings, Inc. Mr. Siegel’s extensive experience in business and finance qualifies him to serve on our Board. | ||

Director Independence

We are a “controlled company” under the NASDAQ rules, which eliminates the requirements that we have a majority of independent directors on our Board and that we have Compensation and Nominating and Corporate Governance Committees composed entirely of independent directors. We have, as required by NASDAQ rules, an Audit Committee composed entirely of independent directors.

Our Board has determined that each of Pankaj Patel, Steven Lerner and Todd H. Siegel is “independent” under the rules of the NASDAQ. Our Board has also determined that each of Steven Lerner, Pankaj Patel and Todd H. Siegel satisfies the independence standards for the Audit Committee established by the SEC and the rules of the NASDAQ.

If at any time we cease to be a “controlled company” under NASDAQ rules, the Board will take all action necessary to comply with the NASDAQ rules, including appointing a majority of independent directors to the Board and establishing certain committees composed entirely of independent directors, subject to a permitted “phase-in” period.

Our stockholders agreement with Aegis LP, the Apollo entity that is the beneficial owner of most of our common stock, provides that, except as otherwise required by applicable law, if Aegis LP or the Apollo Funds holds (a) at least 50% of our outstanding common stock, it will have the right to designate up to five nominees to our Board, (b) at least 30% but less than 50%

12

of our outstanding common stock, it will have the right to designate up to four nominees to our Board, (c) at least 20% but less than 30% of our outstanding common stock, it will have the right to designate up to three nominees to our Board and (d) at least 10% but less than 20% of our outstanding common stock, it will have the right to designate two nominees to our Board. The stockholders agreement also provides that, if the size of our Board is increased or decreased at any time, the nomination rights of Aegis LP (and the Apollo Funds) will be proportionately increased or decreased, respectively, and rounded up to the nearest whole number.

Each director is expected to attend and participate in, either in person or by means of telephonic conference, all scheduled Board meetings and meetings of committees on which such director is a member. Pursuant to our Corporate Governance Guidelines, members of the Board are strongly encouraged to attend the annual meeting each year.

The non-management members of the Board also meet in executive session without management present on a regular basis.

Communicating with our Board

Individuals may communicate directly with members of our Board or members of the Board’s committees by writing to the following address:

Presidio, Inc.

One Penn Plaza, Suite 2832

New York, New York 10119

Attention: Corporate Secretary

The Corporate Secretary will summarize all correspondence received and periodically forward summaries to the Board or appropriate committee. Members of the Board may at any time request copies of any such correspondence. Communications may be addressed to the attention of the Board, a standing committee of the Board, or any individual member of the Board or a committee. Communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requires investigation to verify its content may not be forwarded.

Director Compensation

Each of our non-employee directors (other than Heather Berger, Matthew Nord, Christopher Edson, Salim Hirji and Michael Reiss) receives (i) an annual retainer of $50,000, (ii) $2,000 for each meeting of the Board attended in person and (iii) $1,000 for each meeting of the Board attended telephonically. In addition, directors serving on the Audit Committee receive an additional annual retainer of $12,500, and the Chairman of the Audit Committee also receives, in addition to the $12,500 retainer, an annual retainer of $25,000. Members of the Audit Committee and the Innovation and Technology Committee receive $2,000 for each committee meeting attended in person, and $1,000 for each committee meeting attended telephonically.

The following table sets forth certain information regarding the compensation for each non-employee director of the Company during the fiscal year ended June 30, 2018.

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1)(2) | Total ($) | ||||||

Heather Berger | — | — | — | ||||||

Christopher Edson | — | — | — | ||||||

Salim Hirji | — | — | — | ||||||

Steven Lerner | 79,500 | — | 79,500 | ||||||

Matthew Nord | — | — | — | ||||||

Pankaj Patel | 60,979 | — | 60,979 | ||||||

Michael Reiss | — | — | — | ||||||

Todd Siegel | 101,500 | — | 101,500 | ||||||

Joseph Trost (3) | 19,708 | — | 19,708 | ||||||

Giovanni Visentin (3) | 37,417 | — | 37,417 | ||||||

__________________

13

(1) | Represents the aggregate grant date fair values of options granted during fiscal 2018, computed in accordance with FASB ASC Topic 718. |

(2) | As of June 30, 2018, Mr. Lerner held options to purchase 15,000 shares having an exercise price of $14.00 per share, Mr. Patel held options to purchase 15,000 shares having an exercise price of $8.75 per share, and Mr. Siegel held options to purchase 15,000 shares having an exercise price of $5.00 per share; which options in each case vest in three equal installments on each of the first three anniversaries of the grant date, subject to continued service. |

(3) | These are former non-employee directors whose term expired at the annual meeting of stockholders held on November 8, 2017. |

Board and Committees

Our Board currently has an Audit Committee, an Innovation and Technology Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and an Executive Committee. Each committee operates under a separate charter adopted by our Board. Charters are available on our website at investors.presidio.com under “Corporate Governance.” Members serve on these committees until their resignations or until otherwise determined by our Board.

During the fiscal year ended June 30, 2018, the Board held five meetings and took action seven times by unanimous written consent. There were seven meetings of the Audit Committee. The Compensation Committee took action two times by unanimous written consent, the Nominating and Corporate Governance Committee took action one time by unanimous written consent, and there were no meetings of the Innovation and Technology Committee or the Executive Committee. All of the directors attended at least 75% of the aggregate number of Board meetings and committee meetings during the periods in which they served.

Audit Committee. Our Audit Committee consists of Todd H. Siegel, Steven Lerner and Pankaj Patel. Our Board has determined that each of Steven Lerner, Pankaj Patel and Todd H. Siegel satisfies the requirements for independence and financial literacy under the rules and regulations of the NASDAQ and the SEC. Our Board has also determined that Todd H. Siegel qualifies as an Audit Committee financial expert as defined under SEC rules and regulations and satisfies the financial sophistication requirements of the NASDAQ.

The principal duties and responsibilities of our Audit Committee are to oversee and monitor the following:

• | the annual appointment of auditors, including the independence, qualifications and performance of our auditors and the scope of audit and non-audit assignments and related fees; |

• | the accounting principles we use in financial reporting; |

• | our financial reporting process and internal auditing and control procedures; |

• | our risk management policies; |

• | the integrity of our financial statements; and |

• | our compliance with legal, ethical and regulatory matters. |

Compensation Committee. Our Compensation Committee consists of Robert Cagnazzi, Matthew H. Nord and Christopher L. Edson. The principal duties and responsibilities of our Compensation Committee are the following:

• | approval and recommendation to our Board of all compensation plans for our CEO, all of our employees and those of our subsidiaries who report directly to the CEO and other executive officers, as well as all compensation for our Board; |

• | approval and authorization of grants under our or our subsidiaries’ incentive plans, including all equity plans and long-term incentive plans; and |

• | the preparation of any report on executive compensation required by SEC rules and regulations, if any. |

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of Robert Cagnazzi, Christopher L. Edson and Matthew H. Nord. The principal duties and responsibilities of our Nominating and Corporate Governance Committee are the following:

14

• | implementation and review of criteria for membership on our Board and its committees; |

• | recommendation of proposed nominees for election to our Board and membership on its committees; and |

• | recommendations to our Board regarding governance and related matters. |

Innovation and Technology Committee. Our Innovation and Technology Committee consists of Steven Lerner and Pankaj Patel. The principal duties and responsibilities of our Innovation and Technology Committee are to review and make recommendations to the Board on major strategies and other subjects relating to:

• | the Company’s approach to technical and commercial innovation; |

• | the long-term strategic goals of the Company’s internal and commercial technology investments; |

• | the Company’s technology position in a competitive environment; |

• | the innovation and technology acquisition process to assure accelerated business growth and response to emerging technology threats and opportunities through contracts, grants, collaborative efforts, strategic alliances, mergers and acquisitions; |

• | the management and leverage of intellectual property; |

• | the formal projects and actions being taken to drive and enable technology innovation; and |

• | measurement and tracking systems important to successful innovation. |

Executive Committee. Our Executive Committee consists of Matthew H. Nord, Christopher L. Edson and Robert Cagnazzi. The Executive Committee generally may exercise all of the powers of the Board when the Board is not in session, other than (1) approving any action that, pursuant to applicable law, would require the submission to stockholders of such action for stockholder approval, (2) the declaration of dividends, (3) the creation or filling of vacancies on the Board, (4) the adoption, amendment or repeal of our bylaws, (5) the amendment or repeal of any resolution of the Board that by its terms limits amendment or repeal exclusively to the Board, (6) any action where our certificate of incorporation, our bylaws, the listing standards of the NASDAQ or applicable law require participation by the full Board or another committee of the Board, (7) the issuance of debt or equity securities in excess of $75 million and (8) the filing by the Company of a voluntary petition seeking to take advantage of any bankruptcy, reorganization, insolvency, readjustment of debt, dissolution or liquidation law or statute.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended June 30, 2018, our Compensation Committee consisted of Matthew Nord, Christopher L. Edson and Robert Cagnazzi. Mr. Cagnazzi serves as our Chairman of the Board and Chief Executive Officer. Other than Mr. Cagnazzi, none of the other members of our Compensation Committee serves or has served as one of our officers or employees. During the fiscal year ended June 30, 2018, none of our executive officers served as a member of the Board or Compensation Committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board or our Compensation Committee.

Code of Ethics

We have a Code of Business Conduct and Ethics that applies to all employees, including our Chief Executive Officer and senior financial officers. These standards are designed to deter wrongdoing and to promote the highest ethical, moral and legal conduct of all employees. Our Code of Business Conduct and Ethics is posted on the investor relations section of our website at investors.presidio.com under “Corporate Governance” - “Code of Business Conduct and Ethics” and can be obtained, free of charge, at our Corporate Headquarters in our Human Resources Department. The reference to our website address in this proxy statement does not include or incorporate by reference the information on our website into this proxy statement. We intend to disclose future amendments to certain provisions of our Code of Business Conduct and Ethics, or waivers of these provisions with respect to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller or persons performing similar functions, on our website or in our public filings with the SEC.

15

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines that address the role and composition of, and policies applicable to, the Board. The Nominating and Corporate Governance Committee will periodically review the guidelines and report any recommendations to the Board. The Corporate Governance Guidelines are available on the Company’s website at investors.presidio.com under “Corporate Governance” - “Corporate Governance Guidelines.”

Board Role in Risk Oversight

Risk assessment and oversight are integral parts of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. From time to time, senior management reviews these risks with our Board at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies and presents the steps taken by management to address such risks. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight.

Board Leadership Structure

The positions of Chairman of the Board and Chief Executive Officer currently are held by one individual. Our Board appointed Mr. Cagnazzi to serve as Chairman of the Board as of November 8, 2017, based on the leadership qualities, management capability, knowledge of the business and industry, and a long-term, strategic perspective he has demonstrated as CEO over a period of over six years of running the Company.

Based on extensive review and consideration by our Nominating and Corporate Governance Committee and Board, our Board believes a Board leadership structure composed of an executive Chairman and CEO is in the best interests of the Company and its stockholders at this time. In line with its commitment to best practices, the Company will continue to review and assess Chairman succession planning, including the best leadership structure for the Board to account for the Company’s evolving needs and business environment circumstances.

Policy for Director Recommendations

Our Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates to the Board for election as a director of the Company. The Committee may use outside consultants to assist in identifying candidates, and will also consider advice and recommendations from stockholders, management, and others as it deems appropriate.

A stockholder that wants to recommend a candidate for election to the Board should send the recommendation in accordance with the procedures described in our bylaws. See “Stockholder Proposals and Director Nominations.” In its evaluation of director candidates, the Nominating and Corporate Governance Committee will consider the following:

• | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

• | Nominees should have demonstrated business acumen, experience, and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company. |

• | Nominees should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees. |

• | Nominees should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders. |

• | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director. |

16

• | Nominees will not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on the Board should be considered. |

The renomination of existing directors is not viewed as automatic, but will be based on continuing qualification under the criteria set forth above. In addition, the committee will consider the existing directors’ performance on the Board and any committee, which may include consideration of the extent to which the directors undertook continuing director education. The backgrounds and qualifications of the directors considered as a group should provide a significant breadth of experience, knowledge and abilities that will assist the Board in fulfilling its responsibilities.

The Nominating and Corporate Governance Committee will also consider: (i) any specific minimum qualifications that it believes must be met by a nominee for a position on the Board; (ii) any specific qualities or skills that it believes are necessary for one or more of the Board members to possess; and (iii) the desired qualifications, expertise and characteristics of Board members, with the goal of developing an experienced and highly qualified Board. In making its recommendations, the committee will consider the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of the September 12, 2018 record date, regarding the beneficial ownership of our common stock with respect to:

• | each person that is a beneficial owner of more than 5% of our outstanding common stock; |

• | each director; |

• | each executive officer named in the summary compensation table; and |

• | all directors and executive officers as a group. |

The amounts and percentages of common stock beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, sole voting and investment power with respect to the indicated shares of common stock. In addition, except as otherwise indicated in these footnotes, the address of each of the directors and executive officers of the Company is c/o One Penn Plaza, Suite 2832, New York, New York 10119. The below beneficial ownership information include shares of common stock issuable upon the exercise of options within 60 days of September 12, 2018.

Name of Beneficial Owner | Number of Shares | Percent of Shares | ||||

Beneficial owners of more than 5% of our outstanding common stock: | ||||||

AP VIII Aegis Holdings, L.P. (1) | 57,800,000 | 62.1 | % | |||

FMR LLC (2) | 10,442,654 | 11.2 | % | |||

ArrowMark Colorado Holdings LLC (3) | 4,682,023 | 5.0 | % | |||

Directors and named executive officers: | ||||||

Heather Berger | — | — | ||||

Elliot Brecher (4) | 29,925 | * | ||||

Robert Cagnazzi (5) | 1,433,312 | 1.5 | % | |||

Christopher L. Edson | — | — | ||||

Paul Fletcher (6) | — | — | ||||

David Hart (7) | 355,854 | * | ||||

Salim Hirji | — | — | ||||

Neil O. Johnston (8) | — | — | ||||

Steven Lerner (9) | 15,000 | * | ||||

Matthew H. Nord | — | — | ||||

Pankaj Patel (10) | 20,000 | * | ||||

Michael A. Reiss | — | — | ||||

Todd H. Siegel (11) | 15,000 | * | ||||

Vinu Thomas (12) | 45,465 | * | ||||

All directors and executive officers as a group (13 persons) | 1,914,556 | 2.0 | % | |||

__________________

* Less than 1% of common stock outstanding.

(1) | Aegis LP holds shares of our common stock as indicated in the above table. AP VIII Aegis Holdings GP, LLC ("Aegis GP") is the general partner of Aegis LP, and Apollo Investment Fund VIII, L.P. ("Apollo Fund VIII") is one of the members of Aegis GP and as |

18

such has the right to direct the manager of Aegis GP in its management of Aegis GP. Apollo Management VIII, L.P. ("Management VIII") serves as the non-member manager of Aegis GP and as the investment manager of Apollo Fund VIII. AIF VIII Management LLC ("AIF VIII LLC") serves as the general partner of Management VIII. Apollo Management, L.P. ("Apollo Management") is the sole member and manager of AIF VIII LLC, and Apollo Management GP, LLC ("Apollo Management GP") is the general partner of Apollo Management. Apollo Management Holdings, L.P. ("Management Holdings") is the sole member and manager of Apollo Management GP and Apollo Management Holdings GP, LLC ("Management Holdings GP") is the general partner of Management Holdings. Leon Black, Joshua Harris and Marc Rowan are the managers, as well as executive officers, of Management Holdings GP. The address of each of the entities and individuals named in this paragraph is 9 West 57th Street, New York, New York 10019. Each of Aegis GP, Apollo VIII, Management VIII, AIF VIII LLC, Apollo Management, Apollo Management GP, Management Holdings, and Management Holdings GP, and Messrs. Leon Black, Joshua Harris and Marc Rowan, the managers, as well as executive officers, of Management Holdings GP, disclaims beneficial ownership of all shares of Common Stock included herein, and the foregoing shall not be construed as an admission that any such person or entity is the beneficial owner of any such securities for purposes of Section 13(d) or 13(g) of the Securities Exchange Act of 1934, as amended, or for any other purpose.

(2) | Ownership consists of shares of common stock beneficially owned by FMR LLC (“FMR”), certain of its subsidiaries and affiliates, and other companies as disclosed on its joint Schedule 13G/A filed with the SEC on February 13, 2018. The address of FMR is 245 Summer Street, Boston, MA 02210. |

(3) | Ownership consists of shares of common stock beneficially owned by ArrowMark Colorado Holdings LLC (“ArrowMark”), as disclosed on its Schedule 13G filed with the SEC on February 9, 2018. The address of ArrowMark is 100 Fillmore Street, Suite 325, Denver, CO 80206. |

(4) | Consists of 500 shares of common stock held by Mr. Brecher and options to purchase an aggregate of 29,425 shares of common stock (representing the portion of 184,746 options that have vested or will vest within 60 days of September 12, 2018). |

(5) | Consists of 535,484 shares of common stock held by The Project Brizo Limited Partnership and options to purchase an aggregate of 897,828 shares of common stock (representing the portion of 1,723,528 options that have vested or will vest within 60 days of September 12, 2018). Robert Cagnazzi is the President of KBLAG LTD., which is the general partner of The Project Brizo Limited Partnership. |

(6) | Mr. Fletcher is no longer an executive officer of the Company but is included in this table due to his status as a named executive officer for the purposes of the Summary Compensation Table. |

(7) | Consists of 226,154 shares of common stock held by Mr. Hart and options to purchase an aggregate of 129,700 shares of common stock (representing the portion of 604,000 options that have vested or will vest within 60 days of September 12, 2018). |

(8) | None of the 225,600 options have vested or will vest within 60 days of September 12, 2018. |

(9) | Consists of 10,000 shares of common stock held by Mr. Lerner and options to purchase an aggregate of 5,000 shares of common stock (representing the portion of 15,000 options that have vested or will vest within 60 days of September 12, 2018). |

(10) | Consists of 10,000 shares of common stock held by Mr. Patel and options to purchase an aggregate of 10,000 shares of common stock (representing the portion of 15,000 options that have vested or will vest within 60 days of September 12, 2018). |

(11) | Represents the portion of 15,000 options that have vested or will vest within 60 days of September 12, 2018. |

(12) | Represents the portion of 314,644 options that have vested or will vest within 60 days of September 12, 2018. |

19

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table provides information as of June 30, 2018 about our common stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans. All of the indicated securities are authorized under the Presidio, Inc. 2017 Long-Term Incentive Plan, the Presidio, Inc. Amended and Restated 2015 Long-Term Incentive Plan or the Presidio, Inc. Employee Stock Purchase Plan.

Plan category | Number of Securities to Be Issued Upon Exercise of Outstanding Options, Warrants and Rights (1) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (2) | |||||||

Equity compensation plans approved by security holders | 8,551,232 | $ | 7.19 | 6,226,925 | ||||||

Equity compensation plans not approved by security holders | — | — | — | |||||||

Total | 8,551,232 | $ | 7.19 | 6,226,925 | ||||||

(1) Includes 150,000 issued and outstanding restricted stock units ("RSUs") under the Presidio, Inc. 2017 Long-Term Incentive Plan as of June 30, 2018.

(2) Includes 1,274,564 shares available for issuance under the Presidio, Inc. Employee Stock Purchase Plan (which we refer to as our “ESPP”) as of June 30, 2018. On July 3, 2018, contributions held from employees were used to purchase 46,118 shares under the ESPP.

20

MANAGEMENT

The following table provides information regarding our executive officers:

Name | Age | Title | ||

Robert Cagnazzi | 59 | Chairman of the Board and Chief Executive Officer | ||

Neil O. Johnston | 52 | Executive Vice President, Chief Financial Officer and Assistant Secretary | ||

David Hart | 50 | Executive Vice President and Chief Operating Officer | ||

Elliot Brecher | 53 | Senior Vice President, General Counsel and Secretary | ||

Vinu Thomas | 42 | Chief Technology Officer | ||

Robert Cagnazzi has served as our Chief Executive Officer since February 29, 2012 and as our Chairman of the Board since November 2017. Biographical information concerning Mr. Cagnazzi is set forth above under “Election of Directors.”

Neil O. Johnston has served as our Executive Vice President and Chief Financial Officer since January 16, 2018. Mr. Johnston served as Executive Vice President and Chief Financial Officer of Cox Automotive from June 2015 until December 2017. Before working for Cox Automotive, Mr. Johnston served as Executive Vice President of Strategy and Digital Innovation at Cox Media Group (CMG). Prior to holding that position, he served as Chief Financial Officer of CMG from 2009 to 2012. Mr. Johnston was the CFO of Cox Radio from 2000 until 2009, and he began his career with Cox Enterprises in 1996, serving in various financial and business development roles. Prior to joining Cox, Mr. Johnston worked for Coca-Cola Enterprises, Inc. and Deloitte and Touche, LLP.

David Hart has served as our Chief Operating Officer since June 2013 and, until 2015, also served as our Chief Technology Officer. He joined the Company in 2005 when the Company acquired Networked Information Systems (“NIS”), where he led sales engineering, professional and managed services delivery and project management services from NIS’s founding in 1999. Prior to NIS, Mr. Hart was Vice President of Engineering at Aztec Technology Partners and at its predecessor, Bay State Computer Group.

Elliot Brecher has served as our Senior Vice President and General Counsel since July 2015. Prior to joining us, from 2013 he was General Counsel of Amber Road, Inc., a New York Stock Exchange listed provider of cloud-based global trade management solutions delivered using a SaaS model. He served as Senior Vice President and General Counsel of Insight Communications Company, Inc., a Midwest-based cable operator, from 2000 until its sale to Time Warner Cable, Inc. in 2012. From 1994 until joining Insight, he was associated with the law firm Cooperman Levitt Winikoff Lester & Newman, P.C., where he became a partner in 1996. Prior to that, he was associated with the law firm Rosenman & Colin LLP.

Vinu Thomas has served as our Chief Technology Officer since February 2016 and is responsible for guiding Presidio’s technology strategy, solution and service offerings, vendor and product management and industry thought leadership. He has built Presidio’s technology teams around networking, mobility, data center and collaboration, while also working on strategic initiatives and investments that include cloud, cyber security, data analytics and virtual desktop infrastructure (VDU). He was previously Vice President of Solutions for our Tristate Area and has a total of 20 years of experience in systems integration, practice building and engineering.

21

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides information regarding the objectives and elements of our compensation philosophy, policies, and practices with respect to the compensation of our principal executive officer, our principal financial officer, and our three other most highly compensated executive officers (collectively, our “named executive officers”), for our fiscal year ended June 30, 2018 (“fiscal 2018”).

Our named executive officers for fiscal 2018 were:

• | Robert Cagnazzi, our Chief Executive Officer; |

• | Neil O. Johnston, our Executive Vice President and Chief Financial Officer; |

• | David Hart, our Executive Vice President and Chief Operating Officer; |

• | Elliot Brecher, our Senior Vice President and General Counsel; |

• | Vinu Thomas, our Chief Technology Officer; and |

• | Paul Fletcher, our former Executive Vice President and Chief Financial Officer. |

Neil O. Johnston was appointed as our Executive Vice President and Chief Financial Officer effective January 16, 2018, replacing Paul Fletcher who retired on March 31, 2018 and served in a transitional role from January 16, 2018 through March 31, 2018.

2017 Say on Pay Vote and 2017 Say on When Vote

At the 2017 annual stockholders meeting our stockholders voted, on an advisory basis, to approve the Board's recommended resolution with respect to the compensation of our named executive officers. Although non-binding, the Compensation Committee will take into account such approval, as applicable, when considering future executive compensation arrangements.

At the 2017 annual stockholders meeting, our stockholders also voted, on an advisory basis, to approve the Board's recommendation that future advisory votes regarding our named executive officer compensation be held once every three years. We have determined to follow the stockholder vote.

Compensation Philosophy and Objectives

Commencing with the completion of our IPO in March 2017, the Compensation Committee of our Board has reviewed and approved the compensation of our named executive officers and oversees and administers our executive compensation programs and initiatives. As our business develops over time, we expect that the specific direction, emphasis, and components of our executive compensation program will continue to evolve. Accordingly, the compensation paid to our named executive officers during fiscal 2018 is not necessarily indicative of how we will compensate our named executive officers in the future.

We have worked to create an executive compensation program that balances short- and long-term payments and awards, cash payments and equity awards, and fixed and contingent payments, and that rewards our named executive officers in ways that we believe are most appropriate to motivate them. Our executive compensation program is designed to:

• | attract and retain talented and experienced executives in our industry; |

• | attract and retain executives whose knowledge, skills and performance are critical to our success; |

• | ensure fairness among the executive management team by recognizing the relative contributions each executive makes to our success; |

• | foster a shared commitment among executives by aligning their individual goals with the goals of the Company; and |

• | compensate our executives in a manner that incentivizes them to manage our business to meet our long-range objectives without undue risk taking. |

22

To achieve these objectives, we tie a substantial portion of the executives’ overall compensation to key strategic financial and operational goals and shareholder value creation. We seek to ensure that all incentives are aligned with our stated compensation philosophy of providing compensation commensurate with performance.

Setting Compensation

Role of Our Board, Compensation Committee and Named Executive Officers

Prior to our IPO, we were a privately held company. As a result, most of our historical compensation policies and determinations reflected the priorities under that ownership structure.

Commencing with the completion of our IPO, the Compensation Committee oversees and administers our executive compensation arrangements, including the Presidio, Inc. Amended and Restated 2015 Long-Term Incentive Plan (which we refer to as our “2015 Plan”), the Presidio, Inc. 2017 Long-Term Incentive Plan (which we refer to as our “2017 Plan”), the ESPP, and our Presidio, Inc. Executive Bonus Plan (which we refer to as our “Bonus Plan”).

The Compensation Committee (excluding Mr. Cagnazzi) meets independently from our executives to consider appropriate compensation for our Chief Executive Officer. For all other named executive officers, the Compensation Committee meets outside the presence of all executive officers, except our Chief Executive Officer. Our Chief Executive Officer reviews annually each other named executive officer’s performance with the Compensation Committee and recommends appropriate base salary, cash performance awards and grants of long-term equity incentive awards. Based upon the recommendations of our Chief Executive Officer and in consideration of the principles and objectives described above, the Compensation Committee approves the annual compensation packages of our named executive officers other than our Chief Executive Officer. The Compensation Committee annually analyzes our Chief Executive Officer’s performance and determines his base salary, cash performance awards, and grants of long-term equity incentive awards based on its assessment of his performance with input from any consultants engaged by the Compensation Committee.

Role of Compensation Consultant and Market Analysis

The Compensation Committee retains Semler Brossy Consulting Group, LLC (“Semler Brossy”) as its independent compensation consultant. Semler Brossy provided compensation advice independent of the Company’s management. Semler Brossy was engaged to assist in developing an executive compensation program that will attract and retain executive talent, with a particular focus on employment agreements and long-term incentive compensation. Semler Brossy’s compensation advice during the prior fiscal year included a review of the Company’s executive compensation philosophy, developing market compensation data for our employment agreements with executive officers, and advising the Board on equity grant allocations, annual and long-term incentive program design, and grant terms.

Semler Brossy provided our Compensation Committee with certain market data for base salaries, total cash compensation (defined as actual base salary plus target short-term incentive compensation), total direct compensation (defined as target total cash compensation plus annualized value of long-term incentive grants), severance practices, and equity grants in connection with initial public offerings. Semler Brossy also conducted market analyses based on both general survey data, an industry peer group, a general IPO peer group, and an information technology IPO peer group.

For the industry peer group, Semler Brossy utilized data for companies with last-12 month revenues between $1 billion and $10 billion (this range represents companies roughly 1/3x to 3x the Company's size, in terms of revenue) and focused on technology distributors with consulting attributes. The industry peer group analysis was based on a peer group of 11 publicly traded companies consisting of:

CDW Corporation | Unisys Corporation |

CGI Group, Inc. | PC Connection, Inc. |

Computer Sciences Corporation* | E Plus Inc. |

Insight Enterprises, Inc. | Black Box Corporation |

CRSA Inc. | Datalink Corporation* |

CIBER, Inc. | |

23

*After the completion of the peer group study, Computer Sciences Corporation completed a merger with HP Enterprises Solution to create DXC Technology on April 3, 2017, and Datalink Corporation was acquired by Insight Enterprises on January 6, 2017.

Our Compensation Committee intends to continue to use peer group analysis to assess competitive pay. Because our industry peer group was developed with Semler Brossy to provide market data for compensation plans and arrangements adopted in connection with our IPO, it may be re-evaluated by Semler Brossy and the Compensation Committee in fiscal 2019.

Risk Management

We have determined that any risks arising from our compensation programs and policies are not reasonably likely to have a material adverse effect on the Company. The Company’s compensation programs and policies for all employees mitigate risk by combining performance-based, long-term compensation elements with payouts that are highly correlated to the value delivered to stockholders. The combination of performance measures for annual bonuses and the equity compensation programs, as well as the multi-year vesting schedules for equity awards and certain cash bonuses, encourages employees to maintain both a short- and a long-term view with respect to Company performance.

Elements of Compensation

Our current executive compensation program consists of the following components:

• | base salary; |

• | annual cash incentive awards linked to our overall performance and individual performance; |

• | long-term equity-based compensation; |

• | other executive benefits and perquisites; and |

• | employment agreements, which contain severance benefits. |

We combine these elements to formulate compensation packages that provide competitive pay, reward the achievement of financial, operational, and strategic objectives and align the interests of our executive officers and other senior personnel with those of our stockholders.

Base Salary

Our named executive officers’ base salaries depend on their position within the Company and its subsidiaries, the scope of their responsibilities, the period during which they have been performing those responsibilities, and their overall performance. Base salaries are reviewed annually and are generally adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance, and experience.

Annual Cash Incentive Awards

Our named executive officers are hired to lead and grow our organization and as such we believe that a significant portion of our named executive officers’ compensation should be tied to our overall performance. We maintain an annual incentive cash bonus program for senior management (the “management incentive plan”), which emphasizes pay-for-performance by providing our named executive officers with the opportunity to earn an annual bonus based on company and individual performance goals established by our Board with respect to each fiscal year.

For fiscal 2018, our Board established company performance goals relating to Total Revenue, Adjusted EBITDA, and Adjusted EBITDA margin, as measured on an annual and quarterly basis. The Company selected these performance goals because it feels that these performance metrics combine to reflect our overall performance. In addition, for Messrs. Johnston, Fletcher, Hart, Thomas and Brecher, the Board also established individual performance goals.

24

We define Adjusted EBITDA as net income plus (i) total depreciation and amortization, (ii) interest and other (income) expense, and (iii) income tax expense, as further adjusted to eliminate noncash share-based compensation expense, purchase accounting adjustments, transaction costs and other costs. We define Adjusted EBITDA margin as the ratio of Adjusted EBITDA to Total Revenue. The reconciliation of Adjusted EBITDA, which is a non-GAAP financial measure, from net income for fiscal year 2018 is as follows:

(in millions) | June 30, 2018 | |||

Adjusted EBITDA Reconciliation: | ||||

Net income | $ | 134.2 | ||

Total depreciation and amortization (1) | 89.5 | |||

Interest and other (income) expense | 60.5 | |||