Form 8-K THOR INDUSTRIES INC For: Sep 18

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

CURRENT REPORT

(Exact Name of Registrant as Specified in Charter)

|

|

Delaware

|

|

1-9235

|

|

93-0768752

|

|

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS EmployerIdentification No.)

|

|

|

|

|

|

|

|

|

|

|

|

601 East Beardsley Avenue,

|

|

46514-3305

|

|

|

|

Elkhart, Indiana

|

|

(Zip Code)

|

|

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Exhibit Number

|

Description

|

|

| Thor Industries, Inc. | |||

|

Date: September 18, 2018

|

By:

|

/s/ Colleen Zuhl | |

| Name: Colleen Zuhl | |||

| Title: Senior Vice President and | |||

| Chief Financial Officer | |||

Exhibit 99.1

Thor Industries and Erwin Hymer Group to Create the Largest Global Recreational Vehicle Manufacturer

Thor to Acquire Erwin Hymer Group and Establish Leadership Position in Growing European Market

Hymer family chooses Thor to continue Erwin Hymer’s vision of continuing unique leisure experiences

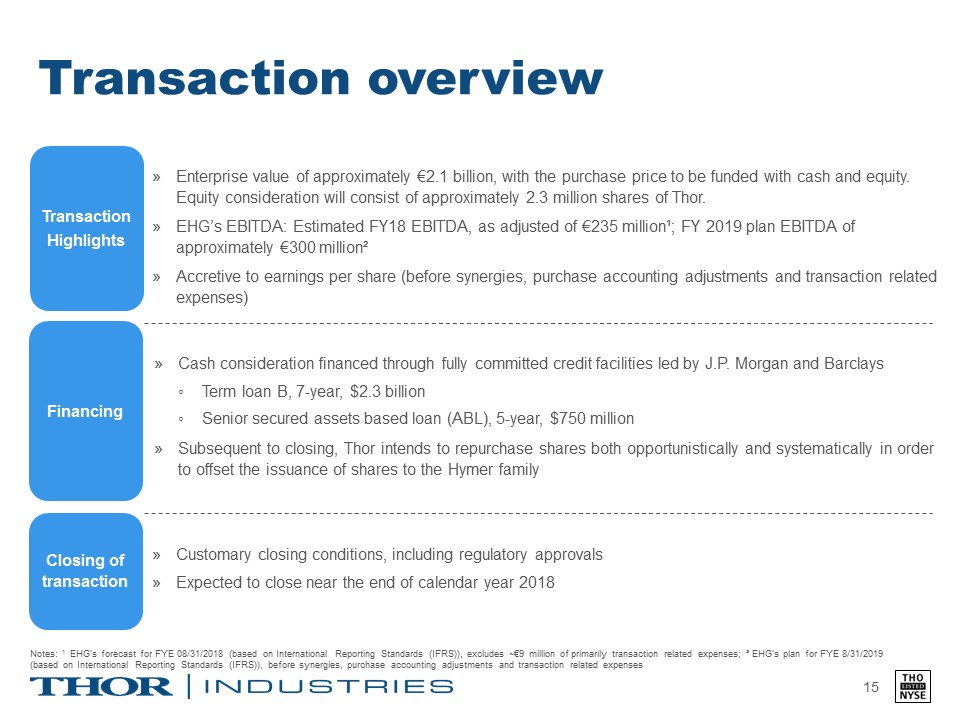

ELKHART, Ind. & BAD WALDSEE, Germany--(BUSINESS WIRE)--September 18, 2018--Thor Industries, Inc. (“Thor”, NYSE: THO) and the shareholders of Erwin Hymer Group SE (Erwin Hymer Group or EHG) today announced that they have entered into a definitive agreement for Thor to acquire Erwin Hymer Group, a privately held international company, for an enterprise value of approximately €2.1 billion, with the purchase price to be funded with cash and equity. Equity consideration will consist of approximately 2.3 million shares of Thor. The Hymer family will thereby remain engaged in the industry. The combination creates the world’s largest RV manufacturer, with the leading position in both North America and Europe, and establishes a global sales and production footprint for the Company.

Thor expects the transaction to be accretive to earnings in the first year, before taking into account anticipated synergies, purchase accounting adjustments and transaction-related expenses. Subsequent to closing, Thor intends to repurchase shares both opportunistically and systematically in order to offset the issuance of shares to the Hymer family.

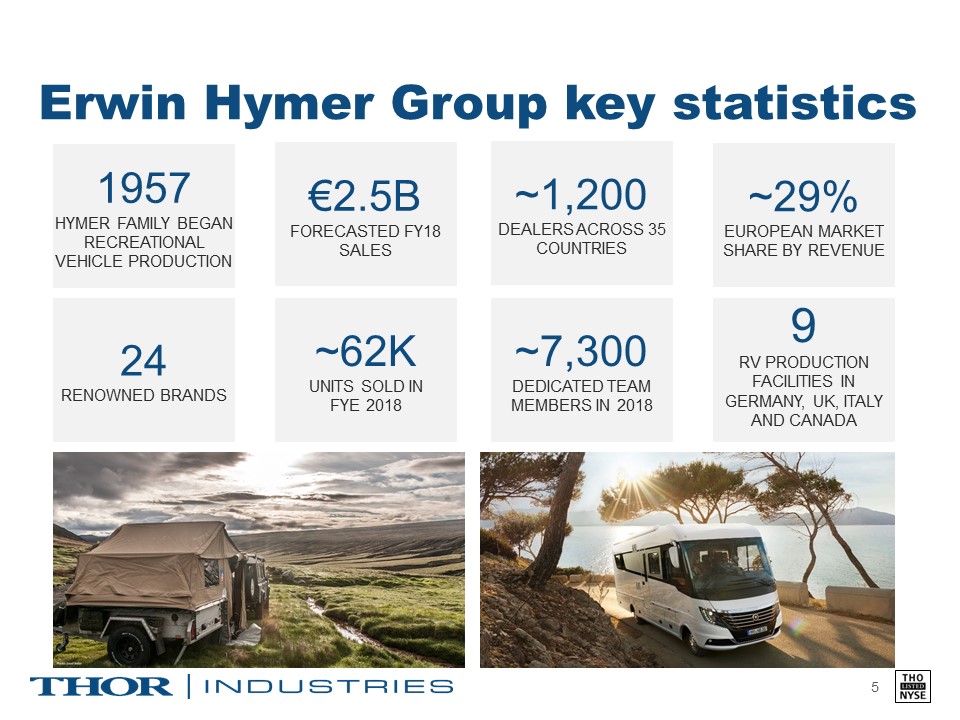

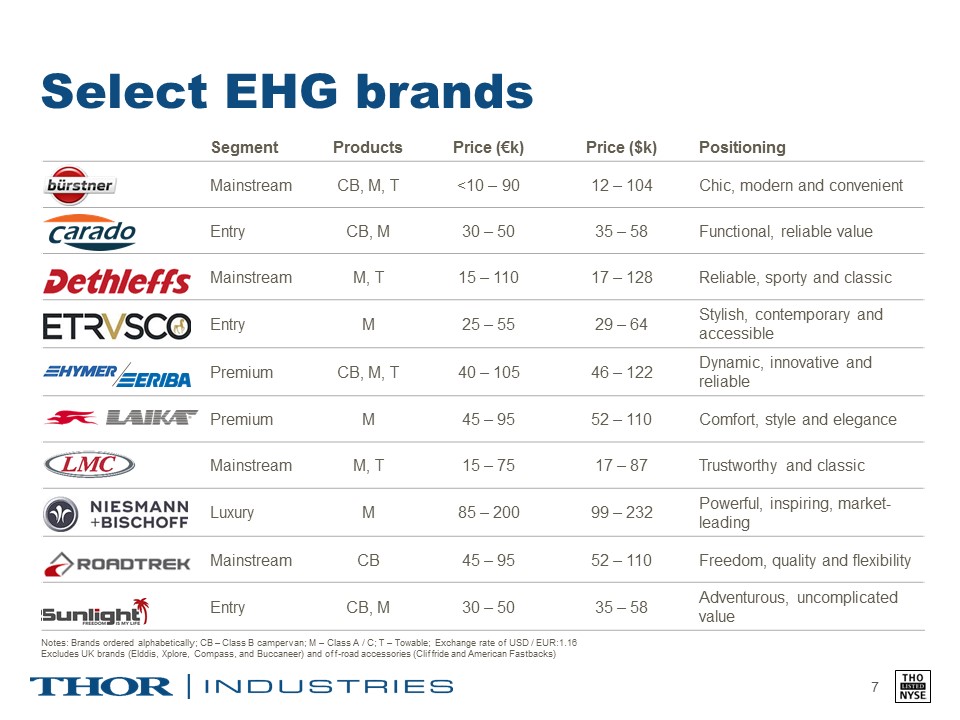

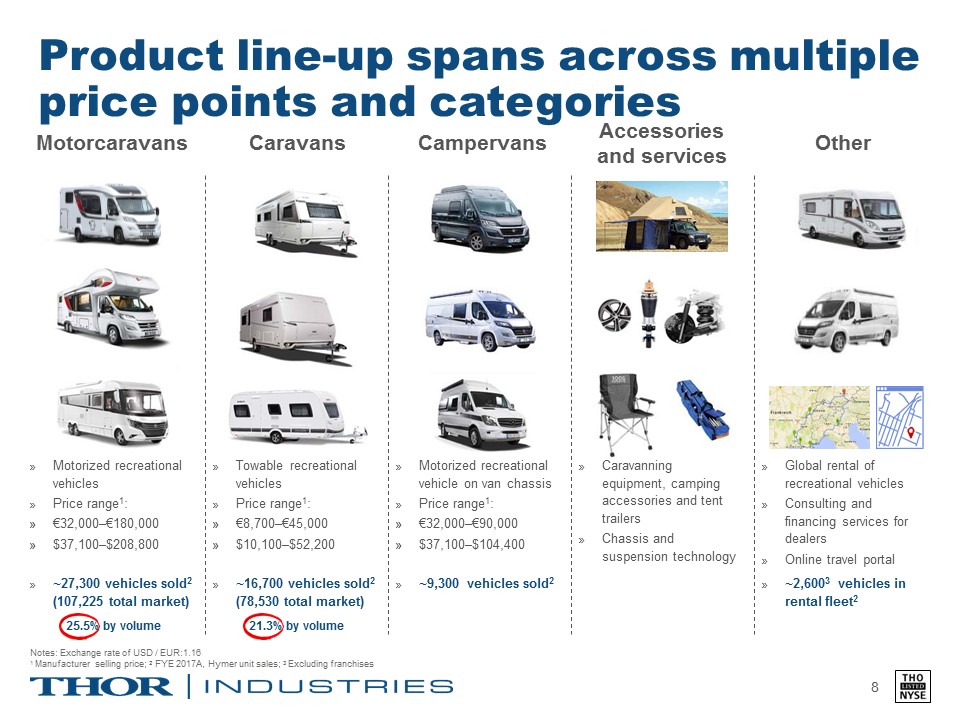

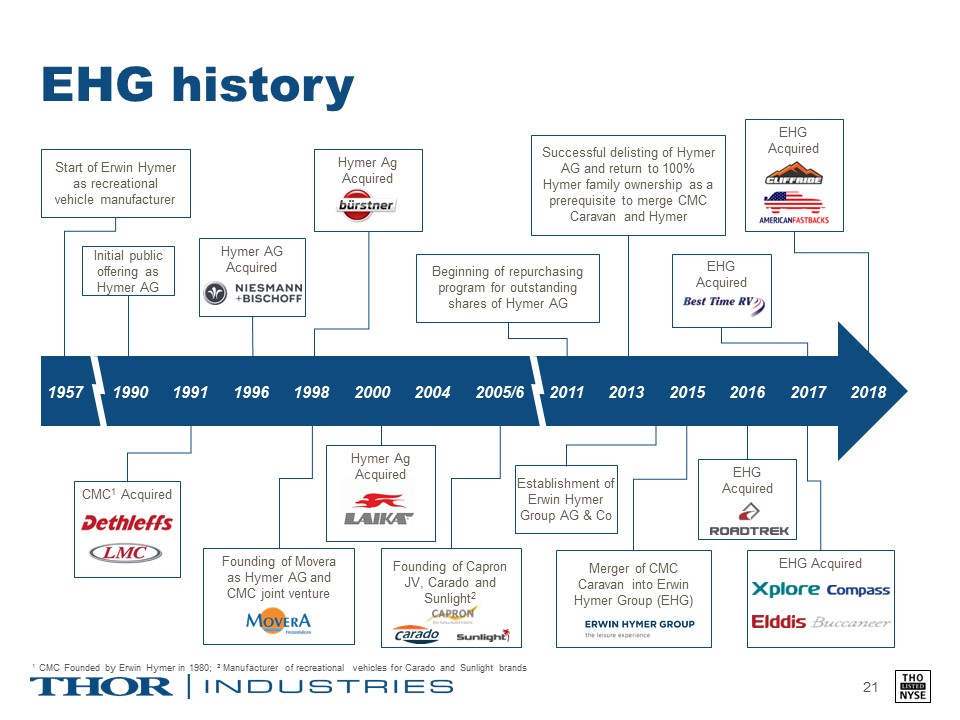

Headquartered in Bad Waldsee, Germany, Erwin Hymer Group (EHG) is one of the premier manufacturers of recreational vehicles in a growing European market, with an impressive lineup of industry leading vehicle brands, a strong reputation for investing in product innovation and a dedication to providing exceptional customer value. EHG sells through a worldwide network of more than 1,200 retail dealerships and employs more than 7,300 dedicated team members globally. EHG’s product portfolio spans all major RV categories and price points, from lightweight travel trailers to high-end motorhomes. For the fiscal year ended August 31, 2018, the Erwin Hymer Group expects to generate revenues of over €2.5 billion (approximately $2.9 billion at current exchange rate).

“The Erwin Hymer Group has an unparalleled history and reputation as well as a talented management team that is focused on building on that tradition and charting new, attractive growth opportunities for the Company,” said Bob Martin, Thor President and CEO. “This transaction provides Thor a unique opportunity to grow with the European RV market leader. The transaction gives us access to a new market with favorable macro and secular trends affecting RV demand similar to those we have seen in North America. In addition, we see numerous areas for near-term and long-term synergies between the Erwin Hymer Group and our existing subsidiaries and are eager to begin working with the entire Erwin Hymer Group,” added Bob Martin.

Christian Hymer, son of the late founder, Erwin Hymer and member of the EHG Supervisory Board said, "With Thor Industries, our family has found the ideal new owner partner for the Erwin Hymer Group to successfully continue on its long-term growth and internationalisation path. Thor Industries and the Erwin Hymer Group are cut from the same cloth and, in their philosophy, still bear the stamp of their founders. An entrepreneurial mindset, a spirit of innovation and quality leadership are top priorities for both groups. Through these shared cultural features and their complementary activities, the two groups will achieve even faster growth together.”

Martin Brandt, the CEO of the Erwin Hymer Group, said: "We're looking forward to opening the next chapter of our company's history with Thor Industries, and are convinced that we will mutually benefit from each other. With Thor Industries, the Erwin Hymer Group will be able to speed up the development of its relatively new activities in the attractive North American market.”

Thor’s Mr. Martin continued, “This acquisition is well aligned with Thor’s long-standing capital allocation strategy. Our focus has been, and continues to be, on delivering value to shareholders by investing opportunistically in accretive growth opportunities with companies that have a strong marketplace position, successful operations, and growth oriented management teams.”

Martin Brandt will continue to lead the Erwin Hymer Group business post-closing as its Chief Executive Officer, reporting directly to Thor’s Chief Executive Officer, Bob Martin. No changes in production facilities or employee levels are anticipated within EHG or Thor as a direct result of this transaction. The transaction has been approved by Thor’s board of directors and is expected to close near the end of the calendar year, subject to customary closing conditions, including regulatory and other necessary approvals.

Advisors

Advisors assisting Thor included: J.P. Morgan serving as lead financial advisor, Barclays serving as an M&A advisor, Baker McKenzie LLP acting as legal counsel and Ernst and Young providing transaction advisory services. J.P. Morgan and Barclays Capital are also providing Thor with fully committed financing. Macquarie Capital is serving as financial advisor to Erwin Hymer Group and Hengeler Mueller is acting as legal counsel.

Conference Call Information

The Company will hold a conference call about the transaction at 9 a.m. ET, September 18, 2018 hosted by Bob Martin, President and Chief Executive Officer, and Colleen Zuhl, Senior Vice President and Chief Financial Officer. Security analysts and investors wishing to participate via telephone should call (877) 682-9330, and reference conference ID 8674138# to be connected. Callers outside of North America should call (647) 689-5428. Those wishing to listen via the internet, go to https://ir.thorindustries.com/.These numbers can be accessed 15 minutes before the call begins, as well as during the call. The webcast replay will also be available at https://ir.thorindustries.com/.

Forward-Looking Statements

This press release contains forward-looking information related to Thor Industries, Inc., and the acquisition of the Erwin Hymer Group (EHG), that is based on current expectations and involves substantial risks and uncertainties that could cause actual results, performance, events, or transactions to differ materially from those expressed or implied by such statements. Forward-looking statements include, among other things, statements about Thor’s plans, objectives, expectations and intentions; the anticipated timing of the closing of the acquisition; the potential benefits of the proposed acquisition, and the anticipated operating synergies; the satisfaction of the conditions to closing the acquisition (including obtaining necessary regulatory approvals) in the anticipated timeframe or at all; the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and Erwin Hymer Group’s business. Other business risks include raw material and commodity price fluctuations; raw material, commodity or chassis supply restrictions; the level of warranty claims incurred; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation, legal and compliance issues including those that may arise in conjunction with recent transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers; restrictive lending practices; management changes; the success of new and existing products and services; consumer preferences; the ability to efficiently utilize production facilities; the pace of acquisitions and the successful closing, integration and financial impact thereof; the potential loss of existing customers of acquisitions; our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; asset impairment charges; cost structure changes; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand; general economic, market and political conditions; and changes to investment and capital allocation strategies or other facets of our strategic plan. In addition, actual results, performance, events and transactions, are subject to other risks and uncertainties that relate more broadly to Thor’s overall business, including those more fully described in Thor’s filings with the U.S. Securities and Exchange Commission (“SEC”) (including, but not limited to, the factors discussed in Item 1A. Risk Factors of Thor’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q). In light of these risks, uncertainties, and other factors, you are cautioned not to place undue reliance on the forward-looking information. Thor, except as required by law, undertakes no obligation to update or revise the forward-looking statements, whether as a result of new developments or otherwise.

About Thor Industries, Inc.

Thor is the sole owner of operating subsidiaries that, combined, represent the world’s largest manufacturer of recreational vehicles. For more information on the Company and its products, please go to www.thorindustries.com.

About Erwin Hymer Group

Erwin Hymer Group is a leading European manufacturer of recreational vehicles. Headquartered in Bad Waldsee, in the state of Baden-Württemberg, Germany, Erwin Hymer Group produces vehicles under 24 brand names and is a recognized leader in vehicle innovation and design. For more information see www.erwinhymergroup.com.

CONTACT:

Thor Industries

Media:

Clermont Partners

Beth Saunders

(630) 546-5941

[email protected]

or

Investors:

Thor Industries

Bruce Byots

Investor Relations

(574) 970-7912

[email protected]

or

Erwin Hymer Group

Media:

Erwin Hymer Group

Stefan von Terzi

Head of Marketing Communications

+49 (0) 160 94959289

[email protected]

or

FTI Consulting

Carolin Amann

+49 (0) 175 2993048

[email protected]

Exhibit 99.2