Form 8-K FORD MOTOR CO For: Sep 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: September 14, 2018

(Date of earliest event reported)

FORD MOTOR COMPANY

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

1-3950 | 38-0549190 |

(Commission File Number) | (IRS Employer Identification No.) |

One American Road, Dearborn, Michigan | 48126 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 313-322-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

Ford Motor Company’s Fixed Income Presentation dated September 17, 2018 is furnished as Exhibit 99 to this Report and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

EXHIBITS*

Designation | Description | Method of Filing |

Fixed Income Presentation dated September 17, 2018 | Furnished with this Report | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FORD MOTOR COMPANY | ||

(Registrant) | ||

Date: September 14, 2018 | By: | /s/ Corey M. MacGillivray |

Corey M. MacGillivray | ||

Assistant Secretary | ||

* | Any reference in the attached exhibit(s) to our corporate website(s) and/or other social media sites or platforms, and the contents thereof, is provided for convenience only; such websites or platforms and the contents thereof are not incorporated by reference into this Report nor deemed filed with the Securities and Exchange Commission. | |

Fixed Income Investor Presentation September 17, 2018

Creating Tomorrow, Together Our Freedom of movement drives human progress. Belief Our To become the world’s most trusted company, Aspiration designing smart vehicles for a smart world. Passion for Product & Deep Customer Insight Our Plan for Value Creation Winning Propulsion Autonomous Mobility Portfolio Choices Technology Experiences Fitness Metrics Operating Leverage Growth Build, Partner, Buy EBIT Margin Capital Efficiency ROIC Strong Balance Sheet Cash Flow Our People Culture & Values 2

Capital Strategy Framework Investment Grade Incremental Fund The Plan / Value Creation Balance Sheet Opportunities • Liquidity At Target • Product Renewal • Sustainable Regular Dividend • Additional Growth • Investment Grade Credit • Profitable Growth • Anti-Dilutive Share Opportunities Rating Through A (ROIC > WACC) Repurchase • Further Balance Cycle; Debt Capacity • EV, AV, Mobility • Shareholder Distributions Sheet Improvements Maintained • Infrastructure Consistent With Strategy • Additional • Funded Pensions Fully • Self-Funded Ford Credit Shareholder Actions Funded & De-Risked • Restructuring Allocation Priorities Allocation Continue to prioritize To be considered Rapidly improve fitness to lower costs, release balance sheet while longer term, once capital and finance growth. Allocate capital to plans for fitness fitness actions areas we can win have taken hold Key Focus Key progress Capital Strategy Framework Unchanged; Focus On Investment Grade Balance Sheet, Fitness And Capital Allocation To Drive Value Creation 3

Company Balance Sheet And Liquidity (Bils) 2017 2018 Dec 31 Jun 30 Company excl. Ford Credit Company Cash $ 26.5 $ 25.2 Liquidity 37.4 36.1 • Company cash and liquidity Debt $ 16.5 $ 16.2 balances remain strong Cash Net of Debt 10.0 9.0 • Extended maturity dates of Company Balance Sheet Underfunded Status* corporate credit facility with U.S. Pension $ 2.2 $ 1.6 terms and conditions Non-U.S. Pension 4.4 4.1 unchanged Total Global Pension $ 6.6 $ 5.7 Total Unfunded OPEB $ 6.2 $ 6.0 * Balances at June 30, 2018 reflect net underfunded status at December 31, 2017, updated for service and interest costs, expected return on assets, separation expense, interim remeasurement expense, actual benefit payments and cash contributions. The discount rate and rate of expected return assumptions are unchanged from year end 2017 4

Ford Credit -- A Strategic Asset Earnings Before Taxes Distributions $4.9 $3.7 $2.9 $3.1 $2.5 $2.5 $2.4 $2.3 $2.1 $2.0 $2.0 $2.0 $1.7 $2.1 $1.8 $1.8 $1.9 $1.9 $1.2 $(2.6) 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 fcst Over The Last 20 Years, Ford Credit Generated $42 Billion In Earnings Before Taxes And $26 Billion In Distributions 5

Winning Portfolio – Capital Focused on • Roadmap for potential High-Margin, High-Growth Businesses EBIT charges of $11B with ROIC (%) HIGHLY ACCRETIVE cash-related effects of $7B over + North Circle size = 2017 +/- EBIT (Bils) the next 3 to 5 years America 30% ~100% of − North America strong – Company accounts for essentially all 20% EBIT of Company EBIT; ROIC Asia well above cost of capital 10% Europe Pacific − Europe and Asia Pacific profitable with relatively - + EBIT weak margins; ROIC below Margin (15)% (10)% (5)% Mobility 5% 10% 15% cost of capital South (10)% America − South America – highly dilutive margin and ROIC (20)% MEA − MEA low performing, but with credible plan to (30)% HIGHLY DILUTIVE - generate appropriate returns Note: All references to EBIT and EBIT Margin are on an adjusted basis, include regional Ford Credit EBT and exclude Corporate Other 6

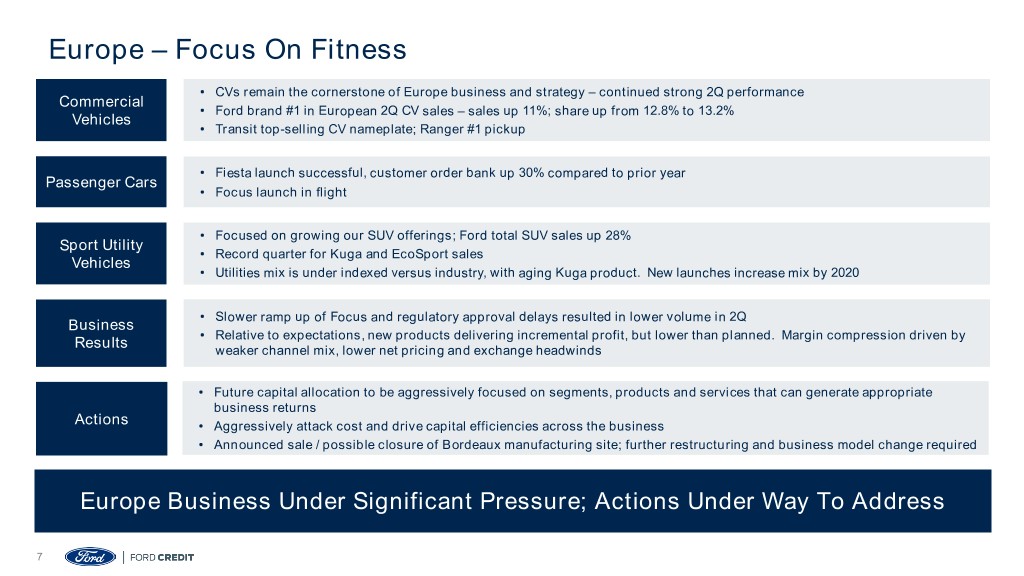

Europe – Focus On Fitness • CVs remain the cornerstone of Europe business and strategy – continued strong 2Q performance Commercial • Ford brand #1 in European 2Q CV sales – sales up 11%; share up from 12.8% to 13.2% Vehicles • Transit top-selling CV nameplate; Ranger #1 pickup • Fiesta launch successful, customer order bank up 30% compared to prior year Passenger Cars • Focus launch in flight • Focused on growing our SUV offerings; Ford total SUV sales up 28% Sport Utility • Record quarter for Kuga and EcoSport sales Vehicles • Utilities mix is under indexed versus industry, with aging Kuga product. New launches increase mix by 2020 • Slower ramp up of Focus and regulatory approval delays resulted in lower volume in 2Q Business • Relative to expectations, new products delivering incremental profit, but lower than planned. Margin compression driven by Results weaker channel mix, lower net pricing and exchange headwinds • Future capital allocation to be aggressively focused on segments, products and services that can generate appropriate business returns Actions • Aggressively attack cost and drive capital efficiencies across the business • Announced sale / possible closure of Bordeaux manufacturing site; further restructuring and business model change required Europe Business Under Significant Pressure; Actions Under Way To Address 7

China Deep Dive – Structural And Go-To-Market Issues Dealers • Actions to improve dealer support and profitability executed end 2Q Disengaged • High dealer stock levels being addressed aggressively Uncompetitive • Localize assembly of Explorer and Lincoln (starting with new Small Utility early 2020) Cost • Integrate Ford Marketing / Sales and Purchasing operations into JVs to remove duplication and optimize costs Structure • Fitness actions to be implemented Product Ageing • 60% of product line-up to be refreshed or new in 2019 And Not • New Ford utility showroom (replacements and additions) launched 2019 through 2021; 50 new vehicles in total by 2025 Aligned With including 8 new SUVs and 15 or more electrified vehicles Customer • New Advanced Product Creation Process at Nanjing Research and Engineering Centre and increased use of ‘in JV’ Demand product creation Go-To-Market • New single authentic and trusted Ford brand voice through Distribution Division to address consistency and differentiation Capability Gaps • New China Futuring group to be established to improve local consumer insights Exposed • Recruiting additional local talent to key management positions Success In China Imperative – World’s Largest Market; Reaches 2X U.S. Volume By 2025 8

Cautionary Note On Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long-term competitiveness depends on the successful execution of fitness actions; • Industry sales volume, particularly in the United States, Europe, or China, could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Ford may face increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, and interest rates can have a significant effect on results; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor disputes, natural or man-made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs; • Safety, emissions, fuel economy, and other regulations affecting Ford may become more stringent; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Ford Credit could face increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and • Ford Credit could be subject to new or increased credit regulations, consumer or data protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 9