Form S-4/A New PennyMac Financial

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on September 12, 2018

Registration No. 333-226531

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

New PennyMac Financial Services, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

6162 (Primary Standard Industrial Classification Code Number) |

83-1098934 (IRS Employer Identification Number) |

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Derek W. Stark, Esq.

Senior Managing Director and Chief Legal Officer and Secretary

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies to:

Bradley C. Weber, Esq.

Laura Hodges Taylor, Esq.

Goodwin Procter LLP

601 Marshall Street

Redwood City, California 94063

(650) 752-3100

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

This document is a joint proxy statement and prospectus and is part of a Registration Statement on Form S-4 (File No. 333-226531) as amended and filed with the U.S. Securities and Exchange Commission.

As such, this document is: (i) a proxy statement relating to a special meeting of PennyMac Financial Services, Inc., a Delaware corporation ("Existing PennyMac") and (ii) a prospectus relating to the common stock, par value $0.0001 per share, of New PennyMac Financial Services, Inc., a Delaware corporation ("New PennyMac") that may be issued in connection with a Contribution Agreement and Plan of Merger by and among Existing PennyMac, New PennyMac and certain other parties dated August 2, 2018.

The information in this proxy statement/prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission with respect to these securities is effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 12, 2018

|

PennyMac Financial Services, Inc. 3043 Townsgate Road Westlake Village, California 91361 |

, 2018

PROXY STATEMENT/PROSPECTUS

A REORGANIZATION IS PROPOSED—YOUR VOTE IS VERY IMPORTANT

Dear PennyMac Financial Services, Inc. Class A and Class B Common Stockholder:

You are invited to attend a special meeting of stockholders of PennyMac Financial Services, Inc. ("Existing PennyMac" or the "Company"), to be held at our corporate offices located at 3043 Townsgate Road, Westlake Village, California 91361, on October 24, 2018 at 11:00 a.m. (PDT).

At the special meeting, Class A and Class B common stockholders will be asked to consider and vote on:

- •

- A proposal, which we refer to as the "Reorganization Proposal," to adopt and approve a

Contribution Agreement and Plan of Merger, as amended from time to time (the "Reorganization Agreement"), in order to create a new holding company above

Existing PennyMac, which we refer to as the "Reorganization." The new holding company will initially be called New PennyMac Financial

Services, Inc. ("New PennyMac").

- •

- A proposal, which we refer to as the "Adjournment Proposal," to adjourn the special meeting, if necessary or appropriate, including to solicit additional proxies if there are not sufficient votes to approve the Reorganization Proposal.

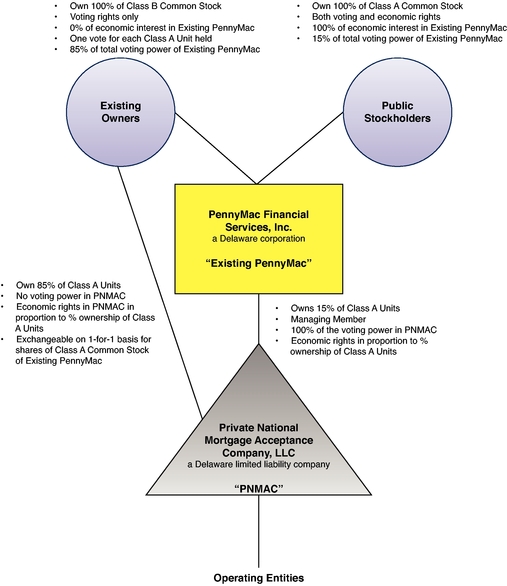

Adding a new holding company above Existing PennyMac will allow Existing PennyMac to simplify its overall corporate structure and financial reporting by (i) eliminating Existing PennyMac's so-called "Up-C" structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New PennyMac, and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes, Class A and Class B, of common stock of Existing PennyMac that are authorized, issued and outstanding today. We believe that one of the effects of this Reorganization will be to increase our current market capitalization at our parent-level entity, which could enable certain investors (those with investment position limits tied to percentages of a company's market capitalization) to own larger positions in our stock than before, and could also make shares of common stock of New PennyMac eligible to be included in certain stock market indices for which shares of Class A common stock of Existing PennyMac currently are not eligible. Such eligibility, in turn, could mean an increased demand for shares of common stock of New PennyMac, which could assist in our stated goal of seeking to maximize long-term stockholder value.

In evaluating the Reorganization Proposal, you should consider the following important aspects of the Reorganization:

- •

- Your existing shares of Class A common stock of Existing PennyMac will be automatically converted in the Reorganization (by way of a

statutory merger), on a one-for-one basis, into shares of common stock of New PennyMac, pursuant to a component of the Reorganization that we refer to as the

"Merger."

- •

- Your existing shares of Class B common stock of Existing PennyMac will be automatically cancelled in the Merger.

- •

- Holders of Class A Units of Private National Mortgage Acceptance Company, LLC, a Delaware limited liability company

("PNMAC"), other than Existing PennyMac, will voluntarily contribute all of such Class A Units to New PennyMac in exchange for, on a one-for-one

basis, the issuance by New PennyMac to such holders of shares of common stock of New PennyMac, pursuant to a component of the Reorganization that we refer to as the

"Contribution."

- •

- Because both the Merger and the Contribution result in exchanges on a one-for-one basis for shares of common stock of New PennyMac, a

Class A common stockholder's overall proportionate economic ownership of the entire PNMAC business in New PennyMac and a Class A common stockholder's voting control percentage in New

PennyMac will be the same as a Class A common stockholder's current overall proportionate economic ownership of the entire PNMAC business and a Class A common stockholder's current

voting control percentage in Existing PennyMac.

- •

- The Reorganization should qualify as a "reorganization" within the meaning of Section 368(a) of the Code and/or a transfer described in

Section 351(a) of the Code.

- •

- We intend to apply to have the common stock of New PennyMac listed on the New York Stock Exchange under Existing PennyMac's current trading

symbol, "PFSI," on or before the effective date of the Merger.

- •

- Your current rights as a Class A common stockholder of Existing PennyMac will be substantially the same as your rights as a common stockholder of New PennyMac. There are differences, however, that you should carefully review under the caption "Comparative Rights of Holders of New PennyMac Common Stock and Existing PennyMac Class A Common Stock" beginning on page 67.

Our Board has carefully considered and approved the Reorganization Agreement and believes that it is advisable and in the best interests of our Class A and Class B common stockholders, and unanimously recommends that you vote FOR the Reorganization Proposal.

Approval of the Reorganization Proposal requires the affirmative vote of a majority of the voting power of all the issued and outstanding shares of common stock of Existing PennyMac, with both the Class A common stock and Class B common stock voting together as a single class (a "Majority").

If a Majority of votes are not cast in favor of the Reorganization Proposal, we would not likely continue to pursue the Reorganization as currently structured and proposed, Existing PennyMac would remain our top-level parent and publicly-listed entity and our so-called "Up-C" structure would remain in place. The closing of the Reorganization is subject to a number of other conditions in addition to the receipt of sufficient stockholder approval, and no assurance can be given that all such conditions will be satisfied, even if sufficient stockholder approval is received. Our Board can terminate the Reorganization Agreement at any time prior to completion of the Reorganization if the Board determines that, for any reason, the completion of the Reorganization would be inadvisable or not in the best interests of Existing PennyMac or its stockholders.

The total number of shares of New PennyMac common stock to be issued in the Reorganization will not be known until immediately prior to completing the Reorganization, but is expected to be up to approximately 79.1 million shares of New PennyMac common stock based on, among other factors, the shares of Existing PennyMac Class A common stock currently outstanding, the Class A Units of PNMAC (other than Class A Units held by Existing PennyMac) currently outstanding and the shares of Existing PennyMac Class A common stock that may be issuable pursuant to outstanding equity-based incentive awards of Existing PennyMac prior to the completion of the Reorganization. On August 1, 2018, the last trading day before announcement of the Reorganization Proposal, the closing price per share of our Class A common stock was $19.15.

At the special meeting, in addition to the Reorganization Proposal (Item 1 on the proxy card), you will be asked to vote on a proposal to approve, if necessary or appropriate, the adjournment of the special meeting, including to solicit additional proxies in favor of the Reorganization Proposal (Item 2 on the proxy card).

Our Board unanimously recommends that you vote FOR the Adjournment Proposal.

Your vote is important. Whether or not you plan to attend the special meeting, please vote as soon as possible. To ensure that your shares are represented at the meeting, we recommend that you submit a proxy to vote your shares of Class A common stock and Class B common stock through the Internet by following the instructions set forth on your proxy card. You may also vote by telephone or mail by following the instructions set forth on your proxy card. This way, your shares will be voted even if you are unable to attend the special meeting. This will not, of course, limit your right to attend the special meeting or prevent you from voting in person at the meeting if you wish to do so. If you hold your shares of Class A common stock in "street name" through a broker, bank, custodian, fiduciary or other nominee, you should review the separate notice supplied by that firm to determine whether and how you may vote by mail, telephone or through the Internet. To vote these shares, you must use the appropriate voting instruction form or toll-free telephone number or website address specified on that firm's voting instruction form for beneficial owners.

The accompanying notice of meeting and this proxy statement/prospectus provide specific information about the special meeting and explain the various proposals. Please read these materials carefully. In particular, you should consider the discussion of risk factors beginning on page 18 before voting on the Reorganization Proposal.

We appreciate your continued confidence in PennyMac and look forward to seeing you at the meeting.

Sincerely,

|

|

|

|

STANFORD L. KURLAND Executive Chairman |

DAVID A. SPECTOR President and Chief Executive Officer |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this proxy statement/prospectus or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2018. This proxy statement/prospectus and the related proxy materials are first being mailed to Existing PennyMac Class A and Class B common stockholders on or about , 2018.

|

PennyMac Financial Services, Inc. 3043 Townsgate Road Westlake Village, California 91361 |

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held on October 24, 2018

To our Class A and Class B Common Stockholders:

PennyMac Financial Services, Inc., a Delaware corporation ("Existing PennyMac"), will hold a special meeting of stockholders on October 24, 2018 at 11:00 a.m. (PDT) at our corporate offices located at 3043 Townsgate Road, Westlake Village, California 91361 (the "Special Meeting"). Existing PennyMac Class A and Class B common stockholders will act on the following matters at the Special Meeting or any adjournment or postponement of that meeting:

- 1.

- Consider

a proposal, which we refer to as the "Reorganization Proposal," to adopt and approve a contribution agreement

and plan of merger, as amended from time to time (the "Reorganization Agreement"), that will create a new holding company above Existing PennyMac and

simplify its overall corporate structure. The Reorganization Agreement is included in the accompanying proxy statement/prospectus as Annex I.

- 2.

- Consider a proposal, which we refer to as the "Adjournment Proposal," to approve, if necessary or appropriate, the adjournment of the Special Meeting, including to solicit additional proxies in favor of the Reorganization Proposal.

Our Board of Directors has approved the Reorganization Agreement, declared that it is advisable and determined that it is in the best interests of all our stockholders, and unanimously recommends that all stockholders vote FOR the Reorganization Proposal. In addition, our Board of Directors unanimously recommends that all stockholders vote FOR the Adjournment Proposal.

Only Class A and Class B common stockholders of record at the close of business on September 7, 2018 (the "Record Date") are entitled to vote at the Special Meeting or any adjournment or postponement of that meeting.

You can vote in one of several ways:

- •

- Visit the website listed on your proxy card to vote VIA THE

INTERNET

- •

- Call the telephone number specified on your proxy card to vote BY

TELEPHONE

- •

- Sign, date and return your proxy card in the enclosed envelope to vote BY

MAIL

- •

- Attend the meeting to vote IN PERSON

| By Order of the Board of Directors, | ||

|

||

DEREK W. STARK Secretary |

Westlake

Village, California

, 2018

This document, which is sometimes referred to as this proxy statement/prospectus, constitutes a proxy statement of PennyMac Financial Services, Inc. with respect to the solicitation of proxies by PennyMac Financial Services, Inc. for the Special Meeting described within and a prospectus of New PennyMac Financial Services, Inc. for the shares of common stock of New PennyMac Financial Services, Inc. to be issued pursuant to the Reorganization Agreement. As permitted under the rules of the U.S. Securities and Exchange Commission (the "SEC"), this proxy statement/prospectus incorporates important business and financial information about PennyMac Financial Services, Inc. that is contained in documents filed with the SEC that are not included in, or delivered with, this proxy statement/prospectus. You may obtain copies of these documents, without charge, from the website maintained by the SEC at www.sec.gov, as well as other sources. See "Where You Can Find Additional Information" on page 79 of this proxy statement/prospectus. You may also obtain copies of these documents, without charge, from PennyMac Financial Services, Inc. by calling us at (818) 224-7442 or writing us at the following address:

PennyMac

Financial Services, Inc.

3043 Townsgate Road

Westlake Village, California 91361

Attention: Investor Relations

In order to ensure timely delivery of the requested documents, requests should be made no later than , 2018, which is business days before the date of the Special Meeting.

You should rely only on the information contained or incorporated by reference in this proxy statement/prospectus and the registration statement of which this proxy statement/prospectus is a part to vote on the proposals being presented at the Special Meeting. We have not authorized any person to provide you with any information or represent anything about us or the proposals that is not contained in this proxy statement/prospectus or the registration statement of which this proxy statement/prospectus is a part or incorporated by reference herein. If such other information or representations are provided to you, they should not be relied upon as having been authorized by us.

This proxy statement/prospectus is dated , 2018. You should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than this date, and neither the mailing of this proxy statement/prospectus to stockholders nor the issuance of New PennyMac Financial Services, Inc. common stock pursuant to the Reorganization Agreement implies that information is accurate as of any other date.

i

ii

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND SPECIAL MEETING

- 1.

- What matters will be voted on at the Special Meeting?

There are two proposals scheduled to be considered and voted on at the Special Meeting:

- •

- The adoption and approval of a contribution agreement and plan of merger, as amended from time to time, that will create a new holding company

above Existing PennyMac and simplify its overall corporate structure (the "Reorganization Proposal"); and

- •

- The approval, if necessary or appropriate, of the adjournment of the Special Meeting, including to solicit additional proxies in favor of the

Reorganization Proposal (the "Adjournment Proposal").

- 2.

- What is the Reorganization Proposal?

We are asking you to approve the creation of a new holding company above Existing PennyMac to help simplify our overall corporate structure and financial reporting by (i) eliminating Existing PennyMac's so-called "Up-C" structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New PennyMac, and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes, Class A and Class B, of common stock of Existing PennyMac that are authorized, issued and outstanding today (the "Reorganization"). We believe that this Reorganization will assist in our stated goal of seeking to maximize long-term stockholder value.

The Reorganization will be governed by the terms and conditions of a Contribution Agreement and Plan of Merger dated as of August 2, 2018, as amended from time to time (the "Reorganization Agreement"), by and among Existing PennyMac, New PennyMac Financial Services, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Existing PennyMac ("New PennyMac"), New PennyMac Merger Sub, LLC, a Delaware limited liability company and a direct wholly-owned subsidiary of New PennyMac ("Merger Sub"), the contributors identified in the schedules to the Reorganization Agreement (the "Contributors") and Private National Mortgage Acceptance Company, LLC, a Delaware limited liability company, all of the outstanding membership interests of which are currently owned by Existing PennyMac and the Contributors ("PNMAC"). A copy of the Reorganization Agreement is attached as Annex I to this proxy statement/prospectus. You are encouraged to read the Reorganization Agreement carefully.

The Reorganization has two primary components, which form a single, integrated transaction that we refer to collectively as the "Reorganization," that will be accomplished simultaneously pursuant to the Reorganization Agreement: (1) the Contribution and (2) the Merger, each as defined and described further below.

- 3.

- What is the "Contribution"?

The Contributors, in the aggregate, hold all of the currently outstanding Class A Units of PNMAC (other than those Class A Units held directly by Existing PennyMac) as well as all of the issued and outstanding shares of Class B common stock, par value $0.0001 per share of Existing PennyMac (the "Class B Common Stock"). Each of the Contributors has agreed, pursuant to the terms of the Reorganization Agreement, to voluntarily contribute all such Class A Units of PNMAC to New PennyMac, in exchange for the issuance by New PennyMac to such Contributors of an aggregate number of shares of common stock, par value $0.0001 per share (the "New Common Stock" or "New PennyMac Common Stock"), of New PennyMac (such shares, the "Contribution Shares") that is equal in number to the number of Class A Units of PNMAC so contributed by the Contributors (the "Contribution"). Other than the receipt of the Contribution Shares, the Contributors will receive no additional consideration or other compensation of any

1

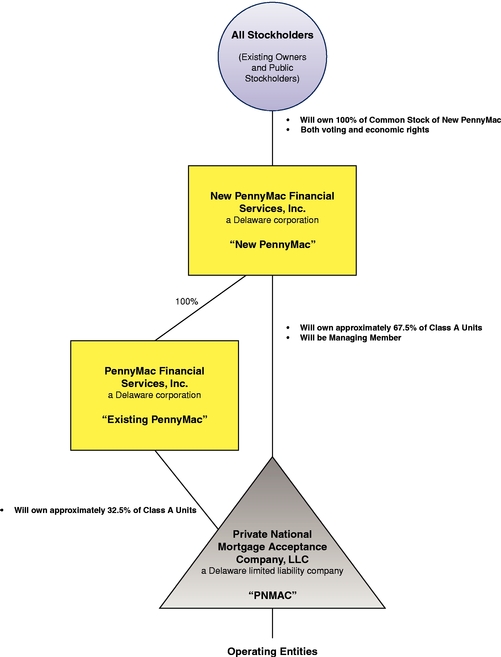

kind in connection with the Contribution. Following the Contribution, New PennyMac expects to be the direct holder of approximately 67.5% of the outstanding Class A Units of PNMAC. Existing PennyMac will remain the owner of the remaining approximately 32.5% of the outstanding Class A Units of PNMAC.

- 4.

- What is the "Merger"?

Simultaneously with the completion of the Contribution, Merger Sub, which is a wholly-owned subsidiary of New PennyMac, will merge with and into Existing PennyMac pursuant to the terms and conditions of the Reorganization Agreement, with Existing PennyMac surviving the Merger as a wholly-owned subsidiary of New PennyMac (the "Merger"). Pursuant to the Reorganization Agreement, each outstanding share of Class A common stock, par value $0.0001 per share of Existing PennyMac (the "Class A Common Stock"), will be converted into one share of New Common Stock of New PennyMac and each outstanding share of Class B Common Stock will be cancelled for no consideration (the "Merger Consideration"). The Class A Units of PNMAC contributed to New PennyMac in the Contribution, taken together with the Class A Units of PNMAC that will remain owned by Existing PennyMac following the Merger, will constitute one hundred percent (100%) of the issued and outstanding Class A Units of PNMAC, such that following the completion of both the Contribution and the Merger, New PennyMac will hold (directly or indirectly) all of the issued and outstanding Class A Units of PNMAC.

- 5.

- Am I being asked to vote on both the Contribution and the Merger?

Yes, because they are part of a single, integrated transaction (the Reorganization), that is governed by the Reorganization Agreement. The approval of Class A and Class B common stockholders of Existing PennyMac is required for the Merger under the Delaware General Corporation Law (the "DGCL"). You are being asked to vote on the Reorganization Proposal, which includes adoption and approval of the Reorganization Agreement, and adoption and approval of all of the transactions contemplated therein. Those transactions include, among other things, both the Contribution and the Merger and the issuance of shares of New Common Stock of New PennyMac in connection therewith.

- 6.

- Are the completion of the Contribution and the Merger contingent upon one another?

Yes. The Contribution and the Merger are part of a single, integrated transaction (the Reorganization), all parts of which will occur simultaneously at closing. The closing of the Reorganization is subject to certain conditions precedent that are described further below. It is not possible for the Contribution to occur without the Merger, and vice versa, because they are part of a single, integrated transaction that must close simultaneously pursuant to the terms of the Reorganization Agreement.

- 7.

- If the Class A and Class B common stockholders do not approve the Reorganization Proposal, what will happen?

If the holders of a majority of the voting power of the Class A and Class B Common Stock, voting together as a single class, do not vote FOR the Reorganization Proposal, we would not likely continue to pursue the Reorganization as currently structured and proposed, Existing PennyMac would remain our top-level parent and publicly-listed entity, and our so-called "Up-C" structure would remain in place. The closing of the Reorganization is subject to a number of other conditions in addition to the receipt of stockholder approval, and there can be no assurances that all of such conditions will be satisfied, even if the Class A and Class B common stockholders approve the Reorganization Proposal. Our Board can terminate the Reorganization Agreement at any time prior to completion of the Reorganization if it determines that, for any reason, the

2

completion of the Reorganization would be inadvisable or not in the best interests of Existing PennyMac or its stockholders.

- 8.

- If the Class A common stockholders do not approve the Reorganization Proposal but the Class B common stockholders approve the Reorganization, what will happen?

Even if no affirmative votes of Class A common stockholders are cast in favor of the Reorganization Proposal, the Reorganization Proposal will be approved if a sufficient number of votes of Class B common stockholders are cast in favor of the Reorganization Proposal. As of the Record Date, 25.2 million shares of Class A Common Stock, 45 shares of Class B Common Stock and 77.5 million Class A Units of PNMAC, respectively, are outstanding. Each holder of Class A Units of PNMAC, other than Existing PennyMac, holds one share of our Class B Common Stock. The shares of Class B Common Stock have no economic rights but entitle the holder, without regard to the number of shares of Class B Common Stock held, to a number of votes on matters presented to our stockholders that is equal to the aggregate number of Class A Units of PNMAC held by such holder. As of the Record Date, holders of Class B Common Stock are entitled to 52.3 million votes based on the aggregate number of Class A Units of PNMAC outstanding as of such date. Further, as of the Record Date, holders of Class B Common Stock are entitled to 52.6 million votes of the shares of Class A Common Stock and Class B Common Stock, or control 67.9% of the votes of the shares of the Class A Common Stock and Class B Common Stock, voting together as a single class. Based upon the percentage of control of the Class B Common Stock of the vote of the shares of Class A Common Stock and Class B Common Stock, voting together as a single class, if sufficient affirmative votes of Class B common stockholders are cast in favor of the Reorganization Proposal, the Reorganization will be approved even if no affirmative votes of Class A common stockholders are cast in favor of the Reorganization Proposal.

- 9.

- Have the Class B common stockholders already agreed to approve or otherwise consented to the Reorganization?

No. There is no arrangement or agreement among the holders of Class B Common Stock, on the one hand, and any of Existing PennyMac, New PennyMac, or Merger Sub, on the other hand (nor, to our knowledge, is there any arrangement or agreement among any of the holders of Class B Common Stock themselves) regarding the approval of the Reorganization Proposal or the Adjournment Proposal at the Special Meeting. Each such holder is entitled to vote however they choose with respect to such proposals. Existing PennyMac is holding the Special Meeting specifically for the purpose of seeking approval from the holders of Class A Common Stock and Class B Common Stock of the Reorganization Proposal and the Adjournment Proposal. Existing PennyMac is furnishing this proxy statement to solicit proxies for approval of these proposals. The outcome of the vote on such proposals is uncertain and any (or all) of the holders of Class B Common Stock may choose not to vote in favor of the Reorganization Proposal or the Adjournment Proposal or both. Moreover, no single holder or group of affiliated holders of Class B Common Stock is capable of controlling the outcome of the vote on either the Reorganization Proposal or the Adjournment Proposal acting alone. The holders of Class B Common Stock, each of whom also separately holds Class A Units of PNMAC, have signed the Contribution Agreement as Contributors, wherein they have agreed to contribute their Class A Units of PNMAC to New PennyMac, but only if the conditions precedent to the Reorganization are satisfied, which conditions include, among other things, approval of the Reorganization Proposal, which remains uncertain and remains within the control of the holders of the Class A Common Stock and Class B Common Stock, voting together as a single class, at the Special Meeting.

3

If, as of the Record Date, a sufficient number of holders of Class B Common Stock—that is, holders of Class B Common Stock entitled to 38.8 million votes based on 77.5 million votes of the shares of Class A Common Stock and Class B Common Stock voting together as a single class, cast votes in favor of the Reorganization Proposal, then the Reorganizational Proposal will pass.

If the holders of a majority of the voting power of the Class A and Class B Common Stock, voting together as a single class, do not vote in favor of the Reorganization Proposal, we would not likely continue to pursue the Reorganization as currently structured and proposed, Existing PennyMac would remain our top-level parent and publicly-listed entity, and our so-called "Up-C" structure would remain in place.

- 10.

- What is the effect of the Reorganization?

As a result of the Reorganization, New PennyMac will replace Existing PennyMac as the publicly held corporation and, through its subsidiaries, will conduct all of the operations currently conducted by Existing PennyMac.

Pursuant to the Reorganization Agreement, Merger Sub will merge with and into Existing PennyMac, with Existing PennyMac continuing as the surviving corporation. In connection with the Merger, each outstanding share of Class A Common Stock of Existing PennyMac will be automatically converted into one share of New Common Stock of New PennyMac, and each outstanding share of Class B Common Stock of Existing PennyMac will automatically be cancelled for no consideration. Further, in connection with the Reorganization, the Contributors will exchange all of their Class A Units of PNMAC on a one-for-one basis for shares of New Common Stock of New PennyMac. Following the Contribution, New PennyMac expects to become the direct holder of approximately 67.5% of the outstanding Class A Units of PNMAC. Existing PennyMac will remain the owner of the remaining approximately 32.5% of the outstanding Class A Units of PNMAC.

Following the completion of the Reorganization, (i) Existing PennyMac will be a wholly-owned subsidiary of New PennyMac, (ii) New PennyMac, as the new holding company, will, through its subsidiaries, conduct all of the operations conducted by Existing PennyMac immediately prior to the Reorganization and (iii) your overall proportionate economic ownership of the entire PNMAC business and your voting control percentage in New PennyMac after the Reorganization will be the same as your current overall proportionate economic ownership of the entire PNMAC business and voting control percentage in Existing PennyMac immediately prior to the Reorganization.

As discussed below under "Description of the Reorganization Proposal—Reasons for the Reorganization Proposal—Our New Proposed Corporate Structure," following completion of the Reorganization, because no Class A Units of PNMAC will be held by any party other than New PennyMac and Existing PennyMac, there will be no future exchanges of Class A Units of PNMAC for shares of Class A Common Stock that generate future tax assets for Existing PennyMac. Existing PennyMac will continue to make payments under the Tax Receivable Agreement (as defined below) with respect to any such exchanges that have already occurred, or that occur prior to the completion of the Reorganization.

- 11.

- Am I being asked to approve any other proposal other than the Reorganization Proposal?

Yes. You are being asked to approve, if necessary or appropriate, the adjournment of the Special Meeting, including to solicit additional proxies in favor of the Reorganization Proposal (the "Adjournment Proposal").

- 12.

- What is the Board's voting recommendation?

- •

- FOR the Reorganization Proposal; and

- •

- FOR the Adjournment Proposal.

Our Board of Directors (the "Board") recommends that you vote as follows:

4

- 13.

- Why are you pursuing Reorganization?

We are asking you to approve the creation of a new holding company above Existing PennyMac to help simplify our overall corporate structure and financial reporting by (i) eliminating Existing PennyMac's so-called "Up-C" structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New PennyMac, and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes, Class A Common Stock and Class B Common Stock, of Existing PennyMac that are authorized, issued and outstanding today. We believe that one of the effects of this Reorganization will be to increase our current market capitalization at our parent-level entity, which could enable certain investors (those with investment position limits tied to percentages of a company's market capitalization) to own larger positions in our stock than before, and could also make shares of New PennyMac Common Stock eligible to be included in certain stock market indices for which shares of Class A Common Stock of Existing PennyMac currently are not eligible. Such eligibility, in turn, could mean an increased demand for shares of New PennyMac Common Stock, which could assist in our stated goal of seeking to maximize long-term stockholder value. For more information, see "Description of the Reorganization Proposal—Reasons for the Reorganization Proposal" on page 37.

- 14.

- Will the management or the businesses of Existing PennyMac or any of its subsidiaries change as a result of the Reorganization?

No. Our management and businesses will not change as a result of the Reorganization.

- 15.

- What will be the name of the public company following the Reorganization?

Effective as of the time of the completion of the Reorganization, Existing PennyMac and New PennyMac will both be renamed. New PennyMac, which will be the public company following the Reorganization, will be renamed "PennyMac Financial Services, Inc." (in order to continue the use of the current public company name for our parent-level public registrant) and Existing PennyMac will be renamed "PNMAC Holdings, Inc." In order to avoid confusion regarding this post-closing name change, we will continue to refer in this proxy statement/prospectus to "New PennyMac" and "New PennyMac Financial Services, Inc." rather than referencing the post-closing name of New PennyMac.

- 16.

- How will being a common stockholder of New PennyMac be different from being a holder of Class A Common Stock of Existing PennyMac?

Your rights as a common stockholder of New PennyMac will be substantially the same as the rights of holders of Class A Common Stock, including rights as to voting and dividends. There are differences, however. You should carefully review the information set forth under the caption "Comparative Rights of Holders of New PennyMac Common Stock and Existing PennyMac Common Stock." For more information, also see "Risk Factors—Risks Related to the Reorganization" and "Description of New PennyMac Capital Stock." You should review this section carefully as some of these differences may be more or less favorable to holders of Class A Common Stock.

Prior to, or upon completion of, the Merger, New PennyMac will adopt an Amended and Restated Certificate of Incorporation, the form of which is attached as Annex II ("New PennyMac's Certificate"), and Amended and Restated Bylaws, the form of which is attached as Annex III ("New PennyMac's Bylaws" and together with New PennyMac's Certificate, "New PennyMac's Organizational Documents").

5

- 17.

- Will the Reorganization have U.S. federal income tax consequences for holders of Class A Common Stock, Class B Common Stock or Class A Units of PNMAC?

The Reorganization is intended to be a tax-free transaction under U.S. federal income tax laws. As a result, you should not recognize any gain or loss for U.S. federal income tax purposes upon the receipt of New Common Stock in the Reorganization, subject to the discussion below in "The Reorganization Proposal—Certain Material U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Consequences to the Equity Owners of the Reorganization." The discussion of the material U.S. federal income tax consequences contained in this registration statement is intended to provide only a general summary, however, and is not a complete description of all potential U.S. federal income tax consequences of the Reorganization. You are urged to consult your own tax advisors concerning the specific tax consequences of the Reorganization to you, including any state, local or non-U.S. tax consequences. For more information, see "The Reorganization Proposal—Certain Material U.S. Federal Income Tax Consequences."

- 18.

- How will the Reorganization be treated for accounting purposes?

For accounting purposes, the Reorganization will be treated as a transaction between entities under common control of an acquisition of noncontrolling interest. Accordingly, the consolidated financial position and results of operations of Existing PennyMac will be included in the consolidated financial statements of New PennyMac on the same basis as currently presented except for the acquisition of noncontrolling interest that will be accounted for as a capital transaction with no resulting gain or loss.

- 19.

- If the Class A and Class B common stockholders approve the Reorganization Proposal, when will the Reorganization occur?

We plan to complete the Reorganization on or about November 1, 2018, provided that our stockholders approve the Reorganization Proposal at the Special Meeting and that all other conditions to the completion of the Reorganization, as set forth in the Reorganization Agreement, have been satisfied or waived on or prior to such date. However, there can be no assurance that the Reorganization will be consummated even if the stockholders approve the Reorganization Proposal. In fact, even if the stockholders approve the Reorganization Proposal, our Board can terminate the Reorganization Agreement at any time prior to the completion of the Reorganization if it determines that, for any reason, the completion of the Reorganization would be inadvisable or not in the best interests of Existing PennyMac or its stockholders.

- 20.

- What will happen to my Existing PennyMac Class A Common Stock as a result of the Reorganization?

In the Reorganization, your shares of Class A Common Stock of Existing PennyMac will automatically be converted into the same number of shares of New Common Stock of New PennyMac. As a result, you will become a stockholder of New PennyMac and your overall proportionate economic ownership of the entire PNMAC business and your voting control percentage in New PennyMac after the Reorganization will be the same as your current overall proportionate economic ownership of the entire PNMAC business and voting control percentage in Existing PennyMac immediately prior to the Reorganization. We intend to apply for the shares of New Common Stock of New PennyMac to be received in the Merger to be listed on the New York Stock Exchange ("NYSE") under Existing PennyMac's current trading symbol, "PFSI," on or before the effective date of the Merger.

6

- 21.

- What will happen to my Existing PennyMac Class B Common Stock as a result of the Reorganization?

In the Reorganization, your shares of Class B Common Stock of Existing PennyMac will automatically be cancelled for no consideration. As a result, holders of Class B Common Stock will receive no continuing equity interest in New PennyMac in exchange for their Class B Common Stock. Holders of Class B Common Stock have waived their appraisal rights in the Reorganization Agreement.

- 22.

- Will the company's CUSIP number change as a result of the Reorganization?

Yes. Following the Reorganization, New PennyMac's CUSIP number will be 68401L100. After New PennyMac changes its name to PennyMac Financial Services, Inc., the CUSIP number will be 70932M107.

- 23.

- Do I have appraisal rights in connection with the Reorganization?

If you are a holder of Class A Common Stock, you will not be entitled to appraisal rights under Section 262 of the DGCL because the only consideration you will receive in the Merger is new shares of publicly listed stock—since your shares of Class A Common Stock are being exchanged on a one-for-one basis for shares of New Common Stock of New PennyMac.

If you are a holder of Class B Common Stock, you would be entitled to appraisal rights and notice of appraisal rights in connection with the Reorganization under Section 262 of the DGCL. However, holders of Class B Common Stock have waived their appraisal rights and the right to receive notice thereof under the Reorganization Agreement.

- 24.

- Who may vote at the Special Meeting?

Holders of Class A and Class B Common Stock at the close of business on the Record Date are entitled to vote at the Special Meeting. As of the Record Date, there were 25.2 million shares of our common stock outstanding (which includes both shares of Class A Common Stock and Class B Common Stock). Holders of Class A Common Stock and Class B Common Stock will vote together as a single class on the proposals at the Special Meeting, in accordance with our Amended and Restated Certificate of Incorporation. Each holder of Class B Common Stock, without regard to the number of shares of Class B Common Stock held, is entitled to a number of votes on matters presented to our stockholders that is equal to the aggregate number of Class A Units of PNMAC held by such holder. As of the Record Date, holders of Class B Common Stock are entitled to 52.3 million votes based on the aggregate number of Class A Units of PNMAC outstanding as of such date. Further, as of the Record Date, holders of Class B Common Stock are entitled to 52.6 million votes of the shares of Class A Common Stock and Class B Common Stock, or control 67.9% of the votes of the shares of the Class A Common Stock and Class B Common Stock, voting together as a single class.

- 25.

- What vote is required for approval of each of the proposals?

Reorganization Proposal. The affirmative vote of a majority of the voting power of all the issued and outstanding shares of common stock of Existing PennyMac, which includes both shares of Class A Common Stock and Class B Common Stock voting together as a single class, is required to approve the Reorganization Proposal. As of the Record Date, the total number of votes represented by all of our issued and outstanding shares of Class A Common Stock and Class B Common Stock that are entitled to vote at the Special Meeting was 77.5 million votes.

7

Adjournment Proposal. Provided a quorum is present, the affirmative vote of a majority of the votes cast, which includes both shares of Class A Common Stock and Class B Common Stock, is required to approve the Adjournment Proposal. If no quorum is present, and the chairman of the meeting declines to exercise his or her authority to adjourn the Special Meeting, the affirmative vote of a majority of the voting power of the shares present, which includes both shares of Class A Common Stock and Class B Common Stock, is required to approve the Adjournment Proposal.

- 26.

- What constitutes a quorum?

As of the Record Date, the total number of votes represented by all of our issued and outstanding shares of common stock that are entitled to vote at the Special Meeting was 77.5 million votes, which is comprised of 25.2 million shares of our Class A Common Stock and 45 shares of our Class B Common Stock which are entitled to 52.3 million votes. A majority of the voting power of the shares issued and outstanding and entitled to vote thereat must be present in person or by proxy to constitute a quorum to transact business at the Special Meeting. If you vote in person, by telephone, over the Internet or by returning a properly executed proxy card, you will be considered a part of that quorum.

A "broker non-vote" on a particular proposal occurs when the broker or nominee does not have discretionary authority to vote on the proposal and is not instructed by the beneficial owner to vote on the proposal. Abstentions and broker non-votes, if any, will be treated as present for the purpose of determining a quorum. Abstentions and broker non-votes, if any, will have the same effect as a vote "AGAINST" the Reorganization Proposal.

If a quorum is present, abstentions and broker non-votes, if any, will have no effect on the approval of the Adjournment Proposal. If no quorum is present, abstentions will have the same effect as a vote "AGAINST" the Adjournment Proposal, but broker non-votes, if any, will have no effect on the approval of the Adjournment Proposal.

- 27.

- Will I receive a Notice of Internet Availability of Proxy Materials?

Under SEC rules, we furnish annual proxy materials to our stockholders on the Internet. However, because these proxy materials are soliciting votes for a business combination under the Reorganization Agreement, we will be mailing printed copies to you. Whether or not you received a Notice of Internet availability of proxy materials by mail for the 2018 Annual Meeting of Stockholders, you will receive a printed copy of the proxy materials for the Special Meeting. Additionally, the printed proxy materials and proxy card will instruct you as to how you may access and review the proxy materials on the Internet and vote your shares online. You may also vote by telephone or mail following the proxy card instructions included in the proxy materials. We expect to commence mailing the proxy materials to our stockholders on or about , 2018.

- 28.

- Who can attend the Special Meeting?

All of our stockholders as of the Record Date are invited to attend the Special Meeting, although seating is limited. If your shares are held in the name of a broker, bank or other nominee, you will need to bring a proxy or letter from that nominee that confirms you are the beneficial owner of those shares.

- 29.

- What shares are included in the proxy card?

Your proxy card represents all shares of our Class A Common Stock or Class B Common Stock that are registered in your name. If your shares of Class A Common Stock or Class B Common Stock are held through a broker, bank or other nominee, you will receive either a voting

8

instruction form or a proxy card from the broker, bank or other nominee instructing you on how to vote your shares.

- 30.

- How do I vote if I am a registered holder as of the Record Date or I own shares through a broker, bank or other nominee?

- •

- Online: Go to the website www.proxyvote.com and follow the instructions on the proxy card to

view the proxy materials online and vote your shares through the Internet. Internet voting is available 24 hours a day, although your vote by Internet must be received by 11:59 p.m.

Eastern Time, October 23, 2018.

- •

- Telephone:

- •

- Please review your proxy card for instructions on how to vote by phone. Telephone voting is available 24 hours a day,

although your vote must be received by 11:59 p.m. Eastern Time, October 23, 2018.

- •

- Mail:

- •

- Please review your proxy card for instructions on how to vote by mail.

Registered stockholders of Class A Common Stock and Class B Common Stock as of the Record Date may submit a proxy by mail, telephone or Internet by following the instructions on the proxy card using any of the following methods:

If you choose to submit your proxy with voting instructions by telephone or through the Internet, you will be required to provide your assigned control number shown on the proxy card before your proxy and voting instructions will be accepted. Once you have indicated how you want to vote in accordance with those instructions, you will receive confirmation that your proxy has been submitted successfully by telephone or through the Internet.

If you hold shares of Class A Common Stock in "street name" through a broker, bank, custodian, fiduciary or other nominee, you should review the separate notice supplied by that firm to determine whether and how you may vote by mail, telephone or through the Internet. To vote these shares, you must use the appropriate voting instruction form or toll-free telephone number or website address specified on that firm's voting instruction form for beneficial owners. If you have not received such voting instructions or require further information regarding such voting instructions, you should contact your bank, broker or other nominee. Brokers, banks or other nominees who hold shares of Class A Common Stock for a beneficial owner of those shares typically have the authority to vote in their discretion on "routine" proposals when they have not received instructions from beneficial owners. However, brokers, banks and other nominees are not allowed to exercise their voting discretion with respect to the approval of matters that are "non-routine" without specific instructions from the beneficial owner. All of the proposals at the Special Meeting are non-routine and non-discretionary. Broker non-votes are shares held by a broker, bank or other nominee that are represented at the meeting but with respect to which the broker, bank or other nominee is not instructed by the beneficial owner of such shares to vote on the particular proposal, and the broker, bank or other nominee does not have discretionary voting power on such proposal. If you hold shares of Class A Common Stock in "street name," your broker or other nominee will vote your shares only if you provide instructions on how to vote by filling out and returning the voter instruction form sent to you.

All shares of Class A Common Stock and Class B Common Stock represented by validly executed proxies will be voted at the Special Meeting, and such shares will be voted in accordance with the instructions provided. If no voting specification is made on your returned proxy card, David A. Spector, our President and Chief Executive Officer, or Derek W. Stark, our Secretary, as

9

individuals named on the proxy card, will vote FOR the Reorganization Proposal and FOR the Adjournment Proposal.

- 31.

- How will broker non-votes be treated?

We will treat broker non-votes as present to determine whether or not there is a quorum at the Special Meeting, but they will not be treated as entitled to vote on the matters, if any, for which the broker indicates it does not have discretionary authority. This means that broker non-votes (i) will have the same effect as a vote AGAINST the Reorganization Proposal and (ii) will have no effect, assuming a quorum is present, on whether the Adjournment Proposal passes.

- 32.

- What happens if I sell my shares of Class A Common Stock after the Record Date but before the Special Meeting or before the Closing?

- •

- You will retain your right to vote those shares at the Special Meeting.

- •

- You will not have the right to receive the Merger Consideration in respect of your shares of Class A Common Stock.

The Record Date for the Special Meeting is earlier than the date of the Special Meeting and earlier than the date that the Reorganization is expected to be completed. If you sell or otherwise transfer your shares of Class A Common Stock after the Record Date but before the date of the Special Meeting:

- 33.

- Can I change my vote once I vote by mail, by telephone or over the Internet?

Yes. You have the right to change or revoke your proxy (1) at any time before the Special Meeting by (a) notifying our Secretary in writing, (b) returning a later-dated proxy card or (c) entering a later dated telephone or Internet vote; or (2) by voting in person at the Special Meeting.

- 34.

- Who will count the vote?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes for shares held in "street name" and the votes of stockholders of record. Representatives of our Company will serve as the Inspector of Elections and determine the final results.

- 35.

- Is my vote confidential?

Yes. Your vote is confidential.

- 36.

- What percentage of the outstanding shares do directors and executive officers hold?

On September 7, 2018, the Record Date for the Special Meeting, directors, executive officers and their affiliates beneficially owned shares representing approximately 64.0% of the voting power of all the issued and outstanding shares of common stock, which includes our Class A Common Stock and Class B Common Stock voting together as a single class.

Certain of our directors, executive officers and their affiliates may have different interests in the Reorganization than our stockholders generally. For more information, see "Description of the Reorganization Proposal—Interests of Certain Directors and Executive Officers in the Reorganization."

- 37.

- Where can I find the voting results of the meeting?

We intend to announce preliminary voting results at the Special Meeting. We will report the final results on a Current Report on Form 8-K filed with the SEC no later than November 6, 2018. You

10

can obtain a copy of the Form 8-K by visiting our website at ir.pennymacfinancial.com, by calling the SEC at 1-800-SEC-0330 for the information on the public reference room or through the SEC's website at www.sec.gov.

If you have any questions about voting your shares or attending the Special Meeting, please call our Secretary at (818) 224-7442.

- 38.

- Who do I contact if I have questions about the Reorganization Proposal?

You may contact us at:

PennyMac

Financial Services, Inc.

3043 Townsgate Road

Westlake Village, California 91361

Attn: Christopher Oltmann, Investor Relations

Tel: (818) 224-7028

QUESTIONS AND ANSWERS ABOUT THE DISTRIBUTION

- 1.

- What is the "Distribution"?

On August 2, 2018, the Board declared a special, one-time cash dividend of $0.40 per share of Class A Common Stock of Existing PennyMac (the "Distribution") to holders of record of Class A Common Stock as of August 13, 2018. The Distribution was distributed on or about August 30, 2018. Holders of Class A Units of PNMAC to be contributed in the Contribution and holders of Class B Common Stock of Existing PennyMac to be cancelled in the Merger will not be entitled to receive the Distribution in respect thereof.

The Distribution generally represents (i) historical tax distributions from PNMAC to Existing PennyMac that were in excess of the actual tax liability of Existing PennyMac and (ii) certain tax refunds receivable by Existing PennyMac, in each case, as reported on the June 30, 2018 balance sheet of Existing PennyMac.

- 2.

- Am I being asked to vote on the Distribution?

No. The Distribution does not require stockholder approval. The Board declared the Distribution on August 2, 2018 to holders of record of Class A Common Stock as of August 13, 2018. The Distribution occurred—prior to the date of the Special Meeting—on or about August 30, 2018.

- 3.

- Was the Distribution contingent upon the Contribution and the Merger?

No. The Distribution occurred on or about August 30, 2018. Accordingly, the Distribution was paid prior to the record date for the Special Meeting and prior to the convening of the Special Meeting. As such, the Distribution is not contingent in any way upon the Contribution and Merger.

- 4.

- Are holders of outstanding equity incentive awards entitled to receive the Distribution?

No. Holders of outstanding equity incentive awards (whether vested or unvested) will not be entitled to receive the Distribution and no adjustment will be made to any such awards in connection with the Distribution.

- 5.

- When was the Distribution paid?

The Distribution was paid on or about August 30, 2018.

11

SUMMARY OF THE REORGANIZATION PROPOSAL

This section highlights key aspects of the Reorganization Proposal, including the Reorganization Agreement, that are described in greater detail elsewhere in the proxy statement/prospectus. It does not contain all of the information that may be important to you. To better understand the Reorganization Proposal, and for a more complete description of the legal terms of the Reorganization Agreement, you should read this entire proxy statement/prospectus carefully, including the Annexes and the additional documents incorporated by reference. You can find information with respect to these additional documents in "Where You Can Find Additional Information."

We are asking you to approve the creation of a new holding company above Existing PennyMac to help simplify its overall corporate structure and financial reporting by (i) eliminating Existing PennyMac's so-called "Up-C" structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New PennyMac and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes, Class A Common Stock and Class B Common Stock, of Existing PennyMac that are authorized, issued and outstanding today. We believe that one of the effects of this Reorganization will be to increase our current market capitalization at our parent-level entity, which could enable certain investors (those with investment position limits tied to percentages of a company's market capitalization) to own larger positions in our stock than before, and could also make shares of New PennyMac Common Stock eligible to be included in certain stock market indices for which shares of Class A Common Stock of Existing PennyMac currently are not eligible. Such eligibility, in turn, could mean an increased demand for shares of New PennyMac Common Stock, which could assist in our stated goal of seeking to maximize long-term stockholder value.

The Reorganization Proposal is for stockholders to adopt and approve the Reorganization Agreement, and thereby adopt and approve the Reorganization. A copy of the Reorganization Agreement is attached as Annex I to this proxy statement/prospectus. You are encouraged to read the Reorganization Agreement carefully.

PennyMac Financial Services, Inc.

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

PennyMac Financial Services, Inc. ("Existing PennyMac") is headquartered in Westlake Village, California, and is our current top-level parent entity. Existing PennyMac was incorporated in Delaware in December 2012 in connection with our initial public offering. Existing PennyMac operates and controls all of the business and affairs, and consolidates the financial results, of PNMAC, which is described further below. Following the Reorganization, Existing PennyMac will become a wholly-owned subsidiary of New PennyMac, shares of Class A Common Stock will be automatically converted, on a one-for-one basis, into shares of New Common Stock of New PennyMac and shares of Class B Common Stock will be automatically cancelled for no consideration.

New PennyMac Financial Services, Inc.

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

12

New PennyMac, a Delaware corporation, is a newly formed, direct, wholly-owned subsidiary of Existing PennyMac. Existing PennyMac formed New PennyMac for the purpose of participating in the transactions contemplated by the Reorganization Agreement. Prior to the Reorganization, New PennyMac will have no assets or operations other than those incident to its formation. If we complete the Reorganization, New PennyMac will replace Existing PennyMac as the publicly held corporation and, through its subsidiaries, will conduct all of the operations currently conducted by Existing PennyMac.

New PennyMac Merger Sub, LLC

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

Merger Sub, a Delaware limited liability company, is a newly formed, direct, wholly-owned subsidiary of New PennyMac. New PennyMac caused Merger Sub to be formed for the purpose of participating in the transactions contemplated by the Reorganization Agreement. Prior to the Reorganization, Merger Sub will have no assets or operations other than those incident to its formation.

Private National Mortgage Acceptance Company, LLC

3043 Townsgate Road

Westlake Village, California 91361

(818) 224-7442

PNMAC, a Delaware limited liability company, was founded in 2008 by members of our executive leadership team and two strategic partners, BlackRock Mortgage Ventures, LLC ("BlackRock") and HC Partners, LLC, formerly known as Highfields Capital Investments, LLC, together with its affiliates ("Highfields"). PNMAC is a specialty financial services firm with a comprehensive mortgage platform and integrated business primarily focused on the production and servicing of U.S. residential mortgage loans (activities which we refer to as mortgage banking) and the management of investments related to the U.S. mortgage market. We believe that our operating capabilities, specialized expertise, access to long-term investment capital and our management's experience across all aspects of the mortgage business will allow us to profitably grow these activities and capitalize on other related opportunities as they arise in the future.

The Contributors are comprised of 45 separate entities and individuals, calculated as of the Record Date, and represent all of the holders of Class A Units of PNMAC other than Existing PennyMac. The Contributors include, among others:

- •

- BlackRock;

- •

- Highfields;

- •

- Stanford L. Kurland, our Executive Chairman and a member of our Board of Directors;

- •

- David A. Spector, our President and Chief Executive Officer and a member of our Board of Directors;

- •

- Anne D. McCallion, our Senior Managing Director and Chief Enterprise Operations Officer and a member of our Board of Directors;

- •

- Andrew S. Chang, our Senior Managing Director and Chief Financial Officer;

- •

- Vandad Fartaj, our Senior Managing Director and Chief Capital Markets Officer;

13

- •

- Doug Jones, our Senior Managing Director and Chief Mortgage Banking Officer;

- •

- David M. Walker, our Senior Managing Director and Chief Risk Officer;

- •

- Matthew Botein, a member of our Board of Directors and a former managing director at BlackRock Inc., a global investment management firm

that is affiliated with BlackRock, and who is currently a managing partner of Gallatin Point Capital;

- •

- Joseph Mazzella, a member of our Board of Directors and a former managing director and general counsel at Highfields Capital

Management LP, an investment management firm affiliated with Highfields;

- •

- Farhad Nanji, a member of our Board of Directors and a former managing director at Highfields Capital Management LP, an investment

management firm affiliated with Highfields, and who is currently a co-founder of MFN Partners Management L.P.; and

- •

- Mark Wiedman, a member of our Board of Directors and global head of the iShares business of BlackRock Inc., a global investment management firm that is affiliated with BlackRock.

Reasons for the Reorganization

We are asking you to approve the creation of a new holding company above Existing PennyMac to help simplify its overall corporate structure and financial reporting by (i) eliminating Existing PennyMac's so-called "Up-C" structure and causing all equityholders to hold all of their equity interests in our business at the same top-level parent entity, which will be New PennyMac, and (ii) transitioning to a single class of common stock held by all stockholders, as opposed to the two classes, Class A Common Stock and Class B Common Stock, of Existing PennyMac that are authorized, issued and outstanding today. We believe that one of the effects of this Reorganization will be to increase our current market capitalization at our parent-level entity, which will assist in our stated goal of seeking to maximize long-term stockholder value. At this time, there is no trading market for our Class B Common Stock and Class A Units of PNMAC. After completion of the Reorganization, our Class B Common Stock will be cancelled and our Class A Units of PNMAC will be exchanged on a one-for-one basis for shares of New Common Stock of New PennyMac. We believe this exchange of Class A Units for New Common Stock will increase our market capitalization at our parent-level entity by approximately 200%. The increase in our market capitalization at our parent-level entity could enable certain investors (those with investment position limits tied to percentages of a company's market capitalization) to own larger positions in our stock than before, and could also make shares of New Common Stock eligible to be included in certain stock market indices for which shares of Class A Common Stock currently are not eligible. Such eligibility, in turn, could mean an increased demand for shares of New Common Stock. These potential benefits may not be obtained if market conditions or other circumstances prevent us from taking advantage of the new attributes that we expect the Reorganization will afford us.

Approval of the Reorganization Proposal requires the affirmative vote of a majority of the voting power of all the issued and outstanding shares of common stock of Existing PennyMac, which includes both shares of Class A Common Stock and Class B Common Stock voting together as a single class.

Existing PennyMac currently owns all of the issued and outstanding common stock of New PennyMac and New PennyMac currently owns all of the issued and outstanding membership interests of Merger Sub. Pursuant to the Reorganization Agreement, the Contributors will voluntarily contribute all of their Class A Units of PNMAC in exchange for the issuance by New PennyMac to such

14

Contributors of an aggregate number of shares of New Common Stock equal in number to the Class A Units of PNMAC so contributed. Further, pursuant to the Reorganization Agreement, Highfields, BlackRock, each of the Company's directors and each of the Company's "officers" as defined for purposes of Section 16 under the Exchange Act agreed to certain transfer restrictions (such persons, the "Restricted Transferors"). Prior to August 14, 2018 (which was the date following the record date for the Distribution), these transfer restrictions prohibited exchanges of Class A Units of PNMAC or shares of Class B Common Stock for shares of Class A Common Stock of Existing PennyMac or the disposition of any Class A Units of PNMAC or shares of Class B Common Stock. Notwithstanding this general prohibition, the transfer restrictions allowed exchanges, and any related sales of shares of Class A Common Stock of Existing PennyMac, pursuant to 10b5-1 trading plans that were established prior to the date of the Reorganization Agreement. Also, Contributors waived their right to receive the Distribution with respect to any shares of Class A Common Stock of Existing PennyMac that were issued to them in exchange for Class A Units of PNMAC after the date of the Reorganization Agreement.

Following the approval of the Reorganization Agreement by Existing PennyMac stockholders of Class A Common Stock and Class B Common Stock, voting together as a single class, and the satisfaction or waiver of the other conditions to the Reorganization specified in the Reorganization Agreement (which are described below), and simultaneous with the Contribution described above, Merger Sub will merge with and into Existing PennyMac, with Existing PennyMac continuing as the surviving corporation, and the separate corporate existence of Merger Sub will cease. As a result of the Reorganization:

- •

- Each Class A Unit of PNMAC contributed by the Contributors will be exchanged for one share of New Common Stock of New PennyMac and

current holders of Class A Units of PNMAC will become stockholders of New PennyMac;

- •

- Each outstanding share of Class A Common Stock of Existing PennyMac will automatically be converted into one share of New Common Stock

of New PennyMac and current stockholders of Class A Common Stock of Existing PennyMac will become stockholders of New PennyMac;

- •

- Each outstanding share of Class B Common Stock of Existing PennyMac will automatically be cancelled for no consideration;

- •

- Existing PennyMac will become a wholly-owned subsidiary of New PennyMac; and

- •

- New PennyMac, as the new holding company, will, through its subsidiaries, conduct all of the operations currently conducted by Existing PennyMac.

Treatment of Common Stock in the Reorganization

Each outstanding share of Class A Common Stock will automatically be converted into one share of New Common Stock of New PennyMac. Each outstanding share of Class B Common Stock will automatically be cancelled for no consideration. Your overall proportionate economic ownership of the entire PNMAC business and your voting control percentage in New PennyMac after the Reorganization will be the same as your current overall proportionate economic ownership of the entire PNMAC business and voting control percentage in Existing PennyMac immediately prior to the Reorganization.

Treatment of Existing PennyMac Equity Incentive Plans and Outstanding Awards in connection with the Reorganization

At the time of the Reorganization, New PennyMac will assume each Existing PennyMac equity incentive plan (collectively, the "Existing PennyMac Plans"), including all performance share awards, restricted share awards, restricted stock units and other incentive awards covering shares of Existing PennyMac Class A Common Stock, whether vested or not vested, that are then outstanding under each

15

Existing PennyMac Plan. The same number of shares reserved under each Existing PennyMac Plan will be reserved by New PennyMac, and the terms and conditions that are in effect immediately prior to the Reorganization under each outstanding incentive award assumed by New PennyMac will continue in full force and effect after the Reorganization, except that the shares of Class A Common Stock reserved under the plans and issuable under each such award will be replaced by shares of New Common Stock of New PennyMac. Incentive awards granted outside of the U.S. will generally be treated as described above, except to the extent required by local law.

No adjustment will be made to any outstanding equity incentive awards (whether vested or unvested) in connection with the payment of the Distribution.

Conditions to Completion of the Reorganization

We will complete the Reorganization only if each of the following conditions is satisfied or waived:

- •

- The absence of any stop order suspending the effectiveness of the registration statement, of which this proxy statement/prospectus

forms a part, relating to the New Common Stock of New PennyMac to be issued in the Reorganization;

- •

- The approval of the Reorganization Proposal by the affirmative vote of at least a majority of the voting power of all issued and outstanding

shares of common stock of Existing PennyMac, with Class A Common Stock and Class B Common Stock voting together as a single class;

- •

- The receipt of approval for listing on the NYSE of shares of New Common Stock of New PennyMac to be issued in the Reorganization;

- •

- The absence of any order or proceeding that would prohibit or make illegal completion of the Reorganization;

- •

- The receipt by Existing PennyMac of a legal opinion of Goodwin Procter LLP to the effect that for U.S. federal income tax purposes, the

Reorganization should qualify as a "reorganization" within the meaning of Section 368(a) of the Code and/or a transfer described in Section 351(a) of the Code; and

- •

- The receipt of all material approvals, licenses and certifications from, and notifications and filings to, governmental entities and non-governmental third parties required to be made or obtained in connection with the Reorganization.

Termination of the Reorganization Agreement

The Reorganization Agreement may be terminated at any time prior to the completion of the Reorganization (even after approval by our stockholders) by (i) action of the Board if it determines that, for any reason, the completion of the transactions provided for therein would be inadvisable or not in the best interests of our Company or our stockholders or (ii) written notice between Existing PennyMac, New PennyMac, Merger Sub and PNMAC on the one hand and certain Contributors holding a majority of the Class A Units then outstanding (including BlackRock and Highfields) on the other hand—if the Reorganization has not occurred nine months after the date of the Reorganization Agreement.

Certain Material U.S. Federal Income Tax Consequences

The Reorganization is conditioned on, among other things, Existing PennyMac's receipt of a written opinion from Goodwin Procter LLP, tax counsel to Existing PennyMac, to the effect that for U.S. federal income tax purposes the Reorganization should qualify as a "reorganization" within the meaning of Section 368(a) of the Code and/or a transfer described in Section 351(a) of the Code. As a result, you should not recognize any gain or loss for U.S. federal income tax purposes upon the receipt

16

of New Common Stock of New PennyMac in exchange for your shares of Class A Common Stock, Class B Common Stock and/or, as applicable, Class A Units of PNMAC, subject to the discussion below in "Description of the Reorganization Proposal—Certain Material U.S. Federal Income Tax Consequences—U.S. Federal Income Tax Consequences to the Equity Owners of the Reorganization."

The discussion of the material U.S. federal income tax consequences contained in this registration statement is intended to provide only a general summary and is not a complete description of all potential U.S. federal income tax consequences of the Reorganization. The discussion does not address tax consequences that may vary with, or are dependent on, individual circumstances. In addition, the discussion does not address the effects of any non-U.S., state or local tax laws. For more information, see "The Reorganization Proposal—Certain Material U.S. Federal Income Tax Consequences."

Security Ownership of Directors and Executive Officers