Form 8-K SUNTRUST BANKS INC For: Sep 12

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 | ||||

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) | September 12, 2018 | |

SunTrust Banks, Inc. |

(Exact name of registrant as specified in its charter) |

Georgia | 001-08918 | 58-1575035 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

303 Peachtree St., N.E., Atlanta, Georgia | 30308 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code | (800) 786- 8787 |

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

SunTrust Banks, Inc. (the “Registrant” or “SunTrust”) is scheduled to make a presentation at the Barclays Global Financial Services Conference in New York City on Wednesday, September 12, 2018 at 9:00 a.m. (ET). Allison Dukes, Corporate Executive Vice President and Chief Financial Officer of SunTrust, will make SunTrust's presentation. A copy of the materials to be used by the Registrant during its presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Such materials will also be available on the Registrant's website at investors.suntrust.com.

Information contained on the Registrant's website is not incorporated by reference into this Current Report on Form 8-K. The information in the preceding paragraph, as well as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section. Such information may only be incorporated by reference into another filing under the Exchange Act or the Securities Act of 1933 if such subsequent filing specifically references Section 7.01 of this Current Report on Form 8-K. All information in the presentation materials speak as of the date thereof, and the Registrant does not assume any obligation to update such information in the future. In addition, the Registrant disclaims any inference regarding the materiality of such information which otherwise may arise as a result of its furnishing such information under Item 7.01 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1. Materials to be presented September 12, 2018 (furnished with the Commission as a part of this Form 8-K).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SUNTRUST BANKS, INC. | ||||

(Registrant) | ||||

Date: September 12, 2018 | By: | /s/ Curt Phillips | ||

Curt Phillips, Senior Vice President, Assistant | ||||

General Counsel and Assistant Corporate Secretary | ||||

2018 BARCLAYS GLOBAL FINANCIAL SERVICES CONFERENCE Allison Dukes, Chief Financial Officer September 12, 2018 © 2018 SunTrust Banks, Inc. SunTrust is a federally registered trademark of SunTrust Banks, Inc.

IMPORTANT CAUTIONARY STATEMENT The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. We reconcile those measures to GAAP measures within the presentation or in the appendix or refer to the location where the reconciliation can be found in a prior release or presentation by the Company. The Company presents the following non-GAAP measures because many investors find them useful. Specifically: • Consistent with Securities and Exchange Commission Industry Guide 3, the Company presents efficiency ratios on a fully taxable equivalent (“FTE”) basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments using applicable federal and state income tax rates to increase tax-exempt interest income to a taxable-equivalent basis. • The Company presents certain capital information on a tangible basis, including return on average tangible common equity. These measures exclude the after-tax impact of purchase accounting intangible assets. • Similarly, the Company presents Efficiency ratio-FTE, Tangible efficiency ratio-FTE, and Adjusted tangible efficiency ratio-FTE. The efficiency ratio is computed by dividing Noninterest expense by Total revenue. Efficiency ratio-FTE is computed by dividing Noninterest expense by Total revenue-FTE. Tangible efficiency ratio-FTE excludes the amortization related to intangible assets and certain tax credits. Adjusted tangible efficiency ratio-FTE removes the impact of certain material and potentially non-recurring items from the calculation of Tangible efficiency ratio-FTE. • The Company presents adjusted EPS which excludes the impact of certain material and potentially non-recurring items. This presentation contains forward-looking statements. Statements regarding future levels of earnings per share, efficiency ratios, capital returns, investment banking market share, the number of full service branches, common equity tier 1 ratio, technology enhancements (including potential cost savings as a result thereof), the percentage of clients that will be using our digital mortgage application, the percentage of client solutions that will be available via digital platforms and the volatility of the Company’s financial performance through different economic cycles are forward looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “strategies,” “goals,” “initiatives,” “opportunity,” “potentially,” “probably,” “projects,” “outlook,” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such statements are based upon the current beliefs and expectations of management and on information currently available to management. They speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2017 and in other periodic reports that we file with the SEC. Those factors include: current and future legislation and regulation could require us to change our business practices, reduce revenue, impose additional costs, or otherwise adversely affect business operations or competitiveness; we are subject to stringent capital adequacy and liquidity requirements and our failure to meet these would adversely affect our financial condition; the monetary and fiscal policies of the federal government and its agencies could have a material adverse effect on our earnings; our financial results have been, and may continue to be, materially affected by general economic conditions, and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; changes in market interest rates or capital markets could adversely affect our revenue and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; our earnings may be affected by volatility in mortgage production and servicing revenues, and by changes in carrying values of our servicing assets and mortgages held for sale due to changes in interest rates; interest rates on our outstanding financial instruments might be subject to change based on regulatory developments, which could adversely affect our revenue, expenses, and the value of those financial instruments; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; we are subject to credit risk; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we rely on the mortgage secondary market and GSEs for some of our liquidity; loss of customer deposits could increase our funding costs; any reduction in our credit rating could increase the cost of our funding from the capital markets; we are subject to litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, or borrower fraud, and this could harm our liquidity, results of operations, and financial condition; we face risks as a servicer of loans; consumers and small businesses may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; negative public opinion could damage our reputation and adversely impact business and revenues; we may face more intense scrutiny of our sales, training, and incentive compensation practices; we rely on other companies to provide key components of our business infrastructure; competition in the financial services industry is intense and we could lose business or suffer margin declines as a result; we continually encounter technological change and must effectively develop and implement new technology; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our framework for managing risks may not be effective in mitigating risk and loss to us; our controls and procedures may not prevent or detect all errors or acts of fraud; we are at risk of increased losses from fraud; our operational and communications systems and infrastructure may fail or may be the subject of a breach or cyber-attack that, if successful, could adversely affect our business and disrupt business continuity; a disruption, breach, or failure in the operational systems and infrastructure of our third party vendors and other service providers, including as a result of cyber-attacks, could adversely affect our business; natural disasters and other catastrophic events could have a material adverse impact on our operations or our financial condition and results; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; our accounting policies and processes are critical to how we report our financial condition and results of operation, and they require management to make estimates about matters that are uncertain; depressed market values for our stock and adverse economic conditions sustained over a period of time may require us to write down some portion of our goodwill; our stock price can be volatile; we might not pay dividends on our stock; our ability to receive dividends from our subsidiaries or other investments could affect our liquidity and ability to pay dividends; and certain banking laws and certain provisions of our articles of incorporation may have an anti-takeover effect. 2

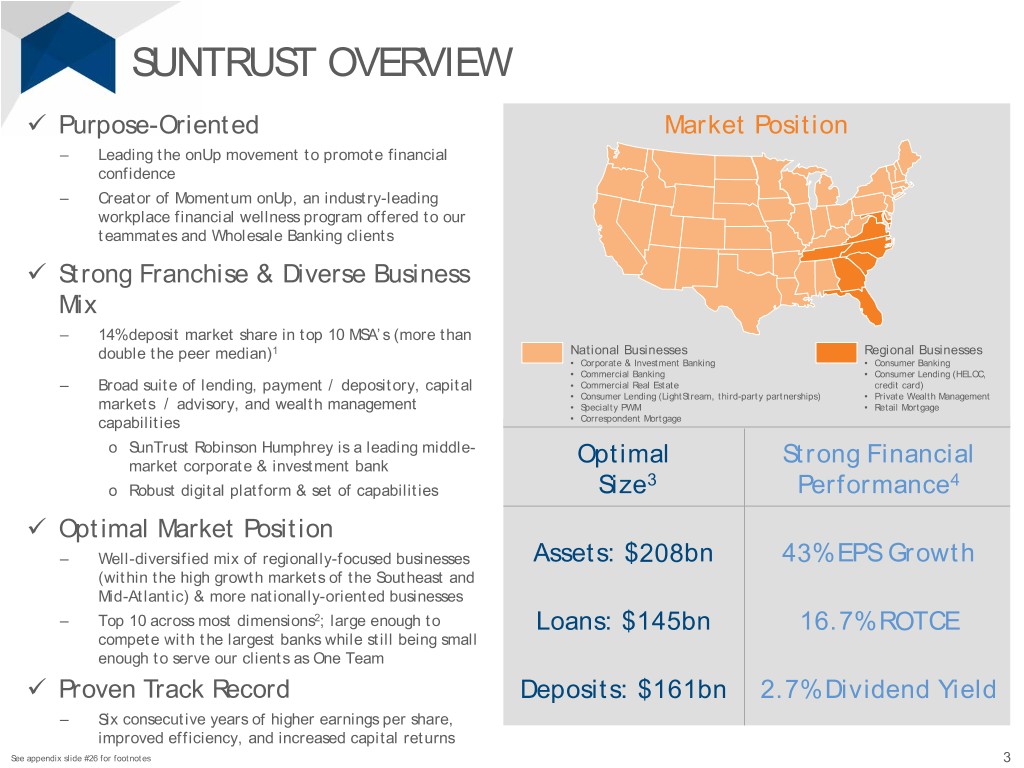

SUNTRUST OVERVIEW Purpose-Oriented Market Position – Leading the onUp movement to promote financial confidence – Creator of Momentum onUp, an industry-leading workplace financial wellness program offered to our teammates and Wholesale Banking clients Strong Franchise & Diverse Business Mix – 14% deposit market share in top 10 MSA’s (more than double the peer median)1 National Businesses Regional Businesses • Corporate & Investment Banking • Consumer Banking • Commercial Banking • Consumer Lending (HELOC, – Broad suite of lending, payment / depository, capital • Commercial Real Estate credit card) • Consumer Lending (LightStream, third-party partnerships) • Private Wealth Management markets / advisory, and wealth management • Specialty PWM • Retail Mortgage capabilities • Correspondent Mortgage o SunTrust Robinson Humphrey is a leading middle- market corporate & investment bank Optimal Strong Financial 3 4 o Robust digital platform & set of capabilities Size Performance Optimal Market Position – Well-diversified mix of regionally-focused businesses Assets: $208bn 43% EPS Growth (within the high growth markets of the Southeast and Mid-Atlantic) & more nationally-oriented businesses – Top 10 across most dimensions2; large enough to Loans: $145bn 16.7% ROTCE compete with the largest banks while still being small enough to serve our clients as One Team Proven Track Record Deposits: $161bn 2.7% Dividend Yield – Six consecutive years of higher earnings per share, improved efficiency, and increased capital returns See appendix slide #26 for footnotes 3

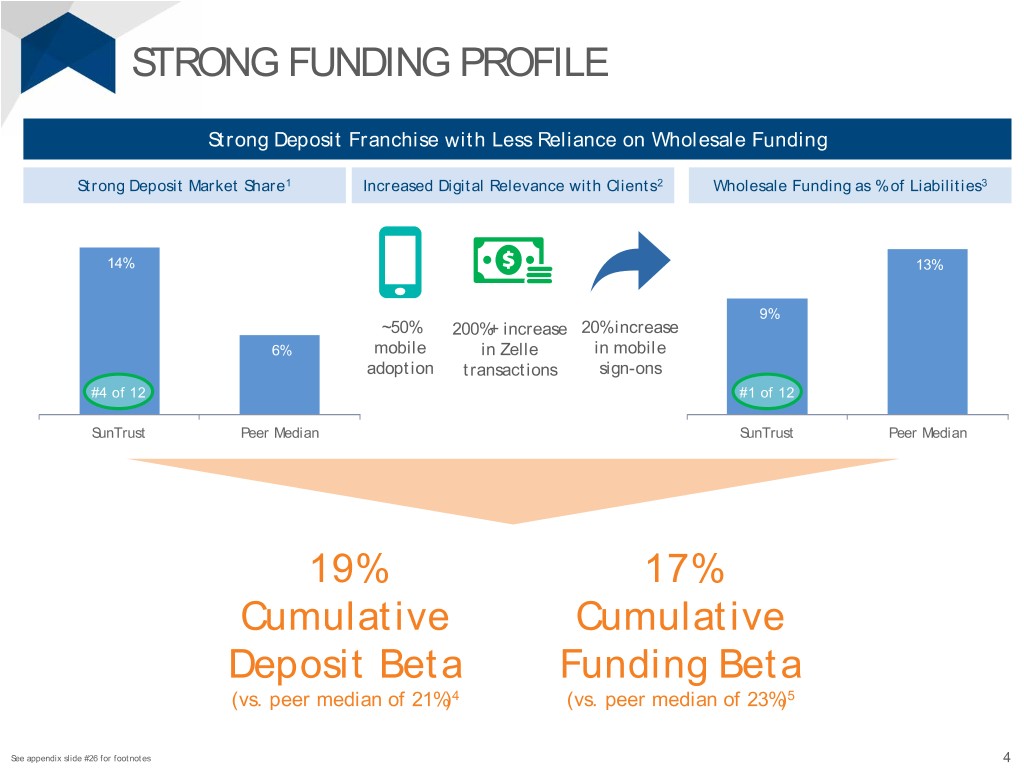

STRONG FUNDING PROFILE Strong Deposit Franchise with Less Reliance on Wholesale Funding Strong Deposit Market Share1 Increased Digital Relevance with Clients2 Wholesale Funding as % of Liabilities3 14% 13% 9% ~50% 200%+ increase 20% increase 6% mobile in Zelle in mobile adoption transactions sign-ons #4 of 12 #1 of 12 SunTrust Peer Median SunTrust Peer Median 19% 17% Cumulative Cumulative Deposit Beta Funding Beta (vs. peer median of 21%)4 (vs. peer median of 23%)5 See appendix slide #26 for footnotes 4

INVESTMENT THESIS 2017 marked the 6th consecutive year of improvement across key metrics; off to a good start in 1H 18 1 2 3 Strong & Diverse Franchise Improving Efficiency Strong Capital Position Investing in Growth & Returns Supports Growth (Earnings per share1) (Adjusted tangible efficiency ratio2) (Dividends & share buybacks as a % of net income) $4.09 71.5% 89% $3.58 $3.60 $3.24 73% $2.74 66.9% 62% $2.19 65.3% 48% 63.3% 62.6% 62.0% 26% $0.94 61.0% 8% 11% 2011 2012 2013 2014 2015 2016 2017 2011 2012 2013 2014 2015 2016 2017 2011 2012 2013 2014 2015 2016 2017 ~7 Year Total Shareholder Return: 375% (peer median: 183%3) 1. 2012, 2013, 2014, and 2017 values represent adjusted earnings per share. The impact of excluding discrete items was ($1.40), $0.33, $0.01, and ($0.39) for 2012, 2013, 2014, and 2017, respectively. Please refer to appendix slide #25 for GAAP reconciliations 2. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions. There were no adjustments in 2011, 2015, and 2016. GAAP efficiency ratios were 73.0%, 60.0%, 72.3%, 67.9%, 64.2%, 63.6%, and 64.1% for 2011, 2012, 2013, 2014, 2015, 2016, and 2017, respectively. Please refer to appendix slide #24 for GAAP reconciliations 3. Source: Bloomberg. Reflects 12/31/2011 – 9/6/2018. Peer group consists of BAC, BBT, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC. Dividends assumed to be reinvested in same security 5

1 STRONG & DIVERSE FRANCHISE Investing in Growth

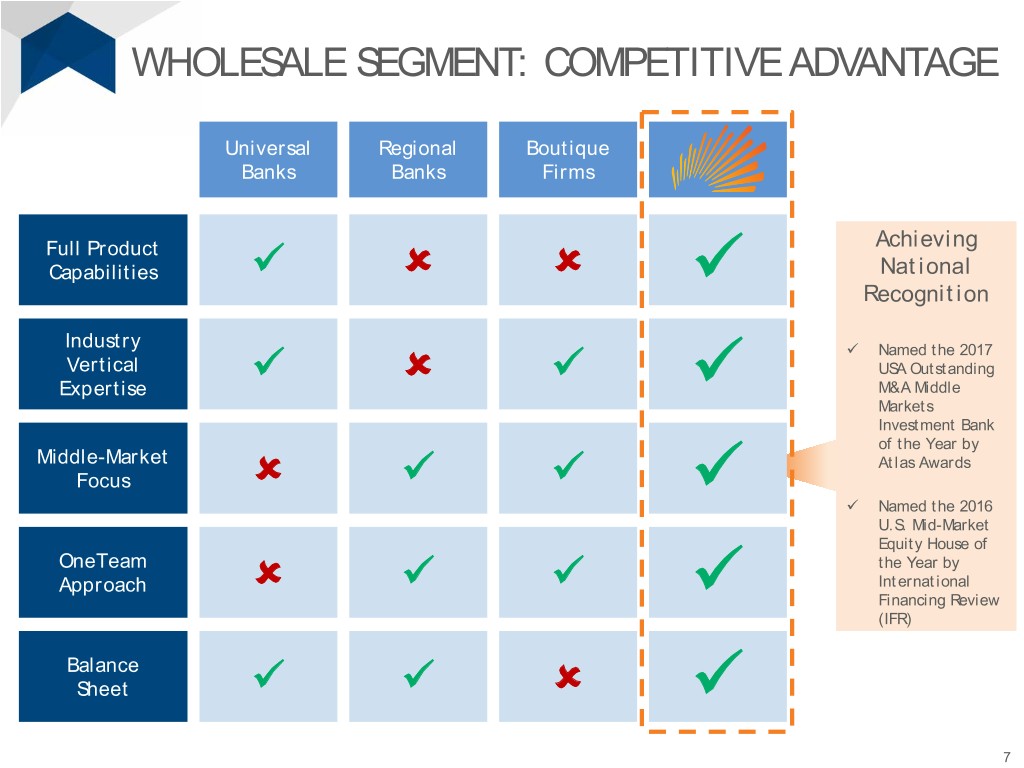

WHOLESALE SEGMENT: COMPETITIVE ADVANTAGE Universal Regional Boutique Banks Banks Firms Full Product Achieving Capabilities National Recognition Industry Named the 2017 Vertical USA Outstanding Expertise M&A Middle Markets Investment Bank of the Year by Middle-Market Atlas Awards Focus Named the 2016 U.S. Mid-Market Equity House of OneTeam the Year by Approach International Financing Review (IFR) Balance Sheet 7

INVESTMENT BANKING: SUSTAINABLE GROWTH Proven Success with Future Growth Potential $599 $494 ~2-3% $461 Current market $404 share1 $341 $355 $311 $315 $270 $232 IB ~5% Income ($MM) Long-term potential 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 The Path to ~5% Market Share: Build on Existing Momentum 2 12% 11% 15% 30% Recent Improvement Grow Left Lead Grow M&A and Increase Average Fee Grow Revenue From Relationships Equity Per Transaction non-CIB Clients SunTrust serves as the left Continue to improve strategic By-product of growth in lead Bring industry and product Future Future Potential lead bank for <15% of clients; relevance with clients relationships and advisory expertise to Commercial significant opportunity remains businesses Banking and CRE clients See appendix slide #26 for footnotes 8

EXPORTING CIB’S COMPETITIVE ADVANTAGE TO COMMERCIAL BANKING Overview Competitive Position • Traditional Commercial Banking client: $5MM – $250MM in annual revenue (privately held) $10B Bulge-Bracket Banks → SunTrust has ~10k Commercial Banking Client Size $1B clients (focus of slide 8) → Primarily within traditional Southeast / Mid-Atlantic markets Regional SunTrust Commercial Banking Banks Capture underserved market by bringing $100MM • Our strategy: bring the skills, discipline, and client advisory solutions to smaller clients coverage model from CIB (including product and industry expertise) to Commercial Banking clients $25MM Community Banks Client Needs → The vast majority of division presidents Deposits / Loans Risk Mgmt. Capital Alt. Liquidity M&A / Strategic now have a background in investment Treasury Mgmt. Solutions Raising Solutions Solutions banking (most previously worked at STRH) Advisory Solutions → Created targeted industry specialties (e.g. aging services, ports & logistics, Proven Success with Significant Growth Potential restaurants & retail) Future Growth Drivers: • Differentiated business model affords us the opportunity to serve clients outside of traditional • Capture additional market retail banking footprint share in existing markets • Continued build out of → Recently expanded into Ohio and Texas product & industry Average expertise (helps drive → Recently expanded scope of Aging Services Revenue capital markets revenue) vertical to be national Per Client • Geographic expansion 2014 LTM 9

CONSUMER LENDING LightStream GreenSky Partnership Credit Card $4.3 $2.1 $1.5 $3.5 $1.8 $1.4 Strong Growth (Average Balance $bn) 2Q 17 2Q 18 2Q 17 2Q 18 2Q 17 2Q 18 Good Risk- Yield: 5.75% Yield: 3.44%2 Yield: 11.45% Adjusted 2 Returns1 NCO: 0.86% NCO: 0.00% NCO: 2.80% Received Top 5 scores for 3 cards Nationally Named Finalist for Top Consumer Named as CNBC’s Top 50 in the 2016 ranking by U.S. News Recognized Lending Platform by LendIt3 Disruptor for 2017 & World Report Less than ~15% of GreenSky SunTrust only has ~25% wallet Future Currently have less than ~2% of customers are SunTrust clients share with the clients that Growth the applicable market share Opportunity for new partnerships already have a SunTrust card (2 partners added in 2018) 5% of Total Loans | High-Quality Portfolios (Average FICO: 750+) | Good Risk-Adjusted Returns See appendix slide #26 for footnotes 10

CONSUMER: MEETING EVOLVING CLIENT NEEDS Our mobile-centric approach allows us to focus on simplifying the client experience, meet clients where they want to do business, and reduce our cost to serve Mobile-Centric Strategy 1 Invest In A Superior Mobile App Branch Mobile App Average Rating (4.3 stars1) Online ATM Banking 2 To Meet Evolving Client Needs2 20% 14% 15% Chat, Teller Email, Mobile Mobile Digital Connect Text Sign-ons Deposits Sales And Optimize Our Branch Network Call 3 Center 1,659 1,222 Full Service Branches 1. Source: iOS and Android app store as of September 6, 2018. Represents the average between iOS and Android ratings 2011 2Q 18 2. Represents growth rates from 2Q 17 to 2Q 18 11

INVESTING IN TECHNOLOGY 1 2 Primary Provide a consistent, superior client experience by creating Enhance the efficiency Objectives an integrated ecosystem which meets clients where they and effectiveness of are and brings SunTrust into their experiences the Company Recent Progress Future Enhancements Impact Brought mobile app in-house (allows Expanded use of enterprise Serves as a client’s single source for for faster enhancements and better client portal (Consumer and financial confidence and increases servicing of Android platform) Wholesale versions) relevance with clients Launched enterprise client portal Enhanced mobile app for Furthers progress against journey to for PWM clients Wholesale clients develop cloud-based, open architecture framework (see slide 13 for more detail) Migrated SunTrust.com to the cloud Ongoing efforts to enhance Improves ability to leverage third party flexibility and integration partnerships API Completed API integration supporting through API’s salesforce.com and nCino platforms Increases agility & lowers cost to serve Established a data lake foundation Advance data lake Provides relevant, tailored, and timely capabilities to enhance offers across client segments Introduced SunTrust Deals (provides targeted client analytics and open new Improves teammate effectiveness offers based on spending history & preferences) revenue streams through smarter client insight Upgraded loan origination platforms in Shortens loan cycle times and Wholesale & Mortgage Leverage LightStream streamlines end-to-end origination platform to enhance digital Digitized front-end of mortgage application lending & fraud detection Provides scalable, cloud-based loan (SmartGUIDE) origination platforms Deploy intelligent processes and Improves service delivery and speed Introduced robotic capabilities bots using process automation, Reduces opportunity for human error (~60 bots in use, 150+ bots in pipeline) data, and cognitive chat Improves efficiency 12

SCALE IS NOT THE ONLY DETERMINANT OF SUCCESS The cloud allows banks to Domestically focused business compete on a more level Less complexity than larger financial institutions playing field, regardless of Fewer legacy systems size, reduces the cost to Strong alignment and coordination between serve, and enables greater Consumer and Wholesale CTOs and their speed to market business partners (benefit of smaller size) > Targeting >50% hybrid cloud adoption by 2021 API’s allow us to connect Simple our platforms and partner Business platforms to the broader ecosystem Model > Created first API between Blend & Black Knight for SmartGUIDE Fewer, leaner teams > Recently created API to > 100+ cross functional, agile tightly integrate delivery teams in place salesforce.com and today; focused on nCino platforms removing friction and maximizing speed to SunTrust has a strong market Agile Cloud -Based, reputation in the FinTech space as a good partner Recent examples of agility: Delivery Open with a proven track record > Since introducing SmartGUIDE in March, we Teams Architecture > Early partner with have added ~15 new Framework GreenSky; two new capabilities. >50% adoption lending partners added rate in 2018 > Identity protection site > Strong partnership with (secure.suntrust.com) Salesforce; industry- created in less than 24 leader in use of hours by 50+ teammates platform > Among the first to deploy nCino (advanced loan origination platform for Wholesale) 13

2 IMPROVING EFFICIENCY & RETURNS

SAVINGS FUND INVESTMENTS Organizational Efficiency Client-Friendly Technology • Streamline operations (in connection with • Make ongoing enhancements to mobile investments in core systems which digitize end-to- app end processes and enhance teammate • Make ongoing enhancements to treasury effectiveness) & payments platform and improve digital • Optimize staffing models capabilities for Wholesale clients • Tailor benefits and incentive plans • Increase digital, self-serve channels (80-90% of solutions will be available via Technology Enhancements digital platforms by 2019) • Increase automation and Wholesale Revenue Growth self-service channels Fund • Continue transition to the cloud Cost • Expand industry and product • Continue to upgrade and digitize Investments expertise in CIB and Commercial core systems (teller platform, Saving Banking payments hub, collections, etc.) in Growth & • Attract, develop, and retain top • Leverage new loan origination Initiatives talent (improves strategic platforms in Wholesale and Technology relevance with clients) Consumer which improve loan • Continue expansion of cycle times and automate Commercial Banking certain capabilities • Enhance CRE capabilities Procurement (including integration of recently acquired agency lending • Consolidate vendors platform) • Improve contract terms • Optimize in-house services and capabilities Consumer Revenue Growth • Expand digital lending platforms (LightStream and Real Estate additional third party partnerships), including further marketing spend • Pursue further branch reductions • Grow wealth management by retaining top talent • Consolidate non-branch real estate (e.g. mortgage and acquiring new teams offices recently reduced from 9 to 3) 15

IMPROVING EFFICIENCY: PROVEN SUCCESS & FUTURE OPPORTUNITY 71.5% 66.9% 65.3% 63.3% 62.6% 62.0% 61.0% <60% Adjusted Tangible Efficiency Ratio (FTE)1 2011 2012 2013 2014 2015 2016 2017 TER Target (2019 or Key Takeaways sooner) • We will achieve our <60% target • Fostering a culture of continuous improvement is as important as this goal → We have further opportunity beyond <60% • Efficiencies generate capacity to invest in growth and technology to better serve our clients and meet more of their needs 1. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions. There were no adjustments in 2011, 2015, and 2016. GAAP efficiency ratios were 73.0%, 60.0%, 72.3%, 67.9%, 64.2%, 63.6%, and 64.1% for 2011, 2012, 2013, 2014, 2015, 2016, and 2017, respectively. Please refer to appendix slide #24 for GAAP reconciliations 16

WELL-POSITIONED FOR THROUGH THE CYCLE PERFORMANCE Diverse Balance Sheet and Business Mix Governed by Emphasis on Discipline Loan Mix1 Business Mix2 . Diverse loan portfolio and business mix CRE → Good mix of national and 6% regional businesses; all Mortgage Home 9% businesses except branch- Equity Consumer based banking have a more 7% Consumer Banking national scope Lending (branch- Commercial & 9% based) . Disciplined focus; strict internal Consumer Industrial 31% 46% limits govern intra- and inter- Lending Commercial 16% diversity Banking 12% Corporate & C&I portfolio diversified Residential Private → Mortgage (non- Wealth Investment across 20+ industries guaranteed) Management Banking 19% 13% 21% . Improved capabilities (risk monitoring, underwriting, and fraud detection), largely enabled Average CCAR Loan Loss Rate3 5-year Standard Deviation4 by data & analytics 5.4% . Strength and diversity of portfolio 0.5% validated by consistently strong CCAR performance 0.3% → Lowest average loan losses relative to peers 4.7% → 2nd lowest standard deviation #1 of 12 #2 of 12 of average loss rate STI Peer Median STI Peer Median See appendix slide #26 for footnotes 17

3 STRONG CAPITAL POSITION SUPPORTS GROWTH

STRONG CAPITAL POSITION Strong Capital Position & Strong CCAR Provides Capacity to Repatriate Capital and Performance Deliver Above-Average Returns Average Stressed Capital Common Equity Tier 11 Total Announced Payout Ratio3 Dividend Yield4 Erosion2 2.8% 9.7% 117% 2.7% 2.6% 2.1% ~8-9% 103% Basel III CET1 Target Level SunTrust Peer Median SunTrust Peer Median SunTrust Peer Median See appendix slide #26 for footnotes 19

RECAP: WHY INVEST IN SUNTRUST? 1 Strong & Diverse Franchise; Investing in Growth Targeting 7th consecutive year of EPS growth 2 Improving Efficiency & Returns Targeting 7th consecutive year of improvements in efficiency 3 Strong Capital Position Targeting 7th consecutive year of increased capital returns Attractive dividend yield 20

APPENDIX

CONSISTENTLY STRONG CCAR PERFORMANCE Average CCAR Loan Loss Rate (2014-2018) 2014: 4.6% 2015: 4.5% 2016: 4.5% 2017: 4.5% 6.50% 6.64% 2018: 5.2% 5.72% 5.44% 5.68% 5.70% 4.94% 4.98% 5.18% 5.20% 4.66% 4.76% STI HBAN PNC BBT BAC CFG KEY MTB WFC FITB RF USB 5 Year Standard Deviation of Average CCAR Loss Rate (2014-2018) 0.68% 0.61% 0.62% 0.55% 0.50% 0.52% 0.43% 0.40% 0.40% 0.34% 0.30% 0.24% FITB STI USB RF HBAN PNC BAC KEY BBT MTB CFG WFC CCAR results continue to validate our consistent, disciplined underwriting & portfolio diversity 22

STRONG CREDIT QUALITY 2Q 18 Nonperforming Loan Ratio1 0.89% 0.74% 0.75% 0.77% 0.77% 0.66% 0.57% 0.61% 0.52% 0.52% 0.28% 0.32% BBT USB STI FITB HBAN KEY BAC CFG RF PNC WFC MTB % Criticized Commercial2 6.9% 6.3% 5.6% 5.7% 5.1% 4.1% 4.1% 4.1% 4.2% 4.3% 2.7% 3.1% STI BBT PNC KEY USB BAC MTB CFG FITB WFC HBAN RF LTM Net Charge-Off Ratio3 0.47% 0.43% 0.34% 0.35% 0.36% 0.29% 0.26% 0.23% 0.20% 0.21% 0.22% 0.15% MTB PNC HBAN KEY STI CFG WFC FITB BBT RF BAC USB See slide #26 for footnotes 23

RECONCILIATION: ADJUSTED EFFICIENCY RATIO (FTE) & ADJUSTED TANGIBLE EFFICIENCY RATIO (FTE) 2011 2012 2013 2014 2015 2016 2017 Reported (GAAP) Basis Net Interest Income 5,065 5,102 4,853 4,840 4,764 5,221 5,633 Noninterest Income 3,421 5,373 3,214 3,323 3,268 3,383 3,354 Revenue 8,486 10,475 8,067 8,163 8,032 8,604 8,987 Noninterest Expense¹ 6,194 6,284 5,831 5,543 5,160 5,468 5,764 Efficiency Ratio 73.0% 60.0% 72.3% 67.9% 64.2% 63.6% 64.1% Reconciliation: Net Interest Income 5,065 5,102 4,853 4,840 4,764 5,221 5,633 FTE Adjustment 114 123 127 142 142 138 145 Net Interest Income-FTE 5,179 5,225 4,980 4,982 4,906 5,359 5,778 Noninterest Income 3,421 5,373 3,214 3,323 3,268 3,383 3,354 Revenue-FTE 8,600 10,598 8,194 8,305 8,174 8,742 9,132 Efficiency Ratio-FTE 72.0% 59.3% 71.2% 66.7% 63.1% 62.6% 63.1% Adjustment Items (Noninterest Income): 3Q-4Q 12 student / Ginnie Mae loan sale (losses) (92) Securities gain related to the sale of Coca Cola stock 1,938 Pre-tax mortgage repurchase provision related to loans sold to GSEs prior to 2009 (371) GSE mortgage repurchase settlements (63) RidgeWorth sale 105 Premium Assignment Corporation sale 107 Securities & MSR losses in connection with tax reform-related actions (114) Adjusted Noninterest Income 3,421 3,898 3,277 3,218 3,268 3,383 3,361 Adjusted Revenue-FTE² 8,600 9,123 8,257 8,200 8,174 8,742 9,139 Noninterest Expense¹ 6,194 6,284 5,831 5,543 5,160 5,468 5,764 Adjustment Items (Noninterest Expense): Legacy affordable housing impairment 96 Charitable contribution of KO shares 38 Impact of certain legacy mortgage legal matters 323 324 Mortgage servicing advances allowance increase 96 Efficiency related charges as outlined in 12/4/17 8-K 36 Contribution to communities / teammates in connection with tax-reform 75 Adjusted Noninterest Expense² 6,194 6,150 5,412 5,219 5,160 5,468 5,653 Amortization Expense 43 46 23 25 40 49 75 Adjusted Tangible Expenses² 6,151 6,104 5,389 5,194 5,120 5,419 5,578 Adjusted Efficiency Ratio-FTE³ 72.0% 67.4% 65.6% 63.7% 63.1% 62.6% 61.9% Adjusted Tangible Efficiency Ratio-FTE³ 71.5% 66.9% 65.3% 63.3% 62.6% 62.0% 61.0% 1. In accordance with updated GAAP, amortization of affordable housing investments of $40 million, $39 million, and $49 million were reclassified and are now presented in provision for income taxes for 2011, 2012, and 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Adjusted revenue and expenses are provided as they remove certain items that are material and potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions 3. Represents adjusted noninterest expense / adjusted revenue – FTE. Adjusted tangible efficiency ratio excludes amortization expense, the impact of which is (0.50%), (0.50%), (0.28%), (0.30%), (0.49%), (0.56%), and (0.82%) for 2011, 2012, 2013, 2014, 2015, 2016, and 2017, respectively 24

RECONCILIATION OF EARNINGS PER SHARE ($ in millions, except per share amounts) 2012 2013 2014 2017 Net income available to common shareholders $1,931 $1,297 $1,722 $2,179 Significant items impacting the year: Securities gains related to sale of Coke stock (1,938) - - - Mortgage repurchase provision 371 - - - Charitable expense related to the Coke stock contribution 38 - - - Provision for credit losses related to NPL sales 172 - - - Losses on sale of guaranteed loans 92 - - - Valuation losses related to planned sale of Affordable Housing investments 96 - - - Charges for legacy mortgage-related matters - 482 324 - Gain on sale of Ridgeworth - - (105) - Gain on sale of Premium Assignment Corporation - - - (107) Securities & MSR losses in connection with tax reform-related actions - - - 114 Contribution to communities / teammates in connection with tax-reform - - - 75 Efficiency related charges as outlined in 12/4/17 8-K - - - 36 Tax (benefit)/expense related to above items 416 (190) (82) (41) Net tax benefit related to subsidiary reorganization and other - (113) - - Tax benefit related to completion of tax authority examination - - (130) - Net tax benefit related to revaluation of net deferred tax liability and other discrete tax items - - - (291) Tax expense related to SunTrust Mortgage ("STM") state NOL valuation allowance adjustment - - - 27 Net income available to common shareholders, excluding significant items impacting the year $1,178 $1,476 $1,729 $1,991 Net income per average common share, diluted $3.59 $2.41 $3.23 $4.47 Net income per average common share, diluted, excluding significant items impacting the year $2.19 $2.74 $3.24 $4.09 25

FOOTNOTES Slide #3: 1. Source: SNL Financial, as of June 30, 2017, based on top 10 MSAs (by deposits) for each institution, pro-forma for completed and pending mergers and acquisitions. Numerator is company’s total deposits in its top 10 MSAs and denominator is total deposits in those 10 MSAs 2. Refers to rank amongst U.S. bank holding companies with respect to assets, loans, and deposits and excludes non-traditional banks. Asset and loan rankings are sourced via bank holding company regulatory filings (Y-9C) and are as of June 30, 2018. Deposit rankings are sourced via FDIC deposit market share data, and are as of June 30, 2017, pro-forma for completed and pending mergers and acquisitions 3. Assets, loans, and deposits as of June 30, 2018 4. EPS growth refers to growth from 1H 17 to 1H 18. ROTCE as of 1H 18; GAAP ROE for 1H 18 was 12.0% and reconciliation to GAAP can be found on page 22 of the 2Q 18 earnings release. Dividend yield as of September 6, 2018 Slide #4: 1. Source: SNL Financial, as of June 30, 2017, based on top 10 MSAs (by deposits) for each institution, pro-forma for completed and pending mergers and acquisitions. Numerator is company’s total deposits in its top 10 MSAs and denominator is total deposits in those 10 MSAs 2. Mobile adoption as of June 30, 2018. Mobile sign-ons refers to growth from 2Q 17 to 2Q 18. Zelle adoption refers to growth since launch in December 2017 3. Represents total debt as a percentage of total liabilities as of June 30, 2018. Source: SNL Financial 4. Represents change in interest bearing deposit costs compared to change in 1-month LIBOR (3Q15 average to 2Q18 average). Source: SNL Financial and Bloomberg 5. Represents change in total funding costs compared to change in 1-month LIBOR (3Q15 average to 2Q18 average). Source: SNL Financial and Bloomberg Slide #8: 1. Refers to market share across Dealogic-tracked products (debt capital markets, M&A, and equity capital markets) within middle market and mid-corporate client coverage universe of STRH, based on Dealogic’s data. Client coverage universe consists of a combination of Corporate Banking and Investment Banking client populations as well as any completed transactions where Dealogic has deemed STRH to have had a role. (Latter generally relates to clients within non-CIB segments for whom STRH has delivered capital markets or M&A solutions) 2. Represents change of 1H 17 vs 1H 18 Slide #10: 1. Yield as of 2Q 18, NCO represents the last twelve months ended June 30, 2018 2. Represents GAAP yield to SunTrust. SunTrust has a loss sharing agreement with GreenSky. 0.00% NCO indicates that losses have not exceeded those provided for in the loss share agreement 3. Refers to the 2017 LendIt Conference, a global conference series connecting the online lending community Slide #17: 1. Data as of June 30, 2018. Consumer Lending includes consumer direct loans (other than student guaranteed), consumer indirect loans and consumer credit cards. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. Construction includes both commercial and residential construction 2. Represents the revenue by line of business for the twelve months ended June 30, 2018. Note: totals may not foot due to rounding 3. Represents the average loan loss rate in the severely adverse scenario for CCAR 2014-2018 4. Represents the 5 year standard deviation of average loan loss rates in the severely adverse scenario for CCAR 2014-2018 Slide #19: 1. If a 250% risk-weighting for MSRs (as contemplated in the FRB’s ‘Simplifications’ NPR) was applied, the Common Equity Tier 1 ratio would be 9.6% 2. Represents the average difference between the starting and the projected minimum Basel III Common Equity Tier 1 Ratios from the Federal Reserve’s 2014-2018 CCAR severely adverse scenarios 3. Payout Ratio = (Common Stock Dividends and Share Repurchases) / Consensus Net Income Available to Common Shareholders for CCAR 2018. Source: Barclays Research CCAR 2018 Review: $164bn of Capital to Be Returned Over Next 4 Quarters 4. As of September 6, 2018 Slide #23: 1. Represents nonaccrual loans divided by total loans (excluding loans held for sale). Source: SNL Financial as of June 30, 2018 2. Represents criticized loans as % of total commercial loans. Regulatory data sourced from SNL Financial as of June 30, 2018 3. Source: SNL Financial as of June 30, 2018 All Slides: Note: Peer group consists of BAC, BBT, CFG, FITB, HBAN, KEY, MTB, PNC, RF, USB, WFC. LTM refers to last twelve months ended June 30, 2018 26