Form 8-K/A TRIMBLE INC. For: Sep 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K/A

___________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2018 (July 2, 2018)

___________________________________

Trimble Inc.

(Exact name of registrant as specified in its charter)

___________________________________

Delaware | 001-14845 | 94-2802192 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer I.D. No.) | ||

935 Stewart Drive, Sunnyvale, California, 94085

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 481-8000

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This amendment is being filed to amend and supplement Item 9.01 of the Current Report on Form 8-K filed by Trimble Inc. (“Trimble” or the “Company”) on July 2, 2018, to include the historical financial statements of Waterfall Holdings, Inc., a Delaware corporation, the holding company of Viewpoint, Inc., a Delaware corporation, the business acquired, and the unaudited pro forma condensed combined financial information required pursuant to Article 11 of Regulation S-X. The acquired business, including Waterfall Holdings, Inc. and its indirect subsidiary Viewpoint, Inc., is referred to herein as “Viewpoint” for the purpose of the unaudited pro forma condensed combined financial statements.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Business Acquired.

The audited consolidated financial statements of Waterfall Holdings, Inc. as of and for the year ended December 31, 2017, are included as Exhibit 99.1 to this Form 8-K/A. The unaudited condensed consolidated financial statements of Waterfall Holdings, Inc. as of and for the first quarter ended March 31, 2018 are included as Exhibit 99.2 to this Form 8-K/A.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined balance sheet for Trimble and Viewpoint as of the first quarter ended fiscal 2018 and unaudited pro forma condensed combined statements of income for Trimble and Viewpoint for the first quarter of fiscal 2018 and fiscal year ended 2017 are included as Exhibit 99.3 to this Form 8-K/A and are incorporated herein by reference.

(d) Exhibits.

Exhibit No. | Description | |

23.1 | ||

99.1 | ||

99.2 | ||

99.3 | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TRIMBLE INC. | |||

(Registrant) | |||

By: | /s/ Robert G. Painter | ||

Robert G. Painter | |||

Chief Financial Officer | |||

(Authorized Officer and Principal Financial Officer) | |||

Dated: September 10, 2018

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors

Waterfall Holdings, Inc.:

Waterfall Holdings, Inc.:

We consent to the incorporation by reference in the registration statement on Form S-3 (No. 333-224166) and in the registration statements on Form S-8 (Nos. 33-78502, 333-04670, 33-45604, 33-39647, 33-57522, 33-78502, 33-91858, 333-53703, 333-84949, 333-38264, 333-65758, 333-28429, 333-97979, 333-118212, 333-138551, 333-161295, 333-183229, 333-222502, 33-37384, 33-62078, 33-45167, 33-46719, 33-50944, 33-84362, 333-208275) of Trimble Inc. of our report dated June 22, 2018, with respect to the consolidated balance sheets of Waterfall Holdings, Inc. as of December 31, 2017, and the related consolidated statements of operations, comprehensive income, stockholders’ equity, and cash flows for the year then ended, and the related notes (collectively, the “consolidated financial statements”), which report appears in the Form 8‑K/A of Trimble Inc. dated September 10, 2018.

/s/ KPMG LLP

Portland, Oregon

September 10, 2018

September 10, 2018

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Financial Statements December 31, 2017 (With Independent Auditors’ Report Thereon)

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Table of Contents Page(s) Independent Auditors’ Report 1 Financial Statements: Consolidated Balance Sheet 2 Consolidated Statement of Operations 3 Consolidated Statement of Comprehensive Income 4 Consolidated Statement of Stockholders’ Equity 5 Consolidated Statement of Cash Flows 6 Notes to Consolidated Financial Statements 7–27

KPMG LLP Suite 3800 1300 South West Fifth Avenue Portland, OR 97201 Independent Auditors ’ Report The Board of Directors Waterfall Holdings, Inc.: We have audited the accompanying consolidated financial statements of Waterfall Holdings, Inc. and its subsidiaries, which comprise the consolidated balance sheet as of December 31, 2017, and the related consolidated statements of operations, comprehensive income, stockholders ’ equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management ’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors ’ Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors ’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity ’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity ’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Waterfall Holdings, Inc. and its subsidiaries as of December 31, 2017, and the results of their operations and their cash flows for the year then ended in accordance with U.S. generally accepted accounting principles. Portland, Oregon June 22, 2018 KPMG LLP is a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity.

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Balance Sheet December 31, 2017 (In thousands, except share data) Assets 2017 Current assets: Cash and cash equivalents $ 19,248 Accounts receivable net of allowance for doubtful accounts of $1,157 15,844 Prepaid expenses 10,329 Other assets 961 Total current assets 46,382 Property and equipment, net 9,542 Goodwill 368,744 Intangible assets, net 211,950 Other long-term assets 1,043 Total assets $ 637,661 Liabilities, Redeemable Preferred Stock, and Stockholders’ Equity Current liabilities: Accounts payable and accrued expenses $ 10,042 Accrued payroll, payroll taxes and benefits 9,729 Income taxes payable 1,490 Deferred revenue 31,523 Current portion of long-term debt 2,551 Total current liabilities 55,335 Deferred rent 2,660 Long-term debt 291,906 Other long-term liabilities 334 Deferred tax liabilities 28,150 Total liabilities $ 378,385 Commitments and contingences (Note 8) Series C redeemable preferred stock, $0.001 par value; 59,715,612 authorized, 59,715,612 issued, and 36,175,826 outstanding $ 47,389 Stockholders’ equity: Series A common stock, $0.001 par value; 135,000,000 authorized, 71,583,371 issued, and 71,337,491 outstanding $ 71 Series B common stock, $0.001 par value; 12,663,476 authorized, 11,000 issued and outstanding — Additional paid in capital 287,501 Accumulated other comprehensive income (91) Accumulated deficit (75,594) Total stockholders' equity 211,887 Total liabilities, redeemable preferred stock, and stockholders' equity $ 637,661 See accompanying notes to consolidated financial statements. 2

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statement of Operations Year ended December 31, 2017 (In thousands) 2017 Net sales: License fees $ 17,824 Professional services 26,968 Recurring and other 110,367 Total net sales 155,159 Cost of sales: License fees 1,307 Professional services 20,711 Recurring and other 25,403 Amortization of intangible assets 11,783 Total cost of sales 59,204 Gross profit 95,955 Operating expenses: Selling and marketing 37,160 Research and development 20,705 General and administrative 37,934 Amortization of intangible assets 13,193 Total operating expenses 108,992 Loss from operations (13,037) Other income (expense): Interest expense (12,323) Other income (expense), net 3,579 Total other expense (8,744) Loss before taxes (21,781) Income tax benefit (24,554) Net income $ 2,773 See accompanying notes to consolidated financial statements. 3

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statement of Comprehensive Income Year ended December 31, 2017 (In thousands) 2017 Net income $ 2,773 Other comprehensive income, net of tax: Net foreign currency translation losses (703) Comprehensive income $ 2,070 See accompanying notes to consolidated financial statements. 4

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statement of Redeemable Preferred Stock and Stockholders' Equity Year ended December 31, 2017 (In thousands, except share data) Accumulated Series C other redeemable preferred stock Series A common stock Series B common stock Additional paid comprehensive Accumulated Total Shares Amount Shares Amount Shares Amount in capital income (loss) Deficit Stockholders' equity Balance at December 31, 2016 59,715,612 $ 70,426 71,170,824 $ 71 — $ — $ 285,014 $ 612 $ (71,925) $ 213,772 Net income — — — — — — — — 2,773 2,773 Share-based compensation — — — — — — 1,447 — — 1,447 Cumulative effect of new accounting principle in period of adoption — — — — — — 521 521 Cumulative translation adjustment — — — — — — — (703) — (703) Accretion of redeemable preferred stock to redemption value — 6,402 — — — — — — (6,402) (6,402) Repurchase of redeemable preferred stock (23,539,786) (29,439) — — — — — — (561) (561) Stock issuance — — 166,667 — — — 1,000 — — 1,000 Exercise of stock options — — — — 11,000 — 40 — — 40 Balance at December 31, 2017 36,175,826 $ 47,389 71,337,491 $ 71 11,000 $ — $ 287,501 $ (91) $ (75,594) $ 211,887 See accompanying notes to consolidated financial statements. 5

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statement of Cash Flows Year ended December 31, 2017 (In thousands) 2017 Cash flows from operating activities: Net income $ 2,773 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 27,902 Impariment of intangible assets 1,463 Bad debt expense 45 Debt extinguishment 155 Share based compensation 1,447 Loss on disposal of property and equipment 173 Deferred taxes (25,341) Unrealized foreign currency gain (5,499) Other 310 Changes in operating assets and liabilities (net of acquisitions): Accounts receivable 3,885 Prepaid expenses, deposits and advances (2,086) Accounts payable and accrued expenses 911 Accrued payroll, taxes and benefits (853) Taxes payable/receivable 835 Deferred revenue 11,471 Deferred rent 173 Net cash provided by operating activities 17,764 Cash flows from investing activities: Acquisitions of business, net of cash acquired (181,021) Capitalized software development costs (4,778) Purchases of property and equipment (1,709) Net cash used in investing activities (187,508) Cash flows from financing activities: Borrowings on long-term debt 305,000 Repayments of long-term debt (86,822) Repurchase of series C redeemable preferred stock (30,000) Debt issuance costs (12,368) Issuance of common stock 1,000 Principal payments on capital lease obligations (695) Exercise of stock options 40 Net cash provided by financing activities 176,155 Effect of foreign currency rate changes on cash and cash equivalents (223) Net increase in cash and cash equivalents 6,188 Cash and cash equivalents at beginning of year 13,060 Cash and cash equivalents at end of year $ 19,248 Supplementary disclosures of cash flow information: Cash paid during the year for: Interest $ 11,747 Income taxes, net of refunds received 480 Noncash investing and financing transactions: Accretion of Series C redeemable preferred stock to redemption price $ 6,402 See accompanying notes to consolidated financial statements. 6

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (1) Significant Accounting Policies (a) Nature of Operations Waterfall Holdings, Inc. and subsidiaries, (“the Company”), through its consolidated subsidiary Viewpoint, Inc., is a provider of construction management software, providing an integrated construction software management platform developed specifically for the needs of the construction industry that helps contractors and construction firms improve efficiency and increase profitability. The Company is controlled by funds under the direction of Bain Capital Partners, LLC (“Bain”). The Company’s software is architected to be deployed via the web from a multi-tenant SaaS environment, to iOS and Android-based tablets and smartphones, and via on-premise installations in client-server environments. The Company’s solutions can be acquired and deployed individually or as a full suite to meet customers’ unique requirements. The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. (b) Principles of Consolidation and Presentation The accompanying Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries. All inter-company accounts and transactions have been properly eliminated in consolidation. (c) Cash and Cash Equivalents The Company considers all cash accounts which are not subject to withdrawal restrictions or penalties, and certificates of deposit and repurchase agreements with original maturities of 90 days or less to be cash or cash equivalents. (d) Concentrations of Credit Risk The Company grants credit to its customers, primarily civil, highway, specialty and general construction contractors throughout the United States, Canada, England and Australia. Concentrations of credit risk with respect to trade receivables are limited due to the large number of customers comprising the Company’s customer base and their dispersion across geographic areas. The Company places its cash and cash equivalents with various high quality financial institutions; these deposits may exceed federally insured limits at various times throughout the year. (e) Accounts Receivable Accounts receivable are carried at original invoice amount less an estimate made for uncollectible amounts. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivables and considering a customer’s financial condition, credit history, and current economic conditions. Account balances are considered delinquent if payment is not received by the due date. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received. Amounts collected on trade accounts receivable are included in net cash provided by operating activities in the Consolidated Statements of Cash Flows. No customers represented 5% or more of accounts receivable at December 31, 2017. 7

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (f) Property and Equipment Property and equipment are stated at cost less accumulated depreciation. Repairs and maintenance are expensed as incurred. Property and equipment under capital lease are stated at the present value of minimum lease payments. Depreciation is calculated on the straight-line method over the estimated useful lives of the various assets. Property and equipment held under capital lease are amortized on a straight line basis over the shorter of the lease term or estimated useful life of the asset. Estimated useful lives of property and equipment range from 3 to 15 years. Upon disposal of assets, the costs of assets and the related accumulated depreciation are removed from the accounts. Gains or losses on disposal are reflected in current earnings. (g) Revenue Recognition For its software arrangements, the Company recognizes and defers revenue using the residual method pursuant to the software revenue recognition requirements of ASC 985-605. Under the residual method, revenue is recognized in a multiple element arrangement when vendor-specific objective evidence (“VSOE”) of fair value exists for all of the undelivered elements in the arrangement, but does not exist for one or more of the delivered elements in the arrangement. VSOE is determined for support and maintenance and professional services elements based upon the pricing in comparable transactions when the element is sold separately. At the outset of the arrangement with the customer, the Company defers revenue for the fair value of its undelivered elements (e.g., support and maintenance and professional services) and recognizes revenue for the remainder of the arrangement fee attributable to the elements initially delivered in the arrangement (e.g., software license). For hosted or time based subscription arrangements, revenues are recognized ratably over the contract term of the arrangement beginning on the date that services are made available to the customer. Amounts that have been invoiced are recorded in revenue or deferred revenue, depending on whether the revenue recognition criteria have been met. For multiple element arrangements which may include software and nonsoftware deliverables, the Company follows the multiple element guidance of ASC 605-25. Where applicable, the Company allocates revenue to each element based on its relative selling price to the overall arrangement consideration. The selling price for a deliverable is based on its VSOE, if available, Third Party Evidence (“TPE”), if VSOE is not available, or Estimated Selling Price (“ESP”), if neither VSOE nor TPE is available. Support and maintenance revenue is recognized ratably over the support period, generally one month to one year. Fees for support and maintenance are billed in advance and included in deferred revenue until recognized. Professional services are generally provided on a time and materials basis and revenue from professional services is recognized as services are performed. The Company’s services are not essential to the functionality of the software. Sales taxes collected from customers and remitted to governmental authorities are accounted for on a net basis and therefore are excluded from revenues in the consolidated statements of operations. (h) Cost of Sales License fees included within cost of sales on the consolidated statement of operations represent license royalties paid to third party software providers. 8

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (i) Software Development Costs The Company accounts for the costs of software to be marketed in compliance with ASC 985-20, Costs of Computer Software to be Sold, Leased or Otherwise Marketed. This policy is applicable to products that are licensed and transferred to a client who takes custody of the software. Such software development costs are expensed as incurred until technological feasibility of the product is established. Development costs incurred subsequent to technological feasibility are capitalized and amortized on a straight line basis over the estimated economic life of the product. Capitalization of computer software costs is discontinued when the computer software product is available to be sold. The Company has determined that technological feasibility is established late in the product development cycle, typically near product completion. Post-technological feasibility product development costs are typically considered immaterial, and therefore, the Company has no software development costs to be sold, leased, or otherwise marketed capitalized on the balance sheet. The Company capitalizes certain software development costs incurred in connection with developing or obtaining computer software for internal use during the application development stage provided it’s probable that the software will be used as intended. This includes capitalized software costs developed in connection with the Company’s cloud product offerings which are included in intangible assets on the Company’s balance sheet and amortized to cost of goods sold on a straight-line basis over the estimated useful lives of the developed software. Other capitalized software costs developed or obtained for internal use are included in property and equipment on the Company’s balance sheet and amortized to operating expense on a straight-line basis over their estimated useful lives. (j) Deferred Rent The Company’s operating leases may provide for tenant improvement allowances, lease incentives, rent holidays and rent escalations. In instances where one or more of these items are included in a lease agreement, the Company records a deferred rent liability and amortizes the items on a straight line basis over term of the lease as adjustments to rent expense. (k) Advertising Advertising costs are expensed as incurred. Advertising costs approximated $4.1 million in 2017 and are included in Sales and Marketing expense in the accompanying financial statements. (l) Income Taxes The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of assets and liabilities and their reported amounts. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the year in which the temporary differences are expected to be recovered or settled. Valuation allowances are established when necessary to reduce deferred tax assets to amounts which are more likely than not to be realized. The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. 9

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (m) Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates in these financial statements include accounting for income taxes; assumptions regarding the elements comprising software arrangements, including the distinction between upgrades, enhancements, and new products; the determination of fair value used in the allocation of revenue in multiple element transactions; the point at which technological feasibility is achieved for products; the life cycles of the Company’s products; reserves for uncollectable accounts and sales returns; and valuation estimates of assets and liabilities acquired through business combinations. Actual results could differ from those estimates. (n) Long-Lived Assets Long-lived assets, such as property, plant, and equipment and purchased intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset or asset group be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, depending on the nature of the asset. (o) Deferred Revenue Deferred revenue consists of billings or payments received in advance of revenue recognition from contracts for subscription licenses, perpetual licenses, hosting, professional services and maintenance. Revenues are recognized as the revenue recognition criteria are met. The Company generally invoices customers in monthly and increasingly in annual installments. Accordingly, the deferred revenues balance does not represent the total contract value of annual support and maintenance or subscription agreements. Deferred revenue also includes certain deferred professional services fees, which are recognized as hours for services are incurred. Approximately 2% of total deferred revenue as of December 31, 2017 related to deferred professional services revenues. (p) Stock Incentive Plan The Company measures share-based compensation in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”), Compensation – Stock Compensation. Stock option compensation expenses are based on the estimated fair value of the underlying option calculated using either the Black-Scholes option pricing model or a Monte Carlo simulation model. Both models require the input of subjective assumptions and judgments, including estimating share price volatility. The Company determines the expected volatility based on a weighted average of the historical volatility of a peer group of comparable publicly traded companies. For employee stock options that qualify as “plain vanilla” stock options in accordance with Staff Accounting Bulletin No. 110 (“SAB 110”) issued by the SEC, the expected term is estimated using the simplified method, as defined in SAB 110. The Company has a limited history of stock option exercises, which does not provide a reasonable basis for the Company to estimate the expected term of employee stock options. For all other employee stock options, the Company estimates the expected life using judgment. The Company accounts for forfeitures as they occur. The assumptions used in calculating 10

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 the fair value of the stock option grants represent best estimates and involve inherent uncertainties and the application of judgment. As a result, if factors change and the Company uses different assumptions, share-based compensation expense could be materially different in the future. For employee options that vest based solely on service conditions, the fair value measurement date is generally on the date of grant and the related compensation expense and is recognized on a straight-line basis over the requisite vesting period of the awards. During 2017, the company issued certain “Performance Options”. The awards vest based on both a required service period as well as based on meeting certain market conditions. As defined by the plan, the market condition would be measured based on a liquidity event and the timing of any such liquidity event is also a factor in the calculation of vesting. The Company measures the fair value of Performance Options using Monte Carlo simulations, consistent with the fair value principles of Topic 718, since these awards vest based upon market conditions. Expense is recognized over a derived service period determined by the Monte Carlo simulation. The input factors used in the valuation model are based on subjective future expectations combined with management’s judgment. These judgments include expected volatility, which is based on a weighted average of the historical volatility of a peer group of comparable publicly traded companies. The Company has applied an expected dividend yield of 0% as the Company has not historically declared a dividend and does not anticipate declaring a dividend during the expected life of the awards. The risk-free rate is based upon the US Treasury yield curve in effect at the time of the grant, with a term that approximates the expected life of the awards. The compensation expense is recorded only at the time of a liquidity event and therefore no compensation costs related to these awards has been recorded. The assumptions used in calculating the fair value of the Performance Options represent best estimates and involve inherent uncertainties and the application of judgment. As a result, if factors change and the Company uses different assumptions, share-based compensation expense related to the Performance Options could be materially different in the future. (q) Commissions Commissions are recorded as a component of selling and marketing expenses and consist of the variable compensation paid to the Company’s direct sales force. Generally, sales commissions are earned and recorded as an expense at the time that a customer has entered into a binding purchase agreement. Commissions paid to sales personnel are recoverable only in the case that the Company cannot collect against any invoiced fee associated with a sales order. Hosted software sales commissions and commissions earned on subscription of term license arrangements are deferred and recognized ratably over the term of the contract. Commission expense was $6.5 million in 2017. (r) Foreign Currency Translation Local currencies are the functional currencies of the Company’s foreign subsidiaries. The Company translates assets and liabilities of foreign operations to U.S. dollars at current rates of exchange and revenues and expenses are translated using weighted average exchange rates. The Company includes foreign currency translation adjustments in stockholders’ equity as a component of accumulated other comprehensive income (loss). 11

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (s) Commitments and Contingencies Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount can be reasonably estimated. Legal costs incurred in connection with loss contingencies are expensed as incurred. (t) Indemnifications and Warranties The Company’s product license and services agreements include a limited indemnification provision for claims from third parties relating to the Company’s intellectual property. The indemnification is generally limited to the amount paid by the customer. To date, claims under such indemnification provisions have not been significant. The Company is required by its by-laws to indemnify directors and officers, and may indemnify other employees and agents, for liabilities arising out of their relationship with the Company and may enter into contracts under which it agrees to indemnify these persons for liabilities arising out of such relationships. In the event that an indemnification claim is made against the Company, an adverse outcome, including a judgment or settlement, may cause a material adverse effect on the Company’s future business, operating results or financial condition. It is not possible to determine the maximum potential amount under these indemnification agreements due to the limited history of prior indemnification claims and the unique facts and circumstances involved in each particular agreement. The Company generally provides a warranty for its products and services. To date, the Company’s product warranty expense has not been significant, and accordingly, no warranty reserve is maintained. (u) Financial Instruments, Fair Value and Market Risks The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible. The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels: Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date. Level 2: Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability. Level 3: Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at measurement date. The fair values of financial instruments have been determined through information obtained from management estimates. For certain types of the Company’s financial instruments, including cash and cash equivalents, accounts receivables, accounts payable and accrued expenses, the carrying amounts approximate fair market value due to their short maturities. The carrying amounts of the Company’s line of credit and long term debt approximates fair market values as interest is incurred at a 12

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 variable rate based on prevailing financial market conditions or the debt’s fixed rate approximates current borrowing rates. (v) Recently Issued Accounting Standards In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, or “ASU 2014-09” which establishes new guidance under which companies will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. ASU 2014-09 also provides for additional disclosure requirements. While ASU 2014-09 was to be effective for annual periods and interim periods beginning after December 15, 2017, on July 9, 2015, the FASB approved the deferral of the effective date to periods beginning on or after December 15, 2018 for non-public business entities. Accordingly, the Company currently intends to adopt ASU 2014-09 on January 1, 2019, and is currently evaluating the impact that the adoption of ASU 2014-09 will have on its consolidated financial statements. In February 2016, the FASB issued ASU 2016-02, Leases, or “ASU 2016-02.” ASU 2016-02 was issued to increase transparency and comparability among organizations by requiring the recognition of lease assets and lease liabilities on the balance sheet. Most prominent among the amendments is the recognition of assets and liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. Under the new standard, disclosures are required to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. The Company will be required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. ASU 2016-02 is effective for fiscal years beginning after December 15, 2019 for non-public business entities. The Company is currently evaluating the impact that the adoption of ASU 2016-02 will have on its consolidated financial statements, the Company expects the primary impact to the consolidated financial position upon adoption will be the recognition, on a discounted basis, of the Company’s minimum commitments under non-cancelable operating leases on the Company’s consolidated balance sheets resulting in the recording of right of use assets and lease obligations. The Company current minimum commitments under non-cancelable operating leases are disclosed in Note 8. In March 2016, the FASB issued ASU 2016-09, Compensation – Stock Compensation – Improvements to Employee Share-Based Payment Accounting, or “ASU 2016-09.” ASU 2016-09 simplifies the accounting for several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statement of cash flows. The Company has adopted the new standard on a prospective basis as of December 31, 2017. The Company accounts for forfeitures as they occur. As a result of the adoption, the company has recorded a credit to retained earnings of $0.5 million due to recognition of a deferred tax asset related to stock compensation expensed in previous years. In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows: Classification of Certain Cash Receipts and Cash Payments, or “ASU 2016-15”. ASU 2016-15 amended the existing accounting standards for the statement of cash flows and provided guidance on certain classification issues related to the statement of cash flows. The new standard is effective for the Company beginning for fiscal periods after December 15, 2017 and early adoption is permitted. The amendments should be applied retrospectively to all periods presented. For issues that are impracticable to apply retrospectively, the amendments may be applied prospectively as of the earliest date practicable. The Company is currently evaluating the timing and the impact of these amendments on its statement of cash flows. 13

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 In January 2017, the FASB issued ASU 2017-01, Clarifying the Definition of a Business, or “ASU 2017- 01”. The Company is currently evaluating the effect of the updated standard on its consolidated financial statements and related disclosures. In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other, or “ASU 2017-04”. ASU 2017-04 simplifies the accounting for goodwill impairment by requiring impairment charges to be based on the first step in current GAAP's two-step impairment test. The impairment test is performed by comparing the fair value of a reporting unit with its carrying amount and an impairment charge would be recognized for the amount by which the carrying amount exceeds the reporting unit’s fair value. The new standard is to be applied on a prospective basis and is effective for the Company beginning in fiscal 2020 and early adoption is permitted. The Company is currently evaluating the effect of the updated standard on its consolidated financial statements and related disclosures. (2) Acquisition Dexter & Chaney LLC On July 21, 2017, the Company acquired 100% of the membership interests of Dexter & Chaney LLC (“D&C”), a North American based construction software solution developer for $181 million. The acquisition was funded through the issuance of $305 million of new borrowing with a group of lenders led by Credit Suisse, the proceeds of which were used to fund the acquisition, retire the existing Wells Fargo term loan, and to retire a portion of the Company’s Series C redeemable preferred stock outstanding and related unpaid dividends. The Company completed the acquisition for the purpose of acquiring D&C’s customer relationships, developed technology, trade name, market presence, cross- selling opportunities, revenue and cost synergies and their knowledgeable and experienced workforce. The Company accounted for the transaction using the acquisition method and, accordingly, the consideration has been allocated to the tangible and intangible assets acquired and liabilities assumed based on their estimated fair values. The purchase price allocation was prepared on a preliminary basis and is subject to further adjustments as additional information becomes available concerning the fair value of the assets acquired and liabilities assumed. The Company expects to continue obtaining information to assist it with determining the fair values of the net assets acquired during the measurement period. Preliminary estimates of working capital assets and liabilities acquired were determined based on replacement cost and represent Level 1 measurements within the fair value hierarchy. The preliminary fair value of deferred revenue was estimated by determining the discounted, after tax cost of fulfilling the obligation plus a normal profit margin and represents a Level 3 measurement within the fair value hierarchy. The preliminary fair value of intangibles assets were estimated using either the income approach or the market approach. The customer relationships were valued using the excess earnings method, and the existing technology and trade names were valued using the relief-from-royalty method. The inputs and assumptions used in the valuations included projected revenue, royalty rates, discount rates, useful lives and income tax rates, among others. The development of a number of these inputs and assumptions in the model required a significant amount of management judgment and is based upon a number of factors, including the selection of royalty rates, growth rates and other relevant factors. These fair value measurements constitute Level 3 measurements within the fair value hierarchy. 14

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The purchase price in excess of the fair value of the tangible and identified intangible assets acquired less liabilities assumed is recognized as goodwill, of which identified intangible assets and goodwill of $88.0 million is expected to be tax deductible. Goodwill is primarily attributed to expected synergies resulting from the acquisition. The purchase price includes the transaction value paid per the purchase agreement less the final working capital adjustment. Other transaction costs of $4.3 million related to the acquisition were charged to expense as incurred and are recorded as a component of General and Administration expense in the statement of operations. The preliminary purchase price allocation is as follows (in thousands): Total purchase price, net of cash acquired $ 181,021 Fair value of net tangible assets acquired and liabilities assumed: Assets Trade receivables 5,101 Prepaid expenses 1,523 Deferred taxes 433 Fixed assets 566 Other 281 Total assets 7,904 Liabilities Deferred revenue 4,715 Accrued payroll and benefits 1,349 Other 640 Total liabilities 6,704 Net assets assumed 1,200 Fair value of identifiable intangible assets acquired 63,200 Goodwill $ 116,621 Preliminary Valuation of Identifiable Intangible Assets Acquired The following table summarizes the preliminary values of intangible assets acquired in connection with the acquisition (in thousands): Estimated Fair Value life (years) Customer relationships $31,900 10 Developed technology 18,900 7 Trade name 12,400 10 Total intangible assets subject to amortization $63,200 15

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The Company is amortizing developed technology asset as an intangible within the cost of sales section of the Consolidated Statement of Operations over the respective estimated life of the intangible asset. Customer relationships and trade name assets are being amortized as an expense within the operating expenses section of the Consolidated Statement of Operations over the respective estimated life of each intangible asset. (3) Property and Equipment Property and equipment consist of the following at December 31 (in thousands): 2017 Leasehold improvements $ 9,863 Computer equipment 3,868 Furniture 3,545 Software 1,976 Construction in progress and equipment deposits 271 19,523 Less accumulated depreciation (9,981) $ 9,542 The Company also leases office equipment through capital leases. Accumulated amortization amounted to $0.4 million at December 31, 2017. Amortization of this equipment is included in depreciation expense. Total depreciation expense for the year ended December 31, 2017 was $2.8 million. (4) Intangible Assets Intangible assets consist of the following at December 31 (in thousands): 2017 Acquired developed technology $ 133,544 Customer relationships 104,895 Trade name 36,108 Software development costs 11,922 Favorable lease 1,800 Backlog 1,605 Noncompete agreements 500 290,374 Less accumulated amortization (78,424) $ 211,950 16

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The Company capitalized $4.8 million of internally developed software costs in 2017. During the year ended December 31, 2017, the Company re-evaluated its marketing and branding usage of two if its trade name assets acquired in a previous acquisition and decided to cease the use of these trade names. The Company impaired the assets and recognized a loss of $1.5 million, which is reflected within general and administrative expenses in the accompanying consolidated statement of operations and comprehensive income for the year ended December 31, 2017. Amortization expense for intangible assets was $24.2 million in 2017. The estimated future annual amortization expense of intangible assets, based on preliminary purchase accounting, is as follows (in thousands): Years ending December 31: 2018 $ 29,076 2019 29,009 2020 28,090 2021 27,033 2022 24,360 Thereafter 74,382 $ 211,950 (5) Goodwill The roll-forward of activity related to goodwill was as follows (in thousands): Balance at December 31, 2016 $ 249,967 Changes in foreign exchange rate 2,156 Purchase of Dexter & Cheney 116,621 Balance at December 31, 2017 $ 368,744 Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. Goodwill is reviewed for impairment at least annually. In September 2011, the FASB issued ASU 2011-08, Testing Goodwill for Impairment, which provides an entity the option to perform a qualitative assessment to determine whether it is more-likely than-not that the fair value of a reporting unit is less than its carrying amount prior to performing the two-step goodwill impairment test. If this is the case, the two-step goodwill impairment test is required. If it is more-likely than-not that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill impairment test is not required. If the two-step goodwill impairment test is required, first, the fair value of the reporting unit is compared with its carrying amount (including goodwill). If the fair value of the reporting unit is less than its carrying amount, an indication of goodwill impairment exists for the reporting unit and the entity must perform step two of the impairment test (measurement). Under step two, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill. The implied fair value of goodwill is determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation and the residual fair value after this allocation is the implied fair value 17

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 of the reporting unit goodwill. Fair value of the reporting unit is determined using a discounted cash flow analysis. If the fair value of the reporting unit exceeds its carrying amount, it is not necessary to perform step two. The goodwill recorded on the Company’s books relates primarily to acquisitions made during 2014 and 2017. The Company performed a qualitative assessment of goodwill in 2017 and after performing step one, determined that no indicators were present to suggest that the fair value is less than the carrying amount. Accordingly, no impairment loss was recorded in 2017. (6) Debt Long term debt consists of the following at December 31 (in thousands): 2017 Term loans $ 304,475 Unamortized loan fees (10,594) Capital leases 576 Total debt 294,457 Less current portion 2,551 Balance at December 31 $ 291,906 On July 21, 2017, the Company executed new syndicated debt agreements with Credit Suisse AG, Cayman Island Branch (“Credit Suisse”) for a total of $305 million, extinguished the existing term loan with Wells Fargo bank, and expensed the remaining unamortized loan fees of $0.5 million. The Company incurred $12.4 million in loan fees associated with the issuance of the Credit Suisse debt, which are recorded as a reduction in the carrying value of debt on the Company’s consolidated balance sheet. As of December 31, 2017, the Company has a First Lien Loan of $210 million and a Second Lien Loan of $95 million outstanding as well as a Revolving Credit Loan with undrawn but available borrowings of $30 million, the “Credit Agreements”, and are backed by a group of lenders led by Credit Suisse. The Credit Agreements were primarily used to fund the acquisition of Dexter and Chaney, payoff existing Wells Fargo Term Loans, and to partially retire the Company’s Series C redeemable preferred stock and related accrued dividends. The Credit Agreements require varying quarterly payments. The First Lien Loan requires a quarterly principal payment of $0.5 million based on 0.125% of the aggregate principal of the First Lien Loan, $210 million, as well as accrued interest. The interest rate on the First Lien Loan is 4.25% + LIBOR. To the extent not previously paid, all outstanding amounts, together with accrued and unpaid interest, shall be due and payable on the maturity date, July 20, 2024. As of December 31, 2017, the all-in interest rate on the First Lien Loan was 5.56%. The Second Lien Loan only requires a quarterly payment of the interest accrued during the quarter. The interest rate on the Second Lien Loan is 8.25% + LIBOR. As of December 31, 2017, the all-in interest rate on the Second Lien Loan was 9.56%. The principal and any accrued and unpaid interest shall be due and payable on the maturity date, July 20, 2025. An unused Facility fee is due on a quarterly basis and is based on the amount of the unused portion of the Facility at an annual rate of 0.50%. 18

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The Credit Agreements do not contain any financial covenants that are in effect at December 31, 2017. The agreements do contain financial covenants that become effective March 31, 2018. Maturities on long-term debt and capital lease payments as of December 31, 2017 are as follows for the years ending December 31 (in thousands): 2018 2,556 2019 2,225 2020 2,100 2021 2,100 2022 2,100 Thereafter 293,975 Total debt service payments 305,056 Less amounts representing interest and discount (5) Total long-term debt $ 305,051 (7) Certain Balance Sheet Components The following tables provide details of selected balance sheet items (In thousands): Prepaid expenses: 2017 Commissions $ 4,538 Software maintenance 2,413 Software subscriptions 2,035 Other 1,343 $ 10,329 Accounts payable and accrued expenses: 2017 Accounts payable $ 2,663 Accrued expenses 2,346 Sales taxes payable 1,878 Reserve for product and service returns 1,704 Customer deposits 768 Other 683 $ 10,042 (8) Commitments and Contingencies The Company leases office equipment and office space in Oregon, Washington, Pennsylvania, Australia, and the United Kingdom under operating leases, which expire at various dates through 2022. Total rent expense for the year ended December 31, 2017 was $3.7 million. 19

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 Future minimum rental payments under noncancelable leases as of December 31, 2017 are as follows (in thousands): Capital Operating lease leases 2018 456 3,385 2019 125 3,175 2020 — 3,125 2021 — 2,919 Thereafter — 10,118 Total minimum lease payments 581 $ 22,722 Less amounts representing interest (5) Present value of minimum lease payments $ 576 The Company is also involved in certain litigation matters arising in the ordinary course of business. In the opinion of the Company’s management, these actions will not have a material effect, if any, on the Company’s financial position, results of operations, or liquidity. (9) Income Taxes Income tax expense differed from the amounts computed by applying the U.S. federal income tax rate of 34% to pretax income as a result of the following (in thousands): 2017 Federal tax, at statutory rate of 34% $ (7,406) State and local income taxes, net of federal tax benefit (2,079) Tax credits (997) Tax reform (13,658) Permanent items and other (1,864) Foreign (685) Valuation allowance 2,135 Total income tax benefit $ (24,554) The difference between the expected tax expense computed by applying the federal statutory rate of 34% to income before taxes, and the actual tax expense is primarily due to the benefit of federal and state credits, state and foreign taxes, and nondeductible expense. In addition, the rate is adjusted due to the federal rate change impact on the Company’s deferred taxes per the Tax Cut and Jobs Act, but that benefit is somewhat offset by an increase in the domestic valuation allowance. 20

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The domestic and international components of loss before income tax benefit are presented as follows (in thousands): 2017 Domestic $ (29,973) International 8,192 Loss before taxes $ (21,781) 2017 Income taxes: Current: Federal $ (274) State 161 Foreign 1,421 Total current 1,308 Deferred: Federal (21,201) State (4,015) Foreign (646) Total deferred (25,862) Total income tax benefit $ (24,554) 21

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 The components of deferred tax assets (liabilities) at December 31 were as follows (in thousands): 2017 Deferred tax assets: Accrued expenses and reserves $ 2,545 Deferred rent 379 Intangibles and fixed assets 3,599 Credits 5,908 Net operating loss 5,256 Other 786 Valuation allowance (2,757) Total deferred tax asset 15,716 Deferred tax liabilities: Goodwill and intangibles (42,648) Fixed assets (1,071) Other (142) Total deferred tax liabilities (43,861) Net deferred tax liabilities $ (28,145) The valuation allowance for deferred tax assets as of December 31, 2017 was $2.8 million. The valuation allowance at December 31, 2017 was primarily related to federal and state net operating losses and tax credit carryforwards and certain UK net operating losses, in the judgement of management, are not more likely than not to be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considers the scheduled reversal of deferred tax liabilities (including the impact of available carryback and carryforward periods), projected future taxable income, and tax planning strategies in making this assessment. The Company has state and local net operating loss carryforwards of approximately $41.5 million, which begin to expire in 2020. The Company has foreign net operation loss carryforwards of approximately $1.0 million that begin to expire in 2034. The Company has federal and state research and development credit carryforwards of approximately $4.7 million and $1.3 million, respectively. The federal credits are available to reduce income taxes through 2037 and begin to expire in 2026. The state credits are available to reduce state income taxes through 2024 and begin to expire in 2017. The Company has foreign tax credits of $0.3 million that are available to reduce income taxes through 2026 and begin to expire in 2023. In addition, the Company has a $1.7 million state tax credit related to its capital investments in e-commerce activities and this credit is available to reduce state income taxes through 2021 and begin to expire in 2018. The Company has not recognized a deferred tax liability for the undistributed earnings of its foreign operations that arose in 2017 and prior years as the Company considers these earnings to be permanently reinvested. If the Company plans to repatriate future earnings, those earnings will be exempt from U.S. tax due to the Tax Cuts and Jobs Act. As of December 31, 2017, the undistributed earnings of these subsidiaries were not significant. 22

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 At December 31, 2017, the Company's unrecognized tax benefits totaled $1.6 million if recognized, would affect the effective tax rate. The Company's ongoing practice is to recognize potential accrued interest and penalties related to unrecognized tax benefits within its global operations in income tax expense. At December 31, 2017, the Company has accrued no interest and penalties. The Company does not expect any significant increases or decreases to its unrecognized tax benefits within the next twelve months. The Company’s total amounts of unrecognized tax benefits at the beginning and end of the period are as follows (in thousands): Total Balance as of December 31, 2016 $ 1,443 Additions based on tax positions related to the current year 119 Reductions for tax positions of prior years — Balance as of December 31, 2017 $ 1,562 At December 31, 2017, the Company's statutes of limitations are closed for federal, state and foreign jurisdictions for the years before 2014, 2013 and 2013, respectively. However, to the extent allowed by law, the tax authorities may have the right to examine prior periods where net operating losses or tax credits were generated and carried forward, and make adjustments up to the amount of the net operating losses or credit carry-forward amount. As of December 31, 2017, the Company has adopted Accounting Standards Update No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Shared-Based Payment Accounting (''ASU 2016-09''). ASU 2016-09 simplifies how several aspects of share-based payments are accounted for and presented in the financial statements. ASU 2016-09 is effective for non-public companies for annual reporting periods beginning after December 15, 2017. However, the Company has chosen to early adopt. As a result, the Company has recorded a credit to retained earnings of $0.5 million. The Tax Cuts and Jobs Act was enacted on December 22, 2017. The Act reduces the US federal corporate tax rate from 35% to 21%, requires companies to pay a one-time transition tax on earnings of certain foreign subsidiaries that were previously tax deferred, and creates new taxes on certain foreign sourced earnings. The Company recognized the income tax effects of the 2017 Tax Act in the 2017 financial statements in accordance with Staff Accounting Bulletin No. 118. As such, the financial statements reflect the income tax effects of the 2017 Tax Act for which the accounting under ASC Topic 740 is complete and provisional amounts for those specific income tax effects of the 2017 Tax Act for which the accounting under ASC Topic 740 is incomplete but a reasonable estimate could be determined. At December 31, 2017, the Company has not completed accounting for the tax effects of enactment of the Act, primarily around calculations regarding the income tax effects of the deemed repatriation of deferred foreign earnings; however, the Company has made a reasonable estimate of the effects on their existing deferred tax balances. As a result of these reasonable estimates, the Company recognized a provisional benefit amount of $13.7 million which is included as a component of income tax expense from continuing operations. The Company will continue to make and refine the calculations regarding the income tax effects of the deemed repatriation of deferred foreign earnings as additional analysis and guidance is completed. 23

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 (10) Series C Redeemable Preferred Stock The Series C redeemable preferred stock (“Series C Stock”) are accounted for outside of stockholders’ equity as they are redeemable at the option of the holder beginning on July 24, 2018. Holders of Series C Stock have no voting rights, and, upon liquidation or dissolution, are entitled to be paid in cash at the original issuance price plus accrued and unpaid dividends prior to any cash or assets are distributed to common stockholders. At the time of recapitalization, the Series C Stock was recorded by the Company at its fair value of $53.2 million and had an estimated redemption value of $83.0 million. The difference between the fair value and redemption value of the Series C Stock will be accreted via a charge to accumulated deficit over the period from the date of initial recognition by the Company to the earliest redemption date, July 24, 2018. On July 21, 2017, the Company redeemed 23,539,786 shares of Series C Stock as well as accrued but unpaid dividends up to that date for a total of $30.0 million. The carrying value at the time of the redemption was $29.4 million resulting in a charge to accumulated deficit of $0.6 million for a deemed dividend. As of December 31, 2017, the redemption value of the Series C Stock was $50.3 million, with a carrying value of $47.4 million, and cumulative accrued but unpaid dividends of $11.7 million on the remaining Series C Stock. Dividends will continue to accrue at a rate of 9% per annum thru the redemption date of July 24, 2018. As of December 31, 2017, the Company had authorized, issued, and outstanding 59,715,612, 59,715,612, and 36,176,826 shares of Series C Stock. For the twelve months ended December 31, 2017, the accretion charge to accumulated deficit of the fair value of the Series C Stock amounted to $6.4 million. (11) Stockholders’ Equity Series A Common Stock Holders of Series A common stock are entitled to one vote per share, and, upon liquidation or dissolution, are entitled to receive all assets available for distribution to common stockholders. The holders of Series A common stock have no preemptive or other subscription rights and there are no redemption or sinking fund provisions with respect to such shares. As of December 31, 2017, the Company had authorized, issued, and outstanding 135,000,000, 71,583,371, and 71,337,491 shares of Series A common stock, respectively. Series B Common Stock Series B common stock were authorized as part of the Waterfall Holdings Inc. 2014 Stock Option Plan (“2014 Plan”).The only difference in the rights and preferences of Series A and Series B common stock is that Series B common stock holders are not entitled to vote. All other rights and preferences remain the same to the Series A common stock. Both Series A and Series B common stock is subordinate to the preferred stock with respect to dividend rights, rights upon liquidation, winding up and dissolution of the Company. As of December 31, 2017, the Company had authorized, issued, and outstanding 12,663,476, 11,000, and 11,000 shares of Series B common stock, respectively. The Company issued 11,000 shares of Series B stock in 2017 due to the exercise of options. (12) Share-based compensation Waterfall Holdings, Inc. 2014 Stock Option Plan On June 8, 2014, the Company adopted the 2014 Plan. Options to purchase 11,625,976 shares of Waterfall Holdings, Inc. Class B Common shares were authorized under the 2014 Plan. On November 28, 2017, Waterfall Holdings, Inc. amended the 2014 Plan and increased the number of authorized shares of Class B Common to 12,663,476 shares. Of these options, 50% vest upon achievement of performance 24

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 goals (Performance Awards) and 50% vest over a five-year period, subject to the optionee’s continued service to the Company (Service-based awards). Options generally expire 10 years from the grant date. In accordance with ASC 718, Compensation – Stock Compensation, the grant of share options in Holding’s common shares is recorded as compensation expense in Viewpoint’s standalone financial statements with a corresponding credit to equity representing Holding’s capital contribution. The Performance Awards vesting is dependent on the timing and amount of the return to the Waterfall Holdings investors of their investment in the future equity financings. The performance vesting will vary from 50% to 100% if the targeted investment return ranges from 150% to 200% and occurs within two years after the recapitalization. If the event occurs after the two-year period, the targeted return range would have to be from 200% to 300% to achieve the same vesting outcome for any remaining unvested shares. As the awards have a performance condition related to return of capital to the investors based on future equity financings, no compensation expense will be recorded until a qualifying equity financing occurs. Total unamortized compensation associated with these awards is $2.7 million. The fair value of performance-based stock options granted under the 2014 Plan was calculated using a Monte-Carlo simulation with the following assumptions: expected dividend yield of 0%, expected volatility between 50% and 55%, and risk-free interest rate between 2.21% and 2.63%. The fair value of each Service-based option award for Holding’s common stock is determined on the date of grant using the Black-Scholes-Merton option-pricing model and recognized in earnings on a straight-line basis over the vesting period. The fair value of service-based stock options granted under the 2014 Plan was calculated with the following assumptions: Valuation assumptions: Expected dividend yield - Expected volatility 49% - 50% Expected term (years) 6 Risk-free interest rate 1.24% - 2.24% Stock option activity during the year ended December 31, 2017 for the 2014 Plan is as follows: Number exercise contractual of shares price term Balance at December 31, 2016 9,358,420 $ 3.97 8.25 Granted 1,367,500 6.00 9.75 Granted 1,350,000 3.97 9.18 Exercised (11,000) 3.97 — Forfeited (1,098,275) 3.97 — Balance at December 31, 2017 10,966,645 $ 4.22 7.33 Exercisable at December 31, 2017 2,317,283 $ 4.22 7.33 During the year ended December 31, 2017, total stock compensation expenses associated with the 2014 Plan was $1.5 million. As of December 31, 2017, 11.0 million options to purchase shares of Holding’s common stock are outstanding with a weighted average exercise price of $4.22 per share and a remaining contractual term of 7.33 years. The weighted average grant date fair value of time-based options granted during 2017 from the 2014 Plan was $2.33 per option. At December 31, 2017, there was $5.6 million of 25

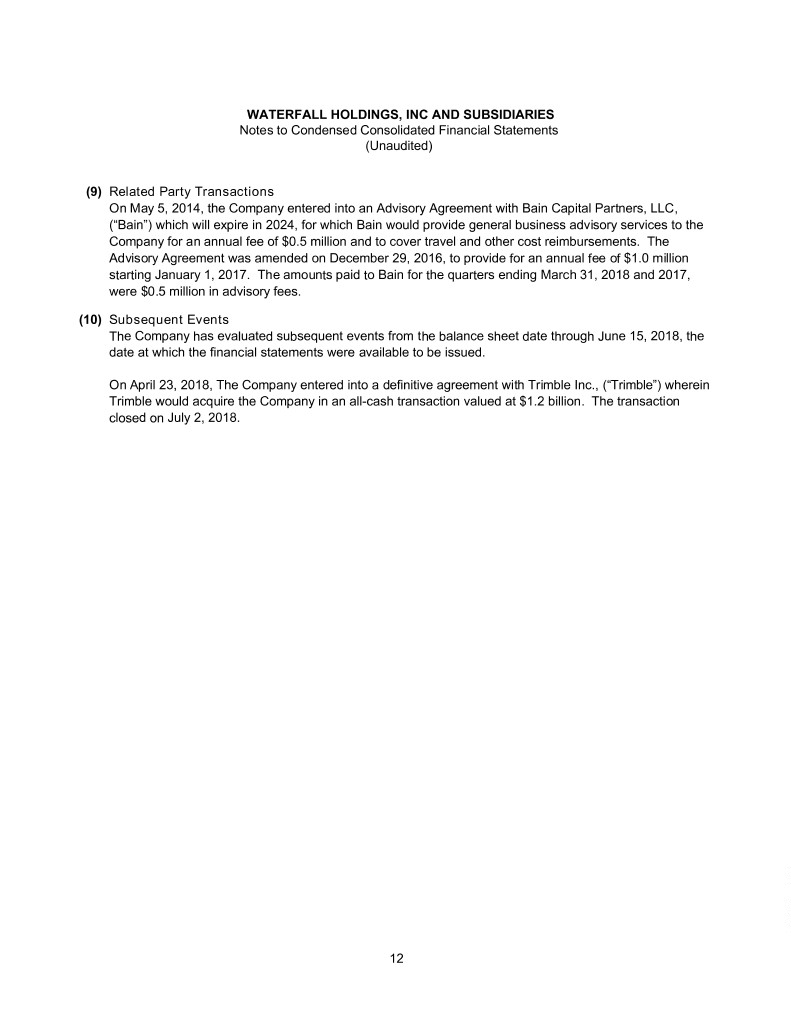

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 total unrecognized compensation cost related to nonvested time-based stock option awards. This cost is expected to be recognized over a weighted average period of 3.4 years. (13) Retirement Plan The Company has an employee savings plan that qualifies as a deferred salary arrangement under Section 401(k) of the Internal Revenue Code. All employees who have completed three months of service and are at least 21 years of age are eligible to participate in the plan. Participating employees may contribute up to 50% (limited to the IRS annual contribution limit) of their income on a pretax basis to the plan, and the Company will make a 50% matching contribution on the first 6% of an employee’s salary deferred in the Plan. The plan also allows for the Company to make additional discretionary contributions. The Company’s matching contributions to the plan were approximately $1.3 million in 2017. No additional discretionary contributions were made in 2017. (14) Restructuring In January 2017, the Company decided to better balance its professional services workforce with anticipated demand. The Company announced in March, 2017 that in connection with its plan, it would terminate approximately 25 employees and partially shut down one of its satellite offices. The employees were eligible for separation benefits upon their termination. In 2017, the Company recorded $1.0 million of expense associated with the planned employee terminations and office closure. All costs related to this restructuring were included in General and administrative expenses in the statement of operations. At December 31, 2017, liabilities of $0.1 million related to these restructuring activities were included in deferred rent. In September 2017, the Company adopted a plan to integrate the newly acquired Dexter & Chaney business and to continue to drive improvements and efficiencies in the Company’s existing operations. The Company announced in October 2017 that in connection with its plan, it would terminate approximately 80 employees and close an office located in the United Kingdom and an office located in the United States. The employees were eligible for separation benefits upon their termination. In 2017, the Company recorded $2.0 million of one-time charges, recorded in General and administrative expenses in the statement of operations, associated with the planned employee terminations. At December 31, 2017, liabilities of $1.6 million related to these restructuring activities were included in accrued expenses and $0.1 million were included in deferred rent. (15) Related Party Transactions On May 5, 2014, the Company entered into an Advisory Agreement with Bain which will expire in 2024, for which Bain would provide general business advisory services to the Company for an annual fee of $0.5 million and to cover travel and other cost reimbursements. The Advisory Agreement was amended on December 29, 2016, to provide for an annual fee of $1.0 million starting January 1, 2017. Amounts paid to Bain for the year ended December 31, 2017 were $1.8 million, which included the advisory fees, reimbursed travel, and other out of pocket expenses. (16) Subsequent Events The Company has evaluated subsequent events from the balance sheet date through June 15, 2018, the date at which the financial statements were available to be issued. On March 30, 2018, the Company acquired 100% of the outstanding shareholder interests in Keystyle Data Solutions, Inc., a privately owned software company based in North America, which provides payroll and human resources software and implementation services for customers who primarily participate in the 26

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements December 31, 2017 construction industry, for total consideration of up to $8.8 million. Of the total consideration, $6.3 million of the purchase price was paid at closing, and $2.5 million of the purchase price will vest to the selling shareholders in annual installments over a two-year period from the acquisition date, subject to such shareholders' compliance with certain employment conditions. Of the $2.5 million, approximately $1.0 million is payable after one year and approximately $1.5 million is payable after two years following the acquisition date. The Company funded the entire acquisition, including the purchase of working capital, with its existing cash on hand. On April 23, 2018, the Company entered into a definitive agreement with Trimble Inc., (Trimble) wherein Trimble would acquire the Company in an all-cash transaction valued at $1.2 billion. 27

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Condensed Consolidated Financial Statements March 31, 2018 (Unaudited)

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Table of Contents Page(s) Financial Statements (Unaudited): Condensed Consolidated Balance Sheets 1 Condensed Consolidated Statements of Operations 2 Condensed Consolidated Statements of Comprehensive Loss 3 Condensed Consolidated Statements of Cash Flows 4 Notes to Condensed Consolidated Financial Statements 5–12

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Balance Sheets (Unaudited, in thousands, except share data) March 31, December 31, Assets 2018 2017 Current assets: Cash and cash equivalents $ 14,053 $ 19,248 Accounts receivable net of allowance for doubtful accounts of of $1,742 and $1,157, respectively 14,573 15,844 Prepaid expenses 12,046 10,329 Other current assets 1,826 961 Total current assets 42,498 46,382 Property and equipment, net 9,271 9,542 Goodwill 373,536 368,744 Intangible assets, net 207,221 211,950 Other long-term assets 2,614 1,043 Total assets $ 635,140 $ 637,661 Liabilities, Redeemable Preferred Stock, and Stockholders’ Equity Current liabilities: Accounts payable and accrued expenses $ 11,432 $ 10,042 Accrued payroll, payroll taxes and benefits 7,450 9,729 Income taxes payable 1,909 1,490 Deferred revenue 39,537 31,523 Current portion of long-term debt 2,493 2,551 Total current liabilities 62,821 55,335 Deferred rent 2,702 2,660 Long-term debt 291,687 291,906 Other long-term liabilities 337 334 Deferred tax liabilities 25,101 28,150 Total liabilities $ 382,648 $ 378,385 Commitments and contingences (Note 6) Series C redeemable preferred stock, $0.001 par value; 59,715,612 authorized, 59,715,612 issued and 36,175,826 outstanding $ 48,641 $ 47,389 Stockholders’ equity: Series A common stock, $0.001 par value; 135,000,000 authorized, 71,583,371 issued and 71,337,491 outstanding $ 71 $ 71 Series B common stock, $0.001 par value; 12,663,476 authorized, 28,000 issued and outstanding — — Additional paid in capital 288,022 287,501 Accumulated other comprehensive income (286) (91) Accumulated deficit (83,956) (75,594) Total stockholders' equity 203,851 211,887 Total liabilities, redeemable preferred stock, and stockholders' equity $ 635,140 $ 637,661 See accompanying notes to condensed consolidated financial statements. 1

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Statements of Operations (Unaudited, in thousands) Quarter Ended Quarter Ended March 31, 2018 March 31, 2017 Net sales: License fees $ 4,636 $ 4,117 Professional services 7,391 6,387 Recurring and other 31,356 25,232 Total net sales 43,383 35,736 Cost of sales: License fees 88 183 Professional services 5,234 4,941 Recurring and other 7,901 5,687 Amortization of intangible assets 3,425 2,621 Total cost of sales 16,648 13,432 Gross profit 26,735 22,304 Operating expenses: Selling and marketing 11,287 8,134 Research and development 6,246 5,408 General and administrative 10,358 6,818 Amortization of intangible assets 3,581 3,767 Total operating expenses 31,472 24,127 Loss from operations (4,737) (1,823) Other income (expense): Interest expense (6,019) (1,030) Other income, net 1,252 1,262 Total other expense (4,767) 232 Loss before taxes (9,504) (1,591) Income tax benefit (2,394) (871) Net loss $ (7,110) $ (720) See accompanying notes to condensed consolidated financial statements. 2

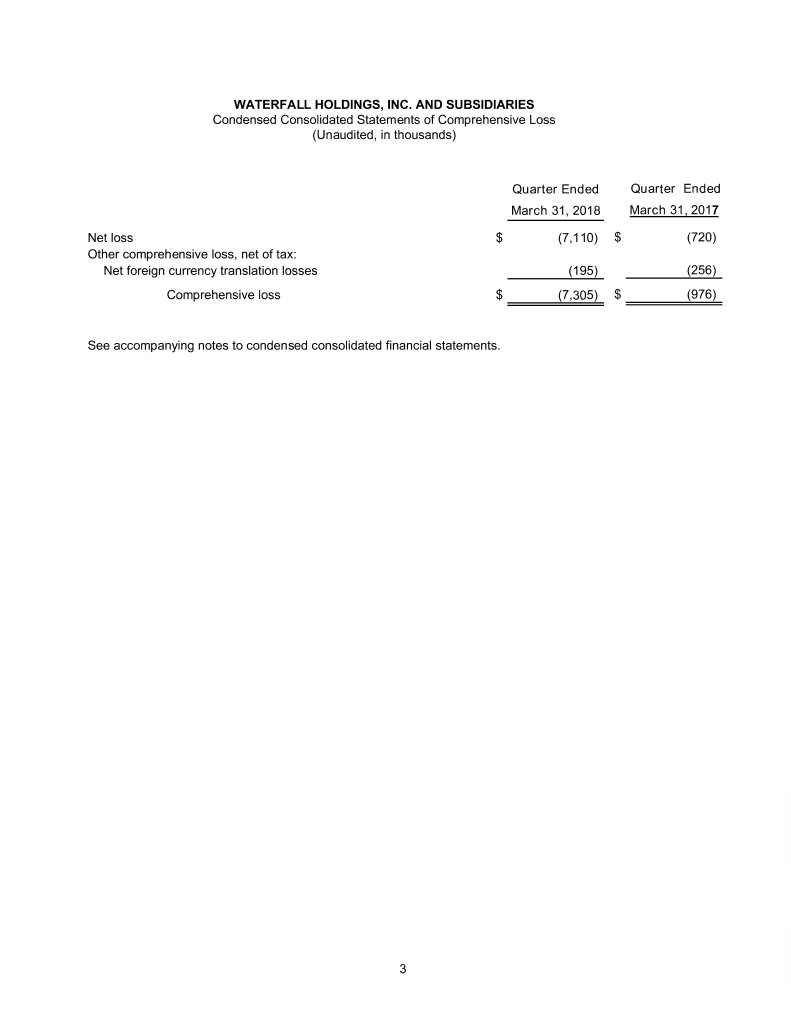

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Statements of Comprehensive Loss (Unaudited, in thousands) Quarter Ended Quarter Ended March 31, 2018 March 31, 2017 Net loss $ (7,110) $ (720) Other comprehensive loss, net of tax: Net foreign currency translation losses (195) (256) Comprehensive loss $ (7,305) $ (976) See accompanying notes to condensed consolidated financial statements. 3