Form 8-K Turning Point Brands, For: Sep 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 5, 2018

TURNING POINT BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-37763

|

20-0709285

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

5201 Interchange Way, Louisville, KY 40229

(Address of principal executive offices)

(502) 778-4421

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8–K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company T

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. T

| Item 1.01 |

Entry into a Material Definitive Agreement.

|

On September 5, 2018, Turning Point Brands, Inc. (the “Company”) completed the acquisition (the “Acquisition”) of International Vapor Group, LLC (“IVG”) pursuant to a Stock Purchase Agreement (the “Stock Purchase Agreement”) dated as of September 5, 2018, by and among (i) Turning Point Brands, LLC, as Buyer, (ii) Pegasus Real Estate Investment Group, LLC, David Epstein, Milander Investments, LLC, David Herrera, David Mardini, John M. Scott, Martin Flumenbaum, Elizabeth McColm, Robert Schumer, Daniel Kramer, Durlan Bergnes, Angelo Bonvino, John Lange and Mark Wlazlo (collectively, the “Shareholders”), (iii) IVG Holdings S Corporation, as Seller, and (iv) Nicolas Molina, as Seller’s Representative.

Pursuant to the Stock Purchase Agreement, the Company purchased the 100% membership interest in IVG held by the Seller for an aggregate purchase price of $24 million, subject to a working capital adjustment. The $24 million purchase price consists of: (i) $15,000,000 in cash at the closing, (ii) 153,079 shares of the Company’s common stock valued at $5,000,000, and (iii) $4,000,000 in the form of an 18-month unsecured promissory note (the “Note”) issued by the Company.

The Note bears interest at a rate equal to 6% per annum, compounded monthly, and has a maturity date 18 months following the closing date. The Note may be prepaid at any time without penalty and is subject to a default rate of 11% per annum. The Note is subject to customary defaults, including defaults for nonpayment, nonperformance and bankruptcy or insolvency of IVG. Upon an event of default and notice by the Seller, the obligations under the Note may accelerate and become immediately due and payable.

In connection with the transaction, IVG will enter into employment agreements with IVG’s two founders, which agreements provide for an aggregate of $4.5 million in contingent earnouts based on performance metrics paid out at the end of two years.

Upon the closing of the Acquisition, the Shareholders and a fund managed by Standard General L.P. have agreed that the Shareholders will exchange the 153,079 shares of the Company’s common stock for 345,525 previously-issued shares of Class A Common Stock of the Company's direct parent, Standard Diversified Inc. Standard General L.P. (and its related funds) constitute the largest shareholder of Standard Diversified Inc. The Company is not a party to this exchange transaction between Standard General L.P. and the Shareholders.

Except as described in this Item 1.01, there are no material relationships between the Company and any of the other parties involved in the Acquisition.

| Item 7.01. |

Regulation FD Disclosure.

|

On September 6, 2018, the Company issued a press release announcing the Acquisition. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

On September 6, 2018, Lawrence S. Wexler, the Company’s President & Chief Executive Officer, and Robert Lavan, the Company’s Chief Financial Officer, will present at the 7th Annual Liolios Gateway Conference. A copy of the slide presentation to be used is attached to this Current Report on Form 8-K as Exhibit 99.2.

The information in this Item 7.01 and the Exhibits attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

| Item 9.01 |

Financial Statements and Exhibits.

|

| (d) |

Exhibits

|

|

Exhibit

|

Description

|

|

|

Press Release dated September 6, 2018

|

||

|

Investor Presentation dated September 6, 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

TURNING POINT BRANDS, INC.

|

|||

|

Dated: September 6, 2018

|

By

|

/s/ James Dobbins

|

|

|

James Dobbins

|

|||

|

Senior Vice President, General

|

|||

|

Counsel and Secretary

|

|||

Exhibit 99.1

FOR IMMEDIATE RELEASE

Turning Point Brands Acquires International Vapor Group

IVG and TPB join together as industry pioneers

LOUISVILLE, Ky. -- (September 6, 2018) -- Turning Points Brands, Inc. (NYSE: TPB) announced that it has acquired International Vapor Group, LLC (“IVG”). TPB is a leader in the Other Tobacco Products space and through its B2B platform, VaporBeast, serves the evolving channels of retail electronic vapor distribution. The acquisition of IVG will add one of the top vapor B2C platforms to the Turning Point Brands family.

IVG markets and sells a broad array of proprietary and third-party vapor products direct to adult consumers via a best-in-class online platform under brand names such as VaporFi, South Beach Smoke, and DirectVapor. VaporFi likewise provides an effective in-store experience at its corporate and franchise retail storefronts where consumers can receive knowledgeable advice on purchases from experienced employees. The company was founded in 2010 and is headquartered in Miami Lakes, Florida.

The acquisition values IVG at $24 million plus $4.5 million of contingent earnouts. Acquisition consideration comprises $15 million of cash, $5 million equivalent of TPB common shares and a $4 million 18-month promissory note. The contingent earnouts are based on performance metrics paid out at the end of two years. For the twelve-month period ending June 30, 2018, IVG had revenue of approximately $47.7 million and EBITDA of $4.9 million. TPB expects the transaction to be immediately accretive. As part of the acquisition, TPB will consolidate underperforming overlapping channels that will lower remaining TPB 2018 net sales by $5.0 million.

TPB President and Chief Executive Officer, Larry Wexler commented, “IVG has played an important role in shaping the vaping industry since its inception through its commitment to the consumer experience with a world class B2C infrastructure. This greatly expands our capabilities across all of our selling channels. The scale created via the combination of IVG and TPB family of vapor businesses will provide significant synergies in logistics, marketing and sourcing, which ultimately will benefit our consumers.”

“Turning Point Brands has been a pioneer in the burgeoning vapor industry,” said Nick Molina, Co-Founder of IVG. “I am excited TPB leadership recognized the growth potential for IVG. This acquisition will continue to enhance the quality of products and buying experience available to consumers and our franchisees.” Nick Molina will join the TPB management team as President of IVG.

“TPB’s increased commitment to the vapor space underlines our company’s dedication to ensuring that this industry succeeds and continues to assist the adult consumers and small businesses who depend on using and selling vapor products,” said Graham Purdy, President, New Ventures. “By bringing IVG into the TPB family, we are leveraging our industry-leading brand and regulatory infrastructure to build the preeminent vertically-integrated smoking alternative platform.”

Frost Brown Todd acted as legal counsel to TPB and Moss Adams acted as financial and tax advisor.

About Turning Point Brands, Inc.

Louisville, Kentucky-based Turning Point Brands, Inc. (NYSE: TPB) is a leading U.S. provider of Other Tobacco Products. TPB, through its three focus brands, Stoker’s® in Smokeless products, Zig-Zag® in Smoking products and the VaporBeast® distribution engine in NewGen products, generates solid cash flow which it uses to finance acquisitions, increase brand support and strengthen its capital structure. TPB does not sell cigarettes. More information about the company is available at its corporate website, www.turningpointbrands.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as "anticipate," "believe," "expect," "intend," "plan" and "will" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. As a result, actual events may differ materially from those expressed in or suggested by the forward-looking statements. Factors that could cause these differences include, but are not limited to, the factors set forth in “Risk Factors” included in TPB’s annual report on Form 10-K and other reports filed with the Securities and Exchange Commission from time to time. Any forward-looking statement made by TPB in this presentation speaks only as of the date hereof. New risks and uncertainties come up from time to time, and it is impossible for TPB to predict these events or how they may affect it. TPB has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws.

Non-GAAP Financial Measures

This press release includes certain non-U.S. generally accepted accounting principles (“GAAP") financial measures, including EBITDA. Such non-GAAP financial measures are not in accordance with, or an alternative to, financial measures prepared in accordance with GAAP. To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, we use non-U.S. GAAP financial measures, including EBITDA. We believe EBITDA provides useful information to management and investors regarding certain financial and business trends relating to financial condition and results of operations. We believe that EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance.

Non-U.S. GAAP measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with U.S. GAAP. EBITDA exclude significant expenses that are required by U.S. GAAP to be recorded in our financial statements and is subject to inherent limitations. In addition, other companies in our industry may calculate these non-U.S. GAAP measure differently than we do or may not calculate it at all, limiting its usefulness as a comparative measure.

IVG’s calculation of EBITDA for the 52 weeks ended June 30, 2018, is as follows:

|

$ thousand

|

||||

|

Net Income

|

4,485

|

|||

|

Depreciation and Amortization

|

458

|

|||

|

Interest Expense

|

6

|

|||

|

Taxes

|

0

|

|||

|

EBITDA

|

4,949

|

|||

EBITDA is not an earnings measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP; accordingly, EBITDA may not be comparable to similar measures presented by other companies. EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial performance prepared in accordance with GAAP. EBITDA is not a completely representative measure of either the historical performance or, necessarily, the future potential of IVG.

Contacts:

(502) 774-9238

Exhibit 99.2

Gateway ConferenceSeptember 6, 2018

Disclaimer FORWARD LOOKING STATEMENTSThis presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may generally be identified by the use of words such as "anticipate," "believe," "expect," "intend," "plan" and "will" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. As a result, actual events may differ materially from those expressed in or suggested by the forward-looking statements. Factors that could cause these differences include, but are not limited to, the factors set forth in “Risk Factors” included in TPB’s annual report on Form 10-K and other reports filed with the Securities and Exchange Commission from time to time. Any forward-looking statement made by TPB in this presentation speaks only as of the date hereof. New risks and uncertainties come up from time to time, and it is impossible for TPB to predict these events or how they may affect it. TPB has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws.This presentation includes industry and market data derived from internal analyses based upon publicly available data or proprietary research and analysis, surveys or studies conducted by third parties and industry and general publications, including those by the Management Science Associates, Inc. (“MSAi”) and Nielsen Holdings, N.V. (“Nielsen”). Third-party industry and general publications, research, surveys and studies generally state that the information contained therein has been obtained from sources believed to be reliable. Although there can be no assurance as to the accuracy or completeness of the included information, we believe that this information is reliable. While we believe our internal analyses are reliable, they have not been verified by any independent sources. Any such data and analysis involve risks and uncertainties and are subject to change based on various factors, including those set forth in “Risk Factors” included in TPB’s annual report on Form 10-K and other reports filed with the Securities and Exchange Commission from time to time.NON-GAAP RECONCILIATIONThis presentation includes certain non-U.S. generally accepted accounting principles (“GAAP") financial measures, including EBITDA, Adjusted EBITDA and Net Debt. Such non-GAAP financial measures are not in accordance with, or an alternative to, financial measures prepared in accordance with GAAP. To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, we use non-U.S. GAAP financial measures, including EBITDA, Adjusted EBITDA and Net Debt. We believe EBITDA and Adjusted EBITDA provide useful information to management and investors regarding certain financial and business trends relating to financial condition and results of operations. Adjusted EBITDA and Net Debt are used by management to compare performance to that of prior periods for trend analyses and planning purposes and are presented to our board of directors. We believe that EBITDA and Adjusted EBITDA are appropriate measures of operating performance because they eliminate the impact of expenses that do not relate to business performance. Non-U.S. GAAP measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA exclude significant expenses that are required by U.S. GAAP to be recorded in our financial statements and is subject to inherent limitations. In addition, other companies in our industry may calculate these non-U.S. GAAP measure differently than we do or may not calculate it at all, limiting its usefulness as a comparative measure. 2

Leading Other Tobacco Products (OTP) provider (not cigarettes)Broad portfolio of compelling brands in higher margin tobacco productsWell positioned for growing vapor and evolving alternative products through NewGen sales engineCreating leverage as an active consolidator through management, regulatory, purchasing and systems 3

FOCUS BRANDS DRIVE ORGANIC GROWTH SMOKELESS SMOKING NEWGEN Among fastest growing MST brands#2 Chew brand Leading vaping ecommerce sitesDistribution engine for vapor and alternatives #1 Premium paper in U.S. and Canada#1 MYO Cigar wrap 29% 37% 34% 4 % of LTM (6/18) Net Sales Source: MSAi

STOKER’S: LONG-TERM ORGANIC GROWTH Acquired Stoker’s brand in 2003Stoker’s was the original “big-bag” chew brand, and its brand equity and quality product drove outperformance in a declining marketExpanded a highly-differentiated and proprietary moist snuff tub (equivalent to 10 cans) in 2007, which directly competed with Philip Morris and ReynoldsOwned manufacturing in Dresden, Tennessee that allows the Company to manage costs and keep up with growing demand and preserve proprietary product formulationHit ~70,000 stores in early 2018 with launch of product in 15,000 Dollar General locationsIndustry has had three price increases over the past 18-months which the Company followed; however, TPB continues to price at 25-40% discount to competition SMOKELESS Stoker’s MST Effective Share Source: MSAi 5

ZIG-ZAG: CONSISTENT SALES WITH TAILWINDS #1 premium paper in the U.S. and CanadaContinued industry leading share in wraps Developed multiple SKUs for promising Canadian market, as our partner prepares for legalization of recreational cannabis in October 2018Early feedback on U.S. Hemp papers has been very positive SMOKING TPB Smoking Segment: Quarterly Reported Sales and Gross Profit 6 $ in millions

NEWGEN: SALES ENGINE Acquired VaporBeast in November 2016. One of the leading wholesale distributors reaching 4,500 vape shopsInternational Vapor Group (“IVG”) announced September 6, 2018, is a best in class B2C engine VaporBeast and IVG combined, along with Vapor Shark and Vapor Supply, creates a fully integrated supply chain with scale: 7 Best positioned in the market to navigate complex regulatory environmentPurchasing, logistics and franchise synergiesTop of the fold domain propertiesRetail and franchise subsets allow for better understanding consumer trendsTPB core infrastructure in R&D and product development will drive retail wins NEWGEN

Acquired International Vapor Group (“IVG”) for $24 million plus $4.5 million of contingent earnouts. 6/18 LTM Sales of $47.7 million and EBITDA of $4.9 millionIVG comprises a handful of B2C brands that provide adult consumers vaping experiences across proprietary and third-party vapor productsTeam includes leaders in online marketing, product development, IT infrastructure, retail and distribution NEWGEN: IVG REVIEW IVG has nine corporate stores and 25 franchisee locationsWill complement seven Vapor Supply corporate stores, seven Vapor Shark corporate stores and 33 Vapor Shark franchisee locationsConsolidated TPB family will be second largest vape brick and mortar retailer in country. Good place to understand consumer dynamics across vaping and other alternatives (on top of troves of data from B2C sites)TPB purchasing team and logistics will drive significant synergiesScale out of leveraging product development and regulatory compliance 8 NEWGEN IVG LTM (6/18) Sales To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, we use non-U.S. GAAP financial measures including EBITDA and Adjusted EBITDA. Please refer to the Appendix (Page 14) for a reconciliation of EBITDA to net income.

BALANCED PORTFOLIO ACROSS CONSUMER CLASSES 9

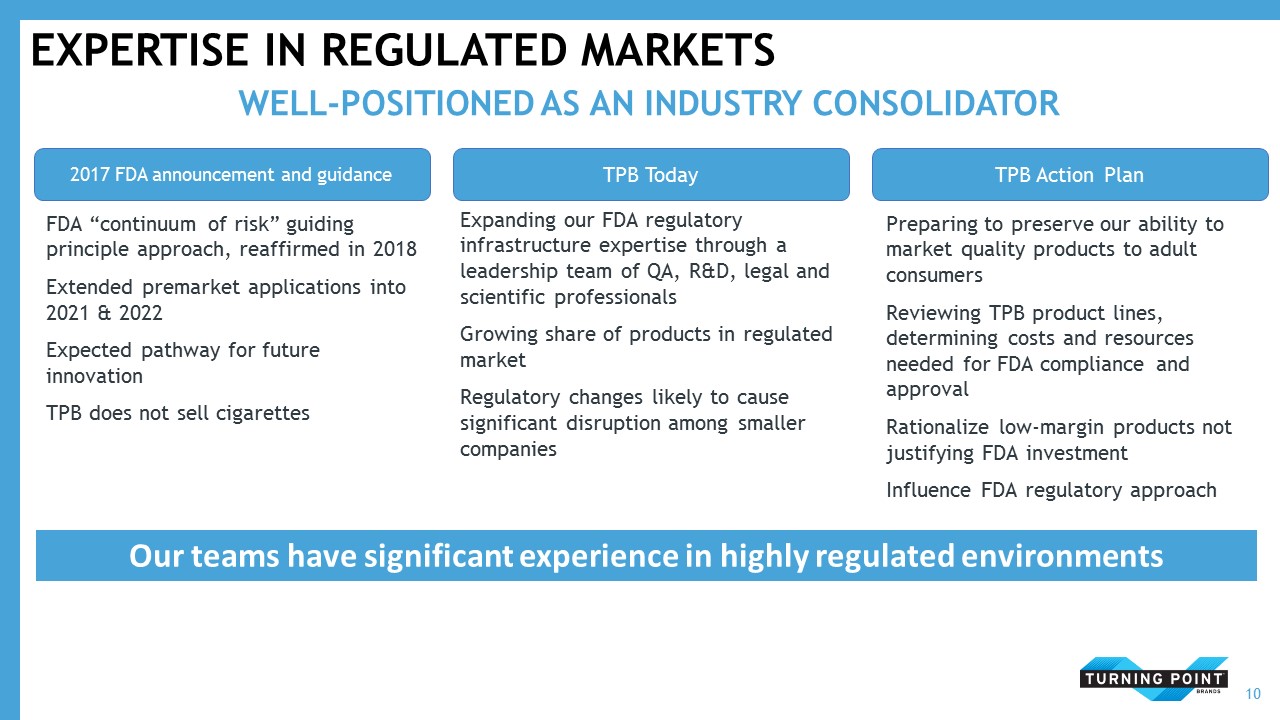

WELL-POSITIONED AS AN INDUSTRY CONSOLIDATOR EXPERTISE IN REGULATED MARKETS TPB Today Expanding our FDA regulatory infrastructure expertise through a leadership team of QA, R&D, legal and scientific professionals Growing share of products in regulated marketRegulatory changes likely to cause significant disruption among smaller companies TPB Action Plan Preparing to preserve our ability to market quality products to adult consumersReviewing TPB product lines, determining costs and resources needed for FDA compliance and approvalRationalize low-margin products not justifying FDA investmentInfluence FDA regulatory approach FDA “continuum of risk” guiding principle approach, reaffirmed in 2018Extended premarket applications into 2021 & 2022Expected pathway for future innovationTPB does not sell cigarettes 2017 FDA announcement and guidance Our teams have significant experience in highly regulated environments 10

GROWING CASH FLOW AND REDUCED LEVERAGE Increasing Adjusted EBITDA Reduced Interest Expense Reduced Leverage (Net Debt / Adjusted EBITDA) Growing Net Sales 11 $ in millions To supplement our financial information presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, we use non-U.S. GAAP financial measures including EBITDA and Adjusted EBITDA. We define “Adjusted EBITDA” as net income before interest expense, loss on extinguishment of debt, income taxes, depreciation, amortization, other non-cash items, and other items that we do not consider ordinary course in our evaluation of ongoing, operating performance. Please refer to the Appendix (Page 13) for a reconciliation of Adjusted EBITDA to net income.

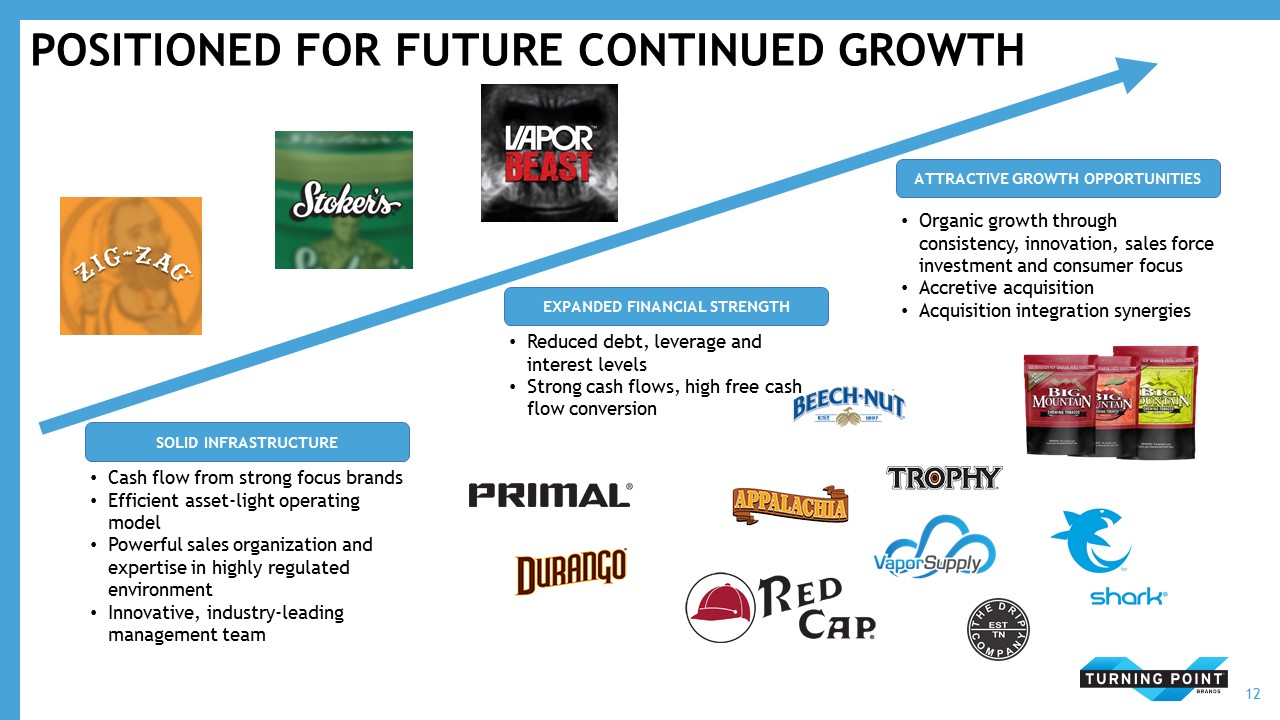

POSITIONED FOR FUTURE CONTINUED GROWTH 12 Cash flow from strong focus brandsEfficient asset-light operating modelPowerful sales organization and expertise in highly regulated environmentInnovative, industry-leading management team Solid infrastructure Reduced debt, leverage and interest levelsStrong cash flows, high free cash flow conversion Expanded financial strength Organic growth through consistency, innovation, sales force investment and consumer focusAccretive acquisitionAcquisition integration synergies Attractive growth opportunities

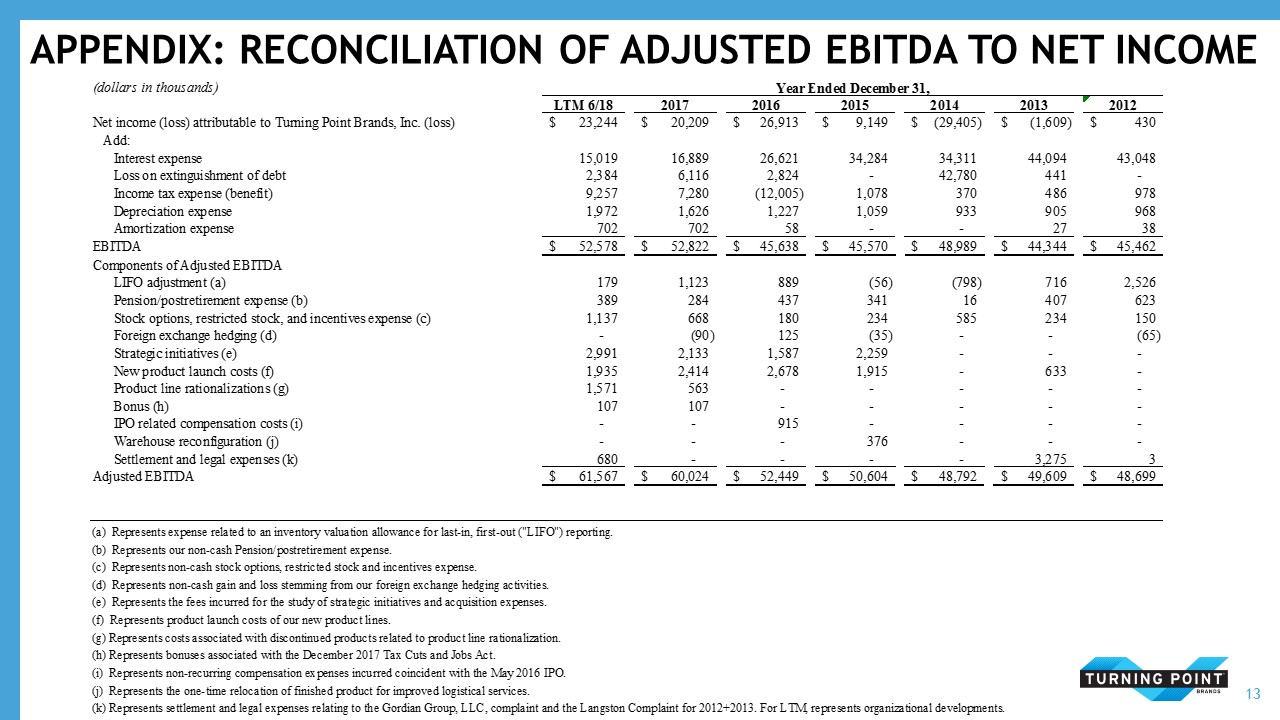

APPENDIX: RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME 13

APPENDIX: RECONCILIATION OF ADJUSTED EBITDA TO NET INCOMEIVG: LTM (6/18) EBITDA 14