Form 8-K NEWPARK RESOURCES INC For: Aug 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2018

NEWPARK RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-02960 | 72-1123385 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

9320 Lakeside Boulevard, Suite 100 The Woodlands, TX | 77381 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (281) 362-6800

Not Applicable |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

p | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

p | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

p | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

p | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Newpark Resources, Inc. (the “Company”) has prepared presentation materials (the “Presentation Materials”) that management intends to use from time to time, on August 20, 2018, and thereafter, in presentations about the Company’s operations and performance. The Company may use the Presentation Materials, possibly with modifications, in presentations to current and potential investors, lenders, creditors, insurers, vendors, customers, employees and others with an interest in the Company and its business.

The information contained in the Presentation Materials is summary information that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While the Company may elect to update the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, the Company specifically disclaims any obligation to do so. The Presentation Materials are furnished as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference. The Presentation Materials will also be posted in the Investor Information section of the Company’s website, http://www.newpark.com for up to 90 days.

The information referenced under Item 7.01 (including Exhibit 99.1 referenced in Item 9.01 below) of this Current Report on Form 8-K is being “furnished” under “Item 7.01. Regulation FD Disclosure” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in this Current Report on Form 8-K (including Exhibit 99.1 referenced in Item 9.01 below) shall not be incorporated by reference into any registration statement, report or other document filed by the Company pursuant to the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

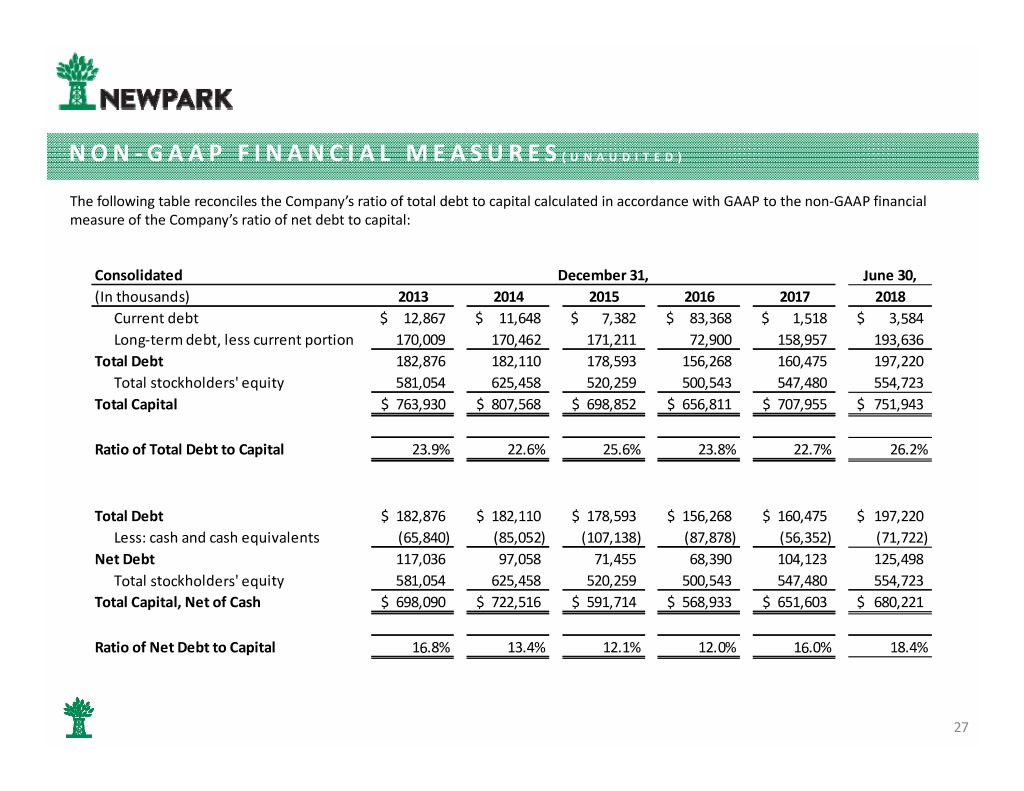

Use of Non-GAAP Financial Information

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include: earnings before interest, taxes, depreciation and amortization (“EBITDA”); EBITDA Margin; Net Debt; and, the Ratio of Net Debt to Capital.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and/or that of other companies in our industry. In addition, management uses these measures to evaluate operating performance, and our annual cash incentive compensation plan has included performance metrics based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Applicable reconciliations to the nearest GAAP financial measure of each non-GAAP financial measure are included in the attached Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) | Exhibits | |||

Exhibit No. | Description | |||

99.1 | ||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NEWPARK RESOURCES, INC. | |||

(Registrant) | |||

Date: | August 20, 2018 | By: | /s/ Gregg S. Piontek |

Gregg S. Piontek | |||

Senior Vice President and Chief Financial Officer | |||

(Principal Financial Officer) | |||

NEWPARK RESOURCES PRESENTATION AUGUST 2018

FORWARD LOOKING STATEMENTS This presentation contains “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements that address expectations or projections about the future, including Newpark's strategy for growth, product development, market position, expected expenditures and future financial results are forward‐looking statements. Words such as “will,” “may,” “could,” “would,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” and similar expressions are intended to identify these forward‐looking statements but are not the exclusive means of identifying them. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, including those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Newpark, particularly its Annual Report on Form 10‐K for the year ended December 31, 2017, as well as others, could cause results to differ materially from those expressed in, or implied by, these statements. These risk factors include, but are not limited to, risks related to the worldwide oil and natural gas industry, our customer concentration and reliance on the U.S. exploration and production market, risks related to our international operations, our ability to replace existing contracts, the cost and continued availability of borrowed funds including noncompliance with debt covenants, operating hazards present in the oil and natural gas industry, our ability to execute our business strategy and make successful business acquisitions and capital investments, the availability of raw materials or the impact of tariffs on the cost of such raw materials, the availability of skilled personnel, our market competition, our ability to expand our product and service offerings and enter new customer markets with our existing products, compliance with legal and regulatory matters, including environmental regulations, the availability of insurance and the risks and limitations of our insurance coverage, the ongoing impact of the U.S. Tax Cuts and Jobs Act and the refinement of provisional estimates, potential impairments of long‐lived intangible assets, technological developments in our industry, risks related to severe weather, particularly in the U.S. Gulf Coast, cybersecurity breaches or business system disruptions and risks related to the fluctuations in the market value of our common stock. Newpark's filings with the Securities and Exchange Commission can be obtained at no charge at www.sec.gov, as well as through our website at www.newpark.com. We assume no obligation to update, amend or clarify publicly any forward‐looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. In light of these risks, uncertainties and assumptions, the forward‐looking events discussed in this presentation might not occur. 2

NON‐ GAAP FINANCIAL MEASURES This presentation includes references to financial measurements that are supplemental to the Company’s financial performance as calculated in accordance with generally accepted accounting principles (“GAAP”). These non‐GAAP financial measures include earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA Margin, Net Debt and the Ratio of Net Debt to Capital. Management believes that these non‐GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and/or that of other companies in our industry. In addition, management uses these measures to evaluate operating performance, and our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non‐GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. 3

COMPANY OVERVIEW Consolidated Revenues $1,400 Balanced income contribution from two Full Year operating segments: $1,200 $1,118 First Half $1,042 $1,000 Fluids Systems 3rd largest global provider of Drilling and millions) $800 $748 ($ $677 Completions Fluids to Oil and Gas $600 $471 exploration** Revenues $400 $464 $342 Mats and Integrated Services $200 Leading provider of engineered worksite $0 solutions, with diversified customer 2013 2014 2015 2016 2017 2018 base across industries First Half 2018 ‐ Breakdown by Segment Oil and gas exploration Electrical transmission and distribution Revenue EBITDA* Fluids Systems Pipeline Mats and Integrated Services Petrochemical 23% Construction 48% 52% 77% Revenue recovery driven by oilfield activity increase and strategic growth * EBITDA is a non‐GAAP financial measure. See reconciliation to the most comparable initiatives GAAP measure in the Appendix to this presentation. EBITDA contribution % based on ** Source: 2017 Oilfield Market Report, Spears & Associates, Inc. Segment EBITDA and excludes Corporate Office expenses. 4

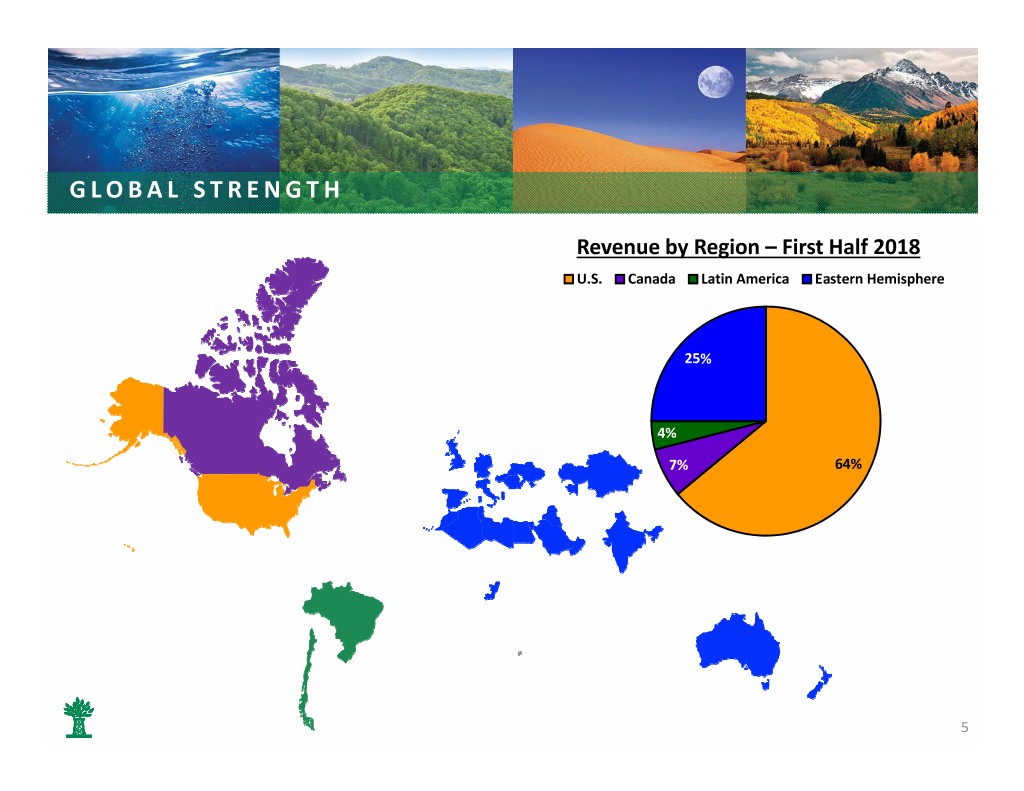

GLOBAL STRENGTH Revenue by Region –First Half 2018 U.S. Canada Latin America Eastern Hemisphere 25% 4% 7% 64% 5

STRENGTHENED BY OUR INVESTMENTS Infrastructure investments significantly enhance our competitiveness and support our market expansion and diversification initiatives Reflects our commitment to be the global leader in fluids and matting technology Fluids: Manufacturing Facility & Distribution Center ‐ Completed 2016 Mats: Manufacturing Facility ‐ Completed 2015 Fluids: Gulf of Mexico Deepwater and Technology Center ‐ Completed 2016 Shorebase –Completed 2017 6

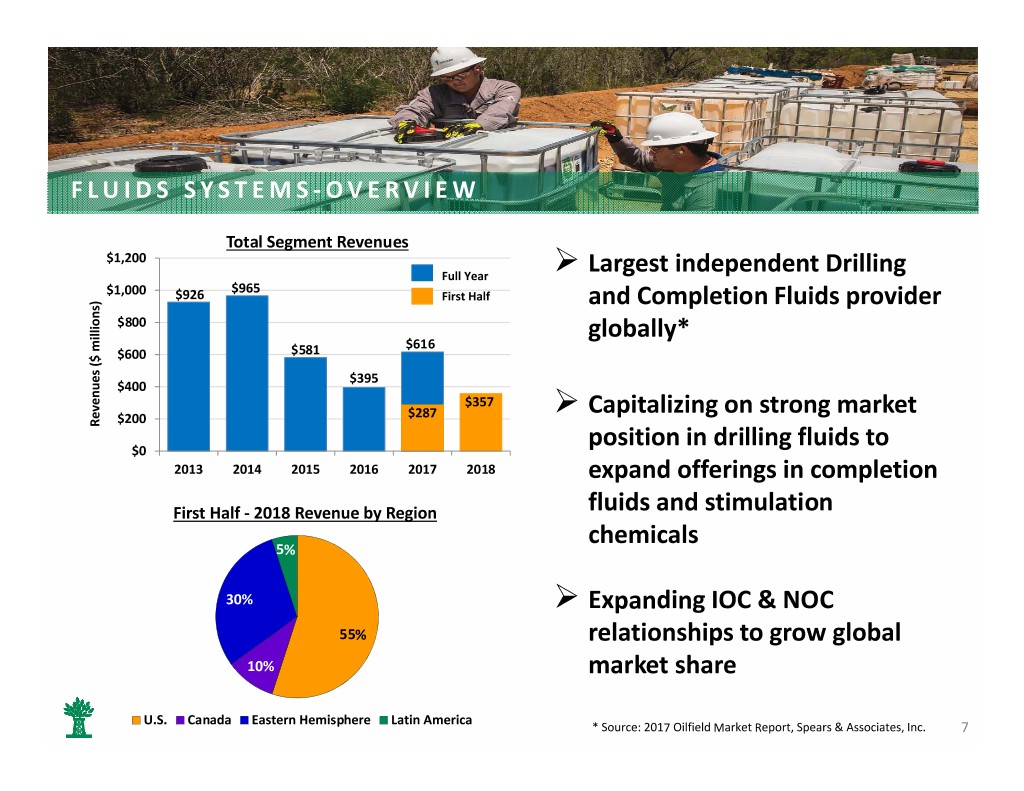

FLUIDS SYSTEMS‐ OVERVIEW Total Segment Revenues $1,200 Full Year Largest independent Drilling $965 $1,000 $926 First Half and Completion Fluids provider $800 globally* millions) $616 $600 $581 ($ $395 $400 $357 Capitalizing on strong market $200 $287 Revenues $0 position in drilling fluids to 2013 2014 2015 2016 2017 2018 expand offerings in completion First Half ‐ 2018 Revenue by Region fluids and stimulation chemicals 5% 30% Expanding IOC & NOC 55% relationships to grow global 10% market share U.S. Canada Eastern Hemisphere Latin America * Source: 2017 Oilfield Market Report, Spears & Associates, Inc. 7

FLUIDS SYSTEMS‐ LEADING TECHNOLOGY Proven drilling fluid systems designed to enhance wellsite performance Evolution® high‐performance, water‐based technology for global applications Fusion™ brine fluid system creates a unique enhancement for shale basins Kronos™ deepwater drilling fluid systems offers operators a consistent fluid across a wide temperature and pressure spectrum Fluids Development Driving continued advancements in technology, bringing new chemistries to enhance drilling efficiencies in challenging environments 8

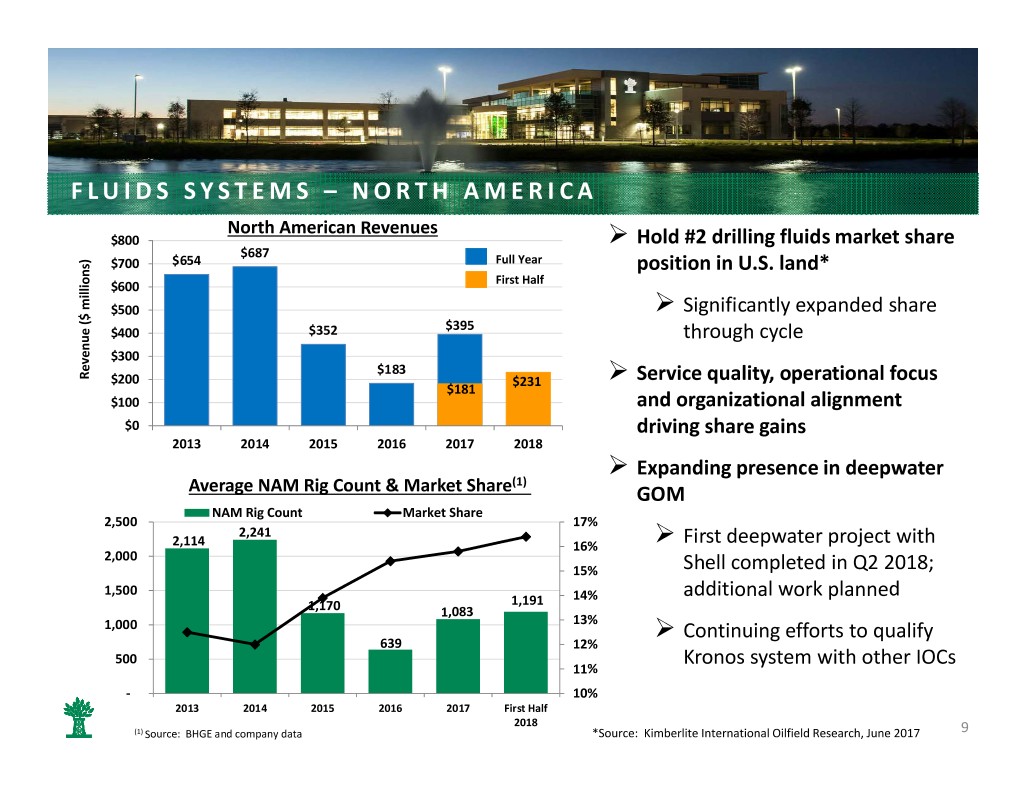

FLUIDS SYSTEMS –NORTH AMERICA North American Revenues $800 Hold #2 drilling fluids market share $687 $700 $654 Full Year position in U.S. land* $600 First Half millions) $500 Significantly expanded share ($ $395 $400 $352 through cycle $300 $183 Revenue $200 $231 Service quality, operational focus $181 $100 and organizational alignment $0 driving share gains 2013 2014 2015 2016 2017 2018 Expanding presence in deepwater (1) Average NAM Rig Count & Market Share GOM NAM Rig Count Market Share 2,500 17% 2,241 2,114 16% First deepwater project with 2,000 15% Shell completed in Q2 2018; 1,500 additional work planned 1,191 14% 1,170 1,083 13% 1,000 Continuing efforts to qualify 639 12% 500 Kronos system with other IOCs 11% ‐ 10% 2013 2014 2015 2016 2017 First Half 2018 (1) Source: BHGE and company data *Source: Kimberlite International Oilfield Research, June 2017 9

FLUIDS SYSTEMS – INTERNATIONAL International Revenues $350 International presence remains key to Full Year $300 $272 $278 First Half our strategy, leveraging IOC/NOC $250 $229 $220 relationships globally $212 $200 millions) More stable than NAM through the ($ $150 industry cycles $126 $100 $106 Longer term contracts Revenue $50 Largely IOCs/NOCs $0 Fewer competitors 2013 2014 2015 2016 2017 2018 Key contract awards have driven steady International Revenues by Region growth in EMEA region $300 APAC $28 Kuwait (KOC) $250 $36 LATAM $5 $4 Algeria (Sonatrach) $18 EMEA $200 $84 $99 $47 $40 $37 Republic of Congo (ENI) millions) $8 ($ $150 Albania (Shell) $100 $17 $166 $164 $167 $179 APAC increasing due to Q1 2018 start‐ $137 Revenue $50 $101 up of Woodside project in offshore $0 Australia 2013 2014 2015 2016 2017 First Half Partnering with Baker Hughes on 2018 integrated service offering 10

MATS & INTEGRATED SERVICES ‐ OVERVIEW Leading provider of engineered Total Segment Revenues worksite and access solutions $180 $153 Full Year $160 First Half Established core business in NAM $140 $132 $116 E&P market, where mats reduce $120 $96 operator’s costs and improve millions) $100 $106 ($ $76 environmental protection during $80 drilling and completion phase $60 Revenues $55 In recent years, expanded into non‐ $40 E&P end markets, which now $20 comprise ~50% of revenues $0 2013 2014 2015 2016 2017 2018 Revenues include rentals & service, as well as sales of manufactured First Half Revenue by End Market First Half Revenue by Type matting products NAM E&P NAM NON‐E&P INT'L NON‐E&P Product Sales Rental Service 2017 acquisition significantly $7 $21 expanded service revenues $46 Patented technology, service $54 capability and size of composite mat $45 rental fleet provide competitive $39 advantage 11

MATS ‐ COMPETITIVE ADVANTAGES ACROSS INDUSTRIES Superior Transportation, Install & Enhanced EH&S Scale & Quality Remediation Efficiency Attributes Responsiveness DO WE HAVE PHOTOS OF ACTUAL INSTALL? PHOTO FROM PG 3 OF BROCHURE? 12

MATS – ACCELERATING MARKET DIVERSIFICATION Leveraging manufacturing capacity expansion to diversify market exposure. Primary markets targeted include: Utility Transmission Pipeline Utility Transmission & Distribution – Primary competitive offerings include wood mats and gravel – Market share currently <3%* – Industry spending projected to grow by 4% annually** Well Completions Oil & Gas Drilling Oil & Gas Pipeline – Primary competitive offerings include wood mats and gravel – Market share currently <3%* – Industry spending projected to grow by 2.9% annually** *Company estimates Heavy Haul Construction **IBISWorld Industry Report 13

MATS – ACCELERATING PRODUCT DEVELOPMENT Leveraging R&D center to drive innovation, including next‐generation matting systems, accessories and adaptations EPZ Grounding System – Patented system – Elevates worksite safety in utility transmission and distribution markets – Fully integrated with Dura‐Base matting EPZ Grounding System Safety Railings system Mobile Mat Washer – Automated system provides efficient mat cleaning on customer sites – Reduces labor costs – Environmental benefits include reduced water consumption and improved separation Pedestrian Access Ramp Mobile Mat Washing System of contaminants Accessories – Safety railing – Pedestrian access ramps – Secondary containment • Berms • Liners Turning Mat Stronghold Berms – Grapple installation system 14

FINANCIAL FOCUS Operating Cash Flow $200 Consistently generated positive operating $152 cash flow and maintained modest debt $150 $122 level throughout the cycle $100 $89 Short‐Term Focus Millions $ $50 $38 $21 Pursue repatriation of available foreign $11 $0 cash following U.S. tax reform 2013 2014 2015 2016 2017 First Half 2018 Continue efforts to optimize working Capital Structure capital Total Debt Net Debt (1) Total Debt to Capital Ratio $250 35% Long‐Term Strategic Focus $197 $200 $183 $182 $179 32% Continue strategic investments in fluids $156 $160 $150 29% $125 IOC/deepwater penetration $117 $104 Millions $100 $97 26% $ $71 $68 Expand product offering to leverage global $50 23% footprint $0 20% Aggressively pursue non‐E&P market 2013 2014 2015 2016 2017 June expansion in mats 2018 (1) Net Debt is a non‐GAAP financial measure. See reconciliation to the most comparable GAAP measure in the Appendix to this presentation. 15

APPENDIX

MATS – UTILITY TRANSMISSION AND DISTRIBUTION Market fully addressable by Newpark* Market partially addressable by Newpark* Site Access Market • Represents 5‐10% of total industry spend * • Primary competitive offerings to composite mats include wood mats and gravel Other Key Demand Drivers (for Access Products) • Aging infrastructure, grid hardening Outlook • Substation upgrade programs The industry is expected to grow moderately • Environmental regulations and sensitivity over the next five years. Demand from • Location / Terrain private electrical power customers is expected to continue expanding as economic • Weather growth boosts electricity demand from businesses. Additionally, as power generation is increasingly shifted from coal to natural gas and renewable sources, requiring higher infrastructure investment, the industry is anticipated to benefit. Market Data and Outlook Source: IBISWorld Industry Report 23713 – Transmission Line Construction in * Based on Company estimates the U.S. – September 2017 17

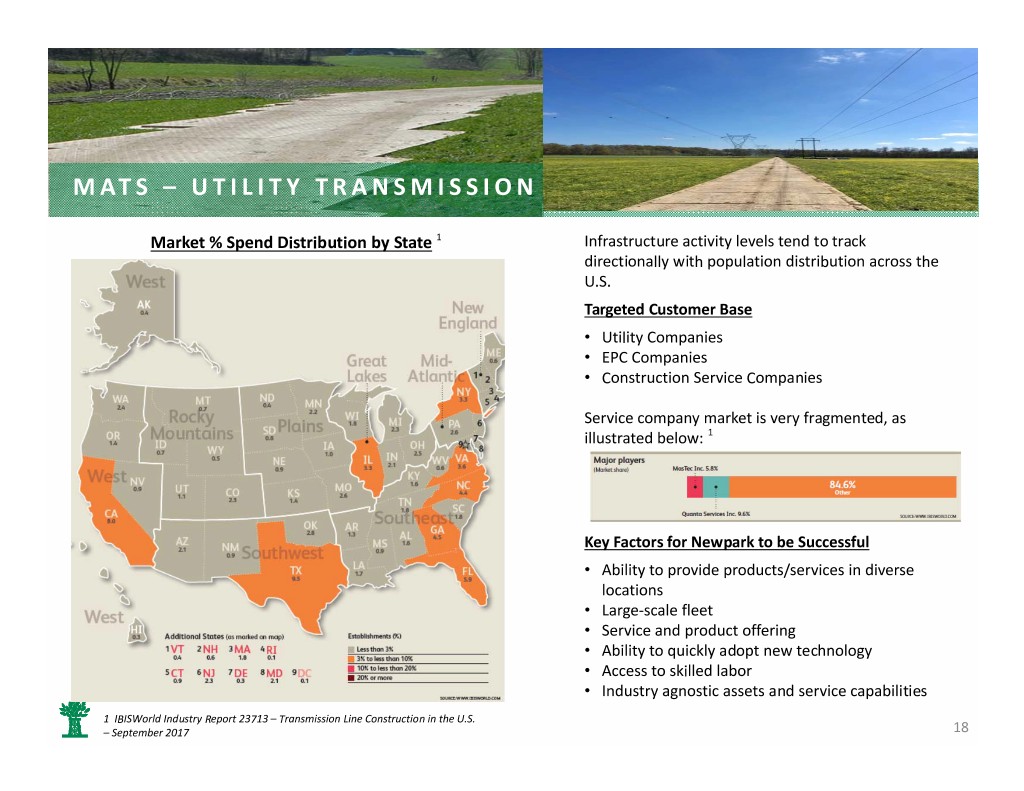

MATS – UTILITY TRANSMISSION AND DISTRIBUTION Market % Spend Distribution by State 1 Infrastructure activity levels tend to track directionally with population distribution across the U.S. Targeted Customer Base • Utility Companies • EPC Companies • Construction Service Companies Service company market is very fragmented, as illustrated below: 1 Key Factors for Newpark to be Successful • Ability to provide products/services in diverse locations • Large‐scale fleet • Service and product offering • Ability to quickly adopt new technology • Access to skilled labor • Industry agnostic assets and service capabilities 1 IBISWorld Industry Report 23713 – Transmission Line Construction in the U.S. – September 2017 18

MATS –OIL AND GAS PIPELINE Market fully addressable by Newpark* Market partially addressable by Newpark* Site Access Market • Represents 5‐10% of total industry spend * • Primary competitive offerings to composite mats include wood mats and gravel Other Key Demand Drivers (for Access Outlook Products) Industry performance is expected to strengthen • Government policy over the five years to 2023, due to growth in the construction of facilities for crude oil and gas • Regulatory framework (inspection / refining. The gas utilities construction market is integrity) also forecast to grow over the next five years, propelled mainly by heightened demand for • Environmental regulations and natural gas, serving both the residential market sensitivity and the expanding electricity‐generation • Location / Terrain market. • Weather Market Data and Outlook Source: IBISWorld Industry Report 23712 –Oil & Gas Construction in the U.S. – April 2018 * Based on Company estimates 19

MATS –OIL AND GAS PIPELINE % Spend Distribution by State 1 Infrastructure activity is concentrated in the regions close to oil and gas resources Targeted Customer Base • Pipeline Operators • EPC Firms • Integrity/Inspection Companies • Construction Service Companies Service company market is very fragmented, with no single company accounting for > 3% market share 1 Key Factors for Newpark to be Successful • Large‐scale fleet • Compliance with Government Regulations • Access to skilled labor • Ability to accommodate environmental requirements • Industry agnostic assets and service capabilities • Ability to expand and curtail operations rapidly, in line with market demand. 1 IBISWorld Industry Report 23712 –Oil & Gas Construction in the U.S. – April 2018 20

CONSOLIDATED STATEMENTS OF OPERATIONS(UNAUDITED) Three Months Ended June 30, March 31, June 30, (In thousands, except per share data) 2018 2018 2017 Revenues$ 236,262 $ 227,293 $ 183,020 Cost of revenues 188,480 186,455 148,431 Selling, general and administrative expenses 28,708 26,954 26,630 Other operating (income) loss, net (69) 46 (9) Operating income 19,143 13,838 7,968 Foreign currency exchange loss 458 225 534 Interest expense, net 3,691 3,300 3,441 Income from operations before income taxes 14,994 10,313 3,993 Provision for income taxes 4,148 3,091 2,361 Net income $ 10,846 $ 7,222 $ 1,632 Calculation of EPS: Net income ‐ basic and diluted$ 10,846 $ 7,222 $ 1,632 Weighted average common shares outstanding ‐ basic 89,703 89,094 84,653 Dilutive effect of stock options and restricted stock awards 2,823 2,637 2,662 Dilutive effect of 2021 Convertible Notes 1,265 ‐ ‐ Weighted average common shares outstanding ‐ diluted 93,791 91,731 87,315 Income per common share ‐ basic$ 0.12 $ 0.08 $ 0.02 Income per common share ‐ diluted$ 0.12 $ 0.08 $ 0.02 21

OPERATING SEGMENT RESULTS (UNAUDITED) Three Months Ended Six Months Ended June 30, March 31, June 30, June 30, June 30, (In thousands) 2018 2018 2017 2018 2017 Revenues Fluids systems$ 179,738 $ 177,379 $ 150,623 $ 357,117 $ 286,673 Mats and integrated services 56,524 49,914 32,397 106,438 55,038 Total revenues $ 236,262 $ 227,293 $ 183,020 $ 463,555 $ 341,711 Operating income (loss) Fluids systems$ 13,327 $ 10,477 $ 5,863 $ 23,804 $ 12,215 Mats and integrated services 14,853 12,086 11,419 26,939 17,821 Corporate office (9,037) (8,725) (9,314) (17,762) (18,322) Operating income $ 19,143 $ 13,838 $ 7,968 $ 32,981 $ 11,714 Segment operating margin Fluids systems 7.4% 5.9% 3.9% 6.7% 4.3% Mats and integrated services 26.3% 24.2% 35.2% 25.3% 32.4% 22

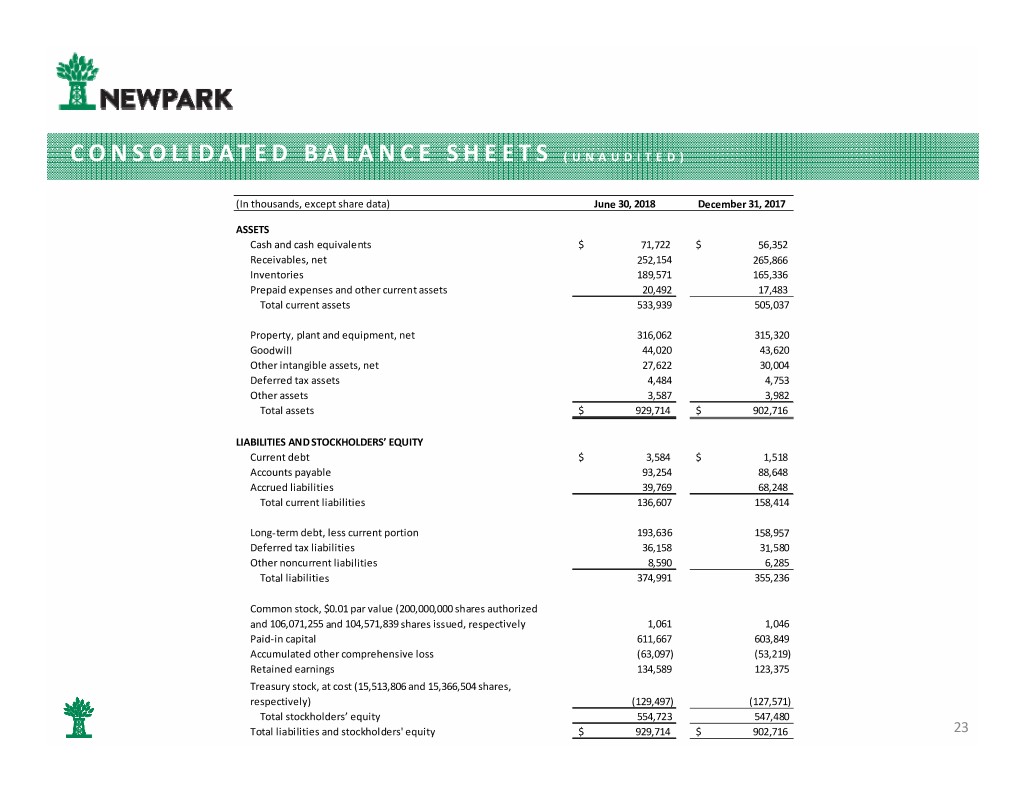

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (In thousands, except share data) June 30, 2018 December 31, 2017 ASSETS Cash and cash equivalents$ 71,722 $ 56,352 Receivables, net 252,154 265,866 Inventories 189,571 165,336 Prepaid expenses and other current assets 20,492 17,483 Total current assets 533,939 505,037 Property, plant and equipment, net 316,062 315,320 Goodwill 44,020 43,620 Other intangible assets, net 27,622 30,004 Deferred tax assets 4,484 4,753 Other assets 3,587 3,982 Total assets$ 929,714 $ 902,716 LIABILITIES AND STOCKHOLDERS’ EQUITY Current debt$ 3,584 $ 1,518 Accounts payable 93,254 88,648 Accrued liabilities 39,769 68,248 Total current liabilities 136,607 158,414 Long‐term debt, less current portion 193,636 158,957 Deferred tax liabilities 36,158 31,580 Other noncurrent liabilities 8,590 6,285 Total liabilities 374,991 355,236 Common stock, $0.01 par value (200,000,000 shares authorized and 106,071,255 and 104,571,839 shares issued, respectively 1,061 1,046 Paid‐in capital 611,667 603,849 Accumulated other comprehensive loss (63,097) (53,219) Retained earnings 134,589 123,375 Treasury stock, at cost (15,513,806 and 15,366,504 shares, respectively) (129,497) (127,571) Total stockholders’ equity 554,723 547,480 Total liabilities and stockholders' equity$ 929,714 $ 902,716 23

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Six Months Ended June 30, (In thousands) 2018 2017 Cash flows from operating activities: Net income$ 18,068 $ 649 Adjustments to reconcile net income to net cash provided by operations: Depreciation and amortization 22,755 19,244 Stock‐based compensation expense 4,848 5,874 Provision for deferred income taxes 243 (3,672) Net provision for doubtful accounts 1,229 1,412 Gain on sale of assets (371) (1,266) Amortization of original issue discount and debt issuance costs 2,643 2,679 Change in assets and liabilities: Increase in receivables (1,185) (48,612) Increase in inventories (21,459) (10,500) Increase in other assets (3,417) (2,773) Increase in accounts payable 6,659 15,590 Increase (decrease) in accrued liabilities and other (9,326) 43,685 Net cash provided by operating activities 20,687 22,310 Cash flows from investing activities: Capital expenditures (24,458) (16,644) Refund of proceeds from sale of a business (13,974) ‐ Proceeds from sale of property, plant and equipment 920 1,222 Business acquisitions, net of cash acquired (249) ‐ Net cash used in investing activities (37,761) (15,422) Cash flows from financing activities: Borrowings on lines of credit 203,716 ‐ Payments on lines of credit (171,796) ‐ Debt issuance costs (11) (335) Proceeds from employee stock plans 3,700 1,517 Purchases of treasury stock (3,074) (2,382) Other financing activities 2,515 2,333 Net cash provided by financing activities 35,050 1,133 Effect of exchange rate changes on cash (2,926) 2,017 Net increase in cash, cash equivalents, and restricted cash 15,050 10,038 Cash, cash equivalents, and restricted cash at beginning of period 65,460 95,299 Cash, cash equivalents, and restricted cash at end of period $ 80,510 $ 105,337 24

NON‐ GAAP FINANCIAL MEASURES(UNAUDITED) To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non‐GAAP financial measures. Such financial measures include earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA Margin, Net Debt and the Ratio of Net Debt to Capital. We believe these non‐GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and/or that of other companies in our industry. In addition, management uses these measures to evaluate operating performance, and our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non‐GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Six Months Ended Consolidated Twelve Months Ended December 31, June 30, (In thousands) 2013 2014 2015 2016 2017 2018 Net income (loss) from continuing operations (GAAP) (1) $ 65,323 $ 102,278 $ (90,828) $ (40,712) $ (6,148) $ 18,068 (Gain) loss from disposal of discontinued operations, net of tax ‐ (22,117) ‐ ‐ 17,367 ‐ (Income) from discontinued operations, net of tax (12,701) (1,152) ‐ ‐ ‐ ‐ Interest expense, net 11,279 10,431 9,111 9,866 13,273 6,991 Provision (benefit) for income taxes 28,725 41,048 (21,398) (24,042) 4,893 7,239 Depreciation and amortization 39,764 41,175 43,917 37,955 39,757 22,755 EBITDA (non‐GAAP) (1) $ 132,390 $ 171,663 $ (59,198) $ (16,933) $ 69,142 $ 55,053 (1) 2015 net loss and EBITDA included $88.7 million of pre‐tax charges associated with goodwill and other asset impairments, workforce reductions and estimated resolution of wage and hour litigation. 2016 net loss and EBITDA included $13.8 million of net pre‐tax charges associated with asset impairments and workforce reductions partially offset by gains for extinguishment of debt and adjustment for settlement of wage and hour litigation. 25

NON‐ GAAP FINANCIAL MEASURES(UNAUDITED) Six Months Ended Fluids Systems Twelve Months Ended December 31, June 30, (In thousands) 2013 2014 2015 2016 2017 2018 Operating income (loss) (GAAP) (2) $ 72,604 $ 95,600 $ (86,770) $ (43,631) $ 27,580 $ 23,804 Depreciation and amortization 26,679 22,934 22,108 20,746 21,566 10,607 EBITDA (non‐GAAP) (2) 99,283 118,534 (64,662) (22,885) 49,146 34,411 Revenues 926,392 965,049 581,136 395,461 615,803 357,117 Operating Margin (GAAP) 7.8% 9.9% ‐14.9% ‐11.0% 4.5% 6.7% EBITDA Margin (non‐GAAP) 10.7% 12.3% ‐11.1% ‐5.8% 8.0% 9.6% Six Months Ended Mats and Integrated Services Twelve Months Ended December 31, June 30, (In thousands) 2013 2014 2015 2016 2017 2018 Operating income (loss) (GAAP) (3) $ 49,394 $ 70,526 $ 24,949 $ 14,741 $ 40,491 $ 26,939 Depreciation and amortization 10,501 15,507 18,869 14,227 14,991 10,361 EBITDA (non‐GAAP) (3) 59,895 86,033 43,818 28,968 55,482 37,300 Revenues 115,964 153,367 95,729 76,035 131,960 106,438 Operating Margin (GAAP) 42.6% 46.0% 26.1% 19.4% 30.7% 25.3% EBITDA Margin (non‐GAAP) 51.6% 56.1% 45.8% 38.1% 42.0% 35.0% (2) 2015 Fluids Systems operating results and EBITDA included $82.7 million of pre‐tax charges associated with goodwill and other asset impairments and workforce reductions. 2016 Fluids Systems operating results and EBITDA included $15.6 million of pre‐tax charges associated with asset impairments and workforce reductions. (3) 2015 Mats and Integrated Services operating results and EBITDA included $0.7 million of pre‐tax charges associated with workforce reductions. 2016 Mats and Integrated Services operating results and EBITDA included $0.3 million of pre‐tax charges associated with workforce reductions. 26

NON‐ GAAP FINANCIAL MEASURES(UNAUDITED) The following table reconciles the Company’s ratio of total debt to capital calculated in accordance with GAAP to the non‐GAAP financial measure of the Company’s ratio of net debt to capital: Consolidated December 31, June 30, (In thousands) 2013 2014 2015 2016 2017 2018 Current debt$ 12,867 $ 11,648 $ 7,382 $ 83,368 $ 1,518 $ 3,584 Long‐term debt, less current portion 170,009 170,462 171,211 72,900 158,957 193,636 Total Debt 182,876 182,110 178,593 156,268 160,475 197,220 Total stockholders' equity 581,054 625,458 520,259 500,543 547,480 554,723 Total Capital $ 763,930 $ 807,568 $ 698,852 $ 656,811 $ 707,955 $ 751,943 Ratio of Total Debt to Capital 23.9% 22.6% 25.6% 23.8% 22.7% 26.2% Total Debt $ 182,876 $ 182,110 $ 178,593 $ 156,268 $ 160,475 $ 197,220 Less: cash and cash equivalents (65,840) (85,052) (107,138) (87,878) (56,352) (71,722) Net Debt 117,036 97,058 71,455 68,390 104,123 125,498 Total stockholders' equity 581,054 625,458 520,259 500,543 547,480 554,723 Total Capital, Net of Cash $ 698,090 $ 722,516 $ 591,714 $ 568,933 $ 651,603 $ 680,221 Ratio of Net Debt to Capital 16.8% 13.4% 12.1% 12.0% 16.0% 18.4% 27

EXPERIENCED LEADERSHIP • Paul Howes President & Chief Executive Officer • Gregg Piontek Senior Vice President & Chief Financial Officer • Mark Airola Senior Vice President, General Counsel & Administration Officer • Phil Vollands President Fluids Systems • Bruce Smith Chief Technology Marketing Officer • Matthew Lanigan President Mats & Integrated Services • Ida Ashley Vice President, Human Resources • Chip Earle Vice President and Executive Advisor 28

MANAGEMENT BIOGRAPHIES Paul L. Howes, President & CEO:Paul L. Howes joined our Board of Directors and was appointed as our Chief Executive Officer in March 2006. In June 2006, Mr. Howes was also appointed as our President. Mr. Howes’ career has included experience in the defense industry, chemicals and plastics manufacturing, and the packaging industry. Following the sale of his former company in October 2005 until he joined our Board of Directors in March 2006, Mr. Howes was working privately as an inventor and engaging in consulting and private investing activities. From 2002 until October 2005, he served as President and Chief Executive Officer of Astaris LLC, aprimary chemicals company headquartered in St. Louis, Missouri, with operations in North America, Europe and South America. Prior to this, from 1997 until 2002, he served as Vice President and General Manager, Packaging Division, for Flint Ink Corporation, a global ink company headquartered in Ann Arbor, Michigan with operations in North America, Europe, Asia Pacific and Latin America. Mr. Howes is also actively engaged in energy industry trade associations. He is currently a member of the Board of Directors of the American Petroleum Institute (API) and the National Association of Manufacturers (NAM). He was previously Chairman of the General Membership Committee and a member of the Executive Committee of the API. Additionally, Mr. Howes was also a previous member of the Board of Directors of the National Ocean Industries Association (NOIA). Gregg S. Piontek, SVP & CFO: Gregg joined Newpark in April 2007 and served as Vice President, Controller and Chief Accounting Officer from April 2007 to October 2011. Prior to joining Newpark, Mr. Piontek was Vice President and Chief Accounting Officer of Stewart & Stevenson LLC from 2006 to 2007. From 2001 to 2006, Mr. Piontek held the positions of Assistant Corporate Controller and Division Controller for Stewart & Stevenson Services, Inc. Prior to that, Mr. Piontek served in various financials roles at General Electric and CNH Global N.V., after beginning his career as an auditor for Deloitte & Touche LLP. Mr. Piontek is a Certified Public Accountant and holds a bachelor degree in Accountancy from Arizona State University and a Master of Business Administration degree from Marquette University. Mark J. Airola, SVP, GC & Admin Officer: Mark joined Newpark in October 2006 as its Vice President, General Counsel and Chief Administrative Officer. Mr. Airola was named Senior Vice President in February of 2011. Prior to joining Newpark, Mr. Airola was Assistant General Counsel and Chief Compliance Officer for BJ Services Company, a leading provider of pressure pumping and other oilfield services to the petroleum industry, serving as an executive officer since 2003. From 1988 to 1995, he held the position of Senior Litigation Counsel at Cooper Industries, Inc., a global manufacturer of electrical products and tools, with initial responsibility for managing environmental regulatory matters and litigation and subsequently managing the company’s commercial litigation. 29

MANAGEMENT BIOGRAPHIES Phillip T. Vollands, President, Fluids Systems: Phil joined Newpark in October 2013 as President, North America Fluids Systems and became President, Western Hemisphere in 2016. Prior to Newpark, he was Vice President, Tubular Running Services for Weatherford International from 2010 to 2013. Previously, from 1997 to 2010, he served in a variety of sales and operational roles of increasing responsibility for National Oilwell Varco including VP Power Generation Division and VP Global Strategic Accounts. Phil started his oilfield career as a wireline logging engineer working primarily in the North Sea. He brings over 25 years of global oilfield service experience that span multiple disciplines with a strong track record in driving profitable growth across the globe. Phil holds a BA in Engineering Science from Oxford University and MA (Oxon). Bruce C. Smith, Chief Technology Marketing Officer: Bruce has been in the drilling fluids industry since 1973 and has held many technical, operational and leadership positions during this 35 year period. Bruce joined Newpark in April 1998 as Vice President International and served as President of Newpark Drilling Fluids from October 2000 – June 2017. Prior to joining Newpark, Mr. Smith was the Managing Director of the UK operations of M‐I SWACO. Matthew Lanigan, President Mats and Integrated Services: Matthew joined Newpark in April 2016, as President of Newpark Mats & Integrated Services. Matthew began his professional career at ExxonMobil in Australia working on rigs as a Drilling & Completions Engineer, progressing from there to Offshore Production Engineer and as a Marketer for Crude & LPG. While pursuing his MBA, he accepted a position with GE in the Plastics division where he rose to the role of Chief Marketing Officer before transferring to the Capital division of GE, based in the UK. His first opportunity to work in the United States came with the Enterprise Client Group of GE's Capital division, where he worked in leadership roles in Sales & Marketing. In 2011, he was appointed as the Director of Commercial Excellence for Asia Pacific, based in Australia. In addition to growing revenue and market share, key responsibilities for this role included developing cross‐organizational synergies and market entry strategies. 30

MANAGEMENT BIOGRAPHIES Ida Ashley, VP, Human Resources: Ida joined Newpark in March 2015 as Vice President, Human Resources. Ida has over 20 years of experience in Human Resources, 17 of which were specific to Oilfield Services where she specialized in Employee Relations, Mergers & Acquisitions and International HR programs. Ida has worked in a variety of HR leadership roles in Smith International, M‐I SWACO and Schlumberger. Her role prior to joining Newpark was VP of HR, North America in Schlumberger. Originating from Smith International, she had the unique opportunity to lead the HR integration project team during the Schlumberger/Smith merger from August 2010 – December 2012. Ida earned her Masters of Science in Human Resources from Houston Baptist University in 2000 and her Bachelors of Arts in Modern Languages from Texas A&M in 1991. Edward “Chip” Earle, Vice President and Executive Advisor: Chip joined Newpark in August 2018 as Vice President and Executive Advisor as part of a succession plan to become the Vice President, General Counsel, Corporate Secretary, Chief Administrative Officer and Chief Compliance Officer in September 2018. Mr. Earle most recently served for six years as Senior Vice President, Chief Legal & Support Officer and Corporate Secretary for Bristow Group, Inc. Prior to Bristow, he worked for Transocean, Ltd where after working in a variety of progressively senior positions within the Legal function, he held the role of Assistant Vice President, Global Legal and Corporate Secretary. Additionally, Mr. Earle has exceptional governance, corporate, securities and M&A experience gained at the start of his legal career during his time in private practice with the law firms of Baker Botts, LLP and Wilson, Sonsini, Goodrich & Rosati, PC. He received his Bachelor of Arts degree from Middlebury College in 1995 and his MBA and JD form the University of Texas in 2001. 31

BOARD OF DIRECTORS Our Board members represent a desirable mix of diverse backgrounds, skills and experiences and we believe they all share the personal attributes of effective directors. They each hold themselves to the highest standards of integrity and are committed to the long‐term interests of our stockholders. ANTHONY J. BEST Retired Chief Executive Officer, SM Energy Company Chairman of the Board G. STEPHEN FINLEY Retired Senior V.P. and Chief Financial Officer, Baker Hughes Incorporated PAUL L. HOWES President and Chief Executive Officer, Newpark Resources RODERICK A. LARSON President and Chief Executive Officer, Oceaneering International, Inc. JOHN C. MINGÉ Chairman and President, BP America ROSE M. ROBESON Retired VP and CFO, general partner of DCP Midstream Partners LP GARY L. WARREN Retired Senior Vice President, Weatherford Please visit our website for full biographies of our Board. 32

FOCUSED ON CUSTOMER’S NEEDS