Form 424B5 Del Frisco's Restaurant

Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-225938

|

$90,000,000

Del Frisco’s Restaurants Group, Inc.

Common Stock, par value $0.001 per share |

| |

| • | Del Frisco’s Restaurants Group, Inc. (the “Company”) is offering 11,250,000 shares of our common stock. |

| • | Our common stock is listed on the Nasdaq Global Select Market under the symbol “DFRG.” |

| • | The last reported sale price of our common stock on July 27, 2018 was $10.55 per share. |

The Company intends to use the proceeds from this offering to repay a portion of the outstanding borrowings under its New Term Loans (as defined herein), which were used to finance the Barteca Acquisition (as defined herein). See “Use of Proceeds.”

Investing in our common stock involves risks. You should carefully consider the matters discussed under the section entitled “Risk Factors” beginning on page S-22 of this prospectus supplement and included in our periodic reports and other information filed with the Securities and Exchange Commission (the “SEC”) and incorporated by reference herein before investing in our common stock.

| Per share | Total(2) | |||||||

| Public offering price |

$ | 8.00 | $ | 90,000,000.0 | ||||

| Underwriting discount |

$ | 0.44 | $ | 4,950,000.0 | ||||

| Proceeds, before expenses, to the Company(1) |

$ | 7.56 | $ | 85,050,000.0 | ||||

| (1) | See the section entitled “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

| (2) | Assumes no exercise of the underwriters’ option to purchase additional shares of common stock described below. |

The Company has granted the underwriters an option exercisable within a 30-day period beginning on, and including, the date of this prospectus supplement, to purchase up to an additional 1,687,500 shares of common stock.

Neither the SEC nor any state securities commission has approved of anyone’s investment in these securities or determined if this prospectus supplement or the related prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to purchasers on or about August 6, 2018.

| Piper Jaffray | J.P. Morgan | |||

| Citizens Capital Markets |

The date of this prospectus supplement is August 1, 2018.

Table of Contents

Prospectus supplement

| Page | ||||

| S-ii | ||||

| WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION BY REFERENCE |

S-iv | |||

| S-v | ||||

| S-1 | ||||

| S-22 | ||||

| S-29 | ||||

| S-30 | ||||

| S-31 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION OF DEL FRISCO’S AND BARTECA |

S-33 | |||

| U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK |

S-49 | |||

| S-52 | ||||

| S-59 | ||||

| S-59 | ||||

Prospectus

| Page | ||||

| ii | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 11 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 23 | ||||

| 23 | ||||

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference. The second part, the base prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined, and when we refer to the “accompanying base prospectus,” we are referring to the base prospectus only.

This prospectus supplement, the accompanying base prospectus and the documents incorporated into each by reference include important information about us, the shares of common stock being offered hereby and other information you should know before investing in our common stock. You should read the prospectus, including the additional information described under the heading “Where You Can Find Additional Information” in the accompanying base prospectus, before investing in our common stock.

If any information varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement. Terms used in this prospectus supplement that are otherwise not defined in this prospectus supplement will have the meanings given to them in the accompanying base prospectus.

We have authorized only the information contained or incorporated by reference in this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and any underwriters have not, authorized anyone to provide you with information that is different. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. You should not assume that the information contained in this prospectus supplement or the accompanying base prospectus is accurate as of any date other than the date on the front of the applicable document, or that any information we have incorporated by reference in this prospectus supplement is accurate as of any date other than the date of the document incorporated by reference regardless of the time of delivery of this prospectus supplement and the accompanying base prospectus or any sale of shares. Our business, financial condition, results of operations and prospects may have changed since those dates. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted.

As used in this prospectus supplement, unless the context otherwise indicates, the references to “DFRG,” “Del Frisco’s Restaurant Group,” “our company,” “the Company,” “us,” “we” and “our” refer to Del Frisco’s Restaurant Group, Inc. and its consolidated subsidiaries which, on and after June 27, 2018, includes Barteca Holdings, LLC and its subsidiaries (“Barteca”) and prior to June 27, 2018, does not include Barteca. Unless otherwise indicated or the context otherwise requires, financial information in this prospectus supplement reflects the consolidated business and operations of Del Frisco’s Restaurant Group, Inc. and its wholly-owned subsidiaries. The defined term “Transactions” refers to our acquisition of Barteca and the related debt financings as more fully defined in Note 1 to “Unaudited Pro Forma Condensed Combined Financial Information of Del Frisco’s and Barteca.” For the avoidance of doubt, such pro forma presentation does not reflect the impact of this offering of shares of our common stock.

References herein to “$” and “dollars” are to the lawful currency of the United States.

NON-GAAP FINANCIAL MEASURES

To supplement the consolidated financial information of the Company, and for Barteca for the periods prior to June 27, 2018, each of which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), we use adjusted EBITDA, Restaurant-level EBITDA, adjusted EBITDA margin and Restaurant-level EBITDA margin of the Company and Barteca, respectively, which are non-GAAP financial measures.

S-ii

Table of Contents

Adjusted EBITDA for Del Frisco’s represents operating income (loss) before depreciation and amortization, plus the sum of certain non-operating expenses, including pre-opening costs, donations, lease termination costs, acquisition and disposition costs, consulting project costs, reorganization severance, impairment charges and insurance settlements. Restaurant-level EBITDA for Del Frisco’s represents Adjusted EBITDA before general and administrative costs. Adjusted EBITDA for Barteca represents net income (loss) before income taxes, interest expense, depreciation and amortization of key money on leases plus the sum of certain non-operating expenses, including pre-opening expenses, non-cash rent, loss on extinguishment of debt, management fees, board expenses, deal expenses, stock compensation expenses and sales of assets. Restaurant-level EBITDA for Barteca represents Adjusted EBITDA before other income (loss) and general and administrative costs. Adjusted EBITDA margin is the ratio of Adjusted EBITDA to revenues. Restaurant-level EBITDA margin is the ratio of Restaurant-level EBITDA to revenues. For more information on our non-GAAP financial measures and reconciliations of such measures to the most directly comparable GAAP measures, see the section entitled “Summary Historical Consolidated Financial Information of Del Frisco’s.” The presentation of this additional non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. We urge investors to review these reconciliations and not to rely on any single financial measure to evaluate the Company’s business.

S-iii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION BY REFERENCE

We file annual, quarterly and current reports, proxy statements and other information with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You may inspect without charge any documents filed by us at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains our reports, proxy and other information regarding us at http://www.sec.gov. Our SEC filings are also available free of charge at our website (www.dfrg.com). The information on our website is not incorporated by reference into this prospectus.

The SEC allows us to “incorporate by reference” information into this prospectus supplement and the accompanying base prospectus, which means that we can disclose important information to you by referring you to other documents filed separately with the SEC. The information incorporated by reference is considered part of this prospectus supplement, and information filed with the SEC subsequent to this prospectus supplement and prior to the termination of this offering will automatically be deemed to update and supersede this information. We incorporate by reference into this prospectus supplement and the accompanying base prospectus the documents listed below (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

| • | our Annual Report on Form 10-K for the fiscal year ended December 26, 2017, filed on March 27, 2018 (the “2017 Annual Report”); |

| • | our Quarterly Reports on Form 10-Q for the quarters ended March 27, 2018 and June 26, 2018, filed on May 7, 2018 and July 27, 2018, respectively (together, the “2018 Quarterly Reports”); |

| • | the portions of the Definitive Proxy Statement on Schedule 14A filed on April 25, 2018, that are incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended December 26, 2017; |

| • | our Current Reports on Form 8-K filed on May 7, 2018, June 15, 2018 and June 28, 2018 (as amended on Form 8-K/A filed on July 30, 2018); and |

| • | the description of our common stock set forth in our registration statement on Form 8-A filed on July 24, 2012, and any amendment or report filed for the purpose of updating such description. |

We also incorporate by reference any future filings made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act between the date of this prospectus supplement and the date all of the securities offered hereby are sold or this offering is otherwise terminated, with the exception of any information furnished under Item 2.02 and Item 7.01 of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings shall be deemed to be incorporated by reference and to be a part of this prospectus supplement from the respective dates of filing of those documents.

We will provide without charge upon written or oral request to each person, including any beneficial owner, to whom this prospectus supplement is delivered, a copy of any and all of the documents which are incorporated by reference into this prospectus supplement but not delivered with this prospectus supplement (other than exhibits unless such exhibits are specifically incorporated by reference herein).

You should direct requests for documents to:

Del Frisco’s Restaurant Group, Inc.

2900 Ranch Trail

Irving, TX 75063

(469) 913-1845

Attention: Investor Relations

S-iv

Table of Contents

This prospectus supplement and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties, which are based on beliefs, expectations, estimates, projections, forecasts, plans, anticipations, targets, outlooks, initiatives, visions, objectives, strategies, opportunities, drivers and intents of our management. Such statements are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements reflect intent, belief, current expectations, estimates or projections about, among other things, our industry, management’s beliefs, and future events and financial trends affecting us. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “projects,” “forecasts,” “targets,” “outlooks,” “initiatives,” “visions,” “objectives,” “strategies,” “opportunities,” “drivers,” “will” and variations of these words or similar expressions are intended to identify forward looking statements. Although we believe the expectations reflected in any forward looking statements are reasonable, such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward looking statements as a result of various factors. Additional important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and include, but are not limited to, the following:

| • | our ability to successfully integrate Barteca (as defined herein), realize the benefits of the acquisition and capitalize on anticipated synergies; |

| • | our levels of indebtedness, our ability to comply with any covenants accompanying such indebtedness and our ability to access future capital; |

| • | our ability to complete this offering; |

| • | economic conditions (including customer spending patterns); |

| • | our ability to compete; |

| • | our ability to pursue strategic initiatives, which may include divesting under-performing brands (including our potential divestiture of Sullivan’s Steakhouse, as discussed further herein) and implementing a growth strategy to develop our other, currently-owned brands, including opening new restaurants, operating them profitably and accelerating development of our brands; |

| • | customer experiences or negative publicity surrounding our restaurants; |

| • | pricing and deliveries of food and other supplies; |

| • | changes in consumer tastes and spending patterns; |

| • | laws and regulations affecting labor and employee benefit costs, including increases in state and federally mandated minimum wages; |

| • | labor shortages; |

| • | general financial and credit market conditions; |

| • | fixed rental payments and the terms of our indebtedness; and |

| • | other factors set forth in our 2017 Annual Report and our 2018 Quarterly Reports. |

This list of important factors is not intended to be exhaustive. We discuss certain of these matters more fully, as well as certain other risk factors that may affect our business operations, financial condition and results of operations, in our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Investors should understand that it is not possible to predict or identify all such factors and should not consider this list to be a complete statement of all potential risks and uncertainties. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward looking statements.

S-v

Table of Contents

Although we believe the expectations reflected in any forward looking statements are reasonable, such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward looking statements as a result of various factors. Forward-looking statements speak only as of the date they are made, and except for our ongoing obligations under the U.S. federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

S-vi

Table of Contents

This summary highlights information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. This summary does not contain all of the information that may be important to you. You should carefully read this prospectus supplement, the accompanying base prospectus and any document incorporated by reference herein in their entirety before making an investment decision. In particular, you should read the section of this prospectus supplement entitled “Risk Factors” and those factors found in “Part I, Item 1A.—Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 26, 2017 (as such risk factors may be updated from time to time in our public filings, including in each of our 2018 Quarterly Reports on Form 10-Q incorporated by reference herein) and the consolidated and combined financial statements and notes related to those statements included or incorporated by reference elsewhere in this prospectus supplement.

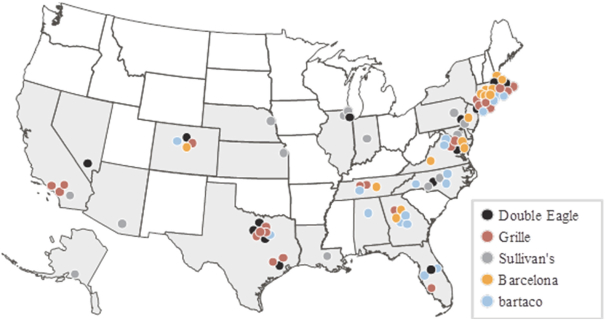

Our Company

Our mission is to celebrate life in restaurants through great food, wine and hospitality. Del Frisco’s Restaurant Group is a collection of five complementary experiential restaurant brands: Del Frisco’s Double Eagle Steakhouse (“Double Eagle”), Del Frisco’s Grille (“Grille”), Sullivan’s Steakhouse (“Sullivan’s”), Barcelona Wine Bar (“Barcelona”), and bartaco. Barcelona and bartaco became a part of our restaurant group upon the consummation of our acquisition of Barteca Holdings, LLC (“Barteca”) on June 27, 2018. Barteca will now be referred to as Del Frisco’s Emerging Brands within the Company’s organizational structure. We are a leader in the fine dining steakhouse dining segment based on average unit volume (“AUV”) and restaurant-level EBITDA margin. We believe the success of our brands reflect relentless and consistent execution across all aspects of the dining experience, from the formulation of proprietary recipes to the procurement and presentation of high quality menu items and delivery of a positive guest experience that leaves a lasting impression. We currently operate 84 restaurants across 24 states and the District of Columbia.

The Double Eagle and Sullivan’s are positioned within the fine dining steakhouse segment and the Grille is in the upscale casual segment. All three brands are designed to appeal to both business and local dining customers. Our Double Eagle restaurants are sited in urban locations to target customers seeking a “destination dining” experience while our Grille restaurants are intended to appeal to a broader demographic, allowing them to be located either in urban areas or in close proximity to affluent residential neighborhoods. Sullivan’s restaurants are located in tertiary markets. The Double Eagle, Grille and Sullivan’s offer steaks as well as other menu selections, such as chops and fresh seafood. These menu selections are complemented by an extensive, award-winning wine list. Our Emerging Brands are designed to provide guests with a polished experience by serving seasonal flavorful food with welcoming service in an attractive and lively atmosphere. By offering this experience at an affordable price point, we believe this generates broad appeal across a wide guest demographic. This broad appeal has enabled Barcelona and bartaco to expand to locations in a variety of markets, including urban, tertiary and college towns.

S-1

Table of Contents

Our Current Restaurant Footprint(1)

| (1) | Represents restaurant locations as of July 27, 2018 (excluding Vinoteca). |

On June 27, 2018, we completed the acquisition (the “Barteca Acquisition”) of Barteca. Barteca, now referred to as Del Frisco’s Emerging Brands within our organizational structure, owns and operates two restaurant concepts: Barcelona and bartaco. Emerging Brands currently operates 33 restaurants in 12 states and the District of Columbia. Emerging Brands’ two restaurant concepts are innovative, with a unique vibe, food, drinks and design. Barcelona serves as a neighborhood Spanish tapas bar with an ever-changing selection of tapas, using both local and seasonal ingredients as well as specialties from Spain and the Mediterranean. Barcelona has a superior Spanish wine program and an award winning selection of wines, with 15 locations in seven states and the District of Columbia. We anticipate opening five to six additional Barcelona locations by the end of 2019. bartaco combines fresh, upscale street food with a coastal vibe in a relaxed environment and is inspired by a healthy, outdoor lifestyle. bartaco has 18 locations across ten states and we anticipate opening ten to 13 more locations by the end of 2019.

We believe that Emerging Brands’ innovative concepts are highly complementary and will provide Del Frisco’s portfolio with significant growth and development opportunities, enabling us to capture market share in the experiential dining segment, while mitigating the effects of seasonality and the risk of economic downturns to our restaurant portfolio. Our dedicated brand teams operate autonomously, making us ideally suited to manage multiple brands and ensuring that each brand retains its own personality. Our strategic rationale for combining the Del Frisco’s and Emerging Brands include:

| • | Highly Complementary Brands with Shared Values. We believe that Barcelona and bartaco share our cultural values and have established differentiated experiential restaurant brands that are highly complementary to the Double Eagle and Grille. |

| • | Multi-Brand Strategy. Our established multi-brand strategy, including dedicated resources and management teams for individual concepts, will benefit the Emerging Brands and allow both Barcelona and bartaco to continue to grow while retaining their respective personalities. |

S-2

Table of Contents

| • | More Diversified and Balanced Portfolio. Barcelona and bartaco provide more diversification and balance to our portfolio through lower average checks and opposite seasonality to our existing brands, with peak seasonality in summer months. Emerging Brands have a less beef-centric menu, thereby decreasing the impact of swings in the price of beef commodities on our supply chain. The Barcelona and bartaco concepts also utilize a smaller footprint for individual locations relative to our Double Eagle and Grille brands, which provides greater flexibility to our real estate strategy. |

| • | Significant Synergy Opportunities. At the corporate level, our shared services are able to efficiently support our multiple brands, and will continue to do so across Barcelona and bartaco. This structure enables brand focus and G&A leverage as each brand grows. |

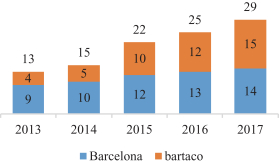

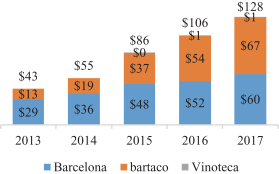

Prior to the acquisition, Emerging Brands grew from 22 restaurants across 7 states in 2015 to 29 restaurants across 12 states in 2017. During the same period, net sales increased from $85.6 million to $127.9 million and Adjusted EBITDA increased from $13.6 million to $20.6 million. For a reconciliation of Adjusted EBITDA to net income and a discussion of why we consider it useful, see footnote (7) to “—Summary Historical and Pro Forma Consolidated Financial Information of Del Frisco’s.”

| Emerging Brands Restaurant Count(1)

|

Emerging Brands Net Sales ($ in millions)

|

| (1) | Excludes Vinoteca. |

In connection with the completion of the Barteca Acquisition, we entered into a new credit agreement (the “Credit Agreement”) that provides for (i) senior secured term loans in an aggregate principal amount of $390,000,000 (the “New Term Loans”) and (ii) senior secured revolving credit commitments in an aggregate principal amount of $50,000,000 (the “New Revolver”). We intend to use a portion of the net proceeds of this offering to repay a portion of the outstanding borrowings under our New Term Loans. See “Use of Proceeds.”

Our Restaurant Concepts

Del Frisco’s Double Eagle Steak House

We believe the Del Frisco’s Double Eagle Steakhouse is one of the premier fine dining steakhouse concepts in the United States. The Double Eagle brand is defined by its menu, which includes USDA Prime grade, wet-aged and dry-aged steaks hand-cut at the time of order and a range of other high-quality offerings, including prime dry-aged lamb, fresh seafood, and signature side dishes and desserts. Our Double Eagle restaurants are also distinguished by “swarming service,” whereby customers are served simultaneously by multiple servers. Each Double Eagle restaurant has a sommelier to guide diners through an extensive, award-winning wine list and our bartenders specialize in hand-shaken martinis and crafted cocktails. Our New York Double Eagle has won Wine Spectator’s prestigious Grand Award in 2017 and 2018 and all other Double Eagles have won their “Best Of”

S-3

Table of Contents

Award of Excellence. The Double Eagle restaurants target customers seeking a full-service, fine dining steakhouse experience. We believe the décor and ambiance, with both contemporary and classic designs, enhance our customers’ experience and differentiate the Double Eagle from other upscale steakhouse concepts. We currently operate 14 Double Eagle steakhouses in nine states and the District of Columbia. These restaurants range in size from 11,000 to 24,000 square feet with seating capacity for at least 300 people. We have secured prominent locations for our restaurants in a number of unique sites, including a historic bank building, a redeveloped wharf and former retail space in Rockefeller Center. We believe the locations of our restaurants distinguish us from our competitors, add to the strength of our brand and help drive our AUVs. Additional Double Eagle openings are planned over the next year, and we anticipate they will range in size from 12,000 to 16,000 square feet. Annual AUVs per Double Eagle for locations open the entire year were $14.2 million for the fiscal year ended December 26, 2017. During the same period, the average check at these Double Eagle locations was $116, with alcoholic beverages accounting for 32% of the Double Eagle’s sales.

Del Frisco’s Grille

We developed the Grille in 2011 to take advantage of the positioning of the Del Frisco’s brand and to provide greater potential for expansion due to its smaller size, lower buildout cost and more diverse menu. The Grille has a refreshing, modern menu that draws inspiration from bold flavors and fresh ingredients. Borrowing from the Del Frisco’s heritage, it appeals broadly to both business and casual diners with the same high quality Double Eagle prime aged steaks, top selling signature menu items and a broad selection of the same quality wines. In addition, the Grille has an extensive menu creating new twists on American comfort classics, including regional flavors and locally sourced ingredients. We believe the ambiance of the concept appeals to a wide range of customers seeking a less formal atmosphere for their dining occasions. Each Grille features a bar that is the centerpiece for a great night out. In 2017, we carried out an in-depth brand analysis with a leading third party consultant to assist us in better understanding the Grille concept’s growth opportunities and target guests. We currently operate 23 Grilles in 10 states and the District of Columbia. These restaurants range in size from 6,500 to 8,000 square feet with seating capacity for at least 200 people. Annual AUVs per Grille restaurant for locations open the entire year were $4.9 million for the fiscal year ended December 26, 2017. During the same period, the average check at these Grille locations was $46, with alcoholic beverages accounting for 30% of the Grille’s sales.

Sullivan’s Steakhouse

Sullivan’s was created in the mid-1990’s as a complementary concept to Del Frisco’s. The Sullivan’s brand is defined by a fine dining experience at a more accessible price point, along with a vibrant atmosphere created by an open kitchen, live music and a bar area designed to be a center for social gathering and entertainment. Each Sullivan’s features fine hand-selected aged steaks, fresh seafood and a broad list of custom cocktails, along with an extensive selection of award-winning wines. We currently operate 14 Sullivan’s steakhouses in 12 states. These restaurants range in size from 7,000 to 11,000 square feet with seating capacity for at least 250 people. Annual AUVs per Sullivan’s restaurant were $4.1 million for the fiscal year ended December 26, 2017. During the same period, the average check at Sullivan’s was $65, with alcoholic beverages accounting for 30% of Sullivan’s sales.

Barcelona Wine Bar

Founded in 1996, Barcelona Wine Bar is a neighborhood Spanish tapas bar that offers simple and elegant small plates and an award-winning wine list. The seasonal, high quality menu combines bold flavors with unique specialties from Spain and the Mediterranean. Barcelona has a superior Spanish wine program and offers an extensive selection of wines from Spain and South America, including over 40 wines by the glass. In 2018, all Barcelona restaurants won Wine Spectator’s “Best Of” Award of Excellence. We design our restaurants with the

S-4

Table of Contents

goal of creating a timeless, sophisticated and vibrant atmosphere. We currently operate 15 locations in seven states and the District of Columbia. Our typical restaurant size is approximately 4,500 square feet. We anticipate opening five to six additional Barcelona locations by end of 2019. Annual AUVs per Barcelona for locations open the entire year were $4.5 million for the fiscal year ended January 2, 2018. During the same period, the average check at these Barcelona locations was $35, with alcoholic beverages accounting for 46% of Barcelona’s sales.

bartaco

Inspired by a healthy, outdoor lifestyle, the first bartaco location was opened in 2010 and has since grown to 18 locations across ten states. Our typical restaurant size is approximately 4,500 square feet. bartaco combines fresh, upscale street food with a coastal vibe in a relaxed environment. The cuisine pulls from a broad palate of bold, spicy flavors from the Mediterranean, Asia and beyond, while our handcrafted cocktails are made with artisanal spirits and freshly-squeezed juices. We aim to create the comfortable yet energetic atmosphere of a rustic beach shack in our restaurants. The minimalistic décor is light and breezy, featuring reclaimed wood, hand-woven basket lights and painted tiles. In addition, our outdoor patios feature lively bars, fireplaces and inviting seating options. We anticipate opening ten to 13 more locations by the end of 2019. Annual AUVs per bartaco for locations open the entire year were $5.2 million for the fiscal year ended January 2, 2018. During the same period, the average check at these bartaco locations was $22, with alcoholic beverages accounting for 36% of bartaco’s sales.

Our Business Strengths

We believe the following are key strengths of our business and serve to differentiate us from our competitors:

Leading Portfolio of Highly Differentiated, Experiential Brands

All of our restaurant concepts are distinctly positioned yet highly complementary to one another. They share a relentless focus on culinary excellence, individualized interior design and attentive service. We believe this creates experiential, destination dining where guests have to sit down in the restaurant in order to obtain the full experience. To maintain this focus, none of our concepts offer delivery. We believe that the distinct positioning and usage occasion of each brand ensures minimal cannibalization and expands the frequency of our guests. In addition, we currently operate multiple concepts in close proximity to each other in 14 of our markets. We believe our complementary positioning will continue to allow us to develop our concepts in a single metropolitan area without competing for customers. We believe many landlords and developers seek out our concepts to be restaurant anchors for their developments as our concepts are complementary to upscale national retailers with similar target demographics.

| Select Operating Data (as of fiscal year 2017) | ||||||||||

| Double Eagle | Grille | Sullivan’s | Barcelona | bartaco | ||||||

| Average Check |

$116 | $46 | $65 | $35 | $22 | |||||

| Menu Mix |

68% Food | 70% Food | 70% Food | 54% Food | 64% Food | |||||

| 32% Alcohol | 30% Alcohol | 30% Alcohol | 46% Alcohol | 36% Alcohol | ||||||

| Daypart Mix |

9% Lunch 91% Dinner |

26% Lunch 74% Dinner |

8% Lunch 92% Dinner |

10% Lunch 80% Dinner 10% Late Night |

30% Lunch 64% Dinner 6% Late Night | |||||

| Targeted Unit Square Feet |

14,000 | 7,250 | 9,000 | 4,500 | 4,500 | |||||

S-5

Table of Contents

Operating Model Drives Industry-Leading Productivity and Profitability

Our AUVs combined with our operating efficiencies enable us to be an industry-leader in sales per square foot and restaurant-level EBITDA margins based on 2017 public company data for U.S. based full-service dining restaurants that generate a majority of their revenues from restaurant operations. We believe that our success is driven by our consistent execution across all aspects of the dining experience, from the formulation of proprietary recipes to the procurement and presentation of high quality menu items and our focus on providing a positive customer experience. We firmly believe that investing in our people will, in turn, lead to a superior guest experience. Our entrepreneurial culture, coupled with our attractive benefits programs, bonus incentives and investment in training and development, empower and motivate the general manager at each restaurant to act as the owner of his or her business. These general managers meet weekly as a group with senior management to share best practices. As a result of the investments we have made in our people, we generated a significant reduction in turnover during 2017. We believe we achieve significant cost, quality and availability advantages through centralized sourcing from our primary suppliers for the heritage Del Frisco’s concepts and expect to do the same with our Emerging Brands. The flexibility of our menus at certain brands also enables us to take advantage of pricing opportunities to reduce food costs.

| Select Operating Data | ||||||||||||||||||||

| as of fiscal year 2017 | ||||||||||||||||||||

| Double Eagle | Grille | Sullivan’s | Barcelona | bartaco | ||||||||||||||||

| Average Unit Volume |

$ | 14.2 million | $ | 4.9 million | $ | 4.1 million | $ | 4.5 million | $ | 5.2 million | ||||||||||

| Average Sales per Square Foot |

$ | 886 | $ | 585 | $ | 441 | $ | 986 | $ | 1,248 | ||||||||||

| as of fiscal year ended December 26, 2017 |

as of fiscal year ended January 2, 2018 |

|||||||||||||||||||

| Restaurant-Level EBITDA Margin(1) |

26.5 | % | 13.2 | % | 15.7 | % | |

25.4%(2) |

| |||||||||||

| (1) | For the definition of Restaurant-Level EBITDA Margin and a reconciliation of Restaurant-Level EBITDA to the most comparable GAAP measure, see footnotes (7) and (9) to “—Summary Historical and Pro Forma Consolidated Financial Information of Del Frisco’s.” |

| (2) | Represents Barteca on a consolidated basis. |

Operating Strategy Designed to Manage Multiple Brands

We have implemented an effective multi-brand operating strategy with dedicated management teams for each of our five concepts. This organizational structure enables each brand to operate autonomously, maintain its own brand identity and build accountability. Within each of our five concepts, we have established a Brand President, Vice President of Operations and Head Chef, in addition to other key senior-level operations, marketing, training and financial planning and analysis roles that are solely focused on one brand. At the corporate level, we support our brands through robust shared services, including systems and processes in place for purchasing, development and real estate, finance and accounting, information technology, human resources, legal and risk management. We believe the multi-brand organizational structure that we have established will enable us to integrate Emerging Brands in an effective and efficient manner. Jeff Carcara, who served as Chief Executive Officer of Barteca, was named Chief Executive Officer of Del Frisco’s Emerging Brands prior to the acquisition, and Barcelona and bartaco will each continue to operate with their respective Brand Presidents. Mr. Carcara will report to Norman Abdallah, who is Chief Executive Officer of the Company. In the future, we believe that the Emerging Brands will be able to leverage our scale and resources, while our combined Del Frisco’s, Barcelona and bartaco capabilities will provide significant growth opportunities for the entire company, including culinary and beverage innovation, purchasing efficiencies and real estate leverage.

S-6

Table of Contents

High Quality Menu Offerings with a Focus on Social Experience and Customer Service

Across all of our concepts, we believe we provide our customers with a differentiated experiential dining occasion through the combination of high quality food, atmosphere and service. Our culinary excellence is driven by talented chefs and innovative menu items made from locally-sourced, seasonal ingredients. These offerings are complemented by an extensive, award-winning wine list and a broad cocktail selection. The dining experience is enhanced by our commitment to providing a social, lively atmosphere and décor that includes curated artwork, private dining rooms and separate bar areas. To further enhance our customers’ dining experience, we have a staff of highly-trained team members who undergo extensive ongoing training and are evaluated regularly by management. These team members are focused on creating frequent and meaningful interactions with our customers. As a testament to our differentiated dining experience, each of our concepts has been the recipient of numerous industry awards, including Barcelona being named one of Nation’s Restaurant News’ Breakout Brands in 2014. Our New York Double Eagle has won Wine Spectator’s prestigious Grand Award in 2017 and 2018 and all other Double Eagles have won their “Best Of” Award of Excellence. In 2018, all Barcelona restaurants won Wine Spectator’s “Best Of” Award of Excellence.

Compelling Restaurant Level Economics

Our operating model and disciplined approach to growth, where each brand must earn the right to grow, have resulted in strong restaurant level performance across a variety of geographies and real estate formats. For our three primary growth brands – the Double Eagle, Barcelona and bartaco – we generated AUVs of $14.2 million, $4.5 million and $5.2 million, respectively, in addition to restaurant-level EBITDA margins of 26.5% for the Double Eagle and 25.4% for Barcelona and bartaco combined for the 2017 fiscal year. During the same period, our comparable restaurants that have been opened for at least 18 months as of December 26, 2017, generated average restaurant-level EBITDA margins of 28.7%, 24.7% and 29.5%, respectively, and average cash-on-cash returns of 54.7%, 57.3% and 87.3%, respectively. We calculate our average cash-on-cash returns by dividing the average restaurant-level EBITDA of our comparable restaurants that have been opened for at least 18 months by our initial cash investment cost (excluding pre-opening expense and net of tenant allowances). We believe that the strong restaurant level economics for our three primary growth brands create an attractive new restaurant growth opportunity.

Experienced Executive Team

Our executive team has extensive experience with an average of over 22 years in the restaurant industry, including significant tenure with our company as well as other restaurant concepts. We are led by our Chief Executive Officer, Norman Abdallah, who first joined our company as a member of our Board of Directors in 2011 and was named CEO in November 2016. Mr. Abdallah has assembled an experienced executive team, including Neil Thomson, our Chief Financial Officer, and Jeff Carcara, our Chief Executive Officer of Del Frisco’s Emerging Brands. We believe our experienced executive team, combined with our effective multi-brand organizational strategy, will position our company well for long-term, sustainable growth.

Our Growth Strategy

We believe there are significant opportunities to grow our business, strengthen our competitive position and enhance our concepts through the continued implementation of the following strategies:

Pursue Disciplined New Restaurant Expansion

We believe our Double Eagle, Barcelona and bartaco concepts have significant room to grow. We have an established growth pipeline and a disciplined strategy for opening new restaurants by selectively entering new

S-7

Table of Contents

markets and expanding our presence in existing markets. We believe our concepts’ distinct positioning, broad range of average checks and menu offerings, coupled with the flexibility of our restaurant models across a range of trade areas and square footage layouts will enable us to create leverage with developers and landlords and, ultimately, expand our existing restaurant footprint. We have successfully opened new restaurants in a number of diverse markets and we continued to grow in 2017, opening a Double Eagle in Plano, Texas, a Grille in Brookfield, New York, a Barcelona in Passyunk, Pennsylvania and three bartacos in Boulder, Colorado, Chapel Hill, North Carolina and Homewood, Alabama. In 2018, we have opened one Double Eagle in Boston, Massachusetts, one Grille in Westwood, Massachusetts, one Barcelona in Denver, Colorado and three bartacos in Fairfax, Virginia, Fort Worth, Texas and Raleigh, North Carolina, and we expect to open up to ten additional restaurants, including up to three Double Eagles, two Grilles, two Barcelonas and up to three bartacos during the remainder of the year.

For our three primary growth brands – the Double Eagle, Barcelona and bartaco – we target a cash-on-cash return beginning in the third operating year of at least 40% for the Double Eagle and our Emerging Brands (excluding pre-opening expense). To achieve these returns, we target restaurant-level EBITDA margins of 24% to 27% for the Double Eagle, 22% to 25% for Barcelona and 24% to 27% for bartaco, in addition to targeting initial cash investment costs (excluding pre-opening expense and net of tenant allowances) of $7 million to $9 million per restaurant for a new Double Eagle and $2 million to $3 million for a new Barcelona or bartaco. We believe we are in the early stages of our new restaurant growth trajectory and estimate a total restaurant potential in the United States of approximately 40-50 for Double Eagle (based on eSite), 50-100 for Barcelona (based on management estimates) and 200-300 for bartaco (based on management estimates). We target an annual unit growth rate of at least 10%, generally composed of two to three Double Eagles, two to three Barcelonas and four to six bartacos. Furthermore, while we believe the Grille remains underpenetrated in the United States, we are continuing to evaluate the performance of recent openings that utilized the new real estate model from the in-depth brand analysis in order to set the foundation for the next phase of Grille unit growth.

Beyond domestic new unit growth, we believe our concepts have the potential for expansion in select international markets through franchising, licensing, company-owned restaurants or a combination of the foregoing. While we do not have a specific global expansion strategy and we have no current intention to expand into international markets, we believe there is a long-term opportunity for our concepts beyond the U.S. market.

Grow Our Comparable Restaurant Sales

We believe there are significant opportunities to increase our customer counts and average check through the following initiatives:

| • | Menu Innovation. In order to drive customer trial and frequency and positive mix shifts, we are continually innovating and enhancing our food and beverage offerings. In fourth quarter 2017, we rolled out new menus at the Double Eagle, Grille and Sullivan’s. At the Double Eagle, we added a new dry-age steak section and simply prepared fish platform, in addition to further elevating our wine selection. At the Grille, leveraging the comprehensive third party brand analysis, we launched a new menu and alcoholic beverage platform targeting our core Grille consumers. At Sullivan’s, leveraging our brand re-positioning analysis, we launched a new menu with a bone-in steak section and revamped cocktail program. At our Emerging Brands, we innovate and evolve our menus on a continual basis in order to reflect the freshest, in-season ingredients. In addition, we believe there are opportunities to continue increasing our per person average check at all of our concepts through maintaining our focus on salesmanship by our servers and by strategically adjusting menu prices and/or mix. |

| • | Drive Relevant and Impactful Marketing Initiatives. We have a balanced approach to marketing that utilizes approximately 70% digital and 30% out-of-home tactics for the Double Eagle and Grille and |

S-8

Table of Contents

| 100% digital for Emerging Brands, which we believe is the appropriate mix to getting the right message to the right people at the right time, driving visitation and increasing our relevance on social media. We are optimizing our digital marketing investments through intelligent campaign targeting and new marketing tools. In addition, our general managers are key to driving grassroots efforts through genuine involvement in the community and cultivating relationships with local businesses and hotels. |

| • | Further Grow Private Dining. We intend to drive growth by enhancing our private dining capacity and increasing awareness of our private dining services. We are creating additional private dining space at select locations by expanding or reconfiguring existing space. In addition, each location currently dedicates a staff member to increasing its private dining business. We have dedicated brand-level Private Dining Managers, who meet weekly with each restaurant’s private dining coordinator regarding upcoming events and sales initiatives. |

Improve Margins by Leveraging Our Infrastructure

We have continually invested in our business and believe our infrastructure can support a much larger restaurant base. Our brand-level organizational structure enables each concept to operate independently, while still leveraging our corporate infrastructure and shared services. As we continue to grow our footprint, we expect to drive supply chain efficiencies by capitalizing on potential cost savings opportunities through increased negotiation and purchasing power. Furthermore, we will leverage both the technology investments already made and the various labor initiatives being implemented at our restaurants to continually improve the guest experience and our team member productivity, while reducing labor costs. In addition, we continually evaluate our corporate office efficiency and expect general and administrative expenses to grow at a slower rate than our restaurant base and revenues. Through the acquisition of Barteca, we also believe there will be significant cost savings opportunities by eliminating redundant expenses, as the Emerging Brands are able to leverage our existing corporate infrastructure and shared services.

S-9

Table of Contents

RECENT DEVELOPMENTS

Exploration of Strategic Alternatives for Sullivan’s Steakhouse

Management continues to review and pursue strategic initiatives to enable the Company to better allocate capital to develop the Double Eagle, Grille and Emerging Brands. As part of this review, management is considering a potential divestiture of Sullivan’s and has engaged a financial advisor to assist in the process. As previously disclosed, we have received several bids from interested parties to purchase the concept and continue to engage in discussions. There can be no assurance if or when we will consummate a transaction or the terms of any transaction.

Pre-Acquisition 2018 Results for Emerging Brands

As the Barteca Acquisition closed on the first day of our third quarter, operating results for Barteca are not included in Del Frisco’s financial results for the second quarter ended June 26, 2018. Barteca’s second quarter was scheduled to end on July 3, 2018, however, it was shortened due to the closing of the Barteca Acquisition on June 27, 2018. Therefore, the operating results for Barteca’s second quarter are for the portion of the quarter that occurred prior to the acquisition and have been presented based on historical data provided by Barteca. In future filings, we may conform the Emerging Brands segment to the presentation of the Company.

| • | Net restaurant sales were $36.9 million during the second quarter of 2018 and $68.2 million for the first two quarters of 2018. |

| • | Net restaurant sales at Barcelona were $16.7 million during the second quarter of 2018 and $31.6 million for the first two quarters of 2018. |

| • | Net restaurant sales at bartaco were $20.1 million during the second quarter of 2018 and $36.2 million for the first two quarters of 2018. |

| • | Total comparable restaurant sales decreased 1.2% during the second quarter of 2018 and increased 0.5% on a year-to-date basis. |

| • | Comparable restaurant sales increased 1.8% at Barcelona Wine Bar during the second quarter of 2018 and increased 2.0% on a year-to-date basis. |

| • | Comparable restaurant sales decreased 4.0% at bartaco during the second quarter of 2018 and decreased 1.1% on a year-to-date basis. Excluding one underperforming location, comparable restaurant sales would have been positive during the second quarter of 2018 and on a year-to-date basis. |

S-10

Table of Contents

THE OFFERING

The summary below contains basic information about this offering. It does not contain all of the information you should consider in making your investment decision. You should read this entire prospectus supplement, the accompanying base prospectus and the information included or incorporated and deemed to be incorporated by reference herein and therein before making an investment decision. As used in this section, except where otherwise indicated, the terms “us,” “we” and “our” refer to Del Frisco’s Restaurant Group, Inc. and not to any of its subsidiaries.

| Issuer |

Del Frisco’s Restaurant Group, Inc., a Delaware corporation. |

| Securities offered |

11,250,000 shares. |

| Number of shares to be outstanding after this offering |

31,632,822 shares(1). |

| Nasdaq Global Select Market symbol |

DFRG. |

| Underwriters’ option to purchase additional shares of common stock |

We have granted the underwriters an option exercisable within a 30-day period beginning on, and including, the date of this prospectus supplement, to purchase up to 1,687,500 additional shares of our common stock at the public offering price, less the underwriting discounts and commissions. |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $85.1 million (or approximately $97.8 million if the underwriters exercise their option to purchase additional shares in full), after deducting the underwriters’ discounts and commissions. |

| We intend to use the net proceeds of this offering to repay a portion of the outstanding borrowings under our New Term Loans, which borrowings were approximately $399.5 million as of July 27, 2018. |

| See “Use of Proceeds.” |

| Conflicts of Interest |

Affiliates of J.P. Morgan Securities LLC and Citizens Capital Markets, Inc., underwriters in this offering, will receive at least 5% of the net proceeds of this offering in connection with the repayment of a portion of the New Term Loans. Accordingly, this offering is being made in compliance with the requirements of Financial Industry Regulatory Authority (“FINRA”) Rule 5121. |

| See “Use of Proceeds” and “Underwriting (Conflicts of Interest).” |

| Transfer agent and registrar |

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. |

| Settlement date |

The shares are expected to be delivered against payment on August 6, 2018. |

S-11

Table of Contents

| Risk factors |

Investment in our common stock involves substantial risks. You should read this prospectus supplement, the accompanying base prospectus and any document incorporated by reference herein carefully, including the section herein entitled “Risk Factors,” the risk factors described in “Part I, Item 1A.—Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 26, 2017 and in “Part II, Item 1A. Risk Factors” in our 2018 Quarterly Reports on Form 10-Q, and the information set forth or incorporated by reference in this prospectus supplement. |

| (1) | The number of shares of common stock outstanding immediately after this offering is based on 20,382,822 shares of our common stock outstanding as of July 27, 2018 plus 11,250,000 shares that we are offering pursuant to this prospectus supplement, but excluding: |

| • | 1,687,500 shares of our common stock issuable on the exercise of the underwriters’ option to purchase additional shares of our common stock in this offering, and |

| • | 793,361 shares of restricted stock, convertible into common stock at the applicable vesting date, and 555,800 shares of our common stock reserved for issuance and available for purchase pursuant to stock options outstanding under our equity incentive plan as of July 27, 2018, 713,897 of which are currently vested. |

Except as otherwise noted, all information in this prospectus supplement assumes that the underwriters’ option to purchase additional shares is not exercised in this offering.

S-12

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA CONSOLIDATED FINANCIAL INFORMATION OF

DEL FRISCO’S

The following summary historical consolidated financial information of Del Frisco’s and its subsidiaries as of December 26, 2017 and December 27, 2016 and for each of the fiscal years ended December 26, 2017, December 27, 2016 and December 29, 2015 has been derived from our audited consolidated financial statements, which are incorporated by reference into this prospectus supplement and the accompanying base prospectus. The summary historical consolidated financial information as of December 29, 2015 has been derived from our audited consolidated financial statements which are not incorporated by reference in this prospectus supplement or accompanying base prospectus. The following summary historical consolidated financial information as of June 26, 2018 and for each of the 26 weeks ended June 26, 2018 and the 24 weeks ended June 13, 2017 has been derived from our unaudited interim consolidated financial statements, which are incorporated by reference into this prospectus supplement and the accompanying base prospectus. In the opinion of management, these unaudited interim consolidated financial statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our financial position and operating results for these periods. Results from interim periods are not necessarily indicative of results that may be expected for the entire year and historical results are not indicative of the results to be expected in the future.

On June 27, 2018, we completed the Barteca Acquisition. Our operating results for the periods and dates indicated below do not reflect the Barteca Acquisition. The following summary unaudited pro forma condensed combined financial information was derived from and should be read in conjunction with (i) Del Frisco’s historical audited and interim unaudited consolidated financial statements, including the notes thereto, included in Del Frisco’s Annual Report on Form 10-K as of and for the year ended December 26, 2017 and Del Frisco’s Quarterly Report on Form 10-Q as of and for the 26 week period ended June 26, 2018, incorporated by reference herein, and (ii) Barteca’s consolidated financial statements, including the notes thereto, as of and for the year ended January 2, 2018 and as of and for the thirteen week period ended April 3, 2018 included in Del Frisco’s Current Report on Form 8-K dated June 27, 2018, as amended on Form 8-K/A on July 30, 2018 and incorporated by reference herein. The financial statements of Barteca for the 12 weeks ended June 26, 2018 were derived from Barteca’s unaudited interim consolidated financial statements to, but not including, the date of the Barteca Acquisition which are not included or incorporated by reference herein. Such twelve-week period for Barteca does not reference a full fiscal quarter and as a consequence, the financial information for such twelve week period have not been the subject to review or audit proecudres, and have not been the subject of Barteca’s customary fiscal period closing procedures. As such, the financial information for the 12 weeks ended June 26, 2018 for Barteca is subject to adjustment and any such adjustment may be material.

The following summary unaudited pro forma condensed combined financial information presents the combination of the historical consolidated financial statements of Del Frisco’s and its subsidiaries and the historical consolidated financial statements of Barteca and its subsidiaries, after giving effect to the related transactions and debt financing as further described in Note 1 to “Unaudited Pro Forma Condensed Combined Financial Information of Del Frisco’s and Barteca” included in this prospectus supplement. The pro forma adjustments are based upon currently available information and certain assumptions that Del Frisco’s management believes are reasonable. The unaudited pro forma condensed combined financial information is presented for informational purposes only and is not intended to present or be indicative of what the results of operations or financial position would have been had the events actually occurred on the dates indicated, nor is it meant to be indicative of future results of operations or financial position for any future period or as of any future date. The unaudited pro forma condensed combined financial information does not give effect to the potential impact of current financial conditions, any anticipated cost savings or operating synergies that may result from the Transactions or the impact of this offering of shares of our common stock. See “Unaudited Pro Forma Condensed Combined Financial Information of Del Frisco’s and Barteca.”

S-13

Table of Contents

The summary financial data presented below represent portions of our financial statements and are not complete. You should read this information in conjunction with “Use of Proceeds” and “Capitalization” in this prospectus supplement, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K, as supplemented and updated by our subsequent Quarterly Reports on Form 10-Q, that we have filed or will file with the SEC, which are incorporated by reference into this prospectus supplement, and our historical consolidated financial statements and the notes thereto incorporated by reference into this prospectus supplement and the accompanying base prospectus. See “Where You Can Find More Information and Incorporation by Reference” in this prospectus supplement.

| Pro Forma |

For the | Pro Forma | For the Year Ended | |||||||||||||||||||||||||

| ($ in thousands except per share data) | For the 26 Weeks Ended June 26, 2018 |

26 Weeks Ended June 26, 2018 |

24 Weeks Ended June 13, 2017 |

Year Ended December 26, 2017 |

December 26, 2017 |

December 27, 2016 |

December 29, 2015 |

|||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Revenues |

$ | 247,561 | $ | 179,343 | $ | 166,191 | $ | 489,600 | $ | 361,431 | $ | 351,681 | $ | 331,612 | ||||||||||||||

| Costs and expenses: |

||||||||||||||||||||||||||||

| Costs of sales |

68,801 | 52,110 | 47,214 | 135,845 | 103,976 | 99,181 | 95,963 | |||||||||||||||||||||

| Restaurant operating expenses (excluding depreciation and amortization shown separately below) |

120,860 | 87,622 | 81,280 | 241,010 | 177,170 | 169,300 | 156,337 | |||||||||||||||||||||

| Insurance recovery(1) |

— | — | — | (1,073 | ) | (1,073 | ) | — | — | |||||||||||||||||||

| Marketing and advertising costs |

4,016 | 4,016 | 2,918 | 8,393 | 8,393 | 8,260 | 7,745 | |||||||||||||||||||||

| Pre-opening costs |

3,298 | 2,549 | 2,008 | 4,316 | 2,182 | 3,446 | 5,228 | |||||||||||||||||||||

| General and administrative |

31,219 | 16,834 | 12,076 | 41,373 | 28,421 | 25,131 | 23,111 | |||||||||||||||||||||

| Donations(2) |

58 | 58 | — | 836 | 836 | — | — | |||||||||||||||||||||

| Consulting project costs |

854 | 854 | 2,633 | 2,786 | 2,786 | — | — | |||||||||||||||||||||

| Acquisition and disposition costs(3) |

733 | 5,015 | — | — | — | — | — | |||||||||||||||||||||

| Reorganization severance costs |

113 | 113 | 719 | 1,072 | 1,072 | 793 | — | |||||||||||||||||||||

| Lease termination costs(4) |

1,389 | 1,389 | 538 | 538 | 538 | 1,031 | 1,386 | |||||||||||||||||||||

| Impairment charges(5) |

84 | 84 | — | 37,053 | 37,053 | 598 | 3,248 | |||||||||||||||||||||

| Depreciation and amortization |

13,125 | 10,475 | 9,813 | 28,704 | 23,399 | 18,865 | 16,766 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total costs and expenses |

244,550 | 181,119 | 159,199 | 500,853 | 384,753 | 326,605 | 309,794 | |||||||||||||||||||||

| Insurance settlements |

— | — | 348 | 1,153 | 1,153 | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating income (loss) |

3,011 | (1,776 | ) | 7,340 | (10,100 | ) | (22,169 | ) | 25,076 | 21,818 | ||||||||||||||||||

| Other income (expense), net: |

||||||||||||||||||||||||||||

| Interest, net of capitalized interest |

(14,877 | ) | (813 | ) | (19 | ) | (29,651 | ) | (783 | ) | (70 | ) | (77 | ) | ||||||||||||||

| Other |

(50 | ) | (49 | ) | (11 | ) | (993 | ) | (1,439 | ) | (432 | ) | (236 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before income taxes |

(11,916 | ) | (2,638 | ) | 7,310 | (40,744 | ) | (24,391 | ) | 24,574 | 21,505 | |||||||||||||||||

| Income tax expense (benefit) |

(4,171 | ) | (1,476 | ) | 1,910 | (20,374 | ) | (12,934 | ) | 6,808 | 5,507 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) |

$ | (7,745 | ) | $ | (1,162 | ) | $ | 5,400 | $ | (20,370 | ) | $ | (11,457 | ) | $ | 17,766 | $ | 15,998 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income (loss) per average common share: |

||||||||||||||||||||||||||||

| Basic |

$ | (0.38 | ) | $ | (0.06 | ) | $ | 0.24 | $ | (0.94 | ) | $ | (0.53 | ) | $ | 0.76 | $ | 0.68 | ||||||||||

| Diluted |

$ | (0.38 | ) | $ | (0.06 | ) | $ | 0.24 | $ | (0.94 | ) | $ | (0.53 | ) | $ | 0.76 | $ | 0.68 | ||||||||||

| Weighted-average number of common shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

20,347 | 20,347 | 22,391 | 21,570 | 21,570 | 23,322 | 23,380 | |||||||||||||||||||||

| Diluted |

20,347 | 20,347 | 22,720 | 21,570 | 21,570 | 23,435 | 23,517 | |||||||||||||||||||||

S-14

Table of Contents

| Pro Forma as of |

As of | As of | ||||||||||||||||||||||

| ($ in thousands) | June 26, 2018 |

June 26, 2018 |

June 13, 2017 |

December 26, 2017 |

December 27, 2016 |

December 29, 2015 |

||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 6,034 | $ | 897 | $ | 2,145 | $ | 4,594 | $ | 14,622 | $ | 5,176 | ||||||||||||

| Working capital (deficit)(6) |

(15,587 | ) | (18,600 | ) | (13,472 | ) | (14,829 | ) | (4,396 | ) | (10,390 | ) | ||||||||||||

| Goodwill |

203,756 | 62,157 | 75,365 | 62,241 | 75,365 | 75,365 | ||||||||||||||||||

| Total assets |

716,040 | 353,122 | 363,656 | 326,787 | 370,782 | 346,655 | ||||||||||||||||||

| Long-term debt |

374,787 | 40,476 | 22,750 | 24,477 | — | 4,500 | ||||||||||||||||||

| Total stockholders’ equity |

188,139 | 190,199 | 223,417 | 189,087 | 246,366 | 227,699 | ||||||||||||||||||

| For the | For the Year Ended | |||||||||||||||||||

| ($ in thousands) | 26 Weeks Ended June 26, 2018 |

24 Weeks Ended June 13, 2017 |

December 26, 2017 |

December 27, 2016 |

December 29, 2015 |

|||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 8,302 | $ | 15,075 | $ | 38,065 | $ | 49,815 | $ | 45,868 | ||||||||||

| Net cash used in investing activities |

(32,509 | ) | (20,626 | ) | (23,929 | ) | (34,168 | ) | (46,530 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

20,510 | (6,926 | ) | (24,164 | ) | (6,201 | ) | 2,318 | ||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Capital expenditures |

$ | 36,573 | $ | 21,928 | $ | 41,334 | $ | 36,950 | $ | 48,109 | ||||||||||

| Adjusted EBITDA(7) |

$ | 18,761 | $ | 22,703 | $ | 44,544 | $ | 49,809 | $ | 48,456 | ||||||||||

| Adjusted EBITDA Margin(8) |

10.5 | % | 13.7 | % | 12.3 | % | 14.2 | % | 14.6 | % | ||||||||||

| Restaurant-level EBITDA(7) |

$ | 35,595 | $ | 34,779 | $ | 72,965 | $ | 74,940 | $ | 71,567 | ||||||||||

| Restaurant-level EBITDA Margin(9) |

19.9 | % | 20.9 | % | 20.2 | % | 21.3 | % | 21.6 | % | ||||||||||

| Operating Data: |

||||||||||||||||||||

| Total restaurants (at end of period) |

50 | 52 | 53 | 53 | 50 | |||||||||||||||

| Total comparable restaurants (at end of period)(11) |

43 | 43 | 46 | 41 | 37 | |||||||||||||||

| Average sales per comparable restaurant |

$ | 3,457 | $ | 3,297 | $ | 6,630 | $ | 7,229 | $ | 7,396 | ||||||||||

| Percentage change in comparable restaurant sales |

(2.5) | % | (1.3) | % | (2 | )% | (0.8 | )% | (0.6 | )% | ||||||||||

| Pro Forma Metrics: |

||||||||||||||||||||

| Adjusted EBITDA(7)(10) |

$ | 22,665 | $ | 64,052 | ||||||||||||||||

| Adjusted EBITDA Margin(8)(10) |

9.2 | % | 13.1 | % | ||||||||||||||||

| Restaurant-level EBITDA(7)(10) |

$ | 53,884 | $ | 105,425 | ||||||||||||||||

| Restaurant-level EBITDA Margin(9)(10) |

21.8 | % | 21.5 | % | ||||||||||||||||

| (1) | Insurance recovery represents the amounts recovered from property damage that occurred during the fiscal year ended December 26, 2017 at two Sullivan’s locations. |

| (2) | Donations in the fiscal year ended December 26, 2017 were primarily related to donations to the Houston area food bank to support victims affected by Hurricane Harvey that occurred during the third quarter of 2017. |

| (3) | Acquisition and disposition costs were approximately $5 million for the first two quarters of 2018 and are primarily related to the Barteca Acquisition. |

| (4) | During the first two quarters of 2018, we closed the Sullivan’s restaurants in Austin, Texas and Chicago Illinois and the Grille restaurants in Little Rock, Arkansas and Stamford, Connecticut and incurred approximately $1.4 million in aggregate related charges. In the fiscal year ended December 26, 2017 we closed two Sullivan’s restaurants and incurred approximately $0.5 million in related lease termination costs. During the fourth quarter of the fiscal year ended December 27, 2016, we decided to close the Sullivan’s restaurant in Seattle, Washington by March 31, 2017, and in connection with this anticipated closing, we incurred approximately $0.9 million in lease termination costs during the fiscal year ended December 27, 2016, and separately, an additional $0.1 million in closing costs related to prior year closures. |

S-15

Table of Contents

| (5) | During the fiscal year ended December 26, 2017, we determined that the carrying values of our goodwill and indefinite-lived intangible assets related to the Sullivan’s concept exceeded their fair values based on estimated future cash flows that would be generated by Sullivan’s restaurants, and therefore recorded a non-cash impairment charge of $13.4 million. We similarly incurred $23.6 million in impairment charges related to one Double Eagle, four Grille and one Sullivan’s locations for the same period. |

| (6) | Working capital is defined as total current assets minus total current liabilities. Our operations have not required significant working capital and, like many restaurant companies, we may at times have negative working capital. Revenues are received primarily in cash or by credit card, and our restaurant operations do not require significant receivables or inventories, other than our wine inventory. In addition, we receive trade credit for the purchase of food, beverages and supplies, thereby reducing the need for incremental working capital to support growth. |

| (7) | We focus on Adjusted EBITDA and Restaurant-level EBITDA as key measures of our performance and for business planning. Adjusted EBITDA and Restaurant-level EBITDA assist us in comparing our performance over various reporting periods on a consistent basis because they remove from our results of operations the impact of items that, in our opinion, do not reflect our core operating performance. We define Adjusted EBITDA for Del Frisco’s as operating income (loss) before depreciation and amortization, plus the sum of certain non-operating expenses, including pre-opening costs, donations, lease termination costs, acquisition and disposition costs, consulting project costs, reorganization severance, impairment charges and insurance settlements. We define Restaurant-level EBITDA for Del Frisco’s as Adjusted EBITDA before general and administrative costs. |

We believe that our presentation of Adjusted EBITDA and Restaurant-level EBITDA is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance. The presentation of this additional non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. There are limitations to using non-GAAP measures such as Adjusted EBITDA and Restaurant-level EBITDA. Some of these limitations are (i) they do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; (ii) they do not reflect changes in, or cash requirements for, our working capital needs; (iii) they do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; (iv) they do not reflect our income tax expense or the cash requirements to pay our taxes; and (v) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

Although we believe that Adjusted EBITDA and Restaurant-level EBITDA can make an evaluation of our operating performance more consistent because they remove items that, in our opinion, do not reflect our core operations, other companies in our industry may define Adjusted EBITDA and Restaurant-level EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA, Restaurant-level EBITDA or similarly named non-GAAP measures that other companies may use to compare the performance of those companies to our performance.

S-16

Table of Contents

The following table presents a reconciliation of operating income (loss) to Adjusted EBITDA and Restaurant-level EBITDA:

| Pro Forma | For the | Pro Forma | For the Year Ended | |||||||||||||||||||||||||

| ($ in thousands) | For the 26 Weeks Ended June 26, 2018 |

26 Weeks Ended June 26, 2018 |

24 Weeks Ended June 13, 2017 |

For the Year Ended December 26, 2017 |

December 26, 2017 |

December 27, 2016 |

December 29, 2015 |

|||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| Operating income (loss) |

$ | 3,011 | $ | (1,776 | ) | $ | 7,340 | $ | (10,100 | ) | $ | (22,169 | ) | $ | 25,076 | $ | 21,818 | |||||||||||

| Pre-opening costs |

3,298 | 2,549 | 2,008 | 4,316 | 2,182 | 3,446 | 5,228 | |||||||||||||||||||||

| Donations |

58 | 58 | — | 836 | 836 | — | — | |||||||||||||||||||||

| Lease termination costs |

1,389 | 1,389 | 538 | 538 | 538 | 1,031 | 1,386 | |||||||||||||||||||||

| Depreciation and amortization |

13,125 | 10,475 | 9,813 | 28,704 | 23,399 | 18,865 | 16,776 | |||||||||||||||||||||

| Acquisition and disposition costs |

733 | 5,015 | — | — | — | — | — | |||||||||||||||||||||

| Consulting project costs |

854 | 854 | 2,633 | 2,786 | 2,786 | — | — | |||||||||||||||||||||

| Reorganization severance costs |

113 | 113 | 719 | 1,072 | 1,072 | 793 | — | |||||||||||||||||||||

| Impairment charges |

84 | 84 | — | 37,053 | 37,053 | 598 | 3,248 | |||||||||||||||||||||

| Insurance settlements |

— | — | (348 | ) | (1,153 | ) | (1,153 | ) | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 22,665 | $ | 18,761 | $ | 22,703 | $ | 64,052 | $ | 44,544 | $ | 49,809 | $ | 48,456 | ||||||||||||||

| General and administrative costs(12) |

31,219 | 16,834 | 12,076 | 41,373 | 28,421 | 25,131 | 23,111 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Restaurant-level EBITDA |

$ | 53,884 | $ | 35,595 | $ | 34,779 | $ | 105,425 | $ | 72,965 | $ | 74,940 | $ | 71,567 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (8) | Adjusted EBITDA margin is the ratio of adjusted EBITDA to revenues. |

| (9) | Restaurant-level EBITDA margin is the ratio of Restaurant-level EBITDA to revenues. |

| (10) | Calculated on a pro forma basis after giving effect to the Barteca Acquisition (including the Company’s payment of the Barteca Acquisition purchase price, the New Term Loans and the outstanding borrowings under the New Revolver), although such pro forma presentation does not reflect the impact of this offering of shares of our common stock. |

| (11) | We consider a restaurant as comparable beginning in the first full fiscal quarter following the eighteenth month of the restaurant’s operations. Changes in comparable restaurant sales reflect changes in sales for the comparable group of restaurants over a specified period of time. |

| (12) | As presented, the pro forma Adjusted EBITDA figure does not add back approximately $7.5 million in incremental share-based compensation costs related to the accelerated vesting of Barteca awards upon a change in control which is included in Barteca’s general and administrative costs. |

S-17

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION OF BARTECA