Form 8-K Bristow Group Inc For: Aug 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2018

Bristow Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-31617 | 72-0679819 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2103 City West Blvd., 4th Floor Houston, Texas |

77042 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 267-7600

Former Name or Former Address, if Changed Since Last Report: NONE

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On August 3, 2018, Bristow Group Inc. posted the First Quarter FY2019 Earnings Presentation to its website at www.bristowgroup.com. This presentation is attached hereto as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1, is being furnished, not “filed,” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Accordingly, the information contained in Exhibit 99.1 will not be incorporated by reference into any registration statement or other document filed by Bristow Group Inc. pursuant to the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description of Exhibit | |

| 99.1 | First Quarter FY2019 Earnings Presentation posted on August 3, 2018. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BRISTOW GROUP INC. | ||||||

| Date: August 3, 2018 |

By: |

/s/ Brian J. Allman | ||||

| Brian J. Allman | ||||||

| Vice President, Chief Accounting Officer | ||||||

First quarter FY19 earnings presentation Bristow Group Inc. August 3, 2018 Exhibit 99.1

Forward-looking statements Statements contained in this presentation regarding the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. These forward-looking statements include statements regarding executing 2019 STRIVE priorities, earnings and liquidity guidance and earnings growth, expected contract revenue, expected liquidity, capital deployment strategy, operational and capital performance, impact of new contracts, cost reduction initiatives, expected OEM cost recoveries, expected financings, capex deferral, market and industry conditions. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Risks and uncertainties include, without limitation: fluctuations in the demand for our services; fluctuations in worldwide prices of and supply and demand for oil and natural gas; fluctuations in levels of oil and natural gas production, exploration and development activities; the impact of competition; actions by clients and suppliers; the risk of reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and regulations; changes in foreign exchange rates and controls; risks associated with international operations; operating risks inherent in our business, including the possibility of declining safety performance; general economic conditions including the capital and credit markets; our ability to obtain financing; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our ability to re-deploy our aircraft to regions with greater demand; our ability to acquire additional aircraft and dispose of older aircraft through sales into the aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment and Operational Excellence programs; availability of employees with the necessary skills; and political instability, war or acts of terrorism in any of the countries in which we operate. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s annual report on Form 10-K for the fiscal year ended March 31, 2018 and its quarterly report on Form 10-Q for the quarter ended June 30, 2018. Bristow Group Inc. disclaims any intention or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events or otherwise. Non-FAAP Financial Measures This presentation contains non-GAAP financial measures. Reconciliations of these measures to the most directly comparable GAAP financial measures to the extent available without unreasonable effort are contained herein. To the extent required, statements disclosing the definitions, utility and purposes of these measures are set forth in the Company’s Form 10-Q for the quarter ended June 30, 2018, which is available on our website free of charge, www.bristowgroup.com

Executive summary and safety review

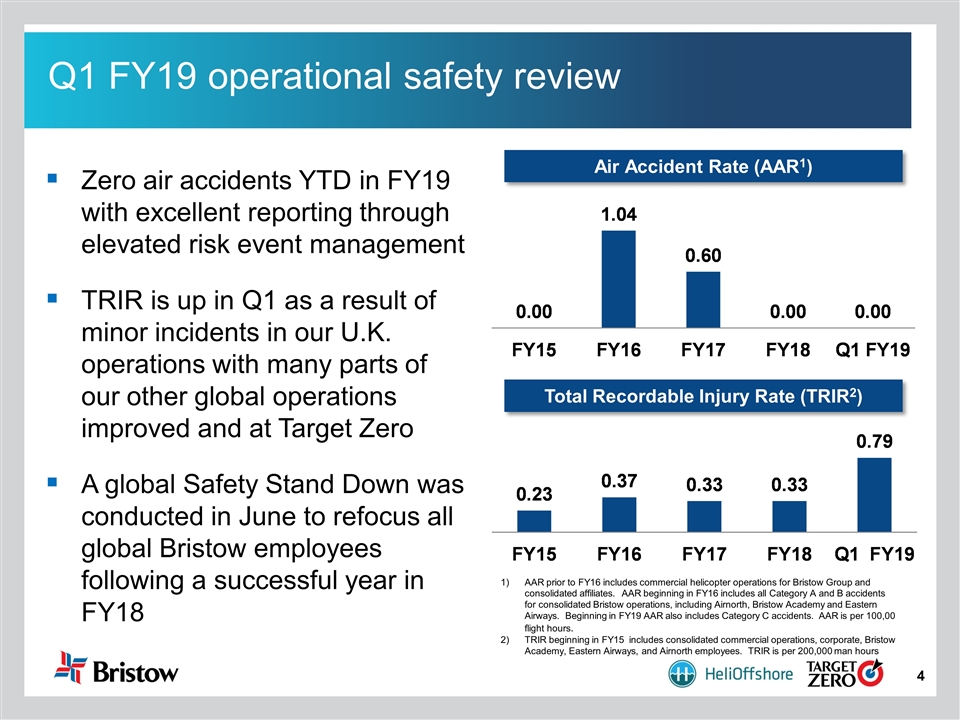

Q1 FY19 operational safety review Zero air accidents YTD in FY19 with excellent reporting through elevated risk event management TRIR is up in Q1 as a result of minor incidents in our U.K. operations with many parts of our other global operations improved and at Target Zero A global Safety Stand Down was conducted in June to refocus all global Bristow employees following a successful year in FY18 Air Accident Rate (AAR1) Total Recordable Injury Rate (TRIR2) AAR prior to FY16 includes commercial helicopter operations for Bristow Group and consolidated affiliates. AAR beginning in FY16 includes all Category A and B accidents for consolidated Bristow operations, including Airnorth, Bristow Academy and Eastern Airways. Beginning in FY19 AAR also includes Category C accidents. AAR is per 100,00 flight hours. TRIR beginning in FY15 includes consolidated commercial operations, corporate, Bristow Academy, Eastern Airways, and Airnorth employees. TRIR is per 200,000 man hours

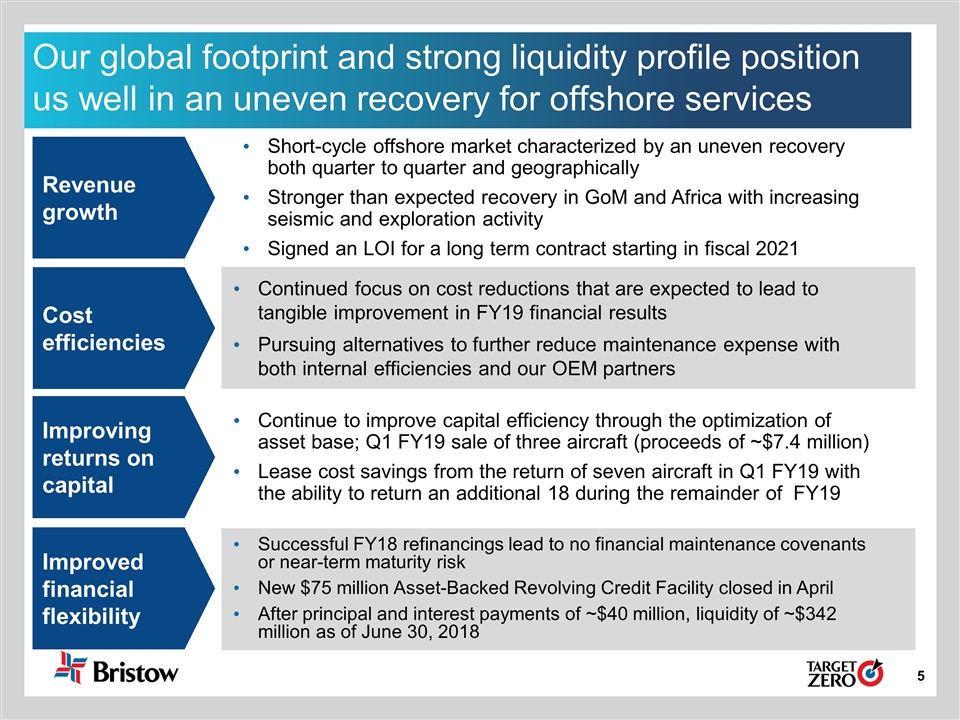

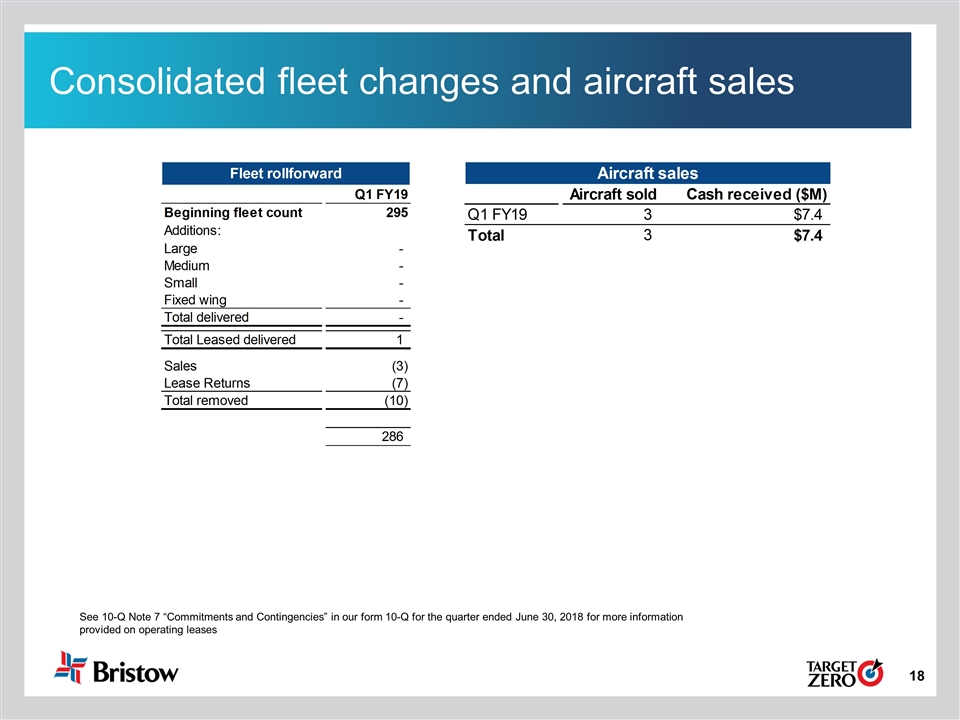

Our global footprint and strong liquidity profile position us well in an uneven recovery for offshore services Cost efficiencies Improving returns on capital Revenue growth Improved financial flexibility Continue to improve capital efficiency through the optimization of asset base; Q1 FY19 sale of three aircraft (proceeds of ~$7.4 million) Lease cost savings from the return of seven aircraft in Q1 FY19 with the ability to return an additional 18 during the remainder of FY19 Continued focus on cost reductions that are expected to lead to tangible improvement in FY19 financial results Pursuing alternatives to further reduce maintenance expense with both internal efficiencies and our OEM partners Successful FY18 refinancings lead to no financial maintenance covenants or near-term maturity risk New $75 million Asset-Backed Revolving Credit Facility closed in April After principal and interest payments of ~$40 million, liquidity of ~$342 million as of June 30, 2018 Short-cycle offshore market characterized by an uneven recovery both quarter to quarter and geographically Stronger than expected recovery in GoM and Africa with increasing seismic and exploration activity Signed an LOI for a long term contract starting in fiscal 2021

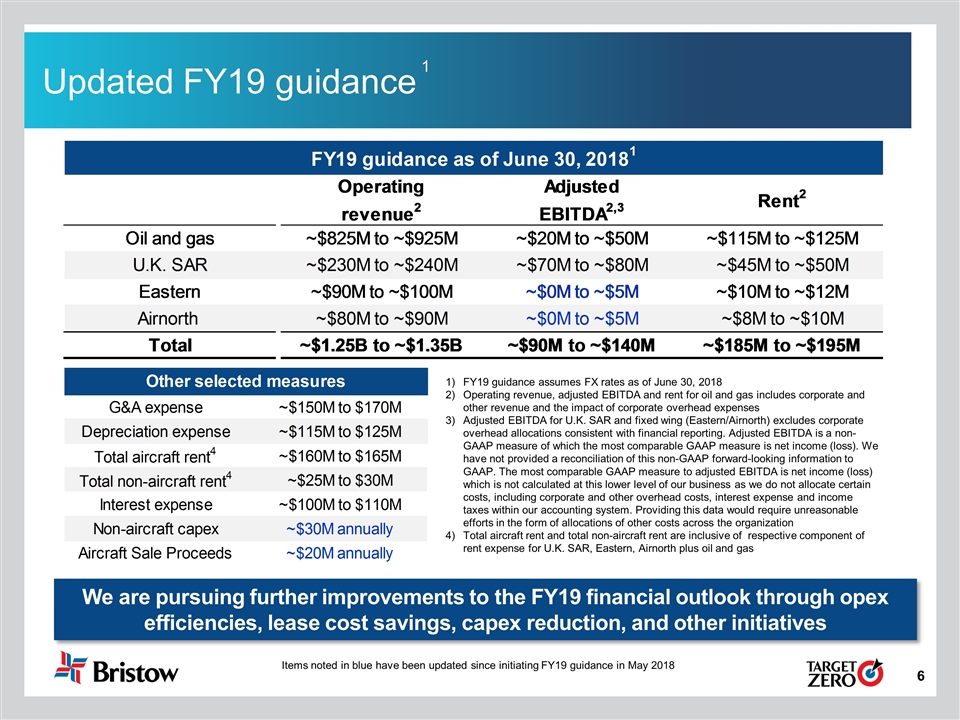

Updated FY19 guidance FY19 guidance assumes FX rates as of June 30, 2018 Operating revenue, adjusted EBITDA and rent for oil and gas includes corporate and other revenue and the impact of corporate overhead expenses Adjusted EBITDA for U.K. SAR and fixed wing (Eastern/Airnorth) excludes corporate overhead allocations consistent with financial reporting. Adjusted EBITDA is a non-GAAP measure of which the most comparable GAAP measure is net income (loss). We have not provided a reconciliation of this non-GAAP forward-looking information to GAAP. The most comparable GAAP measure to adjusted EBITDA is net income (loss) which is not calculated at this lower level of our business as we do not allocate certain costs, including corporate and other overhead costs, interest expense and income taxes within our accounting system. Providing this data would require unreasonable efforts in the form of allocations of other costs across the organization Total aircraft rent and total non-aircraft rent are inclusive of respective component of rent expense for U.K. SAR, Eastern, Airnorth plus oil and gas 1 We are pursuing further improvements to the FY19 financial outlook through opex efficiencies, lease cost savings, capex reduction, and other initiatives Items noted in blue have been updated since initiating FY19 guidance in May 2018

Operational highlights

Q1 FY19 results Adjusted EBITDA1 $ in millions Operating revenue $ in millions Net loss Adjusted net loss1 1) Adjusted EBITDA and adjusted net income (loss) excludes gains (losses) on asset dispositions and special items $ in millions $ in millions

Europe Caspian United Kingdom Norway Turkmenistan $ in millions $ in millions 1) Adjusted EBITDA excludes gains (losses) on asset dispositions and special items Operating revenue Adjusted EBITDA1

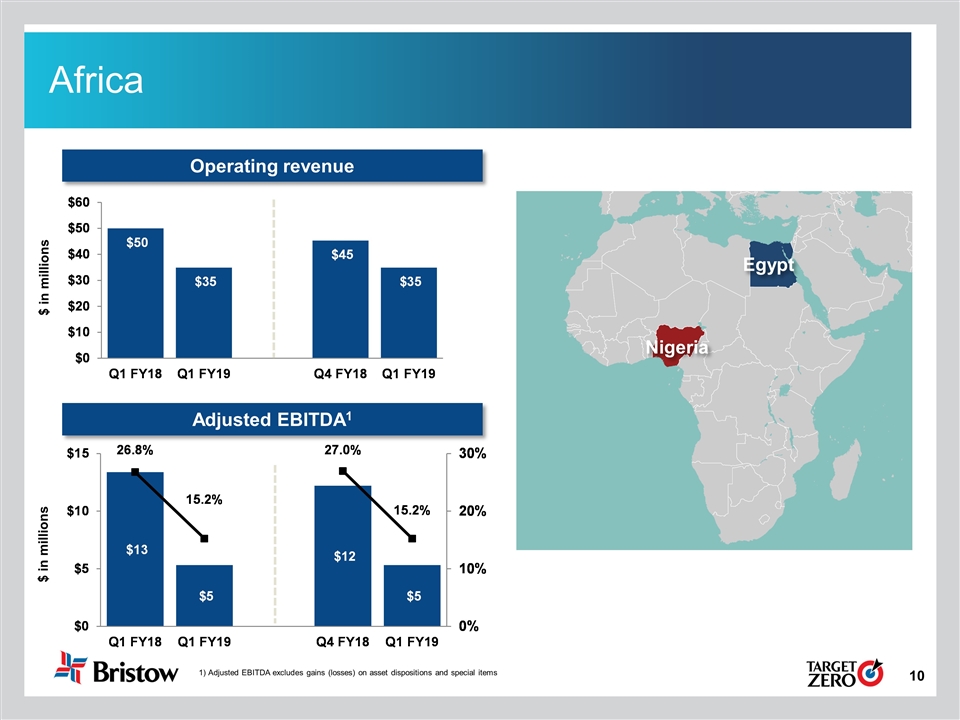

Africa Nigeria Egypt $ in millions $ in millions 1) Adjusted EBITDA excludes gains (losses) on asset dispositions and special items Operating revenue Adjusted EBITDA1

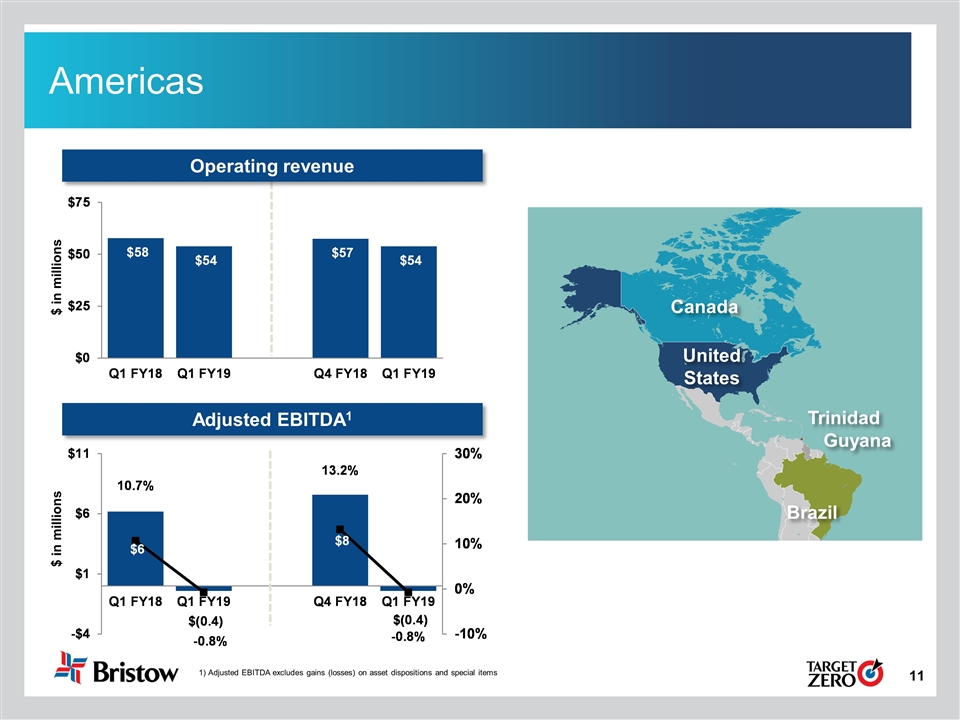

Americas United States Canada Brazil Trinidad $ in millions Guyana $ in millions 1) Adjusted EBITDA excludes gains (losses) on asset dispositions and special items Operating revenue Adjusted EBITDA1

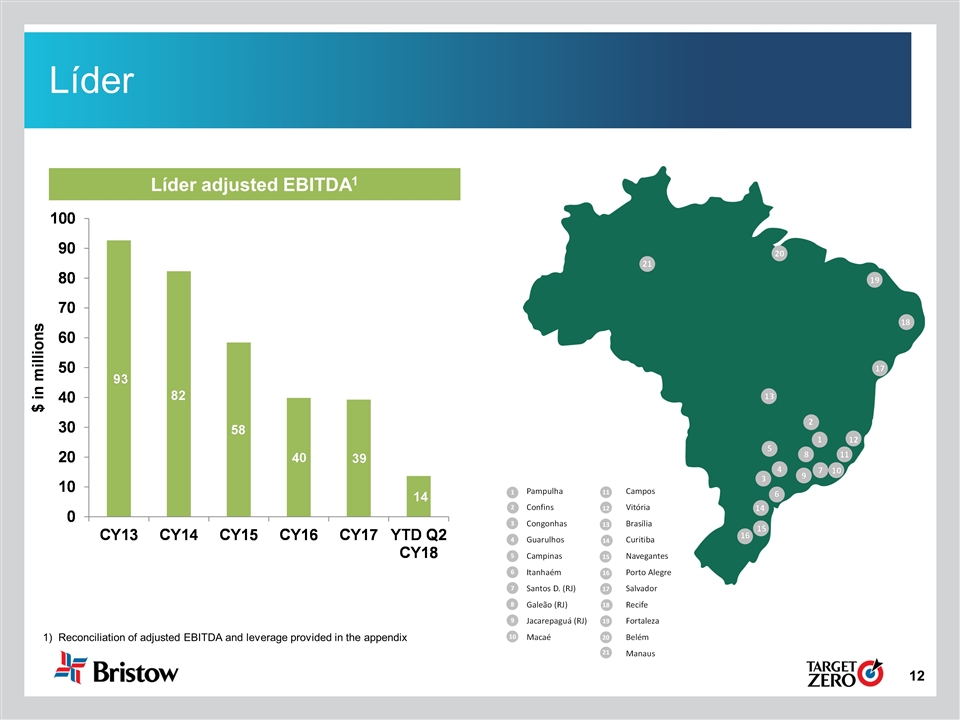

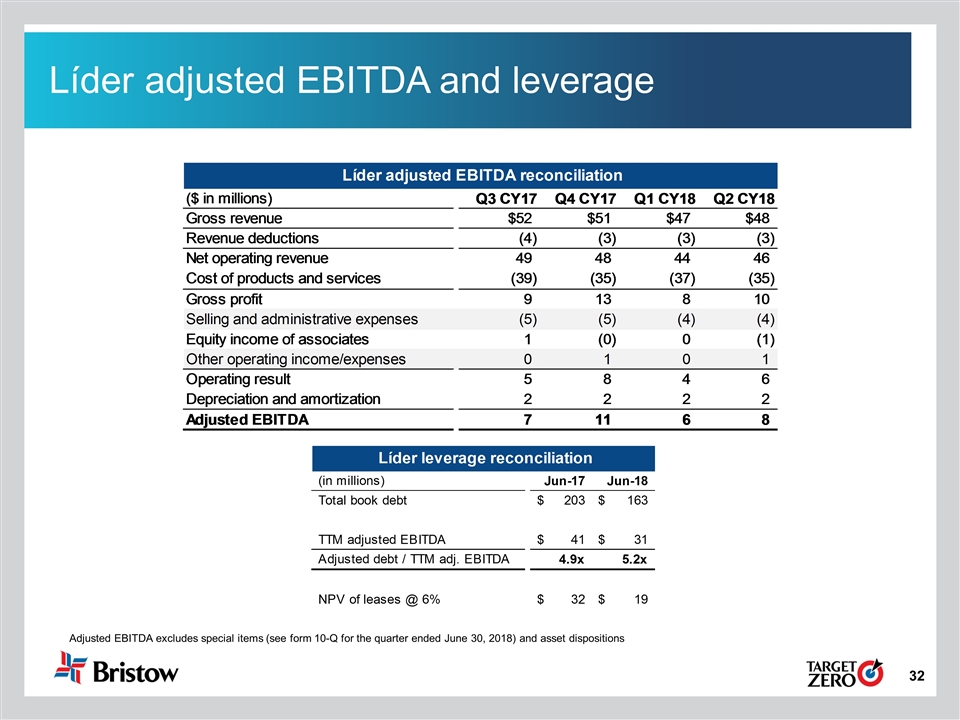

Líder Líder adjusted EBITDA1 1) Reconciliation of adjusted EBITDA and leverage provided in the appendix

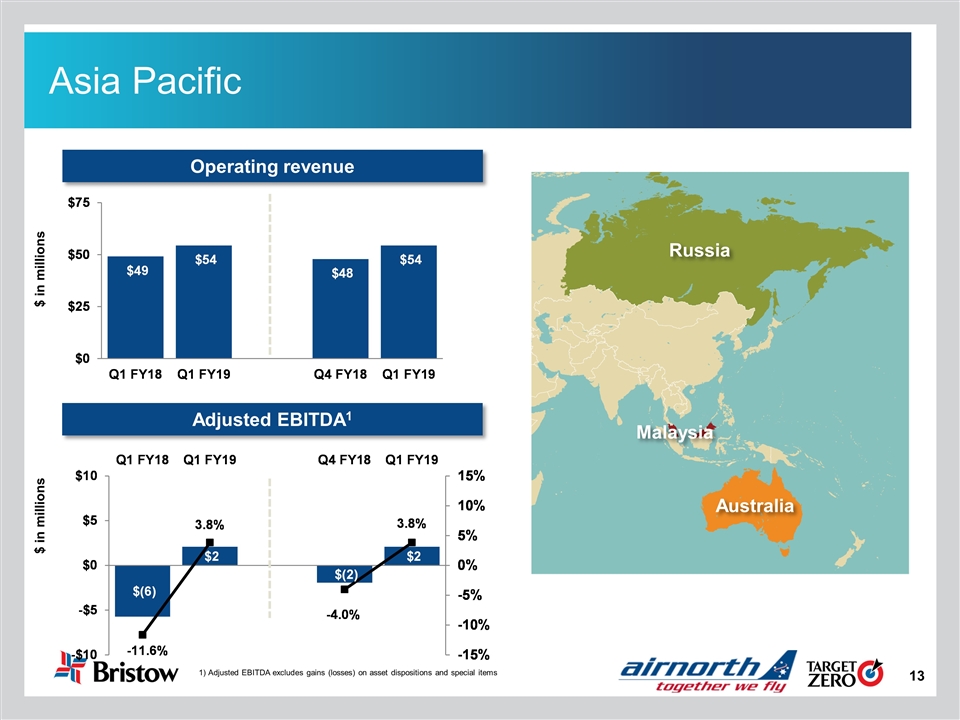

Asia Pacific Russia Australia Malaysia $ in millions $ in millions 1) Adjusted EBITDA excludes gains (losses) on asset dispositions and special items Operating revenue Adjusted EBITDA1

Appendix

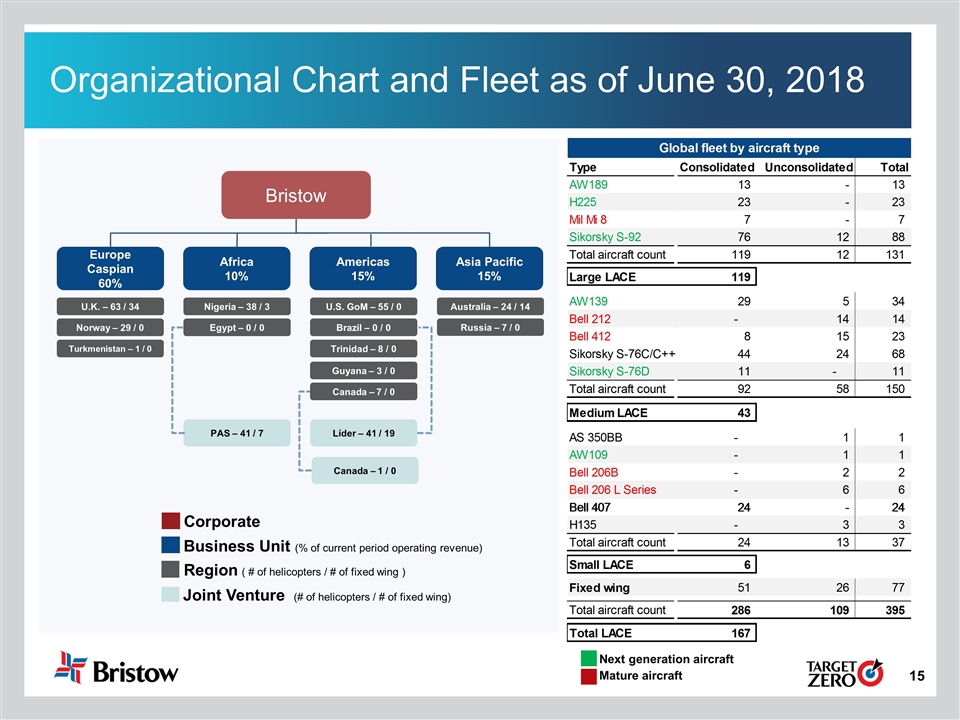

Next generation aircraft Mature aircraft Organizational Chart and Fleet as of June 30, 2018 Bristow Europe Caspian 60% Africa 10% Americas 15% Asia Pacific 15% U.K. – 63 / 34 Norway – 29 / 0 Nigeria – 38 / 3 U.S. GoM – 55 / 0 Canada – 7 / 0 Australia – 24 / 14 Brazil – 0 / 0 Egypt – 0 / 0 Russia – 7 / 0 Trinidad – 8 / 0 Líder – 41 / 19 PAS – 41 / 7 Guyana – 3 / 0 Turkmenistan – 1 / 0 Business Unit (% of current period operating revenue) Corporate Region ( # of helicopters / # of fixed wing ) Joint Venture (# of helicopters / # of fixed wing) Canada – 1 / 0

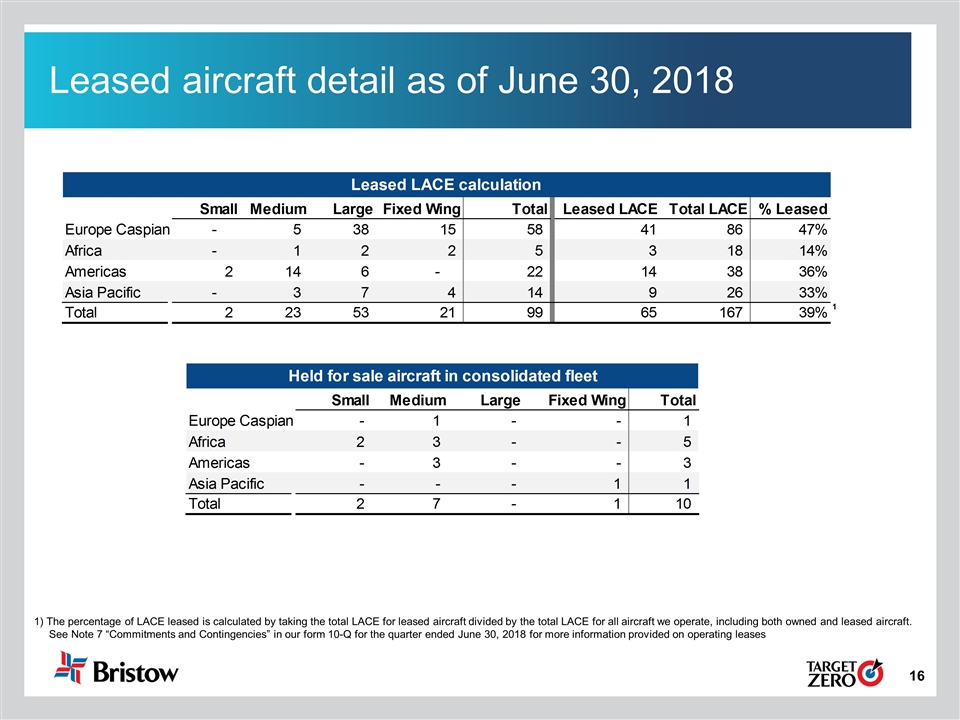

1) The percentage of LACE leased is calculated by taking the total LACE for leased aircraft divided by the total LACE for all aircraft we operate, including both owned and leased aircraft. See Note 7 “Commitments and Contingencies” in our form 10-Q for the quarter ended June 30, 2018 for more information provided on operating leases 1 Leased aircraft detail as of June 30, 2018

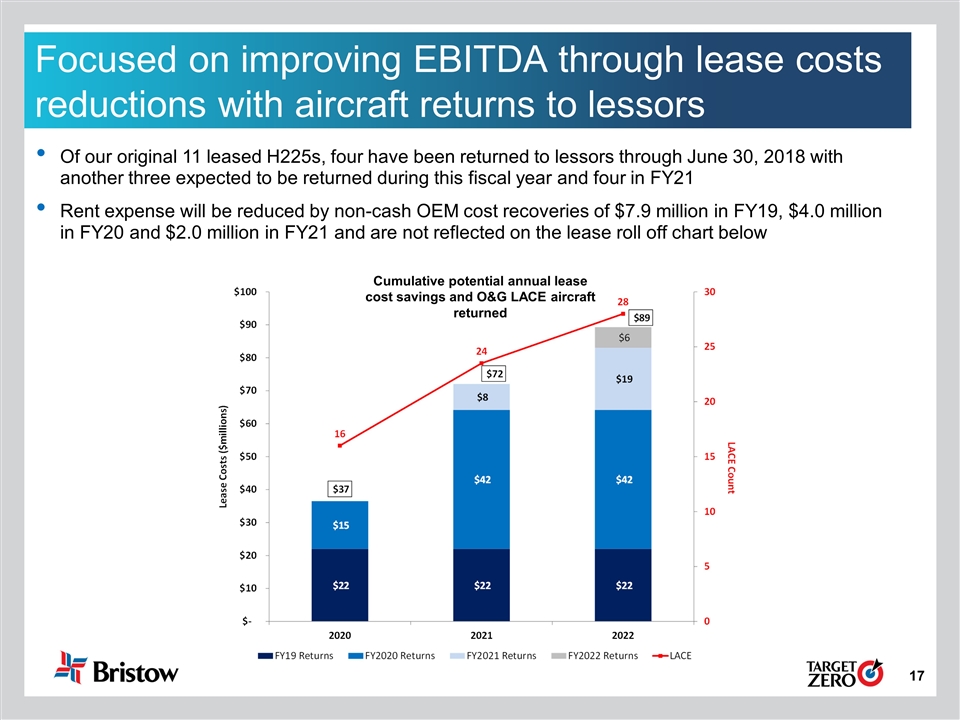

Focused on improving EBITDA through lease costs reductions with aircraft returns to lessors Of our original 11 leased H225s, four have been returned to lessors through June 30, 2018 with another three expected to be returned during this fiscal year and four in FY21 Rent expense will be reduced by non-cash OEM cost recoveries of $7.9 million in FY19, $4.0 million in FY20 and $2.0 million in FY21 and are not reflected on the lease roll off chart below Cumulative potential annual lease cost savings and O&G LACE aircraft returned

See 10-Q Note 7 “Commitments and Contingencies” in our form 10-Q for the quarter ended June 30, 2018 for more information provided on operating leases Consolidated fleet changes and aircraft sales

Operating revenue, LACE and LACE rate by region 4 $ in millions LACE rate is annualized $ in millions per LACE Excludes assets held for sale, Airnorth and Eastern Airways

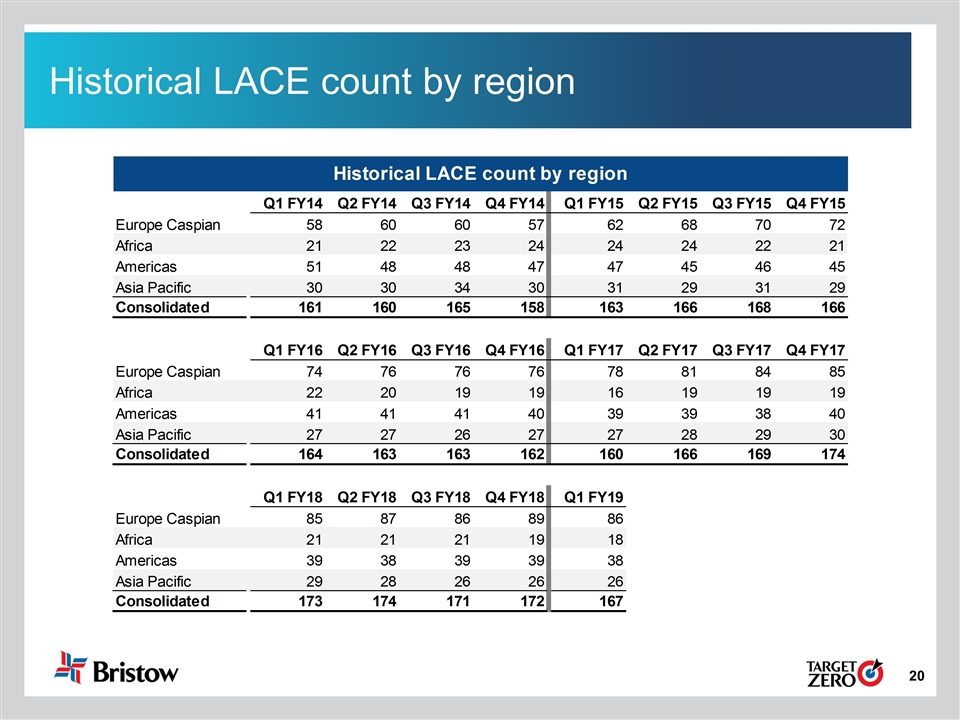

Historical LACE count by region

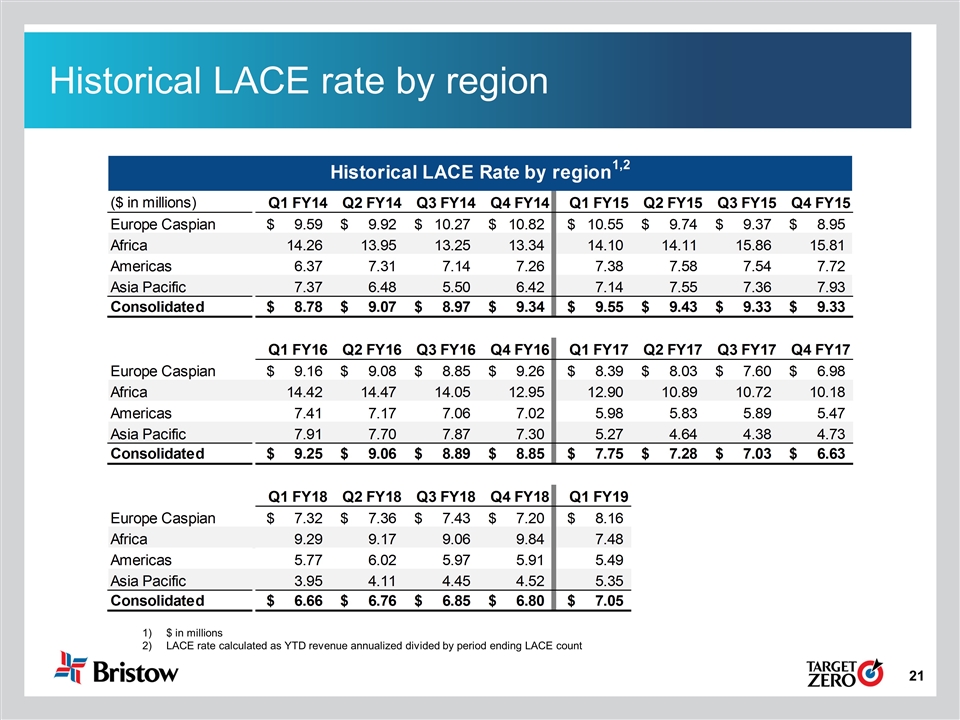

Historical LACE rate by region $ in millions LACE rate calculated as YTD revenue annualized divided by period ending LACE count

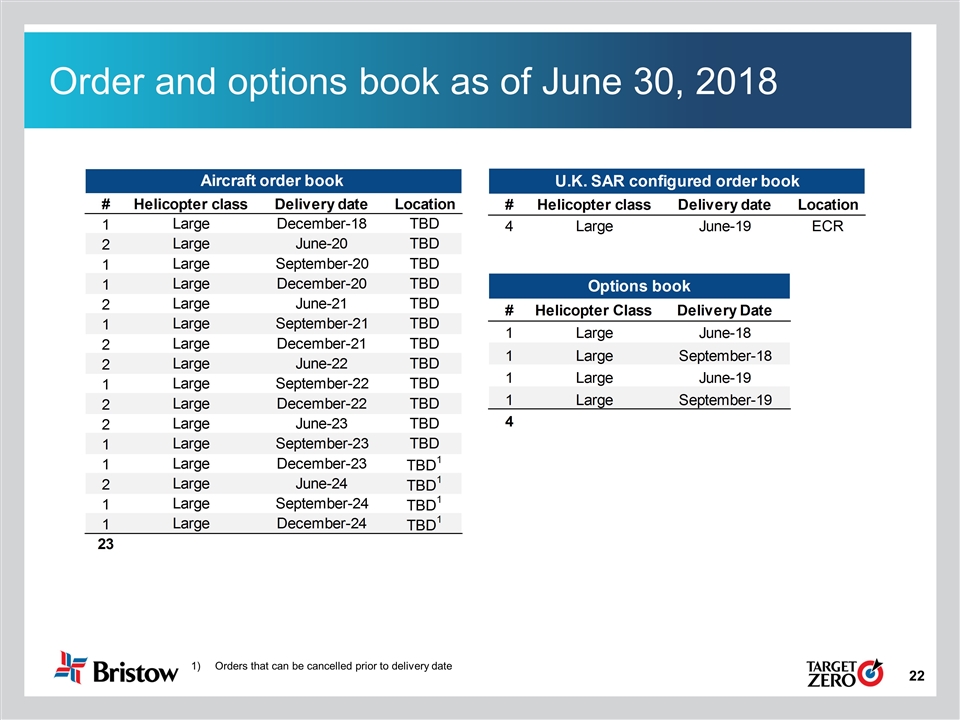

Order and options book as of June 30, 2018 Orders that can be cancelled prior to delivery date

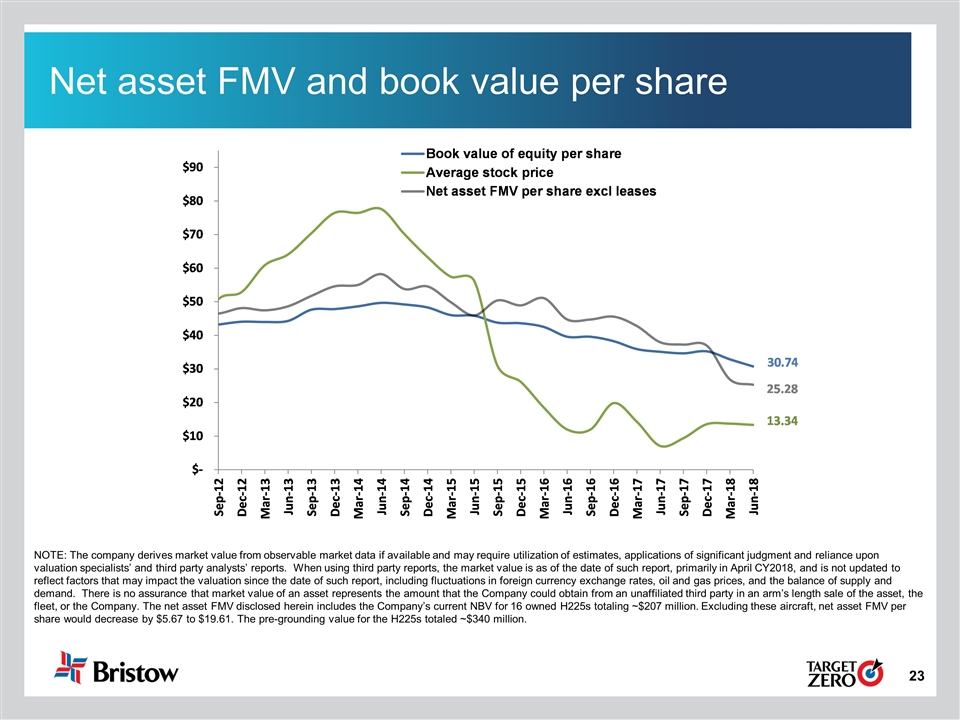

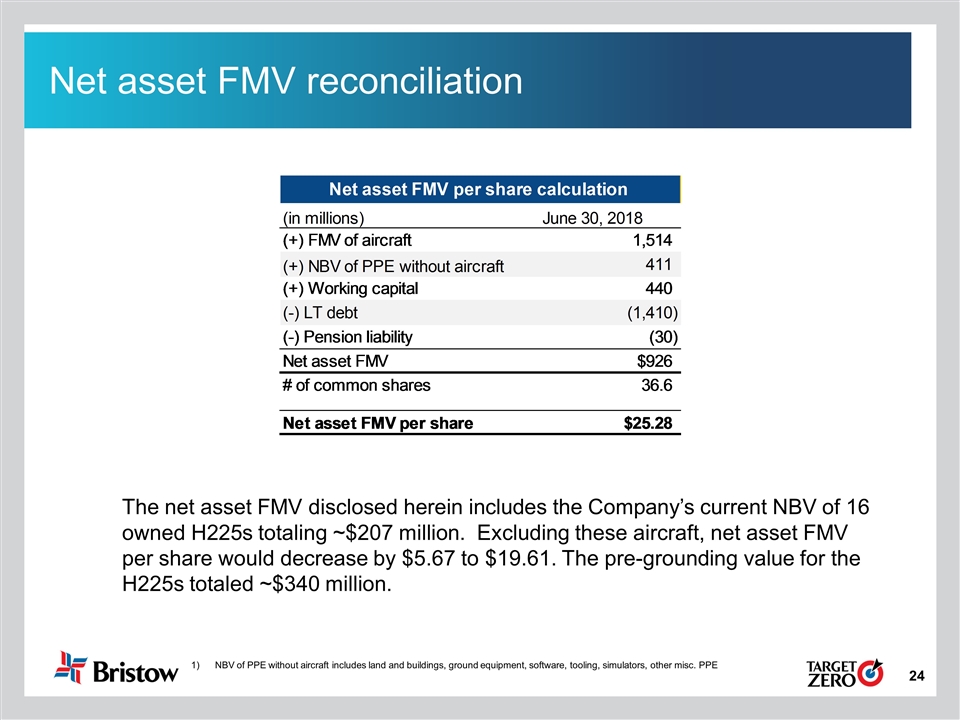

NOTE: The company derives market value from observable market data if available and may require utilization of estimates, applications of significant judgment and reliance upon valuation specialists’ and third party analysts’ reports. When using third party reports, the market value is as of the date of such report, primarily in April CY2018, and is not updated to reflect factors that may impact the valuation since the date of such report, including fluctuations in foreign currency exchange rates, oil and gas prices, and the balance of supply and demand. There is no assurance that market value of an asset represents the amount that the Company could obtain from an unaffiliated third party in an arm’s length sale of the asset, the fleet, or the Company. The net asset FMV disclosed herein includes the Company’s current NBV for 16 owned H225s totaling ~$207 million. Excluding these aircraft, net asset FMV per share would decrease by $5.67 to $19.61. The pre-grounding value for the H225s totaled ~$340 million. Net asset FMV and book value per share

Net asset FMV reconciliation The net asset FMV disclosed herein includes the Company’s current NBV of 16 owned H225s totaling ~$207 million. Excluding these aircraft, net asset FMV per share would decrease by $5.67 to $19.61. The pre-grounding value for the H225s totaled ~$340 million. NBV of PPE without aircraft includes land and buildings, ground equipment, software, tooling, simulators, other misc. PPE

Adjusted EBITDA margin trend by region Adjusted EBITDA excludes special items (see form 10-Q for the quarter ended June 30, 2018) and asset dispositions and margin is calculated by dividing adjusted EBITDA by operating revenue

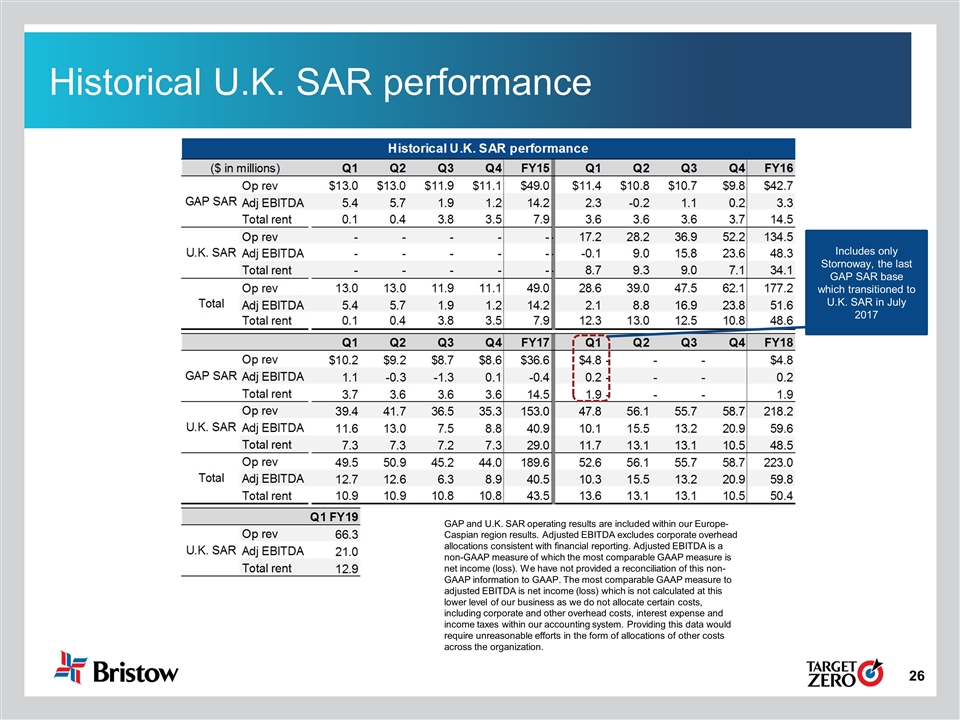

Historical U.K. SAR performance GAP and U.K. SAR operating results are included within our Europe-Caspian region results. Adjusted EBITDA excludes corporate overhead allocations consistent with financial reporting. Adjusted EBITDA is a non-GAAP measure of which the most comparable GAAP measure is net income (loss). We have not provided a reconciliation of this non-GAAP information to GAAP. The most comparable GAAP measure to adjusted EBITDA is net income (loss) which is not calculated at this lower level of our business as we do not allocate certain costs, including corporate and other overhead costs, interest expense and income taxes within our accounting system. Providing this data would require unreasonable efforts in the form of allocations of other costs across the organization. Includes only Stornoway, the last GAP SAR base which transitioned to U.K. SAR in July 2017

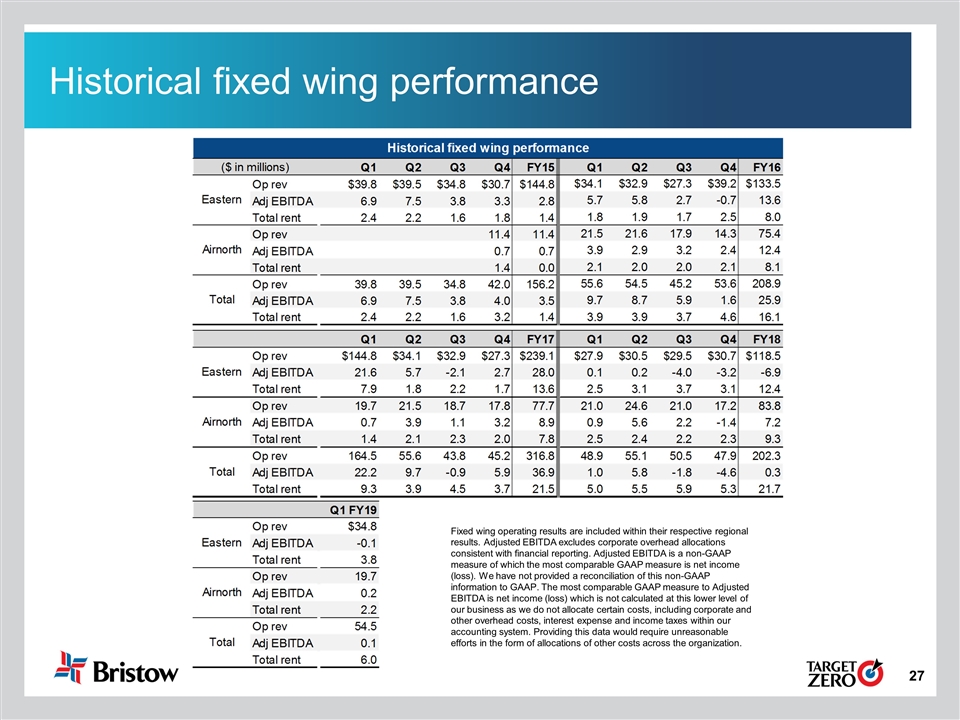

Historical fixed wing performance Fixed wing operating results are included within their respective regional results. Adjusted EBITDA excludes corporate overhead allocations consistent with financial reporting. Adjusted EBITDA is a non-GAAP measure of which the most comparable GAAP measure is net income (loss). We have not provided a reconciliation of this non-GAAP information to GAAP. The most comparable GAAP measure to Adjusted EBITDA is net income (loss) which is not calculated at this lower level of our business as we do not allocate certain costs, including corporate and other overhead costs, interest expense and income taxes within our accounting system. Providing this data would require unreasonable efforts in the form of allocations of other costs across the organization.

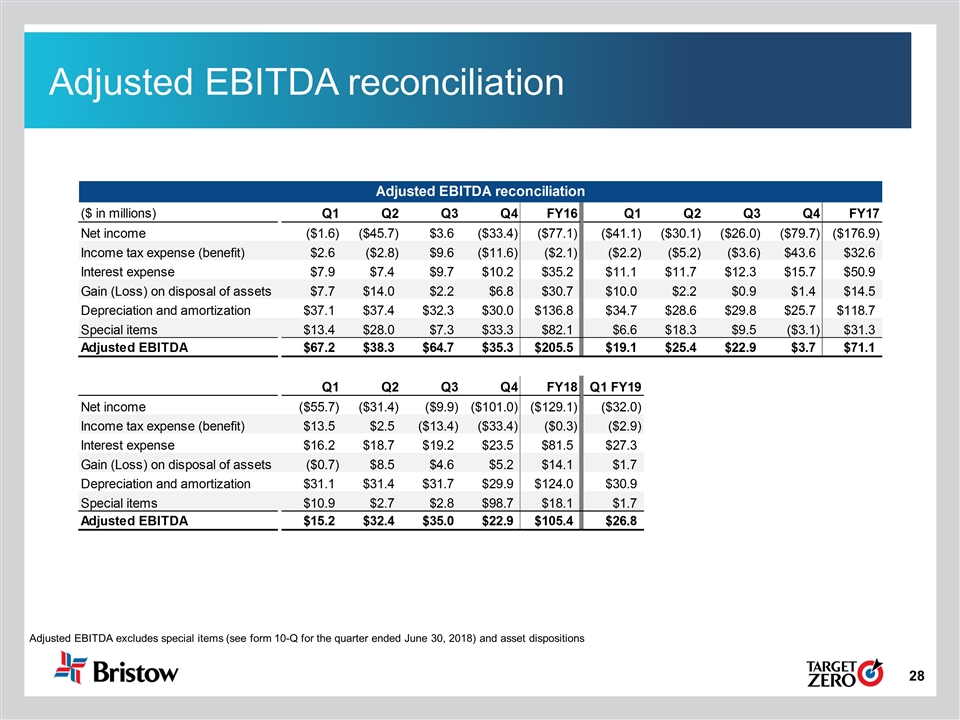

Adjusted EBITDA reconciliation Adjusted EBITDA excludes special items (see form 10-Q for the quarter ended June 30, 2018) and asset dispositions

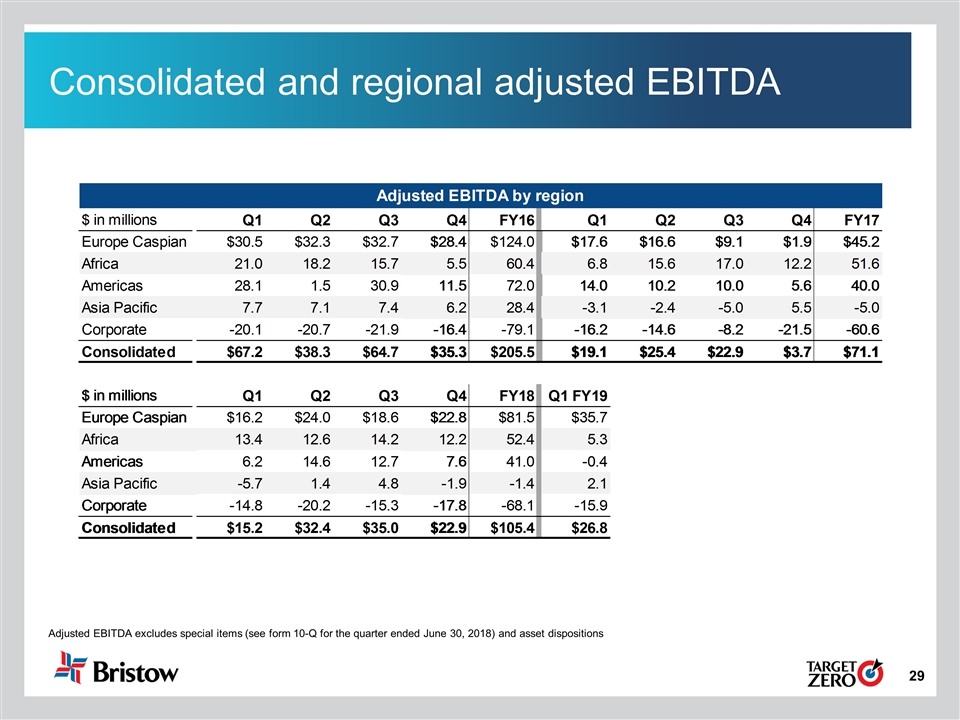

Consolidated and regional adjusted EBITDA Adjusted EBITDA excludes special items (see form 10-Q for the quarter ended June 30, 2018) and asset dispositions

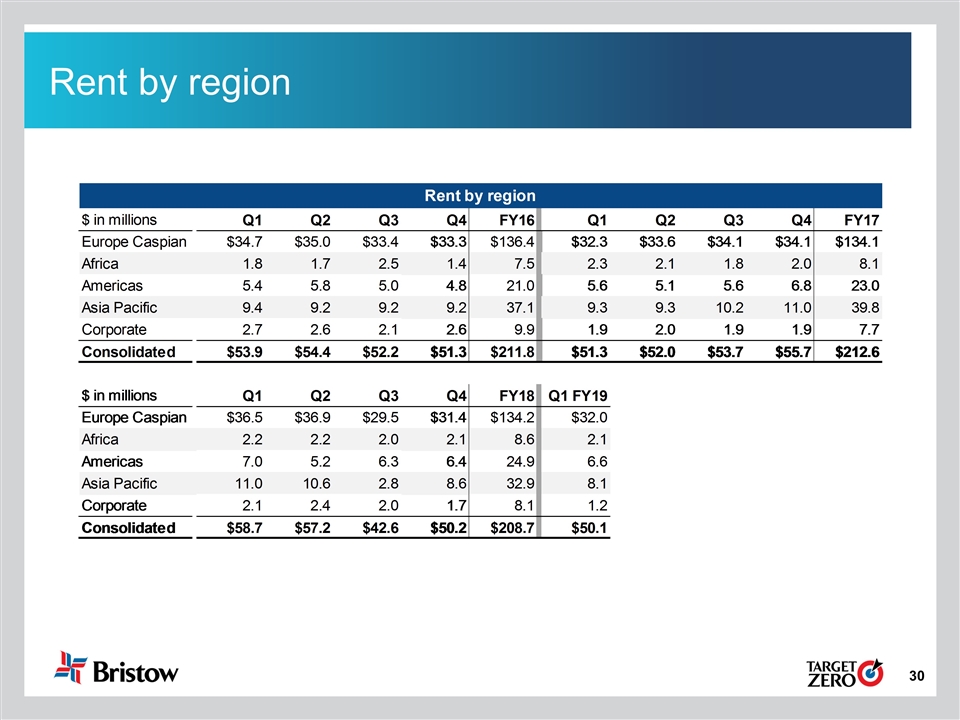

Rent by region

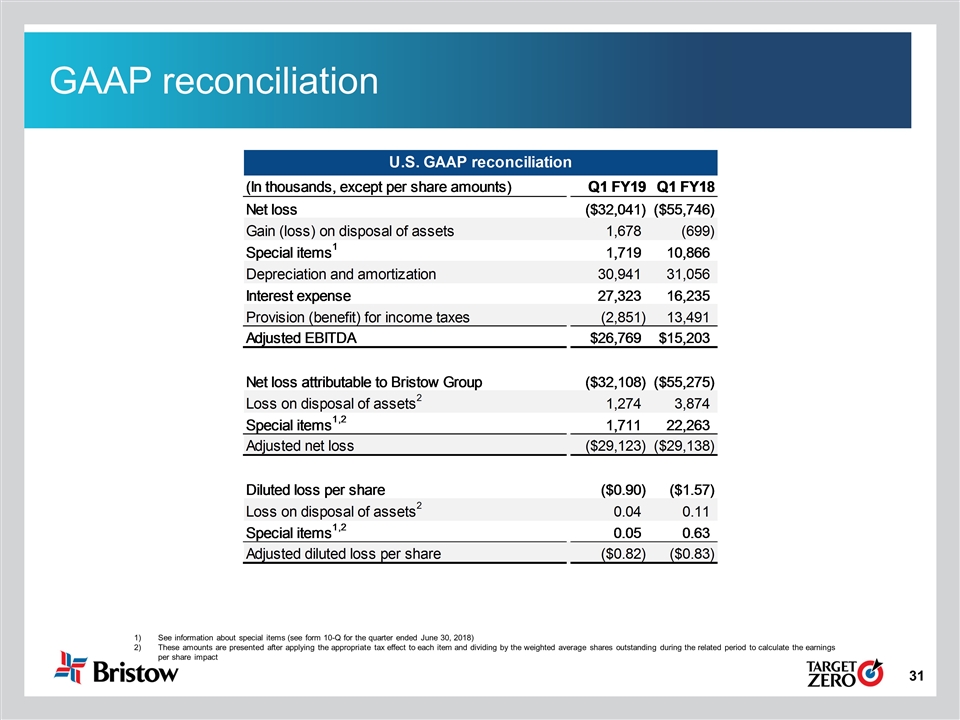

GAAP reconciliation See information about special items (see form 10-Q for the quarter ended June 30, 2018) These amounts are presented after applying the appropriate tax effect to each item and dividing by the weighted average shares outstanding during the related period to calculate the earnings per share impact

Líder adjusted EBITDA and leverage Adjusted EBITDA excludes special items (see form 10-Q for the quarter ended June 30, 2018) and asset dispositions

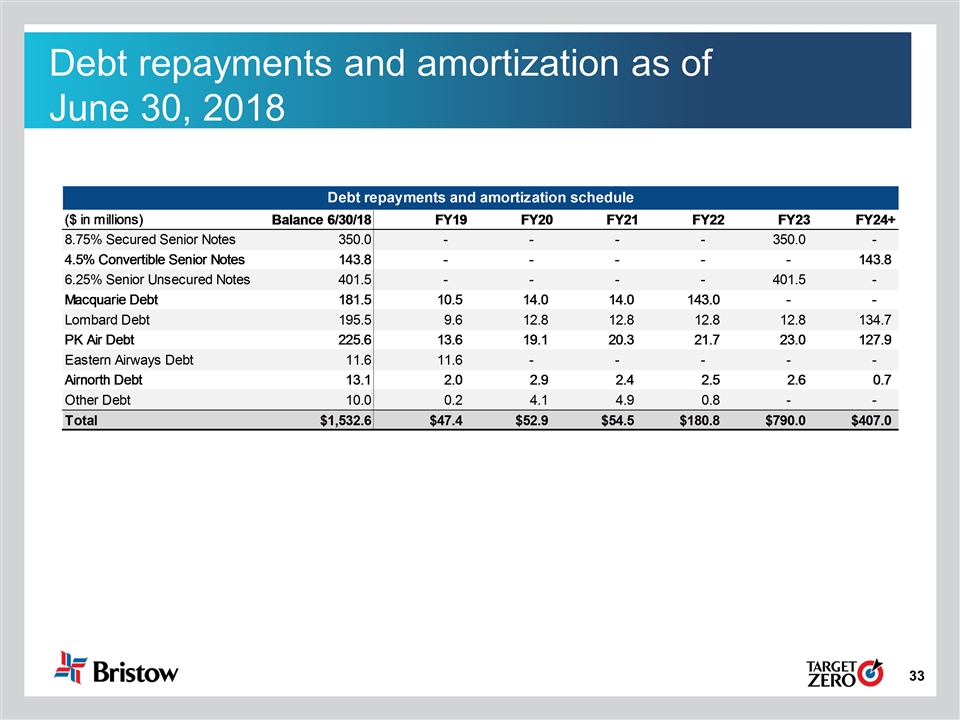

Debt repayments and amortization as of June 30, 2018

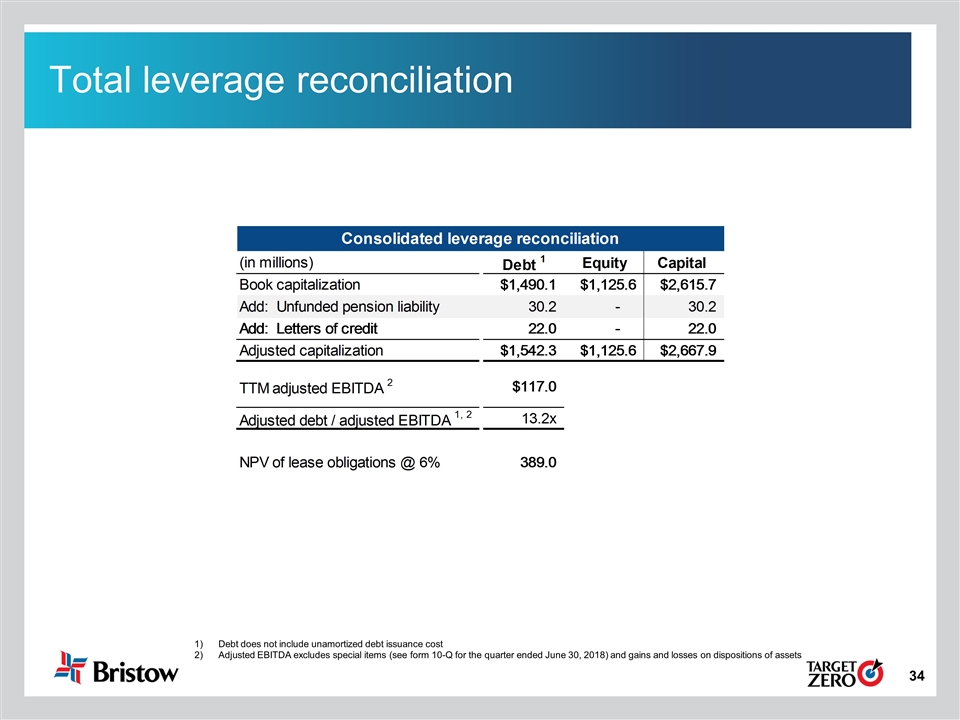

Debt does not include unamortized debt issuance cost Adjusted EBITDA excludes special items (see form 10-Q for the quarter ended June 30, 2018) and gains and losses on dispositions of assets Total leverage reconciliation

Bristow Group Inc. (NYSE: BRS) 2103 City West Blvd., 4th Floor Houston, Texas 77042 t 713.267.7600 f 713.267.7620 bristowgroup.com Contact us