Form 497K SUNAMERICA INCOME FUNDS

| SUMMARY PROSPECTUS JULY 30, 2018

AIG STRATEGIC BOND FUND (CLASS A, CLASS B, CLASS C AND CLASS W) |

|

The Fund’s Statutory Prospectus and Statement of Additional Information dated July 30, 2018, and the most recent shareholder reports are incorporated into and made part of this Summary Prospectus by reference.

Before you invest, you may want to review the Fund’s Statutory Prospectus, which contains more information about the Fund and its risks. You can find the Statutory Prospectus and the above incorporated information online at http://aigfunds.onlineprospectus.net/AIGFunds/FundDocuments/index.html. You can also get this information at no cost by calling (800) 858-8850, by sending an email request to [email protected] or by writing to the Fund at AIG Fund Services, Inc., Mutual Fund Operations, Harborside 5, 185 Hudson Street, Suite 3300, Jersey City, NJ 07311.

The Securities and Exchange Commission has not approved or disapproved these securities, nor has it determined that this Prospectus is accurate or complete. It is a criminal offense to state otherwise.

Investment Goal

The investment goal of the AIG Strategic Bond Fund (the “Strategic Bond Fund” or the “Fund”) is a high level of total return.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the AIG fund complex. More information about these and other discounts is available from your financial professional and in the “Shareholder Account Information—Sales Charge Reductions and Waivers” section on page 20 of the Fund’s Prospectus, in the “Financial Intermediary—Specific Sales Charge Waiver Policies” section on page A-1 of the Fund’s Prospectus and in the “Additional Information Regarding Purchase of Shares” section on page 57 of the Fund’s statement of additional information.

| Class A | Class B | Class C | Class W | |||||||||||||

| Shareholder Fees |

||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

4.75 | % | None | None | None | |||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the amount redeemed or original purchase cost)(1) |

None | 4.00 | % | 1.00 | % | None | ||||||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None | None | None | None | ||||||||||||

| Redemption Fee |

None | None | None | None | ||||||||||||

| - 1 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

| Class A | Class B | Class C | Class W | |||||||||||||

| Annual Fund Operating Expenses |

||||||||||||||||

| Management Fees |

0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | ||||||||

| Distribution and/or Service (12b-1) Fees |

0.35 | % | 1.00 | % | 1.00 | % | None | |||||||||

| Other Expenses |

0.33 | % | 0.37 | % | 0.33 | % | 0.49 | % | ||||||||

| Total Annual Fund Operating Expenses Before Fee Waivers and/or Reimbursements |

1.33 | % | 2.02 | % | 1.98 | % | 1.14 | % | ||||||||

| Fee Waivers and/or Expense Reimbursements(2),(3) |

0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | ||||||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements(2),(3) |

1.08 | % | 1.77 | % | 1.73 | % | 0.89 | % | ||||||||

| (1) | Purchases of Class A shares of $1 million or more will be subject to a contingent deferred sales charge (“CDSC”) on redemptions made within two years of purchase. The CDSC on Class B shares applies only if shares are redeemed within six years of their purchase. The CDSC on Class C shares applies only if shares are redeemed within twelve months of their purchase. See pages 19-21 of the Prospectus for more information about the CDSCs. |

| (2) | Pursuant to an Expense Limitation Agreement, SunAmerica Asset Management, LLC (“SunAmerica”) is contractually obligated to waive its fees and/or reimburse expenses to the extent that the Total Annual Fund Operating Expenses exceed 1.40%, 2.05%, 2.05% and 1.20% for Class A, B, C and W shares, respectively. For purposes of the Expense Limitation Agreement, “Total Annual Fund Operating Expenses” shall not include extraordinary expenses (i.e., expenses that are unusual in nature and/or infrequent in occurrence, such as litigation), or acquired fund fees and expenses, brokerage commissions and other transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees; and other expenses not incurred in the ordinary course of the Fund’s business. This agreement will continue in effect indefinitely, unless terminated by the Board of Trustees, including a majority of the trustees of the Board who are not “interested persons” of SunAmerica Income Funds as defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”). |

| (3) | Pursuant to an Advisory Fee Waiver Agreement, effective May 1, 2018, SunAmerica is contractually obligated to waive its management fee with respect to the Fund so that the management fee payable by the Fund to SunAmerica equals 0.40% on the first $350 million of average daily net assets and 0.35% above $350 million of average daily net assets. This agreement will continue in effect through July 31, 2019, and from year to year thereafter provided such continuance is agreed to by SunAmerica and approved by a majority of the Independent Trustees. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and that all fee waivers and/or reimbursements remain in place through the term of the applicable waiver and/or expense reimbursement. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in the fee table, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class A Shares |

$ | 580 | $ | 853 | $ | 1,146 | $ | 1,980 | ||||||||

| Class B Shares* |

580 | 909 | 1,265 | 2,150 | ||||||||||||

| Class C Shares |

276 | 597 | 1,044 | 2,286 | ||||||||||||

| Class W Shares |

91 | 337 | 603 | 1,364 | ||||||||||||

| - 2 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

You would pay the following expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class A Shares |

$ | 580 | $ | 853 | $ | 1,146 | $ | 1,980 | ||||||||

| Class B Shares* |

180 | 609 | 1,065 | 2,150 | ||||||||||||

| Class C Shares |

176 | 597 | 1,044 | 2,286 | ||||||||||||

| Class W Shares |

91 | 337 | 603 | 1,364 | ||||||||||||

| * | Class B shares generally convert to Class A shares approximately eight years after purchase. Therefore, the expense ratios used in the calculations for years 9 and 10 are the same for both Class A and Class B shares. |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 149% of the average value of its portfolio.

Principal Investment Strategy and Technique of the Fund

The Fund’s principal investment strategy is fixed income investing. The strategy of “fixed income investing” in which the Fund engages includes utilizing economic research and analysis of current economic conditions, potential fluctuations in interest rates, and, where relevant—particularly with respect to the issuers of high-yield, high-risk bonds—the strength of the underlying issuer.

The principal investment technique of the Fund is active trading of a broad range of bonds, including both investment grade and non-investment grade U.S. and foreign corporate bonds, which may include below investment grade debt securities (commonly referred to as “junk bonds”), U.S. and foreign government and agency obligations, and mortgage-backed securities, without regard to the maturities of such securities. Although the Fund may invest in securities of any maturity, the Fund generally expects to maintain a duration of seven years or less, and may use futures contracts, including U.S. Treasury and interest rate futures, to assist in managing the Fund’s duration. Under normal market conditions, at least 80% of the Fund’s net assets, plus any borrowings for investment purposes, will be invested in bonds.

The principal investment strategy and principal investment technique of the Fund may be changed without shareholder approval. You will receive at least sixty (60) days’ notice of any change to the 80% investment policy set forth above.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the Fund’s investment goal will be met or that the net return on an investment in the Fund will exceed what could have been obtained through other investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Fund goes down, you could lose money.

| - 3 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

The following is a summary description of the principal risks of investing in the Fund.

Interest Rate Fluctuations. Interest rates and bond prices typically move inversely to each other. Thus, as interest rates rise, bond prices typically fall and as interest rates fall, bond prices typically rise. Longer-term and lower coupon bonds tend to be more sensitive to changes in interest rates. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. Duration is a measure of interest rate risk that indicates how price-sensitive a bond is to changes in interest rates. Bonds with longer durations are generally more sensitive to interest rate changes than those with shorter durations.

Bond Market Volatility. The bond markets as a whole could go up or down (sometimes dramatically). This could affect the value of the securities in the Fund’s portfolio.

Credit Risk. The Fund will invest in bonds with various credit ratings. The creditworthiness of the issuer is always a factor in analyzing fixed income securities. An issuer with a lower credit rating will be more likely than a higher-rated issuer to default or otherwise become unable to honor its financial obligations.

The Fund may invest in “junk bonds,” which are considered speculative. While management seeks to diversify the Fund and to engage in a credit analysis of each junk bond issuer in which the Fund invests, junk bonds carry a substantial risk of default or they may already be in default. The market price for junk bonds may fluctuate more than higher-quality securities and may decline significantly. In addition, it may be more difficult for the Fund to dispose of junk bonds or to determine their value. Junk bonds may contain redemption or call provisions that, if exercised during a period of declining interest rates, may force the Fund to replace the security with a lower yielding security, which would decrease the return of the Fund.

Foreign Securities Risk. By investing internationally, the value of your investment may be affected by fluctuating currency values, changing local and regional economic, political and social conditions, and greater market volatility. In addition, foreign securities may not be as liquid as domestic securities. Moreover, foreign sovereign debt securities are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal on its sovereign debt, due, for example, to cash flow problems; insufficient foreign currency reserves; political, social and economic considerations; or the relative size of the governmental entity’s debt position in relation to the economy. If a governmental entity defaults, it may ask for more time in which to pay or for further loans. These risks are heightened when the issuer is from an emerging market country.

U.S. Government Securities Risk. Securities issued or guaranteed by federal agencies or authorities and U.S. government-sponsored instrumentalities or enterprises may or may not be backed by the full faith and credit of the U.S. government. For example, securities issued by the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association and the Federal Home Loan Bank are neither insured nor guaranteed by the U.S. government. These securities may be supported only by the credit of the issuing agency, authority, instrumentality or enterprise or by the ability to borrow from the U.S. Treasury and, as a result, are subject to greater credit risk than securities issued or guaranteed by the U.S. Treasury.

Illiquidity. Certain securities may be difficult or impossible to sell at the time and the price that the seller would like. Over recent years, regulatory changes have led to reduced liquidity in the marketplace, and the capacity of dealers to make markets in fixed income securities has been outpaced by the growth in the size of the fixed income markets. Liquidity risk may be magnified in a rising interest rate environment, where the value and liquidity of fixed income securities generally go down. Illiquid securities and relatively less liquid securities may also be difficult to value.

| - 4 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

Active Trading. As part of the Fund’s principal investment technique, the Fund may engage in active trading of its portfolio securities. Because the Fund may sell a security without regard to how long it has held the security, active trading may have tax consequences for certain shareholders, involving a possible increase in short-term capital gains or losses. Active trading may result in high portfolio turnover and correspondingly greater brokerage commissions and other transaction costs, which will be borne directly by the Fund and which will affect the Fund’s performance. During periods of increased market volatility, active trading may be more pronounced.

Securities Selection. A strategy used by the Fund, or securities selected by a portfolio manager, may fail to produce the intended return.

Redemption Risk. The Fund may experience heavy redemptions that could cause the Fund to liquidate its assets at inopportune times or at a loss or depressed value, which could cause the Fund’s net asset value (“NAV”) per share to decline.

Performance Information

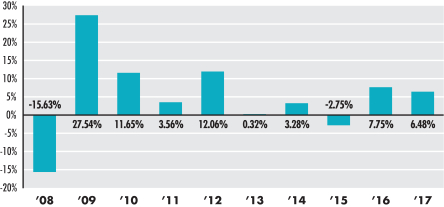

The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Fund by showing changes in the Fund’s performance from calendar year to calendar year, and compare the Fund’s average annual returns to those of the Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of market performance, and the LIBOR 3-Month Index. Sales charges are not reflected in the Bar Chart. If these amounts were reflected, returns would be less than those shown. However, the Table includes all applicable fees and sales charges. Past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated information on the Fund’s performance can be obtained by visiting www.aig.com/funds or can be obtained by phone at 800-858-8850, ext. 6003.

AIG Strategic Bond Fund (Class A)

During the period shown in the Bar Chart, the highest return for a quarter was 12.19% (quarter ended June 30, 2009) and the lowest return for a quarter was –9.99% (quarter ended December 31, 2008).

The Fund’s cumulate year-to-date return through the most recent calendar quarter ended June 30, 2018 was –2.92%.

| - 5 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

Average Annual Total Returns (as of the periods ended December 31, 2017)

| Past One Year |

Past Five Years |

Past Ten Years |

Class W (1/29/15) |

|||||||||||||

| Class W |

6.71 | % | N/A | N/A | 3.63 | % | ||||||||||

| Class B |

1.75 | % | 1.90 | % | 4.36 | % | N/A | |||||||||

| Class C |

4.47 | % | 2.23 | % | 4.22 | % | N/A | |||||||||

| Class A |

1.34 | % | 1.95 | % | 4.37 | % | N/A | |||||||||

| Return After Taxes on Distributions (Class A) |

0.01 | % | 0.31 | % | 2.40 | % | N/A | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares (Class A)(1) |

0.74 | % | 0.71 | % | 2.51 | % | N/A | |||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index |

3.54 | % | 2.10 | % | 4.01 | % | 1.64 | % | ||||||||

| LIBOR 3-Month Index |

1.26 | % | 0.56 | % | 0.77 | % | 0.79 | % | ||||||||

| (1) | When the return after taxes on distributions and sale of Fund shares is higher than the before-tax return, it is because of realized losses. If realized losses occur upon the sale of Fund shares, the capital loss is recorded as a tax benefit, which increases the return. |

The after-tax returns shown were calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. An investor’s actual after-tax returns depend on the investor’s tax situation and may differ from those shown in the above table. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

After-tax returns are shown only for Class A shares. After-tax returns for other classes will vary.

Investment Adviser

The Fund’s investment adviser is SunAmerica. The Fund is subadvised by PineBridge Investments LLC (“PineBridge”). When the Prospectus refers to the “Adviser,” it means SunAmerica or PineBridge, as applicable.

Portfolio Managers

| Name |

Portfolio Manager |

Title | ||

| Robert Vanden Assem, CFA |

2002 | Lead Portfolio Manager, Managing Director, Head of Developed Markets, Investment Grade Fixed Income, at PineBridge | ||

| John Yovanovic, CFA |

2007 | Co-Portfolio Manager, Managing Director, Head of High Yield Portfolio Management, at PineBridge | ||

| Anders Faergemann |

2016 | Co-Portfolio Manager, Managing Director, Senior Sovereign Portfolio Manager, Emerging Markets Fixed Income, at PineBridge | ||

| Dana Burns |

2014 | Co-Portfolio Manager, Managing Director, Senior Portfolio Manager, Investment Grade Credit, at PineBridge |

For important information about purchases and sales of Fund shares, tax information and financial intermediary compensation, please turn to “Important Additional Information” on page 18 of the Prospectus.

| - 6 - | SunAmerica Income Funds |

| AIG STRATEGIC BOND FUND |

Purchase and Sale of Fund Shares

Each Fund’s initial investment minimums generally are as follows:

| Class A, Class B and Class C Shares |

Class W Shares | |||

| Minimum Initial Investment |

• non-retirement account: $500 • retirement account: $250 • dollar cost averaging: $500 to open; you must invest at least $25 a month. |

• $50,000 | ||

| Minimum Subsequent Investment |

• non-retirement account: $100 • retirement account: $25 • the minimum initial and subsequent investments may be waived for certain fee-based programs and/or group plans held in omnibus accounts. |

N/A |

You may purchase or sell shares of each Fund each day the New York Stock Exchange is open. Purchase and redemption requests are executed at the Fund’s next NAV to be calculated after the Fund or its agents receives your request in good order. You should contact your broker, financial adviser or financial institution, or, if you hold your shares through the Fund, you should contact the Fund by phone at 800-858-8850, by regular mail (AIG Funds c/o DST Asset Manager Solutions, Inc., PO Box 219186, Kansas City, MO 64121-9186), by express, certified and registered mail (AIG Funds c/o DST Asset Manager Solutions, Inc., 330 West 9th Street, Kansas City, MO 64105-1514), or via the Internet at www.aig.com/funds.

Tax Information

Each Fund’s dividends and distributions are subject to federal income taxes and will be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to federal income tax upon withdrawal from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| STBSP-7/18 | - 7 - | SunAmerica Income Funds |

[THIS PAGE INTENTIONALLY LEFT BLANK]

| STBSP-7/18 | - 8 - |