Form S-1 National Vision Holdings

As filed with the Securities and Exchange Commission on July 23, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

National Vision Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

3851

|

46-4841717

|

|

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

2435 Commerce Avenue

Bldg. 2200

Duluth, Georgia 30096-4980

Telephone: 770-822-3600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mitchell Goodman, Esq.

Senior Vice President, General Counsel and Secretary

2435 Commerce Avenue

Bldg. 2200

Duluth, Georgia 30096-4980

Telephone: 770-822-4208

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

|

Joseph H. Kaufman, Esq.

Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Marc D. Jaffe, Esq.

Ian D. Schuman, Esq. Latham & Watkins LLP 885 3rd Avenue New York, New York 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

☒ (Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

|

|

Emerging growth company

|

o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

Title Of Each Class Of

Securities To Be Registered |

Amount to be

Registered(1) |

Proposed Maximum

Offering Price Per Share(2) |

Proposed Maximum

Aggregate Offering Price(1)(2) |

Amount of

Registration Fee |

||||||||

|

Common Stock, par value $0.01 per share

|

|

13,800,000

|

|

$

|

40.54

|

|

$

|

559,452,000

|

|

$

|

69,651.78

|

|

| (1) | Includes 1,800,000 shares of common stock that the underwriters have the option to purchase. See “Underwriting (Conflicts of Interest).” |

| (2) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price are based on the average high and low prices of the registrant’s common stock on July 20, 2018 as reported on the NASDAQ Global Select Market. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 23, 2018.

PRELIMINARY PROSPECTUS

12,000,000 Shares

National Vision Holdings, Inc.

Common Stock

The selling stockholders named in this prospectus are offering 12,000,000 shares of common stock of National Vision Holdings, Inc. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

Our common stock is listed on the NASDAQ Global Select Market, or NASDAQ, under the symbol “EYE.” On July 20, 2018, the closing sales price of our common stock as reported on the NASDAQ was $40.49 per share.

To the extent that the underwriters sell more than 12,000,000 shares of our common stock, the underwriters have the option to purchase up to an additional 1,800,000 shares from certain of the selling stockholders at the public offering price, less the underwriting discounts and commissions, within 30 days of the date of this prospectus. We will not receive any proceeds from the sale of our common stock by the selling stockholders pursuant to any exercise of the underwriters’ option to purchase additional shares.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 21 of this prospectus and the risk factors in the documents incorporated by reference in this prospectus to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

Per Share

|

Total

|

||||

|

Public offering price

|

$

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

$

|

|

|

$

|

|

|

|

Proceeds, before expenses, to the selling stockholders(1)

|

$

|

|

|

$

|

|

|

| (1) | See “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2018.

|

BofA Merrill Lynch

|

Citigroup

|

Goldman Sachs & Co. LLC

|

Jefferies

|

KKR

|

Prospectus dated , 2018.

You should rely only on the information contained, or incorporated by reference, in this prospectus or in any free writing prospectus that we authorize to be delivered to you. We, the selling stockholders and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained, or incorporated by reference, in this prospectus or in any free writing prospectuses we have prepared. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. The selling stockholders and the underwriters are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. You should assume that the information contained, or incorporated by reference, in this prospectus or any free writing prospectus prepared by us or on our behalf is accurate only as of their respective dates or on the date or dates which are specified in such documents, and that any information in documents that we have incorporated by reference is accurate only as of the date of such document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: The selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. None of us, the selling stockholders or the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Table of Contents

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

i

MARKET, RANKING, AND OTHER INDUSTRY DATA

The data included, or incorporated by reference, in this prospectus regarding markets, ranking and other industry information are based on reports of government agencies or published industry sources, and our own internal estimates are based on our management’s knowledge and experience in the markets in which we operate. Data regarding the industry in which we compete and our market position and market share within this industry are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. Our own estimates are based on information obtained from our customers, suppliers, trade and business organizations and other contacts in the markets we operate. We are responsible for all of the disclosure included, or incorporated by reference, in this prospectus, and we believe these estimates to be accurate as of the date of this prospectus or such other date stated in this prospectus (or in documents we have incorporated by reference). However, this information may prove to be inaccurate because of the method by which we obtained some of the data for the estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. While we believe that each of the publications used throughout this prospectus (or in documents we have incorporated by reference) are prepared by reputable sources, neither we nor the underwriters have independently verified market and industry data from third-party sources. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report (as defined herein) and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report (as defined herein), each of which is incorporated by reference in this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.” As a result, you should be aware that market, ranking, and other similar industry data included, or incorporated by reference, in this prospectus, and estimates and beliefs based on that data may not be reliable. None of us, the selling stockholders and the underwriters can guarantee the accuracy or completeness of any such information contained, or incorporated by reference, in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We own a number of registered and common law trademarks and pending applications for trademark registrations in the United States, primarily through our subsidiaries, including: America’s Best, America’s Best & design, America’s Best Contacts & Eyeglasses, America’s Best Contacts & Eyeglasses & design, America’s Best Vision Plan, America’s Best owl mascot image, the slogan, “It’s not just a better deal. It’s America’s Best.,” Eyeglass World, Eyeglass World logos, the slogans, “See yourself smile. See yourself save.,” “The world’s best way to buy glasses.” and “The world’s best way to buy contacts.,” the Eyeglass World mast image Mr. World, AC Lens, FirstSight, Vista Optical, Eyecare Club, Sofmed, Digimax, Neverglare, Neverglare Advantage and Neverglare Advantage & design. Solely for convenience, the trademarks, service marks and tradenames referred to in this prospectus (or in documents we have incorporated by reference) are presented without the ®, SM and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and tradenames. All trademarks, service marks and tradenames appearing in this prospectus (or in documents we have incorporated by reference) are the property of their respective owners.

Unless otherwise indicated or the context otherwise requires, financial data included, or incorporated by reference, in this prospectus reflects the business and operations of National Vision Holdings, Inc. and its consolidated subsidiaries. Unless the context otherwise requires, all references herein to “National Vision Holdings, Inc.,” “National Vision,” the “Company,” “we,” “our” or “us” refer to National Vision Holdings, Inc. and its consolidated subsidiaries. National Vision Holdings, Inc. conducts substantially all of its activities through its direct, wholly-owned subsidiary, National Vision, Inc., which we refer to herein as “NVI,” and NVI’s subsidiaries.

ii

We operate on a retail fiscal calendar pursuant to which our fiscal year consists of 52 or 53 weeks, ending on the Saturday closest to December 31. Unless otherwise indicated or the context otherwise requires, all references to years and quarters relate to fiscal periods rather than calendar periods.

References to “fiscal year 2015,” “fiscal year 2016” and “fiscal year 2017” relate to our fiscal year ended January 2, 2016, our fiscal year ended December 31, 2016 and our fiscal year ended December 30, 2017, respectively.

Amounts in this prospectus and the audited consolidated financial statements incorporated by reference in this prospectus are presented in U.S. dollars rounded to the nearest thousand, unless otherwise noted. Certain amounts presented in tables are subject to rounding adjustments and, as a result, the totals in such tables may not sum. The accounting policies set out in the audited consolidated financial statements incorporated by reference in this prospectus have been consistently applied to all periods presented.

The following are definitions of certain terms as used in this prospectus, unless otherwise noted or indicated by context.

| • | “AC Lens” means Arlington Contact Lens Service, Inc., our wholly-owned subsidiary. |

| • | “Annual Report” means our Annual Report on Form 10-K for the fiscal year ended December 30, 2017, filed on March 8, 2018. |

| • | “Berkshire” means Berkshire Partners LLC. |

| • | “Centralized laboratory network” or “laboratory network” mean our three owned, full-service optical laboratories in the United States and two outsourced, third-party owned optical laboratories in Mexico and China. |

| • | “E-commerce platform” means the technology that we use to conduct the online sale of optical goods and accessories, and includes our construction, management and operation of our proprietary websites and websites for third parties, such as Wal-Mart Stores, Inc., or Walmart, Sam’s Club and Giant Eagle, which we refer to herein as our “e-commerce business.” |

| • | “E-commerce sales” means sales from our store, proprietary and partner websites, excluding AC Lens’ fulfilment orders for the Walmart and Sam’s Club websites and ship-to-home orders from our store websites fulfilled by AC Lens. |

| • | “Eye care practitioners” means optometrists and ophthalmologists. |

| • | “FirstSight” means FirstSight Vision Services, Inc., our wholly-owned subsidiary. |

| • | “Host brands” means the Vista Optical brands we operate in Fred Meyer stores and on U.S. Army and Air Force military bases. |

| • | “Host partners” means Fred Meyer, Inc., or Fred Meyer, and the U.S. Army and Air Force Exchange Service. |

| • | “KKR Acquisition” means the acquisition of the Company by affiliates of KKR Sponsor in March 2014. |

| • | “KKR Sponsor” means Kohlberg Kravis Roberts & Co. L.P. |

| • | “Legacy brand” means the Vision Center brand we operate in Walmart stores. |

| • | “Legacy partner” means Walmart. |

| • | “Managed care” or “managed vision care” mean vision care programs and associated benefits (i) sponsored by employers or other groups, (ii) provided by insurers and managed care entities, such as health maintenance organizations, or HMOs, to individuals, and (iii) delivered, typically on a fee-for-service or capitated basis, by health care providers, such as ophthalmologists, optometrists and opticians. |

| • | “Mature stores” means stores that have been in operation for longer than five years. |

iii

| • | “Omni-channel platform” means the technology supporting many of our physical and online retail functionalities and services, including online frame browsing and virtual frame try-on, scheduling of appointments, ship to customer programs, geolocation of our retail locations and online ordering of optical goods. As of March 31, 2018, our omni-channel platform serves our America’s Best Contacts & Eyeglasses, or America’s Best, stores, Eyeglass World stores and Vista Optical operations on U.S. Army and Air Force military bases. |

| • | “Owned brands” or “owned stores” mean our America’s Best and Eyeglass World brands or stores, as applicable. |

| • | “Partner brands” means our host and legacy brands, collectively. |

| • | “Quarterly Report” means our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2018, filed on May 15, 2018. |

| • | “Sponsors” means affiliates of KKR Sponsor and private equity funds managed by Berkshire. |

| • | “Value segment” or “value segment of the U.S. optical retail industry” consists of the Company, Walmart, Costco Wholesale and Eyemart Express, Ltd. |

| • | “Vision care professionals” means optometrists (including optometrists employed by us or by professional corporations owned by eye care practitioners with which we have arrangements) and opticians. |

This prospectus contains, or incorporates by reference, “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with accounting principles generally accepted in the United States, or GAAP. Specifically, we make use of the non-GAAP financial measures “EBITDA,” “Adjusted EBITDA” and “Adjusted Net Income.”

EBITDA, Adjusted EBITDA and Adjusted Net Income have been presented in this prospectus as supplemental measures of financial performance that are not required by, or presented in accordance with GAAP, because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management believes EBITDA, Adjusted EBITDA and Adjusted Net Income are useful to investors in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses EBITDA, Adjusted EBITDA and Adjusted Net Income to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, to establish discretionary annual incentive compensation and to compare our performance against that of other peer companies using similar measures. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone.

EBITDA, Adjusted EBITDA and Adjusted Net Income are not recognized terms under GAAP and should not be considered as an alternative to net income or income from operations, as a measure of financial performance, or cash flows provided by operating activities, as a measure of liquidity, or any other performance measure derived in accordance with GAAP. Additionally, these measures are not intended to be a measure of free cash flow available for management’s discretionary use as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. For a discussion of the use of these measures and a reconciliation of the most directly comparable GAAP measures, see “Prospectus Summary―Summary Historical Consolidated Financial and Other Data.”

iv

This summary highlights certain significant aspects of our business and this offering, and it includes information contained elsewhere in this prospectus or incorporated by reference in this prospectus from our filings with the SEC listed under “Incorporation by Reference.” This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus and the information incorporated by reference in this prospectus, including any free writing prospectus prepared by us or on our behalf, including the sections entitled “Special Note Regarding Forward-Looking Statements” and “Risk Factors” included in this prospectus, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements and related notes thereto in our Annual Report, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the unaudited condensed consolidated financial statements and related notes thereto in our Quarterly Report, each of which is incorporated by reference in this prospectus, before you decide to invest in shares of our common stock.

Our Company

We are one of the largest and fastest growing optical retailers in the United States and a leader in the attractive value segment of the U.S. optical retail industry. We believe that vision is central to quality of life and that people deserve to see their best to live their best, no matter what their budget. Our mission is to make quality eye care and eyewear affordable and accessible to all Americans. We achieve this by providing eye exams, eyeglasses and contact lenses to cost-conscious and low-income consumers. We deliver exceptional value and convenience to our customers, with an opening price point that strives to be among the lowest in the industry, enabled by our low-cost operating platform. We believe our focus on the value segment, breadth of product assortment, committed employees and consultative selling approach generate customer goodwill for our brands. Our long-serving and motivated management team of optical retail experts has delivered a highly-consistent track record of strong results.

We are well positioned to serve our new and existing customers through a diverse portfolio of 1,027 retail stores across five brands and 20 consumer websites as of March 31, 2018. We have two reportable segments: our owned & host segment and our legacy segment. Our owned & host segment includes our two owned brands, America’s Best and Eyeglass World, and our Vista Optical locations in Fred Meyer stores. Within this segment, we also provide low-cost vision care products and services to American military service members by operating Vista Optical locations on military bases across the country. Our legacy segment consists of our 27-year strategic relationship with Walmart to operate Vision Centers in select Walmart stores. In addition, our wholly-owned subsidiary, FirstSight, which is licensed as a single-service health plan under California law, issues individual vision care benefit plans in connection with our America’s Best operations in California and provides, or arranges for the provision of, optometric services at almost all of the optometric offices next to Walmart and Sam’s Club stores in California. We support our owned brands and our Vista Optical military operations through our ever-evolving omni-channel offerings and we also have an established standalone e-commerce business. Our e-commerce platform serves our proprietary e-commerce websites and the e-commerce websites of third parties, including Walmart, Sam’s Club and Giant Eagle. The following table provides an overview of our portfolio of brands:

1

Overview of Our Brands and Omni-channel & E-commerce Platform

Note: Store count as of March 31, 2018. SKU figures refer to eyeglass frame SKUs. ODs are Doctors of Optometry.

| (1) | Vista Optical in Fred Meyers stores does not offer omni-channel services. |

Our financial success has helped fuel our ever-growing philanthropic engine. Through multiple charitable partnerships, we have directly assisted approximately 900,000 individuals to see and have indirectly helped improve the vision of approximately 15 million individuals globally. Our philanthropic culture instills a sense of purpose and engagement in our employees, from in-store staff to senior management. Our employees feel pride in the positive work they are doing, which allows us to attract and retain both store associates and vision care professionals, thus improving the customer experience in our stores.

Our disciplined approach to new store openings, combined with our attractive store economics, has led to strong returns on investment. We believe these elements are the foundation for continued profitable growth from our existing store base, as well as a significant opportunity to deliver growth through new store openings. The fundamentals of our model are:

| • | Differentiated and Defensible Value Proposition. We believe our success is driven by our low prices, convenient locations, broad assortment of branded and private label merchandise and the high levels of in-store service provided by our well-trained and passionate store associates and vision care professionals. We believe our bundled offers, including two-pairs of eyeglasses plus an eye exam for $69.95 at America’s Best and two-pairs of eyeglasses for $78.00 at Eyeglass World, represent among the lowest price offerings of any national chain. Our ability to utilize national advertising for America’s Best allows us to communicate this value proposition to a meaningfully greater number of current and potential customers. |

| • | Recurring Revenue Characteristics. Eye care purchases are predominantly a medical necessity and are therefore considered non-discretionary in nature. We estimate that optical consumers typically replace their eyeglasses every two to three years, while contact lens customers typically order new lenses every six to twelve months, reflecting the predictability of these recurring purchase behaviors. This is further demonstrated by the customer mix of our mature stores, with existing customers representing 63% of total customers in fiscal year 2017 and new customers representing the remaining 37% of total customers in fiscal year 2017. |

2

| • | Attractive Store Economics and Embedded Earnings Growth. Our store economics are based on low capital investment, steady ramping of sales in new locations, low operating costs and consistent sales volume and earnings growth in mature stores, which result in attractive returns on capital. Historically, on average, our owned stores achieve profitability shortly after their first-year opening anniversary and pay back invested capital in less than four years. By consistently replicating the key characteristics of our store model, we execute a formula-based approach to opening new stores and managing existing stores, which has delivered predictable store performance across vintages, diverse geographies and new and existing markets. We believe this leads to a high degree of visibility into the embedded earnings potential of our newly opened stores. For indicative purposes, assuming that each of our open but not mature America’s Best and Eyeglass World stores as of December 30, 2017 were able to attain the average fifth-year financial performance of our existing mature America’s Best and Eyeglass World stores, we would have generated an additional approximately $58 million of revenues and approximately $48 million of EBITDA for our owned & host segment in fiscal year 2017. |

By targeting the high-growth value segment, we have grown revenue at three times the rate of the U.S. optical retail industry over the past five years, gained significant market share and generated a record 65 consecutive quarters of positive comparable store sales growth.

65 Consecutive Quarters of Positive Comparable Store Sales Growth

| 1 | 2009 comparable store sales exclude sales from the Eyeglass World stores for the first six-month “transition” period following our acquisition of Eyeglass World. |

| 2 | Comparable store sales growth in the third quarter of fiscal year 2011 was impacted by the near U.S. federal government shutdown and subsequent adverse impact on the consumer environment. |

For fiscal years 2015, 2016 and 2017, we generated total net revenue of $1.1 billion, $1.2 billion and $1.4 billion, respectively, representing a compound annual growth rate, or CAGR, of approximately 13.7% from fiscal year 2015 to fiscal year 2017. Our net income for these same periods was $4 million, $15 million and $46 million, respectively. Our Adjusted EBITDA for these same periods was $113 million, $138 million and $160 million, respectively, representing a CAGR of approximately 19.0% from fiscal year 2015 to fiscal year 2017. Our Adjusted Net Income for these same periods was $26 million, $33 million and $33 million, respectively, representing a CAGR of approximately 13.1% from fiscal year 2015 to fiscal year 2017. For definitions of Adjusted EBITDA and Adjusted Net Income and a reconciliation of Adjusted EBITDA and Adjusted Net Income to net income, see “―Summary Historical Consolidated Financial and Other Data.”

3

Our Industry

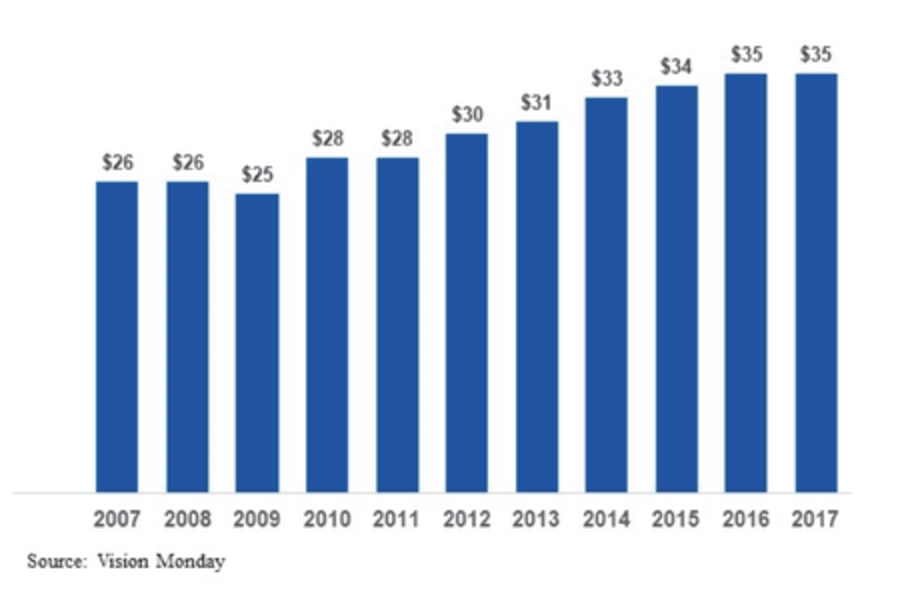

The U.S. optical retail industry, defined by Vision Monday to include optical retailers’ revenues from the sales of products (including managed vision care benefit revenues and omni-channel and e-commerce sales) and eye care services provided by vision care professionals, including eye exams, is a $35 billion industry that has exhibited consistent, stable growth across economic cycles. According to Vision Monday, over the period from 2007 to 2017, the industry grew from $26 billion to $35 billion in annual sales, representing a CAGR of 3.1%. The industry experienced only a modest decline of approximately 3.8% during the 2008 to 2009 recession and rebounded with robust post-recession sales growth of 4.0% CAGR from 2009 to 2017, according to Vision Monday. We believe the ability to see well is a necessity, not a discretionary decision. The steady growth of the industry and its resilience to economic cycles is due in large part to the medical, non-discretionary and recurring nature of eye care purchases. In short, eyesight continues to decline with age, regardless of economic conditions.

Size of U.S. Optical Retail Market ($ in billions)

We anticipate that there are four key secular growth trends that will continue to contribute to the stability and growth of the U.S. optical retail industry:

| • | Aging Population. According to The Vision Council, approximately 76% of adults in the United States used some form of vision correction as of March 2018. At age 45, the need for vision correction begins to increase significantly, with approximately 88% of adults in the United States between the ages of 45 and 54 and approximately 90% of adults in the United States aged 55 and older using vision correction, according to The Vision Council. As the U.S. population ages and life expectancy increases, the pool of potential customers and opportunities for repeat purchases in the optical retail industry are anticipated to rise. In 2014, the U.S. Census Bureau estimated that approximately 42% of the U.S. population would be 45 years old or older by 2020 (the 0.9% increase from 2015 population projections implies an additional 8.4 million adults will enter this 45-plus demographic by 2020). Given that eyesight deteriorates progressively with age, aging of the U.S. population should result in incremental sales of eyewear and related accessories. |

| • | Frequent Replacement Cycle. The repetitive and predictable nature of customer behavior results in a significant volume of recurring revenue for the optical retail industry. The purchasing cycle of vision correction devices is closely tied to the frequency with which consumers obtain eye exams. Most optometrists recommend annual eye exams as a preventive measure against serious eye conditions and to help patients identify changes in their vision correction needs. According to The Vision Council, an estimated 192 million people in the United States using vision correction devices in 2017 received nearly 115 million eye exams that year, implying an average interval between exams of 20 months. The interval between exams contributes to the industry’s stability and shortening this interval represents an opportunity to increase the frequency of customer purchases. |

4

| • | Increased Usage of Computer and Mobile Screens. Due to the proliferation of smartphones, laptops and tablets, the U.S. population has experienced a dramatic increase in the amount of time spent viewing electronic screens. This is anticipated to result in a larger percentage of the population suffering from screen-related vision problems, driving incremental sales of vision correction devices, such as traditional eyeglasses and contact lenses, as well as higher margin products designed specifically to counteract the effect of looking at screens for prolonged stretches of time. |

| • | Growing Focus on Health and Wellness. The optical retail industry is poised to benefit from expansive trends underlying an increasing societal focus on health and wellness. Consumers want personalized solutions that allow them to make informed decisions about their health. Additionally, rising healthcare costs are driving a growing emphasis on preventative healthcare. Eye exams can detect a host of physical ailments, such as hypertension or diabetes, and are one of the most inexpensive and effective forms of detection for many of these conditions. As consumers continue to develop greater awareness of health and wellness issues, there is an opportunity for retailers that are able to offer personalized, inexpensive, health-oriented products and services that can increase quality of life and reduce an individual’s overall level of healthcare expenditures. Furthermore, this increased focus on health means that people are living longer, which increases the overall demand for vision care and the frequency with which people visit their eye care practitioners for vision care products and services. |

Value Chains Gaining Market Share in Optical Retail Industry

Providing consumers with quality vision care and products involves multiple steps and several parties. In the process of purchasing vision care products a consumer will interact directly with eye care practitioners who prescribe (and may also dispense) products. Consumers may likewise interact with optical retail outlets, which dispense products and may offer on-site optometry services to increase customers’ convenience. Retailers also assist consumers in selecting and fitting vision care products, and directly or through third parties, manufacture and finish vision care products and their components. As part of the purchase, the consumer and retailer may interact with an insurance company or managed vision care provider. Further, vision care and optical retail require compliance with numerous regulations, which often vary by state. The industry experience and knowledge to initiate and maintain relationships across all of these parties is crucial to the success of optical retailers.

Several key factors drive the changing dynamics across the optical retail market:

| • | Optical Retail Chains Gaining Market Share From Independents. As a result of customers’ desire for the convenience of a one-stop shop with broad product selection, strong customer service and competitive prices, larger optical retailers have gained market share from independent practitioners over the past approximately 20 years, with total market share of the ten largest optical retailers in the United States increasing from 18% in 1992 to 33% in 2017, according to 20/20 Magazine and Vision Monday. Despite this growth, the top ten optical retailers still have a relatively small share of the overall market, and the largest optical retailers are well-positioned to continue increasing their share. |

| • | Value Chains Are Growing Faster Than Industry. According to Vision Monday estimates, from 2007 to 2017, the value segment of the U.S. optical retail industry grew at a CAGR of 6.7%, more than twice the rate of the broader optical retail industry. Increased consumer cost consciousness has shifted market share toward value optical retail chains and mass merchants that serve the value segment. To the extent this trend continues, the value segment is expected to continue to outpace overall industry growth. |

| • | E-commerce. The optical retail industry is underpenetrated in the e-commerce channel relative to other categories of retail. This is due to inherent penetration barriers that make optical retail better suited for omni-channel offerings rather than pure e-commerce. Although contact lenses lend themselves more to online purchases than do eyeglasses, users still generally need to visit an eye care practitioner or a store to update their prescription. Such visits are an opportunity to sell an annual supply of contact lenses to the customer. |

5

Our Competitive Advantages

Our history of profitable growth is founded on a commitment to a relatively simple business model: providing exceptional value and convenience to customers, enabled by our low-cost operating platform. This business model has multiple areas of competitive advantage:

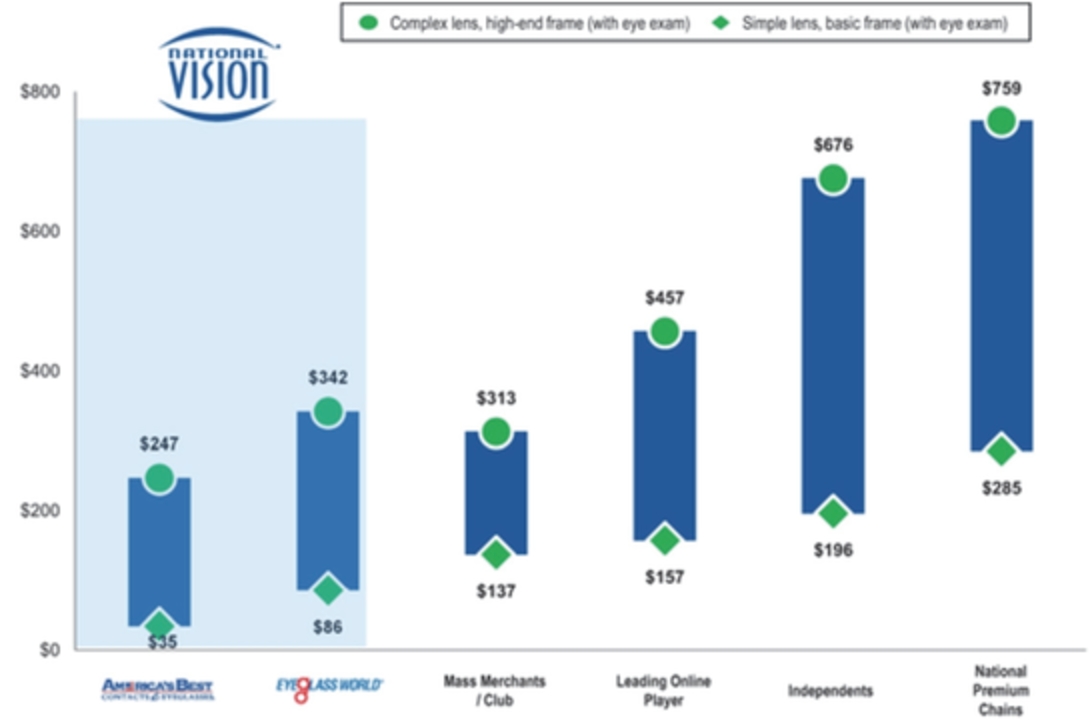

| • | Highly-differentiated and Defensible Value Proposition. Our value price positioning extends across our entire portfolio of brands. We offer among the lowest price points in the optical retail industry and this highly-compelling customer value positioning has been a critical driver of our outsized market share gains and revenue growth. Through its arrangements with individual optometrists or professional corporations owned by eye care practitioners, America’s Best is able to offer customers two distinctive bundled eyewear pricing offers: (i) the two-pairs of eyeglasses offer for $69.95, including an eye exam, and (ii) the Eyecare Club program, which offers several years of eye exams plus a discount on products for a low price. In addition, Eyeglass World’s opening price point offer of two pairs of eyeglasses for $78.00 is among the lowest in our industry. Based on a 2016 study of leading optical retailers and based on these bundled offers, we believe that America’s Best and Eyeglass World’s opening price points for eyeglasses and an eye exam are 74% and 37% lower on a per-pair basis than the next lowest retailer surveyed and 82% and 56% lower than the average of independent retailers surveyed, respectively, each as indicated in the chart below: |

Price for Exam + Single Pair of Glasses

Note: One-pair price for “two-pair shops” calculated by dividing “two-pair price” by two and adding back exam price. For retailers who do not provide eye exams, the average exam price of the other retailers shown has been used.

Source: Haynes and Company Research Study (2016); KKR Capstone analysis.

We are also committed to providing our customers with high levels of in-store customer service and a convenient and compelling shopping experience. On-site optometrists enable a convenient one-stop shop for the clinically-assisted sale of eye exams and eyewear and attract customers. We believe that the comprehensive proposition of our value pricing, the breadth and quality of our product mix and high levels of customer service drive repeat visits and customer loyalty, engagement and ambassadorship.

Our optical retail offerings are also more defensible to potential e-commerce pressure relative to other categories of retail. This is due to inherent penetration barriers that make optical retail better suited for

6

omni-channel offerings rather than pure e-commerce. Eye exams typically involve in-person visits to eye care practitioners or stores and customers generally want to try eyeglasses on before purchasing as slight changes in style, size and color can make a meaningful difference to the functionality and visual appeal of the eyeglass frame. Lastly, the service and sales consultations provided by our on-site vision care professionals and in-store associates are a key part of the vision correction product purchase process, which cannot be replicated online.

| • | Leading Low-cost Operating Model. Our low-cost structure allows us to maintain our low prices to our customers while generating attractive margins. This low-cost structure is a result of our highly-efficient laboratory network and manufacturing capabilities. Orders are routed via a centralized proprietary system to the appropriate processing laboratory, minimizing cost and delivery time. Through a combination of volume increases, continuous operating efficiency improvements and implementation of technological enhancements across our laboratory network, we have increased the number of orders processed through our laboratory network and reduced the cost per job. This has allowed us to maintain our introductory offer of two-pairs of eyeglasses and an eye exam for $69.95 at America’s Best for over ten years. |

Our scale and business model allow us to benefit from procurement and real estate cost structure advantages as well as efficiencies in advertising spend and corporate management. As a result of these factors, we are able to drive attractive profitable growth, while maintaining industry-low prices for our customers.

| • | Best-in-class Management Team with Deep Optical Experience. Our company is led by a highly-accomplished and proven management team with deep expertise. The current team is one of the longest-tenured in the optical retail industry, averaging over 20 years of optical or similar retail experience. Importantly, many of our management team members have come from the optical industry, providing great insight. Our management team has also been a cohesive unit, with an average of 13 years at National Vision and low senior management turnover. Collectively, this team has a wide range of experience across optical merchandising, store openings, customer engagement, operations, omni-channel platform and technology. Combining this operational expertise with a finely-tuned formulaic playbook, management has achieved an impressive long-term track record of significant industry outperformance and generated positive comparable store sales growth in every quarter since 2002, when this management team took over, including during periods of economic contraction. |

| • | Diverse Portfolio of Attractive Brands. We have a differentiated collection of five complementary brands, four of which are supported by either our omni-channel or e-commerce platform, that all target the fast-growing value segment within the U.S. optical retail industry. America’s Best and Eyeglass World, our owned brands, have been the primary source of our store growth. Our partner brands (Vision Centers in Walmart and Vista Optical in Fred Meyer stores and on U.S. military bases) are based in well-known, high-traffic environments, exhibit low capital intensity and generate reliable cash flow. Our omni-channel and e-commerce platforms allow us to capture digital sales, deliver several customer convenience capabilities and serve as an educational resource for our customers. In the aggregate, we believe that this diverse combination of brands exhibits a strong economic profile that combines robust growth potential with significant free cash flow generation. |

| • | Proven Real Estate Site Selection Process. We locate our owned stores in highly-desirable retail developments surrounded by dense concentrations of our target customers, resulting in strong performance across our store base. We have rarely closed or relocated a store due to underperformance, and our five-year rolling average new store success rate—defined as the percentage of stores opened in the last five years that are still open—was 99% as of March 31, 2018. We have long-standing relationships with many leading commercial real estate firms and believe that we are a preferred tenant given our brands and the high volume of customers that visit our stores. As a result, we believe we will continue to have access to desirable retail sites. |

| • | Strong Partnerships with Retail Partners and Vendors. We have developed extensive and long-term strategic relationships with our frame and lens suppliers, our host and legacy partners and managed vision care companies. Our highly-experienced procurement team leverages long-standing relationships with our vendors to source all of our products. Our strong vendor relationships and scale allow us to |

7

maintain broad, on-trend assortments, competitive pricing and favorable payment terms. We have maintained and broadened relationships with our host and legacy partners over several decades. For example, in 2012, we expanded our relationship with Walmart to manage walmartcontacts.com and samsclubcontacts.com and to undertake the back-end logistics and fulfilment services for Walmart’s “ship-to-home” contact lens sales and for virtually all of Sam’s Club contact lens orders. We have also developed strong relationships with managed vision care companies through our network of stores, efficient billing and focus on value. We continually seek to partner with additional managed vision care payors and to increase participation in our partners’ networks. We believe that our above-market growth is also an attractive growth driver for our business partners and positions us as a preferred retailer for key vendors and industry partners.

| • | Deep Experience with the Regulatory Complexity of the Optical Industry. There are extensive and diverse sets of laws and regulations governing the provision of vision care. As a result, regulatory compliance for optical retailers in the United States is complicated and time-consuming, involving many regulatory bodies and licensing agencies at both the federal and state levels. We believe that our deep knowledge of the optical regulatory framework and our significant compliance experience provide us with an important competitive advantage. We also believe that these compliance and licensure requirements, and related costs, serve as a significant hurdle for potential new entrants into the optical retail industry. |

Our Growth Strategies

We believe that we have the right strategy and execution capabilities to capitalize on the substantial growth opportunities afforded by our business model. We intend to further drive growth from five distinct sources:

| • | Grow Our Store Base. We believe that our expansion opportunities in the United States are significant. We have adopted a disciplined expansion strategy designed to leverage the strengths of our compelling and distinct value proposition and recognized America’s Best and Eyeglass World brand names to develop new stores successfully in an array of markets that are primed for growth, including new, existing, small and large markets. In the aggregate, we have opened 512 stores on a net basis (opened 581 new stores and closed 69 stores) since 2006 and, in the past three years, we have increased our new store growth to approximately 75 new stores per annum. We have an established partnership with a third party real estate firm to evaluate potential new America’s Best and Eyeglass World stores and our analysis suggests that we can grow America’s Best to at least 1,000 stores and Eyeglass World to at least 850 stores, inclusive of those already open. We believe that these two brands can accordingly grow from 715 stores as of March 31, 2018 to a total of at least 1,850 stores, with similar economics to the existing store base. We believe that our consistent track record of successfully opening stores across vintages, geographies and markets demonstrates our ability to further increase our store count and, as a result, we believe that our current level of new store growth of approximately 75 stores per annum is sustainable for the foreseeable future. |

| • | Drive Comparable Store Sales Growth. We expect that our value proposition will generate profitable comparable store sales growth. The vast majority of our comparable store sales growth over the past five years has been driven by increased traffic. The typical eyewear replacement cycle, which we estimate is two to three years, creates substantial opportunity for us to increase sales from our existing customer base. We continually strive to improve our in-store shopping experience and to enhance our solutions-based service approach to increase the volume of customer traffic to our stores. We also expect to increase customer traffic by improving marketing programs and omni-channel offerings, and by expanding our participation in managed vision care programs. We are currently underpenetrated in the managed vision care market relative to the broader optical retail industry. We expect that these initiatives collectively will help us to attract new customers to our stores and increase the frequency of purchases by our existing customers. |

| • | Improve Operating Productivity. We believe that our continued growth will provide further opportunities to improve operating margin over time. Growth, both in revenue and stores, will enable us to leverage corporate overhead, our centralized laboratory network and our advertising spend. We expect to benefit from our national network television advertising campaign for America’s Best, which we believe is more cost effective than local market campaigns. This national campaign has helped raise |

8

our brand awareness in both existing and new markets, allowing us to save advertising spend when entering new markets. We also believe that continued efficiencies in store operations and technological advancements in our centralized laboratory network will further enhance margins.

In the past three years, we have accelerated store openings of America’s Best and Eyeglass World to 75 stores per annum. Based on the consistency and predictability of the maturation process for our existing store base, we believe that there are significant embedded earnings in these maturing stores. For indicative purposes, assuming that each of our open but not mature America’s Best and Eyeglass World stores as of December 30, 2017 were able to attain the average fifth-year financial performance of our existing mature America’s Best and Eyeglass World stores, we would have generated an additional approximately $58 million of revenues and approximately $48 million of EBITDA for our owned & host segment in fiscal year 2017.

| • | Leverage Technology to Optimize and Expand the Business. Our experienced management team has consistently leveraged innovative strategies to grow our business and remain at the forefront of technological development in the optical retail industry. We have invested significantly in technological improvements to position us for future growth. We plan to continue investing in software solutions that further develop our omni-channel platform and enhance our customer engagement capabilities, and we will also continue to invest in tools to improve the quality of the in-store eye exam experience. Since eye exams are a critical service element of our business, we believe that investing in technology to improve this experience will aid in retention of both customers and optometric talent. We are regularly presented with opportunities to invest in technological innovators across the optical retail industry and we have invested $8.6 million in venture-backed emerging companies since June 2014. We believe that these investments provide direct access to optical technology innovators, giving us a deeper understanding of emerging trends and developments. We are thus in a better position to evolve our products and services to meet the needs of our customers. |

| • | Explore Strategic Opportunities. We will selectively evaluate strategic acquisition opportunities from time to time as part of our growth strategy. |

Recent Developments

Preliminary, Unaudited Estimates of Consolidated Financial Results as of and for the Six Months Ended June 30, 2018

The unaudited estimated consolidated financial results set forth below are preliminary, based upon our estimates and currently available information and are subject to revision based upon, among other things, our financial closing procedures and the completion of our interim consolidated financial statements and other operational procedures. The preliminary results as of and for the six months ended June 30, 2018 presented below should not be viewed as a substitute for interim consolidated financial statements prepared in accordance with GAAP. Our actual results may be materially different from our estimates, which should not be regarded as a representation by us, our management or the underwriters as to our actual results as of and for the six months ended June 30, 2018. You should not place undue reliance on these estimates. See “Special Note Regarding Forward-Looking Statements” and “Risk Factors.”

All of the data presented below has been prepared by and is the responsibility of management. Our independent accountants, Deloitte & Touche LLP, have not audited, reviewed, compiled or performed any procedures, and do not express an opinion or any other form of assurance with respect to any of such data.

As of June 30, 2018, we operated 1,050 stores, compared to 980 stores as of July 1, 2017. We estimate that our comparable store sales growth will be in the range of 6.9% and 7.1% and our adjusted comparable store sales growth will be in the range of 6.2% and 6.4% for the six months ended June 30, 2018, compared to 7.0% and 6.5%, respectively, for the six months ended July 1, 2017.

For the six months ended June 30, 2018, we estimate that our consolidated net revenue will range from $790.5 million to $792.5 million, compared to consolidated net revenue of $707.4 million for the six months ended July 1, 2017.

We estimate that our net income will be between $36.4 million and $37.4 million for the six months ended June 30, 2018, compared to net income of $15.6 million for the six months ended July 1, 2017. For the six months ended June 30, 2018, we estimate that our Adjusted EBITDA will range from $106.1 million to

9

$107.1 million, compared to Adjusted EBITDA of $98.5 million for the six months ended July 1, 2017. We estimate that our Adjusted Net Income will be between $41.2 million and $42.2 million for the six months ended June 30, 2018, compared to Adjusted Net Income of $30.2 million for the six months ended July 1, 2017.

Our results in the six months ended June 30, 2018 compared to the same period in 2017 benefited from net revenue growth driven by comparable store sales growth, new stores, order volume in our AC Lens e-commerce business, and timing of unearned revenues. The primary drivers for the increase in comparable store sales growth from the three months ended March 31, 2018 were customer traffic that benefited from an extended peak selling season and traffic shift due to inclement March weather conditions. For the six months ended June 30, 2018, Adjusted EBITDA grew at a slower rate than net revenue primarily due to higher optometrist costs, advertising, and public company expenses.

As of June 30, 2018, we estimate that we had cash and cash equivalents of approximately $34.6 million and total debt of approximately $574.3 million.

Please see below for a reconciliation of net income to EBITDA, Adjusted EBITDA and Adjusted Net Income for the six months ended June 30, 2018 (at the low end and high end of the estimated net income range set forth above) and the six months ended July 1, 2017. In addition, please see “—Summary Historical Consolidated Financial and Other Data” for how we define EBITDA, Adjusted EBITDA and Adjusted Net Income, the reasons why we include these measures and certain limitations to their use.

|

|

Six Months Ended

|

||||||||

|

($ in thousands)

|

June 30, 2018

|

July 1, 2017

|

|||||||

|

|

Low

|

High

|

Actual

|

||||||

|

Net income

|

$

|

36,400

|

|

$

|

37,400

|

|

$

|

15,574

|

|

|

Interest expense

|

|

18,700

|

|

|

18,700

|

|

|

26,114

|

|

|

Income tax provision

|

|

8,600

|

|

|

8,600

|

|

|

9,104

|

|

|

Depreciation and amortization

|

|

35,000

|

|

|

35,000

|

|

|

29,052

|

|

|

EBITDA

|

|

98,700

|

|

|

99,700

|

|

|

79,844

|

|

|

Stock compensation expense(a)

|

|

3,100

|

|

|

3,100

|

|

|

1,989

|

|

|

Debt issuance costs(b)

|

|

—

|

|

|

—

|

|

|

2,702

|

|

|

Asset impairment(c)

|

|

—

|

|

|

—

|

|

|

1,000

|

|

|

Non-cash inventory write-offs(d)

|

|

—

|

|

|

—

|

|

|

2,271

|

|

|

Management fees(e)

|

|

—

|

|

|

—

|

|

|

574

|

|

|

New store pre-opening expenses(f)

|

|

1,200

|

|

|

1,200

|

|

|

1,278

|

|

|

Non-cash rent(g)

|

|

800

|

|

|

800

|

|

|

654

|

|

|

Litigation settlement(h)

|

|

—

|

|

|

—

|

|

|

7,000

|

|

|

Secondary offering expenses(i)

|

|

1,100

|

|

|

1,100

|

|

|

—

|

|

|

Other(j)

|

|

1,200

|

|

|

1,200

|

|

|

1,213

|

|

|

Adjusted EBITDA

|

$

|

106,100

|

|

$

|

107,100

|

|

$

|

98,525

|

|

|

|

Six Months Ended

|

||||||||

|

($ in thousands)

|

June 30, 2018

|

July 1, 2017

|

|||||||

|

|

Low

|

High

|

Actual

|

||||||

|

Net income

|

$

|

36,400

|

|

$

|

37,400

|

|

$

|

15,574

|

|

|

Stock compensation expense(a)

|

|

3,100

|

|

|

3,100

|

|

|

1,989

|

|

|

Debt issuance costs(b)

|

|

—

|

|

|

—

|

|

|

2,702

|

|

|

Asset impairment(c)

|

|

—

|

|

|

—

|

|

|

1,000

|

|

|

Non-cash inventory write-offs(d)

|

|

—

|

|

|

—

|

|

|

2,271

|

|

|

Management fees(e)

|

|

—

|

|

|

—

|

|

|

574

|

|

|

New store pre-opening expenses(f)

|

|

1,200

|

|

|

1,200

|

|

|

1,278

|

|

|

Non-cash rent(g)

|

|

800

|

|

|

800

|

|

|

654

|

|

|

Litigation settlement(h)

|

|

—

|

|

|

—

|

|

|

7,000

|

|

|

Secondary offering expenses(i)

|

|

1,100

|

|

|

1,100

|

|

|

—

|

|

10

|

|

Six Months Ended

|

||||||||

|

($ in thousands)

|

June 30, 2018

|

July 1, 2017

|

|||||||

|

|

Low

|

High

|

Actual

|

||||||

|

Other(j)

|

|

1,200

|

|

|

1,200

|

|

|

1,213

|

|

|

Amortization of acquisition intangibles and deferred financing costs(k)

|

|

4,600

|

|

|

4,600

|

|

|

5,744

|

|

|

Tax benefit of stock option exercise(l)

|

|

(4,100

|

)

|

|

(4,100

|

)

|

|

—

|

|

|

Tax effect of total adjustments(m)

|

|

(3,100

|

)

|

|

(3,100

|

)

|

|

(9,770

|

)

|

|

Adjusted Net Income

|

$

|

41,200

|

|

$

|

42,200

|

|

$

|

30,229

|

|

| (a) | Non-cash charges related to stock-based compensation programs, which vary from period to period depending on the timing of awards. |

| (b) | Reflects $2.7 million of fees associated with the borrowing of $175.0 million in additional principal under our first lien credit agreement in the six months ended July 1, 2017. |

| (c) | Reflects write-off of a cost basis investment for the six months ended July 1, 2017. |

| (d) | Reflects write-offs of inventory relating to the expiration of a specific type of contact lenses that could not be sold and required disposal. |

| (e) | Reflects management fees paid to KKR Sponsor and Berkshire in accordance with our monitoring agreement with them. The monitoring agreement was terminated automatically in accordance with its terms upon the consummation of the IPO (as defined below). |

| (f) | Pre-opening expenses, which include marketing and advertising, labor and occupancy expenses incurred prior to opening a new store, are generally higher than comparable expenses incurred once such store is open and generating revenue. We believe that such higher pre-opening expenses are specific in nature and amount to opening a new store and as such, are not indicative of ongoing core operating performance. We adjust for these costs to facilitate comparisons of store operating performance from period to period. Pre-opening costs are permitted exclusions in our calculation of Adjusted EBITDA pursuant to the terms of our existing credit agreement. |

| (g) | Consists of the non-cash portion of rent expense, which reflects the extent to which our straight-line rent expense recognized under GAAP exceeds or is less than our cash rent payments. The adjustment can vary depending on the average age of our lease portfolio, which has been impacted by our significant growth in recent years. For newer leases, our rent expense recognized typically exceeds our cash rent payments, while for more mature leases, rent expense recognized under GAAP is typically less than our cash rent payments. |

| (h) | Amounts accrued related to settlement of litigation. See “Legal Proceedings” and Note 12 in our audited consolidated financial statements, each in our Annual Report, and “Legal Proceedings” and Note 7 in our unaudited condensed consolidated financial statements, each in our Quarterly Report, each of which is incorporated by reference in this prospectus, for further details. |

| (i) | Expenses related to secondary public offerings of our common stock incurred during the six months ended June 30, 2018. |

| (j) | Other adjustments include amounts that management believes are not representative of our operating performance (amounts in brackets represent reductions in Adjusted EBITDA and Adjusted Net Income), including our share of losses on equity method investments of $0.6 million and $0.3 million for the six months ended June 30, 2018 and July 1, 2017, respectively; the amortization impact of the KKR Acquisition-related adjustments (e.g., fair value of leasehold interests) of $69,000 and $(0.2) million for the six months ended June 30, 2018 and July 1, 2017, respectively; expenses related to preparation for being an SEC registrant that were not directly attributable to the IPO and therefore not charged to equity of $1.2 million for the six months ended July 1, 2017; differences between the timing of expense versus cash payments related to contributions to charitable organizations of $(0.5) million for each of the six months ended June 30, 2018 and July 1, 2017; costs of severance and relocation of $0.5 million and $0.3 million for the six months ended June 30, 2018 and July 1, 2017, respectively; and other expenses and adjustments totaling $0.5 million and $71,000 for the six months ended June 30, 2018 and July 1, 2017, respectively. |

| (k) | Amortization of acquisition intangibles related to the increase in the carrying values of definite-lived intangible assets resulting from the application of purchase accounting to the KKR Acquisition of $3.7 million for each of the six months ended June 30, 2018 and July 1, 2017. Amortization of deferred financing costs is primarily associated with the March 2014 term loan borrowings in connection with the KKR Acquisition and, to a lesser extent, amortization of debt discounts associated with the May 2015 and February 2017 incremental first lien term loans and the November 2017 first lien refinancing, aggregating to $0.8 million and $2.0 million for the six months ended June 30, 2018 and July 1, 2017, respectively. |

| (l) | Tax benefit associated with accounting guidance adopted at the beginning of fiscal year 2017 (Accounting Standards Update 2016-09, Compensation - Stock Compensation), requiring excess tax benefits to be recorded in earnings as discrete items in the reporting period in which they occur. |

| (m) | Represents the tax effect of the total adjustments at our estimated annual statutory effective tax rate. |

11

Please see below for a reconciliation of adjusted comparable store sales growth to comparable store sales growth (at the low end and high end of the estimated comparable store sales growth range set forth above). In addition, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How We Assess the Performance of our Business—Adjusted Comparable Store Sales Growth” in the Annual Report and Quarterly Report, each of which is incorporated herein by reference, for how we calculate adjusted comparable store sales growth, the reasons why we include it and certain limitations to its use.

|

|

Six Months Ended

|

||||||||

|

|

June 30, 2018

|

July 1, 2017

|

|||||||

|

|

Low

|

High

|

Actual

|

||||||

|

Comparable store sales growth

|

|

6.9

|

%

|

|

7.1

|

%

|

|

7.0

|

%

|

|

Adjusted comparable store sales growth(1)

|

|

6.2

|

%

|

|

6.4

|

%

|

|

6.5

|

%

|

| (1) | There are two differences between total comparable store sales growth based on consolidated net revenue and adjusted comparable store sales growth: (i) adjusted comparable store sales growth includes the effect of deferred and unearned revenue as if such sales were earned at the point of sale, resulting in a decrease of 0.7% and 0.1% from total comparable store sales growth based on consolidated net revenue for the six months ended June 30, 2018 and July 1, 2017, respectively, and (ii) adjusted comparable store sales growth includes retail sales to the legacy partner’s customers (rather than the revenues recognized consistent with the management and services agreement), resulting in a decrease of 0.4% from total comparable store sales growth based on consolidated net revenue for the six months ended July 1, 2017. |

Legal Proceedings

Our subsidiary, FirstSight is a defendant in a purported class action in the U.S. District Court for the Southern District of California that alleges that FirstSight participated in arrangements that caused the illegal delivery of eye examinations and that FirstSight thereby violated, among other laws, the corporate practice of optometry and the unfair competition and false advertising laws of California. The lawsuit was filed in 2013 and FirstSight was added as a defendant in 2016. In March 2017, the court granted the motion to dismiss previously filed by FirstSight and dismissed the complaint with prejudice. The plaintiffs filed an appeal with the U.S. Court of Appeals for the Ninth Circuit in April 2017. In July 2018, the U.S. Court of Appeals for the Ninth Circuit vacated in part, and reversed in part, the district court’s dismissal and remanded for further proceedings. We intend to continue to defend the litigation vigorously. We believe that the claims alleged are without merit.

Risks Related to Our Business and this Offering

Investing in our common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the optical retail industry. Below is a summary of some of the principal risks we face:

| • | our ability to open and operate new stores in a timely and cost-effective manner, and to successfully enter new markets; |

| • | our ability to maintain sufficient levels of cash flow from our operations to grow; |

| • | our ability to recruit and retain vision care professionals for our stores; |

| • | our ability to adhere to extensive state, local and federal vision care and healthcare laws and regulations; |

| • | our ability to develop and maintain relationships with managed vision care companies, vision insurance providers and other third-party payors; |

| • | our ability to maintain our current operating relationships with our host and legacy partners; |

| • | the loss of, or disruption in the operations of, one or more of our distribution centers and/or optical laboratories; |

| • | risks associated with vendors from whom our products are sourced; |

| • | our ability to successfully compete in the highly competitive optical retail industry; and |

| • | our dependence on a limited number of suppliers. |

Any of the factors set forth under “Risk Factors” in this prospectus and under “Risk Factors” in our Annual Report, which is incorporated herein by reference, may limit our ability to successfully execute our

12

business strategy. You should carefully consider all of the information set forth, or incorporated by reference, in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in this prospectus and under “Risk Factors” in our Annual Report, which is incorporated herein by reference, in deciding whether to invest in our common stock.

Corporate History and Information

Through its predecessors, NVI commenced operations in 1990. In 2005, private equity funds managed by Berkshire acquired both NVI and Consolidated Vision Group, Inc., which operated America’s Best stores, and merged these entities, with NVI surviving. In 2009, NVI acquired the Eyeglass World store chain. In 2011, after a multi-year partnership, NVI acquired AC Lens to bolster its e-commerce platform.

In March 2014, NVI was acquired by affiliates of KKR Sponsor. National Vision Holdings, Inc. was incorporated in Delaware on February 14, 2014 under the name “Nautilus Parent, Inc.” and NVI became our wholly-owned subsidiary in connection with the KKR Acquisition. We changed our name to “National Vision Holdings, Inc.” in June 2017. Our common stock began trading on NASDAQ under the symbol “EYE” on October 26, 2017 and we consummated our initial public offering of our common stock, or the IPO, on October 30, 2017.

Our principal executive offices are located at 2435 Commerce Avenue, Bldg. 2200, Duluth, Georgia 30096. The telephone number of our principal executive offices is (770) 822-3600. We maintain a website at www.nationalvision.com. The information contained on, or that can be accessed through, our corporate website or other company websites referenced elsewhere in this prospectus neither constitutes part of this prospectus nor is incorporated by reference herein.

About KKR & Co.

KKR & Co. Inc., which, together with its subsidiaries, we refer to as KKR & Co., is a leading global investment firm that manages multiple alternative asset classes including private equity, energy, infrastructure, real estate and credit, with its strategic manager partnerships that manage hedge funds. KKR & Co. aims to generate attractive investment returns for its fund investors by following a patient and disciplined investment approach, employing world-class people, and driving growth and value creation with its portfolio companies. KKR & Co. invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business. KKR & Co. Inc. is listed on The New York Stock Exchange (NYSE: KKR).

About Berkshire

Berkshire, a Boston-based investment firm, has raised nine private equity funds with more than $16 billion in aggregate capital and has made over 120 investments in primarily middle market companies since its founding in 1986. Berkshire has developed specific industry experience in several areas including consumer and retail, communications, business services, industrials and healthcare. Berkshire has a strong history of partnering with management teams to grow companies in which it invests.

13

The Offering

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus reflects and assumes no exercise of the underwriters’ option to purchase 1,800,000 additional shares of our common stock.

14