Form DEFA14A DXC Technology Co

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

DXC Technology Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount previously paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing party:

| |||

| 4. | Date Filed:

| |||

Key Discussion Topics: 2018 Annual Meeting of Stockholders

Executive Summary Successful execution on DXC’s strategic roadmap in fiscal 2018, including the integration of CSC and HPE Enterprise Services (HPES), achievement of our first-year financial objectives, and a strengthened leadership position in digital transformation Strong leadership team driving execution of strategy that will position DXC at the top of the IT services market and drive long-term value for stockholders Board led an extensive engagement effort resulting in compensation program changes that were responsive to our stockholders’ concerns In accordance with our pay-for-performance philosophy, we set challenging targets within the annual incentive plan to drive stockholder value Previously disclosed 2017 supplemental PSU retention award made to our CEO following the CSC-HPES merger has rigorous multi-year performance conditions, does not represent a new award, and was addressed during prior outreach

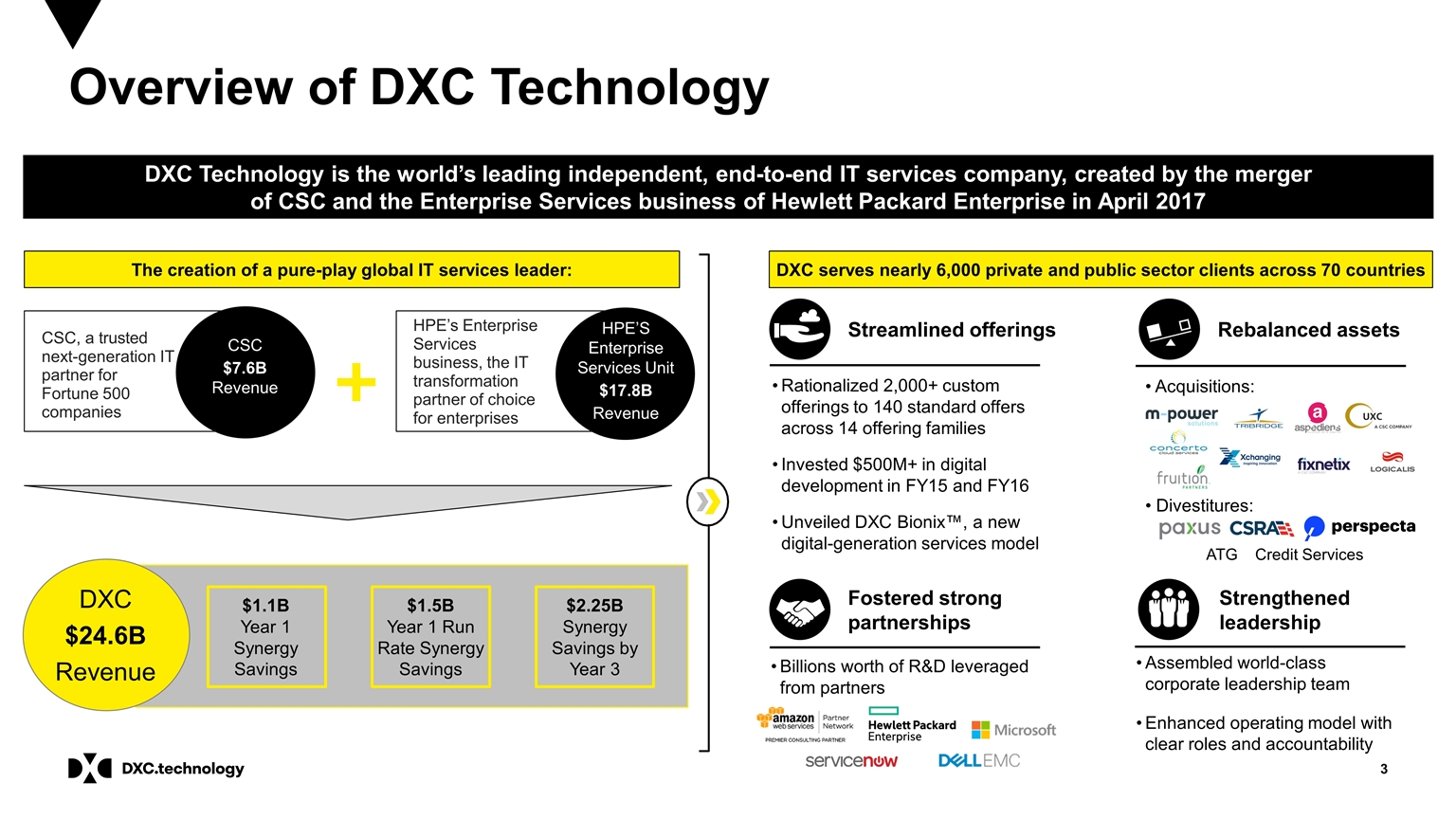

Rationalized 2,000+ custom offerings to 140 standard offers across 14 offering families Invested $500M+ in digital development in FY15 and FY16 Unveiled DXC Bionix™, a new digital-generation services model Streamlined offerings Strengthened leadership Assembled world-class corporate leadership team Enhanced operating model with clear roles and accountability Billions worth of R&D leveraged from partners Fostered strong partnerships Rebalanced assets Divestitures: Acquisitions: Credit Services ATG DXC Technology is the world’s leading independent, end-to-end IT services company, created by the merger of CSC and the Enterprise Services business of Hewlett Packard Enterprise in April 2017 Overview of DXC Technology CSC, a trusted next-generation IT partner for Fortune 500 companies CSC $7.6B Revenue HPE’s Enterprise Services business, the IT transformation partner of choice for enterprises HPE’S Enterprise Services Unit $17.8B Revenue DXC $24.6B Revenue $1.1B Year 1 Synergy Savings $1.5B Year 1 Run Rate Synergy Savings $2.25B Synergy Savings by Year 3 DXC serves nearly 6,000 private and public sector clients across 70 countries The creation of a pure-play global IT services leader:

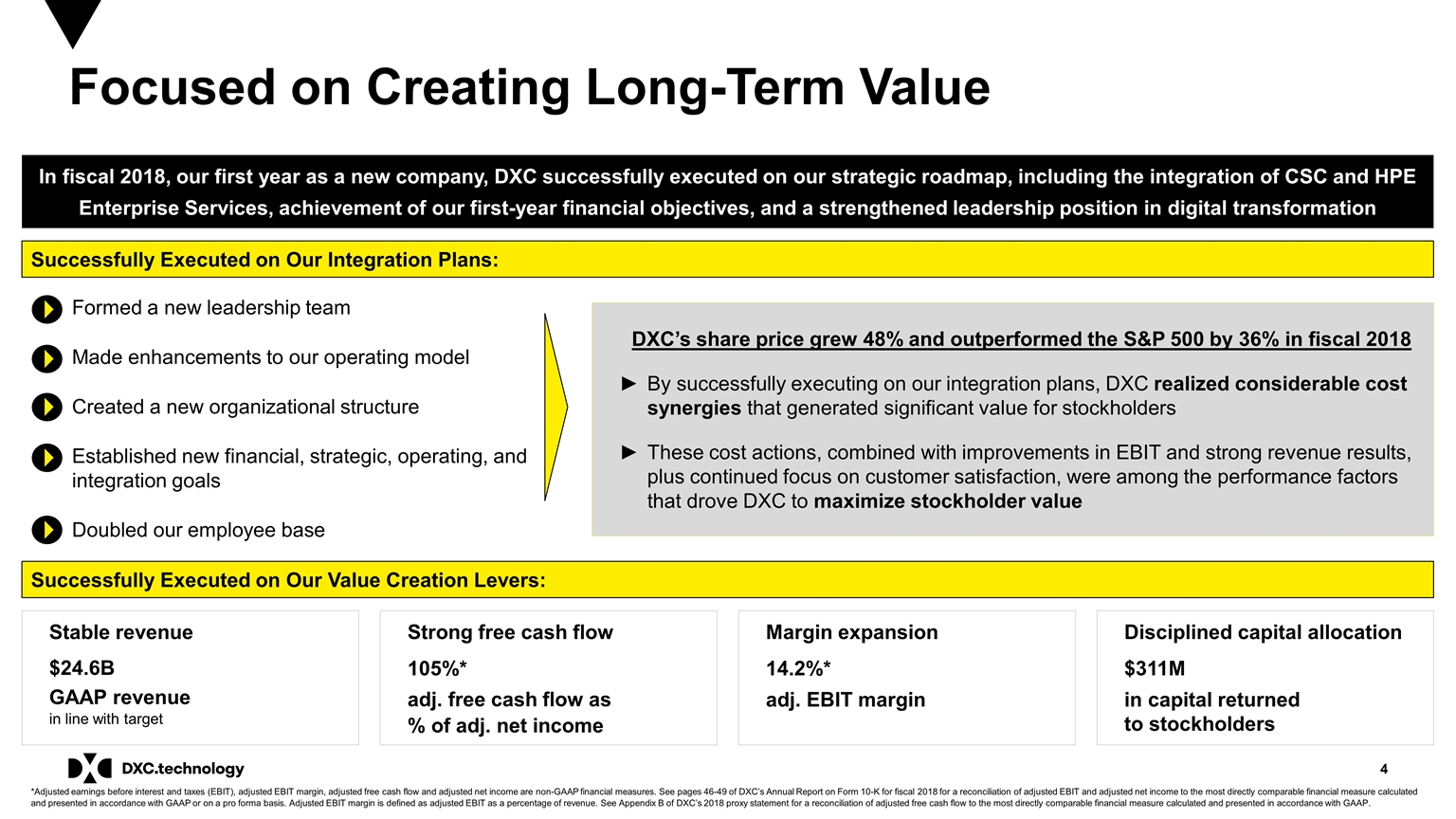

Successfully Executed on Our Integration Plans: Focused on Creating Long-Term Value In fiscal 2018, our first year as a new company, DXC successfully executed on our strategic roadmap, including the integration of CSC and HPE Enterprise Services, achievement of our first-year financial objectives, and a strengthened leadership position in digital transformation *Adjusted earnings before interest and taxes (EBIT), adjusted EBIT margin, adjusted free cash flow and adjusted net income are non-GAAP financial measures. See pages 46-49 of DXC’s Annual Report on Form 10-K for fiscal 2018 for a reconciliation of adjusted EBIT and adjusted net income to the most directly comparable financial measure calculated and presented in accordance with GAAP or on a pro forma basis. Adjusted EBIT margin is defined as adjusted EBIT as a percentage of revenue. See Appendix B of DXC’s 2018 proxy statement for a reconciliation of adjusted free cash flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Successfully Executed on Our Value Creation Levers: Formed a new leadership team Made enhancements to our operating model Created a new organizational structure Established new financial, strategic, operating, and integration goals Doubled our employee base DXC’s share price grew 48% and outperformed the S&P 500 by 36% in fiscal 2018 By successfully executing on our integration plans, DXC realized considerable cost synergies that generated significant value for stockholders These cost actions, combined with improvements in EBIT and strong revenue results, plus continued focus on customer satisfaction, were among the performance factors that drove DXC to maximize stockholder value Disciplined capital allocation $311M in capital returned to stockholders Stable revenue $24.6B GAAP revenue in line with target Margin expansion 14.2%* adj. EBIT margin Strong free cash flow 105%* adj. free cash flow as % of adj. net income

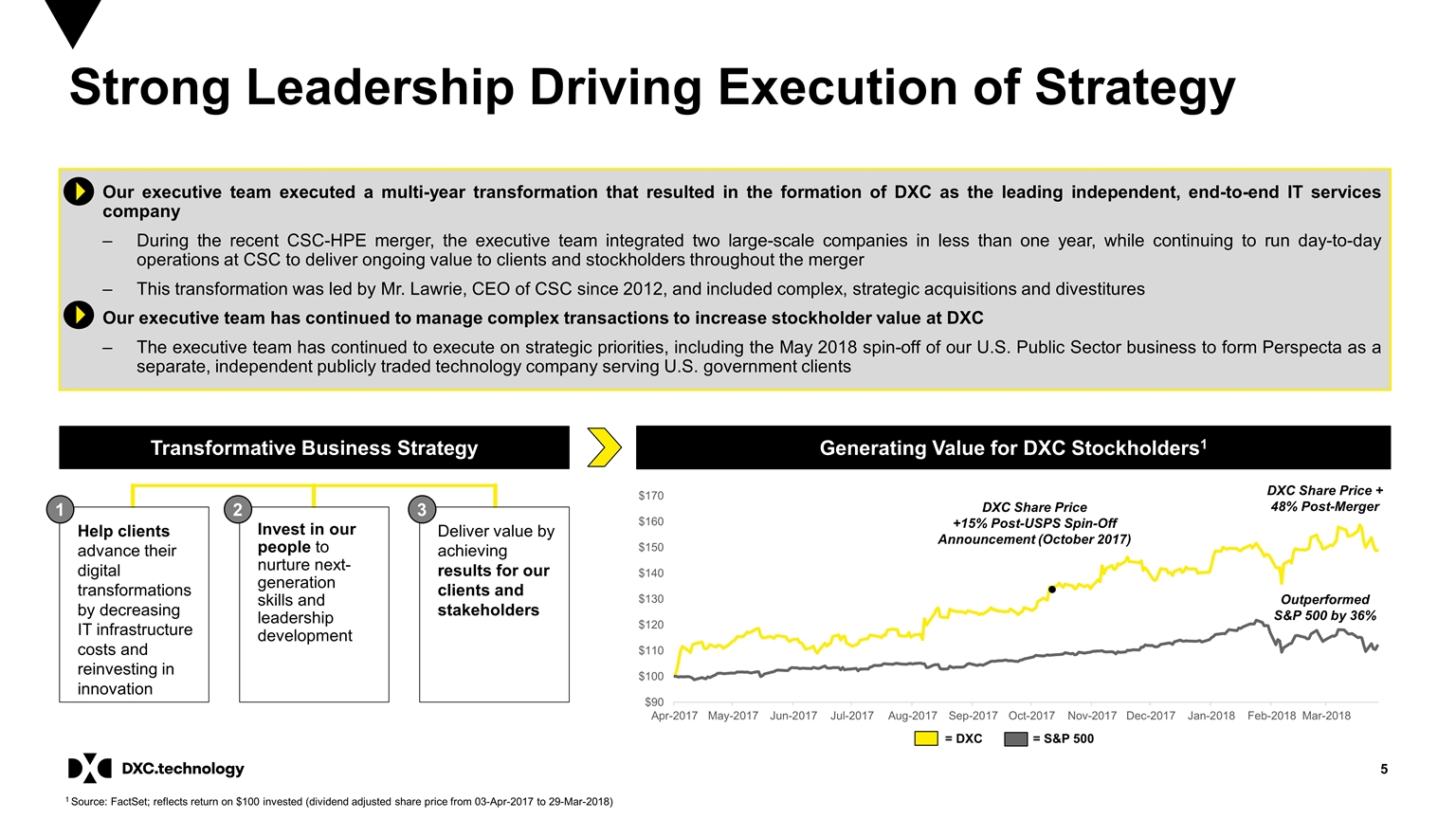

Strong Leadership Driving Execution of Strategy Our executive team executed a multi-year transformation that resulted in the formation of DXC as the leading independent, end-to-end IT services company During the recent CSC-HPE merger, the executive team integrated two large-scale companies in less than one year, while continuing to run day-to-day operations at CSC to deliver ongoing value to clients and stockholders throughout the merger This transformation was led by Mr. Lawrie, CEO of CSC since 2012, and included complex, strategic acquisitions and divestitures Our executive team has continued to manage complex transactions to increase stockholder value at DXC The executive team has continued to execute on strategic priorities, including the May 2018 spin-off of our U.S. Public Sector business to form Perspecta as a separate, independent publicly traded technology company serving U.S. government clients 1 Source: FactSet; reflects return on $100 invested (dividend adjusted share price from 03-Apr-2017 to 29-Mar-2018) Generating Value for DXC Stockholders1 = DXC = S&P 500 DXC Share Price + 48% Post-Merger DXC Share Price +15% Post-USPS Spin-Off Announcement (October 2017) Outperformed S&P 500 by 36% Transformative Business Strategy Help clients advance their digital transformations by decreasing IT infrastructure costs and reinvesting in innovation Invest in our people to nurture next-generation skills and leadership development Deliver value by achieving results for our clients and stakeholders 1 2 3

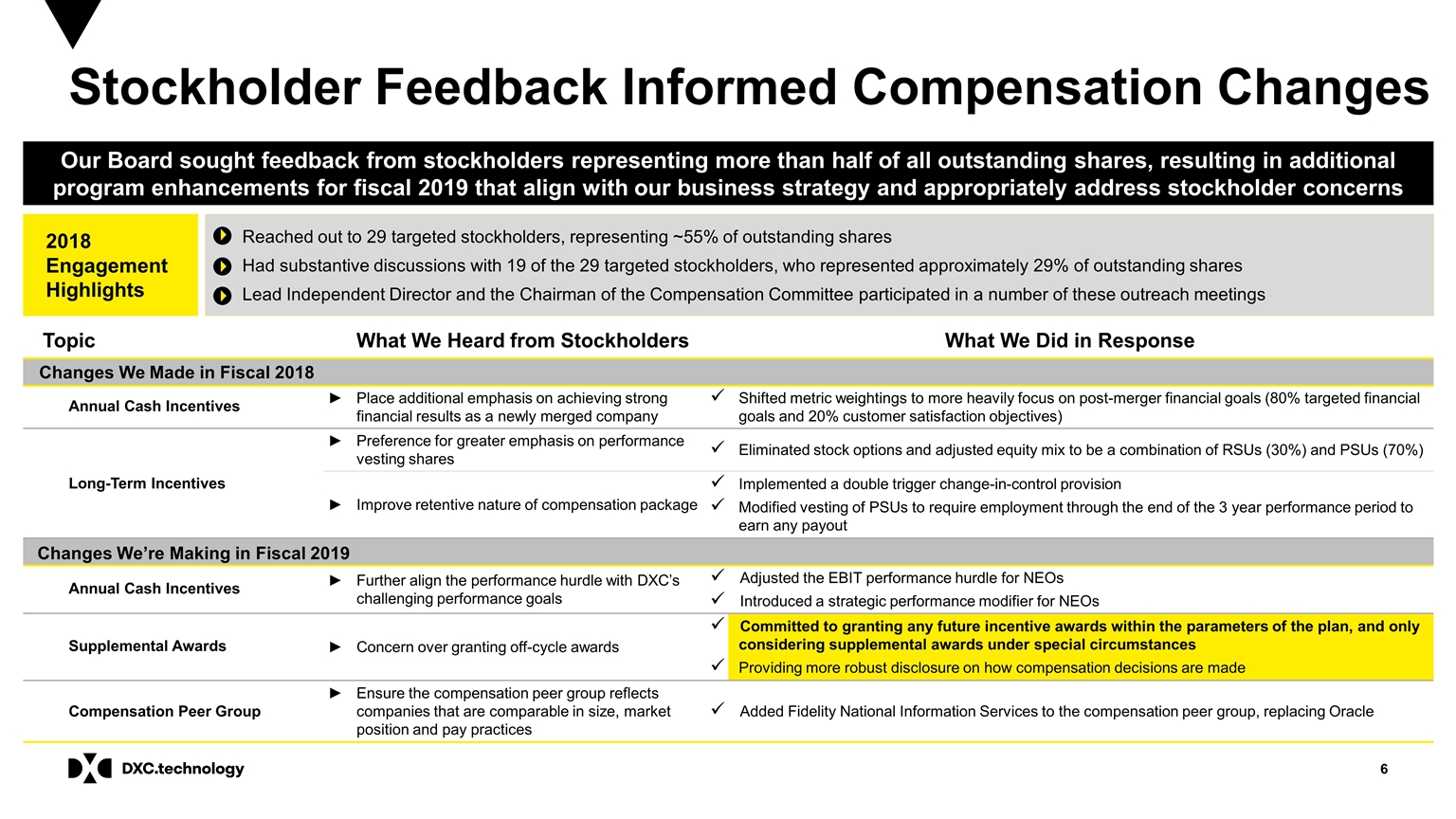

Topic What We Heard from Stockholders What We Did in Response Changes We Made in Fiscal 2018 Annual Cash Incentives Place additional emphasis on achieving strong financial results as a newly merged company Shifted metric weightings to more heavily focus on post-merger financial goals (80% targeted financial goals and 20% customer satisfaction objectives) Long-Term Incentives Preference for greater emphasis on performance vesting shares Eliminated stock options and adjusted equity mix to be a combination of RSUs (30%) and PSUs (70%) Improve retentive nature of compensation package Implemented a double trigger change-in-control provision Modified vesting of PSUs to require employment through the end of the 3 year performance period to earn any payout Changes We’re Making in Fiscal 2019 Annual Cash Incentives Further align the performance hurdle with DXC’s challenging performance goals Adjusted the EBIT performance hurdle for NEOs Introduced a strategic performance modifier for NEOs Supplemental Awards Concern over granting off-cycle awards Committed to granting any future incentive awards within the parameters of the plan, and only considering supplemental awards under special circumstances Providing more robust disclosure on how compensation decisions are made Compensation Peer Group Ensure the compensation peer group reflects companies that are comparable in size, market position and pay practices Added Fidelity National Information Services to the compensation peer group, replacing Oracle Stockholder Feedback Informed Compensation Changes Our Board sought feedback from stockholders representing more than half of all outstanding shares, resulting in additional program enhancements for fiscal 2019 that align with our business strategy and appropriately address stockholder concerns Reached out to 29 targeted stockholders, representing ~55% of outstanding shares Had substantive discussions with 19 of the 29 targeted stockholders, who represented approximately 29% of outstanding shares Lead Independent Director and the Chairman of the Compensation Committee participated in a number of these outreach meetings 2018 Engagement Highlights

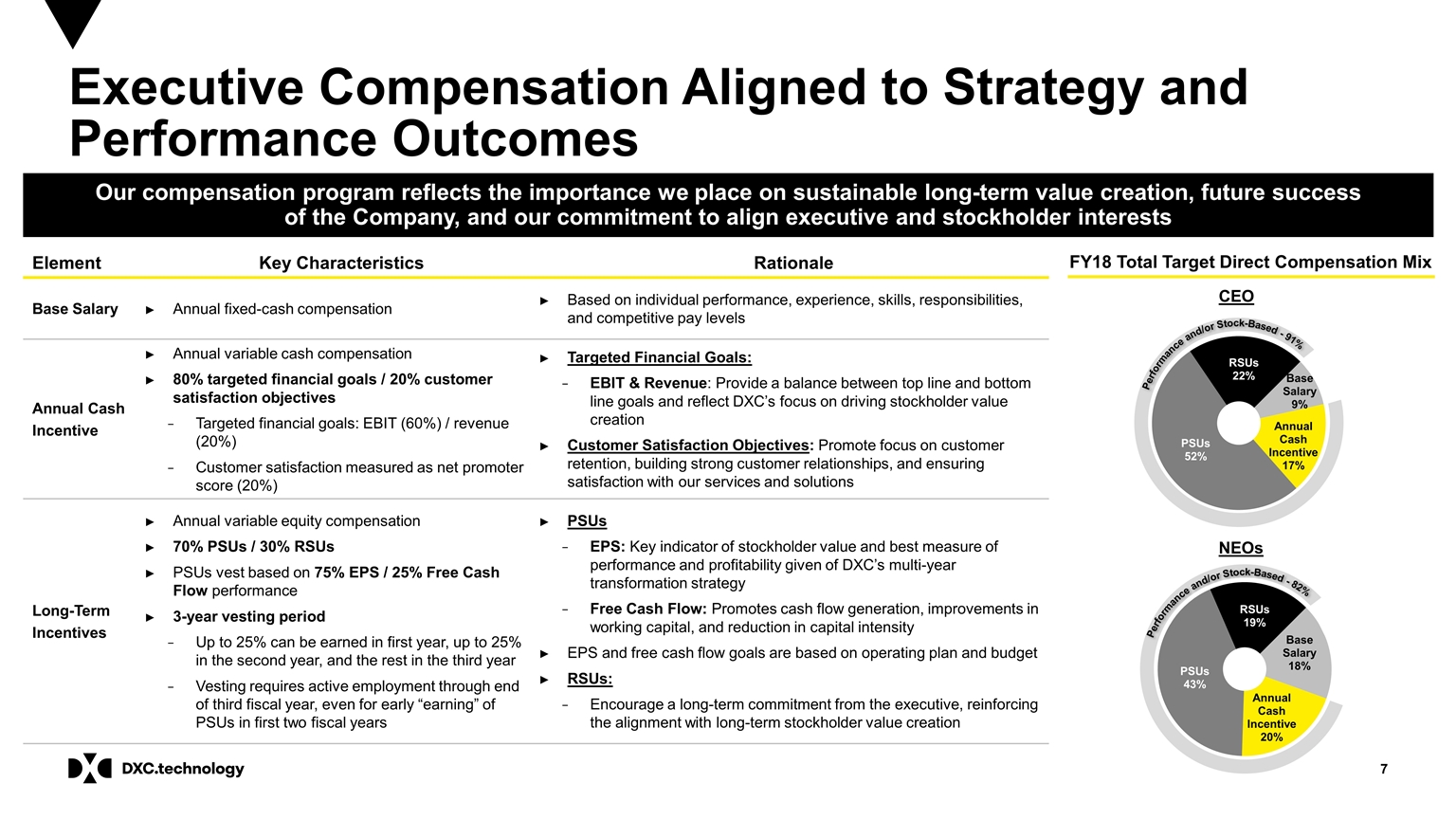

CEO Element Key Characteristics Rationale Base Salary Annual fixed-cash compensation Based on individual performance, experience, skills, responsibilities, and competitive pay levels Annual Cash Incentive Annual variable cash compensation 80% targeted financial goals / 20% customer satisfaction objectives Targeted financial goals: EBIT (60%) / revenue (20%) Customer satisfaction measured as net promoter score (20%) Targeted Financial Goals: EBIT & Revenue: Provide a balance between top line and bottom line goals and reflect DXC’s focus on driving stockholder value creation Customer Satisfaction Objectives: Promote focus on customer retention, building strong customer relationships, and ensuring satisfaction with our services and solutions Long-Term Incentives Annual variable equity compensation 70% PSUs / 30% RSUs PSUs vest based on 75% EPS / 25% Free Cash Flow performance 3-year vesting period Up to 25% can be earned in first year, up to 25% in the second year, and the rest in the third year Vesting requires active employment through end of third fiscal year, even for early “earning” of PSUs in first two fiscal years PSUs EPS: Key indicator of stockholder value and best measure of performance and profitability given of DXC’s multi-year transformation strategy Free Cash Flow: Promotes cash flow generation, improvements in working capital, and reduction in capital intensity EPS and free cash flow goals are based on operating plan and budget RSUs: Encourage a long-term commitment from the executive, reinforcing the alignment with long-term stockholder value creation Our compensation program reflects the importance we place on sustainable long-term value creation, future success of the Company, and our commitment to align executive and stockholder interests FY18 Total Target Direct Compensation Mix Executive Compensation Aligned to Strategy and Performance Outcomes Performance and/or Stock-Based - 91% NEOs Performance and/or Stock-Based - 82%

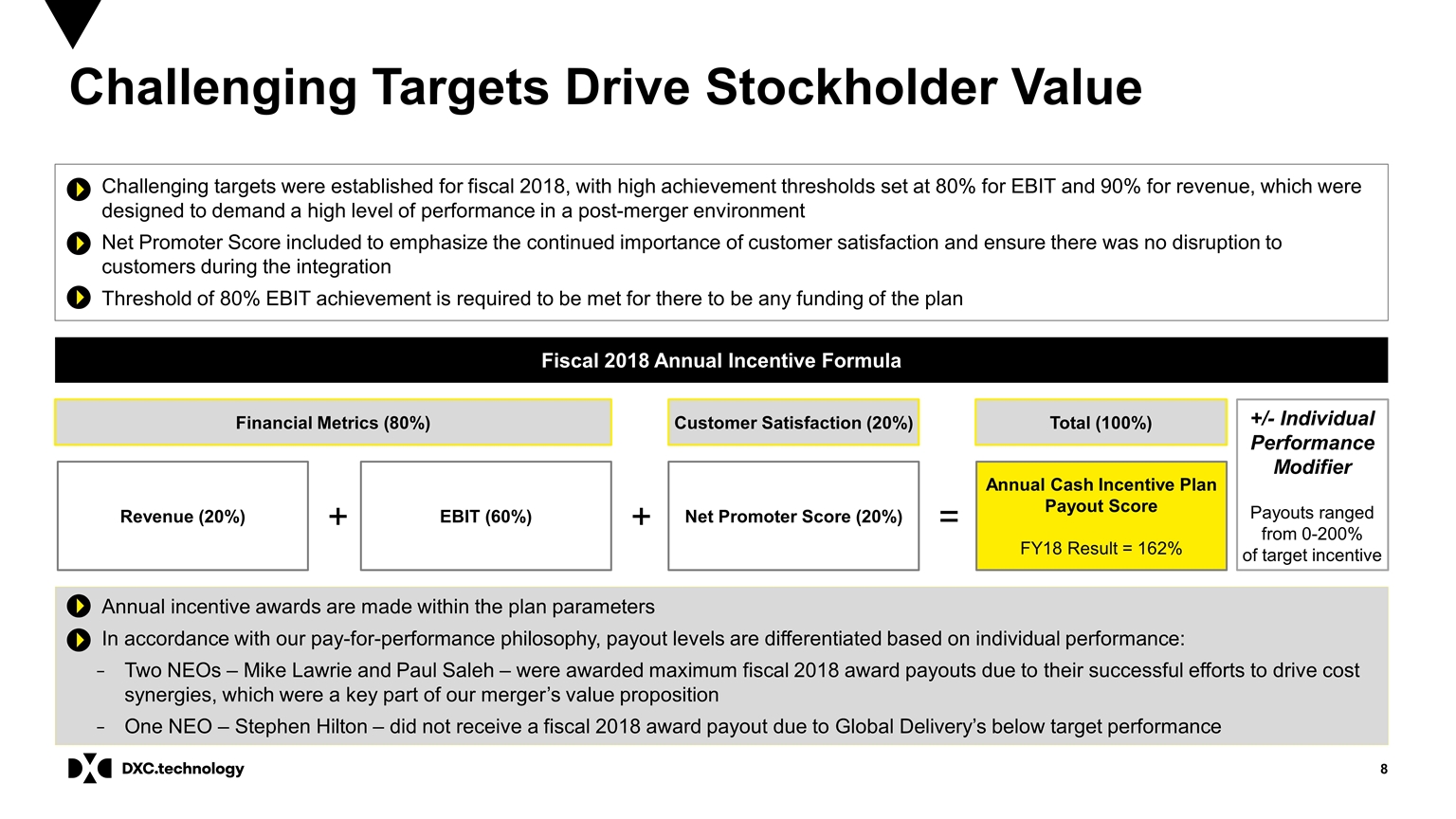

Challenging Targets Drive Stockholder Value Financial Metrics (80%) Customer Satisfaction (20%) Total (100%) Fiscal 2018 Annual Incentive Formula Revenue (20%) EBIT (60%) Net Promoter Score (20%) Annual Cash Incentive Plan Payout Score FY18 Result = 162% + + = +/- Individual Performance Modifier Challenging targets were established for fiscal 2018, with high achievement thresholds set at 80% for EBIT and 90% for revenue, which were designed to demand a high level of performance in a post-merger environment Net Promoter Score included to emphasize the continued importance of customer satisfaction and ensure there was no disruption to customers during the integration Threshold of 80% EBIT achievement is required to be met for there to be any funding of the plan Payouts ranged from 0-200% of target incentive Annual incentive awards are made within the plan parameters In accordance with our pay-for-performance philosophy, payout levels are differentiated based on individual performance: Two NEOs – Mike Lawrie and Paul Saleh – were awarded maximum fiscal 2018 award payouts due to their successful efforts to drive cost synergies, which were a key part of our merger’s value proposition One NEO – Stephen Hilton – did not receive a fiscal 2018 award payout due to Global Delivery’s below target performance

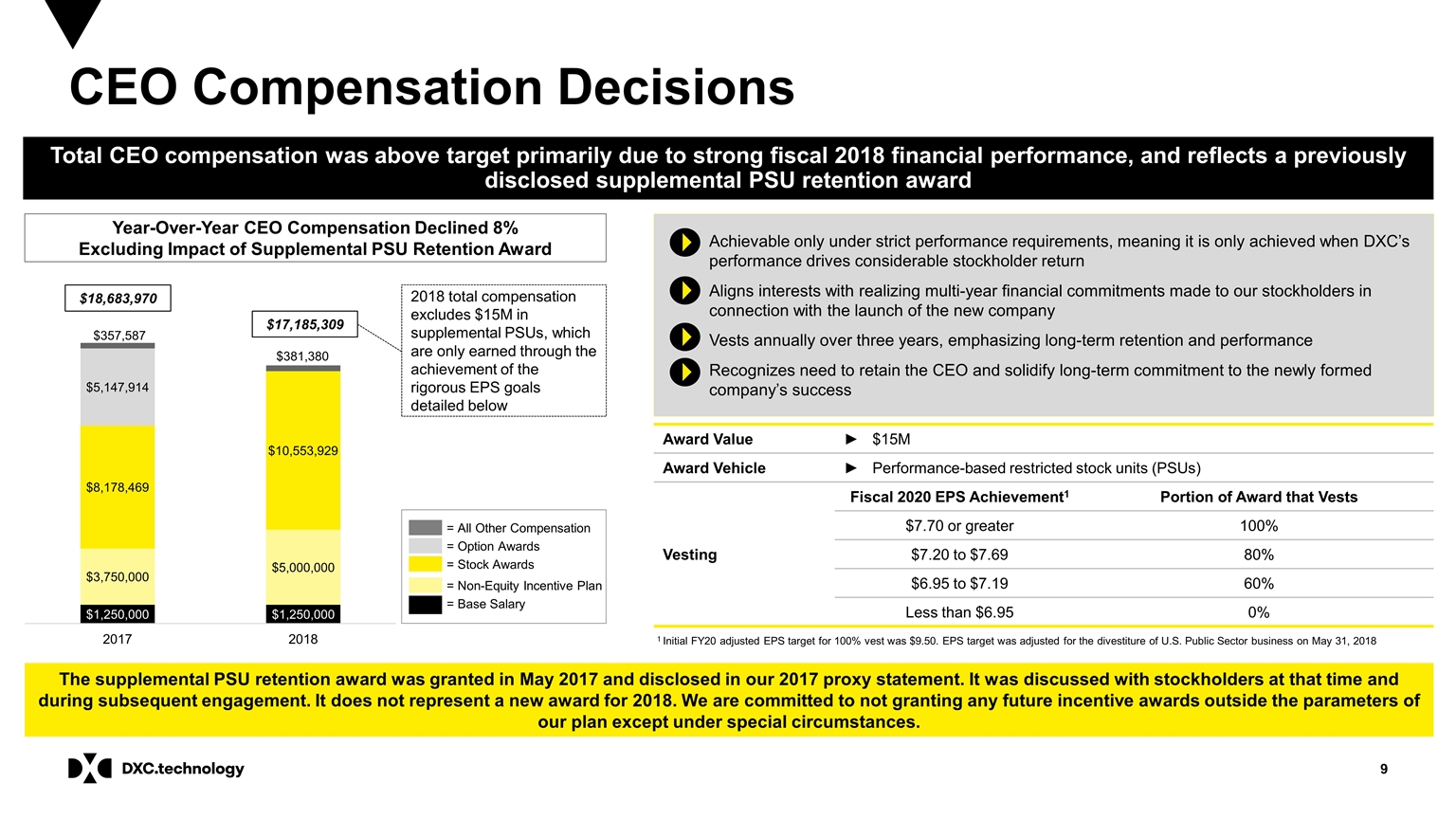

CEO Compensation Decisions Award Value $15M Award Vehicle Performance-based restricted stock units (PSUs) Vesting Fiscal 2020 EPS Achievement1 Portion of Award that Vests $7.70 or greater 100% $7.20 to $7.69 80% $6.95 to $7.19 60% Less than $6.95 0% 1 Initial FY20 adjusted EPS target for 100% vest was $9.50. EPS target was adjusted for the divestiture of U.S. Public Sector business on May 31, 2018 Achievable only under strict performance requirements, meaning it is only achieved when DXC’s performance drives considerable stockholder return Aligns interests with realizing multi-year financial commitments made to our stockholders in connection with the launch of the new company Vests annually over three years, emphasizing long-term retention and performance Recognizes need to retain the CEO and solidify long-term commitment to the newly formed company’s success Year-Over-Year CEO Compensation Declined 8% Excluding Impact of Supplemental PSU Retention Award $17,185,309 $18,683,970 = All Other Compensation = Option Awards = Stock Awards = Non-Equity Incentive Plan = Base Salary 2018 total compensation excludes $15M in supplemental PSUs, which are only earned through the achievement of the rigorous EPS goals detailed below Total CEO compensation was above target primarily due to strong fiscal 2018 financial performance, and reflects a previously disclosed supplemental PSU retention award The supplemental PSU retention award was granted in May 2017 and disclosed in our 2017 proxy statement. It was discussed with stockholders at that time and during subsequent engagement. It does not represent a new award for 2018. We are committed to not granting any future incentive awards outside the parameters of our plan except under special circumstances.

Our Board believes in sound corporate governance and thoughtfully considers stockholder feedback in making decisions on governance processes and compensation programs Sound Compensation and Governance Practices Majority of total compensation at-risk (91% of CEO pay) Significant stock ownership guidelines for directors and executive officers (7x base salary for CEO and 3x base salary for other NEOs) Emphasis on pay-for-performance alignment Clawback policy Anti-hedging policy Use of multiple performance metrics No excise tax gross-ups No single-trigger change-in-control benefits Independent compensation consultant Compensation Best Practices Lead Independent Director with clearly defined role and set of responsibilities Majority voting for directors Annual Board and Committee assessments Annual evaluation of the CEO’s performance by the independent directors Stockholder right to written consent and to call a special meeting Annual director elections Stockholder engagement program Director education program Robust process around talent and succession planning Implemented in 2018: Eliminated supermajority voting requirement for stockholders to amend Bylaws Proxy access (3% / 3 years / 2 directors or 20% of Board / 20 aggregation limit) Governance Best Practices

Additional Information and Where To Find It All statements in this presentation that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. For a written description of these factors, see the section titled “Risk Factors” in DXC’s Form 10-K for the fiscal year ended March 31, 2018 and any updating information in subsequent SEC filings. No assurance can be given that any goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to reflect the occurrence of unanticipated events except as required by law. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.