Form 8-K NET 1 UEPS TECHNOLOGIES For: May 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 5, 2018 (June 28, 2018)

NET 1 UEPS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Florida | 000-31203 | 98-0171860 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

President Place, 4th Floor, Cnr. Jan

Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

(Address of principal executive

offices)

(ZIP Code)

Registrant’s telephone number, including area code: 27-11-343-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: [ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e -4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry Into a Material Definitive Agreement.

Revolving Credit Facility Agreement

On June 28, 2018, DNI-4PL Contracts Proprietary Limited (“DNI”) entered into a revolving credit facility agreement (the “Credit Agreement”) with FirstRand Bank Limited (acting through its Rand Merchant Bank division), a South African corporate and investment bank in its capacity as lender and agent (in such capacities, the “Lender”), and K2018318388 (South Africa) (RF) Proprietary Limited (“Debt Guarantor”), a South African company incorporated for the sole purpose of holding collateral for the benefit of the Lender and acting as debt guarantor. Pursuant to the terms of the Credit Agreement, DNI may borrow up to ZAR 200.0 million, through June 2021, from the Lender to finance the acquisition and/or requisition of telecommunication towers.

DNI has agreed to ensure that Net1 SA will become bound by the terms and conditions applicable to the other DNI shareholders party to the shareholder guarantee, cession and pledge agreement referred to below once the DNI shares pledged as security for the July 2017 facilities are released.

The Credit Agreement contains customary covenants that require DNI to maintain specified net senior debt to EBITDA and EBITDA to net senior interest ratios and restrict the ability of DNI, and certain of its subsidiaries to make certain distributions with respect to their capital stock, prepay other debt, encumber assets, incur additional indebtedness, make investments above specified levels, engage in certain business combinations and various other corporate activities.

Interest on the revolving credit facility is payable quarterly based on the Johannesburg Interbank Agreed Rate (“JIBAR”) in effect from time to time plus a margin of 2.75% . The JIBAR rate was 6.958% on June 29, 2018. DNI paid a non-refundable deal origination fee of approximately ZAR 2.3 million ($0.2 million) to the Lender in July 2018.

Subordination Agreement

Concurrent with the execution of the Credit Agreement, DNI entered into a subordination agreement (the “Subordination Agreement”) among the parties set forth on Annexure A thereto, the Lender and the Debt Guarantor, pursuant to which, among other things, the Subordinating Parties (as defined in the Subordination Agreement) agreed to subordinate any and all of their claims against the obligors set forth in the Credit Agreement to those claims of the Lender and the Debt Guarantor.

Shareholder Guarantee, Cession and Pledge Agreement

Concurrent with the execution of the Credit Agreement, DNI also entered into a shareholder guarantee, cession and pledge agreement among AJD Holdings Proprietary Limited (“AJD”), Richmark Holdings Proprietary Limited (“Richmark”), the Debt Guarantor and FirstRand Bank Limited (acting through its Rand Merchant Bank division) in its capacity as agent (in such capacity, the “Agent”), pursuant to which, among other things, AJD and Richmark agreed to guarantee certain obligations to the Lender under the Credit Agreement, pledge all of their shares in DNI and cede certain assets to the Debt Guarantor.

Guarantee, Cession and Pledge Agreement

Concurrent with the execution of the Credit Agreement, DNI also entered into a guarantee, cession and pledge agreement (the “DNI Guarantee”) among the parties set forth on Annexure A thereto, the Debt Guarantor and the Agent, pursuant to which, among other things, the Guarantors (as defined in the DNI Guarantee) agreed to guarantee certain obligations to the Lender under the Credit Agreement, pledge all of their shares in DNI and cede certain assets to the Debt Guarantor.

Debt Guarantor Management Agreement

Concurrent with the execution of the Credit Agreement, DNI also entered into a debt guarantor management agreement (the “Management Agreement”) among the Debt Guarantor, the Agent, and TMF Corporate Services (South Africa) Proprietary Limited, in its capacity as administrator (the “Administrator”), pursuant to which, among other things, the Administrator agreed to perform and provide certain administrative services for the Debt Guarantor related to the Credit Agreement.

Counter-indemnity Agreement

Concurrent with the execution of the Credit Agreement, DNI also entered into a counter-indemnity agreement in favor of the Debt Guarantor, pursuant to which, among other things, DNI agreed to indemnify and hold harmless the Debt Guarantor against claims related to Debt Guarantor’s guarantee of DNI’s obligations under the Credit Agreement.

The descriptions of the documents above do not purport to be complete and are qualified in their entirety by reference to the full text thereof, copies of which are attached hereto as Exhibits 10.89 through 10.94 and are incorporated herein by reference.

On June 30, 2018, the USD/ZAR exchange rate was $1.00 / ZAR 13.70.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Form 8-K is incorporated by reference.

Item 8.01. Other Events

The Company, through Net1 SA, has closed its acquisition of DNI and will consolidate its voting and economic interest in DNI from June 30, 2018. DNI has settled the ZAR 126.0 million ($9.2 million) loan due to Net1 SA on June 28, 2018, and Net1 SA has paid ZAR 126.0 million for an additional 6% in DNI, increasing Net1 SA’s voting and economic interest in DNI to 55%. Net1 SA is required to pay DNI an additional amount, not to exceed ZAR 400.0 million ($29.2 million), in cash, subject to DNI achieving certain performance targets, upon the finalization of DNI’s audited annual financial statements for the fiscal year ending June 30, 2019.

Item 9.01. Financial Statements and Exhibits.

| (d) |

Exhibits |

| Exhibit No. |

Description |

| 10.89 | |

| 10.90 | |

| 10.91 | |

| 10.92 | |

| 10.93 | |

| 10.94 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NET 1 UEPS TECHNOLOGIES, INC. | |

| Date: July 5, 2018 | By: /s/ Alex M.R. Smith |

| Name: Alex M.R. Smith | |

| Title: Chief Financial Officer |

Exhibit 10.89

REVOLVING CREDIT FACILITY

AGREEMENT

between

DNI-4PL CONTRACTS PROPRIETARY LIMITED

(as Borrower)

and

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND

MERCHANT BANK DIVISION)

(as Lender and Agent)

and

K2018318388 (SOUTH AFRICA) (RF) PROPRIETARY LIMITED

(as Debt Guarantor)

TABLE OF CONTENTS

| 38 | COUNTERPARTS | 94 |

| 39 | WAIVER OF IMMUNITY | 94 |

| 40 | SOLE AGREEMENT | 95 |

| 41 | NO IMPLIED TERMS | 95 |

| 42 | GOVERNING LAW | 95 |

| 43 | JURISDICTION | 95 |

ANNEXURES

1

| 1 |

PARTIES |

| 1.1 |

The Parties to this Agreement are – |

| 1.1.1 |

DNI-4PL Contracts Proprietary Limited, registration number 2005/040937/07 (as "Borrower"); |

| 1.1.2 |

FirstRand Bank Limited (acting through its Rand Merchant Bank division), registration number 1929/001225/06 (as "Lender" and "Agent"); and |

| 1.1.3 |

K2018318388 (South Africa) (RF) Proprietary Limited, registration number 2018/318388/07 (as "Debt Guarantor"). |

| 1.2 |

The Parties agree as set out below. |

| 2 |

DEFINITIONS AND INTERPRETATION |

| 2.1 |

Definitions |

In this Agreement –

| 2.1.1 |

"Acceptable Bank" means – |

| 2.1.1.1 |

the Lender; |

| 2.1.1.2 |

a commercial bank or trust company which has a rating of Baa2 or higher by Moody's or BBB or higher by Standard & Poor's or Fitch, or a comparable rating from a nationally recognised credit rating agency; |

| 2.1.1.3 |

in the case of cash held in South Africa, means the FirstRand Bank Limited, Nedbank Limited, Investec Bank Limited, The Standard Bank of South Africa Limited and Absa Bank Limited; or |

| 2.1.1.4 |

any other commercial bank or trust company which has been approved as an Acceptable Bank by the Agent; |

| 2.1.2 |

"Accounting Reference Date" means the financial year end date for the Group being 30 June; |

| 2.1.3 |

"Accrued Interest" means any interest which has accrued on each Loan pursuant to clause 9.1 (Calculation of Interest); |

| 2.1.4 |

"Agreement" means this agreement and its Annexures; |

| 2.1.5 |

"Affiliate" means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company; |

2

| 2.1.6 |

"AJD" means AJD Holdings Proprietary Limited, registration number 1975/004328/07, a private company duly incorporated in accordance with the laws of South Africa; |

| 2.1.7 |

"Asset Value" means the Fair Market Value (net of any deferred tax liabilities) of all tangible assets of the Group, which shall include cash and cash equivalents but excluding goodwill and other intangible assets; |

| 2.1.8 |

"Auditors" means one of PWC, E&Y, KPMG or Deloittes or any other firm approved in advance by the Lender (such approval not to be unreasonably withheld or delayed); |

| 2.1.9 |

"Authorisation" means an authorisation, consent, approval, resolution, licence, permit, exemption, filing, notarisation, lodgement or registration; |

| 2.1.10 |

"Availability Period" means the period from and including the Fulfilment Date to and including the date falling ninety days prior to the Final Repayment Date; |

| 2.1.11 |

"Available Commitment" means the Commitment less – |

| 2.1.11.1 |

the amount of its participation in any outstanding Loans; and |

| 2.1.11.2 |

in relation to any proposed Utilisation, the amount of any Loans that are due to be repaid or prepaid on or before the proposed Utilisation Date; |

| 2.1.12 |

"Available Facility" means the aggregate for the time being of the Available Commitment; |

| 2.1.13 |

"Base Rate" means – |

| 2.1.13.1 |

in respect of each Interest Period other than a Broken Interest Period, JIBAR; or |

| 2.1.13.2 |

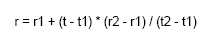

in respect of any Broken Interest Period, the rate calculated with reference to the following formula: |

| where: | |||

| r | = | the Base Rate to be determined in respect of that Broken Interest Period; | |

| r1 | = | JIBAR Overnight Deposit Rate plus 10 basis points; | |

| r2 | = | JIBAR; | |

| t1 | = | the number of days applicable to the period for which r1 is quoted on the first day of that Broken Interest Period; | |

| t2 | = | the total number of days applicable to the period for which r2 is quoted on the first day of that Broken Interest Period; and | |

3

| t | = | the total number of days in that Broken Interest Period; |

| 2.1.14 |

"Basel III" means – |

| 2.1.14.1 |

the global regulatory framework on bank capital and liquidity contained in "Basel III: A global regulatory framework for more resilient banks and banking systems", "Basel III: International framework for liquidity risk measurement, standards and monitoring" and "Guidance for national authorities operating in the countercyclical capital buffer" published by the Basel Committee on Banking Supervision in December 2010, each as amended, supplemented or restated; |

| 2.1.14.2 |

the rules for global systemically important banks contained in "Global systemically important banks: assessment methodology and the additional loss absorbency requirement - Rules text" published by the Basel Committee on Banking Supervision in November 2011, as amended, supplemented or restated; and |

| 2.1.14.3 |

any further guidance or standards published by the Basel Committee on Banking Supervision relating to "Basel III"; |

| 2.1.15 |

"Break Costs" means the amount (if any) determined by the Agent by which – |

| 2.1.15.1 |

the interest (excluding the Margin) which the Lender should have received for the period from the date of receipt of all or any part of a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; exceeds – |

| 2.1.15.2 |

the amount which the Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period; |

| 2.1.16 |

"Break Gains" means the amount (if any) determined by the Agent by which – |

| 2.1.16.1 |

the amount which the Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period; |

|

exceeds – | |

| 2.1.16.2 |

the interest (excluding the Margin) which the Lender should have received for the period from the date of receipt of all or any part of a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; |

4

| 2.1.17 |

"Broken Interest Period" means any Interest Period, to the extent that such Interest Period is less than three Months; |

| 2.1.18 |

"Business Day" means a day (other than a Saturday, a Sunday or official public holiday) on which banks are open for general business in Johannesburg; |

| 2.1.19 |

"Cash and Cash Equivalents" means, in relation to a person at any time - |

| 2.1.19.1 |

cash in hand or on deposit with: (i) any Acceptable Bank; |

| 2.1.19.2 |

certificates of deposit, maturing within one year after the relevant date of calculation, issued by an Acceptable Bank; |

| 2.1.19.3 |

any investment in marketable obligations issued or guaranteed by the government of the United States of America, the UK or any member state of the European Economic Area or by an instrumentality or agency of any of them having an equivalent credit rating which - |

| 2.1.19.3.1 |

matures within one year after the date of the relevant calculation; and |

| 2.1.19.3.2 |

is not convertible to any other security; |

| 2.1.19.4 |

any other debt, security or investment approved by the Lender, |

in each case, to which any member of the Group is beneficially entitled at that time and which is capable of being applied against Gross Senior Debt. For avoidance of doubt it does not include any asset listed in paragraphs 2.1.19.1 to 2.1.19.4 above which is the subject of Security, unable to be utilised without the consent of another person;

| 2.1.20 |

"CDH" means Cliffe Dekker Hofmeyr Inc; |

| 2.1.21 |

"Cell C" means Cell C Proprietary Limited, registration number 1999/007722/07, a private company duly incorporated in accordance with the laws of South Africa or any of its Affiliates; |

| 2.1.22 |

"Code" means the US Internal Revenue Code of 1986; |

| 2.1.23 |

"Commitment" means ZAR200,000,000; |

| 2.1.24 |

"Companies Act" means the Companies Act, No 71 of 2008; |

| 2.1.25 |

"Compliance Certificate" means a certificate substantially in the form set out in Annexure D (Form of Compliance Certificate); |

5

| 2.1.26 |

"Conditions Precedent" means all of the documents and other evidence listed in (or if no actual document is specified, contemplated by) Annexure A (Conditions Precedent); |

| 2.1.27 |

"Confidential Information" means all information relating to the Group, the Finance Documents or the Facility information of which a Finance Party becomes aware in its capacity as, or for the purpose of becoming, a Finance Party or which is received by a Finance Party in relation to, or for the purpose of becoming a Finance Party under the Finance Documents or the Facility from either – |

| 2.1.27.1 |

any member of the Group or any of its advisers; or |

| 2.1.27.2 |

another Finance Party, if the information was obtained by that Finance Party directly or indirectly from any member of the Group or any of its advisers, |

in whatever form, and includes information given orally and any document, electronic file or any other way of representing or recording information which contains or is derived or copied from such information but excludes –

| 2.1.27.3 |

information that – |

| 2.1.27.3.1 |

is or becomes public information other than as a direct or indirect result of any breach by that Finance Party of clause 35 (Confidential Information); or |

| 2.1.27.3.2 |

is identified in writing at the time of delivery as non-confidential by any member of the Group or any of its advisers; or |

| 2.1.27.3.3 |

is known by that Finance Party before the date the information is disclosed to it in accordance with paragraphs 2.1.27.1 or 2.1.27.2 above or is lawfully obtained by that Finance Party after that date, from a source which is, as far as that Finance Party is aware, unconnected with the Group and which, in either case, as far as that Finance Party is aware, has not been obtained in breach of, and is not otherwise subject to, any obligation of confidentiality; and |

| 2.1.27.3.4 |

any Funding Rate or Reference Bank Quotation; |

| 2.1.28 |

"Confidentiality Undertaking" means a confidentiality undertaking substantially in the recommended form of the Loan Market Association or in any other form agreed between the Borrower and the Agent; |

| 2.1.29 |

"Consortium" means, collectively – |

| 2.1.29.1 |

AJD; and |

| 2.1.29.2 |

Richmark, |

6

|

which Consortium is led by Dunn; | |

| 2.1.30 |

"Control" means, in relation to any person, the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to – |

| 2.1.30.1 |

cast, or control the casting of, 50.1% of the maximum number of votes that might be cast at a general meeting of that person; |

| 2.1.30.2 |

hold beneficially 50.1% of the issued share capital (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); |

| 2.1.30.3 |

appoint or remove all, or the majority, of the directors or other equivalent offices of that person; or |

| 2.1.30.4 |

give directions with respect to the operating and financial policies of that person with which the directors or other equivalent officers of that person are obliged to comply; |

| 2.1.31 |

"Counter-Indemnity Agreement" means the counter-indemnity agreement, dated on or about the Signature Date, between the Borrower and the Debt Guarantor; |

| 2.1.32 |

"Debt Guarantee" means the first-ranking debt guarantee, concluded or to be concluded on or about the Signature Date, between the Debt Guarantor and the Finance Parties (other than the Debt Guarantor) as security for the obligations of the Borrower owed to those Finance Parties under the Finance Documents; |

| 2.1.33 |

"Debt Guarantor Management Agreement" means the agreement for the management and administration of the Debt Guarantor, concluded or to be concluded on or about the Signature Date, between the Debt Guarantor, the Agent, the Borrower and TMF Corporate Services (South Africa) Proprietary Limited; |

| 2.1.34 |

"Default" means an Event of Default or any event or circumstance specified in clause 23 (Events of Default) which would (with the expiry of any applicable grace period, the giving of notice, the making of any determination under the Finance Documents or any combination of any of the foregoing) be an Event of Default; |

| 2.1.35 |

"Discharge Date" means the date on which – |

| 2.1.35.1 |

the Facility Outstandings (including without limitation contingent liabilities in respect of continuing indemnities under the Finance Documents, other than contingent liabilities in respect of continuing indemnities in respect of which no claim has been made and which remain undischarged) have been fully and finally paid and discharged, whether or not as a result of enforcement; and |

7

| 2.1.35.2 |

the Lender has no commitment, obligation or liability (whether actual or contingent) to lend money or provide other financial accommodation to the Borrower under any Finance Document; |

| 2.1.36 |

"Disposal" means a sale, lease, licence, transfer, loan or other disposal by a person of any asset, undertaking or business (whether by a voluntary or involuntary single transaction or series of transactions), and "Dispose" shall have a corresponding meaning; |

| 2.1.37 |

"Disruption Event" means either or both of – |

| 2.1.37.1 |

a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; or |

| 2.1.37.2 |

the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing that, or any other Party – |

| 2.1.37.2.1 |

from performing its payment obligations under the Finance Documents; or |

| 2.1.37.2.2 |

from communicating with other Parties in accordance with the terms of the Finance Documents, and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted; |

| 2.1.38 |

"DNI Retail" means DNI Retail Proprietary Limited, registration number 2002/014708/07, a private company duly incorporated in accordance with the laws of South Africa; |

| 2.1.39 |

"Distribution" means, in relation to any company, any payment (whether in cash or in specie and whether by way of set-off, counterclaim or otherwise) by way of interest or principal (whether in respect of an inter-company loan or otherwise), dividend, redemption, fee, royalty or other distribution or payment (including by way of the repurchase of any shares) by or on behalf of that company to or for the account of any direct or indirect shareholder, member, beneficiary or partner of that company or any direct or indirect holder of an economic or beneficial ownership interest in that company or any person that directly or indirectly controls or is controlled by any shareholder, member, beneficiary or partner of that company or any holder of an economic or beneficial ownership interest in that entity, and the term "Distribution" shall include a "distribution", as such term is defined in the Companies Act; |

8

| 2.1.40 |

"Dunn" means Andrew James Dunn, identity number XXX, an adult South African male; |

| 2.1.41 |

"EBITDA" means, in respect of any Measurement Period, the consolidated operating income of the Group (as determined in accordance with IFRS) before the inclusion of the following items - |

| 2.1.41.1 |

interest charged per the income statement; |

| 2.1.41.2 |

Tax charged per the income statement; |

| 2.1.41.3 |

depreciation and amortisation of any intangibles as per the income statement; |

| 2.1.41.4 |

any exceptional, one off, non-recurring or extraordinary items; |

| 2.1.41.5 |

any unrealised gains and losses on any financial instrument which is reported through the income statement; |

| 2.1.41.6 |

any increase or decrease in the foreign currency translation reserves accounted for in the income statement; |

| 2.1.41.7 |

any charge for impairment of goodwill or any reversal of any impairment of goodwill charge, |

but after inclusion interest accrued or received as per the income statement, as determined in accordance with IFRS in each case during such Measurement Period;

| 2.1.42 |

"EBITDA to Net Senior Interest Ratio" means, in respect of any Measurement Period - |

| 2.1.42.1 |

EBITDA; |

| 2.1.42.2 |

divided by Senior Interest Charged, |

in each case for such Measurement Period;

| 2.1.43 |

"Environment" means humans, animals, plants and all other living organisms including the ecological systems of which they form part and the following media – |

| 2.1.43.1 |

air (including, without limitation, air within natural or man-made structures, whether above or below ground); |

| 2.1.43.2 |

water (including, without limitation, territorial, coastal and inland waters, water under or within land and water in drains and sewers); and |

| 2.1.43.3 |

land (including, without limitation, land under water); |

9

| 2.1.44 |

"Environmental Claim" means any claim, proceeding, formal notice or investigation by any person in respect of any Environmental Law; |

| 2.1.45 |

"Environmental Law" means any applicable law or regulation which relates to – |

| 2.1.45.1 |

the pollution or protection of the Environment; |

| 2.1.45.2 |

harm to or the protection of human health; |

| 2.1.45.3 |

the conditions of the workplace; or |

| 2.1.45.4 |

the generation, handling, storage, use, release, emission or spillage of any substance which, alone or in combination with any other, is capable of causing harm to the Environment, including, without limitation, any waste; |

| 2.1.46 |

"Environmental Permits" means any permit and other Authorisation and the filing of any notification, report or assessment required under any Environmental Law for the operation of the business of any member of the Group conducted on or from the properties owned or used by any member of the Group; |

| 2.1.47 |

"Event of Default" means any event or circumstance specified as such in clause 23 (Events of Default); |

| 2.1.48 |

"Exclusivity Agreement" means the master framework agreement concluded between ITC and Cell C on 5 August 2016; |

| 2.1.49 |

"Existing Financial Indebtedness" means any Financial Indebtedness existing at the Signature Date and set out in Annexure F (Disclosure Schedule) to the extent not increased after the Signature Date; |

| 2.1.50 |

"Facility" means the revolving loan facility made available under this Agreement as described in clause 3 (The Facility); |

| 2.1.51 |

"Facility Outstandings" means, at any time, the aggregate of the Loans and all and any other amounts due and payable to the Lender on account of the Facility, including, without limitation, any Break Costs, bona fide claim for damages or restitution and any claim as a result of any recovery by the Borrower of a payment or discharge on the grounds of preference, and any amounts which would be included in any of the above but for any discharge, non-provability or unenforceability; |

| 2.1.52 |

"Fair Market Value" means the value determined or confirmed by an independent valuation expert appointed by the Agent, acting as an expert and not as an arbitrator (taking into account the terms and conditions of the Finance Documents), whose determination will, in the absence of manifest error, be final and binding on the Parties; |

10

| 2.1.53 |

"Final Repayment Date" means the date falling three years after the Fulfilment Date; |

| 2.1.54 |

"Finance Charges" means, in respect of any Measurement Period, all finance costs in respect of any Financial Indebtedness whether paid, payable or capitalised, incurred by any member of the Group (and calculated on a consolidated basis) in respect of that Measurement Period and - |

| 2.1.54.1 |

including the interest (but not the capital element) of payments in respect of finance leases; and |

| 2.1.54.2 |

including any commission, fees, discounts and other finance payments payable by (and deducting any such amounts payable to) any member of the Group under any interest rate hedging arrangement, |

and so that no amount shall be added or deducted more than once;

| 2.1.55 |

"Finance Documents" means – |

| 2.1.55.1 |

this Agreement; |

| 2.1.55.2 |

the M4J Undertaking; |

| 2.1.55.3 |

the Security Documents; |

| 2.1.55.4 |

the Subordination Agreement; |

| 2.1.55.5 |

each Utilisation Request; |

| 2.1.55.6 |

each Compliance Certificate; |

| 2.1.55.7 |

any document amending the Finance Documents listed in clauses 2.1.55.1 and 2.1.55.2 above; and |

| 2.1.55.8 |

any other document designated as such by the Agent and the Borrower, |

and "Finance Document" means any one of them, as the context may require;

| 2.1.56 |

"Finance Party" means the Agent, the Debt Guarantor or the Lender and "Finance Parties" means all or some of them, as the context may require; |

| 2.1.57 |

"Financial Covenants" means the financial covenants listed in clause 21 (Financial Covenants) below; |

| 2.1.58 |

"Financial Indebtedness" means any indebtedness for or in respect of – |

| 2.1.58.1 |

moneys borrowed; |

11

| 2.1.58.2 |

any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; |

| 2.1.58.3 |

any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| 2.1.58.4 |

the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with IFRS, be treated as a finance or capital lease |

| 2.1.58.5 |

receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

| 2.1.58.6 |

any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other clause of this definition having the commercial effect of a borrowing; |

| 2.1.58.7 |

any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) shall be taken into account); |

| 2.1.58.8 |

any amount raised by the issue of shares which are redeemable; |

| 2.1.58.9 |

any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; and the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs 2.1.58.1 to 2.1.58.9 above; |

| 2.1.59 |

"Fulfilment Date" means the date on which the Agent issues the notice contemplated at clause 5.1 (Initial Condition Precedent) confirming that the Conditions Precedent have been satisfied in form and substance satisfactory to it; |

| 2.1.60 |

"Funding Rate" means any individual rate notified by the Lender to the Agent pursuant to clause 11.4.1.2 (Cost of Funds); |

| 2.1.61 |

"General Notarial Bond" means each general notarial bond given by an Obligor in favour of the Debt Guarantor over all of the moveable assets of that Obligor, as continuing covering security for the obligations of the Borrower to the Debt Guarantor under the Finance Documents (including a special power of attorney in favour of CDH to pass and lodge that bond for registration with the applicable statutory public registry); |

| 2.1.62 |

"Gross Senior Debt" means all Financial Indebtedness of the Group other than Financial Indebtedness which is subordinated to the claims of the Finance Parties in terms of the Subordination Agreement or otherwise on terms to the satisfaction of the Agent; |

12

| 2.1.63 |

"Gross Senior Debt to EBITDA Ratio" means in respect of any Measurement Period - |

| 2.1.63.1 |

Gross Senior Debt as at the last day of the applicable Measurement Period; |

| 2.1.63.2 |

divided by EBITDA for such Measurement Period; |

| 2.1.64 |

"Group" means – |

| 2.1.64.1 |

the Borrower; |

| 2.1.64.2 |

M4J; |

| 2.1.64.3 |

DNI Retail; |

| 2.1.64.4 |

ITC; |

| 2.1.64.5 |

TSPC; |

| 2.1.64.6 |

Speckpack; |

| 2.1.64.7 |

each of the Borrower's direct and indirect Subsidiaries or joint venture companies from time to time; and |

| 2.1.64.8 |

each other person which the Borrower or a Subsidiary of the Borrower Controls; |

| 2.1.65 |

"Guarantee, Cession and Pledge Agreement" means a guarantee, cession and pledge agreement concluded or to be concluded on or about the Signature Date between, amongst others, the Borrower, each other Obligor and the Debt Guarantor; |

| 2.1.66 |

"Guarantors" means, collectively – |

| 2.1.66.1 |

the Original Guarantors; and |

| 2.1.66.2 |

any person, company or entity which is required to accede to the Guarantor Cession and Pledge Agreement and any other Finance Document as required in accordance with the provisions of clause 22.21 (Material Subsidiaries), |

and "Guarantor" means any one of them, as the context may require;

| 2.1.67 |

"Holding Company" means, in relation to a person, any other person in respect of which it is a Subsidiary; |

| 2.1.68 |

"IFRS" means international accounting standards within the meaning of the IAS Regulation 1606/2002 to the extent applicable to the relevant financial statements; |

13

| 2.1.69 |

"Indexed" means, in relation to any amount, adjusted annually for inflation in accordance with the consumer price index as published from time to time by Statistics SA in Statistical Release P0141 (referred to as Headline CPI - All Urban Areas (Primary and Secondary), any replacement statistical index published by Statistics SA from time to time, or such other index as may be agreed by the Agent and the Borrower; |

| 2.1.70 |

"Insurances" means the insurances obtained or maintained by an Obligor; |

| 2.1.71 |

"Interest Payment Date" means 31 March, 30 September, 30 June and 31 December of each year; |

| 2.1.72 |

"Interest Period" means – |

| 2.1.72.1 |

in relation to a Loan – |

| 2.1.72.1.1 |

each successive period of three Months commencing, in each case, on (and including) an Interest Payment Date and ending on (but excluding) the next Interest Payment Date, provided that – |

| 2.1.72.1.1.1 |

the first Interest Period shall commence on (and include) the Utilisation Date and end on (and exclude) the first Interest Payment Date to occur thereafter; and |

| 2.1.72.1.1.2 |

the last Interest Period shall commence on (and include) the Interest Payment Date immediately preceding Final Repayment Date and end on (and exclude) the Final Repayment Date; and |

| 2.1.72.2 |

in relation to an Unpaid Sum, each period determined in accordance with clause 9.5 (Default Interest); |

| 2.1.73 |

"ITC" means International Tower Corporation Proprietary Limited, registration number 2015/421641/07, a private company duly incorporated in accordance with the laws of South Africa; |

| 2.1.74 |

"JIBAR" means, in relation to any Loan the applicable Screen Rate – |

| 2.1.74.1 |

as of 11:00am on the Quotation Day for the offering of deposits in ZAR for a period equal in length to the Interest Period of the relevant Loan; or |

| 2.1.74.2 |

as otherwise determined pursuant to clause 11.1 (Unavailability of Screen Rate), and if, in either case, that rate is less than zero, then JIBAR shall be deemed to be zero; |

| 2.1.75 |

"JIBAR Overnight Deposit Rate" means, in respect of a Broken Interest Period – |

14

| 2.1.75.1 |

the applicable Screen Rate; or |

| 2.1.75.2 |

(if no Screen Rate is available for the relevant Interest Period) the arithmetic mean of the rates (rounded upwards to four decimal places), as supplied to the Lender at its request, quoted by the Reference Banks to leading banks in the Johannesburg Interbank Market, |

as of 11h00 on the Quotation Day for the offering of overnight deposits in ZAR;

| 2.1.76 |

"Johannesburg Market" means the South African interbank market; |

| 2.1.77 |

"Lender" means RMB; |

| 2.1.78 |

"Loan" means a loan made or to be made under the Facility or the principal amount outstanding for the time being of that loan; |

| 2.1.79 |

"Longstop Date" means 30 June 2018, or such later date as the Agent may agree in writing; |

| 2.1.80 |

"LTM Measurement Date" means the last day of March, June, September and December of each year; |

| 2.1.81 |

"LTM Measurement Period" means each period of twelve months ending on a LTM Measurement Date, with the first such period being the LTM Measurement Period ending on 30 September 2018; |

| 2.1.82 |

"M4J" means M4Jam Proprietary Limited, registration number 2003/011766/07, a private company duly incorporated in accordance with the laws of South Africa; |

| 2.1.83 |

"M4J Undertaking" means the letter of undertaking substantially in the form of the certificate set out in Annexure E (Form of Irrevocable Letter of Undertaking); |

| 2.1.84 |

"Margin" means 2.75% per annum; |

| 2.1.85 |

"Material Adverse Change" means an occurrence or circumstances which has or is reasonably be likely to have a material adverse effect on– |

| 2.1.85.1 |

the business, operations, property, condition (financial or otherwise) or prospects of the Borrower, and/or any other Obligor or the Group taken as a whole; |

| 2.1.85.2 |

the ability of any Obligor to perform any of its obligations under the Finance Documents; or |

| 2.1.85.3 |

the validity or enforceability of any of the Finance Documents or the validity or enforceability of, or the effectiveness ranking of any Security granted or purporting to be granted or the rights or remedies of the Finance Parties under any of the Finance Documents; |

15

| 2.1.86 |

"Material Subsidiary" means in respect of each financial year of the Borrower, any other person, company or entity (other than M4J) that – |

| 2.1.86.1 |

contributes more than 5% of (i) the EBITDA of the Group or (ii) the Asset Value of the Group or (iii) gross turnover of the Group in respect of such financial year; and |

| 2.1.86.2 |

individually contributes less than 5% of (i) the EBITDA of the Group or (ii) the Asset Value of the Group or (iii) gross turnover of the Group in respect of such financial year but collectively with other such members contributes more than 5% of (i) the EBITDA of the Group or (ii) the Asset Value of the Group or (iii) gross turnover of the Group in respect of such financial year, |

such that at all times until the Discharge Date the Guarantors contribute at least 90% in aggregate of (i) the EBITDA of the Group and (ii) the Asset Value of the Group and/or (iii) gross turnover of the Group in respect of such financial year;

| 2.1.87 |

"Measurement Date" means a LTM Measurement Date; |

| 2.1.88 |

"Measurement Period" means a LTM Measurement Period, and where applicable any forecast measurement period as the context requires; |

| 2.1.89 |

"Month" means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that – |

| 2.1.89.1 |

if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

| 2.1.89.2 |

if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and |

| 2.1.89.3 |

if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end; |

The above rules will only apply to the last Month of any period;

| 2.1.90 |

"Net1 SA" means Net1 Applied Technologies South Africa Proprietary Limited, registration number 2002/031446/07, a private company duly incorporated in accordance with the laws of South Africa; |

| 2.1.91 |

"Net Senior Interest to EBITDA Ratio" means all Gross Senior Debt after deducting Cash and Cash Equivalents; |

16

| 2.1.92 |

"Net Senior Debt" means all Gross Senior Debt after deducting Cash and Cash Equivalents; |

| 2.1.93 |

"Net Senior Debt to EBITDA Ratio" means in respect of any Measurement Period - |

| 2.1.93.1 |

Net Senior Debt as at the last day of the applicable Measurement Period; |

| 2.1.93.2 |

divided by EBITDA for such Measurement Period; |

| 2.1.94 |

"Obligors" means, collectively – |

| 2.1.94.1 |

the Borrower; and |

| 2.1.94.2 |

each Guarantor, |

and "Obligor" means any one of them, as the context may require;

| 2.1.95 |

"Original Financial Statements" means the audited consolidated financial statements of the Borrower for the financial year ended 30 June 2017; |

| 2.1.96 |

"Original Guarantors" means, collectively – |

| 2.1.96.1 |

DNI Retail; |

| 2.1.96.2 |

ITC; and |

| 2.1.96.3 |

TSPC, |

and "Original Guarantor" means any one of them, as the context may require;

| 2.1.97 |

"Permitted Distributions" means Distributions made by the Borrower to its Shareholders, provided that – |

| 2.1.97.1 |

at the time of the making of the proposed Distribution, there is no Default or Event of Default which has occurred and which is continuing; |

| 2.1.97.2 |

a Default or an Event of Default will not occur as a result of the proposed Distribution; and |

| 2.1.97.3 |

at the proposed Distribution date and for two Measurement Periods thereafter it will, taking into account the proposed Distribution, comply with the requirements of clause 8.8.1 (Amortisation Trigger) below; |

| 2.1.98 |

"Quotation Day" means, in relation to any period for which an interest rate is to be determined, the first day of that period unless market practice differs in the Johannesburg Market, in which case the Quotation Day will be determined by the Agent in accordance with market practice in Johannesburg Market (and if quotations would normally be given on more than one day, the Quotation Day will be the last of those days). |

17

| 2.1.99 |

"Reference Bank Quotation" means any quotation supplied to the Agent by a Reference Bank; |

|

| |

| 2.1.100 |

"Reference Bank Rate" means the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Agent at its request by the Reference Banks as the rate at which the relevant Reference Banks could borrow funds in the Johannesburg Market in ZAR and for the relevant period, were it to do so by asking for and then accepting interbank offers for deposits in that currency and for that period; or |

|

| |

| 2.1.101 |

"Reference Banks" means the principal Johannesburg offices of Absa Bank Limited, FirstRand Bank Limited, Investec Bank Limited, Nedbank Limited and The Standard Bank of South Africa Limited or such other entities as may be appointed by the Agent in consultation with the Borrower; |

|

| |

| 2.1.102 |

"Refinancing" means the repayment, prepayment or replacement of the entire Facility funded by way of the incurrence by the Borrower, any Affiliate, any other member of the Group and/or any of their shareholders of indebtedness from a third-party bank, and "Refinance" and "Refinanced" shall be construed accordingly; |

|

| |

| 2.1.103 |

"Registrable Security Documents" means, collectively – |

| 2.1.103.1 | each Special Notarial Bond; and |

| 2.1.103.2 | each General Notarial Bond, |

and "Registrable Security Document" means any one of them, as the context may require;

| 2.1.104 |

"Related Fund" in relation to a fund (the "first fund"), means a fund which is managed or advised by the same investment manager or investment adviser as the first fund or, if it is managed by a different investment manager or investment adviser, a fund whose investment manager or investment adviser is an Affiliate of the investment manager or investment adviser of the first fund; |

|

| |

| 2.1.105 |

"Repeating Representations" means each of the representations set out in clause 19.1 (Status) to clause 19.6 (Governing Law and Enforcement), clause 19.9 (No default), clause 19.10 (No Misleading Information), clause 19.11 (Financial Statements), clause 19.12 (Pari Passu Ranking), clause 19.17 (Authorised Signatures), clause 19.19 (No Immunity) and clause 19.21 (Anti-corruption and Sanctions). |

18

| 2.1.106 | "Representative" means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian; |

| 2.1.107 | "Richmark" means Richmark Holdings Proprietary Limited, registration number 2000/013818/07, a private company duly incorporated in accordance with the laws of South Africa " |

| 2.1.108 | "Sanctioned Entity" means — |

| 2.1.108.1 |

a person, country or territory which is listed on a Sanctions List or is subject to Sanctions; |

| 2.1.108.2 |

a person which is ordinarily resident in a country or territory which is listed on a Sanctions List or is subject to Sanctions; |

| 2.1.109 | "Sanctioned Transaction" means financing or providing any credit, directly or indirectly, to - |

| 2.1.109.1 |

a Sanctioned Entity; or |

| 2.1.109.2 |

any other person or entity, if the Borrower has actual knowledge that the person or entity proposes to use the proceeds of the financing or credit for the purpose of financing or providing any credit, directly or indirectly, to a Sanctioned Entity, |

in each case to the extent that to do so is prohibited by, or would cause any breach of, Sanctions;

| 2.1.110 | "Sanctions" means trade, economic or financial sanctions, laws, regulations, embargoes or restrictive measures imposed, administered or enforced from time to time by any Sanctions Authority; |

| 2.1.111 | "Sanctions Authority" means — |

| 2.1.111.1 | the United Nations; |

| 2.1.111.2 | the European Union; |

| 2.1.111.3 | the Council of Europe (founded under the Treaty of London, 1946); |

| 2.1.111.4 | the government of the United States of America; |

| 2.1.111.5 | the government of the United Kingdom; |

| 2.1.111.6 | the government of the Republic of France, |

and any of their governmental authorities, including, without limitation, the Office of Foreign Assets Control for the US Department of Treasury ("OFAC"), the US Department of Commerce, the US State Department or the US Department of the Treasury, Her Majesty's Treasury ("HMT") and the French Ministry of Finance;

19

| 2.1.112 | "Sanctions List" means— |

| 2.1.112.1 | the Specially Designated Nationals and Blocked Persons List maintained by OFAC; |

| 2.1.112.2 | the Consolidated List of Financial Sanctions Targets and the Investments Ban List maintained by HMT, |

and any similar list maintained, or a public announcement of a Sanctions designation made, by any Sanctions Authority, in each case as amended, supplemented or substituted from time to time;

| 2.1.113 |

"Screen Rate" means the mid-market rate for deposits in ZAR for the relevant period which appears on the Reuters Screen SAFEY Page alongside the caption 'Yield' at the applicable time (or any replacement Reuters page which displays that rate, or on the appropriate page of such other information service which publishes that rate from time to time in place of Reuters). If such page or service ceases to be available, the Agent may specify another page or service displaying the appropriate rate after consultation with the Borrower; |

|

| |

| 2.1.114 |

"Security" means a mortgage bond, notarial bond, cession in security, charge, pledge, hypothec, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect; |

|

| |

| 2.1.115 |

"Security Documents" means, collectively – |

| 2.1.115.1 | the Debt Guarantee; |

| 2.1.115.2 | the Counter-Indemnity Agreement; |

| 2.1.115.3 | the Shareholders Guarantee, Cession and Pledge Agreement; |

| 2.1.115.4 | the Guarantee, Cession and Pledge Agreement; |

| 2.1.115.5 | the Registrable Security Documents; |

| 2.1.115.6 | any document amending the Security Documents listed in clause 2.1.115.1 to 2.1.115.5; and |

| 2.1.115.7 | any other document designated as such by the Agent and the Borrower, |

and "Security Document" means any one of them, as the context may require;

| 2.1.116 | "Security Structure Documents" means, collectively – |

20

| 2.1.116.1 |

the memorandum of incorporation of the Debt Guarantor; |

|

| |

| 2.1.116.2 |

the Debt Guarantor Management Agreement; |

|

| |

| 2.1.116.3 |

the trust deed, in terms of which the DNI SPV Owner Trust, is established (together with the letters of authority issued by the Master of the High Court in favour of the trustees of the trust); |

| 2.1.117 |

"Senior Interest Charged" means, in respect of any Measurement Period, Finance Charges charged in relation to Net Senior Debt as per the consolidated income statement of the Group, in each case for such Measurement Period; |

|

| |

| 2.1.118 |

"Shareholders" means, collectively – |

| 2.1.118.1 | Net1 SA; and |

| 2.1.118.2 | each member of the Consortium, |

and "Shareholder" means any one of them as the context may require;

|

2.1.119 |

"Shareholders Guarantee, Cession and Pledge Agreement" means the guarantee, cession and pledge agreement concluded or to be concluded on or about the Signature Date between, amongst others, the Debt Guarantor and the Shareholders (other than Net1); |

| 2.1.120 |

"Signature Date" means the date of the signature of the Party last signing this Agreement in time; |

|

| |

| 2.1.121 |

"South Africa" means the Republic of South Africa; |

|

| |

| 2.1.122 |

"Special Notarial Bond" means one or more special notarial bonds given by the applicable Obligor in favour of the Debt Guarantor over specified moveable assets of the applicable Obligor, as continuing covering security for the obligations of the Borrower to the Debt Guarantor under the Finance Documents (including, in each case, a special power of attorney in favour of CDH to pass and lodge that bond for registration with the applicable statutory public registry); |

|

| |

| 2.1.123 |

"Speckpack" means Speckpack Field Services Proprietary Limited, registration number 2014/164903/07, a private company duly incorporated in accordance with the laws of South Africa; |

|

| |

| 2.1.124 |

"Subordination Agreement" means the subordination agreement concluded or to be concluded on or about the Signature Date between, amongst others, the Borrower, M4J, the other Obligors, the Shareholders (other than Net1) and the Agent; |

21

| 2.1.125 |

"Subsidiary" means a 'subsidiary' as defined in the Companies Act and shall include any person who would, but for not being a 'company' under the Companies Act, qualify as a 'subsidiary' as defined in the Companies Act; |

|

| |

| 2.1.126 |

"Tax" means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same); |

|

| |

| 2.1.127 |

"TSPC" means The Starterpack Company Proprietary Limited, registration number 2007/010809/07, a private company duly incorporated in accordance with the laws of South Africa; |

|

| |

| 2.1.128 |

"Unpaid Sum" means any sum due and payable but unpaid by the Borrower under the Finance Documents; |

|

| |

| 2.1.129 |

"Utilisation" means a utilisation of the Facility; |

|

| |

| 2.1.130 |

"Utilisation Date" means the date of a Utilisation, being the date on which the relevant Loan is to be made; |

|

| |

| 2.1.131 |

"Utilisation Request" means a notice substantially in the form set out in Annexure C (Form of Utilisation Request); |

|

| |

| 2.1.132 |

"VAT" means (i) any value added tax as provided for in the Value Added Tax Act, 1991, (ii) any general service tax and (iii) any other tax of a similar nature; and |

|

| |

| 2.1.133 |

"ZAR" means South African Rand, the lawful currency of South Africa. |

| 2.2 |

Construction |

| 2.2.1 |

Unless a contrary indication appears, any reference in this Agreement to – |

| 2.2.1.1 |

the "Agent", the "Debt Guarantor", any "Finance Party", the "Lender" or any "Party", or any other person shall be construed so as to include its successors in title, permitted cessionaries and permitted transferees to, or of, its rights and/or obligations under the Finance Documents; |

| 2.2.1.2 |

a document in "agreed form" is a document which is previously agreed in writing by or on behalf of the Borrower and the Agent or, if not so agreed, is in the form specified by the Agent; |

| 2.2.1.3 |

"assets" includes present and future properties, revenues and rights of every description; |

22

| 2.2.1.4 |

"authority" includes any court or any governmental, intergovernmental or supranational body, agency, department or any regulatory, self-regulatory or other authority; |

| 2.2.1.5 |

a "Finance Document" or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended, novated, supplemented, extended or restated; |

| 2.2.1.6 |

"guarantee" means any guarantee, letter of credit, bond, indemnity or similar assurance against loss, or any obligation, direct or indirect, actual or contingent, to purchase or assume any indebtedness of any person or to make an investment or loan to any person or to purchase assets of any person where, in each case, such obligation is assumed in order to maintain or assist the ability of such person to meet its indebtedness; |

| 2.2.1.7 |

the use of the word "including" followed by specific examples will not be construed as limiting the meaning of the general wording preceding it, and the eiusdem generis rule must not be applied in the interpretation of such general wording or such specific examples; |

| 2.2.1.8 |

"indebtedness" includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; |

| 2.2.1.9 |

a "person" includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); |

| 2.2.1.10 |

a "regulation" includes any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department or of any regulatory, self-regulatory or other authority or organisation; |

| 2.2.1.11 |

a provision of law is a reference to that provision as amended or re-enacted; and |

| 2.2.1.12 |

a time of day is a reference to Johannesburg time. |

| 2.2.2 |

The determination of the extent to which a rate is "for a period equal in length" to an Interest Period shall disregard any inconsistency arising from the last day of that Interest Period being determined pursuant to the terms of this Agreement. |

| 2.2.3 |

Section, clause and Annexures headings are for ease of reference only. |

23

| 2.2.4 |

Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

| 2.2.5 |

A Default (other than an Event of Default) is "continuing" if it has not been remedied or waived and an Event of Default is "continuing" if it has not been waived. |

| 2.2.6 |

If any provision in a definition is a substantive provision conferring rights or imposing obligations on any Party, notwithstanding that it appears only in an interpretation clause, effect shall be given to it as if it were a substantive provision of the relevant Finance Document. |

| 2.2.7 |

Unless inconsistent with the context, an expression in any Finance Document which denotes the singular includes the plural and vice versa. |

| 2.2.8 |

The Annexures to any Finance Document form an integral part thereof and a reference to a "clause" or a "Annexures" is a reference to a clause of, or a annexure to, this Agreement. |

| 2.2.9 |

The rule of construction that, in the event of ambiguity, a contract shall be interpreted against the party responsible for the drafting thereof, shall not apply in the interpretation of the Finance Documents. |

| 2.2.10 |

The expiry or termination of any Finance Documents shall not affect those provisions of the Finance Documents that expressly provide that they will operate after any such expiry or termination or which of necessity must continue to have effect after such expiry or termination, notwithstanding that the clauses themselves do not expressly provide for this. |

| 2.2.11 |

The Finance Documents shall to the extent permitted by applicable law be binding on and enforceable by the administrators, trustees, permitted cessionaries, business rescue practitioners or liquidators of the Parties as fully and effectually as if they had signed the Finance Documents in the first instance and reference to any Party shall be deemed to include such Party's administrators, trustees, permitted cessionaries, business rescue practitioners or liquidators, as the case may be. |

| 2.2.12 |

Where figures are referred to in numerals and in words in any Finance Document, if there is any conflict between the two, the words shall prevail. |

| 2.2.13 |

Unless a contrary indication appears, where any number of days is to be calculated from a particular day, such number shall be calculated as including that particular day and excluding the last day of such period. |

24

| 2.3 |

Third Party Rights |

| 2.3.1 |

Except as expressly provided for in this Agreement or in any other Finance Document, no provision of any Finance Document constitutes a stipulation for the benefit of any person who is not a party to that Finance Document. |

| 2.3.2 |

Notwithstanding any term of any Finance Document, the consent of any person who is not a party to that Finance Document is not required to rescind or vary that Finance Document at any time except to the extent that the relevant variation or rescission (as the case may be) relates directly to the right conferred upon any applicable third party under a stipulation for the benefit of that party that has been accepted by that third party. |

| 3 |

THE FACILITY |

| 3.1 |

The Facility |

Subject to the terms of this Agreement, the Lender makes available to the Borrower a ZAR revolving loan facility in an aggregate amount equal to the Commitment.

| 3.2 |

Finance Parties' Rights and Obligations |

| 3.2.1 |

The obligations of each Finance Party under the Finance Documents are separate and independent. Failure by a Finance Party to perform its obligations under the Finance Documents does not affect the obligations of any other Party under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |

| 3.2.2 |

The rights of each Finance Party under or in connection with the Finance Documents are separate and independent rights and any debt arising under the Finance Documents to a Finance Party from the Borrower is a separate and independent debt in respect of which a Finance Party shall be entitled to enforce its rights in accordance with clause 3.2.3 below. The rights of each Finance Party include any debt owing to that Finance Party under the Finance Documents and, for the avoidance of doubt, any part of a Loan or any other amount owed by the Borrower which relates to a Finance Party's participation in the Facility or its role under a Finance Document (including any such amount payable to the Agent on its behalf) is a debt owing to that Finance Party by the Borrower. |

| 3.2.3 |

A Finance Party may, except as specifically provided in the Finance Documents, separately enforce its rights under or in connection with the Finance Documents. |

25

| 4 |

PURPOSE |

| 4.1 |

Purpose |

The Borrower shall apply all amounts borrowed by it under Facility towards –

| 4.1.1 |

advancing funding to other members of the Group for the purposes of facilitating the acquisition and/or requisitioning of telecommunications towers; |

| 4.1.2 |

allow for the reimbursement of any internally generated cashflows utilised by any member of the Group to finance the acquisition and/or requisition of telecommunications towers in the current financial year ending 30 June 2018; and |

| 4.1.3 |

paying the transaction costs incurred in respect of the drafting of the Finance Documents. |

| 4.2 |

Monitoring |

No Finance Party is bound to monitor or verify the application of any amount borrowed pursuant to this Agreement.

| 5 |

CONDITIONS OF UTILISATION |

| 5.1 |

Initial Condition Precedent |

| 5.1.1 |

The Borrower may not deliver a Utilisation Request unless – |

| 5.1.1.1 |

the Agent is satisfied that the Net Senior Debt to EBITDA Ratio (normalised) does not exceed 1.50 times, with EBITDA being the pro forma last twelve Months EBITDA calculated using the latest management accounts of the Borrower on a consolidated basis for the financial quarter immediately preceding the Fulfilment Date; |

| 5.1.1.2 |

all the Conditions Precedent have been delivered to the Agent in form and substance satisfactory to the Agent; or |

| 5.1.1.3 |

to the extent that any Conditions Precedent are not in a form and in substance satisfactory to the Agent or have not been delivered, the Agent has, by notice in writing to the Borrower, waived or deferred delivery of those Conditions Precedent which are not in a form and in substance satisfactory to it or which have not been delivered, upon such terms and conditions as the Agent may specify in the aforesaid notice. |

| 5.1.2 |

The Agent shall notify the Borrower and the Lender promptly upon being so satisfied. |

| 5.1.3 |

Each Utilisation Request delivered by the Borrower shall be accompanied by a Compliance Certificate confirming compliance with clause 21.1 (Financial Condition). |

26

| 5.1.4 |

Other than to the extent that the Lender notifies the Agent in writing to the contrary before the Agent gives the notification described in clause 5.1.1 above, the Lender authorises (but does not require) the Agent to give that notification. The Agent shall not be liable for any damages, costs or losses whatsoever as result of giving any such notification. |

| 5.2 |

Further Conditions Precedent |

The Lender will only be obliged to comply with clause 6.4 (Lender's Participation) if on the date of the Utilisation Request and on the proposed Utilisation Date –

| 5.2.1 |

no Default is continuing or would result from the proposed Loan; |

| 5.2.2 |

no Material Adverse Change has occurred or would result from the proposed Loan; |

| 5.2.3 |

the Repeating Representations are true in all material respects; |

| 5.2.4 |

the Borrower is in compliance with clause 21.1 (Financial Condition) and the ratio set out in clause 8.8 (Amortisation Trigger) and will, over the next two Measurement Periods following the proposed Utilisation Date, continue to be in compliance with the financial covenants set out in clause 21.1 (Financial Condition) and the ratio set out in clause 8.8.1 (Amortisation Trigger); and |

| 5.2.5 |

the Borrower is in compliance with clause 9.4 (Capitalisation of Interest). |

| 5.3 |

If the Conditions Precedent are not fulfilled, deferred and/or waived on or before the Longstop Date the Agent (on behalf of the Lender) shall be entitled to cancel this Agreement and all of the Finance Documents by written notice to the Borrower. Such cancellation shall be without prejudice to the Borrower's obligations under clause 17 (Costs and Expenses) to pay any costs, fees, expenses or taxes then due and payable provided for therein and the provisions of clauses 28 (Payment Mechanics) to 43 (Jurisdiction) shall remain in force for such purpose. |

| 6 |

UTILISATION |

| 6.1 |

Delivery of a Utilisation Request |

The Borrower may utilise the Facility by delivery to the Agent of a duly completed Utilisation Request not later than 10:00am on the day at least three Business Days' prior to the proposed Utilisation Date, or such other period as consented to in writing by the Agent.

| 6.2 |

Completion of a Utilisation Request |

| 6.2.1 |

Each Utilisation Request is irrevocable and will not be regarded as having been duly completed unless – |

27

| 6.2.1.1 |

the proposed Utilisation Date is a Business Day within the Availability Period; and |

| 6.2.1.2 |

the currency and amount of the Utilisation comply with clause 6.3 (Currency and amount). |

| 6.2.2 |

Only one Loan may be requested in each Utilisation Request. |

| 6.2.3 |

Only three Utilisation Requests may be submitted per Month. |

| 6.3 |

Currency and Amount |

| 6.3.1 |

The currency specified in a Utilisation Request must be ZAR. |

| 6.3.2 |

The amount of the proposed Loan must be an amount which is not more than the Available Facility and which is a minimum of ZAR20,000,000 and in integral multiples of ZAR5,000,000 or, if less, the Available Facility. |

| 6.4 |

Lender's Participation |

| 6.4.1 |

If the conditions set out in this Agreement have been met, the Lender shall make each Loan available by the Utilisation Date. |

| 6.4.2 |

The Agent shall notify the Lender of the amount of each Loan by 11:00am the Business Day before the proposed Utilisation Date. |

| 6.5 |

Cancellation of Commitment |

Any part of the Commitment which, at that time, is unutilised shall be immediately cancelled at the end of the Availability Period.

| 6.6 |

Consolidation of Loans |

If, on an Interest Payment Date, there is more than one Loan outstanding, then on such Interest Payment Date such Loans shall be consolidated and treated as a single Loan made under the Facility.

| 7 |

REPAYMENT |

| 7.1 |

Repayment of Loans |

| 7.1.1 |

The aggregate outstanding principal amount of the Loans shall be repaid by the Borrower to the Agent (for the account of the Lender) by the Borrower paying a single bullet payment to the Agent on or before the Final Repayment Date. The Loans, all accrued and unpaid interest and all other amounts owing by the Borrower to the Lender in respect of the Facility shall be paid in full in a single bullet payment by no later than the Final Repayment Date. |

28

| 7.1.2 |

The Borrower may, save for the amount of any Loan prepaid in respect of any mandatory prepayment, re-borrow the amount of any Loan paid, repaid or prepaid. |

| 8 |

PREPAYMENT AND CANCELLATION |

| 8.1 |

Illegality |

|

If it becomes unlawful in any applicable jurisdiction (i) for any Obligor or the Lender to perform any of its obligations as contemplated by this Agreement and/or any other Finance Document or (ii) for the Lender to fund or maintain its participation in any Loan or it becomes unlawful for any Affiliate of the Lender for the Lender to do so – |

| 8.1.1 |

the Lender or the Borrower (as applicable) shall promptly notify the Agent upon becoming aware of that event; |

| 8.1.2 |

upon the Agent notifying the Borrower or the Lender (as applicable), the Available Commitment will be immediately cancelled; and |

| 8.1.3 |

the Borrower shall repay the Facility Outstandings on the last day of the Interest Period occurring after the Agent has notified the Borrower or the Lender (as applicable) or, if earlier, the date specified by the Lender in the notice delivered to the Agent (being no earlier than the last day of any applicable grace period permitted by law). |

| 8.2 |

Change of Control |

| 8.2.1 |

If a Change of Control occurs – |

| 8.2.1.1 |

the Borrower shall promptly notify the Agent upon becoming aware of that event; |

| 8.2.1.2 |

the Lender shall not be obliged to fund a Utilisation; and |

| 8.2.1.3 |

if the Lender so requires and notifies the Agent within three days of the Borrower notifying the Agent of the event, the Agent shall, by not less than three days' notice to the Borrower, cancel the Commitment and declare all outstanding Loans, together with accrued interest, and all other amounts accrued under the Finance Documents immediately due and payable, whereupon the Commitment will be cancelled and all outstanding Loans and amounts will become immediately due and payable. |

| 8.2.2 |

For the purpose of clause 8.2.1 above "Change of Control" means – |

| 8.2.2.1 |

if Net1 SA, at any time before the Discharge Date, increases its shareholding in the Borrower above 50% and thereafter ceases directly or indirectly to – |

29

| 8.2.2.1.1 |

have the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to cast or control the casting of, at least 50% of votes that might be cast at a general meeting of the Borrower; or |

| 8.2.2.1.2 |

hold beneficially and legally more than 50% of the issued share capital of the Borrower (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); or |

| 8.2.2.2 |

if Net1 SA's shareholding remains unchanged from that existing at the Signature Date, it ceases directly or indirectly to – |

| 8.2.2.2.1 |

have the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to cast or control the casting of, at least 49% of votes that might be cast at a general meeting of the Borrower; or |

| 8.2.2.2.2 |

hold beneficially and legally more than 49% of the issued share capital of the Borrower (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); or |

| 8.2.2.3 |

the Consortium ceases directly or indirectly to – |

| 8.2.2.3.1 |

have the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to cast or control the casting of, at least 10% of votes that might be cast at a general meeting of the Borrower; or |

| 8.2.2.3.2 |

hold beneficially and legally more than 10% of the issued share capital of the Borrower (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital); or |

| 8.2.2.4 |

subject to clause 8.2.2.1 above, any person or entity or any group of persons acting in concert to acquire Control of the Borrower. |

| 8.3 |

Material Disposal |

|

If any Obligor or any other member of the Group Disposes of any assets or business which, in the aggregate, contribute more than 25% of total assets and/or 25% of the latest consolidated EBITDA of the Group – |

| 8.3.1 |

the Borrower shall promptly notify the Agent upon becoming aware of that event; |

| 8.3.2 |

upon the Agent notifying the Lender, the Available Commitment will be immediately cancelled; and |

30

| 8.3.3 |

if the Lender so requires and notifies the Agent within three days of the Borrower notifying the Agent of the event, the Agent shall, by not less than three days' notice to the Borrower, cancel the Commitment and declare all outstanding Loans, together with accrued interest, and all other amounts accrued under the Finance Documents immediately due and payable, whereupon the Commitment will be cancelled and all outstanding Loans and amounts will become immediately due and payable. |

| 8.4 |

Mandatory prepayment – Insurance Proceeds |

|

If – |

| 8.4.1 |

any assets of the Borrower are damaged, lost or destroyed; and |

| 8.4.2 |

the Borrower recovers any proceeds of Insurance in excess of ZAR25,000,000 on account of such assets from any insurer, other than any amounts recovered as a result of business interruption and/or third-party claims ("Insurance Proceeds"), |

| 8.5 |

the Borrower shall by no later than five Business Days of receipt of such proceeds, make a mandatory prepayment on account of the Facility, in an amount equal to the Insurance Proceeds less any portion thereof which the Borrower notifies the Agent is, or is to be, applied in the replacement, reinstatement and/or repair of the assets so lost or destroyed and/or repair the assets so damaged or otherwise in amelioration of the loss in respect of which the relevant insurance claim was made (or to reimburse the Borrower for any amount applied in replacing, reinstating and/or repairing such assets) ("Excluded Insurance Proceeds") and such Excluded Insurance Proceeds are – |

| 8.5.1.1 |

committed for such application (as evidenced by a resolution of the board of directors of the Borrower which has been passed within sixty days of the date of receipt of such Insurance Proceeds); and |

| 8.5.1.2 |

are so applied within one hundred and twenty days of the date of receipt or such longer period as may reasonably be required to replace, reinstate and/or repair the relevant asset (as reasonably determined by the Borrower, on the basis of professional advice). |

| 8.6 |

Mandatory prepayment – Disposal Proceeds |

|

Subject to the provisions of clause 8.3 (Material Disposal) above, if – |

| 8.6.1 |

any assets or business of the Borrower is Disposed of; and |

| 8.6.2 |

the Borrower recovers any Disposal Proceeds in excess of ZAR25,000,000 on account of such Disposal, |

31

| 8.7 |

the Borrower shall by no later than five Business Days of receipt of such Disposal Proceeds, make a mandatory prepayment on account of the Facility, in an amount equal to the Disposal Proceeds less any portion thereof which the Borrower notifies the Agent is, or is to be, applied in the replacement of the assets, business or undertaking so Disposed of ("Excluded Disposal Proceeds") and such Excluded Disposal Proceeds are – |

| 8.7.1.1 |