Form SC 13E3 Foundation Medicine, Filed by: Foundation Medicine, Inc.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Rule 13e-100)

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

Foundation Medicine, Inc.

(Name of the Issuer)

Foundation Medicine, Inc.

(Name of Person(s) Filing Statement)

Common Stock, $0.0001 par value per share

(Title of Class of Securities)

350465100

(CUSIP Number of Class of Securities)

Robert W. Hesslein

Senior Vice President and General Counsel

150 Second Street

Cambridge, MA 02141

(617) 418-2200

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of the Person(s) Filing Statement)

With a copy to:

Stuart M. Cable

Lisa R. Haddad

Goodwin Procter LLP

100 Northern Avenue

Boston, MA 02210

(617) 570-1000

This statement is filed in connection with (check the appropriate box):

| a. |

☐ | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. | ||

| b. |

☐ | The filing of a registration statement under the Securities Act of 1933. | ||

| c. |

☒ | A tender offer. | ||

| d. |

☐ | None of the above. | ||

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Calculation of Filing Fee

| Transaction Valuation* | Amount of Filing Fee** | |

| $2,256,908,814.14 | $280,985.15 |

| * | Estimated solely for purposes of calculating the filing fee pursuant to Rule 0-11(d) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Transaction Valuation was calculated by adding (i) the product of (A) 16,093,897, which is the difference between 37,113,008, the number of shares (“Shares”) of common stock of Foundation Medicine, Inc. outstanding as of June 18, 2018, and 21,019,111, the number of Shares beneficially owned by Roche Holding Ltd or its affiliates and (B) $137.00, which is the per Share tender offer price, and (ii) the product of (A) 440,089, which is the number of Shares subject to “in-the-money” options outstanding as of March 31, 2018, and (B) $118.26, which is the difference between the $137.00 per Share tender offer price and $18.74 , the average weighted exercise price of such options. The number of Shares subject to “in-the-money” options and the average weighted exercise price for such options is contained in Foundation Medicine, Inc.’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018. |

The foregoing figures are as of June 29, 2018, the most recent practicable date.

| ** | The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act, by multiplying the Transaction Valuation by 0.0001245. |

| ☒ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. |

| Amount Previously Paid: $280,985.15 | Filing Party: Roche Holdings, Inc. | |

| Form or Registration No.: Schedule TO | Date Filed: July 2, 2018 | |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3 (this “Statement”) is being filed by Foundation Medicine, Inc., a Delaware corporation (“Foundation Medicine” or the “Company”), the issuer of the common stock that is the subject of the Rule 13e-3 transaction described below, and relates to the cash tender offer by 062018 Merger Subsidiary, Inc., a Delaware corporation (“Merger Sub”) and a wholly-owned subsidiary of Roche Holdings, Inc., a Delaware corporation (“Roche Holdings”), to purchase all of the issued and outstanding shares of common stock, par value $0.0001 per share (the “Shares”), of Foundation Medicine at a price per Share equal to $137.00, net to the seller of such Shares in cash, without interest, subject to any withholding of taxes required by applicable law (the “Offer”). The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of June 18, 2018 (together with any amendments or supplements thereto, the “Merger Agreement”), by and among the Company, Roche Holdings and Merger Sub. The Merger Agreement provides that, among other things, following the consummation of the Offer and subject to the terms and conditions of the Merger Agreement, Merger Sub will merge with and into the Company pursuant to Section 251(h) of the General Corporation Law of the State of Delaware (the “DGCL”), with the Company being the surviving corporation (the “Merger”). The terms of the Offer, and the conditions to which it is subject, are set forth in the combined Tender Offer Statement and Rule 13e-3 Transaction Statement filed under cover of Schedule TO by Merger Sub and Roche Holdings on July 2, 2018 (as amended or supplemented from time to time, the “Schedule TO”), which contain as exhibits an Offer to Purchase dated July 2, 2018 (the “Offer to Purchase”), and the related Letter of Transmittal (the “Letter of Transmittal,” which together with the Offer to Purchase, as each of them may be amended or supplemented from time to time, contain the terms of the Offer).

In response to the Offer, the Company filed a Solicitation/Recommendation Statement on Schedule 14D-9 on July 2, 2018 (the “Schedule 14D-9”). The information contained in the Schedule 14D-9 and the Offer to Purchase, including all schedules, annexes and exhibits thereto, copies of which are attached as exhibits hereto, is expressly incorporated by reference to the extent such information is required in response to the items of this Schedule 13E-3, and is supplemented by the information specifically provided herein. The responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in the Schedule 14D-9 and the Offer to Purchase. All information contained in this Schedule 13E-3 concerning the Company, Roche Holdings and Merger Sub has been provided by such person and not by any other person. All capitalized terms used in this Schedule 13E-3 without definition have the meanings ascribed to them in the Schedule 14D-9.

| ITEM 1. | SUMMARY TERM SHEET |

The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

| ITEM 2. | SUBJECT COMPANY INFORMATION |

(a) Name and Address

The information set forth in the Schedule 14D-9 under the heading “Item 1. Subject Company Information—Name and Address” is incorporated herein by reference.

(b) Securities

The information set forth in the Schedule 14D-9 under the heading “Item 1. Subject Company Information—Securities” is incorporated herein by reference.

(c) Trading Market and Price

The information set forth in the Offer to Purchase under the heading “The Offer—Section 6. Price Range of Shares; Dividends” is incorporated herein by reference.

(d) Dividends

The information set forth in the Offer to Purchase under the heading “The Offer—Section 6. Price Range of Shares; Dividends” is incorporated herein by reference.

(e) Prior Public Offerings

Not applicable.

(f) Prior Stock Purchases

Not applicable.

| ITEM 3. | IDENTITY AND BACKGROUND OF FILING PERSON |

(a) Name and Address

The filing person is the subject company. The information set forth in the Schedule 14D-9 under the headings “Item 2. Identity and Background of Filing Persons—Name and Address,” “Item 2. Identity and Background of Filing Persons—Business and Background of the Company’s Directors and Executive Officers” and “Annex A—Business and Background of the Company’s Directors and Executive Officers” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 9. Certain Information Concerning Purchaser and Parent” and “Schedule I—Directors and Executive Officers of Controlling Shareholder of Roche and Directors and Executive Officers of Parent” is incorporated herein by reference.

(b) Business and Background of Entities

The information set forth in the Offer to Purchase under the heading “The Offer—Section 9. Certain Information Concerning Purchaser and Parent” is incorporated herein by reference.

(c) Business and Background of Natural Persons

The information set forth in the Schedule 14D-9 under the headings “Item 2. Identity and Background of Filing Persons—Business and Background of the Company’s Directors and Executive Officers” and “Annex A— Business and Background of the Company’s Directors and Executive Officers” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 9. Certain Information Concerning Purchaser and Parent” and “Schedule I—Directors and Executive Officers of Controlling Shareholder of Roche and Directors and Executive Officers of Parent” is incorporated herein by reference.

| ITEM 4. | TERMS OF THE TRANSACTION |

(a) Material Terms

(1)(i) The information set forth in the Schedule 14D-9 under the heading “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 1. Terms of the Offer” is incorporated herein by reference.

(1)(ii) The information set forth in the Schedule 14D-9 under the heading “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 1. Terms of the Offer” is incorporated herein by reference.

(1)(iii) The information set forth in the Schedule 14D-9 under the heading “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 1. Terms of the Offer” is incorporated herein by reference.

(1)(iv) The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 1. Terms of the Offer” is incorporated herein by reference.

(1)(v) The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 1. Terms of the Offer” and “The Offer—Section 13. The Merger Agreement—Extensions of the Offer” is incorporated herein by reference.

(1)(vi) The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 4. Withdrawal Rights” is incorporated herein by reference.

(1)(vii) The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 3. Procedures for Tendering Shares” and “The Offer—Section 4. Withdrawal Rights” is incorporated herein by reference.

(1)(viii) The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 1. Terms of the Offer” and “The Offer—Section 2. Acceptance for Payment and Payment for Shares” is incorporated herein by reference.

(1)(ix) Not applicable.

(1)(x) Not applicable.

(1)(xi) Not applicable.

(1)(xii) The information set forth in the Offer to Purchase under the heading “The Offer—Section 5. Certain U.S. Federal Income Tax Consequences” is incorporated herein by reference.

(2)(i) The information set forth in the Schedule 14D-9 under the heading “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 13. The Merger Agreement” is incorporated herein by reference.

(2)(ii) The information set forth in the Schedule 14D-9 under the heading “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

(2)(iii) The information set forth in the Schedule 14D-9 under the heading “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

(2)(iv) The information set forth in the Schedule 14D-9 under the heading “Item 8. Additional Information— Stockholder Approval of the Merger Not Required” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

(2)(v) Not applicable.

(2)(vi) Not applicable.

(2)(vii) The information set forth in the Offer to Purchase under the heading “The Offer—Section 5. Certain U.S. Federal Income Tax Consequences” is incorporated herein by reference.

(c) Different Terms

The information set forth in the Schedule 14D-9 under the headings “Item 3. Past Contacts, Transactions, Negotiations and Agreements” and “Item 8. Additional Information—Named Executive Officer Golden Parachute Compensation” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Special Factors—Section 2. Interests of Certain Persons in the Offer” and “Special Factors—Section 4. Related Party Transactions” is incorporated herein by reference.

(d) Appraisal Rights

The information set forth in the Schedule 14D-9 under the headings “Item 8. Additional Information—Appraisal Rights” and “Annex C—Section 262 of the General Corporation Law of the State of Delaware” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” and “Schedule II—General Corporation Law of Delaware Section 262 Appraisal Rights” is incorporated herein by reference.

(e) Provisions for Unaffiliated Security Holders

The filing person has not made any provision in connection with the transaction to grant unaffiliated security holders access to the corporate files of the filing person or to obtain counsel or appraisal services at the expense of the filing person.

(f) Eligibility for Listing or Trading

Not applicable.

| ITEM 5. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

(a) Transactions

The information set forth in the Schedule 14D-9 under the heading “Item 3. Past Contacts, Transactions, Negotiations and Agreements” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special Factors—Section 2. Interests of Certain Persons in the Offer” and “Special Factors—Section 4. Related Party Transactions” is incorporated herein by reference.

(b)-(c) Significant Corporate Events; Negotiations or Contacts

The information set forth in the Schedule 14D-9 under the headings “Item 3. Past Contacts, Transactions, Negotiations and Agreements,” “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger” and “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 11. Background of the Offer; Contacts with FMI,” “Special Factors—Section 3. Transactions and Arrangements Concerning the Shares” and “Special Factors—Section 4. Related Party Transactions” is incorporated herein by reference.

(e) Agreements Involving the Subject Company’s Securities

The information set forth in the Schedule 14D-9 under the headings “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” and “Item 3. Past Contacts, Transactions, Negotiations and Agreements” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special Factors—Section 3. Transactions and Arrangements Concerning the Shares,” “Special Factors—Section 4. Related Party Transactions” and “The Offer—Section 13. The Merger Agreement” is incorporated herein by reference.

| ITEM 6. | PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS |

(b) Use of Securities Acquired

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 7. Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations,” “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” and “The Offer—Section 13. The Merger Agreement” is incorporated herein by reference.

(c)(1)-(8) Plans

The information set forth in the Schedule 14D-9 under the heading “Item 7. Purposes of the Transaction and Plans or Proposals” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 7. Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

| ITEM 7. | PURPOSES, ALTERNATIVES, REASONS AND EFFECTS |

(a) Purposes

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger,” “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” and “Item 7. Purposes of the Transaction and Plans or Proposals” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 11. Background of the Offer; Contacts with FMI” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

(b) Alternatives

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger” and “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 11. Background of the Offer; Contacts with FMI” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

(c) Reasons

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger” and “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Offer—Section 11. Background of the Offer; Contacts with FMI” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

(d) Effects

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger,” “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” and “Item 8. Additional Information” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 5. Certain U.S. Federal Income Tax Consequences,” “The Offer—Section 7. Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration under the Exchange Act; Margin Regulations” and “The Offer—Section 12. Purpose of the Offer; Plans for FMI; Effects of the Offer; Stockholder Approval; Appraisal Rights” is incorporated herein by reference.

| ITEM 8. | FAIRNESS OF THE TRANSACTION |

(a) Fairness

The information set forth in the Schedule 14D-9 under the heading “Item 4. The Solicitation or Recommendation— Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

(b) Factors Considered in Determining Fairness

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation— Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger,” “Item 4. The Solicitation or Recommendation—Opinion of the Special Committee’s Financial Advisor,” “Item 4. The Solicitation or Recommendation—Certain Prospective Financial Information,” “Annex B—Opinion of Goldman Sachs & Co. LLC” and the information set forth in Exhibit (c)(2) attached hereto is incorporated herein by reference.

(c) Approval of Security Holders

The information set forth in the Schedule 14D-9 under the headings “Item 2. Identity and Background of Filing Person—Tender Offer and Merger” and “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Offer—Section 1. Terms of the Offer” and “The Offer—Section 13. The Merger Agreement” is incorporated herein by reference.

(d) Unaffiliated Representative

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors” and “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger” is incorporated herein by reference. An unaffiliated representative was not retained to act solely on behalf of unaffiliated security holders for purposes of negotiating the terms of the transaction or preparing a report concerning the fairness of the transaction.

(e) Approval of Directors

The information set forth in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Background of the Offer and the Merger” and “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger” is incorporated herein by reference.

(f) Other Offers

Not Applicable.

| ITEM 9. | REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS |

(a)-(b) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal

The information set forth in “Annex B—Opinion of Goldman Sachs & Co. LLC” attached to the Schedule 14D-9 and in the Schedule 14D-9 under the headings “Item 4. The Solicitation or Recommendation—Reasons for the Recommendations of the Special Committee and the Board of Directors; Fairness of the Offer and the Merger,” “Item 4. The Solicitation or Recommendation—Opinion of the Special Committee’s Financial Advisor,” “Item 4. The Solicitation or Recommendation—Certain Prospective Financial Information,” “Item 5. Persons/Assets Retained, Employed, Compensated or Used” and the information set forth in Exhibit (c)(2) attached hereto is incorporated herein by reference.

(c) Availability of Documents

The reports, opinions or appraisals referenced in this Item 9 are available for inspection and copying at the Company’s principal executive offices located at 150 Second Street, Cambridge, MA 02141, during regular business hours, by any interested stockholder of the Company or a representative of such interested stockholder who has been so designated in writing by such interested stockholder.

| ITEM 10. | SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION |

(a)-(b) Source of Funds; Conditions

The information set forth in the Offer to Purchase under the heading “The Offer—Section 10. Source and Amount of Funds” is incorporated herein by reference.

(c) Expenses

The information set forth in the Schedule 14D-9 under the heading “Item 5. Persons/Assets Retained, Employed, Compensated or Used” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “The Offer—Section 17. Fees and Expenses” is incorporated herein by reference.

(d) Borrowed Funds

Not applicable.

| ITEM 11. | INTEREST IN SECURITIES OF THE SUBJECT COMPANY |

(a) Securities Ownership

The information set forth in Schedule 14D-9 under the heading “Item 3. Past Contacts, Transactions, Negotiations and Agreements” is incorporated herein by reference. The information set forth in the Offer to Purchase under the headings “Special Factors—Section 3. Transactions and Arrangements Concerning the Shares,” “Special Factors—Section 4. Related Party Transactions” and “Schedule I —Security Ownership of Certain Beneficial Owners and Management” is incorporated herein by reference.

(b) Securities Transactions

The information set forth in Schedule 14D-9 under the heading “Item 6. Interest in Securities of the Subject Company” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “Special Factors—Section 3. Transactions and Arrangements Concerning the Shares” is incorporated herein by reference.

| ITEM 12. | THE SOLICITATION OR RECOMMENDATION |

(d) Intent to Tender or Vote in a Going-Private Transaction

The information set forth in the Schedule 14D-9 under the heading “Item 4. The Solicitation or Recommendation—Intent to Tender” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “Special Factors—Section 3. Transactions and Arrangements Concerning the Shares” is incorporated herein by reference.

(e) Recommendations of Others

The information set forth in the Schedule 14D-9 under the heading “Item 4. The Solicitation or Recommendation— Reasons for the Recommendations of the Special Committee and the Board of Directors” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “The Offer—Section 9. Certain Information Concerning Purchaser and Parent” is incorporated herein by reference.

| ITEM 13. | FINANCIAL STATEMENTS |

(a) Financial Information

The audited financial statements of the Company as of and for the fiscal years ended December 31, 2016 and December 31, 2017 are incorporated herein by reference to Item 15 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 filed with the SEC on March 7, 2018. The unaudited consolidated financial statements of the Company for the three months ended March 31, 2018 are incorporated herein by reference to Item 1 of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2018, filed with the SEC on May 2, 2018.

The information set forth in the Offer to Purchase under the heading “The Offer—Section 8. Certain Information Concerning FMI—Financial Information” is incorporated herein by reference.

(b) Pro Forma Information

Not applicable.

| ITEM 14. | PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED |

(a) Solicitations or Recommendations

The information set forth in the Schedule 14D-9 under the heading “Item 5. Persons/Assets Retained, Employed, Compensated or Used” is incorporated herein by reference. The information set forth in the Offer to Purchase under the heading “The Offer—Section 17. Fees and Expenses” with respect to the persons employed or retained by Roche Holdings is incorporated herein by reference.

(b) Employees and Corporate Assets

The information set forth in the Schedule 14D-9 under the heading “Item 5. Persons/Assets Retained, Employed, Compensated or Used” is incorporated herein by reference.

| ITEM 15. | ADDITIONAL INFORMATION |

(b) Golden Parachute Payments

The information set forth in the Schedule 14D-9 under the headings “Item 3. Past Contacts, Transactions, Negotiations and Agreements—Arrangements with the Company’s Directors and Executive Officers—Golden Parachute Compensation” and “Item 8. Additional Information—Named Executive Officer Golden Parachute Compensation” is incorporated herein by reference.

(c) Other Material Information

The information set forth in the Schedule 14D-9 under the heading “Item 8. Additional Information” is incorporated herein by reference.

| ITEM 16. | EXHIBITS |

The following exhibits are filed herewith:

| Exhibit No. |

Description | |

| (a)(1)(A) | Offer to Purchase, dated July 2, 2018 (incorporated by reference to Exhibit (a)(1)(i) to the Schedule TO filed by Roche Holdings and Merger Sub on July 2, 2018). | |

| (a)(1)(B) | Form of Letter of Transmittal (including Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9) (incorporated by reference to Exhibit (a)(1)(ii) to the Schedule TO). | |

| (a)(1)(C) | Form of Notice of Guaranteed Delivery (incorporated by reference to Exhibit (a)(1)(iii) to the Schedule TO). | |

| (a)(1)(D) | Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit (a)(1)(iv) to the Schedule TO). | |

| (a)(1)(E) | Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit (a)(1)(v) to the Schedule TO). | |

| (a)(1)(F) | Summary Advertisement as published in the Wall Street Journal on July 2, 2018 (incorporated by reference to Exhibit (a)(1)(vi) to the Schedule TO). | |

| (a)(2)(A) | Solicitation/Recommendation Statement on Schedule 14D-9 (incorporated by reference to the Company’s Solicitation/Recommendation Statement on Schedule 14D-9 filed on July 2, 2018). | |

| (a)(2)(B) | Joint Press Release issued by Foundation Medicine, Inc. and Roche Holdings, Inc., on June 19, 2018 (incorporated by reference to Exhibit 99.2 of the Company’s Form 8-K filed on June 19, 2018). | |

| (a)(2)(C) | Email sent to employees from Chief Executive Officer of Foundation Medicine, Inc. dated June 19, 2018 (incorporated by reference to the Company’s Solicitation/Recommendation Statement on Schedule 14D-9 filed on June 19, 2018). | |

| (a)(2)(D) | Letter sent to Biopharma partners by Foundation Medicine, Inc. dated June 19, 2018 (incorporated by reference to the Company’s Solicitation/Recommendation Statement on Schedule 14D-9 filed on June 19, 2018). | |

| (a)(5)(A) | Foundation Medicine, Inc. Current Report on Form 8-K dated June 18, 2018 (incorporated by reference to the Company’s Current Report on Form 8-K filed on June 19, 2018). | |

| (b) | Not applicable. | |

| (c)(1) | Opinion of Goldman Sachs & Co. LLC, dated as of June 18, 2018 (incorporated by reference to Annex B attached to the Company’s Solicitation/Recommendation Statement on Form 14D-9 filed on July 2, 2018). | |

| (c)(2) | Presentation, dated June 18, 2018, of Goldman Sachs & Co. LLC to the Special Committee of the Board of Directors and the Board of Directors of Foundation Medicine, Inc. | |

| (d)(1) | Agreement and Plan of Merger, by and among Foundation Medicine, Inc., 062018 Merger Subsidiary, Inc., and Roche Holdings, Inc., dated June 18, 2018 (incorporated by reference to Exhibit 2.1 of the Company’s Form 8-K filed on June 19, 2018). | |

| (d)(2) | Transaction Agreement, dated January 11, 2015, by and between Foundation Medicine, Inc. and Roche Holdings, Inc. (incorporated by reference to Exhibit 2.1 of the Company’s Form 8-K filed on January 12, 2015). | |

| (d)(3) | Investor Rights Agreement, dated January 11, 2015, by and among Foundation Medicine, Inc., Roche Holdings, Inc. and certain other stockholders named therein (incorporated by reference to Exhibit 4.1 of the Company’s Form 8-K filed on January 12, 2015). | |

| (d)(4)# | Collaboration Agreement, dated January 11, 2015, by and among Foundation Medicine, Inc., F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc. (incorporated by reference to Exhibit 10.2 of the Company’s Form 8-K/A filed on August 24, 2015). | |

| (d)(5)# | First Amendment to Collaboration Agreement, by and among the Company, F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated April 6, 2016 (incorporated by reference to Exhibit 10.2 of the Company’s Form 10-Q filed on August 3, 2016). | |

| (d)(6)# | Second Amendment to Collaboration Agreement, by and among the Company, F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated June 16, 2016 (incorporated by reference to Exhibit 10.3 of the Company’s Form 10-Q filed on August 3, 2016). | |

| (d)(7)# | Third Amendment to Collaboration Agreement, by and among the Company, F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated July 25, 2016 (incorporated by reference to Exhibit 10.2 of the Company’s Form 10-Q filed on November 2, 2016). | |

| (d)(8)# | Fourth Amendment to Collaboration Agreement, by and among the Company, F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated December 20, 2016 (incorporated by reference to Exhibit 10.24 of the Company’s Form 10-K filed on March 3, 2017). | |

| (d)(9)# | Fifth Amendment to Collaboration Agreement, by and among the Company, F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated September 8, 2017 (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on September 13, 2017). | |

| (d)(10)# | Sixth Amendment to Collaboration Agreement, by and among Foundation Medicine, Inc., F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., dated November 1, 2017 (incorporated by reference to Exhibit 10.27 of the Company’s Form 10-K filed on March 7, 2018). | |

| (d)(11)# | US Education Collaboration Agreement, by and between Foundation Medicine, Inc. and Genentech, dated January 11, 2015 (incorporated by reference to Exhibit 10.4 of the Company’s Form 8-K/A filed on August 24, 2015). | |

| (d)(12)# | Amended and Restated Ex-U.S. Commercialization Agreement by and between Foundation Medicine, Inc. and F. Hoffmann-La Roche Ltd, dated February 28, 2018 (incorporated herein by reference to Exhibit 10.1 of the Company’s Form 10-Q filed on May 2, 2018). | |

| (d)(13)# | Master IVD Collaboration Agreement, by and among Foundation Medicine, Inc., Roche Basel and Roche Molecular Systems, Inc., dated April 6, 2016 (incorporated by reference to Exhibit 10.5 of the Company’s Form 10-Q/A filed on November 16, 2016). | |

| (d)(14) | Credit Facility Agreement, by and between Foundation Medicine, Inc. and Roche Finance Ltd, dated August 2, 2016 (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on August 2, 2016). | |

| (d)(15) | Amendment Letter Agreement, dated as of July 31, 2017, by and between Foundation Medicine, Inc. and Roche Finance Ltd (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on August 1, 2017). | |

| (d)(16) | Tax Sharing Agreement, by and between Foundation Medicine, Inc. and Roche Holdings, Inc., dated January 11, 2015 (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on January 12, 2015). | |

| (d)(17) | Waiver and Consent by and between Foundation Medicine, Inc. and Roche Holdings, Inc., dated January 5, 2017 (incorporated by reference to Exhibit 10.4 of the Company’s Form 8-K filed on January 6, 2017). | |

| (d)(18) | Foundation Medicine, Inc. 2010 Stock Incentive Plan, as Amended and Restated, and forms of agreements thereunder (incorporated by reference to Exhibit 10.1 to the Company’s Registration Statement on Form S-1 (File No. 333-190226) filed on July 29, 2013). | |

| (d)(19) | Foundation Medicine, Inc. 2013 Stock Option and Incentive Plan and forms of agreements thereunder (incorporated by reference to Exhibit 10.2 to the Company’s Registration Statement on Form S-1/A (File No. 333-190226) filed on September 12, 2013). | |

| (d)(20) | Employment Agreement, dated January 5, 2017, by and between Foundation Medicine, Inc. and Troy Cox (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on January 6, 2017). | |

| (d)(21) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Tom Civik, dated October 10, 2017 (incorporated by reference to Exhibit 10.1 of the Company’s Form 8-K filed on October 10, 2017). | |

| (d)(22) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Michael Doherty, dated December 5, 2016, as amended (incorporated by reference to Exhibit 10.2 of the Company’s Form 10-Q filed on May 2, 2018). | |

| (d)(23) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Konstantin Fiedler, dated May 1, 2018 (incorporated by reference to Exhibit 10.3 of the Company’s Form 10-Q filed on May 2, 2018). | |

| (d)(24) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Robert W. Hesslein, dated as of March 7, 2013 (incorporated by reference to Exhibit 10.5 to the Company’s Registration Statement on Form S-1 (File No. 333-190226) filed on July 29, 2013). | |

| (d)(25) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Vincent A. Miller, dated as of August 1, 2011, as amended (incorporated by reference to Exhibit 10.15 to the Company’s Registration Statement on Form S-1/A (File No. 333-190226) filed on September 12, 2013). | |

| (d)(26) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Melanie Nallicheri, dated September 12, 2016 (incorporated herein by reference to Exhibit 10.4 of the Company’s Form 10-Q filed on May 2, 2018). | |

| (d)(27) | Executive Employee Offer Letter by and between Foundation Medicine, Inc. and Jason Ryan, dated as of March 7, 2013 (incorporated by reference to Exhibit 10.6 to the Company’s Registration Statement on Form S-1 (File No. 333-190226) filed on July 29, 2013). | |

| (d)(28) | Letter Agreement by and between Foundation Medicine, Inc. and Michael Pellini, M.D., dated January 5, 2017 (incorporated by reference to Exhibit 10.2 of the Company’s Form 8-K filed on January 6, 2017). | |

| (d)(29) | Form of Indemnification Agreement between Foundation Medicine, Inc. and its directors and officers (incorporated by reference to Exhibit 10.8 to the Company’s Registration Statement on Form S-1/A (File No. 333-190226) filed on August 16, 2013). | |

| (d)(30) | Seventh Amended and Restated Certificate of Incorporation of Foundation Medicine, Inc. (incorporated by reference to Exhibit 3.1 of the Company’s Form 8-K filed on April 7, 2015). | |

| (d)(31) | Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.2 of the Company’s Form 8-K filed on October 2, 2013). | |

| (f) | Section 262 of the Delaware General Corporation Law (incorporated by reference to Annex C of the Company’s Solicitation/Recommendation Statement on Schedule 14D-9 filed on July 2, 2018). | |

| (g) | Not applicable. | |

| (h) | Not applicable. | |

| # | Confidential treatment has been requested or granted for certain information contained in this exhibit. Such information has been omitted and filed separately with the Securities and Exchange Commission. |

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Dated: July 2, 2018

| FOUNDATION MEDICINE, INC. | ||

| By: | /s/ Troy Cox | |

| Name: | Troy Cox | |

| Title: | President and Chief Executive Officer | |

Exhibit (c)(2)

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Project Cake Financial Analysis Overview Goldman Sachs & Co. LLC June 18, 2018 Goldman Sachs does not provide accounting, tax, or legal advice. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities law, you (and each of your employees, representatives, and other agents) may disclose to any and all persons the US federal income and state tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind.

Disclaimer CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION These materials have been prepared and are provided by Goldman Sachs on a confidential basis solely for the information and assistance of the Special Committee of the Board of Directors (the “Special Committee”) and senior management of Freeway (the “Company”) in connection with their consideration of the matters referred to herein. These materials and Goldman Sachs’ presentation relating to these materials (the “Confidential Information”) may not be disclosed to any third party or circulated or referred to publicly or used for or relied upon for any other purpose without the prior written consent of Goldman Sachs. The Confidential Information was not prepared with a view to public disclosure or to conform to any disclosure standards under any state, federal or international securities laws or other laws, rules or regulations, and Goldman Sachs does not take any responsibility for the use of the Confidential Information by persons other than those set forth above. Notwithstanding anything in this Confidential Information to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. The Confidential Information has been prepared by the Investment Banking Division of Goldman Sachs and is not a product of its research department. Goldman Sachs and its affiliates are engaged in advisory, underwriting and financing, principal investing, sales and trading, research, investment management and other financial and non-financial activities and services for various persons and entities. Goldman Sachs and its affiliates and employees, and funds or other entities they manage or in which they invest or have other economic interests or with which they co-invest, may at any time purchase, sell, hold or vote long or short positions and investments in securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments of the Company, any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction. Goldman Sachs’ investment banking division maintains regular, ordinary course client service dialogues with clients and potential clients to review events, opportunities, and conditions in particular sectors and industries and, in that connection, Goldman Sachs may make reference to the Company, but Goldman Sachs will not disclose any confidential information received from the Company. The Confidential Information has been prepared based on historical financial information, forecasts and other information obtained by Goldman Sachs from publicly available sources, the management of the Company or other sources (approved for our use by the Company in the case of information from management and non-public information). In preparing the Confidential Information, Goldman Sachs has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by us, and Goldman Sachs does not assume any liability for any such information. Goldman Sachs does not provide accounting, tax, legal or regulatory advice. Goldman Sachs has not made an independent evaluation or appraisal of the assets and liabilities (including any contingent, derivative or other off-balance sheet assets and liabilities) of the Company or any other party to any transaction or any of their respective affiliates and has no obligation to evaluate the solvency of the Company or any other party to any transaction under any state or federal laws relating to bankruptcy, insolvency or similar matters. The analyses contained in the Confidential Information do not purport to be appraisals nor do they necessarily reflect the prices at which businesses or securities actually may be sold or purchased. Goldman Sachs’ role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which may be significantly more or less favorable than suggested by these analyses, and Goldman Sachs does not assume responsibility if future results are materially different from those forecast. The Confidential Information does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any transaction or strategic alternative referred to herein as compared to any other transaction or alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Goldman Sachs as of, the date of such Confidential Information and Goldman Sachs assumes no responsibility for updating or revising the Confidential Information based on circumstances, developments or events occurring after such date. The Confidential Information does not constitute any opinion, nor does the Confidential Information constitute a recommendation to the Special Committee, any security holder of the Company or any other person as to how to vote or act with respect to any transaction or any other matter. The Confidential Information, including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee thereof, on the one hand, and Goldman Sachs, on the other hand. 2

Table of Contents CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION I. Transaction Overview II. Market Perspective III. Financial Plan IV. Financial Analysis Appendix A: Additional Materials

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION I. Transaction Overview

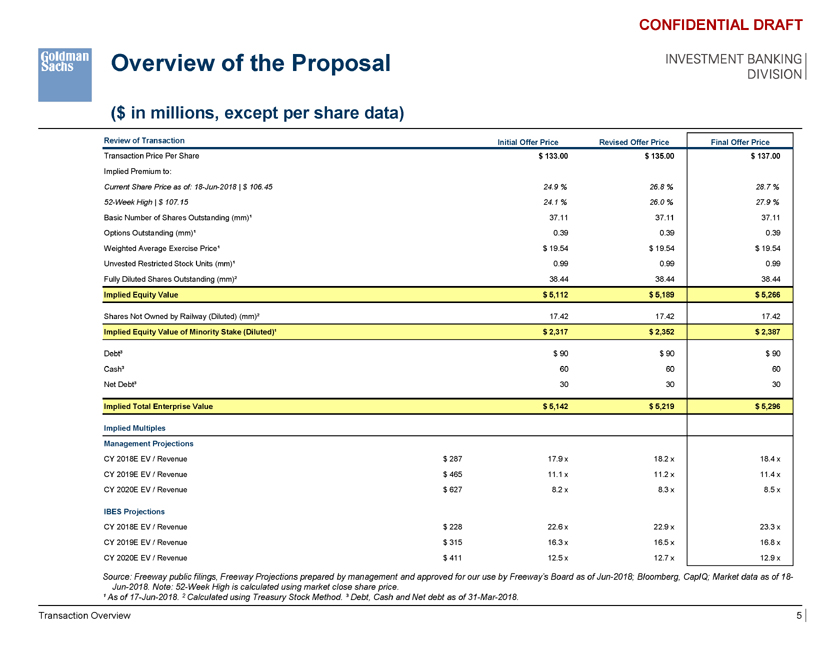

Overview of the Proposal INVESTMENT BANKING DIVISION ($ in millions, except per share data) CONFIDENTIAL DRAFT Review of Transaction Initial Offer Price Revised Offer Price Final Offer Price Transaction Price Per Share $ 133.00 $ 135.00 $ 137.00 Implied Premium to: Current Share Price as of: 18-Jun-2018 | $ 106.45 24.9 % 26.8 % 28.7 % 52-Week High | $ 107.15 24.1 % 26.0 % 27.9 % Basic Number of Shares Outstanding (mm)¹ 37.11 37.11 37.11 Options Outstanding (mm)¹ 0.39 0.39 0.39 Weighted Average Exercise Price¹ $ 19.54 $ 19.54 $ 19.54 Unvested Restricted Stock Units (mm)¹ 0.99 0.99 0.99 Fully Diluted Shares Outstanding (mm)² 38.44 38.44 38.44 Implied Equity Value $ 5,112 $ 5,189 $ 5,266 Shares Not Owned by Railway (Diluted) (mm)² 17.42 17.42 17.42 Implied Equity Value of Minority Stake (Diluted)¹ $ 2,317 $ 2,352 $ 2,387 Debt³ $ 90 $ 90 $ 90 Cash³ 60 60 60 Net Debt³ 30 30 30 Implied Total Enterprise Value $ 5,142 $ 5,219 $ 5,296 Implied Multiples Management Projections CY 2018E EV / Revenue $ 287 17.9 x 18.2 x 18.4 x CY 2019E EV / Revenue $ 465 11.1 x 11.2 x 11.4 x CY 2020E EV / Revenue $ 627 8.2 x 8.3 x 8.5 x IBES Projections CY 2018E EV / Revenue $ 228 22.6 x 22.9 x 23.3 x CY 2019E EV / Revenue $ 315 16.3 x 16.5 x 16.8 x CY 2020E EV / Revenue $ 411 12.5 x 12.7 x 12.9 x Source: Freeway public filings, Freeway Projections prepared by management and approved for our use by Freeway’s Board as of Jun-2018; Bloomberg, CapIQ; Market data as of 18-Jun-2018. Note: 52-Week High is calculated using market close share price. ¹ As of 17-Jun-2018. 2 Calculated using Treasury Stock Method. ³ Debt, Cash and Net debt as of 31-Mar-2018. Transaction Overview 5

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION II. Market Perspective

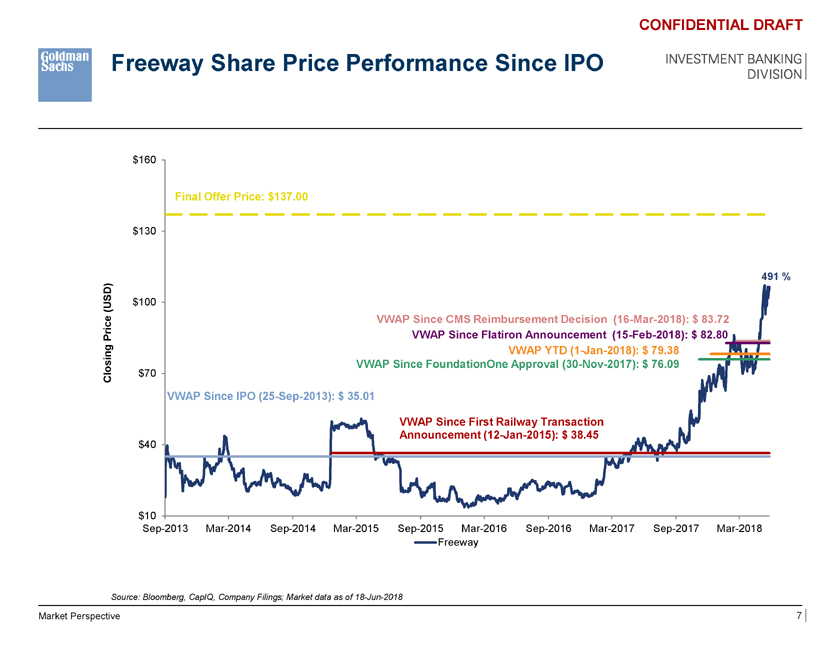

Freeway Share Price Performance Since IPO CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION $160 Final Offer Price: $137.00 $130 491 % D) (US $100 e VWAP Since CMS Reimbursement Decision (16-Mar-2018): $ 83.72 r ic P VWAP Since Flatiron Announcement (15-Feb-2018): $ 82.80 VWAP YTD (1-Jan-2018): $ 79.38 Closing $70 VWAP Since FoundationOne Approval (30-Nov-2017): $ 76.09 VWAP Since IPO (25-Sep-2013): $ 35.01 VWAP Since First Railway Transaction $40 Announcement (12-Jan-2015): $ 38.45 $10 Sep-2013 Mar-2014 Sep-2014 Mar-2015 Sep-2015 Mar-2016 Sep-2016 Mar-2017 Sep-2017 Mar-2018 Freeway Source: Bloomberg, CapIQ, Company Filings; Market data as of 18-Jun-2018 Market Perspective 7

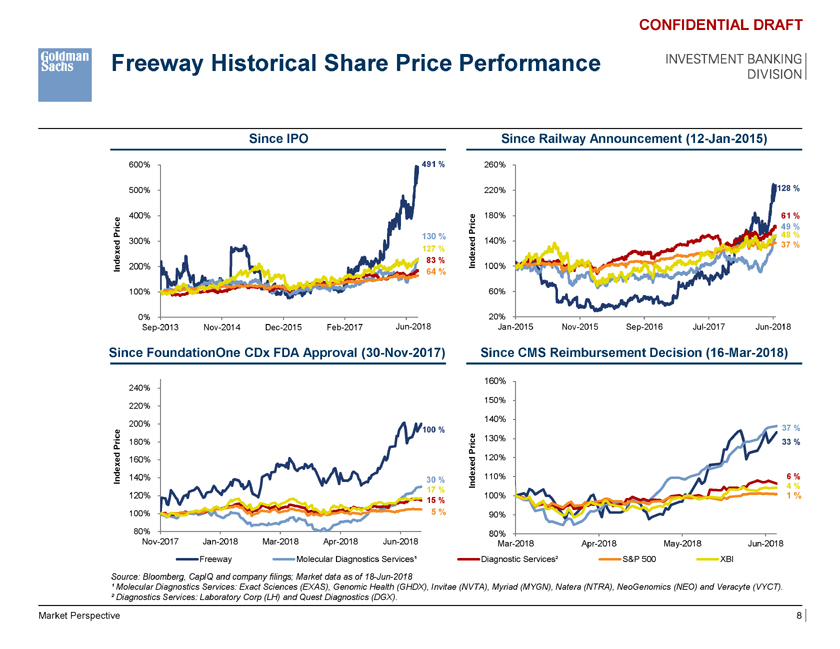

Freeway Historical Share Price Performance INVESTMENT BANKING DIVISION CONFIDENTIAL DRAFT Since IPO Since Railway Announcement (12-Jan-2015) 600% 491 % 260% 500% 220% 128 % 400% e 180% 61 % Pric 49 % Price 130 % 48 % ed 300% 140% 37 % 127 % 83 % Indexed ndex 200% 100% I 64 % 100% 60% 0% 20% Sep-2013 Nov-2014 Dec-2015 Feb-2017 Mar-20 Jun-2018 Jan-2015 Nov-2015 Sep-2016 Jul-2017 Jun-2018 Since FoundationOne CDx FDA Approval (30-Nov-2017) Since CMS Reimbursement Decision (16-Mar-2018) 160% 240% 150% 220% 140% 200% 100 % 37 % rice 180% 130% 33 % P Price d 120% 160% Indexe 140% 30 % Indexed 110% 6 % 4 % 17 % 120% 100% 1 % 15 % 100% 5 % 90% 80% 80% Nov-2017 Jan-2018 Mar-2018 Apr-2018 Jun-2018 Mar-2018 Apr-2018 May-2018 Jun-2018 Freeway Molecular Diagnostics Services¹ Diagnostic Services² S&P 500 XBI Source: Bloomberg, CapIQ and company filings; Market data as of 18-Jun-2018 ¹ Molecular Diagnostics Services: Exact Sciences (EXAS), Genomic Health (GHDX), Invitae (NVTA), Myriad (MYGN), Natera (NTRA), NeoGenomics (NEO) and Veracyte (VYCT). ² Diagnostics Services: Laboratory Corp (LH) and Quest Diagnostics (DGX). Market Perspective 8

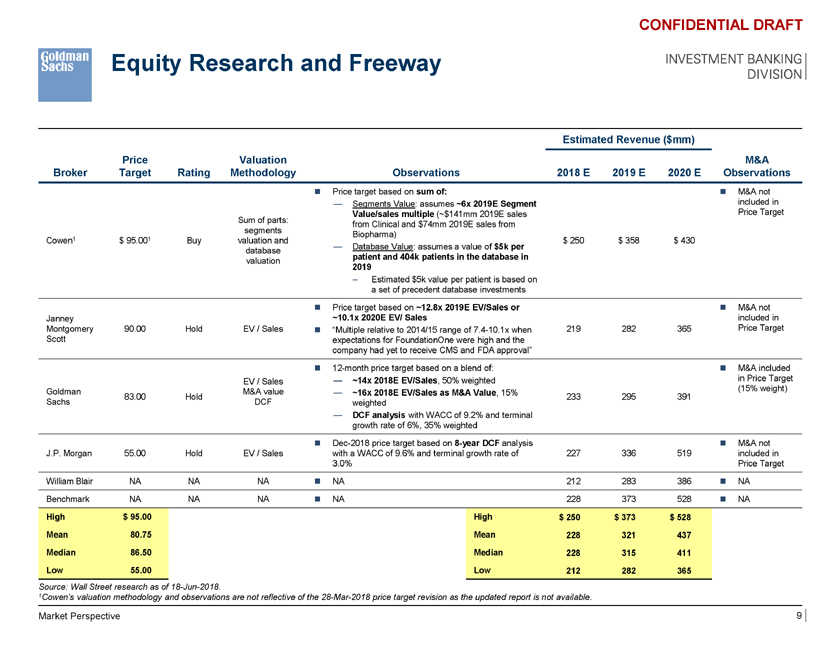

Equity Research and Freeway CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Estimated Revenue ($mm) Price Valuation M&A Broker Target Rating Methodology Observations 2018 E 2019 E 2020 E Observations ï® Price target based on sum of: ï® M&A not — Segments Value: assumes ~6x 2019E Segment included in Value/sales multiple (~$141mm 2019E sales Price Target Sum of parts: from Clinical and $74mm 2019E sales from segments Biopharma) Cowen1 $ 95.001 Buy valuation and $ 250 $ 358 $ 430 — Database Value: assumes a value of $5k per database patient and 404k patients in the database in valuation 2019 – Estimated $5k value per patient is based on a set of precedent database investments ï® Price target based on ~12.8x 2019E EV/Sales or ï® M&A not Janney ~10.1x 2020E EV/ Sales included in Montgomery 90.00 Hold EV / Sales ï® “Multiple relative to 2014/15 range of 7.4-10.1x when 219 282 365 Price Target Scott expectations for FoundationOne were high and the company had yet to receive CMS and FDA approval” ï® 12-month price target based on a blend of: ï® M&A included EV / Sales — ~14x 2018E EV/Sales, 50% weighted in Price Target Goldman M&A value (15% weight) — ~16x 2018E EV/Sales as M&A Value, 15% 83.00 Hold 233 295 391 Sachs DCF weighted — DCF analysis with WACC of 9.2% and terminal growth rate of 6%, 35% weighted ï® Dec-2018 price target based on 8-year DCF analysis ï® M&A not J.P. Morgan 55.00 Hold EV / Sales with a WACC of 9.6% and terminal growth rate of 227 336 519 included in 3.0% Price Target William Blair NA NA NA ï® NA 212 283 386 ï® NA Benchmark NA NA NA ï® NA 228 373 528 ï® NA High $ 95.00 High $ 250 $ 373 $ 528 Mean 80.75 Mean 228 321 437 Median 86.50 Median 228 315 411 Low 55.00 Low 212 282 365 Source: Wall Street research as of 18-Jun-2018. 1Cowen’s valuation methodology and observations are not reflective of the 28-Mar-2018 price target revision as the updated report is not available. Market Perspective 9

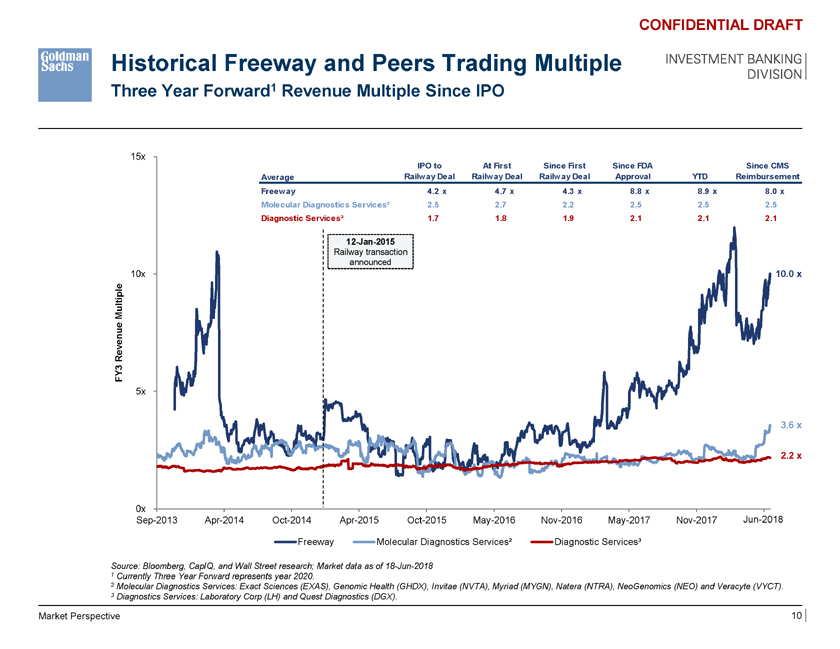

Historical Freeway and Peers Trading Multiple Three Year Forward1 Revenue Multiple Since IPO CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION 15x IPO to At First Since First Since FDA Since CMS Average Railway Deal Railway Deal Railway Deal Approval YTD Reimbursement Freeway 4.2 x 4.7 x 4.3 x 8.8 x 8.9 x 8.0 x Molecular Diagnostics Services² 2.5 2.7 2.2 2.5 2.5 2.5 Diagnostic Services³ 1.7 1.8 1.9 2.1 2.1 2.1 12-Jan-2015 Railway transaction announced 10x 10.0 x p le M ulti e en u Re v Y3 F 5x 3.6 x 2.2 x 0x Sep-2013 Apr-2014 Oct-2014 Apr-2015 Oct-2015 May-2016 Nov-2016 May-2017 Nov-2017 Jun-2018 - Freeway Molecular Diagnostics Services² Diagnostic Services³ Source: Bloomberg, CapIQ, and Wall Street research; Market data as of 18-Jun-2018 1 Currently Three Year Forward represents year 2020. 2 Molecular Diagnostics Services: Exact Sciences (EXAS), Genomic Health (GHDX), Invitae (NVTA), Myriad (MYGN), Natera (NTRA), NeoGenomics (NEO) and Veracyte (VYCT). 3 Diagnostics Services: Laboratory Corp (LH) and Quest Diagnostics (DGX). Market Perspective 10

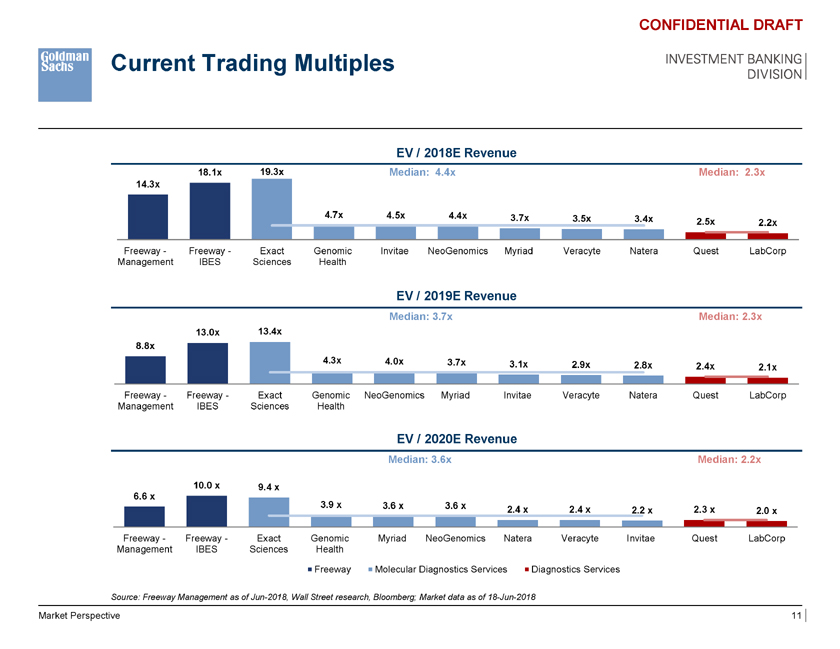

Current Trading Multiples CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION EV / 2018E Revenue 18.1x 19.3x Median: 4.4x Median: 2.3x 14.3x 4.7x 4.5x 4.4x 3.7x 3.5x 3.4x 2.5x 2.2x Freeway—Freeway—Exact Genomic Invitae NeoGenomics Myriad Veracyte Natera Quest LabCorp Management IBES Sciences Health EV / 2019E Revenue Median: 3.7x Median: 2.3x 13.0x 13.4x 8.8x 4.3x 4.0x 3.7x 3.1x 2.9x 2.8x 2.4x 2.1x Freeway—Freeway—Exact Genomic NeoGenomics Myriad Invitae Veracyte Natera Quest LabCorp Management IBES Sciences Health EV / 2020E Revenue Median: 3.6x Median: 2.2x 10.0 x 9.4 x 6.6 x 3.9 x 3.6 x 3.6 x 2.4 x 2.4 x 2.3 x 2.2 x 2.0 x Freeway—Freeway—Exact Genomic Myriad NeoGenomics Natera Veracyte Invitae Quest LabCorp Management IBES Sciences Health Median: 54.3x Median: 12.2x 148.0x Freeway Molecular Diagnostics Services Diagnostics Services Source: Freeway Management as of Jun-2018, 54.3x Wall Street research, Bloomberg; Market data as of 18-Jun-2018 41.8x NM NM NM NM NM 12.3x 12.1x Market Perspective 11

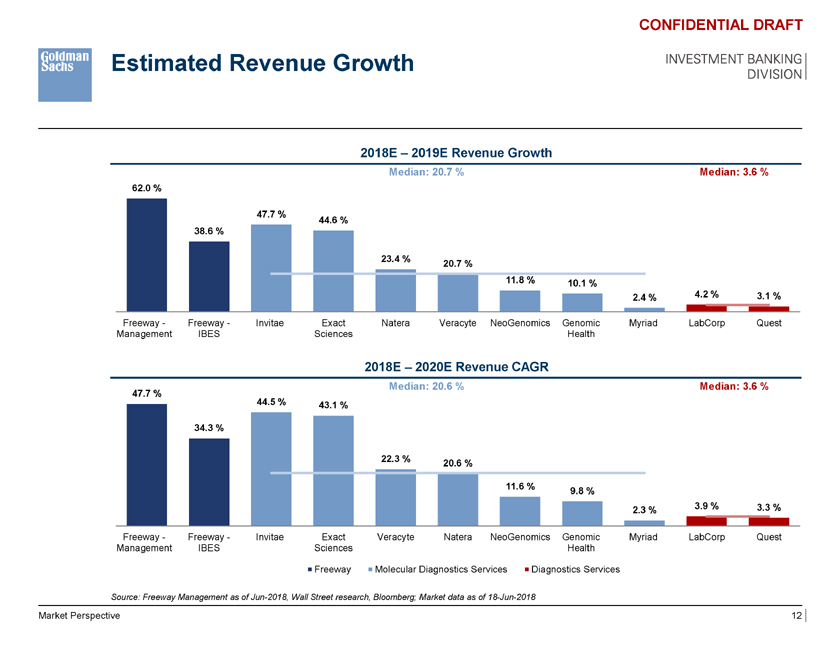

Estimated Revenue Growth CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION 2018E – 2019E Revenue Growth Median: 20.7 % Median: 3.6 % 62.0 % 47.7 % 44.6 % 38.6 % 23.4 % 20.7 % 11.8 % 10.1 % 2.4 % 4.2 % 3.1 % Freeway—Freeway—Invitae Exact Natera Veracyte NeoGenomics Genomic Myriad LabCorp Quest Management IBES Sciences Health 2018E – 2020E Revenue CAGR Median: 20.6 % Median: 3.6 % 47.7 % 44.5 % 43.1 % 34.3 % 22.3 % 20.6 % 11.6 % 9.8 % 3.9 % 3.3 % 2.3 % Freeway—Freeway—Invitae Exact Median:Veracyte 54.3x Natera NeoGenomics Genomic Myriad Median: LabCorp 12.2x Quest Management IBES Sciences Health 148.0x Freeway Molecular Diagnostics Services Diagnostics Services Source: Freeway Management as of Jun-2018, 54.3x Wall Street research, Bloomberg; Market data as of 18-Jun-2018 41.8x NM NM NM NM NM 12.3x 12.1x Market Perspective 12

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION III. Financial Plan

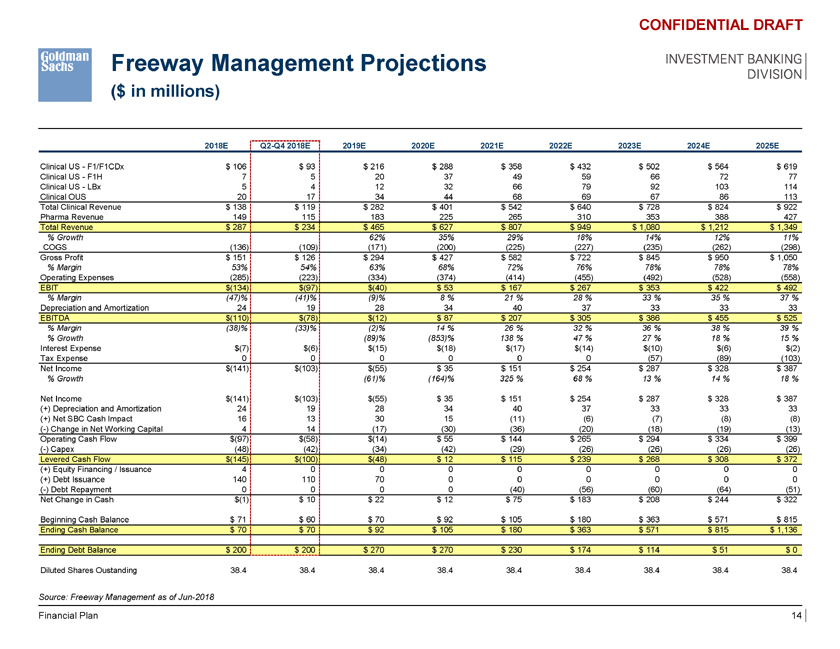

Freeway Management Projections ($ in millions) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION 2018E Q2-Q4 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Clinical US—F1/F1CDx $ 106 $ 93 $ 216 $ 288 $ 358 $ 432 $ 502 $ 564 $ 619 Clinical US—F1H 7 5 20 37 49 59 66 72 77 Clinical US—LBx 5 4 12 32 66 79 92 103 114 Clinical OUS 20 17 34 44 68 69 67 86 113 Total Clinical Revenue $ 138 $ 119 $ 282 $ 401 $ 542 $ 640 $ 728 $ 824 $ 922 Pharma Revenue 149 115 183 225 265 310 353 388 427 Total Revenue $ 287 $ 234 $ 465 $ 627 $ 807 $ 949 $ 1,080 $ 1,212 $ 1,349 % Growth 62% 35% 29% 18% 14% 12% 11% COGS (136) (109) (171) (200) (225) (227) (235) (262) (298) Gross Profit $ 151 $ 126 $ 294 $ 427 $ 582 $ 722 $ 845 $ 950 $ 1,050 % Margin 53% 54% 63% 68% 72% 76% 78% 78% 78% Operating Expenses (285) (223) (334) (374) (414) (455) (492) (528) (558) EBIT $(134) $(97) $(40) $ 53 $ 167 $ 267 $ 353 $ 422 $ 492 % Margin (47)% (41)% (9)% 8 % 21 % 28 % 33 % 35 % 37 % Depreciation and Amortization 24 19 28 34 40 37 33 33 33 EBITDA $(110) $(78) $(12) $ 87 $ 207 $ 305 $ 386 $ 455 $ 525 % Margin (38)% (33)% (2)% 14 % 26 % 32 % 36 % 38 % 39 % % Growth (89)% (853)% 138 % 47 % 27 % 18 % 15 % Interest Expense $(7) $(6) $(15) $(18) $(17) $(14) $(10) $(6) $(2) Tax Expense 0 0 0 0 0 0 (57) (89) (103) Net Income $(141) $(103) $(55) $ 35 $ 151 $ 254 $ 287 $ 328 $ 387 % Growth (61)% (164)% 325 % 68 % 13 % 14 % 18 % Net Income $(141) $(103) $(55) $ 35 $ 151 $ 254 $ 287 $ 328 $ 387 (+) Depreciation and Amortization 24 19 28 34 40 37 33 33 33 (+) Net SBC Cash Impact 16 13 30 15 (11) (6) (7) (8) (8) (-) Change in Net Working Capital 4 14 (17) (30) (36) (20) (18) (19) (13) Operating Cash Flow $(97) $(58) $(14) $ 55 $ 144 $ 265 $ 294 $ 334 $ 399 (-) Capex (48) (42) (34) (42) (29) (26) (26) (26) (26) Levered Cash Flow $(145) $(100) $(48) $ 12 $ 115 $ 239 $ 268 $ 308 $ 372 (+) Equity Financing / Issuance 4 0 0 0 0 0 0 0 0 (+) Debt Issuance 140 110 70 0 0 0 0 0 0 (-) Debt Repayment 0 0 0 0 (40) (56) (60) (64) (51) Net Change in Cash $(1) $ 10 $ 22 $ 12 $ 75 $ 183 $ 208 $ 244 $ 322 Beginning Cash Balance $ 71 $ 60 $ 70 $ 92 $ 105 $ 180 $ 363 $ 571 $ 815 Ending Cash Balance $ 70 $ 70 $ 92 $ 105 $ 180 $ 363 $ 571 $ 815 $ 1,136 Ending Debt Balance $ 200 $ 200 $ 270 $ 270 $ 230 $ 174 $ 114 $ 51 $ 0 Diluted Shares Oustanding 38.4 38.4 38.4 38.4 38.4 38.4 38.4 38.4 38.4 Source: Freeway Management as of Jun-2018 Financial Plan 14

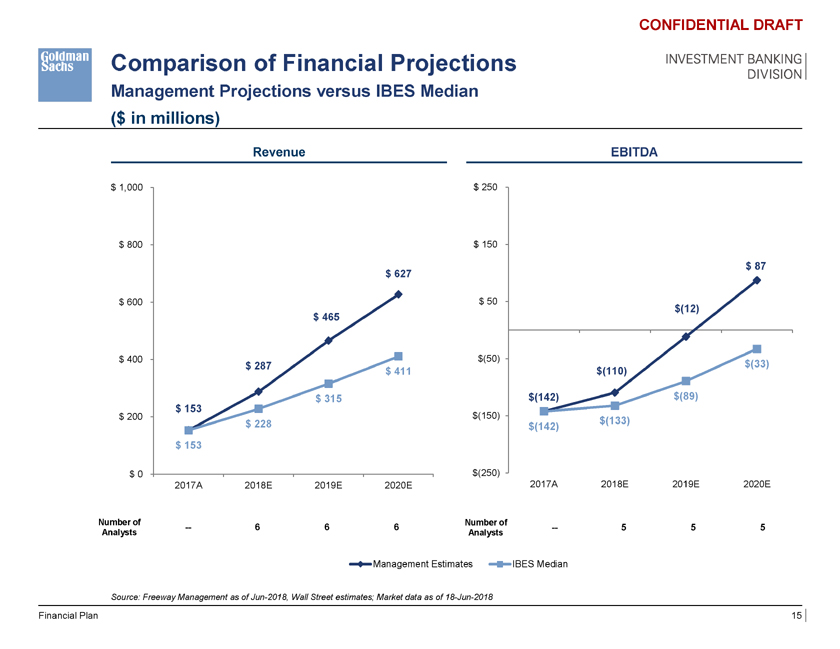

Comparison of Financial Projections Management Projections versus IBES Median ($ in millions) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Revenue EBITDA $ 1,000 $ 250 $ 800 $ 1,000 $ 150 $ 87 $ 627 $ 807 $ 600 $ 800 $ 50 $(12) $ 465 $ 627 $ 400 $ 600 $(50) $(33) $ 287 $ 631 $ 411 $ 465 $(110) $ 315 $(142) $(89) $ 153 $ 400 $ 200 $(150) $ 228 $ 4 $(133) $(142) $ 287 $ 153 $ 315 $ 200 $ 153 $(250) $ 0 $ 228 2017A 2018E 2019E 2020E 2017A 2018E 2019E 2020E $ 153 Number of Number of — 6 $ 0 6 6 — 5 5 5 Analysts Analysts 2017A 2018E 2019E 2020E 2021E Management Estimates IBES Median Source: Freeway Management as of Jun-2018, Wall Street estimates; Market data as of 18-Jun-2018 Financial Plan 15

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION IV. Financial Analysis

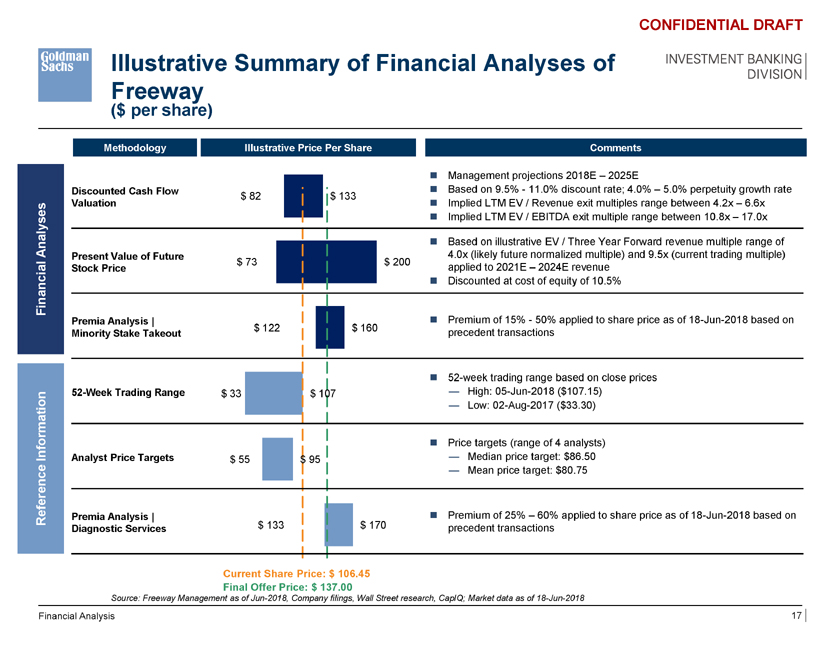

Illustrative Summary of Financial Analyses of Freeway ($ per share) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Methodology Illustrative Price Per Share Comments ï® Management projections 2018E – 2025E Discounted Cash Flow ï® Based on 9.5%—11.0% discount rate; 4.0% – 5.0% perpetuity growth rate $ 82 $ 133 Valuation ï® Implied LTM EV / Revenue exit multiples range between 4.2x – 6.6x ï® Implied LTM EV / EBITDA exit multiple range between 10.8x – 17.0x Analysesï® Based on illustrative EV / Three Year Forward revenue multiple range of Present Value of Future 4.0x (likely future normalized multiple) and 9.5x (current trading multiple) $ 73 $ 200 Stock Price applied to 2021E – 2024E revenue Financialï® Discounted at cost of equity of 10.5% Premia Analysis | ï® Premium of 15%—50% applied to share price as of 18-Jun-2018 based on $ 122 $ 160 Minority Stake Takeout precedent transactions ï® 52-week trading range based on close prices 52-Week Trading Range $ 33 $ 107 — High: 05-Jun-2018 ($107.15) — Low: 02-Aug-2017 ($33.30) ï® Price targets (range of 4 analysts) Information Analyst Price Targets $ 55 $ 95 — Median price target: $86.50 — Mean price target: $80.75 Reference Premia Analysis | ï® Premium of 25% – 60% applied to share price as of 18-Jun-2018 based on Diagnostic Services $ 133 $ 170 precedent transactions Current Share Price: $ 106.45 Final Offer Price: $ 137.00 Source: Freeway Management as of Jun-2018, Company filings, Wall Street research, CapIQ; Market data as of 18-Jun-2018 Financial Analysis 17

INVESTMENT BANKING DIVISION A. Supporting Information and Analysis

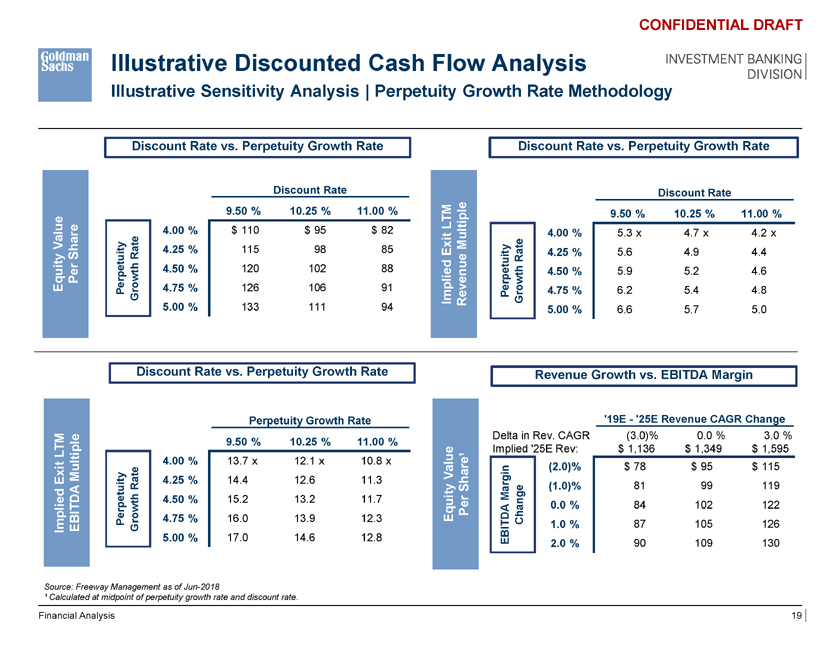

Illustrative Discounted Cash Flow Analysis Illustrative Sensitivity Analysis | Perpetuity Growth Rate Methodology CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Discount Rate vs. Perpetuity Growth Rate Discount Rate vs. Perpetuity Growth Rate Discount Rate Discount Rate $ 102 9.50 % 10.25 % 11.00 % 5.2 x 9.50 % 10.25 % 11.00 % LTM 4.00 % $ 110 $ 95 $ 82 4.00 % 5.3 x 4.7 x 4.2 x Value y Multiple Rate 4.25 % 115 98 85 Exit it y 4.25 % 5.6 4.9 4.4 Share Rate etuit h 4.50 % 120 102 88 etu h 4.50 % 5.9 5.2 4.6 Per p wt wt Equity Per o 4.75 % 126 106 91 erp o 4.75 % 6.2 5.4 4.8 Gr Implied Revenue P G r 5.00 % 133 111 94 5.00 % 6.6 5.7 5.0 Discount Rate vs. Perpetuity Growth Rate Revenue Growth vs. EBITDA Margin Perpetuity Growth Rate ‘19E—‘25E Revenue CAGR Change Delta in Rev. CAGR (3.0)% 0.0 % 3.0 % 13.2 x 9.50 % 10.25 % 11.00 % LTM Implied ‘25E Rev: $ 1,136 $ 1,349 $ 1,595 4.00 % 13.7 x 12.1 x 10.8 x (2.0)% $ 78 $ 95 $ 115 Multiple Value Exit 4.25 % 14.4 12.6 11.3 Rate Share¹ (1.0)% 81 99 119 4.50 % 15.2 13.2 11.7 Margin owth Equity Per DA 0.0 % 84 102 122 Perpetuity r 4.75 % 16.0 13.9 12.3 Change Implied EBITDA G BIT 1.0 % 87 105 126 5.00 % 17.0 14.6 12.8 E 2.0 % 90 109 130 Source: Freeway Management as of Jun-2018 ¹ Calculated at midpoint of perpetuity growth rate and discount rate. Financial Analysis 19

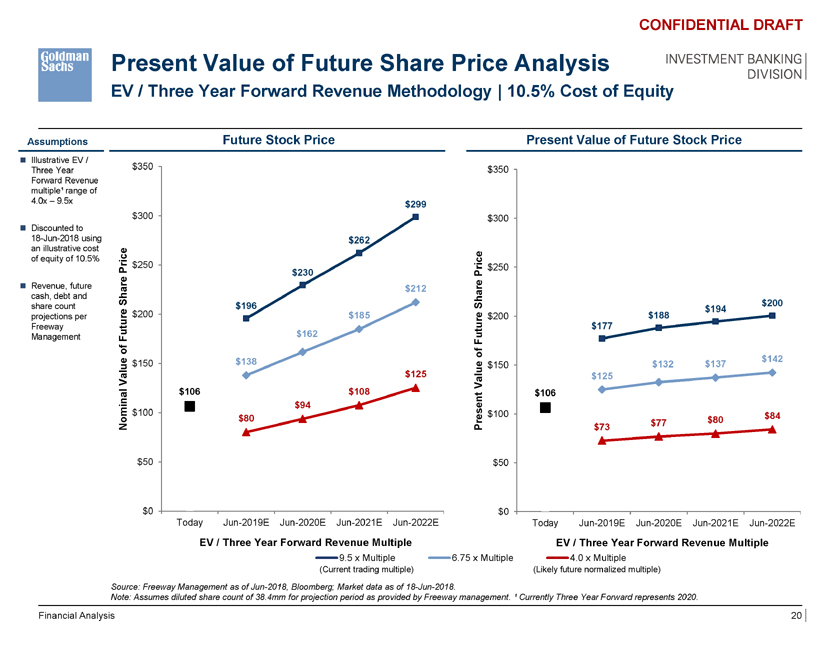

Present Value of Future Share Price Analysis EV / Three Year Forward Revenue Methodology | 10.5% Cost of Equity CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Assumptions Future Stock Price Present Value of Future Stock Price ï® Illustrative EV / Three Year $350 $350 Forward Revenue multiple¹ range of 4.0x – 9.5x $299 $300 $300 ï® Discounted to 18-Jun-2018 using $262 an illustrative cost of equity of 10.5% rice $250 $250 P $230 Price e ï® Revenue, future ar $212 cash, debt and h S hare $200 share count e $200 $196 S $194 projections per tur $185 e $200 $188 Freeway $162 tur $177 Management Fu Fu of f o $142 $150 $138 $150 $132 $137 alue $125 alue $125 V V al $106 $108 $106 $94 $100 $100 $84 $80 $80 Nomin Present $73 $77 $50 $50 $0 $0 Today Jun-2019E Jun-2020E Jun-2021E Jun-2022E Today Jun-2019E Jun-2020E Jun-2021E Jun-2022E EV / Three Year Forward Revenue Multiple EV / Three Year Forward Revenue Multiple 9.5 x Multiple 6.75 x Multiple 4.0 x Multiple (Current trading multiple) (Likely future normalized multiple) Source: Freeway Management as of Jun-2018, Bloomberg; Market data as of 18-Jun-2018. Note: Assumes diluted share count of 38.4mm for projection period as provided by Freeway management. ¹ Currently Three Year Forward represents 2020. Financial Analysis 20

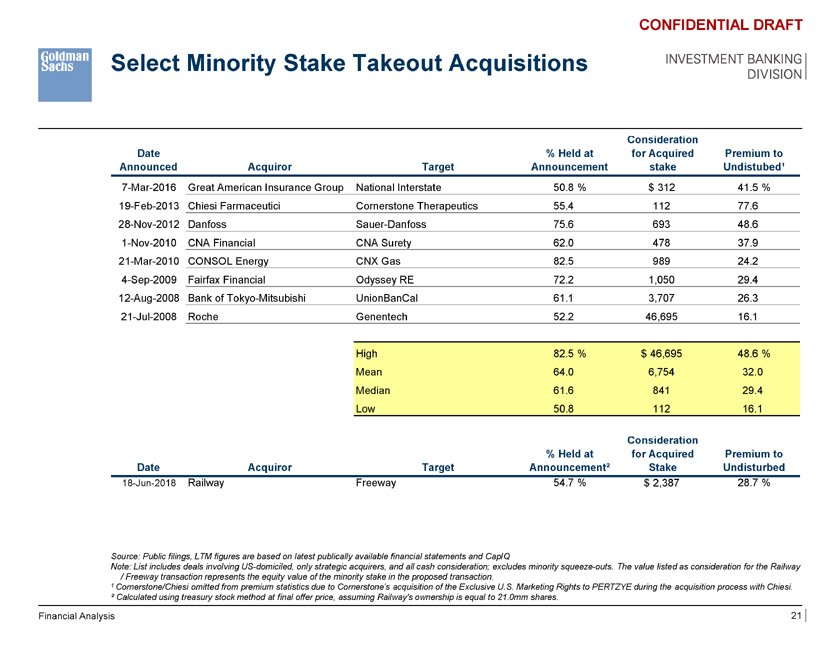

Select Minority Stake Takeout Acquisitions CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION sideration Date % Held at for Acquired Premium to Announced Acquiror Target Announcement stake Undistubed¹ 7-Mar-2016 Great American Insurance Group National Interstate 50.8 % $ 312 41.5 % 19-Feb-2013 Chiesi Farmaceutici Cornerstone Therapeutics 55.4 112 77.6 28-Nov-2012 Danfoss Sauer-Danfoss 75.6 693 48.6 1-Nov-2010 CNA Financial CNA Surety 62.0 478 37.9 21-Mar-2010 CONSOL Energy CNX Gas 82.5 989 24.2 4-Sep-2009 Fairfax Financial Odyssey RE 72.2 1,050 29.4 12-Aug-2008 Bank of Tokyo-Mitsubishi UnionBanCal 61.1 3,707 26.3 21-Jul-2008 Roche Genentech 52.2 46,695 16.1 High 82.5 % $ 46,695 48.6 % Mean 64.0 6,754 32.0 Median 61.6 841 29.4 Low 50.8 112 16.1 Consideration % Held at for Acquired Premium to Date Acquiror Target Announcement² Stake Undisturbed 18-Jun-2018 Railway Freeway 54.7 % $ 2,387 28.7 % Source: Public filings, LTM figures are based on latest publically available financial statements and CapIQ Note: List includes deals involving US-domiciled, only strategic acquirers, and all cash consideration; excludes minority squeeze-outs. The value listed as consideration for the Railway / Freeway transaction represents the equity value of the minority stake in the proposed transaction. 1 Cornerstone/Chiesi omitted from premium statistics due to Cornerstone’s acquisition of the Exclusive U.S. Marketing Rights to PERTZYE during the acquisition process with Chiesi. ² Calculated using treasury stock method at final offer price, assuming Railway’s ownership is equal to 21.0mm shares. Financial Analysis 21

CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Appendix A: Additional Materials

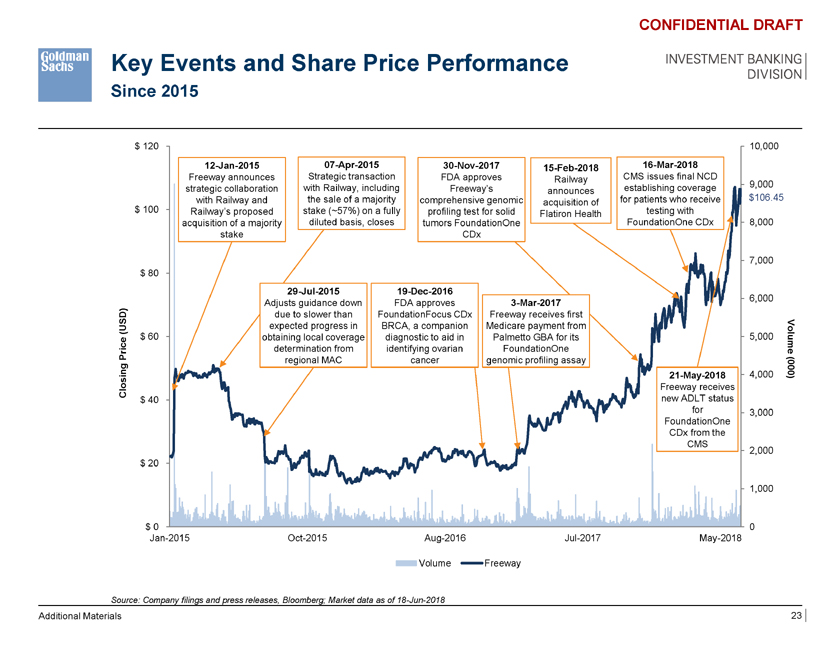

Key Events and Share Price Performance Since 2015 CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION $ 120 10,000 12-Jan-2015 07-Apr-2015 30-Nov-2017 15-Feb-2018 16-Mar-2018 Freeway announces Strategic transaction FDA approves Railway CMS issues final NCD 9,000 strategic collaboration with Railway, including Freeway’s announces establishing coverage with Railway and the sale of a majority comprehensive genomic for patients who receive $106.45 acquisition of $ 100 Railway’s proposed stake (~57%) on a fully profiling test for solid testing with diluted basis, closes Flatiron Health FoundationOne CDx 8,000 acquisition of a majority tumors FoundationOne stake CDx 7,000 $ 80 29-Jul-2015 19-Dec-2016 6,000 Adjusts guidance down FDA approves 3-Mar-2017 due to slower than FoundationFocus CDx Freeway receives first (USD) expected progress in BRCA, a companion Medicare payment from $ 60 obtaining local coverage diagnostic to aid in Palmetto GBA for its 5,000 Volum determination from identifying ovarian FoundationOne e Price regional MAC cancer genomic profiling assay ing 21-May-2018 4,000 0(00 ) Clos Freeway receives $ 40 new ADLT status for 3,000 FoundationOne CDx from the CMS 2,000 $ 20 1,000 $ 0 0 Jan-2015 Oct-2015 Aug-2016 Jul-2017 May-2018 Volume Freeway Source: Company filings and press releases, Bloomberg; Market data as of 18-Jun-2018 Additional Materials 23

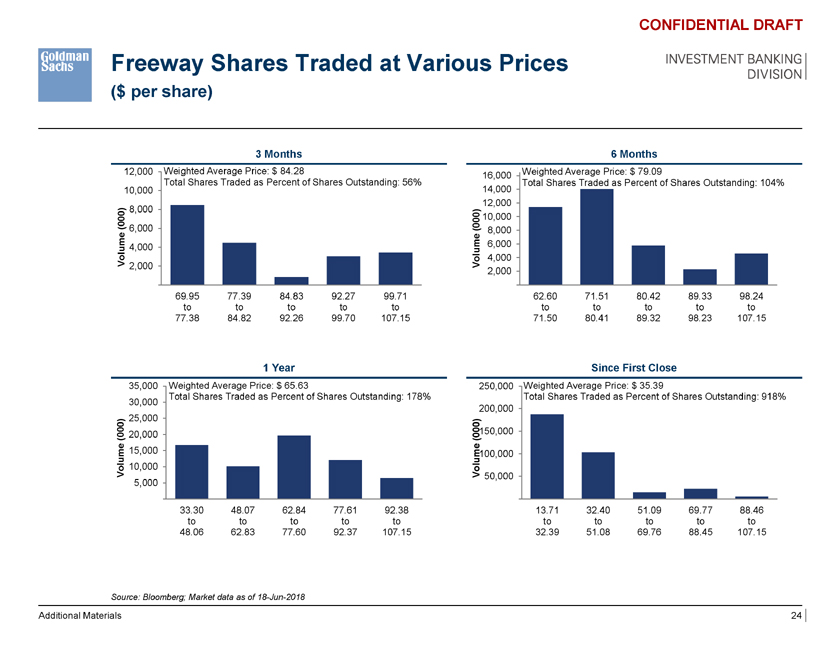

Freeway Shares Traded at Various Prices ($ per share) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION 3 Months 6 Months 12,000 Weighted Average Price: $ 84.28 Weighted Average Price: $ 79.09 16,000 Total Shares Traded as Percent of Shares Outstanding: 56% Total Shares Traded as Percent of Shares Outstanding: 104% 10,000 14,000 12,000 (000) 8,000 00 ) 10,000 6,000(0 8,000 e 4,000 ume 6,000 Volum 2,000 Vol 4,000 2,000 69.95 77.39 84.83 92.27 99.71 62.60 71.51 80.42 89.33 98.24 to to to to to to to to to to 77.38 84.82 92.26 99.70 107.15 71.50 80.41 89.32 98.23 107.15 1 Year Since First Close 35,000 Weighted Average Price: $ 65.63 250,000 Weighted Average Price: $ 35.39 Total Shares Traded as Percent of Shares Outstanding: 178% Total Shares Traded as Percent of Shares Outstanding: 918% 30,000 200,000 25,000 ) (000) 20,000 (000150,000 e 15,000 ume100,000 Volum 10,000 Vol 50,000 5,000 33.30 48.07 62.84 77.61 92.38 13.71 32.40 51.09 69.77 88.46 to to to to to to to to to to 48.06 62.83 77.60 92.37 107.15 32.39 51.08 69.76 88.45 107.15 Source: Bloomberg; Market data as of 18-Jun-2018 Additional Materials 24

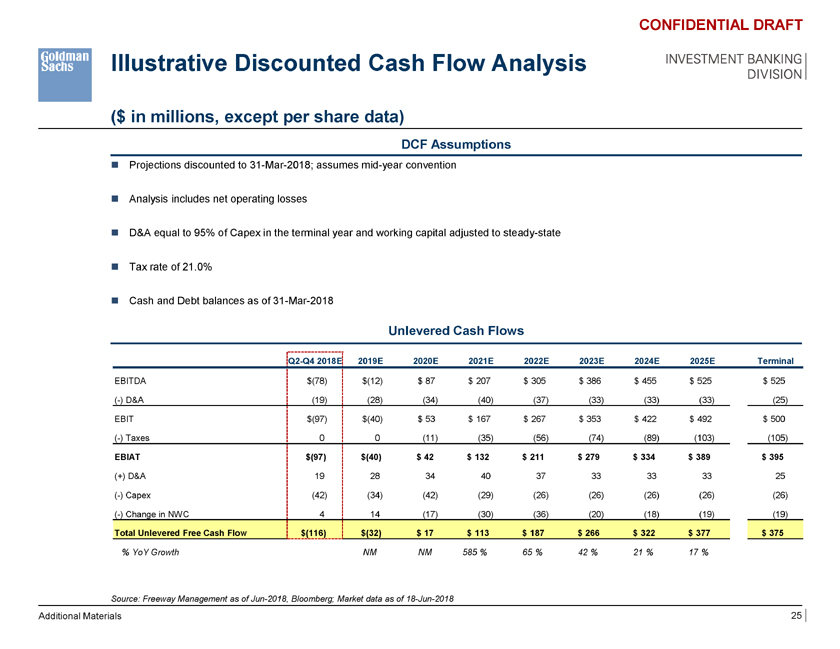

Illustrative Discounted Cash Flow Analysis ($ in millions, except per share data) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION DCF Assumptions ï® Projections discounted to 31-Mar-2018; assumes mid-year convention ï® Analysis includes net operating losses ï® D&A equal to 95% of Capex in the terminal year and working capital adjusted to steady-state ï® Tax rate of 21.0% ï® Cash and Debt balances as of 31-Mar-2018 Unlevered Cash Flows Q2-Q4 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Terminal EBITDA $(78) $(12) $ 87 $ 207 $ 305 $ 386 $ 455 $ 525 $ 525 (-) D&A (19) (28) (34) (40) (37) (33) (33) (33) (25) EBIT $(97) $(40) $ 53 $ 167 $ 267 $ 353 $ 422 $ 492 $ 500 (-) Taxes 0 0 (11) (35) (56) (74) (89) (103) (105) EBIAT $(97) $(40) $ 42 $ 132 $ 211 $ 279 $ 334 $ 389 $ 395 (+) D&A 19 28 34 40 37 33 33 33 25 (-) Capex (42) (34) (42) (29) (26) (26) (26) (26) (26) (-) Change in NWC 4 14 (17) (30) (36) (20) (18) (19) (19) Total Unlevered Free Cash Flow $(116) $(32) $ 17 $ 113 $ 187 $ 266 $ 322 $ 377 $ 375 % YoY Growth NM NM 585 % 65 % 42 % 21 % 17 % Source: Freeway Management as of Jun-2018, Bloomberg; Market data as of 18-Jun-2018 Additional Materials 25

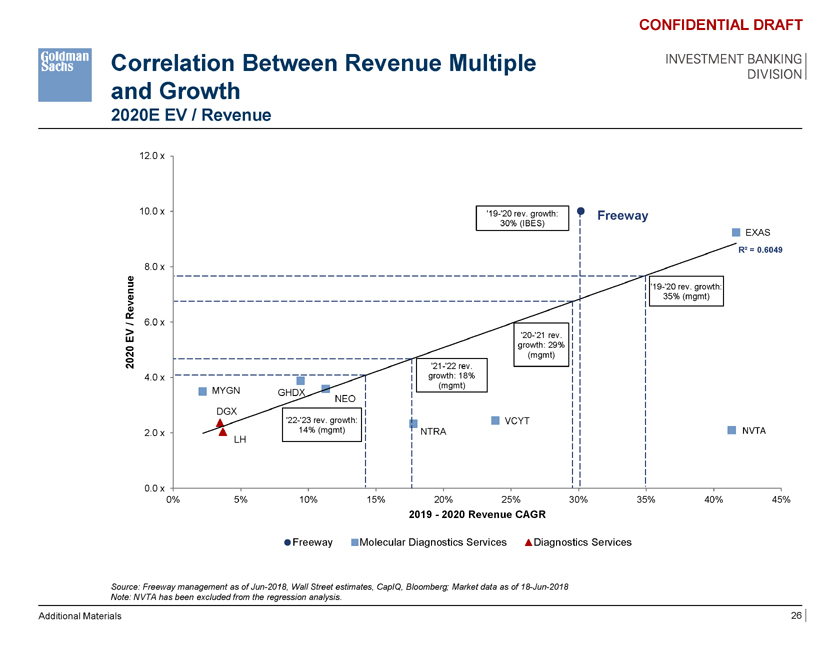

Correlation Between Revenue Multiple and Growth 2020E EV / Revenue CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION 12.0 x 10.0 x ‘19-‘20 rev. growth: Freeway 30% (IBES) EXAS R² = 0.6049 8.0 x e ‘19-‘20 rev. growth: Revenu 35% (mgmt) / 6.0 x V ‘20-‘21 rev. E growth: 29% 20 (mgmt) 20 ‘21-‘22 rev. 4.0 x growth: 18% (mgmt) MYGN GHDX NEO DGX ‘22-‘23 rev. growth: VCYT 2.0 x 14% (mgmt) NTRA NVTA LH 0.0 x 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2019—2020 Revenue CAGR Freeway Molecular Diagnostics Services Diagnostics Services Source: Freeway management as of Jun-2018, Wall Street estimates, CapIQ, Bloomberg; Market data as of 18-Jun-2018 Note: NVTA has been excluded from the regression analysis. Additional Materials 26

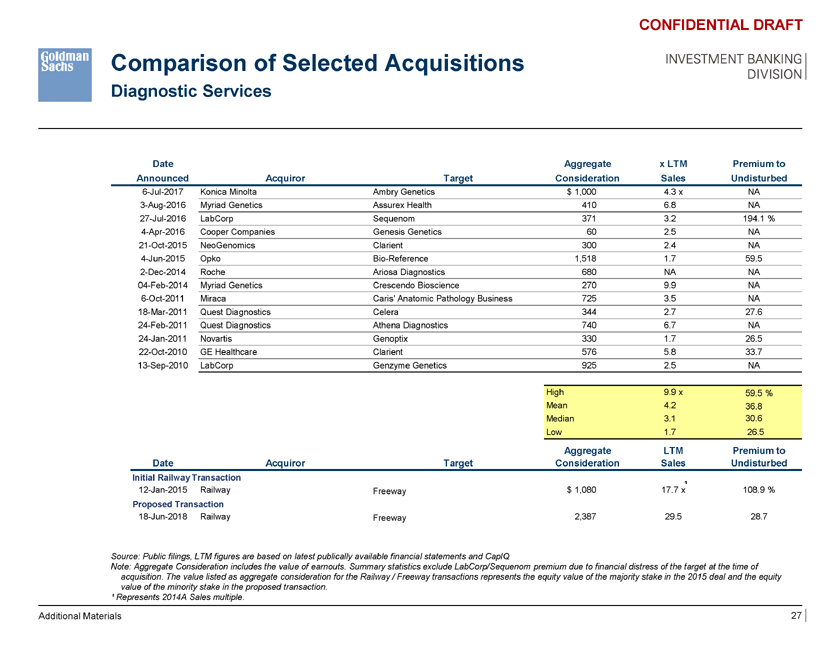

Comparison of Selected Acquisitions Diagnostic Services CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Date Aggregate x LTM Premium to Announced Acquiror Target Consideration Sales Undisturbed 6-Jul-2017 Konica Minolta Ambry Genetics $ 1,000 4.3 x NA 3-Aug-2016 Myriad Genetics Assurex Health 410 6.8 NA 27-Jul-2016 LabCorp Sequenom 371 3.2 194.1 % 4-Apr-2016 Cooper Companies Genesis Genetics 60 2.5 NA 21-Oct-2015 NeoGenomics Clarient 300 2.4 NA 4-Jun-2015 Opko Bio-Reference 1,518 1.7 59.5 2-Dec-2014 Roche Ariosa Diagnostics 680 NA NA 04-Feb-2014 Myriad Genetics Crescendo Bioscience 270 9.9 NA 6-Oct-2011 Miraca Caris’ Anatomic Pathology Business 725 3.5 NA 18-Mar-2011 Quest Diagnostics Celera 344 2.7 27.6 24-Feb-2011 Quest Diagnostics Athena Diagnostics 740 6.7 NA 24-Jan-2011 Novartis Genoptix 330 1.7 26.5 22-Oct-2010 GE Healthcare Clarient 576 5.8 33.7 13-Sep-2010 LabCorp Genzyme Genetics 925 2.5 NA High 9.9 x 59.5 % Mean 4.2 36.8 Median 3.1 30.6 Low 1.7 26.5 Aggregate LTM Premium to Date Acquiror Target Consideration Sales Undisturbed Initial Railway Transaction ¹ 12-Jan-2015 Railway Freeway $ 1,080 17.7 x 108.9 % Proposed Transaction 18-Jun-2018 Railway Freeway 2,387 29.5 28.7 Source: Public filings, LTM figures are based on latest publically available financial statements and CapIQ Note: Aggregate Consideration includes the value of earnouts. Summary statistics exclude LabCorp/Sequenom premium due to financial distress of the target at the time of acquisition. The value listed as aggregate consideration for the Railway / Freeway transactions represents the equity value of the majority stake in the 2015 deal and the equity value of the minority stake in the proposed transaction. ¹ Represents 2014A Sales multiple. Additional Materials 27

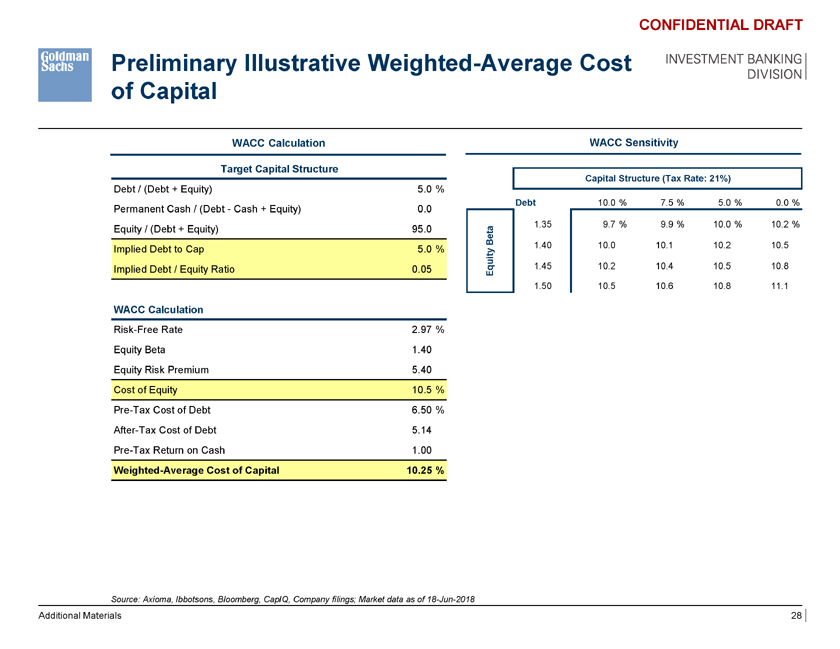

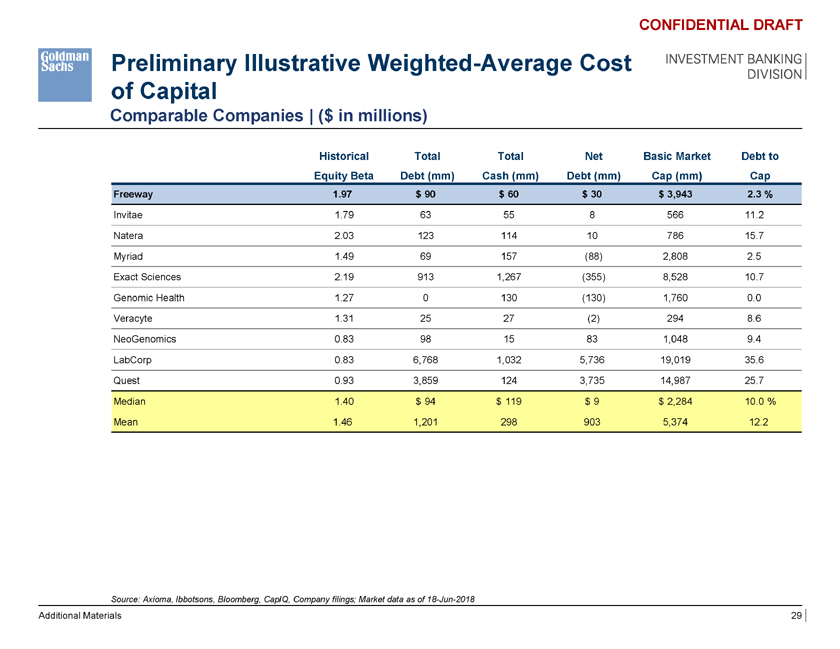

Preliminary Illustrative Weighted-Average Cost of Capital CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION WACC Calculation WACC Sensitivity Target Capital Structure Capital Structure (Tax Rate: 21%) Debt / (Debt + Equity) 5.0 % Debt 10.0 % 7.5 % 5.0 % 0.0 % Permanent Cash / (Debt—Cash + Equity) 0.0 1.35 9.7 % 9.9 % 10.0 % 10.2 % Equity / (Debt + Equity) 95.0 a t Be 1.40 10.0 10.1 10.2 10.5 Implied Debt to Cap 5.0 % ity Implied Debt / Equity Ratio 0.05 qu 1.45 10.2 10.4 10.5 10.8 E 1.50 10.5 10.6 10.8 11.1 WACC Calculation Risk-Free Rate 2.97 % Equity Beta 1.40 Equity Risk Premium 5.40 Cost of Equity 10.5 % Pre-Tax Cost of Debt 6.50 % After-Tax Cost of Debt 5.14 Pre-Tax Return on Cash 1.00 Weighted-Average Cost of Capital 10.25 % Source: Axioma, Ibbotsons, Bloomberg, CapIQ, Company filings; Market data as of 18-Jun-2018 Additional Materials 28

Preliminary Illustrative Weighted-Average Cost of Capital Comparable Companies | ($ in millions) CONFIDENTIAL DRAFT INVESTMENT BANKING DIVISION Historical Total Total Net Basic Market Debt to Equity Beta Debt (mm) Cash (mm) Debt (mm) Cap (mm) Cap Freeway 1.97 $ 90 $ 60 $ 30 $ 3,943 2.3 % Invitae 1.79 63 55 8 566 11.2 Natera 2.03 123 114 10 786 15.7 Myriad 1.49 69 157 (88) 2,808 2.5 Exact Sciences 2.19 913 1,267 (355) 8,528 10.7 Genomic Health 1.27 0 130 (130) 1,760 0.0 Veracyte 1.31 25 27 (2) 294 8.6 NeoGenomics 0.83 98 15 83 1,048 9.4 LabCorp 0.83 6,768 1,032 5,736 19,019 35.6 Quest 0.93 3,859 124 3,735 14,987 25.7 Median 1.40 $ 94 $ 119 $ 9 $ 2,284 10.0 % Mean 1.46 1,201 298 903 5,374 12.2 Source: Axioma, Ibbotsons, Bloomberg, CapIQ, Company filings; Market data as of 18-Jun-2018 Additional Materials 29