Form FWP CYTORI THERAPEUTICS, Filed by: CYTORI THERAPEUTICS, INC.

Cytori Therapeutics Investor Presentation June 2018 NASDAQ:CYTX Issuer Free Writing Prospectus Filed pursuant to Rule 433 Registration Statement No. 333-224502 June 12, 2018

Forward-Looking Statements & Disclaimers The forward-looking statements included in this presentation, involve known and unknown risks that relate to future events or our future financial performance and the actual results could differ materially from those discussed in this presentation. Some of those forward-looking statements include statements regarding: our financial condition and prospects; the expected reduction in operating expenses following our restructuring; our commercialized and pipeline products and technologies; the timing and conduct of our clinical trials and other parties’ clinical trials involving Cytori Cell Therapy™ and Cytori Nanomedicine, including associated financial, clinical and regulatory burdens and projected timing for trial approval, enrollment and completion; the various medical indications and markets that may be addressed by Cytori Cell Therapy and Cytori Nanomedicine; the potential benefits of our strategic initiatives in Japan; the potential effectiveness of Cytori Cell Therapy and Cytori Nanomedicine, including clinical outcomes; conduct of our European managed access program; anticipated uses of clinical trial data; regulatory, reimbursement and commercial strategies and pathways; potential costs and other adverse effects of diseases targeted for treatment by our products, including the Celution System; and anticipated future funding and contract revenues. Some risks and uncertainties related to such forward looking statements include risks and uncertainties regarding: the funding, conduct and completion of our clinical trials and other parties’ clinical trials involving Cytori Cell Therapy and Cytori Nanomedicine; our ability to successfully execute our managed access program; uncertain clinical outcomes, including the possibility that we may determine that there is not a viable continued development path for one or more of our product candidates; regulatory uncertainties (including potentially adverse decisions regarding our existing and expected regulatory registrations, approvals and authorizations); unfavorable reimbursement outcomes; inability to access sufficient capital on acceptable terms (including inability to fund, or find third party sources to fund, our proposed clinical trials or continued development of our technologies); the risk that the cost and other negative effects related to our workforce reduction may be greater than anticipated; the risk that we may not realize the benefits expected from our workforce reduction or other cost control measures; our ability to retain our existing employees and effectively operate our business with our reduced workforce; failure to maintain our substantially reduced cash burn; failure to achieve projected product revenue and contract revenue growth; our and our partners’ failure to launch products and grow revenues in markets where we currently forecast sales; our ability to service, pay and/or refinance our corporate debt and the potential that our secured lender, which has a lien on all of our assets, including our intellectual property, may accelerate our indebtedness and/or foreclose on our assets; availability of future government funding and changes in government procurement priorities; the U.S. federal government’s ability to reduce, modify or terminate the BARDA contract if it determines it is in its best interests to do so; increasing or unanticipated competitive pressures; potential performance issues with our products and technologies; lack of customer acceptance of our technologies; inability to find commercial partners for our therapies; risks related to our dependence on third party performance; the potential for litigation or other disagreements with third parties; and other risks and uncertainties described under the "Risk Factors" section in our filings with the U.S. Securities and Exchange Commission. These risks and uncertainties may cause our actual results to differ materially from those discussed in this presentation. We advise reading our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission for a more detailed description of these risks. Disclaimers Caution: Within the U.S., the Celution System is an investigational device limited by U.S. law to investigational use. Celase, Celution, Celution (with design), Cytori Therapeutics, and Cytori (with design) are registered trademarks of Cytori Therapeutics. Cytori Cell Therapy is a trademark of Cytori Therapeutics. All third party trademarks are the property of their respective owners.

Free Writing Prospectus Statement This presentation highlights basic information about us and the offering. Being a summary document, this slide does not contain all the information that you should consider before investing. We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this presentation relates. The registration statement has not yet become effective. Before you invest, you should read the preliminary prospectus in the registration statement (including but not limited to the risk factors described therein) and other documents, including our Form 10-Ks and Form 10-Qs, that we have filed with the SEC for more complete information about us and the offering. You may get these documents for free by visiting the “Search EDGAR” section on the SEC web site at http://www.sec.gov. The preliminary prospectus, dated June 6, 2018, is available on the SEC website. Alternatively, we or the dealer-manager for this offering, Maxim Group LLC will arrange to send you a preliminary prospectus of you contact Maxim Group LLC, Prospectus Department, 405 Lexington Ave., New York, NY, 10174; Telephone: (212) 895-3745; Email: [email protected].

About Cytori Cytori Therapeutics, Inc. is a U.S. headquartered company with global operations. We are committed to providing meaningful and quality therapeutic options with broad utility that benefit patients and healthcare providers around the world. Whether it’s advancing our product and technology pipeline, performing clinical trials, or commercializing approved therapies, we believe that every day, every trial and every patient matters.

Cytori Nanomedicine & Cell Therapy Platforms Anticipate Phase III trial read out in urinary incontinence indication Double-digit consumable growth in lead market- Japan* BARDA contract with financial offsets Lead: ATI-0918 potential 1st EU generic of market leading oncology drug ATI-0918 potential positive cash flow by 2020 Pipeline: ATI-1123 phase II ready oncology drug *Based on 2016/2017 year-over-year consumable growth

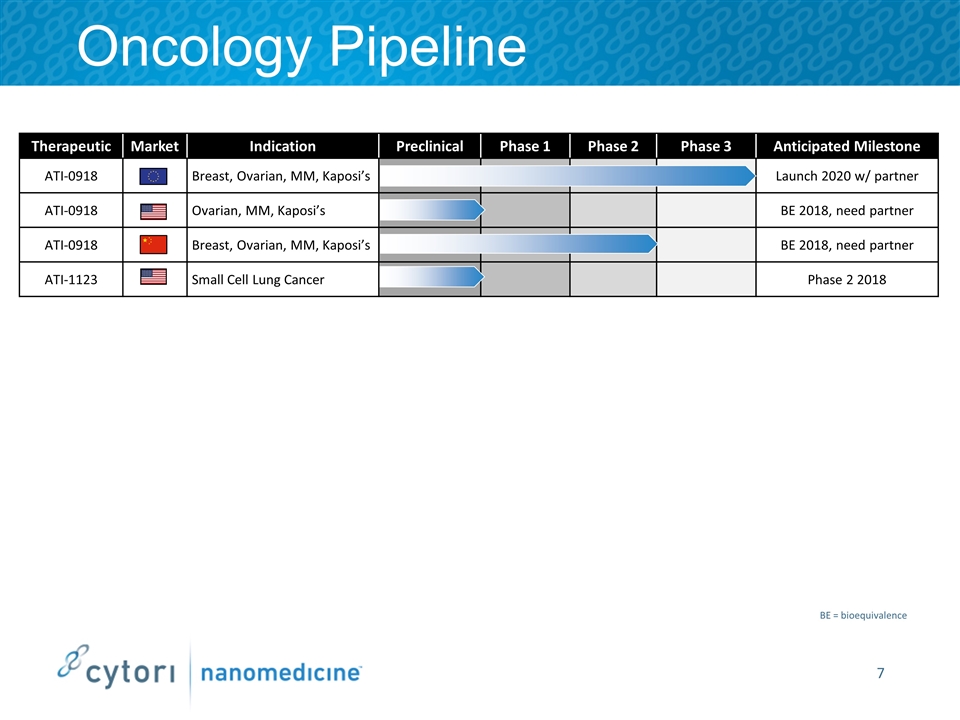

Oncology Pipeline Therapeutic Market Indication Preclinical Phase 1 Phase 2 Phase 3 Anticipated Milestone ATI-0918 Breast, Ovarian, MM, Kaposi’s Launch 2020 w/ partner ATI-0918 Ovarian, MM, Kaposi’s BE 2018, need partner ATI-0918 Breast, Ovarian, MM, Kaposi’s BE 2018, need partner ATI-1123 Small Cell Lung Cancer Phase 2 2018 BE = bioequivalence

Nanomedicine Encapsulation Platform Lead: ATI-0918, liposomal doxorubicin, generic formulation of market leader Doxil/Caelyx. Pipeline: ATI-1123, liposomal docetaxel- ready for Phase II, proprietary technology for lipophilic compounds. Cytori operates dedicated liposomal manufacturing plant in Texas. Proprietary manufacturing know-how & test methods with 10+ years experience

‘The Liposomal Doxorubicin Story’ Doxorubicin- highly effective chemotherapeutic Liposomal encapsulation substantially lowers cardiotoxity of doxorubicin Widely used & profitable oncology drug as a branded therapeutic Therapy for advanced breast & ovarian cancer, multiple myeloma & Kaposi’s sarcoma Production process complex- more of a biosimilar Global supply plagued by manufacturing, scalability and quality issues Pricing analogous to branded drugs Cytori well positioned to compete in largest doxorubicin market segment as U.S.-manufactured, high quality, complex generic

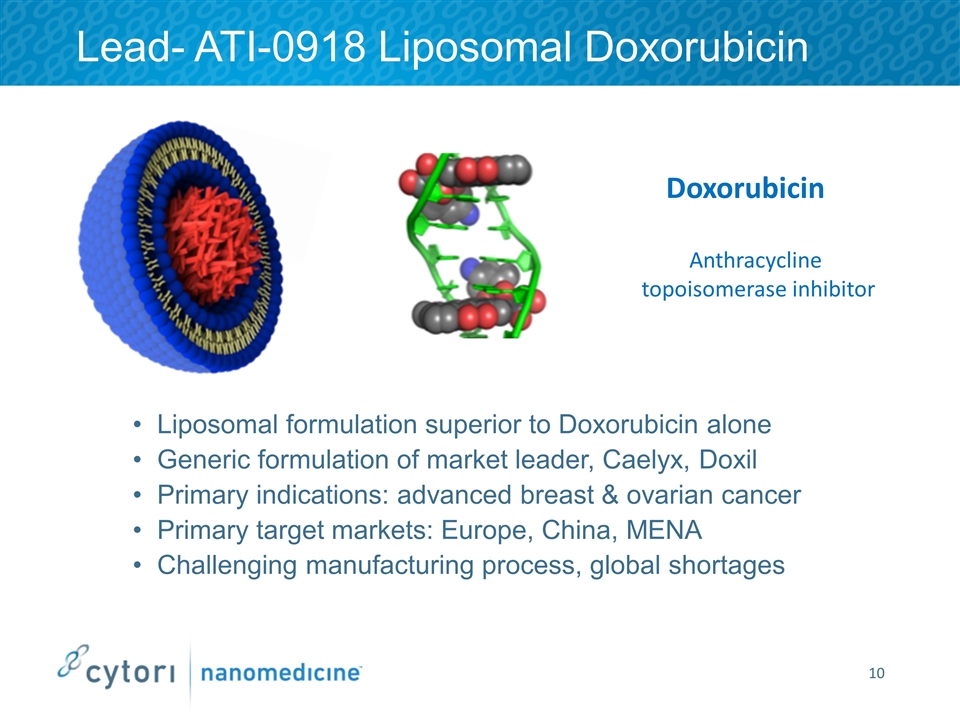

Lead- ATI-0918 Liposomal Doxorubicin Liposomal formulation superior to Doxorubicin alone Generic formulation of market leader, Caelyx, Doxil Primary indications: advanced breast & ovarian cancer Primary target markets: Europe, China, MENA Challenging manufacturing process, global shortages Anthracycline topoisomerase inhibitor Doxorubicin

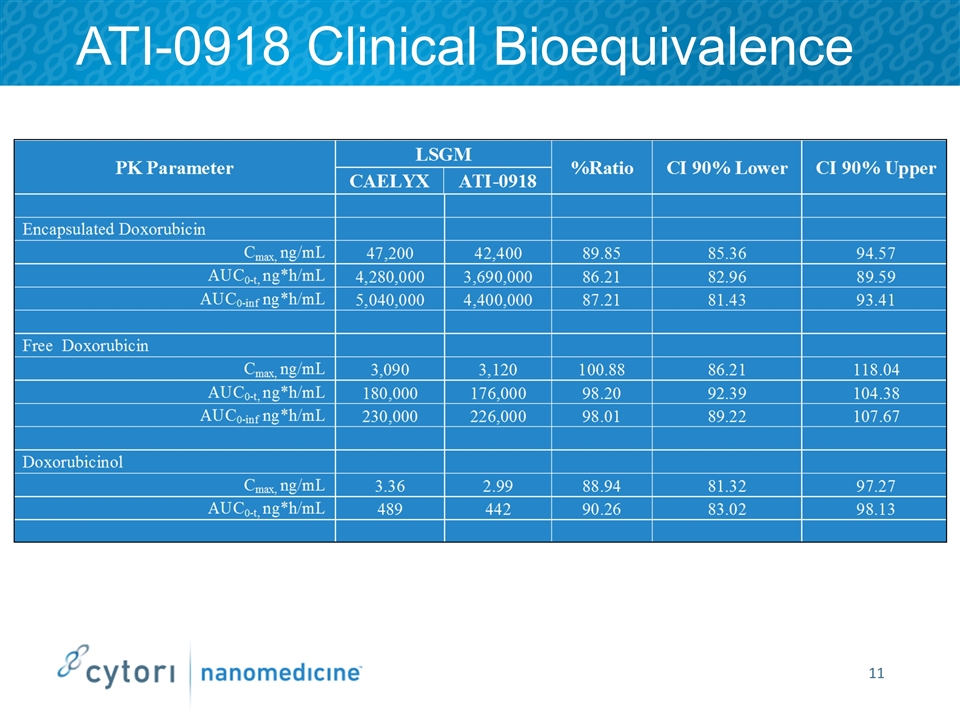

ATI-0918 Clinical Bioequivalence

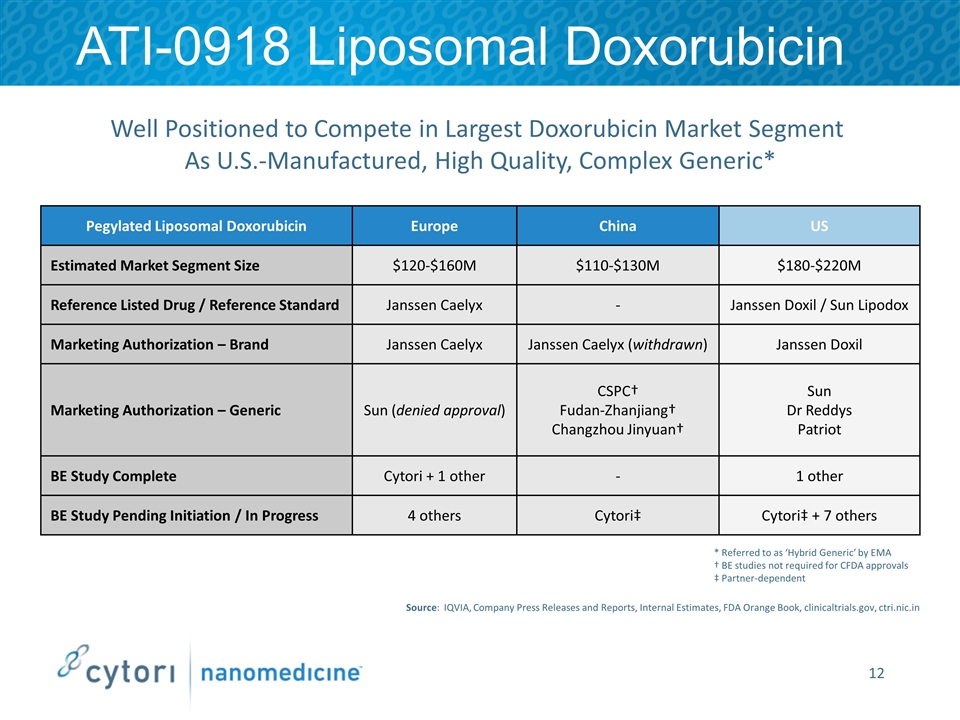

ATI-0918 Liposomal Doxorubicin Pegylated Liposomal Doxorubicin Europe China US Estimated Market Segment Size $120-$160M $110-$130M $180-$220M Reference Listed Drug / Reference Standard Janssen Caelyx - Janssen Doxil / Sun Lipodox Marketing Authorization – Brand Janssen Caelyx Janssen Caelyx (withdrawn) Janssen Doxil Marketing Authorization – Generic Sun (denied approval) CSPC† Fudan-Zhanjiang† Changzhou Jinyuan† Sun Dr Reddys Patriot BE Study Complete Cytori + 1 other - 1 other BE Study Pending Initiation / In Progress 4 others Cytori‡ Cytori‡ + 7 others Well Positioned to Compete in Largest Doxorubicin Market Segment As U.S.-Manufactured, High Quality, Complex Generic* Source: IQVIA, Company Press Releases and Reports, Internal Estimates, FDA Orange Book, clinicaltrials.gov, ctri.nic.in * Referred to as ‘Hybrid Generic’ by EMA † BE studies not required for CFDA approvals ‡ Partner-dependent

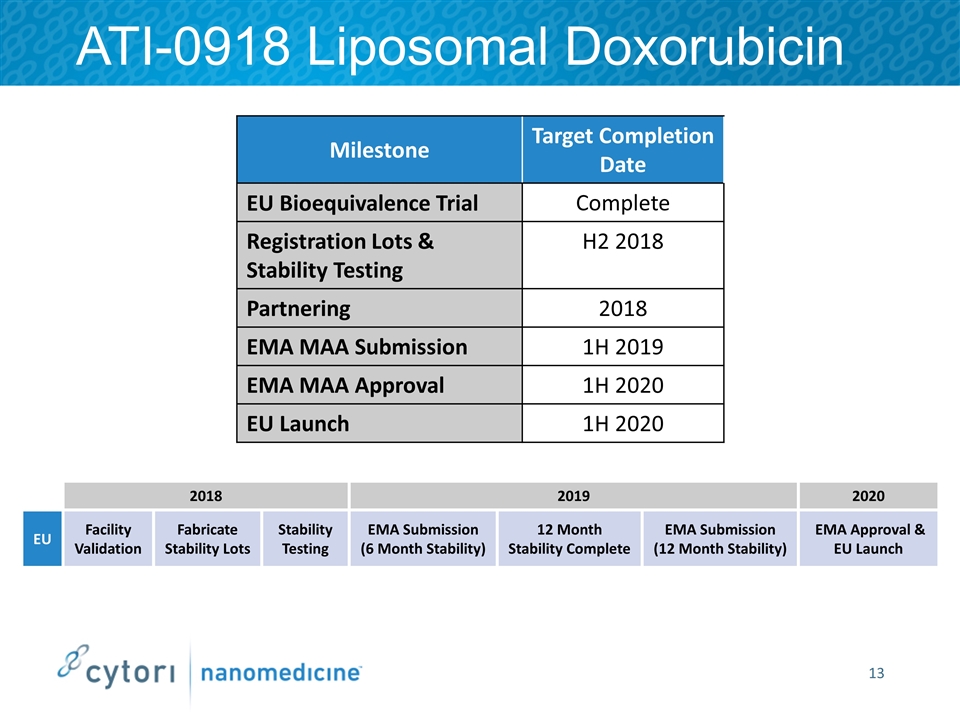

ATI-0918 Liposomal Doxorubicin Milestone Target Completion Date EU Bioequivalence Trial Complete Registration Lots & Stability Testing H2 2018 Partnering 2018 EMA MAA Submission 1H 2019 EMA MAA Approval 1H 2020 EU Launch 1H 2020 2018 2019 2020 EU Facility Validation Fabricate Stability Lots Stability Testing EMA Submission (6 Month Stability) 12 Month Stability Complete EMA Submission (12 Month Stability) EMA Approval & EU Launch

ATI-1123 Liposomal Docetaxel Protein stabilization overcomes liposomal instability with lipophilic compounds (USPTO #7179484) 14 preclinical studies indicate: ATI-1123 serum AUC 4-5x higher than Docetaxel alone Better tissue distribution and greater activity in key tumors Potentially greater efficacy than docetaxel alone Potential reduction of side effect profile *Mahalingam et al (2014) Cancer Chemother Pharmacol. 74(6):1241-50 Highly Lipophillic Taxane Mitotic inhibitor Apoptosis via Bcl-2 phosphorylator Docetaxel New Chemical Entity Pegylated & Protein Stabilized

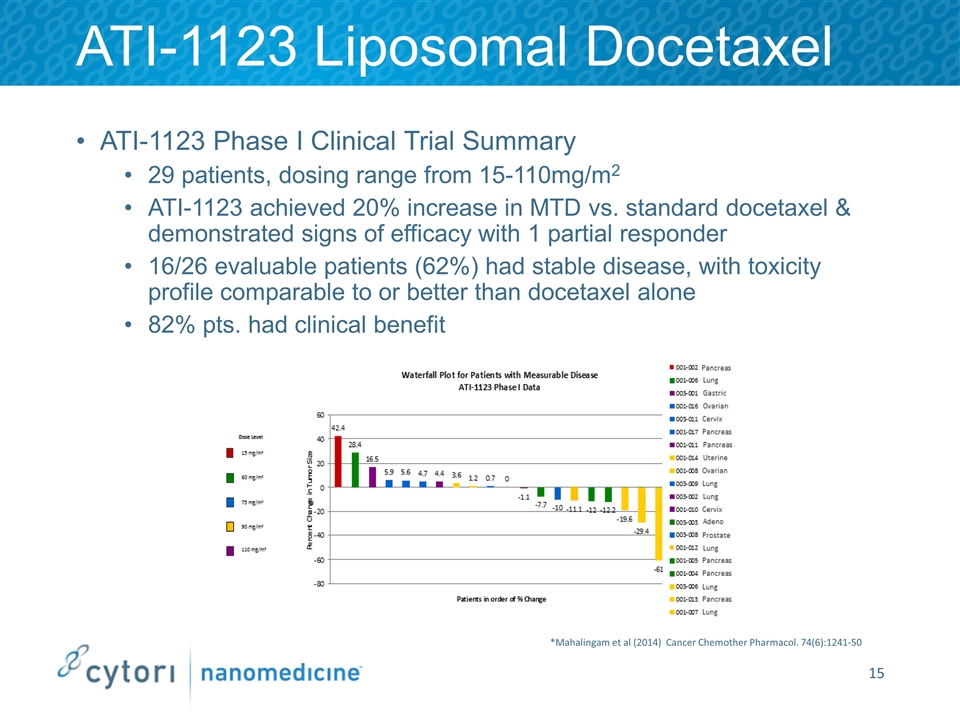

ATI-1123 Liposomal Docetaxel ATI-1123 Phase I Clinical Trial Summary 29 patients, dosing range from 15-110mg/m2 ATI-1123 achieved 20% increase in MTD vs. standard docetaxel & demonstrated signs of efficacy with 1 partial responder 16/26 evaluable patients (62%) had stable disease, with toxicity profile comparable to or better than docetaxel alone 82% pts. had clinical benefit *Mahalingam et al (2014) Cancer Chemother Pharmacol. 74(6):1241-50

ATI-1123 Liposomal Docetaxel Initial Clinical Target- Small Cell Lung Cancer, Highly Aggressive Rare Disease Small Cell Lung Cancer (SCLC) 30,000 adults in the U.S. 15% of total lung cancer cases 93% of patients relapse/refractory to 1st line therapy 68% of relapse/refractory patients receive 2nd line therapy Topotecan- only FDA-approved drug for SCLC 2nd line therapy Generates $70M in annual sales U.S., top 5 EU markets, and Japan Standard docetaxel is used off-label for SCLC, included in MD Anderson practice algorithm as 2nd line therapy Patented, protein-stabilized liposomal docetaxel (ATI-1123)- 3 part positioning: less toxicity, similar or improved efficacy, and more patient-friendly dosing schedule vs. Topotecan Company intends to expand clinical indications beyond SCLC in subsequent trials Source: GlobalData

ATI-1123 Liposomal Docetaxel Regulatory Strategy- SCLC initial indication Potential eligibility for orphan status and US FDA 505(b)(2) pathway SPA Clinical Development Plan- Open label, single dose study of ATI-1123 Dosage of 90 mg/m2 on an every 3 week schedule. In phase 1 trial, doses of 75 - 90 mg/m2 would be clinically appropriate. Enrollment of up to 40 subjects at approximately 8 clinical centers. Primary end point- objective response rate at up to 30 weeks for each subject. Key secondary end points- duration of response, overall survival and progression-free survival (PFS) (each assessed at up to 30 weeks for each subject) Business Development Plan- Seek partner for non small cell lung cancer and pancreatic indications

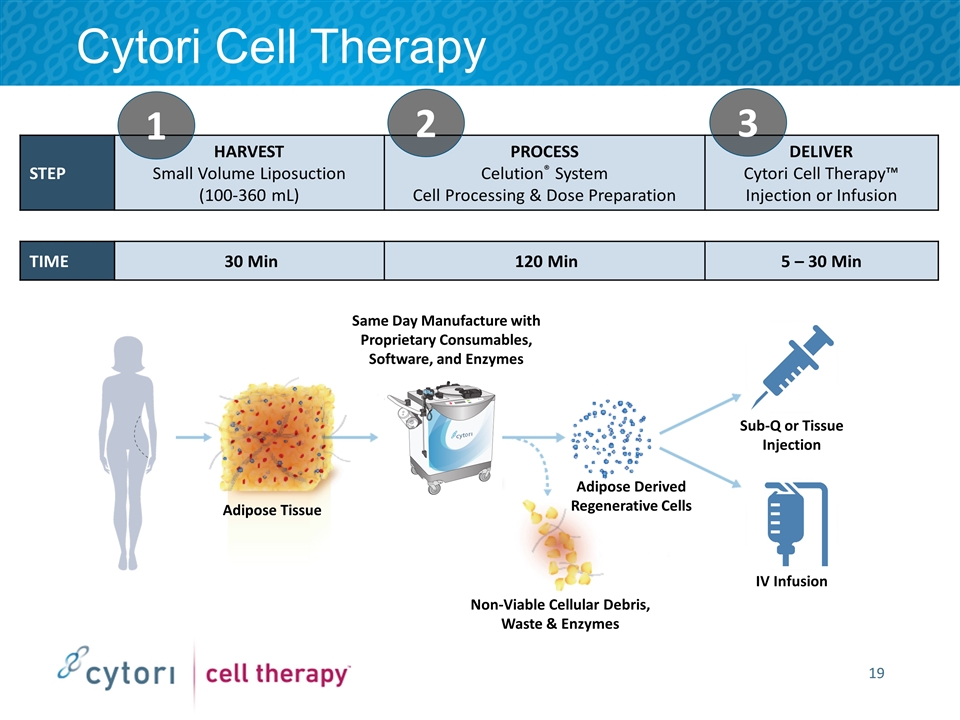

Cytori Cell Therapy Same Day Manufacture with Proprietary Consumables, Software, and Enzymes Adipose Tissue Non-Viable Cellular Debris, Waste & Enzymes Adipose Derived Regenerative Cells 1 2 3 IV Infusion Sub-Q or Tissue Injection

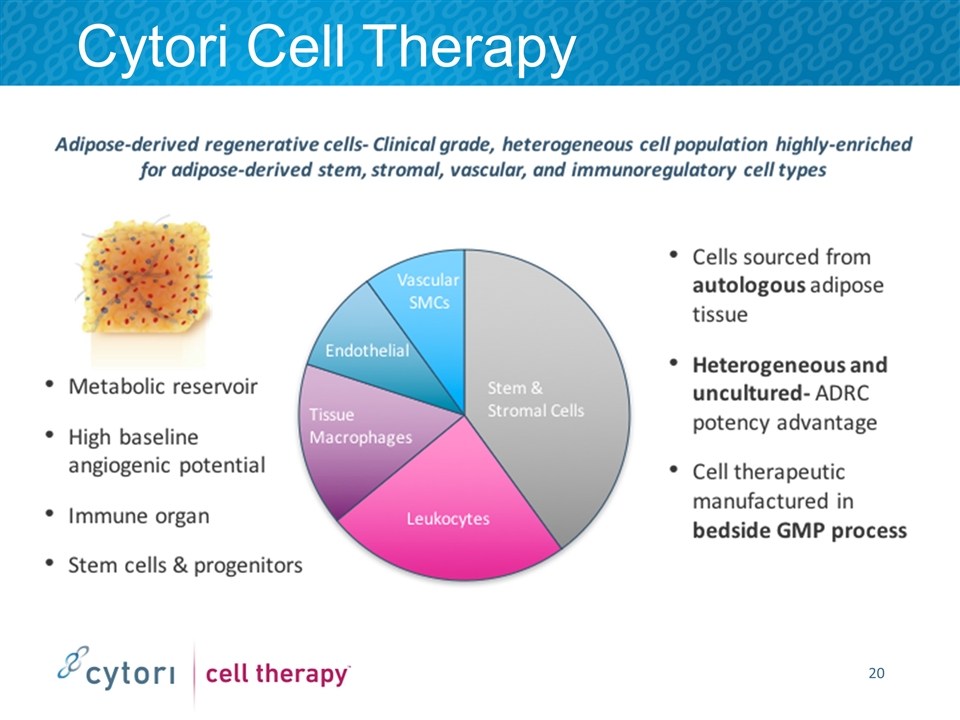

Cytori Cell Therapy

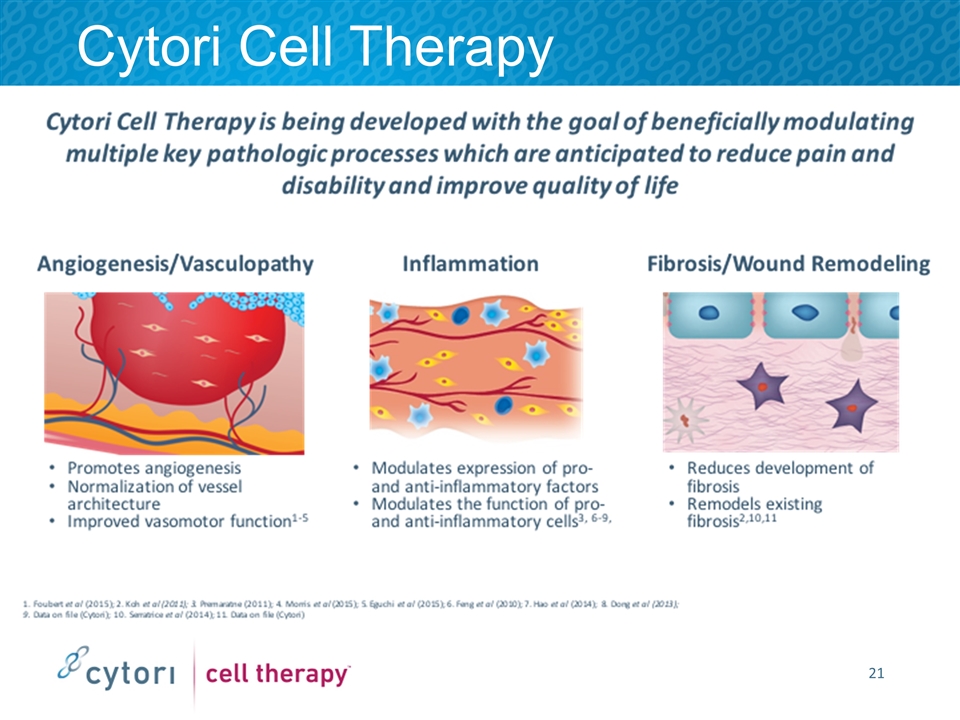

Cytori Cell Therapy

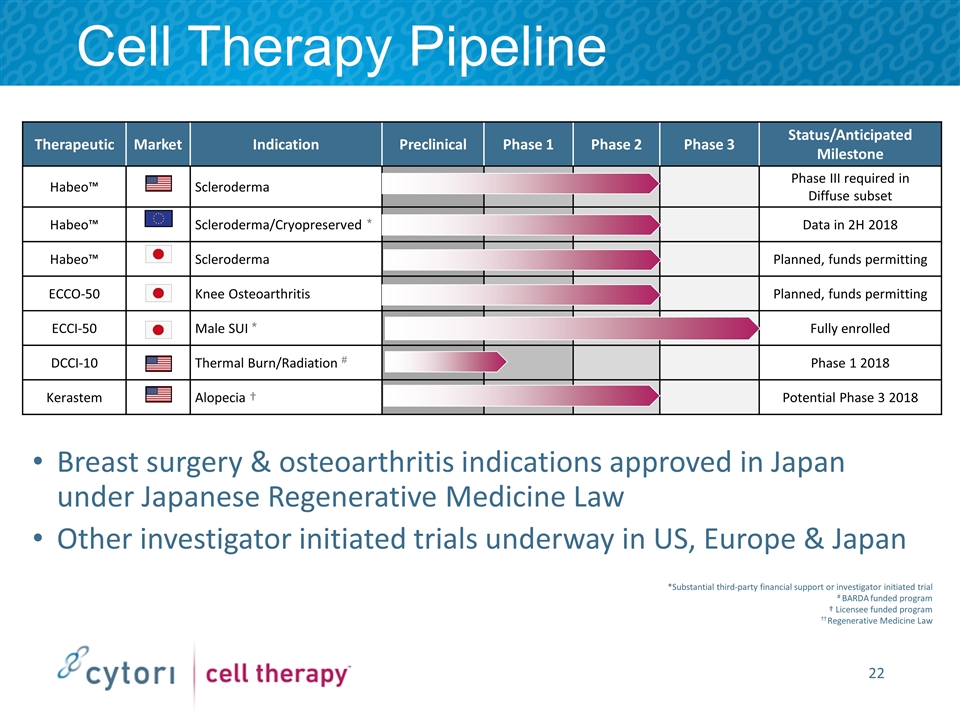

Cell Therapy Pipeline Therapeutic Market Indication Preclinical Phase 1 Phase 2 Phase 3 Status/Anticipated Milestone Habeo™ Scleroderma Phase III required in Diffuse subset Habeo™ Scleroderma/Cryopreserved * Data in 2H 2018 Habeo™ Scleroderma Planned, funds permitting ECCO-50 Knee Osteoarthritis Planned, funds permitting ECCI-50 Male SUI * Fully enrolled DCCI-10 Thermal Burn/Radiation # Phase 1 2018 Kerastem Alopecia † Potential Phase 3 2018 Breast surgery & osteoarthritis indications approved in Japan under Japanese Regenerative Medicine Law Other investigator initiated trials underway in US, Europe & Japan *Substantial third-party financial support or investigator initiated trial # BARDA funded program † Licensee funded program †† Regenerative Medicine Law

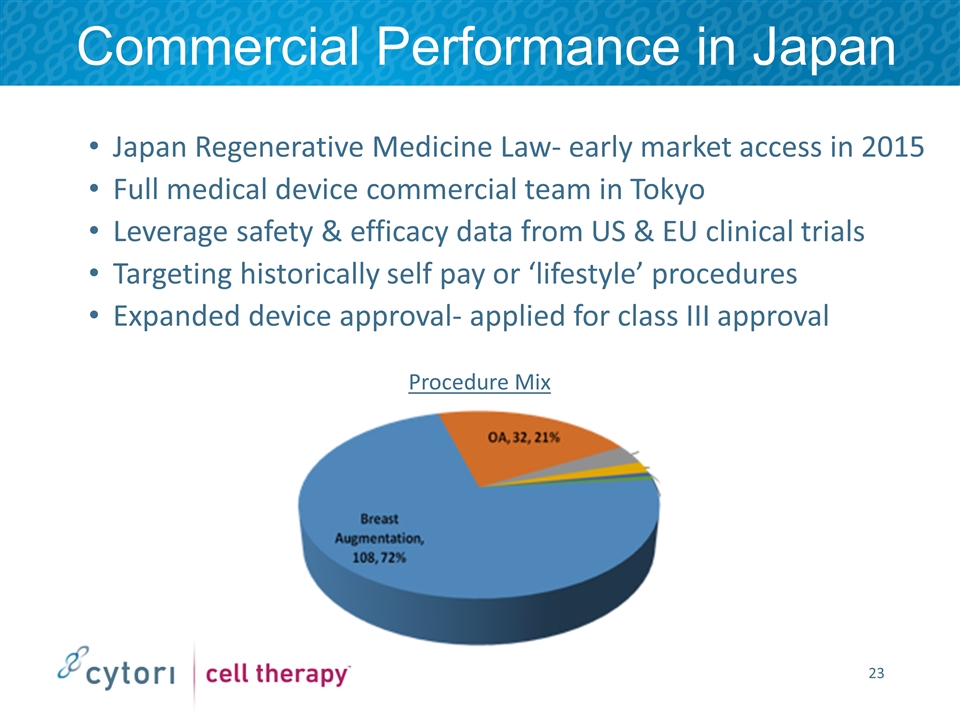

Commercial Performance in Japan Japan Regenerative Medicine Law- early market access in 2015 Full medical device commercial team in Tokyo Leverage safety & efficacy data from US & EU clinical trials Targeting historically self pay or ‘lifestyle’ procedures Expanded device approval- applied for class III approval Procedure Mix

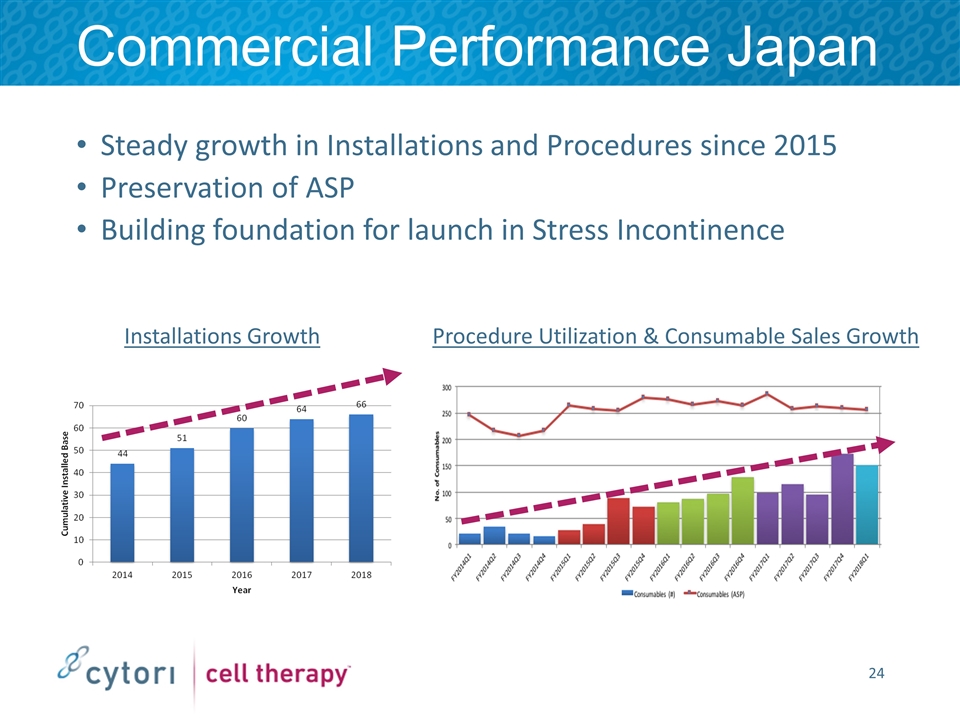

Commercial Performance Japan Procedure Utilization & Consumable Sales Growth Steady growth in Installations and Procedures since 2015 Preservation of ASP Building foundation for launch in Stress Incontinence Installations Growth

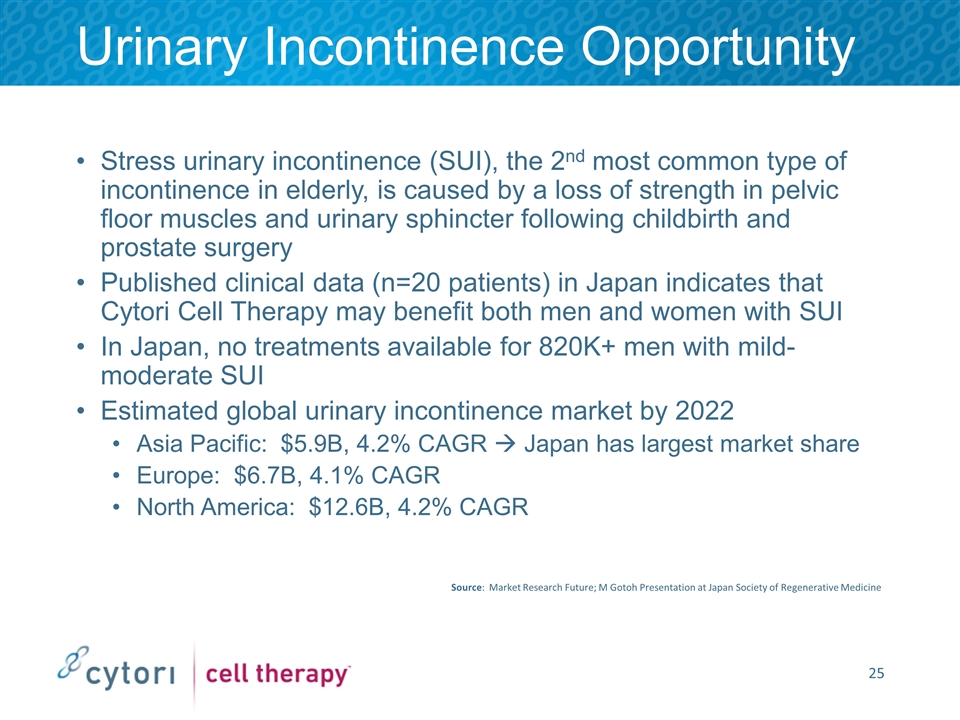

Urinary Incontinence Opportunity Stress urinary incontinence (SUI), the 2nd most common type of incontinence in elderly, is caused by a loss of strength in pelvic floor muscles and urinary sphincter following childbirth and prostate surgery Published clinical data (n=20 patients) in Japan indicates that Cytori Cell Therapy may benefit both men and women with SUI In Japan, no treatments available for 820K+ men with mild-moderate SUI Estimated global urinary incontinence market by 2022 Asia Pacific: $5.9B, 4.2% CAGR à Japan has largest market share Europe: $6.7B, 4.1% CAGR North America: $12.6B, 4.2% CAGR Source: Market Research Future; M Gotoh Presentation at Japan Society of Regenerative Medicine

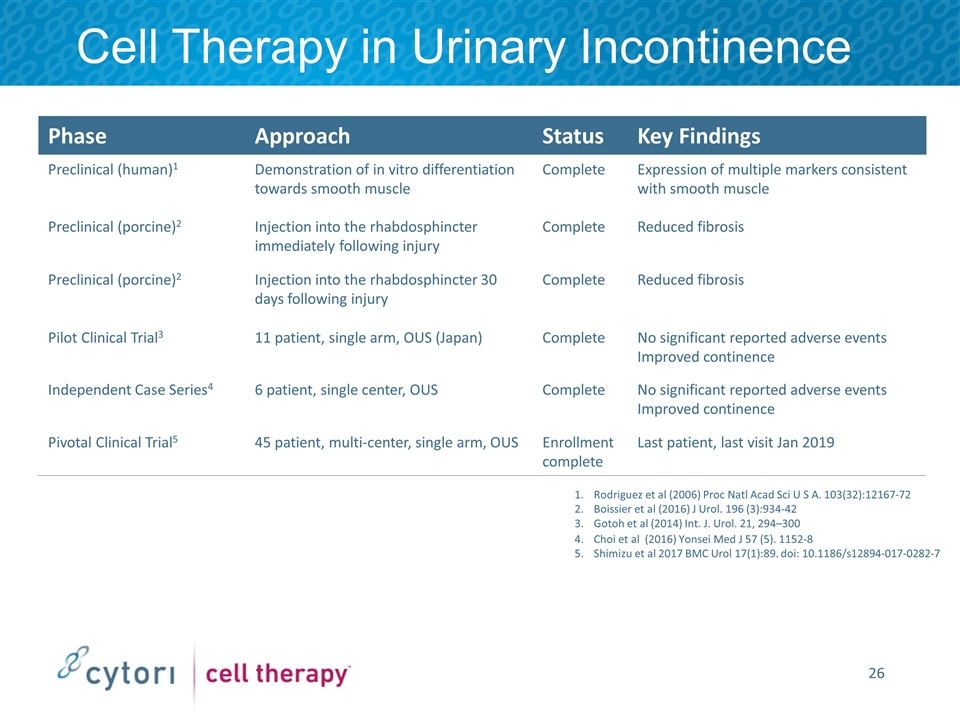

Cell Therapy in Urinary Incontinence Phase Approach Status Key Findings Preclinical (human)1 Demonstration of in vitro differentiation towards smooth muscle Complete Expression of multiple markers consistent with smooth muscle Preclinical (porcine)2 Injection into the rhabdosphincter immediately following injury Complete Reduced fibrosis Preclinical (porcine)2 Injection into the rhabdosphincter 30 days following injury Complete Reduced fibrosis Pilot Clinical Trial3 11 patient, single arm, OUS (Japan) Complete No significant reported adverse events Improved continence Independent Case Series4 6 patient, single center, OUS Complete No significant reported adverse events Improved continence Pivotal Clinical Trial5 45 patient, multi-center, single arm, OUS Enrollment complete Last patient, last visit Jan 2019 Rodriguez et al (2006) Proc Natl Acad Sci U S A. 103(32):12167-72 Boissier et al (2016) J Urol. 196 (3):934-42 Gotoh et al (2014) Int. J. Urol. 21, 294–300 Choi et al (2016) Yonsei Med J 57 (5). 1152-8 Shimizu et al 2017 BMC Urol 17(1):89. doi: 10.1186/s12894-017-0282-7

Initial Clinical Data in Urinary Incontinence Pilot Trial Single center, open label study Patients with mild-to-moderate urine leakage persisting more than 2 years after prostatectomy 11 subjects enrolled and followed-up for 12 months Results1 No serious adverse events reported 55% (6/11) of patients exhibited >50% improvement in 24 hour leakage at 1 year Anticipated incidence of spontaneous improvement with standard care is 10% 41% mean improvement in 24 hour urinary leakage volume (p=0.01) Benefit sustained for several years2 14 patients with median follow-up >4yrs Retention of efficacy 39% mean improvement in 24 hour urinary leakage volume 79% (11/14) of patients exhibited improvement 56% mean reduction in daily leakage volume Gotoh et al (2014) Int. J. Urol. 21, 294–300 Gotoh et al (2017) International Continence Society: Abst 489 Gotoh et al. Int J Urology 2014

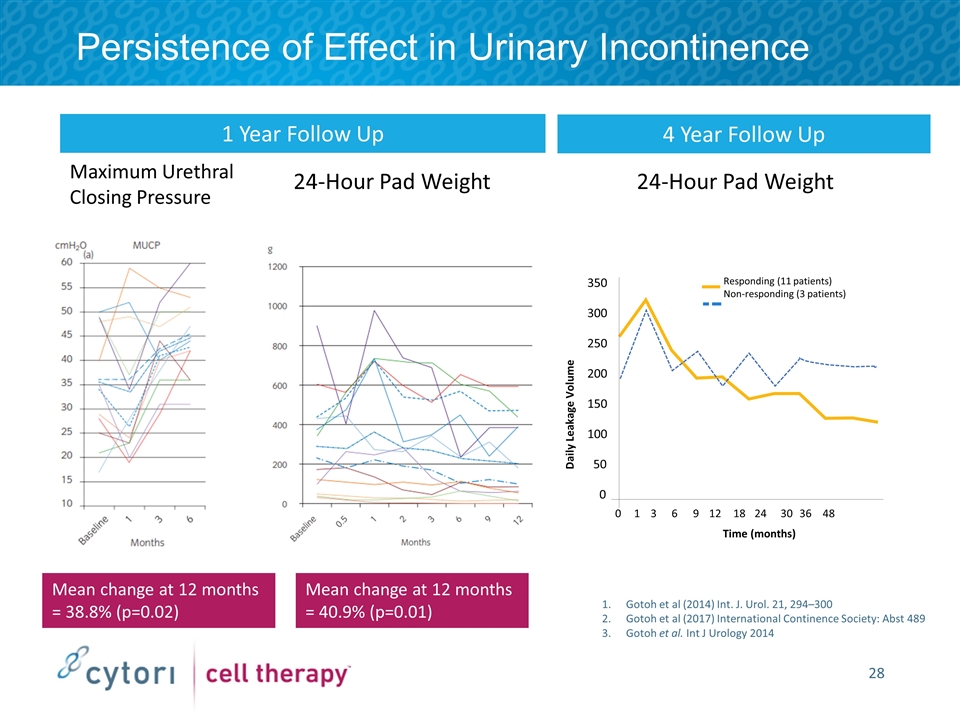

Persistence of Effect in Urinary Incontinence Maximum Urethral Closing Pressure 24-Hour Pad Weight Mean change at 12 months = 40.9% (p=0.01) Mean change at 12 months = 38.8% (p=0.02) Gotoh et al (2014) Int. J. Urol. 21, 294–300 Gotoh et al (2017) International Continence Society: Abst 489 Gotoh et al. Int J Urology 2014 01 36 912 18 24 30 3648 350 300 250 200 150 100 50 0 Time (months) Daily Leakage Volume Responding (11 patients) Non-responding (3 patients) 24-Hour Pad Weight 1 Year Follow Up 4 Year Follow Up

Pivotal Trial Design Indication Stress urinary incontinence following prostatectomy Study Design Multi-center, single arm, open label Primary Endpoint Percentage of subjects with >50% reduction in urinary leakage at 1 year Anticipated percentage with spontaneous improvement with standard care is 10% Observed rate of improvement in pilot study =55% ADRESU powered for statistical significance at 30% rate of improvement Secondary Endpoints Percentage of subjects with >50% reduction in urinary leakage at other time points Urine leakage volume per day Number of incontinence episodes per day Incontinence-related Quality of Life Urodynamics (maximum urethral closing pressure) Status: Enrollment complete; last subject will complete 12 month visit in Q1 2019 Shimizu et al 2017 BMC Urol 17(1):89. doi: 10.1186/s12894-017-0282-7.

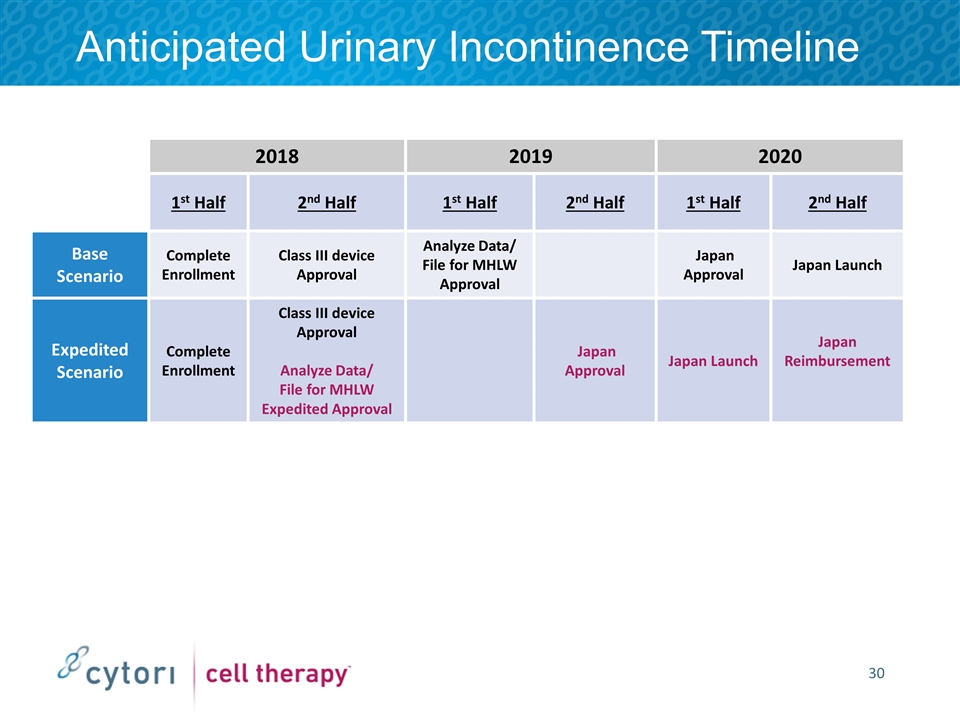

Anticipated Urinary Incontinence Timeline 2018 2019 2020 1st Half 2nd Half 1st Half 2nd Half 1st Half 2nd Half Base Scenario Complete Enrollment Class III device Approval Analyze Data/ File for MHLW Approval Japan Approval Japan Launch Expedited Scenario Complete Enrollment Class III device Approval Analyze Data/ File for MHLW Expedited Approval Japan Approval Japan Launch Japan Reimbursement

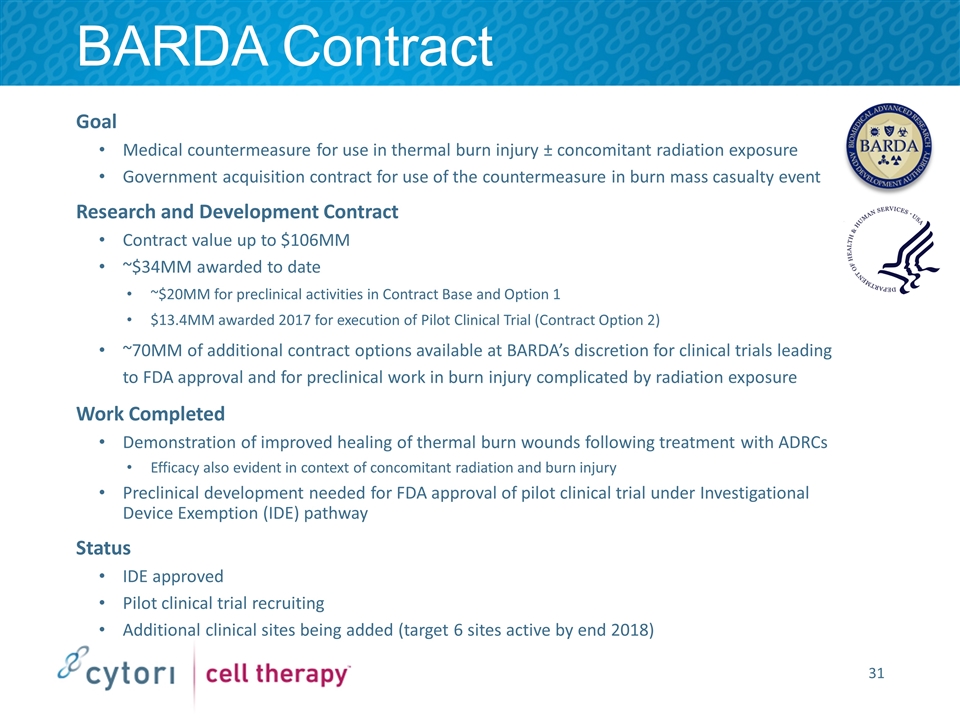

BARDA Contract Goal Medical countermeasure for use in thermal burn injury ± concomitant radiation exposure Government acquisition contract for use of the countermeasure in burn mass casualty event Research and Development Contract Contract value up to $106MM ~$34MM awarded to date ~$20MM for preclinical activities in Contract Base and Option 1 $13.4MM awarded 2017 for execution of Pilot Clinical Trial (Contract Option 2) ~70MM of additional contract options available at BARDA’s discretion for clinical trials leading to FDA approval and for preclinical work in burn injury complicated by radiation exposure Work Completed Demonstration of improved healing of thermal burn wounds following treatment with ADRCs Efficacy also evident in context of concomitant radiation and burn injury Preclinical development needed for FDA approval of pilot clinical trial under Investigational Device Exemption (IDE) pathway Status IDE approved Pilot clinical trial recruiting Additional clinical sites being added (target 6 sites active by end 2018)

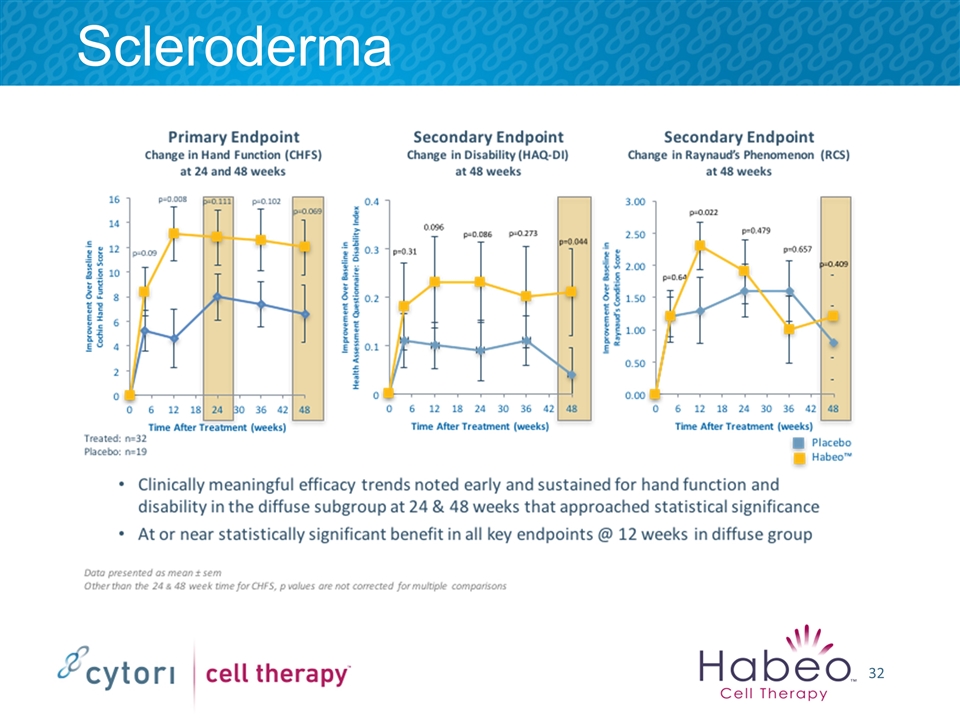

Scleroderma

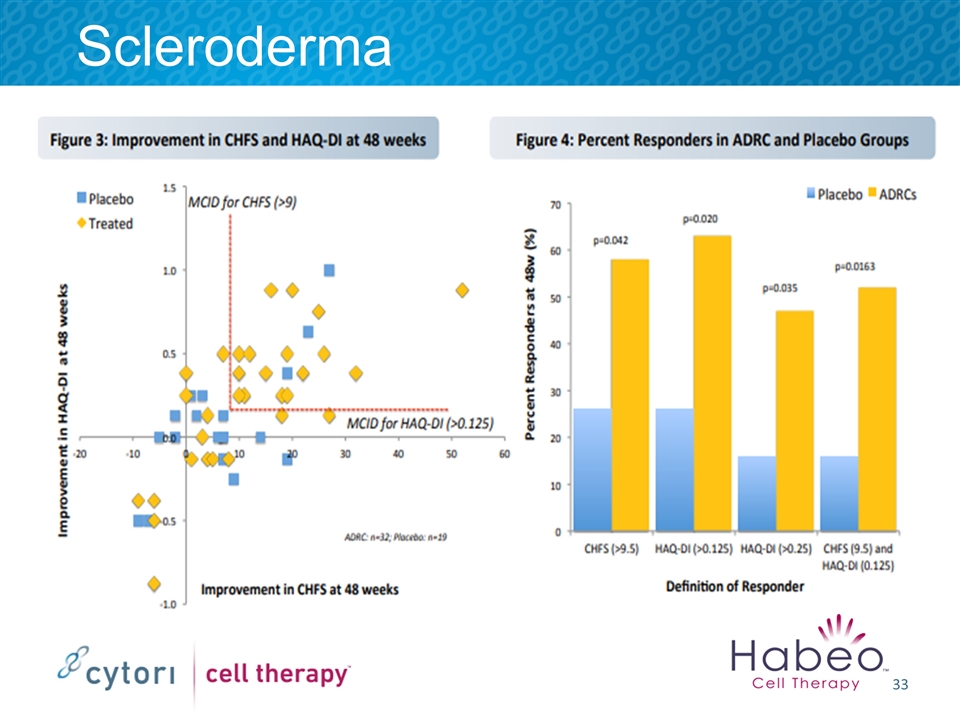

Scleroderma 33

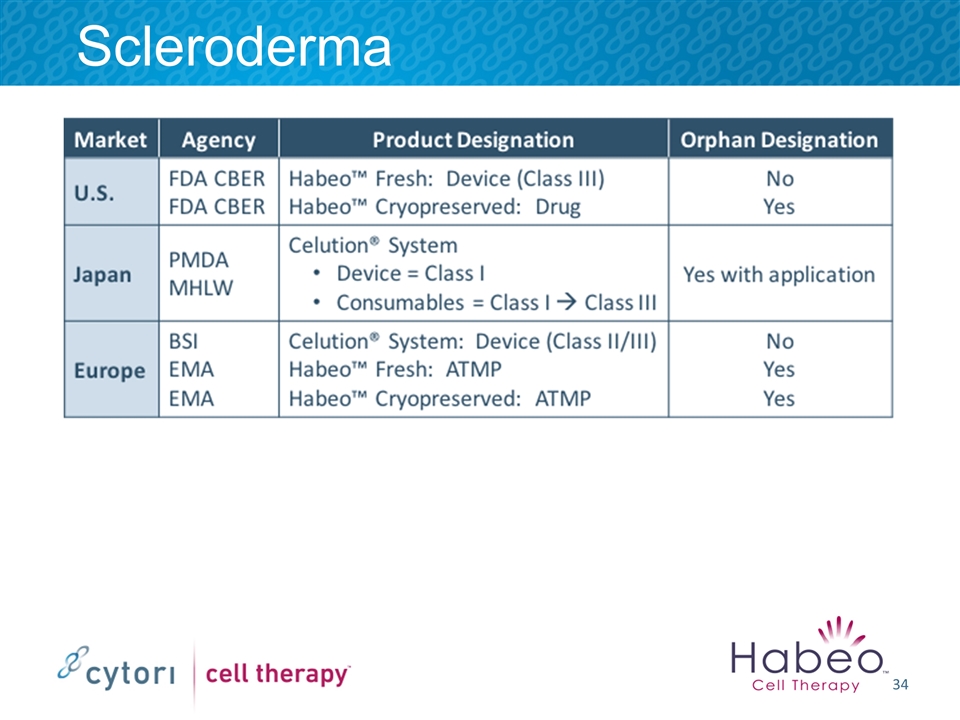

Scleroderma

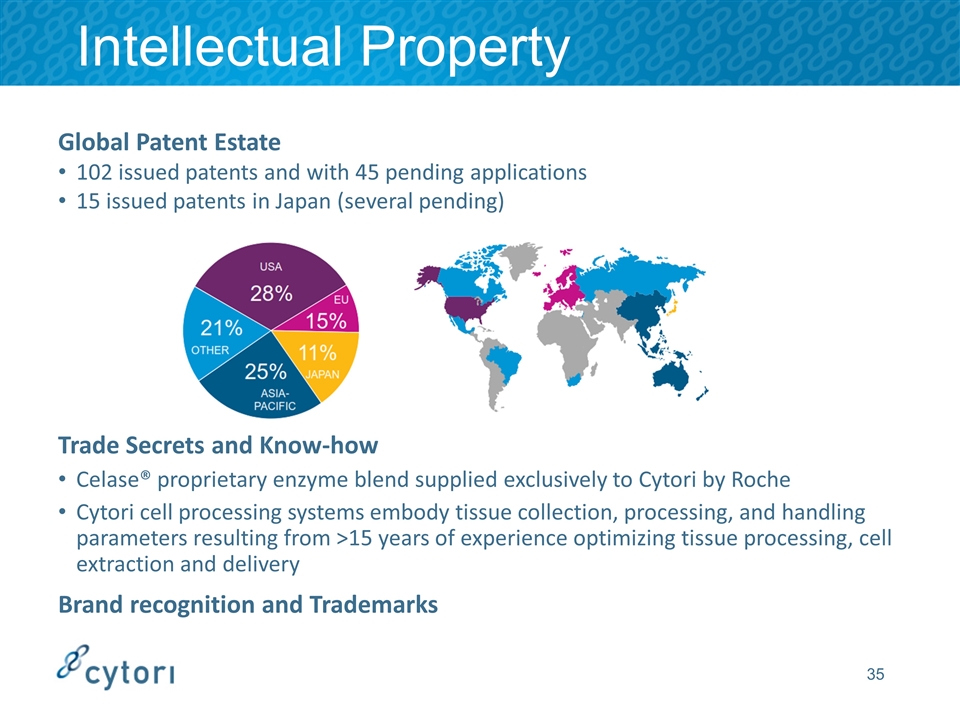

Intellectual Property Trade Secrets and Know-how Celase® proprietary enzyme blend supplied exclusively to Cytori by Roche Cytori cell processing systems embody tissue collection, processing, and handling parameters resulting from >15 years of experience optimizing tissue processing, cell extraction and delivery Brand recognition and Trademarks Global Patent Estate 102 issued patents and with 45 pending applications 15 issued patents in Japan (several pending)

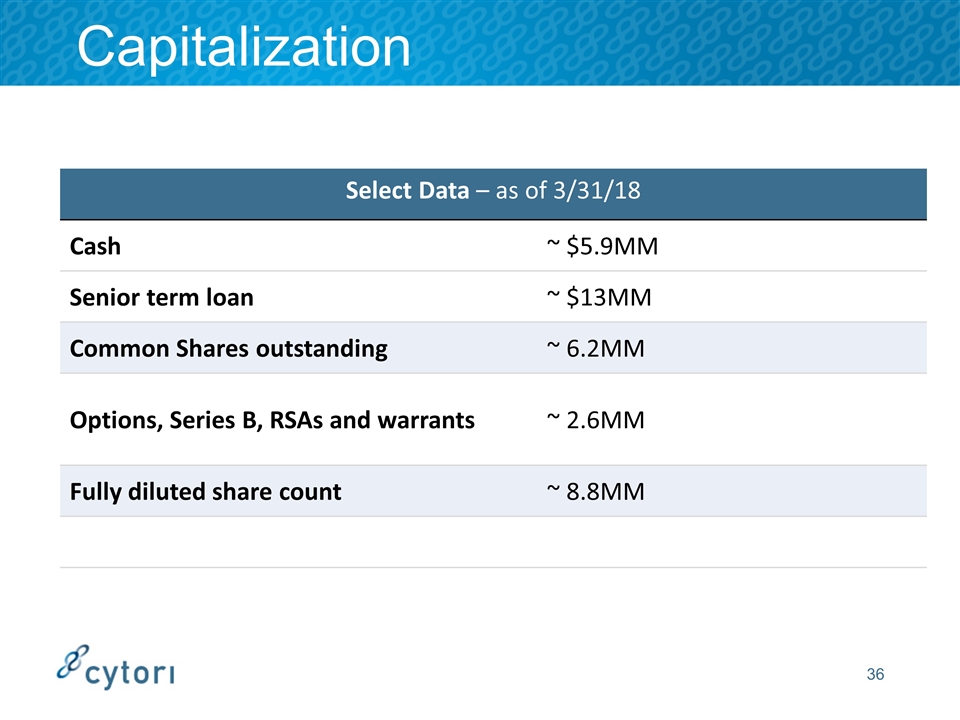

Capitalization Select Data – as of 3/31/18 Cash ~ $5.9MM Senior term loan ~ $13MM Common Shares outstanding ~ 6.2MM Options, Series B, RSAs and warrants ~ 2.6MM Fully diluted share count ~ 8.8MM

Anticipated Milestones SCLERADEC-II trial readout First enrolled partient for US RELIEF trial funded by BARDA Identify commercial partner for ATI-0918 ATI-0918- complete manufacturing validation and production of stability lots ATI-0918- file for EMA approval following 6 months stability ATI-1123 development & Phase II- Decisions on orphan designation, viability of 505(b)2 pathway & SPA ADRESU trial readout & file for approval Begin Japanese scleroderma trial– pending funding Puregraft royalty milestone Japan Class III device approval Decision on expedited review for incontinence trial

The End Investor Presentation June 2018 NASDAQ:CYTX